Holmes Institute: Australian Property Market and Economic Factors

VerifiedAdded on 2022/09/14

|18

|3411

|12

Report

AI Summary

This report provides a comprehensive analysis of the Australian property market, focusing on the economic factors influencing its performance. It begins with an executive summary and an introduction outlining the significant changes in the market due to shifts in demand and supply. The report describes the market structure, including the property bubble, and examines the impact of various factors such as government policies (immigration, subsidies, tax discounts), interest rates, foreign investment, and income growth on housing prices. It also discusses market competitiveness and changes in market conditions, supported by relevant data and graphs from the Reserve Bank of Australia. The analysis covers the period of 2018-19, exploring the factors that affected the market's performance and concludes with a discussion on the effects of the housing market on the Australian economy. The report highlights the role of financial deregulation, low-interest rates, and foreign investment in driving up property prices and the impact of government policies such as capital gains tax discounts. Additionally, it addresses issues like negative gearing, mortgage fraud, and the influence of population growth and supply dynamics on the market.

Running head: ECONOMICS AND INTERNATIONAL TRADE

Economics and International Trade

Name of the Student

Name of the University

Author note

Economics and International Trade

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS AND INTERNATIONAL TRADE

EXECUTIVE SUMMARY

This paper emphasises on the market conditions that influences the Australian property market.

The huge housing market of Australia going through several significant changes in recent years

because of change in demand and supply. This paper examines those factors of demand and

supply, which causes economic bubble in the property market of Australia. Different government

policies, lower rate of interest, overseas investment in residential sector and the growth of

income exacerbating the price of the household market. The price of housing market increased

drastically and impact on the Australian economy is massive. Here the market structure, degree

of competitiveness, factors influencing price and quantity of residential market is discussed. The

performance of the property market of Australia in 2018-19 and the factors impacting its

performance is examined in this paper. The overall analysis of the property market of Australia

and the relevant data to support the analysis is provided in the paper.

EXECUTIVE SUMMARY

This paper emphasises on the market conditions that influences the Australian property market.

The huge housing market of Australia going through several significant changes in recent years

because of change in demand and supply. This paper examines those factors of demand and

supply, which causes economic bubble in the property market of Australia. Different government

policies, lower rate of interest, overseas investment in residential sector and the growth of

income exacerbating the price of the household market. The price of housing market increased

drastically and impact on the Australian economy is massive. Here the market structure, degree

of competitiveness, factors influencing price and quantity of residential market is discussed. The

performance of the property market of Australia in 2018-19 and the factors impacting its

performance is examined in this paper. The overall analysis of the property market of Australia

and the relevant data to support the analysis is provided in the paper.

2ECONOMICS AND INTERNATIONAL TRADE

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Market Description......................................................................................................................3

Changes in market conditions and their impact...........................................................................8

Conclusion.....................................................................................................................................13

Reference List................................................................................................................................15

Table of Contents

Introduction......................................................................................................................................3

Discussion........................................................................................................................................3

Market Description......................................................................................................................3

Changes in market conditions and their impact...........................................................................8

Conclusion.....................................................................................................................................13

Reference List................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS AND INTERNATIONAL TRADE

Introduction

The property market of Australia rose at a faster rate from 1990 to 2017 and now

showing the signs of contraction. The drastic changes in price of Australian property market lead

to economic bubble. Several factors of economy affected the housing market of the country

(Austin, Gurran and Whitehead 2014). The supply and demand of the housing market influenced

by the immigration policy, subsidies and tax discounts of the Federal government. The high price

of the housing in Australia caused by foreign investment in housing property, lower rate of

interest and income growth. The competition and threats in the property market of the nation

regulated by the demand of housing. The crisis of Australian housing market can be controlled

with the help of growth in income generation (Bentley et al. 2016). The tax system of the

government of Australia push the policies like capital gain tax discounts and negative gearing

which hiked the housing price. The analysis of factors of supply and demand in housing sector

and their impact on price and quantity of housing of Australian is essential. As the economy of

Australia is largely depends on the household market. The turmoil in the residential market of

country affected the economic growth and development.

Discussion

Market Description

The property market of Australia includes the tradable land and its permanent fixtures

situated within Australia. In recent years, there is a property bubble in Australia. The residential

housing market of Australia gone through a drastic changes in terms of changes in prices. Some

cities of Australia such as Melbourne, Sydney, Adelaide, Brisbane, Hobart and Perth witnessed

soaring property prices (Atkinson 2015). In 2016, the median price of house peaked to $780,000

Introduction

The property market of Australia rose at a faster rate from 1990 to 2017 and now

showing the signs of contraction. The drastic changes in price of Australian property market lead

to economic bubble. Several factors of economy affected the housing market of the country

(Austin, Gurran and Whitehead 2014). The supply and demand of the housing market influenced

by the immigration policy, subsidies and tax discounts of the Federal government. The high price

of the housing in Australia caused by foreign investment in housing property, lower rate of

interest and income growth. The competition and threats in the property market of the nation

regulated by the demand of housing. The crisis of Australian housing market can be controlled

with the help of growth in income generation (Bentley et al. 2016). The tax system of the

government of Australia push the policies like capital gain tax discounts and negative gearing

which hiked the housing price. The analysis of factors of supply and demand in housing sector

and their impact on price and quantity of housing of Australian is essential. As the economy of

Australia is largely depends on the household market. The turmoil in the residential market of

country affected the economic growth and development.

Discussion

Market Description

The property market of Australia includes the tradable land and its permanent fixtures

situated within Australia. In recent years, there is a property bubble in Australia. The residential

housing market of Australia gone through a drastic changes in terms of changes in prices. Some

cities of Australia such as Melbourne, Sydney, Adelaide, Brisbane, Hobart and Perth witnessed

soaring property prices (Atkinson 2015). In 2016, the median price of house peaked to $780,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS AND INTERNATIONAL TRADE

in Sydney. However, in all major cities of Australia residential property prices have started

reducing, for fall in interest rate and tighter credit policy from overseas investors. In comparison

with soaring prices of 2017, in 2018 housing prices decreased by 7.2% in Melbourne and 11.1%

in Sydney. The reasons behind exacerbation of Australia’s housing affordability problem are the

new arrivals propensity and high immigration to cluster in capital cities. The policies of Federal

government that fuel housing demand includes capital gains tax discounts, high immigration

level and subsidies for fertility boosting.

The impact of these policies of Federal government on housing affordability is very

significant. The housing demand of Australia induced because of relaxing credit guidelines for

temporary residents by Australian lenders, which allowed them to purchase a house with a

deposit of 10%. The demand for rental housing also boosted by the rapid of growth of foreign

visitors like students. Even the short stay visitors such as foreigners coming to study or work in

Australia have added to the housing demand (Beer et al. 2016). The Australian infrastructure is

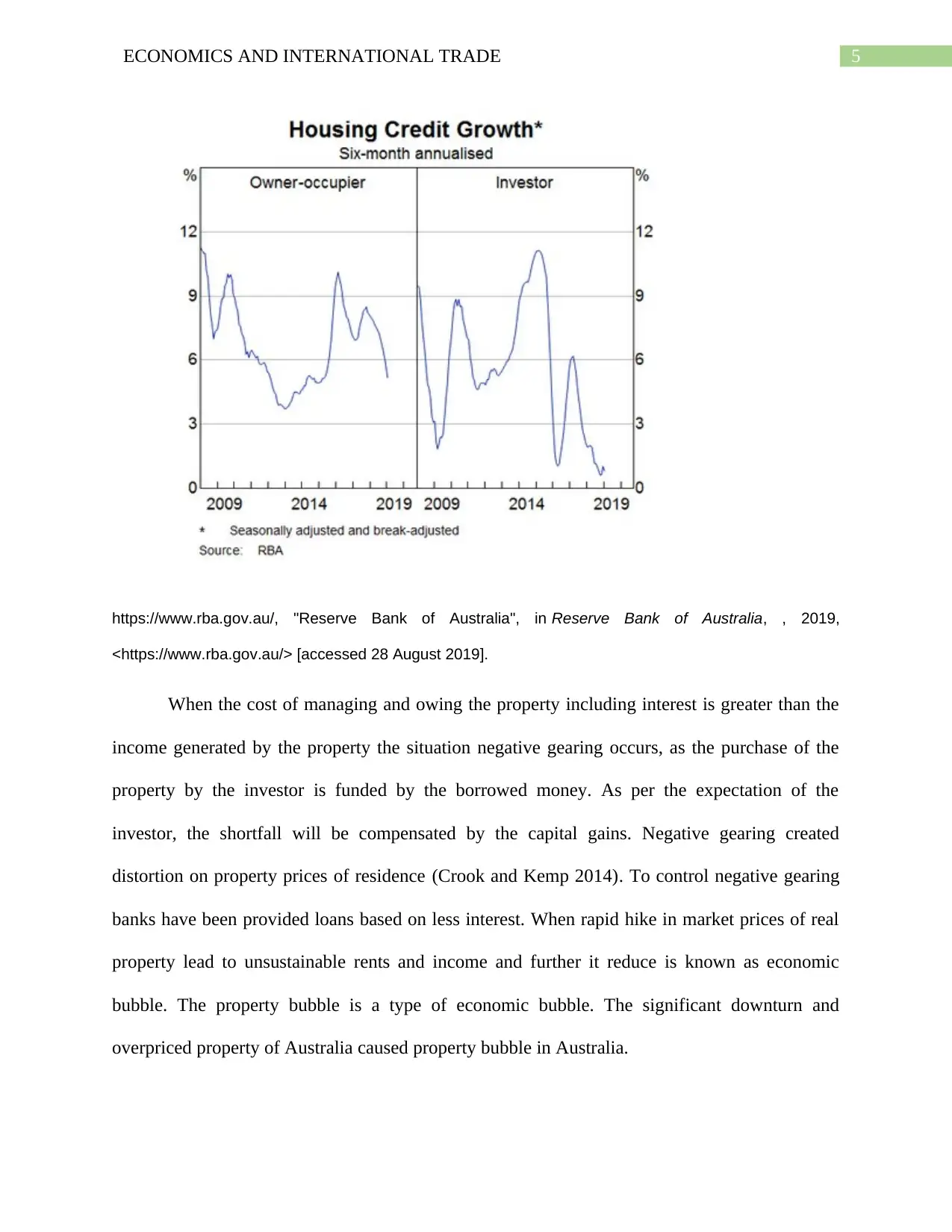

overburdened with immigration and overseas visitors. The negative gearing in Australian

property market is very common.

in Sydney. However, in all major cities of Australia residential property prices have started

reducing, for fall in interest rate and tighter credit policy from overseas investors. In comparison

with soaring prices of 2017, in 2018 housing prices decreased by 7.2% in Melbourne and 11.1%

in Sydney. The reasons behind exacerbation of Australia’s housing affordability problem are the

new arrivals propensity and high immigration to cluster in capital cities. The policies of Federal

government that fuel housing demand includes capital gains tax discounts, high immigration

level and subsidies for fertility boosting.

The impact of these policies of Federal government on housing affordability is very

significant. The housing demand of Australia induced because of relaxing credit guidelines for

temporary residents by Australian lenders, which allowed them to purchase a house with a

deposit of 10%. The demand for rental housing also boosted by the rapid of growth of foreign

visitors like students. Even the short stay visitors such as foreigners coming to study or work in

Australia have added to the housing demand (Beer et al. 2016). The Australian infrastructure is

overburdened with immigration and overseas visitors. The negative gearing in Australian

property market is very common.

5ECONOMICS AND INTERNATIONAL TRADE

https://www.rba.gov.au/, "Reserve Bank of Australia", in Reserve Bank of Australia, , 2019,

<https://www.rba.gov.au/> [accessed 28 August 2019].

When the cost of managing and owing the property including interest is greater than the

income generated by the property the situation negative gearing occurs, as the purchase of the

property by the investor is funded by the borrowed money. As per the expectation of the

investor, the shortfall will be compensated by the capital gains. Negative gearing created

distortion on property prices of residence (Crook and Kemp 2014). To control negative gearing

banks have been provided loans based on less interest. When rapid hike in market prices of real

property lead to unsustainable rents and income and further it reduce is known as economic

bubble. The property bubble is a type of economic bubble. The significant downturn and

overpriced property of Australia caused property bubble in Australia.

https://www.rba.gov.au/, "Reserve Bank of Australia", in Reserve Bank of Australia, , 2019,

<https://www.rba.gov.au/> [accessed 28 August 2019].

When the cost of managing and owing the property including interest is greater than the

income generated by the property the situation negative gearing occurs, as the purchase of the

property by the investor is funded by the borrowed money. As per the expectation of the

investor, the shortfall will be compensated by the capital gains. Negative gearing created

distortion on property prices of residence (Crook and Kemp 2014). To control negative gearing

banks have been provided loans based on less interest. When rapid hike in market prices of real

property lead to unsustainable rents and income and further it reduce is known as economic

bubble. The property bubble is a type of economic bubble. The significant downturn and

overpriced property of Australia caused property bubble in Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS AND INTERNATIONAL TRADE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS AND INTERNATIONAL TRADE

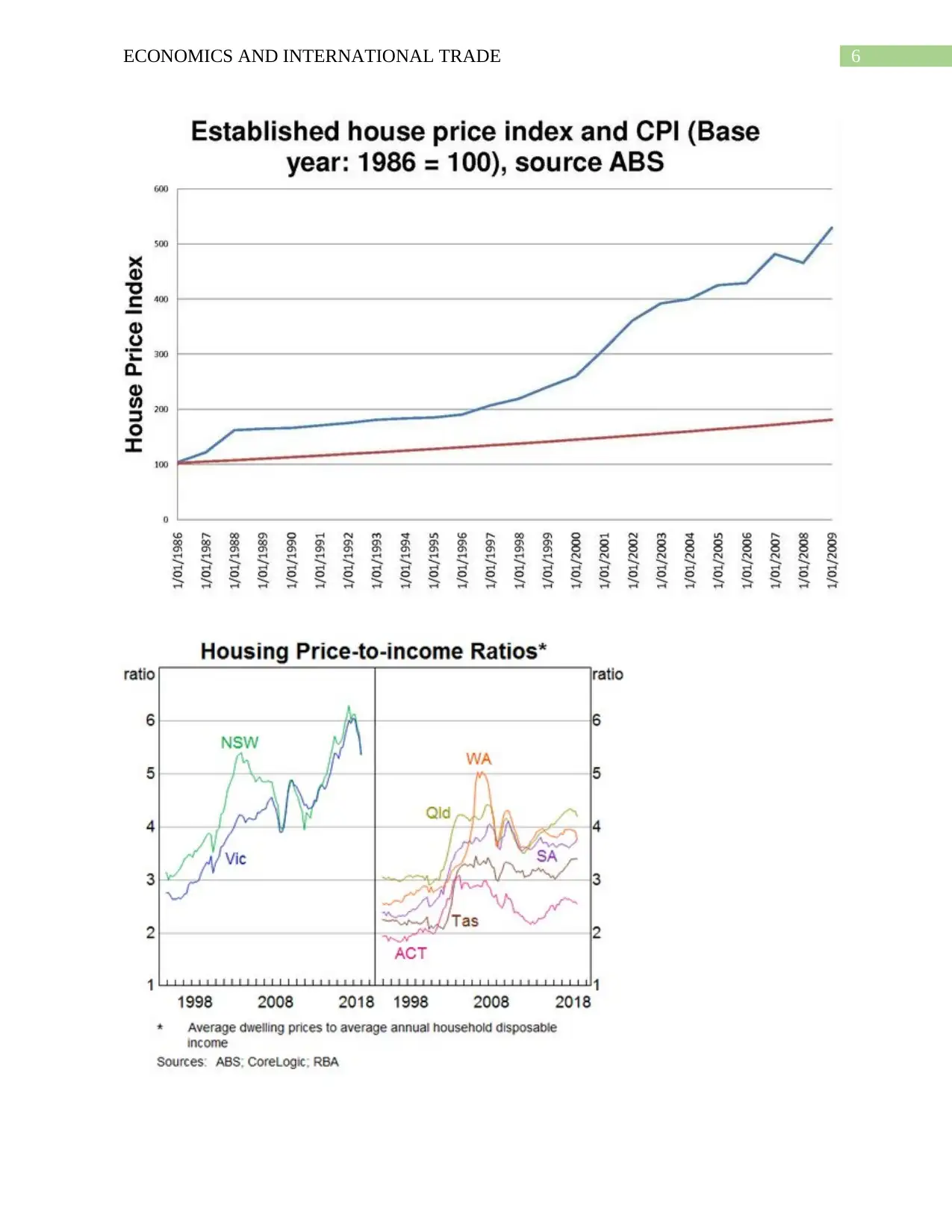

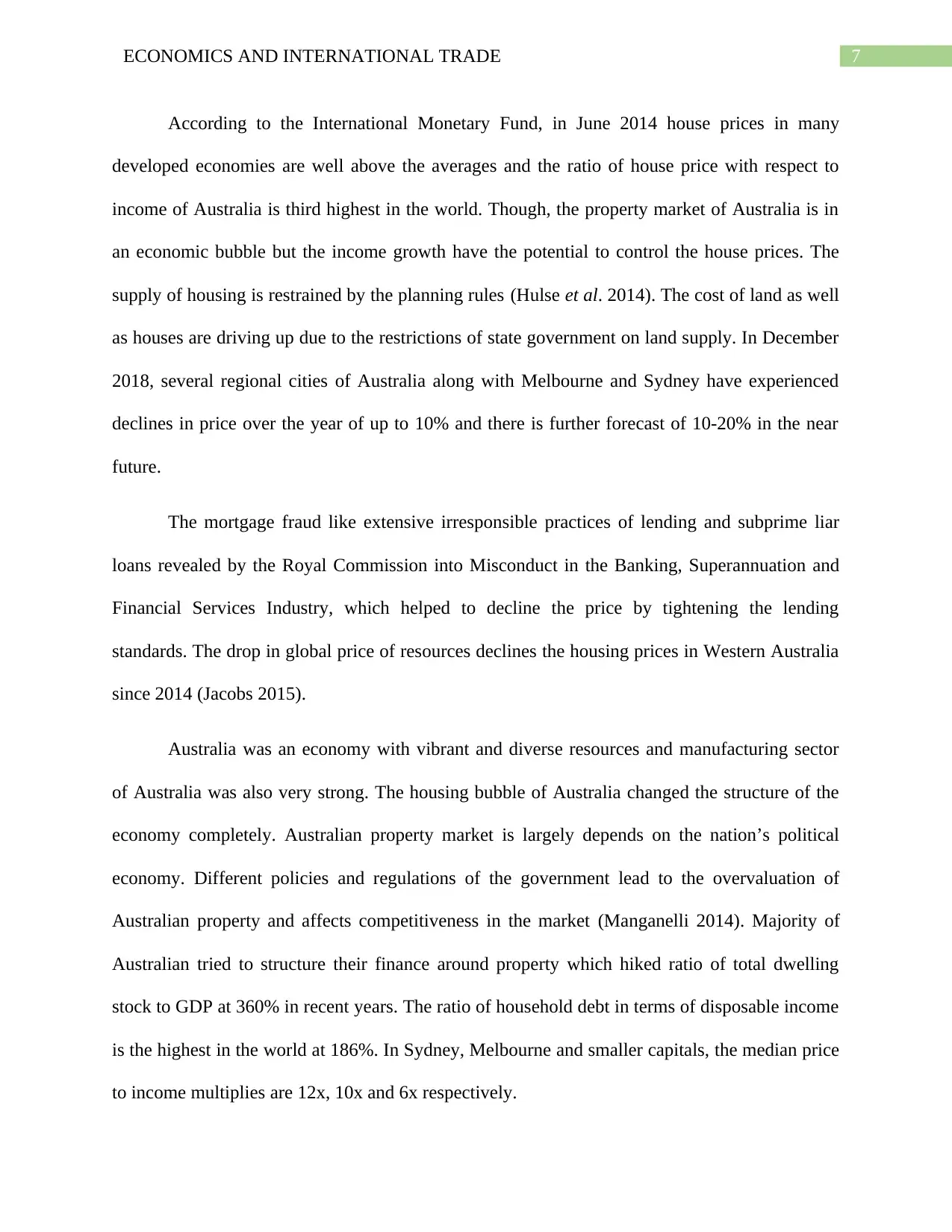

According to the International Monetary Fund, in June 2014 house prices in many

developed economies are well above the averages and the ratio of house price with respect to

income of Australia is third highest in the world. Though, the property market of Australia is in

an economic bubble but the income growth have the potential to control the house prices. The

supply of housing is restrained by the planning rules (Hulse et al. 2014). The cost of land as well

as houses are driving up due to the restrictions of state government on land supply. In December

2018, several regional cities of Australia along with Melbourne and Sydney have experienced

declines in price over the year of up to 10% and there is further forecast of 10-20% in the near

future.

The mortgage fraud like extensive irresponsible practices of lending and subprime liar

loans revealed by the Royal Commission into Misconduct in the Banking, Superannuation and

Financial Services Industry, which helped to decline the price by tightening the lending

standards. The drop in global price of resources declines the housing prices in Western Australia

since 2014 (Jacobs 2015).

Australia was an economy with vibrant and diverse resources and manufacturing sector

of Australia was also very strong. The housing bubble of Australia changed the structure of the

economy completely. Australian property market is largely depends on the nation’s political

economy. Different policies and regulations of the government lead to the overvaluation of

Australian property and affects competitiveness in the market (Manganelli 2014). Majority of

Australian tried to structure their finance around property which hiked ratio of total dwelling

stock to GDP at 360% in recent years. The ratio of household debt in terms of disposable income

is the highest in the world at 186%. In Sydney, Melbourne and smaller capitals, the median price

to income multiplies are 12x, 10x and 6x respectively.

According to the International Monetary Fund, in June 2014 house prices in many

developed economies are well above the averages and the ratio of house price with respect to

income of Australia is third highest in the world. Though, the property market of Australia is in

an economic bubble but the income growth have the potential to control the house prices. The

supply of housing is restrained by the planning rules (Hulse et al. 2014). The cost of land as well

as houses are driving up due to the restrictions of state government on land supply. In December

2018, several regional cities of Australia along with Melbourne and Sydney have experienced

declines in price over the year of up to 10% and there is further forecast of 10-20% in the near

future.

The mortgage fraud like extensive irresponsible practices of lending and subprime liar

loans revealed by the Royal Commission into Misconduct in the Banking, Superannuation and

Financial Services Industry, which helped to decline the price by tightening the lending

standards. The drop in global price of resources declines the housing prices in Western Australia

since 2014 (Jacobs 2015).

Australia was an economy with vibrant and diverse resources and manufacturing sector

of Australia was also very strong. The housing bubble of Australia changed the structure of the

economy completely. Australian property market is largely depends on the nation’s political

economy. Different policies and regulations of the government lead to the overvaluation of

Australian property and affects competitiveness in the market (Manganelli 2014). Majority of

Australian tried to structure their finance around property which hiked ratio of total dwelling

stock to GDP at 360% in recent years. The ratio of household debt in terms of disposable income

is the highest in the world at 186%. In Sydney, Melbourne and smaller capitals, the median price

to income multiplies are 12x, 10x and 6x respectively.

8ECONOMICS AND INTERNATIONAL TRADE

Moreover, the four major banks of Australia borrowed almost $1 trillion from offshore to

cover huge proportion of debt of Australian property. As a result, the local currency of Australia

inflated and the input costs such as land prices increased, which diminished competitiveness in

the Australian market and drove tradable sectors such as manufacturing offshore dramatically. In

1970, the output of manufacturing sector was 14% which dropped to 5% in the 2016, the lowest

in the OECD.

To improve the economic condition of the country Reserve Bank of Australia already cut

rate of interest to record lows (Paris 2017). Therefore, possibility of further rate cut to control

downturn is very less. Monetary policy of the country will be unable to change the economic

conditions. The country witnessed very high household debt and the growth of wages is very

low. The fragile household sector of the Australia is controlling the spending habit of the people.

The effects of crisis of household sector and economic downturn is different for the various cities

of Australia. Sydney is expected to suffer from financial crisis, Queensland and Western

Australia will suffer from collapse of resource price.

Changes in market conditions and their impact

Several factors contributed to rise in property prices of Australia are (Colic-Peisker, Ong

and Wood 2015):

Financial deregulation induced the availability of credit, which in turn increase the credit

burden of the economy and hiked the price of the household.

Since 2008, low rate of interest prevailed in the economy, which pushed the borrowing

capacity of the people because of lower repayments.

The expansion of the average floor area of new houses is another reason for the rise in

property prices.

Moreover, the four major banks of Australia borrowed almost $1 trillion from offshore to

cover huge proportion of debt of Australian property. As a result, the local currency of Australia

inflated and the input costs such as land prices increased, which diminished competitiveness in

the Australian market and drove tradable sectors such as manufacturing offshore dramatically. In

1970, the output of manufacturing sector was 14% which dropped to 5% in the 2016, the lowest

in the OECD.

To improve the economic condition of the country Reserve Bank of Australia already cut

rate of interest to record lows (Paris 2017). Therefore, possibility of further rate cut to control

downturn is very less. Monetary policy of the country will be unable to change the economic

conditions. The country witnessed very high household debt and the growth of wages is very

low. The fragile household sector of the Australia is controlling the spending habit of the people.

The effects of crisis of household sector and economic downturn is different for the various cities

of Australia. Sydney is expected to suffer from financial crisis, Queensland and Western

Australia will suffer from collapse of resource price.

Changes in market conditions and their impact

Several factors contributed to rise in property prices of Australia are (Colic-Peisker, Ong

and Wood 2015):

Financial deregulation induced the availability of credit, which in turn increase the credit

burden of the economy and hiked the price of the household.

Since 2008, low rate of interest prevailed in the economy, which pushed the borrowing

capacity of the people because of lower repayments.

The expansion of the average floor area of new houses is another reason for the rise in

property prices.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS AND INTERNATIONAL TRADE

The supply of the land is reduced by the government. Therefore, the limited land release

caused disruption in the Australian property price (Kohler and Van Der Merwe 2015).

The use of high density land is restricted by the Federal government.

The change in foreign investment rule of 2008 for temporary visa holders affected the

household price dramatically.

The government imposed restrictions, to encourage urban densification on Greenfield

development (Hulse and Yates 2017).

In early 2000s, the introduction of upfront levies on infrastructure by local councils

influenced the price and demand of the housing market.

The current increase in rate of housing in Australia is not associated with rise in mortgage

rates or rise in unemployment rate of the nation. Instead, the downturn in unemployment rate

contributed to decline in household prices in New South Wales (Rogers, Lee and Yan 2015).

Rather, the turmoil of the housing market is influenced by huge shifts in population growth and

lack of flexibility in the supply side of the household market.

The housing market of the Australia affected the profitability of the financial institutions.

The access to finance by the small business may affect due to the value of the collateral for

loans.

The supply of the land is reduced by the government. Therefore, the limited land release

caused disruption in the Australian property price (Kohler and Van Der Merwe 2015).

The use of high density land is restricted by the Federal government.

The change in foreign investment rule of 2008 for temporary visa holders affected the

household price dramatically.

The government imposed restrictions, to encourage urban densification on Greenfield

development (Hulse and Yates 2017).

In early 2000s, the introduction of upfront levies on infrastructure by local councils

influenced the price and demand of the housing market.

The current increase in rate of housing in Australia is not associated with rise in mortgage

rates or rise in unemployment rate of the nation. Instead, the downturn in unemployment rate

contributed to decline in household prices in New South Wales (Rogers, Lee and Yan 2015).

Rather, the turmoil of the housing market is influenced by huge shifts in population growth and

lack of flexibility in the supply side of the household market.

The housing market of the Australia affected the profitability of the financial institutions.

The access to finance by the small business may affect due to the value of the collateral for

loans.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS AND INTERNATIONAL TRADE

Graph 1

https://www.rba.gov.au/, "Reserve Bank of Australia", in Reserve Bank of Australia, , 2019,

<https://www.rba.gov.au/> [accessed 28 August 2019].

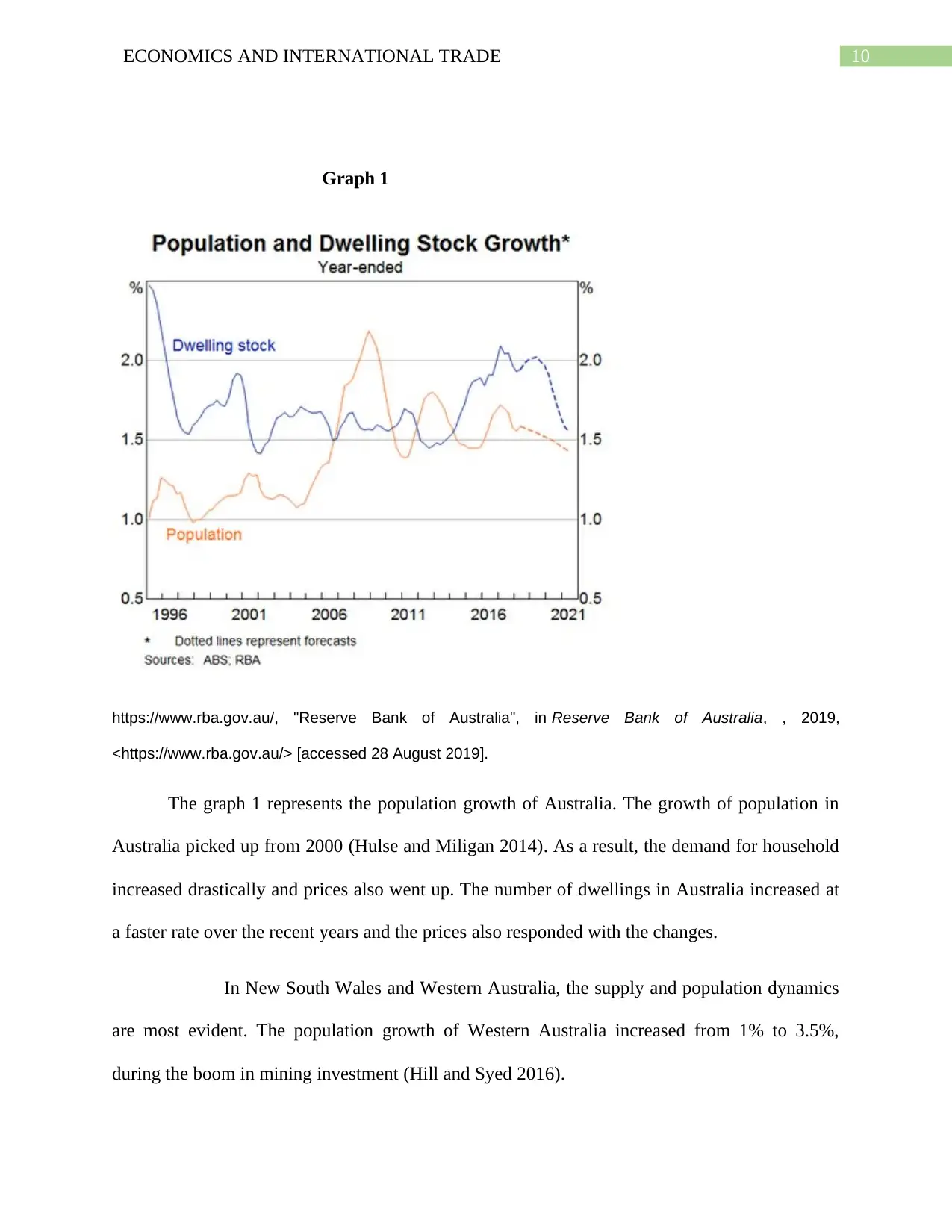

The graph 1 represents the population growth of Australia. The growth of population in

Australia picked up from 2000 (Hulse and Miligan 2014). As a result, the demand for household

increased drastically and prices also went up. The number of dwellings in Australia increased at

a faster rate over the recent years and the prices also responded with the changes.

In New South Wales and Western Australia, the supply and population dynamics

are most evident. The population growth of Western Australia increased from 1% to 3.5%,

during the boom in mining investment (Hill and Syed 2016).

Graph 1

https://www.rba.gov.au/, "Reserve Bank of Australia", in Reserve Bank of Australia, , 2019,

<https://www.rba.gov.au/> [accessed 28 August 2019].

The graph 1 represents the population growth of Australia. The growth of population in

Australia picked up from 2000 (Hulse and Miligan 2014). As a result, the demand for household

increased drastically and prices also went up. The number of dwellings in Australia increased at

a faster rate over the recent years and the prices also responded with the changes.

In New South Wales and Western Australia, the supply and population dynamics

are most evident. The population growth of Western Australia increased from 1% to 3.5%,

during the boom in mining investment (Hill and Syed 2016).

11ECONOMICS AND INTERNATIONAL TRADE

Graph 2

https://www.rba.gov.au/, "Reserve Bank of Australia", in Reserve Bank of Australia, , 2019,

<https://www.rba.gov.au/> [accessed 28 August 2019].

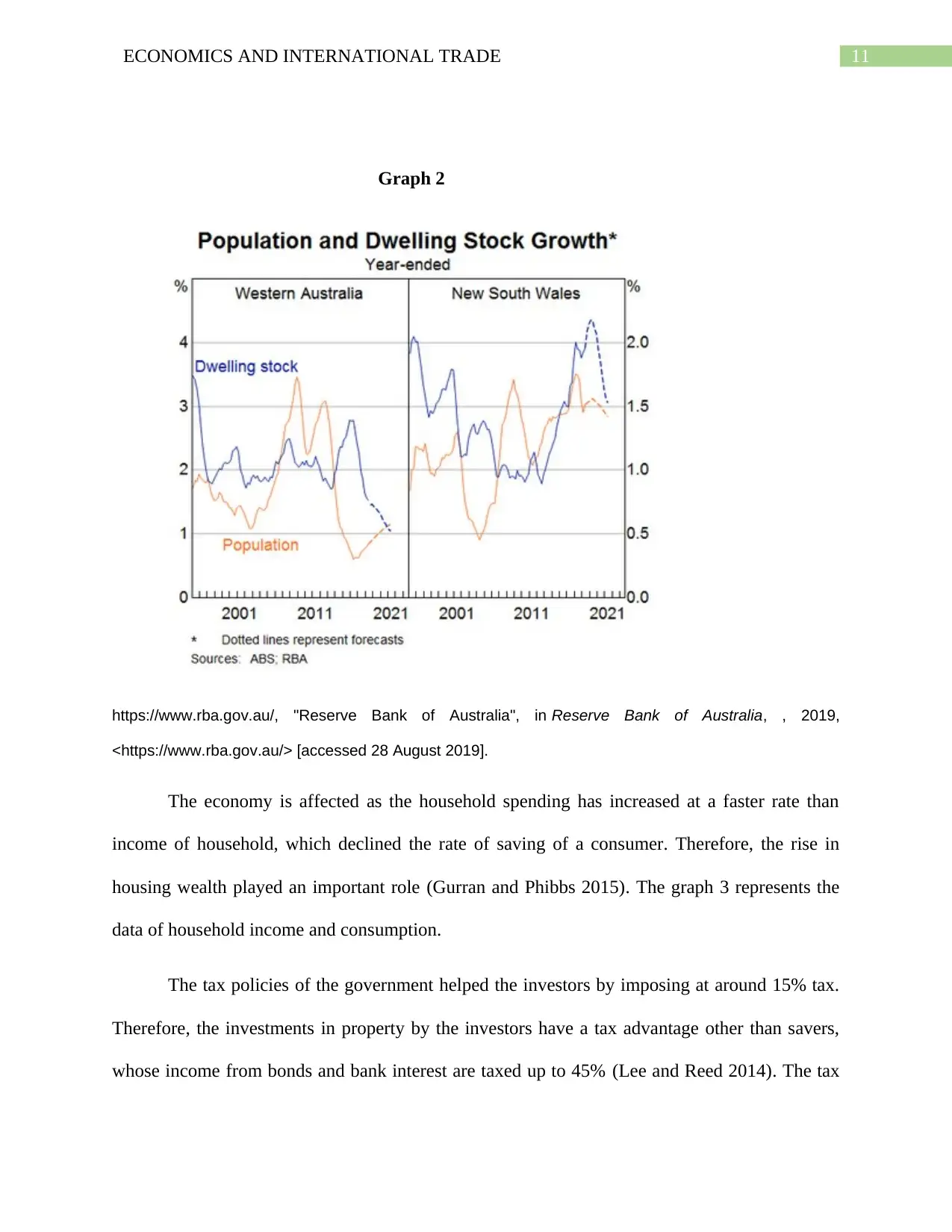

The economy is affected as the household spending has increased at a faster rate than

income of household, which declined the rate of saving of a consumer. Therefore, the rise in

housing wealth played an important role (Gurran and Phibbs 2015). The graph 3 represents the

data of household income and consumption.

The tax policies of the government helped the investors by imposing at around 15% tax.

Therefore, the investments in property by the investors have a tax advantage other than savers,

whose income from bonds and bank interest are taxed up to 45% (Lee and Reed 2014). The tax

Graph 2

https://www.rba.gov.au/, "Reserve Bank of Australia", in Reserve Bank of Australia, , 2019,

<https://www.rba.gov.au/> [accessed 28 August 2019].

The economy is affected as the household spending has increased at a faster rate than

income of household, which declined the rate of saving of a consumer. Therefore, the rise in

housing wealth played an important role (Gurran and Phibbs 2015). The graph 3 represents the

data of household income and consumption.

The tax policies of the government helped the investors by imposing at around 15% tax.

Therefore, the investments in property by the investors have a tax advantage other than savers,

whose income from bonds and bank interest are taxed up to 45% (Lee and Reed 2014). The tax

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.