Financial Statement Analysis of Vodafone Group

VerifiedAdded on 2023/01/19

|14

|2946

|44

AI Summary

This report assesses the financial performance of Vodafone through ratio analysis and compares it with Deutsche Telekom. It analyzes profitability, liquidity, efficiency, and solvency ratios to determine the company's financial health and competitive position.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

Financial Statement Analysis of Vodafone Group for year 2016 and 2017

Financial Statement Analysis of Vodafone Group for year 2016 and 2017

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

Contents

Introduction......................................................................................................................................3

Task 1: Collection of financial data and ratio calculation for the case company Vodafone and its

competitor Deutsche Telekom.........................................................................................................3

Task 2: Financial Analysis of Vodafone in Comparison to Deutsche Telecom..............................5

Recommendation & Conclusion....................................................................................................11

References......................................................................................................................................12

Appendix........................................................................................................................................13

Contents

Introduction......................................................................................................................................3

Task 1: Collection of financial data and ratio calculation for the case company Vodafone and its

competitor Deutsche Telekom.........................................................................................................3

Task 2: Financial Analysis of Vodafone in Comparison to Deutsche Telecom..............................5

Recommendation & Conclusion....................................................................................................11

References......................................................................................................................................12

Appendix........................................................................................................................................13

3

Introduction

The financial ratio analysis is an adequate technique used in evaluation of the financial

performance of a company and thus determining its financial health in key terms of risk,

profitability, solvency, efficiency and many other aspects. In this context, this report intends to

assess the financial performance of a selected company, that is, Vodafone, a multinational

telecommunication company, through the technique of ratio analysis. The key ratios are

calculated with interpretation of the financial information provided within the financial

statements of the company for the year 2016-2017. The results achieved are interpreted and

compared with its competitor of Deutsche Telekom for examining the competitive position of

Vodafone and implications for future growth. The possible causes for the difference in

performance between Vodafone and its competitor is analyzed for assessing whether Vodafone

should be concerned about its competitor performance.

Task 1: Collection of financial data and ratio calculation for the case company Vodafone

and its competitor Deutsche Telekom

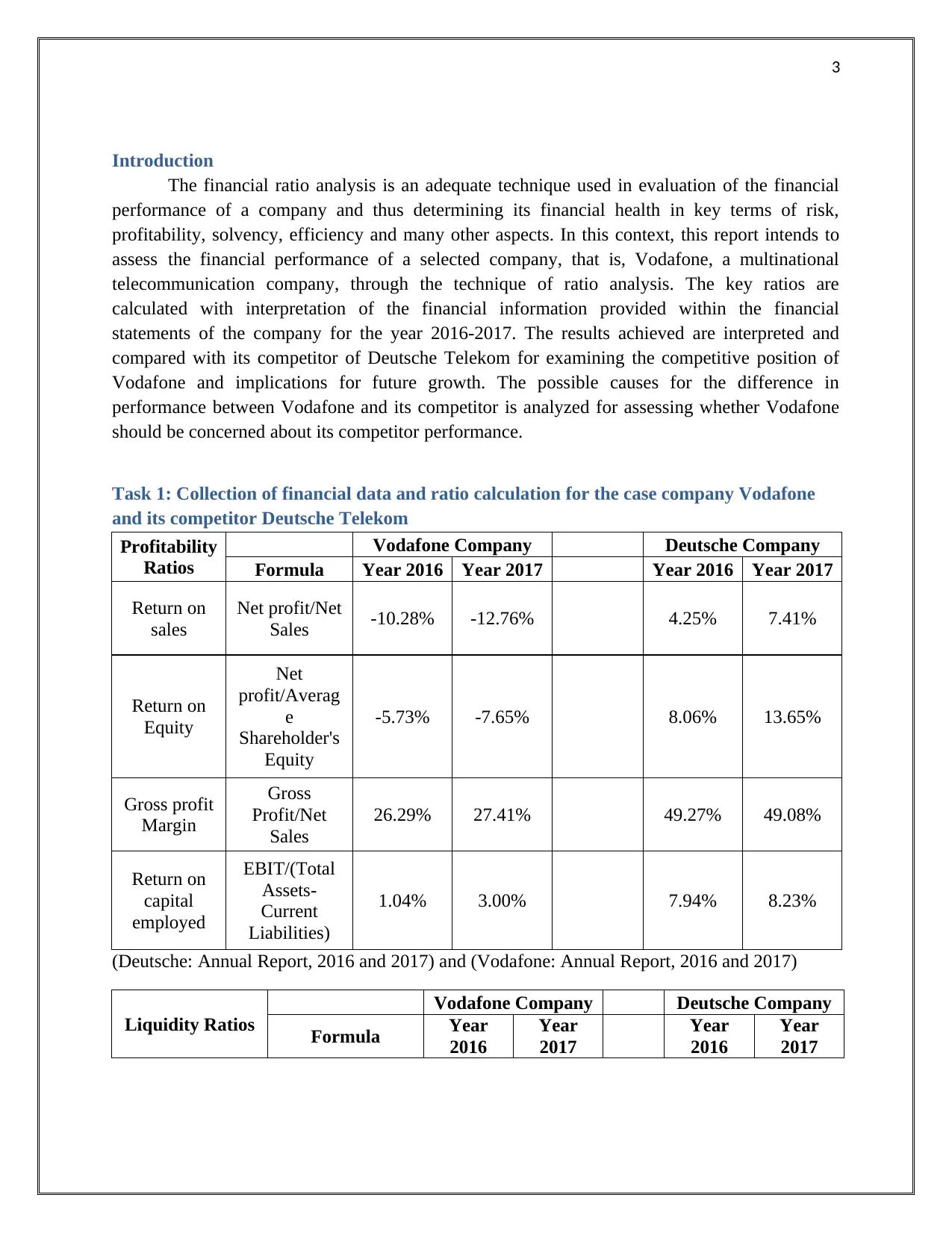

Profitability

Ratios

Vodafone Company Deutsche Company

Formula Year 2016 Year 2017 Year 2016 Year 2017

Return on

sales

Net profit/Net

Sales -10.28% -12.76% 4.25% 7.41%

Return on

Equity

Net

profit/Averag

e

Shareholder's

Equity

-5.73% -7.65% 8.06% 13.65%

Gross profit

Margin

Gross

Profit/Net

Sales

26.29% 27.41% 49.27% 49.08%

Return on

capital

employed

EBIT/(Total

Assets-

Current

Liabilities)

1.04% 3.00% 7.94% 8.23%

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Liquidity Ratios

Vodafone Company Deutsche Company

Formula Year

2016

Year

2017

Year

2016

Year

2017

Introduction

The financial ratio analysis is an adequate technique used in evaluation of the financial

performance of a company and thus determining its financial health in key terms of risk,

profitability, solvency, efficiency and many other aspects. In this context, this report intends to

assess the financial performance of a selected company, that is, Vodafone, a multinational

telecommunication company, through the technique of ratio analysis. The key ratios are

calculated with interpretation of the financial information provided within the financial

statements of the company for the year 2016-2017. The results achieved are interpreted and

compared with its competitor of Deutsche Telekom for examining the competitive position of

Vodafone and implications for future growth. The possible causes for the difference in

performance between Vodafone and its competitor is analyzed for assessing whether Vodafone

should be concerned about its competitor performance.

Task 1: Collection of financial data and ratio calculation for the case company Vodafone

and its competitor Deutsche Telekom

Profitability

Ratios

Vodafone Company Deutsche Company

Formula Year 2016 Year 2017 Year 2016 Year 2017

Return on

sales

Net profit/Net

Sales -10.28% -12.76% 4.25% 7.41%

Return on

Equity

Net

profit/Averag

e

Shareholder's

Equity

-5.73% -7.65% 8.06% 13.65%

Gross profit

Margin

Gross

Profit/Net

Sales

26.29% 27.41% 49.27% 49.08%

Return on

capital

employed

EBIT/(Total

Assets-

Current

Liabilities)

1.04% 3.00% 7.94% 8.23%

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Liquidity Ratios

Vodafone Company Deutsche Company

Formula Year

2016

Year

2017

Year

2016

Year

2017

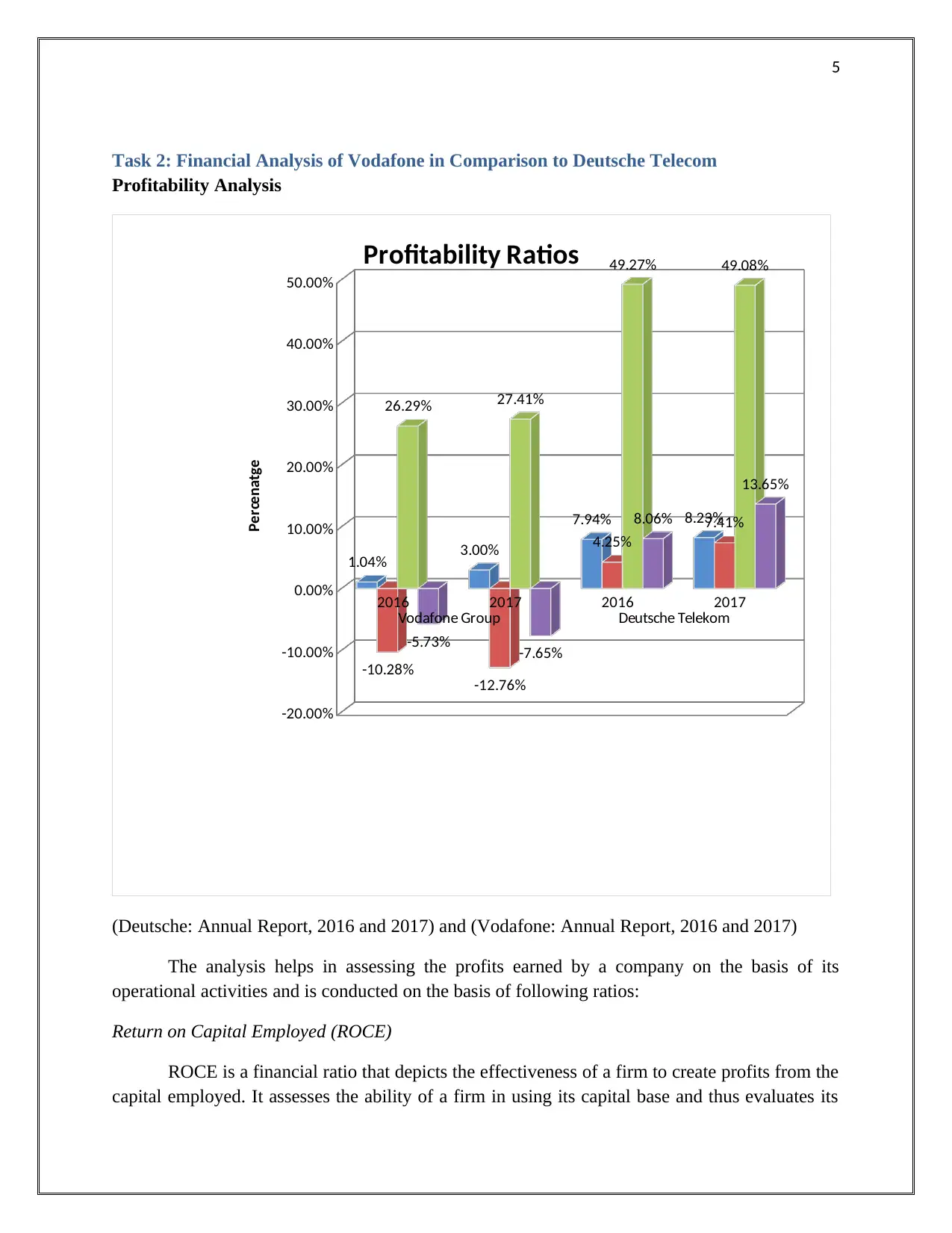

4

Quick Ratio

(Current Assets-

Inventory-Prepaid

Expenses)/Current

Liabilities

0.75 0.82 0.75 0.67

Current Ratio

Current

Assets/Current

Liabilities

0.76 0.83 0.80 0.75

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Efficiency

Ratios

Vodafone Company Deutsche Company

Formula Year

2016

Year

2017

Year

2016

Year

2017

Current trade

payables days

(365/Average

Account

Payables)/Total

Purchases 62.85 72.25 106.59 101.45

Asset

Utilization

Ratio

Net

Sales/Average

Total Assets 0.29 0.29 0.50 0.52

Current trade

receivables

days

(365/Average

Account

Receivables)/Net

Credit Sales 34.84 40.38 46.44 46.47

Stock Days

(365*Average

inventory)/COG

S 6.98 6.82 17.11 17.28

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Solvency

Ratios

Vodafone Company Deutsche Company

Formula Year

2016

Year

2017

Year

2016

Year

2017

Interest

Coverage Ratio

EBIT/Interest

Expenses 0.65 2.65 3.38 3.73

Gearing Ratio

Total

Liabilities/Shareholder

s Equity 98.63% 109.83% 282.25% 232.79%

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Quick Ratio

(Current Assets-

Inventory-Prepaid

Expenses)/Current

Liabilities

0.75 0.82 0.75 0.67

Current Ratio

Current

Assets/Current

Liabilities

0.76 0.83 0.80 0.75

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Efficiency

Ratios

Vodafone Company Deutsche Company

Formula Year

2016

Year

2017

Year

2016

Year

2017

Current trade

payables days

(365/Average

Account

Payables)/Total

Purchases 62.85 72.25 106.59 101.45

Asset

Utilization

Ratio

Net

Sales/Average

Total Assets 0.29 0.29 0.50 0.52

Current trade

receivables

days

(365/Average

Account

Receivables)/Net

Credit Sales 34.84 40.38 46.44 46.47

Stock Days

(365*Average

inventory)/COG

S 6.98 6.82 17.11 17.28

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Solvency

Ratios

Vodafone Company Deutsche Company

Formula Year

2016

Year

2017

Year

2016

Year

2017

Interest

Coverage Ratio

EBIT/Interest

Expenses 0.65 2.65 3.38 3.73

Gearing Ratio

Total

Liabilities/Shareholder

s Equity 98.63% 109.83% 282.25% 232.79%

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

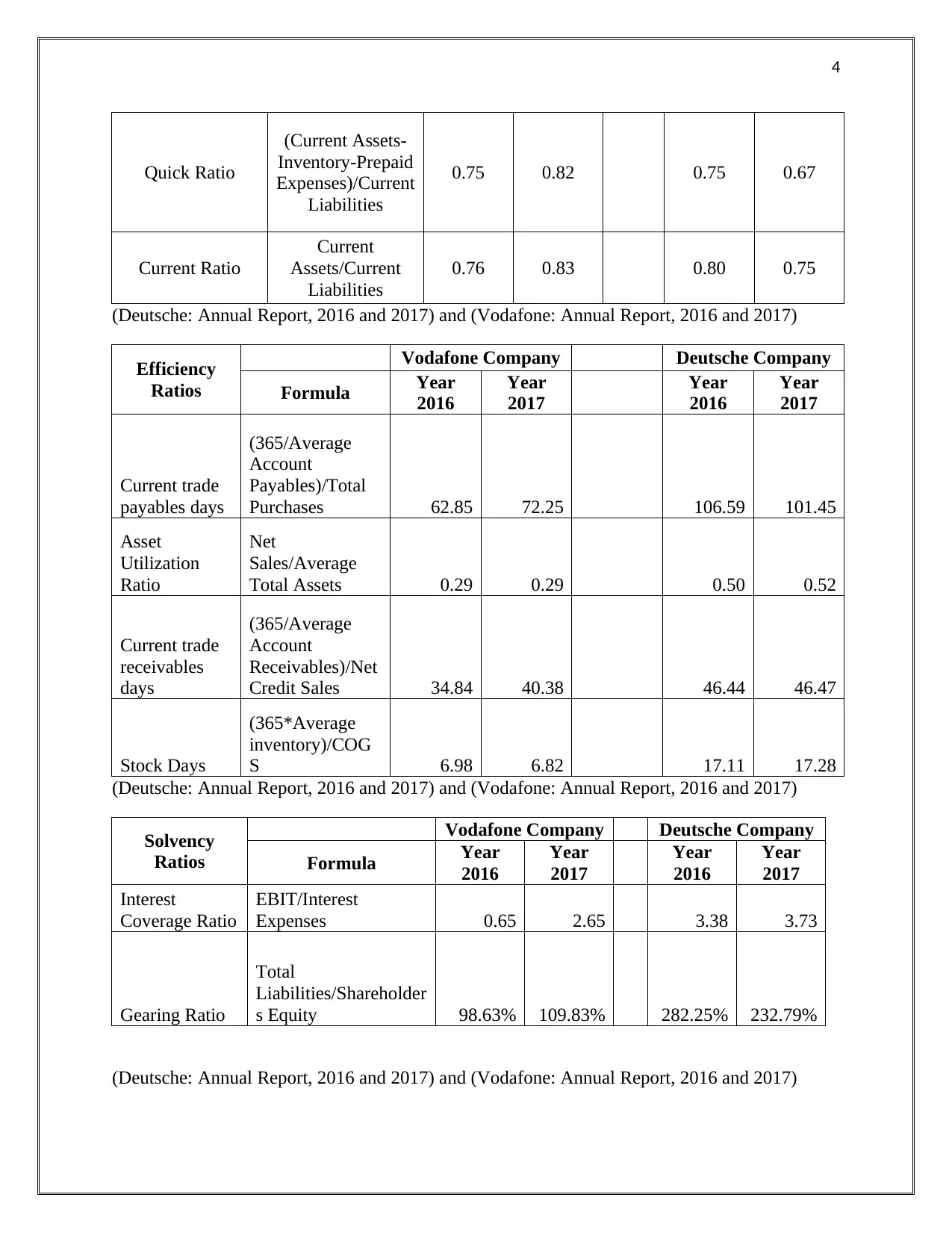

Task 2: Financial Analysis of Vodafone in Comparison to Deutsche Telecom

Profitability Analysis

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

1.04% 3.00%

7.94% 8.23%

-10.28% -12.76%

4.25%

7.41%

26.29% 27.41%

49.27% 49.08%

-5.73% -7.65%

8.06%

13.65%

Profitability Ratios

Percenatge

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

The analysis helps in assessing the profits earned by a company on the basis of its

operational activities and is conducted on the basis of following ratios:

Return on Capital Employed (ROCE)

ROCE is a financial ratio that depicts the effectiveness of a firm to create profits from the

capital employed. It assesses the ability of a firm in using its capital base and thus evaluates its

Task 2: Financial Analysis of Vodafone in Comparison to Deutsche Telecom

Profitability Analysis

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

1.04% 3.00%

7.94% 8.23%

-10.28% -12.76%

4.25%

7.41%

26.29% 27.41%

49.27% 49.08%

-5.73% -7.65%

8.06%

13.65%

Profitability Ratios

Percenatge

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

The analysis helps in assessing the profits earned by a company on the basis of its

operational activities and is conducted on the basis of following ratios:

Return on Capital Employed (ROCE)

ROCE is a financial ratio that depicts the effectiveness of a firm to create profits from the

capital employed. It assesses the ability of a firm in using its capital base and thus evaluates its

6

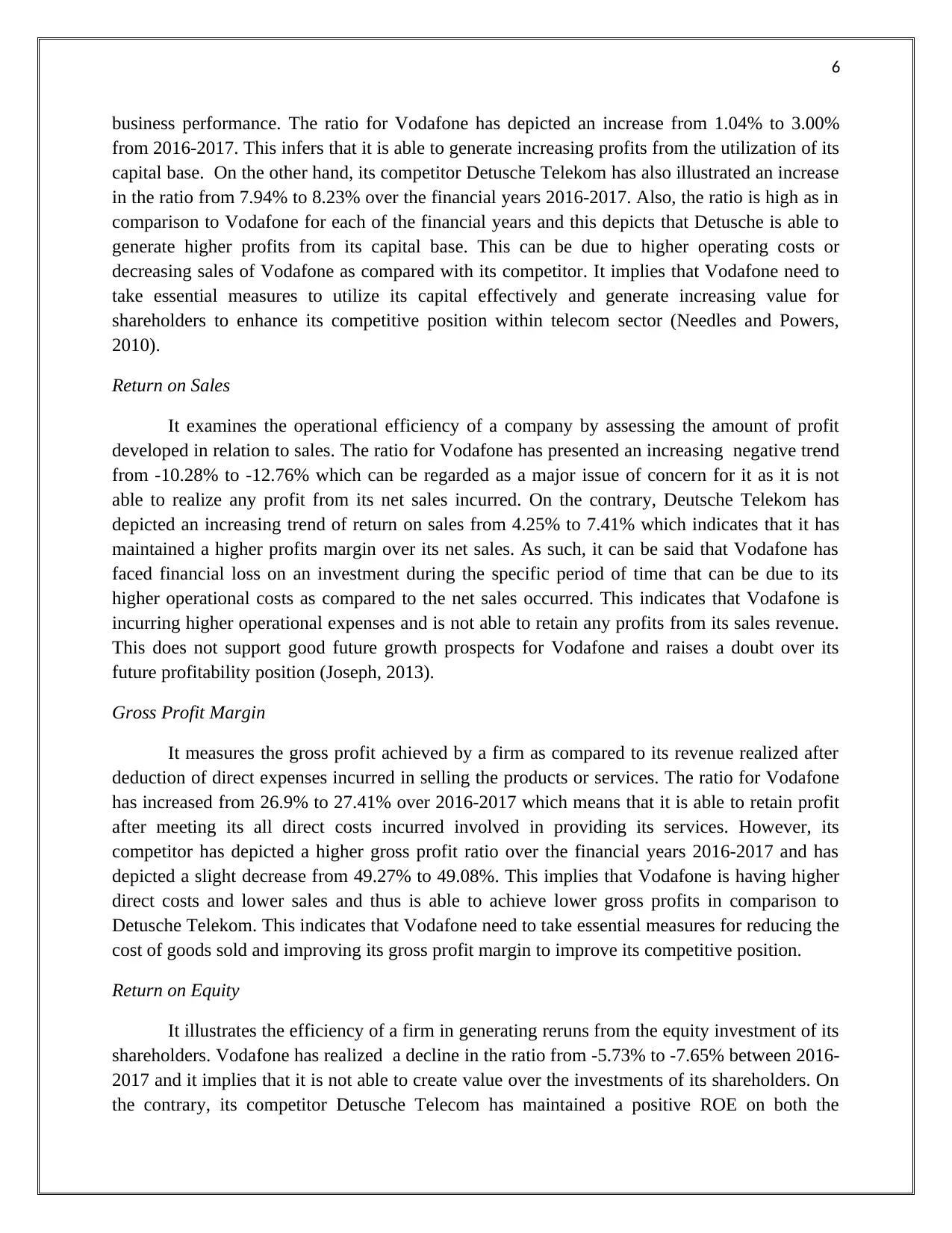

business performance. The ratio for Vodafone has depicted an increase from 1.04% to 3.00%

from 2016-2017. This infers that it is able to generate increasing profits from the utilization of its

capital base. On the other hand, its competitor Detusche Telekom has also illustrated an increase

in the ratio from 7.94% to 8.23% over the financial years 2016-2017. Also, the ratio is high as in

comparison to Vodafone for each of the financial years and this depicts that Detusche is able to

generate higher profits from its capital base. This can be due to higher operating costs or

decreasing sales of Vodafone as compared with its competitor. It implies that Vodafone need to

take essential measures to utilize its capital effectively and generate increasing value for

shareholders to enhance its competitive position within telecom sector (Needles and Powers,

2010).

Return on Sales

It examines the operational efficiency of a company by assessing the amount of profit

developed in relation to sales. The ratio for Vodafone has presented an increasing negative trend

from -10.28% to -12.76% which can be regarded as a major issue of concern for it as it is not

able to realize any profit from its net sales incurred. On the contrary, Deutsche Telekom has

depicted an increasing trend of return on sales from 4.25% to 7.41% which indicates that it has

maintained a higher profits margin over its net sales. As such, it can be said that Vodafone has

faced financial loss on an investment during the specific period of time that can be due to its

higher operational costs as compared to the net sales occurred. This indicates that Vodafone is

incurring higher operational expenses and is not able to retain any profits from its sales revenue.

This does not support good future growth prospects for Vodafone and raises a doubt over its

future profitability position (Joseph, 2013).

Gross Profit Margin

It measures the gross profit achieved by a firm as compared to its revenue realized after

deduction of direct expenses incurred in selling the products or services. The ratio for Vodafone

has increased from 26.9% to 27.41% over 2016-2017 which means that it is able to retain profit

after meeting its all direct costs incurred involved in providing its services. However, its

competitor has depicted a higher gross profit ratio over the financial years 2016-2017 and has

depicted a slight decrease from 49.27% to 49.08%. This implies that Vodafone is having higher

direct costs and lower sales and thus is able to achieve lower gross profits in comparison to

Detusche Telekom. This indicates that Vodafone need to take essential measures for reducing the

cost of goods sold and improving its gross profit margin to improve its competitive position.

Return on Equity

It illustrates the efficiency of a firm in generating reruns from the equity investment of its

shareholders. Vodafone has realized a decline in the ratio from -5.73% to -7.65% between 2016-

2017 and it implies that it is not able to create value over the investments of its shareholders. On

the contrary, its competitor Detusche Telecom has maintained a positive ROE on both the

business performance. The ratio for Vodafone has depicted an increase from 1.04% to 3.00%

from 2016-2017. This infers that it is able to generate increasing profits from the utilization of its

capital base. On the other hand, its competitor Detusche Telekom has also illustrated an increase

in the ratio from 7.94% to 8.23% over the financial years 2016-2017. Also, the ratio is high as in

comparison to Vodafone for each of the financial years and this depicts that Detusche is able to

generate higher profits from its capital base. This can be due to higher operating costs or

decreasing sales of Vodafone as compared with its competitor. It implies that Vodafone need to

take essential measures to utilize its capital effectively and generate increasing value for

shareholders to enhance its competitive position within telecom sector (Needles and Powers,

2010).

Return on Sales

It examines the operational efficiency of a company by assessing the amount of profit

developed in relation to sales. The ratio for Vodafone has presented an increasing negative trend

from -10.28% to -12.76% which can be regarded as a major issue of concern for it as it is not

able to realize any profit from its net sales incurred. On the contrary, Deutsche Telekom has

depicted an increasing trend of return on sales from 4.25% to 7.41% which indicates that it has

maintained a higher profits margin over its net sales. As such, it can be said that Vodafone has

faced financial loss on an investment during the specific period of time that can be due to its

higher operational costs as compared to the net sales occurred. This indicates that Vodafone is

incurring higher operational expenses and is not able to retain any profits from its sales revenue.

This does not support good future growth prospects for Vodafone and raises a doubt over its

future profitability position (Joseph, 2013).

Gross Profit Margin

It measures the gross profit achieved by a firm as compared to its revenue realized after

deduction of direct expenses incurred in selling the products or services. The ratio for Vodafone

has increased from 26.9% to 27.41% over 2016-2017 which means that it is able to retain profit

after meeting its all direct costs incurred involved in providing its services. However, its

competitor has depicted a higher gross profit ratio over the financial years 2016-2017 and has

depicted a slight decrease from 49.27% to 49.08%. This implies that Vodafone is having higher

direct costs and lower sales and thus is able to achieve lower gross profits in comparison to

Detusche Telekom. This indicates that Vodafone need to take essential measures for reducing the

cost of goods sold and improving its gross profit margin to improve its competitive position.

Return on Equity

It illustrates the efficiency of a firm in generating reruns from the equity investment of its

shareholders. Vodafone has realized a decline in the ratio from -5.73% to -7.65% between 2016-

2017 and it implies that it is not able to create value over the investments of its shareholders. On

the contrary, its competitor Detusche Telecom has maintained a positive ROE on both the

7

financial years of 2016-2017 and has depicted an increase from 8.06% to 13.65% which signifies

that it is able to generate higher returns for its shareholders. This indicates an issue of concern for

Vodafone as it may not be able to achieve funds from its shareholders that can negatively impact

its growth and development in future context. This is because it is having negative amount of

owner’s equity by having high liability as compared to the assets that does not support the good

future growth prospects for the company (Baker and Powell, 2009).

Liquidity Analysis

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

0.76

0.83 0.80

0.750.75

0.82

0.75

0.67

Liquidity Ratios

Times

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

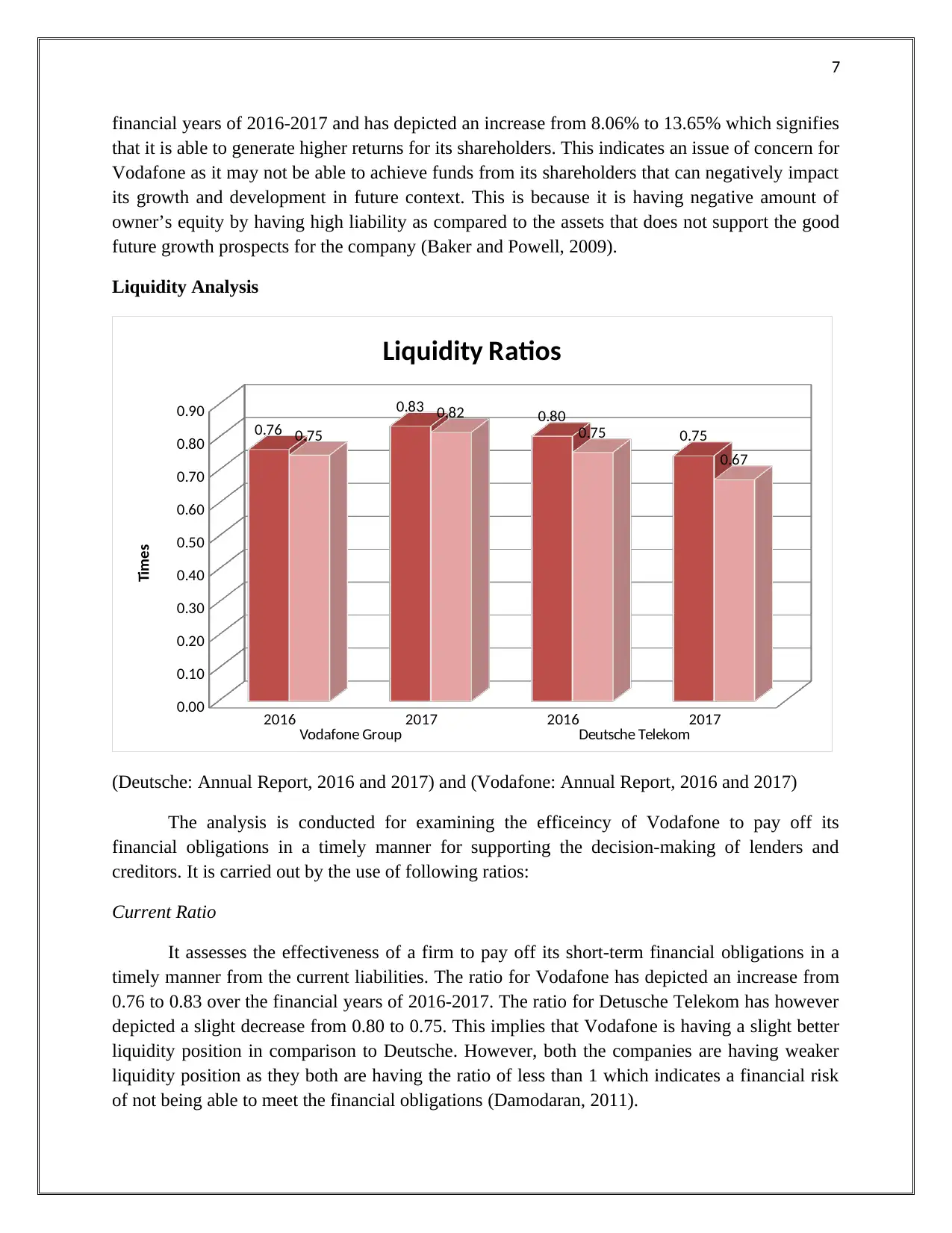

The analysis is conducted for examining the efficeincy of Vodafone to pay off its

financial obligations in a timely manner for supporting the decision-making of lenders and

creditors. It is carried out by the use of following ratios:

Current Ratio

It assesses the effectiveness of a firm to pay off its short-term financial obligations in a

timely manner from the current liabilities. The ratio for Vodafone has depicted an increase from

0.76 to 0.83 over the financial years of 2016-2017. The ratio for Detusche Telekom has however

depicted a slight decrease from 0.80 to 0.75. This implies that Vodafone is having a slight better

liquidity position in comparison to Deutsche. However, both the companies are having weaker

liquidity position as they both are having the ratio of less than 1 which indicates a financial risk

of not being able to meet the financial obligations (Damodaran, 2011).

financial years of 2016-2017 and has depicted an increase from 8.06% to 13.65% which signifies

that it is able to generate higher returns for its shareholders. This indicates an issue of concern for

Vodafone as it may not be able to achieve funds from its shareholders that can negatively impact

its growth and development in future context. This is because it is having negative amount of

owner’s equity by having high liability as compared to the assets that does not support the good

future growth prospects for the company (Baker and Powell, 2009).

Liquidity Analysis

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

0.76

0.83 0.80

0.750.75

0.82

0.75

0.67

Liquidity Ratios

Times

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

The analysis is conducted for examining the efficeincy of Vodafone to pay off its

financial obligations in a timely manner for supporting the decision-making of lenders and

creditors. It is carried out by the use of following ratios:

Current Ratio

It assesses the effectiveness of a firm to pay off its short-term financial obligations in a

timely manner from the current liabilities. The ratio for Vodafone has depicted an increase from

0.76 to 0.83 over the financial years of 2016-2017. The ratio for Detusche Telekom has however

depicted a slight decrease from 0.80 to 0.75. This implies that Vodafone is having a slight better

liquidity position in comparison to Deutsche. However, both the companies are having weaker

liquidity position as they both are having the ratio of less than 1 which indicates a financial risk

of not being able to meet the financial obligations (Damodaran, 2011).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Quick Ratio

It examines the capability of a firm to meet its current obligations with its most liquid

assets such as accounts receivables and cash equivalents. It has depicted an increase from 0.75 to

0.82 for Vodafone while for Detusche Telekom has depicted a decrease from 0.75 to 0.67. This

implies that although both Vodafone and Deutsche Telekom are having lower current asset

resources that can be quickly transferred into cash but Vodafone is able to improve its liquidity

position but Detusche liquid position is getting weaker over the financial period 2016-2017

(Krantz, 2016).

Efficiency Analysis

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

0.00

20.00

40.00

60.00

80.00

100.00

120.00

0.29 0.29 0.50 0.52

6.98 6.82

17.11 17.28

34.84

40.38

46.44 46.47

62.85

72.25

106.59

101.45

Efficiency Ratio

Times

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

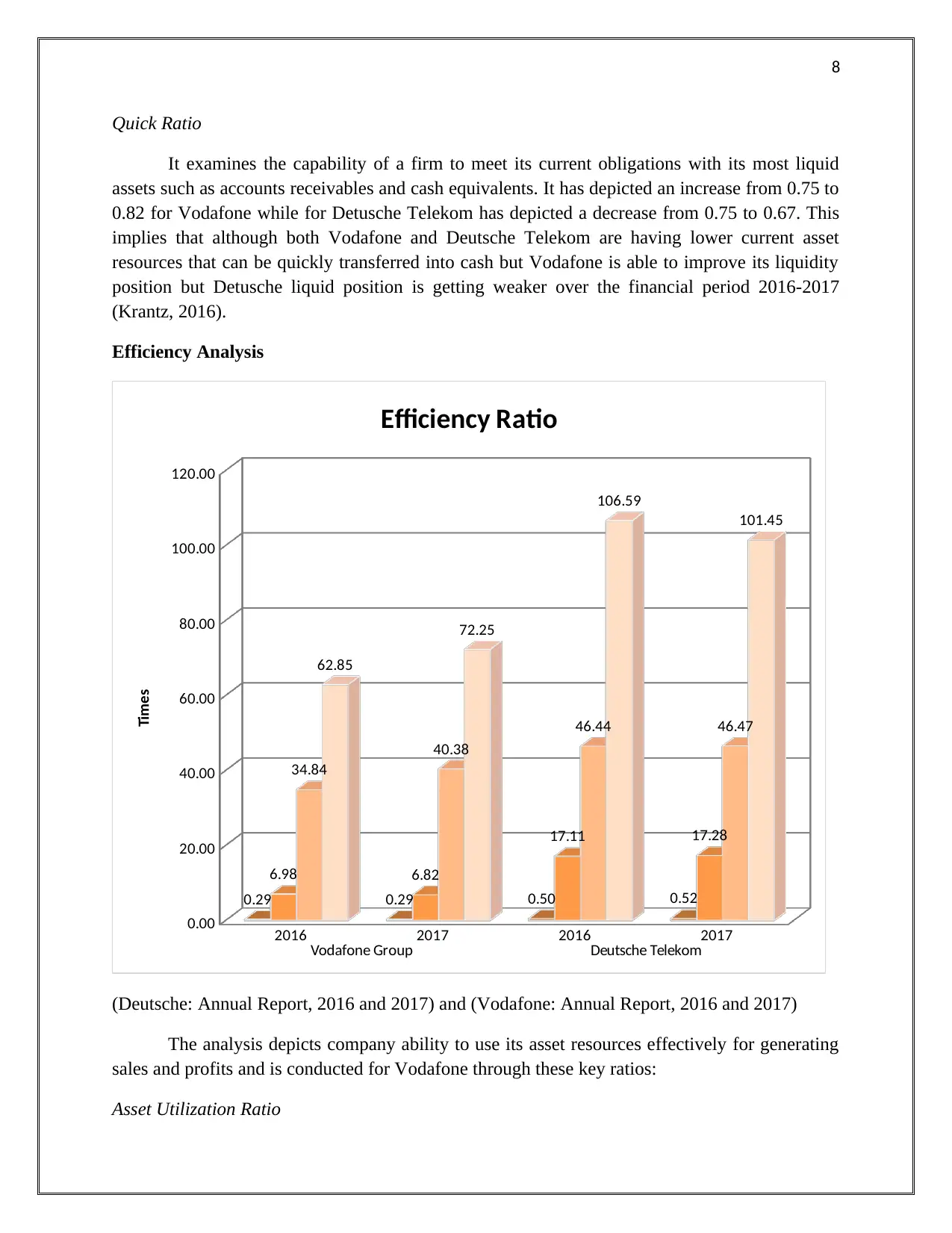

The analysis depicts company ability to use its asset resources effectively for generating

sales and profits and is conducted for Vodafone through these key ratios:

Asset Utilization Ratio

Quick Ratio

It examines the capability of a firm to meet its current obligations with its most liquid

assets such as accounts receivables and cash equivalents. It has depicted an increase from 0.75 to

0.82 for Vodafone while for Detusche Telekom has depicted a decrease from 0.75 to 0.67. This

implies that although both Vodafone and Deutsche Telekom are having lower current asset

resources that can be quickly transferred into cash but Vodafone is able to improve its liquidity

position but Detusche liquid position is getting weaker over the financial period 2016-2017

(Krantz, 2016).

Efficiency Analysis

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

0.00

20.00

40.00

60.00

80.00

100.00

120.00

0.29 0.29 0.50 0.52

6.98 6.82

17.11 17.28

34.84

40.38

46.44 46.47

62.85

72.25

106.59

101.45

Efficiency Ratio

Times

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

The analysis depicts company ability to use its asset resources effectively for generating

sales and profits and is conducted for Vodafone through these key ratios:

Asset Utilization Ratio

9

It depicts overall revenue realized by a company as compared to the value of the asset

base. The ratios for Vodafone is lower than 1 for both the years and have depicted a relative

stable trend of 0.29 for both the financial years of 2016-2017. On contrary, the ratio for Detusche

Telekom is slightly higher than Vodafone for both the financial years and has also depicted a

slight increase from 0.50 to 052 from 2016-2017. However, the ratio for both the companies is

lower than 1 which means that they need to improve the efficiency of utilizing the asset base to

generate sales. Vodafone should take measures for increasing its sales in comparison to Detusche

Telekom for improve the ratio trend and also reducing the operational cost related to asset use

such as minimizing the cost of holding the inventory (Feldman and Libman, 2011).

Stock Days

The ratio depicts the number of days that has been taken for converting its inventory to

sales. The ratio for Vodafone has depicted a decrease from 6.98 to 6.82 during the financial years

2016-2017 but is lower than that of its competitor Detusche Telekom which has depicted an

increase from 17.11 to 17.28 over the selected financial period. This implies that Vodafone

possess better efficiency in realizing sales from inventory as it has lower holding days of

inventory.

Current Trade Receivable Days

The ratio depicts the number of days that a company takes for collecting the outstanding

debt from the customers. The ratio for Vodafone has depicted an increase from 34.84 to 40.38

which depicts that it has reported an increase in the number of days to collect outstanding invoice

form the customers. The ratio for its competitor has also depicted an increase from 46.44 to

46.47 and the ratios for both the years are also significantly higher than Vodafone. This implies

that Vodafone possess better efficiency to collect debt from its customers in comparison to its

competitor which is good for its future growth due to better availability of cash for conducting its

daily operations (Davies and Crawford, 2011).

Current Trade Payable Days

It indicates the number of days that a company takes for meeting its debt obligations. The

ratio for Vodafone has depicted an increase from 62.85 to 72.25 which is not good for its future

financial growth as it is taking higher number of days to meet its accounts payable. However, its

competitor Detusche Telekom possess higher ratio for both the years but has depicted a

decreasing trend from 106.59 to 101.45 during the financial period 2016-2017. This implies that

Vodafone is able to better manage its debt obligations as compared to Detusche Telekom but it

need to overcome its increasing trend of the ratio as it can result in negatively impacting its

future financial growth by increasing the financial risk of defaulting on its loan (Brigham and

Michael, 2013).

Solvency Analysis

It depicts overall revenue realized by a company as compared to the value of the asset

base. The ratios for Vodafone is lower than 1 for both the years and have depicted a relative

stable trend of 0.29 for both the financial years of 2016-2017. On contrary, the ratio for Detusche

Telekom is slightly higher than Vodafone for both the financial years and has also depicted a

slight increase from 0.50 to 052 from 2016-2017. However, the ratio for both the companies is

lower than 1 which means that they need to improve the efficiency of utilizing the asset base to

generate sales. Vodafone should take measures for increasing its sales in comparison to Detusche

Telekom for improve the ratio trend and also reducing the operational cost related to asset use

such as minimizing the cost of holding the inventory (Feldman and Libman, 2011).

Stock Days

The ratio depicts the number of days that has been taken for converting its inventory to

sales. The ratio for Vodafone has depicted a decrease from 6.98 to 6.82 during the financial years

2016-2017 but is lower than that of its competitor Detusche Telekom which has depicted an

increase from 17.11 to 17.28 over the selected financial period. This implies that Vodafone

possess better efficiency in realizing sales from inventory as it has lower holding days of

inventory.

Current Trade Receivable Days

The ratio depicts the number of days that a company takes for collecting the outstanding

debt from the customers. The ratio for Vodafone has depicted an increase from 34.84 to 40.38

which depicts that it has reported an increase in the number of days to collect outstanding invoice

form the customers. The ratio for its competitor has also depicted an increase from 46.44 to

46.47 and the ratios for both the years are also significantly higher than Vodafone. This implies

that Vodafone possess better efficiency to collect debt from its customers in comparison to its

competitor which is good for its future growth due to better availability of cash for conducting its

daily operations (Davies and Crawford, 2011).

Current Trade Payable Days

It indicates the number of days that a company takes for meeting its debt obligations. The

ratio for Vodafone has depicted an increase from 62.85 to 72.25 which is not good for its future

financial growth as it is taking higher number of days to meet its accounts payable. However, its

competitor Detusche Telekom possess higher ratio for both the years but has depicted a

decreasing trend from 106.59 to 101.45 during the financial period 2016-2017. This implies that

Vodafone is able to better manage its debt obligations as compared to Detusche Telekom but it

need to overcome its increasing trend of the ratio as it can result in negatively impacting its

future financial growth by increasing the financial risk of defaulting on its loan (Brigham and

Michael, 2013).

Solvency Analysis

10

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

0.00%

50.00%

100.00%

150.00%

200.00%

250.00%

300.00%

350.00%

400.00%

98.63% 109.83%

282.25%

232.79%

0.65

2.65

3.38

3.73

Solvency Ratios

In Percentage/Times

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

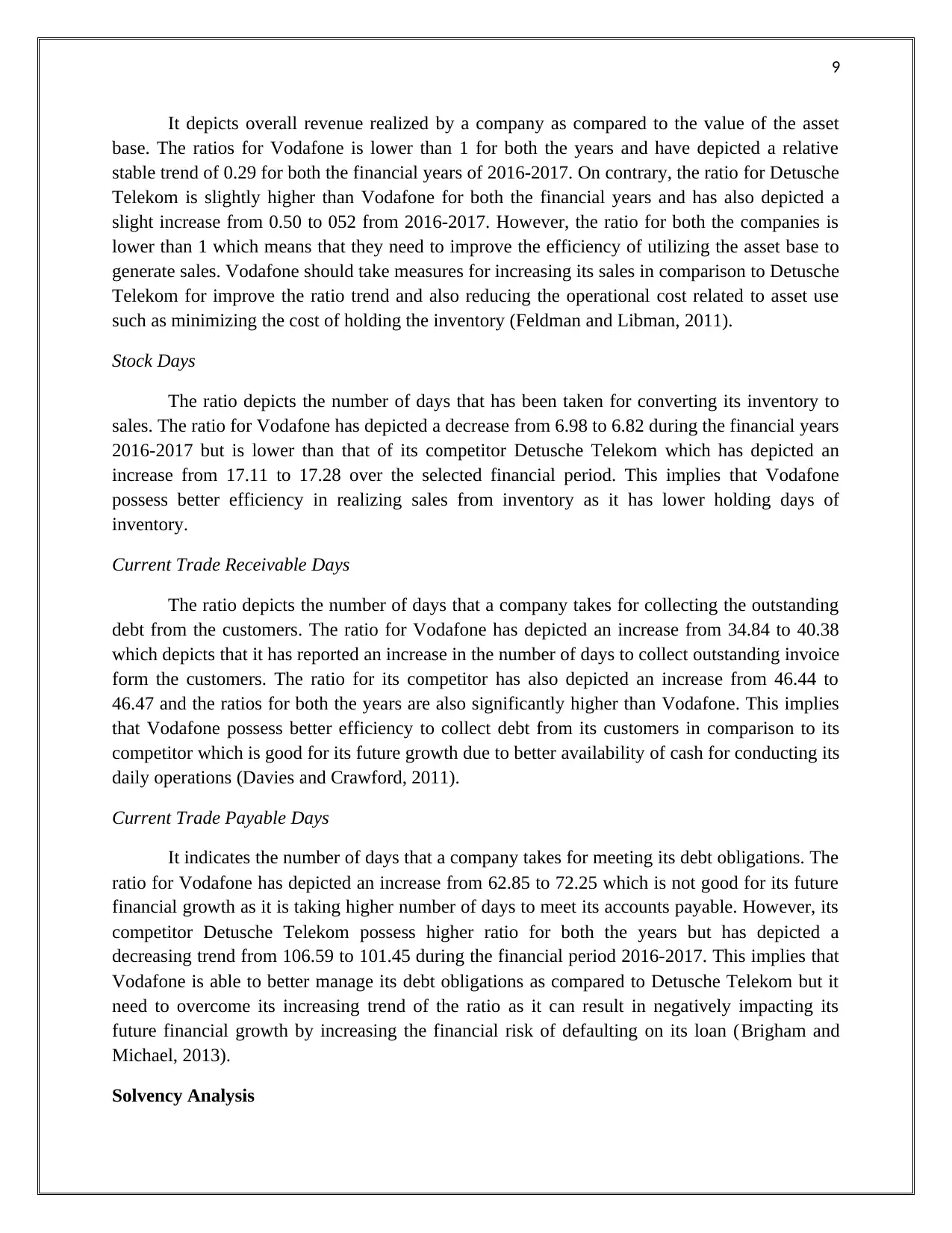

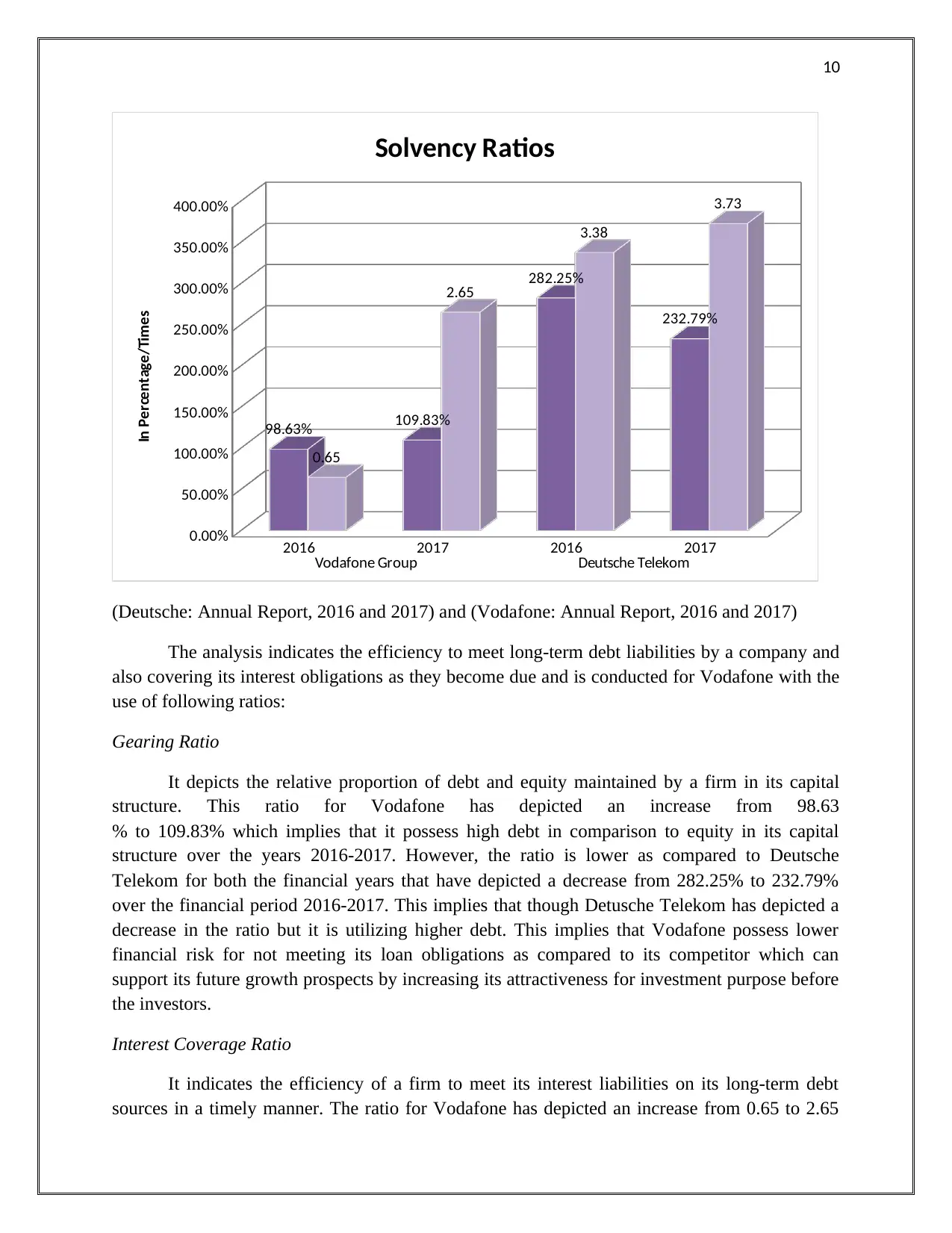

The analysis indicates the efficiency to meet long-term debt liabilities by a company and

also covering its interest obligations as they become due and is conducted for Vodafone with the

use of following ratios:

Gearing Ratio

It depicts the relative proportion of debt and equity maintained by a firm in its capital

structure. This ratio for Vodafone has depicted an increase from 98.63

% to 109.83% which implies that it possess high debt in comparison to equity in its capital

structure over the years 2016-2017. However, the ratio is lower as compared to Deutsche

Telekom for both the financial years that have depicted a decrease from 282.25% to 232.79%

over the financial period 2016-2017. This implies that though Detusche Telekom has depicted a

decrease in the ratio but it is utilizing higher debt. This implies that Vodafone possess lower

financial risk for not meeting its loan obligations as compared to its competitor which can

support its future growth prospects by increasing its attractiveness for investment purpose before

the investors.

Interest Coverage Ratio

It indicates the efficiency of a firm to meet its interest liabilities on its long-term debt

sources in a timely manner. The ratio for Vodafone has depicted an increase from 0.65 to 2.65

2016 2017 2016 2017

Vodafone Group Deutsche Telekom

0.00%

50.00%

100.00%

150.00%

200.00%

250.00%

300.00%

350.00%

400.00%

98.63% 109.83%

282.25%

232.79%

0.65

2.65

3.38

3.73

Solvency Ratios

In Percentage/Times

(Deutsche: Annual Report, 2016 and 2017) and (Vodafone: Annual Report, 2016 and 2017)

The analysis indicates the efficiency to meet long-term debt liabilities by a company and

also covering its interest obligations as they become due and is conducted for Vodafone with the

use of following ratios:

Gearing Ratio

It depicts the relative proportion of debt and equity maintained by a firm in its capital

structure. This ratio for Vodafone has depicted an increase from 98.63

% to 109.83% which implies that it possess high debt in comparison to equity in its capital

structure over the years 2016-2017. However, the ratio is lower as compared to Deutsche

Telekom for both the financial years that have depicted a decrease from 282.25% to 232.79%

over the financial period 2016-2017. This implies that though Detusche Telekom has depicted a

decrease in the ratio but it is utilizing higher debt. This implies that Vodafone possess lower

financial risk for not meeting its loan obligations as compared to its competitor which can

support its future growth prospects by increasing its attractiveness for investment purpose before

the investors.

Interest Coverage Ratio

It indicates the efficiency of a firm to meet its interest liabilities on its long-term debt

sources in a timely manner. The ratio for Vodafone has depicted an increase from 0.65 to 2.65

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

from 2016-2017 which implies that it has improved its efficiency to pay its interest amount due

on its debt obligations which is good for its future growth prospects. On the other hand, the ratio

for Deutsche Telekom has reported a decrease from 3.38 to 3.73 but the ratio for both years is

higher as compared to Vodafone which mean that it is having higher interest obligations due to

presence of higher debt as compared to Vodafone. However, its efficiency to meet its interest

obligations has depicted a light decrease whereas for Vodafone has reported an increase which

indicates its improved capabilities to meet its interest obligations in a timely manner (Bragg,

2010).

Recommendation & Conclusion

It can be summarized from the overall financial analysis of Vodafone as compared to

Detusche Telekom that it is having weaker profitability and has incurred financial losses that can

negatively impact its future financial growth. This is because negative return on sales and equity

can undermine its attractiveness for the investors and restricted funds realized from them can

result in negatively impacting its future financial growth. Its efficiency, liquidity and solvency

position though better than Detusche Telecom but it needs to improve its sales and reduce its

operational expenses to enhance its competitive position in the Telekom sector. Vodafone major

issue of concern is to take measures for improving the net profits by reducing the operational

expenses as its weaker profitability position as compared to Detusche can negatively impact its

plan for future financial growth.

from 2016-2017 which implies that it has improved its efficiency to pay its interest amount due

on its debt obligations which is good for its future growth prospects. On the other hand, the ratio

for Deutsche Telekom has reported a decrease from 3.38 to 3.73 but the ratio for both years is

higher as compared to Vodafone which mean that it is having higher interest obligations due to

presence of higher debt as compared to Vodafone. However, its efficiency to meet its interest

obligations has depicted a light decrease whereas for Vodafone has reported an increase which

indicates its improved capabilities to meet its interest obligations in a timely manner (Bragg,

2010).

Recommendation & Conclusion

It can be summarized from the overall financial analysis of Vodafone as compared to

Detusche Telekom that it is having weaker profitability and has incurred financial losses that can

negatively impact its future financial growth. This is because negative return on sales and equity

can undermine its attractiveness for the investors and restricted funds realized from them can

result in negatively impacting its future financial growth. Its efficiency, liquidity and solvency

position though better than Detusche Telecom but it needs to improve its sales and reduce its

operational expenses to enhance its competitive position in the Telekom sector. Vodafone major

issue of concern is to take measures for improving the net profits by reducing the operational

expenses as its weaker profitability position as compared to Detusche can negatively impact its

plan for future financial growth.

12

References

Baker, H. and Powell, G. 2009. Understanding Financial Management: A Practical Guide.

USA: John Wiley & Sons

Bragg, S. 2010. Business Ratios and Formulas: A Comprehensive Guide. US: John Wiley &

Sons.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. and Crawford, I. 2011. Business accounting and finance. USA: Pearson.

Deutsche: Annual Report. 2016. Deutsche Telecom. [Online]. Available at:

https://www.telekom.com/en/investor-relations [Accessed on: 13 June 2019].

Deutsche: Annual Report. 2017. Deutsche Telecom. [Online]. Available at:

https://www.telekom.com/en/investor-relations [Accessed on: 13 June 2019].

Feldman, M. and Libman, L. 2011. Crash Course in Accounting and Financial Statement

Analysis. USA: John Wiley & Sons.

Joseph, C. 2013. Advanced Credit Risk Analysis and Management. USA: John Wiley & Sons.

Krantz, M. 2016. Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Needles, B. and Powers, M. 2010. Principles of Financial Accounting. Cengage Learning.

Vodafone: Annual Report. 2016. Vodafone Group Limited. [Online]. Available at:

http://www.annualreports.com/Company/vodafone-group-plc [Accessed on: 13 June 2019].

Vodafone: Annual Report. 2017. Vodafone Group Limited. [Online]. Available at:

http://www.annualreports.com/Company/vodafone-group-plc [Accessed on: 13 June 2019].

References

Baker, H. and Powell, G. 2009. Understanding Financial Management: A Practical Guide.

USA: John Wiley & Sons

Bragg, S. 2010. Business Ratios and Formulas: A Comprehensive Guide. US: John Wiley &

Sons.

Brigham, F., and Michael C. 2013. Financial management: Theory & practice. Canada: Cengage

Learning.

Damodaran, A, 2011. Applied corporate finance. USA: John Wiley & sons.

Davies, T. and Crawford, I. 2011. Business accounting and finance. USA: Pearson.

Deutsche: Annual Report. 2016. Deutsche Telecom. [Online]. Available at:

https://www.telekom.com/en/investor-relations [Accessed on: 13 June 2019].

Deutsche: Annual Report. 2017. Deutsche Telecom. [Online]. Available at:

https://www.telekom.com/en/investor-relations [Accessed on: 13 June 2019].

Feldman, M. and Libman, L. 2011. Crash Course in Accounting and Financial Statement

Analysis. USA: John Wiley & Sons.

Joseph, C. 2013. Advanced Credit Risk Analysis and Management. USA: John Wiley & Sons.

Krantz, M. 2016. Fundamental Analysis for Dummies. USA: John Wiley & Sons.

Needles, B. and Powers, M. 2010. Principles of Financial Accounting. Cengage Learning.

Vodafone: Annual Report. 2016. Vodafone Group Limited. [Online]. Available at:

http://www.annualreports.com/Company/vodafone-group-plc [Accessed on: 13 June 2019].

Vodafone: Annual Report. 2017. Vodafone Group Limited. [Online]. Available at:

http://www.annualreports.com/Company/vodafone-group-plc [Accessed on: 13 June 2019].

13

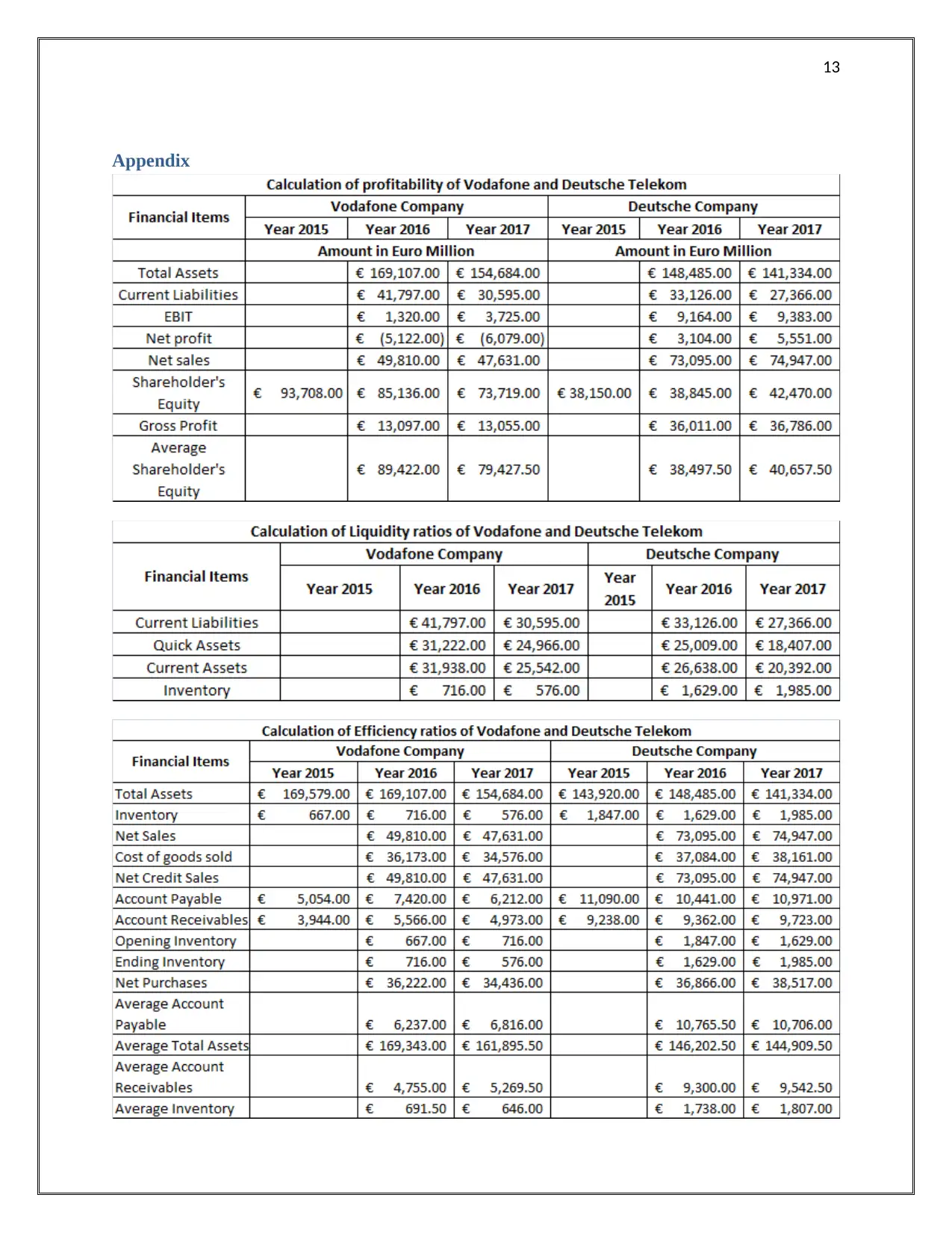

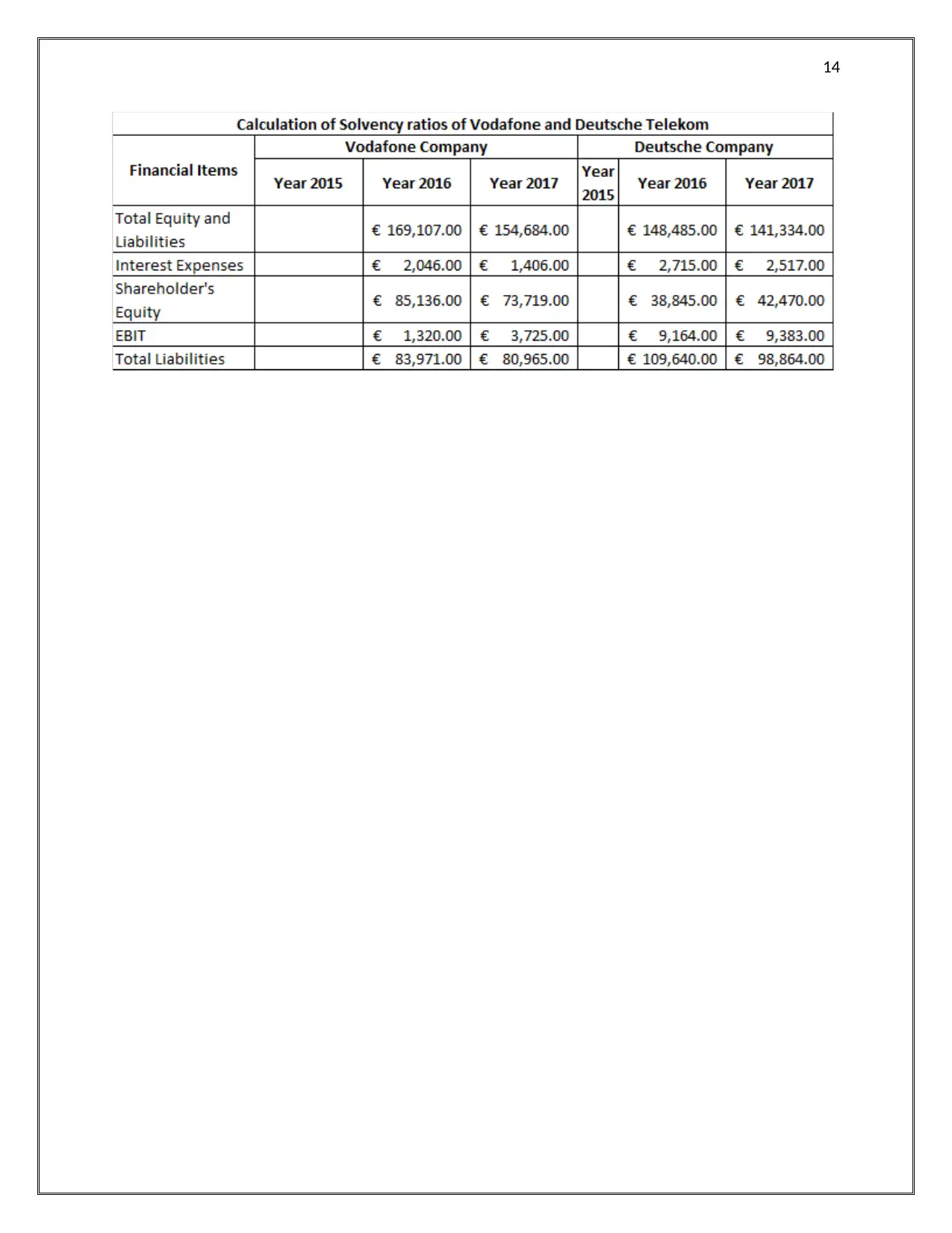

Appendix

Appendix

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.