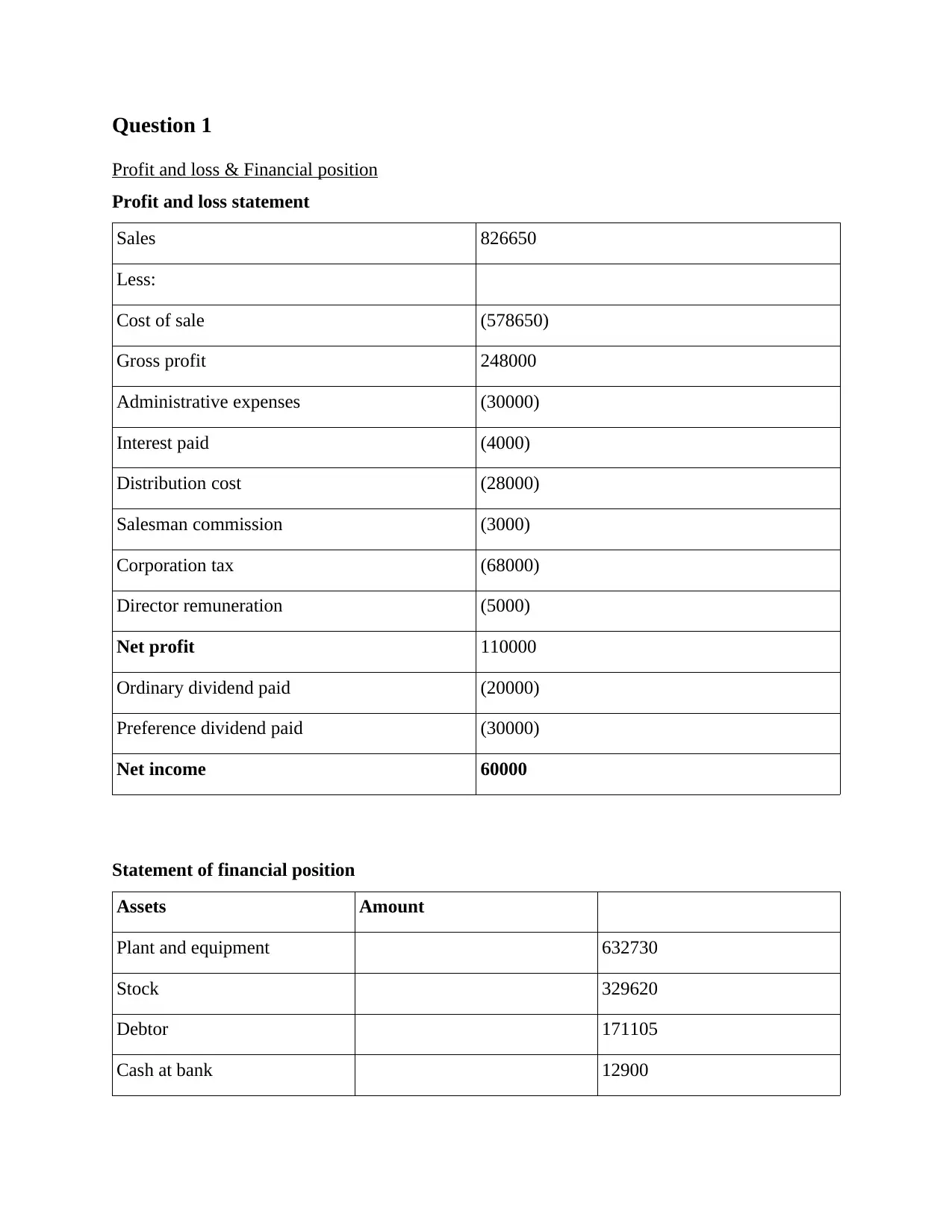

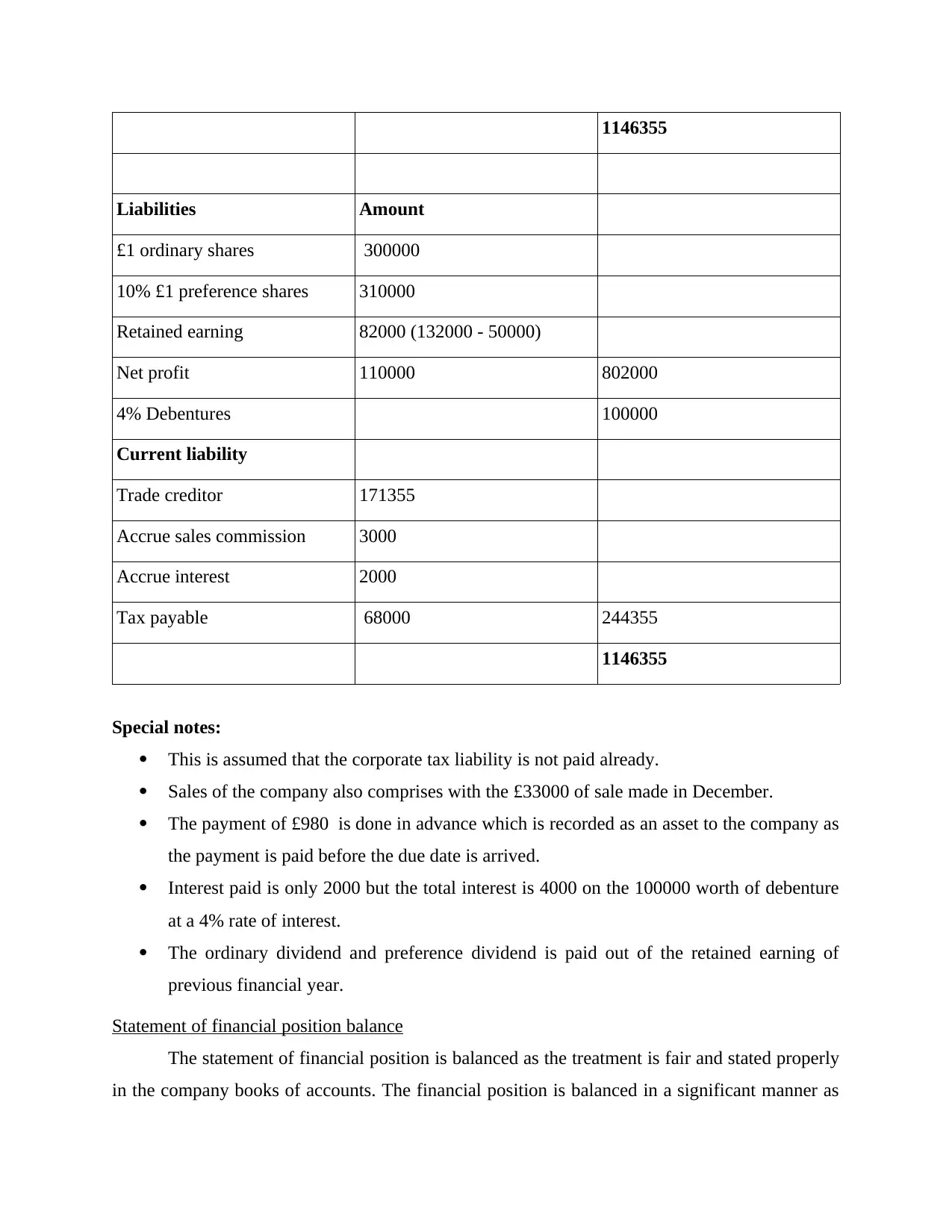

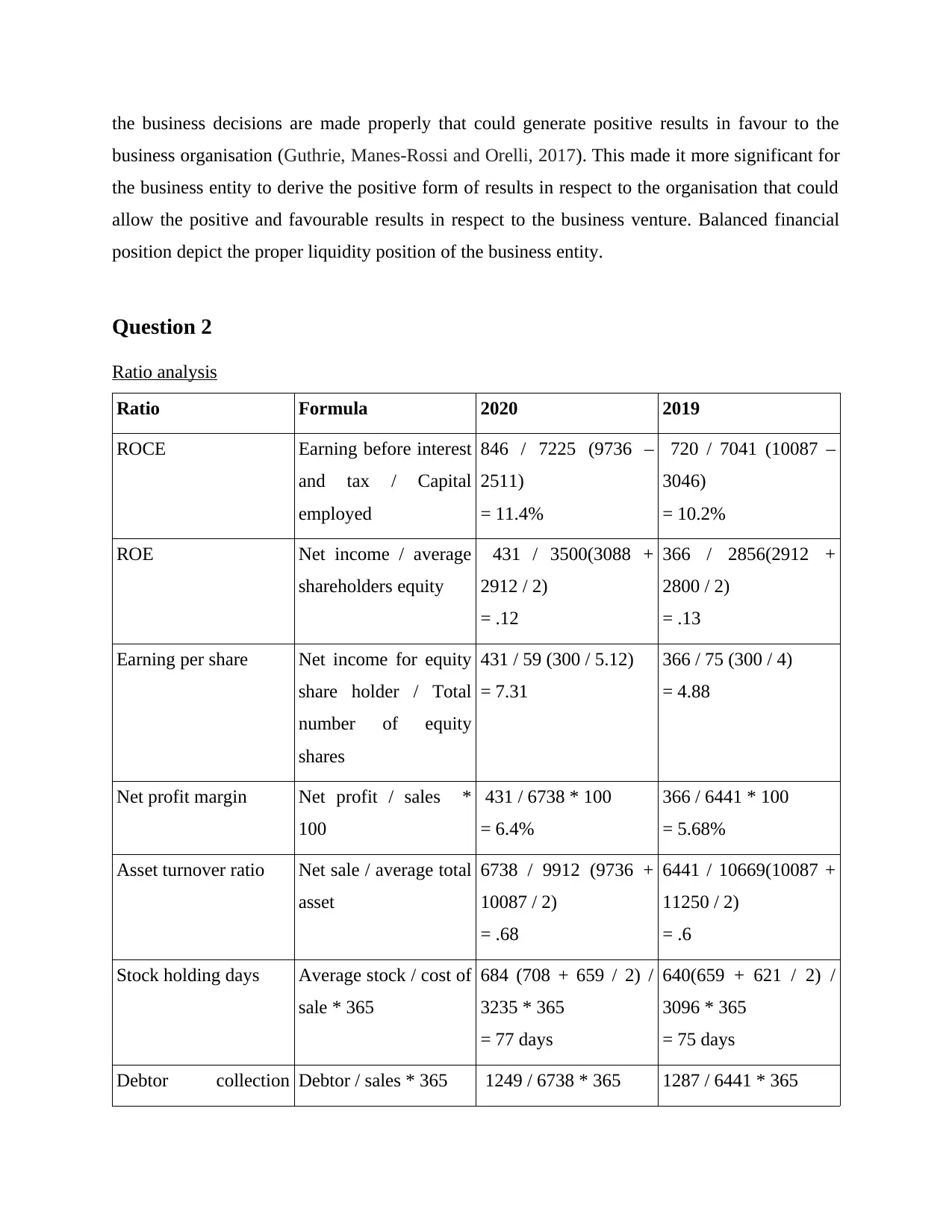

Accounting Fundamentals: Profit and Loss, Financial Position, and Ratio Analysis

VerifiedAdded on 2023/06/18

|7

|963

|83

AI Summary

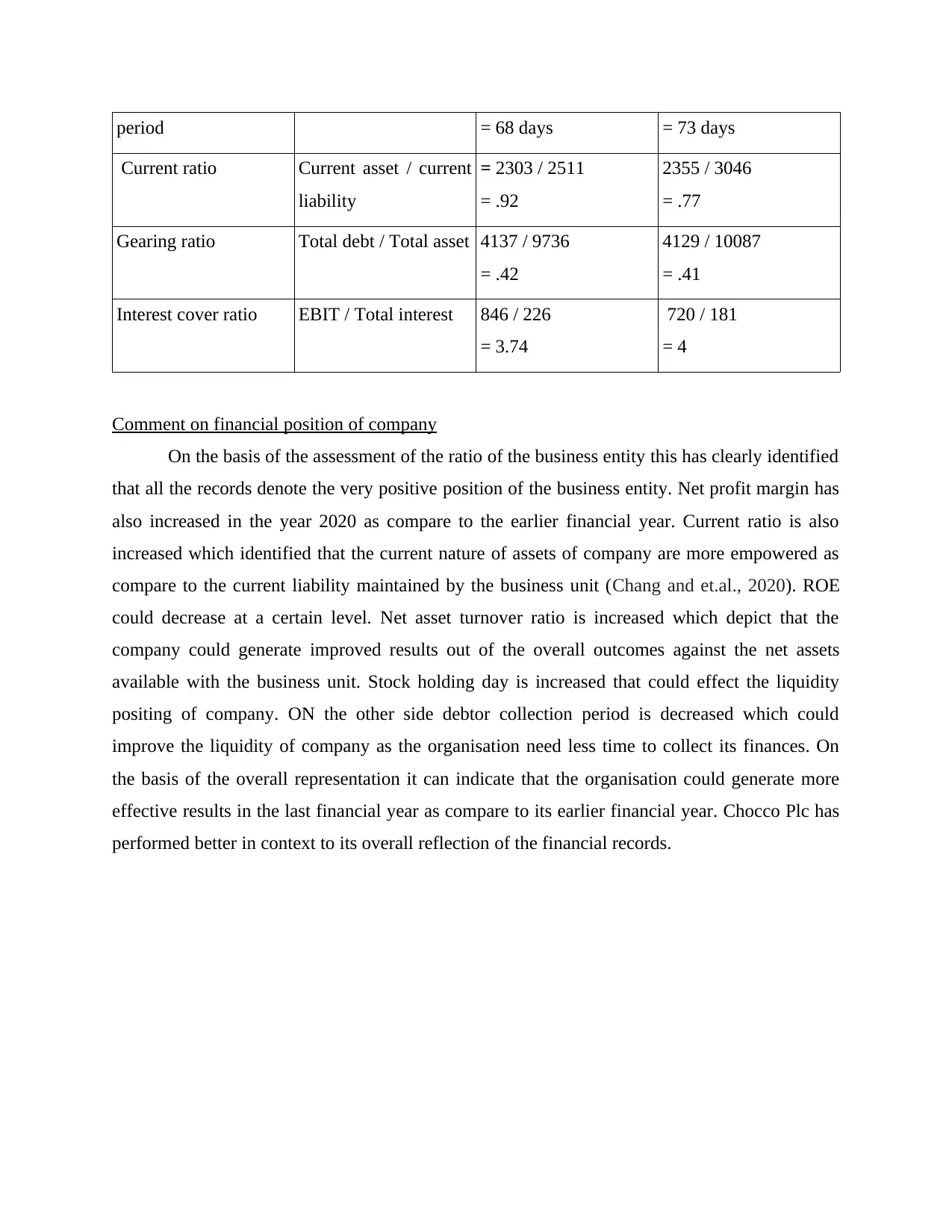

This article covers the basics of accounting fundamentals, including profit and loss statements, financial position statements, and ratio analysis. It includes a sample statement of financial position and a comment on the financial position of Chocco Plc.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 7

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)