Analysis of the UK Taxation Environment: A Comprehensive Report

VerifiedAdded on 2021/04/21

|29

|4640

|36

Report

AI Summary

This report provides a comprehensive overview of the UK taxation environment. It begins with an introduction to the concept of taxation, differentiating between direct and indirect taxes, and explaining the structure of the UK taxation system. The report delves into the history of UK taxation, tracing its evolution and key milestones. It then explores the roles and responsibilities of tax practitioners, detailing their functions in ensuring compliance and providing advisory services. The report also examines individual and business tax obligations, including compliance requirements and the consequences of non-compliance. Finally, the report includes a case study analyzing the tax calculations for a self-employed individual, providing practical application of the concepts discussed. The analysis includes considerations for income, deductions, and taxable profit.

Taxation

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

The description of UK taxation environment is shown in this assignment. The research

analyst gains the knowledge from different sources about the UK tax law. The two types of

taxation are described in the report that is direct tax and indirect tax. The history of UK tax

and how it is evolved with the time is shown in this report. The roles of tax officials and

experts are briefly explained in the report.

2

The description of UK taxation environment is shown in this assignment. The research

analyst gains the knowledge from different sources about the UK tax law. The two types of

taxation are described in the report that is direct tax and indirect tax. The history of UK tax

and how it is evolved with the time is shown in this report. The roles of tax officials and

experts are briefly explained in the report.

2

Task 1

AC1.1

Description of UK taxation and its environment

The tax is compulsory contribution made by the peoples of a country to the government. The

government charges tax from the citizens in the form of money. The tax is taken by the

government to use the money for the development of the country. The non-payment of tax

leads towards to the offence towards the government. The punishment is given by the

government as per it is described in the taxation law. The assessment of taxation in UK has

gone through at least three unique levels. The structure of UK taxation environment is as

follows:

The tax of any country is mainly divided into two parts. These two parts are known as direct

tax and the indirect tax. The tax paid on the income is known as income tax and it forms a

major part of the direct tax. The tax paid on the wealth is known as wealth tax. It is also the

3

AC1.1

Description of UK taxation and its environment

The tax is compulsory contribution made by the peoples of a country to the government. The

government charges tax from the citizens in the form of money. The tax is taken by the

government to use the money for the development of the country. The non-payment of tax

leads towards to the offence towards the government. The punishment is given by the

government as per it is described in the taxation law. The assessment of taxation in UK has

gone through at least three unique levels. The structure of UK taxation environment is as

follows:

The tax of any country is mainly divided into two parts. These two parts are known as direct

tax and the indirect tax. The tax paid on the income is known as income tax and it forms a

major part of the direct tax. The tax paid on the wealth is known as wealth tax. It is also the

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

part of the wealth tax. In every country, they have their own taxation system which is used to

collect the tax from the people of the country. The tax can be charged at a fixed rate or a slab

rate. Slab rate is applied on the income tax. In United Kingdom, the tax officials collect the

tax in various forms like income tax, feel duty, corporation tax, and VAT.

Income earned during his time of employment

Self-employed earnings of an individual

Income received after retirement like pension income and other benefits

House Property income or income from rent

Income earned under the business

Various deductions are available on the income earned as it may be allowed while investing

in government notified investments which provides deductions and helps in reducing the

amount of tax.

Indirect tax is not paid by the person who earns money from it. It is charged from the

customer by selling the goods and services to the consumers. In this case, the seller receives

the amount of tax from the customer and deposits the tax amount to the government on the

behalf of the customer.

History of UK taxation

The first reporting of income tax in the United Kingdom is made by William Pitt in 1798

when he described his financial plan to everyone. The income tax was introduced in 1978 and

it is applied in the next year in the country. The main reason for the introduction of taxation

system in the country is to generate funds to fight war against the Napoleons. The taxation

system formed by the William Pitt remains in existence from 1799 to 1802. The tax is

demolished from the country as the country leaves in the peace after that. The taxation system

made by the Pitt includes 5 Schedules and some other guidelines. The income not mentioned

in these schedules is not treated as taxable income and no tax was levied on that income.

In year 1842, the taxation system in the United Kingdom re-enacted by Sir Robert Peel. The

taxation system made by the Sir Robert Peel is made after analysing the shortcomings of the

previous taxation system of William Pitt and it overcomes those shortcomings. The taxation

system of Robert Peel also helps in filling the resource requirements for the general elections.

After that the income earned in the UK is chargeable to tax. The taxation system of the

4

collect the tax from the people of the country. The tax can be charged at a fixed rate or a slab

rate. Slab rate is applied on the income tax. In United Kingdom, the tax officials collect the

tax in various forms like income tax, feel duty, corporation tax, and VAT.

Income earned during his time of employment

Self-employed earnings of an individual

Income received after retirement like pension income and other benefits

House Property income or income from rent

Income earned under the business

Various deductions are available on the income earned as it may be allowed while investing

in government notified investments which provides deductions and helps in reducing the

amount of tax.

Indirect tax is not paid by the person who earns money from it. It is charged from the

customer by selling the goods and services to the consumers. In this case, the seller receives

the amount of tax from the customer and deposits the tax amount to the government on the

behalf of the customer.

History of UK taxation

The first reporting of income tax in the United Kingdom is made by William Pitt in 1798

when he described his financial plan to everyone. The income tax was introduced in 1978 and

it is applied in the next year in the country. The main reason for the introduction of taxation

system in the country is to generate funds to fight war against the Napoleons. The taxation

system formed by the William Pitt remains in existence from 1799 to 1802. The tax is

demolished from the country as the country leaves in the peace after that. The taxation system

made by the Pitt includes 5 Schedules and some other guidelines. The income not mentioned

in these schedules is not treated as taxable income and no tax was levied on that income.

In year 1842, the taxation system in the United Kingdom re-enacted by Sir Robert Peel. The

taxation system made by the Sir Robert Peel is made after analysing the shortcomings of the

previous taxation system of William Pitt and it overcomes those shortcomings. The taxation

system of Robert Peel also helps in filling the resource requirements for the general elections.

After that the income earned in the UK is chargeable to tax. The taxation system of the

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

country changes from time to time as per the needs of the external financial environment. In

past years, the taxation system of the country took a formal shape and structure.

The tax system of the United Kingdom is now divided in four parts which are as follows:

Income Tax: The amount of income which is paid to the government in the form of

tax is known as income tax. It is the main source of income for the United Kingdom

government. 30% revenue of the country is generated from the income tax.

Value Added Tax: This tax comes under indirect tax as it is charged on the value of

goods and services sold to the customers. The rate of VAT on the goods and services in

United Kingdom is different for the products and it varies from 0% to 20%. When the VAT is

first introduced in the United Kingdom in 1973, the rate of tax charged on the goods and

services is 10%. The changes in the rules and regulation leads to the change in the rate.

Corporation Tax: The tax charged from the individual’s income is known as income

tax and when it is charged from the company it becomes corporation tax and is charged by

the companies which are resident of the United Kingdom. The revenue generated from the

corporation tax stands on 4th position of the total revenue generated.

5

past years, the taxation system of the country took a formal shape and structure.

The tax system of the United Kingdom is now divided in four parts which are as follows:

Income Tax: The amount of income which is paid to the government in the form of

tax is known as income tax. It is the main source of income for the United Kingdom

government. 30% revenue of the country is generated from the income tax.

Value Added Tax: This tax comes under indirect tax as it is charged on the value of

goods and services sold to the customers. The rate of VAT on the goods and services in

United Kingdom is different for the products and it varies from 0% to 20%. When the VAT is

first introduced in the United Kingdom in 1973, the rate of tax charged on the goods and

services is 10%. The changes in the rules and regulation leads to the change in the rate.

Corporation Tax: The tax charged from the individual’s income is known as income

tax and when it is charged from the company it becomes corporation tax and is charged by

the companies which are resident of the United Kingdom. The revenue generated from the

corporation tax stands on 4th position of the total revenue generated.

5

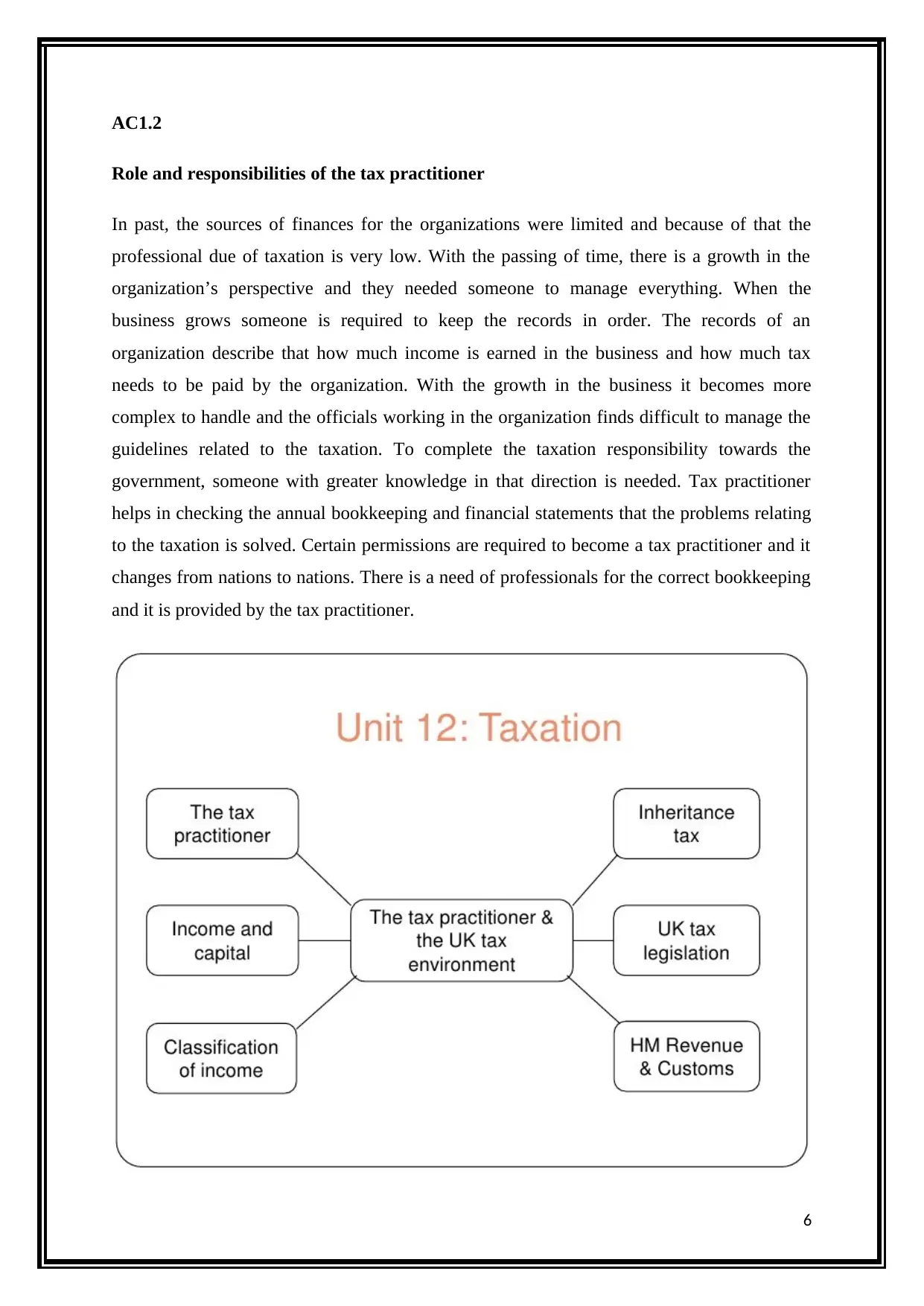

AC1.2

Role and responsibilities of the tax practitioner

In past, the sources of finances for the organizations were limited and because of that the

professional due of taxation is very low. With the passing of time, there is a growth in the

organization’s perspective and they needed someone to manage everything. When the

business grows someone is required to keep the records in order. The records of an

organization describe that how much income is earned in the business and how much tax

needs to be paid by the organization. With the growth in the business it becomes more

complex to handle and the officials working in the organization finds difficult to manage the

guidelines related to the taxation. To complete the taxation responsibility towards the

government, someone with greater knowledge in that direction is needed. Tax practitioner

helps in checking the annual bookkeeping and financial statements that the problems relating

to the taxation is solved. Certain permissions are required to become a tax practitioner and it

changes from nations to nations. There is a need of professionals for the correct bookkeeping

and it is provided by the tax practitioner.

6

Role and responsibilities of the tax practitioner

In past, the sources of finances for the organizations were limited and because of that the

professional due of taxation is very low. With the passing of time, there is a growth in the

organization’s perspective and they needed someone to manage everything. When the

business grows someone is required to keep the records in order. The records of an

organization describe that how much income is earned in the business and how much tax

needs to be paid by the organization. With the growth in the business it becomes more

complex to handle and the officials working in the organization finds difficult to manage the

guidelines related to the taxation. To complete the taxation responsibility towards the

government, someone with greater knowledge in that direction is needed. Tax practitioner

helps in checking the annual bookkeeping and financial statements that the problems relating

to the taxation is solved. Certain permissions are required to become a tax practitioner and it

changes from nations to nations. There is a need of professionals for the correct bookkeeping

and it is provided by the tax practitioner.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A business organization also has other needs apart from taxation. Appointing an expert who

has good amount of knowledge gives an extra benefit to the business. Now a days expert has

started to giving outsourcing services, operational review and advisory services in taxation.

They also provide other services related to taxation and directs in correct way. Tax

practitioner plays different roles while assessing the calculations of taxation amount for their

clients. Some of the roles of tax practitioner are as follows:

Roles of tax practitioners

The first role of the tax practitioner is to fill the taxation return sincerely by using his

skills and it is filled in a valid format.

Helps in disclosing the necessary compliance issues comes into financial statement of

the business so the changes can be made accordingly.

For the correct and proper presentation of financial statement, they also give advisory

services.

Directs the organization in correct way to comply with the rules and regulations of

taxation law.

They also provide legal tax related commitments to the citizens.

They give assurance about the returns filed by them and they also assure that the

records are kept in appropriate formats according to the description of the client.

Responsibilities of tax practitioner

The records maintain by the tax practitioner needs to be remain in appropriate format

with all the taxation expertise. The data should not contain any deceiving statement which

will hurt someone.

There is no misrepresentation is made by the tax practitioner in customer business in

order to fulfil his own motive. If there is any misstatement in the records and it is not stated

by the advisor then it is considered as misrepresentation of records.

The tax practitioner has great amount of knowledge and they can easily identify the

data at budgetary explanations and the records of the customer base.

AC1.3

Notwithstanding the way that these are the greatly surely understood points of view people

have, in reality altogether different. Truth be told any individual or an association who has

7

has good amount of knowledge gives an extra benefit to the business. Now a days expert has

started to giving outsourcing services, operational review and advisory services in taxation.

They also provide other services related to taxation and directs in correct way. Tax

practitioner plays different roles while assessing the calculations of taxation amount for their

clients. Some of the roles of tax practitioner are as follows:

Roles of tax practitioners

The first role of the tax practitioner is to fill the taxation return sincerely by using his

skills and it is filled in a valid format.

Helps in disclosing the necessary compliance issues comes into financial statement of

the business so the changes can be made accordingly.

For the correct and proper presentation of financial statement, they also give advisory

services.

Directs the organization in correct way to comply with the rules and regulations of

taxation law.

They also provide legal tax related commitments to the citizens.

They give assurance about the returns filed by them and they also assure that the

records are kept in appropriate formats according to the description of the client.

Responsibilities of tax practitioner

The records maintain by the tax practitioner needs to be remain in appropriate format

with all the taxation expertise. The data should not contain any deceiving statement which

will hurt someone.

There is no misrepresentation is made by the tax practitioner in customer business in

order to fulfil his own motive. If there is any misstatement in the records and it is not stated

by the advisor then it is considered as misrepresentation of records.

The tax practitioner has great amount of knowledge and they can easily identify the

data at budgetary explanations and the records of the customer base.

AC1.3

Notwithstanding the way that these are the greatly surely understood points of view people

have, in reality altogether different. Truth be told any individual or an association who has

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

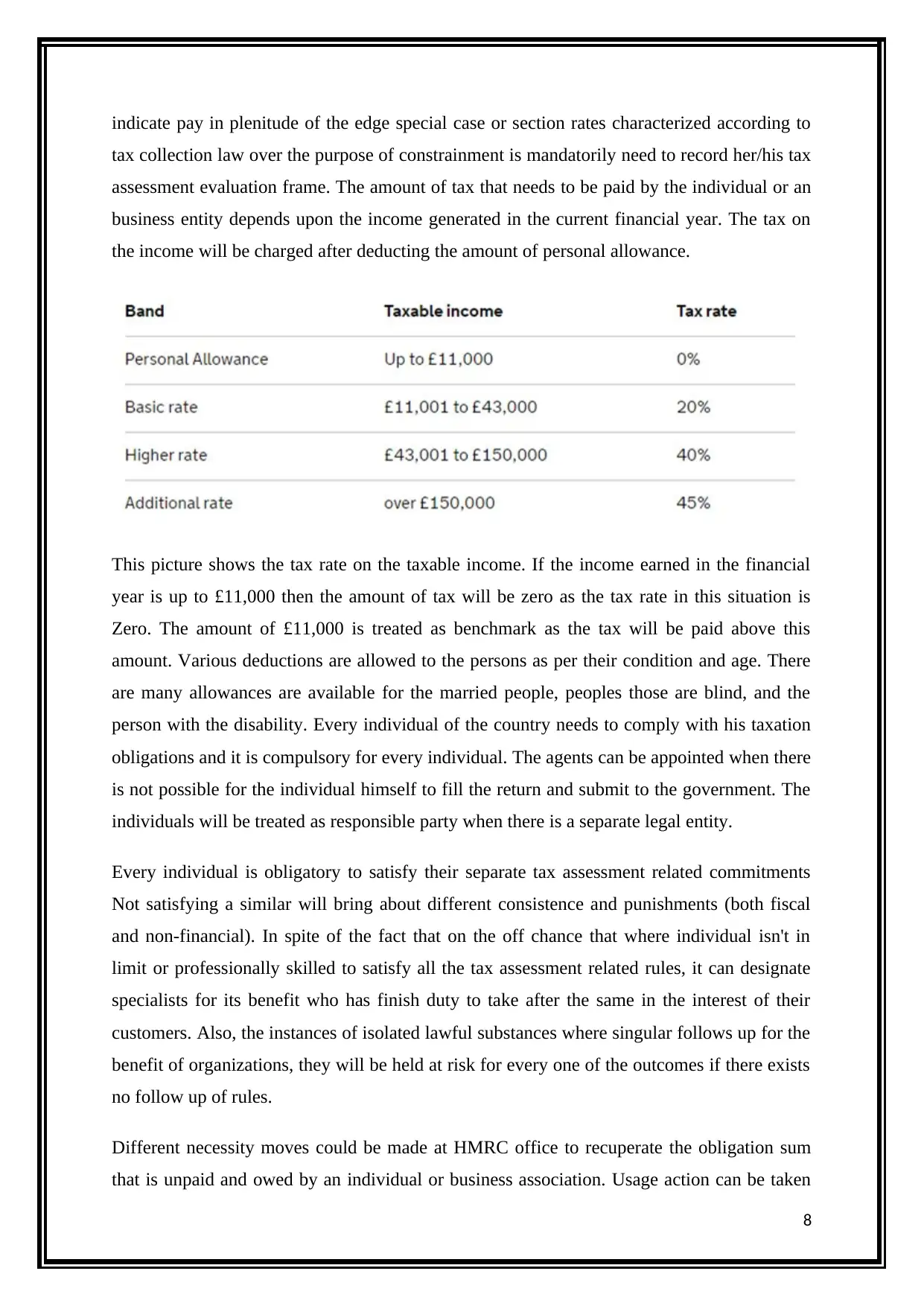

indicate pay in plenitude of the edge special case or section rates characterized according to

tax collection law over the purpose of constrainment is mandatorily need to record her/his tax

assessment evaluation frame. The amount of tax that needs to be paid by the individual or an

business entity depends upon the income generated in the current financial year. The tax on

the income will be charged after deducting the amount of personal allowance.

This picture shows the tax rate on the taxable income. If the income earned in the financial

year is up to £11,000 then the amount of tax will be zero as the tax rate in this situation is

Zero. The amount of £11,000 is treated as benchmark as the tax will be paid above this

amount. Various deductions are allowed to the persons as per their condition and age. There

are many allowances are available for the married people, peoples those are blind, and the

person with the disability. Every individual of the country needs to comply with his taxation

obligations and it is compulsory for every individual. The agents can be appointed when there

is not possible for the individual himself to fill the return and submit to the government. The

individuals will be treated as responsible party when there is a separate legal entity.

Every individual is obligatory to satisfy their separate tax assessment related commitments

Not satisfying a similar will bring about different consistence and punishments (both fiscal

and non-financial). In spite of the fact that on the off chance that where individual isn't in

limit or professionally skilled to satisfy all the tax assessment related rules, it can designate

specialists for its benefit who has finish duty to take after the same in the interest of their

customers. Also, the instances of isolated lawful substances where singular follows up for the

benefit of organizations, they will be held at risk for every one of the outcomes if there exists

no follow up of rules.

Different necessity moves could be made at HMRC office to recuperate the obligation sum

that is unpaid and owed by an individual or business association. Usage action can be taken

8

tax collection law over the purpose of constrainment is mandatorily need to record her/his tax

assessment evaluation frame. The amount of tax that needs to be paid by the individual or an

business entity depends upon the income generated in the current financial year. The tax on

the income will be charged after deducting the amount of personal allowance.

This picture shows the tax rate on the taxable income. If the income earned in the financial

year is up to £11,000 then the amount of tax will be zero as the tax rate in this situation is

Zero. The amount of £11,000 is treated as benchmark as the tax will be paid above this

amount. Various deductions are allowed to the persons as per their condition and age. There

are many allowances are available for the married people, peoples those are blind, and the

person with the disability. Every individual of the country needs to comply with his taxation

obligations and it is compulsory for every individual. The agents can be appointed when there

is not possible for the individual himself to fill the return and submit to the government. The

individuals will be treated as responsible party when there is a separate legal entity.

Every individual is obligatory to satisfy their separate tax assessment related commitments

Not satisfying a similar will bring about different consistence and punishments (both fiscal

and non-financial). In spite of the fact that on the off chance that where individual isn't in

limit or professionally skilled to satisfy all the tax assessment related rules, it can designate

specialists for its benefit who has finish duty to take after the same in the interest of their

customers. Also, the instances of isolated lawful substances where singular follows up for the

benefit of organizations, they will be held at risk for every one of the outcomes if there exists

no follow up of rules.

Different necessity moves could be made at HMRC office to recuperate the obligation sum

that is unpaid and owed by an individual or business association. Usage action can be taken

8

by HMRC to get the trade out the occasion when an individual don't pay particular tax

assessment charge. It can have control or parade of the benefits and assets of individual

possessions of a person in case of non-instalment of assessments. They have authority to

direct and to make an individual bankrupt or close down their separate business.

Notwithstanding the intrigue sum on the late instalment of expense obligation assesse would

be subject to pay the tax assessment obligation on the exceptional sum. However there is

choice accessible to the assesse to pay the duties while worried with the administrative expert

through portion course and upgrade the time term for the instalment commitment.

9

assessment charge. It can have control or parade of the benefits and assets of individual

possessions of a person in case of non-instalment of assessments. They have authority to

direct and to make an individual bankrupt or close down their separate business.

Notwithstanding the intrigue sum on the late instalment of expense obligation assesse would

be subject to pay the tax assessment obligation on the exceptional sum. However there is

choice accessible to the assesse to pay the duties while worried with the administrative expert

through portion course and upgrade the time term for the instalment commitment.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

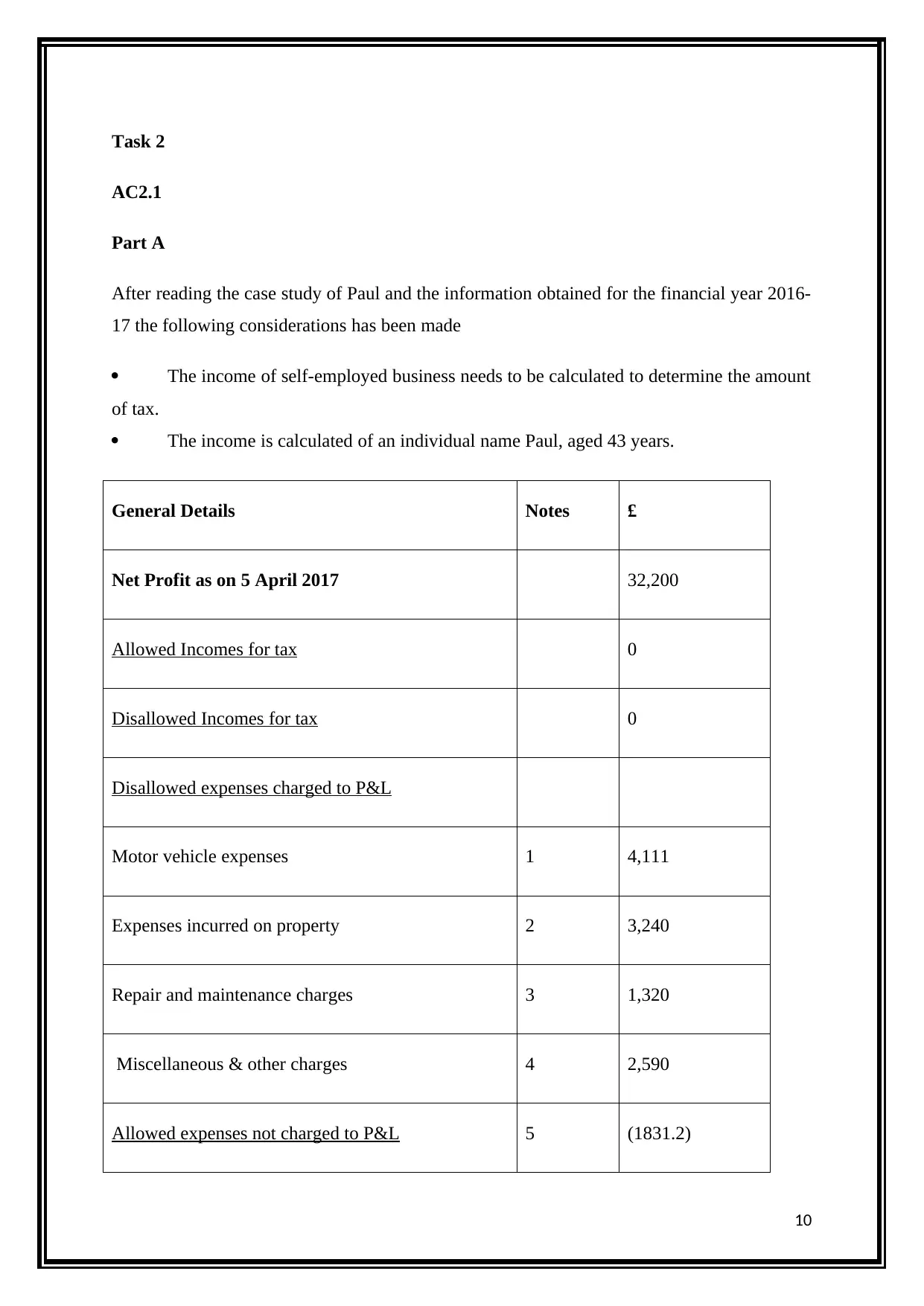

Task 2

AC2.1

Part A

After reading the case study of Paul and the information obtained for the financial year 2016-

17 the following considerations has been made

The income of self-employed business needs to be calculated to determine the amount

of tax.

The income is calculated of an individual name Paul, aged 43 years.

General Details Notes £

Net Profit as on 5 April 2017 32,200

Allowed Incomes for tax 0

Disallowed Incomes for tax 0

Disallowed expenses charged to P&L

Motor vehicle expenses 1 4,111

Expenses incurred on property 2 3,240

Repair and maintenance charges 3 1,320

Miscellaneous & other charges 4 2,590

Allowed expenses not charged to P&L 5 (1831.2)

10

AC2.1

Part A

After reading the case study of Paul and the information obtained for the financial year 2016-

17 the following considerations has been made

The income of self-employed business needs to be calculated to determine the amount

of tax.

The income is calculated of an individual name Paul, aged 43 years.

General Details Notes £

Net Profit as on 5 April 2017 32,200

Allowed Incomes for tax 0

Disallowed Incomes for tax 0

Disallowed expenses charged to P&L

Motor vehicle expenses 1 4,111

Expenses incurred on property 2 3,240

Repair and maintenance charges 3 1,320

Miscellaneous & other charges 4 2,590

Allowed expenses not charged to P&L 5 (1831.2)

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Taxable profit for the year 41629.80

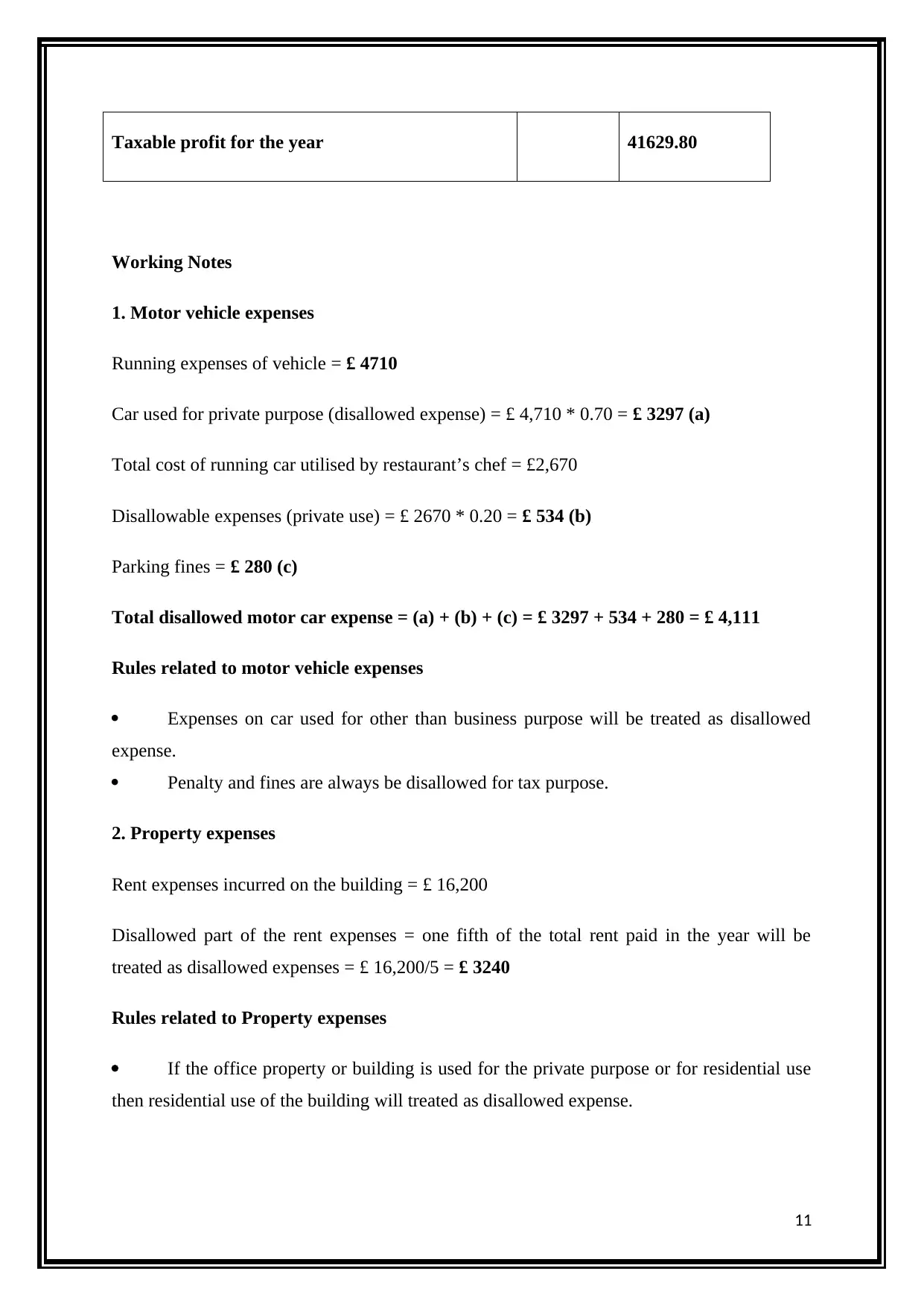

Working Notes

1. Motor vehicle expenses

Running expenses of vehicle = £ 4710

Car used for private purpose (disallowed expense) = £ 4,710 * 0.70 = £ 3297 (a)

Total cost of running car utilised by restaurant’s chef = £2,670

Disallowable expenses (private use) = £ 2670 * 0.20 = £ 534 (b)

Parking fines = £ 280 (c)

Total disallowed motor car expense = (a) + (b) + (c) = £ 3297 + 534 + 280 = £ 4,111

Rules related to motor vehicle expenses

Expenses on car used for other than business purpose will be treated as disallowed

expense.

Penalty and fines are always be disallowed for tax purpose.

2. Property expenses

Rent expenses incurred on the building = £ 16,200

Disallowed part of the rent expenses = one fifth of the total rent paid in the year will be

treated as disallowed expenses = £ 16,200/5 = £ 3240

Rules related to Property expenses

If the office property or building is used for the private purpose or for residential use

then residential use of the building will treated as disallowed expense.

11

Working Notes

1. Motor vehicle expenses

Running expenses of vehicle = £ 4710

Car used for private purpose (disallowed expense) = £ 4,710 * 0.70 = £ 3297 (a)

Total cost of running car utilised by restaurant’s chef = £2,670

Disallowable expenses (private use) = £ 2670 * 0.20 = £ 534 (b)

Parking fines = £ 280 (c)

Total disallowed motor car expense = (a) + (b) + (c) = £ 3297 + 534 + 280 = £ 4,111

Rules related to motor vehicle expenses

Expenses on car used for other than business purpose will be treated as disallowed

expense.

Penalty and fines are always be disallowed for tax purpose.

2. Property expenses

Rent expenses incurred on the building = £ 16,200

Disallowed part of the rent expenses = one fifth of the total rent paid in the year will be

treated as disallowed expenses = £ 16,200/5 = £ 3240

Rules related to Property expenses

If the office property or building is used for the private purpose or for residential use

then residential use of the building will treated as disallowed expense.

11

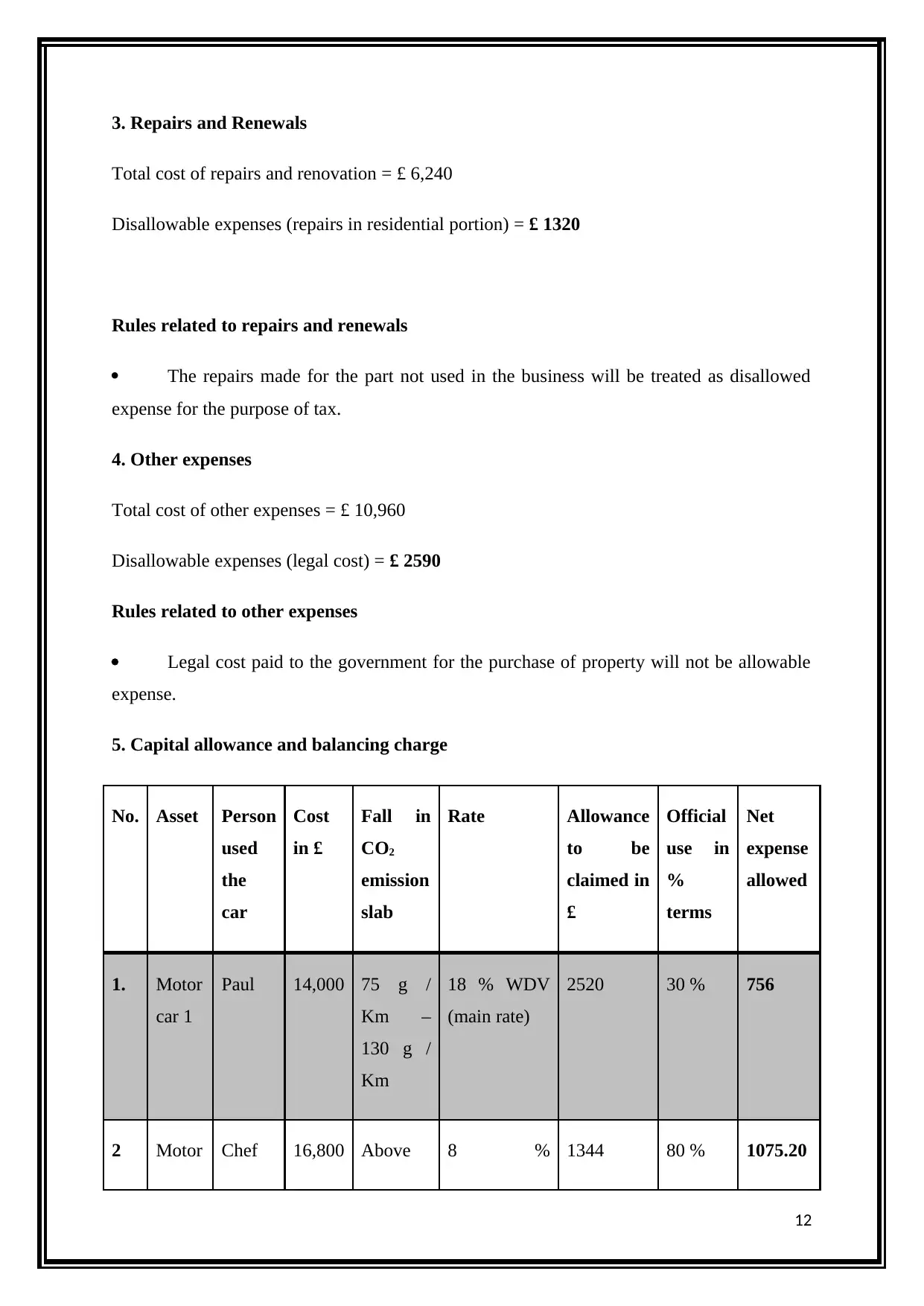

3. Repairs and Renewals

Total cost of repairs and renovation = £ 6,240

Disallowable expenses (repairs in residential portion) = £ 1320

Rules related to repairs and renewals

The repairs made for the part not used in the business will be treated as disallowed

expense for the purpose of tax.

4. Other expenses

Total cost of other expenses = £ 10,960

Disallowable expenses (legal cost) = £ 2590

Rules related to other expenses

Legal cost paid to the government for the purchase of property will not be allowable

expense.

5. Capital allowance and balancing charge

No. Asset Person

used

the

car

Cost

in £

Fall in

CO2

emission

slab

Rate Allowance

to be

claimed in

£

Official

use in

%

terms

Net

expense

allowed

1. Motor

car 1

Paul 14,000 75 g /

Km –

130 g /

Km

18 % WDV

(main rate)

2520 30 % 756

2 Motor Chef 16,800 Above 8 % 1344 80 % 1075.20

12

Total cost of repairs and renovation = £ 6,240

Disallowable expenses (repairs in residential portion) = £ 1320

Rules related to repairs and renewals

The repairs made for the part not used in the business will be treated as disallowed

expense for the purpose of tax.

4. Other expenses

Total cost of other expenses = £ 10,960

Disallowable expenses (legal cost) = £ 2590

Rules related to other expenses

Legal cost paid to the government for the purchase of property will not be allowable

expense.

5. Capital allowance and balancing charge

No. Asset Person

used

the

car

Cost

in £

Fall in

CO2

emission

slab

Rate Allowance

to be

claimed in

£

Official

use in

%

terms

Net

expense

allowed

1. Motor

car 1

Paul 14,000 75 g /

Km –

130 g /

Km

18 % WDV

(main rate)

2520 30 % 756

2 Motor Chef 16,800 Above 8 % 1344 80 % 1075.20

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 29

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.