Strategic Growth and Funding Analysis for Vectair Holdings Limited

VerifiedAdded on 2020/10/22

|16

|5165

|444

Report

AI Summary

This report provides a comprehensive analysis of Vectair Holdings' growth opportunities. It begins with an introduction to strategic business planning and evaluates growth opportunities using PESTLE and Porter's Five Forces analyses. The report then applies the Ansoff Matrix to identify growth strategies such as market development, market penetration, product development, and diversification. It explores potential sources of funding for business expansion, discussing the advantages and disadvantages of each, including personal savings, investors, and loans. Furthermore, the report outlines the key components of designing a business plan for Vectair Holdings, encompassing financial and strategic objectives. Finally, it examines exit and succession options for the company, considering their benefits and drawbacks. The report concludes with a summary of the key findings and recommendations for Vectair Holdings' future growth.

Planning for Growth

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

P1 Evaluation of the growth opportunities in the context of the Vectair holdings.....................3

P2 Ans off matrix for growth opportunities ...............................................................................5

P3 Potential source of funding in the business with its advantages and disadvantages of each

source..........................................................................................................................................7

P4 Designing a Business plan for Vectair Holdings Limited.....................................................9

P5 Exit or succession options of the Vactaire holdings with its drawbacks and benefits........12

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION...........................................................................................................................3

P1 Evaluation of the growth opportunities in the context of the Vectair holdings.....................3

P2 Ans off matrix for growth opportunities ...............................................................................5

P3 Potential source of funding in the business with its advantages and disadvantages of each

source..........................................................................................................................................7

P4 Designing a Business plan for Vectair Holdings Limited.....................................................9

P5 Exit or succession options of the Vactaire holdings with its drawbacks and benefits........12

CONCLUSION..............................................................................................................................14

REFERENCES .............................................................................................................................15

INTRODUCTION

Planning for growth is the strategic thinking about business. It is one of ways to develop

business. This can happen by applying changes in the company. By this, organisation can

generate revenue for its entity. Market is changing on regular basis with new technologies

implemented by entity. It can create chances of development for it.

This report will discuss key considerations for the growth opportunities. It will study Ans

off Growth Matrix by evaluating the opportunities for growth. There will be potential sources of

funding which are available in business. It will discuss about making business plan, which

includes financial and strategic objectives. This study is about exit and succession options with

its advantages and disadvantages.

P1 Evaluation of the growth opportunities in the context of the Vectair holdings

For reviewing growth opportunities various plan are made to develop company. There are

two ways for developing of entity. These are PESTLE Analysis and Porter five forces model

Pestle analysis for analysing the external environment of the organisation. Both analyses can

help in finding out the loopholes in Vectair Holdings. This company is operating on the hygiene

products for the people.

PESTLE Analysis of the Vectair Holdings is:

Political factors - this is one of the factors, which is helping the company to make its

development. It directly impacts on entity which is making the working complicated

because of this factor. In this factor changes of the rules and regulations. If government

makes the changes in tax policy then organisation whole working will change. If some

changes are made on the trade policy will directly affect the sales of the Vectair

holdings. Therefore, business place must be chosen wisely that can prevent from this

type of continuous changes (Rudolf and et.al., 2018).

Economic factors- this factor has long termed effect on any company. These are

dependent on the market conditions. At the time of inflation in that case product prices

are increased and buying capacity of the consumer is decreasing. It will affect the profits

of company. This factor includes interest rates, foreign exchange rates, inflation rate and

many more. In inflation, product prices are more and vectair holdings have to face very

difficulty in selling the goods (Campbell, 2017). Purchasing power of the buyer is not

Planning for growth is the strategic thinking about business. It is one of ways to develop

business. This can happen by applying changes in the company. By this, organisation can

generate revenue for its entity. Market is changing on regular basis with new technologies

implemented by entity. It can create chances of development for it.

This report will discuss key considerations for the growth opportunities. It will study Ans

off Growth Matrix by evaluating the opportunities for growth. There will be potential sources of

funding which are available in business. It will discuss about making business plan, which

includes financial and strategic objectives. This study is about exit and succession options with

its advantages and disadvantages.

P1 Evaluation of the growth opportunities in the context of the Vectair holdings

For reviewing growth opportunities various plan are made to develop company. There are

two ways for developing of entity. These are PESTLE Analysis and Porter five forces model

Pestle analysis for analysing the external environment of the organisation. Both analyses can

help in finding out the loopholes in Vectair Holdings. This company is operating on the hygiene

products for the people.

PESTLE Analysis of the Vectair Holdings is:

Political factors - this is one of the factors, which is helping the company to make its

development. It directly impacts on entity which is making the working complicated

because of this factor. In this factor changes of the rules and regulations. If government

makes the changes in tax policy then organisation whole working will change. If some

changes are made on the trade policy will directly affect the sales of the Vectair

holdings. Therefore, business place must be chosen wisely that can prevent from this

type of continuous changes (Rudolf and et.al., 2018).

Economic factors- this factor has long termed effect on any company. These are

dependent on the market conditions. At the time of inflation in that case product prices

are increased and buying capacity of the consumer is decreasing. It will affect the profits

of company. This factor includes interest rates, foreign exchange rates, inflation rate and

many more. In inflation, product prices are more and vectair holdings have to face very

difficulty in selling the goods (Campbell, 2017). Purchasing power of the buyer is not

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

that much to buy products and their fully focus is on the saving of product. Company

has to make new strategy for facing this type of the situation.

Social factors - it includes demographics, population, cultural trends, lifestyle affect the

selling of firm. As Vectair is operating in hygiene products and in that case

segmentation of the market is made on basis of the products they are targeting for which

age group. It is based on age, gender, income, place, buying behaviour.

Legal factors-in this factor changes in the law are affecting the business. Like labour

law, consumer law, safety law and many. In Vectair Holdings, employees are doing the

business in hygiene products and if its related law changes then it will be difficulty in

operating in that situation.

Environmental factors - this factor is not only related to the climatic conditions but it

has a wider meaning. While doing the business its working is affecting the surrounding

environment. Like waste material while making the goods smells bad and it is affecting

the society. Its adverse impacts on the air.

Technological factors - this includes using of advanced type of technology which can

improve in quality of the product. This will help in selling of products due to its

attractiveness of the goods. It can be change in packaging, labelling, branding and more.

Vectair Holdings is also implemented in their company.

Porter’s five forces

Competition in the industry- in every industry, there is competition due to the

competitors. The more will be contenders risk can also increases. All firms which are

under the same industry making similar products. Price wars and grabbing the

opportunity is common (Rudolf and et.al.,2018).

Potential of the new entrant - if company is fully established in that case chance of

enter of the new firm are difficult. Vectair Holdings is well established firm in that case

there is no threat of the new firm in industry,

Power of the customer's- clients of any industry has power to make the company

products more popular or nowhere. These are the persons who are buying the products

and through them only entity is earning the profits.

Power of the suppliers- if there is only one supplier, in that case an organisation has no

chance to purchase its raw materials from them only. In middle of the financial year, if

has to make new strategy for facing this type of the situation.

Social factors - it includes demographics, population, cultural trends, lifestyle affect the

selling of firm. As Vectair is operating in hygiene products and in that case

segmentation of the market is made on basis of the products they are targeting for which

age group. It is based on age, gender, income, place, buying behaviour.

Legal factors-in this factor changes in the law are affecting the business. Like labour

law, consumer law, safety law and many. In Vectair Holdings, employees are doing the

business in hygiene products and if its related law changes then it will be difficulty in

operating in that situation.

Environmental factors - this factor is not only related to the climatic conditions but it

has a wider meaning. While doing the business its working is affecting the surrounding

environment. Like waste material while making the goods smells bad and it is affecting

the society. Its adverse impacts on the air.

Technological factors - this includes using of advanced type of technology which can

improve in quality of the product. This will help in selling of products due to its

attractiveness of the goods. It can be change in packaging, labelling, branding and more.

Vectair Holdings is also implemented in their company.

Porter’s five forces

Competition in the industry- in every industry, there is competition due to the

competitors. The more will be contenders risk can also increases. All firms which are

under the same industry making similar products. Price wars and grabbing the

opportunity is common (Rudolf and et.al.,2018).

Potential of the new entrant - if company is fully established in that case chance of

enter of the new firm are difficult. Vectair Holdings is well established firm in that case

there is no threat of the new firm in industry,

Power of the customer's- clients of any industry has power to make the company

products more popular or nowhere. These are the persons who are buying the products

and through them only entity is earning the profits.

Power of the suppliers- if there is only one supplier, in that case an organisation has no

chance to purchase its raw materials from them only. In middle of the financial year, if

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company is changing its suppliers then it will be costly to the entity that's why firm has

made long-term relationship with the suppliers and this will help in future as well. In

Vectair Holdings, has already made long-term relationship with the suppliers which are

helping them to easy supply of the raw material.

Threat of the substitutes - if there will be lot of substitutes for same products then

buyers can switch anytime. Therefore, entity must ensure that quality, quantity of

product is good and then only customer will not switch to other firms (Sanchez, 2018).

Vectair Holdings is follows Porters five forces which are helping the firm for development. It is

helping to analyse entity loopholes and recovers them as much as earlier.

P2 Ans off matrix for growth opportunities

Ansoff Matrix is a tool for the growth of an entity. It is helps in finding out ways through

which company can make development by grabbing opportunities. This will help in reaching

success. It was invented by H. Igor Ans off in 1957.

There are four stages involved such as Market development, Market Penetration, Product

Development, and Diversification that is very helpful for the company.

Market Development - it refers to targeting the new market and it will support in

maximising sales and popularising products. Just try to sell the products to new people.

Through this, product is recognisable in market and helps in increasing brand value of an

entity. For this finding out the ways through which new opportunities and threats are

identified and help in growth of the company (Rudolf and et.al.,2018). Entity can use

more channels from which product can reach to customer. It can be on line as well as off

line, through retailers and whole sellers. It can also be via agents or intermediaries.

Vectair Holdings is selling its hygiene products by various modes which helps in

making the goods popular. For this, segmentation of the market is done through age

group, culture, gender, place etc if product is needed to rebrand or repositioning of the

product then marketing is better option for this.

Diversification- it means the product is diverse as well as customers who are buying the goods

are also different. They are trying to reach new clients and help them to increase sales of product.

It can be risky in selling the products of hygiene in new place but chances of earning profit and

loss are equal (Olesen and Carter, 2018). This force of porter can be facilitative in expanding in

made long-term relationship with the suppliers and this will help in future as well. In

Vectair Holdings, has already made long-term relationship with the suppliers which are

helping them to easy supply of the raw material.

Threat of the substitutes - if there will be lot of substitutes for same products then

buyers can switch anytime. Therefore, entity must ensure that quality, quantity of

product is good and then only customer will not switch to other firms (Sanchez, 2018).

Vectair Holdings is follows Porters five forces which are helping the firm for development. It is

helping to analyse entity loopholes and recovers them as much as earlier.

P2 Ans off matrix for growth opportunities

Ansoff Matrix is a tool for the growth of an entity. It is helps in finding out ways through

which company can make development by grabbing opportunities. This will help in reaching

success. It was invented by H. Igor Ans off in 1957.

There are four stages involved such as Market development, Market Penetration, Product

Development, and Diversification that is very helpful for the company.

Market Development - it refers to targeting the new market and it will support in

maximising sales and popularising products. Just try to sell the products to new people.

Through this, product is recognisable in market and helps in increasing brand value of an

entity. For this finding out the ways through which new opportunities and threats are

identified and help in growth of the company (Rudolf and et.al.,2018). Entity can use

more channels from which product can reach to customer. It can be on line as well as off

line, through retailers and whole sellers. It can also be via agents or intermediaries.

Vectair Holdings is selling its hygiene products by various modes which helps in

making the goods popular. For this, segmentation of the market is done through age

group, culture, gender, place etc if product is needed to rebrand or repositioning of the

product then marketing is better option for this.

Diversification- it means the product is diverse as well as customers who are buying the goods

are also different. They are trying to reach new clients and help them to increase sales of product.

It can be risky in selling the products of hygiene in new place but chances of earning profit and

loss are equal (Olesen and Carter, 2018). This force of porter can be facilitative in expanding in

business. Many companies use this factor to grow its business. Vetair Holdings has also tried to

sell its products in new market so it can prosper its operations in other places.

Market Penetration -in these products are similar and sold to the same clients which is a

bit difficult in this competitive market. For this many sales techniques which are used by

the company to attract customers. It is one of the strategies which is increasing the loyalty

of consumers towards the organisation. There are more methods from which increase of

sales takes place are offers, discounts and many more. It will attract customers to buy the

product. Many products use low pricing strategy which is helping entity to cover the

mass market coverage. To maximise sales public relation is more important which is

helping the entity to generate more opportunities of development if the product. Like

owner must analyse the product and identify which has potential of becoming successful

and which is not. Through this firm get to know about chances of survival of the product

and its investment needs. For Vectair Holdings is the company is selling its products by

using more promotional methods. It is more facilitative in handling the sales of the

product. This entity is also determined chances of survival of the product which is more

helpful in taking the decision of investment.

Product development- it means goods which firm is selling requires the innovation or

additional features for selling the product (Sanchez, 2018). Clients is bore by seeing the

same products and now trying the to switch to different firm. Changes can be made in the

packing, labelling, branding, adding some new features and many more which is helping

in the product development. Product development is made by considering the taste and

preferences of customers. It will help in making to grow more customer of firms which

will help in achieving the objectives of the company. In the Vectair holding also working

on the products which requires adopting changes in product. After some additional

features are added then only product is sold in market. It will be helpful in making the

company to grow more.

P3 Potential source of funding in the business with its advantages and disadvantages of each

source

For starting of the business or expanding money is needed. It is helps in making the

company to grow more. For choosing the correct finance source is the toughest job. It has lot of

risk involves. Through this only people get chance to show the talent via their business. it is

sell its products in new market so it can prosper its operations in other places.

Market Penetration -in these products are similar and sold to the same clients which is a

bit difficult in this competitive market. For this many sales techniques which are used by

the company to attract customers. It is one of the strategies which is increasing the loyalty

of consumers towards the organisation. There are more methods from which increase of

sales takes place are offers, discounts and many more. It will attract customers to buy the

product. Many products use low pricing strategy which is helping entity to cover the

mass market coverage. To maximise sales public relation is more important which is

helping the entity to generate more opportunities of development if the product. Like

owner must analyse the product and identify which has potential of becoming successful

and which is not. Through this firm get to know about chances of survival of the product

and its investment needs. For Vectair Holdings is the company is selling its products by

using more promotional methods. It is more facilitative in handling the sales of the

product. This entity is also determined chances of survival of the product which is more

helpful in taking the decision of investment.

Product development- it means goods which firm is selling requires the innovation or

additional features for selling the product (Sanchez, 2018). Clients is bore by seeing the

same products and now trying the to switch to different firm. Changes can be made in the

packing, labelling, branding, adding some new features and many more which is helping

in the product development. Product development is made by considering the taste and

preferences of customers. It will help in making to grow more customer of firms which

will help in achieving the objectives of the company. In the Vectair holding also working

on the products which requires adopting changes in product. After some additional

features are added then only product is sold in market. It will be helpful in making the

company to grow more.

P3 Potential source of funding in the business with its advantages and disadvantages of each

source

For starting of the business or expanding money is needed. It is helps in making the

company to grow more. For choosing the correct finance source is the toughest job. It has lot of

risk involves. Through this only people get chance to show the talent via their business. it is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

more helpful in supporting the businesses, now there are many billionaires who want to invest in

the new business. They want to represent talent of the people to all and help in making the entity

more successful. There are many entrepreneurs who have good ideas but lack of fund didn't want

to become their idea prosperous. There are many sources of funding which is helping the entities

to flourish their idea. Some of them are :

Personal saving and assets- it is one of the source of fund which organisation already

have. It is owners saving and assets which enhance of the sources of funding. It is more

helpful due to no extra cost is charged in getting it (Zhu and Tang, 2018). Extra costs

means interest or sharing of the returns with investors. Assets of the person can be fixed

assets and current assets. In fixed assets land and building, machinery or any immovable

property which has more working life. It is one of the main source of fund in the

company. It is one of the most reliable source of the company. From this more sources of

revenue can be generated. It can be more helpful due to its prices appreciate after some

period. It will be more helpful in usage of this fund in the business.

Drawback - in this all the savings which has been saved for more time period is all gone and

there are few chances of getting back it. the saving which can be used in the business as pension

for the old people. It can be helpful in situation of the bankruptcy and in emergency

circumstance.

Investors- if firm has good idea and just lacking behind in the funds then persons who is

having the funds will see the balance sheet and if they are satisfied in that case only they

will provide or invest in the company. He is the person who is taking all the risk because

he has belief in the idea and which is helpful in growth of the business (Sanchez, 2018).

There are two types of investors one is the silent investors who just invest money in the

business and wait for getting its returns. Other one who is investing in business and help

as an active partners (Zhu and Tang, 2018).

Disadvantages - in this type of source of fund owner of the business needs to happy the

investors. Now interference of the investor increase in the business (Rijal and et.al., 2018). Some

control of the business is in hands of that person. Like risk, profit is also shared with investors.

Bank loans

It is common method by which Vectair Holdings can raise finance in the best possible

manner. Generally, principal amount is to be repaid by the firm along with interest accrued on

the new business. They want to represent talent of the people to all and help in making the entity

more successful. There are many entrepreneurs who have good ideas but lack of fund didn't want

to become their idea prosperous. There are many sources of funding which is helping the entities

to flourish their idea. Some of them are :

Personal saving and assets- it is one of the source of fund which organisation already

have. It is owners saving and assets which enhance of the sources of funding. It is more

helpful due to no extra cost is charged in getting it (Zhu and Tang, 2018). Extra costs

means interest or sharing of the returns with investors. Assets of the person can be fixed

assets and current assets. In fixed assets land and building, machinery or any immovable

property which has more working life. It is one of the main source of fund in the

company. It is one of the most reliable source of the company. From this more sources of

revenue can be generated. It can be more helpful due to its prices appreciate after some

period. It will be more helpful in usage of this fund in the business.

Drawback - in this all the savings which has been saved for more time period is all gone and

there are few chances of getting back it. the saving which can be used in the business as pension

for the old people. It can be helpful in situation of the bankruptcy and in emergency

circumstance.

Investors- if firm has good idea and just lacking behind in the funds then persons who is

having the funds will see the balance sheet and if they are satisfied in that case only they

will provide or invest in the company. He is the person who is taking all the risk because

he has belief in the idea and which is helpful in growth of the business (Sanchez, 2018).

There are two types of investors one is the silent investors who just invest money in the

business and wait for getting its returns. Other one who is investing in business and help

as an active partners (Zhu and Tang, 2018).

Disadvantages - in this type of source of fund owner of the business needs to happy the

investors. Now interference of the investor increase in the business (Rijal and et.al., 2018). Some

control of the business is in hands of that person. Like risk, profit is also shared with investors.

Bank loans

It is common method by which Vectair Holdings can raise finance in the best possible

manner. Generally, principal amount is to be repaid by the firm along with interest accrued on

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the same. This implies that along with main loan amount, interest is paid by the company and as

such, firm is required to paid the amount in a better way. This implies that business is required to

pay further payments.

Advantages

It is advantageous because interest accrued can be calculated as interest rate is fixed.

The main merit is that as compared to others, it is a cheaper source of finance.

Disadvantages

Debt burden increases as more of the amount is to be paid on regular instalments.

Liquidity position and solvency gets affected if default is made by firm.

Retained earnings - It is another source of raising funds from the profits attained in a

previous year. This means that firm can easily attain source of funds in effective manner.

The retained earnings are provided in relevance to profits earned and certain margin of

the same is retained by company. Hence, it is quite useful way to attain funds. It is useful

source of finance as no burden arises to pay amount to stakeholders of the business.

Advantages

It is advantageous as no external party is involved in providing funds.

It is suitable for attaining desired funds and no burden prevails to repay funds.

Disadvantages

Retained earnings is not liked by investors as dividends are not paid to them because

profits are not distributed which disheartens shareholders.

It leads to over capitalisation as more of funds are there which can lead to wastage of

funds.

P4 Designing a Business plan for Vectair Holdings Limited

In relation with operating the business activities in the market there will be suitable

development and enhancement of various operations which will be attainable and adequate as

per making raise in the operational efficiencies and ability to meet the challenges in the market.

Thus drafting a business plan which is consists of all the information such as market analysis,

such, firm is required to paid the amount in a better way. This implies that business is required to

pay further payments.

Advantages

It is advantageous because interest accrued can be calculated as interest rate is fixed.

The main merit is that as compared to others, it is a cheaper source of finance.

Disadvantages

Debt burden increases as more of the amount is to be paid on regular instalments.

Liquidity position and solvency gets affected if default is made by firm.

Retained earnings - It is another source of raising funds from the profits attained in a

previous year. This means that firm can easily attain source of funds in effective manner.

The retained earnings are provided in relevance to profits earned and certain margin of

the same is retained by company. Hence, it is quite useful way to attain funds. It is useful

source of finance as no burden arises to pay amount to stakeholders of the business.

Advantages

It is advantageous as no external party is involved in providing funds.

It is suitable for attaining desired funds and no burden prevails to repay funds.

Disadvantages

Retained earnings is not liked by investors as dividends are not paid to them because

profits are not distributed which disheartens shareholders.

It leads to over capitalisation as more of funds are there which can lead to wastage of

funds.

P4 Designing a Business plan for Vectair Holdings Limited

In relation with operating the business activities in the market there will be suitable

development and enhancement of various operations which will be attainable and adequate as

per making raise in the operational efficiencies and ability to meet the challenges in the market.

Thus drafting a business plan which is consists of all the information such as market analysis,

operational analysis, financial feasibilities and the strategies to meet the competition in the

market.

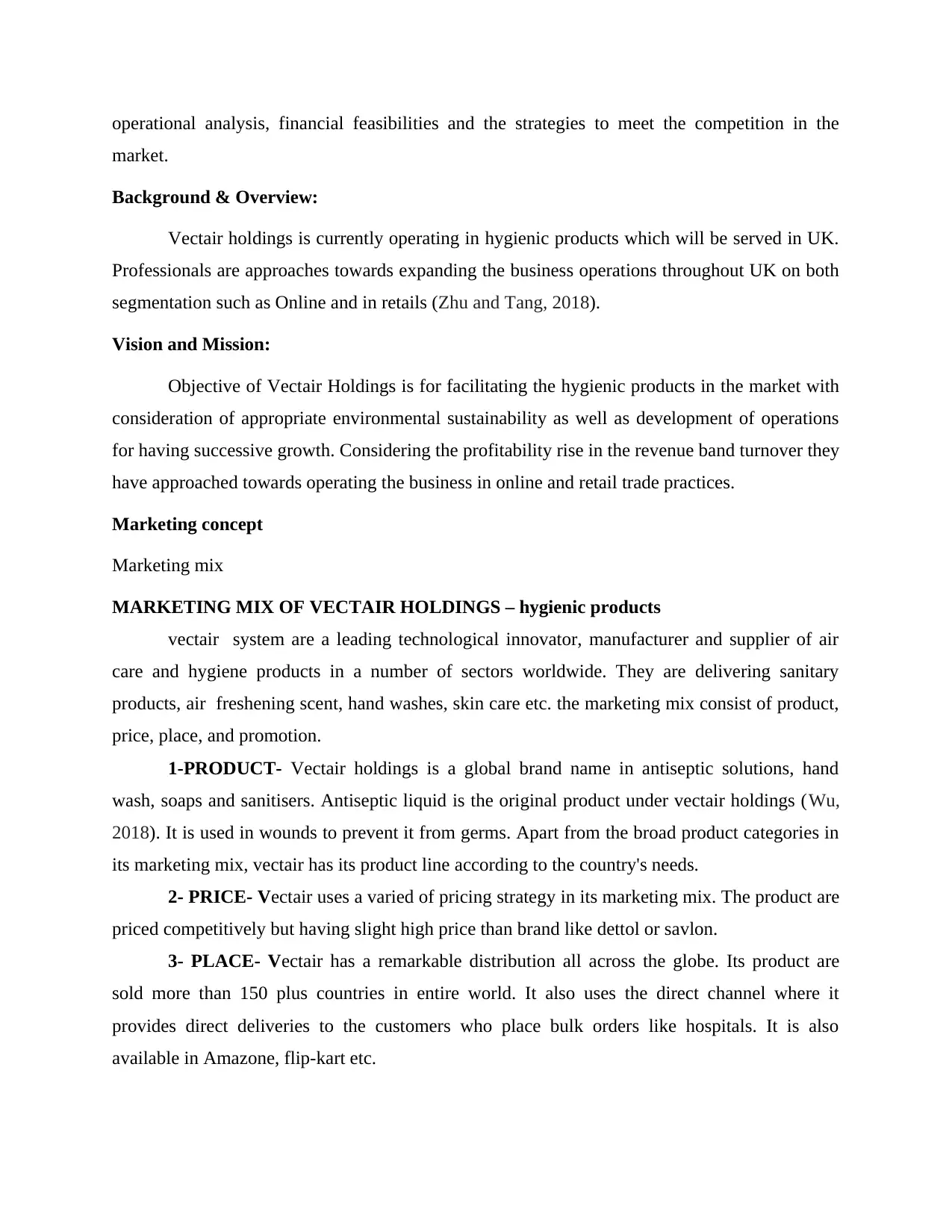

Background & Overview:

Vectair holdings is currently operating in hygienic products which will be served in UK.

Professionals are approaches towards expanding the business operations throughout UK on both

segmentation such as Online and in retails (Zhu and Tang, 2018).

Vision and Mission:

Objective of Vectair Holdings is for facilitating the hygienic products in the market with

consideration of appropriate environmental sustainability as well as development of operations

for having successive growth. Considering the profitability rise in the revenue band turnover they

have approached towards operating the business in online and retail trade practices.

Marketing concept

Marketing mix

MARKETING MIX OF VECTAIR HOLDINGS – hygienic products

vectair system are a leading technological innovator, manufacturer and supplier of air

care and hygiene products in a number of sectors worldwide. They are delivering sanitary

products, air freshening scent, hand washes, skin care etc. the marketing mix consist of product,

price, place, and promotion.

1-PRODUCT- Vectair holdings is a global brand name in antiseptic solutions, hand

wash, soaps and sanitisers. Antiseptic liquid is the original product under vectair holdings (Wu,

2018). It is used in wounds to prevent it from germs. Apart from the broad product categories in

its marketing mix, vectair has its product line according to the country's needs.

2- PRICE- Vectair uses a varied of pricing strategy in its marketing mix. The product are

priced competitively but having slight high price than brand like dettol or savlon.

3- PLACE- Vectair has a remarkable distribution all across the globe. Its product are

sold more than 150 plus countries in entire world. It also uses the direct channel where it

provides direct deliveries to the customers who place bulk orders like hospitals. It is also

available in Amazone, flip-kart etc.

market.

Background & Overview:

Vectair holdings is currently operating in hygienic products which will be served in UK.

Professionals are approaches towards expanding the business operations throughout UK on both

segmentation such as Online and in retails (Zhu and Tang, 2018).

Vision and Mission:

Objective of Vectair Holdings is for facilitating the hygienic products in the market with

consideration of appropriate environmental sustainability as well as development of operations

for having successive growth. Considering the profitability rise in the revenue band turnover they

have approached towards operating the business in online and retail trade practices.

Marketing concept

Marketing mix

MARKETING MIX OF VECTAIR HOLDINGS – hygienic products

vectair system are a leading technological innovator, manufacturer and supplier of air

care and hygiene products in a number of sectors worldwide. They are delivering sanitary

products, air freshening scent, hand washes, skin care etc. the marketing mix consist of product,

price, place, and promotion.

1-PRODUCT- Vectair holdings is a global brand name in antiseptic solutions, hand

wash, soaps and sanitisers. Antiseptic liquid is the original product under vectair holdings (Wu,

2018). It is used in wounds to prevent it from germs. Apart from the broad product categories in

its marketing mix, vectair has its product line according to the country's needs.

2- PRICE- Vectair uses a varied of pricing strategy in its marketing mix. The product are

priced competitively but having slight high price than brand like dettol or savlon.

3- PLACE- Vectair has a remarkable distribution all across the globe. Its product are

sold more than 150 plus countries in entire world. It also uses the direct channel where it

provides direct deliveries to the customers who place bulk orders like hospitals. It is also

available in Amazone, flip-kart etc.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

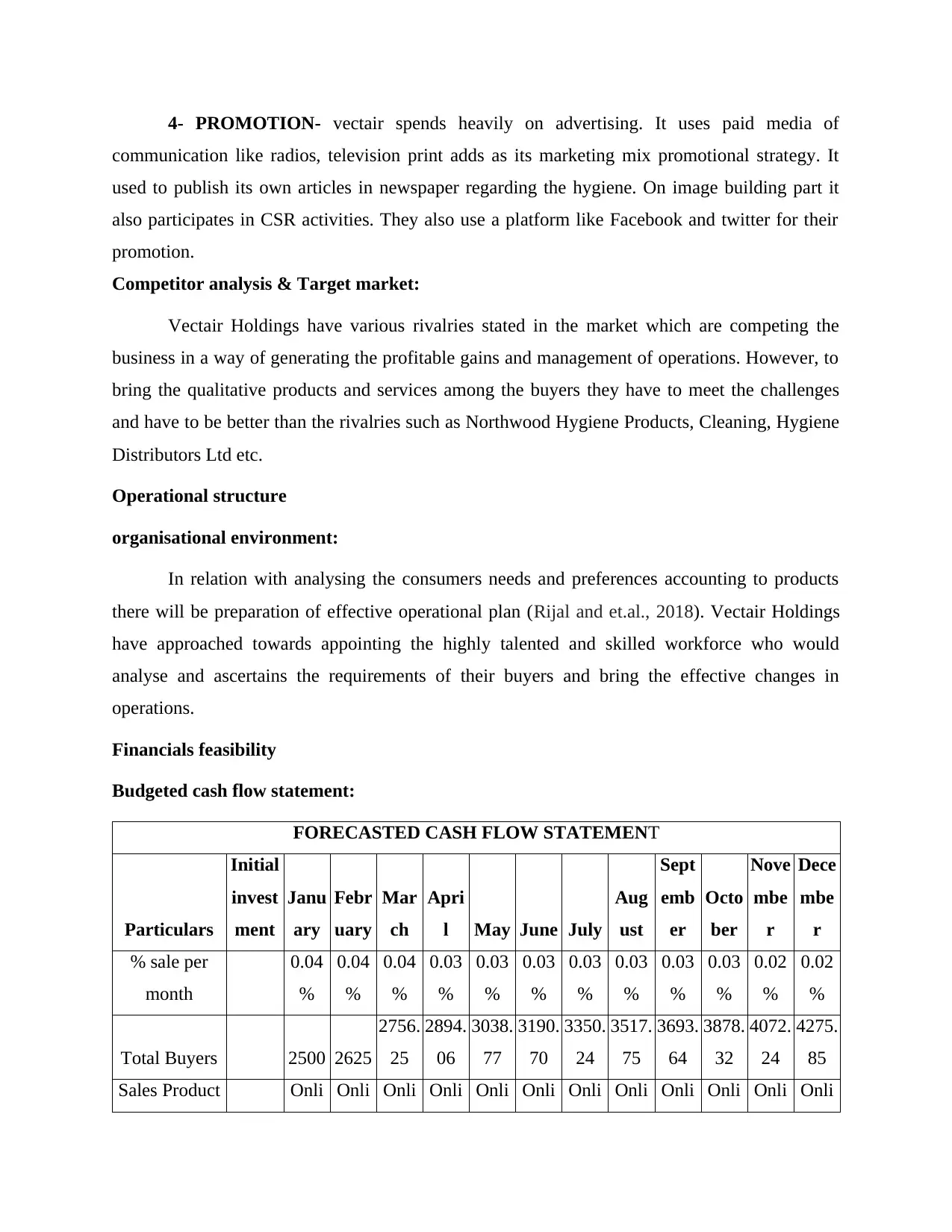

4- PROMOTION- vectair spends heavily on advertising. It uses paid media of

communication like radios, television print adds as its marketing mix promotional strategy. It

used to publish its own articles in newspaper regarding the hygiene. On image building part it

also participates in CSR activities. They also use a platform like Facebook and twitter for their

promotion.

Competitor analysis & Target market:

Vectair Holdings have various rivalries stated in the market which are competing the

business in a way of generating the profitable gains and management of operations. However, to

bring the qualitative products and services among the buyers they have to meet the challenges

and have to be better than the rivalries such as Northwood Hygiene Products, Cleaning, Hygiene

Distributors Ltd etc.

Operational structure

organisational environment:

In relation with analysing the consumers needs and preferences accounting to products

there will be preparation of effective operational plan (Rijal and et.al., 2018). Vectair Holdings

have approached towards appointing the highly talented and skilled workforce who would

analyse and ascertains the requirements of their buyers and bring the effective changes in

operations.

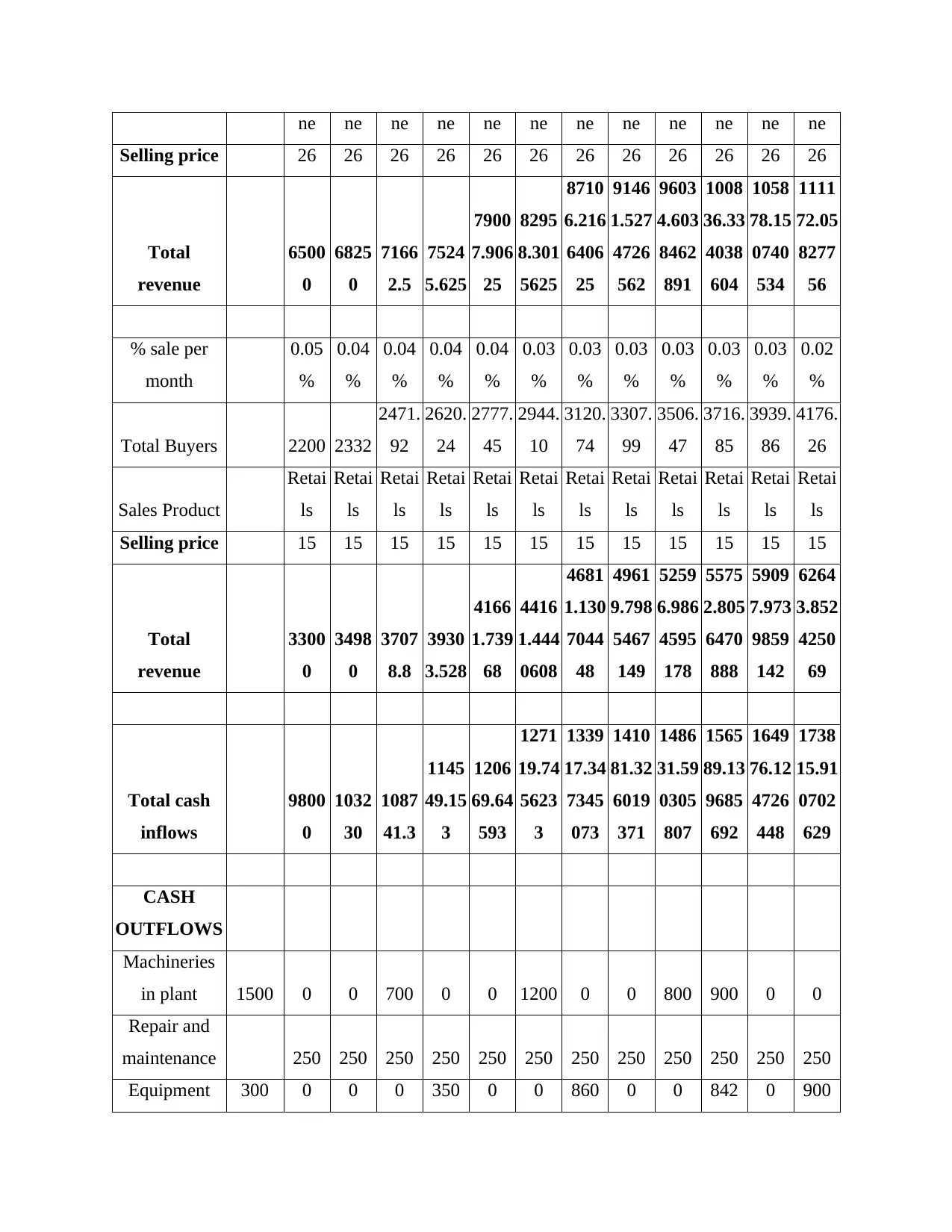

Financials feasibility

Budgeted cash flow statement:

FORECASTED CASH FLOW STATEMENT

Particulars

Initial

invest

ment

Janu

ary

Febr

uary

Mar

ch

Apri

l May June July

Aug

ust

Sept

emb

er

Octo

ber

Nove

mbe

r

Dece

mbe

r

% sale per

month

0.04

%

0.04

%

0.04

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.02

%

0.02

%

Total Buyers 2500 2625

2756.

25

2894.

06

3038.

77

3190.

70

3350.

24

3517.

75

3693.

64

3878.

32

4072.

24

4275.

85

Sales Product Onli Onli Onli Onli Onli Onli Onli Onli Onli Onli Onli Onli

communication like radios, television print adds as its marketing mix promotional strategy. It

used to publish its own articles in newspaper regarding the hygiene. On image building part it

also participates in CSR activities. They also use a platform like Facebook and twitter for their

promotion.

Competitor analysis & Target market:

Vectair Holdings have various rivalries stated in the market which are competing the

business in a way of generating the profitable gains and management of operations. However, to

bring the qualitative products and services among the buyers they have to meet the challenges

and have to be better than the rivalries such as Northwood Hygiene Products, Cleaning, Hygiene

Distributors Ltd etc.

Operational structure

organisational environment:

In relation with analysing the consumers needs and preferences accounting to products

there will be preparation of effective operational plan (Rijal and et.al., 2018). Vectair Holdings

have approached towards appointing the highly talented and skilled workforce who would

analyse and ascertains the requirements of their buyers and bring the effective changes in

operations.

Financials feasibility

Budgeted cash flow statement:

FORECASTED CASH FLOW STATEMENT

Particulars

Initial

invest

ment

Janu

ary

Febr

uary

Mar

ch

Apri

l May June July

Aug

ust

Sept

emb

er

Octo

ber

Nove

mbe

r

Dece

mbe

r

% sale per

month

0.04

%

0.04

%

0.04

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.02

%

0.02

%

Total Buyers 2500 2625

2756.

25

2894.

06

3038.

77

3190.

70

3350.

24

3517.

75

3693.

64

3878.

32

4072.

24

4275.

85

Sales Product Onli Onli Onli Onli Onli Onli Onli Onli Onli Onli Onli Onli

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ne ne ne ne ne ne ne ne ne ne ne ne

Selling price 26 26 26 26 26 26 26 26 26 26 26 26

Total

revenue

6500

0

6825

0

7166

2.5

7524

5.625

7900

7.906

25

8295

8.301

5625

8710

6.216

6406

25

9146

1.527

4726

562

9603

4.603

8462

891

1008

36.33

4038

604

1058

78.15

0740

534

1111

72.05

8277

56

% sale per

month

0.05

%

0.04

%

0.04

%

0.04

%

0.04

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.02

%

Total Buyers 2200 2332

2471.

92

2620.

24

2777.

45

2944.

10

3120.

74

3307.

99

3506.

47

3716.

85

3939.

86

4176.

26

Sales Product

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Selling price 15 15 15 15 15 15 15 15 15 15 15 15

Total

revenue

3300

0

3498

0

3707

8.8

3930

3.528

4166

1.739

68

4416

1.444

0608

4681

1.130

7044

48

4961

9.798

5467

149

5259

6.986

4595

178

5575

2.805

6470

888

5909

7.973

9859

142

6264

3.852

4250

69

Total cash

inflows

9800

0

1032

30

1087

41.3

1145

49.15

3

1206

69.64

593

1271

19.74

5623

3

1339

17.34

7345

073

1410

81.32

6019

371

1486

31.59

0305

807

1565

89.13

9685

692

1649

76.12

4726

448

1738

15.91

0702

629

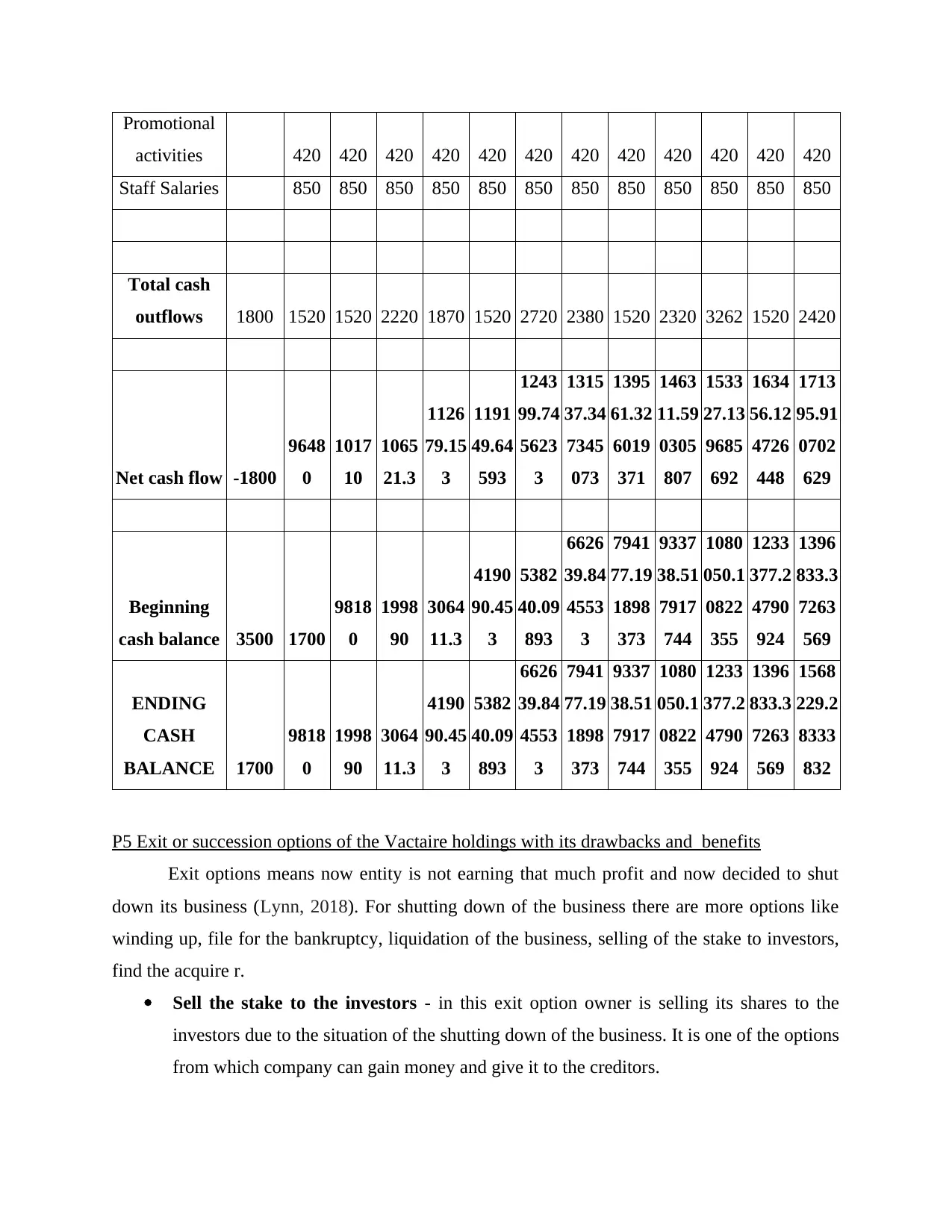

CASH

OUTFLOWS

Machineries

in plant 1500 0 0 700 0 0 1200 0 0 800 900 0 0

Repair and

maintenance 250 250 250 250 250 250 250 250 250 250 250 250

Equipment 300 0 0 0 350 0 0 860 0 0 842 0 900

Selling price 26 26 26 26 26 26 26 26 26 26 26 26

Total

revenue

6500

0

6825

0

7166

2.5

7524

5.625

7900

7.906

25

8295

8.301

5625

8710

6.216

6406

25

9146

1.527

4726

562

9603

4.603

8462

891

1008

36.33

4038

604

1058

78.15

0740

534

1111

72.05

8277

56

% sale per

month

0.05

%

0.04

%

0.04

%

0.04

%

0.04

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.02

%

Total Buyers 2200 2332

2471.

92

2620.

24

2777.

45

2944.

10

3120.

74

3307.

99

3506.

47

3716.

85

3939.

86

4176.

26

Sales Product

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Retai

ls

Selling price 15 15 15 15 15 15 15 15 15 15 15 15

Total

revenue

3300

0

3498

0

3707

8.8

3930

3.528

4166

1.739

68

4416

1.444

0608

4681

1.130

7044

48

4961

9.798

5467

149

5259

6.986

4595

178

5575

2.805

6470

888

5909

7.973

9859

142

6264

3.852

4250

69

Total cash

inflows

9800

0

1032

30

1087

41.3

1145

49.15

3

1206

69.64

593

1271

19.74

5623

3

1339

17.34

7345

073

1410

81.32

6019

371

1486

31.59

0305

807

1565

89.13

9685

692

1649

76.12

4726

448

1738

15.91

0702

629

CASH

OUTFLOWS

Machineries

in plant 1500 0 0 700 0 0 1200 0 0 800 900 0 0

Repair and

maintenance 250 250 250 250 250 250 250 250 250 250 250 250

Equipment 300 0 0 0 350 0 0 860 0 0 842 0 900

Promotional

activities 420 420 420 420 420 420 420 420 420 420 420 420

Staff Salaries 850 850 850 850 850 850 850 850 850 850 850 850

Total cash

outflows 1800 1520 1520 2220 1870 1520 2720 2380 1520 2320 3262 1520 2420

Net cash flow -1800

9648

0

1017

10

1065

21.3

1126

79.15

3

1191

49.64

593

1243

99.74

5623

3

1315

37.34

7345

073

1395

61.32

6019

371

1463

11.59

0305

807

1533

27.13

9685

692

1634

56.12

4726

448

1713

95.91

0702

629

Beginning

cash balance 3500 1700

9818

0

1998

90

3064

11.3

4190

90.45

3

5382

40.09

893

6626

39.84

4553

3

7941

77.19

1898

373

9337

38.51

7917

744

1080

050.1

0822

355

1233

377.2

4790

924

1396

833.3

7263

569

ENDING

CASH

BALANCE 1700

9818

0

1998

90

3064

11.3

4190

90.45

3

5382

40.09

893

6626

39.84

4553

3

7941

77.19

1898

373

9337

38.51

7917

744

1080

050.1

0822

355

1233

377.2

4790

924

1396

833.3

7263

569

1568

229.2

8333

832

P5 Exit or succession options of the Vactaire holdings with its drawbacks and benefits

Exit options means now entity is not earning that much profit and now decided to shut

down its business (Lynn, 2018). For shutting down of the business there are more options like

winding up, file for the bankruptcy, liquidation of the business, selling of the stake to investors,

find the acquire r.

Sell the stake to the investors - in this exit option owner is selling its shares to the

investors due to the situation of the shutting down of the business. It is one of the options

from which company can gain money and give it to the creditors.

activities 420 420 420 420 420 420 420 420 420 420 420 420

Staff Salaries 850 850 850 850 850 850 850 850 850 850 850 850

Total cash

outflows 1800 1520 1520 2220 1870 1520 2720 2380 1520 2320 3262 1520 2420

Net cash flow -1800

9648

0

1017

10

1065

21.3

1126

79.15

3

1191

49.64

593

1243

99.74

5623

3

1315

37.34

7345

073

1395

61.32

6019

371

1463

11.59

0305

807

1533

27.13

9685

692

1634

56.12

4726

448

1713

95.91

0702

629

Beginning

cash balance 3500 1700

9818

0

1998

90

3064

11.3

4190

90.45

3

5382

40.09

893

6626

39.84

4553

3

7941

77.19

1898

373

9337

38.51

7917

744

1080

050.1

0822

355

1233

377.2

4790

924

1396

833.3

7263

569

ENDING

CASH

BALANCE 1700

9818

0

1998

90

3064

11.3

4190

90.45

3

5382

40.09

893

6626

39.84

4553

3

7941

77.19

1898

373

9337

38.51

7917

744

1080

050.1

0822

355

1233

377.2

4790

924

1396

833.3

7263

569

1568

229.2

8333

832

P5 Exit or succession options of the Vactaire holdings with its drawbacks and benefits

Exit options means now entity is not earning that much profit and now decided to shut

down its business (Lynn, 2018). For shutting down of the business there are more options like

winding up, file for the bankruptcy, liquidation of the business, selling of the stake to investors,

find the acquire r.

Sell the stake to the investors - in this exit option owner is selling its shares to the

investors due to the situation of the shutting down of the business. It is one of the options

from which company can gain money and give it to the creditors.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.