Accounting & Budgeting Assessment No. 1

VerifiedAdded on 2023/05/31

|46

|10474

|359

AI Summary

This assessment includes tasks related to accounting and budgeting. Task 1 requires preparing an adjusted trial balance, Task 2 requires preparing an income statement and balance sheet, Task 3 requires preparing a statement of cash flow, and Task 4 requires calculating ratios and analyzing financial statements. The subject is Accounting and Budgeting, and the course code is FNSACC414 and FNSACC412 for the units of competency. The college is not mentioned.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

T-1.8.1

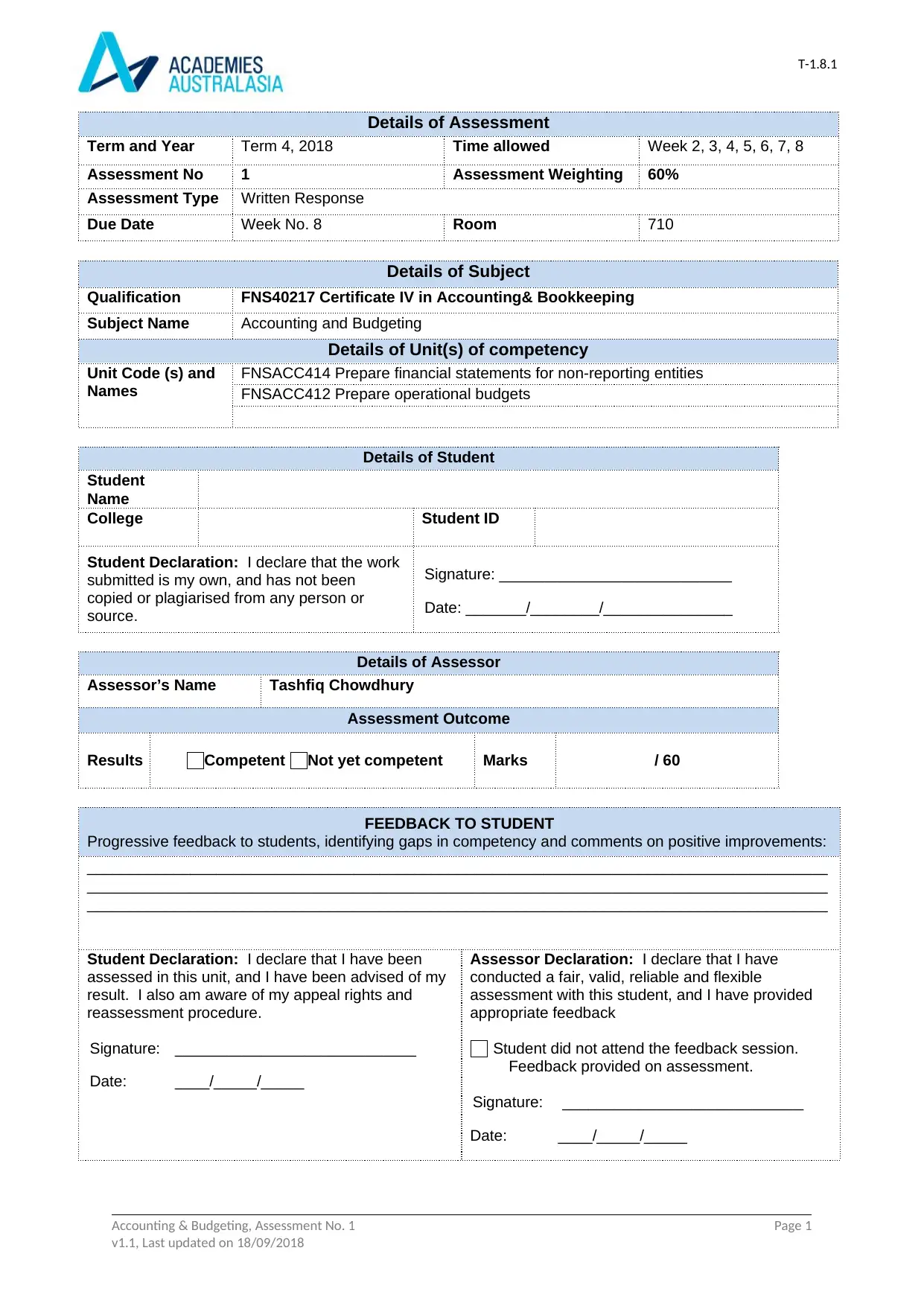

Details of Assessment

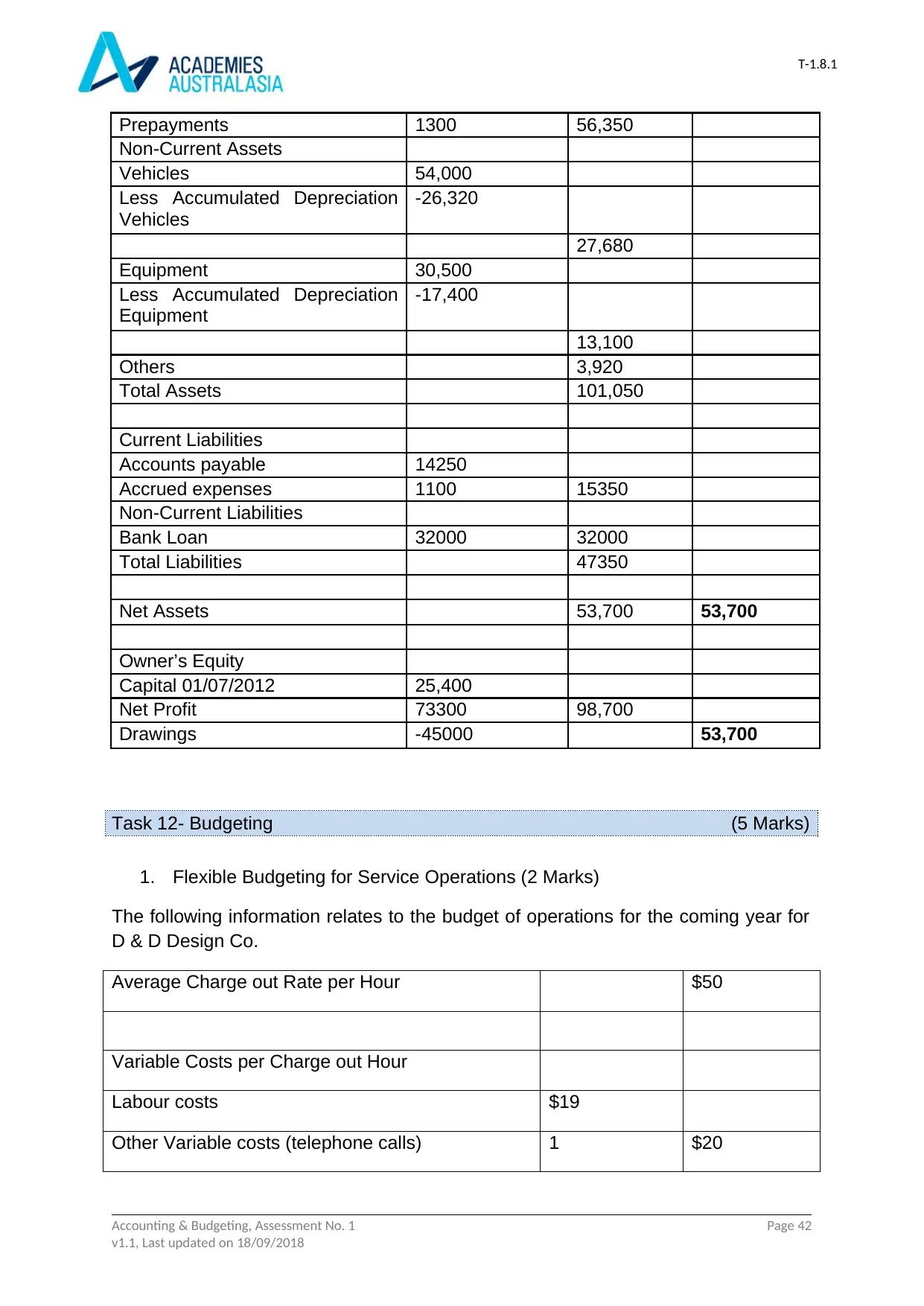

Term and Year Term 4, 2018 Time allowed Week 2, 3, 4, 5, 6, 7, 8

Assessment No 1 Assessment Weighting 60%

Assessment Type Written Response

Due Date Week No. 8 Room 710

Details of Subject

Qualification FNS40217 Certificate IV in Accounting& Bookkeeping

Subject Name Accounting and Budgeting

Details of Unit(s) of competency

Unit Code (s) and

Names

FNSACC414 Prepare financial statements for non-reporting entities

FNSACC412 Prepare operational budgets

Details of Student

Student

Name

College Student ID

Student Declaration: I declare that the work

submitted is my own, and has not been

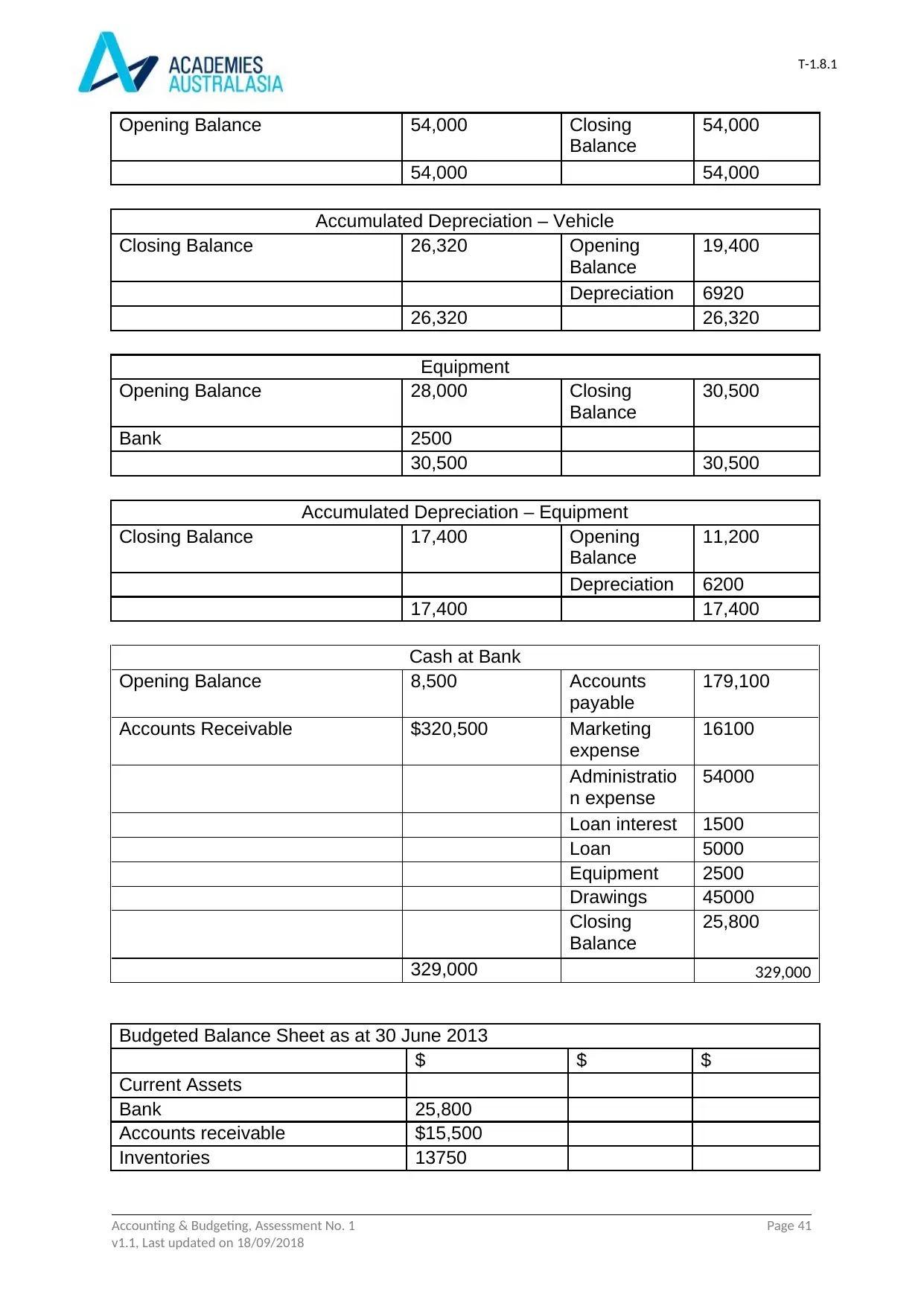

copied or plagiarised from any person or

source.

Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name Tashfiq Chowdhury

Assessment Outcome

Results Competent Not yet competent Marks / 60

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive improvements:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I also am aware of my appeal rights and

reassessment procedure.

Signature: ____________________________

Date: ____/_____/_____

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have provided

appropriate feedback

Student did not attend the feedback session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/_____/_____

Accounting & Budgeting, Assessment No. 1 Page 1

v1.1, Last updated on 18/09/2018

Details of Assessment

Term and Year Term 4, 2018 Time allowed Week 2, 3, 4, 5, 6, 7, 8

Assessment No 1 Assessment Weighting 60%

Assessment Type Written Response

Due Date Week No. 8 Room 710

Details of Subject

Qualification FNS40217 Certificate IV in Accounting& Bookkeeping

Subject Name Accounting and Budgeting

Details of Unit(s) of competency

Unit Code (s) and

Names

FNSACC414 Prepare financial statements for non-reporting entities

FNSACC412 Prepare operational budgets

Details of Student

Student

Name

College Student ID

Student Declaration: I declare that the work

submitted is my own, and has not been

copied or plagiarised from any person or

source.

Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name Tashfiq Chowdhury

Assessment Outcome

Results Competent Not yet competent Marks / 60

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive improvements:

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I also am aware of my appeal rights and

reassessment procedure.

Signature: ____________________________

Date: ____/_____/_____

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have provided

appropriate feedback

Student did not attend the feedback session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/_____/_____

Accounting & Budgeting, Assessment No. 1 Page 1

v1.1, Last updated on 18/09/2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

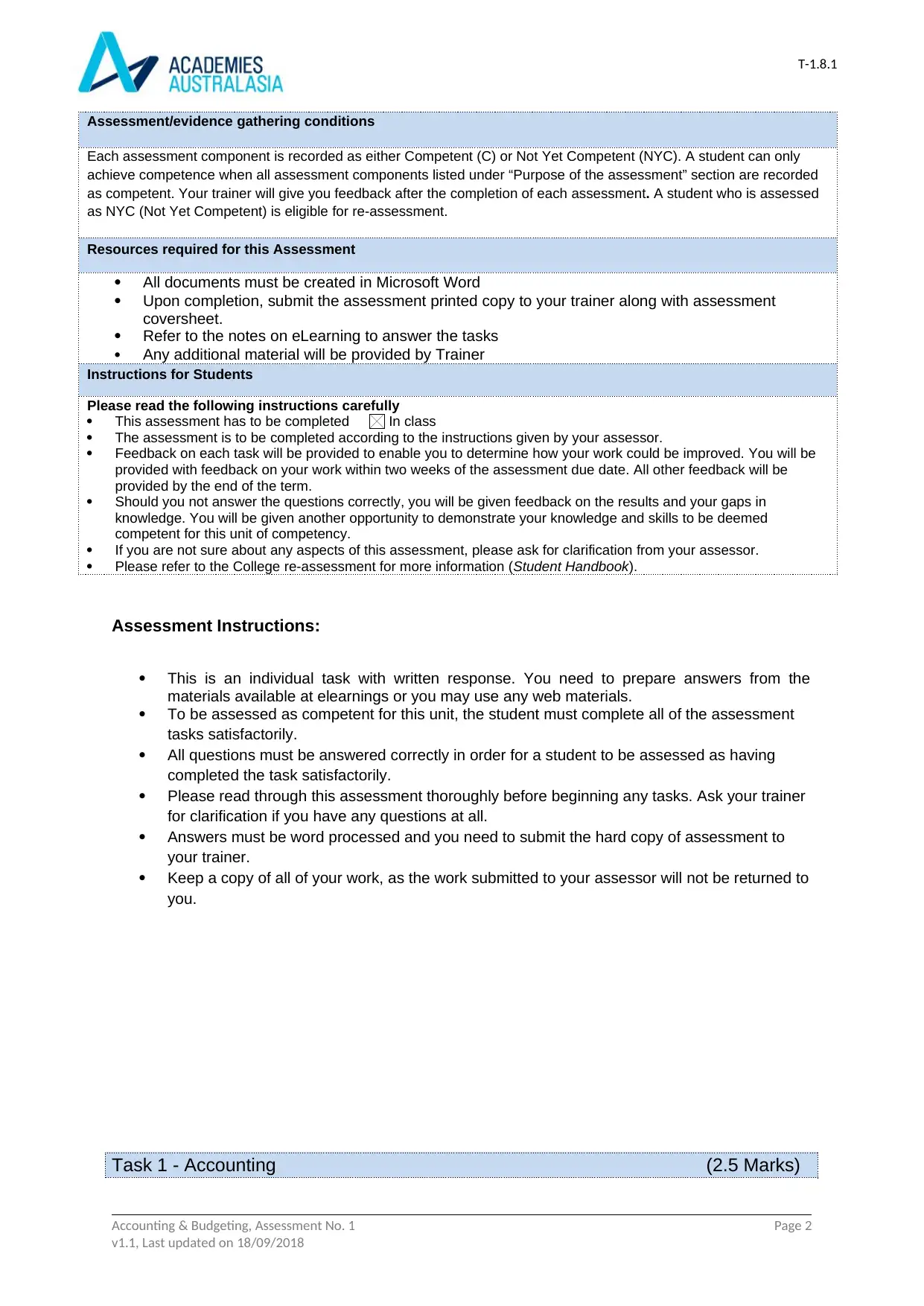

Assessment/evidence gathering conditions

Each assessment component is recorded as either Competent (C) or Not Yet Competent (NYC). A student can only

achieve competence when all assessment components listed under “Purpose of the assessment” section are recorded

as competent. Your trainer will give you feedback after the completion of each assessment. A student who is assessed

as NYC (Not Yet Competent) is eligible for re-assessment.

Resources required for this Assessment

All documents must be created in Microsoft Word

Upon completion, submit the assessment printed copy to your trainer along with assessment

coversheet.

Refer to the notes on eLearning to answer the tasks

Any additional material will be provided by Trainer

Instructions for Students

Please read the following instructions carefully

This assessment has to be completed In class

The assessment is to be completed according to the instructions given by your assessor.

Feedback on each task will be provided to enable you to determine how your work could be improved. You will be

provided with feedback on your work within two weeks of the assessment due date. All other feedback will be

provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps in

knowledge. You will be given another opportunity to demonstrate your knowledge and skills to be deemed

competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your assessor.

Please refer to the College re-assessment for more information (Student Handbook).

Assessment Instructions:

This is an individual task with written response. You need to prepare answers from the

materials available at elearnings or you may use any web materials.

To be assessed as competent for this unit, the student must complete all of the assessment

tasks satisfactorily.

All questions must be answered correctly in order for a student to be assessed as having

completed the task satisfactorily.

Please read through this assessment thoroughly before beginning any tasks. Ask your trainer

for clarification if you have any questions at all.

Answers must be word processed and you need to submit the hard copy of assessment to

your trainer.

Keep a copy of all of your work, as the work submitted to your assessor will not be returned to

you.

Task 1 - Accounting (2.5 Marks)

Accounting & Budgeting, Assessment No. 1 Page 2

v1.1, Last updated on 18/09/2018

Assessment/evidence gathering conditions

Each assessment component is recorded as either Competent (C) or Not Yet Competent (NYC). A student can only

achieve competence when all assessment components listed under “Purpose of the assessment” section are recorded

as competent. Your trainer will give you feedback after the completion of each assessment. A student who is assessed

as NYC (Not Yet Competent) is eligible for re-assessment.

Resources required for this Assessment

All documents must be created in Microsoft Word

Upon completion, submit the assessment printed copy to your trainer along with assessment

coversheet.

Refer to the notes on eLearning to answer the tasks

Any additional material will be provided by Trainer

Instructions for Students

Please read the following instructions carefully

This assessment has to be completed In class

The assessment is to be completed according to the instructions given by your assessor.

Feedback on each task will be provided to enable you to determine how your work could be improved. You will be

provided with feedback on your work within two weeks of the assessment due date. All other feedback will be

provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps in

knowledge. You will be given another opportunity to demonstrate your knowledge and skills to be deemed

competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your assessor.

Please refer to the College re-assessment for more information (Student Handbook).

Assessment Instructions:

This is an individual task with written response. You need to prepare answers from the

materials available at elearnings or you may use any web materials.

To be assessed as competent for this unit, the student must complete all of the assessment

tasks satisfactorily.

All questions must be answered correctly in order for a student to be assessed as having

completed the task satisfactorily.

Please read through this assessment thoroughly before beginning any tasks. Ask your trainer

for clarification if you have any questions at all.

Answers must be word processed and you need to submit the hard copy of assessment to

your trainer.

Keep a copy of all of your work, as the work submitted to your assessor will not be returned to

you.

Task 1 - Accounting (2.5 Marks)

Accounting & Budgeting, Assessment No. 1 Page 2

v1.1, Last updated on 18/09/2018

T-1.8.1

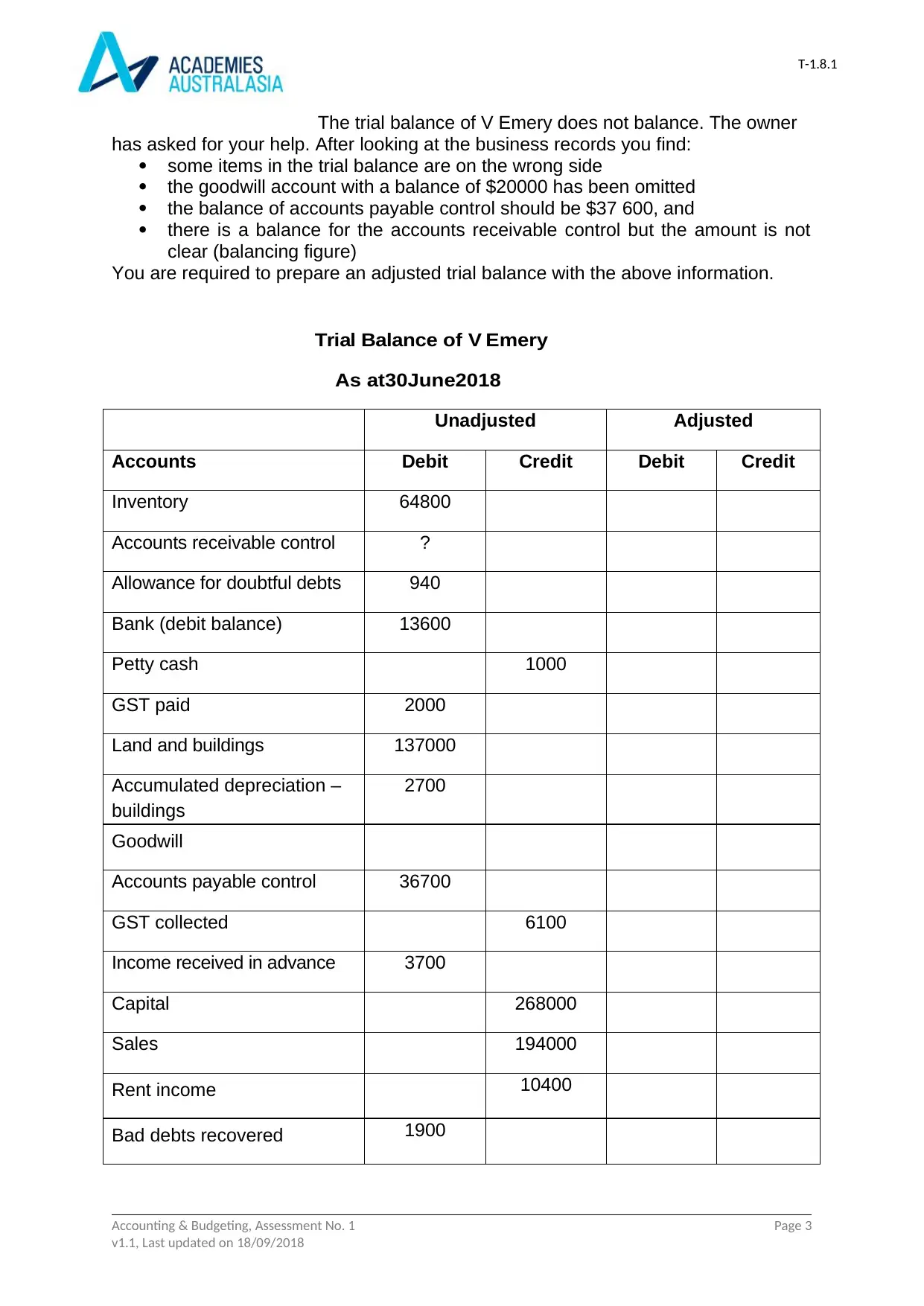

The trial balance of V Emery does not balance. The owner

has asked for your help. After looking at the business records you find:

some items in the trial balance are on the wrong side

the goodwill account with a balance of $20000 has been omitted

the balance of accounts payable control should be $37 600, and

there is a balance for the accounts receivable control but the amount is not

clear (balancing figure)

You are required to prepare an adjusted trial balance with the above information.

Trial Balance of V Emery

As at30June2018

Unadjusted Adjusted

Accounts Debit Credit Debit Credit

Inventory 64800

Accounts receivable control ?

Allowance for doubtful debts 940

Bank (debit balance) 13600

Petty cash 1000

GST paid 2000

Land and buildings 137000

Accumulated depreciation –

buildings

2700

Goodwill

Accounts payable control 36700

GST collected 6100

Income received in advance 3700

Capital 268000

Sales 194000

Rent income 10400

Bad debts recovered 1900

Accounting & Budgeting, Assessment No. 1 Page 3

v1.1, Last updated on 18/09/2018

The trial balance of V Emery does not balance. The owner

has asked for your help. After looking at the business records you find:

some items in the trial balance are on the wrong side

the goodwill account with a balance of $20000 has been omitted

the balance of accounts payable control should be $37 600, and

there is a balance for the accounts receivable control but the amount is not

clear (balancing figure)

You are required to prepare an adjusted trial balance with the above information.

Trial Balance of V Emery

As at30June2018

Unadjusted Adjusted

Accounts Debit Credit Debit Credit

Inventory 64800

Accounts receivable control ?

Allowance for doubtful debts 940

Bank (debit balance) 13600

Petty cash 1000

GST paid 2000

Land and buildings 137000

Accumulated depreciation –

buildings

2700

Goodwill

Accounts payable control 36700

GST collected 6100

Income received in advance 3700

Capital 268000

Sales 194000

Rent income 10400

Bad debts recovered 1900

Accounting & Budgeting, Assessment No. 1 Page 3

v1.1, Last updated on 18/09/2018

T-1.8.1

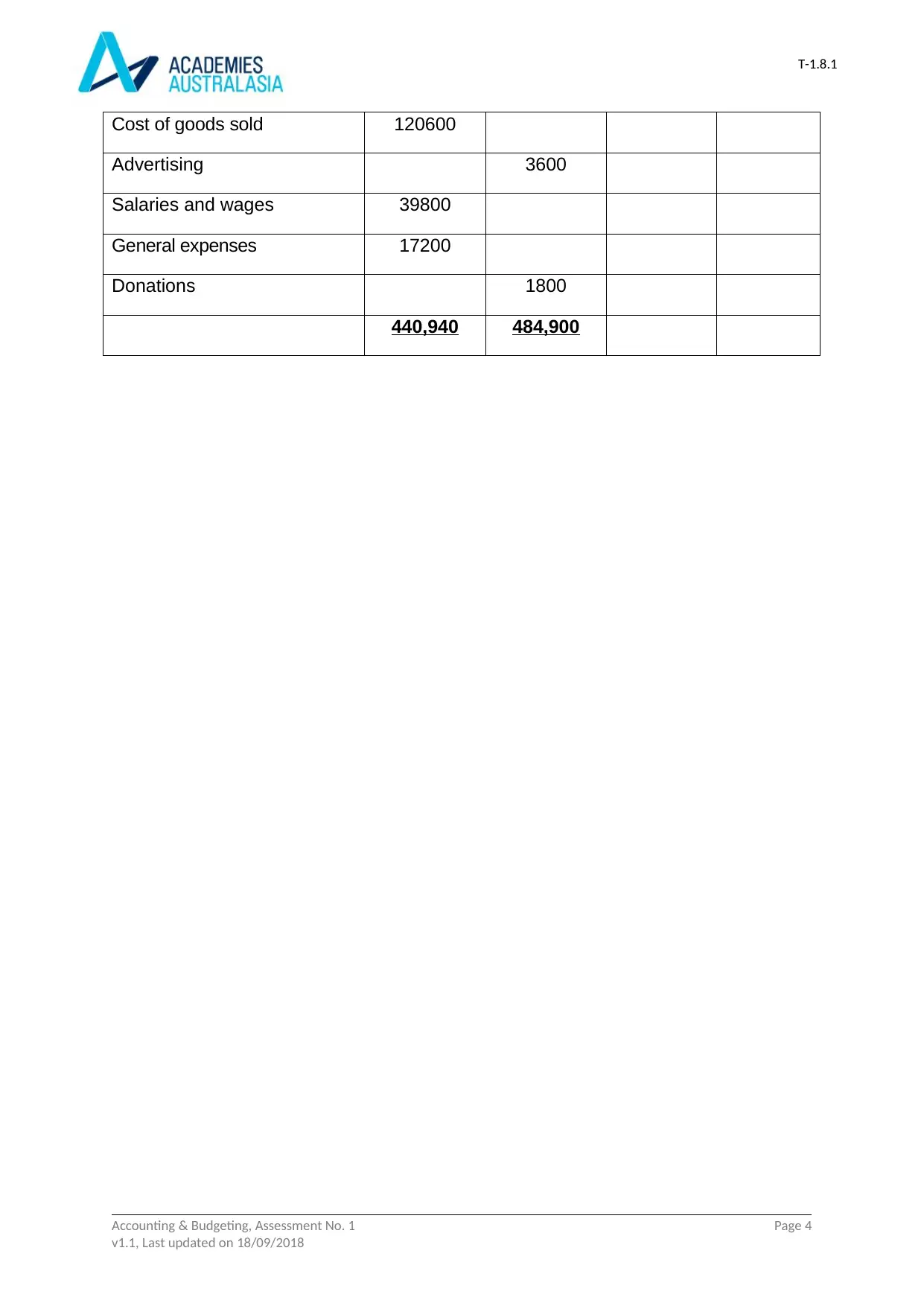

Cost of goods sold 120600

Advertising 3600

Salaries and wages 39800

General expenses 17200

Donations 1800

440,940 484,900

Accounting & Budgeting, Assessment No. 1 Page 4

v1.1, Last updated on 18/09/2018

Cost of goods sold 120600

Advertising 3600

Salaries and wages 39800

General expenses 17200

Donations 1800

440,940 484,900

Accounting & Budgeting, Assessment No. 1 Page 4

v1.1, Last updated on 18/09/2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

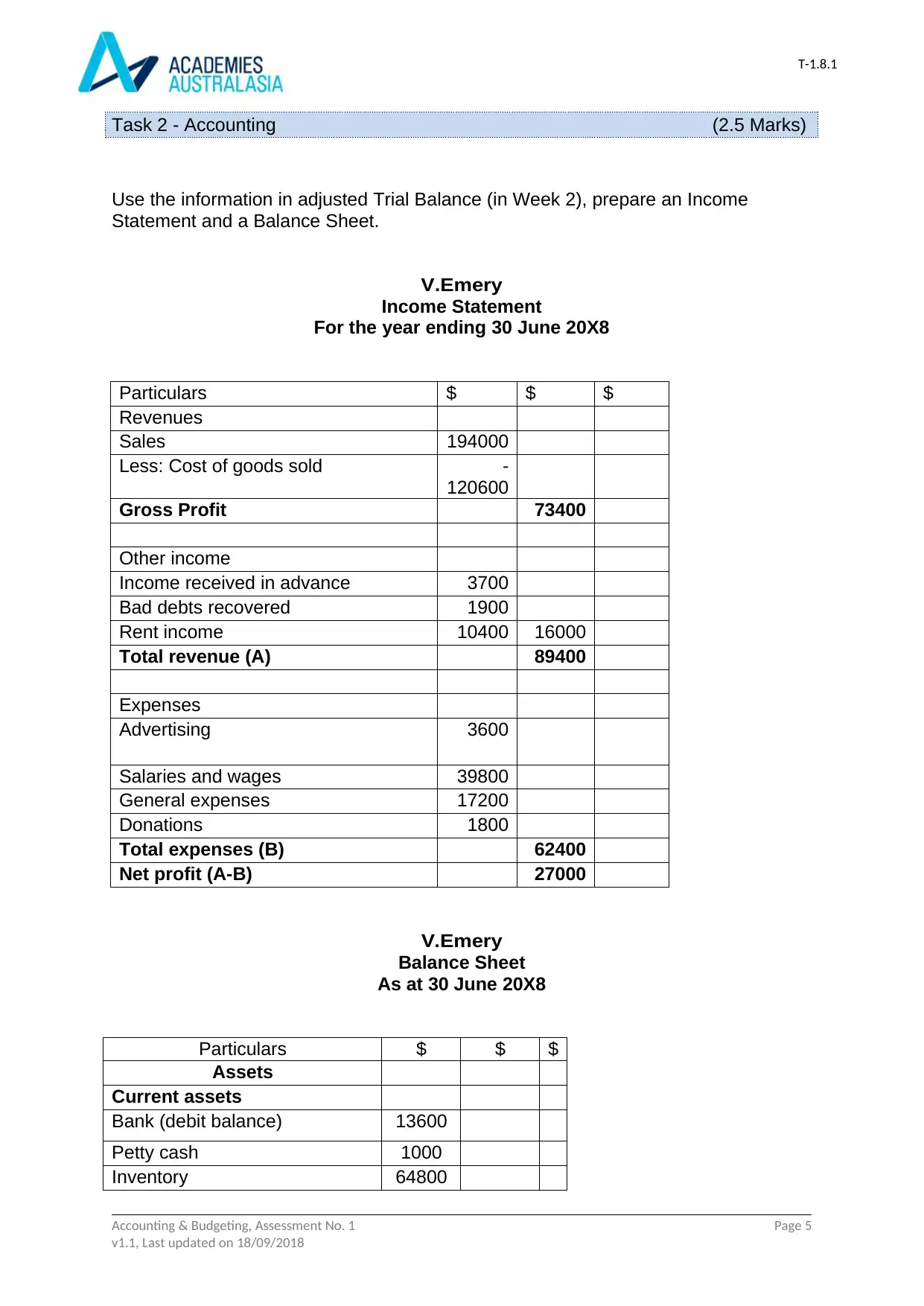

Task 2 - Accounting (2.5 Marks)

Use the information in adjusted Trial Balance (in Week 2), prepare an Income

Statement and a Balance Sheet.

V.Emery

Income Statement

For the year ending 30 June 20X8

Particulars $ $ $

Revenues

Sales 194000

Less: Cost of goods sold -

120600

Gross Profit 73400

Other income

Income received in advance 3700

Bad debts recovered 1900

Rent income 10400 16000

Total revenue (A) 89400

Expenses

Advertising 3600

Salaries and wages 39800

General expenses 17200

Donations 1800

Total expenses (B) 62400

Net profit (A-B) 27000

V.Emery

Balance Sheet

As at 30 June 20X8

Particulars $ $ $

Assets

Current assets

Bank (debit balance) 13600

Petty cash 1000

Inventory 64800

Accounting & Budgeting, Assessment No. 1 Page 5

v1.1, Last updated on 18/09/2018

Task 2 - Accounting (2.5 Marks)

Use the information in adjusted Trial Balance (in Week 2), prepare an Income

Statement and a Balance Sheet.

V.Emery

Income Statement

For the year ending 30 June 20X8

Particulars $ $ $

Revenues

Sales 194000

Less: Cost of goods sold -

120600

Gross Profit 73400

Other income

Income received in advance 3700

Bad debts recovered 1900

Rent income 10400 16000

Total revenue (A) 89400

Expenses

Advertising 3600

Salaries and wages 39800

General expenses 17200

Donations 1800

Total expenses (B) 62400

Net profit (A-B) 27000

V.Emery

Balance Sheet

As at 30 June 20X8

Particulars $ $ $

Assets

Current assets

Bank (debit balance) 13600

Petty cash 1000

Inventory 64800

Accounting & Budgeting, Assessment No. 1 Page 5

v1.1, Last updated on 18/09/2018

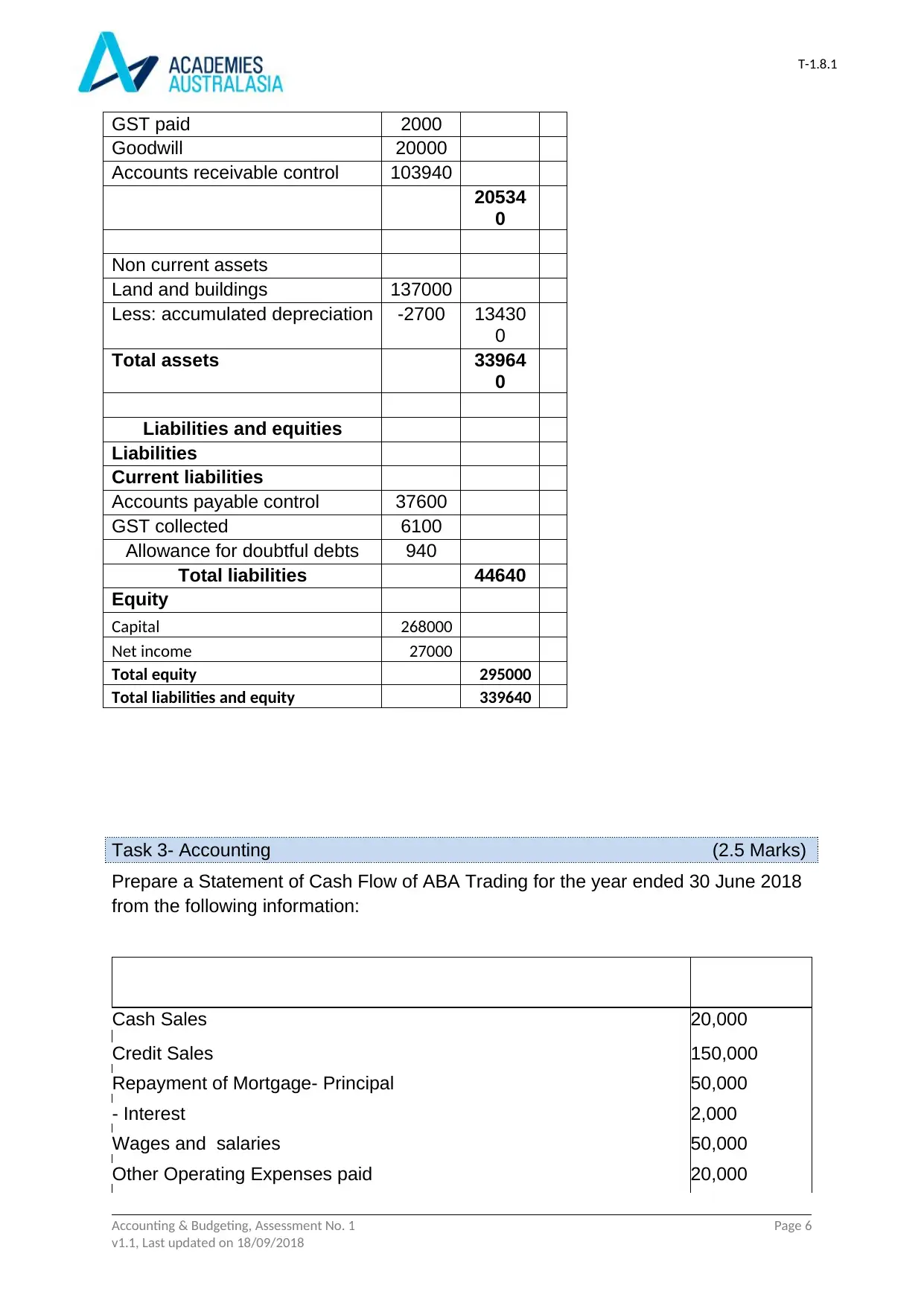

T-1.8.1

GST paid 2000

Goodwill 20000

Accounts receivable control 103940

20534

0

Non current assets

Land and buildings 137000

Less: accumulated depreciation -2700 13430

0

Total assets 33964

0

Liabilities and equities

Liabilities

Current liabilities

Accounts payable control 37600

GST collected 6100

Allowance for doubtful debts 940

Total liabilities 44640

Equity

Capital 268000

Net income 27000

Total equity 295000

Total liabilities and equity 339640

Task 3- Accounting (2.5 Marks)

Prepare a Statement of Cash Flow of ABA Trading for the year ended 30 June 2018

from the following information:

Cash Sales 20,000

Credit Sales 150,000

Repayment of Mortgage- Principal 50,000

- Interest 2,000

Wages and salaries 50,000

Other Operating Expenses paid 20,000

Accounting & Budgeting, Assessment No. 1 Page 6

v1.1, Last updated on 18/09/2018

GST paid 2000

Goodwill 20000

Accounts receivable control 103940

20534

0

Non current assets

Land and buildings 137000

Less: accumulated depreciation -2700 13430

0

Total assets 33964

0

Liabilities and equities

Liabilities

Current liabilities

Accounts payable control 37600

GST collected 6100

Allowance for doubtful debts 940

Total liabilities 44640

Equity

Capital 268000

Net income 27000

Total equity 295000

Total liabilities and equity 339640

Task 3- Accounting (2.5 Marks)

Prepare a Statement of Cash Flow of ABA Trading for the year ended 30 June 2018

from the following information:

Cash Sales 20,000

Credit Sales 150,000

Repayment of Mortgage- Principal 50,000

- Interest 2,000

Wages and salaries 50,000

Other Operating Expenses paid 20,000

Accounting & Budgeting, Assessment No. 1 Page 6

v1.1, Last updated on 18/09/2018

T-1.8.1

Payments to Accounts Payable 30,000

Discount Received 1,000

Depreciation expense 5,000

Receipts from Accounts Receivable 160,000

Dividends received on share investments 500

Proceeds from sale of Office Equipment 2,000

New Capital introduced by the owner 40,000

Bad Debts written off 3,000

Drawings by the owner 20,000

Purchase of Office Equipment 5,500

Cash at Bank 1/7/2017 5,000

Cash at Bank 30/6/2018 ?

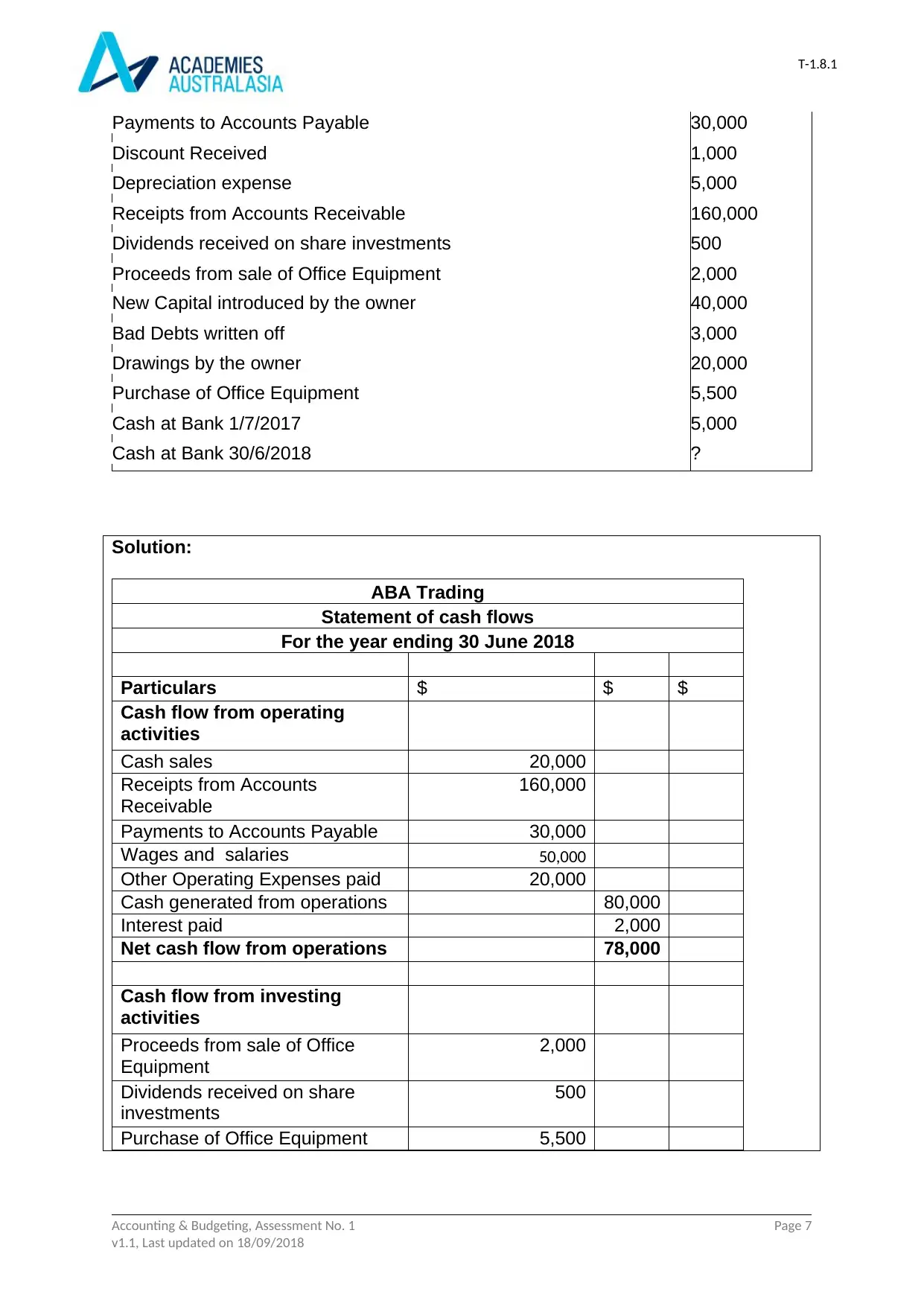

Solution:

ABA Trading

Statement of cash flows

For the year ending 30 June 2018

Particulars $ $ $

Cash flow from operating

activities

Cash sales 20,000

Receipts from Accounts

Receivable

160,000

Payments to Accounts Payable 30,000

Wages and salaries 50,000

Other Operating Expenses paid 20,000

Cash generated from operations 80,000

Interest paid 2,000

Net cash flow from operations 78,000

Cash flow from investing

activities

Proceeds from sale of Office

Equipment

2,000

Dividends received on share

investments

500

Purchase of Office Equipment 5,500

Accounting & Budgeting, Assessment No. 1 Page 7

v1.1, Last updated on 18/09/2018

Payments to Accounts Payable 30,000

Discount Received 1,000

Depreciation expense 5,000

Receipts from Accounts Receivable 160,000

Dividends received on share investments 500

Proceeds from sale of Office Equipment 2,000

New Capital introduced by the owner 40,000

Bad Debts written off 3,000

Drawings by the owner 20,000

Purchase of Office Equipment 5,500

Cash at Bank 1/7/2017 5,000

Cash at Bank 30/6/2018 ?

Solution:

ABA Trading

Statement of cash flows

For the year ending 30 June 2018

Particulars $ $ $

Cash flow from operating

activities

Cash sales 20,000

Receipts from Accounts

Receivable

160,000

Payments to Accounts Payable 30,000

Wages and salaries 50,000

Other Operating Expenses paid 20,000

Cash generated from operations 80,000

Interest paid 2,000

Net cash flow from operations 78,000

Cash flow from investing

activities

Proceeds from sale of Office

Equipment

2,000

Dividends received on share

investments

500

Purchase of Office Equipment 5,500

Accounting & Budgeting, Assessment No. 1 Page 7

v1.1, Last updated on 18/09/2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Cash used in investing

activities

-3,000

Cash flows from financing

activities

New Capital introduced by the

owner

40,000

Repayment of Mortgage-

Principal

50,000

Drawings by the owner 20,000

Cash used in financing

activities -30,000

Net increase/decrease in cash 45,000

Add: Opening balance 5,000

Closing balance 50,000

Task 4 - Accounting (5 Marks)

Financial Statement Analysis:

You are given the following financial statements for Huffington Post Trading:

Income Statement for the year ended 30June 2018

$ $ $

Sales (all credit) 480,000

Less, Cost of Goods Sold

inventories (1/7/2017)Purchases 54,500

Goods available for sale 331,800 386,300

Less, Inventories 30/6/2018 69,500 316,800

Gross Profit 163,200

Other Income 5,000

Total Operating Income 168,200

Less, Operating Expenses 110,600

Net Profit 57,600

Balance Sheet as at 30 June 2018

$ $ $

Current Assets

Accounts Receivable 78,000

Less, Allowance for Doubtful Debts 3,000 75,000

Inventories 69,500

Prepaid Expenses 500

Accrued revenue 1,000 146,000

Non-Current Assets

Accounting & Budgeting, Assessment No. 1 Page 8

v1.1, Last updated on 18/09/2018

Cash used in investing

activities

-3,000

Cash flows from financing

activities

New Capital introduced by the

owner

40,000

Repayment of Mortgage-

Principal

50,000

Drawings by the owner 20,000

Cash used in financing

activities -30,000

Net increase/decrease in cash 45,000

Add: Opening balance 5,000

Closing balance 50,000

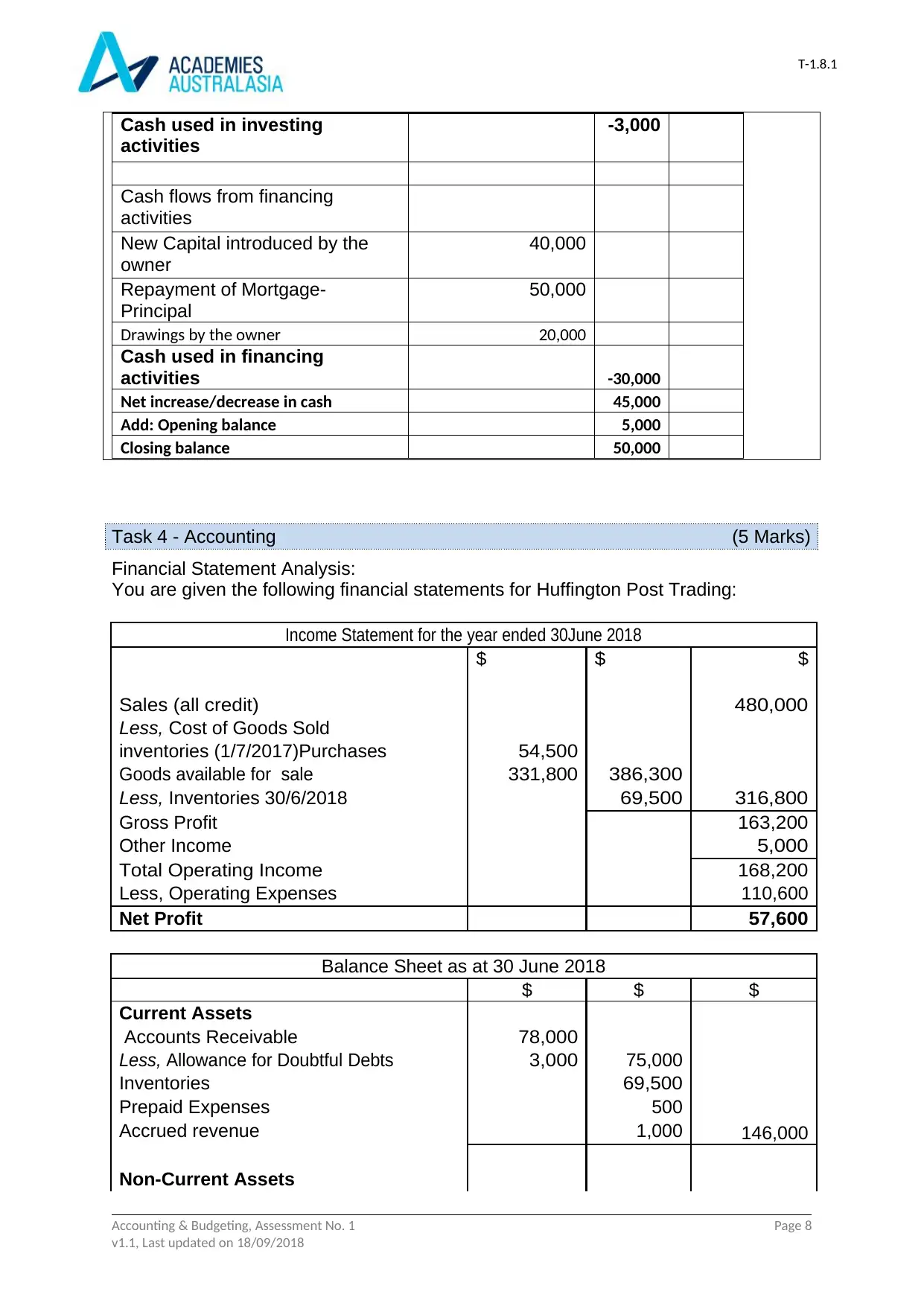

Task 4 - Accounting (5 Marks)

Financial Statement Analysis:

You are given the following financial statements for Huffington Post Trading:

Income Statement for the year ended 30June 2018

$ $ $

Sales (all credit) 480,000

Less, Cost of Goods Sold

inventories (1/7/2017)Purchases 54,500

Goods available for sale 331,800 386,300

Less, Inventories 30/6/2018 69,500 316,800

Gross Profit 163,200

Other Income 5,000

Total Operating Income 168,200

Less, Operating Expenses 110,600

Net Profit 57,600

Balance Sheet as at 30 June 2018

$ $ $

Current Assets

Accounts Receivable 78,000

Less, Allowance for Doubtful Debts 3,000 75,000

Inventories 69,500

Prepaid Expenses 500

Accrued revenue 1,000 146,000

Non-Current Assets

Accounting & Budgeting, Assessment No. 1 Page 8

v1.1, Last updated on 18/09/2018

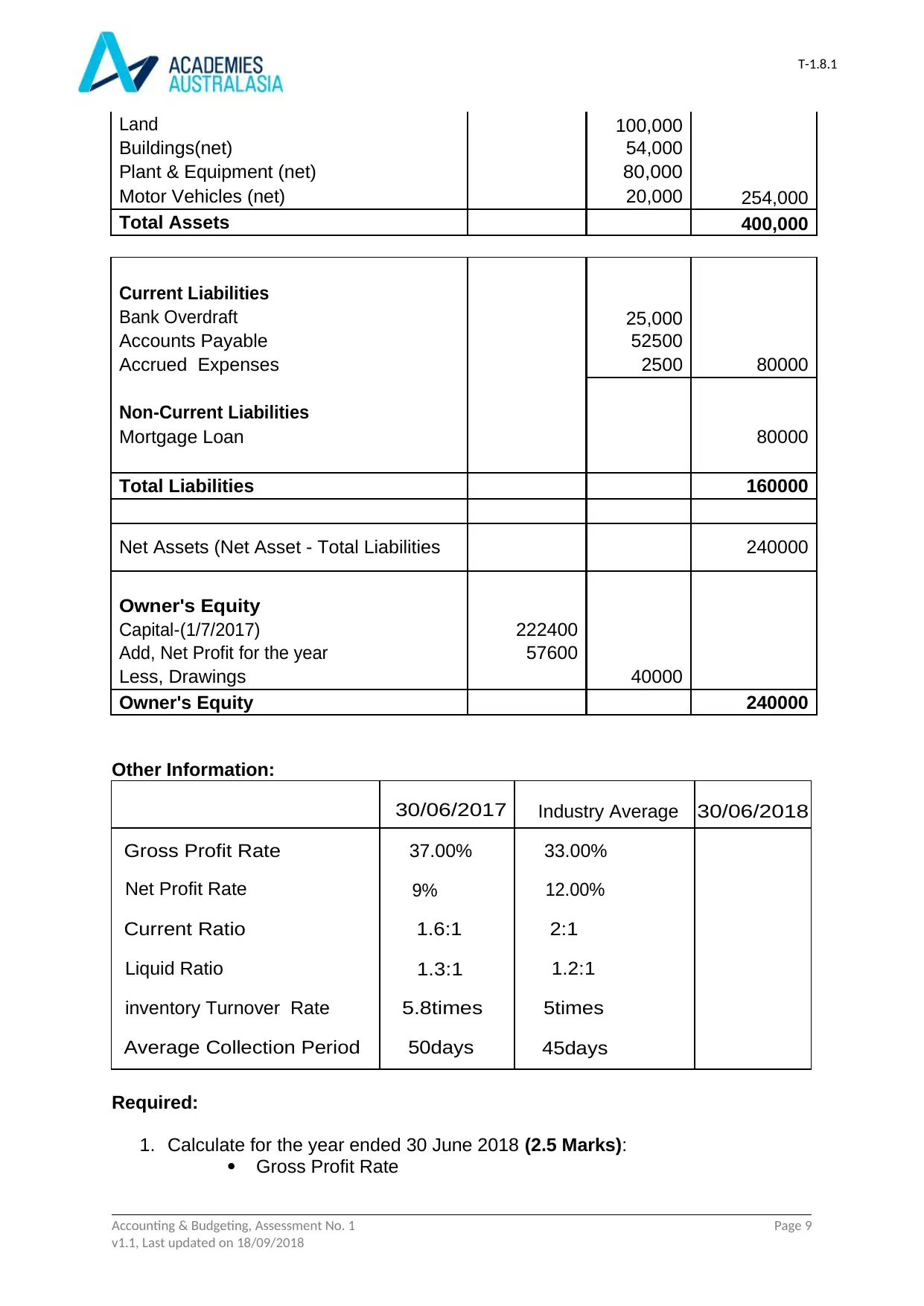

T-1.8.1

Land 100,000

Buildings(net) 54,000

Plant & Equipment (net) 80,000

Motor Vehicles (net) 20,000 254,000

Total Assets 400,000

Current Liabilities

Bank Overdraft 25,000

Accounts Payable 52500

Accrued Expenses 2500 80000

Non-Current Liabilities

Mortgage Loan 80000

Total Liabilities 160000

Net Assets (Net Asset - Total Liabilities 240000

Owner's Equity

Capital-(1/7/2017) 222400

Add, Net Profit for the year 57600

Less, Drawings 40000

Owner's Equity 240000

Other Information:

30/06/2017 Industry Average 30/06/2018

Gross Profit Rate 37.00% 33.00%

Net Profit Rate 9% 12.00%

Current Ratio 1.6:1 2:1

Liquid Ratio 1.3:1 1.2:1

inventory Turnover Rate 5.8times 5times

Average Collection Period 50days 45days

Required:

1. Calculate for the year ended 30 June 2018 (2.5 Marks):

Gross Profit Rate

Accounting & Budgeting, Assessment No. 1 Page 9

v1.1, Last updated on 18/09/2018

Land 100,000

Buildings(net) 54,000

Plant & Equipment (net) 80,000

Motor Vehicles (net) 20,000 254,000

Total Assets 400,000

Current Liabilities

Bank Overdraft 25,000

Accounts Payable 52500

Accrued Expenses 2500 80000

Non-Current Liabilities

Mortgage Loan 80000

Total Liabilities 160000

Net Assets (Net Asset - Total Liabilities 240000

Owner's Equity

Capital-(1/7/2017) 222400

Add, Net Profit for the year 57600

Less, Drawings 40000

Owner's Equity 240000

Other Information:

30/06/2017 Industry Average 30/06/2018

Gross Profit Rate 37.00% 33.00%

Net Profit Rate 9% 12.00%

Current Ratio 1.6:1 2:1

Liquid Ratio 1.3:1 1.2:1

inventory Turnover Rate 5.8times 5times

Average Collection Period 50days 45days

Required:

1. Calculate for the year ended 30 June 2018 (2.5 Marks):

Gross Profit Rate

Accounting & Budgeting, Assessment No. 1 Page 9

v1.1, Last updated on 18/09/2018

T-1.8.1

Net Profit Rate

Current Ratio

Liquid Ratio

Inventory Turnover Rate

Average Collection Period

2. Based on the ratios you have calculated and the other information given,

comment briefly on each of the following for Bowman's business (1.5 Marks):

Profitability

Business Activity

Liquidity

3. Advise the company of possible reasons for any unsatisfactory situations that

exist in relation to the business and suggest actions that may be taken to

improve them. (1 Mark)

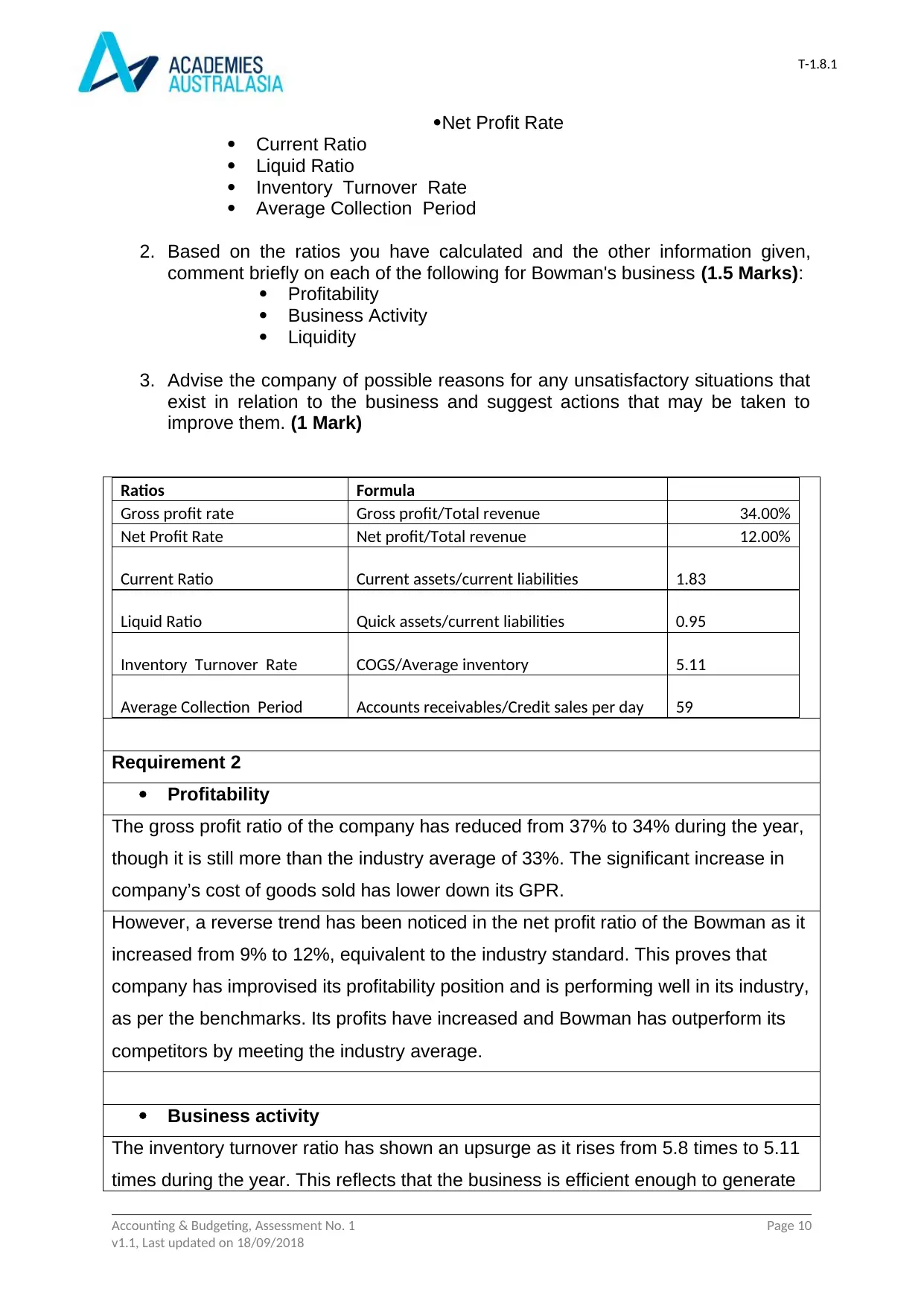

Ratios Formula

Gross profit rate Gross profit/Total revenue 34.00%

Net Profit Rate Net profit/Total revenue 12.00%

Current Ratio Current assets/current liabilities 1.83

Liquid Ratio Quick assets/current liabilities 0.95

Inventory Turnover Rate COGS/Average inventory 5.11

Average Collection Period Accounts receivables/Credit sales per day 59

Requirement 2

Profitability

The gross profit ratio of the company has reduced from 37% to 34% during the year,

though it is still more than the industry average of 33%. The significant increase in

company’s cost of goods sold has lower down its GPR.

However, a reverse trend has been noticed in the net profit ratio of the Bowman as it

increased from 9% to 12%, equivalent to the industry standard. This proves that

company has improvised its profitability position and is performing well in its industry,

as per the benchmarks. Its profits have increased and Bowman has outperform its

competitors by meeting the industry average.

Business activity

The inventory turnover ratio has shown an upsurge as it rises from 5.8 times to 5.11

times during the year. This reflects that the business is efficient enough to generate

Accounting & Budgeting, Assessment No. 1 Page 10

v1.1, Last updated on 18/09/2018

Net Profit Rate

Current Ratio

Liquid Ratio

Inventory Turnover Rate

Average Collection Period

2. Based on the ratios you have calculated and the other information given,

comment briefly on each of the following for Bowman's business (1.5 Marks):

Profitability

Business Activity

Liquidity

3. Advise the company of possible reasons for any unsatisfactory situations that

exist in relation to the business and suggest actions that may be taken to

improve them. (1 Mark)

Ratios Formula

Gross profit rate Gross profit/Total revenue 34.00%

Net Profit Rate Net profit/Total revenue 12.00%

Current Ratio Current assets/current liabilities 1.83

Liquid Ratio Quick assets/current liabilities 0.95

Inventory Turnover Rate COGS/Average inventory 5.11

Average Collection Period Accounts receivables/Credit sales per day 59

Requirement 2

Profitability

The gross profit ratio of the company has reduced from 37% to 34% during the year,

though it is still more than the industry average of 33%. The significant increase in

company’s cost of goods sold has lower down its GPR.

However, a reverse trend has been noticed in the net profit ratio of the Bowman as it

increased from 9% to 12%, equivalent to the industry standard. This proves that

company has improvised its profitability position and is performing well in its industry,

as per the benchmarks. Its profits have increased and Bowman has outperform its

competitors by meeting the industry average.

Business activity

The inventory turnover ratio has shown an upsurge as it rises from 5.8 times to 5.11

times during the year. This reflects that the business is efficient enough to generate

Accounting & Budgeting, Assessment No. 1 Page 10

v1.1, Last updated on 18/09/2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

more revenues from its inventory.

However, its average collection period increased from 50 days to 59 days and is also

way more than the industry average of 45 days. This means that the business is not

competent enough to collect its receivables quickly and on time. Bowman needs to

focus on improving this as it may create problems in company’s functioning.

Liquidity

The current ratio of the business increase from 1.61:1 to 1.85:1. This was due to the

fact that the current assets of the business are more than its current liabilities which

anyway boosted up the ratio.

In contrast to it, the quick ratio reduced to 0.95:1 from 1.3:1 because of the no cash

balance within the business. Most of the cash is hold by accounts receivables and

inventories which eventually eliminates the liquid assets of the company. overall,

Bowman has stable liquidity position as it can pay off all its short term financial

obligations easily.

Requirement 3

It is advisable to Bowman that it should reduce its cost of goods sold and increase its

overall revenue. Moreover, it should also include some cash sales in the business so

that the whole dependence for liquidity does not go on to debtors. Having minimum

cash balance in the business is very much necessary for Bowman to maintain its

liquidity and solvency position. Along with that the company should also focus on

reducing its average collection period so that the cash balance can increase and

quick ratio can be improved. By focusing on these areas, Bowman will be able to

enhance its overall profitability and liquidity position.

Task 5- Accounting (10 x 0.5 Mark = 5 Marks)

Short questionnaire

1. What is the difference between current assets and non-current assets?

Current assets

These are those assets which can be converted into cash within a period of one year

or less than that. They include cash and bank, inventories, debtors, prepaid

Accounting & Budgeting, Assessment No. 1 Page 11

v1.1, Last updated on 18/09/2018

more revenues from its inventory.

However, its average collection period increased from 50 days to 59 days and is also

way more than the industry average of 45 days. This means that the business is not

competent enough to collect its receivables quickly and on time. Bowman needs to

focus on improving this as it may create problems in company’s functioning.

Liquidity

The current ratio of the business increase from 1.61:1 to 1.85:1. This was due to the

fact that the current assets of the business are more than its current liabilities which

anyway boosted up the ratio.

In contrast to it, the quick ratio reduced to 0.95:1 from 1.3:1 because of the no cash

balance within the business. Most of the cash is hold by accounts receivables and

inventories which eventually eliminates the liquid assets of the company. overall,

Bowman has stable liquidity position as it can pay off all its short term financial

obligations easily.

Requirement 3

It is advisable to Bowman that it should reduce its cost of goods sold and increase its

overall revenue. Moreover, it should also include some cash sales in the business so

that the whole dependence for liquidity does not go on to debtors. Having minimum

cash balance in the business is very much necessary for Bowman to maintain its

liquidity and solvency position. Along with that the company should also focus on

reducing its average collection period so that the cash balance can increase and

quick ratio can be improved. By focusing on these areas, Bowman will be able to

enhance its overall profitability and liquidity position.

Task 5- Accounting (10 x 0.5 Mark = 5 Marks)

Short questionnaire

1. What is the difference between current assets and non-current assets?

Current assets

These are those assets which can be converted into cash within a period of one year

or less than that. They include cash and bank, inventories, debtors, prepaid

Accounting & Budgeting, Assessment No. 1 Page 11

v1.1, Last updated on 18/09/2018

T-1.8.1

expenses and others. All these assets provide economic benefit to the company

within a year.

Non-current assets

These assets are held by the company for more than one year and are considered

as the long term investments of the firm. They provide economic benefits to the

company for long run and require more than one year to get converted into cash. For

instance, property, plant and equipment, land, machinery, building and others.

2. Explain revenue and revenue recognition.

Revenue

In accounting terms, revenue the amount earned by a business from its operations

or activities. It is generated by the sale of goods and services to the consumers.

Revenue is also received from other sources like interest income, fees, royalties and

many more.

Revenue recognition

It is an accounting concept that focuses on specific circumstances under which the

revenue is recognized by the company. IFRS has laid down some criteria for the

same such as transfer of risks and rewards from seller to buyer, measureable

amount of revenue and cost of revenue and others.

3. What does it mean to capitalize expenditure?

Capitalization of expenditure means that it will now recorded in the balance sheet as

an asset rather than in income statement as an expense.

4. What supporting charts, diagrams or data may be useful to be presented with

the financial statements?

Charts like pie-chart reflecting the revenue of the company from different

segments, line graph showing the net profit growth, column graph reflecting the

main items like historical sales, return on equity, operating profit and others might

Accounting & Budgeting, Assessment No. 1 Page 12

v1.1, Last updated on 18/09/2018

expenses and others. All these assets provide economic benefit to the company

within a year.

Non-current assets

These assets are held by the company for more than one year and are considered

as the long term investments of the firm. They provide economic benefits to the

company for long run and require more than one year to get converted into cash. For

instance, property, plant and equipment, land, machinery, building and others.

2. Explain revenue and revenue recognition.

Revenue

In accounting terms, revenue the amount earned by a business from its operations

or activities. It is generated by the sale of goods and services to the consumers.

Revenue is also received from other sources like interest income, fees, royalties and

many more.

Revenue recognition

It is an accounting concept that focuses on specific circumstances under which the

revenue is recognized by the company. IFRS has laid down some criteria for the

same such as transfer of risks and rewards from seller to buyer, measureable

amount of revenue and cost of revenue and others.

3. What does it mean to capitalize expenditure?

Capitalization of expenditure means that it will now recorded in the balance sheet as

an asset rather than in income statement as an expense.

4. What supporting charts, diagrams or data may be useful to be presented with

the financial statements?

Charts like pie-chart reflecting the revenue of the company from different

segments, line graph showing the net profit growth, column graph reflecting the

main items like historical sales, return on equity, operating profit and others might

Accounting & Budgeting, Assessment No. 1 Page 12

v1.1, Last updated on 18/09/2018

T-1.8.1

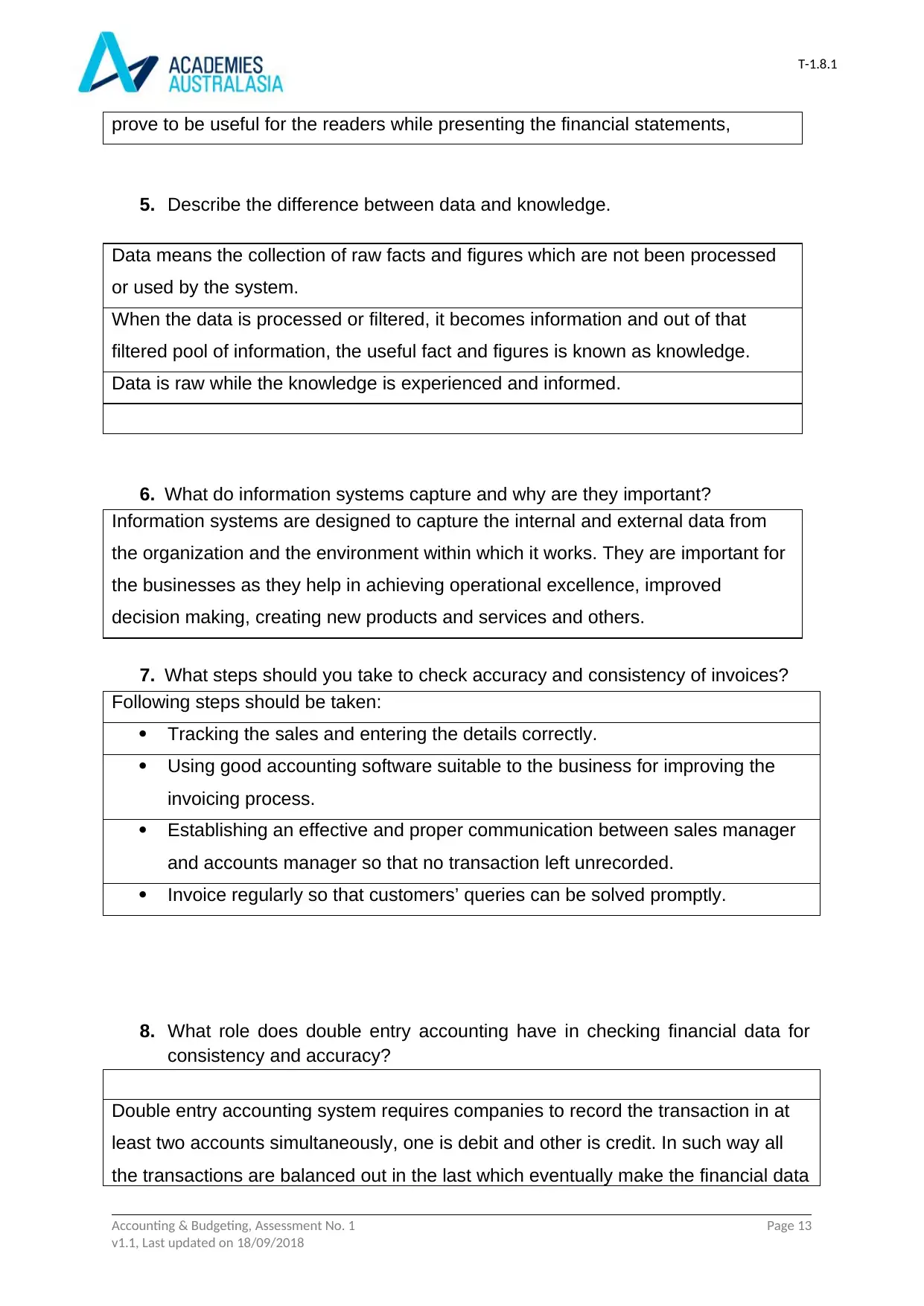

prove to be useful for the readers while presenting the financial statements,

5. Describe the difference between data and knowledge.

Data means the collection of raw facts and figures which are not been processed

or used by the system.

When the data is processed or filtered, it becomes information and out of that

filtered pool of information, the useful fact and figures is known as knowledge.

Data is raw while the knowledge is experienced and informed.

6. What do information systems capture and why are they important?

Information systems are designed to capture the internal and external data from

the organization and the environment within which it works. They are important for

the businesses as they help in achieving operational excellence, improved

decision making, creating new products and services and others.

7. What steps should you take to check accuracy and consistency of invoices?

Following steps should be taken:

Tracking the sales and entering the details correctly.

Using good accounting software suitable to the business for improving the

invoicing process.

Establishing an effective and proper communication between sales manager

and accounts manager so that no transaction left unrecorded.

Invoice regularly so that customers’ queries can be solved promptly.

8. What role does double entry accounting have in checking financial data for

consistency and accuracy?

Double entry accounting system requires companies to record the transaction in at

least two accounts simultaneously, one is debit and other is credit. In such way all

the transactions are balanced out in the last which eventually make the financial data

Accounting & Budgeting, Assessment No. 1 Page 13

v1.1, Last updated on 18/09/2018

prove to be useful for the readers while presenting the financial statements,

5. Describe the difference between data and knowledge.

Data means the collection of raw facts and figures which are not been processed

or used by the system.

When the data is processed or filtered, it becomes information and out of that

filtered pool of information, the useful fact and figures is known as knowledge.

Data is raw while the knowledge is experienced and informed.

6. What do information systems capture and why are they important?

Information systems are designed to capture the internal and external data from

the organization and the environment within which it works. They are important for

the businesses as they help in achieving operational excellence, improved

decision making, creating new products and services and others.

7. What steps should you take to check accuracy and consistency of invoices?

Following steps should be taken:

Tracking the sales and entering the details correctly.

Using good accounting software suitable to the business for improving the

invoicing process.

Establishing an effective and proper communication between sales manager

and accounts manager so that no transaction left unrecorded.

Invoice regularly so that customers’ queries can be solved promptly.

8. What role does double entry accounting have in checking financial data for

consistency and accuracy?

Double entry accounting system requires companies to record the transaction in at

least two accounts simultaneously, one is debit and other is credit. In such way all

the transactions are balanced out in the last which eventually make the financial data

Accounting & Budgeting, Assessment No. 1 Page 13

v1.1, Last updated on 18/09/2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

accurate and consistent.

Another reason is that it implements the matching principle which deals with the

recording of accrual revenue and expenses. Such recording leads to accurate

calculation of profits and loss making the entire data accurate.

Further, human errors can also be detected as the system provides checks and

balances.

9. What approach would you take if you were required to make a presentation

about profit and loss over the last financial period?

Conducting a graphical representation of the items which contributed to the profit

and loss can be a suitable approach. It includes creation of bar graphs and pie

charts of the figures representing revenue and expenses and amount of profit and

loss.

10. Consider the following scenario. While preparing bank reconciliation you have

noticed several inconsistencies that have been made by one of your

managers in accounts. It is not fraudulent but charges have been wrongly

allocated which has resulted in inaccurate information. What would you do in

this scenario?

Firstly, the discrepancies or the items which are wrongly charged must be identified

in order to be got corrected. Then the adjustments of the identified items must be

done so that the balance as per bank and balance as per cash book can be

matched. Proper treatment of each and every transaction should be made and the

company should communicate the differences to the bank immediately.

Task 6- Accounting (7.5 Marks)

Partnership:

1. On 1 January 2018 A and B agreed to go into a business partnership

contributing $50,000 and $30,000 respectively as capital. Prepare general

journal entries to record the capital contributions of A and B. (0.5 Mark)

Date Particulars Debit Credit

1-Jan Cash A/c $80,000

Accounting & Budgeting, Assessment No. 1 Page 14

v1.1, Last updated on 18/09/2018

accurate and consistent.

Another reason is that it implements the matching principle which deals with the

recording of accrual revenue and expenses. Such recording leads to accurate

calculation of profits and loss making the entire data accurate.

Further, human errors can also be detected as the system provides checks and

balances.

9. What approach would you take if you were required to make a presentation

about profit and loss over the last financial period?

Conducting a graphical representation of the items which contributed to the profit

and loss can be a suitable approach. It includes creation of bar graphs and pie

charts of the figures representing revenue and expenses and amount of profit and

loss.

10. Consider the following scenario. While preparing bank reconciliation you have

noticed several inconsistencies that have been made by one of your

managers in accounts. It is not fraudulent but charges have been wrongly

allocated which has resulted in inaccurate information. What would you do in

this scenario?

Firstly, the discrepancies or the items which are wrongly charged must be identified

in order to be got corrected. Then the adjustments of the identified items must be

done so that the balance as per bank and balance as per cash book can be

matched. Proper treatment of each and every transaction should be made and the

company should communicate the differences to the bank immediately.

Task 6- Accounting (7.5 Marks)

Partnership:

1. On 1 January 2018 A and B agreed to go into a business partnership

contributing $50,000 and $30,000 respectively as capital. Prepare general

journal entries to record the capital contributions of A and B. (0.5 Mark)

Date Particulars Debit Credit

1-Jan Cash A/c $80,000

Accounting & Budgeting, Assessment No. 1 Page 14

v1.1, Last updated on 18/09/2018

T-1.8.1

A’s Capital A/c $50,000

B’s Capital A/c $30,000

2. M and N agreed to form a partnership on the 15 January 2018. M will provide

the business premises valued at $250,000 and Motor Vehicle $33,000 as his

capital contribution. N is to bring in an equivalent amount in cash $280,000.

Market value of motor vehicle is $30000.

Prepare general journal entries to record the capital contributions of M and N.

(0.5 Mark)

Date Particulars Debit Credit

15 Jan Business premises A/c 250,000

Motor Vehicle A/c 30,000

M’s Capital A/c 280,000

15 Jan Cash A/c 280,000

N’s Capital A/c 280,000

3. On 31 December 2017, A and B agreed to combine their businesses and

operate as Happy Traders. The balance sheets of the respective businesses

are as follows:(1 Mark)

A B

Balance sheet as at 31

Dec 2017

Balance sheet as at 31

Dec 2017

Asset Asset

Bank 8,000 Inventory 12,000

Accounts

receivable

10,000 Premises 20,000

Inventory 12,000 Delivery

Van

16,000

Accounting & Budgeting, Assessment No. 1 Page 15

v1.1, Last updated on 18/09/2018

A’s Capital A/c $50,000

B’s Capital A/c $30,000

2. M and N agreed to form a partnership on the 15 January 2018. M will provide

the business premises valued at $250,000 and Motor Vehicle $33,000 as his

capital contribution. N is to bring in an equivalent amount in cash $280,000.

Market value of motor vehicle is $30000.

Prepare general journal entries to record the capital contributions of M and N.

(0.5 Mark)

Date Particulars Debit Credit

15 Jan Business premises A/c 250,000

Motor Vehicle A/c 30,000

M’s Capital A/c 280,000

15 Jan Cash A/c 280,000

N’s Capital A/c 280,000

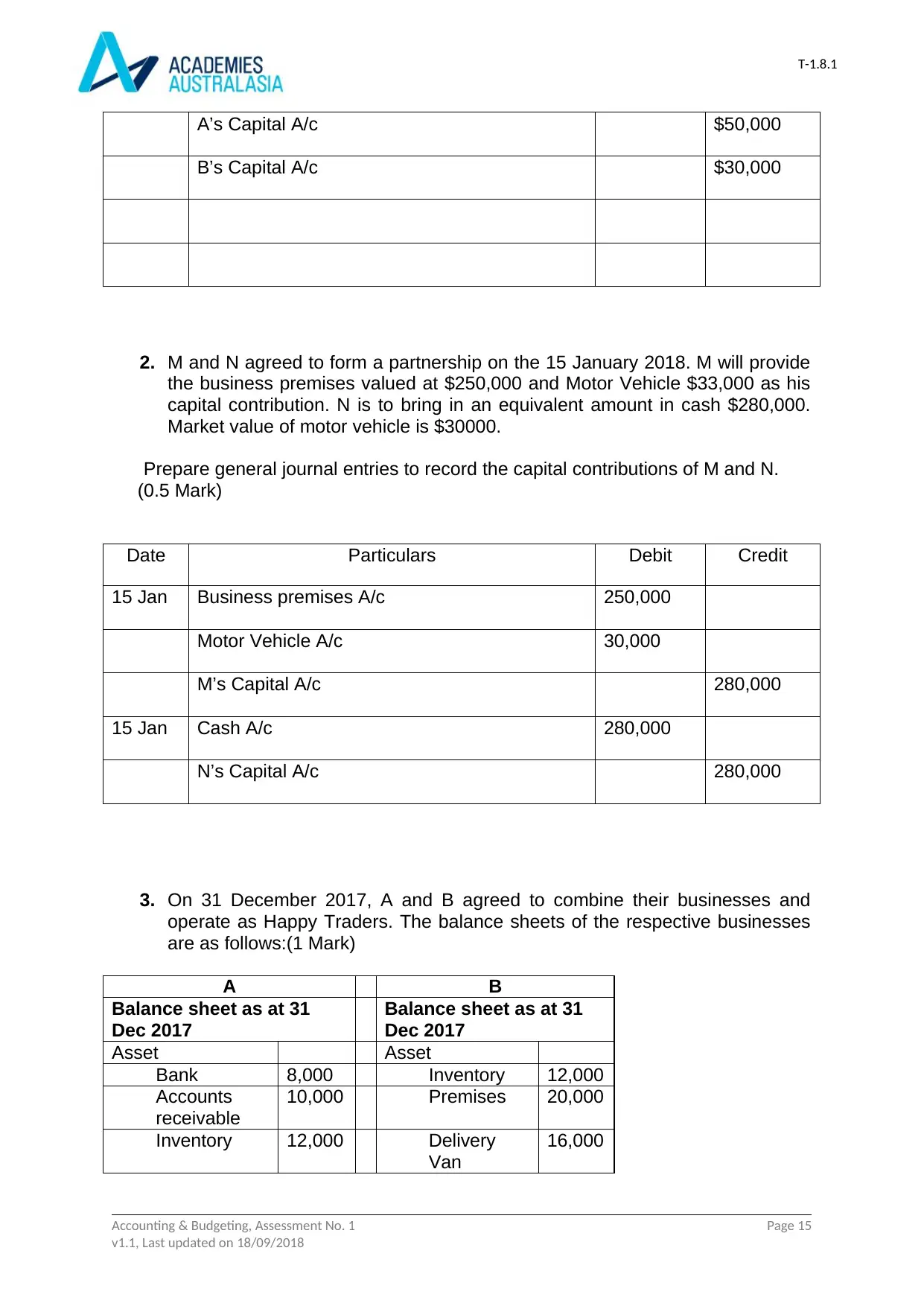

3. On 31 December 2017, A and B agreed to combine their businesses and

operate as Happy Traders. The balance sheets of the respective businesses

are as follows:(1 Mark)

A B

Balance sheet as at 31

Dec 2017

Balance sheet as at 31

Dec 2017

Asset Asset

Bank 8,000 Inventory 12,000

Accounts

receivable

10,000 Premises 20,000

Inventory 12,000 Delivery

Van

16,000

Accounting & Budgeting, Assessment No. 1 Page 15

v1.1, Last updated on 18/09/2018

T-1.8.1

30,000 48,000

Liability Liability

Accounts

Payable

12,000 Overdraft 15,000

Net Asset 18,000 Net Asset 33,000

Owner’s Equity Owner’s Equity

Capital - A 18,000 Capital - B 33,000

The agreed values of A's and B's businesses are $25,000 and $40,000 respectively.

The agreed value of A's inventory and accounts receivable are $10,000 and $7000

respectively. The agreed value of B's premises and delivery van are $22,000 and

$6,000 respectively. The agreed value of all other items was at their book value.

Prepare general journal entries to record the capital contributions of A and B.

Date Particulars Debit Credit

Inventory A/c 10000

Accounts Receivable A/c 7000

A’s Capital A/c 17000

Business premises A/c 22000

Delivery Van A/c 6000

B’s Capital A/c 28000

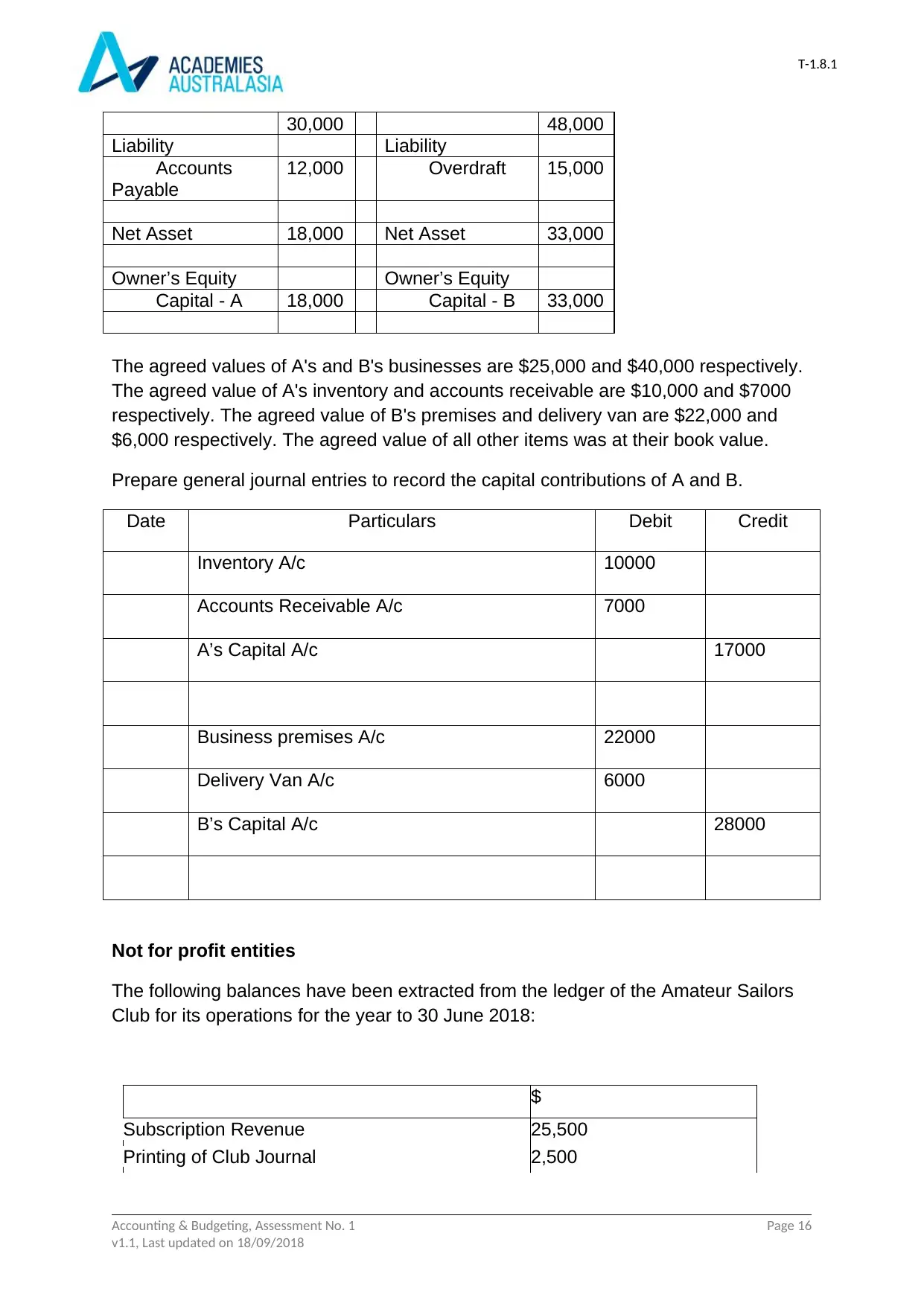

Not for profit entities

The following balances have been extracted from the ledger of the Amateur Sailors

Club for its operations for the year to 30 June 2018:

$

Subscription Revenue 25,500

Printing of Club Journal 2,500

Accounting & Budgeting, Assessment No. 1 Page 16

v1.1, Last updated on 18/09/2018

30,000 48,000

Liability Liability

Accounts

Payable

12,000 Overdraft 15,000

Net Asset 18,000 Net Asset 33,000

Owner’s Equity Owner’s Equity

Capital - A 18,000 Capital - B 33,000

The agreed values of A's and B's businesses are $25,000 and $40,000 respectively.

The agreed value of A's inventory and accounts receivable are $10,000 and $7000

respectively. The agreed value of B's premises and delivery van are $22,000 and

$6,000 respectively. The agreed value of all other items was at their book value.

Prepare general journal entries to record the capital contributions of A and B.

Date Particulars Debit Credit

Inventory A/c 10000

Accounts Receivable A/c 7000

A’s Capital A/c 17000

Business premises A/c 22000

Delivery Van A/c 6000

B’s Capital A/c 28000

Not for profit entities

The following balances have been extracted from the ledger of the Amateur Sailors

Club for its operations for the year to 30 June 2018:

$

Subscription Revenue 25,500

Printing of Club Journal 2,500

Accounting & Budgeting, Assessment No. 1 Page 16

v1.1, Last updated on 18/09/2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

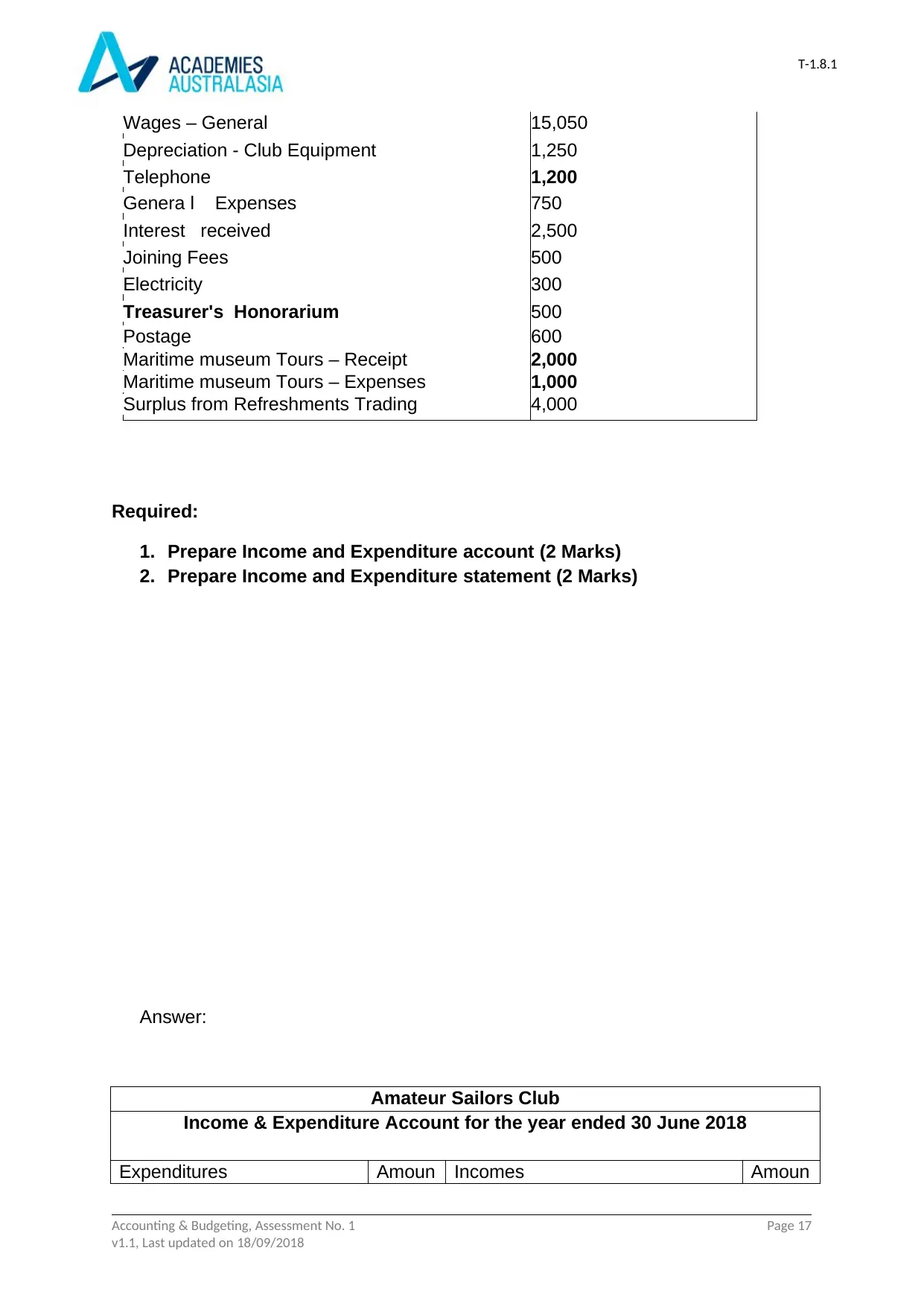

Wages – General 15,050

Depreciation - Club Equipment 1,250

Telephone 1,200

Genera l Expenses 750

Interest received 2,500

Joining Fees 500

Electricity 300

Treasurer's Honorarium 500

Postage 600

Maritime museum Tours – Receipt 2,000

Maritime museum Tours – Expenses 1,000

Surplus from Refreshments Trading 4,000

Required:

1. Prepare Income and Expenditure account (2 Marks)

2. Prepare Income and Expenditure statement (2 Marks)

Answer:

Amateur Sailors Club

Income & Expenditure Account for the year ended 30 June 2018

Expenditures Amoun Incomes Amoun

Accounting & Budgeting, Assessment No. 1 Page 17

v1.1, Last updated on 18/09/2018

Wages – General 15,050

Depreciation - Club Equipment 1,250

Telephone 1,200

Genera l Expenses 750

Interest received 2,500

Joining Fees 500

Electricity 300

Treasurer's Honorarium 500

Postage 600

Maritime museum Tours – Receipt 2,000

Maritime museum Tours – Expenses 1,000

Surplus from Refreshments Trading 4,000

Required:

1. Prepare Income and Expenditure account (2 Marks)

2. Prepare Income and Expenditure statement (2 Marks)

Answer:

Amateur Sailors Club

Income & Expenditure Account for the year ended 30 June 2018

Expenditures Amoun Incomes Amoun

Accounting & Budgeting, Assessment No. 1 Page 17

v1.1, Last updated on 18/09/2018

T-1.8.1

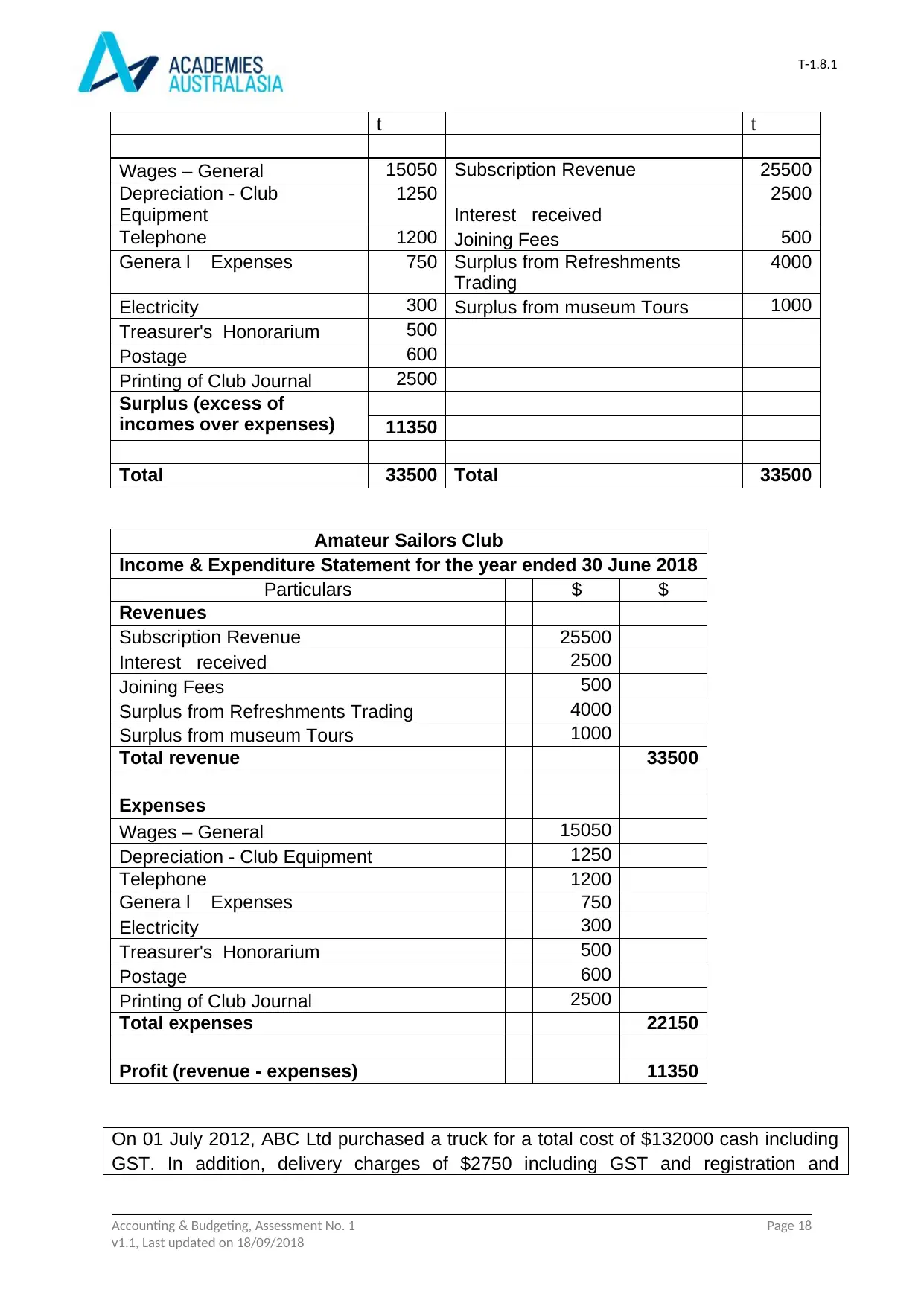

t t

Wages – General 15050 Subscription Revenue 25500

Depreciation - Club

Equipment

1250

Interest received

2500

Telephone 1200 Joining Fees 500

Genera l Expenses 750 Surplus from Refreshments

Trading

4000

Electricity 300 Surplus from museum Tours 1000

Treasurer's Honorarium 500

Postage 600

Printing of Club Journal 2500

Surplus (excess of

incomes over expenses) 11350

Total 33500 Total 33500

Amateur Sailors Club

Income & Expenditure Statement for the year ended 30 June 2018

Particulars $ $

Revenues

Subscription Revenue 25500

Interest received 2500

Joining Fees 500

Surplus from Refreshments Trading 4000

Surplus from museum Tours 1000

Total revenue 33500

Expenses

Wages – General 15050

Depreciation - Club Equipment 1250

Telephone 1200

Genera l Expenses 750

Electricity 300

Treasurer's Honorarium 500

Postage 600

Printing of Club Journal 2500

Total expenses 22150

Profit (revenue - expenses) 11350

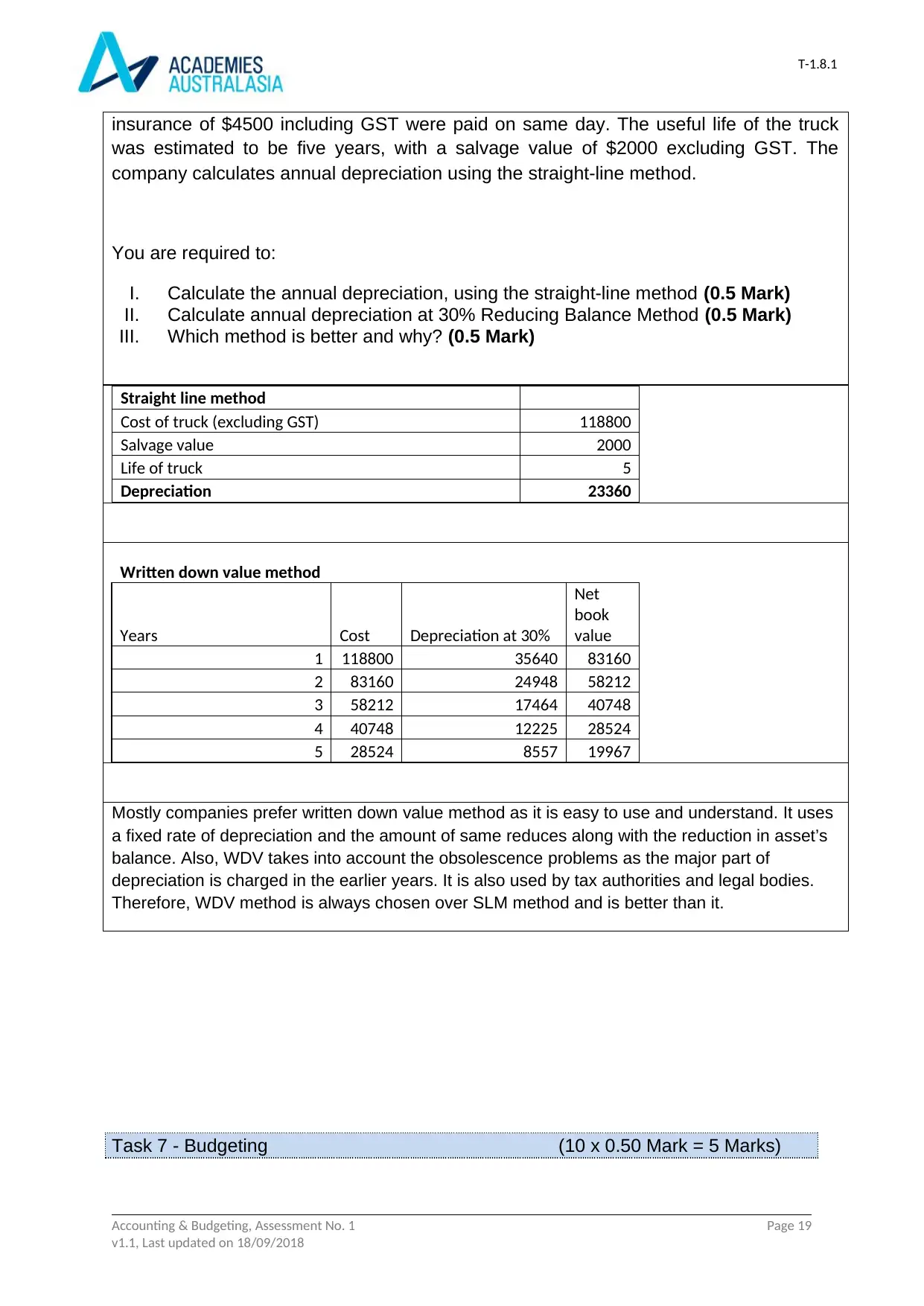

On 01 July 2012, ABC Ltd purchased a truck for a total cost of $132000 cash including

GST. In addition, delivery charges of $2750 including GST and registration and

Accounting & Budgeting, Assessment No. 1 Page 18

v1.1, Last updated on 18/09/2018

t t

Wages – General 15050 Subscription Revenue 25500

Depreciation - Club

Equipment

1250

Interest received

2500

Telephone 1200 Joining Fees 500

Genera l Expenses 750 Surplus from Refreshments

Trading

4000

Electricity 300 Surplus from museum Tours 1000

Treasurer's Honorarium 500

Postage 600

Printing of Club Journal 2500

Surplus (excess of

incomes over expenses) 11350

Total 33500 Total 33500

Amateur Sailors Club

Income & Expenditure Statement for the year ended 30 June 2018

Particulars $ $

Revenues

Subscription Revenue 25500

Interest received 2500

Joining Fees 500

Surplus from Refreshments Trading 4000

Surplus from museum Tours 1000

Total revenue 33500

Expenses

Wages – General 15050

Depreciation - Club Equipment 1250

Telephone 1200

Genera l Expenses 750

Electricity 300

Treasurer's Honorarium 500

Postage 600

Printing of Club Journal 2500

Total expenses 22150

Profit (revenue - expenses) 11350

On 01 July 2012, ABC Ltd purchased a truck for a total cost of $132000 cash including

GST. In addition, delivery charges of $2750 including GST and registration and

Accounting & Budgeting, Assessment No. 1 Page 18

v1.1, Last updated on 18/09/2018

T-1.8.1

insurance of $4500 including GST were paid on same day. The useful life of the truck

was estimated to be five years, with a salvage value of $2000 excluding GST. The

company calculates annual depreciation using the straight-line method.

You are required to:

I. Calculate the annual depreciation, using the straight-line method (0.5 Mark)

II. Calculate annual depreciation at 30% Reducing Balance Method (0.5 Mark)

III. Which method is better and why? (0.5 Mark)

Straight line method

Cost of truck (excluding GST) 118800

Salvage value 2000

Life of truck 5

Depreciation 23360

Written down value method

Years Cost Depreciation at 30%

Net

book

value

1 118800 35640 83160

2 83160 24948 58212

3 58212 17464 40748

4 40748 12225 28524

5 28524 8557 19967

Mostly companies prefer written down value method as it is easy to use and understand. It uses

a fixed rate of depreciation and the amount of same reduces along with the reduction in asset’s

balance. Also, WDV takes into account the obsolescence problems as the major part of

depreciation is charged in the earlier years. It is also used by tax authorities and legal bodies.

Therefore, WDV method is always chosen over SLM method and is better than it.

Task 7 - Budgeting (10 x 0.50 Mark = 5 Marks)

Accounting & Budgeting, Assessment No. 1 Page 19

v1.1, Last updated on 18/09/2018

insurance of $4500 including GST were paid on same day. The useful life of the truck

was estimated to be five years, with a salvage value of $2000 excluding GST. The

company calculates annual depreciation using the straight-line method.

You are required to:

I. Calculate the annual depreciation, using the straight-line method (0.5 Mark)

II. Calculate annual depreciation at 30% Reducing Balance Method (0.5 Mark)

III. Which method is better and why? (0.5 Mark)

Straight line method

Cost of truck (excluding GST) 118800

Salvage value 2000

Life of truck 5

Depreciation 23360

Written down value method

Years Cost Depreciation at 30%

Net

book

value

1 118800 35640 83160

2 83160 24948 58212

3 58212 17464 40748

4 40748 12225 28524

5 28524 8557 19967

Mostly companies prefer written down value method as it is easy to use and understand. It uses

a fixed rate of depreciation and the amount of same reduces along with the reduction in asset’s

balance. Also, WDV takes into account the obsolescence problems as the major part of

depreciation is charged in the earlier years. It is also used by tax authorities and legal bodies.

Therefore, WDV method is always chosen over SLM method and is better than it.

Task 7 - Budgeting (10 x 0.50 Mark = 5 Marks)

Accounting & Budgeting, Assessment No. 1 Page 19

v1.1, Last updated on 18/09/2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Scenario

A new member of the staff-Sally has been working with you for two months as

Accounts Clerk. She is new to budgeting and forecasting. She needs a clear

understanding of organisational policy, aims, projects and forecasts to prepare

different budgets. She studied budgeting in the Accounting study, but she has

forgotten most of what she learnt. You are given a job by your supervisor to provide

a comprehensive orientation on budgeting, particularly focusing in the following

areas related to the purpose & policy statement of your company's budget policy.

You are required to read these two issues of budget policy and answer all questions

carefully.

1. Purpose

When identifying the purpose of the policy, consider how it might apply to your

organisation’s activities. Your organisation may have a need for separate budgets

for different activities for monitoring or reporting purposes and may need to report to

external bodies on different budgets for accountability purposes.

2. Policy statement

If you are adopting the policy statement in the template, consider whether there are

any additional commitments your organisation wants to make.

In identifying the actions your organisation will take to implement this policy, you

should include the following:

developing an annual budget for the organisation for approval by the board or

management committee

monitoring income and expenditure against the budget on a regular basis

reporting to the board or management committee on the budget position

taking action when there is a significant variation between projected and

actual figures

reviewing and adjusting the budget on a regular basis."

Required: Provide answers based on scenario.

1. Define the term 'budgeting'.

Budgeting refers to a procedure of planning in advance the income and expenses of

the business for a particular fiscal year. It involves creation of budgets and deals

with balancing the income and expenditures. It is the very important function of

management and needed to be carried out at each level of the organization.

Accounting & Budgeting, Assessment No. 1 Page 20

v1.1, Last updated on 18/09/2018

Scenario

A new member of the staff-Sally has been working with you for two months as

Accounts Clerk. She is new to budgeting and forecasting. She needs a clear

understanding of organisational policy, aims, projects and forecasts to prepare

different budgets. She studied budgeting in the Accounting study, but she has

forgotten most of what she learnt. You are given a job by your supervisor to provide

a comprehensive orientation on budgeting, particularly focusing in the following

areas related to the purpose & policy statement of your company's budget policy.

You are required to read these two issues of budget policy and answer all questions

carefully.

1. Purpose

When identifying the purpose of the policy, consider how it might apply to your

organisation’s activities. Your organisation may have a need for separate budgets

for different activities for monitoring or reporting purposes and may need to report to

external bodies on different budgets for accountability purposes.

2. Policy statement

If you are adopting the policy statement in the template, consider whether there are

any additional commitments your organisation wants to make.

In identifying the actions your organisation will take to implement this policy, you

should include the following:

developing an annual budget for the organisation for approval by the board or

management committee

monitoring income and expenditure against the budget on a regular basis

reporting to the board or management committee on the budget position

taking action when there is a significant variation between projected and

actual figures

reviewing and adjusting the budget on a regular basis."

Required: Provide answers based on scenario.

1. Define the term 'budgeting'.

Budgeting refers to a procedure of planning in advance the income and expenses of

the business for a particular fiscal year. It involves creation of budgets and deals

with balancing the income and expenditures. It is the very important function of

management and needed to be carried out at each level of the organization.

Accounting & Budgeting, Assessment No. 1 Page 20

v1.1, Last updated on 18/09/2018

T-1.8.1

2. List objectives of the budget policy.

Allocate the organization’s available resources as per the economic and

social benefit to the business.

Preparation of separate budgets for various activities and departments.

Ensuring proper review and monitoring of the income and expenses of the

business.

Reporting to the external bodies on the budgets prepared in order to establish

accountability in the business.

3. Why is it necessary to determine and confirm scope and nature of budgetary

planning activity with relevant colleagues?

It is very important for the company to define the scope of budgetary planning with

its employees as they are the one who needs to be aware about the activities that

are planned in order to achieve the set target of the company. Budgets are basically

the financial plans which are used by the every organization as per their needs and

requirements. They are also of different time frames and prepared for different

purposes. Such information is needed to be shared with the team members as the

purpose and time frame will identify the type of information required to be collected

and determine the manner in which it can be used.

Budgets reflect how the money has to be spent and help in determining who is

accountable for what activity and how it has to be performed. Overall it guides the

company in utilizing its human resources effectively and efficiently. Therefore, it is

necessary to discuss the scope and nature of budgetary planning with the

colleagues.

4. According to Policy Statement, who will approve the annual budget?

As per the policy statement, the board of directors or the

management committee of the organization is authorized

for the approval of annual budget.

5. List the activities involves in budgeting process.

Accounting & Budgeting, Assessment No. 1 Page 21

v1.1, Last updated on 18/09/2018

2. List objectives of the budget policy.

Allocate the organization’s available resources as per the economic and

social benefit to the business.

Preparation of separate budgets for various activities and departments.

Ensuring proper review and monitoring of the income and expenses of the

business.

Reporting to the external bodies on the budgets prepared in order to establish

accountability in the business.

3. Why is it necessary to determine and confirm scope and nature of budgetary

planning activity with relevant colleagues?

It is very important for the company to define the scope of budgetary planning with

its employees as they are the one who needs to be aware about the activities that

are planned in order to achieve the set target of the company. Budgets are basically

the financial plans which are used by the every organization as per their needs and

requirements. They are also of different time frames and prepared for different

purposes. Such information is needed to be shared with the team members as the

purpose and time frame will identify the type of information required to be collected

and determine the manner in which it can be used.

Budgets reflect how the money has to be spent and help in determining who is

accountable for what activity and how it has to be performed. Overall it guides the

company in utilizing its human resources effectively and efficiently. Therefore, it is

necessary to discuss the scope and nature of budgetary planning with the

colleagues.

4. According to Policy Statement, who will approve the annual budget?

As per the policy statement, the board of directors or the

management committee of the organization is authorized

for the approval of annual budget.

5. List the activities involves in budgeting process.

Accounting & Budgeting, Assessment No. 1 Page 21

v1.1, Last updated on 18/09/2018

T-1.8.1

Communication within the executive management.

Determining the objectives and targets.

Preparation of detailed budget.

Compilation and revision of budget model.

Review and approval from budget committee.

Approval from board of directors.

6. List the benefits of budgeting.

Helps in the planning and controlling function of the management.

It is used as a performance measurement tool by the management which

helps the managers to evaluate the company’s performance.

It provides a benchmark against which the actual results are compared and

variances are identified.

Budgeting helps the management to improve their decision making process.

It provides an overview of company’s profitability by estimating the incomes

and expenses in advance.

7. List the limitations of budgets.

Budgeting is completely based on assumptions and thus may prove to be

inaccurate in actual circumstances.

It is a very time consuming and costly process.

There is a full scope of manipulation as budgets are prepared by managers

and they can modify the figures in their best interest.

It only covers the financial outcomes and does not define the non financial

performance of the company.

8. Examine five cost reduction methods that could be investigated and identify

who (person or role), within a business, could be made responsible for each

method or strategy.

The five cost reduction methods that could be identified and applied by the

organization are as follows:

Using the advanced technology in the business by using automated

machines with the help of information technology. This will eventually lower

the labour cost of the firm. The IT department and its manager is responsible

to carry out such method.

Another method is outsourcing the activities in which the company is not

Accounting & Budgeting, Assessment No. 1 Page 22

v1.1, Last updated on 18/09/2018

Communication within the executive management.

Determining the objectives and targets.

Preparation of detailed budget.

Compilation and revision of budget model.

Review and approval from budget committee.

Approval from board of directors.

6. List the benefits of budgeting.

Helps in the planning and controlling function of the management.

It is used as a performance measurement tool by the management which

helps the managers to evaluate the company’s performance.

It provides a benchmark against which the actual results are compared and

variances are identified.

Budgeting helps the management to improve their decision making process.

It provides an overview of company’s profitability by estimating the incomes

and expenses in advance.

7. List the limitations of budgets.

Budgeting is completely based on assumptions and thus may prove to be

inaccurate in actual circumstances.

It is a very time consuming and costly process.

There is a full scope of manipulation as budgets are prepared by managers

and they can modify the figures in their best interest.

It only covers the financial outcomes and does not define the non financial

performance of the company.

8. Examine five cost reduction methods that could be investigated and identify

who (person or role), within a business, could be made responsible for each

method or strategy.

The five cost reduction methods that could be identified and applied by the

organization are as follows:

Using the advanced technology in the business by using automated

machines with the help of information technology. This will eventually lower

the labour cost of the firm. The IT department and its manager is responsible

to carry out such method.

Another method is outsourcing the activities in which the company is not

Accounting & Budgeting, Assessment No. 1 Page 22

v1.1, Last updated on 18/09/2018

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

competent enough as this will allow it to control and reduce the costs to a

great extent. The top management must be responsible for conducting such

outsourcing operations.

Reducing and removing the wastage from the process such as unnecessary

activities and inventories. The operational manager should be authorized for

looking up to the operational efficiency of the workers and removing the

waste.

Applying various costing techniques such as activity based costing, target

costing which help the company to identify the costs appropriately and reduce

the same. Senior managers and executives are responsible for strategizing

the most appropriate costing technique for their business.

Establishing quality control within the operations also results in reduced and

minimized costs. Identifying the quality problems at each and every stage of

the production is the responsibility of every manager who is appointed at

every stage.

9. What is the importance of a cash flow budget or report?

Cash flow is the important factor which is required to keep the business in

operations by funding the day to day expenses. Therefore, preparation of cash flow

budgets and reports are vital for the organization. They provide the data which is

necessary for the creation of new forecasts and design of new budgets. Such

reports help the company to manage their cash flow as it provides them with the

forecasted surplus and shortage of cash. This eventually results in more informed

decisions taken by the management regarding the purchase of equipment, tax

purposes and others. Overall, the cash flow budget or report helps in improvising the

performance of the company by facilitating proper control and monitoring of the cash

position.

10. Explain the principles of double entry bookkeeping.

The main principle of double entry bookkeeping system is that one account is

debited while the other in correspondence is credited. In other words, the key

Accounting & Budgeting, Assessment No. 1 Page 23

v1.1, Last updated on 18/09/2018

competent enough as this will allow it to control and reduce the costs to a

great extent. The top management must be responsible for conducting such

outsourcing operations.

Reducing and removing the wastage from the process such as unnecessary

activities and inventories. The operational manager should be authorized for

looking up to the operational efficiency of the workers and removing the

waste.

Applying various costing techniques such as activity based costing, target

costing which help the company to identify the costs appropriately and reduce

the same. Senior managers and executives are responsible for strategizing

the most appropriate costing technique for their business.

Establishing quality control within the operations also results in reduced and

minimized costs. Identifying the quality problems at each and every stage of

the production is the responsibility of every manager who is appointed at

every stage.

9. What is the importance of a cash flow budget or report?

Cash flow is the important factor which is required to keep the business in

operations by funding the day to day expenses. Therefore, preparation of cash flow

budgets and reports are vital for the organization. They provide the data which is

necessary for the creation of new forecasts and design of new budgets. Such

reports help the company to manage their cash flow as it provides them with the

forecasted surplus and shortage of cash. This eventually results in more informed

decisions taken by the management regarding the purchase of equipment, tax

purposes and others. Overall, the cash flow budget or report helps in improvising the

performance of the company by facilitating proper control and monitoring of the cash

position.

10. Explain the principles of double entry bookkeeping.

The main principle of double entry bookkeeping system is that one account is

debited while the other in correspondence is credited. In other words, the key

Accounting & Budgeting, Assessment No. 1 Page 23

v1.1, Last updated on 18/09/2018

T-1.8.1

principle of the system states that every debit has a corresponding credit of the

equal amount of money. Under this, every transaction has two entries and is

recorded twice in the accounts. It follows the matching principle by balancing out the

amounts in ledger accounts.

Task 8 – Budgeting (10 x 1 Mark = 10 Marks)

Answer all questions

1. You are employed by a white goods distributor and have been asked to

prepare a list of controllable and uncontrollable factors that might affect the

sales of refrigerators in the coming year. Prepare a list for the next

management meeting.

Controllable factors are also known as marketing mix which includes four Ps that

can affect the sale of refrigerators.

Product: The refrigerators should be designed in such a manner that they

occupies less space and are faster on operations with latest technology

installed in them. More product quality, more will be the demand and more

will be the sale.

Place: the company must target the potential market where the refrigerators

can be sold and are easily accessible to the consumers. Pointing out the

favourable market segment and targeted consumer group will have a great

impact on the product sales.

Price: a competitive pricing policy must be farmed in order to create a strong

consumer base and beating the competitors.

Promotion: another factor which can affect the sales as proper advertising of

the product leads to high demand and high sale of the product.

Uncontrollable factors:

Political conditions

Economic forces

Competition

Technological changes

Legal compilations

Socio-cultural conditions.

Accounting & Budgeting, Assessment No. 1 Page 24

v1.1, Last updated on 18/09/2018

principle of the system states that every debit has a corresponding credit of the

equal amount of money. Under this, every transaction has two entries and is

recorded twice in the accounts. It follows the matching principle by balancing out the

amounts in ledger accounts.

Task 8 – Budgeting (10 x 1 Mark = 10 Marks)

Answer all questions

1. You are employed by a white goods distributor and have been asked to

prepare a list of controllable and uncontrollable factors that might affect the

sales of refrigerators in the coming year. Prepare a list for the next

management meeting.

Controllable factors are also known as marketing mix which includes four Ps that

can affect the sale of refrigerators.

Product: The refrigerators should be designed in such a manner that they

occupies less space and are faster on operations with latest technology

installed in them. More product quality, more will be the demand and more

will be the sale.

Place: the company must target the potential market where the refrigerators

can be sold and are easily accessible to the consumers. Pointing out the

favourable market segment and targeted consumer group will have a great

impact on the product sales.

Price: a competitive pricing policy must be farmed in order to create a strong

consumer base and beating the competitors.

Promotion: another factor which can affect the sales as proper advertising of

the product leads to high demand and high sale of the product.

Uncontrollable factors:

Political conditions

Economic forces

Competition

Technological changes

Legal compilations

Socio-cultural conditions.

Accounting & Budgeting, Assessment No. 1 Page 24

v1.1, Last updated on 18/09/2018

T-1.8.1

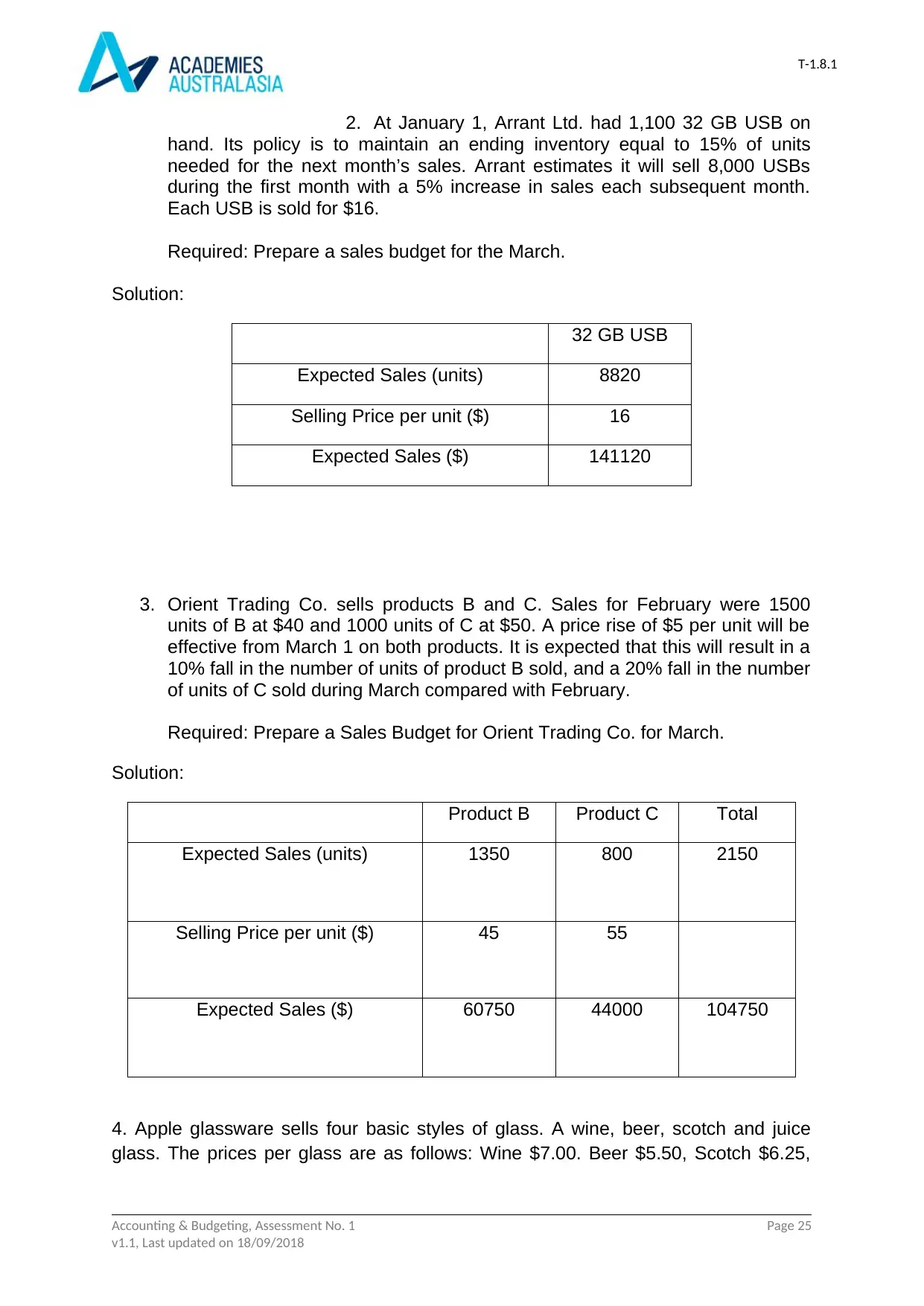

2. At January 1, Arrant Ltd. had 1,100 32 GB USB on

hand. Its policy is to maintain an ending inventory equal to 15% of units

needed for the next month’s sales. Arrant estimates it will sell 8,000 USBs

during the first month with a 5% increase in sales each subsequent month.

Each USB is sold for $16.

Required: Prepare a sales budget for the March.

Solution:

32 GB USB

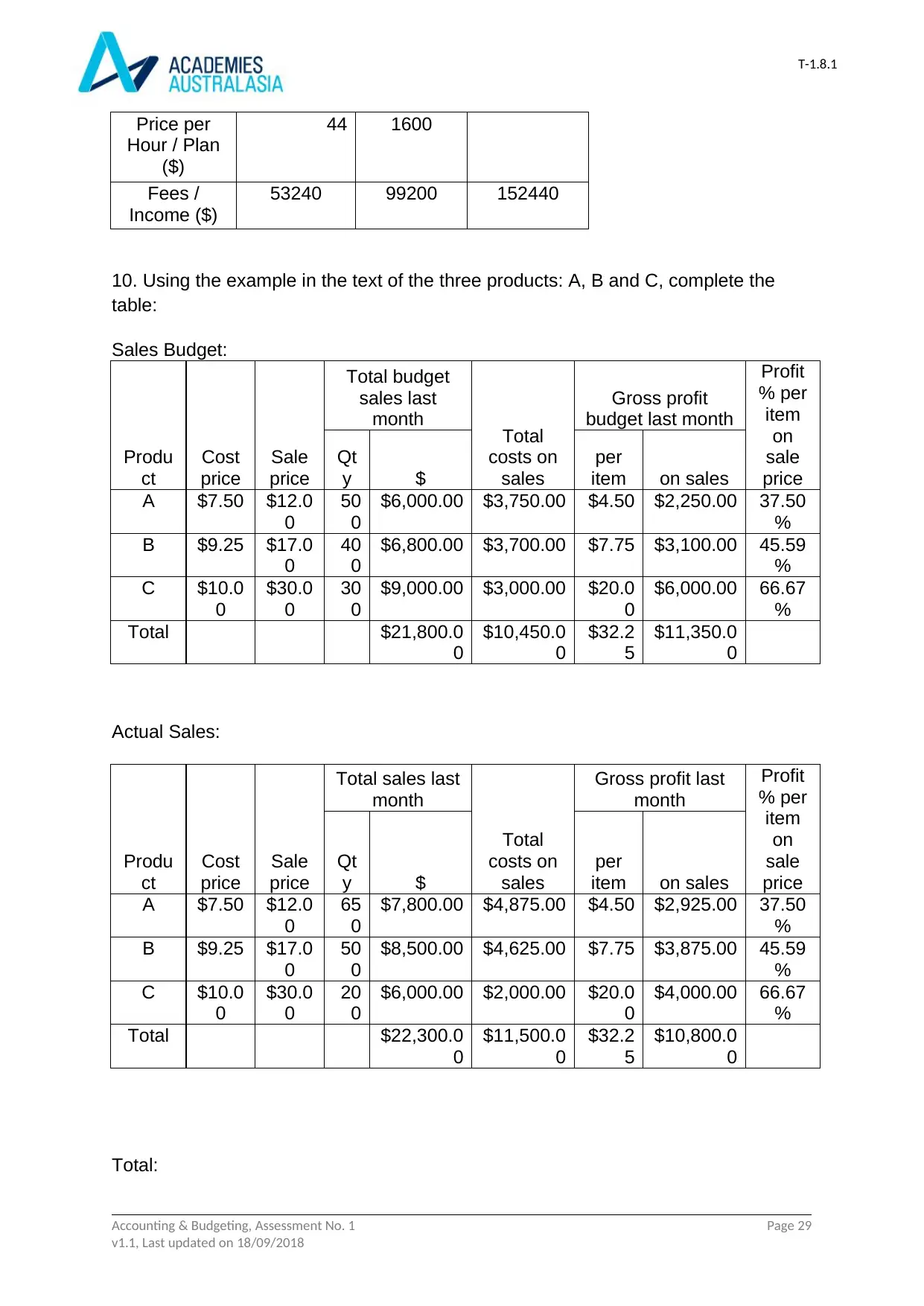

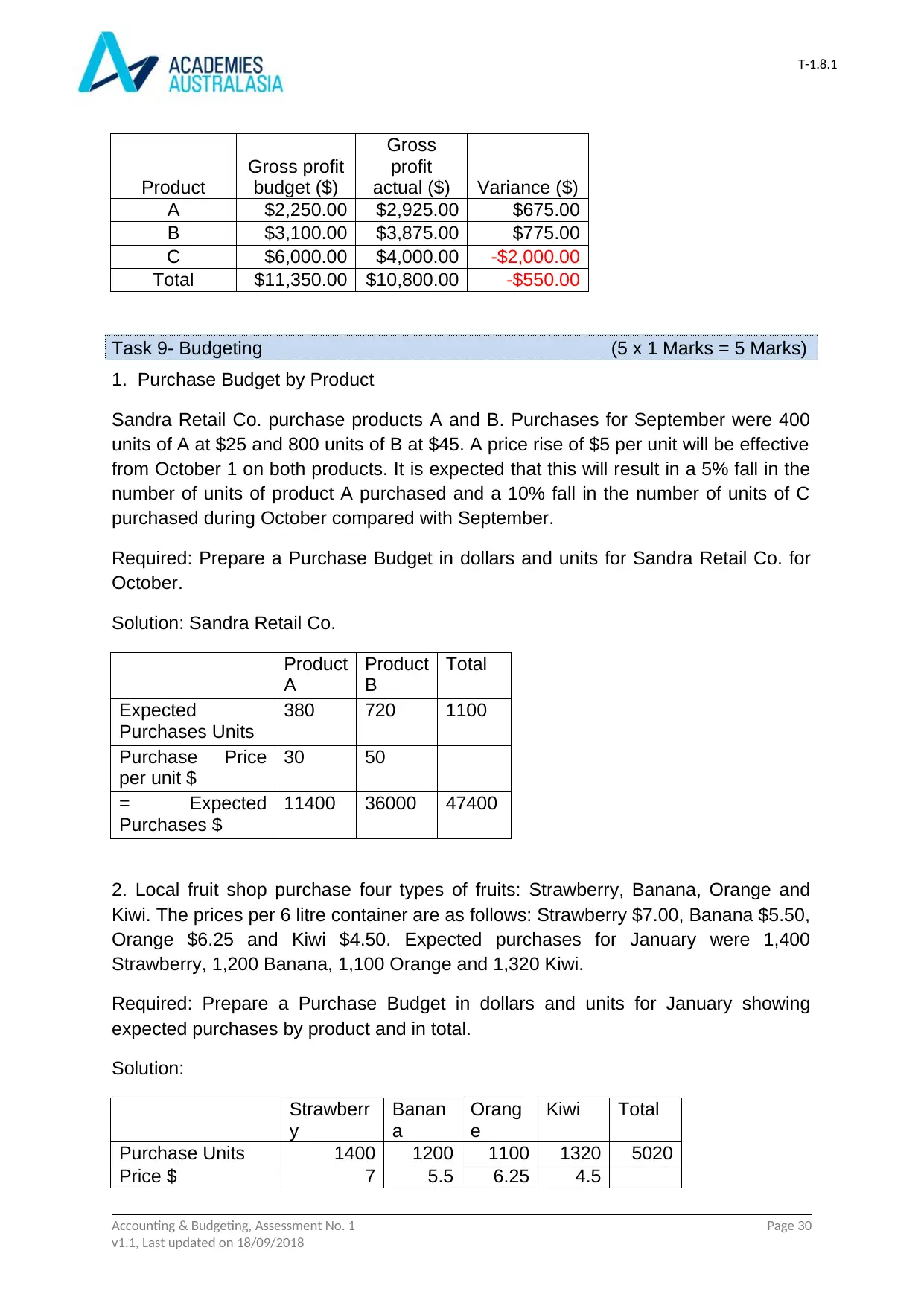

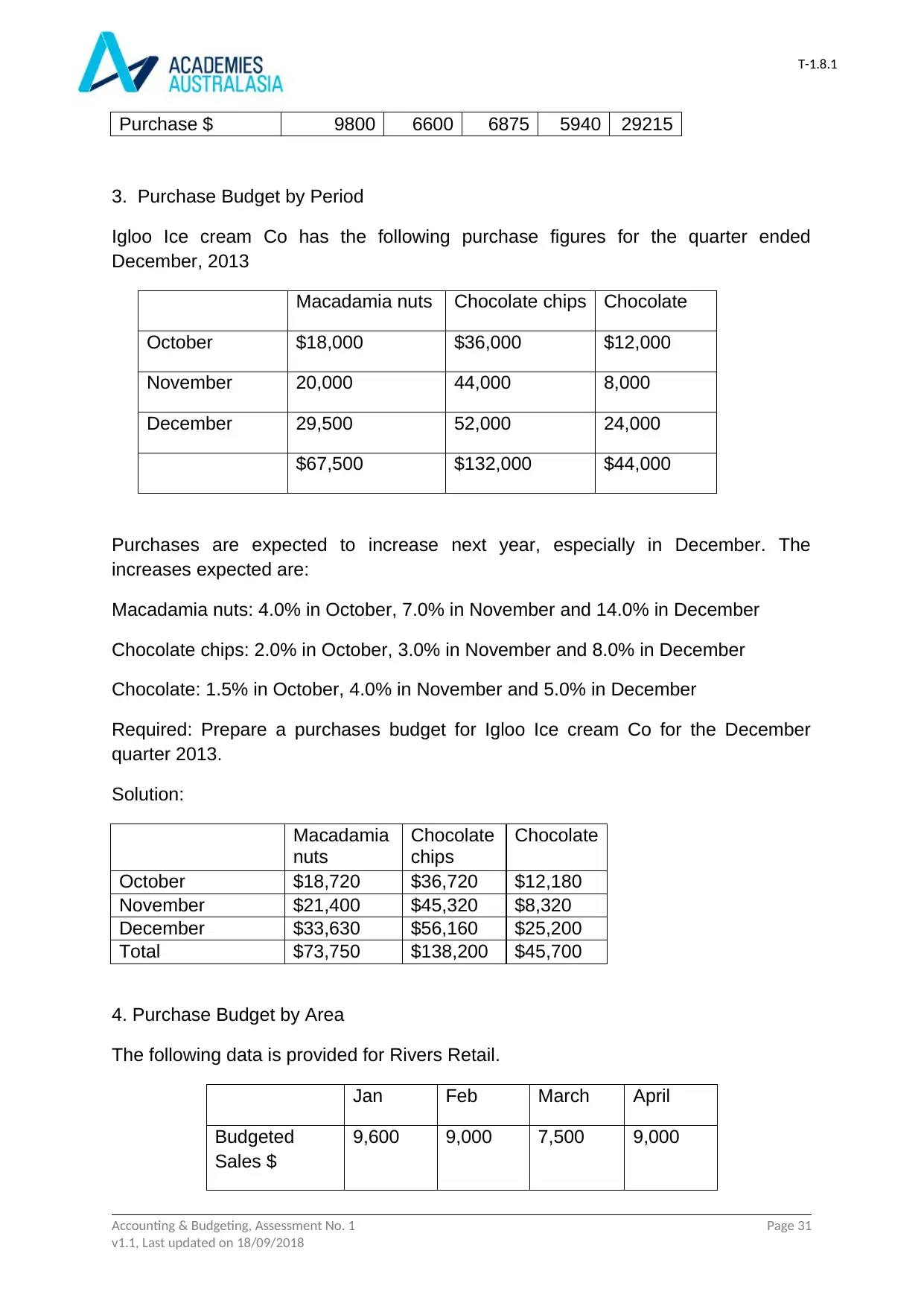

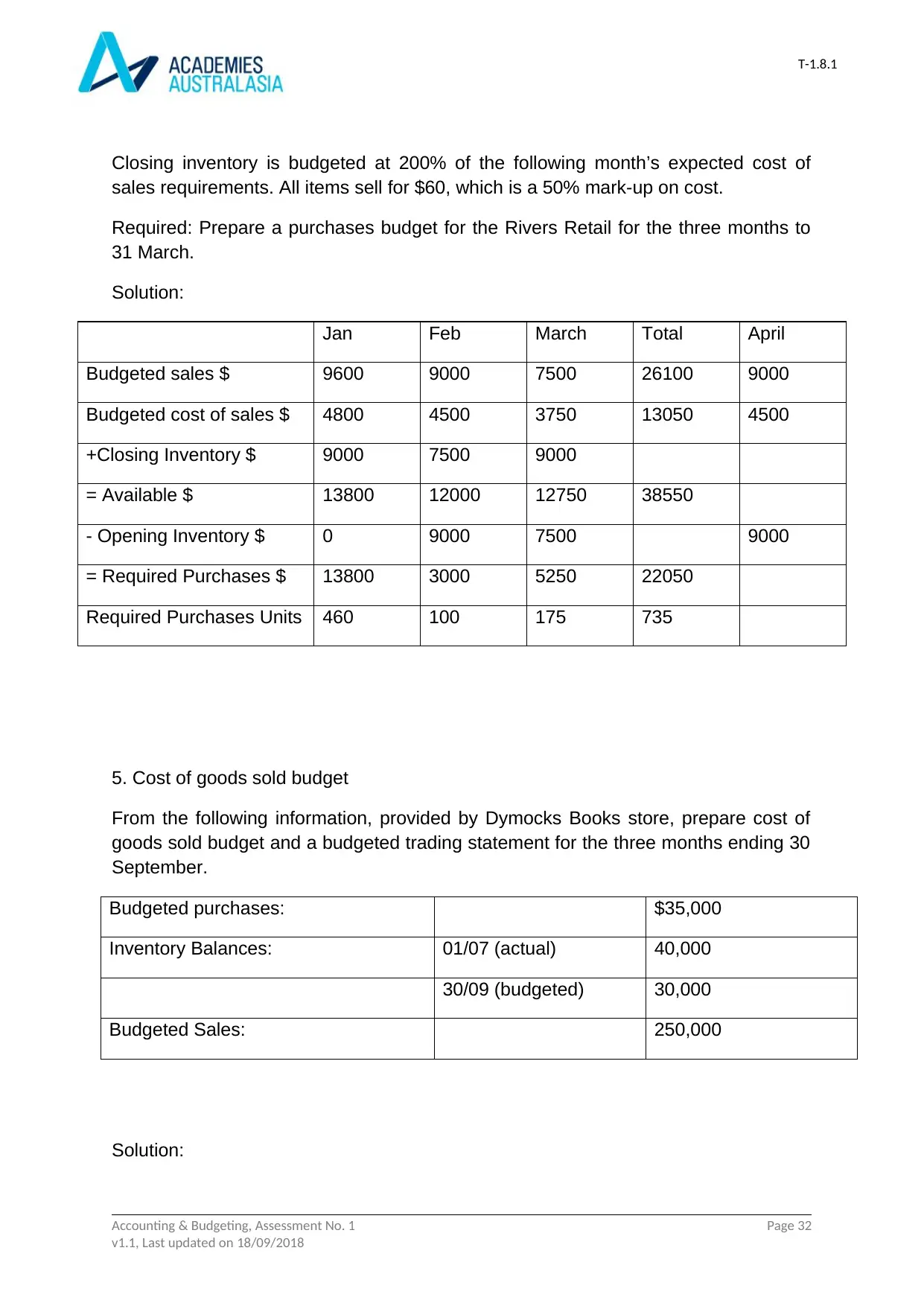

Expected Sales (units) 8820