Zirra: Analysis of Growth Opportunities and Business Planning Report

VerifiedAdded on 2020/06/03

|18

|5518

|47

Report

AI Summary

This report provides a detailed analysis of Zirra, a financial service provider, focusing on its growth strategies and business planning. The report begins with an analysis of key considerations for growth, including turnover, market share, profitability, staff, and technology. It then evaluates growth opportunities using the Ansoff matrix, exploring market penetration, market development, product development, and diversification. The report also examines potential sources of funding, such as equity shares and loans, outlining their benefits and drawbacks. Furthermore, it formulates a business plan for growth, defining financial and strategic objectives, and concludes with a discussion of exit and succession options for the business. The analysis utilizes various sources and frameworks to provide a comprehensive overview of Zirra's growth potential.

Planning For Growth

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Analysis of key consideration for growth opportunities in organisation context..................1

M1...............................................................................................................................................3

P2 Evaluation of opportunities of growth by using Ansoff matrix.............................................3

D1 ...............................................................................................................................................5

TASK 2............................................................................................................................................5

P3 Potential sources of funding with each one benefits and drawbacks.....................................5

M2...............................................................................................................................................7

D2................................................................................................................................................7

TASK 3............................................................................................................................................7

P4 Formulation of business plan for growth with financial and strategic objectives of scaling

up.................................................................................................................................................7

M3...............................................................................................................................................9

D3..............................................................................................................................................10

TASK 4..........................................................................................................................................10

P5 Exit and succession option for business with its benefits and drawbacks...........................10

M4.............................................................................................................................................11

D4..............................................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Analysis of key consideration for growth opportunities in organisation context..................1

M1...............................................................................................................................................3

P2 Evaluation of opportunities of growth by using Ansoff matrix.............................................3

D1 ...............................................................................................................................................5

TASK 2............................................................................................................................................5

P3 Potential sources of funding with each one benefits and drawbacks.....................................5

M2...............................................................................................................................................7

D2................................................................................................................................................7

TASK 3............................................................................................................................................7

P4 Formulation of business plan for growth with financial and strategic objectives of scaling

up.................................................................................................................................................7

M3...............................................................................................................................................9

D3..............................................................................................................................................10

TASK 4..........................................................................................................................................10

P5 Exit and succession option for business with its benefits and drawbacks...........................10

M4.............................................................................................................................................11

D4..............................................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

For a business process, planning is a highly essential element for growth of business in

which the main focus of managers is on maximising returns. Planning for growth is a process in

which there are various kinds of factors which have potential to make the business grow and get

success which in turn can lead to grab competitive advantages within marketplace (Barbour and

Deakin, 2012). Company taken for this report is Zirra which is a financial service provider for

the kind of people who have a unique idea of starting up of new kind of business. This company

was established in 2014 and their turnover is approx. 2.3 million dollars as well as their

employee strength is around 20 (Est) + 6%. There are various elements which are being

discussed in the report like key considerations included while growing. Moreover, a business

plan is presented by management in which follow up can be taken of in an effectual manner and

for the same, funding is required in order to conduct in-depth analysis.

TASK 1

P1. Analysis of key considerations for the growth opportunities in organisational context

The main focus of every kind of business is on conducting their operations on a large

scale and making it much more effective and gaining competitive advantage. All the elements

are needed to be identified by manager in to allot them at appropriate place. Vital role is being

played by the manager as he\she makes effective and better plans as well as strategies for the risk

factors which come along with various opportunities of development. There are various key

considerations which are being taken into account and these are being described as below: Turnover: Through the turnover of business process, measurement of growth becomes

possible which in turn enables them to monitor their operations that are being conducted.

Zirra's funding is approx. 41.6 million which is being utilised in conducting of

operations.

Market share: For an organisation, it is highly essential to make decision-making process

much more effective and that is done through analysis of marketplace in an in-depth

manner (Brinckmann, Grichnik and Kapsa, 2010). This can provide various kinds of

benefits like bringing sustainability and implementation of modifications in the growth

oriented process. The current growth rate of Zirra is around 5.3% which is enhanced and

giving competition to other companies. Major competitor of this company is AdmantaX

with the growth rate of 5%.

1

For a business process, planning is a highly essential element for growth of business in

which the main focus of managers is on maximising returns. Planning for growth is a process in

which there are various kinds of factors which have potential to make the business grow and get

success which in turn can lead to grab competitive advantages within marketplace (Barbour and

Deakin, 2012). Company taken for this report is Zirra which is a financial service provider for

the kind of people who have a unique idea of starting up of new kind of business. This company

was established in 2014 and their turnover is approx. 2.3 million dollars as well as their

employee strength is around 20 (Est) + 6%. There are various elements which are being

discussed in the report like key considerations included while growing. Moreover, a business

plan is presented by management in which follow up can be taken of in an effectual manner and

for the same, funding is required in order to conduct in-depth analysis.

TASK 1

P1. Analysis of key considerations for the growth opportunities in organisational context

The main focus of every kind of business is on conducting their operations on a large

scale and making it much more effective and gaining competitive advantage. All the elements

are needed to be identified by manager in to allot them at appropriate place. Vital role is being

played by the manager as he\she makes effective and better plans as well as strategies for the risk

factors which come along with various opportunities of development. There are various key

considerations which are being taken into account and these are being described as below: Turnover: Through the turnover of business process, measurement of growth becomes

possible which in turn enables them to monitor their operations that are being conducted.

Zirra's funding is approx. 41.6 million which is being utilised in conducting of

operations.

Market share: For an organisation, it is highly essential to make decision-making process

much more effective and that is done through analysis of marketplace in an in-depth

manner (Brinckmann, Grichnik and Kapsa, 2010). This can provide various kinds of

benefits like bringing sustainability and implementation of modifications in the growth

oriented process. The current growth rate of Zirra is around 5.3% which is enhanced and

giving competition to other companies. Major competitor of this company is AdmantaX

with the growth rate of 5%.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

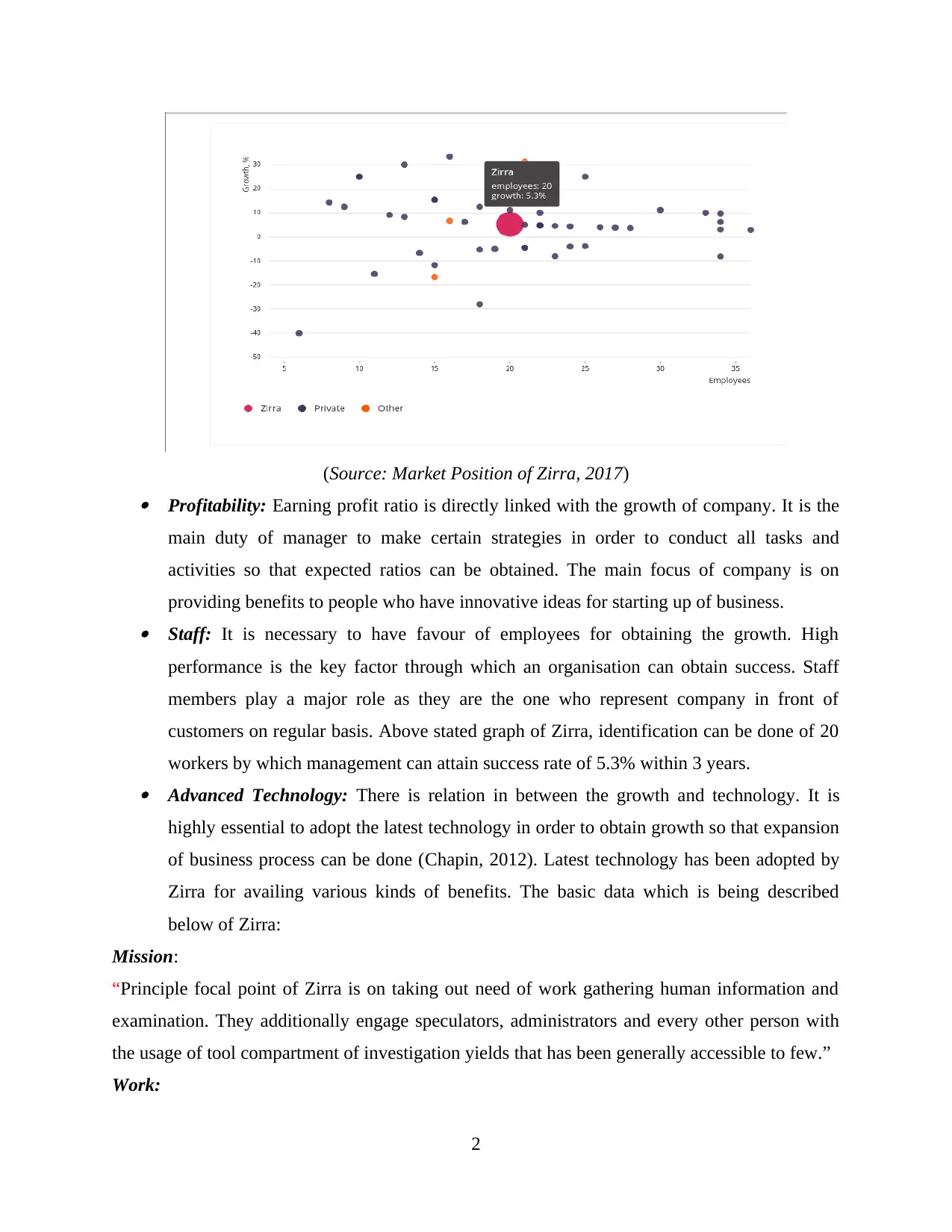

(Source: Market Position of Zirra, 2017) Profitability: Earning profit ratio is directly linked with the growth of company. It is the

main duty of manager to make certain strategies in order to conduct all tasks and

activities so that expected ratios can be obtained. The main focus of company is on

providing benefits to people who have innovative ideas for starting up of business. Staff: It is necessary to have favour of employees for obtaining the growth. High

performance is the key factor through which an organisation can obtain success. Staff

members play a major role as they are the one who represent company in front of

customers on regular basis. Above stated graph of Zirra, identification can be done of 20

workers by which management can attain success rate of 5.3% within 3 years. Advanced Technology: There is relation in between the growth and technology. It is

highly essential to adopt the latest technology in order to obtain growth so that expansion

of business process can be done (Chapin, 2012). Latest technology has been adopted by

Zirra for availing various kinds of benefits. The basic data which is being described

below of Zirra:

Mission:

“Principle focal point of Zirra is on taking out need of work gathering human information and

examination. They additionally engage speculators, administrators and every other person with

the usage of tool compartment of investigation yields that has been generally accessible to few.”

Work:

2

main duty of manager to make certain strategies in order to conduct all tasks and

activities so that expected ratios can be obtained. The main focus of company is on

providing benefits to people who have innovative ideas for starting up of business. Staff: It is necessary to have favour of employees for obtaining the growth. High

performance is the key factor through which an organisation can obtain success. Staff

members play a major role as they are the one who represent company in front of

customers on regular basis. Above stated graph of Zirra, identification can be done of 20

workers by which management can attain success rate of 5.3% within 3 years. Advanced Technology: There is relation in between the growth and technology. It is

highly essential to adopt the latest technology in order to obtain growth so that expansion

of business process can be done (Chapin, 2012). Latest technology has been adopted by

Zirra for availing various kinds of benefits. The basic data which is being described

below of Zirra:

Mission:

“Principle focal point of Zirra is on taking out need of work gathering human information and

examination. They additionally engage speculators, administrators and every other person with

the usage of tool compartment of investigation yields that has been generally accessible to few.”

Work:

2

Collecting data regarding various companies Collecting and giving accurate data for an organisation for making better decisions

Founded and founders:

Company was established in the year 2014 and working team members are:

Moshit Yaffe – Co founder and CEO

Aner Ravon – Co founder and CPO

David Hessing – CTO

M1

There are various options which are being taken into account while making company get

growth and success. Most essential among those is planning through which every task and

activity can be conducted in a smooth manner. Apart from that, there are various other elements

like staff, advanced technology and mission which play a crucial role in the growth and

development of company.

P2. Evaluation of opportunities of growth by using Ansoff matrix

Business is being expanded by capturing a large number of customers and expansion of

clients from various other places. The main focus of this every kind of business to gain

customers and create long term relations with them (Christofakis and Papadaskalopoulos, 2011).

Formulating an audit plan is highly essential while entering in a new market so that pros and

cons can be recognised. While taking a step into new market, Ansoff Matrix can be evaluated

through which market can be analysed and thus, can be utilised in developing the business.

3

Founded and founders:

Company was established in the year 2014 and working team members are:

Moshit Yaffe – Co founder and CEO

Aner Ravon – Co founder and CPO

David Hessing – CTO

M1

There are various options which are being taken into account while making company get

growth and success. Most essential among those is planning through which every task and

activity can be conducted in a smooth manner. Apart from that, there are various other elements

like staff, advanced technology and mission which play a crucial role in the growth and

development of company.

P2. Evaluation of opportunities of growth by using Ansoff matrix

Business is being expanded by capturing a large number of customers and expansion of

clients from various other places. The main focus of this every kind of business to gain

customers and create long term relations with them (Christofakis and Papadaskalopoulos, 2011).

Formulating an audit plan is highly essential while entering in a new market so that pros and

cons can be recognised. While taking a step into new market, Ansoff Matrix can be evaluated

through which market can be analysed and thus, can be utilised in developing the business.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

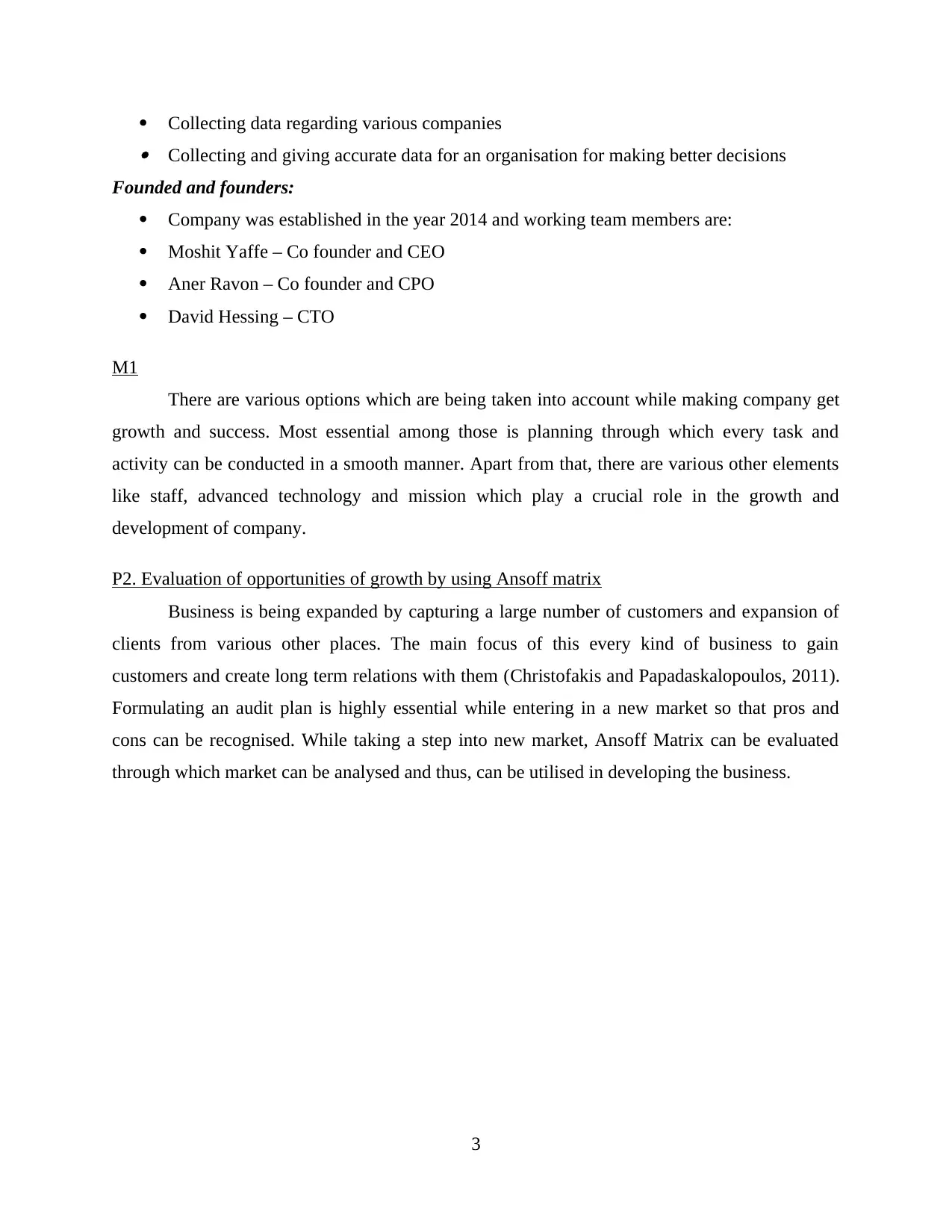

Illustration 1: Ansoff Matrix

(Source: Growth share of Matrix , 2016) Market penetration: In this kind of approach, main focus of company is on analysing the

market for actual needs and wants of customers so that satisfaction can be provided by

goods and services. High kind of investment is needed in this of approach and thus, in for

promoting, number of campaigns can be launched within marketplace. There are various

growth opportunities which can be availed by new market target so that modifications

can be done by adopting the digital technology. Market development: For growing up of business, it is highly needed to have an area of

expansion where all the required processes can take place. The priority of managers is on

expansion of business process by developing activities in a new market. This will in turn

improve the production and profit ratios. Zirra can obtain growth by introducing business

at new kind of level and thus they will improve the various services which are being

provided by them (Eddleston And et. al., 2013). In the present situation, firm is being

dealing in providing framework of advices to investors as they provide guidelines to them

regarding in small scale business. Segmentation of market is being done when the

business process will move onto next level of expansion along with various tools and

techniques. Besides this, operations will be merged with other consultants who have high

experience in establishing the brands. Product development: In this kind of approach, product developing is the main focus of

an organisation and through this they satisfy the customers in better manner. There are

various tools and techniques which are being utilised to attract the customers by creating

4

(Source: Growth share of Matrix , 2016) Market penetration: In this kind of approach, main focus of company is on analysing the

market for actual needs and wants of customers so that satisfaction can be provided by

goods and services. High kind of investment is needed in this of approach and thus, in for

promoting, number of campaigns can be launched within marketplace. There are various

growth opportunities which can be availed by new market target so that modifications

can be done by adopting the digital technology. Market development: For growing up of business, it is highly needed to have an area of

expansion where all the required processes can take place. The priority of managers is on

expansion of business process by developing activities in a new market. This will in turn

improve the production and profit ratios. Zirra can obtain growth by introducing business

at new kind of level and thus they will improve the various services which are being

provided by them (Eddleston And et. al., 2013). In the present situation, firm is being

dealing in providing framework of advices to investors as they provide guidelines to them

regarding in small scale business. Segmentation of market is being done when the

business process will move onto next level of expansion along with various tools and

techniques. Besides this, operations will be merged with other consultants who have high

experience in establishing the brands. Product development: In this kind of approach, product developing is the main focus of

an organisation and through this they satisfy the customers in better manner. There are

various tools and techniques which are being utilised to attract the customers by creating

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

new kind of products or doing modification in existing ones. This is being utilised by

Zirra as it has became mandatory to adopt latest technology so that facility to investors

can be facilitated (Grover, Bokalo and Greenway, 2014). In current situation they are

acting as mediator between starts up and investors. This is providing them assistance in

conducting of various operations and thus gain heavy returns from business.

Diversification: The another factors which can be applied within Zirra so that products

and services can be created with attractive offers. There are various effective operations

and thus funds can be arranged for business process as Venture Capitalist. This in turn

will help business to work in better and effective manner.

In Zirra, diversification can be stated as best option which can be chosen and can be applied

while conduction of operations. This will in turn enable them to create new and attractive offers

in marketplace. Through this they can undergo analysation of various firms who are capable of

availing high turnover and revenue generates. This option is best suitable.

Another option is BCG matrix-

Boston consulting group designed a matrix in which they create plan for a long term

benefit like to invest in which sector, to discontinue with their products or not. It include four

parts dogs, question mark, cash cow and stars. For these Zirra implement stars factor in BCG

matrix as diversification help company to gain more customer from the market. The second

option is of cash cow which help company to generate more customer with their existing

products.

D1

According to Wu, (2015) , there are various kind of risks which are being involved in the

growth and development of business process. Ansoff Matrix is being applied by the company

when they are putting their hands into new market. There are various kind of approaches which

are being followed within Ansoff Matrix and amongst them, diversification has been applied by

Zirra for making new market successful for company.

TASK 2

P3 Potential sources of funding with each one benefits and drawbacks

Equity Share:-

5

Zirra as it has became mandatory to adopt latest technology so that facility to investors

can be facilitated (Grover, Bokalo and Greenway, 2014). In current situation they are

acting as mediator between starts up and investors. This is providing them assistance in

conducting of various operations and thus gain heavy returns from business.

Diversification: The another factors which can be applied within Zirra so that products

and services can be created with attractive offers. There are various effective operations

and thus funds can be arranged for business process as Venture Capitalist. This in turn

will help business to work in better and effective manner.

In Zirra, diversification can be stated as best option which can be chosen and can be applied

while conduction of operations. This will in turn enable them to create new and attractive offers

in marketplace. Through this they can undergo analysation of various firms who are capable of

availing high turnover and revenue generates. This option is best suitable.

Another option is BCG matrix-

Boston consulting group designed a matrix in which they create plan for a long term

benefit like to invest in which sector, to discontinue with their products or not. It include four

parts dogs, question mark, cash cow and stars. For these Zirra implement stars factor in BCG

matrix as diversification help company to gain more customer from the market. The second

option is of cash cow which help company to generate more customer with their existing

products.

D1

According to Wu, (2015) , there are various kind of risks which are being involved in the

growth and development of business process. Ansoff Matrix is being applied by the company

when they are putting their hands into new market. There are various kind of approaches which

are being followed within Ansoff Matrix and amongst them, diversification has been applied by

Zirra for making new market successful for company.

TASK 2

P3 Potential sources of funding with each one benefits and drawbacks

Equity Share:-

5

Equity share can be defined as ordinary share which mainly provides equity rights to

shareholders or in simple words, it can be stated as source of raising capital by sales of share in

business. After becoming the owner of company,enjoy dividend, right to attend board meeting ,

voting rights and also participate in important decision making but rate of dividend is not fixed

depend upon profit of company (Hough and et. al., 2010). Equity share can be paid back in case

of winding up of company after stetting up of claims of preference shareholders. It also get share

in sweat equity, right share. If we considered Zirra as source of finance at the time of start then

following are advantages and disadvantages.

Advantages:-

In this, commitment of funding is being done to intended projects and thus investor invest

the capital when only the business is doing well by sales of shares to new kind of

investors.

Idea of capacity along with growth and profitability ratios are being enhanced by

investors.

Cost is being reduced as entrepreneur is not required to pay interest to the bank and

provide platform of opportunities for utilising capital amount in business activities.

They also assist at the time making strategies, policies, financial planning which give

future benefits to business.

If company performance is satisfied them also prepared to provide follow up finding in

future also.

Disadvantages:-

Funds are being raised by equity share and that is time consuming, costlier, riskier and

also take away the management team from the core activities.

There are many kind of obstacles which are being created by investors at the time of

taking financial decisions.

There are some compliances and legal rules which must be addressed at the time of

promoting investments.

Loans:-

Credits are acquiring sum or as such whole of sum anticipated that would be paid back with

interest. On the off chance that financing from obligation is picked as alternative then business

will raise funds for working capital, capital use by pitching notes to investors (Keough, 2015).

6

shareholders or in simple words, it can be stated as source of raising capital by sales of share in

business. After becoming the owner of company,enjoy dividend, right to attend board meeting ,

voting rights and also participate in important decision making but rate of dividend is not fixed

depend upon profit of company (Hough and et. al., 2010). Equity share can be paid back in case

of winding up of company after stetting up of claims of preference shareholders. It also get share

in sweat equity, right share. If we considered Zirra as source of finance at the time of start then

following are advantages and disadvantages.

Advantages:-

In this, commitment of funding is being done to intended projects and thus investor invest

the capital when only the business is doing well by sales of shares to new kind of

investors.

Idea of capacity along with growth and profitability ratios are being enhanced by

investors.

Cost is being reduced as entrepreneur is not required to pay interest to the bank and

provide platform of opportunities for utilising capital amount in business activities.

They also assist at the time making strategies, policies, financial planning which give

future benefits to business.

If company performance is satisfied them also prepared to provide follow up finding in

future also.

Disadvantages:-

Funds are being raised by equity share and that is time consuming, costlier, riskier and

also take away the management team from the core activities.

There are many kind of obstacles which are being created by investors at the time of

taking financial decisions.

There are some compliances and legal rules which must be addressed at the time of

promoting investments.

Loans:-

Credits are acquiring sum or as such whole of sum anticipated that would be paid back with

interest. On the off chance that financing from obligation is picked as alternative then business

will raise funds for working capital, capital use by pitching notes to investors (Keough, 2015).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Advantages:-

Funds increment leads to more profits and earnings.

Tax is being reduced at the time of interest payment.

There are always obligation for the debt payment which leads to effective cash control

management.

Disadvantages:-

Due to non payment by debtors, risk factor is being increased.

If the business fails, then the lenders have first claim on funds.

Regular repayments of both interest and principal.

Friends and Family:-

In the event that individual not getting both value and obligations, as per budget then following

stage is to approach family,friends for their start up. Under this, entrepreneur get fund on simple

terms and instalment commitment is some way or another liberal as contrast with above both

financing (Li, Mobin and Keyser, 2016).

Advantages:-

Burden of risk is being minimised due to less interference by lender.

Amount of finance is being used by owner with full confidence at any business and thus

can have better chances of expected outcomes.

Their is no cost to utilising this fund in terms of an interest rate.

No need to fulfil legal obligation as compare to equity and debts.

Disadvantages:-

There are limited amount of funds available for an entrepreneur while starting up of new

business.

Sometime borrowing from family, friends create conflicts in long term relationship.

There is limited knowledge of market which entrepreneur possess and this can hamper

the process of business.

Business angel investor

The angel investor is an individual who have high net worth and they provide monetary

support to establish a new venture. Angel investor provide funds to a new business to support

them in their early stage.

Advantage:

7

Funds increment leads to more profits and earnings.

Tax is being reduced at the time of interest payment.

There are always obligation for the debt payment which leads to effective cash control

management.

Disadvantages:-

Due to non payment by debtors, risk factor is being increased.

If the business fails, then the lenders have first claim on funds.

Regular repayments of both interest and principal.

Friends and Family:-

In the event that individual not getting both value and obligations, as per budget then following

stage is to approach family,friends for their start up. Under this, entrepreneur get fund on simple

terms and instalment commitment is some way or another liberal as contrast with above both

financing (Li, Mobin and Keyser, 2016).

Advantages:-

Burden of risk is being minimised due to less interference by lender.

Amount of finance is being used by owner with full confidence at any business and thus

can have better chances of expected outcomes.

Their is no cost to utilising this fund in terms of an interest rate.

No need to fulfil legal obligation as compare to equity and debts.

Disadvantages:-

There are limited amount of funds available for an entrepreneur while starting up of new

business.

Sometime borrowing from family, friends create conflicts in long term relationship.

There is limited knowledge of market which entrepreneur possess and this can hamper

the process of business.

Business angel investor

The angel investor is an individual who have high net worth and they provide monetary

support to establish a new venture. Angel investor provide funds to a new business to support

them in their early stage.

Advantage:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Angel investor built a business from its initial stage till its development stage.

These types of investment is beneficial because angel investor require less rate of returns.

Disadvantage

Angel investor provide business one time investment to a new business. So to raise more funds

entrepreneur has to deal with more persons.

As it is a new start up for a business so in these case investor have high risk to loss it money.

Crowd funding

It is the collection of small amount of funds from large number of individuals for a new

venture. This collection can be done through website or by network of people.

Advantages

To start a crowd funding, individual does not need any special qualification.

Crown funding is easy to start because in these there is no need of presentation nor a business

plan is required.

Disadvantage

In the crowd funding entrepreneur interact with different numbers of people. So at time convince

or sharing idea with large number of people important information can be leaked and rumours

are generated in regard to company information.

Venture capital

In the venture capital investor provide funds to small companies. Venture capital include

support in monetary terms as well in technical and managerial support also. From the past few

years venture capital is increasing because by it company easily raise funds.

Advantages

Venture capitalist provide support to companies in different ways. Like by they provide

financial support and expertise advise to different companies.

Disadvantage

The drawback that is the major loss of Venture capital is that when venture capitalist

provide funds to a start up then company has to loose some share. So they hold the power to take

decision.

M2

There are various sources of funding through which a business can arrange funds and can

start up the business process. Various ways can be like issuing of equity share, bank loan or it

8

These types of investment is beneficial because angel investor require less rate of returns.

Disadvantage

Angel investor provide business one time investment to a new business. So to raise more funds

entrepreneur has to deal with more persons.

As it is a new start up for a business so in these case investor have high risk to loss it money.

Crowd funding

It is the collection of small amount of funds from large number of individuals for a new

venture. This collection can be done through website or by network of people.

Advantages

To start a crowd funding, individual does not need any special qualification.

Crown funding is easy to start because in these there is no need of presentation nor a business

plan is required.

Disadvantage

In the crowd funding entrepreneur interact with different numbers of people. So at time convince

or sharing idea with large number of people important information can be leaked and rumours

are generated in regard to company information.

Venture capital

In the venture capital investor provide funds to small companies. Venture capital include

support in monetary terms as well in technical and managerial support also. From the past few

years venture capital is increasing because by it company easily raise funds.

Advantages

Venture capitalist provide support to companies in different ways. Like by they provide

financial support and expertise advise to different companies.

Disadvantage

The drawback that is the major loss of Venture capital is that when venture capitalist

provide funds to a start up then company has to loose some share. So they hold the power to take

decision.

M2

There are various sources of funding through which a business can arrange funds and can

start up the business process. Various ways can be like issuing of equity share, bank loan or it

8

can be from relatives. These kind of ways are most chosen by the new company who wants go

set up their footmark in marketplace (MacLeod, 2013). For Zirra, as it is medium size company,

it can opt for Equity share as this will be suitable way as there are number of benefits which are

being availed like no interest, time effective strategies, returning money only after getting profit

and many others.

D2

According to Burton, (2010) , Zirra has adopted most effective techniques for arranging

some funds and that is issuing up of equity shares through which company can obtain enough

funds for stepping up in new marketplace. There are some barriers while adopting this kind of

way for arranging funds like this process is time consuming, costlier, riskier and investors who

are buying up shares can create some obstacles as in legal issues.

TASK 3

P4 Formulation of business plan for growth with financial and strategic objectives of scaling up

There are some companies which are running in marketplace and are focusing on

planning which is being done for constructing of legal statements by which aims and objectives

can be attained in effective and efficient manner. There are number of impacts while processing

the plans and strategies and all the impacts are being obtained through dynamic nature of

environment which changes on regular interval of time. Plans and strategies should be flexible in

nature so that success can be obtained within marketplace. In order to gain competitive

advantage, managers needs to make effective planning in marketing and thin turn will also help

in bringing sustainability (Mitchelmore and Rowley, 2013). The motive behind formulating of

marketing plan to provide certain changes in existing products so that large number of customers

can be grabbed along with market share. Some of the objective is as follow:

The first objective for a finance company is to keep accurate records. It includes all

factors such as tax, debt and future plans.

To maintain the cash flow and fund flow for the whole year. It help to record all the bills

and earn revenues that take place in the whole year of company.

For overtaking the advantages that help company to maintain their customer service.

To develop the wider range of products from its competitor.

9

set up their footmark in marketplace (MacLeod, 2013). For Zirra, as it is medium size company,

it can opt for Equity share as this will be suitable way as there are number of benefits which are

being availed like no interest, time effective strategies, returning money only after getting profit

and many others.

D2

According to Burton, (2010) , Zirra has adopted most effective techniques for arranging

some funds and that is issuing up of equity shares through which company can obtain enough

funds for stepping up in new marketplace. There are some barriers while adopting this kind of

way for arranging funds like this process is time consuming, costlier, riskier and investors who

are buying up shares can create some obstacles as in legal issues.

TASK 3

P4 Formulation of business plan for growth with financial and strategic objectives of scaling up

There are some companies which are running in marketplace and are focusing on

planning which is being done for constructing of legal statements by which aims and objectives

can be attained in effective and efficient manner. There are number of impacts while processing

the plans and strategies and all the impacts are being obtained through dynamic nature of

environment which changes on regular interval of time. Plans and strategies should be flexible in

nature so that success can be obtained within marketplace. In order to gain competitive

advantage, managers needs to make effective planning in marketing and thin turn will also help

in bringing sustainability (Mitchelmore and Rowley, 2013). The motive behind formulating of

marketing plan to provide certain changes in existing products so that large number of customers

can be grabbed along with market share. Some of the objective is as follow:

The first objective for a finance company is to keep accurate records. It includes all

factors such as tax, debt and future plans.

To maintain the cash flow and fund flow for the whole year. It help to record all the bills

and earn revenues that take place in the whole year of company.

For overtaking the advantages that help company to maintain their customer service.

To develop the wider range of products from its competitor.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.