UK Taxation System: Analysis, Comparisons, and Unincorporated Bodies

VerifiedAdded on 2023/06/08

|23

|6423

|455

Report

AI Summary

This report provides a detailed analysis of the UK taxation system, differentiating between direct and indirect taxes, and comparing it with the taxation systems of India and the USA. It covers various aspects of the UK tax system, including tax rates, exemptions, and the roles of different government levels in tax collection. The report also discusses the characteristics, advantages, and disadvantages of unincorporated associations, along with their taxation liabilities. Furthermore, it offers recommendations for developing an effective tax system in the UK, focusing on increasing public finance, capital expenditure, and labor productivity. The content aims to provide a comprehensive understanding of the UK taxation landscape and related entities, offering valuable insights for students and professionals. Access more solved assignments and resources on Desklib.

TAXATION

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1:..................................................................................................................................3

TASK 2:..................................................................................................................................9

TASK 3:................................................................................................................................12

TASK 4:................................................................................................................................15

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

TASK 1:..................................................................................................................................3

TASK 2:..................................................................................................................................9

TASK 3:................................................................................................................................12

TASK 4:................................................................................................................................15

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................20

INTRODUCTION

Taxation simply means imposition of various types of levies on the individual or different

types of assesses such as partnership firm, local authority, company and so on in almost every

country in the world. The primary purpose of the taxation is to raise revenue for the government

department so that they can meet out the expenditure they incurred for public welfare, salary

payment to various government employee etc. Further these funds also helpful for those needy

people who does not food and shelter to meet out their daily needs. Further the taxation has been

divided into two different categories that is direct tax which includes mainly income tax that is

levied on the income of various assesses. The other one is indirect tax that has been levied on

sale of goods and services and such tax has been collected ultimately from the consumers. In this

report different case scenarios are being depicted and accordingly these are being discussed in a

detailed manner along with their recommendation and conclusion thereof. The purpose of this

report is to analyse the taxation system along with the legislation which governs the same

(Princen, and et.al, 2020).

MAIN BODY

TASK 1:

Tax-

Tax is levied on the total income of the previous year of every person. Tax do not pay all types

of income such as dividend received from shares, income earn from individual saving account.

The base rate of income tax is 20%. HM revenue and custom is responsible for collecting the tax.

There are two types of tax-

Direct Tax-The tax is directly levied on the income of person is known as direct tax for example-

salary income, income earn from business and income earn from trust etc.

Through the direct tax the government earned more revenue. The income is determined of the tax

payer according to specific manner for example if income earn from salary then deduction is

allowed on the personal allowance, saving interest and dividend. The U.K. Residents pays the

taxes on the U.K. Income, to safe the double taxation the U.K. Government has agreements with

many countries to offset the U.K taxes has already paid. If the income of a person is £ 100001 to

£125140 then marginal income tax is 61.50%. The direct tax is paid on the earning of person.

Taxation simply means imposition of various types of levies on the individual or different

types of assesses such as partnership firm, local authority, company and so on in almost every

country in the world. The primary purpose of the taxation is to raise revenue for the government

department so that they can meet out the expenditure they incurred for public welfare, salary

payment to various government employee etc. Further these funds also helpful for those needy

people who does not food and shelter to meet out their daily needs. Further the taxation has been

divided into two different categories that is direct tax which includes mainly income tax that is

levied on the income of various assesses. The other one is indirect tax that has been levied on

sale of goods and services and such tax has been collected ultimately from the consumers. In this

report different case scenarios are being depicted and accordingly these are being discussed in a

detailed manner along with their recommendation and conclusion thereof. The purpose of this

report is to analyse the taxation system along with the legislation which governs the same

(Princen, and et.al, 2020).

MAIN BODY

TASK 1:

Tax-

Tax is levied on the total income of the previous year of every person. Tax do not pay all types

of income such as dividend received from shares, income earn from individual saving account.

The base rate of income tax is 20%. HM revenue and custom is responsible for collecting the tax.

There are two types of tax-

Direct Tax-The tax is directly levied on the income of person is known as direct tax for example-

salary income, income earn from business and income earn from trust etc.

Through the direct tax the government earned more revenue. The income is determined of the tax

payer according to specific manner for example if income earn from salary then deduction is

allowed on the personal allowance, saving interest and dividend. The U.K. Residents pays the

taxes on the U.K. Income, to safe the double taxation the U.K. Government has agreements with

many countries to offset the U.K taxes has already paid. If the income of a person is £ 100001 to

£125140 then marginal income tax is 61.50%. The direct tax is paid on the earning of person.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Indirect Tax-The tax is charge on the price of good and service then it is known as indirect tax

for Example-Good and service tax, custom duty and value added tax.

Custom Tax – The tax is levied on the import goods that is the goods which is import from

another country. The government uses this tax to increases the industry size and generating

revenue sources.

Value added tax – The tax is paid goods and services by the registered businesses. It is paid by

the seller but the economic burden of the tax is bear by the consumer. The vat rate is 5% on the

domestic fuel and 0% on the food and children cloth.

Excise Tax – It is a type of indirect tax and paid goods which is produced within the country. It

is also known as central value added tax (Dey and Jena, 2018).

Tax has paid at three different level of government.

Central Government-It revenue comes from income tax, value added tax and corporation tax.

Local Government-It revenue comes from grant received from central government and council

tax.

Devolved Government-It revenue comes from tax has charge on land and building (Kurauone

and et.al 2020).

Taxation system of UK-

UK government has made more simple and transparent tax policy which can make better

globalisation trading market in the world. To improve the business environment helps the

multinational companies and investors to invest in a company then it tax should be an asset of

the UK. Efficiency tax system provide the needed for long term planning. In 2010 UK has

perform the corporate tax road map which has includes-

Stable a good tax system which avoids to unnecessary changes in tax legislation

Too few reliefs such as deduction and allowances with a lower tax rates.

Tax policy changes according to modern business practices (Alessandrini, 2021).

The overall function and purpose of taxation in modern U.K economy.

The purpose of taxation to earn revenue and pay the expenses to the government. The objective

of tax collected to finance the government. To use reduced pollution, efficient allocation of

resources to achieve the objective of economy. The public expenditure increases at least but the

national expenditure increases fast so that should produce revenue. To increases the economic

growth, the government should reduce the marginal tax so that diversion of resource. The taxes

for Example-Good and service tax, custom duty and value added tax.

Custom Tax – The tax is levied on the import goods that is the goods which is import from

another country. The government uses this tax to increases the industry size and generating

revenue sources.

Value added tax – The tax is paid goods and services by the registered businesses. It is paid by

the seller but the economic burden of the tax is bear by the consumer. The vat rate is 5% on the

domestic fuel and 0% on the food and children cloth.

Excise Tax – It is a type of indirect tax and paid goods which is produced within the country. It

is also known as central value added tax (Dey and Jena, 2018).

Tax has paid at three different level of government.

Central Government-It revenue comes from income tax, value added tax and corporation tax.

Local Government-It revenue comes from grant received from central government and council

tax.

Devolved Government-It revenue comes from tax has charge on land and building (Kurauone

and et.al 2020).

Taxation system of UK-

UK government has made more simple and transparent tax policy which can make better

globalisation trading market in the world. To improve the business environment helps the

multinational companies and investors to invest in a company then it tax should be an asset of

the UK. Efficiency tax system provide the needed for long term planning. In 2010 UK has

perform the corporate tax road map which has includes-

Stable a good tax system which avoids to unnecessary changes in tax legislation

Too few reliefs such as deduction and allowances with a lower tax rates.

Tax policy changes according to modern business practices (Alessandrini, 2021).

The overall function and purpose of taxation in modern U.K economy.

The purpose of taxation to earn revenue and pay the expenses to the government. The objective

of tax collected to finance the government. To use reduced pollution, efficient allocation of

resources to achieve the objective of economy. The public expenditure increases at least but the

national expenditure increases fast so that should produce revenue. To increases the economic

growth, the government should reduce the marginal tax so that diversion of resource. The taxes

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

are collected of the taxpayer is used for the welfare of people. Contribution is the relationship

between tax paid and benefits received and it is used to motor fuels to finance the construction

and road maintenance. The main purpose of tax collected is to redistribution of income

(Newman, Mwandambira, and Ongayi, 2018).

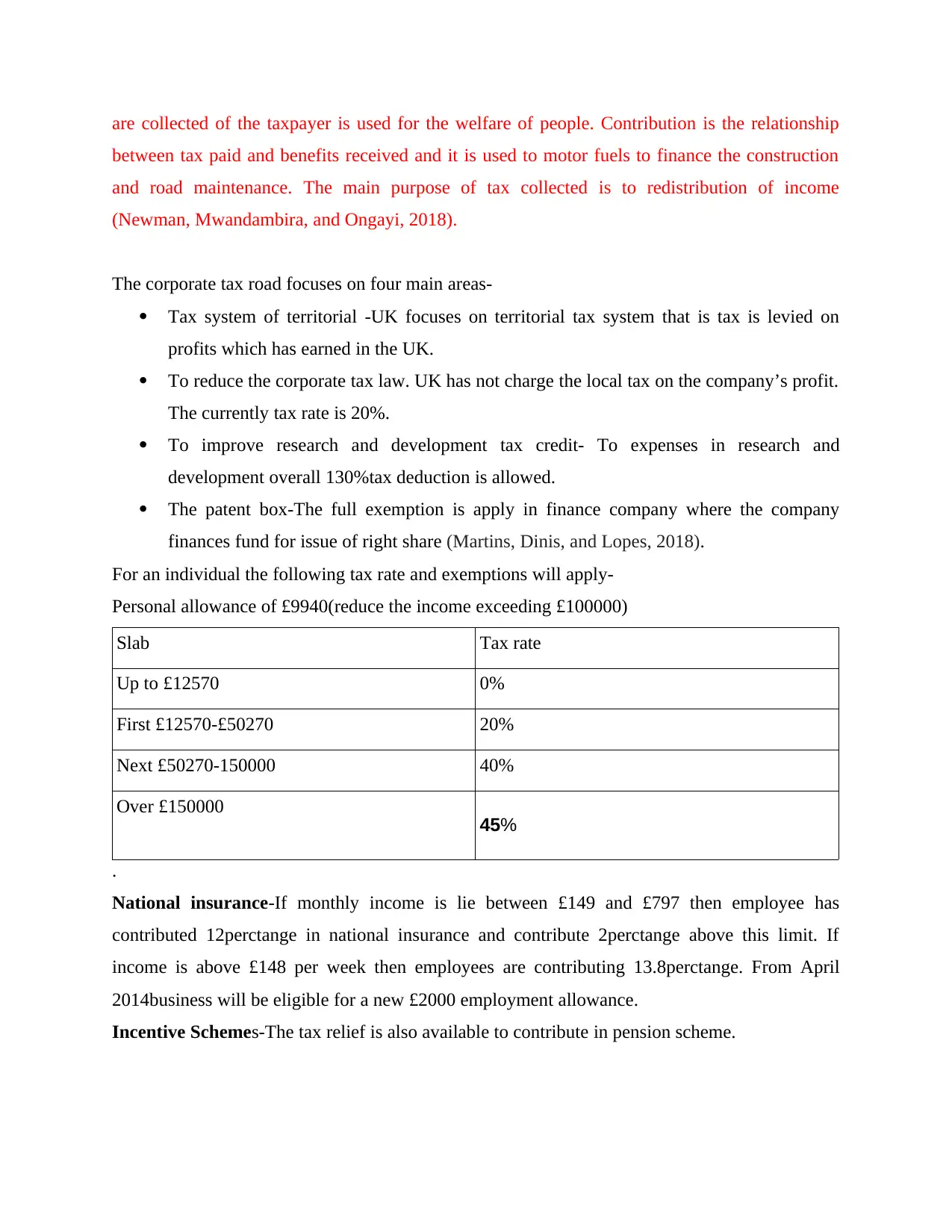

The corporate tax road focuses on four main areas-

Tax system of territorial -UK focuses on territorial tax system that is tax is levied on

profits which has earned in the UK.

To reduce the corporate tax law. UK has not charge the local tax on the company’s profit.

The currently tax rate is 20%.

To improve research and development tax credit- To expenses in research and

development overall 130%tax deduction is allowed.

The patent box-The full exemption is apply in finance company where the company

finances fund for issue of right share (Martins, Dinis, and Lopes, 2018).

For an individual the following tax rate and exemptions will apply-

Personal allowance of £9940(reduce the income exceeding £100000)

Slab Tax rate

Up to £12570 0%

First £12570-£50270 20%

Next £50270-150000 40%

Over £150000 45%

.

National insurance-If monthly income is lie between £149 and £797 then employee has

contributed 12perctange in national insurance and contribute 2perctange above this limit. If

income is above £148 per week then employees are contributing 13.8perctange. From April

2014business will be eligible for a new £2000 employment allowance.

Incentive Schemes-The tax relief is also available to contribute in pension scheme.

between tax paid and benefits received and it is used to motor fuels to finance the construction

and road maintenance. The main purpose of tax collected is to redistribution of income

(Newman, Mwandambira, and Ongayi, 2018).

The corporate tax road focuses on four main areas-

Tax system of territorial -UK focuses on territorial tax system that is tax is levied on

profits which has earned in the UK.

To reduce the corporate tax law. UK has not charge the local tax on the company’s profit.

The currently tax rate is 20%.

To improve research and development tax credit- To expenses in research and

development overall 130%tax deduction is allowed.

The patent box-The full exemption is apply in finance company where the company

finances fund for issue of right share (Martins, Dinis, and Lopes, 2018).

For an individual the following tax rate and exemptions will apply-

Personal allowance of £9940(reduce the income exceeding £100000)

Slab Tax rate

Up to £12570 0%

First £12570-£50270 20%

Next £50270-150000 40%

Over £150000 45%

.

National insurance-If monthly income is lie between £149 and £797 then employee has

contributed 12perctange in national insurance and contribute 2perctange above this limit. If

income is above £148 per week then employees are contributing 13.8perctange. From April

2014business will be eligible for a new £2000 employment allowance.

Incentive Schemes-The tax relief is also available to contribute in pension scheme.

Capital gain tax -In UK capital gain tax rate is very lower. The higher rate is 28perctange with

available some reliefs which is support in business activities. In currently £10900 is annual

exempt amount (Markus and Paffendorf, 2022).

Statutory residence-In April 2013 the government has come a statutory residence test which

provides certainty to an individual with better living and arrangements. Such accommodation is

available to an individual which has spent the number of days in the UK with the family and

employment.

Non domicile-Non domicile status affects the tax liability of UK. Non domicile has to pay the

tax on the money sent in UK.

Mrs Thompson has annual income on £60000 which comes under slab rate of 40perctange. For

first £12750 the tax rate is 0 percentage next (£60000-£12570) =£47430 tax pay 20perctange that

is £9486. In nation insurance he will eligible the tax relief of £2000.

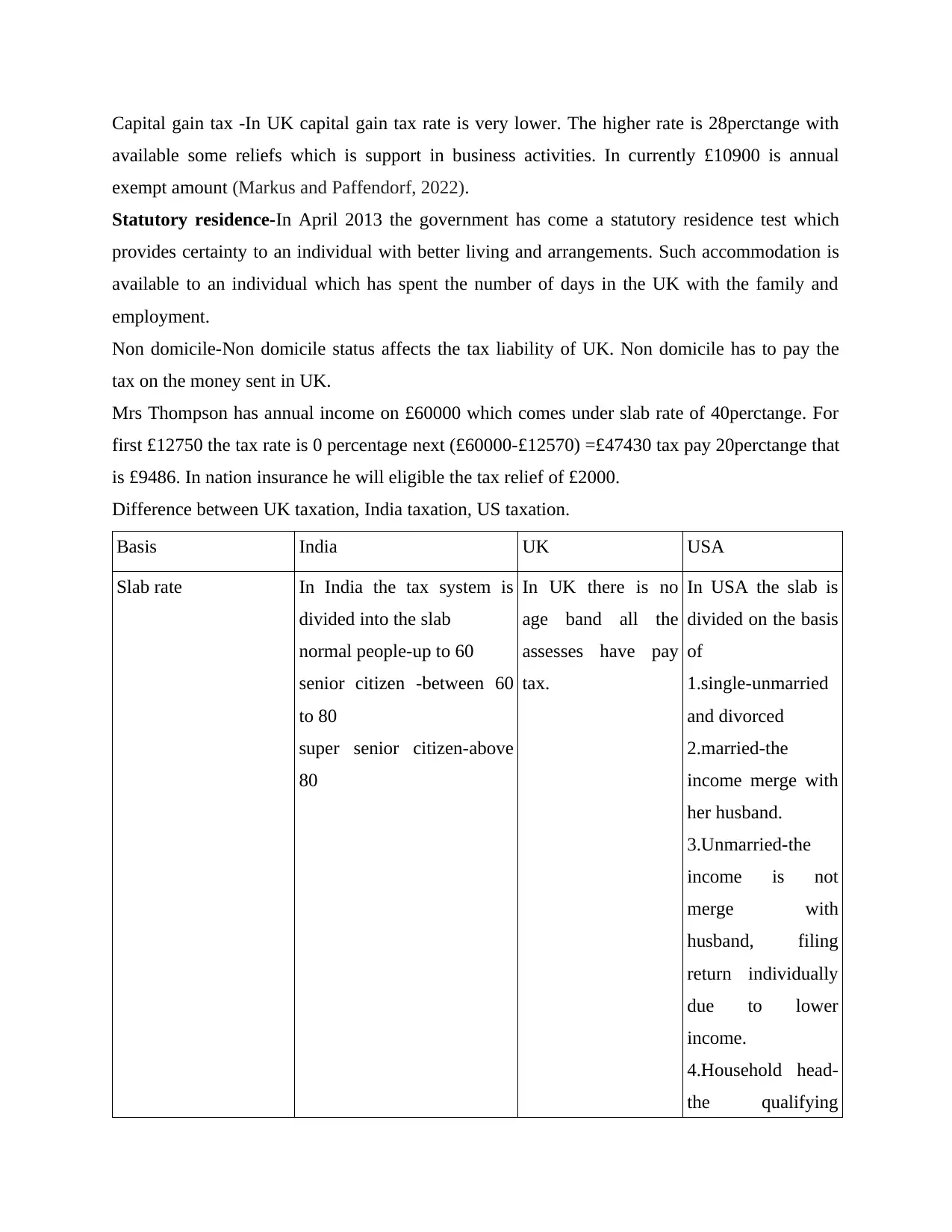

Difference between UK taxation, India taxation, US taxation.

Basis India UK USA

Slab rate In India the tax system is

divided into the slab

normal people-up to 60

senior citizen -between 60

to 80

super senior citizen-above

80

In UK there is no

age band all the

assesses have pay

tax.

In USA the slab is

divided on the basis

of

1.single-unmarried

and divorced

2.married-the

income merge with

her husband.

3.Unmarried-the

income is not

merge with

husband, filing

return individually

due to lower

income.

4.Household head-

the qualifying

available some reliefs which is support in business activities. In currently £10900 is annual

exempt amount (Markus and Paffendorf, 2022).

Statutory residence-In April 2013 the government has come a statutory residence test which

provides certainty to an individual with better living and arrangements. Such accommodation is

available to an individual which has spent the number of days in the UK with the family and

employment.

Non domicile-Non domicile status affects the tax liability of UK. Non domicile has to pay the

tax on the money sent in UK.

Mrs Thompson has annual income on £60000 which comes under slab rate of 40perctange. For

first £12750 the tax rate is 0 percentage next (£60000-£12570) =£47430 tax pay 20perctange that

is £9486. In nation insurance he will eligible the tax relief of £2000.

Difference between UK taxation, India taxation, US taxation.

Basis India UK USA

Slab rate In India the tax system is

divided into the slab

normal people-up to 60

senior citizen -between 60

to 80

super senior citizen-above

80

In UK there is no

age band all the

assesses have pay

tax.

In USA the slab is

divided on the basis

of

1.single-unmarried

and divorced

2.married-the

income merge with

her husband.

3.Unmarried-the

income is not

merge with

husband, filing

return individually

due to lower

income.

4.Household head-

the qualifying

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

person to pay half

money needed to

keep the home

(Luccasen and

Thomas 2019).

Tax Forms The form-16 has to filed the

income earned from salary

and ITR-2, ITR-4 has to

filed the income earned for

other sources.

The form -SA100

for individuals,

SA800 for

partnership,

SA900for trust,

CT600 for

companies paying

corporate tax,

VAT100 for value

added tax.

The form W-2 has

to filed the income

earned form salary

and 1099-R form

file for annuities,

1099-MISC for

miscellaneous

sources of income

and 1099-G for

unemployment

compensation.

Tax Deduction If income earns up to 2.5

lakhs there is no tax

liability. Above this limit

the deduction of section

80CCD, 80C, 80E has avail.

If income earn up to

£12570 there is no

tax liability. Above

this limit the

deduction of

national insurance

up to £2000 is

exempt.

In US taxation

system, standard

deduction can be

availed by the

assesses.

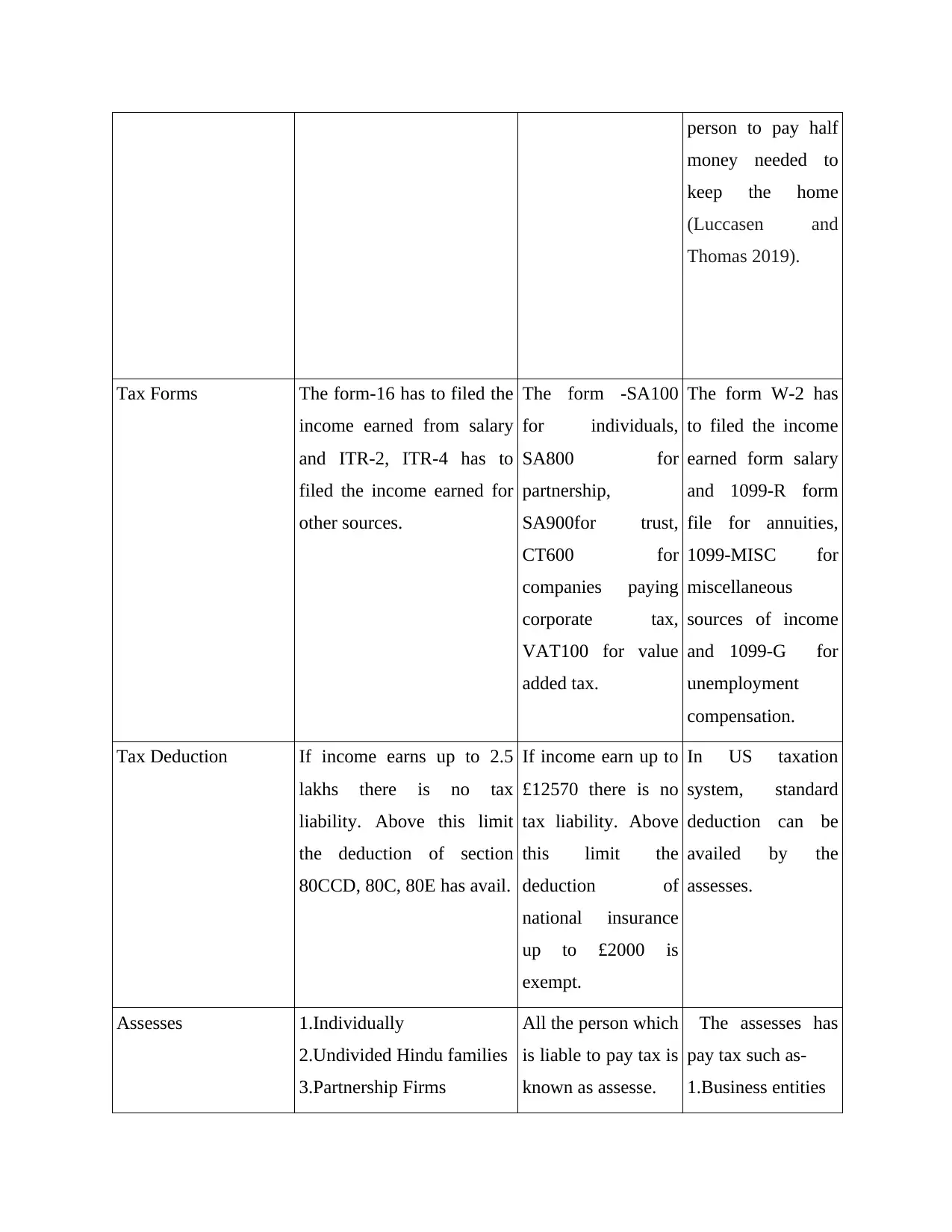

Assesses 1.Individually

2.Undivided Hindu families

3.Partnership Firms

All the person which

is liable to pay tax is

known as assesse.

The assesses has

pay tax such as-

1.Business entities

money needed to

keep the home

(Luccasen and

Thomas 2019).

Tax Forms The form-16 has to filed the

income earned from salary

and ITR-2, ITR-4 has to

filed the income earned for

other sources.

The form -SA100

for individuals,

SA800 for

partnership,

SA900for trust,

CT600 for

companies paying

corporate tax,

VAT100 for value

added tax.

The form W-2 has

to filed the income

earned form salary

and 1099-R form

file for annuities,

1099-MISC for

miscellaneous

sources of income

and 1099-G for

unemployment

compensation.

Tax Deduction If income earns up to 2.5

lakhs there is no tax

liability. Above this limit

the deduction of section

80CCD, 80C, 80E has avail.

If income earn up to

£12570 there is no

tax liability. Above

this limit the

deduction of

national insurance

up to £2000 is

exempt.

In US taxation

system, standard

deduction can be

availed by the

assesses.

Assesses 1.Individually

2.Undivided Hindu families

3.Partnership Firms

All the person which

is liable to pay tax is

known as assesse.

The assesses has

pay tax such as-

1.Business entities

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4.Artificial juridical person

5.Municipal bodies or local

authority

6.Artificial juridical person

7.Company

2.US Residents

3.Estates

4.Trust Funds

5.Other forms of

Organisation

Some states of USA

have exempt for

tax-

1.Alaska

2.Florida

3.Texas

4.Wyoming

5.Washington

6.South Dakota

Types of taxes In India there has many

types of tax-

1.Direct tax

2.Indirect tax

3.Corporate tax

4.Capital Gain Tax

5.Wealth tax

6.Gift tax (Frecknall-

Hughes, 2020).

In UK there has

many types of taxes-

1.Property tax

2.VAT

3.Capital Gain

In UK there has

different types of

tax

1.Federal tax

2.Local tax

3.Income tax

4.Sales tax

5.property tax

6.Payroll tax

7.Excise tax

8.Special purpose

governmental

jurisdictions

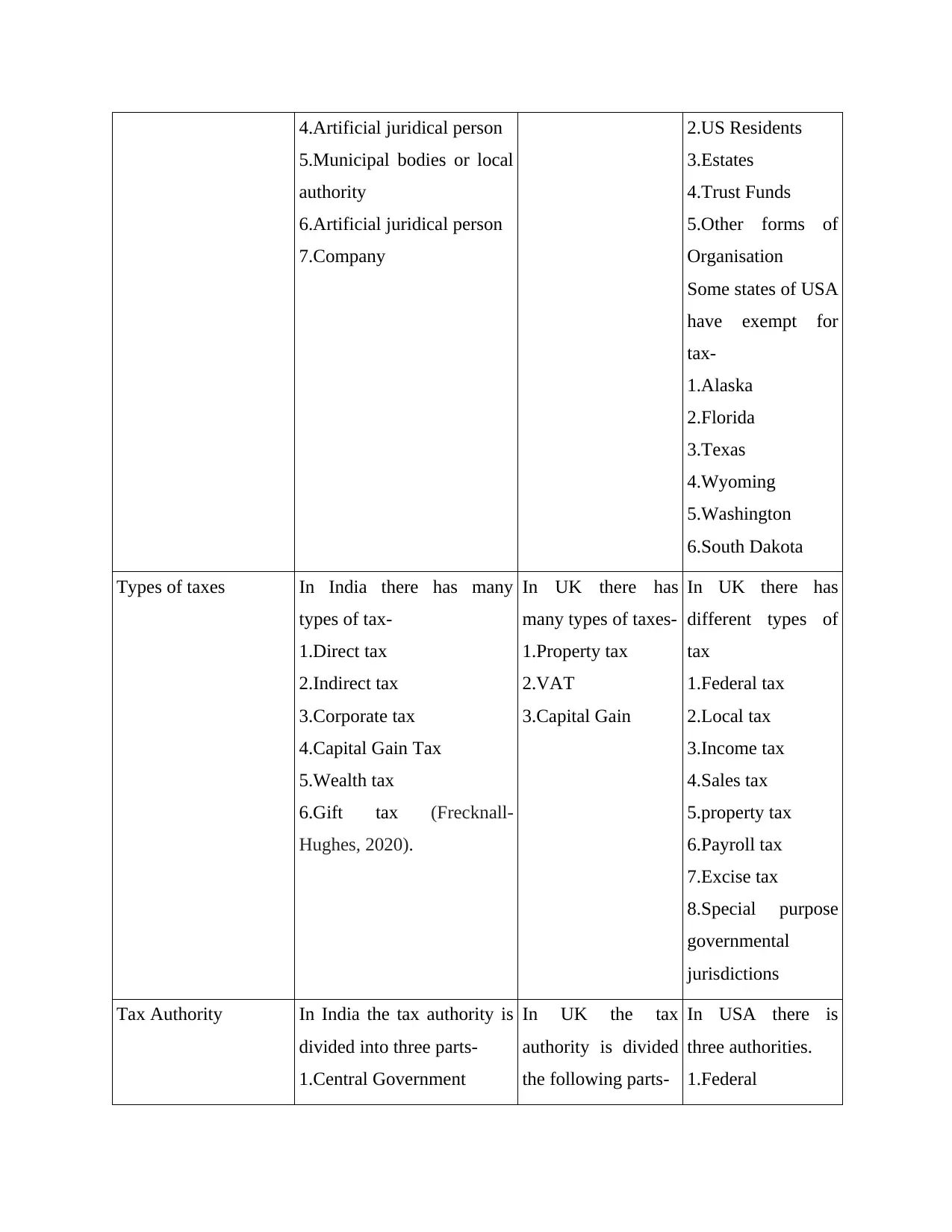

Tax Authority In India the tax authority is

divided into three parts-

1.Central Government

In UK the tax

authority is divided

the following parts-

In USA there is

three authorities.

1.Federal

5.Municipal bodies or local

authority

6.Artificial juridical person

7.Company

2.US Residents

3.Estates

4.Trust Funds

5.Other forms of

Organisation

Some states of USA

have exempt for

tax-

1.Alaska

2.Florida

3.Texas

4.Wyoming

5.Washington

6.South Dakota

Types of taxes In India there has many

types of tax-

1.Direct tax

2.Indirect tax

3.Corporate tax

4.Capital Gain Tax

5.Wealth tax

6.Gift tax (Frecknall-

Hughes, 2020).

In UK there has

many types of taxes-

1.Property tax

2.VAT

3.Capital Gain

In UK there has

different types of

tax

1.Federal tax

2.Local tax

3.Income tax

4.Sales tax

5.property tax

6.Payroll tax

7.Excise tax

8.Special purpose

governmental

jurisdictions

Tax Authority In India the tax authority is

divided into three parts-

1.Central Government

In UK the tax

authority is divided

the following parts-

In USA there is

three authorities.

1.Federal

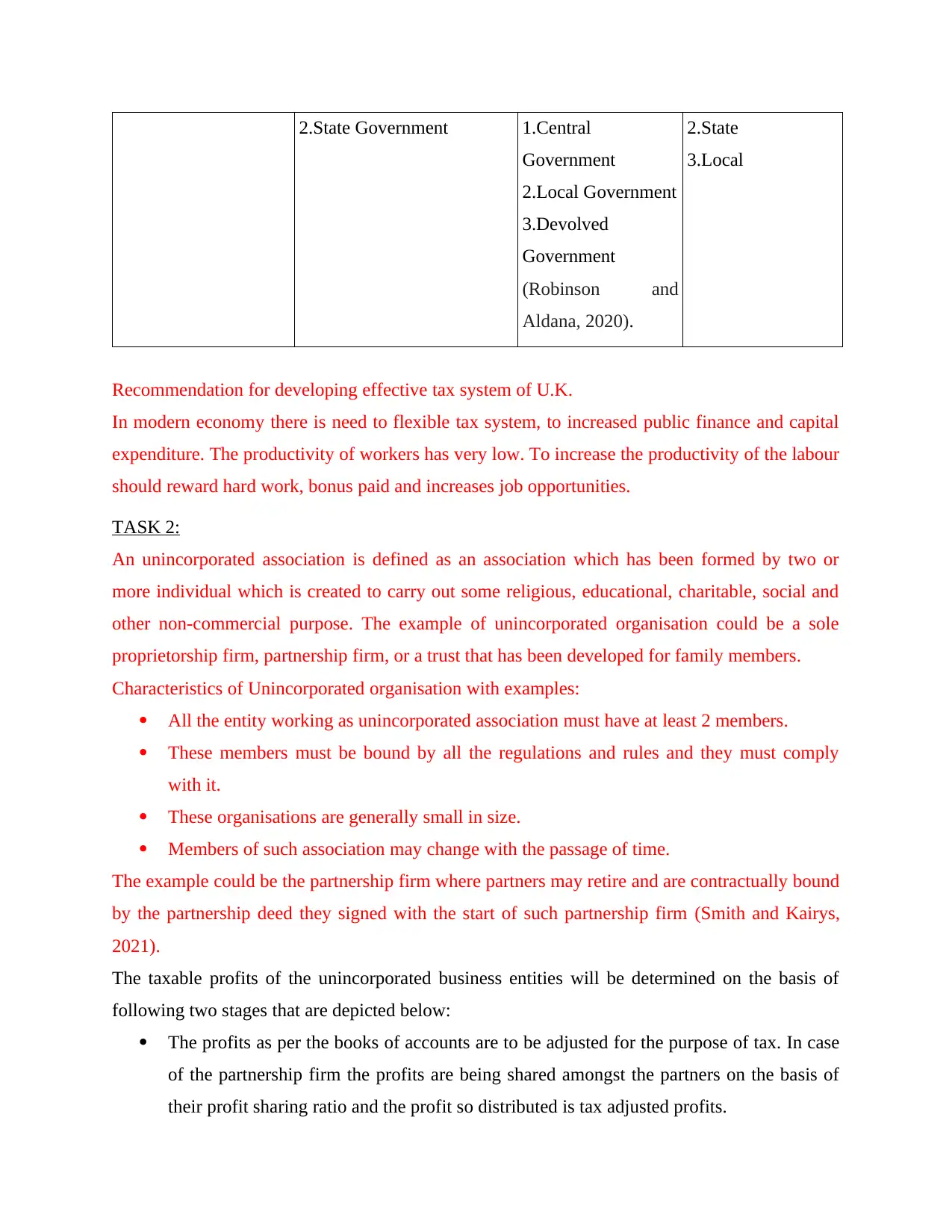

2.State Government 1.Central

Government

2.Local Government

3.Devolved

Government

(Robinson and

Aldana, 2020).

2.State

3.Local

Recommendation for developing effective tax system of U.K.

In modern economy there is need to flexible tax system, to increased public finance and capital

expenditure. The productivity of workers has very low. To increase the productivity of the labour

should reward hard work, bonus paid and increases job opportunities.

TASK 2:

An unincorporated association is defined as an association which has been formed by two or

more individual which is created to carry out some religious, educational, charitable, social and

other non-commercial purpose. The example of unincorporated organisation could be a sole

proprietorship firm, partnership firm, or a trust that has been developed for family members.

Characteristics of Unincorporated organisation with examples:

All the entity working as unincorporated association must have at least 2 members.

These members must be bound by all the regulations and rules and they must comply

with it.

These organisations are generally small in size.

Members of such association may change with the passage of time.

The example could be the partnership firm where partners may retire and are contractually bound

by the partnership deed they signed with the start of such partnership firm (Smith and Kairys,

2021).

The taxable profits of the unincorporated business entities will be determined on the basis of

following two stages that are depicted below:

The profits as per the books of accounts are to be adjusted for the purpose of tax. In case

of the partnership firm the profits are being shared amongst the partners on the basis of

their profit sharing ratio and the profit so distributed is tax adjusted profits.

Government

2.Local Government

3.Devolved

Government

(Robinson and

Aldana, 2020).

2.State

3.Local

Recommendation for developing effective tax system of U.K.

In modern economy there is need to flexible tax system, to increased public finance and capital

expenditure. The productivity of workers has very low. To increase the productivity of the labour

should reward hard work, bonus paid and increases job opportunities.

TASK 2:

An unincorporated association is defined as an association which has been formed by two or

more individual which is created to carry out some religious, educational, charitable, social and

other non-commercial purpose. The example of unincorporated organisation could be a sole

proprietorship firm, partnership firm, or a trust that has been developed for family members.

Characteristics of Unincorporated organisation with examples:

All the entity working as unincorporated association must have at least 2 members.

These members must be bound by all the regulations and rules and they must comply

with it.

These organisations are generally small in size.

Members of such association may change with the passage of time.

The example could be the partnership firm where partners may retire and are contractually bound

by the partnership deed they signed with the start of such partnership firm (Smith and Kairys,

2021).

The taxable profits of the unincorporated business entities will be determined on the basis of

following two stages that are depicted below:

The profits as per the books of accounts are to be adjusted for the purpose of tax. In case

of the partnership firm the profits are being shared amongst the partners on the basis of

their profit sharing ratio and the profit so distributed is tax adjusted profits.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

After that the assessment rules are being applied to the partner’s tax adjusted profits for

the trading period (Christensen and Seabrooke, 2020).

Advantage and disadvantage of Operating an unincorporated organisation:

Advantage could be that these firms have legal status as they are registered with the government

authority. Therefore, they are bound to the laws and regulation which are application to them.

The example could be in case of partnership firm would be that they need to follow partnership

act establish by the act of law.

Disadvantage could be that as they are being carrying out by minimum 2 members, therefore

they may be dispute arises amongst them regarding profit sharing which affects the business of

the organisation.

The taxation liabilities of unincorporated association are that they have to pay the income tax

they earned on the profits throughout the year to the government. Their individual partners have

to file the business return and shows that they have earned profits from the firm as their business

income. Their taxability will be separate from the association as they both have separate legal

status.

Personal taxation is the tax which is imposed or levied on individual from the income they

earned throughout the financial year such as from salary, other sources, rental income and so on.

The partnership firm has to pay tax on their profits which they earn during the financial year by

filling the tax return of firm. On the other hand, in case of sole traders, the return has to be

submitted by sole trader as an individual carrying out business. No return or tax has to be paid in

the name of sole trader organisation (Martin, 2019).

When a trader started the new business then they can operate that business as an unincorporated

entity. The trader has the choice for the legal status of their business depending upon the tax

implications in various business structure that is suitable for the trader to carry out the business

in a smooth manner. When the carried upon by the two persons then it is better to start the

business in the form of partnership firm as it consists of clarity amongst the ratio in which profit

and loss will be distributed. From the point of view of Tax, the decision must be taken by making

comparison with that self-employed person and the salaried employee. In case where the

business is incurring the losses in that case the issue arises towards the employment of someone

that will create employee cost for the corporation.

The calculation of tax liability of Mr Lucian is being computed in the following manner:

the trading period (Christensen and Seabrooke, 2020).

Advantage and disadvantage of Operating an unincorporated organisation:

Advantage could be that these firms have legal status as they are registered with the government

authority. Therefore, they are bound to the laws and regulation which are application to them.

The example could be in case of partnership firm would be that they need to follow partnership

act establish by the act of law.

Disadvantage could be that as they are being carrying out by minimum 2 members, therefore

they may be dispute arises amongst them regarding profit sharing which affects the business of

the organisation.

The taxation liabilities of unincorporated association are that they have to pay the income tax

they earned on the profits throughout the year to the government. Their individual partners have

to file the business return and shows that they have earned profits from the firm as their business

income. Their taxability will be separate from the association as they both have separate legal

status.

Personal taxation is the tax which is imposed or levied on individual from the income they

earned throughout the financial year such as from salary, other sources, rental income and so on.

The partnership firm has to pay tax on their profits which they earn during the financial year by

filling the tax return of firm. On the other hand, in case of sole traders, the return has to be

submitted by sole trader as an individual carrying out business. No return or tax has to be paid in

the name of sole trader organisation (Martin, 2019).

When a trader started the new business then they can operate that business as an unincorporated

entity. The trader has the choice for the legal status of their business depending upon the tax

implications in various business structure that is suitable for the trader to carry out the business

in a smooth manner. When the carried upon by the two persons then it is better to start the

business in the form of partnership firm as it consists of clarity amongst the ratio in which profit

and loss will be distributed. From the point of view of Tax, the decision must be taken by making

comparison with that self-employed person and the salaried employee. In case where the

business is incurring the losses in that case the issue arises towards the employment of someone

that will create employee cost for the corporation.

The calculation of tax liability of Mr Lucian is being computed in the following manner:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

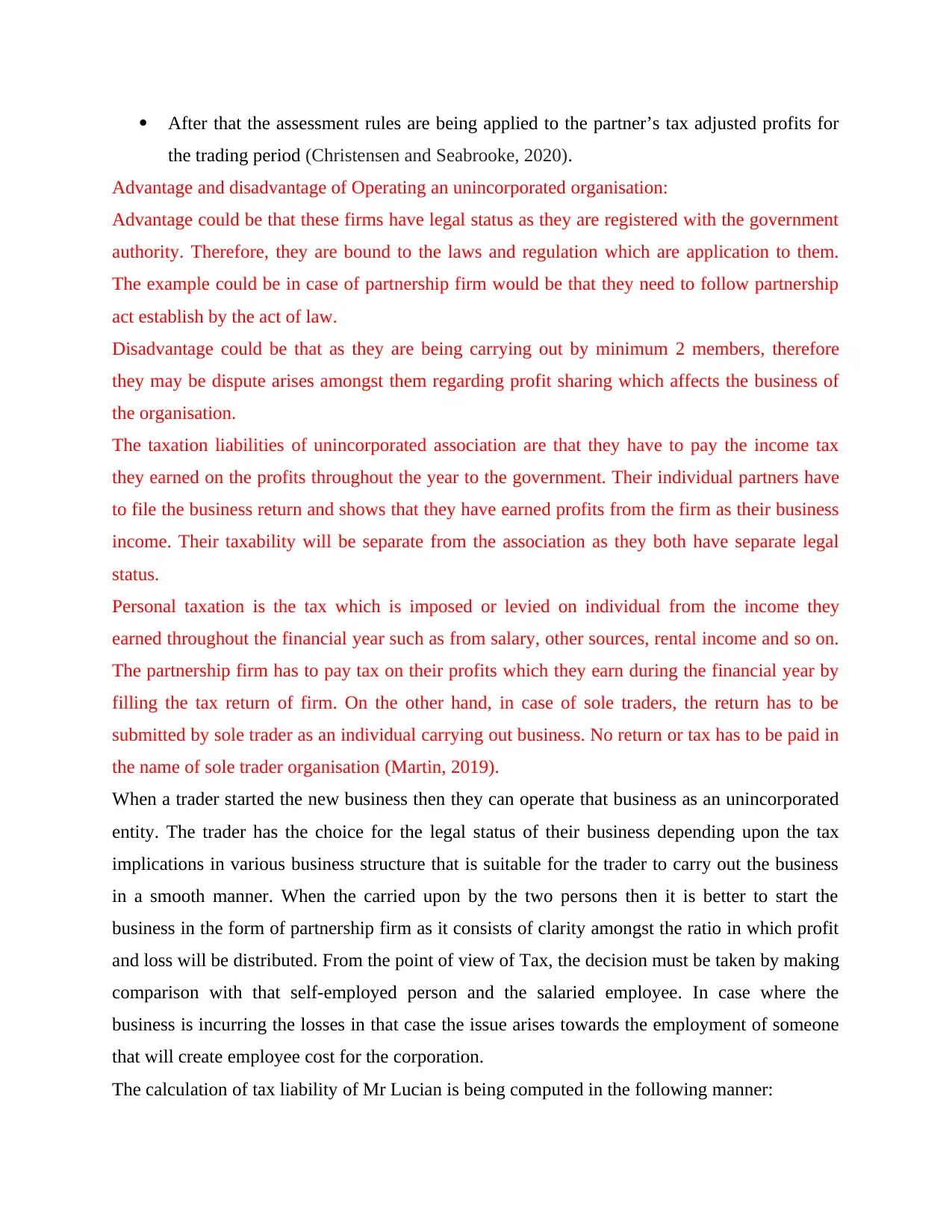

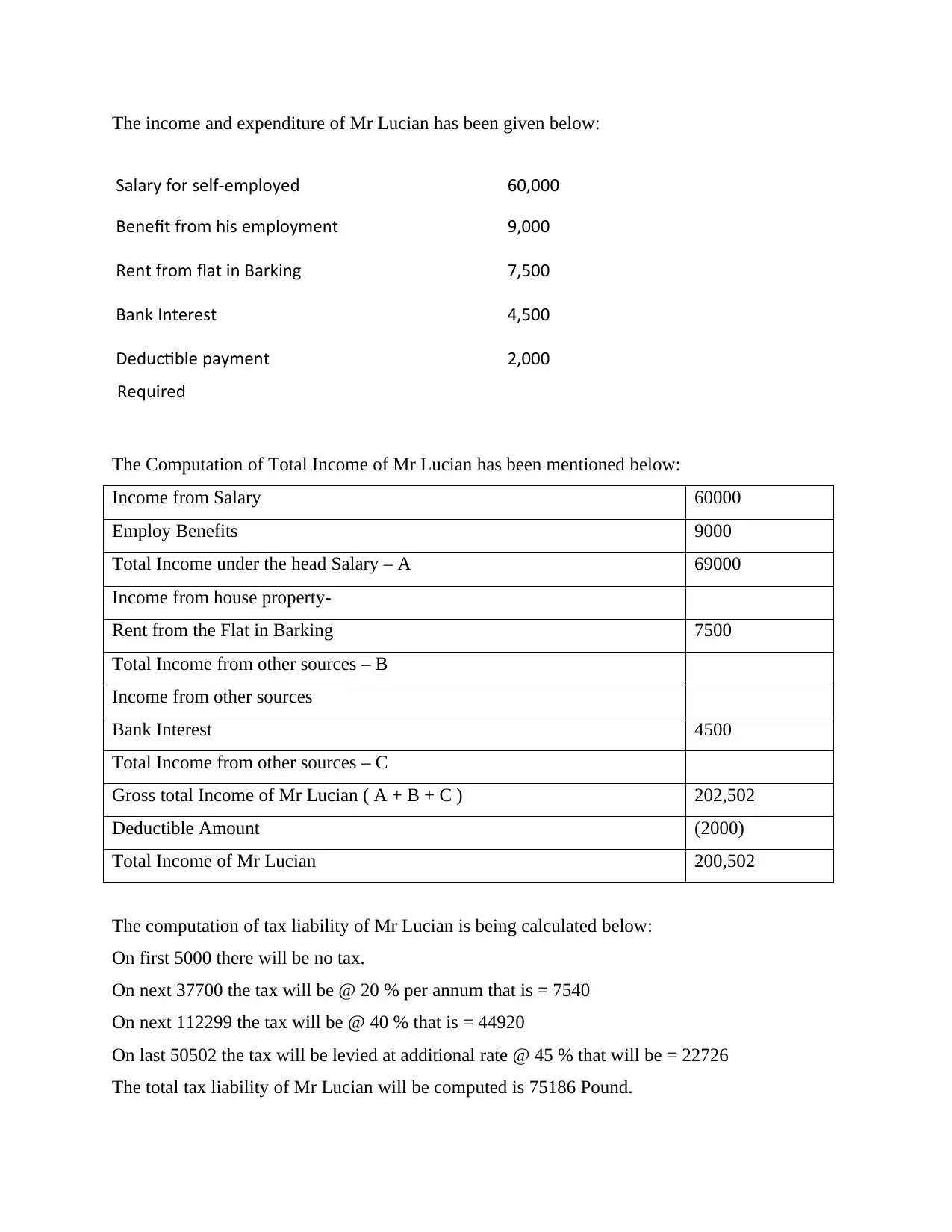

The income and expenditure of Mr Lucian has been given below:

Salary for self-employed 60,000

Benefit from his employment 9,000

Rent from flat in Barking 7,500

Bank Interest 4,500

Deductible payment

Required

2,000

The Computation of Total Income of Mr Lucian has been mentioned below:

Income from Salary 60000

Employ Benefits 9000

Total Income under the head Salary – A 69000

Income from house property-

Rent from the Flat in Barking 7500

Total Income from other sources – B

Income from other sources

Bank Interest 4500

Total Income from other sources – C

Gross total Income of Mr Lucian ( A + B + C ) 202,502

Deductible Amount (2000)

Total Income of Mr Lucian 200,502

The computation of tax liability of Mr Lucian is being calculated below:

On first 5000 there will be no tax.

On next 37700 the tax will be @ 20 % per annum that is = 7540

On next 112299 the tax will be @ 40 % that is = 44920

On last 50502 the tax will be levied at additional rate @ 45 % that will be = 22726

The total tax liability of Mr Lucian will be computed is 75186 Pound.

Salary for self-employed 60,000

Benefit from his employment 9,000

Rent from flat in Barking 7,500

Bank Interest 4,500

Deductible payment

Required

2,000

The Computation of Total Income of Mr Lucian has been mentioned below:

Income from Salary 60000

Employ Benefits 9000

Total Income under the head Salary – A 69000

Income from house property-

Rent from the Flat in Barking 7500

Total Income from other sources – B

Income from other sources

Bank Interest 4500

Total Income from other sources – C

Gross total Income of Mr Lucian ( A + B + C ) 202,502

Deductible Amount (2000)

Total Income of Mr Lucian 200,502

The computation of tax liability of Mr Lucian is being calculated below:

On first 5000 there will be no tax.

On next 37700 the tax will be @ 20 % per annum that is = 7540

On next 112299 the tax will be @ 40 % that is = 44920

On last 50502 the tax will be levied at additional rate @ 45 % that will be = 22726

The total tax liability of Mr Lucian will be computed is 75186 Pound.

On the basis of above analysis, the conclusion will be drawn that if Mr Lucian taxable income is

lower than 150000 then the additional tax he has paid @ 45% could have saved easily. For that

purpose, it is essential for him to indulge in more saving that would reduce his taxable income

below 1500000 Pound.

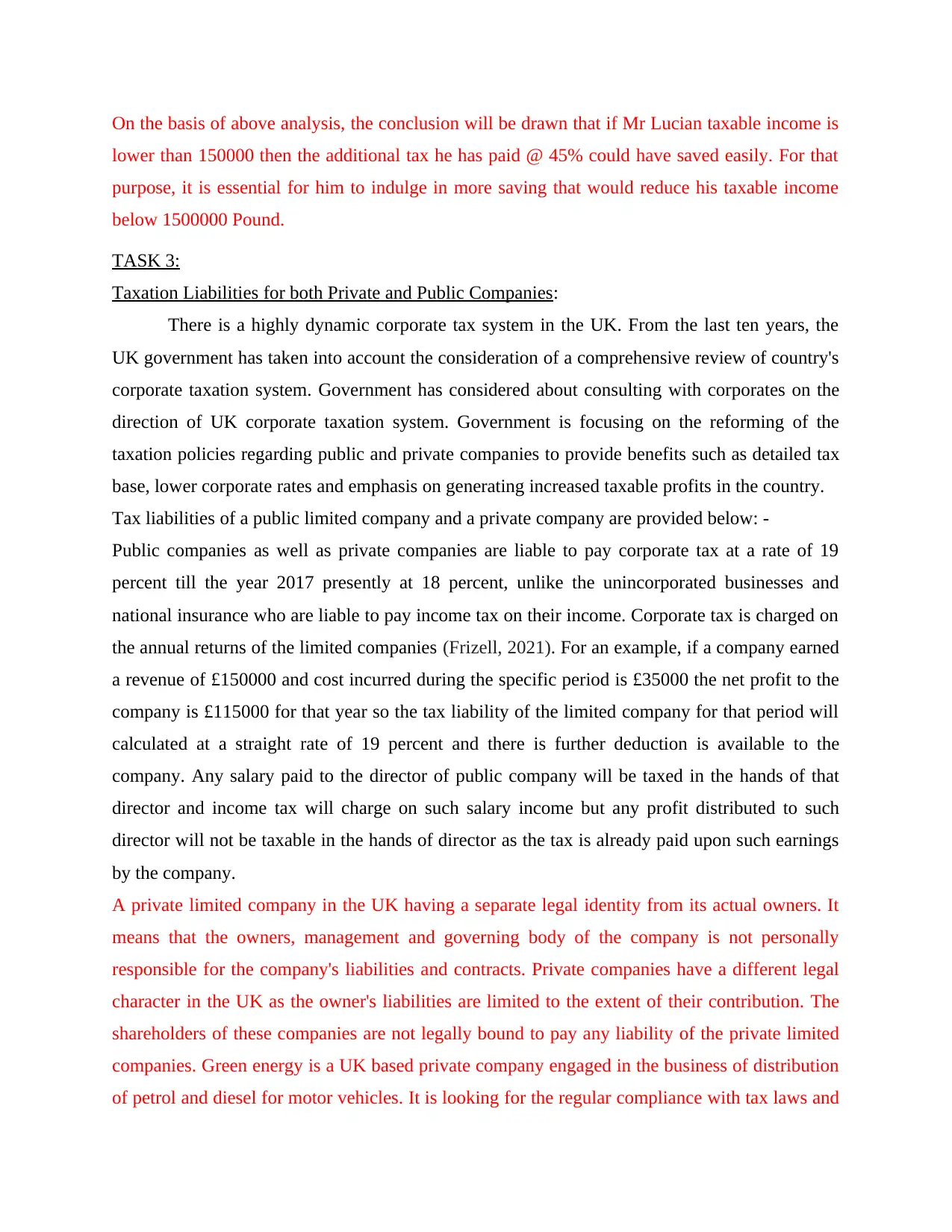

TASK 3:

Taxation Liabilities for both Private and Public Companies:

There is a highly dynamic corporate tax system in the UK. From the last ten years, the

UK government has taken into account the consideration of a comprehensive review of country's

corporate taxation system. Government has considered about consulting with corporates on the

direction of UK corporate taxation system. Government is focusing on the reforming of the

taxation policies regarding public and private companies to provide benefits such as detailed tax

base, lower corporate rates and emphasis on generating increased taxable profits in the country.

Tax liabilities of a public limited company and a private company are provided below: -

Public companies as well as private companies are liable to pay corporate tax at a rate of 19

percent till the year 2017 presently at 18 percent, unlike the unincorporated businesses and

national insurance who are liable to pay income tax on their income. Corporate tax is charged on

the annual returns of the limited companies (Frizell, 2021). For an example, if a company earned

a revenue of £150000 and cost incurred during the specific period is £35000 the net profit to the

company is £115000 for that year so the tax liability of the limited company for that period will

calculated at a straight rate of 19 percent and there is further deduction is available to the

company. Any salary paid to the director of public company will be taxed in the hands of that

director and income tax will charge on such salary income but any profit distributed to such

director will not be taxable in the hands of director as the tax is already paid upon such earnings

by the company.

A private limited company in the UK having a separate legal identity from its actual owners. It

means that the owners, management and governing body of the company is not personally

responsible for the company's liabilities and contracts. Private companies have a different legal

character in the UK as the owner's liabilities are limited to the extent of their contribution. The

shareholders of these companies are not legally bound to pay any liability of the private limited

companies. Green energy is a UK based private company engaged in the business of distribution

of petrol and diesel for motor vehicles. It is looking for the regular compliance with tax laws and

lower than 150000 then the additional tax he has paid @ 45% could have saved easily. For that

purpose, it is essential for him to indulge in more saving that would reduce his taxable income

below 1500000 Pound.

TASK 3:

Taxation Liabilities for both Private and Public Companies:

There is a highly dynamic corporate tax system in the UK. From the last ten years, the

UK government has taken into account the consideration of a comprehensive review of country's

corporate taxation system. Government has considered about consulting with corporates on the

direction of UK corporate taxation system. Government is focusing on the reforming of the

taxation policies regarding public and private companies to provide benefits such as detailed tax

base, lower corporate rates and emphasis on generating increased taxable profits in the country.

Tax liabilities of a public limited company and a private company are provided below: -

Public companies as well as private companies are liable to pay corporate tax at a rate of 19

percent till the year 2017 presently at 18 percent, unlike the unincorporated businesses and

national insurance who are liable to pay income tax on their income. Corporate tax is charged on

the annual returns of the limited companies (Frizell, 2021). For an example, if a company earned

a revenue of £150000 and cost incurred during the specific period is £35000 the net profit to the

company is £115000 for that year so the tax liability of the limited company for that period will

calculated at a straight rate of 19 percent and there is further deduction is available to the

company. Any salary paid to the director of public company will be taxed in the hands of that

director and income tax will charge on such salary income but any profit distributed to such

director will not be taxable in the hands of director as the tax is already paid upon such earnings

by the company.

A private limited company in the UK having a separate legal identity from its actual owners. It

means that the owners, management and governing body of the company is not personally

responsible for the company's liabilities and contracts. Private companies have a different legal

character in the UK as the owner's liabilities are limited to the extent of their contribution. The

shareholders of these companies are not legally bound to pay any liability of the private limited

companies. Green energy is a UK based private company engaged in the business of distribution

of petrol and diesel for motor vehicles. It is looking for the regular compliance with tax laws and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.