Capital Structure and Investment Appraisal: ACC91210 Case Study

VerifiedAdded on 2022/12/28

|12

|2700

|85

Case Study

AI Summary

This case study, prepared for a Finance for Managers course, analyzes the capital structure and investment appraisal techniques of a company, CSL Limited. Task 1 focuses on describing and evaluating CSL Limited's capital structure and payout policies over three years, using financial data and theoretical frameworks like the Modigliani and Miller Theorem. It examines debt and equity ratios, dividend payout, and their impact on the company's financial health. Task 2 involves providing investment recommendations to the CEO of OnePack Limited, incorporating investment appraisal techniques (NPV, IRR, payback period, profitability index) and sensitivity analysis to assess the viability of a proposed project, including detailed cash flow analysis and justifying the project's financial merits. The analysis highlights the project's financial viability and potential for high returns, emphasizing the importance of financial decision-making.

Running head: ACCOUNTING FOR MANAGERS

Accounting for Managers

Name of the Student:

Name of the University:

Authors Note:

Accounting for Managers

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

1

Table of Contents

Introduction:...............................................................................................................................2

Task 1:........................................................................................................................................2

1. Analysing the capital structure of CSL Limited over the period of three years:...................2

2. Utilising the capital structure of CSL Limited with the help of relevant practical and

theoretical approach:..................................................................................................................4

Task 2: Providing relevant information of the proposed project to the CEO of OnePack’s with

relevant justification from investment appraisal techniques and sensitivity analysis................5

Conclusion:................................................................................................................................9

References and Bibliography:..................................................................................................10

1

Table of Contents

Introduction:...............................................................................................................................2

Task 1:........................................................................................................................................2

1. Analysing the capital structure of CSL Limited over the period of three years:...................2

2. Utilising the capital structure of CSL Limited with the help of relevant practical and

theoretical approach:..................................................................................................................4

Task 2: Providing relevant information of the proposed project to the CEO of OnePack’s with

relevant justification from investment appraisal techniques and sensitivity analysis................5

Conclusion:................................................................................................................................9

References and Bibliography:..................................................................................................10

ACCOUNTING FOR MANAGERS

2

Introduction:

The main evaluation that has been conducted in the overall assessment is directly

related to the capital structure analysis the CSL limited and investment approach then used

for analysing a proposed project. Moreover, from the relevant evaluation, it can be detected

that the overall capital structure of the organisation is mainly evaluated to determine the

financial viability of their current options and the measure that has been made to secure

investment decisions. In the similar process, the analysis has been conducted on different

investment appraisal techniques and sensitivity analysis on the project that is presented to

Onepack Limited.

Task 1:

1. Analysing the capital structure of CSL Limited over the period of three years:

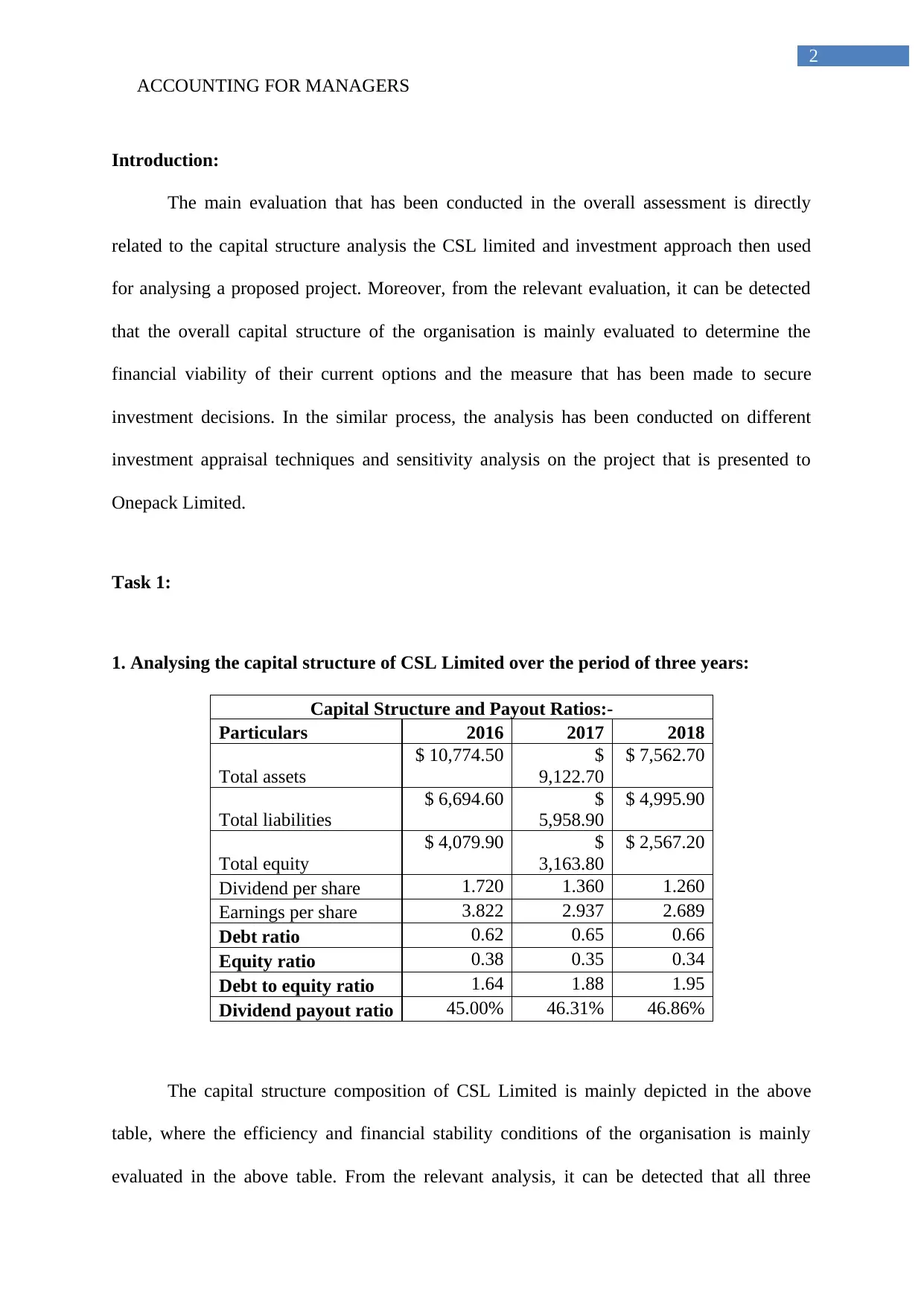

Capital Structure and Payout Ratios:-

Particulars 2016 2017 2018

Total assets

$ 10,774.50 $

9,122.70

$ 7,562.70

Total liabilities

$ 6,694.60 $

5,958.90

$ 4,995.90

Total equity

$ 4,079.90 $

3,163.80

$ 2,567.20

Dividend per share 1.720 1.360 1.260

Earnings per share 3.822 2.937 2.689

Debt ratio 0.62 0.65 0.66

Equity ratio 0.38 0.35 0.34

Debt to equity ratio 1.64 1.88 1.95

Dividend payout ratio 45.00% 46.31% 46.86%

The capital structure composition of CSL Limited is mainly depicted in the above

table, where the efficiency and financial stability conditions of the organisation is mainly

evaluated in the above table. From the relevant analysis, it can be detected that all three

2

Introduction:

The main evaluation that has been conducted in the overall assessment is directly

related to the capital structure analysis the CSL limited and investment approach then used

for analysing a proposed project. Moreover, from the relevant evaluation, it can be detected

that the overall capital structure of the organisation is mainly evaluated to determine the

financial viability of their current options and the measure that has been made to secure

investment decisions. In the similar process, the analysis has been conducted on different

investment appraisal techniques and sensitivity analysis on the project that is presented to

Onepack Limited.

Task 1:

1. Analysing the capital structure of CSL Limited over the period of three years:

Capital Structure and Payout Ratios:-

Particulars 2016 2017 2018

Total assets

$ 10,774.50 $

9,122.70

$ 7,562.70

Total liabilities

$ 6,694.60 $

5,958.90

$ 4,995.90

Total equity

$ 4,079.90 $

3,163.80

$ 2,567.20

Dividend per share 1.720 1.360 1.260

Earnings per share 3.822 2.937 2.689

Debt ratio 0.62 0.65 0.66

Equity ratio 0.38 0.35 0.34

Debt to equity ratio 1.64 1.88 1.95

Dividend payout ratio 45.00% 46.31% 46.86%

The capital structure composition of CSL Limited is mainly depicted in the above

table, where the efficiency and financial stability conditions of the organisation is mainly

evaluated in the above table. From the relevant analysis, it can be detected that all three

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

3

components such as total assets, total liabilities and total equity of the organisation has

mainly increased over the period of three years. Hence, the analysis can eventually help in

determining the actual financial performance of CSL Limited over the period of three years.

2016 2017 2018

-

0.50

1.00

1.50

2.00

2.50

Capital Structure and Payout Rati os

The information provided in the above graph directly states about the financial

performance of the organisation over the period of time. Hence, from the analysis, it is

determined that the total debt composition of the company’s capital structure has mainly

improved over the period of time. The debt composition of CSL Limited from 2016 to 2018

has mainly increased from the levels of 0.62 to 0.66, which is negatively affecting the total

solvency conditions of the organisation (Csl.com 2019). From the analysis, it is detected that

the organisation has been accumulating debt to support its operations over the period of three

years, which is the main reason why the debt level has increased, while equity levels have

declined. Guinnane and Schneebacher (2018) mentioned that the increment in debt levels of

an organisation directly increases the insolvency conditions and finance cost, which might

negatively affect the profit conditions of the organisation.

In the similar instance, the equity level of the company has mainly declined from the

levels of 0.38 in 2016 to 0.34 in 2018, which is the main reason behind the declining capital

3

components such as total assets, total liabilities and total equity of the organisation has

mainly increased over the period of three years. Hence, the analysis can eventually help in

determining the actual financial performance of CSL Limited over the period of three years.

2016 2017 2018

-

0.50

1.00

1.50

2.00

2.50

Capital Structure and Payout Rati os

The information provided in the above graph directly states about the financial

performance of the organisation over the period of time. Hence, from the analysis, it is

determined that the total debt composition of the company’s capital structure has mainly

improved over the period of time. The debt composition of CSL Limited from 2016 to 2018

has mainly increased from the levels of 0.62 to 0.66, which is negatively affecting the total

solvency conditions of the organisation (Csl.com 2019). From the analysis, it is detected that

the organisation has been accumulating debt to support its operations over the period of three

years, which is the main reason why the debt level has increased, while equity levels have

declined. Guinnane and Schneebacher (2018) mentioned that the increment in debt levels of

an organisation directly increases the insolvency conditions and finance cost, which might

negatively affect the profit conditions of the organisation.

In the similar instance, the equity level of the company has mainly declined from the

levels of 0.38 in 2016 to 0.34 in 2018, which is the main reason behind the declining capital

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

4

structure composition of CSL Limited. Serrasqueiro and Caetano (2015) stated that with the

help of capital structure able to analyze the level of return that could be generated by the

organization. In the similar process, it could be identified that the overall debt to equity ratio

of the company has a relative to increase during the past three financial years. This is also due

to the level of increment in debt capital in comparison to equity capital. Therefore, the

finance cost of the company is relatively high which is reducing the level of income

generated from the overall operations.

The dividend payout ratio analysis has relatively indicated the overall progress in

dividend payments of CSL Limited over the period of 3 financial years. The company has

been providing higher level of dividends over a period of 3 years in comparison to its overall

earnings per share. This is relevantly increasing the dividend payout ratio of the organization

and indicating about the level of income that could be generated by investors after investing

in the company. This is the main reason why the overall dividend payout ratio has increased

from 45% in 2016 to 46.86% in 2018.

2. Utilising the capital structure of CSL Limited with the help of relevant practical and

theoretical approach:

The capital structure condition of CSL Limited has relatively declined over a period

of 3 years, which can be identified from the above calculations. Moreover, the analysis of the

capital structure can be conducted on theoretical basis where Modigliani and Miller Theorem

can be utilized for understanding the impact of capital structure on the valuation of the

organization. The evaluation of Modigliani and Miller theorem directly indicates about the

relevant assumptions, which has been made by the authors regarding the capital structure of

an organization. The major assumption of the theorem is to neglect the overall transaction

cost that is incurred by investors while conducting the trade in a particular investment.

4

structure composition of CSL Limited. Serrasqueiro and Caetano (2015) stated that with the

help of capital structure able to analyze the level of return that could be generated by the

organization. In the similar process, it could be identified that the overall debt to equity ratio

of the company has a relative to increase during the past three financial years. This is also due

to the level of increment in debt capital in comparison to equity capital. Therefore, the

finance cost of the company is relatively high which is reducing the level of income

generated from the overall operations.

The dividend payout ratio analysis has relatively indicated the overall progress in

dividend payments of CSL Limited over the period of 3 financial years. The company has

been providing higher level of dividends over a period of 3 years in comparison to its overall

earnings per share. This is relevantly increasing the dividend payout ratio of the organization

and indicating about the level of income that could be generated by investors after investing

in the company. This is the main reason why the overall dividend payout ratio has increased

from 45% in 2016 to 46.86% in 2018.

2. Utilising the capital structure of CSL Limited with the help of relevant practical and

theoretical approach:

The capital structure condition of CSL Limited has relatively declined over a period

of 3 years, which can be identified from the above calculations. Moreover, the analysis of the

capital structure can be conducted on theoretical basis where Modigliani and Miller Theorem

can be utilized for understanding the impact of capital structure on the valuation of the

organization. The evaluation of Modigliani and Miller theorem directly indicates about the

relevant assumptions, which has been made by the authors regarding the capital structure of

an organization. The major assumption of the theorem is to neglect the overall transaction

cost that is incurred by investors while conducting the trade in a particular investment.

ACCOUNTING FOR MANAGERS

5

Moreover, the theorem further states that there will be no impact of debt on the capital

valuation of the organization. Both assumptions that were presented in the theoretical

approach are relatively not appropriate as the assumptions would not hold ground in Real

world practices. Hence, the current capital structure conditions of the organization in

accordance with the theoretical approach is appropriate and does not need any kind of

alterations to increase its valuation in future (Lin 2017). Therefore, adequate improvements in

the capital structure conditions of CSL Limited need to be conducted, as the company is

nearing towards higher debt accumulation, which is directly affecting its solvency conditions.

The use of equity capital and reduce in debt exposure will also reduce the finance cost and

increase the level of net profits generated from operations.

Task 2: Providing relevant information of the proposed project to the CEO of

OnePack’s with relevant justification from investment appraisal techniques and

sensitivity analysis

MEMORANDUM

To,

The CEO,

OnePack Limited

From: The Manager

Date: 11th June 2019

Subject: Understanding the performance of the project under different investment appraisal

techniques and sensitivity analysis

After evaluating the performance of the project relevant explanation has been

presented to identify the financial viability and the need for the commencement of the

project. Critical analysis has been conducted on the overall project by detecting the overall

free cash flow, investment appraisal techniques and sensitivity analysis.

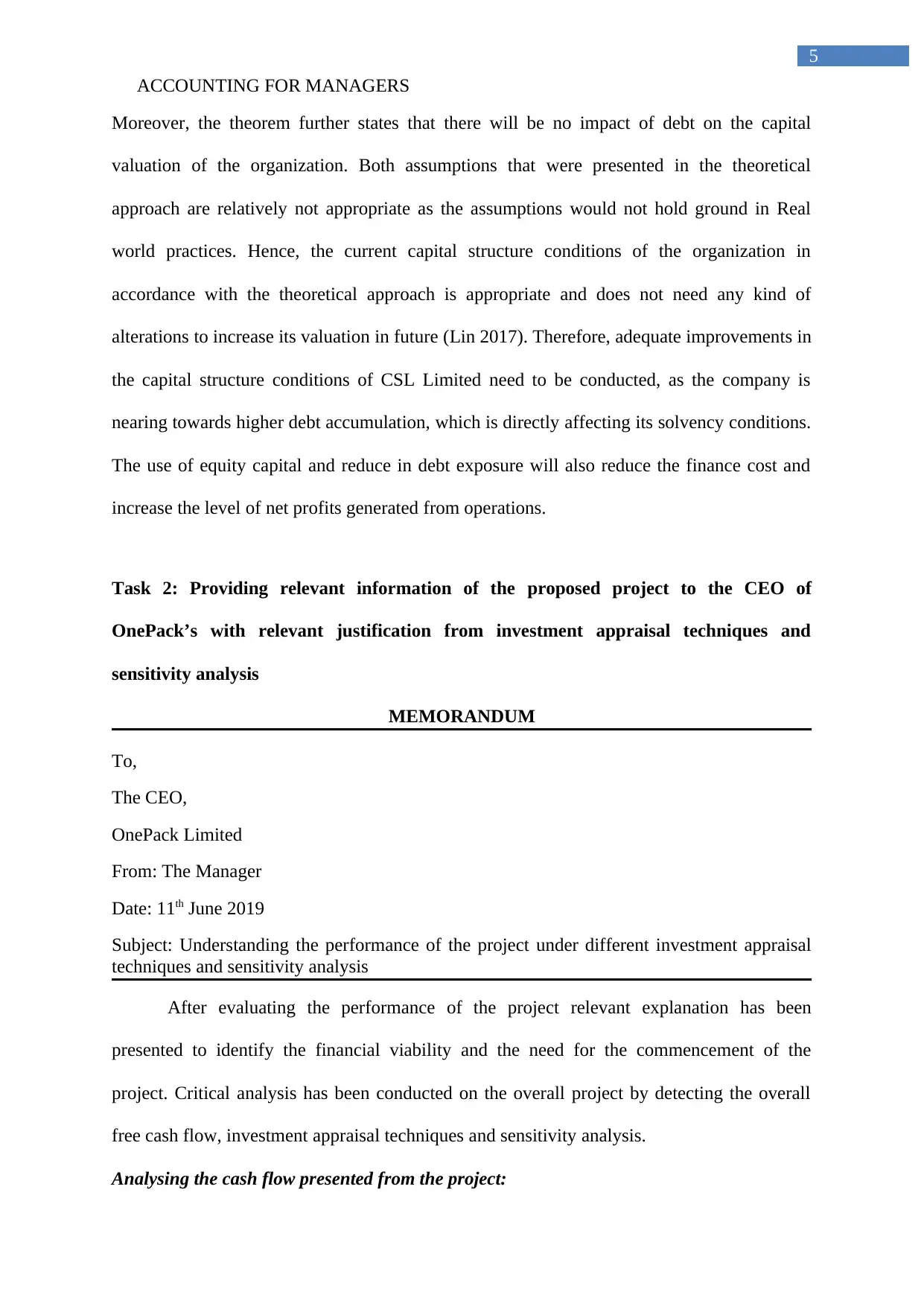

Analysing the cash flow presented from the project:

5

Moreover, the theorem further states that there will be no impact of debt on the capital

valuation of the organization. Both assumptions that were presented in the theoretical

approach are relatively not appropriate as the assumptions would not hold ground in Real

world practices. Hence, the current capital structure conditions of the organization in

accordance with the theoretical approach is appropriate and does not need any kind of

alterations to increase its valuation in future (Lin 2017). Therefore, adequate improvements in

the capital structure conditions of CSL Limited need to be conducted, as the company is

nearing towards higher debt accumulation, which is directly affecting its solvency conditions.

The use of equity capital and reduce in debt exposure will also reduce the finance cost and

increase the level of net profits generated from operations.

Task 2: Providing relevant information of the proposed project to the CEO of

OnePack’s with relevant justification from investment appraisal techniques and

sensitivity analysis

MEMORANDUM

To,

The CEO,

OnePack Limited

From: The Manager

Date: 11th June 2019

Subject: Understanding the performance of the project under different investment appraisal

techniques and sensitivity analysis

After evaluating the performance of the project relevant explanation has been

presented to identify the financial viability and the need for the commencement of the

project. Critical analysis has been conducted on the overall project by detecting the overall

free cash flow, investment appraisal techniques and sensitivity analysis.

Analysing the cash flow presented from the project:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

6

Particulars 0 1 2 3 4 5 6

Revenue

$

440,000

,000.0

$

460,020

,000.0

$

480,950,

910.0

$

502,834

,176.4

$

525,713

,131.4

$

549,633

,078.9

Variable cost

$

(27,000,

000.0)

$

(24,786,

000.0)

$

(22,753,

548.0)

$

(20,887,

757.1)

$

(19,174,

961.0)

$

(17,602,

614.2)

Administrative

and general

expenses

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

Marketing cost

$

(13,000,

000.0)

$

-

$

-

$

-

$

-

$

-

Depreciation

expense

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

Profit before

tax

$

391,000

,000.0

$

426,234

,000.0

$

449,197,

362.0

$

472,946

,419.3

$

497,538

,170.4

$

523,030

,464.7

Tax

$

(117,30

0,000.0)

$

(127,87

0,200.0)

$

(134,759

,208.6)

$

(141,88

3,925.8)

$

(149,26

1,451.1)

$

(156,90

9,139.4)

Profit after tax

$

273,700

,000.0

$

298,363

,800.0

$

314,438,

153.4

$

331,062

,493.5

$

348,276

,719.3

$

366,121

,325.3

Cash flow

$

(35,450,

000.0)

$

278,700

,000.0

$

303,363

,800.0

$

319,438,

153.4

$

336,062

,493.5

$

353,276

,719.3

$

375,521

,325.3

The above table provides information about the overall cash flow that has been

calculated for the project. This cash flow has been derived by analyzing the relevant level of

revenues and expenses incurred over a period of 6 years. The analysis directly indicated that

the variable cost conditions of the project are relatively related to an increment of 2% and a

reduction of 10% cost. This relevant analysis would eventually help in determining the level

of expenses that will be conducted by the project over a period of time. The project also

analyses the administrative and general expenses, which is fixed throughout the six years of

the project. On the contrary, the marketing cost of the project is only incurred on the first year

after which there is no it expenses on marketing that need to be conducted by the project.

Moreover, depreciation expenses also calculated to include all the relevant investment on the

6

Particulars 0 1 2 3 4 5 6

Revenue

$

440,000

,000.0

$

460,020

,000.0

$

480,950,

910.0

$

502,834

,176.4

$

525,713

,131.4

$

549,633

,078.9

Variable cost

$

(27,000,

000.0)

$

(24,786,

000.0)

$

(22,753,

548.0)

$

(20,887,

757.1)

$

(19,174,

961.0)

$

(17,602,

614.2)

Administrative

and general

expenses

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

$

(4,000,0

00.0)

Marketing cost

$

(13,000,

000.0)

$

-

$

-

$

-

$

-

$

-

Depreciation

expense

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

$

(5,000,0

00.0)

Profit before

tax

$

391,000

,000.0

$

426,234

,000.0

$

449,197,

362.0

$

472,946

,419.3

$

497,538

,170.4

$

523,030

,464.7

Tax

$

(117,30

0,000.0)

$

(127,87

0,200.0)

$

(134,759

,208.6)

$

(141,88

3,925.8)

$

(149,26

1,451.1)

$

(156,90

9,139.4)

Profit after tax

$

273,700

,000.0

$

298,363

,800.0

$

314,438,

153.4

$

331,062

,493.5

$

348,276

,719.3

$

366,121

,325.3

Cash flow

$

(35,450,

000.0)

$

278,700

,000.0

$

303,363

,800.0

$

319,438,

153.4

$

336,062

,493.5

$

353,276

,719.3

$

375,521

,325.3

The above table provides information about the overall cash flow that has been

calculated for the project. This cash flow has been derived by analyzing the relevant level of

revenues and expenses incurred over a period of 6 years. The analysis directly indicated that

the variable cost conditions of the project are relatively related to an increment of 2% and a

reduction of 10% cost. This relevant analysis would eventually help in determining the level

of expenses that will be conducted by the project over a period of time. The project also

analyses the administrative and general expenses, which is fixed throughout the six years of

the project. On the contrary, the marketing cost of the project is only incurred on the first year

after which there is no it expenses on marketing that need to be conducted by the project.

Moreover, depreciation expenses also calculated to include all the relevant investment on the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

7

machinery that is purchased for the project. Thus, cash flow conditions of the project is viable

and can be further used in investment appraisal techniques (Harris 2017).

Evaluating the investment appraisal techniques for analysing the efficiency of the project:

Yea

r Cash flow

Discount

rate Dis-cash flow Cum-cash flow

0

$ (35,450,000.0) 1.0

0

$ (35,450,000.0) $ (35,450,000.0)

1

$ 278,700,000.0 0.9

2

$ 255,688,073.4 $ 243,250,000.0

2

$ 303,363,800.0 0.8

4

$ 255,335,241.1 $ 546,613,800.0

3

$ 319,438,153.4 0.7

7

$ 246,664,865.0 $ 866,051,953.4

4

$ 336,062,493.5 0.7

1

$ 238,075,142.9 $ 1,202,114,446.9

5

$ 353,276,719.3 0.6

5

$ 229,605,627.9 $ 1,555,391,166.3

6

$ 375,521,325.3 0.6

0

$ 223,911,096.8 $ 1,930,912,491.6

NPV $ 1,413,830,047.2

Payback period 0.1 years

IRR 795%

Profitability index 40.9

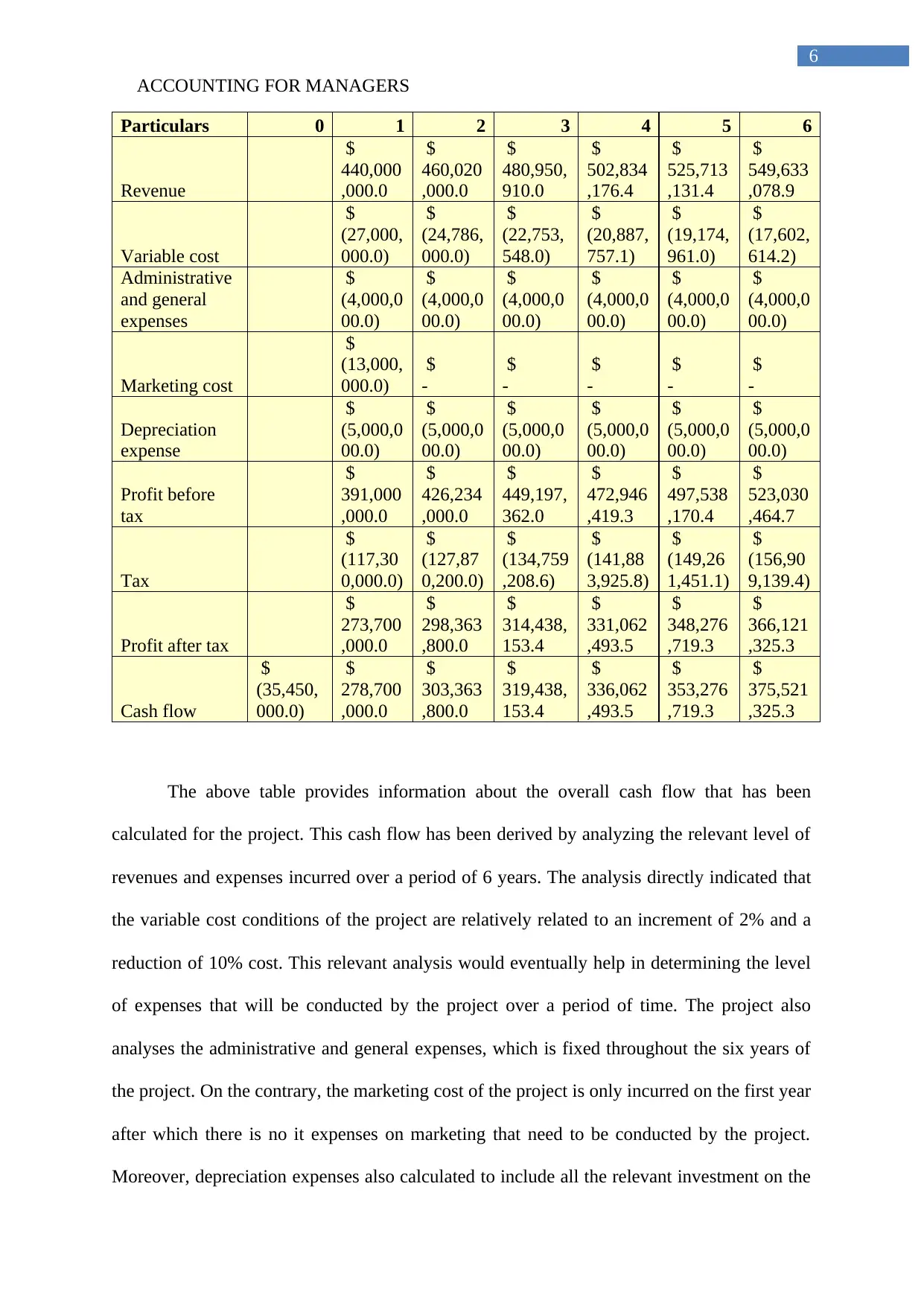

The calculations in the above tables directly represent the discounted cash flow and

values from the investment appraisal methods of the project. The valuation is directly

indicating about the overall performance that could be generated by the project over a period

of time. The analysis for the indicated that the overall discounted period cash flow has a

positive value which represents the net present value of the project. This positive net present

value state financial viability of the project and indicate about the positive cash inflow that

would be generated over the period of six years. Further analysis indicates that the payback

period of the overall project is within one year, as the initial investment is relatively low in

comparison to the high level of revenue generated in first year. Moreover, the internal rate of

7

machinery that is purchased for the project. Thus, cash flow conditions of the project is viable

and can be further used in investment appraisal techniques (Harris 2017).

Evaluating the investment appraisal techniques for analysing the efficiency of the project:

Yea

r Cash flow

Discount

rate Dis-cash flow Cum-cash flow

0

$ (35,450,000.0) 1.0

0

$ (35,450,000.0) $ (35,450,000.0)

1

$ 278,700,000.0 0.9

2

$ 255,688,073.4 $ 243,250,000.0

2

$ 303,363,800.0 0.8

4

$ 255,335,241.1 $ 546,613,800.0

3

$ 319,438,153.4 0.7

7

$ 246,664,865.0 $ 866,051,953.4

4

$ 336,062,493.5 0.7

1

$ 238,075,142.9 $ 1,202,114,446.9

5

$ 353,276,719.3 0.6

5

$ 229,605,627.9 $ 1,555,391,166.3

6

$ 375,521,325.3 0.6

0

$ 223,911,096.8 $ 1,930,912,491.6

NPV $ 1,413,830,047.2

Payback period 0.1 years

IRR 795%

Profitability index 40.9

The calculations in the above tables directly represent the discounted cash flow and

values from the investment appraisal methods of the project. The valuation is directly

indicating about the overall performance that could be generated by the project over a period

of time. The analysis for the indicated that the overall discounted period cash flow has a

positive value which represents the net present value of the project. This positive net present

value state financial viability of the project and indicate about the positive cash inflow that

would be generated over the period of six years. Further analysis indicates that the payback

period of the overall project is within one year, as the initial investment is relatively low in

comparison to the high level of revenue generated in first year. Moreover, the internal rate of

ACCOUNTING FOR MANAGERS

8

return calculation as indicated a value of 795%, which has been derived as the overall income

of the project is higher in comparison to other costs and expenses. This is the main reason

why the project is so lucrative that the organization need to commence it as quickly as

possible. The further analysis of the investment appraisal techniques are conducted on

profitability index, which also indicate a positive attribute. The values of profitability index

are at the levels of 40.9, which are directly indicating a higher level of revenue that can be

generated by the project after its commencement. Therefore, after the analysis of the overall

investment appraisal technique, it can be identified that the project is financially viable and

would generate high level of income for the organization in the long run (Throsby 2016).

Understanding the impact of sensitivity analysis on the project:

Sensitivity analysis

Sale Value NPV IRR Profitability index

$ 13,750,000.0 $ 44,182,189.0 24.8% 1.28

$ 27,500,000.0 $ 88,364,377.9 49.7% 2.56

$ 55,000,000.0 $ 176,728,755.9 99.3% 5.11

$ 110,000,000.0 $ 353,457,511.8 198.6% 10.22

$ 220,000,000.0 $ 706,915,023.6 397.3% 20.44

$ 440,000,000.0 $ 1,413,830,047.2 794.6% 40.88

$ 660,000,000.0 $ 2,120,745,070.8

1191.9

% 61.32

$ 990,000,000.0 $ 3,181,117,606.1

1787.8

% 91.99

$ 1,485,000,000.0 $ 4,771,676,409.2

2681.8

% 137.98

$ 2,227,500,000.0 $ 7,157,514,613.8

4022.6

% 206.97

$ 3,341,250,000.0 $ 10,736,271,920.7

6033.9

% 310.45

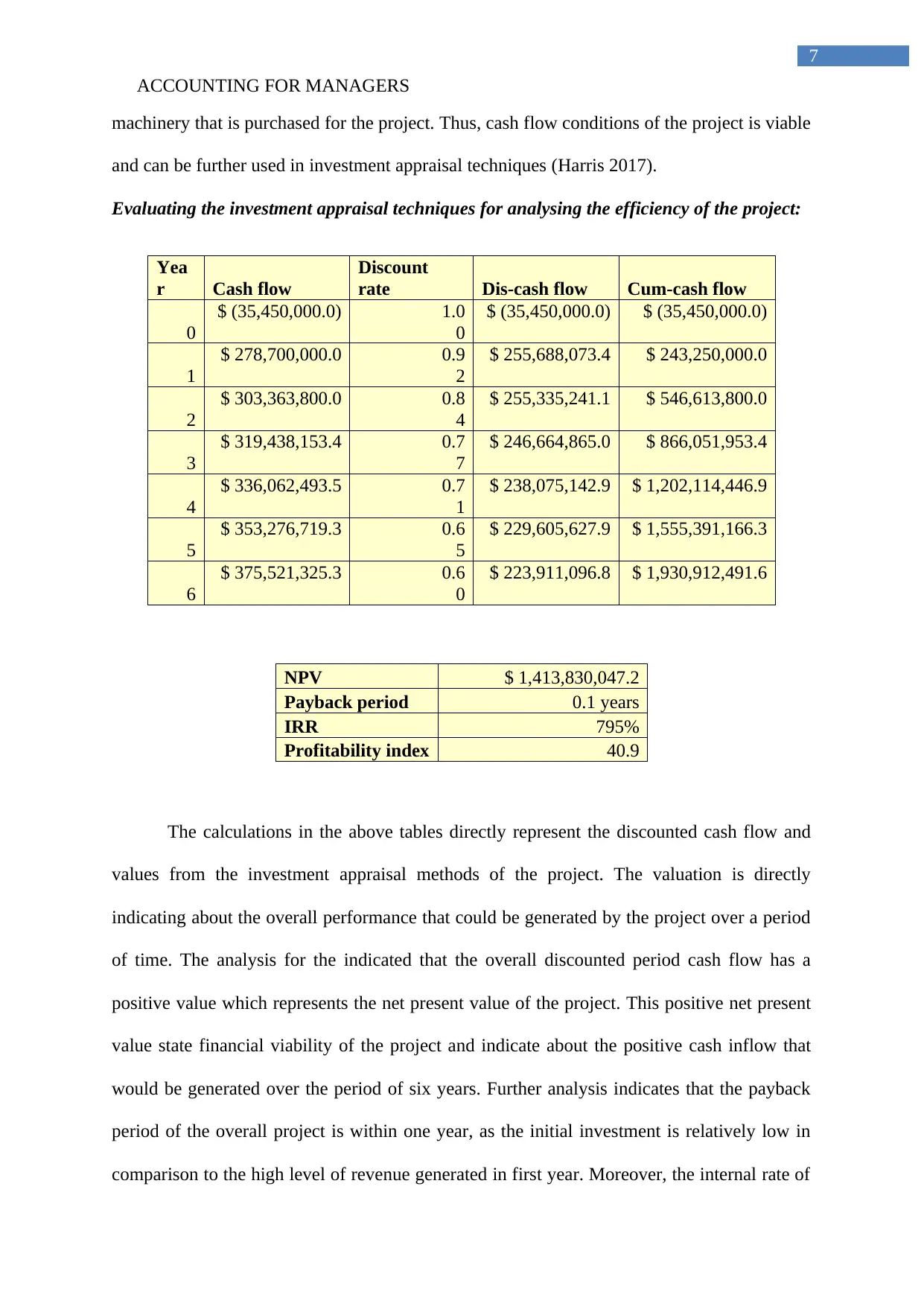

The information provided in the above table directly highlights the overall changes in

the sensitivity conditions of the project. Hence, the sensitivity analysis depicts that even after

reducing the overall value of the project by 50% the overall NPV, IRR, and profitability

index is positive. The sales value on the first year of the project is relatively altered by 50%,

8

return calculation as indicated a value of 795%, which has been derived as the overall income

of the project is higher in comparison to other costs and expenses. This is the main reason

why the project is so lucrative that the organization need to commence it as quickly as

possible. The further analysis of the investment appraisal techniques are conducted on

profitability index, which also indicate a positive attribute. The values of profitability index

are at the levels of 40.9, which are directly indicating a higher level of revenue that can be

generated by the project after its commencement. Therefore, after the analysis of the overall

investment appraisal technique, it can be identified that the project is financially viable and

would generate high level of income for the organization in the long run (Throsby 2016).

Understanding the impact of sensitivity analysis on the project:

Sensitivity analysis

Sale Value NPV IRR Profitability index

$ 13,750,000.0 $ 44,182,189.0 24.8% 1.28

$ 27,500,000.0 $ 88,364,377.9 49.7% 2.56

$ 55,000,000.0 $ 176,728,755.9 99.3% 5.11

$ 110,000,000.0 $ 353,457,511.8 198.6% 10.22

$ 220,000,000.0 $ 706,915,023.6 397.3% 20.44

$ 440,000,000.0 $ 1,413,830,047.2 794.6% 40.88

$ 660,000,000.0 $ 2,120,745,070.8

1191.9

% 61.32

$ 990,000,000.0 $ 3,181,117,606.1

1787.8

% 91.99

$ 1,485,000,000.0 $ 4,771,676,409.2

2681.8

% 137.98

$ 2,227,500,000.0 $ 7,157,514,613.8

4022.6

% 206.97

$ 3,341,250,000.0 $ 10,736,271,920.7

6033.9

% 310.45

The information provided in the above table directly highlights the overall changes in

the sensitivity conditions of the project. Hence, the sensitivity analysis depicts that even after

reducing the overall value of the project by 50% the overall NPV, IRR, and profitability

index is positive. The sales value on the first year of the project is relatively altered by 50%,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING FOR MANAGERS

9

which represent a new who sales value for the first year under different circumstances.

Hence, it could be identified the project after receiving tremendous decline in its overall

revenues is still considered to be a viable investment option. This would eventually allow the

organization to generate high level of revenues and improve with current financial conditions

after implementing the proposed project.

Conclusion:

The overall assessment has directly analyzed the capital structure conditions of CSL

Limited, which indicates that adequate improvements in the capital structure needs to be

conducted. The financial performance of the company will eventually increase if the

accumulation of debt capital is reduced, as it will help in minimizing the finance cost and

maximizing the solvency position of the organization. From the relevant analysis of the

assessment, it has directly indicated that the project is reliable and would generate high level

of revenues for Onepack Limited. Hence, the project should be selected by Onepack Limited,

as it satisfies all the requirement of the investment appraisal techniques used for calculating

its financial viability.

9

which represent a new who sales value for the first year under different circumstances.

Hence, it could be identified the project after receiving tremendous decline in its overall

revenues is still considered to be a viable investment option. This would eventually allow the

organization to generate high level of revenues and improve with current financial conditions

after implementing the proposed project.

Conclusion:

The overall assessment has directly analyzed the capital structure conditions of CSL

Limited, which indicates that adequate improvements in the capital structure needs to be

conducted. The financial performance of the company will eventually increase if the

accumulation of debt capital is reduced, as it will help in minimizing the finance cost and

maximizing the solvency position of the organization. From the relevant analysis of the

assessment, it has directly indicated that the project is reliable and would generate high level

of revenues for Onepack Limited. Hence, the project should be selected by Onepack Limited,

as it satisfies all the requirement of the investment appraisal techniques used for calculating

its financial viability.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING FOR MANAGERS

10

References and Bibliography:

Awojobi, O. and Jenkins, G.P., 2016. Managing the cost overrun risks of hydroelectric dams:

An application of reference class forecasting techniques. Renewable and Sustainable Energy

Reviews, 63, pp.19-32.

Brisley, R., Wylde, R., Lamb, R., Cooper, J., Sayers, P. and Hall, J., 2016. Techniques for

valuing adaptive capacity in flood risk management. Proceedings of the ICE-Water

Management, 169(2), pp.75-84.

Brusov, P., Filatova, T., Orekhova, N. and Eskindarov, M., 2018. New meaningful effects in

modern capital structure theory. In Modern Corporate Finance, Investments, Taxation and

Ratings (pp. 537-568). Springer, Cham.

Csl.com. 2019. Annual Reports. [online] Available at:

https://www.csl.com/investors/financial-results-and-information/annual-reports [Accessed 11

Jun. 2019].

Guinnane, T.W. and Schneebacher, J., 2018. Capital Structure and the Choice of Enterprise

Form: theory and history. Yale University Economic Growth Center Discussion Paper,

(1061).

Harris, E., 2017. Strategic project risk appraisal and management. Routledge.

Lin, N., 2017. Building a network theory of social capital. In Social capital (pp. 3-28).

Routledge.

Onatca Engin, S.N., Unver Erbas, C. and Sokmen, A.G., 2019. Pecking Order Theory in

Determining The Capital Structure: A Panel Data Analysis Of Companies in

Turkey. Business and Economics Research Journal, 10(3), pp.687-698.

10

References and Bibliography:

Awojobi, O. and Jenkins, G.P., 2016. Managing the cost overrun risks of hydroelectric dams:

An application of reference class forecasting techniques. Renewable and Sustainable Energy

Reviews, 63, pp.19-32.

Brisley, R., Wylde, R., Lamb, R., Cooper, J., Sayers, P. and Hall, J., 2016. Techniques for

valuing adaptive capacity in flood risk management. Proceedings of the ICE-Water

Management, 169(2), pp.75-84.

Brusov, P., Filatova, T., Orekhova, N. and Eskindarov, M., 2018. New meaningful effects in

modern capital structure theory. In Modern Corporate Finance, Investments, Taxation and

Ratings (pp. 537-568). Springer, Cham.

Csl.com. 2019. Annual Reports. [online] Available at:

https://www.csl.com/investors/financial-results-and-information/annual-reports [Accessed 11

Jun. 2019].

Guinnane, T.W. and Schneebacher, J., 2018. Capital Structure and the Choice of Enterprise

Form: theory and history. Yale University Economic Growth Center Discussion Paper,

(1061).

Harris, E., 2017. Strategic project risk appraisal and management. Routledge.

Lin, N., 2017. Building a network theory of social capital. In Social capital (pp. 3-28).

Routledge.

Onatca Engin, S.N., Unver Erbas, C. and Sokmen, A.G., 2019. Pecking Order Theory in

Determining The Capital Structure: A Panel Data Analysis Of Companies in

Turkey. Business and Economics Research Journal, 10(3), pp.687-698.

ACCOUNTING FOR MANAGERS

11

Serrasqueiro, Z. and Caetano, A., 2015. Trade-Off Theory versus Pecking Order Theory:

capital structure decisions in a peripheral region of Portugal. Journal of Business Economics

and Management, 16(2), pp.445-466.

Throsby, D., 2016. Investment in urban heritage conservation in developing countries:

Concepts, methods and data. City, Culture and Society, 7(2), pp.81-86.

11

Serrasqueiro, Z. and Caetano, A., 2015. Trade-Off Theory versus Pecking Order Theory:

capital structure decisions in a peripheral region of Portugal. Journal of Business Economics

and Management, 16(2), pp.445-466.

Throsby, D., 2016. Investment in urban heritage conservation in developing countries:

Concepts, methods and data. City, Culture and Society, 7(2), pp.81-86.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.