Analysis of the UK Housing Market: 2009-2019 and Beyond

VerifiedAdded on 2023/01/11

|12

|3886

|76

Report

AI Summary

This report provides a comprehensive analysis of the UK housing market between 2009 and 2019. It examines the fluctuations in average house prices, highlighting the impact of economic determinants such as earnings, mortgage rates, and unemployment. The report also explores how government interventions influenced the market during this period. Furthermore, it predicts the potential impact of the COVID-19 pandemic on the UK housing market. The analysis draws on various sources to present a detailed overview of the market's dynamics and the factors driving its changes. The report considers the interplay of supply and demand, investment, and economic growth, offering insights into the complex forces shaping the UK's housing landscape.

Contemporary

Business Environment

(Evaluating internal and external business

environment)

Business Environment

(Evaluating internal and external business

environment)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. How have average house prices in the UK changed over the period from 2009 - 2019?. .3

2. What are the economic determinants of the changes outlined in your answer to Question 1?

................................................................................................................................................5

3. How has government action over the period 2009-2019 affected the UK Housing market?

................................................................................................................................................8

4. Predict what would be the impact of COVID-19 on UK Housing Market?......................9

Conclusion.....................................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

1. How have average house prices in the UK changed over the period from 2009 - 2019?. .3

2. What are the economic determinants of the changes outlined in your answer to Question 1?

................................................................................................................................................5

3. How has government action over the period 2009-2019 affected the UK Housing market?

................................................................................................................................................8

4. Predict what would be the impact of COVID-19 on UK Housing Market?......................9

Conclusion.....................................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Business environment specifically consists of both external and internal factors which

impacts negatively and positively on an organisation. Over the years, housing industry of United

Kingdom has been going through different range of issues like fluctuation among the prices of

houses which has not only impacted negatively on overall performance level but also it has

raised concerns for many business organisations that are dealing at small and medium level

(Hamilton and Webster, 2018). Present report is going to be enclosed with average house prices

in United Kingdom which has changed from the period of time of 2009 to 2019.

Also, report will also be delivering information in relation to economic determinants of

alterations which affected house prices in United Kingdom. On the other hand, what were the

government actions that affected UK housing market is also so going to be enlightened in this

assignment. Lastly, the impact of Covid-19 is also going to be mentioned in this report.

MAIN BODY

1. How have average house prices in the UK changed over the period from 2009 - 2019?

Over the years, house prices within United Kingdom carried dynamic nature where it has

been analysed that 2013 was considered to be the year where highest prices with hike ok of 9%

came in front. On the other hand, fluctuation among house prices impacted negatively on overall

performance level of the entire housing market of United Kingdom. Including this, House costs

are influenced by various variables, for example, contract rates, flexibly, and request available.

In the event that request exceeds gracefully, house costs are probably going to increment.

United Kingdom (UK) has the absolute most noteworthy house costs in Europe. Starting

at July 2019, private property costs in the United Kingdom (UK) saw their most minimal yearly

increment since 2012. The normal cost of a house in the UK expanded by 1.1 percent in the year

before July 2019, arriving at an expected estimation of about 216 thousand British pounds in the

second quarter of 2019 (Baptista and et. al., 2016).

Expanding housing costs: It is considered to be a European marvel where the pattern of

expanding housing costs isn't selective to the UK. When contrasting a few European nations'

private property RHPI (value file in genuine terms, for example amended for expansion), houses

turned out to be increasingly costly from 2013 onwards in the UK, Ireland, Germany, Denmark

and the Netherlands (Orford, 2017).

Business environment specifically consists of both external and internal factors which

impacts negatively and positively on an organisation. Over the years, housing industry of United

Kingdom has been going through different range of issues like fluctuation among the prices of

houses which has not only impacted negatively on overall performance level but also it has

raised concerns for many business organisations that are dealing at small and medium level

(Hamilton and Webster, 2018). Present report is going to be enclosed with average house prices

in United Kingdom which has changed from the period of time of 2009 to 2019.

Also, report will also be delivering information in relation to economic determinants of

alterations which affected house prices in United Kingdom. On the other hand, what were the

government actions that affected UK housing market is also so going to be enlightened in this

assignment. Lastly, the impact of Covid-19 is also going to be mentioned in this report.

MAIN BODY

1. How have average house prices in the UK changed over the period from 2009 - 2019?

Over the years, house prices within United Kingdom carried dynamic nature where it has

been analysed that 2013 was considered to be the year where highest prices with hike ok of 9%

came in front. On the other hand, fluctuation among house prices impacted negatively on overall

performance level of the entire housing market of United Kingdom. Including this, House costs

are influenced by various variables, for example, contract rates, flexibly, and request available.

In the event that request exceeds gracefully, house costs are probably going to increment.

United Kingdom (UK) has the absolute most noteworthy house costs in Europe. Starting

at July 2019, private property costs in the United Kingdom (UK) saw their most minimal yearly

increment since 2012. The normal cost of a house in the UK expanded by 1.1 percent in the year

before July 2019, arriving at an expected estimation of about 216 thousand British pounds in the

second quarter of 2019 (Baptista and et. al., 2016).

Expanding housing costs: It is considered to be a European marvel where the pattern of

expanding housing costs isn't selective to the UK. When contrasting a few European nations'

private property RHPI (value file in genuine terms, for example amended for expansion), houses

turned out to be increasingly costly from 2013 onwards in the UK, Ireland, Germany, Denmark

and the Netherlands (Orford, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

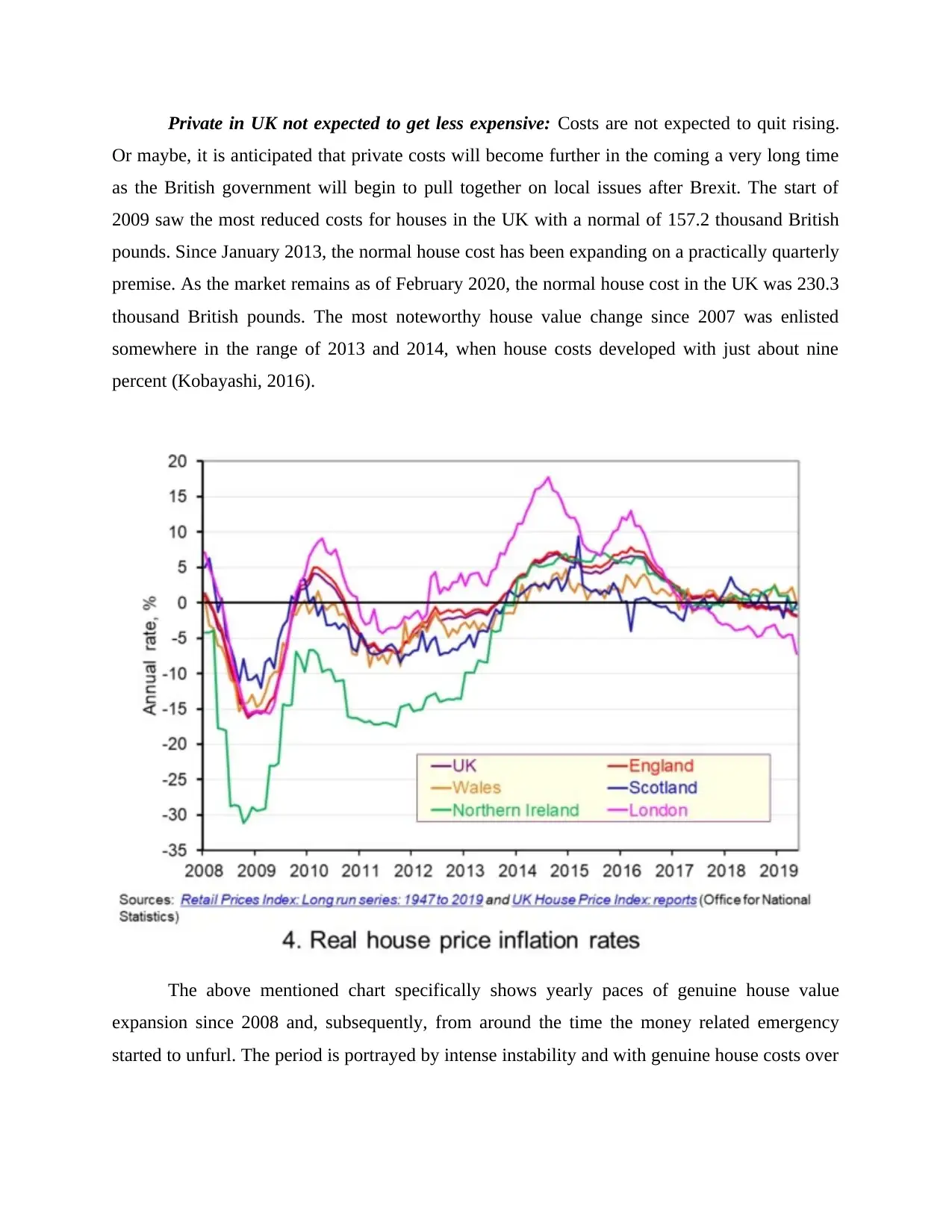

Private in UK not expected to get less expensive: Costs are not expected to quit rising.

Or maybe, it is anticipated that private costs will become further in the coming a very long time

as the British government will begin to pull together on local issues after Brexit. The start of

2009 saw the most reduced costs for houses in the UK with a normal of 157.2 thousand British

pounds. Since January 2013, the normal house cost has been expanding on a practically quarterly

premise. As the market remains as of February 2020, the normal house cost in the UK was 230.3

thousand British pounds. The most noteworthy house value change since 2007 was enlisted

somewhere in the range of 2013 and 2014, when house costs developed with just about nine

percent (Kobayashi, 2016).

The above mentioned chart specifically shows yearly paces of genuine house value

expansion since 2008 and, subsequently, from around the time the money related emergency

started to unfurl. The period is portrayed by intense instability and with genuine house costs over

Or maybe, it is anticipated that private costs will become further in the coming a very long time

as the British government will begin to pull together on local issues after Brexit. The start of

2009 saw the most reduced costs for houses in the UK with a normal of 157.2 thousand British

pounds. Since January 2013, the normal house cost has been expanding on a practically quarterly

premise. As the market remains as of February 2020, the normal house cost in the UK was 230.3

thousand British pounds. The most noteworthy house value change since 2007 was enlisted

somewhere in the range of 2013 and 2014, when house costs developed with just about nine

percent (Kobayashi, 2016).

The above mentioned chart specifically shows yearly paces of genuine house value

expansion since 2008 and, subsequently, from around the time the money related emergency

started to unfurl. The period is portrayed by intense instability and with genuine house costs over

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the UK falling at a yearly pace of 16 percent in 2009 and by as much 29 percent in Northern

Ireland (Cook and Watson, 2016).

The UK saw a bounce back in ostensible and genuine house value development in the period

from 2013, driven by a solid flood in costs in London and the South East, and bolstered by

government activities, for example, help to buy intended to assist individuals with standing to

purchase property. Be that as it may, house value development at that point started to ease from

ahead of schedule/mid 2016.

A portion of the facilitating might be halfway because of any over the top bubble ebbing

from the market, particularly in London, and the effect on the interest for purchase to-let

speculations coming about because of decreases in charge alleviation on premium instalments on

purchase to-let contracts. Notwithstanding, the lodging market is famously touchy to

vulnerability, which isn't astonishing when you think about the size of the venture individuals are

making when they enter the market. The vulnerability encompassing Brexit and the UK's future

exchanging connections will have been a delay request and thus on house costs (Panagiotidis and

Printzis, 2016).

2. What are the economic determinants of the changes outlined in your answer to Question 1?

House costs are controlled by supply and demand where on the off chance that request

rises or if gracefully falls, the balance cost of houses will rise. Thus, it can be said that if the

demand increases then automatically the supply also rises where the harmony cost are ultimately

will fall. Along these lines, the house costs rise so quickly during the 2013, yet fall in the same

year. The reasons lies fundamentally in change in the interest for lodging. There are different

range of economy related determinants which has not only impacted upon the housing market of

United Kingdom but also raised issues to overcome all the problems that are being faced by

small and medium-sized agencies that belongs to housing market. Some of these determinants

have been portrayed underneath;

Earnings (real and foreseen):- In the asking of the 2009 was the ideal opportunity for

quickly rising wages. The economy was encountering a financial aspects "Growth". Numerous

individuals needed to spend their additional wages on lodging; either purchasing a house just

because, or moving to a superior one. Numerous individuals imagined that their earnings would

proceed to develop and were in this way arranged to extend themselves monetarily in the present

moment by purchasing a costly house, sure that their home loan instalments would turn out to be

Ireland (Cook and Watson, 2016).

The UK saw a bounce back in ostensible and genuine house value development in the period

from 2013, driven by a solid flood in costs in London and the South East, and bolstered by

government activities, for example, help to buy intended to assist individuals with standing to

purchase property. Be that as it may, house value development at that point started to ease from

ahead of schedule/mid 2016.

A portion of the facilitating might be halfway because of any over the top bubble ebbing

from the market, particularly in London, and the effect on the interest for purchase to-let

speculations coming about because of decreases in charge alleviation on premium instalments on

purchase to-let contracts. Notwithstanding, the lodging market is famously touchy to

vulnerability, which isn't astonishing when you think about the size of the venture individuals are

making when they enter the market. The vulnerability encompassing Brexit and the UK's future

exchanging connections will have been a delay request and thus on house costs (Panagiotidis and

Printzis, 2016).

2. What are the economic determinants of the changes outlined in your answer to Question 1?

House costs are controlled by supply and demand where on the off chance that request

rises or if gracefully falls, the balance cost of houses will rise. Thus, it can be said that if the

demand increases then automatically the supply also rises where the harmony cost are ultimately

will fall. Along these lines, the house costs rise so quickly during the 2013, yet fall in the same

year. The reasons lies fundamentally in change in the interest for lodging. There are different

range of economy related determinants which has not only impacted upon the housing market of

United Kingdom but also raised issues to overcome all the problems that are being faced by

small and medium-sized agencies that belongs to housing market. Some of these determinants

have been portrayed underneath;

Earnings (real and foreseen):- In the asking of the 2009 was the ideal opportunity for

quickly rising wages. The economy was encountering a financial aspects "Growth". Numerous

individuals needed to spend their additional wages on lodging; either purchasing a house just

because, or moving to a superior one. Numerous individuals imagined that their earnings would

proceed to develop and were in this way arranged to extend themselves monetarily in the present

moment by purchasing a costly house, sure that their home loan instalments would turn out to be

increasingly more reasonable after some time. In 2010/11 on the other hand, were times of

downturn, with rising joblessness and either is falling or considerably more gradually developing

livelihoods. Individuals had considerably less certainty about their capacity to manage the cost of

huge home loans (Gurran and Bramley, 2017).

The expense of home loans:- In mid 2009 the home loans rates was not as much as now.

That implied individuals could manage the cost of bigger home loans and in this way bear to

purchase progressively costly houses. Yet, contracts financing costs were currently rising.

Numerous individuals thought that it was hard to keep up existing instalments, let along to take

on a bigger home loan. In 2013 home loans rates were commonly decreased once more, again

fuelling the interest for houses. In any event, when the financing costs rose slowly over the

period from 2014 to 2017 they didn't approach the rates arrived at like previously. By 2013/40,

be that as it may, higher home loan financing costs were getting progressively unreasonably

expensive for some individuals and this was one factor adding to the underlying downturn in

lodging costs.

The accessibility of home loans:- In the beginning of 2009 and till December of 2011,

housing market of United Kingdom specifically boomed where the contracts were promptly

accessible. With house costs rising, banks and building social orders were set up to acknowledge

littler stores on houses and to loan a bigger numerous of individuals' salary. All things

considered, if borrowers somehow happened to default, loan specialists would at present have an

excellent possibility of recovering all their cash. In the asking of the 2011 banks and building

social orders were progressively careful about conceding contracts. They knew that, with falling

house costs, rising joblessness and the developing issue of negative value, there was an expanded

peril that borrowers would default on instalments. In 2011/13 the issue was exacerbated by credit

crunch, implying that banks had less cash to loan (Wijburg and Aalbers, 2017).

Speculation related to prices of houses in United Kingdom:- Housing market of United

Kingdom specifically saw growth wherein individuals for the most part accepted that house costs

would keep rising. This urges individuals to purchase at the earliest opportunity and take out the

greatest home loan conceivable, before costs went up any further. There was additionally an

impact on gracefully. Those with houses to sell kept down until the last conceivable second in

the desire for getting a more significant expense. The net impact was rightward move in the

interest bend for houses and leftward move in the supply bend. The impact of this theory,

downturn, with rising joblessness and either is falling or considerably more gradually developing

livelihoods. Individuals had considerably less certainty about their capacity to manage the cost of

huge home loans (Gurran and Bramley, 2017).

The expense of home loans:- In mid 2009 the home loans rates was not as much as now.

That implied individuals could manage the cost of bigger home loans and in this way bear to

purchase progressively costly houses. Yet, contracts financing costs were currently rising.

Numerous individuals thought that it was hard to keep up existing instalments, let along to take

on a bigger home loan. In 2013 home loans rates were commonly decreased once more, again

fuelling the interest for houses. In any event, when the financing costs rose slowly over the

period from 2014 to 2017 they didn't approach the rates arrived at like previously. By 2013/40,

be that as it may, higher home loan financing costs were getting progressively unreasonably

expensive for some individuals and this was one factor adding to the underlying downturn in

lodging costs.

The accessibility of home loans:- In the beginning of 2009 and till December of 2011,

housing market of United Kingdom specifically boomed where the contracts were promptly

accessible. With house costs rising, banks and building social orders were set up to acknowledge

littler stores on houses and to loan a bigger numerous of individuals' salary. All things

considered, if borrowers somehow happened to default, loan specialists would at present have an

excellent possibility of recovering all their cash. In the asking of the 2011 banks and building

social orders were progressively careful about conceding contracts. They knew that, with falling

house costs, rising joblessness and the developing issue of negative value, there was an expanded

peril that borrowers would default on instalments. In 2011/13 the issue was exacerbated by credit

crunch, implying that banks had less cash to loan (Wijburg and Aalbers, 2017).

Speculation related to prices of houses in United Kingdom:- Housing market of United

Kingdom specifically saw growth wherein individuals for the most part accepted that house costs

would keep rising. This urges individuals to purchase at the earliest opportunity and take out the

greatest home loan conceivable, before costs went up any further. There was additionally an

impact on gracefully. Those with houses to sell kept down until the last conceivable second in

the desire for getting a more significant expense. The net impact was rightward move in the

interest bend for houses and leftward move in the supply bend. The impact of this theory,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accordingly, was to help achieve the very impact that individuals were foreseeing. In 2009 the

inverse happened. Individuals considering purchasing houses kept down, wanting to purchase at

a lower cost. Individuals with houses to offer attempted to sell as fast as conceivable before costs

fell any future. Again the impact of this theory was to exasperate the adjustments in costs this

time a fall in costs.

Unemployment rate: This is another crucial economic determinant that came in front

which has impacted upon on demand and supply of housing and on the prices as well. In the year

of 2007, the whole world was going through financial crisis which has also raised in

unemployment rate in United Kingdom. This raised concerns where most of the business

organisations would required to fire ample number of employees and this also affected the whole

GDP rate of United Kingdom as well. Due to rise in unemployment rate, buyers specifically

become unable to purchase lands and houses. Identified with monetary development is

joblessness. At the point when joblessness is rising, less individuals will have the option to bear

the cost of a house. In any case, even the dread of joblessness may dishearten individuals from

entering the property showcase.

Interest fees: Financing costs influence the expense of month to month contract

installments. A time of high-financing costs will expand cost of home loan installments and will

cause lower interest for purchasing a house. High-financing costs make leasing moderately

progressively appealing contrasted with purchasing. Loan fees have a greater impact if property

holders have huge variable home loans. For instance, in 2013, the sharp ascent in financing costs

caused a precarious fall in UK house costs on the grounds that numerous mortgage holders

couldn't bear the cost of the ascent in loan costs.

Monetary development: Interest for lodging is reliant upon pay. With higher monetary

development and rising wages, individuals will have the option to spend more on houses; this

will build request and push up costs. Actually, interest for lodging is regularly noted to be pay

versatile (extravagance great); rising salaries prompting a greater % of pay being spent on

houses. So also, in a downturn, falling wages will mean individuals can't bear to purchase and

the individuals who lose their employment may fall behind on their home loan installments and

end up with their home repossessed (Murdoch and Abram, 2017).

inverse happened. Individuals considering purchasing houses kept down, wanting to purchase at

a lower cost. Individuals with houses to offer attempted to sell as fast as conceivable before costs

fell any future. Again the impact of this theory was to exasperate the adjustments in costs this

time a fall in costs.

Unemployment rate: This is another crucial economic determinant that came in front

which has impacted upon on demand and supply of housing and on the prices as well. In the year

of 2007, the whole world was going through financial crisis which has also raised in

unemployment rate in United Kingdom. This raised concerns where most of the business

organisations would required to fire ample number of employees and this also affected the whole

GDP rate of United Kingdom as well. Due to rise in unemployment rate, buyers specifically

become unable to purchase lands and houses. Identified with monetary development is

joblessness. At the point when joblessness is rising, less individuals will have the option to bear

the cost of a house. In any case, even the dread of joblessness may dishearten individuals from

entering the property showcase.

Interest fees: Financing costs influence the expense of month to month contract

installments. A time of high-financing costs will expand cost of home loan installments and will

cause lower interest for purchasing a house. High-financing costs make leasing moderately

progressively appealing contrasted with purchasing. Loan fees have a greater impact if property

holders have huge variable home loans. For instance, in 2013, the sharp ascent in financing costs

caused a precarious fall in UK house costs on the grounds that numerous mortgage holders

couldn't bear the cost of the ascent in loan costs.

Monetary development: Interest for lodging is reliant upon pay. With higher monetary

development and rising wages, individuals will have the option to spend more on houses; this

will build request and push up costs. Actually, interest for lodging is regularly noted to be pay

versatile (extravagance great); rising salaries prompting a greater % of pay being spent on

houses. So also, in a downturn, falling wages will mean individuals can't bear to purchase and

the individuals who lose their employment may fall behind on their home loan installments and

end up with their home repossessed (Murdoch and Abram, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. How has government action over the period 2009-2019 affected the UK Housing market?

Over the years from 2009 to 2019, government has made ample number of interventions in

order to help United Kingdom's housing market. Some of the interventions has also impacted

positively on overall performance level of agencies that are working in housing industry. On the

other hand, it is the duty of Monetary Policy Committee (MPC) and Bank of England to set

Interest rates in UK. The MPC works freely from the Government. Prior to 1997, financing costs

used to be set by the Chancellor. It was contended, with a level of legitimization, loan costs were

dependent upon political inspiration.

The administration now just sets the MPC an expansion focus of CPI = 2% +/ - 1. The

MPC intends to keep expansion as near this objective as could be expected under the

circumstances (Al-Shemmeri and Naylor, 2017). On the off chance that swelling is above or

beneath this level, the legislative leader of the Bank of England needs to compose a letter of

clarification to the chancellor. In principle, they just objective swelling; anyway practically

speaking they may consider the impacts of financing cost changes on monetary development,

joblessness, and to a lesser degree the housing market and the conversion scale. The Government

is in a manner attempting to forestall house costs falling by: Rescuing banks and urging them to

loan for example RBS, Northern Rock and so on. The MPC is radically slicing loan fees to make

getting less expensive. The legislature is squeezing the banks to pass these rate cuts on. Decrease

in VAT and expanded spending, could confine the degree of the downturn (Hulse and Yates,

2017).

Then again, in the current financial emergencies it is hard to perceive any administration

strategy which could effectively forestall house costs fall. This is because of that there is a solid

contrary force in houses costs, individuals imagine that they are exaggerated and banks would

prefer not to loan. Henceforth it doesn't have any effect what so ever government says or

attempts to do (Samad and et. al., 2016). The main strategy which truly would have balanced out

house costs would be better adjustment of the credit blast and bust. On the off chance that the

administration had constrained banks to spare more and offer credit in the blast, the blast would

have been less and banks would now have more assets to keep up loaning in the present

downturn. Along these lines, the legislature can't generally stop house costs falling. In any case,

they should discover much better arrangements to forestall a rehash of the blast and bust we have

encountered twice in the previous 17 years.

Over the years from 2009 to 2019, government has made ample number of interventions in

order to help United Kingdom's housing market. Some of the interventions has also impacted

positively on overall performance level of agencies that are working in housing industry. On the

other hand, it is the duty of Monetary Policy Committee (MPC) and Bank of England to set

Interest rates in UK. The MPC works freely from the Government. Prior to 1997, financing costs

used to be set by the Chancellor. It was contended, with a level of legitimization, loan costs were

dependent upon political inspiration.

The administration now just sets the MPC an expansion focus of CPI = 2% +/ - 1. The

MPC intends to keep expansion as near this objective as could be expected under the

circumstances (Al-Shemmeri and Naylor, 2017). On the off chance that swelling is above or

beneath this level, the legislative leader of the Bank of England needs to compose a letter of

clarification to the chancellor. In principle, they just objective swelling; anyway practically

speaking they may consider the impacts of financing cost changes on monetary development,

joblessness, and to a lesser degree the housing market and the conversion scale. The Government

is in a manner attempting to forestall house costs falling by: Rescuing banks and urging them to

loan for example RBS, Northern Rock and so on. The MPC is radically slicing loan fees to make

getting less expensive. The legislature is squeezing the banks to pass these rate cuts on. Decrease

in VAT and expanded spending, could confine the degree of the downturn (Hulse and Yates,

2017).

Then again, in the current financial emergencies it is hard to perceive any administration

strategy which could effectively forestall house costs fall. This is because of that there is a solid

contrary force in houses costs, individuals imagine that they are exaggerated and banks would

prefer not to loan. Henceforth it doesn't have any effect what so ever government says or

attempts to do (Samad and et. al., 2016). The main strategy which truly would have balanced out

house costs would be better adjustment of the credit blast and bust. On the off chance that the

administration had constrained banks to spare more and offer credit in the blast, the blast would

have been less and banks would now have more assets to keep up loaning in the present

downturn. Along these lines, the legislature can't generally stop house costs falling. In any case,

they should discover much better arrangements to forestall a rehash of the blast and bust we have

encountered twice in the previous 17 years.

4. Predict what would be the impact of COVID-19 on UK Housing Market?

The prices of housing industry within UK had started to recover from the uncertainty that is

caused by brexit and also get victory in December in order to set the market up for the better start

within 2020. But with the arrival of COVID-19 along send the UK into lockdown which means

the buyers could not visit the houses and does not take significant step in order to move and shift

(House prices see the largest drop since 2009 reveals Nationwide, 2020). Along with this the

domestic economy also hit hard on the profitability of the real estate with the impact of COVID-

19 on UK that leads to decrease the prices of houses. Along with this within a month the house

prices face the biggest monthly drop since 2009 which describe the nationwide house price index

revealed and fell by around 1.7%. The housing market activity slowly and sharply result the

measures that is implemented in order to control the spread of virus (Esposito, Tse and Soufani,

2017).

Along with this the centre of economics and the investigators predict that the housing prices

will fall by around 13% at the end of the year because of the pandemic. They also revealed that

the impact will vary across the country depend on the regions and the manpower was also Hit

hard because of the impact of corona virus. They also predict that the housing prices in

Yorkshire and Northern Ireland will falls the hardest and the reason behind is that the main

industries considering the manufacturing construction retail and Hospitality have been hit the

hardest (How badly will coronavirus hit UK house prices in 2020?, 2020). In terms of this the

government offer the huge package in order to support the lack of demand and because of the

pandemic many workers lose their job and lot of them will face cut in the incomes. Apart from

this it is very early to suitable assess the potential long term impact on the current lockdown that

has on the UK housing market which can become the significant uncertainty at the present time

and also take lot of restrictions body housing business. In terms of this the housing and sales

agents suffered a lot as the lockdown impact the prices and leads to reduce the sales numbers

(Ho, 2017).

Despite from this, the pandemic triggers innovation and because of this government develop

suitable policies impeding the development of houses that release the green belt land around and

also reform the text system considering the permission of local authorities regarding the

development. In addition to this it is analysed that the impact on house prices and rate of the

historic epidemics within the Paris and Amsterdam found quite relative for the short life and

The prices of housing industry within UK had started to recover from the uncertainty that is

caused by brexit and also get victory in December in order to set the market up for the better start

within 2020. But with the arrival of COVID-19 along send the UK into lockdown which means

the buyers could not visit the houses and does not take significant step in order to move and shift

(House prices see the largest drop since 2009 reveals Nationwide, 2020). Along with this the

domestic economy also hit hard on the profitability of the real estate with the impact of COVID-

19 on UK that leads to decrease the prices of houses. Along with this within a month the house

prices face the biggest monthly drop since 2009 which describe the nationwide house price index

revealed and fell by around 1.7%. The housing market activity slowly and sharply result the

measures that is implemented in order to control the spread of virus (Esposito, Tse and Soufani,

2017).

Along with this the centre of economics and the investigators predict that the housing prices

will fall by around 13% at the end of the year because of the pandemic. They also revealed that

the impact will vary across the country depend on the regions and the manpower was also Hit

hard because of the impact of corona virus. They also predict that the housing prices in

Yorkshire and Northern Ireland will falls the hardest and the reason behind is that the main

industries considering the manufacturing construction retail and Hospitality have been hit the

hardest (How badly will coronavirus hit UK house prices in 2020?, 2020). In terms of this the

government offer the huge package in order to support the lack of demand and because of the

pandemic many workers lose their job and lot of them will face cut in the incomes. Apart from

this it is very early to suitable assess the potential long term impact on the current lockdown that

has on the UK housing market which can become the significant uncertainty at the present time

and also take lot of restrictions body housing business. In terms of this the housing and sales

agents suffered a lot as the lockdown impact the prices and leads to reduce the sales numbers

(Ho, 2017).

Despite from this, the pandemic triggers innovation and because of this government develop

suitable policies impeding the development of houses that release the green belt land around and

also reform the text system considering the permission of local authorities regarding the

development. In addition to this it is analysed that the impact on house prices and rate of the

historic epidemics within the Paris and Amsterdam found quite relative for the short life and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

localised people that leads to reduce the house prices and rent. Despite from this lifting lockdown

restrictions give the kick-start to the market and property industry by considering the various

ways to stimulate the activity (Bonnet and et. al., 2016). The Government of UK extend the help

to purchase the scheme that provide the Government support to the people in order to purchase

and built their new properties. Therefore, general support regarding the development of housing

and industry need to make sure the supply of fresh housing stock.

Conclusion

With the help of above mentioned report, it can easily be said that economic crisis along

with the Hike among interest rates of banks and policies and procedures of government has

impacted housing market in both positive and negative manner. It has also summarised that, The

immediate arrangement of social lodging is just a single manner by which governments

endeavour to upgrade housing industry for low-pay family units. Numerous nations additionally

have some type of means-tried remittances for rental convenience. The plan, take-up also,

liberality of rental recompenses shift generally across nations. They seem, by all accounts, to be

generally noteworthy in Ireland, the United Kingdom and some Nordic nations as far as the

worth and inclusion of appropriations.

restrictions give the kick-start to the market and property industry by considering the various

ways to stimulate the activity (Bonnet and et. al., 2016). The Government of UK extend the help

to purchase the scheme that provide the Government support to the people in order to purchase

and built their new properties. Therefore, general support regarding the development of housing

and industry need to make sure the supply of fresh housing stock.

Conclusion

With the help of above mentioned report, it can easily be said that economic crisis along

with the Hike among interest rates of banks and policies and procedures of government has

impacted housing market in both positive and negative manner. It has also summarised that, The

immediate arrangement of social lodging is just a single manner by which governments

endeavour to upgrade housing industry for low-pay family units. Numerous nations additionally

have some type of means-tried remittances for rental convenience. The plan, take-up also,

liberality of rental recompenses shift generally across nations. They seem, by all accounts, to be

generally noteworthy in Ireland, the United Kingdom and some Nordic nations as far as the

worth and inclusion of appropriations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Al-Shemmeri, T. and Naylor, L., 2017. Energy saving in UK FE colleges: The relative

importance of the socio-economic groups and environmental attitudes of

employees. Renewable and Sustainable Energy Reviews. 68. pp.1130-1143.

Baptista, R and et. al., 2016. Macroprudential policy in an agent-based model of the UK housing

market.

Bonnet, F and et. al., 2016. Better residential than ethnic discrimination! Reconciling audit and

interview findings in the Parisian housing market. Urban Studies. 53(13). pp.2815-2833.

Cook, S. and Watson, D., 2016. A new perspective on the ripple effect in the UK housing

market: Comovement, cyclical subsamples and alternative indices. Urban

Studies. 53(14). pp.3048-3062.

Esposito, M., Tse, T. and Soufani, K., 2017. Is the circular economy a new fast‐expanding

market?. Thunderbird International Business Review. 59(1). pp.9-14.

Gurran, N. and Bramley, G., 2017. Urban Planning and the Housing Market. Palgrave

Macmillan: London, UK.

Hamilton, L. and Webster, P., 2018. The international business environment. Oxford University

Press.

Ho, S., 2017. Can Money Illusion Effect Explain Hong Kong Housing Market?.

Hulse, K. and Yates, J., 2017. A private rental sector paradox: unpacking the effects of urban

restructuring on housing market dynamics. Housing studies. 32(3). pp.253-270.

Kobayashi, M., 2016. The housing market and housing policies in Japan.

Murdoch, J. and Abram, S., 2017. Rationalities of planning: development versus environment in

planning for housing. Taylor & Francis.

Orford, S., 2017. Valuing the built environment: GIS and house price analysis. Routledge.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing

market in Greece: A VECM approach. International Economics and Economic

Policy. 13(3). pp.387-409.

Samad, D and et. al., 2016. Malaysian affordability housing policies revisited. In MATEC Web of

Conferences (Vol. 66, p. 00010). EDP Sciences.

Wijburg, G. and Aalbers, M.B., 2017. The alternative financialization of the German housing

market. Housing Studies. 32(7). pp.968-989.

Online

House prices see the largest drop since 2009 reveals Nationwide. 2020. [Online] Available

through <https://www.idealhome.co.uk/news/coronavirus-impact-on-the-housing-market-

244791>./

How badly will coronavirus hit UK house prices in 2020?. 2020. [Online] Available through

<https://www.cityam.com/how-badly-will-coronavirus-hit-uk-house-prices-in-2020/>./

Books and Journals

Al-Shemmeri, T. and Naylor, L., 2017. Energy saving in UK FE colleges: The relative

importance of the socio-economic groups and environmental attitudes of

employees. Renewable and Sustainable Energy Reviews. 68. pp.1130-1143.

Baptista, R and et. al., 2016. Macroprudential policy in an agent-based model of the UK housing

market.

Bonnet, F and et. al., 2016. Better residential than ethnic discrimination! Reconciling audit and

interview findings in the Parisian housing market. Urban Studies. 53(13). pp.2815-2833.

Cook, S. and Watson, D., 2016. A new perspective on the ripple effect in the UK housing

market: Comovement, cyclical subsamples and alternative indices. Urban

Studies. 53(14). pp.3048-3062.

Esposito, M., Tse, T. and Soufani, K., 2017. Is the circular economy a new fast‐expanding

market?. Thunderbird International Business Review. 59(1). pp.9-14.

Gurran, N. and Bramley, G., 2017. Urban Planning and the Housing Market. Palgrave

Macmillan: London, UK.

Hamilton, L. and Webster, P., 2018. The international business environment. Oxford University

Press.

Ho, S., 2017. Can Money Illusion Effect Explain Hong Kong Housing Market?.

Hulse, K. and Yates, J., 2017. A private rental sector paradox: unpacking the effects of urban

restructuring on housing market dynamics. Housing studies. 32(3). pp.253-270.

Kobayashi, M., 2016. The housing market and housing policies in Japan.

Murdoch, J. and Abram, S., 2017. Rationalities of planning: development versus environment in

planning for housing. Taylor & Francis.

Orford, S., 2017. Valuing the built environment: GIS and house price analysis. Routledge.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing

market in Greece: A VECM approach. International Economics and Economic

Policy. 13(3). pp.387-409.

Samad, D and et. al., 2016. Malaysian affordability housing policies revisited. In MATEC Web of

Conferences (Vol. 66, p. 00010). EDP Sciences.

Wijburg, G. and Aalbers, M.B., 2017. The alternative financialization of the German housing

market. Housing Studies. 32(7). pp.968-989.

Online

House prices see the largest drop since 2009 reveals Nationwide. 2020. [Online] Available

through <https://www.idealhome.co.uk/news/coronavirus-impact-on-the-housing-market-

244791>./

How badly will coronavirus hit UK house prices in 2020?. 2020. [Online] Available through

<https://www.cityam.com/how-badly-will-coronavirus-hit-uk-house-prices-in-2020/>./

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.