Business Finance Report: Cash Flow Analysis & Budgeting - Victory PLC

VerifiedAdded on 2023/06/12

|10

|2799

|239

Report

AI Summary

This business finance report provides an analysis of cash flow and budgeting, focusing on Victory PLC and Bemus Ltd. Part A differentiates between cash flow and profit, explains working capital, and suggests steps to improve cash flow for Victory PLC, including negotiating payment terms and studying cash flow patterns. Part B prepares a cash budget for Bemus Ltd. for four months and analyzes the cash budget, recommending improvements in cash management by attracting clients with markdowns and controlling expenditures. The report emphasizes the importance of maintaining a proper cash budget for better cash flow management and highlights the impact of liquidity on operational, investing, and financing activities.

Business Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

PART A:..........................................................................................................................................3

Report to Board of Director: -.....................................................................................................3

1. Explain the difference between Cash flow and profit.............................................................3

2. Explain working capital and also explain the effect of change in working capital.................4

3. State the steps to improve the cash flow of Victory Plc..........................................................5

PART B...........................................................................................................................................6

1. Prepare the Cash Budget for Bemus Ltd. for 4 consecutive months from March 2022..........6

2. Prepare an analyse report of cash budget of David Bemus.....................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................3

MAIN BODY..................................................................................................................................3

PART A:..........................................................................................................................................3

Report to Board of Director: -.....................................................................................................3

1. Explain the difference between Cash flow and profit.............................................................3

2. Explain working capital and also explain the effect of change in working capital.................4

3. State the steps to improve the cash flow of Victory Plc..........................................................5

PART B...........................................................................................................................................6

1. Prepare the Cash Budget for Bemus Ltd. for 4 consecutive months from March 2022..........6

2. Prepare an analyse report of cash budget of David Bemus.....................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Business finance is the life blood for any organization. All the day to day operations

performed in the organization require funds. For effective management, it is necessary to look at

the financial statements and take numerous decisions accordingly (Barnhill and Rundio, 2021).

This report is divided into two parts. In part one, it consists the difference between profits and

cash flow. It also comprises the meaning of working capital and impact on trade receivable,

inventory, and trade payable. There are various measures which can be taken to improve the cash

flows of the enterprise. In part two, it encompasses the preparation of cash budget on monthly

basis. It comprises the recommendation to the firm for improving the management.

MAIN BODY

PART A:

Report to Board of Director: -

Organisation can raise funds from various sources that fulfil the requirement of business.

The rates may vary of funds received based on the source from where it has been derived. An

organisation uses sources such as issue of equity shares, debentures, loans from the bank, raise

further capital from existing shareholders by issuing right shares, etc. In order to raise funds, the

organisation has to choose the best option very the repayment is lowest and it can be paid within

a reasonable period of time. Banks loans are provided at the cheaper rates are considered as one

of the best option as it does not dissolve the ownership of the business (Ríos and et.al., 2018). It

the organisation chooses to issue right share then it will reduce the shareholdings of the existing

shareholders as well it will dilute more ownership of the business. In the following case Victory

Plc. Is already suffering from financial crises so the business does not have to opt for bank loan

as it has to be paid on regular basis and business have to arrange funds for the repayment of loan.

Thus the organisation can choose any of the other options available.

1. Explain the difference between Cash flow and profit.

Working capital requirement is the basic requirement for any business organization which

can be utilized for the purpose of purchasing of raw material, essential, etc. It is derived by

subtracting current assets and current liabilities. On the other hand, Net profit is derived by

deducing the operating expenses from the gross profit of the organization. Cash flow are derived

Business finance is the life blood for any organization. All the day to day operations

performed in the organization require funds. For effective management, it is necessary to look at

the financial statements and take numerous decisions accordingly (Barnhill and Rundio, 2021).

This report is divided into two parts. In part one, it consists the difference between profits and

cash flow. It also comprises the meaning of working capital and impact on trade receivable,

inventory, and trade payable. There are various measures which can be taken to improve the cash

flows of the enterprise. In part two, it encompasses the preparation of cash budget on monthly

basis. It comprises the recommendation to the firm for improving the management.

MAIN BODY

PART A:

Report to Board of Director: -

Organisation can raise funds from various sources that fulfil the requirement of business.

The rates may vary of funds received based on the source from where it has been derived. An

organisation uses sources such as issue of equity shares, debentures, loans from the bank, raise

further capital from existing shareholders by issuing right shares, etc. In order to raise funds, the

organisation has to choose the best option very the repayment is lowest and it can be paid within

a reasonable period of time. Banks loans are provided at the cheaper rates are considered as one

of the best option as it does not dissolve the ownership of the business (Ríos and et.al., 2018). It

the organisation chooses to issue right share then it will reduce the shareholdings of the existing

shareholders as well it will dilute more ownership of the business. In the following case Victory

Plc. Is already suffering from financial crises so the business does not have to opt for bank loan

as it has to be paid on regular basis and business have to arrange funds for the repayment of loan.

Thus the organisation can choose any of the other options available.

1. Explain the difference between Cash flow and profit.

Working capital requirement is the basic requirement for any business organization which

can be utilized for the purpose of purchasing of raw material, essential, etc. It is derived by

subtracting current assets and current liabilities. On the other hand, Net profit is derived by

deducing the operating expenses from the gross profit of the organization. Cash flow are derived

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

by business transactions which includes various activities that impacts the profitability of a

business. Profitability of a business does not assures regarding cash flow. On the other hand,

cash flow encompasses all the detailed aspects about the inflow and outflow of the organization.

There are three activities in the cash flow statement such as operating activities, investing

activities and financing activities. Liquidity and cash are the basic requirement of a business. For

any business to perform its day to day operations there is a need of cash and liquidity. Profits are

the basic requirement of any business concern which helps the management in surviving for the

long in the industry. There is certain situation in which firm is having adequate amount of profits

but does not have optimum level of cash in the organization. Hence, it can be interpreted that

cash flows signifies the in and out of the money from the enterprise whereas profits is the net

income which is computed by subtracting expenses from total amount of sales.

2. Explain working capital and also explain the effect of change in working capital.

Working capital is the requirement of funds for the business operations of a business

concern. This funds helps in making payment of routine payment and short term liability or

arranging funds for meeting the business requirements. Working capital requirements are

generally sourced from short term finances such as trade credit, commercial paper, etc. Cash

flow is affected by the changes in the assets and liability of a business concern. Positive changes

in trade receivables and stock of an organisation, tends to increase the current assets of the

organisation. Negative change in the current assets decreases cash flow of the organisation.

Increase in trade payables increase the liability of the organisation. Decrease in the trade payable

increase the available cash flow of the business concern. Long term funds are mainly used for the

purpose of making investment (van der Cruijsen and van der Horst, 2019). It can also be used by

the organisation in order to meet the working capital requirement. Long term finance includes

debentures, equity shares, retained earnings, etc. Working capital is determined by subtracting

the current assets from current liabilities. There are different types of working capital such as

reserve margin working capital, seasonal working capital, special variable working capital,

permanent working capital and variable working capital. In order to achieve efficiency in

managing working capital requirement, business concern has to view more efficiently on the

working capital cycle to reduce the risk of shortage of funds. Working capital cycle is defined as

the time period in which the raw material is converted in monetary terms.

Consequence of liquidity on various actions is as follows:

business. Profitability of a business does not assures regarding cash flow. On the other hand,

cash flow encompasses all the detailed aspects about the inflow and outflow of the organization.

There are three activities in the cash flow statement such as operating activities, investing

activities and financing activities. Liquidity and cash are the basic requirement of a business. For

any business to perform its day to day operations there is a need of cash and liquidity. Profits are

the basic requirement of any business concern which helps the management in surviving for the

long in the industry. There is certain situation in which firm is having adequate amount of profits

but does not have optimum level of cash in the organization. Hence, it can be interpreted that

cash flows signifies the in and out of the money from the enterprise whereas profits is the net

income which is computed by subtracting expenses from total amount of sales.

2. Explain working capital and also explain the effect of change in working capital.

Working capital is the requirement of funds for the business operations of a business

concern. This funds helps in making payment of routine payment and short term liability or

arranging funds for meeting the business requirements. Working capital requirements are

generally sourced from short term finances such as trade credit, commercial paper, etc. Cash

flow is affected by the changes in the assets and liability of a business concern. Positive changes

in trade receivables and stock of an organisation, tends to increase the current assets of the

organisation. Negative change in the current assets decreases cash flow of the organisation.

Increase in trade payables increase the liability of the organisation. Decrease in the trade payable

increase the available cash flow of the business concern. Long term funds are mainly used for the

purpose of making investment (van der Cruijsen and van der Horst, 2019). It can also be used by

the organisation in order to meet the working capital requirement. Long term finance includes

debentures, equity shares, retained earnings, etc. Working capital is determined by subtracting

the current assets from current liabilities. There are different types of working capital such as

reserve margin working capital, seasonal working capital, special variable working capital,

permanent working capital and variable working capital. In order to achieve efficiency in

managing working capital requirement, business concern has to view more efficiently on the

working capital cycle to reduce the risk of shortage of funds. Working capital cycle is defined as

the time period in which the raw material is converted in monetary terms.

Consequence of liquidity on various actions is as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. Effect on Operation activities: Cash flow from operating activities includes activities

which are of recurring nature and generates income and expenditure related to the

production (Mazzarol and Reboud, 2020). Level of liquidity affects the creditworthiness

of a corporate. An organisation that has a significant amount of liquidity does not need to

do much for the loans from the banks. But organisations that do not have a significant

liquidity in their business, this type of entities has to try hard for the credits as they

already lag to meet the daily needs of the funds.

2. Effect on investing activities: These are activities which are concerned with the sale and

acquisition of property or savings. For example, an administration buys a machinery for

its business operations, that will eventually increase the entire assets of the corporation as

well as causes outflow of cash, that will ultimately reduce the existing cash in the

management.

3. Effect on financing activities: financing activities includes alter in number of share

issued, redemption of debenture, securities and long term loans (Ponco Azi, 2018).

Liquidity is affected by the financing activities such as reduce in the liability, redemption

of debenture of the organisation.

3. State the steps to improve the cash flow of Victory Plc.

Cash flow assists in knowing the flow of cash in the organization. There are various steps which

can be taken by the organization to improve the cash flow. These can be described as given

below:

Negotiate quick payment terms: When credit sales are made to various clients, the

organization should ensure the timely payment from the debtors. The debtor’s collection

should be not being too high; it will create the debts in the organization. Eventually,

organization has to face negative cash flows (Akatwijuka, 2018).

Studying cash flow patterns: The organization should analyze the previous year’s cash

flows and it helps in taking present as well as future decisions of the enterprise. The

enterprise forecasts the performance of the concern.

Cut unnecessary spending: There are various expenses of the enterprise which should

be minimized for achieving the positive cash flows of the organization. When the

expenses of the enterprise are greater than its income, firm has to experience negative

cash flows.

which are of recurring nature and generates income and expenditure related to the

production (Mazzarol and Reboud, 2020). Level of liquidity affects the creditworthiness

of a corporate. An organisation that has a significant amount of liquidity does not need to

do much for the loans from the banks. But organisations that do not have a significant

liquidity in their business, this type of entities has to try hard for the credits as they

already lag to meet the daily needs of the funds.

2. Effect on investing activities: These are activities which are concerned with the sale and

acquisition of property or savings. For example, an administration buys a machinery for

its business operations, that will eventually increase the entire assets of the corporation as

well as causes outflow of cash, that will ultimately reduce the existing cash in the

management.

3. Effect on financing activities: financing activities includes alter in number of share

issued, redemption of debenture, securities and long term loans (Ponco Azi, 2018).

Liquidity is affected by the financing activities such as reduce in the liability, redemption

of debenture of the organisation.

3. State the steps to improve the cash flow of Victory Plc.

Cash flow assists in knowing the flow of cash in the organization. There are various steps which

can be taken by the organization to improve the cash flow. These can be described as given

below:

Negotiate quick payment terms: When credit sales are made to various clients, the

organization should ensure the timely payment from the debtors. The debtor’s collection

should be not being too high; it will create the debts in the organization. Eventually,

organization has to face negative cash flows (Akatwijuka, 2018).

Studying cash flow patterns: The organization should analyze the previous year’s cash

flows and it helps in taking present as well as future decisions of the enterprise. The

enterprise forecasts the performance of the concern.

Cut unnecessary spending: There are various expenses of the enterprise which should

be minimized for achieving the positive cash flows of the organization. When the

expenses of the enterprise are greater than its income, firm has to experience negative

cash flows.

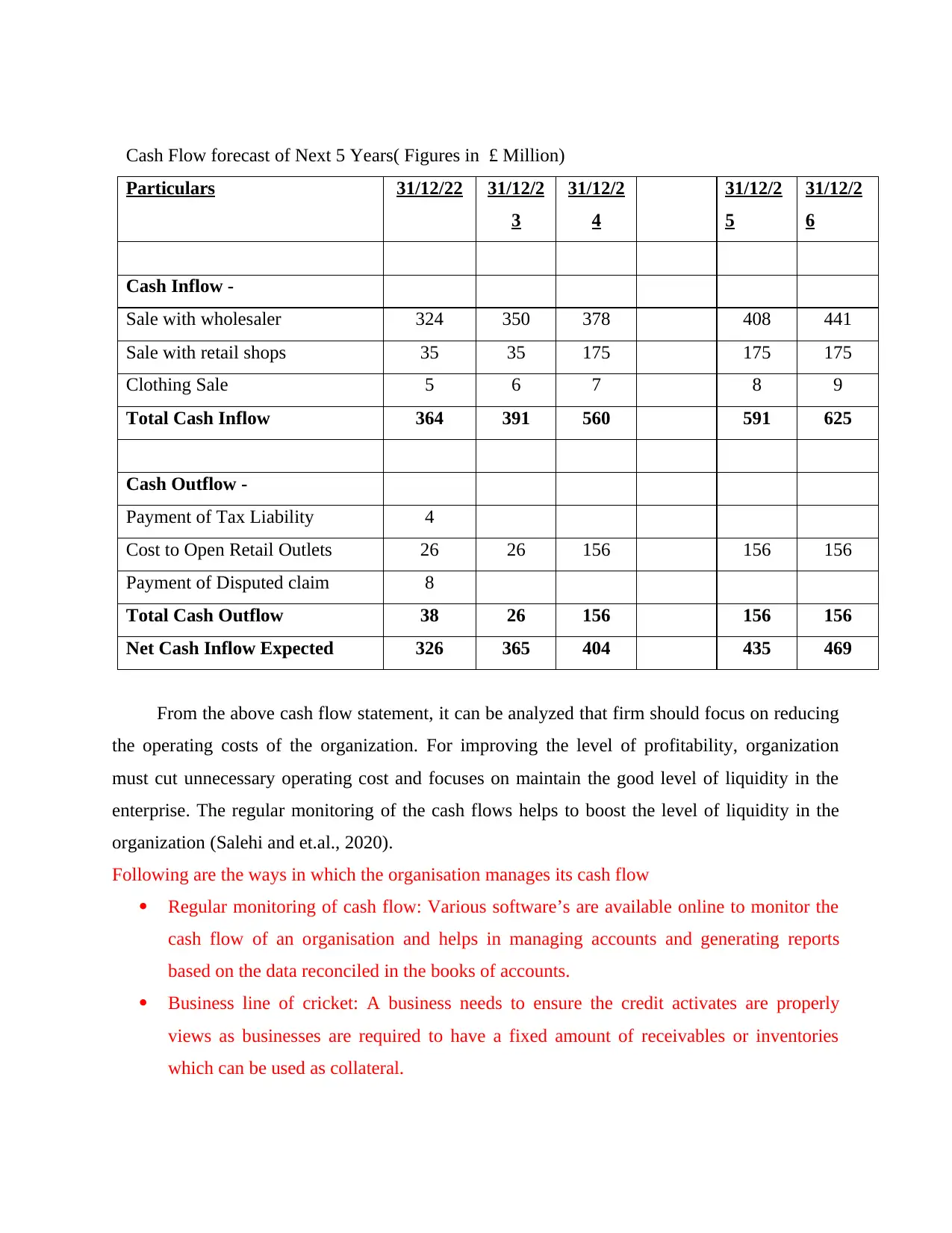

Cash Flow forecast of Next 5 Years( Figures in £ Million)

Particulars 31/12/22 31/12/2

3

31/12/2

4

31/12/2

5

31/12/2

6

Cash Inflow -

Sale with wholesaler 324 350 378 408 441

Sale with retail shops 35 35 175 175 175

Clothing Sale 5 6 7 8 9

Total Cash Inflow 364 391 560 591 625

Cash Outflow -

Payment of Tax Liability 4

Cost to Open Retail Outlets 26 26 156 156 156

Payment of Disputed claim 8

Total Cash Outflow 38 26 156 156 156

Net Cash Inflow Expected 326 365 404 435 469

From the above cash flow statement, it can be analyzed that firm should focus on reducing

the operating costs of the organization. For improving the level of profitability, organization

must cut unnecessary operating cost and focuses on maintain the good level of liquidity in the

enterprise. The regular monitoring of the cash flows helps to boost the level of liquidity in the

organization (Salehi and et.al., 2020).

Following are the ways in which the organisation manages its cash flow

Regular monitoring of cash flow: Various software’s are available online to monitor the

cash flow of an organisation and helps in managing accounts and generating reports

based on the data reconciled in the books of accounts.

Business line of cricket: A business needs to ensure the credit activates are properly

views as businesses are required to have a fixed amount of receivables or inventories

which can be used as collateral.

Particulars 31/12/22 31/12/2

3

31/12/2

4

31/12/2

5

31/12/2

6

Cash Inflow -

Sale with wholesaler 324 350 378 408 441

Sale with retail shops 35 35 175 175 175

Clothing Sale 5 6 7 8 9

Total Cash Inflow 364 391 560 591 625

Cash Outflow -

Payment of Tax Liability 4

Cost to Open Retail Outlets 26 26 156 156 156

Payment of Disputed claim 8

Total Cash Outflow 38 26 156 156 156

Net Cash Inflow Expected 326 365 404 435 469

From the above cash flow statement, it can be analyzed that firm should focus on reducing

the operating costs of the organization. For improving the level of profitability, organization

must cut unnecessary operating cost and focuses on maintain the good level of liquidity in the

enterprise. The regular monitoring of the cash flows helps to boost the level of liquidity in the

organization (Salehi and et.al., 2020).

Following are the ways in which the organisation manages its cash flow

Regular monitoring of cash flow: Various software’s are available online to monitor the

cash flow of an organisation and helps in managing accounts and generating reports

based on the data reconciled in the books of accounts.

Business line of cricket: A business needs to ensure the credit activates are properly

views as businesses are required to have a fixed amount of receivables or inventories

which can be used as collateral.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Invoice process: Invoice process needs to be quick in order to realise cash quickly from

its buyers and debtors.

PART B

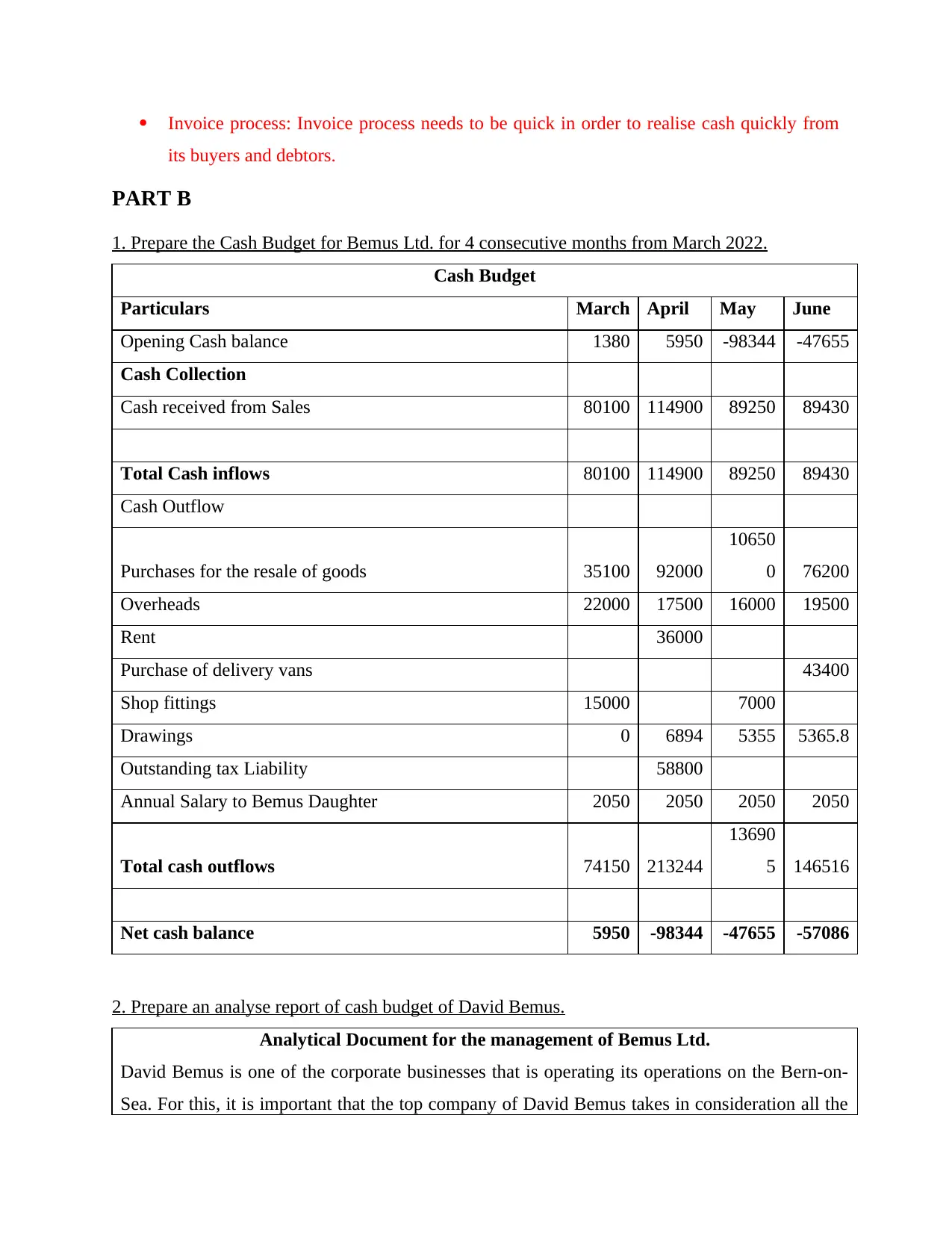

1. Prepare the Cash Budget for Bemus Ltd. for 4 consecutive months from March 2022.

Cash Budget

Particulars March April May June

Opening Cash balance 1380 5950 -98344 -47655

Cash Collection

Cash received from Sales 80100 114900 89250 89430

Total Cash inflows 80100 114900 89250 89430

Cash Outflow

Purchases for the resale of goods 35100 92000

10650

0 76200

Overheads 22000 17500 16000 19500

Rent 36000

Purchase of delivery vans 43400

Shop fittings 15000 7000

Drawings 0 6894 5355 5365.8

Outstanding tax Liability 58800

Annual Salary to Bemus Daughter 2050 2050 2050 2050

Total cash outflows 74150 213244

13690

5 146516

Net cash balance 5950 -98344 -47655 -57086

2. Prepare an analyse report of cash budget of David Bemus.

Analytical Document for the management of Bemus Ltd.

David Bemus is one of the corporate businesses that is operating its operations on the Bern-on-

Sea. For this, it is important that the top company of David Bemus takes in consideration all the

its buyers and debtors.

PART B

1. Prepare the Cash Budget for Bemus Ltd. for 4 consecutive months from March 2022.

Cash Budget

Particulars March April May June

Opening Cash balance 1380 5950 -98344 -47655

Cash Collection

Cash received from Sales 80100 114900 89250 89430

Total Cash inflows 80100 114900 89250 89430

Cash Outflow

Purchases for the resale of goods 35100 92000

10650

0 76200

Overheads 22000 17500 16000 19500

Rent 36000

Purchase of delivery vans 43400

Shop fittings 15000 7000

Drawings 0 6894 5355 5365.8

Outstanding tax Liability 58800

Annual Salary to Bemus Daughter 2050 2050 2050 2050

Total cash outflows 74150 213244

13690

5 146516

Net cash balance 5950 -98344 -47655 -57086

2. Prepare an analyse report of cash budget of David Bemus.

Analytical Document for the management of Bemus Ltd.

David Bemus is one of the corporate businesses that is operating its operations on the Bern-on-

Sea. For this, it is important that the top company of David Bemus takes in consideration all the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

numbers that are mentioned in the arrivals and cash discharges, also taking into account sales

income that was earned on credit basis. Business prepares budget analysis report to take better

decisions relating to all the finance that is used in operating the company (Heald and Hodges,

2020). It is necessary for the company to improve its cash related transactions by attracting

clients and providing more markdowns which means providing trade rebate for all the cash

expenditures made during the sales. The company is also earning a huge amount of direct and

operational expenditure which can be controlled and reduced by meeting the exploiting revenue

of the entity. The acquisition can also be performed with less expense by confirming with the

contractor to provide cash rebate and deduction related to trade for making the payment

immediately (Seppänen and Teinilä, 2022). Thus, the net cash balance reflected in the month of

April, May and June is representing the adverse amount which clearly defines that the amount of

expenditures is more than that of cash arrivals. The concluding balance related to the previous

month affects the amounts of the following financial years as it gets delivered as the initial

amount of cash balance. So, it is very important to maintain a proper cash budget of every month

for better flow of cash in the company. The drawings that are affected by the occupational

expenses could be reserved from the expenses of corporate, as these are defined in the name of

individual spending capacity for which the company is responsible to pay the amount. Moreover,

the overhead cost related to the company unit is resulting huge amount of transactions, which

must also be controlled affectively for earning good amounts of profit for the company. It will

help the administration department in managing the position of fluidity in the company by giving

a proper concern that cash balance related to a particular month are suffering from losses

(Majumdar and Bose, 2018). The main thing that company must take into consideration for

achieving high growth and productivity in the market is make the sales and cash disbursement.

This will help the company in maintaining their stability in the next months and also helps in

identifying the debt which has been paid by the firm regardless of the purchases and sales. The

unsettled liability of tax must also be satisfied for the previous months, as it will affect the

current balance and cash and balances of upcoming months (Tran, 2020).

income that was earned on credit basis. Business prepares budget analysis report to take better

decisions relating to all the finance that is used in operating the company (Heald and Hodges,

2020). It is necessary for the company to improve its cash related transactions by attracting

clients and providing more markdowns which means providing trade rebate for all the cash

expenditures made during the sales. The company is also earning a huge amount of direct and

operational expenditure which can be controlled and reduced by meeting the exploiting revenue

of the entity. The acquisition can also be performed with less expense by confirming with the

contractor to provide cash rebate and deduction related to trade for making the payment

immediately (Seppänen and Teinilä, 2022). Thus, the net cash balance reflected in the month of

April, May and June is representing the adverse amount which clearly defines that the amount of

expenditures is more than that of cash arrivals. The concluding balance related to the previous

month affects the amounts of the following financial years as it gets delivered as the initial

amount of cash balance. So, it is very important to maintain a proper cash budget of every month

for better flow of cash in the company. The drawings that are affected by the occupational

expenses could be reserved from the expenses of corporate, as these are defined in the name of

individual spending capacity for which the company is responsible to pay the amount. Moreover,

the overhead cost related to the company unit is resulting huge amount of transactions, which

must also be controlled affectively for earning good amounts of profit for the company. It will

help the administration department in managing the position of fluidity in the company by giving

a proper concern that cash balance related to a particular month are suffering from losses

(Majumdar and Bose, 2018). The main thing that company must take into consideration for

achieving high growth and productivity in the market is make the sales and cash disbursement.

This will help the company in maintaining their stability in the next months and also helps in

identifying the debt which has been paid by the firm regardless of the purchases and sales. The

unsettled liability of tax must also be satisfied for the previous months, as it will affect the

current balance and cash and balances of upcoming months (Tran, 2020).

CONCLUSION

The above report explains about the Estimation of cash flows in the Victory Plc and

suggestions by the Board of directors. The following company is planning appropriately to

increase around 100 million Pounds from the market in order to earn stability and profits. The

company also has to select a desirable option from the different options mentioned for availing

credit facility. There are different types of methods and sources that an organization consider at

the time of preparing statement of Cash flow of 5 years. The report also includes Part B which

consists of preparing cash budget for Bemus Ltd. and recommendation has also been given after

analysing the prepared budget.

The above report explains about the Estimation of cash flows in the Victory Plc and

suggestions by the Board of directors. The following company is planning appropriately to

increase around 100 million Pounds from the market in order to earn stability and profits. The

company also has to select a desirable option from the different options mentioned for availing

credit facility. There are different types of methods and sources that an organization consider at

the time of preparing statement of Cash flow of 5 years. The report also includes Part B which

consists of preparing cash budget for Bemus Ltd. and recommendation has also been given after

analysing the prepared budget.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Akatwijuka, M., 2018. Assessing cash management in small and medium enterprises: a case of

small and medium enterprises in Jinja district (Doctoral dissertation, Makerere University).

Barnhill, C. and Rundio, A., 2021. Developing a Cash Budget for the Savannah Squares. Case

Studies in Sport Management, 10(1), pp.42-45.

Hoitash, R. And et.al., 2018. An input-based measure of financial statement

comparability. Available at SSRN 3208928.

Mazzarol, T. and Reboud, S., 2020. Work Book: Cash Flow, Profit and Working Capital.

In Workbook for small business management (pp. 117-125). Springer, Singapore.

Ponco Azi, P., 2018. PERENCANAAN KEUANGAN JANGKA PENDEK DENGAN

MENGGUNAKAN MODEL CASH BUDGET PADA CV. PRATAMA KARYA

YOGYAKARTA TAHUN 2018 (Doctoral dissertation, Universitas Teknologi Yogyakarta).

Ríos, A.M. and et.al., 2018. The influence of transparency on budget forecast deviations in

municipal governments. Journal of Forecasting, 37(4), pp.457-474.

Salehi, M., and et.al., 2020. Auditors’ response to readability of financial statement notes. Asian

Review of Accounting.

Seppänen, H. and Teinilä, T., 2022. Two minds of credit professionals: accrual vs. cash

accounting information. International Journal of Managerial and Financial Accounting, 14(1),

pp.56-83.

Tran, Q.T., 2020. Corporate cash holdings and financial crisis: new evidence from an emerging

market. Eurasian Business Review, 10(2), pp.271-285.

van der Cruijsen, C. and van der Horst, F., 2019. Cash or card? Unravelling the role of socio-

psychological factors. De Economist, 167(2), pp.145-175.

Books and Journals

Akatwijuka, M., 2018. Assessing cash management in small and medium enterprises: a case of

small and medium enterprises in Jinja district (Doctoral dissertation, Makerere University).

Barnhill, C. and Rundio, A., 2021. Developing a Cash Budget for the Savannah Squares. Case

Studies in Sport Management, 10(1), pp.42-45.

Hoitash, R. And et.al., 2018. An input-based measure of financial statement

comparability. Available at SSRN 3208928.

Mazzarol, T. and Reboud, S., 2020. Work Book: Cash Flow, Profit and Working Capital.

In Workbook for small business management (pp. 117-125). Springer, Singapore.

Ponco Azi, P., 2018. PERENCANAAN KEUANGAN JANGKA PENDEK DENGAN

MENGGUNAKAN MODEL CASH BUDGET PADA CV. PRATAMA KARYA

YOGYAKARTA TAHUN 2018 (Doctoral dissertation, Universitas Teknologi Yogyakarta).

Ríos, A.M. and et.al., 2018. The influence of transparency on budget forecast deviations in

municipal governments. Journal of Forecasting, 37(4), pp.457-474.

Salehi, M., and et.al., 2020. Auditors’ response to readability of financial statement notes. Asian

Review of Accounting.

Seppänen, H. and Teinilä, T., 2022. Two minds of credit professionals: accrual vs. cash

accounting information. International Journal of Managerial and Financial Accounting, 14(1),

pp.56-83.

Tran, Q.T., 2020. Corporate cash holdings and financial crisis: new evidence from an emerging

market. Eurasian Business Review, 10(2), pp.271-285.

van der Cruijsen, C. and van der Horst, F., 2019. Cash or card? Unravelling the role of socio-

psychological factors. De Economist, 167(2), pp.145-175.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.