Financial Accounting: Woolworths Ltd

VerifiedAdded on 2019/10/30

|11

|3199

|365

Report

AI Summary

This report provides a detailed financial analysis of Woolworths Ltd. for the year 2016. It begins with an overview of the company, its history, and key directors. The report then analyzes the company's financial statements, including the auditor's opinion, sales figures (showing a slight decrease compared to 2015), and a cash flow analysis. A key section focuses on ratio analysis, examining profitability, liquidity, asset turnover, and leverage ratios. The analysis reveals a decline in profitability and liquidity, indicating areas needing improvement. The report concludes by summarizing the financial position of Woolworths Ltd. and highlighting the need for improvements in its financial performance despite the auditor's positive opinion on the financial statement preparation.

FINANCIAL ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

Brief of the company...................................................................................................................1

Which section dominate..............................................................................................................2

Main directors..............................................................................................................................2

Auditor opinion............................................................................................................................3

Sales increased or decreased........................................................................................................4

Cash flow analysis.......................................................................................................................4

Retained profit.............................................................................................................................5

Ratio analysis...............................................................................................................................5

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

Brief of the company...................................................................................................................1

Which section dominate..............................................................................................................2

Main directors..............................................................................................................................2

Auditor opinion............................................................................................................................3

Sales increased or decreased........................................................................................................4

Cash flow analysis.......................................................................................................................4

Retained profit.............................................................................................................................5

Ratio analysis...............................................................................................................................5

CONCLUSION................................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Financial analysis is most crucial for the organization as it helps in knowing the present

performance of the entity. Further, in the modern era with the rise in the level of competition in

the market, it has become necessary for every business to indulge in the practice of financial

analysis such as calculating ratios with the help of which present performance can be compared

with the past (Bailey 2017). The present study carried out is based on Woolworths Ltd where the

description of the organization has been provided regarding background, history, etc. Auditor

and director report of the organization has been analyzed along with the financial statements so

as to know overall performance. Apart from this, various ratios have been calculated.

Brief of the company

Woolworths group plc is a British firm that owns high street retail chain in the market of

Australia. The company other owns another type of entities that are book and resource

distributor, entertainment distributor, etc. Woolworths limited was founded in the year 1924 on

September 22 where its key founders are Percy Christmas Stanley Chatterton Cecil Scott Waine

George Creed Ernest Williams (Group 2017). The organization is based in New South Wales,

Australia. Further, the key areas served involves Australia, India and New Zealand. The stores

through which company operates are popular in every type of market. In the year 1955, the first

self-service store of the organization was opened with the motive to deliver the high experience

to the target market. The organization manages some of the most trusted brands in the Australian

market and at present company has more than 28 million satisfied customers worldwide.

Woolworths employs 205,000 team members and has trusted partners which involve

manufacturers and local farmers.

The company is one of the largest supermarket chains where 995 stores are operated

across Australia. Company sources 96% of the fresh fruits and vegetables from the farmers

present in the Australian market. All form of retail products is offered by the organization that

involves food, clothes, grocery items, etc. In short, all the items that are used in day to day life of

the consumers are offered by Woolworths in the market, and this allows business to satisfy the

need of its target market in the proper manner (Group 2017). Time to time new products are

added in the existing range of products so that level of brand loyalty can be well maintained with

the help of this and through this Woolworths can manage its overall performance in the market

1

Financial analysis is most crucial for the organization as it helps in knowing the present

performance of the entity. Further, in the modern era with the rise in the level of competition in

the market, it has become necessary for every business to indulge in the practice of financial

analysis such as calculating ratios with the help of which present performance can be compared

with the past (Bailey 2017). The present study carried out is based on Woolworths Ltd where the

description of the organization has been provided regarding background, history, etc. Auditor

and director report of the organization has been analyzed along with the financial statements so

as to know overall performance. Apart from this, various ratios have been calculated.

Brief of the company

Woolworths group plc is a British firm that owns high street retail chain in the market of

Australia. The company other owns another type of entities that are book and resource

distributor, entertainment distributor, etc. Woolworths limited was founded in the year 1924 on

September 22 where its key founders are Percy Christmas Stanley Chatterton Cecil Scott Waine

George Creed Ernest Williams (Group 2017). The organization is based in New South Wales,

Australia. Further, the key areas served involves Australia, India and New Zealand. The stores

through which company operates are popular in every type of market. In the year 1955, the first

self-service store of the organization was opened with the motive to deliver the high experience

to the target market. The organization manages some of the most trusted brands in the Australian

market and at present company has more than 28 million satisfied customers worldwide.

Woolworths employs 205,000 team members and has trusted partners which involve

manufacturers and local farmers.

The company is one of the largest supermarket chains where 995 stores are operated

across Australia. Company sources 96% of the fresh fruits and vegetables from the farmers

present in the Australian market. All form of retail products is offered by the organization that

involves food, clothes, grocery items, etc. In short, all the items that are used in day to day life of

the consumers are offered by Woolworths in the market, and this allows business to satisfy the

need of its target market in the proper manner (Group 2017). Time to time new products are

added in the existing range of products so that level of brand loyalty can be well maintained with

the help of this and through this Woolworths can manage its overall performance in the market

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

where overall operations are being carried out. Therefore these are some of the key insights

associated with Woolworths for the year 2016 (Bloomberg 2017).

Which section dominate

Considering the annual report of the enterprise it has been found that the financial section

dominates the entire report Woolworths group has highlighted its financial performance

appropriately so as to deliver the right information to its stakeholders that involve shareholders,

customers, supplier, financial institutions, etc (Bailey 2017). The Company has focused on key

areas that involves profit level, dividend per share, earning before interest and tax, sales from

different sources such as hotels, drink group, new Zealand group, etc. Group sales have been

highlighted that undertakes the different type of areas such as BIGW, New Zealand food, hotels,

Australian, etc. All these are key areas in which company operates, and they are managed

appropriately.

Group profit and loss account have been reflected in the entire report that considers the

main expenses and income sources of the through which it has been known that income level of

the enterprise is high and firm has control on its major expenses. Generally, for every type of

company operating in the market it is necessary to highlight the financial performance properly

for the benefit of the parties that have the direct interest in the firm. The section of Australian

food and petrol has been highlighted differently with the help of its sales and EBIT. It has been

known that this section is most important for the business on the basis of the sales level. The

Endeavour drink group and New Zealand food section have also been highlighted separately by

the business (Kang & Gray 2013). So, in this way, the financial section of the business

dominates the entire report of the organization and highlights how the organization is performing

efficiently in the market. Apart from this, the financial section provides a base for comparison

where present performance can be compared with the past. Due to this reason this section is most

crucial.

Main directors

The key directors of Woolworths limited are Mr. Bradford Leon Banducci who is CEO of

the company, Mr. David Paul Marr who is CFO, Mr. Martin Smith who is managing director of

Endeavour drinks and Ms. Claire Peters who is managing director Woolworths supermarket

(Group 2016). All these directors are indulged into the practice of developing the strategic plan

for the business, and they take various crucial decisions for the welfare of the entire organization.

2

associated with Woolworths for the year 2016 (Bloomberg 2017).

Which section dominate

Considering the annual report of the enterprise it has been found that the financial section

dominates the entire report Woolworths group has highlighted its financial performance

appropriately so as to deliver the right information to its stakeholders that involve shareholders,

customers, supplier, financial institutions, etc (Bailey 2017). The Company has focused on key

areas that involves profit level, dividend per share, earning before interest and tax, sales from

different sources such as hotels, drink group, new Zealand group, etc. Group sales have been

highlighted that undertakes the different type of areas such as BIGW, New Zealand food, hotels,

Australian, etc. All these are key areas in which company operates, and they are managed

appropriately.

Group profit and loss account have been reflected in the entire report that considers the

main expenses and income sources of the through which it has been known that income level of

the enterprise is high and firm has control on its major expenses. Generally, for every type of

company operating in the market it is necessary to highlight the financial performance properly

for the benefit of the parties that have the direct interest in the firm. The section of Australian

food and petrol has been highlighted differently with the help of its sales and EBIT. It has been

known that this section is most important for the business on the basis of the sales level. The

Endeavour drink group and New Zealand food section have also been highlighted separately by

the business (Kang & Gray 2013). So, in this way, the financial section of the business

dominates the entire report of the organization and highlights how the organization is performing

efficiently in the market. Apart from this, the financial section provides a base for comparison

where present performance can be compared with the past. Due to this reason this section is most

crucial.

Main directors

The key directors of Woolworths limited are Mr. Bradford Leon Banducci who is CEO of

the company, Mr. David Paul Marr who is CFO, Mr. Martin Smith who is managing director of

Endeavour drinks and Ms. Claire Peters who is managing director Woolworths supermarket

(Group 2016). All these directors are indulged into the practice of developing the strategic plan

for the business, and they take various crucial decisions for the welfare of the entire organization.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CEO of Woolworths limited named Bradford Banducci takes investment decisions and ensures

whether financial resources are utilized efficiently or not. Role of every director present within

the Woolworths plays the different role (Kang & Gray 2013).

Considering the director report of the business the background of every director has been

provided in the report which involves their educational background, the career as a leader and

another type of crucial information that is significant for the business. The principal activities of

the organization have been highlighted in the director's report which involves Australian food

and petrol, BIGW, petrol, New Zealand supermarkets and Endeavour drink group. Dividend

declared in the financial year 2016 has been shown where the high amount of dividends were

paid in the year 2016 as compared with the previous year (Group 2017). Director interest in

share and performance right part has been shown in the report along with meetings of directors

that held during the financial period ended 26 June 2016. Along with this environmental

regulations have been highlighted in the report where it has been highlighted that all the

operations of the Woolworths group are as per the environmental regulations. Apart from this,

the remuneration report of the directors has been reflected in the director's report that highlights

the salary paid to the top executives of the company. Moreover, the range of KPI undertaken for

every individual has also been shown in the report.

Auditor opinion

The main auditors of Woolworths limited are Ernst & Young Inc, Deloitte and SAB&T

Inc where both these companies hold the responsibility to audit the financial statements of the

company in order to know overall performance in the market. The audit committee of the

Woolworths limited carries out different functions that take into consideration reviewing reports

that are presented by the treasury committee, reviewing the interim results, considering the

independence of the external auditors, etc (Group 2016). In short, each and every function of the

audit committee is quite crucial, and they ensure whether the organization is carrying out every

financial function in the proper manner or not. The committee has reviewed the annual financial

statements of the group and is satisfied with the business activities as its practices comply with

the international financial reporting standards.

Further, the entire committee also reviewed the assessment of the going concern status of

the group, and it has been suggested to the board that group will be a going concern for the

foreseeable future. Considering the audit opinion, the entire committee has audited the

3

whether financial resources are utilized efficiently or not. Role of every director present within

the Woolworths plays the different role (Kang & Gray 2013).

Considering the director report of the business the background of every director has been

provided in the report which involves their educational background, the career as a leader and

another type of crucial information that is significant for the business. The principal activities of

the organization have been highlighted in the director's report which involves Australian food

and petrol, BIGW, petrol, New Zealand supermarkets and Endeavour drink group. Dividend

declared in the financial year 2016 has been shown where the high amount of dividends were

paid in the year 2016 as compared with the previous year (Group 2017). Director interest in

share and performance right part has been shown in the report along with meetings of directors

that held during the financial period ended 26 June 2016. Along with this environmental

regulations have been highlighted in the report where it has been highlighted that all the

operations of the Woolworths group are as per the environmental regulations. Apart from this,

the remuneration report of the directors has been reflected in the director's report that highlights

the salary paid to the top executives of the company. Moreover, the range of KPI undertaken for

every individual has also been shown in the report.

Auditor opinion

The main auditors of Woolworths limited are Ernst & Young Inc, Deloitte and SAB&T

Inc where both these companies hold the responsibility to audit the financial statements of the

company in order to know overall performance in the market. The audit committee of the

Woolworths limited carries out different functions that take into consideration reviewing reports

that are presented by the treasury committee, reviewing the interim results, considering the

independence of the external auditors, etc (Group 2016). In short, each and every function of the

audit committee is quite crucial, and they ensure whether the organization is carrying out every

financial function in the proper manner or not. The committee has reviewed the annual financial

statements of the group and is satisfied with the business activities as its practices comply with

the international financial reporting standards.

Further, the entire committee also reviewed the assessment of the going concern status of

the group, and it has been suggested to the board that group will be a going concern for the

foreseeable future. Considering the audit opinion, the entire committee has audited the

3

consolidated and separate financial statements of the Woolworths holding limited where the

responsibility of the auditors have been highlighted. It is ensured by the auditor that they comply

with the ethical requirement and carry out all the audit practices as per the regulatory

requirement. It has been analyzed by the auditors that financial information has been represented

in a fair manner and no unethical practice has been undertaken so as to highlight the company’s

performance in the wrong manner (Limited 2016). Apart from this, it is recommended to the

Woolworths group to maintain this performance for the longer period. Therefore, this highlights

the overall opinion of the auditor of Woolworths group where they are satisfied after auditing the

financial statements of the business.

Sales increased or decreased

After undertaking the annual report of Woolworths Ltd for the year 2016 sales of the

organization has been known. In the year 2016 the group sales were 60,186 $M, and in the year

2015, it was 60,679 $M where the decline in (0.8%) has been witnessed in the overall sales of

the enterprise. The major change has been witnessed in the fuel sector where less amount of

petrol has been sold by the company in the year 2016 as compared with the previous year. Apart

from this, the sale of another sector such as food, the drink has enhanced in the present year as

compared with the past (Group 2016). The possible reason for the decline in the sales volume of

the enterprise can be competition in the market. This issue is adversely affecting organization

where Woolworths ltd is not able to accomplish its key goals and objectives.

Apart from this, the company is required to focus more on marketing and the promotional

medium through which it is possible to attract customers towards the range of its products, and

this can surely act as the development tool for the enterprise (Mertens et al. 2016). Further, sales

of the group have been segregated into different areas which involve Australian food, petrol,

drinks group, etc. All these are the main sources of income of Woolworths limited.

Cash flow analysis

Cash from operating activities helps in knowing the inflow and outflow of the money

from the main activities of the enterprise. Further, it helps in knowing whether the organization

is effectively carrying out its main operations or not (Phillipov 2016). Considering the cash flow

statement of Woolworths ltd for the year 2016 the operating activities of the enterprise has been

undertaken where it is showing positive outcome with the inflow of 2,357.5 $M, and this is the

favorable situation for the organization. As compared with the previous year the cash inflow

4

responsibility of the auditors have been highlighted. It is ensured by the auditor that they comply

with the ethical requirement and carry out all the audit practices as per the regulatory

requirement. It has been analyzed by the auditors that financial information has been represented

in a fair manner and no unethical practice has been undertaken so as to highlight the company’s

performance in the wrong manner (Limited 2016). Apart from this, it is recommended to the

Woolworths group to maintain this performance for the longer period. Therefore, this highlights

the overall opinion of the auditor of Woolworths group where they are satisfied after auditing the

financial statements of the business.

Sales increased or decreased

After undertaking the annual report of Woolworths Ltd for the year 2016 sales of the

organization has been known. In the year 2016 the group sales were 60,186 $M, and in the year

2015, it was 60,679 $M where the decline in (0.8%) has been witnessed in the overall sales of

the enterprise. The major change has been witnessed in the fuel sector where less amount of

petrol has been sold by the company in the year 2016 as compared with the previous year. Apart

from this, the sale of another sector such as food, the drink has enhanced in the present year as

compared with the past (Group 2016). The possible reason for the decline in the sales volume of

the enterprise can be competition in the market. This issue is adversely affecting organization

where Woolworths ltd is not able to accomplish its key goals and objectives.

Apart from this, the company is required to focus more on marketing and the promotional

medium through which it is possible to attract customers towards the range of its products, and

this can surely act as the development tool for the enterprise (Mertens et al. 2016). Further, sales

of the group have been segregated into different areas which involve Australian food, petrol,

drinks group, etc. All these are the main sources of income of Woolworths limited.

Cash flow analysis

Cash from operating activities helps in knowing the inflow and outflow of the money

from the main activities of the enterprise. Further, it helps in knowing whether the organization

is effectively carrying out its main operations or not (Phillipov 2016). Considering the cash flow

statement of Woolworths ltd for the year 2016 the operating activities of the enterprise has been

undertaken where it is showing positive outcome with the inflow of 2,357.5 $M, and this is the

favorable situation for the organization. As compared with the previous year the cash inflow

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

which was 3345.1 $M in the year 2015 from the operating activity has been declined by 29.53

percent. The main reason behind the same is the decline in the level of receipts from customers.

It is indicating the Woolworths group is efficiently carrying out its major operations, and this is

one of the main reason behind the success of the enterprise in the market where it operates. In

terms of money and percentage both cash, inflow has changed in the year 2016 as compared with

the previous year. Therefore, it is recommended to the entire group to maintain this performance

for the longer period.

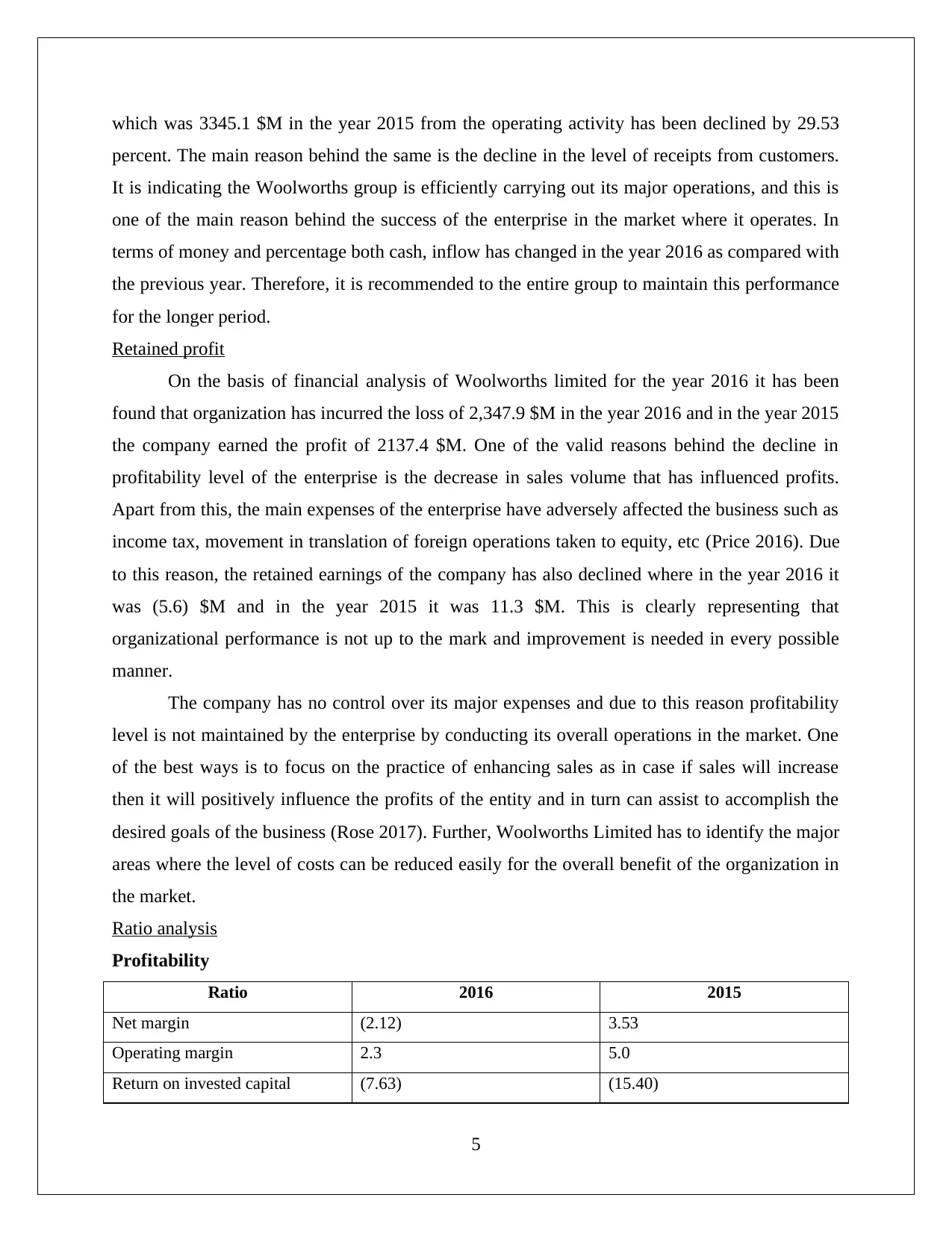

Retained profit

On the basis of financial analysis of Woolworths limited for the year 2016 it has been

found that organization has incurred the loss of 2,347.9 $M in the year 2016 and in the year 2015

the company earned the profit of 2137.4 $M. One of the valid reasons behind the decline in

profitability level of the enterprise is the decrease in sales volume that has influenced profits.

Apart from this, the main expenses of the enterprise have adversely affected the business such as

income tax, movement in translation of foreign operations taken to equity, etc (Price 2016). Due

to this reason, the retained earnings of the company has also declined where in the year 2016 it

was (5.6) $M and in the year 2015 it was 11.3 $M. This is clearly representing that

organizational performance is not up to the mark and improvement is needed in every possible

manner.

The company has no control over its major expenses and due to this reason profitability

level is not maintained by the enterprise by conducting its overall operations in the market. One

of the best ways is to focus on the practice of enhancing sales as in case if sales will increase

then it will positively influence the profits of the entity and in turn can assist to accomplish the

desired goals of the business (Rose 2017). Further, Woolworths Limited has to identify the major

areas where the level of costs can be reduced easily for the overall benefit of the organization in

the market.

Ratio analysis

Profitability

Ratio 2016 2015

Net margin (2.12) 3.53

Operating margin 2.3 5.0

Return on invested capital (7.63) (15.40)

5

percent. The main reason behind the same is the decline in the level of receipts from customers.

It is indicating the Woolworths group is efficiently carrying out its major operations, and this is

one of the main reason behind the success of the enterprise in the market where it operates. In

terms of money and percentage both cash, inflow has changed in the year 2016 as compared with

the previous year. Therefore, it is recommended to the entire group to maintain this performance

for the longer period.

Retained profit

On the basis of financial analysis of Woolworths limited for the year 2016 it has been

found that organization has incurred the loss of 2,347.9 $M in the year 2016 and in the year 2015

the company earned the profit of 2137.4 $M. One of the valid reasons behind the decline in

profitability level of the enterprise is the decrease in sales volume that has influenced profits.

Apart from this, the main expenses of the enterprise have adversely affected the business such as

income tax, movement in translation of foreign operations taken to equity, etc (Price 2016). Due

to this reason, the retained earnings of the company has also declined where in the year 2016 it

was (5.6) $M and in the year 2015 it was 11.3 $M. This is clearly representing that

organizational performance is not up to the mark and improvement is needed in every possible

manner.

The company has no control over its major expenses and due to this reason profitability

level is not maintained by the enterprise by conducting its overall operations in the market. One

of the best ways is to focus on the practice of enhancing sales as in case if sales will increase

then it will positively influence the profits of the entity and in turn can assist to accomplish the

desired goals of the business (Rose 2017). Further, Woolworths Limited has to identify the major

areas where the level of costs can be reduced easily for the overall benefit of the organization in

the market.

Ratio analysis

Profitability

Ratio 2016 2015

Net margin (2.12) 3.53

Operating margin 2.3 5.0

Return on invested capital (7.63) (15.40)

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

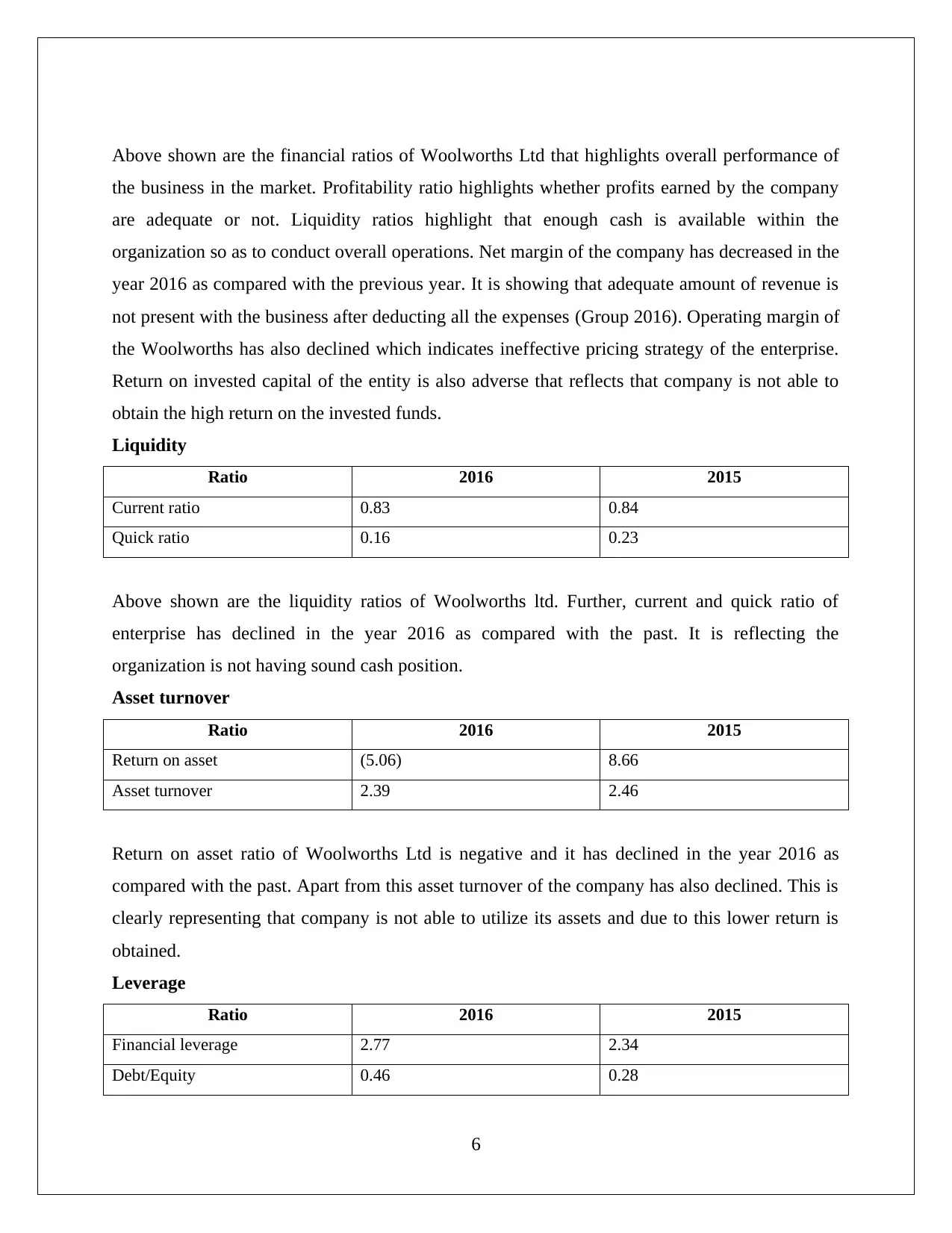

Above shown are the financial ratios of Woolworths Ltd that highlights overall performance of

the business in the market. Profitability ratio highlights whether profits earned by the company

are adequate or not. Liquidity ratios highlight that enough cash is available within the

organization so as to conduct overall operations. Net margin of the company has decreased in the

year 2016 as compared with the previous year. It is showing that adequate amount of revenue is

not present with the business after deducting all the expenses (Group 2016). Operating margin of

the Woolworths has also declined which indicates ineffective pricing strategy of the enterprise.

Return on invested capital of the entity is also adverse that reflects that company is not able to

obtain the high return on the invested funds.

Liquidity

Ratio 2016 2015

Current ratio 0.83 0.84

Quick ratio 0.16 0.23

Above shown are the liquidity ratios of Woolworths ltd. Further, current and quick ratio of

enterprise has declined in the year 2016 as compared with the past. It is reflecting the

organization is not having sound cash position.

Asset turnover

Ratio 2016 2015

Return on asset (5.06) 8.66

Asset turnover 2.39 2.46

Return on asset ratio of Woolworths Ltd is negative and it has declined in the year 2016 as

compared with the past. Apart from this asset turnover of the company has also declined. This is

clearly representing that company is not able to utilize its assets and due to this lower return is

obtained.

Leverage

Ratio 2016 2015

Financial leverage 2.77 2.34

Debt/Equity 0.46 0.28

6

the business in the market. Profitability ratio highlights whether profits earned by the company

are adequate or not. Liquidity ratios highlight that enough cash is available within the

organization so as to conduct overall operations. Net margin of the company has decreased in the

year 2016 as compared with the previous year. It is showing that adequate amount of revenue is

not present with the business after deducting all the expenses (Group 2016). Operating margin of

the Woolworths has also declined which indicates ineffective pricing strategy of the enterprise.

Return on invested capital of the entity is also adverse that reflects that company is not able to

obtain the high return on the invested funds.

Liquidity

Ratio 2016 2015

Current ratio 0.83 0.84

Quick ratio 0.16 0.23

Above shown are the liquidity ratios of Woolworths ltd. Further, current and quick ratio of

enterprise has declined in the year 2016 as compared with the past. It is reflecting the

organization is not having sound cash position.

Asset turnover

Ratio 2016 2015

Return on asset (5.06) 8.66

Asset turnover 2.39 2.46

Return on asset ratio of Woolworths Ltd is negative and it has declined in the year 2016 as

compared with the past. Apart from this asset turnover of the company has also declined. This is

clearly representing that company is not able to utilize its assets and due to this lower return is

obtained.

Leverage

Ratio 2016 2015

Financial leverage 2.77 2.34

Debt/Equity 0.46 0.28

6

Financial leverage of Woolworths ltd is indicating that organization is using higher debt to

acquire additional assets and this is considered to be risk for the business (Price 2016). Company

has high dependency on loan and this can have adverse impact on the organization. Debt equity

ratio of company is also high which reflects more ratio of debt which is not favorable.

CONCLUSION

The entire study carried out has supported in knowing the financial position of

Woolworths Ltd in the market. Further, with the help of ratio analysis, it has been identified that

organization is not operating efficiently in the market where its profitability, liquidity, leverage

position is adverse, and improvement is needed. Moreover, the auditor report has shown that

financial statements are prepared by the company in the proper manner as per IFRS. Therefore,

business is efficient, but improvement is needed in the financial position.

7

acquire additional assets and this is considered to be risk for the business (Price 2016). Company

has high dependency on loan and this can have adverse impact on the organization. Debt equity

ratio of company is also high which reflects more ratio of debt which is not favorable.

CONCLUSION

The entire study carried out has supported in knowing the financial position of

Woolworths Ltd in the market. Further, with the help of ratio analysis, it has been identified that

organization is not operating efficiently in the market where its profitability, liquidity, leverage

position is adverse, and improvement is needed. Moreover, the auditor report has shown that

financial statements are prepared by the company in the proper manner as per IFRS. Therefore,

business is efficient, but improvement is needed in the financial position.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Arli, V, Dylke, S, Burgess, R, Campus, R & Soldo, E 2013, ' Woolworths Australia and Walmart

US: Best practices in supply chain collaboration. ', Journal of Economics, Business &

Accountancy Ventura, vol 16, no. 1.

Bailey, M 2017, 'Absorptive Capacity, International Business Knowledge Transfer, and Local

Adaptation: Establishing Discount Department Stores in Australia.', Australian Economic

History Review, vol 57, no. 2, pp. 194-216.

Bloomberg 2017, Company Overview of Woolworths Limited, viewed 13 September 2017,

<https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=874687>.

Group, W 2016, Annual Report 2016, viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/icms_docs/185865_annual-report-2016.pdf>.

Group, W 2016, Board of Directors , viewed 13 September 2017,

<https://wow2016ar.qreports.com.au/xresources/pdf/wow16ar-directors-report.pdf>.

Group, W 2017, About Us, viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/page/about-us/>.

Group, W 2017, The Woolworths Story , viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/page/about-us/The_Woolworths_Story/

How_We_Were_Founded>.

Group, W 2017, Woolworths Supermarkets, viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/page/about-us/our-brands/supermarkets/Woolworths>.

Kang, H & Gray, SJ 2013, 'Segment reporting practices in Australia: Has IFRS 8 made a

difference?', Australian Accounting Review, vol 23, no. 3, pp. 232-243.

Limited, WH 2016, WOOLWORTHS HOLDINGS LIMITED 2016 AUDITED ANNUAL

FINANCIAL STATEMENTS, viewed 13 September 2017,

<http://www.woolworthsholdings.co.za/downloads/2016/WHL-Audited-Annual-Financial-

Statements-2016.pdf>.

Mertens, W, Recker, J, Kummer, TF, Kohlborn, T & Viaene, S 2016, 'Constructive deviance as a

driver for performance in retail', Journal of Retailing and Consumer Services, vol 30, pp. 193-

203.

Phillipov, M 2016, 'Helping Australia Grow’: supermarkets, television cooking shows, and the

strategic manufacture of consumer trust', Agriculture and human values, vol 33, no. 3, pp. 587-

8

Arli, V, Dylke, S, Burgess, R, Campus, R & Soldo, E 2013, ' Woolworths Australia and Walmart

US: Best practices in supply chain collaboration. ', Journal of Economics, Business &

Accountancy Ventura, vol 16, no. 1.

Bailey, M 2017, 'Absorptive Capacity, International Business Knowledge Transfer, and Local

Adaptation: Establishing Discount Department Stores in Australia.', Australian Economic

History Review, vol 57, no. 2, pp. 194-216.

Bloomberg 2017, Company Overview of Woolworths Limited, viewed 13 September 2017,

<https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=874687>.

Group, W 2016, Annual Report 2016, viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/icms_docs/185865_annual-report-2016.pdf>.

Group, W 2016, Board of Directors , viewed 13 September 2017,

<https://wow2016ar.qreports.com.au/xresources/pdf/wow16ar-directors-report.pdf>.

Group, W 2017, About Us, viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/page/about-us/>.

Group, W 2017, The Woolworths Story , viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/page/about-us/The_Woolworths_Story/

How_We_Were_Founded>.

Group, W 2017, Woolworths Supermarkets, viewed 13 September 2017,

<https://www.woolworthsgroup.com.au/page/about-us/our-brands/supermarkets/Woolworths>.

Kang, H & Gray, SJ 2013, 'Segment reporting practices in Australia: Has IFRS 8 made a

difference?', Australian Accounting Review, vol 23, no. 3, pp. 232-243.

Limited, WH 2016, WOOLWORTHS HOLDINGS LIMITED 2016 AUDITED ANNUAL

FINANCIAL STATEMENTS, viewed 13 September 2017,

<http://www.woolworthsholdings.co.za/downloads/2016/WHL-Audited-Annual-Financial-

Statements-2016.pdf>.

Mertens, W, Recker, J, Kummer, TF, Kohlborn, T & Viaene, S 2016, 'Constructive deviance as a

driver for performance in retail', Journal of Retailing and Consumer Services, vol 30, pp. 193-

203.

Phillipov, M 2016, 'Helping Australia Grow’: supermarkets, television cooking shows, and the

strategic manufacture of consumer trust', Agriculture and human values, vol 33, no. 3, pp. 587-

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

596.

Price, R 2016, 'Controlling routine front line service workers: an Australian retail supermarket

case', Work, employment and society, vol 30, no. 6, pp. 915-931.

Rose, N 2017, ' Community food hubs: an economic and social justice model for regional

Australia?', Rural Society, pp. 1-13.

9

Price, R 2016, 'Controlling routine front line service workers: an Australian retail supermarket

case', Work, employment and society, vol 30, no. 6, pp. 915-931.

Rose, N 2017, ' Community food hubs: an economic and social justice model for regional

Australia?', Rural Society, pp. 1-13.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.