University Portfolio Management: A Comparative Analysis

VerifiedAdded on 2022/08/11

|19

|4259

|24

Project

AI Summary

This report presents an in-depth analysis of three distinct investment portfolios, each managed under different styles and strategies. The project involves creating and managing an actively selected portfolio, a randomly selected portfolio, and a passive portfolio, each containing four common equity stocks. The report outlines the investment policy statements for each portfolio, detailing the risk and return objectives, and specific investor profiles. It then delves into the portfolio management styles, comparing active and passive approaches. The stock selection process is explained, including industry analysis and the rationale behind choosing specific stocks for each portfolio. The report evaluates the initial and end values of the portfolios over an eight-week period, comparing their performance. This includes an examination of the returns generated by each portfolio, and the strategies employed. The analysis includes transaction costs and the impact of market conditions, providing a comprehensive overview of portfolio management techniques and their effectiveness.

Running head: PORTFOLIO MANAGEMENT

Portfolio Management

Name of the Student:

Name of the University:

Author Note:

Portfolio Management

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT

Executive Summary:

Portfolio management is a skill which is demonstrated by managing the portfolio in different

style, employing different strategies and achieving different results. The styles can be active –

passive, value vs. growth, large cap vs. small cap and many more styles. The strategies which

can be employed can be both buy and hold, or short and recover and many other strategies

which are employed by the portfolio manager depending on his economic belief. Thus in this

report three portfolio are created and managed using different styles of portfolio

management. The portfolio are created using equal weights provided to each holding,

however the initial value of the portfolio differing for each of the portfolio. The portfolio are

held for a period of 8 weeks, with weekly review of the portfolio. Thus the portfolio creation,

specification and performance are compared after the end of 8 weeks, which is provided

below in the following report.

Executive Summary:

Portfolio management is a skill which is demonstrated by managing the portfolio in different

style, employing different strategies and achieving different results. The styles can be active –

passive, value vs. growth, large cap vs. small cap and many more styles. The strategies which

can be employed can be both buy and hold, or short and recover and many other strategies

which are employed by the portfolio manager depending on his economic belief. Thus in this

report three portfolio are created and managed using different styles of portfolio

management. The portfolio are created using equal weights provided to each holding,

however the initial value of the portfolio differing for each of the portfolio. The portfolio are

held for a period of 8 weeks, with weekly review of the portfolio. Thus the portfolio creation,

specification and performance are compared after the end of 8 weeks, which is provided

below in the following report.

PORTFOLIO MANAGEMENT

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

Investment Policy Statement:.................................................................................................3

Investment Policy Statement for Portfolio P1:...................................................................4

Investment Policy Statement for Portfolio P2:...................................................................5

Investment Policy Statement for Portfolio P3:...................................................................5

Portfolio Management Style:.................................................................................................6

Portfolio Stock Selection and Industry Analysis:..................................................................7

Stock and Industry of the Portfolio P1:..............................................................................7

Stock and Industry of the Portfolio P2:..............................................................................8

Stock and Industry of the Portfolio P:................................................................................8

Initial and End Value of the Portfolio:...................................................................................9

Portfolio Strategy and Performance:....................................................................................10

Performance of Portfolio P1:...........................................................................................10

Performance of Portfolio P2:...........................................................................................11

Performance of Portfolio P3:...........................................................................................12

Conclusion:..............................................................................................................................12

Table of Contents

Introduction:...............................................................................................................................3

Discussion:.................................................................................................................................3

Investment Policy Statement:.................................................................................................3

Investment Policy Statement for Portfolio P1:...................................................................4

Investment Policy Statement for Portfolio P2:...................................................................5

Investment Policy Statement for Portfolio P3:...................................................................5

Portfolio Management Style:.................................................................................................6

Portfolio Stock Selection and Industry Analysis:..................................................................7

Stock and Industry of the Portfolio P1:..............................................................................7

Stock and Industry of the Portfolio P2:..............................................................................8

Stock and Industry of the Portfolio P:................................................................................8

Initial and End Value of the Portfolio:...................................................................................9

Portfolio Strategy and Performance:....................................................................................10

Performance of Portfolio P1:...........................................................................................10

Performance of Portfolio P2:...........................................................................................11

Performance of Portfolio P3:...........................................................................................12

Conclusion:..............................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT

Introduction:

The following report is the analysis of three portfolio’s consisting of 4 stocks each in

each portfolio. The portfolio management process is a skill which requires the manager to

generate returns which beat the benchmark. However, sometimes in order to generate higher

returns the portfolio is rebalanced frequently, thus leads to an increase in the transaction cost

and taxes. Thus, reducing the returns on the portfolio on an overall basis. Thus the portfolio

which is managed actively by the portfolio manager in order to generate higher returns is

called actively managed portfolio. However, sometimes investors tend to generate returns

which is equal to the index or benchmark return. Thus the portfolio manager need not beat

the benchmark, but generate returns which is equal to the benchmark index or slightly

greater. Thus the manager need not rebalance the portfolio so frequently and hence can be

expected to mimic the benchmark (Buston, 2016).

Thus the aim of this report is to highlight the actions which is taken by an active fund

manager to a passive fund manager. The portfolio will be held for a period of 8 weeks and the

prices of the holding will be recorded on a weekly basis. Thus the returns which is generated

by the three portfolio along with their investment style will be covered in the report.

Discussion:

Investment Policy Statement:

The investment policy statement is a document which is prepared by the portfolio

manager before the starting of the investment. It clarifies all the risk and return objective of

the clients and highlights the special consideration which is pertaining to the client. It defines

the method of execution which can be taken by the portfolio manager when undertaking

investments. It specifies the risk which can be taken by the client with respect to the portfolio,

Introduction:

The following report is the analysis of three portfolio’s consisting of 4 stocks each in

each portfolio. The portfolio management process is a skill which requires the manager to

generate returns which beat the benchmark. However, sometimes in order to generate higher

returns the portfolio is rebalanced frequently, thus leads to an increase in the transaction cost

and taxes. Thus, reducing the returns on the portfolio on an overall basis. Thus the portfolio

which is managed actively by the portfolio manager in order to generate higher returns is

called actively managed portfolio. However, sometimes investors tend to generate returns

which is equal to the index or benchmark return. Thus the portfolio manager need not beat

the benchmark, but generate returns which is equal to the benchmark index or slightly

greater. Thus the manager need not rebalance the portfolio so frequently and hence can be

expected to mimic the benchmark (Buston, 2016).

Thus the aim of this report is to highlight the actions which is taken by an active fund

manager to a passive fund manager. The portfolio will be held for a period of 8 weeks and the

prices of the holding will be recorded on a weekly basis. Thus the returns which is generated

by the three portfolio along with their investment style will be covered in the report.

Discussion:

Investment Policy Statement:

The investment policy statement is a document which is prepared by the portfolio

manager before the starting of the investment. It clarifies all the risk and return objective of

the clients and highlights the special consideration which is pertaining to the client. It defines

the method of execution which can be taken by the portfolio manager when undertaking

investments. It specifies the risk which can be taken by the client with respect to the portfolio,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT

and the limits for each level of risk. The return objective is defined along with the benchmark

with which the portfolio performance would be compared. This statement also provides the

period of rebalancing the portfolio, and the standard norms defines to revise the investment

policy statement on a yearly basis, or when a significant change happens in the clients

circumstances (Champagne, Karoui & Patel 2018).

Investment Policy Statement for Portfolio P1:

The investment policy statement for the portfolio p1 is presented in the following

bullets.

Name of the Investor: Mr Billy Jones.

Age of the Investor: 38

Occupation of the Investor: Business Owner of a chain of restaurant

Marital Status: Single

Property owned: Two condos, 1 yacht and 6 cars.

Discretionary Income: 1000000 million dollars.

Thus the above is the basic details of the investor who is willing to invest in a

portfolio. The client or investor has an above average ability to bear risk as highlighted from

the basic information and the client has specified as to invest in stocks which bear risk. Hence

the investor seems to be a risk lover and is willing and able to bear risk. Also the client has a

long time horizon, which is prominent from the age and the client has no plans to retire in the

near future. There are no liquidity requirements which are needed to be met from the

portfolio, hence liquidity and time is not a constraint for the portfolio manager. The legal and

tax requirements of the client are effectively dealt with and the client has efficient tax saving

strategies which are not directly proportional to the investment portfolio. However, the client

and the limits for each level of risk. The return objective is defined along with the benchmark

with which the portfolio performance would be compared. This statement also provides the

period of rebalancing the portfolio, and the standard norms defines to revise the investment

policy statement on a yearly basis, or when a significant change happens in the clients

circumstances (Champagne, Karoui & Patel 2018).

Investment Policy Statement for Portfolio P1:

The investment policy statement for the portfolio p1 is presented in the following

bullets.

Name of the Investor: Mr Billy Jones.

Age of the Investor: 38

Occupation of the Investor: Business Owner of a chain of restaurant

Marital Status: Single

Property owned: Two condos, 1 yacht and 6 cars.

Discretionary Income: 1000000 million dollars.

Thus the above is the basic details of the investor who is willing to invest in a

portfolio. The client or investor has an above average ability to bear risk as highlighted from

the basic information and the client has specified as to invest in stocks which bear risk. Hence

the investor seems to be a risk lover and is willing and able to bear risk. Also the client has a

long time horizon, which is prominent from the age and the client has no plans to retire in the

near future. There are no liquidity requirements which are needed to be met from the

portfolio, hence liquidity and time is not a constraint for the portfolio manager. The legal and

tax requirements of the client are effectively dealt with and the client has efficient tax saving

strategies which are not directly proportional to the investment portfolio. However, the client

PORTFOLIO MANAGEMENT

has a unique circumstance to analyse the performance of the portfolio for two months before

making the decision to invest with the portfolio manager.

Investment Policy Statement for Portfolio P2:

The investment policy statement for the portfolio p1 is presented in the following

bullets.

Name of the Investor: Mr Jack Ryan.

Age of the Investor: 27

Occupation of the Investor: Started his career as a sales manager.

Marital Status: Single

Property owned: Own home with mortgage, one car.

Discretionary Income: 10000 dollars.

The client is a job oriented person who has just started his career as a sales manager,

and is willing to invest and try the luck in the stock markets. The investor has own home with

mortgage while owing a car, thus the ability to take risk is less for the investor. Also the

investor has specified as he no specific risk preference in the management of the portfolio

and is neutral with lower risk or higher risk. Thus the investor can be classified as a risk

neutral investor according to the specific circumstances of the investor. The investor has a

unique circumstance to invest in the markets for 2 months and analyse the performance of the

portfolio and then making a decision to invest in the portfolio for a longer term. The liquidity

requirements for the client are low as the basic expense of the client are met from the salary

of the client. The discretionary income which is available by the client can be used for

making the investment which he has received from his grandmother.

has a unique circumstance to analyse the performance of the portfolio for two months before

making the decision to invest with the portfolio manager.

Investment Policy Statement for Portfolio P2:

The investment policy statement for the portfolio p1 is presented in the following

bullets.

Name of the Investor: Mr Jack Ryan.

Age of the Investor: 27

Occupation of the Investor: Started his career as a sales manager.

Marital Status: Single

Property owned: Own home with mortgage, one car.

Discretionary Income: 10000 dollars.

The client is a job oriented person who has just started his career as a sales manager,

and is willing to invest and try the luck in the stock markets. The investor has own home with

mortgage while owing a car, thus the ability to take risk is less for the investor. Also the

investor has specified as he no specific risk preference in the management of the portfolio

and is neutral with lower risk or higher risk. Thus the investor can be classified as a risk

neutral investor according to the specific circumstances of the investor. The investor has a

unique circumstance to invest in the markets for 2 months and analyse the performance of the

portfolio and then making a decision to invest in the portfolio for a longer term. The liquidity

requirements for the client are low as the basic expense of the client are met from the salary

of the client. The discretionary income which is available by the client can be used for

making the investment which he has received from his grandmother.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT

Investment Policy Statement for Portfolio P3:

The investment policy statement for the portfolio p1 is presented in the following

bullets.

Name of the Investor: Mr Robert Downey.

Age of the Investor: 57

Occupation of the Investor: Working as an office manager.

Marital Status: Married with two teen children

Property owned: Own home, two car and a holiday home in suburbs.

Discretionary Income: 100000 dollars.

The client is a senior employee and working as an office manager, thus the age of the

investor reduces the ability of the investor to take risk. Although the ability to take risk is

moderate for the investor given the net worth of the investor. The ability to take risk by the

investor reduces further due to the presence of dependants on the investor. The investor has

no liquidity requirements as he is covered with retirement plans and is investing the available

funds to generate capital appreciation which would be given to the children at the time of his

death. Thus, the aim of the investor is to generate capital appreciation which is at par with the

index. Thus the investor wants the portfolio to mimic the index, and generate returns which is

at par with the index. The client has no legal and tax circumstances which needs to be

considered by the portfolio manager while making investment decision. Also the client has no

unique circumstances which needs to be considered by the portfolio manager while making

the investment decision.

Portfolio Management Style:

The portfolio can be managed in different styles depending upon the risk and return

requirements of individual clients. Thus primarily there are two types of managing the

Investment Policy Statement for Portfolio P3:

The investment policy statement for the portfolio p1 is presented in the following

bullets.

Name of the Investor: Mr Robert Downey.

Age of the Investor: 57

Occupation of the Investor: Working as an office manager.

Marital Status: Married with two teen children

Property owned: Own home, two car and a holiday home in suburbs.

Discretionary Income: 100000 dollars.

The client is a senior employee and working as an office manager, thus the age of the

investor reduces the ability of the investor to take risk. Although the ability to take risk is

moderate for the investor given the net worth of the investor. The ability to take risk by the

investor reduces further due to the presence of dependants on the investor. The investor has

no liquidity requirements as he is covered with retirement plans and is investing the available

funds to generate capital appreciation which would be given to the children at the time of his

death. Thus, the aim of the investor is to generate capital appreciation which is at par with the

index. Thus the investor wants the portfolio to mimic the index, and generate returns which is

at par with the index. The client has no legal and tax circumstances which needs to be

considered by the portfolio manager while making investment decision. Also the client has no

unique circumstances which needs to be considered by the portfolio manager while making

the investment decision.

Portfolio Management Style:

The portfolio can be managed in different styles depending upon the risk and return

requirements of individual clients. Thus primarily there are two types of managing the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT

portfolio which are active management and passive management of the portfolio. The active

management of the portfolio involves churning of the portfolio by the portfolio based on its

expectations of the stock. The portfolio manager aims to earn abnormal return and to beat the

benchmark, thus this involves churning of the portfolio. Thus the active management can lead

to the portfolio incurring greater transaction cost which can increase the cost for the investor.

Passive management of the portfolio involves the portfolio manager to invest in stocks and

try to mimic the return which is generated from the index. Thus this management style

involves less churning of the portfolio by the manager which reduces the transaction cost and

taxes for the investor (Chandra, 2017).

Portfolio Stock Selection and Industry Analysis:

The portfolio which have been created have been conducted by an analysis of the

industry and the stock are selected after the analysis. The rationale for taking the stocks in the

portfolio is based on the following points.

Stock and Industry of the Portfolio P1:

The following stocks which have been listed in the bullets have been selected for the

portfolio along with the reasons for selection.

Verizon Communication: The stock is related to the communication and

entertainment industry. The stock has been selected as due to the fear of corona virus

people would tend to communicate more over the phone for personal and business

communication, which can lead to rise in the revenue of the share

(www.theverge.com 2020).

Amazon: The stock provides all products which are required by the consumers, for

daily basis and also provides entertainment services. Thus due to the fear of Corona

Virus, consumers would tend to shop for essentials online and to avoid public

portfolio which are active management and passive management of the portfolio. The active

management of the portfolio involves churning of the portfolio by the portfolio based on its

expectations of the stock. The portfolio manager aims to earn abnormal return and to beat the

benchmark, thus this involves churning of the portfolio. Thus the active management can lead

to the portfolio incurring greater transaction cost which can increase the cost for the investor.

Passive management of the portfolio involves the portfolio manager to invest in stocks and

try to mimic the return which is generated from the index. Thus this management style

involves less churning of the portfolio by the manager which reduces the transaction cost and

taxes for the investor (Chandra, 2017).

Portfolio Stock Selection and Industry Analysis:

The portfolio which have been created have been conducted by an analysis of the

industry and the stock are selected after the analysis. The rationale for taking the stocks in the

portfolio is based on the following points.

Stock and Industry of the Portfolio P1:

The following stocks which have been listed in the bullets have been selected for the

portfolio along with the reasons for selection.

Verizon Communication: The stock is related to the communication and

entertainment industry. The stock has been selected as due to the fear of corona virus

people would tend to communicate more over the phone for personal and business

communication, which can lead to rise in the revenue of the share

(www.theverge.com 2020).

Amazon: The stock provides all products which are required by the consumers, for

daily basis and also provides entertainment services. Thus due to the fear of Corona

Virus, consumers would tend to shop for essentials online and to avoid public

PORTFOLIO MANAGEMENT

exposure would prefer use of entertainment service online. Thus the revenue of the

company can be expected to increase in the short term (www.dailymail.co.uk 2020).

Apple: The stock can be expected to provide a superior results due to its successful

launch of I-phone 11 and increased sales due to the new phone. A new smart watch

which is expected to be launched by apple can lead to rise in price of the shares of the

company.

Walmart: Due to fear of Corona virus, general consumers would tend to purchase

grocery and daily essential online thus can lead to rise in revenue for the company

(www.cnbc.com 2020).

Stock and Industry of the Portfolio P2:

The following stocks which have been listed in the bullets have been selected for the

portfolio along with the reasons for selection.

Nike: The Company has been making advancements in the athletic footwear, and

developing new technology to enhance performance of athletes. The Company has

been making advancements with its Go-fly technology and thus would lead to

creation of value for the shareholders (www.forbes.com 2020).

Chipotle Mexican Grill: The Company is expected to announce positive earnings for

the 1st quarter of 2020, thus this would lead to creation of value for the shareholders.

Whirlpool: The Company has been investing in its supply chain management which

would effectively deliver products to end consumers. Thus this would increase the

efficiency of the company and would enhance the brand value of the company

(redmondregister.com 2020).

Pay-pal: It is a mode of payment which is used around the globe by users to make

payment. The company is planning to expand its operations in India, thus would lead

exposure would prefer use of entertainment service online. Thus the revenue of the

company can be expected to increase in the short term (www.dailymail.co.uk 2020).

Apple: The stock can be expected to provide a superior results due to its successful

launch of I-phone 11 and increased sales due to the new phone. A new smart watch

which is expected to be launched by apple can lead to rise in price of the shares of the

company.

Walmart: Due to fear of Corona virus, general consumers would tend to purchase

grocery and daily essential online thus can lead to rise in revenue for the company

(www.cnbc.com 2020).

Stock and Industry of the Portfolio P2:

The following stocks which have been listed in the bullets have been selected for the

portfolio along with the reasons for selection.

Nike: The Company has been making advancements in the athletic footwear, and

developing new technology to enhance performance of athletes. The Company has

been making advancements with its Go-fly technology and thus would lead to

creation of value for the shareholders (www.forbes.com 2020).

Chipotle Mexican Grill: The Company is expected to announce positive earnings for

the 1st quarter of 2020, thus this would lead to creation of value for the shareholders.

Whirlpool: The Company has been investing in its supply chain management which

would effectively deliver products to end consumers. Thus this would increase the

efficiency of the company and would enhance the brand value of the company

(redmondregister.com 2020).

Pay-pal: It is a mode of payment which is used around the globe by users to make

payment. The company is planning to expand its operations in India, thus would lead

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT

to capture one of the most populated countries. Thus would tend to increase the

revenue for the company (www.cnbc.com/ 2020).

Stock and Industry of the Portfolio P:

The following stocks which have been listed in the bullets have been selected for the

portfolio along with the reasons for selection.

JC Penny and Co: The Company has been facing trouble, but can turn around with

effective policies. Thus the earnings for the quarter are expected to be positive for the

company which can lead to increase in the share price of the company

(www.financialexpress.com 2020).

Plantronics: The company is involved in producing superior electronic products, thus

the new head phones by the company is one of the most awaited product for music

lovers, and thus can lead to rise in the profits of the company (www.letsrun.com

2020).

Vivint Solar Inc.: The company provides solar power solutions and thus with the

awareness of use of renewable source of energy, this can create profits for the

shareholders in the future.

Plexus Group: The Company had been in news and some high stakes were taken by

Asset Management Company, thus which highlights the presence of some favourable

future opportunities which is available to the company (www.reuters.com 2020).

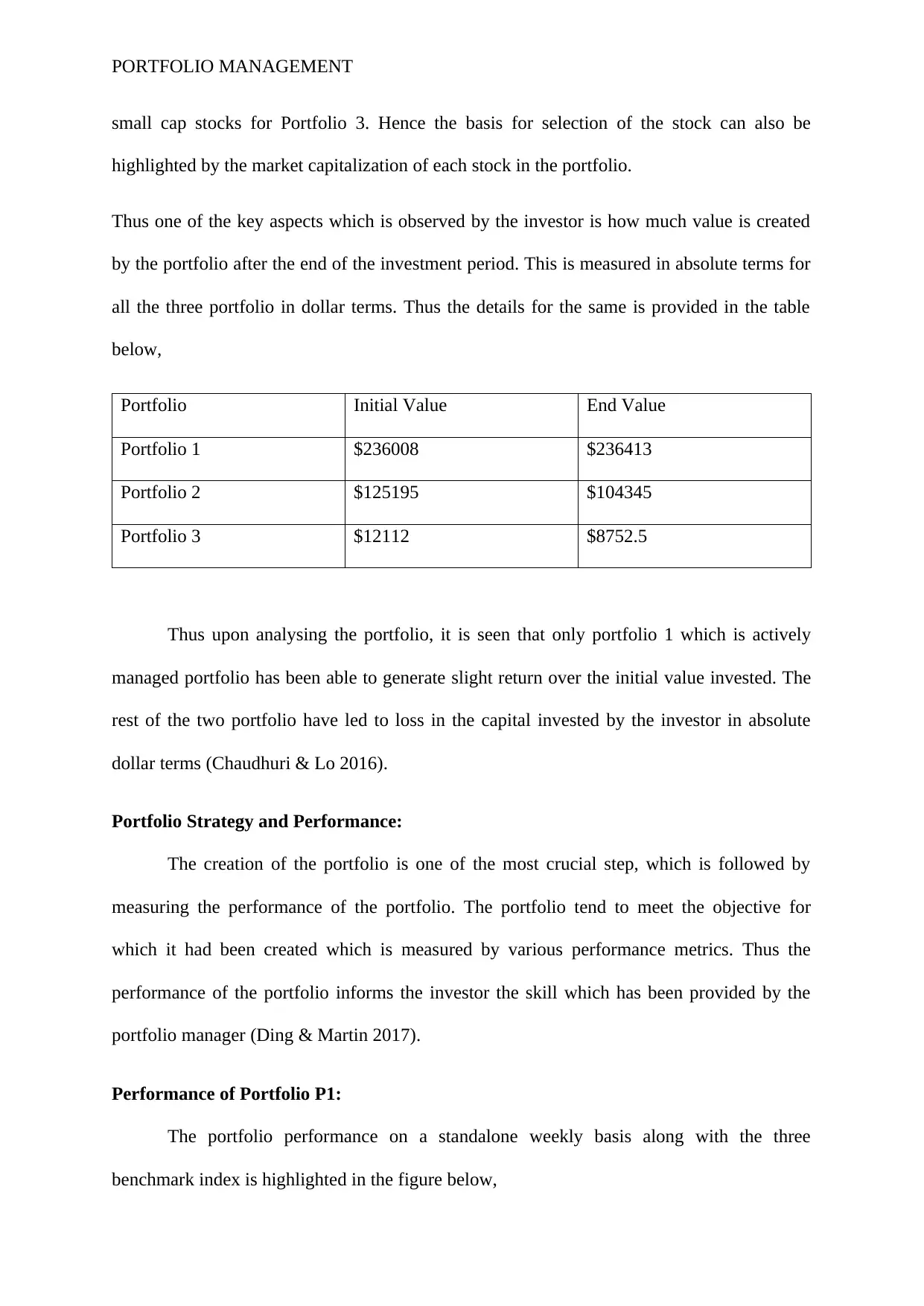

Initial and End Value of the Portfolio Comprising of strategy outline:

The portfolio which have been created at the start of week 1, have been created using

the financial news which have been highlighted in the points above. The basic strategy which

is employed by all the portfolio is to buy and hold the stocks for the 8 week period. The

stocks can be classified as Mega cap for portfolio 1, Large Cap stocks for Portfolio 2 and

to capture one of the most populated countries. Thus would tend to increase the

revenue for the company (www.cnbc.com/ 2020).

Stock and Industry of the Portfolio P:

The following stocks which have been listed in the bullets have been selected for the

portfolio along with the reasons for selection.

JC Penny and Co: The Company has been facing trouble, but can turn around with

effective policies. Thus the earnings for the quarter are expected to be positive for the

company which can lead to increase in the share price of the company

(www.financialexpress.com 2020).

Plantronics: The company is involved in producing superior electronic products, thus

the new head phones by the company is one of the most awaited product for music

lovers, and thus can lead to rise in the profits of the company (www.letsrun.com

2020).

Vivint Solar Inc.: The company provides solar power solutions and thus with the

awareness of use of renewable source of energy, this can create profits for the

shareholders in the future.

Plexus Group: The Company had been in news and some high stakes were taken by

Asset Management Company, thus which highlights the presence of some favourable

future opportunities which is available to the company (www.reuters.com 2020).

Initial and End Value of the Portfolio Comprising of strategy outline:

The portfolio which have been created at the start of week 1, have been created using

the financial news which have been highlighted in the points above. The basic strategy which

is employed by all the portfolio is to buy and hold the stocks for the 8 week period. The

stocks can be classified as Mega cap for portfolio 1, Large Cap stocks for Portfolio 2 and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT

small cap stocks for Portfolio 3. Hence the basis for selection of the stock can also be

highlighted by the market capitalization of each stock in the portfolio.

Thus one of the key aspects which is observed by the investor is how much value is created

by the portfolio after the end of the investment period. This is measured in absolute terms for

all the three portfolio in dollar terms. Thus the details for the same is provided in the table

below,

Portfolio Initial Value End Value

Portfolio 1 $236008 $236413

Portfolio 2 $125195 $104345

Portfolio 3 $12112 $8752.5

Thus upon analysing the portfolio, it is seen that only portfolio 1 which is actively

managed portfolio has been able to generate slight return over the initial value invested. The

rest of the two portfolio have led to loss in the capital invested by the investor in absolute

dollar terms (Chaudhuri & Lo 2016).

Portfolio Strategy and Performance:

The creation of the portfolio is one of the most crucial step, which is followed by

measuring the performance of the portfolio. The portfolio tend to meet the objective for

which it had been created which is measured by various performance metrics. Thus the

performance of the portfolio informs the investor the skill which has been provided by the

portfolio manager (Ding & Martin 2017).

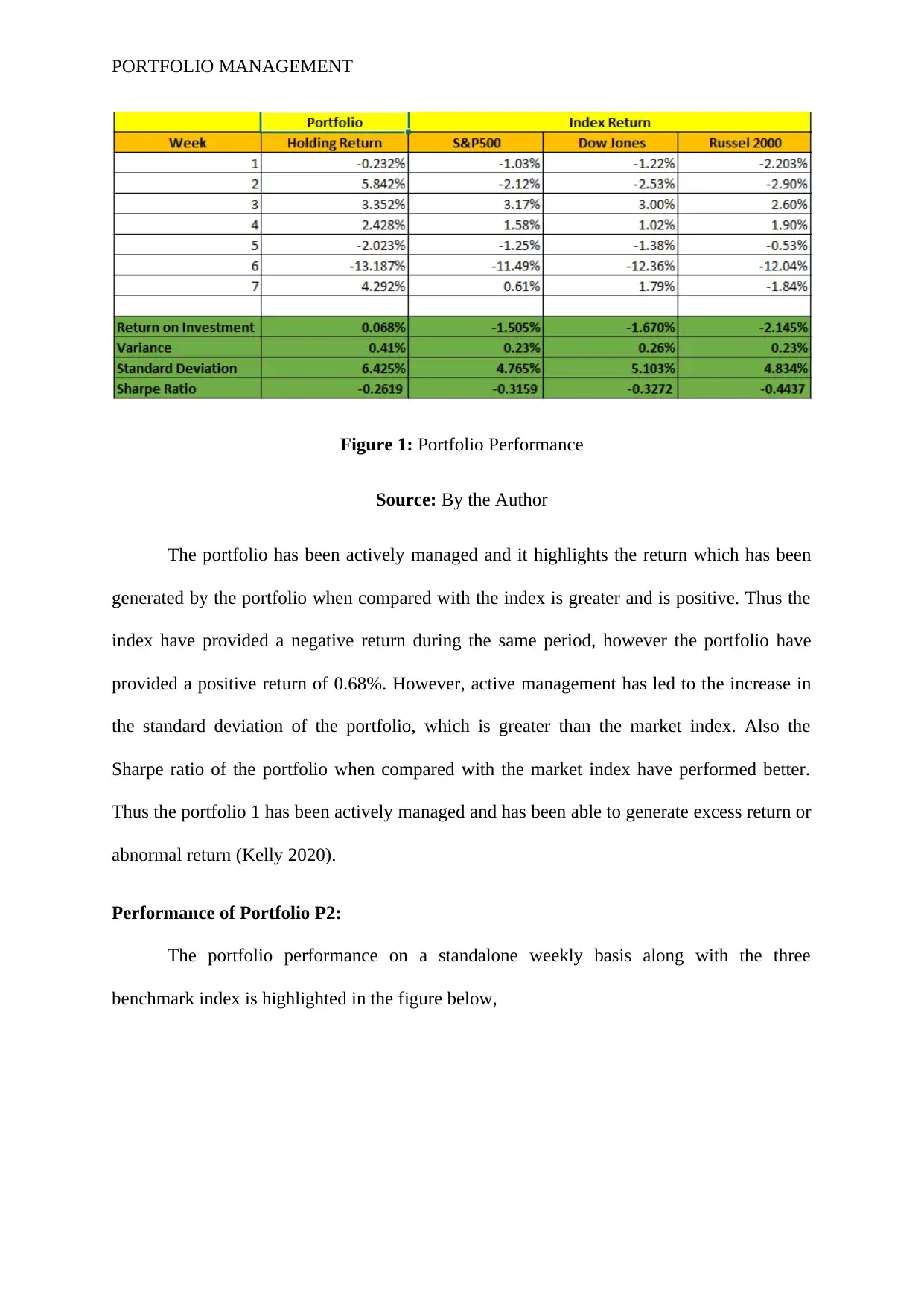

Performance of Portfolio P1:

The portfolio performance on a standalone weekly basis along with the three

benchmark index is highlighted in the figure below,

small cap stocks for Portfolio 3. Hence the basis for selection of the stock can also be

highlighted by the market capitalization of each stock in the portfolio.

Thus one of the key aspects which is observed by the investor is how much value is created

by the portfolio after the end of the investment period. This is measured in absolute terms for

all the three portfolio in dollar terms. Thus the details for the same is provided in the table

below,

Portfolio Initial Value End Value

Portfolio 1 $236008 $236413

Portfolio 2 $125195 $104345

Portfolio 3 $12112 $8752.5

Thus upon analysing the portfolio, it is seen that only portfolio 1 which is actively

managed portfolio has been able to generate slight return over the initial value invested. The

rest of the two portfolio have led to loss in the capital invested by the investor in absolute

dollar terms (Chaudhuri & Lo 2016).

Portfolio Strategy and Performance:

The creation of the portfolio is one of the most crucial step, which is followed by

measuring the performance of the portfolio. The portfolio tend to meet the objective for

which it had been created which is measured by various performance metrics. Thus the

performance of the portfolio informs the investor the skill which has been provided by the

portfolio manager (Ding & Martin 2017).

Performance of Portfolio P1:

The portfolio performance on a standalone weekly basis along with the three

benchmark index is highlighted in the figure below,

PORTFOLIO MANAGEMENT

Figure 1: Portfolio Performance

Source: By the Author

The portfolio has been actively managed and it highlights the return which has been

generated by the portfolio when compared with the index is greater and is positive. Thus the

index have provided a negative return during the same period, however the portfolio have

provided a positive return of 0.68%. However, active management has led to the increase in

the standard deviation of the portfolio, which is greater than the market index. Also the

Sharpe ratio of the portfolio when compared with the market index have performed better.

Thus the portfolio 1 has been actively managed and has been able to generate excess return or

abnormal return (Kelly 2020).

Performance of Portfolio P2:

The portfolio performance on a standalone weekly basis along with the three

benchmark index is highlighted in the figure below,

Figure 1: Portfolio Performance

Source: By the Author

The portfolio has been actively managed and it highlights the return which has been

generated by the portfolio when compared with the index is greater and is positive. Thus the

index have provided a negative return during the same period, however the portfolio have

provided a positive return of 0.68%. However, active management has led to the increase in

the standard deviation of the portfolio, which is greater than the market index. Also the

Sharpe ratio of the portfolio when compared with the market index have performed better.

Thus the portfolio 1 has been actively managed and has been able to generate excess return or

abnormal return (Kelly 2020).

Performance of Portfolio P2:

The portfolio performance on a standalone weekly basis along with the three

benchmark index is highlighted in the figure below,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.