Accounting for Business: Sales, Cost of Goods Sold, Ratios, Cash Inflows

VerifiedAdded on 2023/06/17

|6

|839

|386

AI Summary

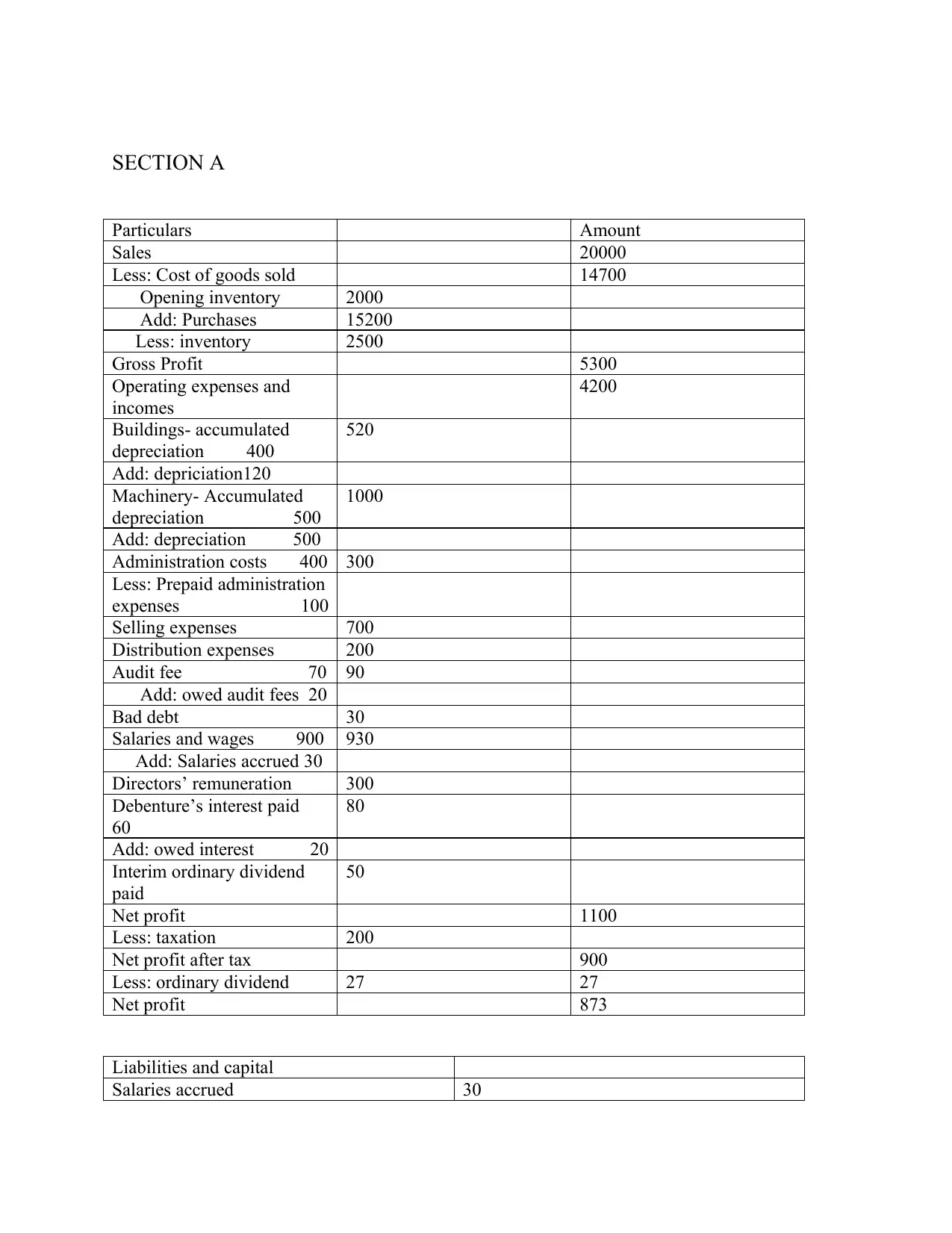

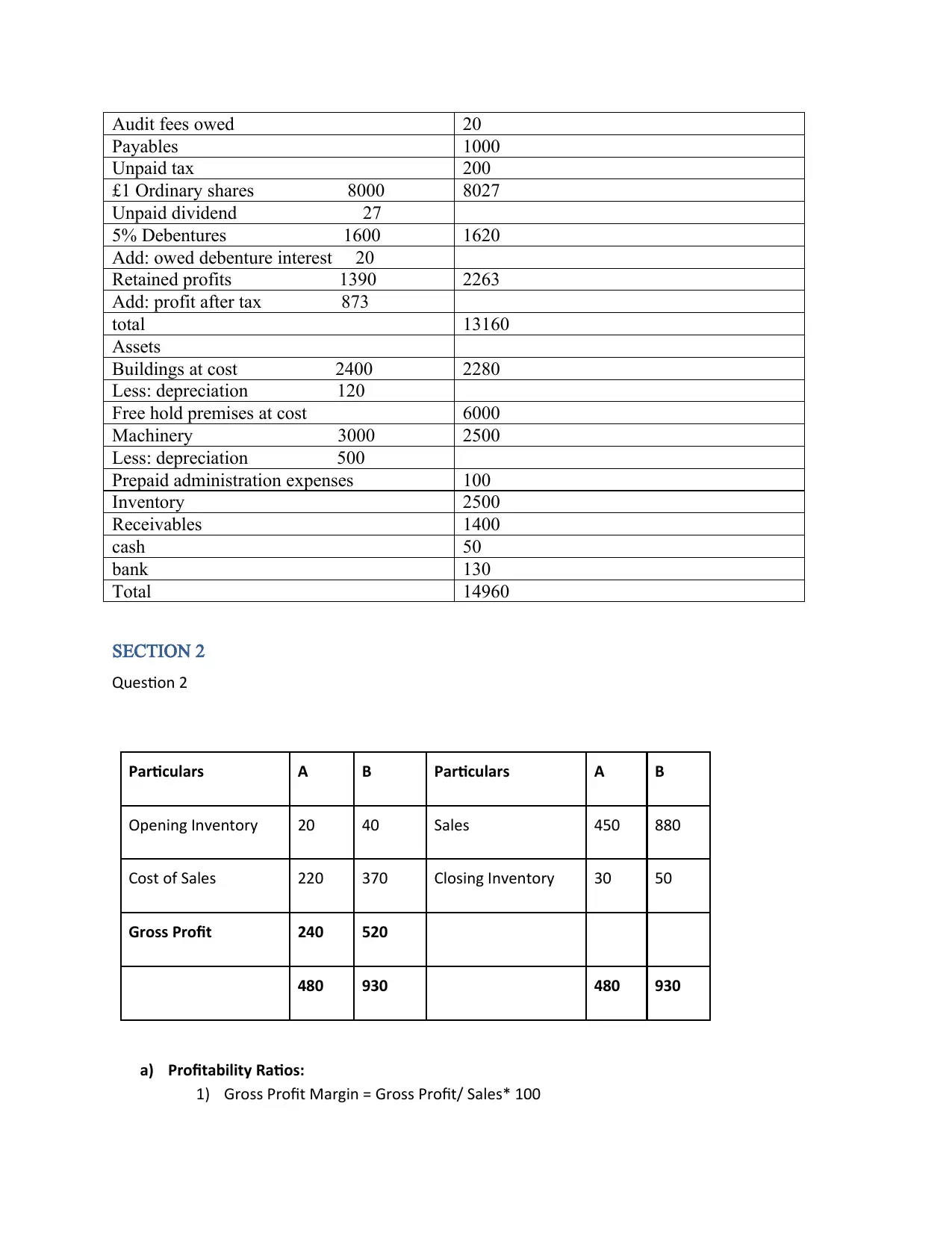

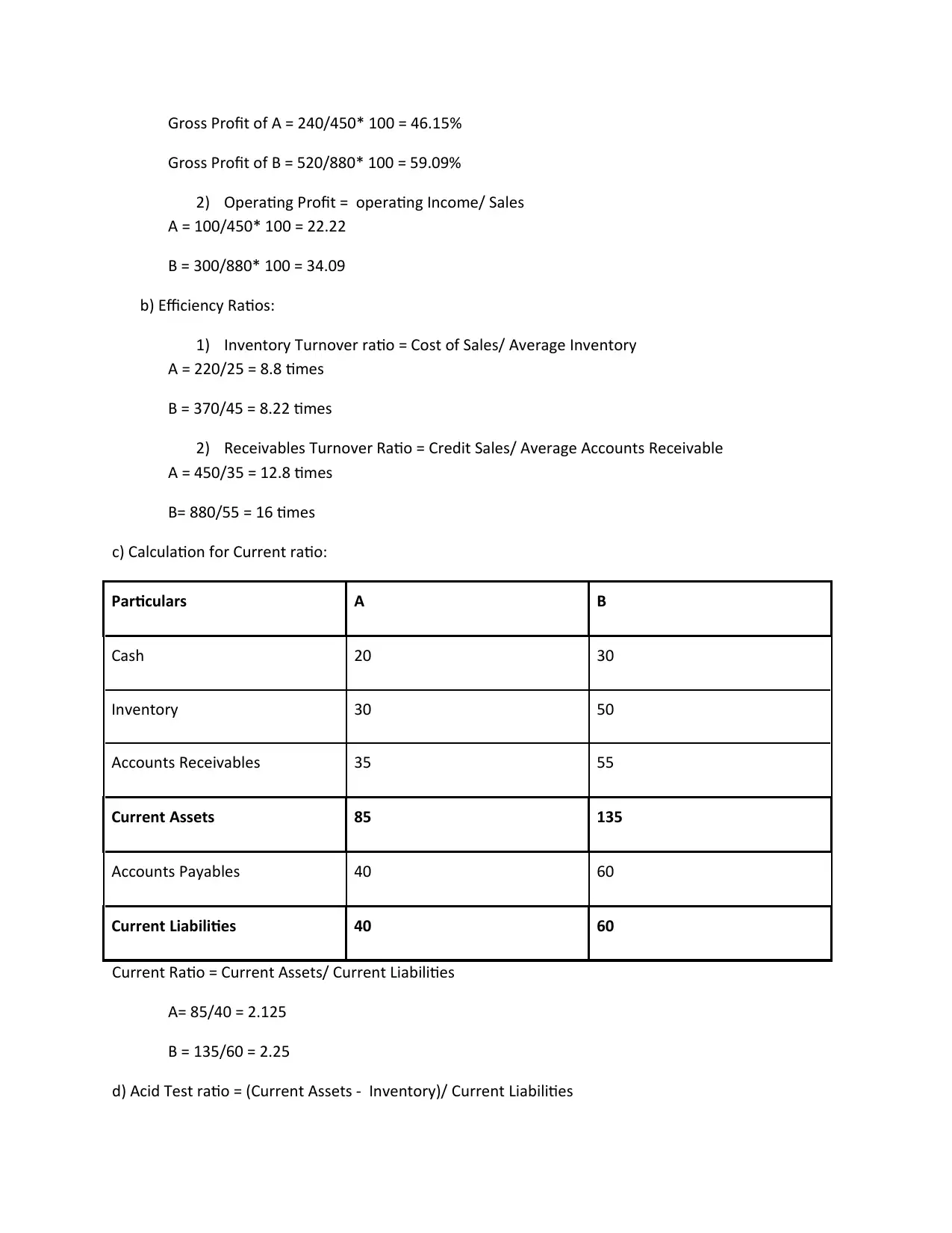

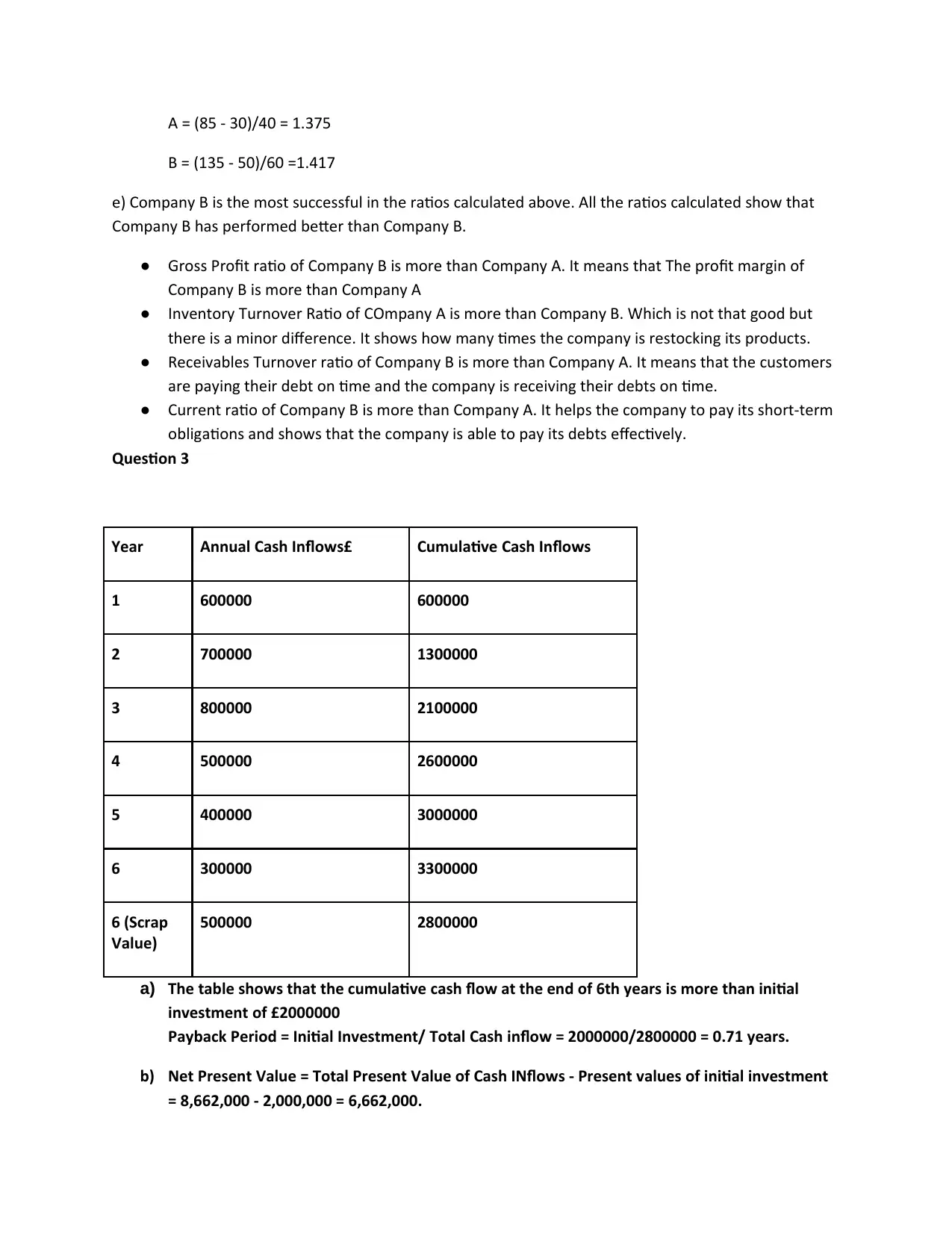

This article covers Accounting for Business with solved assignments, essays, dissertation, and ratios like Gross Profit Margin, Operating Profit, Inventory Turnover Ratio, Receivables Turnover Ratio, Current Ratio, Acid Test Ratio, and Cash Inflows. It also includes a comparison of two companies based on their ratios.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)