Financial Statements Analysis Example

VerifiedAdded on 2020/05/28

|5

|734

|49

AI Summary

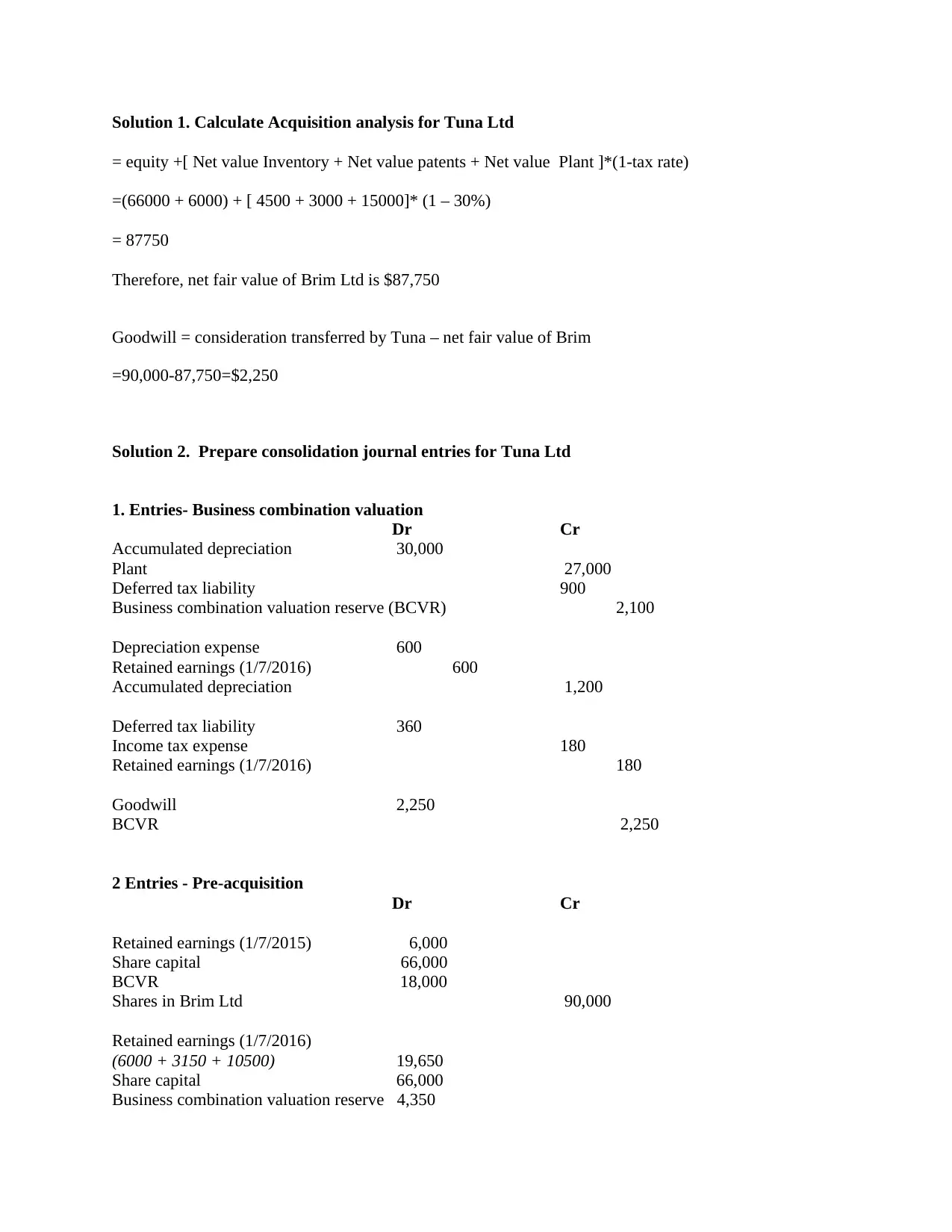

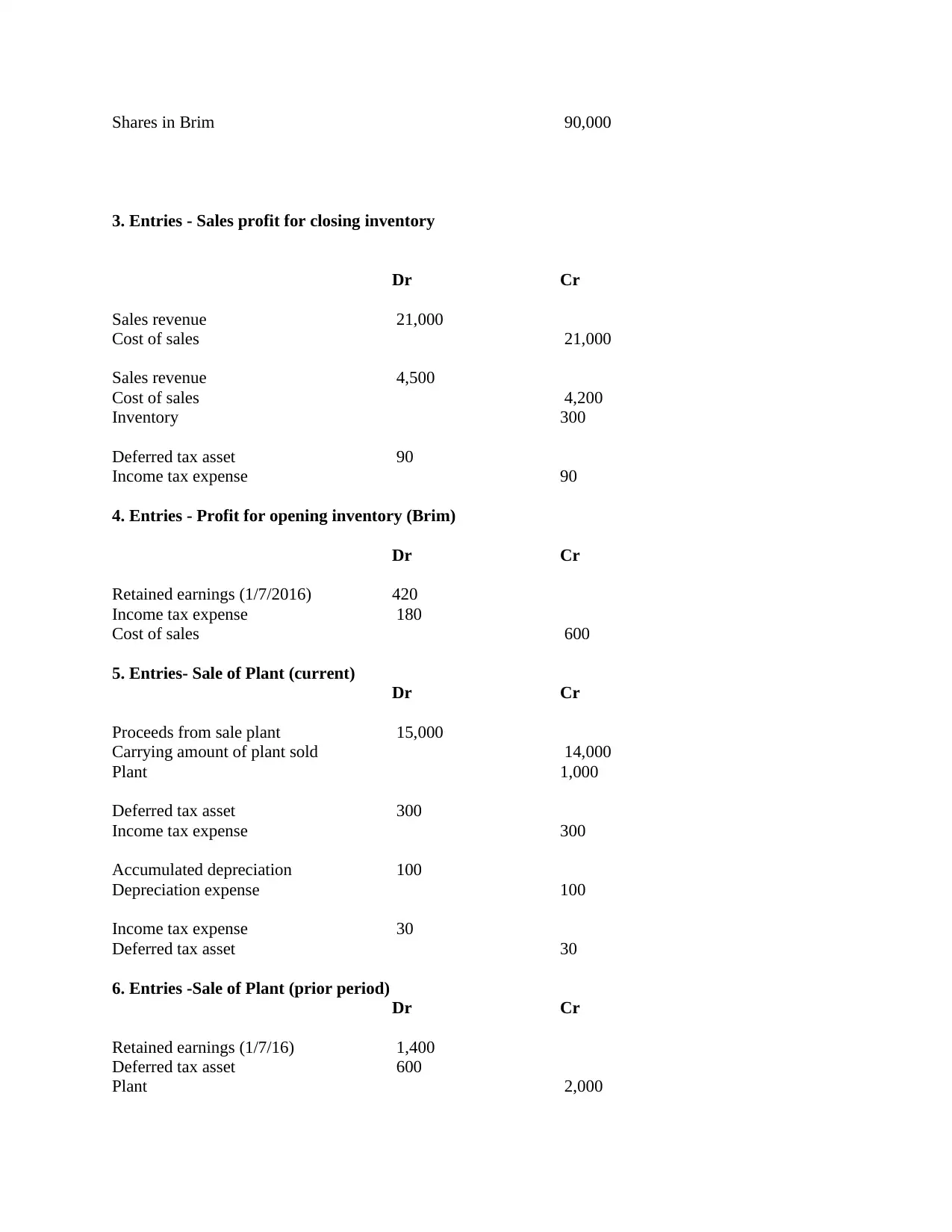

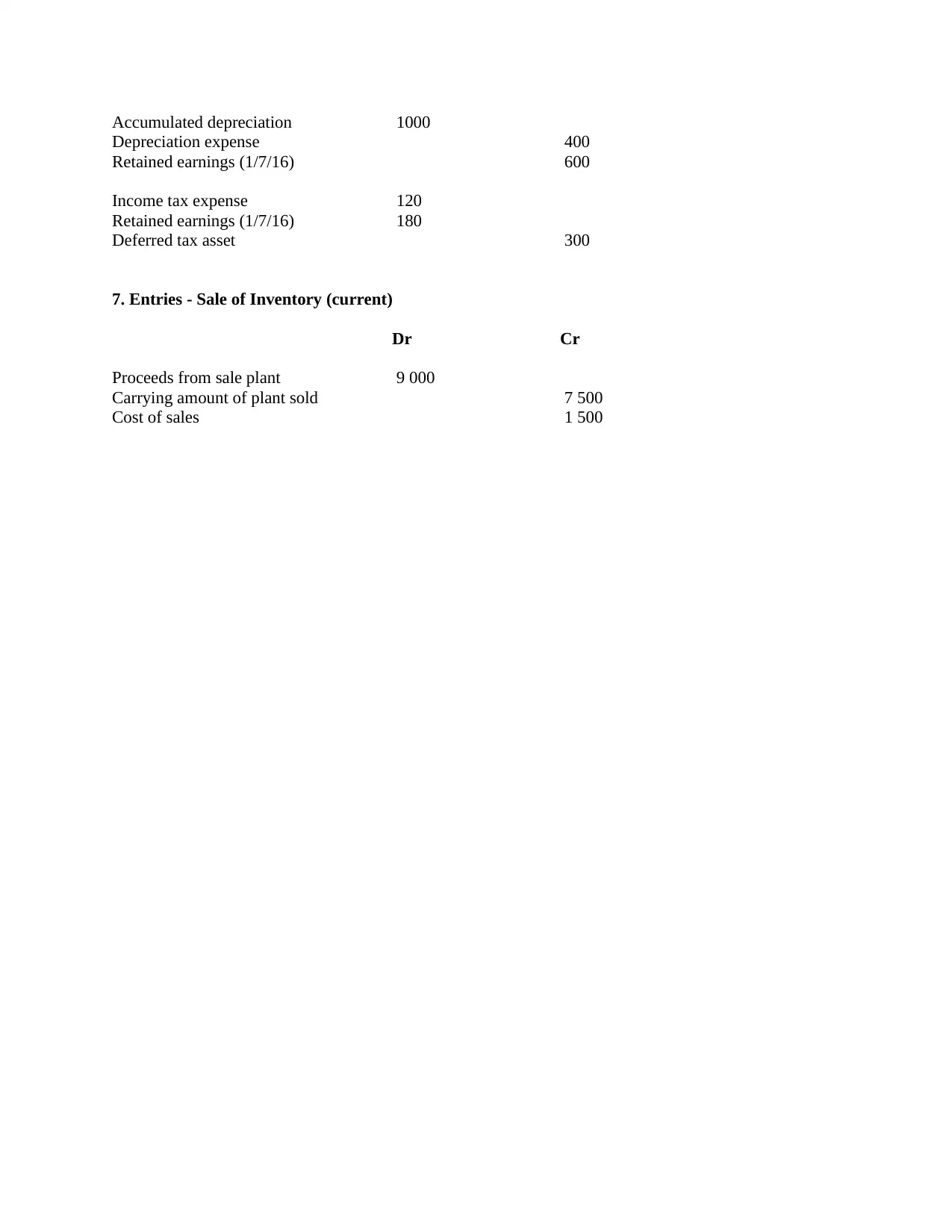

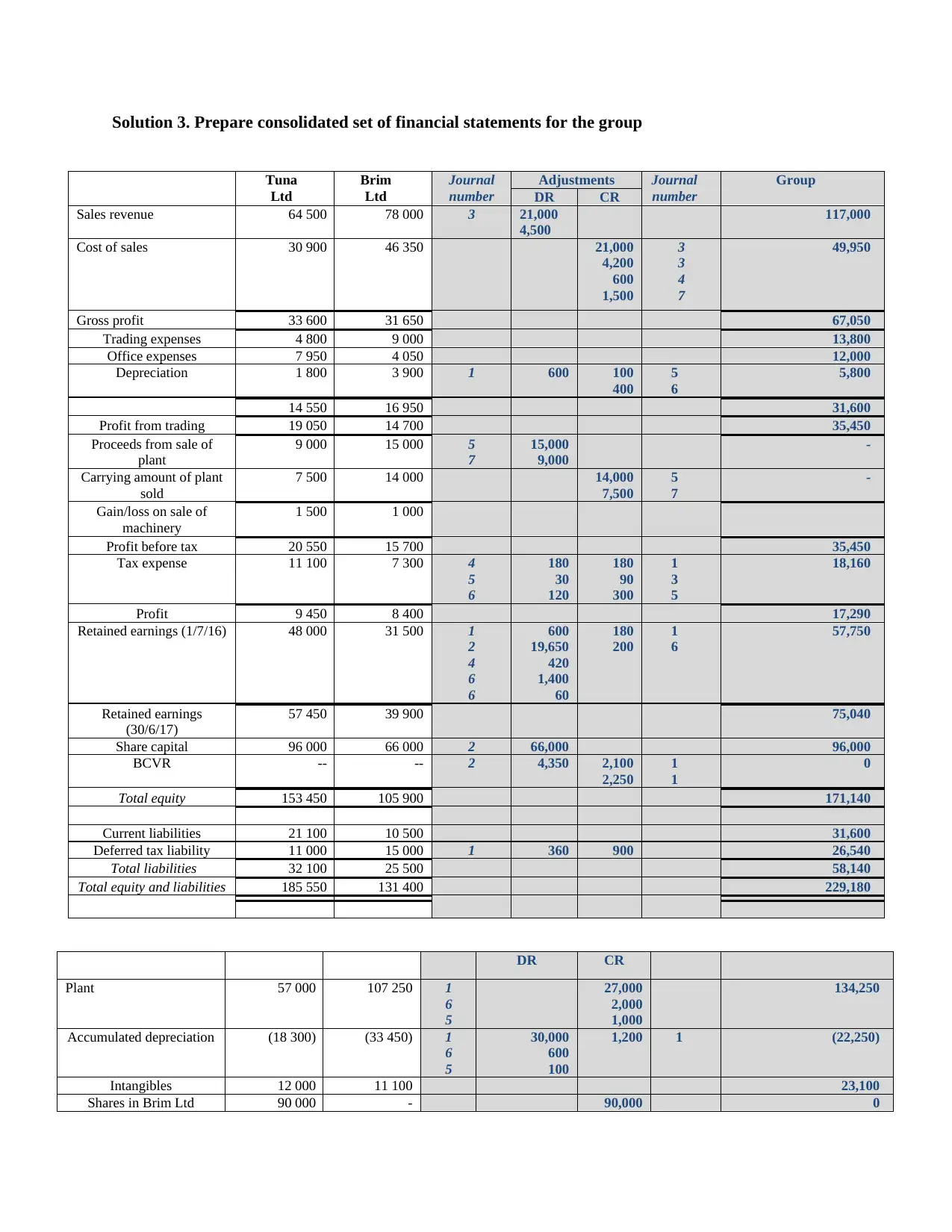

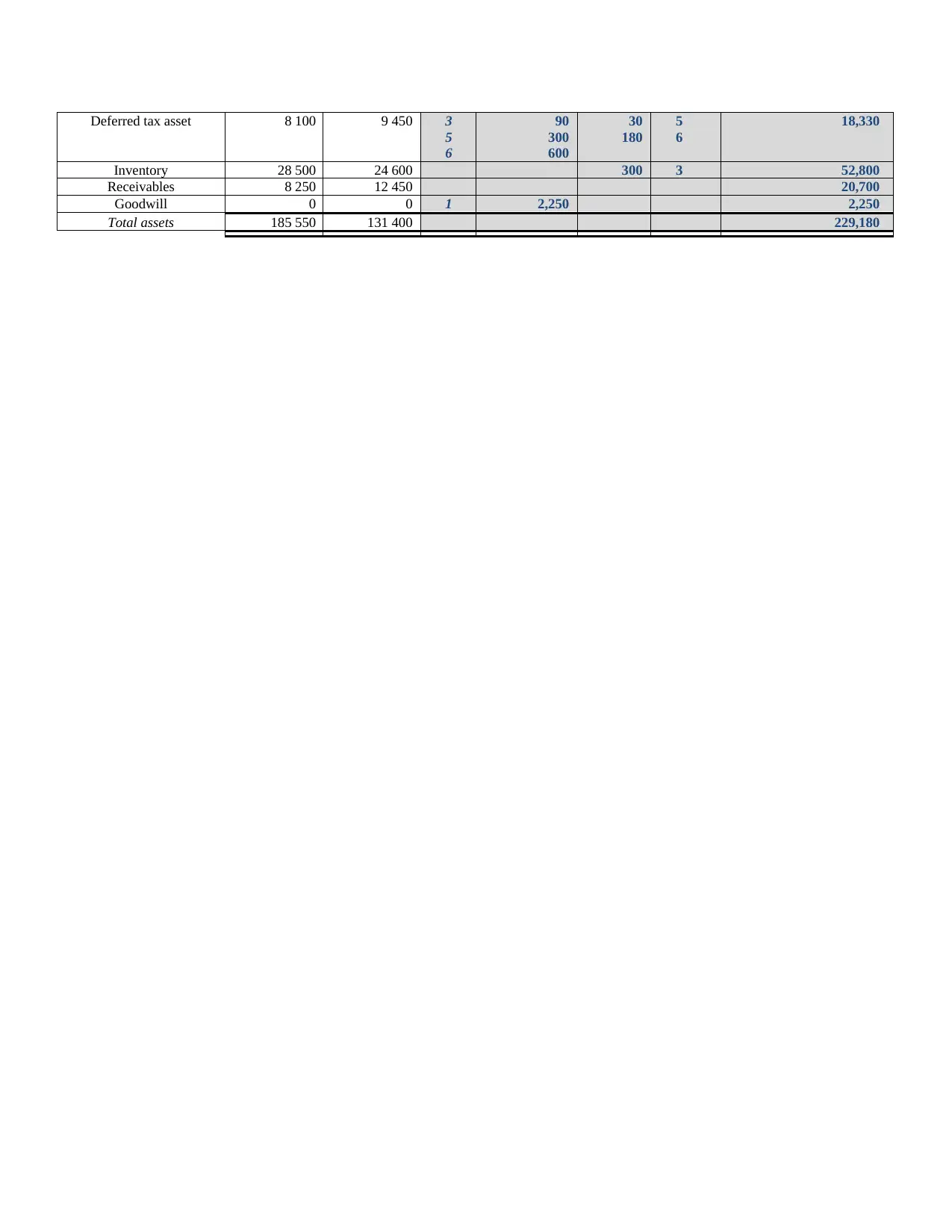

This assignment provides a comparative example of financial statement analysis focusing on the balance sheets of two companies. It outlines key financial elements such as assets (plant, intangibles, inventory, receivables), liabilities (total liabilities), equity, and their respective values for both companies. The data is presented in a table format with clear headings and columns for better understanding.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)