To What Extent Does UK Inward Investment Affected by Brexit?

VerifiedAdded on 2023/04/11

|18

|4076

|169

Project

AI Summary

This research proposal investigates the extent to which the UK's inward investment will be affected in response to Brexit. It begins with an introduction and background, emphasizing the importance of inward investment (primarily Foreign Direct Investment, or FDI) for economic growth, employment, and GDP, and highlights the potential impacts of Brexit. The rationale of the study underscores the significance of understanding Brexit's effects on FDI, examining how political, economic, and legal factors influence investment. The proposal outlines the research aim and objectives, including understanding inward investment concepts, assessing factors, and evaluating Brexit's influence, leading to specific research questions. A comprehensive literature review explores the concept of UK inward investment, factors influencing it, and the potential impacts of Brexit, drawing on existing studies. The methodology section details the qualitative research strategy, the use of primary and secondary research, data sources, and data collection methods. The proposal also includes a timescale, conclusion, references, and appendices, including figures and tables. The study aims to provide valuable insights into the relationship between Brexit and UK inward investment, offering recommendations to stimulate investment in the post-Brexit era. The research will collect data from managers of Walmart using a purposive sampling technique.

Research Proposal

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

1.0 Title......................................................................................................................................1

2.0 Background..........................................................................................................................1

2.1 Rationale of the study.......................................................................................................1

2.2 Research aim and objectives............................................................................................1

2.3 Research questions...........................................................................................................2

3.0 Literature review..................................................................................................................2

3.1 The concept of UK inward investment and importance to the country...........................2

3.2 Assessing the factors affecting inward investment in the UK.........................................3

3.3 Critically evaluating the influence of Brexit on the inward investments in the UK........3

4.0 Methodology........................................................................................................................4

4.1 Research strategy.............................................................................................................4

4.2 Primary and secondary research.......................................................................................4

4.3 Sources of data.................................................................................................................5

4.4 Population and sampling..................................................................................................5

4.5 Data collection methods...................................................................................................6

5.0 Timescale.............................................................................................................................6

6.0 Conclusion............................................................................................................................7

7.0 References............................................................................................................................8

8.0 Appendix............................................................................................................................11

1.0 Title......................................................................................................................................1

2.0 Background..........................................................................................................................1

2.1 Rationale of the study.......................................................................................................1

2.2 Research aim and objectives............................................................................................1

2.3 Research questions...........................................................................................................2

3.0 Literature review..................................................................................................................2

3.1 The concept of UK inward investment and importance to the country...........................2

3.2 Assessing the factors affecting inward investment in the UK.........................................3

3.3 Critically evaluating the influence of Brexit on the inward investments in the UK........3

4.0 Methodology........................................................................................................................4

4.1 Research strategy.............................................................................................................4

4.2 Primary and secondary research.......................................................................................4

4.3 Sources of data.................................................................................................................5

4.4 Population and sampling..................................................................................................5

4.5 Data collection methods...................................................................................................6

5.0 Timescale.............................................................................................................................6

6.0 Conclusion............................................................................................................................7

7.0 References............................................................................................................................8

8.0 Appendix............................................................................................................................11

List of figures

Figure 1: Ratio of new jobs from FDI......................................................................................13

List of tables

Table 1: Type of study.............................................................................................................11

Table 2: Selection of type of research......................................................................................11

Table 3: Data collection methods.............................................................................................12

Table 4: External environment of UK......................................................................................14

Figure 1: Ratio of new jobs from FDI......................................................................................13

List of tables

Table 1: Type of study.............................................................................................................11

Table 2: Selection of type of research......................................................................................11

Table 3: Data collection methods.............................................................................................12

Table 4: External environment of UK......................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.0 Title

To what extent does the UK inward investment is going to be affected in response to Brexit

2.0 Background

Inward investment is associated with Foreign Direct Investments (FDI) because

international companies invest in overseas countries for exporting products and services to

expand the businesses (Šušićv, 2018). Inward speculations are essential factors for the growth

and economic development of the countries because it ensures the FDI in foreign areas

(Azam, 2009). Moreover, inward investment helps to increase the employment opportunities,

living standards of public, Gross Domestic Product (GDP), the growth of economy etc.

However, several factors such as trade openness, laws and political, the legal system, low-

cost labor affect the ratio of inward investment in positive and negative aspects because these

factors influence the investors to invest the money in the overseas market or not (Hailu, 2010;

Holmes etc., 2013). In this context, the current proposal is based on the effects of Brexit on

UK inward investment. Here, it has been identified that FDI inward investment increase or

decrease after Brexit in the UK or not.

2.1 Rationale of the study

Foreign investments are essential in the current competitive era because the MNCs

take interest in the expansion of businesses overseas. The study is based on the effects on

inward investment after application of Brexit in the UK. Brexit is a hot topic in the current

business environment because it will affect trade with the UK and EU countries. Here, the

study will identify the factors which affect the inward investments in the UK because after

Brexit the country will be going to be affected. The research is important to conduct because

it will disclose many hidden clauses regarding the Brexit and uncover the reasons which will

reduce the FDI after Brexit. Apart from this, the research will provide in-depth information

regarding the relationship between inward investment and Brexit.

2.2 Research aim and objectives

Aim

To what extent does the UK inward investment will be affected with response to Brexit. A

study on Walmart.

Objectives

1

To what extent does the UK inward investment is going to be affected in response to Brexit

2.0 Background

Inward investment is associated with Foreign Direct Investments (FDI) because

international companies invest in overseas countries for exporting products and services to

expand the businesses (Šušićv, 2018). Inward speculations are essential factors for the growth

and economic development of the countries because it ensures the FDI in foreign areas

(Azam, 2009). Moreover, inward investment helps to increase the employment opportunities,

living standards of public, Gross Domestic Product (GDP), the growth of economy etc.

However, several factors such as trade openness, laws and political, the legal system, low-

cost labor affect the ratio of inward investment in positive and negative aspects because these

factors influence the investors to invest the money in the overseas market or not (Hailu, 2010;

Holmes etc., 2013). In this context, the current proposal is based on the effects of Brexit on

UK inward investment. Here, it has been identified that FDI inward investment increase or

decrease after Brexit in the UK or not.

2.1 Rationale of the study

Foreign investments are essential in the current competitive era because the MNCs

take interest in the expansion of businesses overseas. The study is based on the effects on

inward investment after application of Brexit in the UK. Brexit is a hot topic in the current

business environment because it will affect trade with the UK and EU countries. Here, the

study will identify the factors which affect the inward investments in the UK because after

Brexit the country will be going to be affected. The research is important to conduct because

it will disclose many hidden clauses regarding the Brexit and uncover the reasons which will

reduce the FDI after Brexit. Apart from this, the research will provide in-depth information

regarding the relationship between inward investment and Brexit.

2.2 Research aim and objectives

Aim

To what extent does the UK inward investment will be affected with response to Brexit. A

study on Walmart.

Objectives

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To understand the concept of inward investment and its importance to the country

To assess the factors affecting inward investment of Walmart in the UK

To critically evaluate the influence of Brexit on the inward investments of Walmart in

the UK

To recommend the ways to stimulate inward investments in the response of Brexit

2.3 Research questions

What is the the concept of inward investment and its importance to the country?

What factors affect the inward investment of Walmart in the UK?

How Brexit influences the inward investments of Walmart in the UK?

What recommendations are suitable to stimulate inward investments in the response

of Brexit?

3.0 Literature review

3.1 The concept of UK inward investment and importance to the country

According to Holmes, Miller, Hitt and Salmador (2013), inward investment includes

the foreign or external entity that either invests or purchases the goods and services from the

local economy. Basically, Foreign Direct Investment (FDI) is known as general type of

inward investment which supports the multinational companies to invest in other countries to

expand the businesses. Similarly, Azam (2009) examined that FDI occurs at the time of one

company procure another business or establish new operations in different countries except

the existing one. In this context, Šušićv (2018) stated that inward investment is important for

the investors as well as country in which it is going to invest or establish the business

operations. Additionally, economic conditions get affected by the foreign investment because

the investment made by the outsiders generates the economic value for the country. Further,

Olney (2013, p.191) asserted that the inward investment generates the huge employment

opportunities in the foreign countries which supports to enhance the living standard of

people. Thus, it shows that inward investment takes place in the form of FDI which

contributes in creating the employment opportunities and improvement in the living standards

of the public.

3.2 Assessing the factors affecting inward investment in the UK

Few studies revealed that there are different factors such as political, economic, legal

factors which affects the inward investment in the overseas countries (Quer, Claver and

2

To assess the factors affecting inward investment of Walmart in the UK

To critically evaluate the influence of Brexit on the inward investments of Walmart in

the UK

To recommend the ways to stimulate inward investments in the response of Brexit

2.3 Research questions

What is the the concept of inward investment and its importance to the country?

What factors affect the inward investment of Walmart in the UK?

How Brexit influences the inward investments of Walmart in the UK?

What recommendations are suitable to stimulate inward investments in the response

of Brexit?

3.0 Literature review

3.1 The concept of UK inward investment and importance to the country

According to Holmes, Miller, Hitt and Salmador (2013), inward investment includes

the foreign or external entity that either invests or purchases the goods and services from the

local economy. Basically, Foreign Direct Investment (FDI) is known as general type of

inward investment which supports the multinational companies to invest in other countries to

expand the businesses. Similarly, Azam (2009) examined that FDI occurs at the time of one

company procure another business or establish new operations in different countries except

the existing one. In this context, Šušićv (2018) stated that inward investment is important for

the investors as well as country in which it is going to invest or establish the business

operations. Additionally, economic conditions get affected by the foreign investment because

the investment made by the outsiders generates the economic value for the country. Further,

Olney (2013, p.191) asserted that the inward investment generates the huge employment

opportunities in the foreign countries which supports to enhance the living standard of

people. Thus, it shows that inward investment takes place in the form of FDI which

contributes in creating the employment opportunities and improvement in the living standards

of the public.

3.2 Assessing the factors affecting inward investment in the UK

Few studies revealed that there are different factors such as political, economic, legal

factors which affects the inward investment in the overseas countries (Quer, Claver and

2

Rienda, 2012; Kurtishi-Kastrati, 2013). In this context, Solomon and Ruiz (2012) asserted

that political factors play a critical role in the inward and foreign investments because

different countries have diversified political conditions and systems. Moreover, the stable

political conditions are supportive for the inward FDI for MNEs because the political systems

remain stable in nature and do not change the policies and regulations regarding foreign

trade. Moreover, Mathur and Singh (2013, p.991) pointed out that the level of democracy and

perception towards corruption influences the FDI in developing countries. Additionally,

extensive FDI takes place in the least corrupted and democratic countries because it is highly

associated with the economic freedom which reduces the political interreferences. Apart

from this, Boateng, Hua, Nisar and Wu (2015, p.118) stated that Gross Domestic Products

(GDP) and trade openness has positive impact on the investment climates because it focuses

on the liberalization of trade regimes. However, Adhikary (2011) argued that plenty of

inward speculations takes place in spite of low level of trade openness in the country. Hence,

it shows that level of trade openness, political viability, stability and level of corruption have

positive effects on the inward investment climate because it determines the ratio of

speculation.

3.3 Critically evaluating the influence of Brexit on the inward investments in the UK

Simionescu (2016, p.2) stated that the Brexit has positive and negative impact on the

inward investments in the UK. Additionally, Brexit develops the issues related to labor

markets and reduces the employment opportunities in the countries. However, Dhingra et al.

(2016) asserted that inward investors get benefits to enter into several countries for the

establishment of new business or purchase of existing one instead of only investing into UK

because UK become a separate entity after Brexit. Apart from this, Simionescu (2017, p.1)

mentioned that number of inward projects might get reduced after Brexit in UK by 65%

because the speculators has to stick towards UK trade in spite of EU countries. Further,

Dhingra, Ottaviano, Sampson and Van Reenen (2016) delineated that FDI will fall in UK

after Brexit because the multinational organizations get a strong platform for exports as a

result of lower tariffs and non-tariffs for the exporting in compare to EU countries. Besides

this, Ebell and Warren (2016) identified that the UK will face the issues in context of labour

market after Brexit since earlier EU was offering the extensive opportunity for the businesses

to get the cost effective human resources. However, Simionescu (2016) argued that the UK

gets benefit from the foreign investors because multinational businesses prefer to invest in the

low cost labour countries to enhance the profitability; therefore, UK inwards would be

3

that political factors play a critical role in the inward and foreign investments because

different countries have diversified political conditions and systems. Moreover, the stable

political conditions are supportive for the inward FDI for MNEs because the political systems

remain stable in nature and do not change the policies and regulations regarding foreign

trade. Moreover, Mathur and Singh (2013, p.991) pointed out that the level of democracy and

perception towards corruption influences the FDI in developing countries. Additionally,

extensive FDI takes place in the least corrupted and democratic countries because it is highly

associated with the economic freedom which reduces the political interreferences. Apart

from this, Boateng, Hua, Nisar and Wu (2015, p.118) stated that Gross Domestic Products

(GDP) and trade openness has positive impact on the investment climates because it focuses

on the liberalization of trade regimes. However, Adhikary (2011) argued that plenty of

inward speculations takes place in spite of low level of trade openness in the country. Hence,

it shows that level of trade openness, political viability, stability and level of corruption have

positive effects on the inward investment climate because it determines the ratio of

speculation.

3.3 Critically evaluating the influence of Brexit on the inward investments in the UK

Simionescu (2016, p.2) stated that the Brexit has positive and negative impact on the

inward investments in the UK. Additionally, Brexit develops the issues related to labor

markets and reduces the employment opportunities in the countries. However, Dhingra et al.

(2016) asserted that inward investors get benefits to enter into several countries for the

establishment of new business or purchase of existing one instead of only investing into UK

because UK become a separate entity after Brexit. Apart from this, Simionescu (2017, p.1)

mentioned that number of inward projects might get reduced after Brexit in UK by 65%

because the speculators has to stick towards UK trade in spite of EU countries. Further,

Dhingra, Ottaviano, Sampson and Van Reenen (2016) delineated that FDI will fall in UK

after Brexit because the multinational organizations get a strong platform for exports as a

result of lower tariffs and non-tariffs for the exporting in compare to EU countries. Besides

this, Ebell and Warren (2016) identified that the UK will face the issues in context of labour

market after Brexit since earlier EU was offering the extensive opportunity for the businesses

to get the cost effective human resources. However, Simionescu (2016) argued that the UK

gets benefit from the foreign investors because multinational businesses prefer to invest in the

low cost labour countries to enhance the profitability; therefore, UK inwards would be

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

maximized after Brexit. Moreover, Welfens and Baier (2018) mentioned that the single

market program has high positive impact on the FDI inflows in the UK. Besides this,

Breinlich et al. (2016) notified that foreign ownership in the UK capital stock is likely to be

maximized after Brexit because of leaving the EU, MNEs would enter into UK with low

interest rates and receive skilled workforce in huge quantity. Thus, it indicates that Brexit

would have positive and negative both kind of effects on UK inward investments. In positive

aspects the FDI increase due to cheap and skilled workforce; however, the number of FDI

projects might be reduce due to strong trading laws in UK.

4.0 Methodology

4.1 Research strategy

By considering the importance of qualitative strategy, the current study will use the

qualitative study to grab the information regarding the impact of UK inward investments on

the responses to Brexit (refer table 1). In this context, quantitative study will not be

appropriate to analyse the different aspect of UK inward investments on Brexit because it

requires statistical operations. However, in qualitative study will use the thematic analysis on

the basis of information gathered by responses which provides the descriptive data for the

study. Furthermore, the factual information related topic under consideration is collected and

data are quantified under the quantitative study (refer table 2). Apart from this, qualitative

studies demand for the detailed information regarding the research issues and accordingly

huge information is collected. Here, the current study will be based on the qualitative study

which contributes to get the relevant data with detail perspectives. Hence, the use of

qualitative study will be justifiable for the study.

4.2 Primary and secondary research

A systematic research process is required to collect adequate data for the study to

achieve optimum outcomes (Saunders, 2011). In this context, a different approach would be

followed by the investigator to conduct the study for the achievement of objectives. Here, the

study is based on at what extent the UK inward investment will be affected by the response to

Brexit. In this manner, primary and secondary both types of research will be conducted for

the current study (refer table 3). The objective to conduct research would be mentioned

before commencing primary research. Thus, by adopting the appropriate approach primary

and secondary research will be conducted in the current study.

4

market program has high positive impact on the FDI inflows in the UK. Besides this,

Breinlich et al. (2016) notified that foreign ownership in the UK capital stock is likely to be

maximized after Brexit because of leaving the EU, MNEs would enter into UK with low

interest rates and receive skilled workforce in huge quantity. Thus, it indicates that Brexit

would have positive and negative both kind of effects on UK inward investments. In positive

aspects the FDI increase due to cheap and skilled workforce; however, the number of FDI

projects might be reduce due to strong trading laws in UK.

4.0 Methodology

4.1 Research strategy

By considering the importance of qualitative strategy, the current study will use the

qualitative study to grab the information regarding the impact of UK inward investments on

the responses to Brexit (refer table 1). In this context, quantitative study will not be

appropriate to analyse the different aspect of UK inward investments on Brexit because it

requires statistical operations. However, in qualitative study will use the thematic analysis on

the basis of information gathered by responses which provides the descriptive data for the

study. Furthermore, the factual information related topic under consideration is collected and

data are quantified under the quantitative study (refer table 2). Apart from this, qualitative

studies demand for the detailed information regarding the research issues and accordingly

huge information is collected. Here, the current study will be based on the qualitative study

which contributes to get the relevant data with detail perspectives. Hence, the use of

qualitative study will be justifiable for the study.

4.2 Primary and secondary research

A systematic research process is required to collect adequate data for the study to

achieve optimum outcomes (Saunders, 2011). In this context, a different approach would be

followed by the investigator to conduct the study for the achievement of objectives. Here, the

study is based on at what extent the UK inward investment will be affected by the response to

Brexit. In this manner, primary and secondary both types of research will be conducted for

the current study (refer table 3). The objective to conduct research would be mentioned

before commencing primary research. Thus, by adopting the appropriate approach primary

and secondary research will be conducted in the current study.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4.3 Sources of data

According to Lyon, Mšllering and Saunders (2015), there are two types of sources of

data such as primary and secondary sources which are used by investors to collect the data.

Here, primary sources include interview, observation, survey, questionnaire etc. which

provides the fresh data for the study whereas secondary sources include literature review,

annual reports, newspaper, web sources, case studies, journals etc. (Walliman, 2017). In this

context, primary sources provide the current and new information regarding the study

whereas secondary sources offer detail regarding past information as well as current data for

the achievement of purpose. Here, the current study will use both type of sources to gather

the data because the study has the requirement to use the old data as well as current

information regarding responses of Brexit on the UK inward investments. In this context,

merely primary sources will not provide the descriptive information for the study because

primary sources might be possible that do not have relevant and complete information

regarding the research problem. By considering this, both primary and secondary sources of

data will be used to meet the demand of research. In this manner, the only the use of

secondary sources for the recent study will not be justifiable because it might provide only

past data and the current information will be skipped from the researcher. Hence, the use of

both primary and secondary sources will be justifiable for the study.

4.4 Population and sampling

Population and sampling are one of the important elements to conduct the research as

it facilitates to find the evidence the collected information by referring the relevant sourrces.

In this context, the selection of right respondents is mandatory to derive the optimum results

otherwise the exact and correct data may not be gathered. Here, in the current study, data

would be collected from managers of Walmart. In this regard, the purposive sampling

technique would be applied because the study has a specific objective to identify the impact

of Brexit on the UK inwards. By considering this, 15 managers would be selected from

Walmart so as to get the information regarding the inward investment.

4.5 Data collection methods

Primary and secondary two types of data collection methods are used by the

investigator to collect the specific data related to the study (Saunders, 2011). Primary data

collection methods are used by the researchers to collect the data for the first time whereas

secondary data are already collected by several investigators for prior research. In this

context, primary data would be collected by questionnaire method and secondary data would

5

According to Lyon, Mšllering and Saunders (2015), there are two types of sources of

data such as primary and secondary sources which are used by investors to collect the data.

Here, primary sources include interview, observation, survey, questionnaire etc. which

provides the fresh data for the study whereas secondary sources include literature review,

annual reports, newspaper, web sources, case studies, journals etc. (Walliman, 2017). In this

context, primary sources provide the current and new information regarding the study

whereas secondary sources offer detail regarding past information as well as current data for

the achievement of purpose. Here, the current study will use both type of sources to gather

the data because the study has the requirement to use the old data as well as current

information regarding responses of Brexit on the UK inward investments. In this context,

merely primary sources will not provide the descriptive information for the study because

primary sources might be possible that do not have relevant and complete information

regarding the research problem. By considering this, both primary and secondary sources of

data will be used to meet the demand of research. In this manner, the only the use of

secondary sources for the recent study will not be justifiable because it might provide only

past data and the current information will be skipped from the researcher. Hence, the use of

both primary and secondary sources will be justifiable for the study.

4.4 Population and sampling

Population and sampling are one of the important elements to conduct the research as

it facilitates to find the evidence the collected information by referring the relevant sourrces.

In this context, the selection of right respondents is mandatory to derive the optimum results

otherwise the exact and correct data may not be gathered. Here, in the current study, data

would be collected from managers of Walmart. In this regard, the purposive sampling

technique would be applied because the study has a specific objective to identify the impact

of Brexit on the UK inwards. By considering this, 15 managers would be selected from

Walmart so as to get the information regarding the inward investment.

4.5 Data collection methods

Primary and secondary two types of data collection methods are used by the

investigator to collect the specific data related to the study (Saunders, 2011). Primary data

collection methods are used by the researchers to collect the data for the first time whereas

secondary data are already collected by several investigators for prior research. In this

context, primary data would be collected by questionnaire method and secondary data would

5

be gathered by using a literature review by using different sources. Here, the questionnaire

would be mailed to specific respondents to collect the primary data and available information

on web sources, books, journals would be considered to collect secondary data regarding

effects of inward investments on Brexit. Hence, the use of both data collection methods will

be justifiable.

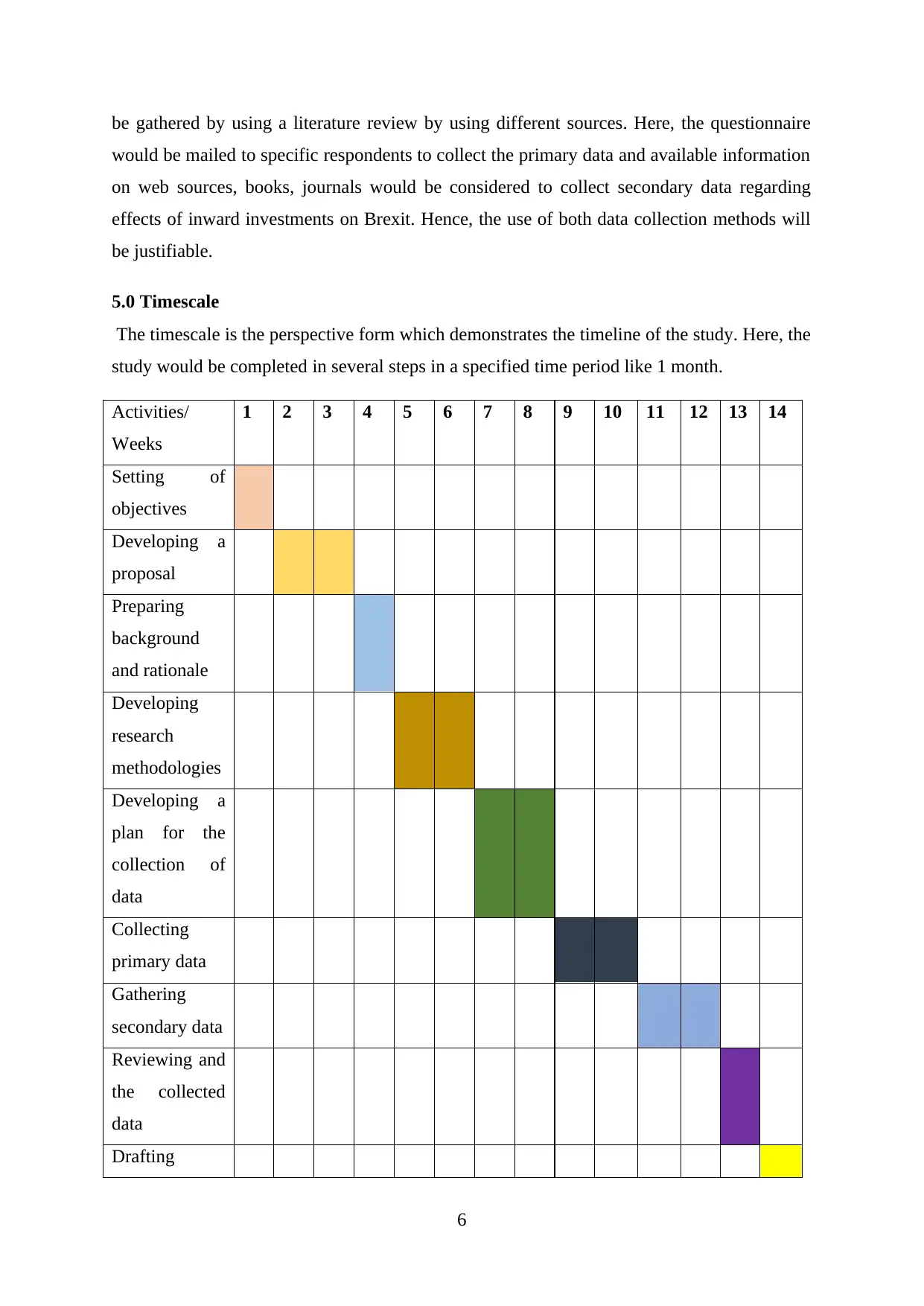

5.0 Timescale

The timescale is the perspective form which demonstrates the timeline of the study. Here, the

study would be completed in several steps in a specified time period like 1 month.

Activities/

Weeks

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Setting of

objectives

Developing a

proposal

Preparing

background

and rationale

Developing

research

methodologies

Developing a

plan for the

collection of

data

Collecting

primary data

Gathering

secondary data

Reviewing and

the collected

data

Drafting

6

would be mailed to specific respondents to collect the primary data and available information

on web sources, books, journals would be considered to collect secondary data regarding

effects of inward investments on Brexit. Hence, the use of both data collection methods will

be justifiable.

5.0 Timescale

The timescale is the perspective form which demonstrates the timeline of the study. Here, the

study would be completed in several steps in a specified time period like 1 month.

Activities/

Weeks

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Setting of

objectives

Developing a

proposal

Preparing

background

and rationale

Developing

research

methodologies

Developing a

plan for the

collection of

data

Collecting

primary data

Gathering

secondary data

Reviewing and

the collected

data

Drafting

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

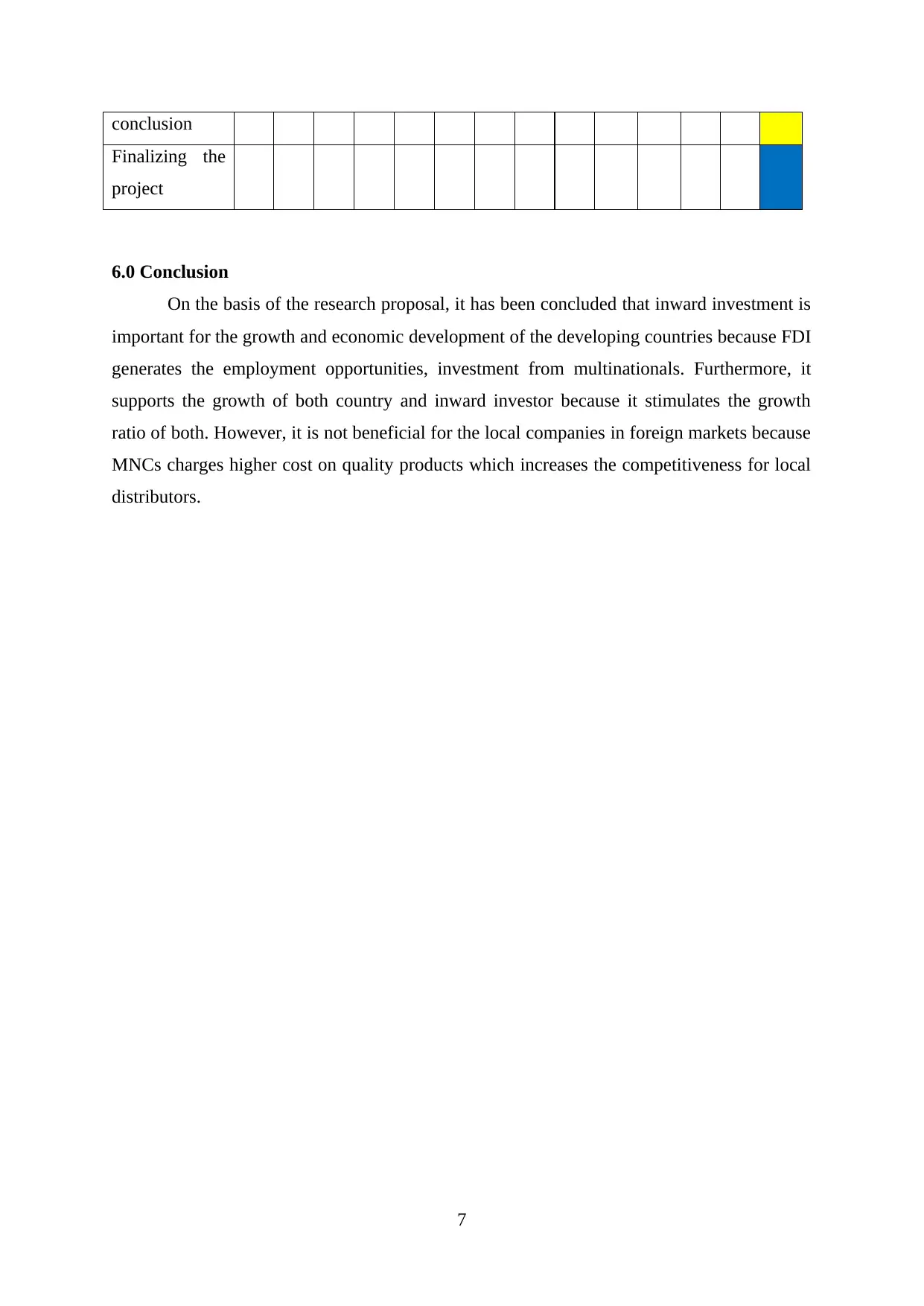

conclusion

Finalizing the

project

6.0 Conclusion

On the basis of the research proposal, it has been concluded that inward investment is

important for the growth and economic development of the developing countries because FDI

generates the employment opportunities, investment from multinationals. Furthermore, it

supports the growth of both country and inward investor because it stimulates the growth

ratio of both. However, it is not beneficial for the local companies in foreign markets because

MNCs charges higher cost on quality products which increases the competitiveness for local

distributors.

7

Finalizing the

project

6.0 Conclusion

On the basis of the research proposal, it has been concluded that inward investment is

important for the growth and economic development of the developing countries because FDI

generates the employment opportunities, investment from multinationals. Furthermore, it

supports the growth of both country and inward investor because it stimulates the growth

ratio of both. However, it is not beneficial for the local companies in foreign markets because

MNCs charges higher cost on quality products which increases the competitiveness for local

distributors.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7.0 References

Adhikary, B.K., 2011. FDI, trade openness, capital formation, and economic growth in

Bangladesh: a linkage analysis. International Journal of Business and Management, 6(1),

p.16.

Azam, M., 2009. Significance of foreign direct investment in the economic development of

Pakistan and Afghanistan. Journal of Central Asia, 64, pp.65-75.

Banco Santander, S.A., 2019. United kingdom: economic and political outline. (Online).

Available at: <https://en.portal.santandertrade.com/analyse-markets/united-kingdom/

economic-political-outline/>. [Accessed on 9 April 2019

Boateng, A., Hua, X., Nisar, S. and Wu, J., 2015. Examining the determinants of inward FDI:

Evidence from Norway. Economic Modelling, 47, pp.118-127.

Brannen, J., 2017. Mixing methods: Qualitative and quantitative research. Routledge.

Breinlich, H., Dhingra, S., Ottaviano, G., Sampson, T., Van Reenen, J. and Wadsworth, J.,

2016. BREXIT 2016: Policy analysis from the Centre for Economic Performance. CEP,

LSE, 2016.

Bush, T., 2016. PEST analysis of UK. (Online). Available at:

<https://pestleanalysis.com/pest-analysis-of-the-uk/>. [Accessed on 9 April 2019]

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on

foreign investment in the UK. BREXIT 2016, 24, p.2.

Ebell, M. and Warren, J., 2016. The long-term economic impact of leaving the EU. National

Institute Economic Review, 236(1), pp.121-138.

Hailu, Z.A., 2010. Demand side factors affecting the inflow of foreign direct investment to

African countries: does capital market matter?. International Journal of Business and

Management, 5(5), p.104.

Holmes Jr, R.M., Miller, T., Hitt, M.A. and Salmador, M.P., 2013. The interrelationships

among informal institutions, formal institutions, and inward foreign direct

investment. Journal of Management, 39(2), pp.531-566.

Jones, J. and Wren, C., 2016. Foreign direct investment and the regional economy.

Routledge.

8

Adhikary, B.K., 2011. FDI, trade openness, capital formation, and economic growth in

Bangladesh: a linkage analysis. International Journal of Business and Management, 6(1),

p.16.

Azam, M., 2009. Significance of foreign direct investment in the economic development of

Pakistan and Afghanistan. Journal of Central Asia, 64, pp.65-75.

Banco Santander, S.A., 2019. United kingdom: economic and political outline. (Online).

Available at: <https://en.portal.santandertrade.com/analyse-markets/united-kingdom/

economic-political-outline/>. [Accessed on 9 April 2019

Boateng, A., Hua, X., Nisar, S. and Wu, J., 2015. Examining the determinants of inward FDI:

Evidence from Norway. Economic Modelling, 47, pp.118-127.

Brannen, J., 2017. Mixing methods: Qualitative and quantitative research. Routledge.

Breinlich, H., Dhingra, S., Ottaviano, G., Sampson, T., Van Reenen, J. and Wadsworth, J.,

2016. BREXIT 2016: Policy analysis from the Centre for Economic Performance. CEP,

LSE, 2016.

Bush, T., 2016. PEST analysis of UK. (Online). Available at:

<https://pestleanalysis.com/pest-analysis-of-the-uk/>. [Accessed on 9 April 2019]

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on

foreign investment in the UK. BREXIT 2016, 24, p.2.

Ebell, M. and Warren, J., 2016. The long-term economic impact of leaving the EU. National

Institute Economic Review, 236(1), pp.121-138.

Hailu, Z.A., 2010. Demand side factors affecting the inflow of foreign direct investment to

African countries: does capital market matter?. International Journal of Business and

Management, 5(5), p.104.

Holmes Jr, R.M., Miller, T., Hitt, M.A. and Salmador, M.P., 2013. The interrelationships

among informal institutions, formal institutions, and inward foreign direct

investment. Journal of Management, 39(2), pp.531-566.

Jones, J. and Wren, C., 2016. Foreign direct investment and the regional economy.

Routledge.

8

Kothari, C.R., 2004. Research methodology: Methods and techniques. New Age

International.

Kurtishi-Kastrati, S., 2013. The effects of foreign direct investments for host country's

economy. European Journal of Interdisciplinary Studies, 5(1), p.26.

Lai, Y.C. and Sarkar, S., 2011. Labour Cost & Foreign Direct Investment-Evidence from

India. Indian Journal of Industrial Relations, pp.396-411.

Lyon, F., Mšllering, G. and Saunders, M.N. eds., 2015. Handbook of research methods on

trust. Edward Elgar Publishing.

Mathur, A. and Singh, K., 2013. Foreign direct investment, corruption and

democracy. Applied Economics, 45(8), pp.991-1002.

Olney, W.W., 2013. A race to the bottom? Employment protection and foreign direct

investment. Journal of International Economics, 91(2), pp.191-203.

O'malley, E. and O'gorman, C., 2001. Competitive advantage in the Irish indigenous software

industry and the role of inward foreign direct investment. European Planning Studies, 9(3),

pp.303-321.

Quer, D., Claver, E. and Rienda, L., 2012. Political risk, cultural distance, and outward

foreign direct investment: Empirical evidence from large Chinese firms. Asia Pacific journal

of management, 29(4), pp.1089-1104.

Saunders, M.N., 2011. Research methods for business students, 5/e. Pearson Education India.

Simionescu, M., 2016. The impact of BREXIT on the foreign direct investment in the United

Kingdom. Bulgarian Economic Papers, (7), pp.2-17.

Simionescu, M., 2017. The influence of BrExit on the foreign direct investment projects and

inflows in the United Kingdom(No. 68). GLO Discussion Paper.

Solomon, B. and Ruiz, I., 2012. Political risk, macroeconomic uncertainty, and the patterns of

foreign direct investment. The International Trade Journal, 26(2), pp.181-198.

Šušićv, M., 2018. Importance and Impact of Foreign Investment on the Economic

Development of Bosnia and Herzegovina. Economics, 6(1), pp.63-80.

The Heritage Foundation, 2019. United kingdom. (Online). Available at:

<https://www.heritage.org/index/country/unitedkingdom>. [Accessed on 9 April 2019

9

International.

Kurtishi-Kastrati, S., 2013. The effects of foreign direct investments for host country's

economy. European Journal of Interdisciplinary Studies, 5(1), p.26.

Lai, Y.C. and Sarkar, S., 2011. Labour Cost & Foreign Direct Investment-Evidence from

India. Indian Journal of Industrial Relations, pp.396-411.

Lyon, F., Mšllering, G. and Saunders, M.N. eds., 2015. Handbook of research methods on

trust. Edward Elgar Publishing.

Mathur, A. and Singh, K., 2013. Foreign direct investment, corruption and

democracy. Applied Economics, 45(8), pp.991-1002.

Olney, W.W., 2013. A race to the bottom? Employment protection and foreign direct

investment. Journal of International Economics, 91(2), pp.191-203.

O'malley, E. and O'gorman, C., 2001. Competitive advantage in the Irish indigenous software

industry and the role of inward foreign direct investment. European Planning Studies, 9(3),

pp.303-321.

Quer, D., Claver, E. and Rienda, L., 2012. Political risk, cultural distance, and outward

foreign direct investment: Empirical evidence from large Chinese firms. Asia Pacific journal

of management, 29(4), pp.1089-1104.

Saunders, M.N., 2011. Research methods for business students, 5/e. Pearson Education India.

Simionescu, M., 2016. The impact of BREXIT on the foreign direct investment in the United

Kingdom. Bulgarian Economic Papers, (7), pp.2-17.

Simionescu, M., 2017. The influence of BrExit on the foreign direct investment projects and

inflows in the United Kingdom(No. 68). GLO Discussion Paper.

Solomon, B. and Ruiz, I., 2012. Political risk, macroeconomic uncertainty, and the patterns of

foreign direct investment. The International Trade Journal, 26(2), pp.181-198.

Šušićv, M., 2018. Importance and Impact of Foreign Investment on the Economic

Development of Bosnia and Herzegovina. Economics, 6(1), pp.63-80.

The Heritage Foundation, 2019. United kingdom. (Online). Available at:

<https://www.heritage.org/index/country/unitedkingdom>. [Accessed on 9 April 2019

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.