Accounting and Finance - Woolworths company

VerifiedAdded on 2022/08/27

|27

|3735

|32

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Accounting and finance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting and Finance 1

Executive Summary

The main purpose of this paper is to understand the topic of financial statement analysis. In this

paper, Woolworths has been taken into consideration to summarize the financial performance. In

this report, ratio analysis, horizontal analysis, and vertical analysis have been used to summarize

the financial position. As per the Ratio Analysis, it has been found that financial performance of

Woolworths has been decreases as compare to Wesfarmers. Horizontal analysis states that

Woolworths cost of goods sold has been increases as compare to revenue. Vertical Analysis

depicts that the company invests the less amount in current assets as compare to fixed assets due

to which its liquidity situation has been affected.

Executive Summary

The main purpose of this paper is to understand the topic of financial statement analysis. In this

paper, Woolworths has been taken into consideration to summarize the financial performance. In

this report, ratio analysis, horizontal analysis, and vertical analysis have been used to summarize

the financial position. As per the Ratio Analysis, it has been found that financial performance of

Woolworths has been decreases as compare to Wesfarmers. Horizontal analysis states that

Woolworths cost of goods sold has been increases as compare to revenue. Vertical Analysis

depicts that the company invests the less amount in current assets as compare to fixed assets due

to which its liquidity situation has been affected.

Accounting and Finance 2

Contents

Introduction......................................................................................................................................3

Ratio Analysis..................................................................................................................................3

Horizontal Analysis.........................................................................................................................7

Vertical Analysis.............................................................................................................................8

Conclusion.......................................................................................................................................8

References......................................................................................................................................10

Appendix-1....................................................................................................................................11

Appendix-2....................................................................................................................................16

Contents

Introduction......................................................................................................................................3

Ratio Analysis..................................................................................................................................3

Horizontal Analysis.........................................................................................................................7

Vertical Analysis.............................................................................................................................8

Conclusion.......................................................................................................................................8

References......................................................................................................................................10

Appendix-1....................................................................................................................................11

Appendix-2....................................................................................................................................16

Accounting and Finance 3

Introduction

Financial analysis is the process of analyzing, summarizing and evaluating the financial

position of the company. There are numerous ways in which the company can determine the

financial situation such as Ratio Analysis, Horizontal Analysis, Vertical Analysis and the others.

These techniques helps the company to summaries the financial performance so that it can

improve its position by developing strategies (Robinson, 2020). In this paper, the discussion is

based on the topic of “financial analysis of the company”. Woolworths has been taken into

consideration to assess the financial performance in Australian market. In this paper, the

financial statements of 2018 and 2019 have been selected to evaluate the financial position of the

firm.

Woolworths is a supermarket chain of Australia that provides the grocery services. It was

founded in the year 1924. It is one of the leading companies of Australian supermarket chain.

Wesfarmers is one of its main competitors that have been also analyzing to compare the financial

situation (Woolworths Group, 2018).

Ratio Analysis

Profitability Ratio

Ratio's

Wesfar

mers

Wesfar

mers

Woolwo

rths

Woolwo

rths

AUD in Million 2018 2019 2018 2019

Introduction

Financial analysis is the process of analyzing, summarizing and evaluating the financial

position of the company. There are numerous ways in which the company can determine the

financial situation such as Ratio Analysis, Horizontal Analysis, Vertical Analysis and the others.

These techniques helps the company to summaries the financial performance so that it can

improve its position by developing strategies (Robinson, 2020). In this paper, the discussion is

based on the topic of “financial analysis of the company”. Woolworths has been taken into

consideration to assess the financial performance in Australian market. In this paper, the

financial statements of 2018 and 2019 have been selected to evaluate the financial position of the

firm.

Woolworths is a supermarket chain of Australia that provides the grocery services. It was

founded in the year 1924. It is one of the leading companies of Australian supermarket chain.

Wesfarmers is one of its main competitors that have been also analyzing to compare the financial

situation (Woolworths Group, 2018).

Ratio Analysis

Profitability Ratio

Ratio's

Wesfar

mers

Wesfar

mers

Woolwo

rths

Woolwo

rths

AUD in Million 2018 2019 2018 2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting and Finance 4

Profitability

Ratio

(Net) Profit

margin (a/b) Net Profit 1197 5510 1724 2693

Net Sales 66594 27818 56726 59984

2% 20% 3% 4%

Gross Profit

Margin Gross Profit 20876.00 10578.00 16470.00 17442

Net Sales 66594.00 27818.00 56726.00 59984.00

31% 38% 29% 29%

Return on Assets Net income 1197 5510 1724 2693

Total assets 36933 18333 23558 23491

3% 30% 7% 11%

Return on Equity

Net income after preference

dividends 1197 5510 1724 2693

Average common stock

holder's equity 22238 18981 5835 5941.5

5% 29% 30% 45%

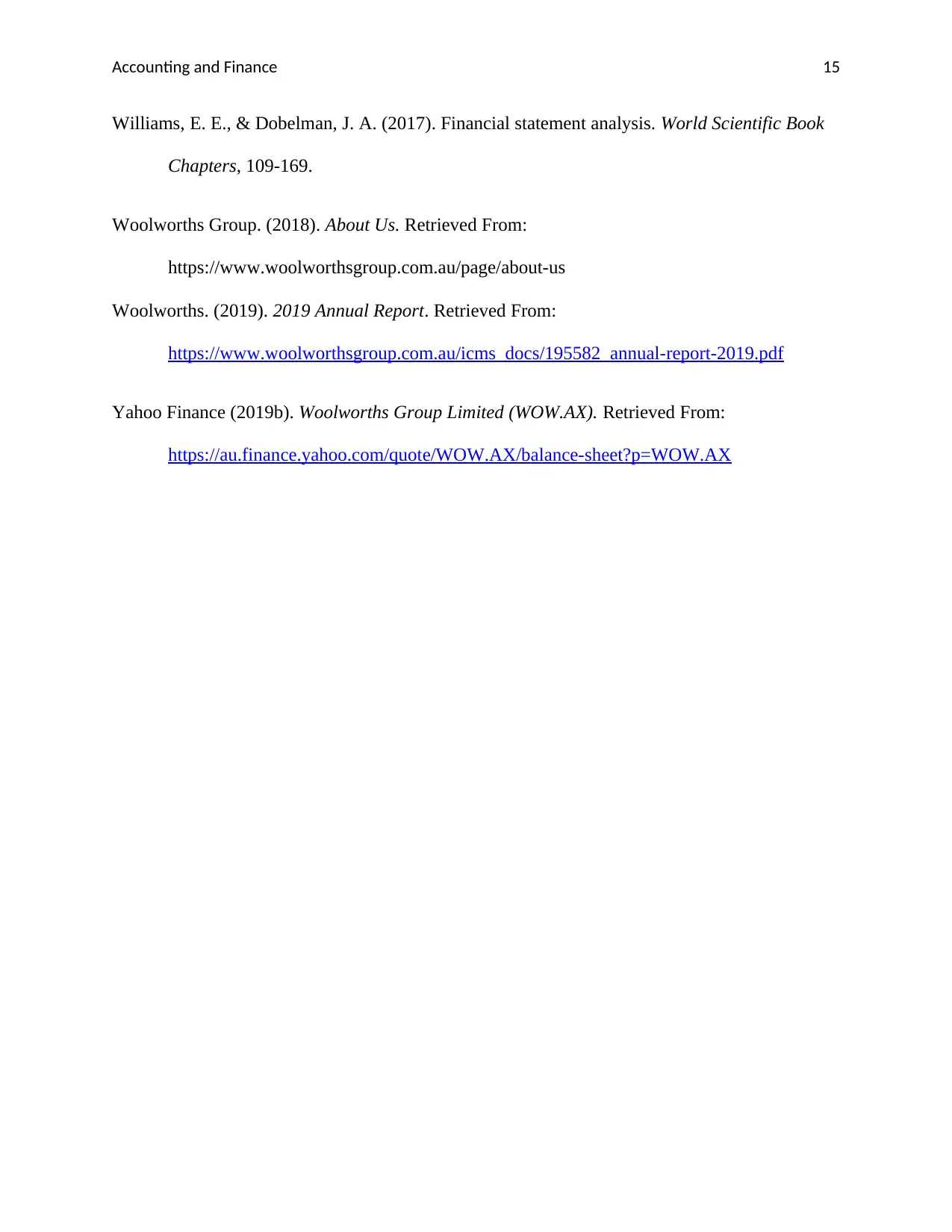

According to profitability ratio of Woolworths, it has been seen that the ability of the firm

to create the revenue has been increases. The net profit ratio of the firm is increasing from 3% to

Profitability

Ratio

(Net) Profit

margin (a/b) Net Profit 1197 5510 1724 2693

Net Sales 66594 27818 56726 59984

2% 20% 3% 4%

Gross Profit

Margin Gross Profit 20876.00 10578.00 16470.00 17442

Net Sales 66594.00 27818.00 56726.00 59984.00

31% 38% 29% 29%

Return on Assets Net income 1197 5510 1724 2693

Total assets 36933 18333 23558 23491

3% 30% 7% 11%

Return on Equity

Net income after preference

dividends 1197 5510 1724 2693

Average common stock

holder's equity 22238 18981 5835 5941.5

5% 29% 30% 45%

According to profitability ratio of Woolworths, it has been seen that the ability of the firm

to create the revenue has been increases. The net profit ratio of the firm is increasing from 3% to

Accounting and Finance 5

4% in the year 2018 to 2019. But it is observed that net profit margin of Wesfarmers has been

increases with the high percentage such as 2% to 20%. These depicts that Wesfarmers has been

more capacity to generate the revenue.

This graph of Wesfarmers represents that Return on Assets is high as compare to Return

on Equity. Return on Assets depicts that the company uses the assets properly in order to

generate the profit. The ratio of Return on Assets has been increases from 3% to 30% in the year

2018 to 2019. It has been determined that Return on Equity ratio has been increases from the

previous year such as 5% and 29% in 2018 and 2019 respectively. Woolworths gives high

amount of return to shareholders as compare to Wesfarmers such as 30% to 45%. The

4% in the year 2018 to 2019. But it is observed that net profit margin of Wesfarmers has been

increases with the high percentage such as 2% to 20%. These depicts that Wesfarmers has been

more capacity to generate the revenue.

This graph of Wesfarmers represents that Return on Assets is high as compare to Return

on Equity. Return on Assets depicts that the company uses the assets properly in order to

generate the profit. The ratio of Return on Assets has been increases from 3% to 30% in the year

2018 to 2019. It has been determined that Return on Equity ratio has been increases from the

previous year such as 5% and 29% in 2018 and 2019 respectively. Woolworths gives high

amount of return to shareholders as compare to Wesfarmers such as 30% to 45%. The

Accounting and Finance 6

Woolworths is highly committed to pay to return the high amount to shareholders due to which

its investors has been increases (Monahan, 2018).

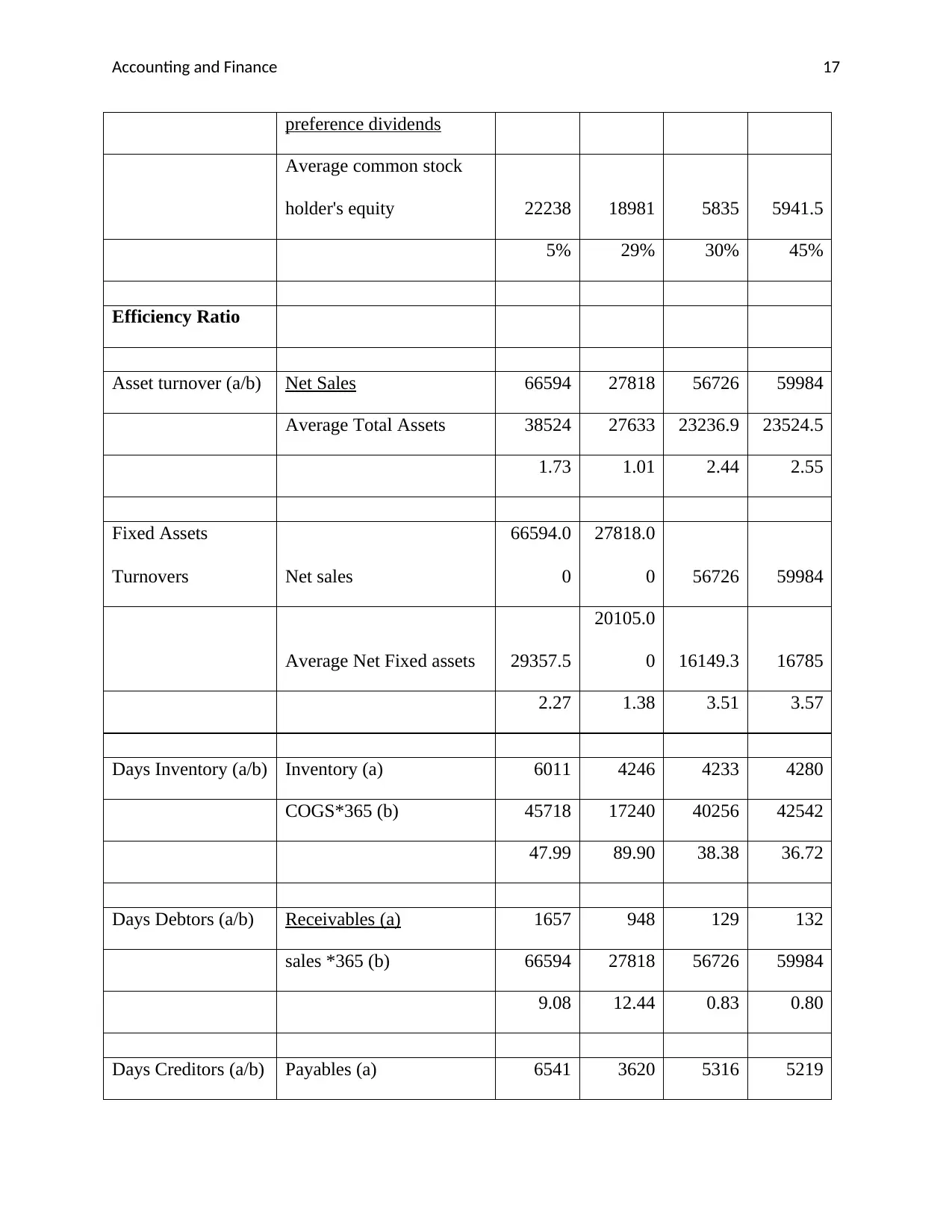

Liquidity Ratio

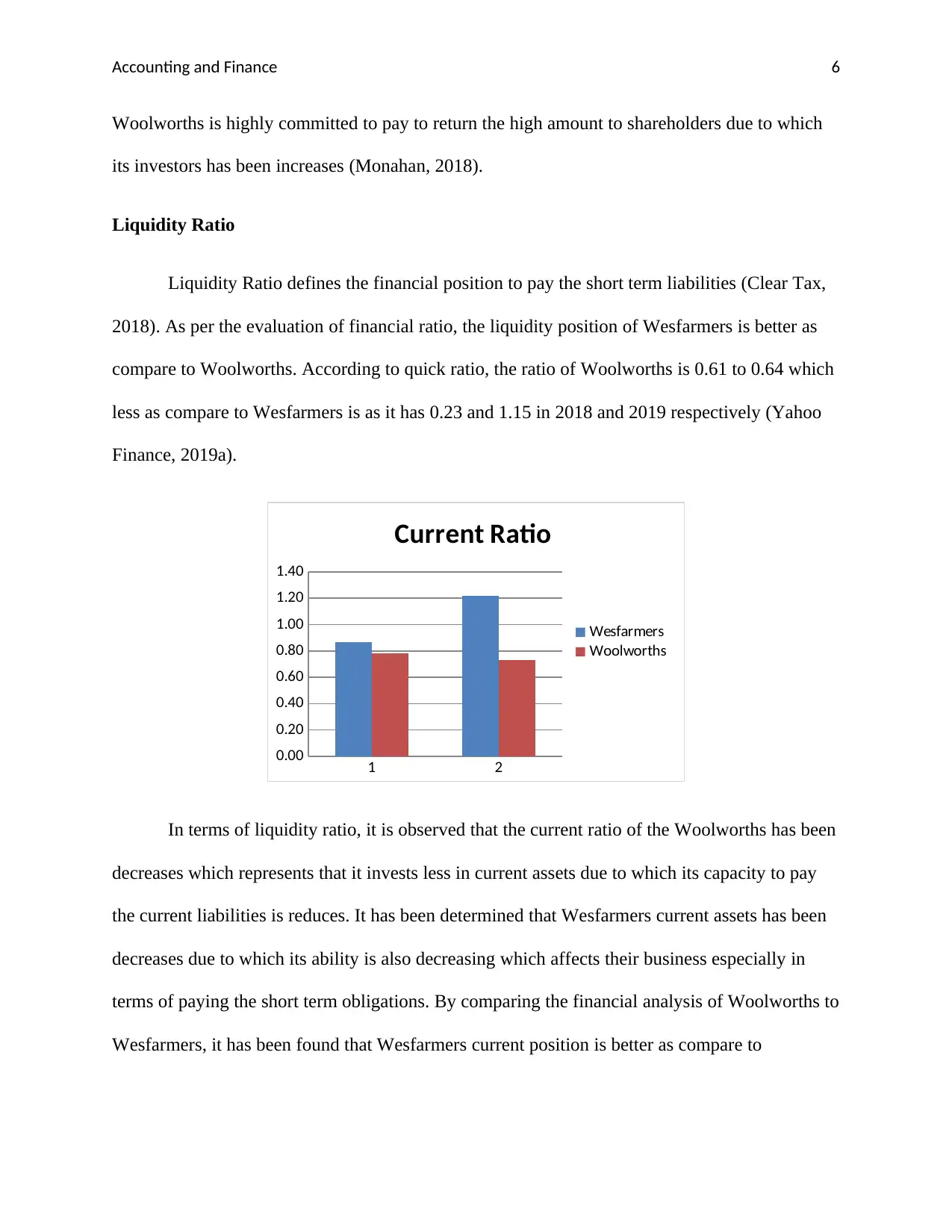

Liquidity Ratio defines the financial position to pay the short term liabilities (Clear Tax,

2018). As per the evaluation of financial ratio, the liquidity position of Wesfarmers is better as

compare to Woolworths. According to quick ratio, the ratio of Woolworths is 0.61 to 0.64 which

less as compare to Wesfarmers is as it has 0.23 and 1.15 in 2018 and 2019 respectively (Yahoo

Finance, 2019a).

1 2

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Current Ratio

Wesfarmers

Woolworths

In terms of liquidity ratio, it is observed that the current ratio of the Woolworths has been

decreases which represents that it invests less in current assets due to which its capacity to pay

the current liabilities is reduces. It has been determined that Wesfarmers current assets has been

decreases due to which its ability is also decreasing which affects their business especially in

terms of paying the short term obligations. By comparing the financial analysis of Woolworths to

Wesfarmers, it has been found that Wesfarmers current position is better as compare to

Woolworths is highly committed to pay to return the high amount to shareholders due to which

its investors has been increases (Monahan, 2018).

Liquidity Ratio

Liquidity Ratio defines the financial position to pay the short term liabilities (Clear Tax,

2018). As per the evaluation of financial ratio, the liquidity position of Wesfarmers is better as

compare to Woolworths. According to quick ratio, the ratio of Woolworths is 0.61 to 0.64 which

less as compare to Wesfarmers is as it has 0.23 and 1.15 in 2018 and 2019 respectively (Yahoo

Finance, 2019a).

1 2

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

Current Ratio

Wesfarmers

Woolworths

In terms of liquidity ratio, it is observed that the current ratio of the Woolworths has been

decreases which represents that it invests less in current assets due to which its capacity to pay

the current liabilities is reduces. It has been determined that Wesfarmers current assets has been

decreases due to which its ability is also decreasing which affects their business especially in

terms of paying the short term obligations. By comparing the financial analysis of Woolworths to

Wesfarmers, it has been found that Wesfarmers current position is better as compare to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance 7

Woolworths. The current ratio of Woolworths is 0.87 and 1.22, Wesfarmers is 0.78 and 0.73 in

2018 and 2019 respectively (Wesfarmers, 2019).

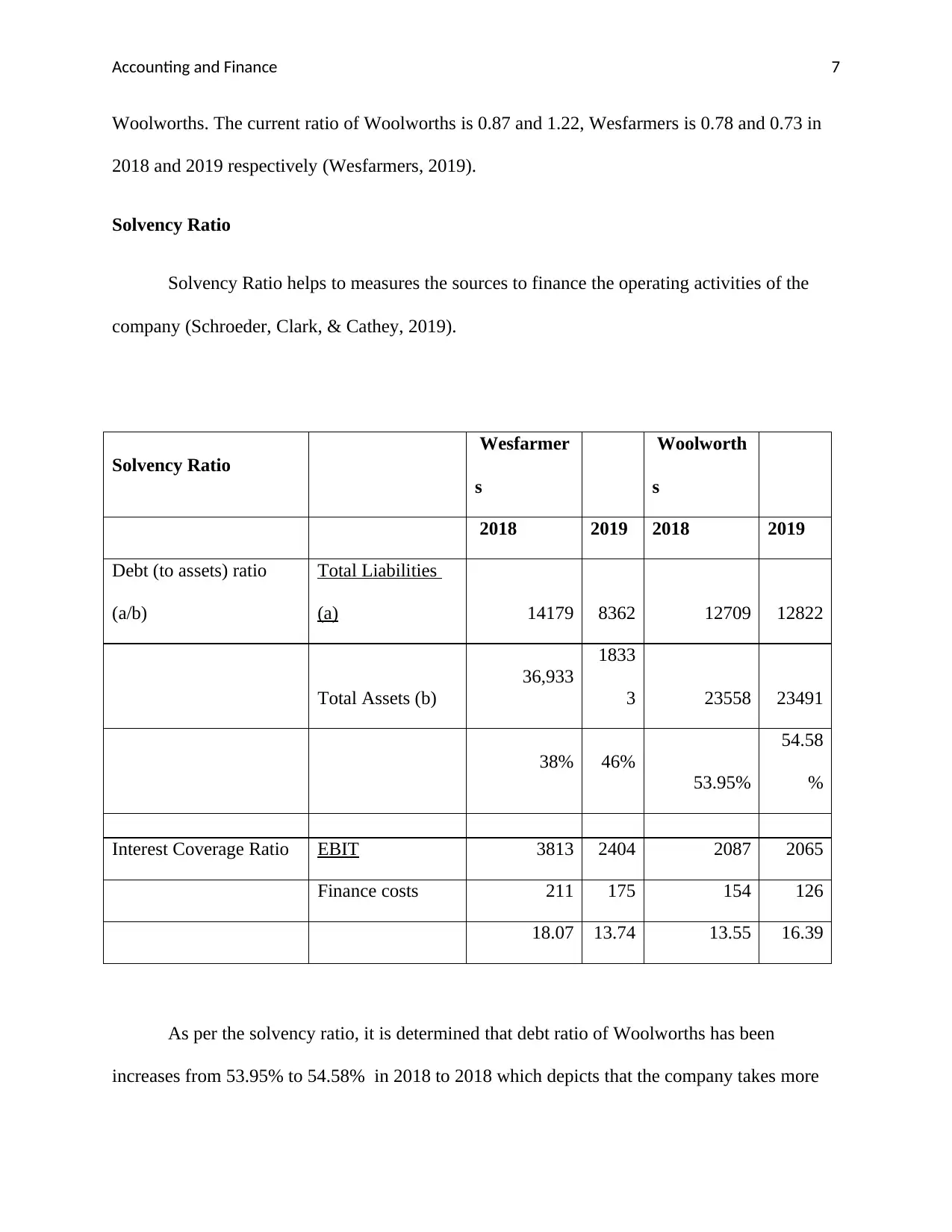

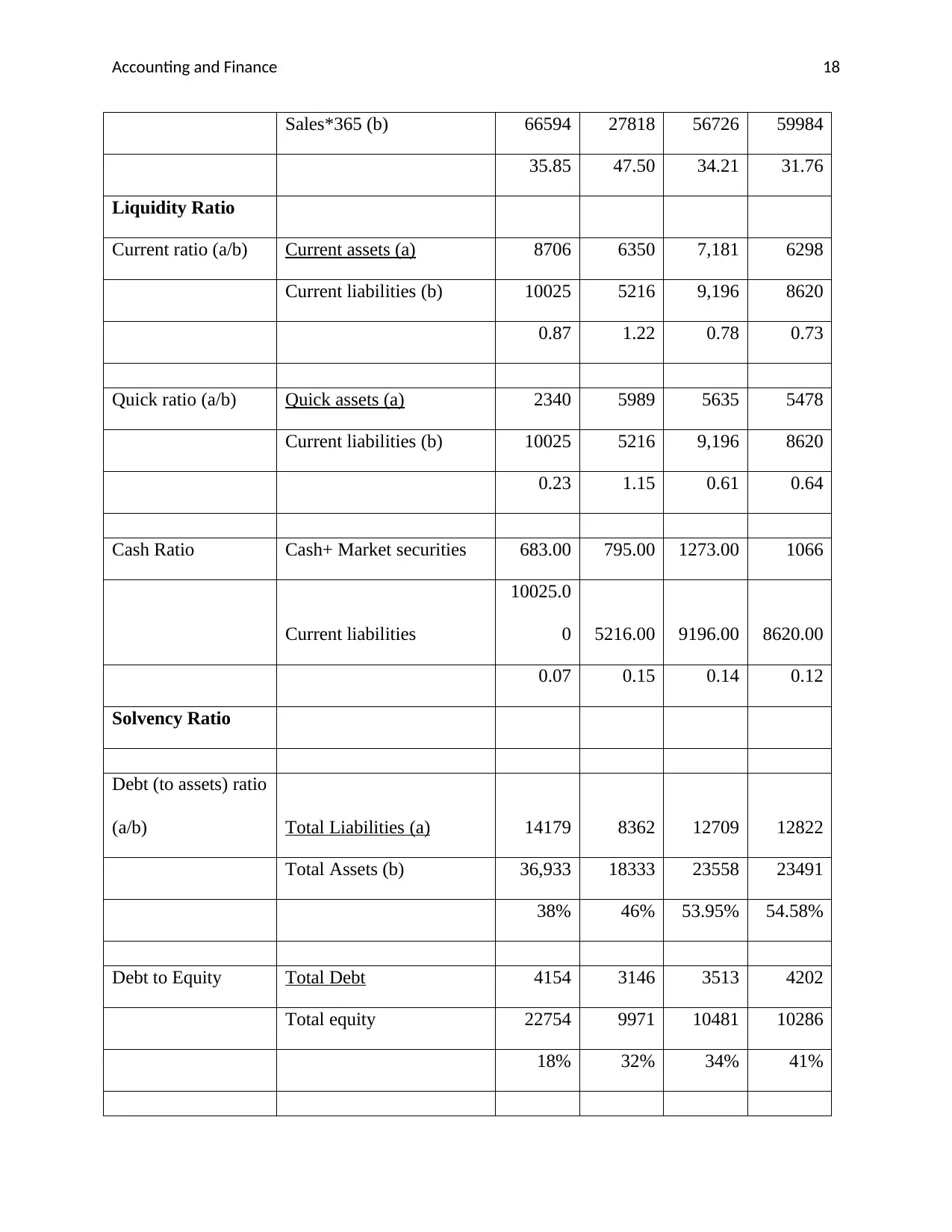

Solvency Ratio

Solvency Ratio helps to measures the sources to finance the operating activities of the

company (Schroeder, Clark, & Cathey, 2019).

Solvency Ratio

Wesfarmer

s

Woolworth

s

2018 2019 2018 2019

Debt (to assets) ratio

(a/b)

Total Liabilities

(a) 14179 8362 12709 12822

Total Assets (b)

36,933

1833

3 23558 23491

38% 46%

53.95%

54.58

%

Interest Coverage Ratio EBIT 3813 2404 2087 2065

Finance costs 211 175 154 126

18.07 13.74 13.55 16.39

As per the solvency ratio, it is determined that debt ratio of Woolworths has been

increases from 53.95% to 54.58% in 2018 to 2018 which depicts that the company takes more

Woolworths. The current ratio of Woolworths is 0.87 and 1.22, Wesfarmers is 0.78 and 0.73 in

2018 and 2019 respectively (Wesfarmers, 2019).

Solvency Ratio

Solvency Ratio helps to measures the sources to finance the operating activities of the

company (Schroeder, Clark, & Cathey, 2019).

Solvency Ratio

Wesfarmer

s

Woolworth

s

2018 2019 2018 2019

Debt (to assets) ratio

(a/b)

Total Liabilities

(a) 14179 8362 12709 12822

Total Assets (b)

36,933

1833

3 23558 23491

38% 46%

53.95%

54.58

%

Interest Coverage Ratio EBIT 3813 2404 2087 2065

Finance costs 211 175 154 126

18.07 13.74 13.55 16.39

As per the solvency ratio, it is determined that debt ratio of Woolworths has been

increases from 53.95% to 54.58% in 2018 to 2018 which depicts that the company takes more

Accounting and Finance 8

debt instead of using assets. The amount of total assets of the company has been decreases

which represents that the capability to pay long term obligations such as 23558 to 23491in the

year 2018 and 2019 respectively (Woolworths, 2019). In Wesfarmers, the debt ratio has been

increases but with the less percentage than the Woolworths as the total liabilities of Wesfarmers

is 38% to 46% in 2018 to 2019 respectively. Interest coverage ratio represents that Woolworths

cover its interest amount in more days as compare to Wesfarmers such as it takes 16.39 time and

Woolworths takes 13.74 times in 2019 (Yahoo Finance, 2019b).

.

1 2

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Debt to Equity ratio

Woolworths

Wesfarmers

As per the above graph of debt to equity ratio, it has been seen that Woolworths is the

company who issues the shares instead of borrowing money on loan to finance the operating

activities. Although, its amount of total liabilities has been increases from the previous year but

as compare to total equity, the amount of total liabilities is less which represents that it finances

the operating activities by issuing equity. In Wesfarmers, it has been seen that the amount of total

equity is decreasing with the high percentage due to which its financial position is affected. In

terms of solvency ratio, it has been determined that Woolworths finance the operating activities

from appropriately rather than Wesfarmers (Storey, Keasey, Watson, & Wynarczyk, 2016).

debt instead of using assets. The amount of total assets of the company has been decreases

which represents that the capability to pay long term obligations such as 23558 to 23491in the

year 2018 and 2019 respectively (Woolworths, 2019). In Wesfarmers, the debt ratio has been

increases but with the less percentage than the Woolworths as the total liabilities of Wesfarmers

is 38% to 46% in 2018 to 2019 respectively. Interest coverage ratio represents that Woolworths

cover its interest amount in more days as compare to Wesfarmers such as it takes 16.39 time and

Woolworths takes 13.74 times in 2019 (Yahoo Finance, 2019b).

.

1 2

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Debt to Equity ratio

Woolworths

Wesfarmers

As per the above graph of debt to equity ratio, it has been seen that Woolworths is the

company who issues the shares instead of borrowing money on loan to finance the operating

activities. Although, its amount of total liabilities has been increases from the previous year but

as compare to total equity, the amount of total liabilities is less which represents that it finances

the operating activities by issuing equity. In Wesfarmers, it has been seen that the amount of total

equity is decreasing with the high percentage due to which its financial position is affected. In

terms of solvency ratio, it has been determined that Woolworths finance the operating activities

from appropriately rather than Wesfarmers (Storey, Keasey, Watson, & Wynarczyk, 2016).

Accounting and Finance 9

Cash Flow Ratio

Cash Flow Ratio measures the operating activities of the company.

According to Woolworths, the operating cash flow ratio is constant in both year that is

2018 and 2019. The operating cash flow margin of Woolworths has been constant with the ratio

of 0.5 which depicts that the company spent the money equal to earning revenue (Weygandt,

Kimmel, & Kieso, 2019).

1 2

0.00

0.05

0.10

0.15

0.20

0.25

0.30

Wesfarmers

Operating Cash Flow

Margin

Cash Return on

owners equity

In terms of Wesfarmers, it has been seen that operating cash flow is increasing from the

previous years by 0.18 to 0.27 in 2018 and 2019 respectively (Wesfarmers, 2019). It represents

Cash Flow Ratio

Cash Flow Ratio measures the operating activities of the company.

According to Woolworths, the operating cash flow ratio is constant in both year that is

2018 and 2019. The operating cash flow margin of Woolworths has been constant with the ratio

of 0.5 which depicts that the company spent the money equal to earning revenue (Weygandt,

Kimmel, & Kieso, 2019).

1 2

0.00

0.05

0.10

0.15

0.20

0.25

0.30

Wesfarmers

Operating Cash Flow

Margin

Cash Return on

owners equity

In terms of Wesfarmers, it has been seen that operating cash flow is increasing from the

previous years by 0.18 to 0.27 in 2018 and 2019 respectively (Wesfarmers, 2019). It represents

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting and Finance 10

that the operating activities of the company has been improved as it borrows the less amount

from the third party.

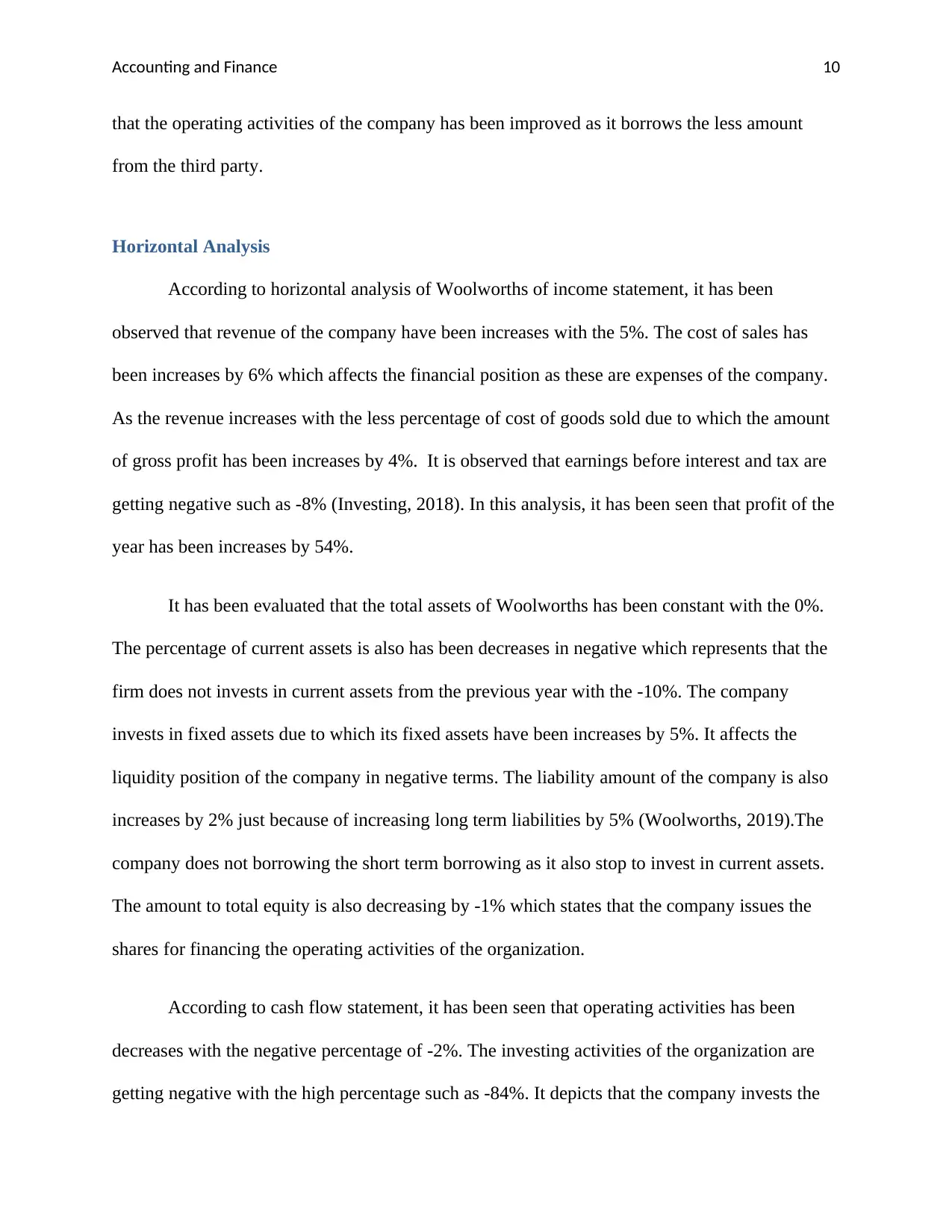

Horizontal Analysis

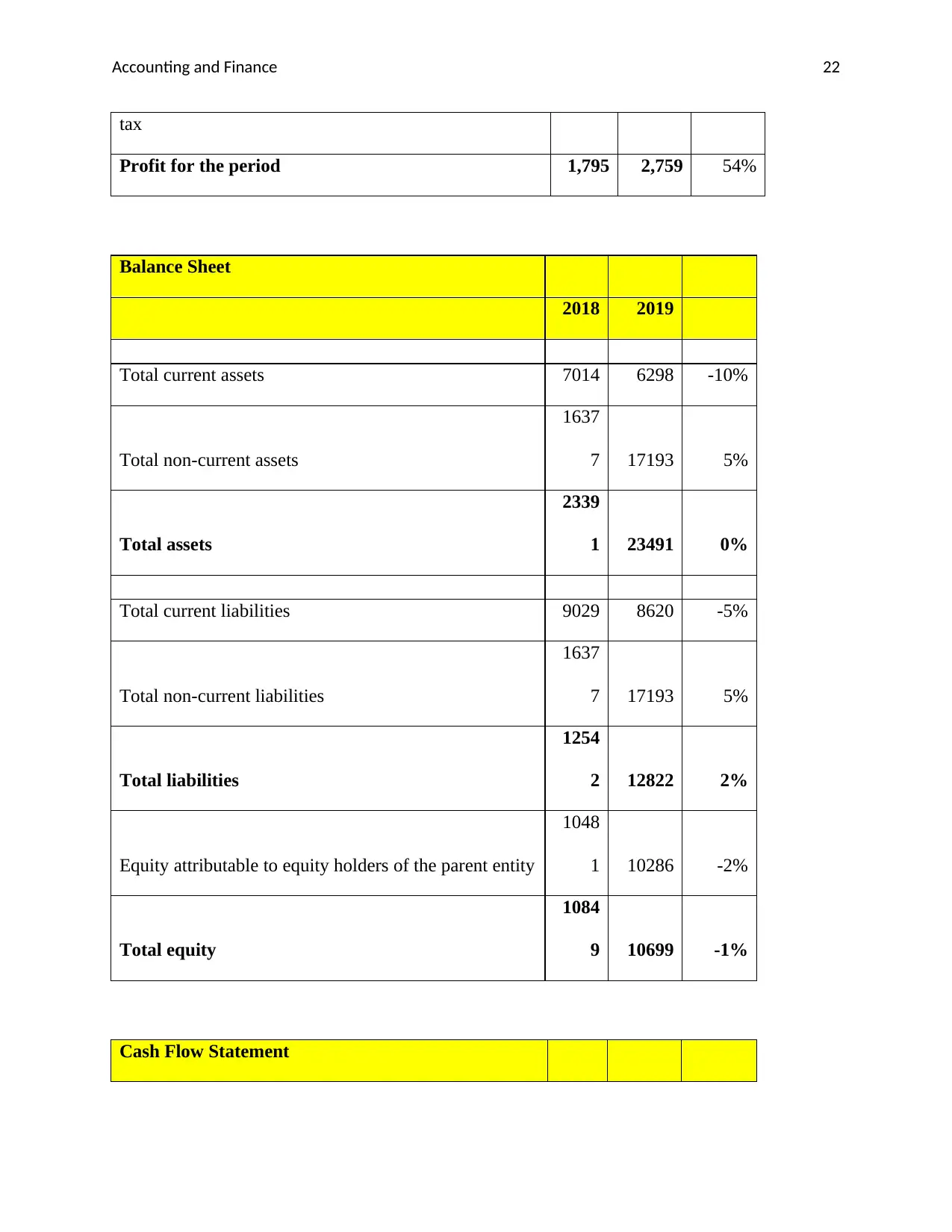

According to horizontal analysis of Woolworths of income statement, it has been

observed that revenue of the company have been increases with the 5%. The cost of sales has

been increases by 6% which affects the financial position as these are expenses of the company.

As the revenue increases with the less percentage of cost of goods sold due to which the amount

of gross profit has been increases by 4%. It is observed that earnings before interest and tax are

getting negative such as -8% (Investing, 2018). In this analysis, it has been seen that profit of the

year has been increases by 54%.

It has been evaluated that the total assets of Woolworths has been constant with the 0%.

The percentage of current assets is also has been decreases in negative which represents that the

firm does not invests in current assets from the previous year with the -10%. The company

invests in fixed assets due to which its fixed assets have been increases by 5%. It affects the

liquidity position of the company in negative terms. The liability amount of the company is also

increases by 2% just because of increasing long term liabilities by 5% (Woolworths, 2019).The

company does not borrowing the short term borrowing as it also stop to invest in current assets.

The amount to total equity is also decreasing by -1% which states that the company issues the

shares for financing the operating activities of the organization.

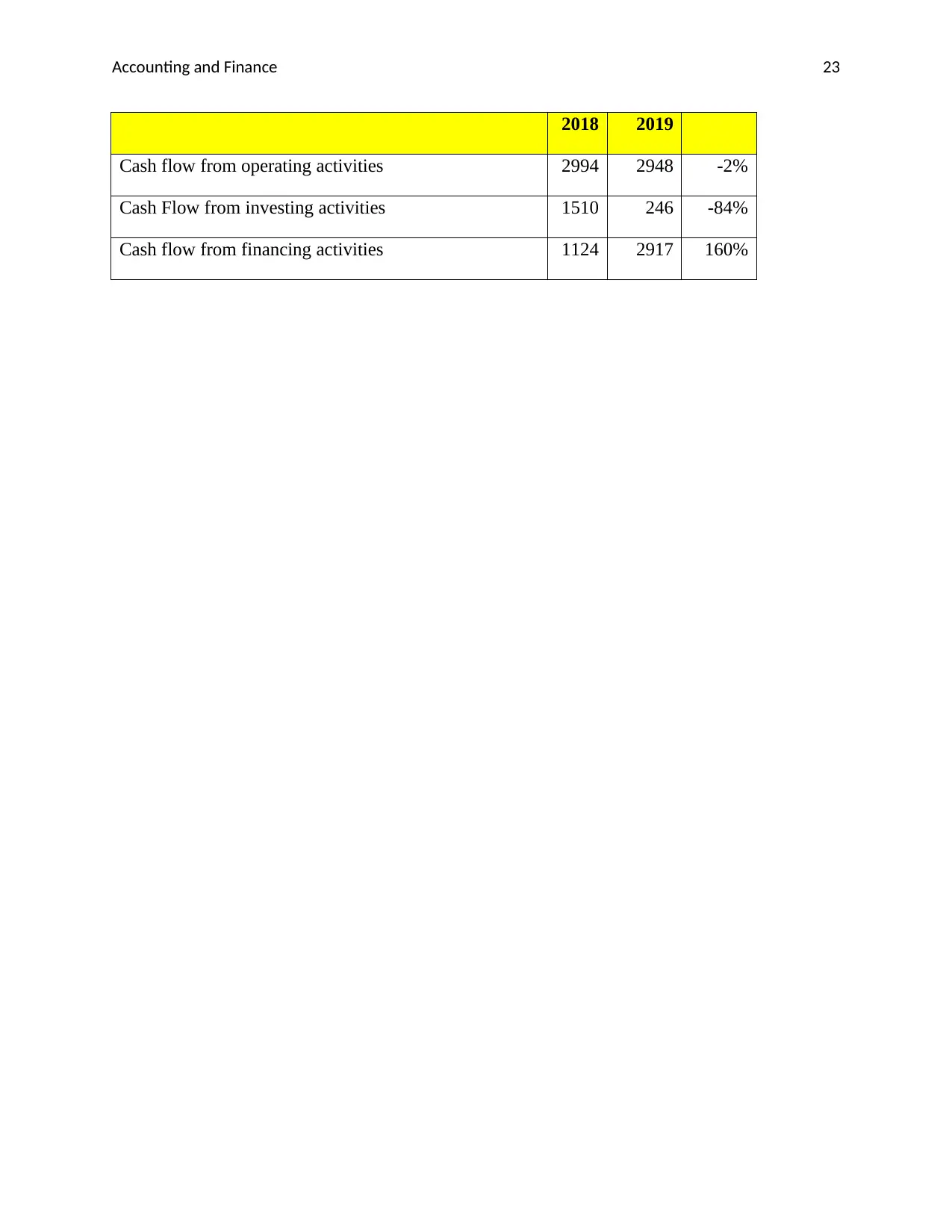

According to cash flow statement, it has been seen that operating activities has been

decreases with the negative percentage of -2%. The investing activities of the organization are

getting negative with the high percentage such as -84%. It depicts that the company invests the

that the operating activities of the company has been improved as it borrows the less amount

from the third party.

Horizontal Analysis

According to horizontal analysis of Woolworths of income statement, it has been

observed that revenue of the company have been increases with the 5%. The cost of sales has

been increases by 6% which affects the financial position as these are expenses of the company.

As the revenue increases with the less percentage of cost of goods sold due to which the amount

of gross profit has been increases by 4%. It is observed that earnings before interest and tax are

getting negative such as -8% (Investing, 2018). In this analysis, it has been seen that profit of the

year has been increases by 54%.

It has been evaluated that the total assets of Woolworths has been constant with the 0%.

The percentage of current assets is also has been decreases in negative which represents that the

firm does not invests in current assets from the previous year with the -10%. The company

invests in fixed assets due to which its fixed assets have been increases by 5%. It affects the

liquidity position of the company in negative terms. The liability amount of the company is also

increases by 2% just because of increasing long term liabilities by 5% (Woolworths, 2019).The

company does not borrowing the short term borrowing as it also stop to invest in current assets.

The amount to total equity is also decreasing by -1% which states that the company issues the

shares for financing the operating activities of the organization.

According to cash flow statement, it has been seen that operating activities has been

decreases with the negative percentage of -2%. The investing activities of the organization are

getting negative with the high percentage such as -84%. It depicts that the company invests the

Accounting and Finance 11

less amount just because of less amount of funds collected by the investors. The financing

activity of cash flow statement is also high as it is increases by 160% from the base year 2018

(Woolworths, 2019).

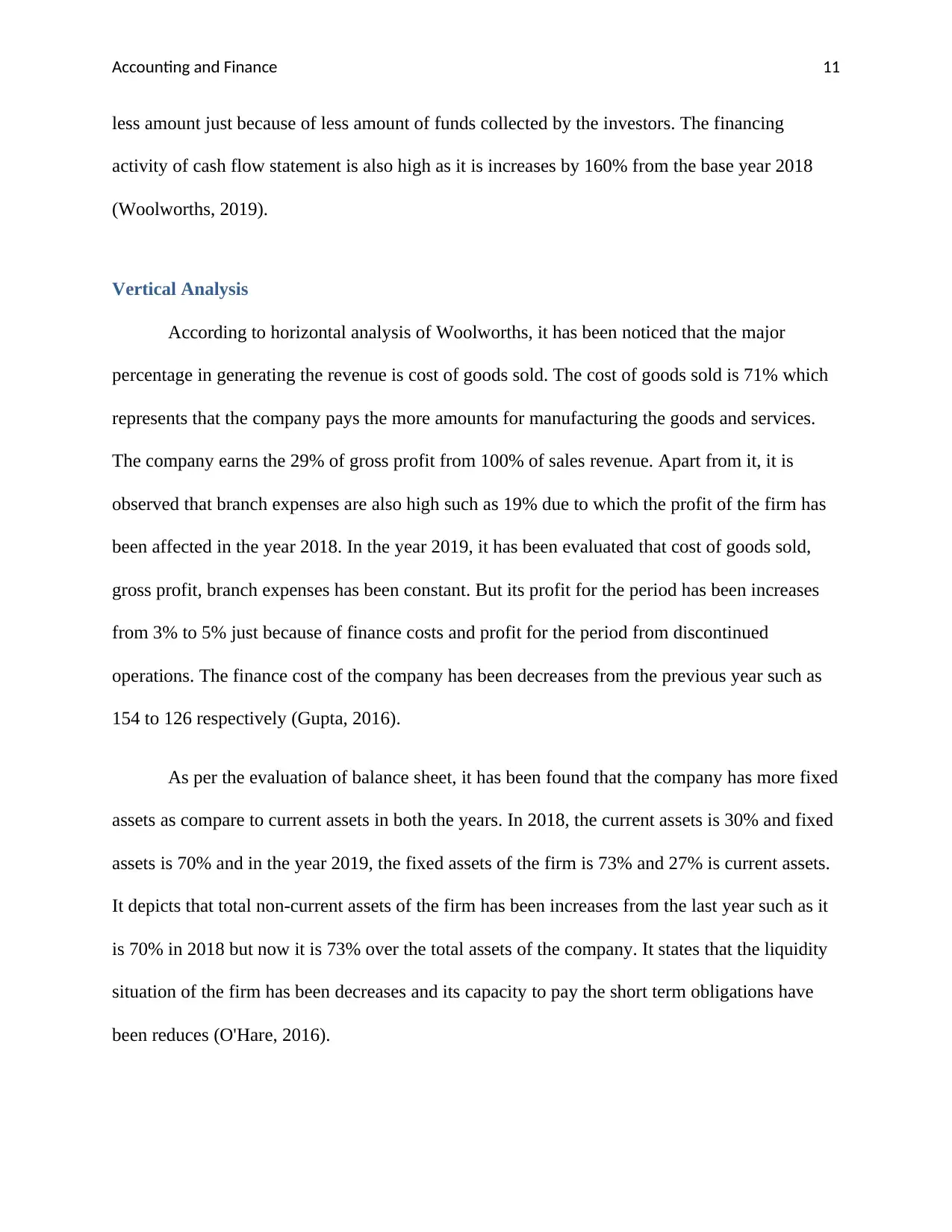

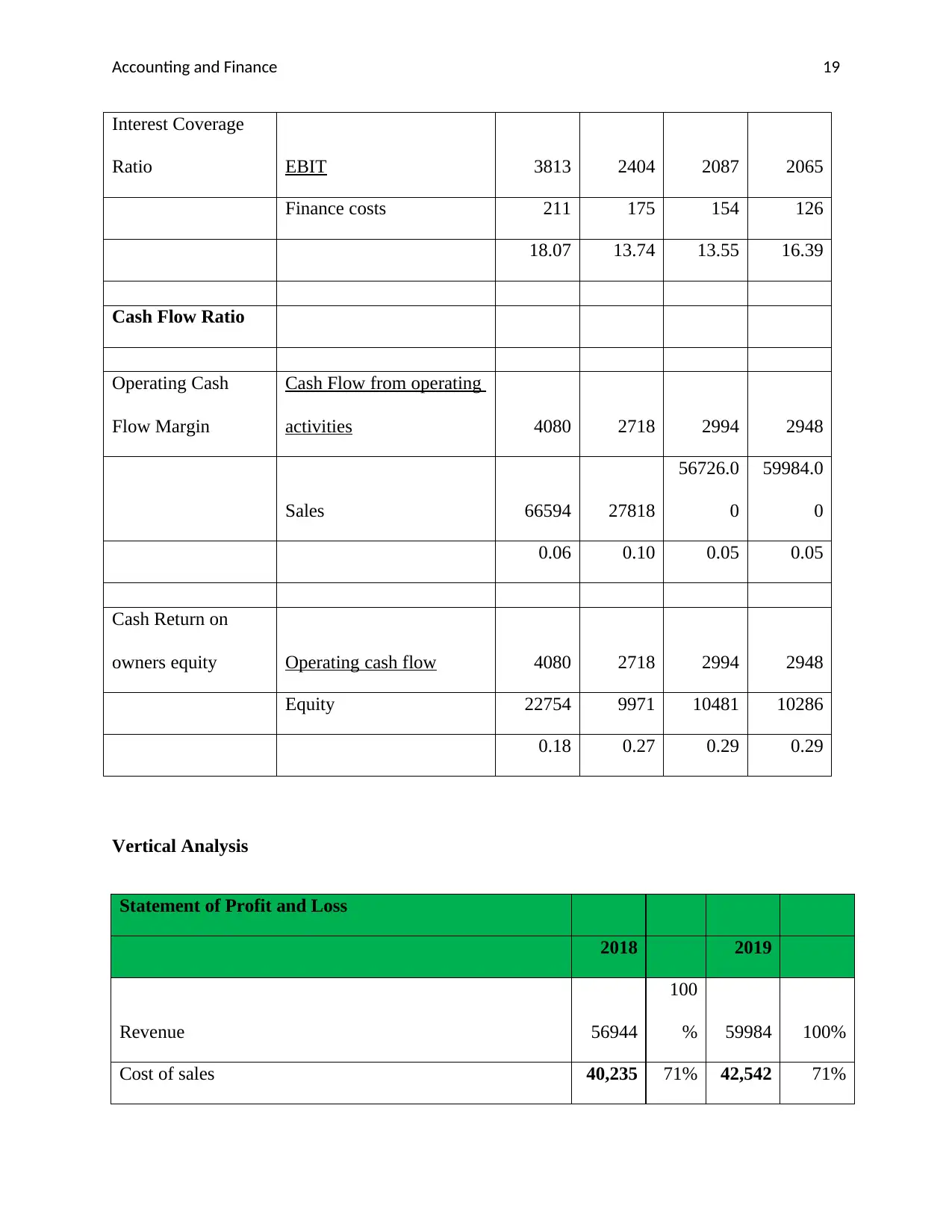

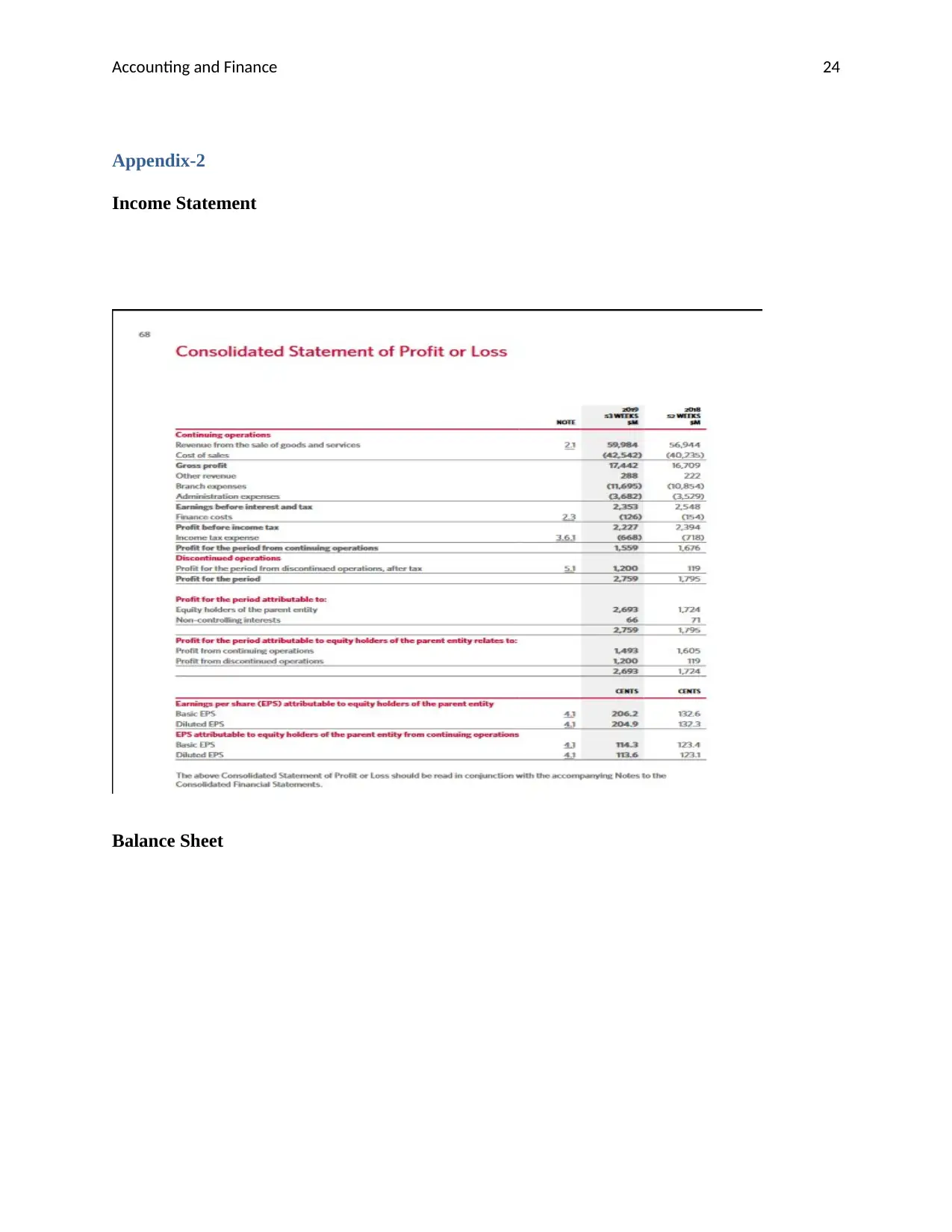

Vertical Analysis

According to horizontal analysis of Woolworths, it has been noticed that the major

percentage in generating the revenue is cost of goods sold. The cost of goods sold is 71% which

represents that the company pays the more amounts for manufacturing the goods and services.

The company earns the 29% of gross profit from 100% of sales revenue. Apart from it, it is

observed that branch expenses are also high such as 19% due to which the profit of the firm has

been affected in the year 2018. In the year 2019, it has been evaluated that cost of goods sold,

gross profit, branch expenses has been constant. But its profit for the period has been increases

from 3% to 5% just because of finance costs and profit for the period from discontinued

operations. The finance cost of the company has been decreases from the previous year such as

154 to 126 respectively (Gupta, 2016).

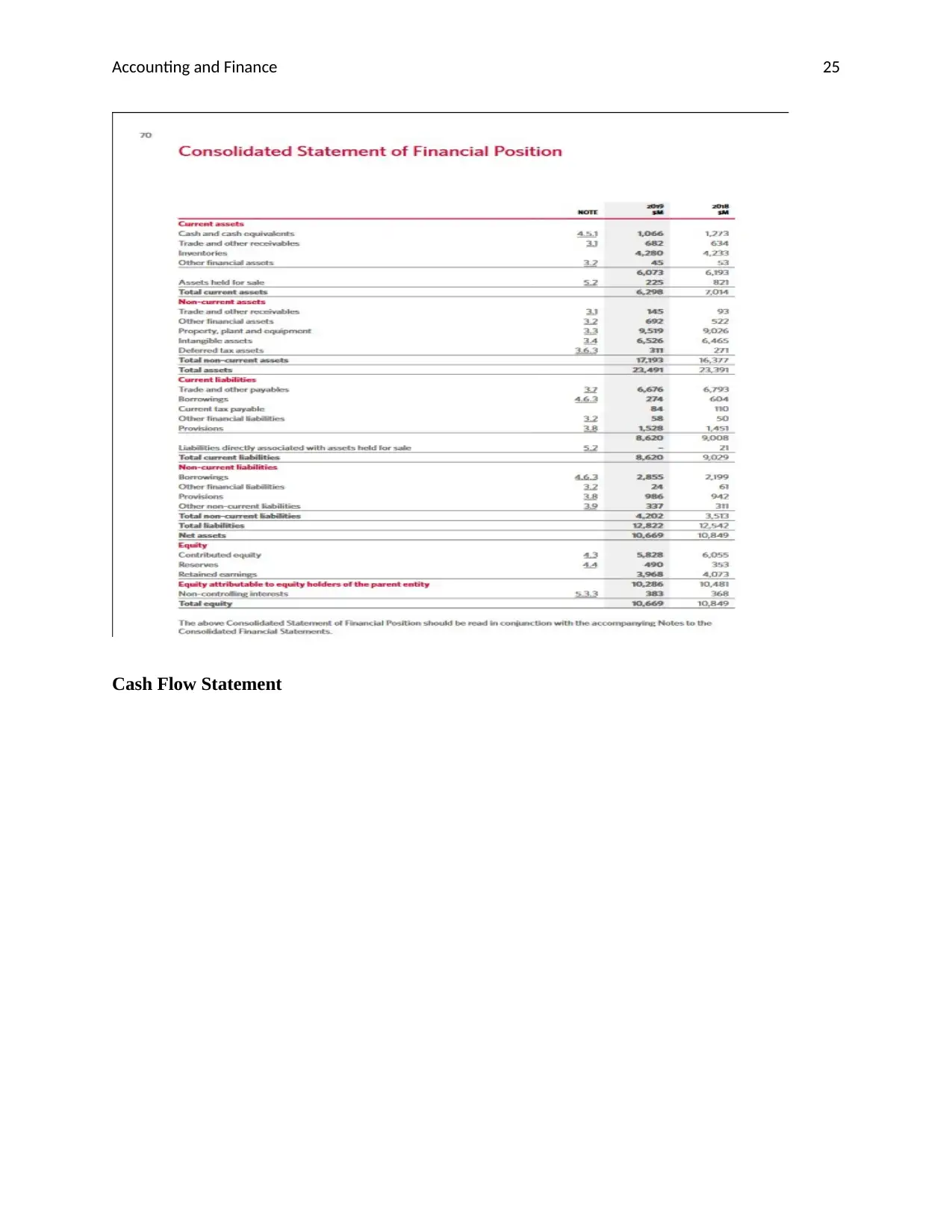

As per the evaluation of balance sheet, it has been found that the company has more fixed

assets as compare to current assets in both the years. In 2018, the current assets is 30% and fixed

assets is 70% and in the year 2019, the fixed assets of the firm is 73% and 27% is current assets.

It depicts that total non-current assets of the firm has been increases from the last year such as it

is 70% in 2018 but now it is 73% over the total assets of the company. It states that the liquidity

situation of the firm has been decreases and its capacity to pay the short term obligations have

been reduces (O'Hare, 2016).

less amount just because of less amount of funds collected by the investors. The financing

activity of cash flow statement is also high as it is increases by 160% from the base year 2018

(Woolworths, 2019).

Vertical Analysis

According to horizontal analysis of Woolworths, it has been noticed that the major

percentage in generating the revenue is cost of goods sold. The cost of goods sold is 71% which

represents that the company pays the more amounts for manufacturing the goods and services.

The company earns the 29% of gross profit from 100% of sales revenue. Apart from it, it is

observed that branch expenses are also high such as 19% due to which the profit of the firm has

been affected in the year 2018. In the year 2019, it has been evaluated that cost of goods sold,

gross profit, branch expenses has been constant. But its profit for the period has been increases

from 3% to 5% just because of finance costs and profit for the period from discontinued

operations. The finance cost of the company has been decreases from the previous year such as

154 to 126 respectively (Gupta, 2016).

As per the evaluation of balance sheet, it has been found that the company has more fixed

assets as compare to current assets in both the years. In 2018, the current assets is 30% and fixed

assets is 70% and in the year 2019, the fixed assets of the firm is 73% and 27% is current assets.

It depicts that total non-current assets of the firm has been increases from the last year such as it

is 70% in 2018 but now it is 73% over the total assets of the company. It states that the liquidity

situation of the firm has been decreases and its capacity to pay the short term obligations have

been reduces (O'Hare, 2016).

Accounting and Finance 12

In terms of total liabilities, it is observed that the non-current liabilities of the firm has

less percentage such as it is 28% and current liabilities has 67% over the total liabilities in 2019.

In 2018, the non-current liability of the company is 33% and current liabilities have high

contribution in total liabilities such as 67% (Woolworths, 2019). It presents that the company

borrow the money from third party for a short term basis instead of long term. Although, from

the past year 2018, the long term liability of the company has been increases from 28% to 33%

but as compare to current liabilities it is less. It can be said that the company borrow the money

for short period of time due to which its finance cost has been decreases (Williams, & Dobelman,

2017). From the previous year, the total liability of the company has been an increase that affects

the profits.

In terms of equity, it has been found that the item of balance sheet is “Equity attributable to

equity holders of the parent entity” has been decreases with the minor percentage such as it is

97% in 2018 and now it is 96% in the year 2019. The amount of total equity has been decreases

from previous year which depicts that the company changes its source of funds as it borrow

money from third party.

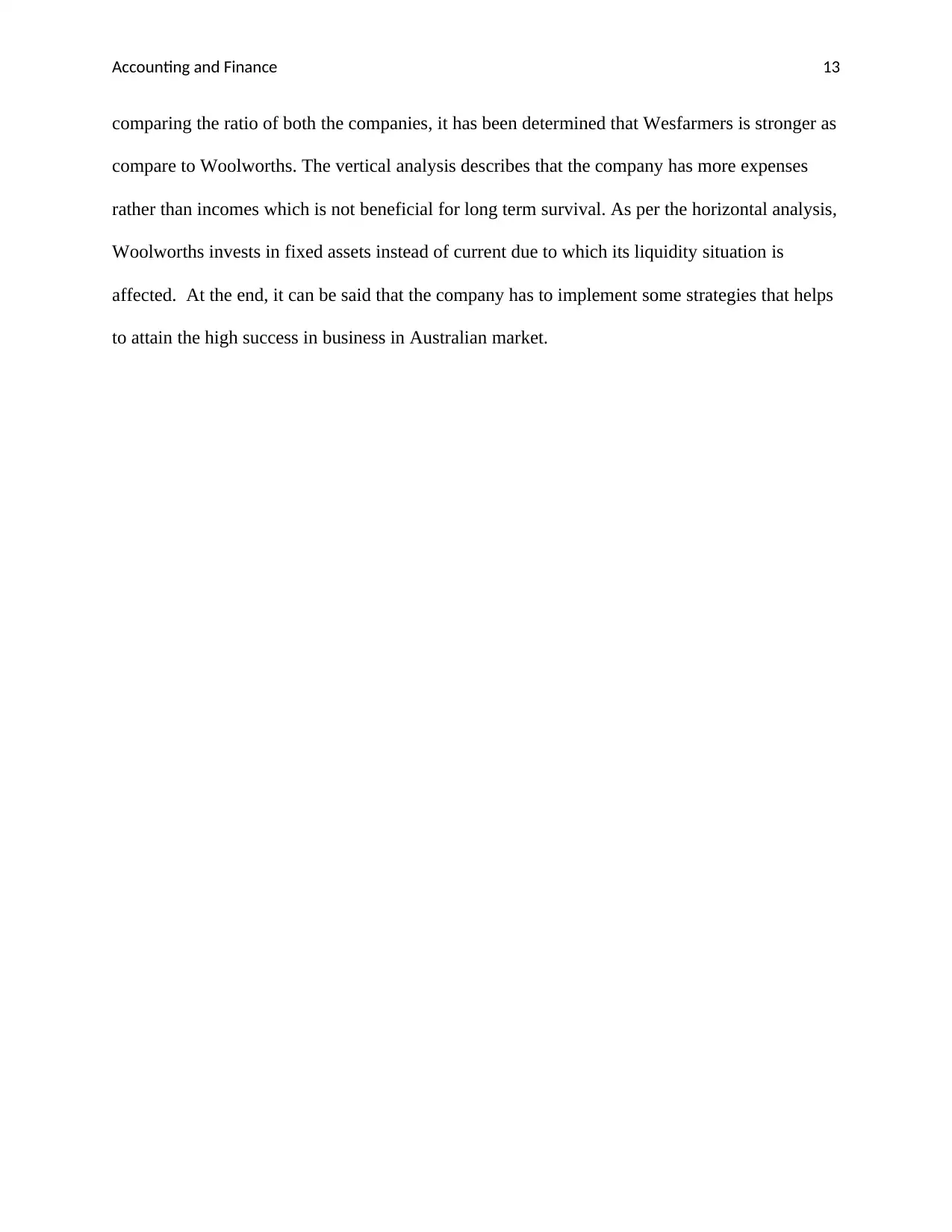

Conclusion

At the end, it is concluded that Woolworths is a leading company of Australia

supermarket industry. According to its financial analysis, it has been found that its ability to

generate the profit is high. The three ways has been used to assess the financial situation of the

firm such as ratio analysis, vertical and horizontal analysis. According to analysis, it can be said

that it has the opportunity to expand the business and beat the competitors. The main competitor

of the company is Wesfarmers as it is also one of leading companies of Australian market. By

In terms of total liabilities, it is observed that the non-current liabilities of the firm has

less percentage such as it is 28% and current liabilities has 67% over the total liabilities in 2019.

In 2018, the non-current liability of the company is 33% and current liabilities have high

contribution in total liabilities such as 67% (Woolworths, 2019). It presents that the company

borrow the money from third party for a short term basis instead of long term. Although, from

the past year 2018, the long term liability of the company has been increases from 28% to 33%

but as compare to current liabilities it is less. It can be said that the company borrow the money

for short period of time due to which its finance cost has been decreases (Williams, & Dobelman,

2017). From the previous year, the total liability of the company has been an increase that affects

the profits.

In terms of equity, it has been found that the item of balance sheet is “Equity attributable to

equity holders of the parent entity” has been decreases with the minor percentage such as it is

97% in 2018 and now it is 96% in the year 2019. The amount of total equity has been decreases

from previous year which depicts that the company changes its source of funds as it borrow

money from third party.

Conclusion

At the end, it is concluded that Woolworths is a leading company of Australia

supermarket industry. According to its financial analysis, it has been found that its ability to

generate the profit is high. The three ways has been used to assess the financial situation of the

firm such as ratio analysis, vertical and horizontal analysis. According to analysis, it can be said

that it has the opportunity to expand the business and beat the competitors. The main competitor

of the company is Wesfarmers as it is also one of leading companies of Australian market. By

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance 13

comparing the ratio of both the companies, it has been determined that Wesfarmers is stronger as

compare to Woolworths. The vertical analysis describes that the company has more expenses

rather than incomes which is not beneficial for long term survival. As per the horizontal analysis,

Woolworths invests in fixed assets instead of current due to which its liquidity situation is

affected. At the end, it can be said that the company has to implement some strategies that helps

to attain the high success in business in Australian market.

comparing the ratio of both the companies, it has been determined that Wesfarmers is stronger as

compare to Woolworths. The vertical analysis describes that the company has more expenses

rather than incomes which is not beneficial for long term survival. As per the horizontal analysis,

Woolworths invests in fixed assets instead of current due to which its liquidity situation is

affected. At the end, it can be said that the company has to implement some strategies that helps

to attain the high success in business in Australian market.

Accounting and Finance 14

References

Clear Tax. (2018). Liquidity Ratio, Formula With Examples. Retrieved From:

https://cleartax.in/s/liquidity-ratio

Gupta, A. (2016). Financial Accounting for Management. Pearson Education India.

Investing. (2018). Woolworths Ltd (WOW). Retrieved From:

https://in.investing.com/equities/woolworths-limited-ratios

Monahan, S. J. (2018). Financial Statement Analysis and Earnings Forecasting. Foundations and

Trends® in Accounting, 12(2), 105-215.

O'Hare, J. (2016). Analysing financial statements for non-specialists. Routledge.

Robinson, T. R. (2020). International financial statement analysis. John Wiley & Sons.

Schroeder, R. G., Clark, M. W., & Cathey, J. M. (2019). Financial accounting theory and

analysis: text and cases. John Wiley & Sons.

Storey, D. J., Keasey, K., Watson, R., & Wynarczyk, P. (2016). The performance of small firms:

profits, jobs and failures. Routledge.

Wesfarmers. (2019). 2019 Wesfarmers Annual Report. Retrieved From:

https://www.wesfarmers.com.au/docs/default-source/asx-announcements/2019-annual-

report.pdf?sfvrsn=0

Yahoo Finance (2019a). Wesfarmers Limited (WES.AX). Retrieved From:

https://au.finance.yahoo.com/quote/WES.AX/balance-sheet?p=WES.AX

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2019). Financial accounting. Wiley.

References

Clear Tax. (2018). Liquidity Ratio, Formula With Examples. Retrieved From:

https://cleartax.in/s/liquidity-ratio

Gupta, A. (2016). Financial Accounting for Management. Pearson Education India.

Investing. (2018). Woolworths Ltd (WOW). Retrieved From:

https://in.investing.com/equities/woolworths-limited-ratios

Monahan, S. J. (2018). Financial Statement Analysis and Earnings Forecasting. Foundations and

Trends® in Accounting, 12(2), 105-215.

O'Hare, J. (2016). Analysing financial statements for non-specialists. Routledge.

Robinson, T. R. (2020). International financial statement analysis. John Wiley & Sons.

Schroeder, R. G., Clark, M. W., & Cathey, J. M. (2019). Financial accounting theory and

analysis: text and cases. John Wiley & Sons.

Storey, D. J., Keasey, K., Watson, R., & Wynarczyk, P. (2016). The performance of small firms:

profits, jobs and failures. Routledge.

Wesfarmers. (2019). 2019 Wesfarmers Annual Report. Retrieved From:

https://www.wesfarmers.com.au/docs/default-source/asx-announcements/2019-annual-

report.pdf?sfvrsn=0

Yahoo Finance (2019a). Wesfarmers Limited (WES.AX). Retrieved From:

https://au.finance.yahoo.com/quote/WES.AX/balance-sheet?p=WES.AX

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2019). Financial accounting. Wiley.

Accounting and Finance 15

Williams, E. E., & Dobelman, J. A. (2017). Financial statement analysis. World Scientific Book

Chapters, 109-169.

Woolworths Group. (2018). About Us. Retrieved From:

https://www.woolworthsgroup.com.au/page/about-us

Woolworths. (2019). 2019 Annual Report. Retrieved From:

https://www.woolworthsgroup.com.au/icms_docs/195582_annual-report-2019.pdf

Yahoo Finance (2019b). Woolworths Group Limited (WOW.AX). Retrieved From:

https://au.finance.yahoo.com/quote/WOW.AX/balance-sheet?p=WOW.AX

Williams, E. E., & Dobelman, J. A. (2017). Financial statement analysis. World Scientific Book

Chapters, 109-169.

Woolworths Group. (2018). About Us. Retrieved From:

https://www.woolworthsgroup.com.au/page/about-us

Woolworths. (2019). 2019 Annual Report. Retrieved From:

https://www.woolworthsgroup.com.au/icms_docs/195582_annual-report-2019.pdf

Yahoo Finance (2019b). Woolworths Group Limited (WOW.AX). Retrieved From:

https://au.finance.yahoo.com/quote/WOW.AX/balance-sheet?p=WOW.AX

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting and Finance 16

Appendix-1

Ratio Analysis

Ratio's

Wesfar

mers

Wesfar

mers

Woolwo

rths

Woolwo

rths

AUD in Million 2018 2019 2018 2019

Profitability Ratio

(Net) Profit margin

(a/b) Net Profit 1197 5510 1724 2693

Net Sales 66594 27818 56726 59984

2% 20% 3% 4%

Gross Profit Margin Gross Profit

20876.0

0

10578.0

0

16470.0

0 17442

Net Sales

66594.0

0

27818.0

0

56726.0

0

59984.0

0

31% 38% 29% 29%

Return on Assets Net income 1197 5510 1724 2693

Total assets 36933 18333 23558 23491

3% 30% 7% 11%

Return on Equity Net income after 1197 5510 1724 2693

Appendix-1

Ratio Analysis

Ratio's

Wesfar

mers

Wesfar

mers

Woolwo

rths

Woolwo

rths

AUD in Million 2018 2019 2018 2019

Profitability Ratio

(Net) Profit margin

(a/b) Net Profit 1197 5510 1724 2693

Net Sales 66594 27818 56726 59984

2% 20% 3% 4%

Gross Profit Margin Gross Profit

20876.0

0

10578.0

0

16470.0

0 17442

Net Sales

66594.0

0

27818.0

0

56726.0

0

59984.0

0

31% 38% 29% 29%

Return on Assets Net income 1197 5510 1724 2693

Total assets 36933 18333 23558 23491

3% 30% 7% 11%

Return on Equity Net income after 1197 5510 1724 2693

Accounting and Finance 17

preference dividends

Average common stock

holder's equity 22238 18981 5835 5941.5

5% 29% 30% 45%

Efficiency Ratio

Asset turnover (a/b) Net Sales 66594 27818 56726 59984

Average Total Assets 38524 27633 23236.9 23524.5

1.73 1.01 2.44 2.55

Fixed Assets

Turnovers Net sales

66594.0

0

27818.0

0 56726 59984

Average Net Fixed assets 29357.5

20105.0

0 16149.3 16785

2.27 1.38 3.51 3.57

Days Inventory (a/b) Inventory (a) 6011 4246 4233 4280

COGS*365 (b) 45718 17240 40256 42542

47.99 89.90 38.38 36.72

Days Debtors (a/b) Receivables (a) 1657 948 129 132

sales *365 (b) 66594 27818 56726 59984

9.08 12.44 0.83 0.80

Days Creditors (a/b) Payables (a) 6541 3620 5316 5219

preference dividends

Average common stock

holder's equity 22238 18981 5835 5941.5

5% 29% 30% 45%

Efficiency Ratio

Asset turnover (a/b) Net Sales 66594 27818 56726 59984

Average Total Assets 38524 27633 23236.9 23524.5

1.73 1.01 2.44 2.55

Fixed Assets

Turnovers Net sales

66594.0

0

27818.0

0 56726 59984

Average Net Fixed assets 29357.5

20105.0

0 16149.3 16785

2.27 1.38 3.51 3.57

Days Inventory (a/b) Inventory (a) 6011 4246 4233 4280

COGS*365 (b) 45718 17240 40256 42542

47.99 89.90 38.38 36.72

Days Debtors (a/b) Receivables (a) 1657 948 129 132

sales *365 (b) 66594 27818 56726 59984

9.08 12.44 0.83 0.80

Days Creditors (a/b) Payables (a) 6541 3620 5316 5219

Accounting and Finance 18

Sales*365 (b) 66594 27818 56726 59984

35.85 47.50 34.21 31.76

Liquidity Ratio

Current ratio (a/b) Current assets (a) 8706 6350 7,181 6298

Current liabilities (b) 10025 5216 9,196 8620

0.87 1.22 0.78 0.73

Quick ratio (a/b) Quick assets (a) 2340 5989 5635 5478

Current liabilities (b) 10025 5216 9,196 8620

0.23 1.15 0.61 0.64

Cash Ratio Cash+ Market securities 683.00 795.00 1273.00 1066

Current liabilities

10025.0

0 5216.00 9196.00 8620.00

0.07 0.15 0.14 0.12

Solvency Ratio

Debt (to assets) ratio

(a/b) Total Liabilities (a) 14179 8362 12709 12822

Total Assets (b) 36,933 18333 23558 23491

38% 46% 53.95% 54.58%

Debt to Equity Total Debt 4154 3146 3513 4202

Total equity 22754 9971 10481 10286

18% 32% 34% 41%

Sales*365 (b) 66594 27818 56726 59984

35.85 47.50 34.21 31.76

Liquidity Ratio

Current ratio (a/b) Current assets (a) 8706 6350 7,181 6298

Current liabilities (b) 10025 5216 9,196 8620

0.87 1.22 0.78 0.73

Quick ratio (a/b) Quick assets (a) 2340 5989 5635 5478

Current liabilities (b) 10025 5216 9,196 8620

0.23 1.15 0.61 0.64

Cash Ratio Cash+ Market securities 683.00 795.00 1273.00 1066

Current liabilities

10025.0

0 5216.00 9196.00 8620.00

0.07 0.15 0.14 0.12

Solvency Ratio

Debt (to assets) ratio

(a/b) Total Liabilities (a) 14179 8362 12709 12822

Total Assets (b) 36,933 18333 23558 23491

38% 46% 53.95% 54.58%

Debt to Equity Total Debt 4154 3146 3513 4202

Total equity 22754 9971 10481 10286

18% 32% 34% 41%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance 19

Interest Coverage

Ratio EBIT 3813 2404 2087 2065

Finance costs 211 175 154 126

18.07 13.74 13.55 16.39

Cash Flow Ratio

Operating Cash

Flow Margin

Cash Flow from operating

activities 4080 2718 2994 2948

Sales 66594 27818

56726.0

0

59984.0

0

0.06 0.10 0.05 0.05

Cash Return on

owners equity Operating cash flow 4080 2718 2994 2948

Equity 22754 9971 10481 10286

0.18 0.27 0.29 0.29

Vertical Analysis

Statement of Profit and Loss

2018 2019

Revenue 56944

100

% 59984 100%

Cost of sales 40,235 71% 42,542 71%

Interest Coverage

Ratio EBIT 3813 2404 2087 2065

Finance costs 211 175 154 126

18.07 13.74 13.55 16.39

Cash Flow Ratio

Operating Cash

Flow Margin

Cash Flow from operating

activities 4080 2718 2994 2948

Sales 66594 27818

56726.0

0

59984.0

0

0.06 0.10 0.05 0.05

Cash Return on

owners equity Operating cash flow 4080 2718 2994 2948

Equity 22754 9971 10481 10286

0.18 0.27 0.29 0.29

Vertical Analysis

Statement of Profit and Loss

2018 2019

Revenue 56944

100

% 59984 100%

Cost of sales 40,235 71% 42,542 71%

Accounting and Finance 20

Gross profit 16,709 29% 17,442 29%

Other revenue 222 0.4% 288 0.5%

Branch expenses 10,854 19% 11,695 19%

Administration expenses 3,529 6% 3,682 6%

Earnings before interest and tax 2,548 4% 2,353 4%

Finance costs 154 0.3% 126 0.2%

Profit before income tax 2,394 4% 2,227 4%

Income tax expense 718 1% 668 1%

Profit for the period from continuing operations 1,676 3% 1,559 3%

Profit for the period from discontinued operations, after tax 119 0.2% 1200 2%

Profit for the period 1,795 3% 2,759 5%

Balance Sheet

2018 2019

Total current assets 7014 30% 6298 27%

Total non-current assets 16377 70% 17193 73%

Total assets 23391 100% 23491 100%

Total current liabilities 9029 72% 8620 67%

Total non-current liabilities 3513 28% 4202 33%

Total liabilities 12542 100% 12822 100%

Gross profit 16,709 29% 17,442 29%

Other revenue 222 0.4% 288 0.5%

Branch expenses 10,854 19% 11,695 19%

Administration expenses 3,529 6% 3,682 6%

Earnings before interest and tax 2,548 4% 2,353 4%

Finance costs 154 0.3% 126 0.2%

Profit before income tax 2,394 4% 2,227 4%

Income tax expense 718 1% 668 1%

Profit for the period from continuing operations 1,676 3% 1,559 3%

Profit for the period from discontinued operations, after tax 119 0.2% 1200 2%

Profit for the period 1,795 3% 2,759 5%

Balance Sheet

2018 2019

Total current assets 7014 30% 6298 27%

Total non-current assets 16377 70% 17193 73%

Total assets 23391 100% 23491 100%

Total current liabilities 9029 72% 8620 67%

Total non-current liabilities 3513 28% 4202 33%

Total liabilities 12542 100% 12822 100%

Accounting and Finance 21

Equity attributable to equity holders of the parent entity 10481 97% 10286 96%

Total equity 10849 100% 10699 100%

Horizontal Analysis

Statement of Profit and Loss

2018 2019

Revenue 56944 59984 5%

Cost of sales

40,23

5 42,542 6%

Gross profit

16,70

9 17,442 4%

Other revenue 222 288 30%

Branch expenses

10,85

4 11,695 8%

Administration expenses 3,529 3,682 4%

Earnings before interest and tax 2,548 2,353 -8%

Finance costs 154 126 -18%

Profit before income tax 2,394 2,227 -7%

Income tax expense 718 668 -7%

Profit for the period from continuing operations 1,676 1,559 -7%

Profit for the period from discontinued operations, after 119 1200 908%

Equity attributable to equity holders of the parent entity 10481 97% 10286 96%

Total equity 10849 100% 10699 100%

Horizontal Analysis

Statement of Profit and Loss

2018 2019

Revenue 56944 59984 5%

Cost of sales

40,23

5 42,542 6%

Gross profit

16,70

9 17,442 4%

Other revenue 222 288 30%

Branch expenses

10,85

4 11,695 8%

Administration expenses 3,529 3,682 4%

Earnings before interest and tax 2,548 2,353 -8%

Finance costs 154 126 -18%

Profit before income tax 2,394 2,227 -7%

Income tax expense 718 668 -7%

Profit for the period from continuing operations 1,676 1,559 -7%

Profit for the period from discontinued operations, after 119 1200 908%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Accounting and Finance 22

tax

Profit for the period 1,795 2,759 54%

Balance Sheet

2018 2019

Total current assets 7014 6298 -10%

Total non-current assets

1637

7 17193 5%

Total assets

2339

1 23491 0%

Total current liabilities 9029 8620 -5%

Total non-current liabilities

1637

7 17193 5%

Total liabilities

1254

2 12822 2%

Equity attributable to equity holders of the parent entity

1048

1 10286 -2%

Total equity

1084

9 10699 -1%

Cash Flow Statement

tax

Profit for the period 1,795 2,759 54%

Balance Sheet

2018 2019

Total current assets 7014 6298 -10%

Total non-current assets

1637

7 17193 5%

Total assets

2339

1 23491 0%

Total current liabilities 9029 8620 -5%

Total non-current liabilities

1637

7 17193 5%

Total liabilities

1254

2 12822 2%

Equity attributable to equity holders of the parent entity

1048

1 10286 -2%

Total equity

1084

9 10699 -1%

Cash Flow Statement

Accounting and Finance 23

2018 2019

Cash flow from operating activities 2994 2948 -2%

Cash Flow from investing activities 1510 246 -84%

Cash flow from financing activities 1124 2917 160%

2018 2019

Cash flow from operating activities 2994 2948 -2%

Cash Flow from investing activities 1510 246 -84%

Cash flow from financing activities 1124 2917 160%

Accounting and Finance 24

Appendix-2

Income Statement

Balance Sheet

Appendix-2

Income Statement

Balance Sheet

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance 25

Cash Flow Statement

Cash Flow Statement

Accounting and Finance 26

1 out of 27

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.