University Portfolio Management Report: FIN323 Analysis

VerifiedAdded on 2022/11/26

|8

|982

|379

Report

AI Summary

This report details a hypothetical finance portfolio managed over a year, analyzing the performance of individual stocks like Cochlear, Webjet, A2Milk, and Facebook. It includes calculations of individual stock returns, all trades with options and futures, and brokerage fees. The analysis covers the period from December 1, 2017, to December 1, 2018, with specific data on stock prices and returns. The report calculates the average return, portfolio return, and discusses stock selection based on past performance and future prospects. The analysis includes a breakdown of trades, brokerage fees, and the rationale behind stock choices, offering a comprehensive overview of portfolio management strategies and outcomes. The report also presents the faculty of business school of accounting, economics and finance FIN323 portfolio management assignment academic assessment requirement and learning objectives.

Running head: FINANCE PORTFOLIO MANAGEMENT

Finance Portfolio Management

Name of the Student:

Name of the University:

Authors Note:

Finance Portfolio Management

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

FINANCE PORTFOLIO MANAGEMENT

Contents

Individual stock performance:.........................................................................................................2

All trades for quarter:.......................................................................................................................3

Brokerage fees:................................................................................................................................5

Stock selection:................................................................................................................................6

References:......................................................................................................................................7

FINANCE PORTFOLIO MANAGEMENT

Contents

Individual stock performance:.........................................................................................................2

All trades for quarter:.......................................................................................................................3

Brokerage fees:................................................................................................................................5

Stock selection:................................................................................................................................6

References:......................................................................................................................................7

2

FINANCE PORTFOLIO MANAGEMENT

Individual stock performance:

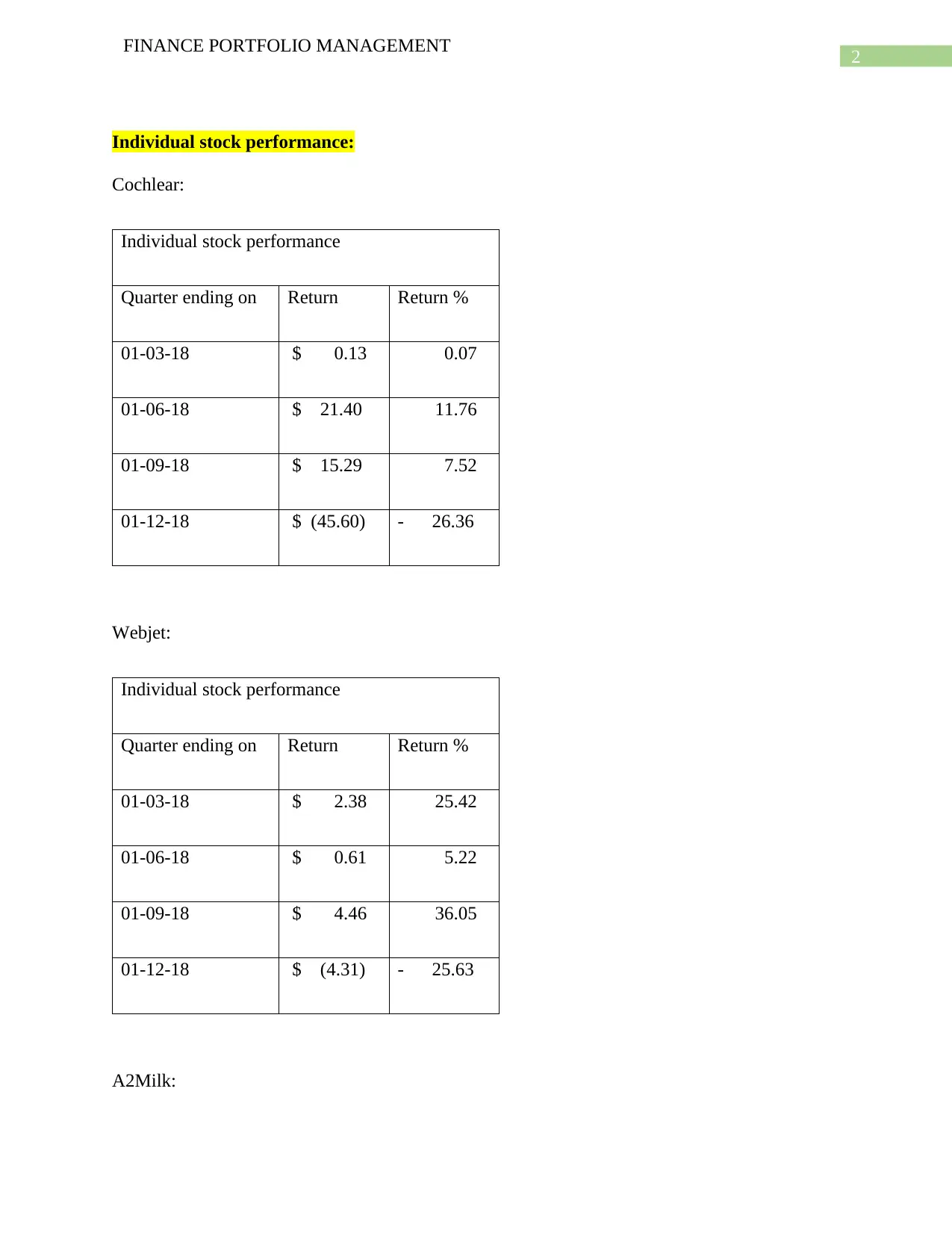

Cochlear:

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 0.13 0.07

01-06-18 $ 21.40 11.76

01-09-18 $ 15.29 7.52

01-12-18 $ (45.60) - 26.36

Webjet:

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 2.38 25.42

01-06-18 $ 0.61 5.22

01-09-18 $ 4.46 36.05

01-12-18 $ (4.31) - 25.63

A2Milk:

FINANCE PORTFOLIO MANAGEMENT

Individual stock performance:

Cochlear:

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 0.13 0.07

01-06-18 $ 21.40 11.76

01-09-18 $ 15.29 7.52

01-12-18 $ (45.60) - 26.36

Webjet:

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 2.38 25.42

01-06-18 $ 0.61 5.22

01-09-18 $ 4.46 36.05

01-12-18 $ (4.31) - 25.63

A2Milk:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

FINANCE PORTFOLIO MANAGEMENT

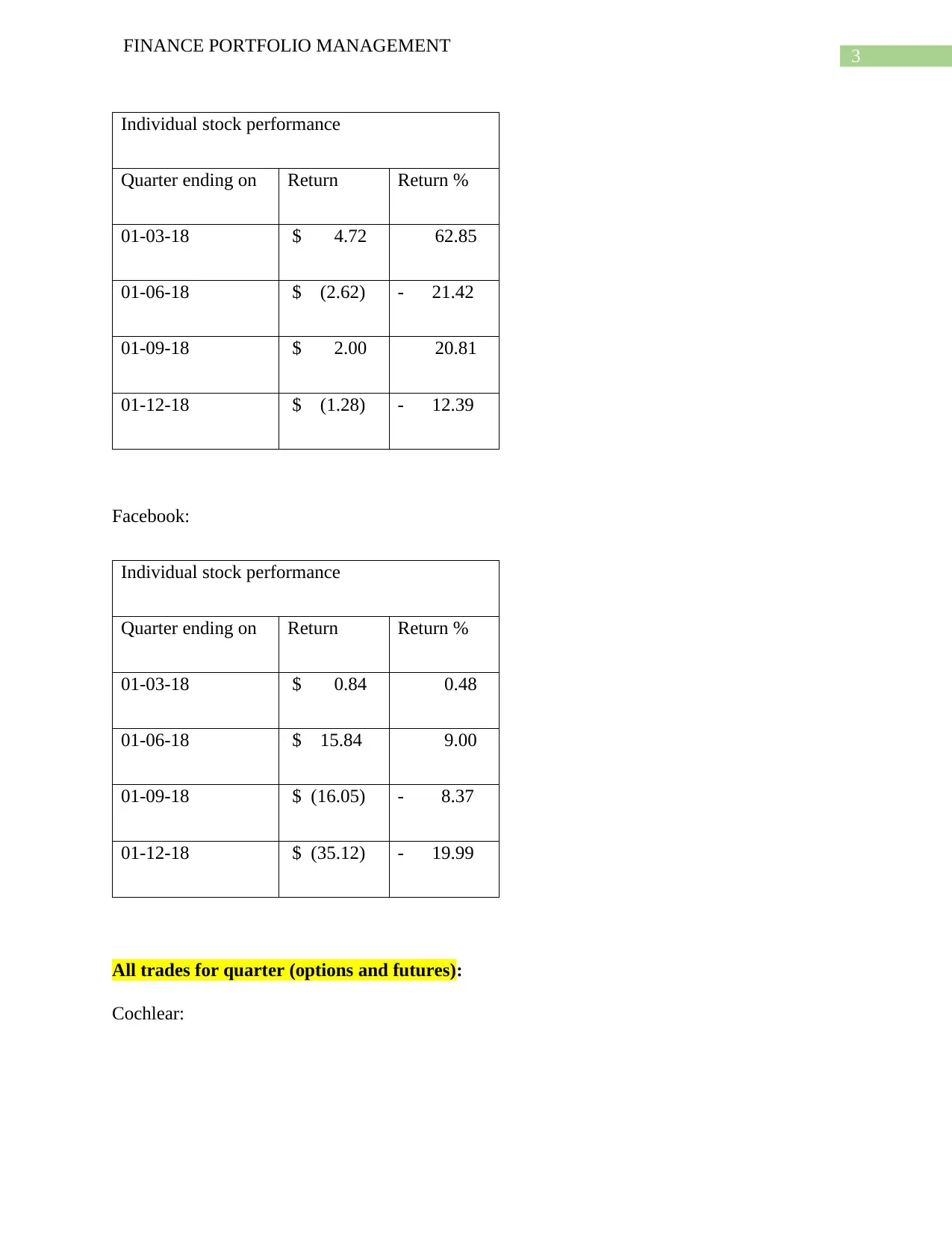

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 4.72 62.85

01-06-18 $ (2.62) - 21.42

01-09-18 $ 2.00 20.81

01-12-18 $ (1.28) - 12.39

Facebook:

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 0.84 0.48

01-06-18 $ 15.84 9.00

01-09-18 $ (16.05) - 8.37

01-12-18 $ (35.12) - 19.99

All trades for quarter (options and futures):

Cochlear:

FINANCE PORTFOLIO MANAGEMENT

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 4.72 62.85

01-06-18 $ (2.62) - 21.42

01-09-18 $ 2.00 20.81

01-12-18 $ (1.28) - 12.39

Facebook:

Individual stock performance

Quarter ending on Return Return %

01-03-18 $ 0.84 0.48

01-06-18 $ 15.84 9.00

01-09-18 $ (16.05) - 8.37

01-12-18 $ (35.12) - 19.99

All trades for quarter (options and futures):

Cochlear:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

FINANCE PORTFOLIO MANAGEMENT

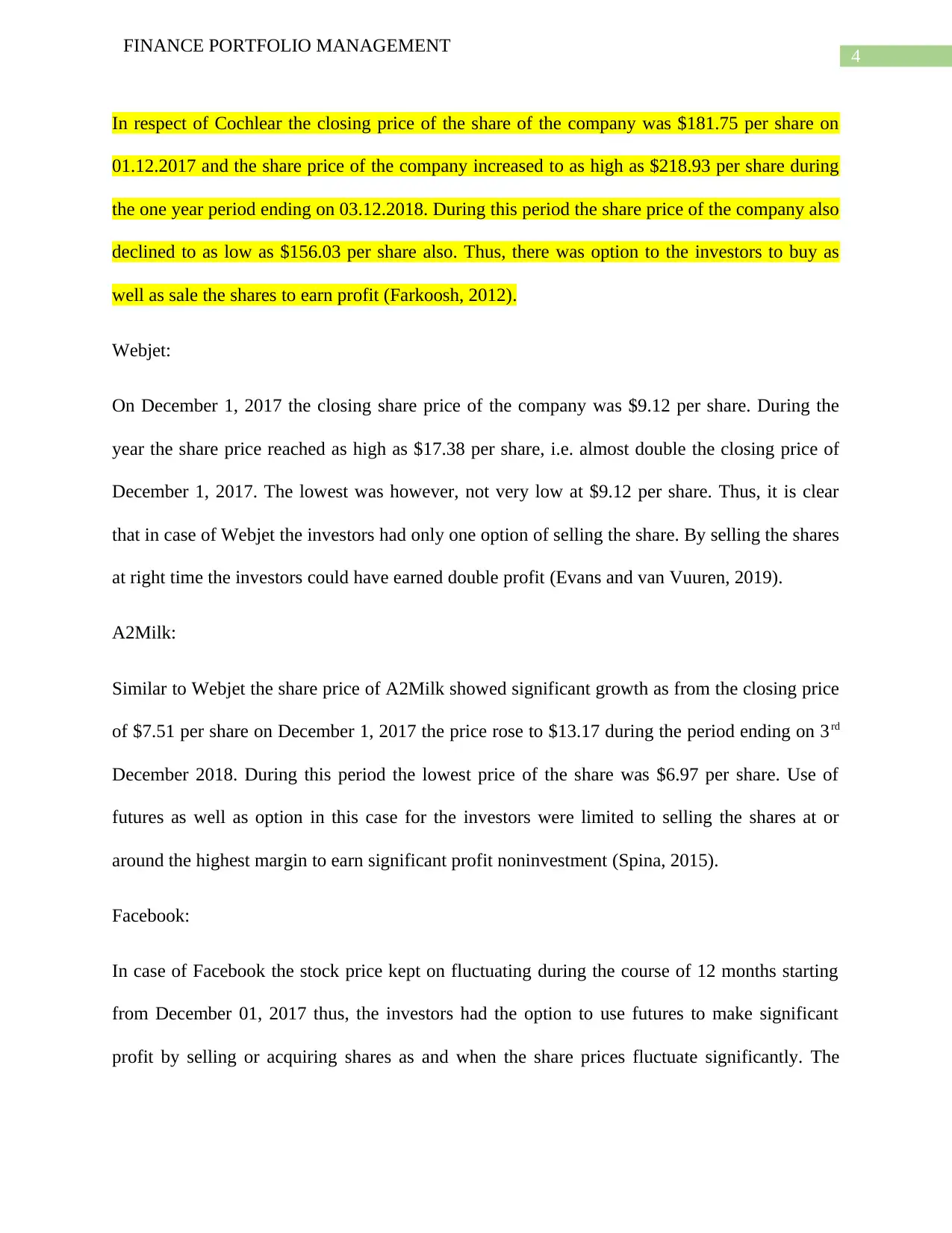

In respect of Cochlear the closing price of the share of the company was $181.75 per share on

01.12.2017 and the share price of the company increased to as high as $218.93 per share during

the one year period ending on 03.12.2018. During this period the share price of the company also

declined to as low as $156.03 per share also. Thus, there was option to the investors to buy as

well as sale the shares to earn profit (Farkoosh, 2012).

Webjet:

On December 1, 2017 the closing share price of the company was $9.12 per share. During the

year the share price reached as high as $17.38 per share, i.e. almost double the closing price of

December 1, 2017. The lowest was however, not very low at $9.12 per share. Thus, it is clear

that in case of Webjet the investors had only one option of selling the share. By selling the shares

at right time the investors could have earned double profit (Evans and van Vuuren, 2019).

A2Milk:

Similar to Webjet the share price of A2Milk showed significant growth as from the closing price

of $7.51 per share on December 1, 2017 the price rose to $13.17 during the period ending on 3rd

December 2018. During this period the lowest price of the share was $6.97 per share. Use of

futures as well as option in this case for the investors were limited to selling the shares at or

around the highest margin to earn significant profit noninvestment (Spina, 2015).

Facebook:

In case of Facebook the stock price kept on fluctuating during the course of 12 months starting

from December 01, 2017 thus, the investors had the option to use futures to make significant

profit by selling or acquiring shares as and when the share prices fluctuate significantly. The

FINANCE PORTFOLIO MANAGEMENT

In respect of Cochlear the closing price of the share of the company was $181.75 per share on

01.12.2017 and the share price of the company increased to as high as $218.93 per share during

the one year period ending on 03.12.2018. During this period the share price of the company also

declined to as low as $156.03 per share also. Thus, there was option to the investors to buy as

well as sale the shares to earn profit (Farkoosh, 2012).

Webjet:

On December 1, 2017 the closing share price of the company was $9.12 per share. During the

year the share price reached as high as $17.38 per share, i.e. almost double the closing price of

December 1, 2017. The lowest was however, not very low at $9.12 per share. Thus, it is clear

that in case of Webjet the investors had only one option of selling the share. By selling the shares

at right time the investors could have earned double profit (Evans and van Vuuren, 2019).

A2Milk:

Similar to Webjet the share price of A2Milk showed significant growth as from the closing price

of $7.51 per share on December 1, 2017 the price rose to $13.17 during the period ending on 3rd

December 2018. During this period the lowest price of the share was $6.97 per share. Use of

futures as well as option in this case for the investors were limited to selling the shares at or

around the highest margin to earn significant profit noninvestment (Spina, 2015).

Facebook:

In case of Facebook the stock price kept on fluctuating during the course of 12 months starting

from December 01, 2017 thus, the investors had the option to use futures to make significant

profit by selling or acquiring shares as and when the share prices fluctuate significantly. The

5

FINANCE PORTFOLIO MANAGEMENT

highest closing price of Facebook share during the period was $21750 per share with lowest

being $131.55 per share (Cumming and Murtinu, 2017).

Thus in the cases there were ample opportunity to trade in share as the share prices during the

entire period kept on fluctuating.

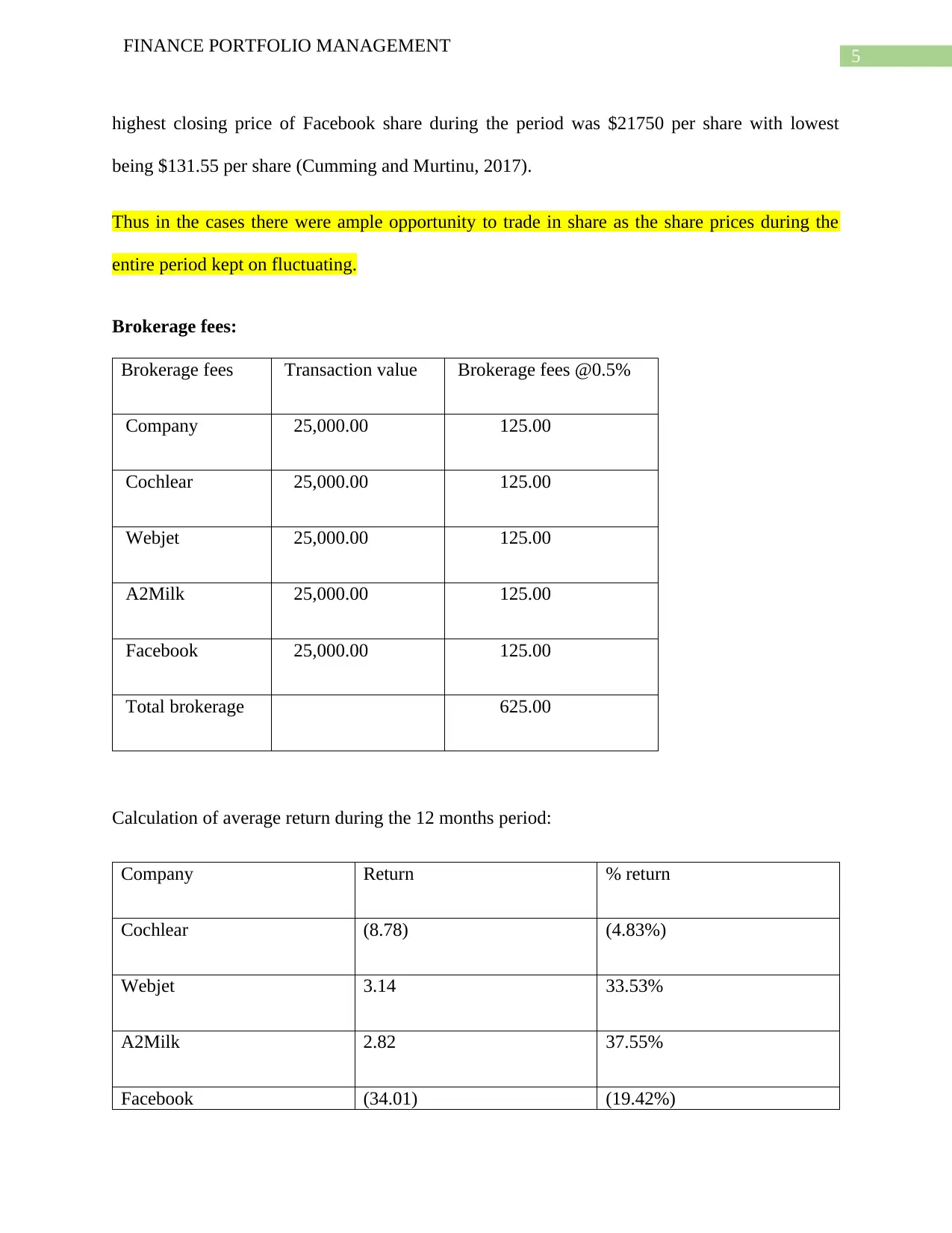

Brokerage fees:

Brokerage fees Transaction value Brokerage fees @0.5%

Company 25,000.00 125.00

Cochlear 25,000.00 125.00

Webjet 25,000.00 125.00

A2Milk 25,000.00 125.00

Facebook 25,000.00 125.00

Total brokerage 625.00

Calculation of average return during the 12 months period:

Company Return % return

Cochlear (8.78) (4.83%)

Webjet 3.14 33.53%

A2Milk 2.82 37.55%

Facebook (34.01) (19.42%)

FINANCE PORTFOLIO MANAGEMENT

highest closing price of Facebook share during the period was $21750 per share with lowest

being $131.55 per share (Cumming and Murtinu, 2017).

Thus in the cases there were ample opportunity to trade in share as the share prices during the

entire period kept on fluctuating.

Brokerage fees:

Brokerage fees Transaction value Brokerage fees @0.5%

Company 25,000.00 125.00

Cochlear 25,000.00 125.00

Webjet 25,000.00 125.00

A2Milk 25,000.00 125.00

Facebook 25,000.00 125.00

Total brokerage 625.00

Calculation of average return during the 12 months period:

Company Return % return

Cochlear (8.78) (4.83%)

Webjet 3.14 33.53%

A2Milk 2.82 37.55%

Facebook (34.01) (19.42%)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

FINANCE PORTFOLIO MANAGEMENT

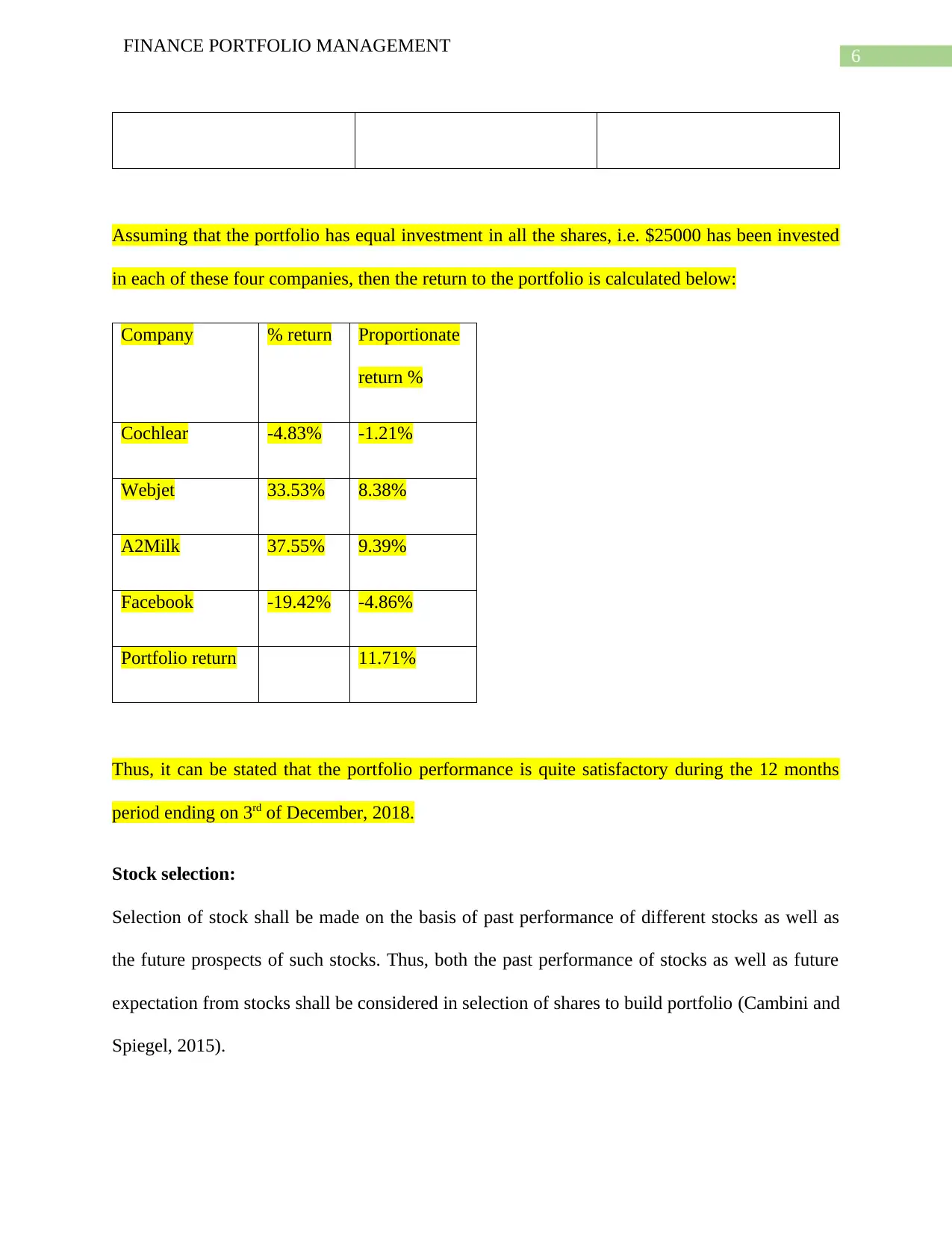

Assuming that the portfolio has equal investment in all the shares, i.e. $25000 has been invested

in each of these four companies, then the return to the portfolio is calculated below:

Company % return Proportionate

return %

Cochlear -4.83% -1.21%

Webjet 33.53% 8.38%

A2Milk 37.55% 9.39%

Facebook -19.42% -4.86%

Portfolio return 11.71%

Thus, it can be stated that the portfolio performance is quite satisfactory during the 12 months

period ending on 3rd of December, 2018.

Stock selection:

Selection of stock shall be made on the basis of past performance of different stocks as well as

the future prospects of such stocks. Thus, both the past performance of stocks as well as future

expectation from stocks shall be considered in selection of shares to build portfolio (Cambini and

Spiegel, 2015).

FINANCE PORTFOLIO MANAGEMENT

Assuming that the portfolio has equal investment in all the shares, i.e. $25000 has been invested

in each of these four companies, then the return to the portfolio is calculated below:

Company % return Proportionate

return %

Cochlear -4.83% -1.21%

Webjet 33.53% 8.38%

A2Milk 37.55% 9.39%

Facebook -19.42% -4.86%

Portfolio return 11.71%

Thus, it can be stated that the portfolio performance is quite satisfactory during the 12 months

period ending on 3rd of December, 2018.

Stock selection:

Selection of stock shall be made on the basis of past performance of different stocks as well as

the future prospects of such stocks. Thus, both the past performance of stocks as well as future

expectation from stocks shall be considered in selection of shares to build portfolio (Cambini and

Spiegel, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

FINANCE PORTFOLIO MANAGEMENT

References:

Cambini, C. and Spiegel, Y. (2015). Investment and Capital Structure of Partially Private

Regulated Firms. Journal of Economics & Management Strategy, 25(2), pp.487-515.

Cumming, D. and Murtinu, S. (2017). Banks Joining Venture Capital Investments: Portfolio

Selection, Strategic Objectives, Performance and Exit. SSRN Electronic Journal, 1(2),

pp.24-34.

Evans, C. and van Vuuren, G. (2019). Investment strategy performance under tracking error

constraints. Investment Management and Financial Innovations, 16(1), pp.239-257.

Farkoosh, P. (2012). The effect net assets value in purchasing the shares of investment

companies. IOSR Journal of Humanities and Social Science, 5(2), pp.17-20.

Spina, J. (2015). Survey on International Portfolio Investments. SSRN Electronic Journal, 3(5),

pp.12-61.

FINANCE PORTFOLIO MANAGEMENT

References:

Cambini, C. and Spiegel, Y. (2015). Investment and Capital Structure of Partially Private

Regulated Firms. Journal of Economics & Management Strategy, 25(2), pp.487-515.

Cumming, D. and Murtinu, S. (2017). Banks Joining Venture Capital Investments: Portfolio

Selection, Strategic Objectives, Performance and Exit. SSRN Electronic Journal, 1(2),

pp.24-34.

Evans, C. and van Vuuren, G. (2019). Investment strategy performance under tracking error

constraints. Investment Management and Financial Innovations, 16(1), pp.239-257.

Farkoosh, P. (2012). The effect net assets value in purchasing the shares of investment

companies. IOSR Journal of Humanities and Social Science, 5(2), pp.17-20.

Spina, J. (2015). Survey on International Portfolio Investments. SSRN Electronic Journal, 3(5),

pp.12-61.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.