Financial Analysis Report: Evaluating Investment Projects - Finance

VerifiedAdded on 2019/12/03

|22

|5045

|304

Report

AI Summary

This report provides a comprehensive financial analysis of Wm Morrison Supermarkets plc, a major UK food retailer, focusing on financial management techniques. The report is divided into two parts: the first part presents a detailed ratio analysis, including profitability, liquidity, performance, and efficiency ratios, calculated from the company's financial statements from 2011 to 2013. The analysis evaluates the company's financial health and provides recommendations for improvement. The second part assesses the viability of two competing investment projects using Net Present Value (NPV), Internal Rate of Return (IRR), and payback period methods, offering a comparative evaluation of their potential returns and risks. The report concludes with a summary of findings and recommendations, supported by tables and calculations, aiming to provide an in-depth understanding of financial tools and techniques for effective decision-making.

FINANCIAL

MANAGEMENT

April, 2013

MANAGEMENT

April, 2013

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

Company Overview.....................................................................................................................1

1.1 Ratio Calculation...................................................................................................................1

Profitability Ratios...................................................................................................................1

Liquidity Ratio.........................................................................................................................2

Performance Ratio...................................................................................................................3

Efficiency Ratios.....................................................................................................................3

1.2 Evaluation and Recommendations........................................................................................4

1.3 Summarised Report...............................................................................................................7

PART 2............................................................................................................................................8

2.1 Assessing the viability of the competing investment projects...............................................9

2.2: Payback Period Method......................................................................................................12

2.3 Advantages and Disadvantages...........................................................................................13

2.4 Summarised Report.............................................................................................................15

CONCLUSION..............................................................................................................................16

References......................................................................................................................................17

APPENDIX....................................................................................................................................18

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

Company Overview.....................................................................................................................1

1.1 Ratio Calculation...................................................................................................................1

Profitability Ratios...................................................................................................................1

Liquidity Ratio.........................................................................................................................2

Performance Ratio...................................................................................................................3

Efficiency Ratios.....................................................................................................................3

1.2 Evaluation and Recommendations........................................................................................4

1.3 Summarised Report...............................................................................................................7

PART 2............................................................................................................................................8

2.1 Assessing the viability of the competing investment projects...............................................9

2.2: Payback Period Method......................................................................................................12

2.3 Advantages and Disadvantages...........................................................................................13

2.4 Summarised Report.............................................................................................................15

CONCLUSION..............................................................................................................................16

References......................................................................................................................................17

APPENDIX....................................................................................................................................18

List of Tables

Table 1 Ratio Calculation................................................................................................................4

Table 2 Summarised Report of Ratio Analysis...............................................................................7

Table 3 Calculation of NPV for Project 1.......................................................................................9

Table 4 Calculation of NPV for Project 2.......................................................................................9

Table 5 Calculation of IRR for Project 1.......................................................................................10

Table 6 Calculation of IRR for Project 2.......................................................................................11

Table 7 Calculation of Payback Period for Project 1....................................................................12

Table 8 Calculation of Payback Period for Project 2....................................................................13

Table 9 Summarised Report..........................................................................................................15

Table 1 Ratio Calculation................................................................................................................4

Table 2 Summarised Report of Ratio Analysis...............................................................................7

Table 3 Calculation of NPV for Project 1.......................................................................................9

Table 4 Calculation of NPV for Project 2.......................................................................................9

Table 5 Calculation of IRR for Project 1.......................................................................................10

Table 6 Calculation of IRR for Project 2.......................................................................................11

Table 7 Calculation of Payback Period for Project 1....................................................................12

Table 8 Calculation of Payback Period for Project 2....................................................................13

Table 9 Summarised Report..........................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

In the present business environment, the key role is played by financial manager in

business performance. The financial manager has to plan, organize, direct and control the

financial activities of the organization. Finance is one of the most important resources for any

organization and in order to have effective business performance a manager needs to take

optimum utilization of its financial resources. The role of financial manager is to apply the

general management principles to financial resources of the organization.

The aim of the study is to provide an in-depth understanding of financial tools and

techniques that help a manager in making effective decisions. This report will be divided into

two major parts, first part includes the financial analysis of an organization and another part

includes the evaluation of two strategic investment projects.

PART 1

Company Overview

Wm Morrison Supermarkets plc (registered on LSE i.e. London Stock Exchange) is the

fourth largest food retailer in UK with its more than 400 stores. It was founded in 1899 and

presently branded as Morrisons. As on January, 2013 Company’s total revenue was £18,116m

(LSE, 2013).

1.1 Ratio Calculation: Most of the organizations publish their annual reports including their

financial statements for the year. Ratio analysis is the tool that is used for quantitative analysis of

those financial statements. The monetary growth of the organization can be identified by

calculating the ratios and comparing them with previous year ratios. Ratios can also be used for

comparing the business performance with any other organization or industry. On the basis of

financial statements, several ratios can be calculated that indicates the performance, financing,

activities and liquidity of the company (Arnold, 2005). Some common ratios for Wm Morrison

Supermarkets plc are being calculated below:

Profitability Ratios: It is a class of financial metrics that indicates the ability of company to

generate earnings as compared to its expenses and other relevant costs. Some key profitability

ratios are gross profit margin, net profit margin and return on equity (Collier, 2012).

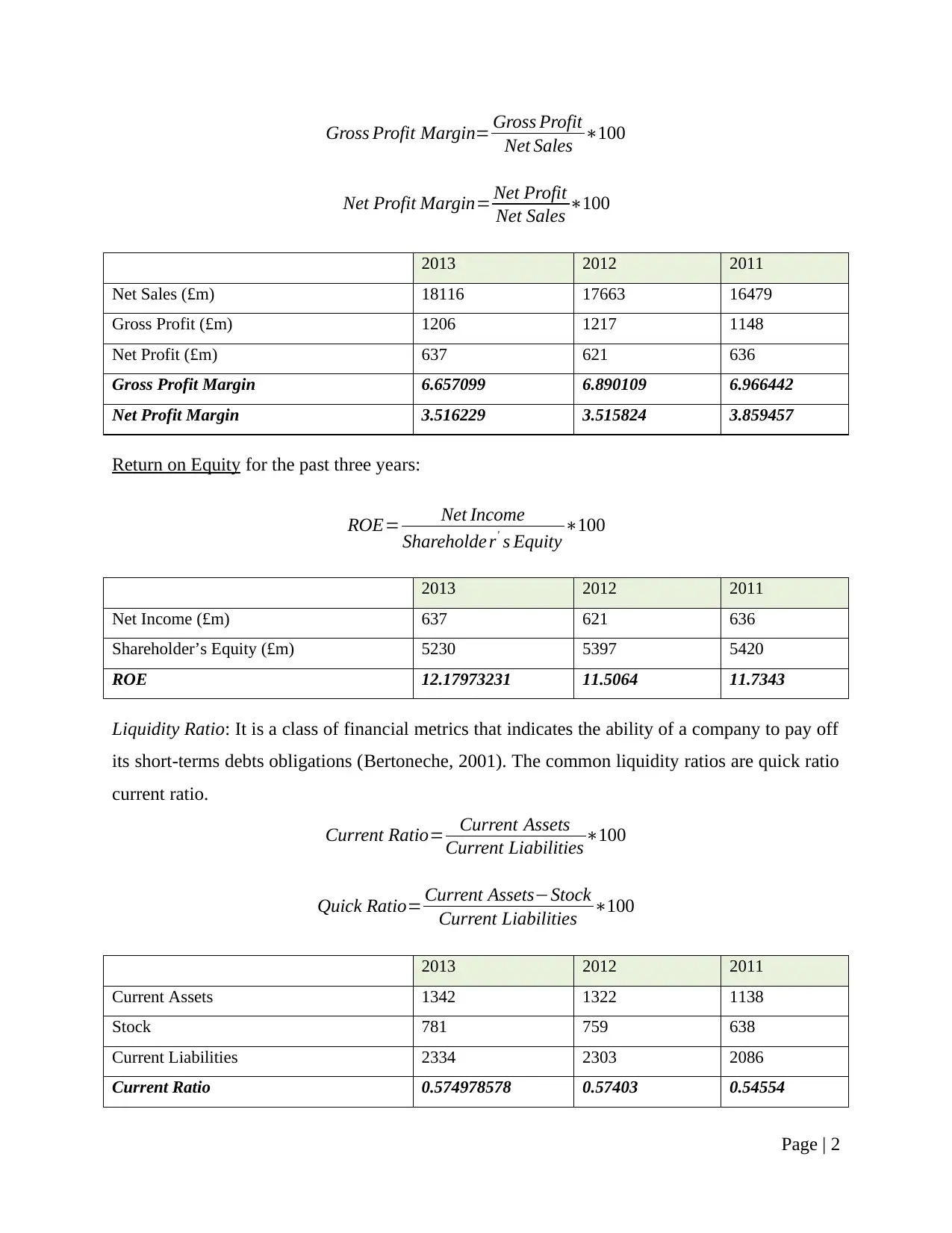

Gross profit margin and Net Profit Margin for the past three years:

Page | 1

In the present business environment, the key role is played by financial manager in

business performance. The financial manager has to plan, organize, direct and control the

financial activities of the organization. Finance is one of the most important resources for any

organization and in order to have effective business performance a manager needs to take

optimum utilization of its financial resources. The role of financial manager is to apply the

general management principles to financial resources of the organization.

The aim of the study is to provide an in-depth understanding of financial tools and

techniques that help a manager in making effective decisions. This report will be divided into

two major parts, first part includes the financial analysis of an organization and another part

includes the evaluation of two strategic investment projects.

PART 1

Company Overview

Wm Morrison Supermarkets plc (registered on LSE i.e. London Stock Exchange) is the

fourth largest food retailer in UK with its more than 400 stores. It was founded in 1899 and

presently branded as Morrisons. As on January, 2013 Company’s total revenue was £18,116m

(LSE, 2013).

1.1 Ratio Calculation: Most of the organizations publish their annual reports including their

financial statements for the year. Ratio analysis is the tool that is used for quantitative analysis of

those financial statements. The monetary growth of the organization can be identified by

calculating the ratios and comparing them with previous year ratios. Ratios can also be used for

comparing the business performance with any other organization or industry. On the basis of

financial statements, several ratios can be calculated that indicates the performance, financing,

activities and liquidity of the company (Arnold, 2005). Some common ratios for Wm Morrison

Supermarkets plc are being calculated below:

Profitability Ratios: It is a class of financial metrics that indicates the ability of company to

generate earnings as compared to its expenses and other relevant costs. Some key profitability

ratios are gross profit margin, net profit margin and return on equity (Collier, 2012).

Gross profit margin and Net Profit Margin for the past three years:

Page | 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Gross Profit Margin= Gross Profit

Net Sales ∗100

Net Profit Margin= Net Profit

Net Sales ∗100

2013 2012 2011

Net Sales (£m) 18116 17663 16479

Gross Profit (£m) 1206 1217 1148

Net Profit (£m) 637 621 636

Gross Profit Margin 6.657099 6.890109 6.966442

Net Profit Margin 3.516229 3.515824 3.859457

Return on Equity for the past three years:

ROE= Net Income

Shareholde r' s Equity ∗100

2013 2012 2011

Net Income (£m) 637 621 636

Shareholder’s Equity (£m) 5230 5397 5420

ROE 12.17973231 11.5064 11.7343

Liquidity Ratio: It is a class of financial metrics that indicates the ability of a company to pay off

its short-terms debts obligations (Bertoneche, 2001). The common liquidity ratios are quick ratio

current ratio.

Current Ratio= Current Assets

Current Liabilities∗100

Quick Ratio= Current Assets−Stock

Current Liabilities ∗100

2013 2012 2011

Current Assets 1342 1322 1138

Stock 781 759 638

Current Liabilities 2334 2303 2086

Current Ratio 0.574978578 0.57403 0.54554

Page | 2

Net Sales ∗100

Net Profit Margin= Net Profit

Net Sales ∗100

2013 2012 2011

Net Sales (£m) 18116 17663 16479

Gross Profit (£m) 1206 1217 1148

Net Profit (£m) 637 621 636

Gross Profit Margin 6.657099 6.890109 6.966442

Net Profit Margin 3.516229 3.515824 3.859457

Return on Equity for the past three years:

ROE= Net Income

Shareholde r' s Equity ∗100

2013 2012 2011

Net Income (£m) 637 621 636

Shareholder’s Equity (£m) 5230 5397 5420

ROE 12.17973231 11.5064 11.7343

Liquidity Ratio: It is a class of financial metrics that indicates the ability of a company to pay off

its short-terms debts obligations (Bertoneche, 2001). The common liquidity ratios are quick ratio

current ratio.

Current Ratio= Current Assets

Current Liabilities∗100

Quick Ratio= Current Assets−Stock

Current Liabilities ∗100

2013 2012 2011

Current Assets 1342 1322 1138

Stock 781 759 638

Current Liabilities 2334 2303 2086

Current Ratio 0.574978578 0.57403 0.54554

Page | 2

Quick Ratio 0.240359897 0.24446 0.23969

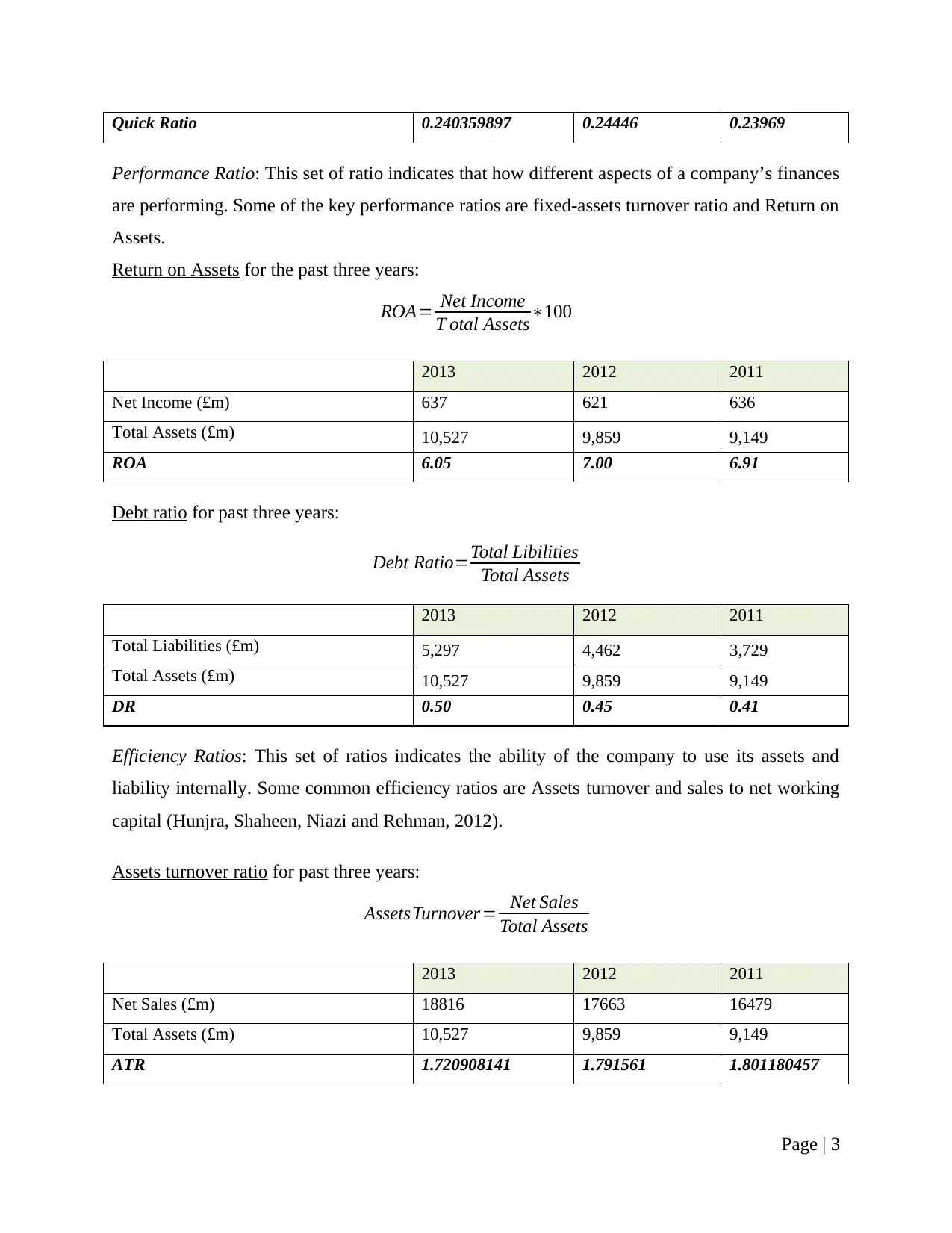

Performance Ratio: This set of ratio indicates that how different aspects of a company’s finances

are performing. Some of the key performance ratios are fixed-assets turnover ratio and Return on

Assets.

Return on Assets for the past three years:

ROA= Net Income

T otal Assets∗100

2013 2012 2011

Net Income (£m) 637 621 636

Total Assets (£m) 10,527 9,859 9,149

ROA 6.05 7.00 6.91

Debt ratio for past three years:

Debt Ratio=Total Libilities

Total Assets

2013 2012 2011

Total Liabilities (£m) 5,297 4,462 3,729

Total Assets (£m) 10,527 9,859 9,149

DR 0.50 0.45 0.41

Efficiency Ratios: This set of ratios indicates the ability of the company to use its assets and

liability internally. Some common efficiency ratios are Assets turnover and sales to net working

capital (Hunjra, Shaheen, Niazi and Rehman, 2012).

Assets turnover ratio for past three years:

AssetsTurnover= Net Sales

Total Assets

2013 2012 2011

Net Sales (£m) 18816 17663 16479

Total Assets (£m) 10,527 9,859 9,149

ATR 1.720908141 1.791561 1.801180457

Page | 3

Performance Ratio: This set of ratio indicates that how different aspects of a company’s finances

are performing. Some of the key performance ratios are fixed-assets turnover ratio and Return on

Assets.

Return on Assets for the past three years:

ROA= Net Income

T otal Assets∗100

2013 2012 2011

Net Income (£m) 637 621 636

Total Assets (£m) 10,527 9,859 9,149

ROA 6.05 7.00 6.91

Debt ratio for past three years:

Debt Ratio=Total Libilities

Total Assets

2013 2012 2011

Total Liabilities (£m) 5,297 4,462 3,729

Total Assets (£m) 10,527 9,859 9,149

DR 0.50 0.45 0.41

Efficiency Ratios: This set of ratios indicates the ability of the company to use its assets and

liability internally. Some common efficiency ratios are Assets turnover and sales to net working

capital (Hunjra, Shaheen, Niazi and Rehman, 2012).

Assets turnover ratio for past three years:

AssetsTurnover= Net Sales

Total Assets

2013 2012 2011

Net Sales (£m) 18816 17663 16479

Total Assets (£m) 10,527 9,859 9,149

ATR 1.720908141 1.791561 1.801180457

Page | 3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Working capital turnover ratio for Past three years:

Working capital turnove ratio= Sales

Working Capital

2013 2012 2011

Sales Revenue (£m) 18816 17663 16479

Working capital -992 -971 -948

Working capital turnover -18.2621 -18.0051 -17.3829

Table 1 Ratio Calculation

Ratios

2013 2012 2011

Profitability Gross Profit Margin 6.66 6.89 6.97

Net Profit Margin 3.52 3.52 3.86

Return on Equity

12.18 11.51 11.73

Liquidity Current Ratio 0.57 0.57 0.55

Quick Ratio 0.24 0.24 0.24

Performanc

e

Return on Assets

6.05 7.00 6.91

Debt Ratio 0.50 0.45 0.41

Efficiency Assets Turnover 1.72 1.79 1.80

Working capital

turnover

-18.26 -

18.00

-17.38

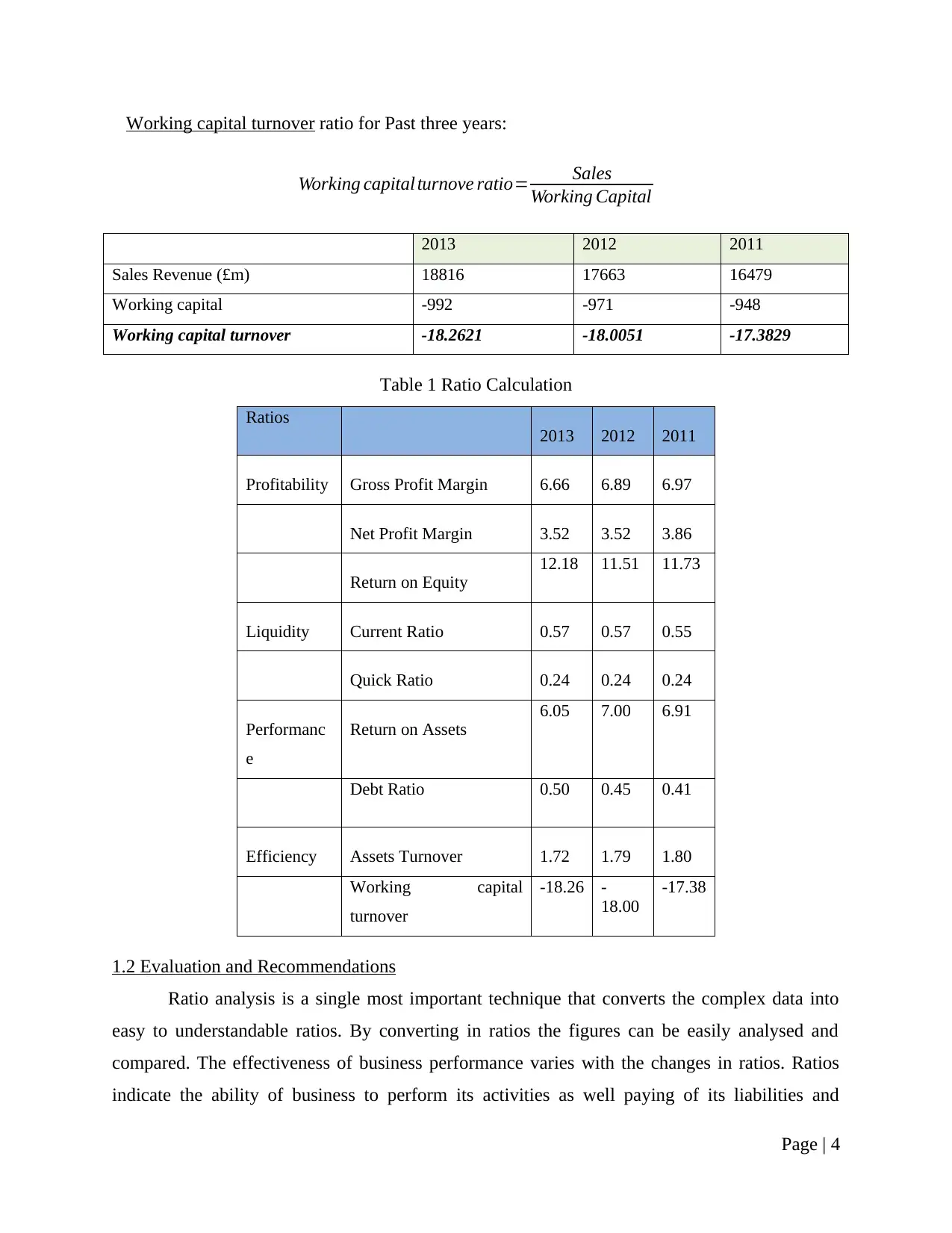

1.2 Evaluation and Recommendations

Ratio analysis is a single most important technique that converts the complex data into

easy to understandable ratios. By converting in ratios the figures can be easily analysed and

compared. The effectiveness of business performance varies with the changes in ratios. Ratios

indicate the ability of business to perform its activities as well paying of its liabilities and

Page | 4

Working capital turnove ratio= Sales

Working Capital

2013 2012 2011

Sales Revenue (£m) 18816 17663 16479

Working capital -992 -971 -948

Working capital turnover -18.2621 -18.0051 -17.3829

Table 1 Ratio Calculation

Ratios

2013 2012 2011

Profitability Gross Profit Margin 6.66 6.89 6.97

Net Profit Margin 3.52 3.52 3.86

Return on Equity

12.18 11.51 11.73

Liquidity Current Ratio 0.57 0.57 0.55

Quick Ratio 0.24 0.24 0.24

Performanc

e

Return on Assets

6.05 7.00 6.91

Debt Ratio 0.50 0.45 0.41

Efficiency Assets Turnover 1.72 1.79 1.80

Working capital

turnover

-18.26 -

18.00

-17.38

1.2 Evaluation and Recommendations

Ratio analysis is a single most important technique that converts the complex data into

easy to understandable ratios. By converting in ratios the figures can be easily analysed and

compared. The effectiveness of business performance varies with the changes in ratios. Ratios

indicate the ability of business to perform its activities as well paying of its liabilities and

Page | 4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

utilizing its resources (Mao, 2012). The above ratios of Morrisons indicate its financial stability,

most of its ratios are indicating a positive sign but few of them indicating negative mark too.

Profitability Ratio: Most of the organization concerned with their profitability. Profitability ratios

are one of the most frequently used tools of ratio analysis. The above calculated profit margins

indicate the ability of firm to generate profit for its investors. These ratios identify the overall

performance and efficiency of the company. The gross profit margin and net profit margin

provides the firm's aptitude to convert sales into profits at various stages of dimension. Higher

the ratios better the performance (Neale and McElroy, 2004).

Gross Profit Margin: This ratio is calculated by looking at cost of goods sold as a

percentage of sales. The GP ratios of Morrisons for past three year are, 6.66 for 2013,

6.89 for 2012 and 6.97 for 6.97. This figure indicates a fall in company’s gross profit that

is not a good sign for it. The larger the gross profit margin, the better for the firm.

Company should focus on increasing its gross profit. IT is not an exact estimate of the

company's pricing strategy but it provides a good indication of financial health. Company

should maintain an adequate gross profit margin without it the company will not be able

to pay its operating and other expenses. The stability in its GP margin is a positive

indication for the company.

Net Profit Margin: It indicates the percentage of profit after paying all expenses. It is one

of the most often ratio that is used for calculating the net income after deducting all

expenses. It indicates how much profit the company made for every £1 it generates in

sales. A higher ratio indicates the greater performance. Morrisons’s net profit margin for

2013 is 3.52, for 2012, 3.52 and for 2011 is 3.86. As like its gross profit company’s net

profit is also decreasing. Company should focus on increasing its overall revenue and

decrease its administrative expenses.

Return on Equity: ROE measures the profit generated by company in relation to its

shareholders investments. Morrisons’s ROE for past three years are: for 2013 – 12-18, for

2012 – 11.51 and for 2011 – 11.73. Increasing figure of ROE for 2013 is a improved sign

for the company.

Liquidity Ratios: Liquidity ratios indicate the ability of company to pay off its immediate debts.

In order to fulfil its financial requirements a company takes the help of debts. But every time the

Page | 5

most of its ratios are indicating a positive sign but few of them indicating negative mark too.

Profitability Ratio: Most of the organization concerned with their profitability. Profitability ratios

are one of the most frequently used tools of ratio analysis. The above calculated profit margins

indicate the ability of firm to generate profit for its investors. These ratios identify the overall

performance and efficiency of the company. The gross profit margin and net profit margin

provides the firm's aptitude to convert sales into profits at various stages of dimension. Higher

the ratios better the performance (Neale and McElroy, 2004).

Gross Profit Margin: This ratio is calculated by looking at cost of goods sold as a

percentage of sales. The GP ratios of Morrisons for past three year are, 6.66 for 2013,

6.89 for 2012 and 6.97 for 6.97. This figure indicates a fall in company’s gross profit that

is not a good sign for it. The larger the gross profit margin, the better for the firm.

Company should focus on increasing its gross profit. IT is not an exact estimate of the

company's pricing strategy but it provides a good indication of financial health. Company

should maintain an adequate gross profit margin without it the company will not be able

to pay its operating and other expenses. The stability in its GP margin is a positive

indication for the company.

Net Profit Margin: It indicates the percentage of profit after paying all expenses. It is one

of the most often ratio that is used for calculating the net income after deducting all

expenses. It indicates how much profit the company made for every £1 it generates in

sales. A higher ratio indicates the greater performance. Morrisons’s net profit margin for

2013 is 3.52, for 2012, 3.52 and for 2011 is 3.86. As like its gross profit company’s net

profit is also decreasing. Company should focus on increasing its overall revenue and

decrease its administrative expenses.

Return on Equity: ROE measures the profit generated by company in relation to its

shareholders investments. Morrisons’s ROE for past three years are: for 2013 – 12-18, for

2012 – 11.51 and for 2011 – 11.73. Increasing figure of ROE for 2013 is a improved sign

for the company.

Liquidity Ratios: Liquidity ratios indicate the ability of company to pay off its immediate debts.

In order to fulfil its financial requirements a company takes the help of debts. But every time the

Page | 5

company should have enough liquid assets to pay off its immediate debts (Sangster, 2006). It

includes all the current liabilities that need to be paid within one year.

Current Ratio: current ratio indicates the capability of company to pay off its current

liabilities from current assets. Current assets can produce fast cash to the company that

can be paid for the current liabilities. A ratio of 1:1 is the ideal position of current ratio,

where company can pay off all its current liabilities with its current assets. Morrisons

current ratio for 2013 is 0.57, for 2012, 0.57 and for 2011 is 0.55. This ratio indicates the

negative liquid position of the company. The current ratio of Morrisons indicates that

company does not have enough liquid assets to pay off its immediate liabilities. So

company should increase its current assets or on the other hand it can focus on decreasing

the current liabilities.

Quick Ratio: it is also called acid test ratio. This ratio also indicates the liquid financial

position of the company but it does not include stock in its immediate assets. While

calculating the current ratio stock is also countered as a liquid asset but stock requires the

long time for converting into cash (Leigh, 2008). So while calculating the quick ratio

stock is not treated as a liquid asset. Morrisos has quick ratio of 0.24 for past three years.

There is no change in company’s quick ratio in past three years. But the difference in

current and quick ratio indicates that the stock is a big part of company’s overall

liquidity. In order to improve its liquid position company should decrease the current

liabilities. Company can reduce its creditors for this purpose.

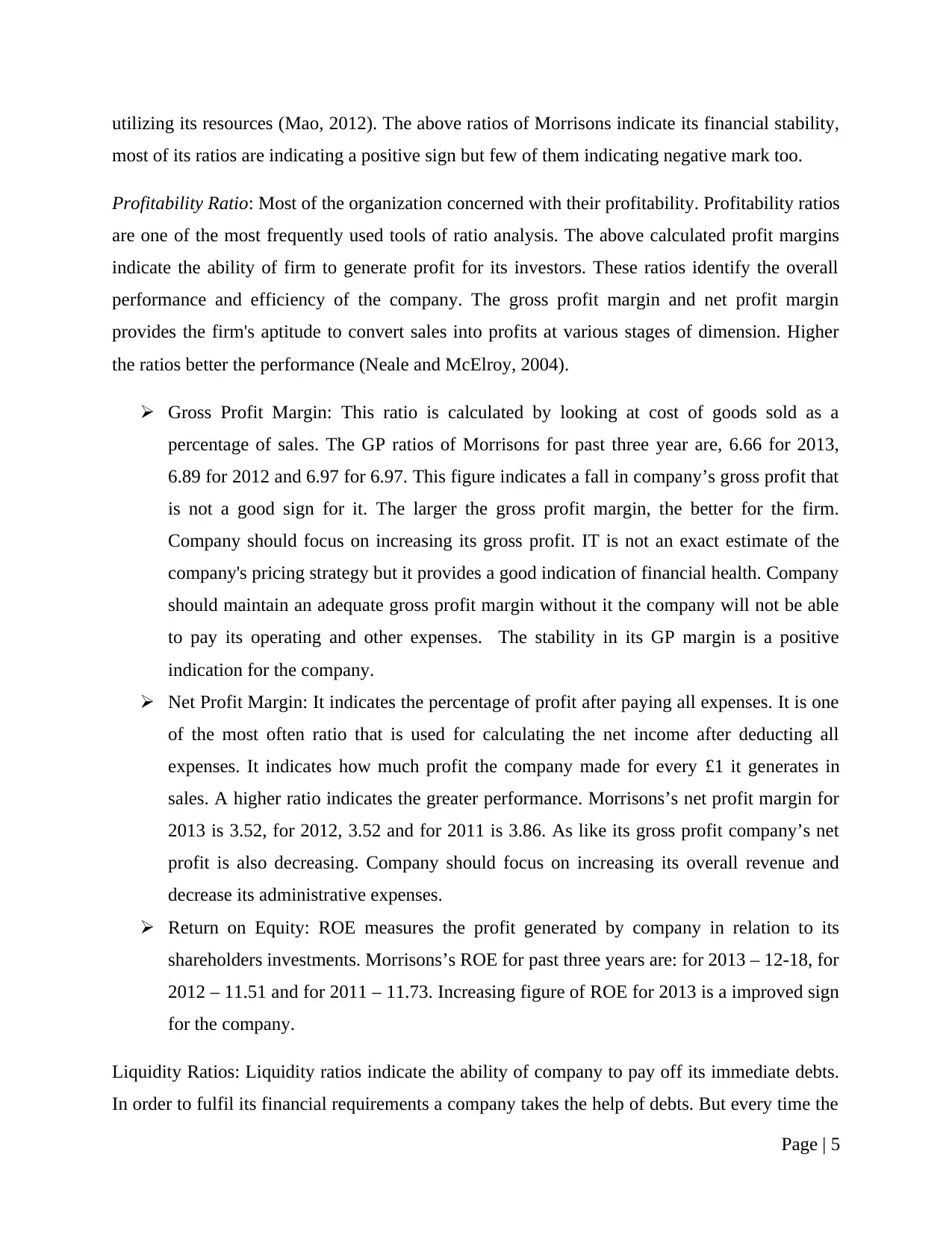

Performance Ratios: This set of financial ratios indicts the performance of the company in

different aspects of finance. Such as, it’s return on assets and fixed assets turnover. Both these

ratios indicate the efficiency of firm to generate revenue through its assets (Atrill, 2009).

Return on Assets: this ratio identifies the profitability of the company relative to its total

assets. Morrisons has the ROA of 6.05 for 2013, 7.00 for 2012 and 6.91 for 2011. The

higher figure of ROA indicates the better performance of company. The performance of

Morrisons was much better in 2012 compared to 2013 and 11. Company should use its

assets more effectively for improved ROA figure. Company is not making enough money

compared to investment so management should make wise choices in allocating its

resources.

Page | 6

includes all the current liabilities that need to be paid within one year.

Current Ratio: current ratio indicates the capability of company to pay off its current

liabilities from current assets. Current assets can produce fast cash to the company that

can be paid for the current liabilities. A ratio of 1:1 is the ideal position of current ratio,

where company can pay off all its current liabilities with its current assets. Morrisons

current ratio for 2013 is 0.57, for 2012, 0.57 and for 2011 is 0.55. This ratio indicates the

negative liquid position of the company. The current ratio of Morrisons indicates that

company does not have enough liquid assets to pay off its immediate liabilities. So

company should increase its current assets or on the other hand it can focus on decreasing

the current liabilities.

Quick Ratio: it is also called acid test ratio. This ratio also indicates the liquid financial

position of the company but it does not include stock in its immediate assets. While

calculating the current ratio stock is also countered as a liquid asset but stock requires the

long time for converting into cash (Leigh, 2008). So while calculating the quick ratio

stock is not treated as a liquid asset. Morrisos has quick ratio of 0.24 for past three years.

There is no change in company’s quick ratio in past three years. But the difference in

current and quick ratio indicates that the stock is a big part of company’s overall

liquidity. In order to improve its liquid position company should decrease the current

liabilities. Company can reduce its creditors for this purpose.

Performance Ratios: This set of financial ratios indicts the performance of the company in

different aspects of finance. Such as, it’s return on assets and fixed assets turnover. Both these

ratios indicate the efficiency of firm to generate revenue through its assets (Atrill, 2009).

Return on Assets: this ratio identifies the profitability of the company relative to its total

assets. Morrisons has the ROA of 6.05 for 2013, 7.00 for 2012 and 6.91 for 2011. The

higher figure of ROA indicates the better performance of company. The performance of

Morrisons was much better in 2012 compared to 2013 and 11. Company should use its

assets more effectively for improved ROA figure. Company is not making enough money

compared to investment so management should make wise choices in allocating its

resources.

Page | 6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

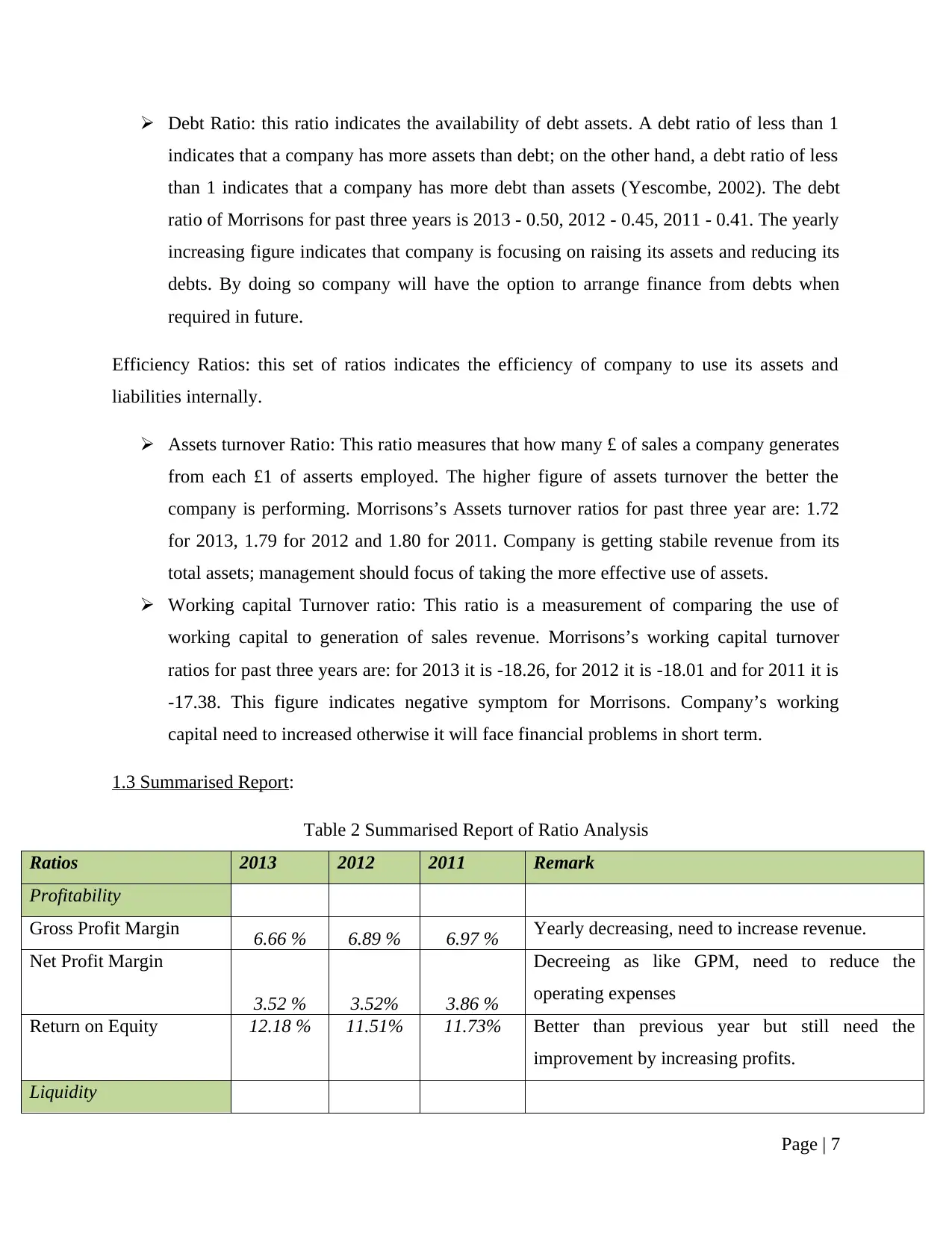

Debt Ratio: this ratio indicates the availability of debt assets. A debt ratio of less than 1

indicates that a company has more assets than debt; on the other hand, a debt ratio of less

than 1 indicates that a company has more debt than assets (Yescombe, 2002). The debt

ratio of Morrisons for past three years is 2013 - 0.50, 2012 - 0.45, 2011 - 0.41. The yearly

increasing figure indicates that company is focusing on raising its assets and reducing its

debts. By doing so company will have the option to arrange finance from debts when

required in future.

Efficiency Ratios: this set of ratios indicates the efficiency of company to use its assets and

liabilities internally.

Assets turnover Ratio: This ratio measures that how many £ of sales a company generates

from each £1 of asserts employed. The higher figure of assets turnover the better the

company is performing. Morrisons’s Assets turnover ratios for past three year are: 1.72

for 2013, 1.79 for 2012 and 1.80 for 2011. Company is getting stabile revenue from its

total assets; management should focus of taking the more effective use of assets.

Working capital Turnover ratio: This ratio is a measurement of comparing the use of

working capital to generation of sales revenue. Morrisons’s working capital turnover

ratios for past three years are: for 2013 it is -18.26, for 2012 it is -18.01 and for 2011 it is

-17.38. This figure indicates negative symptom for Morrisons. Company’s working

capital need to increased otherwise it will face financial problems in short term.

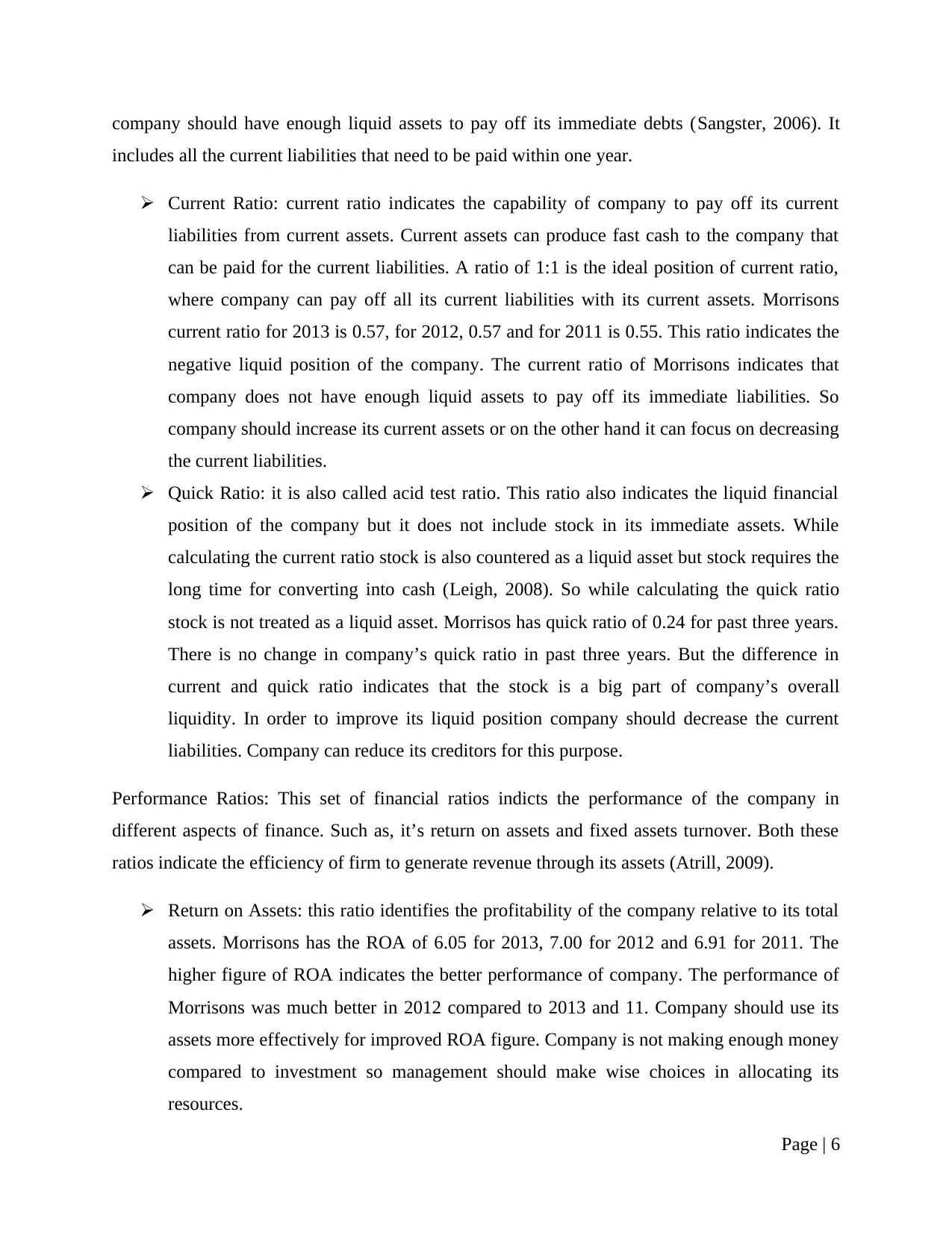

1.3 Summarised Report:

Table 2 Summarised Report of Ratio Analysis

Ratios 2013 2012 2011 Remark

Profitability

Gross Profit Margin 6.66 % 6.89 % 6.97 % Yearly decreasing, need to increase revenue.

Net Profit Margin

3.52 % 3.52% 3.86 %

Decreeing as like GPM, need to reduce the

operating expenses

Return on Equity 12.18 % 11.51% 11.73% Better than previous year but still need the

improvement by increasing profits.

Liquidity

Page | 7

indicates that a company has more assets than debt; on the other hand, a debt ratio of less

than 1 indicates that a company has more debt than assets (Yescombe, 2002). The debt

ratio of Morrisons for past three years is 2013 - 0.50, 2012 - 0.45, 2011 - 0.41. The yearly

increasing figure indicates that company is focusing on raising its assets and reducing its

debts. By doing so company will have the option to arrange finance from debts when

required in future.

Efficiency Ratios: this set of ratios indicates the efficiency of company to use its assets and

liabilities internally.

Assets turnover Ratio: This ratio measures that how many £ of sales a company generates

from each £1 of asserts employed. The higher figure of assets turnover the better the

company is performing. Morrisons’s Assets turnover ratios for past three year are: 1.72

for 2013, 1.79 for 2012 and 1.80 for 2011. Company is getting stabile revenue from its

total assets; management should focus of taking the more effective use of assets.

Working capital Turnover ratio: This ratio is a measurement of comparing the use of

working capital to generation of sales revenue. Morrisons’s working capital turnover

ratios for past three years are: for 2013 it is -18.26, for 2012 it is -18.01 and for 2011 it is

-17.38. This figure indicates negative symptom for Morrisons. Company’s working

capital need to increased otherwise it will face financial problems in short term.

1.3 Summarised Report:

Table 2 Summarised Report of Ratio Analysis

Ratios 2013 2012 2011 Remark

Profitability

Gross Profit Margin 6.66 % 6.89 % 6.97 % Yearly decreasing, need to increase revenue.

Net Profit Margin

3.52 % 3.52% 3.86 %

Decreeing as like GPM, need to reduce the

operating expenses

Return on Equity 12.18 % 11.51% 11.73% Better than previous year but still need the

improvement by increasing profits.

Liquidity

Page | 7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Current Ratio

0.57 % 0.57 % 0.55 %

Company need to increase its current assets or

decrease current liabilities

Quick Ratio

0.24 % 0.24 % 0.24 %

Stock holding a big part of total liquid assets,

company need to reduce its creditors.

Performance

Return on Assets 6.05 % 7 % 6.91 % Company need to take effective use of resources.

Debt Ratio 0.5 0.45 0.41 Debt is less so required fund can be arranged from

debts.

Efficiency

Assets Turnover

1.72 1.79 1.8

Debasing, company need to take moiré effective

use of its resources.

Working capital turnover -18.26 -18 -17.38 High risk of facing financial troubles in short term.

Current assets need to be increased

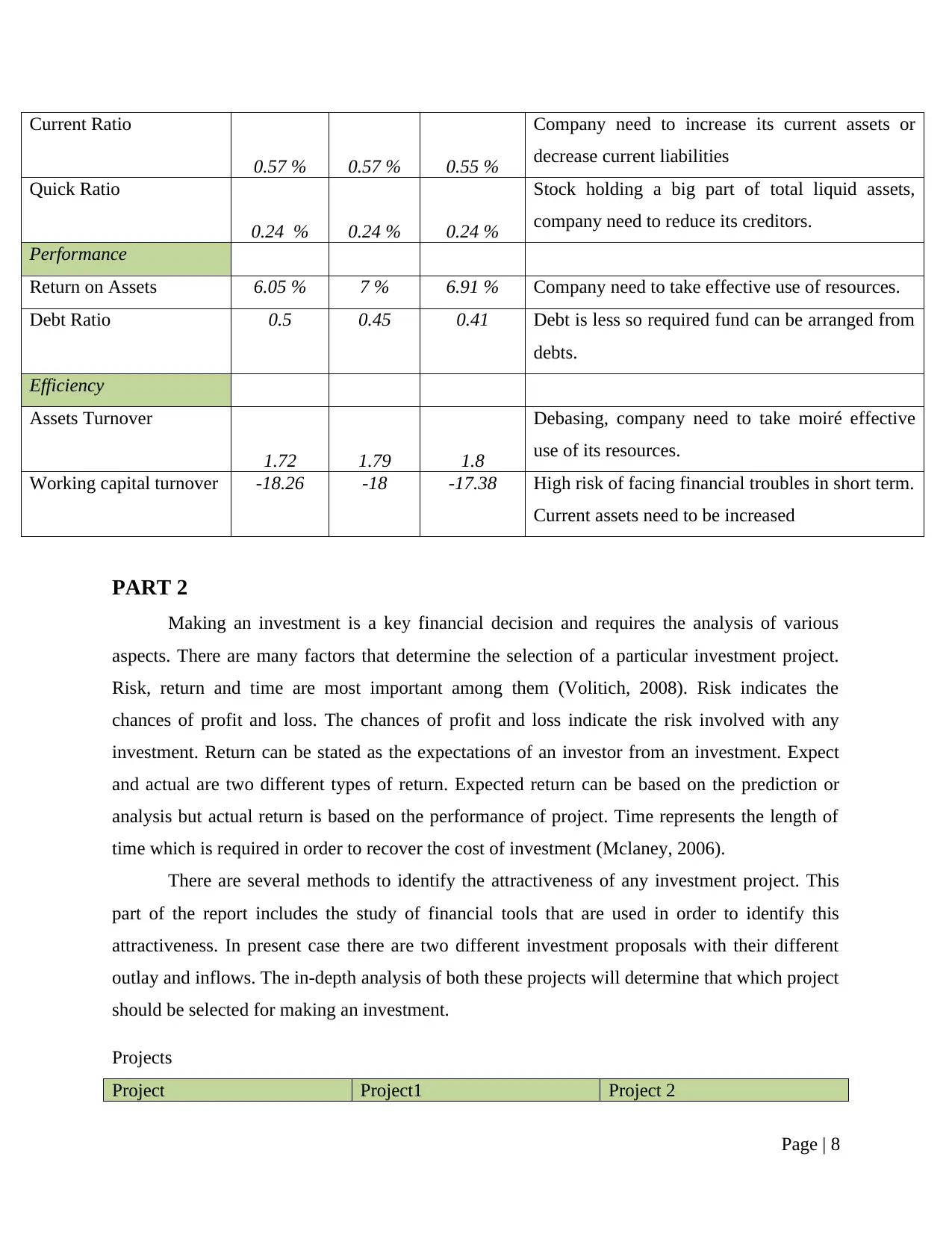

PART 2

Making an investment is a key financial decision and requires the analysis of various

aspects. There are many factors that determine the selection of a particular investment project.

Risk, return and time are most important among them (Volitich, 2008). Risk indicates the

chances of profit and loss. The chances of profit and loss indicate the risk involved with any

investment. Return can be stated as the expectations of an investor from an investment. Expect

and actual are two different types of return. Expected return can be based on the prediction or

analysis but actual return is based on the performance of project. Time represents the length of

time which is required in order to recover the cost of investment (Mclaney, 2006).

There are several methods to identify the attractiveness of any investment project. This

part of the report includes the study of financial tools that are used in order to identify this

attractiveness. In present case there are two different investment proposals with their different

outlay and inflows. The in-depth analysis of both these projects will determine that which project

should be selected for making an investment.

Projects

Project Project1 Project 2

Page | 8

0.57 % 0.57 % 0.55 %

Company need to increase its current assets or

decrease current liabilities

Quick Ratio

0.24 % 0.24 % 0.24 %

Stock holding a big part of total liquid assets,

company need to reduce its creditors.

Performance

Return on Assets 6.05 % 7 % 6.91 % Company need to take effective use of resources.

Debt Ratio 0.5 0.45 0.41 Debt is less so required fund can be arranged from

debts.

Efficiency

Assets Turnover

1.72 1.79 1.8

Debasing, company need to take moiré effective

use of its resources.

Working capital turnover -18.26 -18 -17.38 High risk of facing financial troubles in short term.

Current assets need to be increased

PART 2

Making an investment is a key financial decision and requires the analysis of various

aspects. There are many factors that determine the selection of a particular investment project.

Risk, return and time are most important among them (Volitich, 2008). Risk indicates the

chances of profit and loss. The chances of profit and loss indicate the risk involved with any

investment. Return can be stated as the expectations of an investor from an investment. Expect

and actual are two different types of return. Expected return can be based on the prediction or

analysis but actual return is based on the performance of project. Time represents the length of

time which is required in order to recover the cost of investment (Mclaney, 2006).

There are several methods to identify the attractiveness of any investment project. This

part of the report includes the study of financial tools that are used in order to identify this

attractiveness. In present case there are two different investment proposals with their different

outlay and inflows. The in-depth analysis of both these projects will determine that which project

should be selected for making an investment.

Projects

Project Project1 Project 2

Page | 8

£000 £000

Initial outlay (1,100) (800)

Inflow/Profit (Loss)

1st Year (110) (20)

2nd Year 200 140

3rd Year 400 250

4th Year 500 300

5th Year 520 380

Residual Value 150 80

Rate on Return on investments: 10%

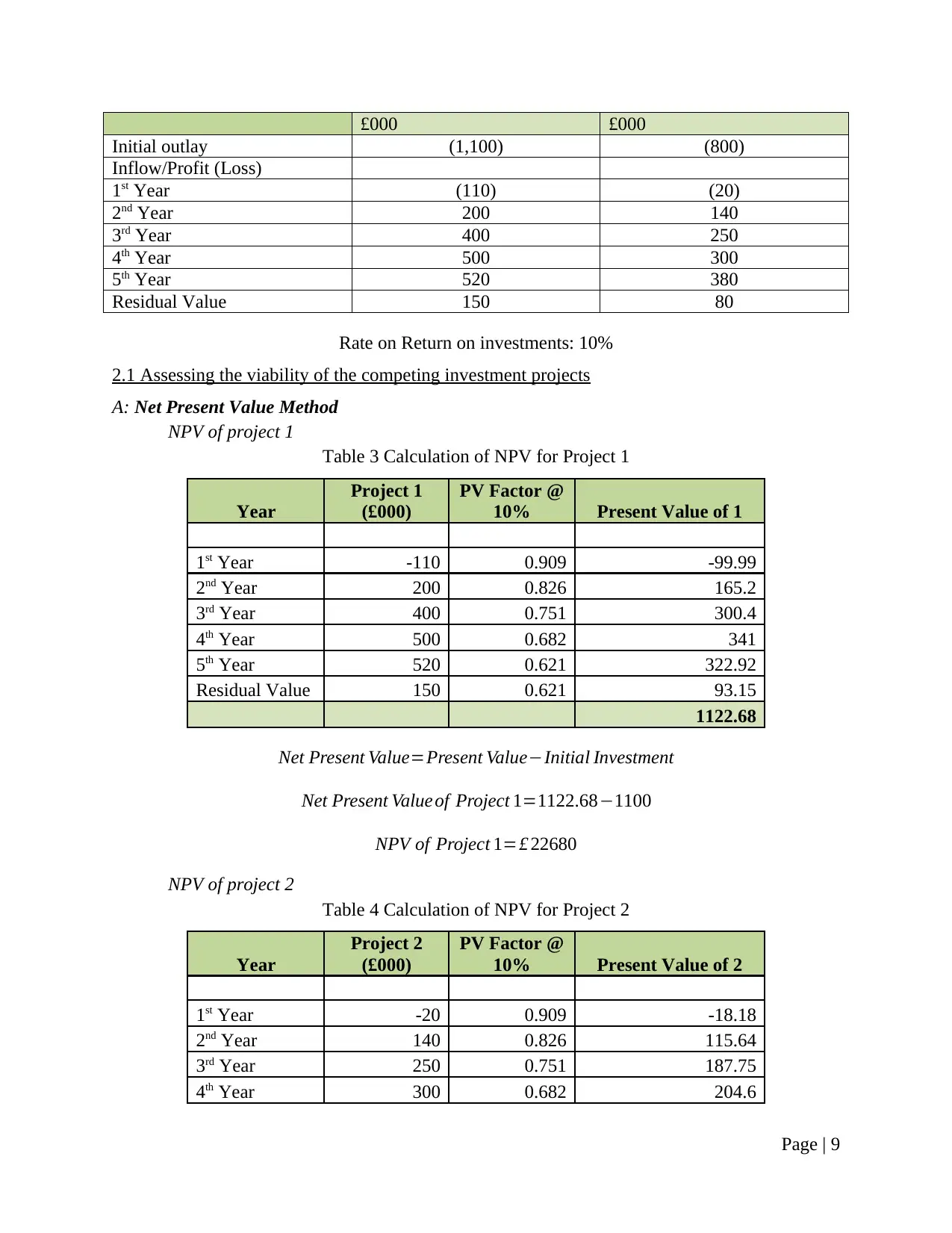

2.1 Assessing the viability of the competing investment projects

A: Net Present Value Method

NPV of project 1

Table 3 Calculation of NPV for Project 1

Year

Project 1

(£000)

PV Factor @

10% Present Value of 1

1st Year -110 0.909 -99.99

2nd Year 200 0.826 165.2

3rd Year 400 0.751 300.4

4th Year 500 0.682 341

5th Year 520 0.621 322.92

Residual Value 150 0.621 93.15

1122.68

Net Present Value=Present Value−Initial Investment

Net Present Valueof Project 1=1122.68−1100

NPV of Project 1=£ 22680

NPV of project 2

Table 4 Calculation of NPV for Project 2

Year

Project 2

(£000)

PV Factor @

10% Present Value of 2

1st Year -20 0.909 -18.18

2nd Year 140 0.826 115.64

3rd Year 250 0.751 187.75

4th Year 300 0.682 204.6

Page | 9

Initial outlay (1,100) (800)

Inflow/Profit (Loss)

1st Year (110) (20)

2nd Year 200 140

3rd Year 400 250

4th Year 500 300

5th Year 520 380

Residual Value 150 80

Rate on Return on investments: 10%

2.1 Assessing the viability of the competing investment projects

A: Net Present Value Method

NPV of project 1

Table 3 Calculation of NPV for Project 1

Year

Project 1

(£000)

PV Factor @

10% Present Value of 1

1st Year -110 0.909 -99.99

2nd Year 200 0.826 165.2

3rd Year 400 0.751 300.4

4th Year 500 0.682 341

5th Year 520 0.621 322.92

Residual Value 150 0.621 93.15

1122.68

Net Present Value=Present Value−Initial Investment

Net Present Valueof Project 1=1122.68−1100

NPV of Project 1=£ 22680

NPV of project 2

Table 4 Calculation of NPV for Project 2

Year

Project 2

(£000)

PV Factor @

10% Present Value of 2

1st Year -20 0.909 -18.18

2nd Year 140 0.826 115.64

3rd Year 250 0.751 187.75

4th Year 300 0.682 204.6

Page | 9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.