Impact of Economic Factors on UK Housing Market (2010-2020)

VerifiedAdded on 2023/01/10

|11

|3781

|35

Report

AI Summary

This report provides a comprehensive analysis of the UK housing market, focusing on trends from 2010 to 2020. It examines the significant changes in average property prices over the decade, highlighting the rapid growth observed. The report delves into the economic determinants influencing the housing market, including disposable income, unemployment rates, interest rates, consumer confidence, and mortgage availability, and how these factors have both positively and negatively impacted housing prices. Furthermore, it explores the role of government actions, such as tax policies and price controls, in shaping the market. The impact of the COVID-19 pandemic on the UK housing market is also assessed. The report concludes by summarizing key findings and providing insights into the complex interplay of economic, governmental, and global events that have influenced the UK housing market.

Contemporary Business

Environment

Table of Contents

INTRODUCTION.................................................................................................................................3

Environment

Table of Contents

INTRODUCTION.................................................................................................................................3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MAIN BODY........................................................................................................................................3

1. Change in average prices of housing property changed in a decade..........................................3

2. Economic determinants of the changes in the Housing market......................................................4

3.Government actions affected the housing prices.............................................................................6

4. Impact of COVID-19 on UK housing market................................................................................8

CONCLUSION.....................................................................................................................................9

REFERENCES....................................................................................................................................11

INTRODUCTION

Business environment is defined as analysing different factors influence the business

of organisation. Business environment is a sum of different internal and external factor

affecting business of organisation. This report will emphasis over how the average prices of

1. Change in average prices of housing property changed in a decade..........................................3

2. Economic determinants of the changes in the Housing market......................................................4

3.Government actions affected the housing prices.............................................................................6

4. Impact of COVID-19 on UK housing market................................................................................8

CONCLUSION.....................................................................................................................................9

REFERENCES....................................................................................................................................11

INTRODUCTION

Business environment is defined as analysing different factors influence the business

of organisation. Business environment is a sum of different internal and external factor

affecting business of organisation. This report will emphasis over how the average prices of

housing market in United Kingdom has changed over the past one decade. How the economic

determinants has impacted over the housing prices in United Kingdom. This report will

further emphasis over the impacts government actions have created over the housing prices in

United Kingdom. Furthermore, report will project the key impacts COVID 19 crisis created

over the housing prices in United Kingdom.

MAIN BODY

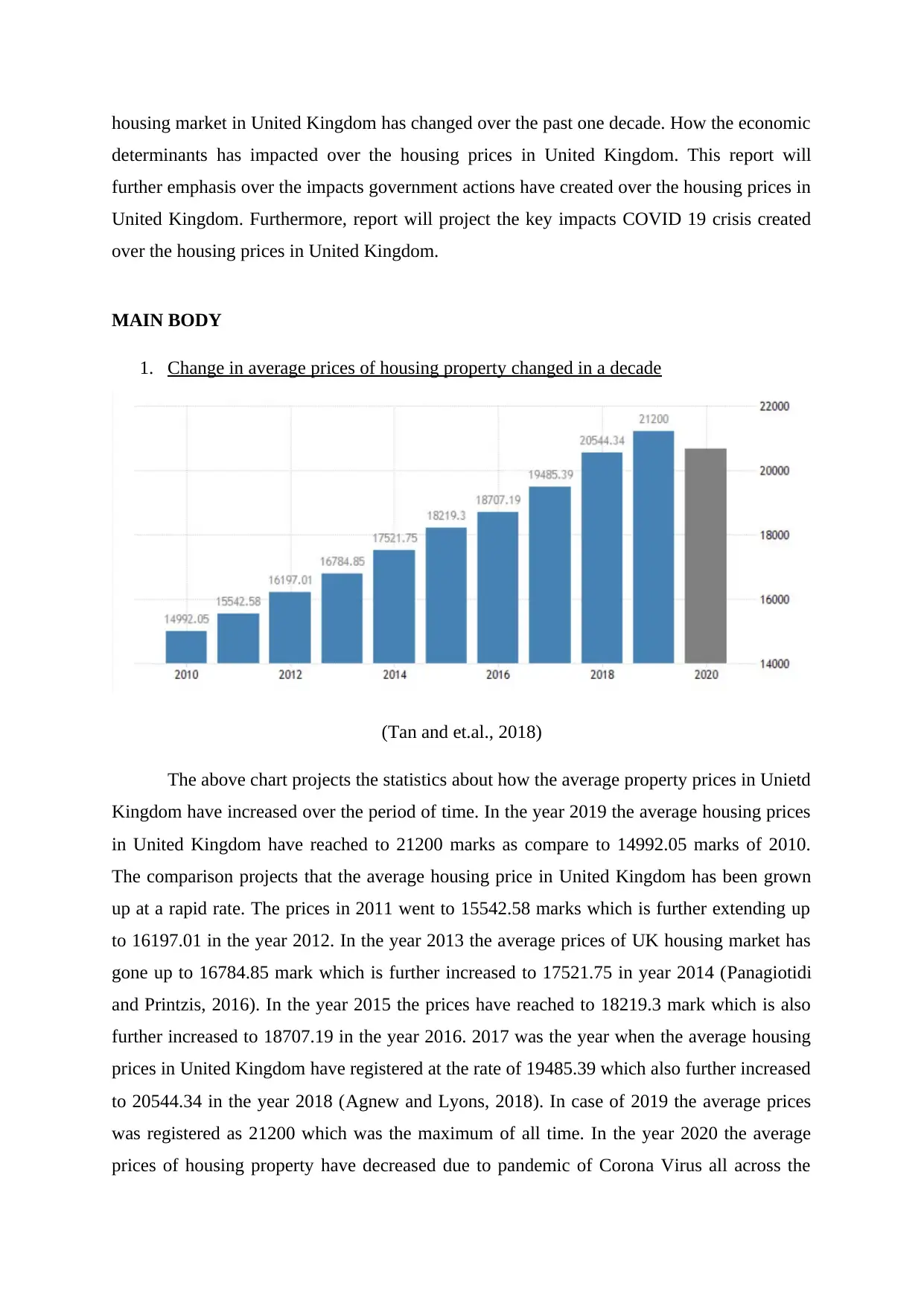

1. Change in average prices of housing property changed in a decade

(Tan and et.al., 2018)

The above chart projects the statistics about how the average property prices in Unietd

Kingdom have increased over the period of time. In the year 2019 the average housing prices

in United Kingdom have reached to 21200 marks as compare to 14992.05 marks of 2010.

The comparison projects that the average housing price in United Kingdom has been grown

up at a rapid rate. The prices in 2011 went to 15542.58 marks which is further extending up

to 16197.01 in the year 2012. In the year 2013 the average prices of UK housing market has

gone up to 16784.85 mark which is further increased to 17521.75 in year 2014 (Panagiotidi

and Printzis, 2016). In the year 2015 the prices have reached to 18219.3 mark which is also

further increased to 18707.19 in the year 2016. 2017 was the year when the average housing

prices in United Kingdom have registered at the rate of 19485.39 which also further increased

to 20544.34 in the year 2018 (Agnew and Lyons, 2018). In case of 2019 the average prices

was registered as 21200 which was the maximum of all time. In the year 2020 the average

prices of housing property have decreased due to pandemic of Corona Virus all across the

determinants has impacted over the housing prices in United Kingdom. This report will

further emphasis over the impacts government actions have created over the housing prices in

United Kingdom. Furthermore, report will project the key impacts COVID 19 crisis created

over the housing prices in United Kingdom.

MAIN BODY

1. Change in average prices of housing property changed in a decade

(Tan and et.al., 2018)

The above chart projects the statistics about how the average property prices in Unietd

Kingdom have increased over the period of time. In the year 2019 the average housing prices

in United Kingdom have reached to 21200 marks as compare to 14992.05 marks of 2010.

The comparison projects that the average housing price in United Kingdom has been grown

up at a rapid rate. The prices in 2011 went to 15542.58 marks which is further extending up

to 16197.01 in the year 2012. In the year 2013 the average prices of UK housing market has

gone up to 16784.85 mark which is further increased to 17521.75 in year 2014 (Panagiotidi

and Printzis, 2016). In the year 2015 the prices have reached to 18219.3 mark which is also

further increased to 18707.19 in the year 2016. 2017 was the year when the average housing

prices in United Kingdom have registered at the rate of 19485.39 which also further increased

to 20544.34 in the year 2018 (Agnew and Lyons, 2018). In case of 2019 the average prices

was registered as 21200 which was the maximum of all time. In the year 2020 the average

prices of housing property have decreased due to pandemic of Corona Virus all across the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

globe which has created a sudden down fall in the entire market. It can be projected that

except from 2020 the prices of the housing have always seen an increasing trend in United

Kingdom due to many reasons but the demands of the property becomes one of the major

reason behind the constant increment in property prices. Several other reasons as well

inflation that has contently increased the prices of all the properties. Other than that many

other reasons have also noticed like income of peoples in United Kingdom has also increased.

People started earning more which allows them to invest in the hosing property as it is

denoted as the safest technique to invest in long run. Increase in income is one of the major

reasons behind increasing demands in housing properties over United Kingdom real estate

market. All peoples all around the globe lies to invest in the properties as it do not contain

any losses rather in majority of case the investor wounded get a potential return against the

investment he or she has done in the property. The comparison between the prices is totally

denoting the facts that prices are hiking constantly on a very good rate.

2. Economic determinants of the changes in the Housing market

Economic determinants are those factors that measure socioeconomical positioning of

family, neighbourhood financial conditions and societal and cultural factors that promotes

health. It is important to understand for the business because it supports to analyse profit ratio

of business as well as sustainability rate. Economical determinants are disposable income of

people, interest rate, unemployment rate, construction cost, credit and supply of money that

directly impacts on housing market of UK positively and negatively. (Antonakakis and

Floros, 2016) These economic determinants lead vast change in business profitability from

2009 to 2019. In this mean while time, there are various determinants like disposable income,

credit and supply of money etc. increases that improves pricing of housing market. while

other factors like high cost of construction, high unemployment rate etc. brings huge loss in

prices of housing market in the UK. However, housing market influence by the state of the

economy, disposable income, interest rate and flexibility in population size. Economical

determinants impact on housing market is described below:

Economic growth: It is a major economic determinant whereas housing demands are

basically dependent upon disposable income of population (Wang and et.al., 2018). With

high economic growth and improvement in disposable incomes, people enable to invest more

on houses, it denotes that it will improves demand of the houses and declines bargaining

power of people for the house price. Demand of the hoses is properly dependent on income

elastic such as rising incomes of people improves their spending behaviour on houses. As

except from 2020 the prices of the housing have always seen an increasing trend in United

Kingdom due to many reasons but the demands of the property becomes one of the major

reason behind the constant increment in property prices. Several other reasons as well

inflation that has contently increased the prices of all the properties. Other than that many

other reasons have also noticed like income of peoples in United Kingdom has also increased.

People started earning more which allows them to invest in the hosing property as it is

denoted as the safest technique to invest in long run. Increase in income is one of the major

reasons behind increasing demands in housing properties over United Kingdom real estate

market. All peoples all around the globe lies to invest in the properties as it do not contain

any losses rather in majority of case the investor wounded get a potential return against the

investment he or she has done in the property. The comparison between the prices is totally

denoting the facts that prices are hiking constantly on a very good rate.

2. Economic determinants of the changes in the Housing market

Economic determinants are those factors that measure socioeconomical positioning of

family, neighbourhood financial conditions and societal and cultural factors that promotes

health. It is important to understand for the business because it supports to analyse profit ratio

of business as well as sustainability rate. Economical determinants are disposable income of

people, interest rate, unemployment rate, construction cost, credit and supply of money that

directly impacts on housing market of UK positively and negatively. (Antonakakis and

Floros, 2016) These economic determinants lead vast change in business profitability from

2009 to 2019. In this mean while time, there are various determinants like disposable income,

credit and supply of money etc. increases that improves pricing of housing market. while

other factors like high cost of construction, high unemployment rate etc. brings huge loss in

prices of housing market in the UK. However, housing market influence by the state of the

economy, disposable income, interest rate and flexibility in population size. Economical

determinants impact on housing market is described below:

Economic growth: It is a major economic determinant whereas housing demands are

basically dependent upon disposable income of population (Wang and et.al., 2018). With

high economic growth and improvement in disposable incomes, people enable to invest more

on houses, it denotes that it will improves demand of the houses and declines bargaining

power of people for the house price. Demand of the hoses is properly dependent on income

elastic such as rising incomes of people improves their spending behaviour on houses. As

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

same concept implement in recession period, falling in disposable income reduces capacity of

spending on houses or they cannot afford to buy luxuries when they loss their job or may fail

to pay their mortgage payments.

Unemployment: It is second economical determinants that also impacts on market housing in

UK. Economical growth in the country is the main reason of unemployment. For example

unemployment rate was increased in 2009 due to fewer opportunity of jobs that causes fewer

people was enabled to afford houses while others are fear of unemployment demotivates

them to enter the property market (Panagiotidis and Printzis, 2016). By and by organization’s

economic growth was increasing due to improves availability of job opportunity that has

decreased unemployment ratio as resultant housing market demand again has increased in

2019. So it can be analysed that unemployment is also a effective economical determinants.

Interest rate: Interest rate is also another economical determinate that is directly

impact the price of monthly mortgage or loan payments. For example when interest rate is

high then automatically increases mortgage payments which cause demand of the house

buying in people will be decreased. Generally high interest rate improves renting price and

makes it more attractive rather than buying. Interest rate gives huge effect if homeowners

have larger and various mortgage payments. For example, in 2011 to 2012, sudden how rise

in interest rate that led huge loss in UK house prices. The reason behind was that most of the

homeowners could not capable to afford the rise in interest rates. But in 2013, UK’s

government took initiative by reducing interest rate that again improves homeowners buying

behaviour that rises UK’s house prices.

Consumer confidence: Confidence is also considered in economic determinants

because it is essential to identify either that people wants to take risk to take out loan

payments. Expectation is important towards the housing market because if people fear to

think that house prices can fall then they will avoid to buy houses (Rubaszek and Rubio,

2019). When people are fully filled with expectation then they like to buy large number of

houses to keep positive thinking that prices of house will not fall. Such confidence improves

spending behaviour of people and improves selling behaviour of housing market in the UK.

UK’s people are more confidante as compared other countries and they prefer to take large

number of houses without concerning about economical crisis. Thus, consumer confidence

also gives huge contribution in housing market. For ex

spending on houses or they cannot afford to buy luxuries when they loss their job or may fail

to pay their mortgage payments.

Unemployment: It is second economical determinants that also impacts on market housing in

UK. Economical growth in the country is the main reason of unemployment. For example

unemployment rate was increased in 2009 due to fewer opportunity of jobs that causes fewer

people was enabled to afford houses while others are fear of unemployment demotivates

them to enter the property market (Panagiotidis and Printzis, 2016). By and by organization’s

economic growth was increasing due to improves availability of job opportunity that has

decreased unemployment ratio as resultant housing market demand again has increased in

2019. So it can be analysed that unemployment is also a effective economical determinants.

Interest rate: Interest rate is also another economical determinate that is directly

impact the price of monthly mortgage or loan payments. For example when interest rate is

high then automatically increases mortgage payments which cause demand of the house

buying in people will be decreased. Generally high interest rate improves renting price and

makes it more attractive rather than buying. Interest rate gives huge effect if homeowners

have larger and various mortgage payments. For example, in 2011 to 2012, sudden how rise

in interest rate that led huge loss in UK house prices. The reason behind was that most of the

homeowners could not capable to afford the rise in interest rates. But in 2013, UK’s

government took initiative by reducing interest rate that again improves homeowners buying

behaviour that rises UK’s house prices.

Consumer confidence: Confidence is also considered in economic determinants

because it is essential to identify either that people wants to take risk to take out loan

payments. Expectation is important towards the housing market because if people fear to

think that house prices can fall then they will avoid to buy houses (Rubaszek and Rubio,

2019). When people are fully filled with expectation then they like to buy large number of

houses to keep positive thinking that prices of house will not fall. Such confidence improves

spending behaviour of people and improves selling behaviour of housing market in the UK.

UK’s people are more confidante as compared other countries and they prefer to take large

number of houses without concerning about economical crisis. Thus, consumer confidence

also gives huge contribution in housing market. For ex

Mortgage availability: The year of 2009 to 2014 are known as boom years for the

UK’s housing market because in this period most of the banks were very keen to lend loans

to the people. Many banks encourage people to borrow large capital in multiple time or five-

time income from their actual income. In addition, banks provide loan at low deposits i.e.

hundred percent loans. Thus, high availability of mortgages in numerous banks influenced

demands of houses as large number of people was enabled to buy hike price houses. While

other banks were offered credit crunch services that raised funds for lending on the money

markets. it has tightened lending criteria and requires large deposit for purchasing houses.

Due to lending funds in the money market has reduced mortgages availability in the business

market which directly lead huge fall in demands of houses. From past few years like 2016 to

2019, many banks set different platforms of mortgages so that people can borrow money as

per their needs without concerning about interest rates. It denotes that availability of

mortgagees impacts on housing market price. In 2019 UK’s government has decreased 0.5%

interest rate that led lower mortgage payments that also influence demands of houses in

housing market (Sunde and Muzindutsi, 2017).

Brexit is also another reason that lead extensive fall in housing market. for example,

due to Brexit interferences decreases demand of houses in people because Brexit leads

change in policies and currency exchange rates etc. that causes most of the small-scale

business have to face huge economical loss and they requires large investment to sustain in

the business market. But due to high mortgage payments small business owners has lost their

business which improves unemployment rate in UK. It discourages people spending

capabilities on houses. Due to uncertainty in currency and political policies has influenced

prices of housing market is about £215,925 as result fall in demand in people.

3.Government actions affected the housing prices

Government in United Kingdom has been very active to control the housing prices in

United Kingdom. It becomes important from government’s point of view to control the

property prices in United Kingdom to sustain it affordable for the peoples in United

Kingdom.

Taxes and subsidiaries: Government in United Kingdom has provided deduction in taxation

over the purchase of housing property in United Kingdom. This has created positive impacts

over the housing market of United Kingdom. The benefits in taxation have improved the

UK’s housing market because in this period most of the banks were very keen to lend loans

to the people. Many banks encourage people to borrow large capital in multiple time or five-

time income from their actual income. In addition, banks provide loan at low deposits i.e.

hundred percent loans. Thus, high availability of mortgages in numerous banks influenced

demands of houses as large number of people was enabled to buy hike price houses. While

other banks were offered credit crunch services that raised funds for lending on the money

markets. it has tightened lending criteria and requires large deposit for purchasing houses.

Due to lending funds in the money market has reduced mortgages availability in the business

market which directly lead huge fall in demands of houses. From past few years like 2016 to

2019, many banks set different platforms of mortgages so that people can borrow money as

per their needs without concerning about interest rates. It denotes that availability of

mortgagees impacts on housing market price. In 2019 UK’s government has decreased 0.5%

interest rate that led lower mortgage payments that also influence demands of houses in

housing market (Sunde and Muzindutsi, 2017).

Brexit is also another reason that lead extensive fall in housing market. for example,

due to Brexit interferences decreases demand of houses in people because Brexit leads

change in policies and currency exchange rates etc. that causes most of the small-scale

business have to face huge economical loss and they requires large investment to sustain in

the business market. But due to high mortgage payments small business owners has lost their

business which improves unemployment rate in UK. It discourages people spending

capabilities on houses. Due to uncertainty in currency and political policies has influenced

prices of housing market is about £215,925 as result fall in demand in people.

3.Government actions affected the housing prices

Government in United Kingdom has been very active to control the housing prices in

United Kingdom. It becomes important from government’s point of view to control the

property prices in United Kingdom to sustain it affordable for the peoples in United

Kingdom.

Taxes and subsidiaries: Government in United Kingdom has provided deduction in taxation

over the purchase of housing property in United Kingdom. This has created positive impacts

over the housing market of United Kingdom. The benefits in taxation have improved the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

decision making of peoples planning to buy a housing property in United Kingdom. With the

support of section 24 the tax benefits granted to buyer is provided extra benefits to the buyer

over the purchase of property. It has also played a role in sustaining the property prices in a

limit. Tax deduction is great benefits to the peoples whose income covers under the taxable

income limit as per the income tax law of United Kingdom (Meen, Mihailov and Wang,

2016). Government has also provided subsidiary to all the buyers planning top buy a housing

property in United Kingdom. This is also a key benefit buyers of the housing property are

gaining by buying the property in United Kingdom. These both benefits have impacted over

the investment decisions of peoples as well in property. Now due to subsidiary and tax

benefits peoples like to invest in the housing property in United Kingdom as it has made the

positive impact over the property prices. Due to both the benefits prices of property did not

increased at a aggressive rate so as increased in other part of world.

Maximum and minimum prices: Government in United Kingdom has set the maximum and

minimum prices for housing property. This is the prices which denote the prices of the

property can e be exceeded to a certain limit or can’t be restricted into a certain limit. Seller

of the housing property carries the right to get the minimum price against the housing

property he is aiming to sale. The maximum and minimum prices will differ based on the

location of property. Every location in United Kingdom carries the minimum as well as

maximum price that can be charged by the owner of the property. These prices are changes

every year by year (Tao, 2019). Government played a major role in controlling the prices of

property in United Kingdom with the support of this policy. This rule has allowed them to

take control over the prices of housing property in United Kingdom. It becomes essential for

the government to keep the prices under control so that even the normal human being can

afford the property in United Kingdom. Government considered the fact that home and

shelter is among the basic needs of human being. It becomes essential to control the property

price for better control the standard of living of people in society.

Regulating the market: Government in United Kingdom has regulated the property market

on a continuous basis. Regular modifications have been done by government in property act

of United Kingdom that has supported government to keep the housing property prices under

control. With the support of necessary changes in the property act of United Kingdom

government could make a effective modification to control the property prices. In recent

times government has implemented the maximum and minimum prices for properties in

United Kingdom. This is also an important modification government has done to control the

support of section 24 the tax benefits granted to buyer is provided extra benefits to the buyer

over the purchase of property. It has also played a role in sustaining the property prices in a

limit. Tax deduction is great benefits to the peoples whose income covers under the taxable

income limit as per the income tax law of United Kingdom (Meen, Mihailov and Wang,

2016). Government has also provided subsidiary to all the buyers planning top buy a housing

property in United Kingdom. This is also a key benefit buyers of the housing property are

gaining by buying the property in United Kingdom. These both benefits have impacted over

the investment decisions of peoples as well in property. Now due to subsidiary and tax

benefits peoples like to invest in the housing property in United Kingdom as it has made the

positive impact over the property prices. Due to both the benefits prices of property did not

increased at a aggressive rate so as increased in other part of world.

Maximum and minimum prices: Government in United Kingdom has set the maximum and

minimum prices for housing property. This is the prices which denote the prices of the

property can e be exceeded to a certain limit or can’t be restricted into a certain limit. Seller

of the housing property carries the right to get the minimum price against the housing

property he is aiming to sale. The maximum and minimum prices will differ based on the

location of property. Every location in United Kingdom carries the minimum as well as

maximum price that can be charged by the owner of the property. These prices are changes

every year by year (Tao, 2019). Government played a major role in controlling the prices of

property in United Kingdom with the support of this policy. This rule has allowed them to

take control over the prices of housing property in United Kingdom. It becomes essential for

the government to keep the prices under control so that even the normal human being can

afford the property in United Kingdom. Government considered the fact that home and

shelter is among the basic needs of human being. It becomes essential to control the property

price for better control the standard of living of people in society.

Regulating the market: Government in United Kingdom has regulated the property market

on a continuous basis. Regular modifications have been done by government in property act

of United Kingdom that has supported government to keep the housing property prices under

control. With the support of necessary changes in the property act of United Kingdom

government could make a effective modification to control the property prices. In recent

times government has implemented the maximum and minimum prices for properties in

United Kingdom. This is also an important modification government has done to control the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

property prices in United Kingdom (Kuang and Wang, 2018). With the support of this

modification government has supported the normal peoples of United Kingdom to buy

properties in United Kingdom. These regulations have created positive impacts over the

property prices hike in United Kingdom. Regulations are all about controlling the property

market of United Kingdom. All such regulation like tax deduction and subsidiaries has

allowed government to control the property prices in United Kingdom real estate market.

State ownership: As per the regulations of United Kingdom the property comes under the

state ownership in the United Kingdom. The property located in the state will be the owner of

the state. The ownership of property is transferred as the regulation issued by state in United

Kingdom (Dewilde and Ronald, 2017). In case of any specific taxation have been imposed

over the property sale from the side of state that will also be applicable on the property due to

state ownership of property. This is also a key concepts implemented over the real estate

market of United Kingdom.

All the above regulations and government actions has controlled the price increment

over the real estate market of United Kingdom. Government do believe that house is among

the basic need and requirements of the human being. It becomes essential for the humans to

have a safe house as it covers the basic need of human being. Government opposed all these

regulation to support the affordable pricing concepts for the real estate market of United

Kingdom. Over the period of time prices of property has increased in United Kingdom but

the per capita income of people in United Kingdom have increased more than the price hike

in United Kingdom over the housing property.

4. Impact of COVID-19 on UK housing market

There is a great impact on the housing in UK market which is that the people do not

want to shift out. There is a great risk for the housing industry in the country because the

customers do not want to come in contact with anyone. To make this industry start in the

market again is going to take a lot of time because the customers have to know there rights

and it is in their own hands to be sure of their security. There is no business which is taking

place in the country which is a great risk for the growth and there are a lot of employees

which are left from the industry as well. There are a lot of customers who have already

purchased the houses are not being able to give the rents or loans they have taken because

there is an imbalance in the economic stability of the people as well. There are a lot of

changes which have come in the market because of this one disease. There are a lot of

modification government has supported the normal peoples of United Kingdom to buy

properties in United Kingdom. These regulations have created positive impacts over the

property prices hike in United Kingdom. Regulations are all about controlling the property

market of United Kingdom. All such regulation like tax deduction and subsidiaries has

allowed government to control the property prices in United Kingdom real estate market.

State ownership: As per the regulations of United Kingdom the property comes under the

state ownership in the United Kingdom. The property located in the state will be the owner of

the state. The ownership of property is transferred as the regulation issued by state in United

Kingdom (Dewilde and Ronald, 2017). In case of any specific taxation have been imposed

over the property sale from the side of state that will also be applicable on the property due to

state ownership of property. This is also a key concepts implemented over the real estate

market of United Kingdom.

All the above regulations and government actions has controlled the price increment

over the real estate market of United Kingdom. Government do believe that house is among

the basic need and requirements of the human being. It becomes essential for the humans to

have a safe house as it covers the basic need of human being. Government opposed all these

regulation to support the affordable pricing concepts for the real estate market of United

Kingdom. Over the period of time prices of property has increased in United Kingdom but

the per capita income of people in United Kingdom have increased more than the price hike

in United Kingdom over the housing property.

4. Impact of COVID-19 on UK housing market

There is a great impact on the housing in UK market which is that the people do not

want to shift out. There is a great risk for the housing industry in the country because the

customers do not want to come in contact with anyone. To make this industry start in the

market again is going to take a lot of time because the customers have to know there rights

and it is in their own hands to be sure of their security. There is no business which is taking

place in the country which is a great risk for the growth and there are a lot of employees

which are left from the industry as well. There are a lot of customers who have already

purchased the houses are not being able to give the rents or loans they have taken because

there is an imbalance in the economic stability of the people as well. There are a lot of

changes which have come in the market because of this one disease. There are a lot of

customers are not having sufficient amount to buy their groceries and there are a lot of people

who have lost their employment as well in the country which has to be maintained in the

organization.

The housing employees in the country are being given salary but there is a cut in the

salary as well because of the instable economy of the country as well. The employees do not

have to lose their jobs and they are making sure that there is a better functioning of them in

the market. The industry is planning for a long term impact on it therefore they are taking this

measure. There are a lot of protests which are taking place in the country and it is because of

the lockdown that the people are not getting enough amounts to pay the rents because they

can either survive or pay rents from it (Nikitina and Lapiņa, 2019). The media is also being

supportive of the customers because they understand them but there are a lot of employees

which are there in the organization as well which have to be paid and if they are not paid then

the organization will be forced to leave the people out of the company. The market is already

not being able to function in the country which is why there has to be a better functioning

only then there are operations. The trends in the market is shifting which is why there has to

be a better functioning and the organization will have to make sure that they are taking the

right measures and paying the employees from time to time otherwise the company till lose

on a lot of loyal customers and employees as well. It is very important for the organization to

have a change in the strategy as well so that there is a better functioning and long term

planning.

CONCLUSION

This report has projected about the different aspects related to, price hike in the

property market of United Kingdom. Over the period of time from last one decade prices of

property has reached to next level in the real estate market of United Kingdom. Government

has implemented tax deductions, subsidiaries and other regulations to control the prices hike

of property in United Kingdom. Various reasons like inflation increase in demand increase in

per capita income and so many key reasons that has supported the price hike in the property

market of United Kingdom. Government in United Kingdom has also implemented the

minimum and maximum pricing rule to control the prices of real estate properties in United

Kingdom. Due to COVID 19 the prices of real estate market have reduced as it have affected

over the demand.

who have lost their employment as well in the country which has to be maintained in the

organization.

The housing employees in the country are being given salary but there is a cut in the

salary as well because of the instable economy of the country as well. The employees do not

have to lose their jobs and they are making sure that there is a better functioning of them in

the market. The industry is planning for a long term impact on it therefore they are taking this

measure. There are a lot of protests which are taking place in the country and it is because of

the lockdown that the people are not getting enough amounts to pay the rents because they

can either survive or pay rents from it (Nikitina and Lapiņa, 2019). The media is also being

supportive of the customers because they understand them but there are a lot of employees

which are there in the organization as well which have to be paid and if they are not paid then

the organization will be forced to leave the people out of the company. The market is already

not being able to function in the country which is why there has to be a better functioning

only then there are operations. The trends in the market is shifting which is why there has to

be a better functioning and the organization will have to make sure that they are taking the

right measures and paying the employees from time to time otherwise the company till lose

on a lot of loyal customers and employees as well. It is very important for the organization to

have a change in the strategy as well so that there is a better functioning and long term

planning.

CONCLUSION

This report has projected about the different aspects related to, price hike in the

property market of United Kingdom. Over the period of time from last one decade prices of

property has reached to next level in the real estate market of United Kingdom. Government

has implemented tax deductions, subsidiaries and other regulations to control the prices hike

of property in United Kingdom. Various reasons like inflation increase in demand increase in

per capita income and so many key reasons that has supported the price hike in the property

market of United Kingdom. Government in United Kingdom has also implemented the

minimum and maximum pricing rule to control the prices of real estate properties in United

Kingdom. Due to COVID 19 the prices of real estate market have reduced as it have affected

over the demand.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Books and Journals

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Agnew, K. and Lyons, R. C., 2018. The impact of employment on housing prices: Detailed

evidence from FDI in Ireland. Regional Science and Urban Economics. 70. pp.174-

189.

Antonakakis, N. and Floros, C., 2016. Dynamic interdependencies among the housing

market, stock market, policy uncertainty and the macroeconomy in the United

Kingdom. International Review of Financial Analysis, 44, pp.111-122.

Dewilde, C. and Ronald, R. eds., 2017. Housing wealth and welfare. Edward Elgar

Publishing.

Kuang, W. and Wang, Q., 2018. Cultural similarities and housing market linkage: evidence

from OECD countries. Frontiers of Business Research in China. 12(1). p.10.

Meen, G., Mihailov, A. and Wang, Y., 2016. Endogenous UK Housing Cycles and the Risk

Premium: Understanding the Next Housing Crisis (No. em-dp2016-02). Henley

Business School, Reading University.

Nikitina, T. and Lapiņa, I., 2019. Creating and managing knowledge towards managerial

competence development in contemporary business environment. Knowledge Management

Research & Practice. 17(1). pp.96-107.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing

market in Greece: A VECM approach. International Economics and Economic

Policy, 13(3), pp.387-409.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing

market in Greece: A VECM approach. International Economics and Economic

Policy. 13(3). pp.387-409.

Rubaszek, M. and Rubio, M., 2019. Does the rental housing market stabilize the economy? A

micro and macro perspective. Empirical Economics, pp.1-25.

Sunde, T. and Muzindutsi, P.F., 2017. Determinants of house prices and new construction

activity: an empirical investigation of the Namibian housing market. The Journal of

Developing Areas, 51(3), pp.389-407.

Tan, C. T. and et.al., 2018. A Nonlinear ARDL Analysis on the Relation between Housing

Price and Interest Rate: The case of Malaysia. Journal of Islamic, Social, Economics

and Development. 3(14). pp.109-121.

Tao, Q., 2019. Analysis of Commodity Housing Price Based on Partial Least Squares

Regression. Academic Journal of Computing & Information Science. 2(3).

Wang, J and et.al., 2018. Is the Australian housing market in a bubble?. International Journal

of Housing Markets and Analysis.

evidence from FDI in Ireland. Regional Science and Urban Economics. 70. pp.174-

189.

Antonakakis, N. and Floros, C., 2016. Dynamic interdependencies among the housing

market, stock market, policy uncertainty and the macroeconomy in the United

Kingdom. International Review of Financial Analysis, 44, pp.111-122.

Dewilde, C. and Ronald, R. eds., 2017. Housing wealth and welfare. Edward Elgar

Publishing.

Kuang, W. and Wang, Q., 2018. Cultural similarities and housing market linkage: evidence

from OECD countries. Frontiers of Business Research in China. 12(1). p.10.

Meen, G., Mihailov, A. and Wang, Y., 2016. Endogenous UK Housing Cycles and the Risk

Premium: Understanding the Next Housing Crisis (No. em-dp2016-02). Henley

Business School, Reading University.

Nikitina, T. and Lapiņa, I., 2019. Creating and managing knowledge towards managerial

competence development in contemporary business environment. Knowledge Management

Research & Practice. 17(1). pp.96-107.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing

market in Greece: A VECM approach. International Economics and Economic

Policy, 13(3), pp.387-409.

Panagiotidis, T. and Printzis, P., 2016. On the macroeconomic determinants of the housing

market in Greece: A VECM approach. International Economics and Economic

Policy. 13(3). pp.387-409.

Rubaszek, M. and Rubio, M., 2019. Does the rental housing market stabilize the economy? A

micro and macro perspective. Empirical Economics, pp.1-25.

Sunde, T. and Muzindutsi, P.F., 2017. Determinants of house prices and new construction

activity: an empirical investigation of the Namibian housing market. The Journal of

Developing Areas, 51(3), pp.389-407.

Tan, C. T. and et.al., 2018. A Nonlinear ARDL Analysis on the Relation between Housing

Price and Interest Rate: The case of Malaysia. Journal of Islamic, Social, Economics

and Development. 3(14). pp.109-121.

Tao, Q., 2019. Analysis of Commodity Housing Price Based on Partial Least Squares

Regression. Academic Journal of Computing & Information Science. 2(3).

Wang, J and et.al., 2018. Is the Australian housing market in a bubble?. International Journal

of Housing Markets and Analysis.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.