University Quantitative Methods Assignment Analysis Report

VerifiedAdded on 2022/09/30

|9

|705

|31

Homework Assignment

AI Summary

This document presents a comprehensive solution to a Quantitative Methods assignment, addressing a scenario involving a winery and its Pinot Noir production. The assignment involves analyzing the variation in alcohol content based on the origin of grapes. The solution includes an ANOVA test to determine if there are significant differences in alcohol content among different grape origins. It also explores Spearman's rank correlation to assess the relationship between the closing prices of two stocks, Apple and Microsoft, and performs a hypothesis test to determine the significance of the correlation. Furthermore, the document discusses Type I and Type II errors in the context of statistical analysis, providing clear explanations and examples. The assignment demonstrates the application of statistical methods to real-world business problems, offering insights into data analysis and decision-making. The document is a valuable resource for students seeking to understand and solve quantitative problems.

University

Quantitative Methods

By

Your Name

Date

Page 1 of 9

©<Your Name>2019

Quantitative Methods

By

Your Name

Date

Page 1 of 9

©<Your Name>2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Quantitative Methods

Question 1

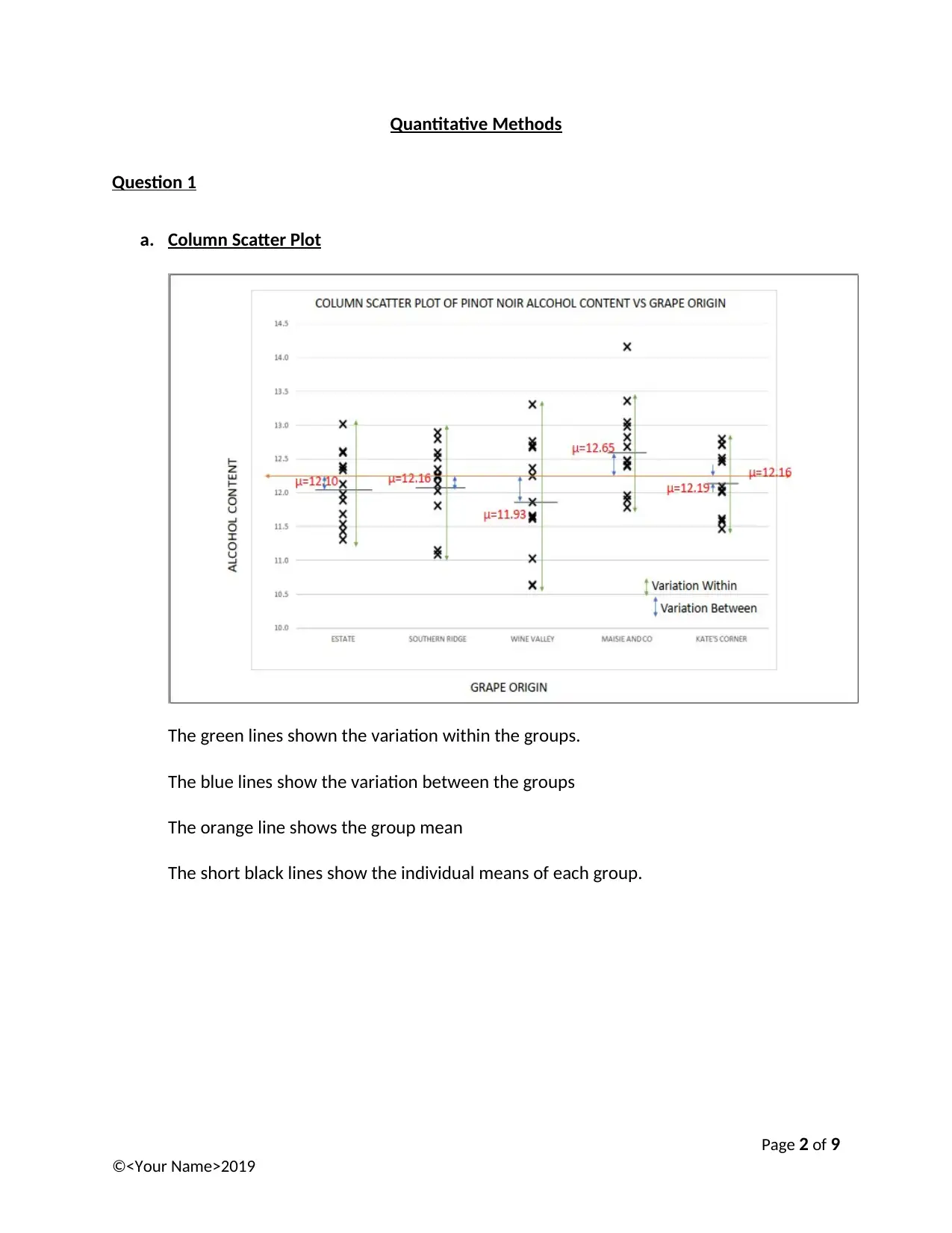

a. Column Scatter Plot

The green lines shown the variation within the groups.

The blue lines show the variation between the groups

The orange line shows the group mean

The short black lines show the individual means of each group.

Page 2 of 9

©<Your Name>2019

Question 1

a. Column Scatter Plot

The green lines shown the variation within the groups.

The blue lines show the variation between the groups

The orange line shows the group mean

The short black lines show the individual means of each group.

Page 2 of 9

©<Your Name>2019

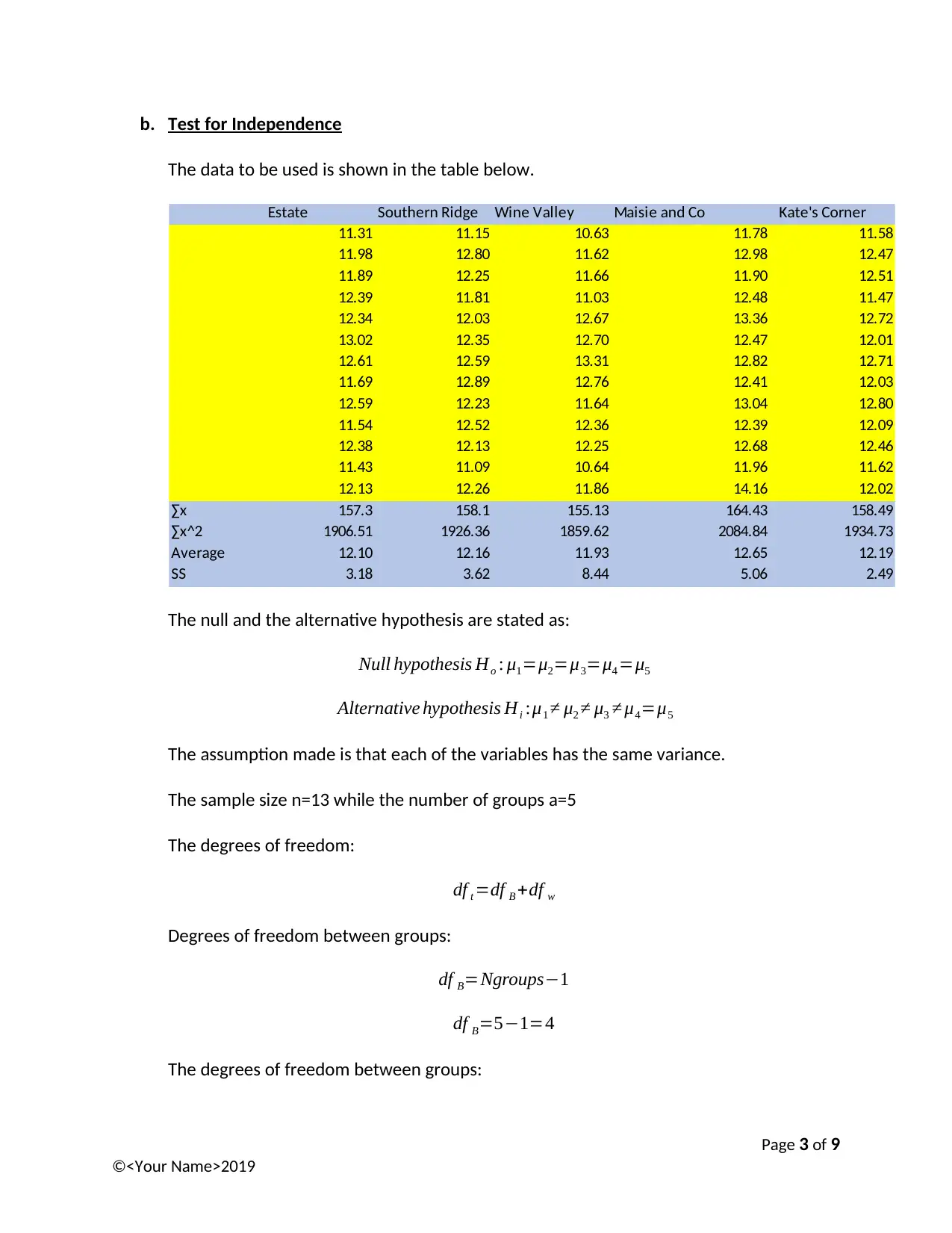

b. Test for Independence

The data to be used is shown in the table below.

Estate Southern Ridge Wine Valley Maisie and Co Kate's Corner

11.31 11.15 10.63 11.78 11.58

11.98 12.80 11.62 12.98 12.47

11.89 12.25 11.66 11.90 12.51

12.39 11.81 11.03 12.48 11.47

12.34 12.03 12.67 13.36 12.72

13.02 12.35 12.70 12.47 12.01

12.61 12.59 13.31 12.82 12.71

11.69 12.89 12.76 12.41 12.03

12.59 12.23 11.64 13.04 12.80

11.54 12.52 12.36 12.39 12.09

12.38 12.13 12.25 12.68 12.46

11.43 11.09 10.64 11.96 11.62

12.13 12.26 11.86 14.16 12.02

∑x 157.3 158.1 155.13 164.43 158.49

∑x^2 1906.51 1926.36 1859.62 2084.84 1934.73

Average 12.10 12.16 11.93 12.65 12.19

SS 3.18 3.62 8.44 5.06 2.49

The null and the alternative hypothesis are stated as:

Null hypothesis Ho : μ1=μ2=μ3=μ4 =μ5

Alternative hypothesis Hi :μ1 ≠ μ2 ≠ μ3 ≠ μ4=μ5

The assumption made is that each of the variables has the same variance.

The sample size n=13 while the number of groups a=5

The degrees of freedom:

df t =df B +df w

Degrees of freedom between groups:

df B=Ngroups−1

df B=5−1=4

The degrees of freedom between groups:

Page 3 of 9

©<Your Name>2019

The data to be used is shown in the table below.

Estate Southern Ridge Wine Valley Maisie and Co Kate's Corner

11.31 11.15 10.63 11.78 11.58

11.98 12.80 11.62 12.98 12.47

11.89 12.25 11.66 11.90 12.51

12.39 11.81 11.03 12.48 11.47

12.34 12.03 12.67 13.36 12.72

13.02 12.35 12.70 12.47 12.01

12.61 12.59 13.31 12.82 12.71

11.69 12.89 12.76 12.41 12.03

12.59 12.23 11.64 13.04 12.80

11.54 12.52 12.36 12.39 12.09

12.38 12.13 12.25 12.68 12.46

11.43 11.09 10.64 11.96 11.62

12.13 12.26 11.86 14.16 12.02

∑x 157.3 158.1 155.13 164.43 158.49

∑x^2 1906.51 1926.36 1859.62 2084.84 1934.73

Average 12.10 12.16 11.93 12.65 12.19

SS 3.18 3.62 8.44 5.06 2.49

The null and the alternative hypothesis are stated as:

Null hypothesis Ho : μ1=μ2=μ3=μ4 =μ5

Alternative hypothesis Hi :μ1 ≠ μ2 ≠ μ3 ≠ μ4=μ5

The assumption made is that each of the variables has the same variance.

The sample size n=13 while the number of groups a=5

The degrees of freedom:

df t =df B +df w

Degrees of freedom between groups:

df B=Ngroups−1

df B=5−1=4

The degrees of freedom between groups:

Page 3 of 9

©<Your Name>2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

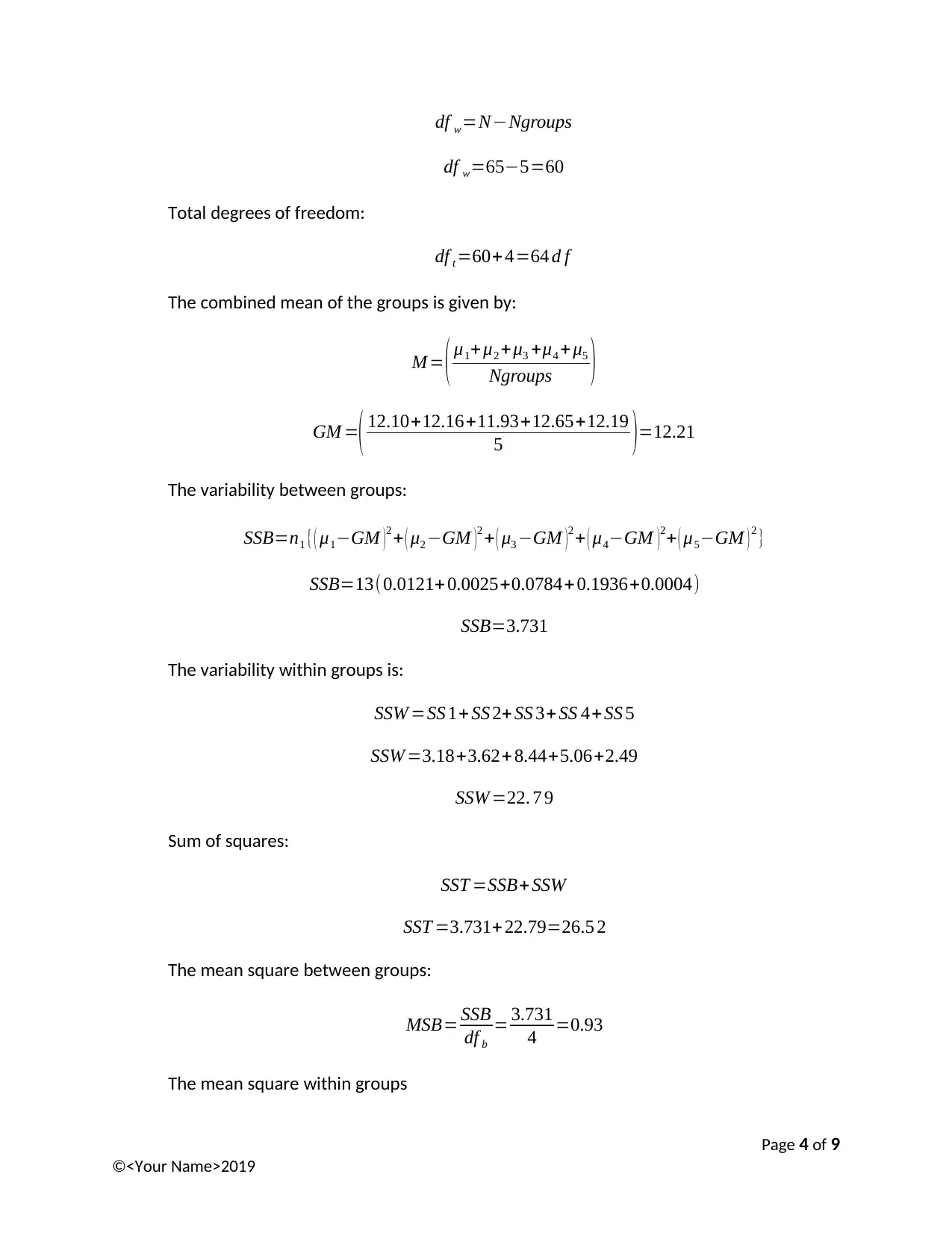

df w=N−Ngroups

df w=65−5=60

Total degrees of freedom:

df t =60+ 4=64 d f

The combined mean of the groups is given by:

M = ( μ1+ μ2 +μ3 +μ4 + μ5

Ngroups )

GM =( 12.10+12.16+11.93+12.65+12.19

5 )=12.21

The variability between groups:

SSB=n1 {( μ1−GM )

2 + ( μ2 −GM )

2 + ( μ3 −GM )

2 + ( μ4−GM )

2+ ( μ5−GM ) 2 }

SSB=13(0.0121+ 0.0025+0.0784+0.1936+0.0004)

SSB=3.731

The variability within groups is:

SSW =SS 1+ SS 2+ SS 3+ SS 4+SS 5

SSW =3.18+3.62+8.44+5.06+2.49

SSW =22. 7 9

Sum of squares:

SST =SSB+SSW

SST =3.731+ 22.79=26.5 2

The mean square between groups:

MSB= SSB

df b

= 3.731

4 =0.93

The mean square within groups

Page 4 of 9

©<Your Name>2019

df w=65−5=60

Total degrees of freedom:

df t =60+ 4=64 d f

The combined mean of the groups is given by:

M = ( μ1+ μ2 +μ3 +μ4 + μ5

Ngroups )

GM =( 12.10+12.16+11.93+12.65+12.19

5 )=12.21

The variability between groups:

SSB=n1 {( μ1−GM )

2 + ( μ2 −GM )

2 + ( μ3 −GM )

2 + ( μ4−GM )

2+ ( μ5−GM ) 2 }

SSB=13(0.0121+ 0.0025+0.0784+0.1936+0.0004)

SSB=3.731

The variability within groups is:

SSW =SS 1+ SS 2+ SS 3+ SS 4+SS 5

SSW =3.18+3.62+8.44+5.06+2.49

SSW =22. 7 9

Sum of squares:

SST =SSB+SSW

SST =3.731+ 22.79=26.5 2

The mean square between groups:

MSB= SSB

df b

= 3.731

4 =0.93

The mean square within groups

Page 4 of 9

©<Your Name>2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MSW = SSW

df w

= 22.79

60 =0.38

The F-statistic is given by:

F statistic= MSB

MSW =0.93

0.38 =2.45

The critical value of F for the given degrees of freedom at 0.05 significance level is

2.5252. The decision rule requires that the null hypothesis be rejected when the test

statistic is higher than the critical value. Here, Fstat < Fcric i.e. 2.45<2.53 and therefore

we fail to reject the null hypothesis and make the conclusion that the means are the

same. A conclusion can be made that the various grape origins are not related with a

significant difference in alcohol content. The manager should therefore search for

available alternative factors that would explain the alcohol content variation.

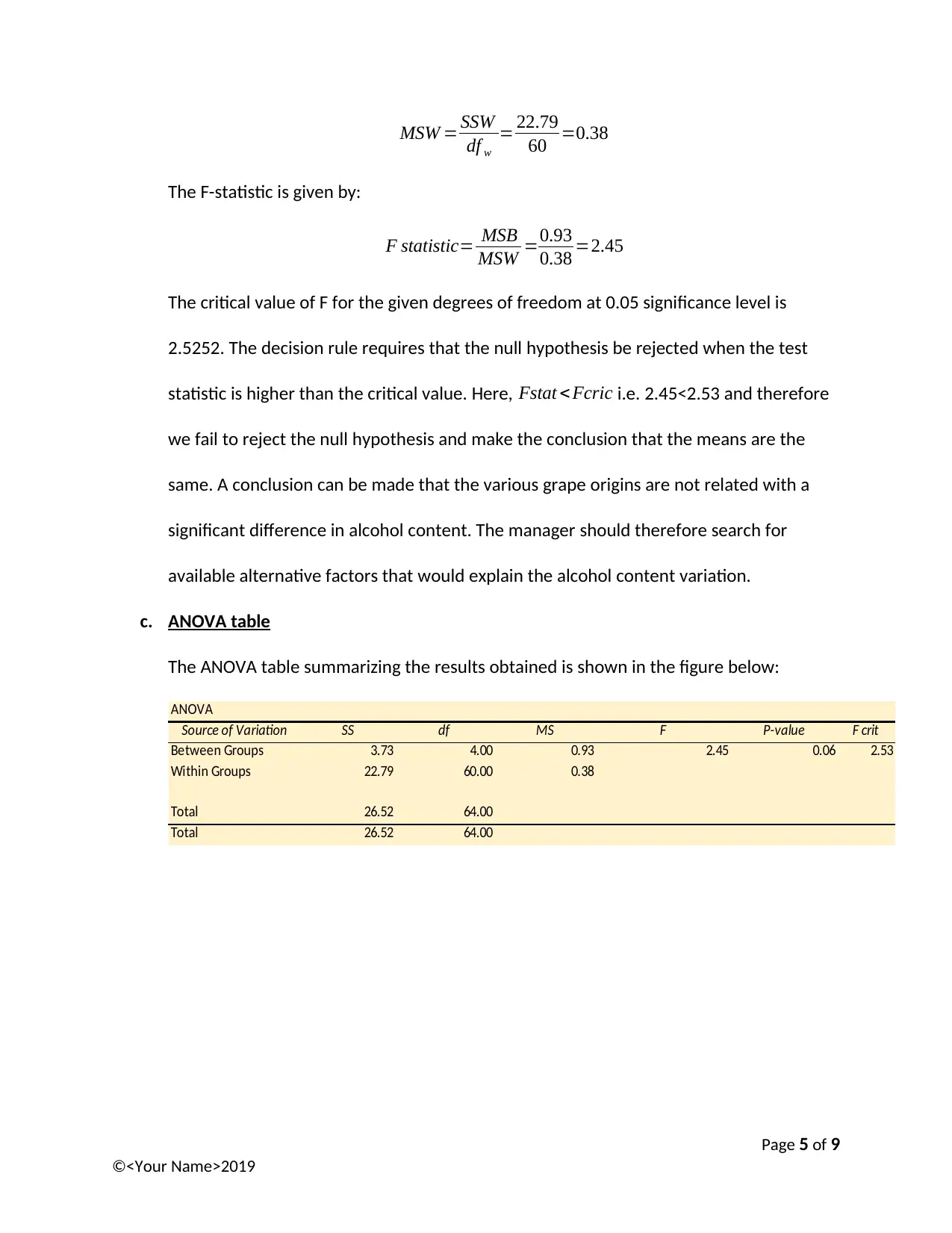

c. ANOVA table

The ANOVA table summarizing the results obtained is shown in the figure below:

ANOVA

Source of Variation SS df MS F P-value F crit

Between Groups 3.73 4.00 0.93 2.45 0.06 2.53

Within Groups 22.79 60.00 0.38

Total 26.52 64.00

Total 26.52 64.00

Page 5 of 9

©<Your Name>2019

df w

= 22.79

60 =0.38

The F-statistic is given by:

F statistic= MSB

MSW =0.93

0.38 =2.45

The critical value of F for the given degrees of freedom at 0.05 significance level is

2.5252. The decision rule requires that the null hypothesis be rejected when the test

statistic is higher than the critical value. Here, Fstat < Fcric i.e. 2.45<2.53 and therefore

we fail to reject the null hypothesis and make the conclusion that the means are the

same. A conclusion can be made that the various grape origins are not related with a

significant difference in alcohol content. The manager should therefore search for

available alternative factors that would explain the alcohol content variation.

c. ANOVA table

The ANOVA table summarizing the results obtained is shown in the figure below:

ANOVA

Source of Variation SS df MS F P-value F crit

Between Groups 3.73 4.00 0.93 2.45 0.06 2.53

Within Groups 22.79 60.00 0.38

Total 26.52 64.00

Total 26.52 64.00

Page 5 of 9

©<Your Name>2019

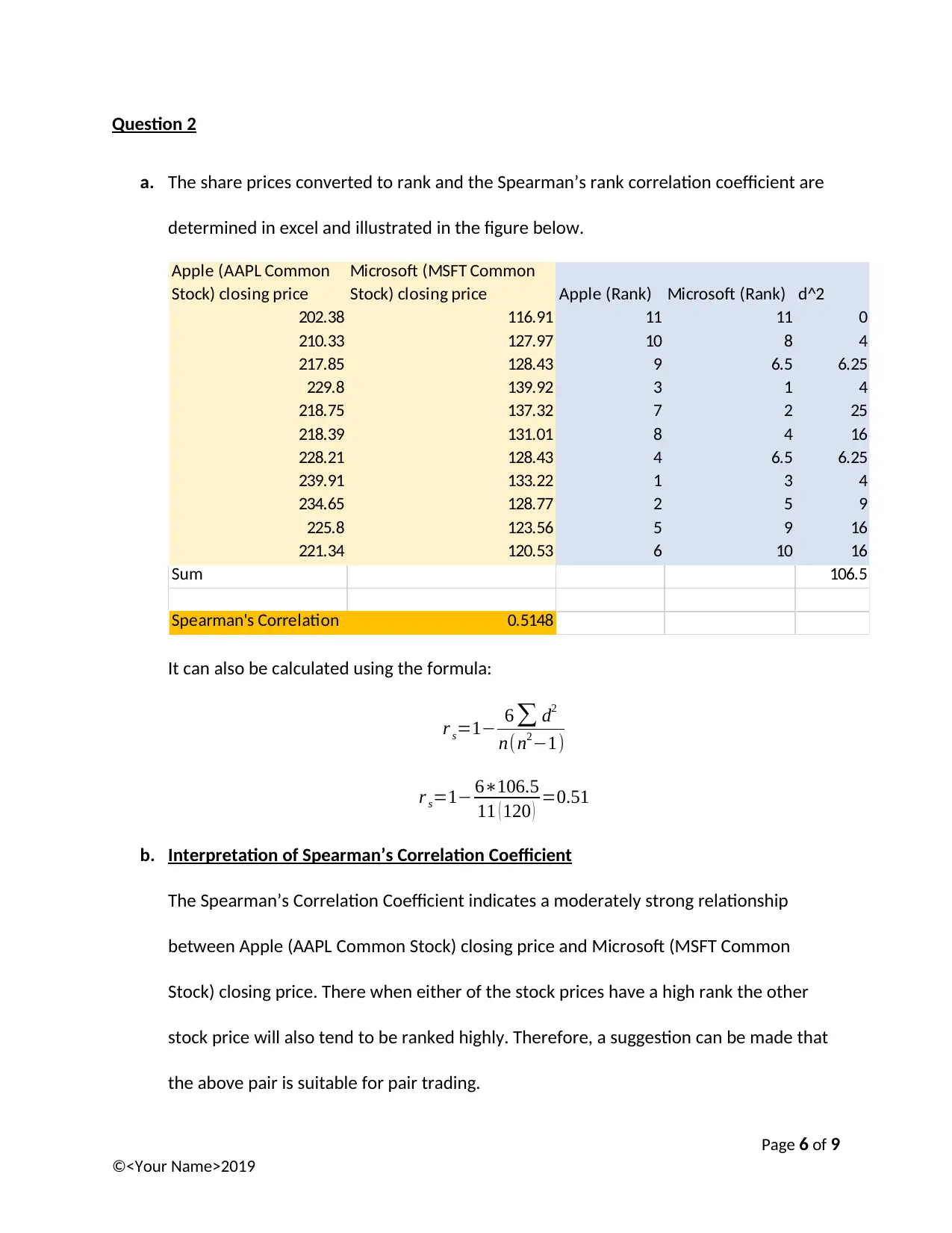

Question 2

a. The share prices converted to rank and the Spearman’s rank correlation coefficient are

determined in excel and illustrated in the figure below.

Apple (AAPL Common

Stock) closing price

Microsoft (MSFT Common

Stock) closing price Apple (Rank) Microsoft (Rank) d^2

202.38 116.91 11 11 0

210.33 127.97 10 8 4

217.85 128.43 9 6.5 6.25

229.8 139.92 3 1 4

218.75 137.32 7 2 25

218.39 131.01 8 4 16

228.21 128.43 4 6.5 6.25

239.91 133.22 1 3 4

234.65 128.77 2 5 9

225.8 123.56 5 9 16

221.34 120.53 6 10 16

Sum 106.5

Spearman's Correlation 0.5148

It can also be calculated using the formula:

r s=1− 6 ∑ d2

n(n2−1)

r s=1− 6∗106.5

11 ( 120 ) =0.51

b. Interpretation of Spearman’s Correlation Coefficient

The Spearman’s Correlation Coefficient indicates a moderately strong relationship

between Apple (AAPL Common Stock) closing price and Microsoft (MSFT Common

Stock) closing price. There when either of the stock prices have a high rank the other

stock price will also tend to be ranked highly. Therefore, a suggestion can be made that

the above pair is suitable for pair trading.

Page 6 of 9

©<Your Name>2019

a. The share prices converted to rank and the Spearman’s rank correlation coefficient are

determined in excel and illustrated in the figure below.

Apple (AAPL Common

Stock) closing price

Microsoft (MSFT Common

Stock) closing price Apple (Rank) Microsoft (Rank) d^2

202.38 116.91 11 11 0

210.33 127.97 10 8 4

217.85 128.43 9 6.5 6.25

229.8 139.92 3 1 4

218.75 137.32 7 2 25

218.39 131.01 8 4 16

228.21 128.43 4 6.5 6.25

239.91 133.22 1 3 4

234.65 128.77 2 5 9

225.8 123.56 5 9 16

221.34 120.53 6 10 16

Sum 106.5

Spearman's Correlation 0.5148

It can also be calculated using the formula:

r s=1− 6 ∑ d2

n(n2−1)

r s=1− 6∗106.5

11 ( 120 ) =0.51

b. Interpretation of Spearman’s Correlation Coefficient

The Spearman’s Correlation Coefficient indicates a moderately strong relationship

between Apple (AAPL Common Stock) closing price and Microsoft (MSFT Common

Stock) closing price. There when either of the stock prices have a high rank the other

stock price will also tend to be ranked highly. Therefore, a suggestion can be made that

the above pair is suitable for pair trading.

Page 6 of 9

©<Your Name>2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

c. Hypothesis Test

The null and alternative hypothesis are stated as:

Null hypothesis Ho : ρs ≥ 0.6

The alternative hypothesis Hi : ρs <0.6

This is a one tailed test with alpha equals to 0.05, n= 11 and the Spearman’s correlation

coefficient equals to 0.5148.

The test statistic is determined by:

z= rs −ρs

σr s

Where:

σ rs

= 1

√ ( n−1 ) = 1

√ 10 =0.31623

Hence:

z= 0.5148−0.6

0.31623 =−0.2694

The critical value of z is:

Zcrit=± Z0.05=± 1.64

The test statistics obtained is -0.07 and therefore it false with the bound of the critical

values. From the decision rule, we fail to reject the null hypothesis and make a

conclusion that with a 5% significance level the investor is supposed to seek for a full

year data (Evans and Basu, 2013).

d. Type 1 and Type II error

A type I error is a statistical error that occurs when a true null hypothesis is rejected. For

example, in our case, we concluded that the correlation in the population was not

Page 7 of 9

©<Your Name>2019

The null and alternative hypothesis are stated as:

Null hypothesis Ho : ρs ≥ 0.6

The alternative hypothesis Hi : ρs <0.6

This is a one tailed test with alpha equals to 0.05, n= 11 and the Spearman’s correlation

coefficient equals to 0.5148.

The test statistic is determined by:

z= rs −ρs

σr s

Where:

σ rs

= 1

√ ( n−1 ) = 1

√ 10 =0.31623

Hence:

z= 0.5148−0.6

0.31623 =−0.2694

The critical value of z is:

Zcrit=± Z0.05=± 1.64

The test statistics obtained is -0.07 and therefore it false with the bound of the critical

values. From the decision rule, we fail to reject the null hypothesis and make a

conclusion that with a 5% significance level the investor is supposed to seek for a full

year data (Evans and Basu, 2013).

d. Type 1 and Type II error

A type I error is a statistical error that occurs when a true null hypothesis is rejected. For

example, in our case, we concluded that the correlation in the population was not

Page 7 of 9

©<Your Name>2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

strong ρs< 0.6 we would have committed a type I error since the relationship is actually

strong.

Type II error occurs is a statistical error that occurs when we fail to reject a false null

hypothesis (Watkins, Scheaffer, and Cobb, 2009). For example, in this case, type II error

would occur if we concluded that there is a strong correlation between the variables

ρs ≥ 0.6when in reality there is no strong relationship.

Page 8 of 9

©<Your Name>2019

strong.

Type II error occurs is a statistical error that occurs when we fail to reject a false null

hypothesis (Watkins, Scheaffer, and Cobb, 2009). For example, in this case, type II error

would occur if we concluded that there is a strong correlation between the variables

ρs ≥ 0.6when in reality there is no strong relationship.

Page 8 of 9

©<Your Name>2019

References

Evans, J. R., and Basu, A. 2013. Statistics, data analysis, and decision modeling.5th ed. Boston:

Pearson.

Watkins, A. E., Scheaffer, R. L., and Cobb, G. W. 2009. Statistics in action: Understanding a

world of data. 2nd ed. Hoboken, NJ: Wiley

Page 9 of 9

©<Your Name>2019

Evans, J. R., and Basu, A. 2013. Statistics, data analysis, and decision modeling.5th ed. Boston:

Pearson.

Watkins, A. E., Scheaffer, R. L., and Cobb, G. W. 2009. Statistics in action: Understanding a

world of data. 2nd ed. Hoboken, NJ: Wiley

Page 9 of 9

©<Your Name>2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.