Comprehensive Analysis: Accounting for Managers Assignment - Finance

VerifiedAdded on 2020/02/24

|7

|1544

|104

Homework Assignment

AI Summary

This assignment solution for Accounting for Managers delves into various aspects of financial and cost accounting. It begins by explaining the importance of financial budgets, contrasting fixed and flexible budgets, and demonstrating their application with examples. The solution then explores cash budgets, sales, production, and raw material budgets, highlighting their significance in financial planning. It also discusses the cash cycle, operating cycle, and working capital ratios, emphasizing their role in financial management. Furthermore, the assignment addresses the importance of accounting in both private and government organizations. The solution also covers costing systems, overhead allocation, and the advantages of predetermined overhead rates, providing calculations and explanations to support the concepts discussed. The references include key accounting textbooks and resources.

ACCOUNTING FOR MANAGERS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer 1.

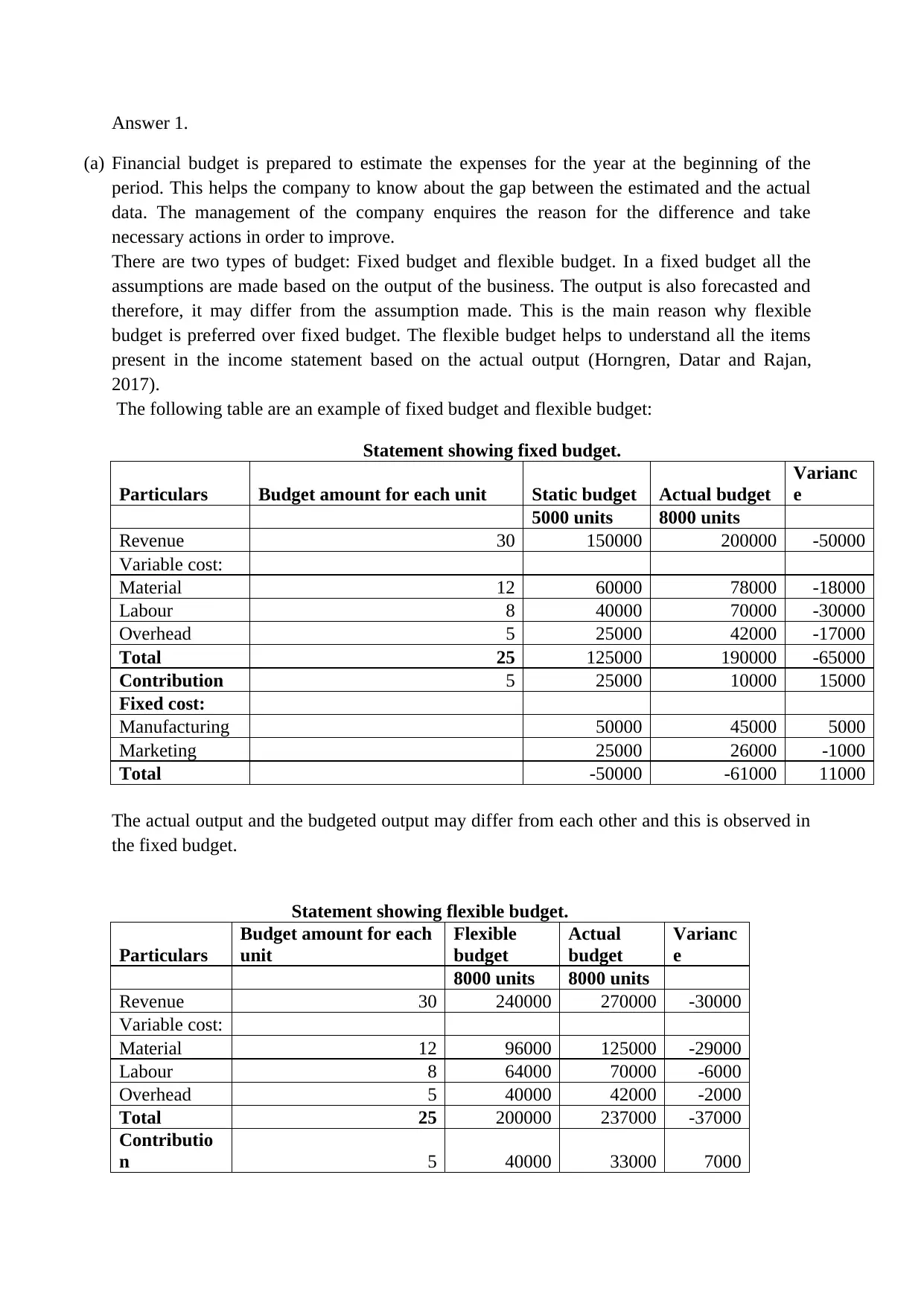

(a) Financial budget is prepared to estimate the expenses for the year at the beginning of the

period. This helps the company to know about the gap between the estimated and the actual

data. The management of the company enquires the reason for the difference and take

necessary actions in order to improve.

There are two types of budget: Fixed budget and flexible budget. In a fixed budget all the

assumptions are made based on the output of the business. The output is also forecasted and

therefore, it may differ from the assumption made. This is the main reason why flexible

budget is preferred over fixed budget. The flexible budget helps to understand all the items

present in the income statement based on the actual output (Horngren, Datar and Rajan,

2017).

The following table are an example of fixed budget and flexible budget:

Statement showing fixed budget.

Particulars Budget amount for each unit Static budget Actual budget

Varianc

e

5000 units 8000 units

Revenue 30 150000 200000 -50000

Variable cost:

Material 12 60000 78000 -18000

Labour 8 40000 70000 -30000

Overhead 5 25000 42000 -17000

Total 25 125000 190000 -65000

Contribution 5 25000 10000 15000

Fixed cost:

Manufacturing 50000 45000 5000

Marketing 25000 26000 -1000

Total -50000 -61000 11000

The actual output and the budgeted output may differ from each other and this is observed in

the fixed budget.

Statement showing flexible budget.

Particulars

Budget amount for each

unit

Flexible

budget

Actual

budget

Varianc

e

8000 units 8000 units

Revenue 30 240000 270000 -30000

Variable cost:

Material 12 96000 125000 -29000

Labour 8 64000 70000 -6000

Overhead 5 40000 42000 -2000

Total 25 200000 237000 -37000

Contributio

n 5 40000 33000 7000

(a) Financial budget is prepared to estimate the expenses for the year at the beginning of the

period. This helps the company to know about the gap between the estimated and the actual

data. The management of the company enquires the reason for the difference and take

necessary actions in order to improve.

There are two types of budget: Fixed budget and flexible budget. In a fixed budget all the

assumptions are made based on the output of the business. The output is also forecasted and

therefore, it may differ from the assumption made. This is the main reason why flexible

budget is preferred over fixed budget. The flexible budget helps to understand all the items

present in the income statement based on the actual output (Horngren, Datar and Rajan,

2017).

The following table are an example of fixed budget and flexible budget:

Statement showing fixed budget.

Particulars Budget amount for each unit Static budget Actual budget

Varianc

e

5000 units 8000 units

Revenue 30 150000 200000 -50000

Variable cost:

Material 12 60000 78000 -18000

Labour 8 40000 70000 -30000

Overhead 5 25000 42000 -17000

Total 25 125000 190000 -65000

Contribution 5 25000 10000 15000

Fixed cost:

Manufacturing 50000 45000 5000

Marketing 25000 26000 -1000

Total -50000 -61000 11000

The actual output and the budgeted output may differ from each other and this is observed in

the fixed budget.

Statement showing flexible budget.

Particulars

Budget amount for each

unit

Flexible

budget

Actual

budget

Varianc

e

8000 units 8000 units

Revenue 30 240000 270000 -30000

Variable cost:

Material 12 96000 125000 -29000

Labour 8 64000 70000 -6000

Overhead 5 40000 42000 -2000

Total 25 200000 237000 -37000

Contributio

n 5 40000 33000 7000

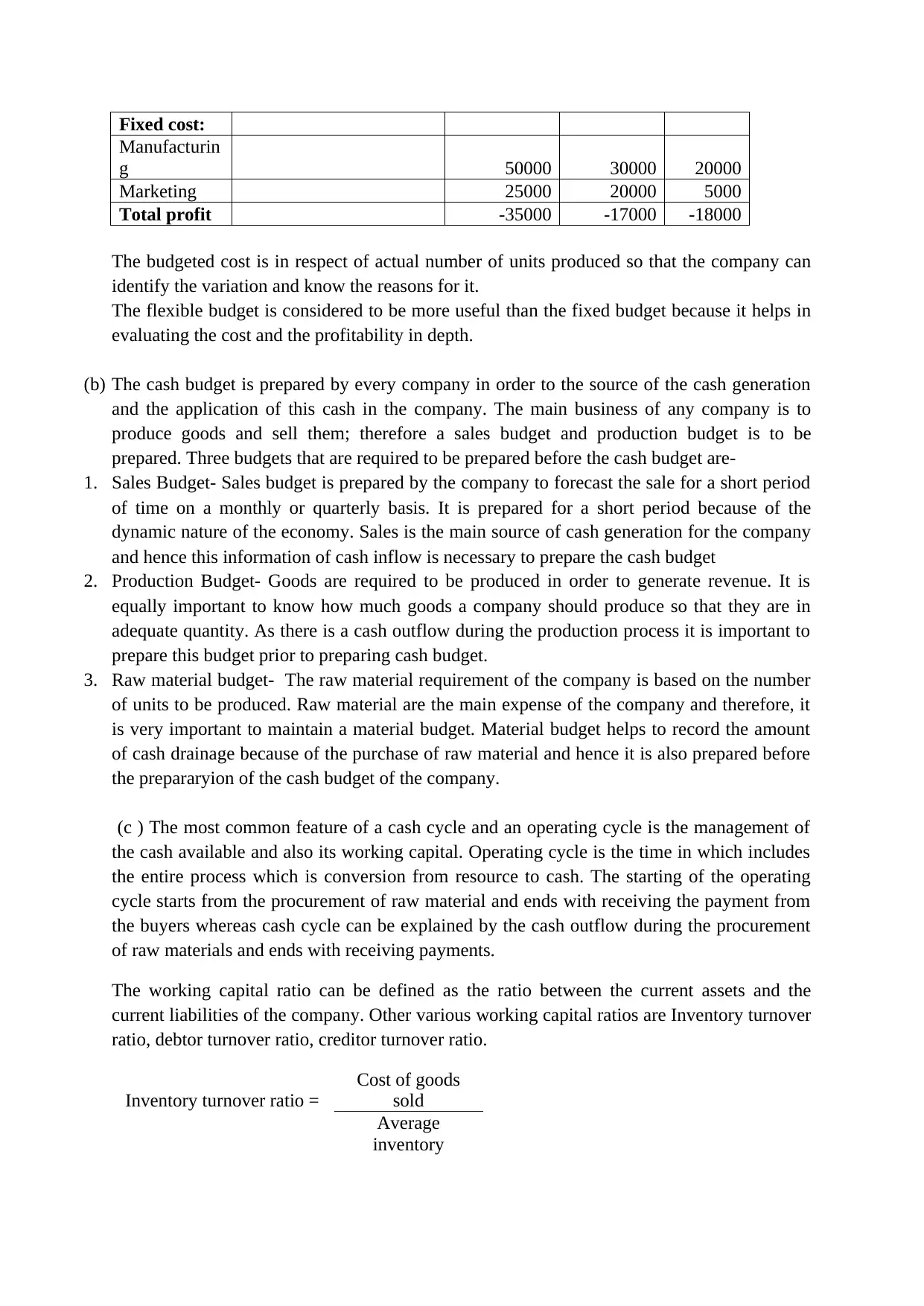

Fixed cost:

Manufacturin

g 50000 30000 20000

Marketing 25000 20000 5000

Total profit -35000 -17000 -18000

The budgeted cost is in respect of actual number of units produced so that the company can

identify the variation and know the reasons for it.

The flexible budget is considered to be more useful than the fixed budget because it helps in

evaluating the cost and the profitability in depth.

(b) The cash budget is prepared by every company in order to the source of the cash generation

and the application of this cash in the company. The main business of any company is to

produce goods and sell them; therefore a sales budget and production budget is to be

prepared. Three budgets that are required to be prepared before the cash budget are-

1. Sales Budget- Sales budget is prepared by the company to forecast the sale for a short period

of time on a monthly or quarterly basis. It is prepared for a short period because of the

dynamic nature of the economy. Sales is the main source of cash generation for the company

and hence this information of cash inflow is necessary to prepare the cash budget

2. Production Budget- Goods are required to be produced in order to generate revenue. It is

equally important to know how much goods a company should produce so that they are in

adequate quantity. As there is a cash outflow during the production process it is important to

prepare this budget prior to preparing cash budget.

3. Raw material budget- The raw material requirement of the company is based on the number

of units to be produced. Raw material are the main expense of the company and therefore, it

is very important to maintain a material budget. Material budget helps to record the amount

of cash drainage because of the purchase of raw material and hence it is also prepared before

the prepararyion of the cash budget of the company.

(c ) The most common feature of a cash cycle and an operating cycle is the management of

the cash available and also its working capital. Operating cycle is the time in which includes

the entire process which is conversion from resource to cash. The starting of the operating

cycle starts from the procurement of raw material and ends with receiving the payment from

the buyers whereas cash cycle can be explained by the cash outflow during the procurement

of raw materials and ends with receiving payments.

The working capital ratio can be defined as the ratio between the current assets and the

current liabilities of the company. Other various working capital ratios are Inventory turnover

ratio, debtor turnover ratio, creditor turnover ratio.

Inventory turnover ratio =

Cost of goods

sold

Average

inventory

Manufacturin

g 50000 30000 20000

Marketing 25000 20000 5000

Total profit -35000 -17000 -18000

The budgeted cost is in respect of actual number of units produced so that the company can

identify the variation and know the reasons for it.

The flexible budget is considered to be more useful than the fixed budget because it helps in

evaluating the cost and the profitability in depth.

(b) The cash budget is prepared by every company in order to the source of the cash generation

and the application of this cash in the company. The main business of any company is to

produce goods and sell them; therefore a sales budget and production budget is to be

prepared. Three budgets that are required to be prepared before the cash budget are-

1. Sales Budget- Sales budget is prepared by the company to forecast the sale for a short period

of time on a monthly or quarterly basis. It is prepared for a short period because of the

dynamic nature of the economy. Sales is the main source of cash generation for the company

and hence this information of cash inflow is necessary to prepare the cash budget

2. Production Budget- Goods are required to be produced in order to generate revenue. It is

equally important to know how much goods a company should produce so that they are in

adequate quantity. As there is a cash outflow during the production process it is important to

prepare this budget prior to preparing cash budget.

3. Raw material budget- The raw material requirement of the company is based on the number

of units to be produced. Raw material are the main expense of the company and therefore, it

is very important to maintain a material budget. Material budget helps to record the amount

of cash drainage because of the purchase of raw material and hence it is also prepared before

the prepararyion of the cash budget of the company.

(c ) The most common feature of a cash cycle and an operating cycle is the management of

the cash available and also its working capital. Operating cycle is the time in which includes

the entire process which is conversion from resource to cash. The starting of the operating

cycle starts from the procurement of raw material and ends with receiving the payment from

the buyers whereas cash cycle can be explained by the cash outflow during the procurement

of raw materials and ends with receiving payments.

The working capital ratio can be defined as the ratio between the current assets and the

current liabilities of the company. Other various working capital ratios are Inventory turnover

ratio, debtor turnover ratio, creditor turnover ratio.

Inventory turnover ratio =

Cost of goods

sold

Average

inventory

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

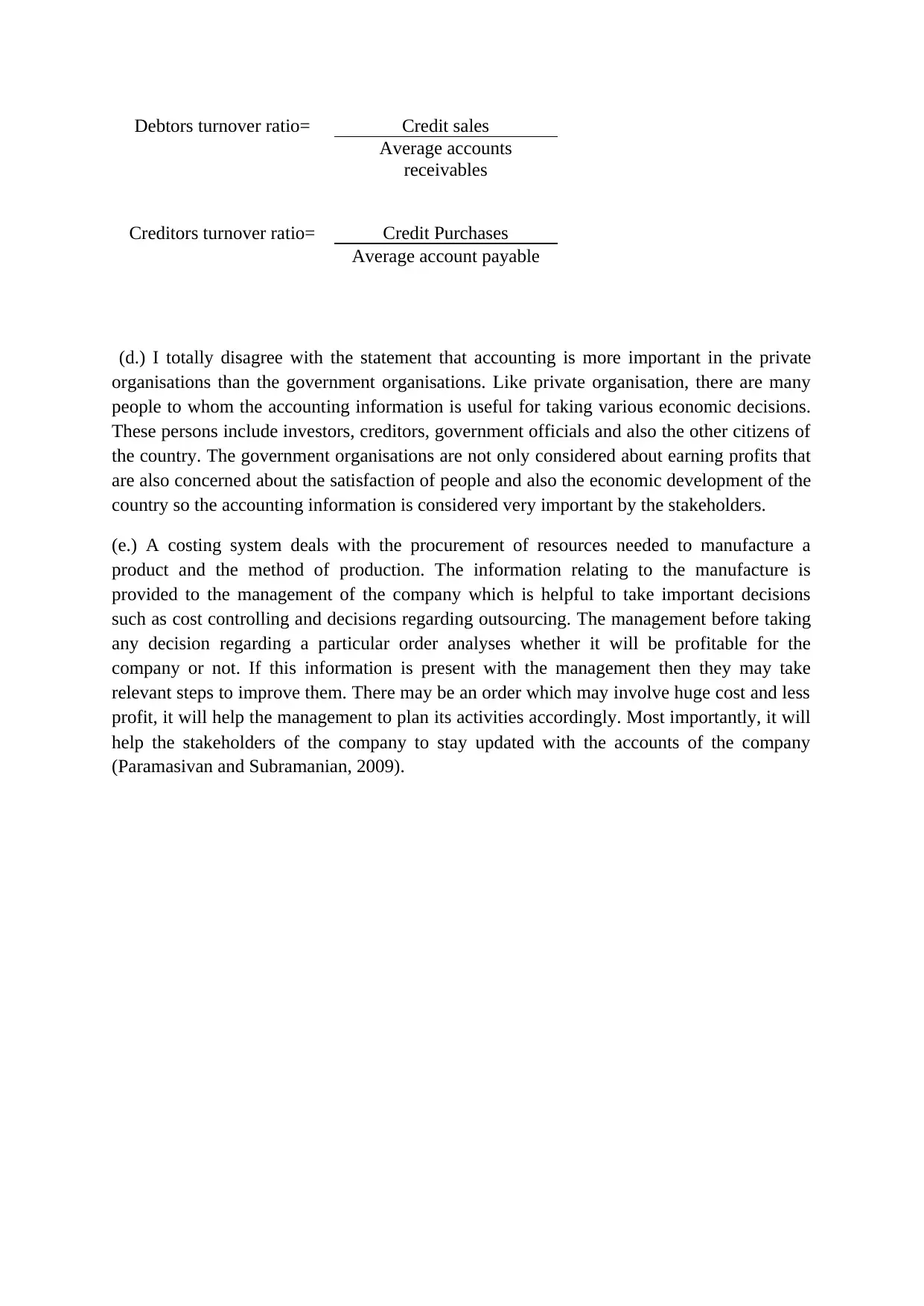

Debtors turnover ratio= Credit sales

Average accounts

receivables

Creditors turnover ratio= Credit Purchases

Average account payable

(d.) I totally disagree with the statement that accounting is more important in the private

organisations than the government organisations. Like private organisation, there are many

people to whom the accounting information is useful for taking various economic decisions.

These persons include investors, creditors, government officials and also the other citizens of

the country. The government organisations are not only considered about earning profits that

are also concerned about the satisfaction of people and also the economic development of the

country so the accounting information is considered very important by the stakeholders.

(e.) A costing system deals with the procurement of resources needed to manufacture a

product and the method of production. The information relating to the manufacture is

provided to the management of the company which is helpful to take important decisions

such as cost controlling and decisions regarding outsourcing. The management before taking

any decision regarding a particular order analyses whether it will be profitable for the

company or not. If this information is present with the management then they may take

relevant steps to improve them. There may be an order which may involve huge cost and less

profit, it will help the management to plan its activities accordingly. Most importantly, it will

help the stakeholders of the company to stay updated with the accounts of the company

(Paramasivan and Subramanian, 2009).

Average accounts

receivables

Creditors turnover ratio= Credit Purchases

Average account payable

(d.) I totally disagree with the statement that accounting is more important in the private

organisations than the government organisations. Like private organisation, there are many

people to whom the accounting information is useful for taking various economic decisions.

These persons include investors, creditors, government officials and also the other citizens of

the country. The government organisations are not only considered about earning profits that

are also concerned about the satisfaction of people and also the economic development of the

country so the accounting information is considered very important by the stakeholders.

(e.) A costing system deals with the procurement of resources needed to manufacture a

product and the method of production. The information relating to the manufacture is

provided to the management of the company which is helpful to take important decisions

such as cost controlling and decisions regarding outsourcing. The management before taking

any decision regarding a particular order analyses whether it will be profitable for the

company or not. If this information is present with the management then they may take

relevant steps to improve them. There may be an order which may involve huge cost and less

profit, it will help the management to plan its activities accordingly. Most importantly, it will

help the stakeholders of the company to stay updated with the accounts of the company

(Paramasivan and Subramanian, 2009).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer 2.

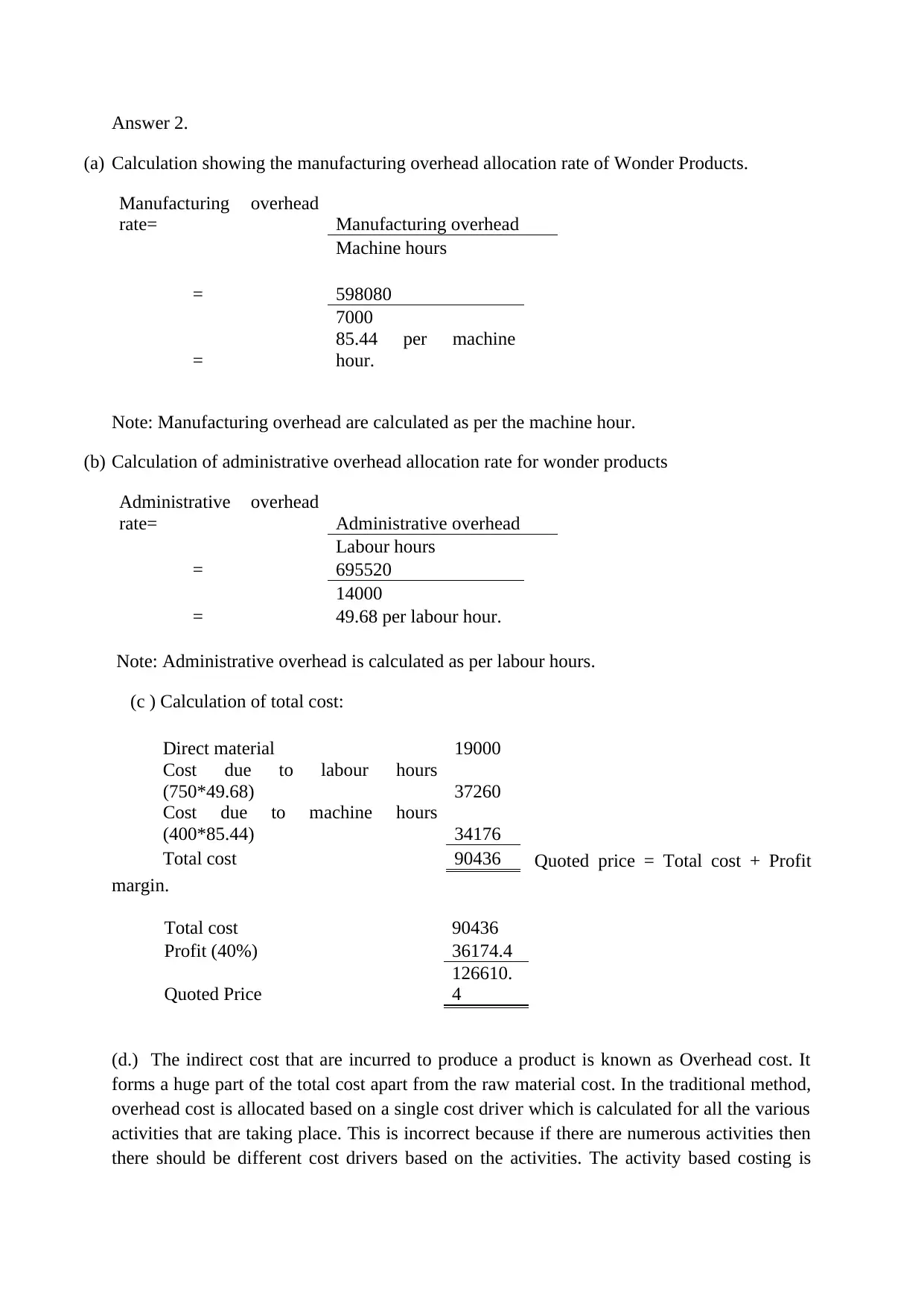

(a) Calculation showing the manufacturing overhead allocation rate of Wonder Products.

Manufacturing overhead

rate= Manufacturing overhead

Machine hours

= 598080

7000

=

85.44 per machine

hour.

Note: Manufacturing overhead are calculated as per the machine hour.

(b) Calculation of administrative overhead allocation rate for wonder products

Administrative overhead

rate= Administrative overhead

Labour hours

= 695520

14000

= 49.68 per labour hour.

Note: Administrative overhead is calculated as per labour hours.

(c ) Calculation of total cost:

Quoted price = Total cost + Profit

margin.

Total cost 90436

Profit (40%) 36174.4

Quoted Price

126610.

4

(d.) The indirect cost that are incurred to produce a product is known as Overhead cost. It

forms a huge part of the total cost apart from the raw material cost. In the traditional method,

overhead cost is allocated based on a single cost driver which is calculated for all the various

activities that are taking place. This is incorrect because if there are numerous activities then

there should be different cost drivers based on the activities. The activity based costing is

Direct material 19000

Cost due to labour hours

(750*49.68) 37260

Cost due to machine hours

(400*85.44) 34176

Total cost 90436

(a) Calculation showing the manufacturing overhead allocation rate of Wonder Products.

Manufacturing overhead

rate= Manufacturing overhead

Machine hours

= 598080

7000

=

85.44 per machine

hour.

Note: Manufacturing overhead are calculated as per the machine hour.

(b) Calculation of administrative overhead allocation rate for wonder products

Administrative overhead

rate= Administrative overhead

Labour hours

= 695520

14000

= 49.68 per labour hour.

Note: Administrative overhead is calculated as per labour hours.

(c ) Calculation of total cost:

Quoted price = Total cost + Profit

margin.

Total cost 90436

Profit (40%) 36174.4

Quoted Price

126610.

4

(d.) The indirect cost that are incurred to produce a product is known as Overhead cost. It

forms a huge part of the total cost apart from the raw material cost. In the traditional method,

overhead cost is allocated based on a single cost driver which is calculated for all the various

activities that are taking place. This is incorrect because if there are numerous activities then

there should be different cost drivers based on the activities. The activity based costing is

Direct material 19000

Cost due to labour hours

(750*49.68) 37260

Cost due to machine hours

(400*85.44) 34176

Total cost 90436

adopted by most countries in order to get information relating to the cost of each unit and its

breakup (Pillai, 2010).

In the above question different activities were based on different cost drivers like labour

hours and machine hours. The cost of overhead is added along with the other direct cost in

order to get the total cost.

(e) The reason for preferring predetermined overhead allocation rate than real overhead rate

is the Time frame. The actual overhead that has been incurred is known by the company only

when the work gets completed. It becomes difficult for the company to estimate the overhead

and recover from the customers. Therefore, a predetermined rate is calculated and according

to that the cost is recovered. It is however not necessary that the cost will be recovered

correctly i.e. it is possible that there may be under absorption or over absorption. Therefore,

the rate determined is not calculated as a long term view (Tulsian, 2006).

breakup (Pillai, 2010).

In the above question different activities were based on different cost drivers like labour

hours and machine hours. The cost of overhead is added along with the other direct cost in

order to get the total cost.

(e) The reason for preferring predetermined overhead allocation rate than real overhead rate

is the Time frame. The actual overhead that has been incurred is known by the company only

when the work gets completed. It becomes difficult for the company to estimate the overhead

and recover from the customers. Therefore, a predetermined rate is calculated and according

to that the cost is recovered. It is however not necessary that the cost will be recovered

correctly i.e. it is possible that there may be under absorption or over absorption. Therefore,

the rate determined is not calculated as a long term view (Tulsian, 2006).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References:

Horngren, C., Datar, S. and Rajan, M. (2017). Horngren's cost accounting. Harlow, Essex,

England: Pearson Education Limited.

Paramasivan, C. and Subramanian, T. (2009). Financial management. New Delhi: New Age

International (P) Ltd., Publishers.

Pillai, R. (2010). Management accounting. [Place of publication not identified]: S Chand &

Co Ltd.

Tulsian, P. (2006). Financial accounting. New Delhi: Pearson/Education.

Horngren, C., Datar, S. and Rajan, M. (2017). Horngren's cost accounting. Harlow, Essex,

England: Pearson Education Limited.

Paramasivan, C. and Subramanian, T. (2009). Financial management. New Delhi: New Age

International (P) Ltd., Publishers.

Pillai, R. (2010). Management accounting. [Place of publication not identified]: S Chand &

Co Ltd.

Tulsian, P. (2006). Financial accounting. New Delhi: Pearson/Education.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.