Analysis and Improvement of Zylla Company's Accounting System

VerifiedAdded on 2024/05/17

|20

|4415

|472

Report

AI Summary

This assignment focuses on improving the management accounting system of Zylla Company, addressing the benefits of management accounting, various costing techniques, and their impact on profitability. It covers management accounting reporting methods and evaluates the advantages and disadvantages of planning tools, particularly in budgetary control. The report includes applications for budget preparation and how management accounting systems respond to financial challenges. Furthermore, it integrates management accounting systems and reporting into Zylla Company's organizational context, including cost and sales reports, budget reports, investment appraisal reports, and divisional/segmental reports. Cost analysis is performed using marginal and absorption costing, and the implications of these methods are discussed. Inventory management and variance analysis are also examined as part of the budgetary control process.

Improving Zylla Company management accounting system

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction....................................................................................................................................3

LO1..................................................................................................................................................4

P1.................................................................................................................................................4

P2.................................................................................................................................................5

M1............................................................................................................................................7

D1............................................................................................................................................8

LO2..................................................................................................................................................9

P3.................................................................................................................................................9

LO3................................................................................................................................................11

P4...............................................................................................................................................11

M3..........................................................................................................................................13

LO4................................................................................................................................................14

P5...............................................................................................................................................14

M4..........................................................................................................................................15

D3..........................................................................................................................................16

Conclusion....................................................................................................................................17

References.....................................................................................................................................18

2

Introduction....................................................................................................................................3

LO1..................................................................................................................................................4

P1.................................................................................................................................................4

P2.................................................................................................................................................5

M1............................................................................................................................................7

D1............................................................................................................................................8

LO2..................................................................................................................................................9

P3.................................................................................................................................................9

LO3................................................................................................................................................11

P4...............................................................................................................................................11

M3..........................................................................................................................................13

LO4................................................................................................................................................14

P5...............................................................................................................................................14

M4..........................................................................................................................................15

D3..........................................................................................................................................16

Conclusion....................................................................................................................................17

References.....................................................................................................................................18

2

Introduction

The assignment includes the Zylla Company which has gone through many changes and need to

review existing system. The assignment consists of the benefits that management accounting

have in the organization. There is the inclusion of the various costing techniques and effect of the

same on the profitability of the company. The various management accounting reporting

methods are also stated in the assignment of the company. The various advantages and

disadvantages that planning tools have in the organization are also stated related to the budgetary

control. The applications of the same for preparation of the budgets are also stated in the

assignment. The ways through which management accounting systems and planning tools are

able to respond to the financial problem and achieve the sustainable success is also stated. There

is also the inclusion of how the management accounting system and reporting are integrated into

an organizational context.

3

The assignment includes the Zylla Company which has gone through many changes and need to

review existing system. The assignment consists of the benefits that management accounting

have in the organization. There is the inclusion of the various costing techniques and effect of the

same on the profitability of the company. The various management accounting reporting

methods are also stated in the assignment of the company. The various advantages and

disadvantages that planning tools have in the organization are also stated related to the budgetary

control. The applications of the same for preparation of the budgets are also stated in the

assignment. The ways through which management accounting systems and planning tools are

able to respond to the financial problem and achieve the sustainable success is also stated. There

is also the inclusion of how the management accounting system and reporting are integrated into

an organizational context.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LO1

P1. Explain management accounting and give the essential requirements for different types

of management accounting.

The management accounting is an internal function which is used by the managers to develop the

information for an effective and efficient decision making. The management accounting is a tool

to achieve the goals and objectives that are being established with the help of formulation of

reports, analysis of the data and the cost involved in the operation. The management accounting

is flexible and the use of same depends upon company to company as per the requirement.

Management Accounting is very useful for an organization because of the following reasons:-

Reduction in the Expenses – Management accounting helps in reducing the cost expenses that

are incurred by the organization. It is important that there is a regular improvement in reduction

of cost by the managers to sustain in the market and increase the profitability. The managers of

Zylla Company can analyze the cost that is being incurred during an operation and analyze the

reason for any deviations and take preventive steps to overcome them. The company can analyze

whether the resources available are utilized effectively and try to minimize any overhead cost of

the company.

Facilitates the decision making – The management accounting is essential in the decision

making of the company. The Zylla Company can take various decisions depending on the

quantitative data that are available to them. The company can analyze the data that is being

recorded and review the prospect of each available option and then take the decision accordingly.

Increase in financial returns – The financial returns can be increased by effective forecasting

of the factors that are surrounding the organization and take steps accordingly. Zylla Company

can analyze the market trends, demands and other factors to meet the demand of the customers.

The company can grab the available opportunities and safeguard from any threats that can affect

organization profitability resulting in an increase in the financial returns.

4

P1. Explain management accounting and give the essential requirements for different types

of management accounting.

The management accounting is an internal function which is used by the managers to develop the

information for an effective and efficient decision making. The management accounting is a tool

to achieve the goals and objectives that are being established with the help of formulation of

reports, analysis of the data and the cost involved in the operation. The management accounting

is flexible and the use of same depends upon company to company as per the requirement.

Management Accounting is very useful for an organization because of the following reasons:-

Reduction in the Expenses – Management accounting helps in reducing the cost expenses that

are incurred by the organization. It is important that there is a regular improvement in reduction

of cost by the managers to sustain in the market and increase the profitability. The managers of

Zylla Company can analyze the cost that is being incurred during an operation and analyze the

reason for any deviations and take preventive steps to overcome them. The company can analyze

whether the resources available are utilized effectively and try to minimize any overhead cost of

the company.

Facilitates the decision making – The management accounting is essential in the decision

making of the company. The Zylla Company can take various decisions depending on the

quantitative data that are available to them. The company can analyze the data that is being

recorded and review the prospect of each available option and then take the decision accordingly.

Increase in financial returns – The financial returns can be increased by effective forecasting

of the factors that are surrounding the organization and take steps accordingly. Zylla Company

can analyze the market trends, demands and other factors to meet the demand of the customers.

The company can grab the available opportunities and safeguard from any threats that can affect

organization profitability resulting in an increase in the financial returns.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

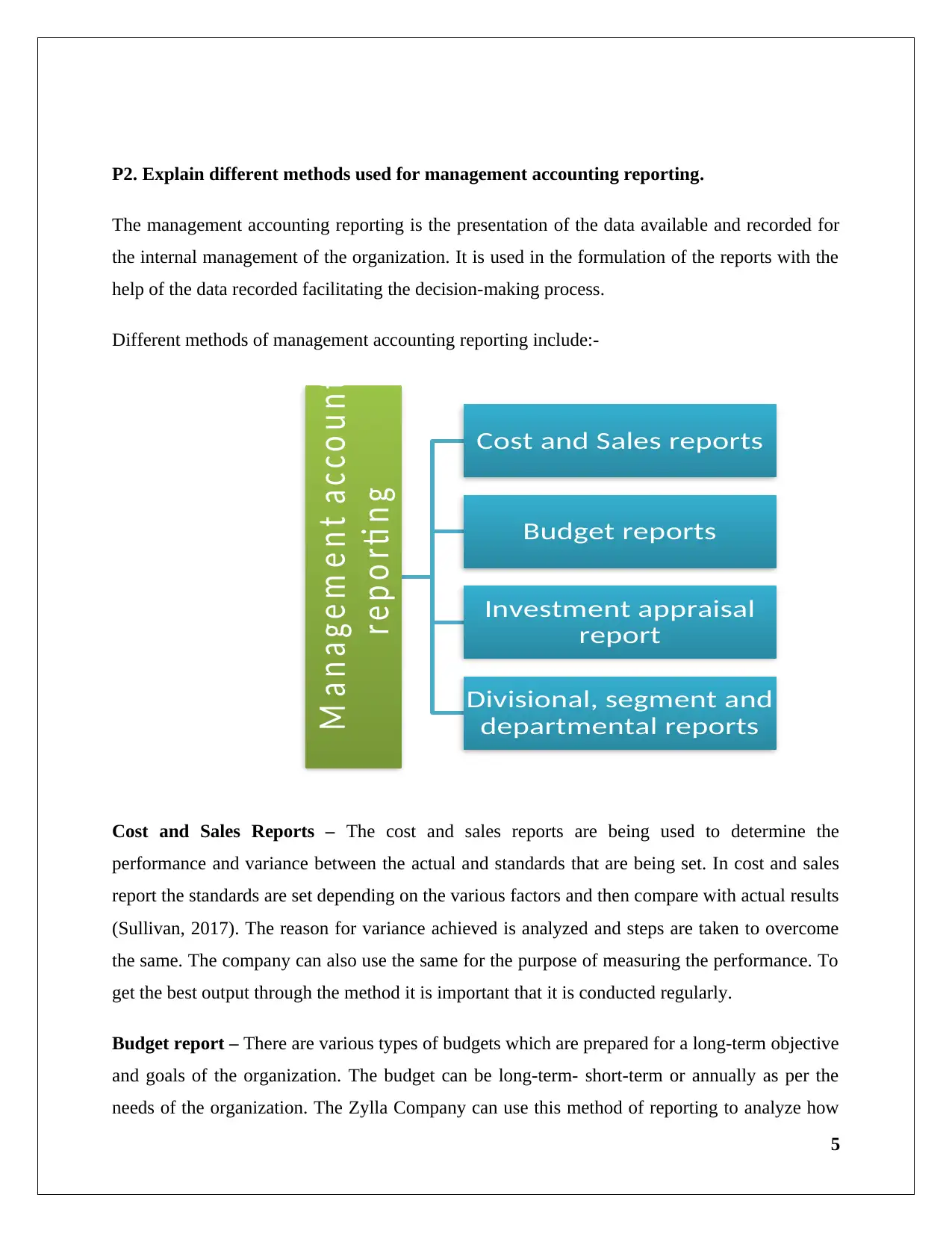

P2. Explain different methods used for management accounting reporting.

The management accounting reporting is the presentation of the data available and recorded for

the internal management of the organization. It is used in the formulation of the reports with the

help of the data recorded facilitating the decision-making process.

Different methods of management accounting reporting include:-

Cost and Sales Reports – The cost and sales reports are being used to determine the

performance and variance between the actual and standards that are being set. In cost and sales

report the standards are set depending on the various factors and then compare with actual results

(Sullivan, 2017). The reason for variance achieved is analyzed and steps are taken to overcome

the same. The company can also use the same for the purpose of measuring the performance. To

get the best output through the method it is important that it is conducted regularly.

Budget report – There are various types of budgets which are prepared for a long-term objective

and goals of the organization. The budget can be long-term- short-term or annually as per the

needs of the organization. The Zylla Company can use this method of reporting to analyze how

5

M a n a g e m e n t a c c o u n ti n g

r e p o r ti n g

Cost and Sales reports

Budget reports

Investment appraisal

report

Divisional, segment and

departmental reports

The management accounting reporting is the presentation of the data available and recorded for

the internal management of the organization. It is used in the formulation of the reports with the

help of the data recorded facilitating the decision-making process.

Different methods of management accounting reporting include:-

Cost and Sales Reports – The cost and sales reports are being used to determine the

performance and variance between the actual and standards that are being set. In cost and sales

report the standards are set depending on the various factors and then compare with actual results

(Sullivan, 2017). The reason for variance achieved is analyzed and steps are taken to overcome

the same. The company can also use the same for the purpose of measuring the performance. To

get the best output through the method it is important that it is conducted regularly.

Budget report – There are various types of budgets which are prepared for a long-term objective

and goals of the organization. The budget can be long-term- short-term or annually as per the

needs of the organization. The Zylla Company can use this method of reporting to analyze how

5

M a n a g e m e n t a c c o u n ti n g

r e p o r ti n g

Cost and Sales reports

Budget reports

Investment appraisal

report

Divisional, segment and

departmental reports

effective the company is able to achieve the goals and objectives that are being set (Henttu-Aho,

and Järvinen, 2013).

Investment appraisal report – The long-term investment projects requires a lot of funds and

inefficiency while taking the decision can result in heavy losses. The Investment appraisal report

can be helpful for the Zylla Company in selecting the best alternative that is most profitable for

the company (Sartori, et. al., 2014).

Divisional, Segment and Departmental reports – The other methods used for the management

reporting are the reports on the basis of the division, segment, and department in the

organization. The Zylla Company can use this method to check the efficiency and effectiveness

of each of the operations that are being carried out by the company (Ingram, 2017).

6

and Järvinen, 2013).

Investment appraisal report – The long-term investment projects requires a lot of funds and

inefficiency while taking the decision can result in heavy losses. The Investment appraisal report

can be helpful for the Zylla Company in selecting the best alternative that is most profitable for

the company (Sartori, et. al., 2014).

Divisional, Segment and Departmental reports – The other methods used for the management

reporting are the reports on the basis of the division, segment, and department in the

organization. The Zylla Company can use this method to check the efficiency and effectiveness

of each of the operations that are being carried out by the company (Ingram, 2017).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

M1. Evaluate the benefits of management accounting systems and their application within

an organizational context.

The management accounting systems are used to record the data and presentation of the same for

the managerial decision making. The benefits of the Management accounting systems are as

follows:-

Quicker and Cheaper – The application of the management accounting system in an

organization leads to quicker completion of the work and also is cheaper than other resources or

manual work. The data can be recorded more quickly due to ease in the process.

Facilitate production process – The management accounting systems helps in the production

process. It helps in determining the process which is best suitable for the organization and also

with respect to the cost involved. The reporting helps the managers in the decision making of the

company (Guinea, 2016).

Processing and recording in real time – The processing and recording is done in the real time

in management accounting system thus helping the managers to be up to date with the data that

is recording. The availability of the data helps in various decision making related to the

operational process (Leitner, and Wall, 2015).

Increase in efficiency, productivity and effectiveness – The application of the management

accounting system results in an increase in the efficiency, productivity, and effectiveness as it

eases the process. The management can analyze the report in the real-time and take advantage of

it. It is lot quicker which increases the productivity and efficiency of the company as the

resources available are used to the fullest (Guinea, 2016).

7

an organizational context.

The management accounting systems are used to record the data and presentation of the same for

the managerial decision making. The benefits of the Management accounting systems are as

follows:-

Quicker and Cheaper – The application of the management accounting system in an

organization leads to quicker completion of the work and also is cheaper than other resources or

manual work. The data can be recorded more quickly due to ease in the process.

Facilitate production process – The management accounting systems helps in the production

process. It helps in determining the process which is best suitable for the organization and also

with respect to the cost involved. The reporting helps the managers in the decision making of the

company (Guinea, 2016).

Processing and recording in real time – The processing and recording is done in the real time

in management accounting system thus helping the managers to be up to date with the data that

is recording. The availability of the data helps in various decision making related to the

operational process (Leitner, and Wall, 2015).

Increase in efficiency, productivity and effectiveness – The application of the management

accounting system results in an increase in the efficiency, productivity, and effectiveness as it

eases the process. The management can analyze the report in the real-time and take advantage of

it. It is lot quicker which increases the productivity and efficiency of the company as the

resources available are used to the fullest (Guinea, 2016).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D1. Provide a critical evaluation of how management accounting systems and management

accounting reporting are integrated into organizational processes.

The management accounting system and reporting go hand in hand in an organization. They are

integrated into the organizational process as they are supportive of each other. It can be

understood as follows:-

Recording of the Data – The management accounting system is a tool to record all the

transaction that is carried out. There is a recording of the data in the real-time which is important

for the formulation of the data. The data recorded is important for the reporting of it.

Formulation of reports – The formulation of the report is done by the management accounting

reporting which can be used only if the data recorded is true and actual which is only possible

with the help of error-free recording that can be executed in the management accounting

systems.

Analysis of data – The analysis of the data is possible for the managers if there is the proper

formulation of the reports. It is not enough to just record the data. It is important that the

information is readable, understandable and can be analyzed which is possible only through the

management accounting reporting.

Presentation of the work – The presentation of work is important as the decision making is

dependent upon the reports that are being finalized. The system and reporting help in providing a

complete presentation of the data which can be analyzed and the decision can be taken by the

management.

8

accounting reporting are integrated into organizational processes.

The management accounting system and reporting go hand in hand in an organization. They are

integrated into the organizational process as they are supportive of each other. It can be

understood as follows:-

Recording of the Data – The management accounting system is a tool to record all the

transaction that is carried out. There is a recording of the data in the real-time which is important

for the formulation of the data. The data recorded is important for the reporting of it.

Formulation of reports – The formulation of the report is done by the management accounting

reporting which can be used only if the data recorded is true and actual which is only possible

with the help of error-free recording that can be executed in the management accounting

systems.

Analysis of data – The analysis of the data is possible for the managers if there is the proper

formulation of the reports. It is not enough to just record the data. It is important that the

information is readable, understandable and can be analyzed which is possible only through the

management accounting reporting.

Presentation of the work – The presentation of work is important as the decision making is

dependent upon the reports that are being finalized. The system and reporting help in providing a

complete presentation of the data which can be analyzed and the decision can be taken by the

management.

8

LO2

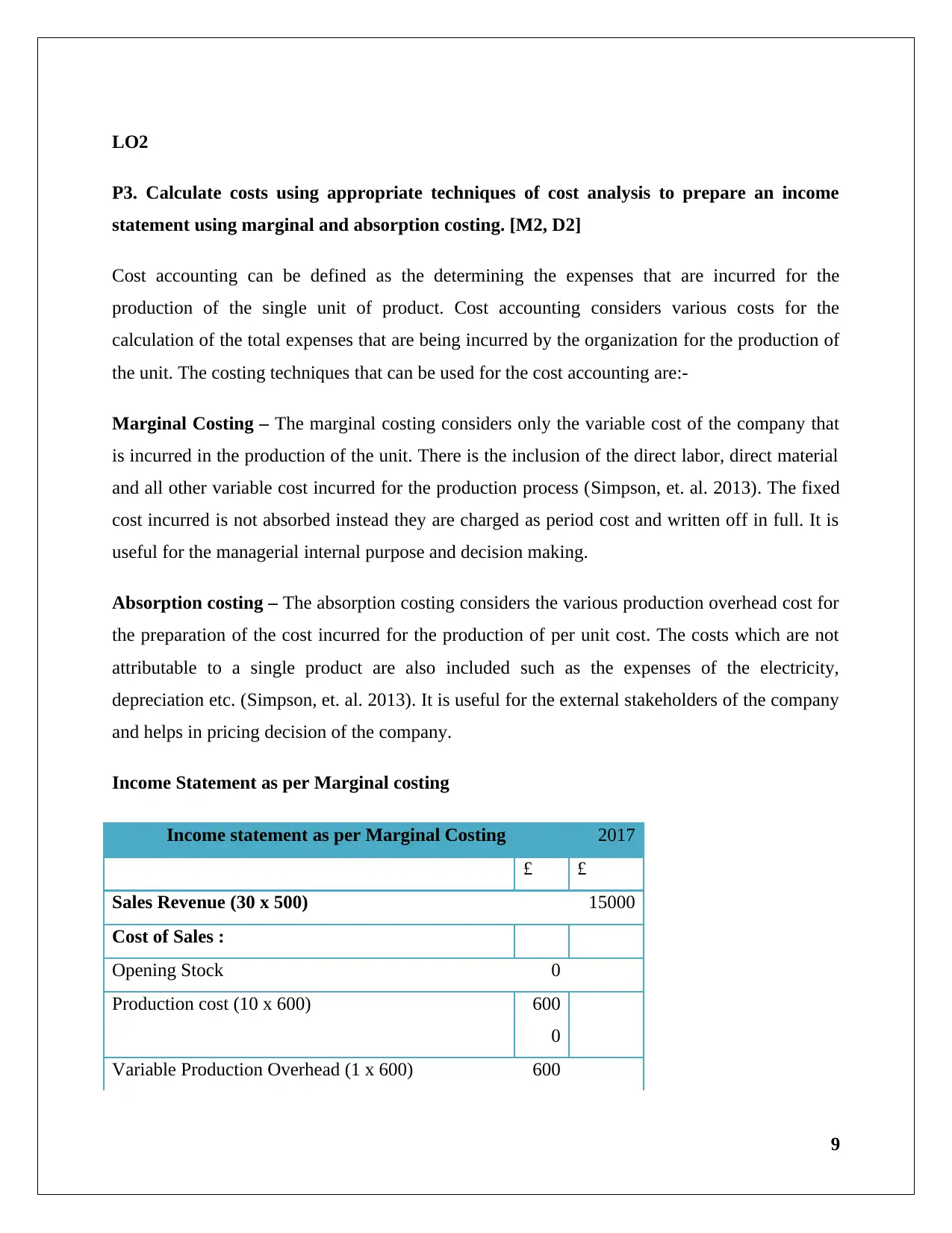

P3. Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costing. [M2, D2]

Cost accounting can be defined as the determining the expenses that are incurred for the

production of the single unit of product. Cost accounting considers various costs for the

calculation of the total expenses that are being incurred by the organization for the production of

the unit. The costing techniques that can be used for the cost accounting are:-

Marginal Costing – The marginal costing considers only the variable cost of the company that

is incurred in the production of the unit. There is the inclusion of the direct labor, direct material

and all other variable cost incurred for the production process (Simpson, et. al. 2013). The fixed

cost incurred is not absorbed instead they are charged as period cost and written off in full. It is

useful for the managerial internal purpose and decision making.

Absorption costing – The absorption costing considers the various production overhead cost for

the preparation of the cost incurred for the production of per unit cost. The costs which are not

attributable to a single product are also included such as the expenses of the electricity,

depreciation etc. (Simpson, et. al. 2013). It is useful for the external stakeholders of the company

and helps in pricing decision of the company.

Income Statement as per Marginal costing

Income statement as per Marginal Costing 2017

£ £

Sales Revenue (30 x 500) 15000

Cost of Sales :

Opening Stock 0

Production cost (10 x 600) 600

0

Variable Production Overhead (1 x 600) 600

9

P3. Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costing. [M2, D2]

Cost accounting can be defined as the determining the expenses that are incurred for the

production of the single unit of product. Cost accounting considers various costs for the

calculation of the total expenses that are being incurred by the organization for the production of

the unit. The costing techniques that can be used for the cost accounting are:-

Marginal Costing – The marginal costing considers only the variable cost of the company that

is incurred in the production of the unit. There is the inclusion of the direct labor, direct material

and all other variable cost incurred for the production process (Simpson, et. al. 2013). The fixed

cost incurred is not absorbed instead they are charged as period cost and written off in full. It is

useful for the managerial internal purpose and decision making.

Absorption costing – The absorption costing considers the various production overhead cost for

the preparation of the cost incurred for the production of per unit cost. The costs which are not

attributable to a single product are also included such as the expenses of the electricity,

depreciation etc. (Simpson, et. al. 2013). It is useful for the external stakeholders of the company

and helps in pricing decision of the company.

Income Statement as per Marginal costing

Income statement as per Marginal Costing 2017

£ £

Sales Revenue (30 x 500) 15000

Cost of Sales :

Opening Stock 0

Production cost (10 x 600) 600

0

Variable Production Overhead (1 x 600) 600

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

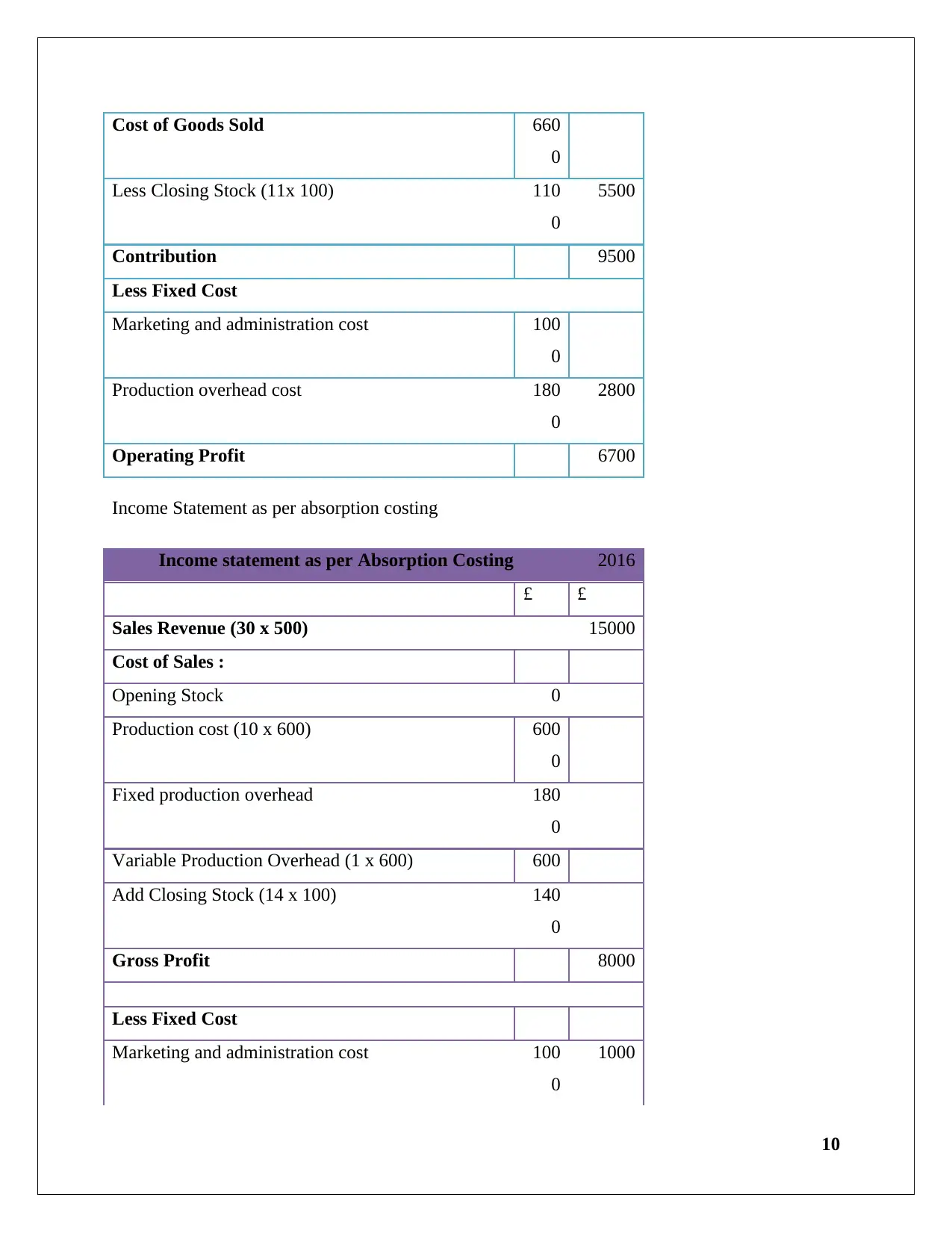

Cost of Goods Sold 660

0

Less Closing Stock (11x 100) 110

0

5500

Contribution 9500

Less Fixed Cost

Marketing and administration cost 100

0

Production overhead cost 180

0

2800

Operating Profit 6700

Income Statement as per absorption costing

Income statement as per Absorption Costing 2016

£ £

Sales Revenue (30 x 500) 15000

Cost of Sales :

Opening Stock 0

Production cost (10 x 600) 600

0

Fixed production overhead 180

0

Variable Production Overhead (1 x 600) 600

Add Closing Stock (14 x 100) 140

0

Gross Profit 8000

Less Fixed Cost

Marketing and administration cost 100

0

1000

10

0

Less Closing Stock (11x 100) 110

0

5500

Contribution 9500

Less Fixed Cost

Marketing and administration cost 100

0

Production overhead cost 180

0

2800

Operating Profit 6700

Income Statement as per absorption costing

Income statement as per Absorption Costing 2016

£ £

Sales Revenue (30 x 500) 15000

Cost of Sales :

Opening Stock 0

Production cost (10 x 600) 600

0

Fixed production overhead 180

0

Variable Production Overhead (1 x 600) 600

Add Closing Stock (14 x 100) 140

0

Gross Profit 8000

Less Fixed Cost

Marketing and administration cost 100

0

1000

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

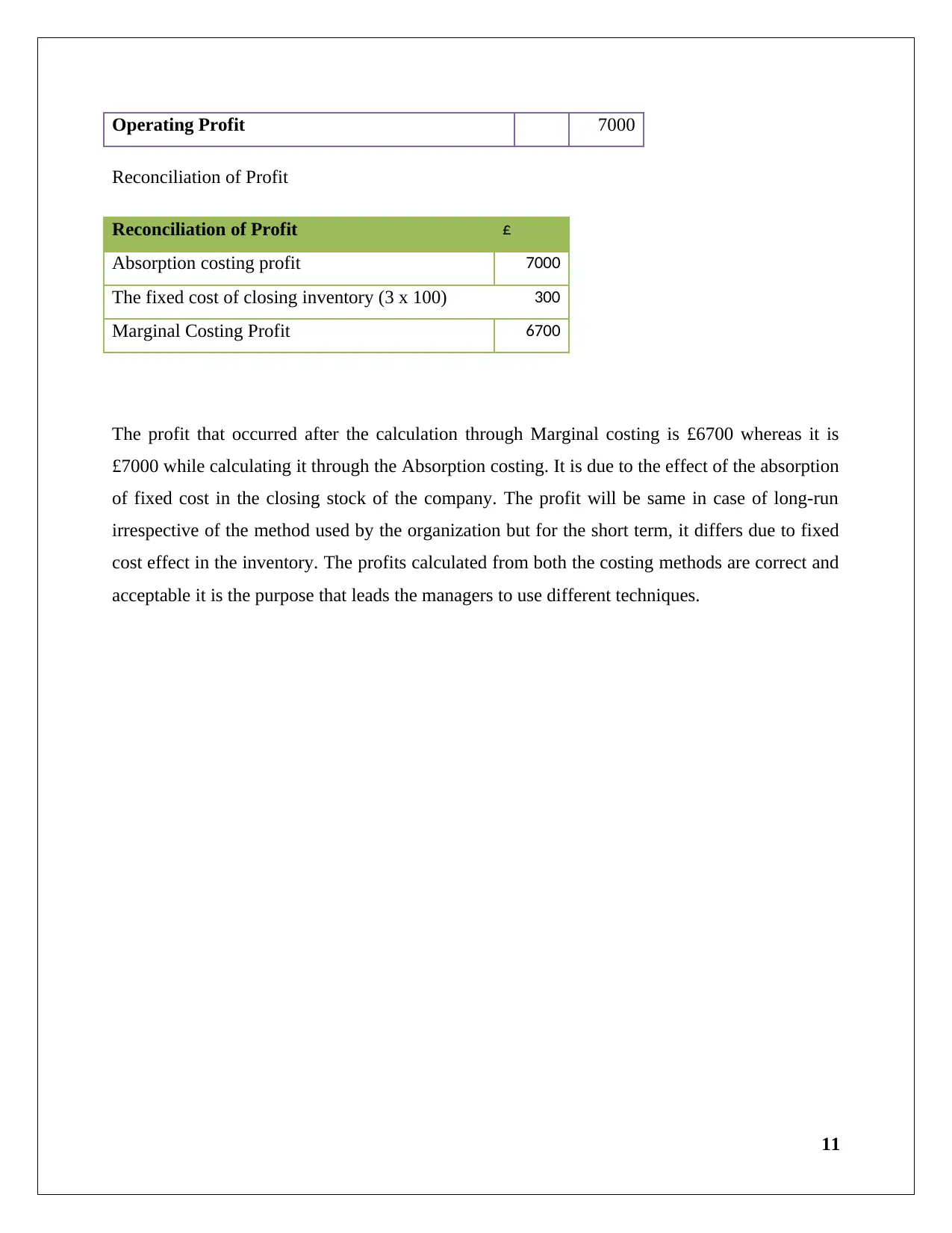

Operating Profit 7000

Reconciliation of Profit

Reconciliation of Profit £

Absorption costing profit 7000

The fixed cost of closing inventory (3 x 100) 300

Marginal Costing Profit 6700

The profit that occurred after the calculation through Marginal costing is £6700 whereas it is

£7000 while calculating it through the Absorption costing. It is due to the effect of the absorption

of fixed cost in the closing stock of the company. The profit will be same in case of long-run

irrespective of the method used by the organization but for the short term, it differs due to fixed

cost effect in the inventory. The profits calculated from both the costing methods are correct and

acceptable it is the purpose that leads the managers to use different techniques.

11

Reconciliation of Profit

Reconciliation of Profit £

Absorption costing profit 7000

The fixed cost of closing inventory (3 x 100) 300

Marginal Costing Profit 6700

The profit that occurred after the calculation through Marginal costing is £6700 whereas it is

£7000 while calculating it through the Absorption costing. It is due to the effect of the absorption

of fixed cost in the closing stock of the company. The profit will be same in case of long-run

irrespective of the method used by the organization but for the short term, it differs due to fixed

cost effect in the inventory. The profits calculated from both the costing methods are correct and

acceptable it is the purpose that leads the managers to use different techniques.

11

LO3

P4. Explain the advantages and disadvantages of different types of planning tools used in

the budgetary control.

The different types of planning tools for budgetary control are as follows:-

Inventory management – The inventory management is an important planning tool that is used

by the budgetary control. The Inventory attracts variable cost which needs to minimize to

increase the profitability of the company.

Advantages

It is helpful in minimizing the variable cost of inventory as well as the ABC analysis helps in

effective management of the inventory in case there is more than one product.

Disadvantage

It can lead to a position of the stock out and delay in the production process if there is not

effective management of the inventory.

Variance analysis – The variance analysis refers to the analysis of the variance which leads to

differentiation in the actual and budgeted results (Lajevardi, 2017).

Advantage

The Variance analysis helps to overcome the reason for the deviation and also in increasing the

efficiency and productivity of the company.

Disadvantage

The variance analysis needs to be done at a regular interval for effectiveness which leads to

wastage of money and time.

12

P4. Explain the advantages and disadvantages of different types of planning tools used in

the budgetary control.

The different types of planning tools for budgetary control are as follows:-

Inventory management – The inventory management is an important planning tool that is used

by the budgetary control. The Inventory attracts variable cost which needs to minimize to

increase the profitability of the company.

Advantages

It is helpful in minimizing the variable cost of inventory as well as the ABC analysis helps in

effective management of the inventory in case there is more than one product.

Disadvantage

It can lead to a position of the stock out and delay in the production process if there is not

effective management of the inventory.

Variance analysis – The variance analysis refers to the analysis of the variance which leads to

differentiation in the actual and budgeted results (Lajevardi, 2017).

Advantage

The Variance analysis helps to overcome the reason for the deviation and also in increasing the

efficiency and productivity of the company.

Disadvantage

The variance analysis needs to be done at a regular interval for effectiveness which leads to

wastage of money and time.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.