Auditing and Reporting Assessment 2

VerifiedAdded on 2023/04/26

|34

|9188

|277

AI Summary

This assessment evaluates the student's ability to evaluate information systems, develop implementation plans, review resource use and monitor plans. It includes tasks such as identifying hardware and software needs, analysing organisational procedures and policies, and monitoring sources of data input. The subject is Auditing and Reporting, and the course code is FNSACC602. The document type is an assignment.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

T-1.8.1

Details of Assessment

Term and Year T4, 2018 Time allowed Week 2 to Week 7

Assessment No 2 Assessment Weighting 60%

Assessment Type Assignment

Due Date Week 08 Room

Details of Subject

Qualification FNS60217 Advanced Diploma of Accounting

Subject Name Auditing and Reporting

Details of Unit(s) of competency

Unit Code and

Title

FNSACC602 Audit and report on financial systems and records

FNSACC606 Conduct internal audit

Details of Student

Student Name

Student ID College

Student Declaration: I declare that the work

submitted is my own, and has not been copied or

plagiarised from any person or source. Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name

Assessment Outcome

Results Competent Not Competent Marks / 60

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive improvements:

_______________________________________________________________________

_______________________________________________________________________

______________

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I also am aware of my appeal rights and

reassessment procedure.

Signature: ____________________________

Date: ____/_____/ 2018___

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have provided

appropriate feedback

Student did not attend the feedback session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/ / 2018

Purpose of the Assessment

Auditing and Reporting, Assessment 2, v1.0 Page 1

Details of Assessment

Term and Year T4, 2018 Time allowed Week 2 to Week 7

Assessment No 2 Assessment Weighting 60%

Assessment Type Assignment

Due Date Week 08 Room

Details of Subject

Qualification FNS60217 Advanced Diploma of Accounting

Subject Name Auditing and Reporting

Details of Unit(s) of competency

Unit Code and

Title

FNSACC602 Audit and report on financial systems and records

FNSACC606 Conduct internal audit

Details of Student

Student Name

Student ID College

Student Declaration: I declare that the work

submitted is my own, and has not been copied or

plagiarised from any person or source. Signature: ___________________________

Date: _______/________/_______________

Details of Assessor

Assessor’s Name

Assessment Outcome

Results Competent Not Competent Marks / 60

FEEDBACK TO STUDENT

Progressive feedback to students, identifying gaps in competency and comments on positive improvements:

_______________________________________________________________________

_______________________________________________________________________

______________

Student Declaration: I declare that I have been

assessed in this unit, and I have been advised of my

result. I also am aware of my appeal rights and

reassessment procedure.

Signature: ____________________________

Date: ____/_____/ 2018___

Assessor Declaration: I declare that I have

conducted a fair, valid, reliable and flexible

assessment with this student, and I have provided

appropriate feedback

Student did not attend the feedback session.

Feedback provided on assessment.

Signature: ____________________________

Date: ____/ / 2018

Purpose of the Assessment

Auditing and Reporting, Assessment 2, v1.0 Page 1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

The purpose of this assessment is to assess the student

in the following learning outcomes:

Assessment task 2:

Assignment

Satisfactory

(S)

Not yet

Satisfactory

(NS)

Element 1: [Evaluate information systems]

1.1 Evaluate system specifications against user

requirements and feedback to identify redundancies

and constraints, and capacities of information

technology

Activity 01

Q: 01

1.2 Identify hardware and software needs from

assessment of available products and services

Activity 01

Q: 01

1.3 Evaluate possible uses and handling of accounting

data in consultation with users to determine security

requirements

Activity 05

1.4 Analyse organisational procedures and policy to

evaluate scope of strategies for risk management,

internal control of expenditure and compliance with

statutory requirements

Activity 01

Q: 01

1.5 Monitor and record enquiries regarding use of

systems to ensure ongoing evaluation

Activity 05

Element 2: [Develop implementation plans]

2.1 Review internal control systems to determine any

implementation issues that impact on organisational

processes

Activity 05

2.2 Analyse strengths and weaknesses of

organisational processes, including present and future

capacities, and incorporate in implementation plan

Activity 03

2.3 Design implementation to cover outcomes,

resource use, costs, and achievement and

maintenance of professional accounting standards

Activity 03

2.4 Establish schedules that are realistic and feasible

in context of organisation’s short-term and long-term

objectives

Activity 04

Element 3: [Review resource use]

3.1 Monitor sources of data input to identify influences

and variations in returns and costs

Activity 03

3.2 Monitor estimates of stock levels and review to

ensure appropriate stocking and ordering of materials

and inventory items

Activity 03

Activity 05

3.3 Compare records of resource use with unit cost

estimates to evaluate projected costs

Activity 03

3.4 Analyse factors influencing resource use in future

to assess impact on operations and objectives

Activity 05

Element 4: [Monitor plans]

4.1 Adjust implementation to take account of emerging

external influences and establishment of alternative

targets

Activity 4

Activity 05

4.2 Monitor and control costs of plans by evaluating

net benefits to operations from allocation of resources

Activity 4

Activity 05

Auditing and Reporting, Assessment 2, v1.0 Page 2

The purpose of this assessment is to assess the student

in the following learning outcomes:

Assessment task 2:

Assignment

Satisfactory

(S)

Not yet

Satisfactory

(NS)

Element 1: [Evaluate information systems]

1.1 Evaluate system specifications against user

requirements and feedback to identify redundancies

and constraints, and capacities of information

technology

Activity 01

Q: 01

1.2 Identify hardware and software needs from

assessment of available products and services

Activity 01

Q: 01

1.3 Evaluate possible uses and handling of accounting

data in consultation with users to determine security

requirements

Activity 05

1.4 Analyse organisational procedures and policy to

evaluate scope of strategies for risk management,

internal control of expenditure and compliance with

statutory requirements

Activity 01

Q: 01

1.5 Monitor and record enquiries regarding use of

systems to ensure ongoing evaluation

Activity 05

Element 2: [Develop implementation plans]

2.1 Review internal control systems to determine any

implementation issues that impact on organisational

processes

Activity 05

2.2 Analyse strengths and weaknesses of

organisational processes, including present and future

capacities, and incorporate in implementation plan

Activity 03

2.3 Design implementation to cover outcomes,

resource use, costs, and achievement and

maintenance of professional accounting standards

Activity 03

2.4 Establish schedules that are realistic and feasible

in context of organisation’s short-term and long-term

objectives

Activity 04

Element 3: [Review resource use]

3.1 Monitor sources of data input to identify influences

and variations in returns and costs

Activity 03

3.2 Monitor estimates of stock levels and review to

ensure appropriate stocking and ordering of materials

and inventory items

Activity 03

Activity 05

3.3 Compare records of resource use with unit cost

estimates to evaluate projected costs

Activity 03

3.4 Analyse factors influencing resource use in future

to assess impact on operations and objectives

Activity 05

Element 4: [Monitor plans]

4.1 Adjust implementation to take account of emerging

external influences and establishment of alternative

targets

Activity 4

Activity 05

4.2 Monitor and control costs of plans by evaluating

net benefits to operations from allocation of resources

Activity 4

Activity 05

Auditing and Reporting, Assessment 2, v1.0 Page 2

T-1.8.1

4.3 Adjust internal control systems to ensure

maintenance and achievement of accounting

standards

Activity 05

Assessment/evidence gathering conditions

Each assessment component is recorded as either Satisfactory (S) or Not Satisfactory (NS). A student can only achieve

competence when all assessment components listed under Purpose of the assessment section are Satisfactory. Your

trainer will give you feedback after the completion of each assessment. A student who is assessed as NS (Not

Satisfactory) is eligible for re-assessment.

Resources required for this Assessment

All documents must be created in Microsoft Word

Upon completion, submit the assessment printed copy to your trainer along with assessment coversheet.

Refer to the notes on eLearning to answer the tasks

Any additional material will be provided by Trainer

Instructions for Students

Please read the following instructions carefully

This assessment has to be completed In class At home

This assessment is to be completed according to the instructions given by your assessor.

Students are allowed to take this assessment home.

Feedback on each task will be provided to enable you to determine how your work could be improved. You will be

provided with feedback on your work within 2 weeks of the assessment due date. All other feedbacks will be

provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps in

knowledge. You will be given another opportunity to demonstrate your knowledge and skills to be deemed

competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your assessor.

Please refer to the College re-assessment and re-sit policy for more information.

Activity - 01 Due: Week 2 10 Marks

(This activity to be completed both in class and at home)

Assessment description

Task 1: As an auditor, how would you ensure the different aspects of General EDP control and

EDP application in an organisation? (6 Marks)

Provide examples in each scenario. (4 Marks)

Your assessor will be looking for:

You judgement and analytical skills as an auditor to below aspects:

General EDP controls and EDP Application controls

● System Specification against user requirement

Auditing and Reporting, Assessment 2, v1.0 Page 3

4.3 Adjust internal control systems to ensure

maintenance and achievement of accounting

standards

Activity 05

Assessment/evidence gathering conditions

Each assessment component is recorded as either Satisfactory (S) or Not Satisfactory (NS). A student can only achieve

competence when all assessment components listed under Purpose of the assessment section are Satisfactory. Your

trainer will give you feedback after the completion of each assessment. A student who is assessed as NS (Not

Satisfactory) is eligible for re-assessment.

Resources required for this Assessment

All documents must be created in Microsoft Word

Upon completion, submit the assessment printed copy to your trainer along with assessment coversheet.

Refer to the notes on eLearning to answer the tasks

Any additional material will be provided by Trainer

Instructions for Students

Please read the following instructions carefully

This assessment has to be completed In class At home

This assessment is to be completed according to the instructions given by your assessor.

Students are allowed to take this assessment home.

Feedback on each task will be provided to enable you to determine how your work could be improved. You will be

provided with feedback on your work within 2 weeks of the assessment due date. All other feedbacks will be

provided by the end of the term.

Should you not answer the questions correctly, you will be given feedback on the results and your gaps in

knowledge. You will be given another opportunity to demonstrate your knowledge and skills to be deemed

competent for this unit of competency.

If you are not sure about any aspects of this assessment, please ask for clarification from your assessor.

Please refer to the College re-assessment and re-sit policy for more information.

Activity - 01 Due: Week 2 10 Marks

(This activity to be completed both in class and at home)

Assessment description

Task 1: As an auditor, how would you ensure the different aspects of General EDP control and

EDP application in an organisation? (6 Marks)

Provide examples in each scenario. (4 Marks)

Your assessor will be looking for:

You judgement and analytical skills as an auditor to below aspects:

General EDP controls and EDP Application controls

● System Specification against user requirement

Auditing and Reporting, Assessment 2, v1.0 Page 3

T-1.8.1

● Effective an efficient use of information technology

● Hardware and Software requirement as per organisational needs

● Control over the use of system and segregating of duty

● Record keeping and communication.

Answer:

Usually, internal controls can be detailed in a computer based accounting system which

are of two basic types namely, General controls also known as organization controls and

Application or procedural controls.

To begin with, general controls covers generally the environment in which computer

processing is conducted. The countable objectives of general control include, to ensure

adequate segregation of duties, that is, division of functional responsibilities. Another objective of

the general control is to protect information contained in computer records and many other

objectives. Further, general controls can as well be subdivided into, Systems development and

control and Administrative controls

The system development and control actually covers numerous areas like,

Documentation, Standards, File conversion and Authorization. Changes to operational system or

programs should be subjected to the same controls as initial development. It must be authorized

and controlled.

Therefore, taking system development scenario, as an auditor various consultations

frequently flows because many would want to ensure that sufficient control is present in the new

system to maintain reliable accounting records.

The administrative controls include; segregation or division of duties, Control over computer

operators and file control.

For the side of application controls, it includes, Input, processing, output and master

file controls that is totally computer program based. These controls are to ensure the

completeness and accurate processing of data. Besides, validation checks or data vet or edit

control can be built or programmed into input conversion to validate input for

reasonableness. Examples are types or data vet or field or character check, limit or range

check, existence check, reasonableness check, sequence check, completeness check.

Therefore, there should separation of duties between EDP functions and from those of

users. The effective operations of the systems not only rely on the software but also on the

hardware maintenance. This is greatly because of the fact that there shall be no communication

neither input information nor output information shall occur whenever any computer component

is not properly maintained.

Auditing and Reporting, Assessment 2, v1.0 Page 4

● Effective an efficient use of information technology

● Hardware and Software requirement as per organisational needs

● Control over the use of system and segregating of duty

● Record keeping and communication.

Answer:

Usually, internal controls can be detailed in a computer based accounting system which

are of two basic types namely, General controls also known as organization controls and

Application or procedural controls.

To begin with, general controls covers generally the environment in which computer

processing is conducted. The countable objectives of general control include, to ensure

adequate segregation of duties, that is, division of functional responsibilities. Another objective of

the general control is to protect information contained in computer records and many other

objectives. Further, general controls can as well be subdivided into, Systems development and

control and Administrative controls

The system development and control actually covers numerous areas like,

Documentation, Standards, File conversion and Authorization. Changes to operational system or

programs should be subjected to the same controls as initial development. It must be authorized

and controlled.

Therefore, taking system development scenario, as an auditor various consultations

frequently flows because many would want to ensure that sufficient control is present in the new

system to maintain reliable accounting records.

The administrative controls include; segregation or division of duties, Control over computer

operators and file control.

For the side of application controls, it includes, Input, processing, output and master

file controls that is totally computer program based. These controls are to ensure the

completeness and accurate processing of data. Besides, validation checks or data vet or edit

control can be built or programmed into input conversion to validate input for

reasonableness. Examples are types or data vet or field or character check, limit or range

check, existence check, reasonableness check, sequence check, completeness check.

Therefore, there should separation of duties between EDP functions and from those of

users. The effective operations of the systems not only rely on the software but also on the

hardware maintenance. This is greatly because of the fact that there shall be no communication

neither input information nor output information shall occur whenever any computer component

is not properly maintained.

Auditing and Reporting, Assessment 2, v1.0 Page 4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

Auditing and Reporting, Assessment 2, v1.0 Page 5

Auditing and Reporting, Assessment 2, v1.0 Page 5

T-1.8.1

Activity – 02 Due: Week 3 10 Marks

(This activity to be completed both in class and at home)

Assessment description

Task 1: List at least 4 inherent risks of the following business. What controls you would

suggest mitigating those risks. (6 Marks)

i. A retail business such as a service station/food centre

ii. A construction business

Task 2: Why do you think clearly defined policies and procedures are important for Internal

Control perspective? Please strengthen your answer with examples. (4 Marks)

Your assessor will be looking for:

You judgement and analytical skills as an auditor to below aspects:

● Inherent risks identification based on nature of business.

● Understanding of policies and procedures

● Compliance of Policy and procedures with Statutory requirements

Task 1

(i)

-Competition- the possible high level of competition may be one of the major challenges a retail

business as they may not easily overcome bigger businesses. The appropriate on time remady

against this type of risk is to try having a bit stable backgrounds, quality inventory and good

finance capital base for easily sustainability coping with business environ competitions.

-Theft- retail businesses as well is exposed to theft risks as most retail premises usually lucks

appropriate security. Therefore, theft cases can highly costs retailers incurring losses. To

attempt safety, there must be strong building used for storage and personal surveys most

times.

-Customer injury- due to the unfriendly business environments like Icy sidewalks and rainy days

could lead to huge legal bills for your store if a customer slips and falls.

-Damage to inventory-the stock are at a possible risk of damages. For example, windstorm,

tornado, or power outage could leave your store with a costly surplus of spoiled or damaged

inventory

(ii)

-Equipment damage- A contractor's tools are their livelihood. Without your equipment, the job

simply can't get done. Some tools can be quickly and easily replaced, but for those that can't,

Auditing and Reporting, Assessment 2, v1.0 Page 6

Activity – 02 Due: Week 3 10 Marks

(This activity to be completed both in class and at home)

Assessment description

Task 1: List at least 4 inherent risks of the following business. What controls you would

suggest mitigating those risks. (6 Marks)

i. A retail business such as a service station/food centre

ii. A construction business

Task 2: Why do you think clearly defined policies and procedures are important for Internal

Control perspective? Please strengthen your answer with examples. (4 Marks)

Your assessor will be looking for:

You judgement and analytical skills as an auditor to below aspects:

● Inherent risks identification based on nature of business.

● Understanding of policies and procedures

● Compliance of Policy and procedures with Statutory requirements

Task 1

(i)

-Competition- the possible high level of competition may be one of the major challenges a retail

business as they may not easily overcome bigger businesses. The appropriate on time remady

against this type of risk is to try having a bit stable backgrounds, quality inventory and good

finance capital base for easily sustainability coping with business environ competitions.

-Theft- retail businesses as well is exposed to theft risks as most retail premises usually lucks

appropriate security. Therefore, theft cases can highly costs retailers incurring losses. To

attempt safety, there must be strong building used for storage and personal surveys most

times.

-Customer injury- due to the unfriendly business environments like Icy sidewalks and rainy days

could lead to huge legal bills for your store if a customer slips and falls.

-Damage to inventory-the stock are at a possible risk of damages. For example, windstorm,

tornado, or power outage could leave your store with a costly surplus of spoiled or damaged

inventory

(ii)

-Equipment damage- A contractor's tools are their livelihood. Without your equipment, the job

simply can't get done. Some tools can be quickly and easily replaced, but for those that can't,

Auditing and Reporting, Assessment 2, v1.0 Page 6

T-1.8.1

a Property Insurance policy can be a lifesaver.

- Injuries to third parties and workers- No matter how hard you strive to create a safe work area,

a construction site is a dangerous place full of potential hazards. This can be especially true for

people unfamiliar with safety rules, such as clients who are visiting the worksite. Even veterans

of the construction industry can be hurt on the job, including your employees.

- Faulty work- A construction business may be liable for finished projects that are structurally

unsound, not up to code, or faulty in some other way. If your work doesn't comply with local,

state, and federal building regulations, your client could lose money and look to you for

reimbursement.

- Missed deadlines- There's a reason school teachers enforce due dates for homework. People

in the business world expect projects to be done on time. Building materials can be delivered

too late, tools can break, and plans might have to be redrawn entirely if something unexpected

is discovered.

Task2

Internal control is all of the policies and procedures management uses to achieve various

goals. These goals can therefore confirm the importance of clearly defined policies. Examples

of these goals include;

-Ensure the reliability and integrity of financial information - Internal controls ensure that

management has accurate, timely and complete information, including accounting

records, in order to plan, monitor and report business operations.

-Ensure compliance - Internal controls help to ensure the University is in compliance

with the many federal, state and local laws and regulations affecting the operations of

our business.

-Promote efficient and effective operations - Internal controls provide an environment in

which managers and staff can maximize the efficiency and effectiveness of their

operations.

-Accomplishment of goals and objectives - Internal controls system provide a

mechanism for management to monitor the achievement of operational goals and

objectives.

Auditing and Reporting, Assessment 2, v1.0 Page 7

a Property Insurance policy can be a lifesaver.

- Injuries to third parties and workers- No matter how hard you strive to create a safe work area,

a construction site is a dangerous place full of potential hazards. This can be especially true for

people unfamiliar with safety rules, such as clients who are visiting the worksite. Even veterans

of the construction industry can be hurt on the job, including your employees.

- Faulty work- A construction business may be liable for finished projects that are structurally

unsound, not up to code, or faulty in some other way. If your work doesn't comply with local,

state, and federal building regulations, your client could lose money and look to you for

reimbursement.

- Missed deadlines- There's a reason school teachers enforce due dates for homework. People

in the business world expect projects to be done on time. Building materials can be delivered

too late, tools can break, and plans might have to be redrawn entirely if something unexpected

is discovered.

Task2

Internal control is all of the policies and procedures management uses to achieve various

goals. These goals can therefore confirm the importance of clearly defined policies. Examples

of these goals include;

-Ensure the reliability and integrity of financial information - Internal controls ensure that

management has accurate, timely and complete information, including accounting

records, in order to plan, monitor and report business operations.

-Ensure compliance - Internal controls help to ensure the University is in compliance

with the many federal, state and local laws and regulations affecting the operations of

our business.

-Promote efficient and effective operations - Internal controls provide an environment in

which managers and staff can maximize the efficiency and effectiveness of their

operations.

-Accomplishment of goals and objectives - Internal controls system provide a

mechanism for management to monitor the achievement of operational goals and

objectives.

Auditing and Reporting, Assessment 2, v1.0 Page 7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Activity – 03 Due: Week 4 10 Mark

(This activity is to completed both in class and at home)

Assessment description

Task 01: Why is it very important to monitor the Data inputs from different sources within an

organisation? Give an example. (4 marks)

Task 02: What are internal and external factors that influence the resources of an organisation? How

do they impact on organisation’s operations and objective?

(6

marks)

Your assessor will be looking for:

Task 01 Identify the different data inputs received from different departments within an organisation

How to verify those data inputs to ensure data integrity.

Task 02

Identify the factors both inside and outside of the organisation that influence the company

resources

Analyse how do they impact on company objectives and business operations

(a)

-Provide constant feedback on the extent to which the projects are achieving their

goals.

-Identify potential problems at an early stage and propose possible solutions.

-Monitor the accessibility of the project to all sectors of the target population.

-Monitor the efficiency with which the different components of the project are being

implemented and suggest improvements.

(b)

-Provide guidelines for the planning of future projects.

-Influence sector assistance strategy. Relevant analysis from project and policy

evaluation can highlight the outcomes of previous interventions, and the strengths and

weaknesses of their implementation.

-Improve project design. Use of project design tools such as the log frame (logical

framework) results in systematic selection of indicators for monitoring project

performance. The process of selecting indicators for monitoring is a test of the

soundness of project objectives and can lead to improvements in project design.

Auditing and Reporting, Assessment 2, v1.0 Page 8

Activity – 03 Due: Week 4 10 Mark

(This activity is to completed both in class and at home)

Assessment description

Task 01: Why is it very important to monitor the Data inputs from different sources within an

organisation? Give an example. (4 marks)

Task 02: What are internal and external factors that influence the resources of an organisation? How

do they impact on organisation’s operations and objective?

(6

marks)

Your assessor will be looking for:

Task 01 Identify the different data inputs received from different departments within an organisation

How to verify those data inputs to ensure data integrity.

Task 02

Identify the factors both inside and outside of the organisation that influence the company

resources

Analyse how do they impact on company objectives and business operations

(a)

-Provide constant feedback on the extent to which the projects are achieving their

goals.

-Identify potential problems at an early stage and propose possible solutions.

-Monitor the accessibility of the project to all sectors of the target population.

-Monitor the efficiency with which the different components of the project are being

implemented and suggest improvements.

(b)

-Provide guidelines for the planning of future projects.

-Influence sector assistance strategy. Relevant analysis from project and policy

evaluation can highlight the outcomes of previous interventions, and the strengths and

weaknesses of their implementation.

-Improve project design. Use of project design tools such as the log frame (logical

framework) results in systematic selection of indicators for monitoring project

performance. The process of selecting indicators for monitoring is a test of the

soundness of project objectives and can lead to improvements in project design.

Auditing and Reporting, Assessment 2, v1.0 Page 8

T-1.8.1

-Incorporate views of stakeholders. Awareness is growing that participation by project

beneficiaries in design and implementation brings greater “ownership” of project

objectives and encourages the sustainability of project benefits. Ownership brings

accountability. Objectives should be set and indicators selected in consultation with

stakeholders, so that objectives and targets are jointly “owned”. The emergence of

recorded benefits early on helps reinforce ownership, and early warning of emerging

problems allows action to be taken before costs rise.

-Show need for mid-course corrections. A reliable flow of information during

implementation enables managers to keep track of progress and adjust operations to

take account of experience.

Activity – 04 Due: Week 5 10 Marks

(This activity to be completed both in class and at home)

Assessment description

Task 01: Imagine, you are an Internal Auditor of ACA and you meant to do following tasks. Please

justify your answer with examples.

i. What Monitoring techniques you can apply for documentation purpose. Please also advise which one do

you think is the most cost effective control? (4 Marks)

ii. What external influences do you need to consider while implementing those controls?

(3 Marks)

iii. State the important aspects of reviewing in the evaluation process? (3 Marks)

Your assessor will be looking for:

You judgement and analytical skills as an auditor to below aspects:

● Documentation techniques of Monitoring for internal control

● Capabilities and influences of stakeholders, competitors and regulators.

● Review process of evaluation.

Answer:

Business performance monitoring- for a successful business, full understanding of the

major sources of problems and opportunities is worth considerable. A business that is being

managed without fully understanding its sources opportunities as well as existing problems easily

results in unnecessary cost incurred or even loosing profit.

Another monitoring technique is the determining specifically whatever is being measured

and how it is measured. The process of determining what is being measured is appropriately

important for proper business monitoring this is supported by the common need of a fact-based

Auditing and Reporting, Assessment 2, v1.0 Page 9

-Incorporate views of stakeholders. Awareness is growing that participation by project

beneficiaries in design and implementation brings greater “ownership” of project

objectives and encourages the sustainability of project benefits. Ownership brings

accountability. Objectives should be set and indicators selected in consultation with

stakeholders, so that objectives and targets are jointly “owned”. The emergence of

recorded benefits early on helps reinforce ownership, and early warning of emerging

problems allows action to be taken before costs rise.

-Show need for mid-course corrections. A reliable flow of information during

implementation enables managers to keep track of progress and adjust operations to

take account of experience.

Activity – 04 Due: Week 5 10 Marks

(This activity to be completed both in class and at home)

Assessment description

Task 01: Imagine, you are an Internal Auditor of ACA and you meant to do following tasks. Please

justify your answer with examples.

i. What Monitoring techniques you can apply for documentation purpose. Please also advise which one do

you think is the most cost effective control? (4 Marks)

ii. What external influences do you need to consider while implementing those controls?

(3 Marks)

iii. State the important aspects of reviewing in the evaluation process? (3 Marks)

Your assessor will be looking for:

You judgement and analytical skills as an auditor to below aspects:

● Documentation techniques of Monitoring for internal control

● Capabilities and influences of stakeholders, competitors and regulators.

● Review process of evaluation.

Answer:

Business performance monitoring- for a successful business, full understanding of the

major sources of problems and opportunities is worth considerable. A business that is being

managed without fully understanding its sources opportunities as well as existing problems easily

results in unnecessary cost incurred or even loosing profit.

Another monitoring technique is the determining specifically whatever is being measured

and how it is measured. The process of determining what is being measured is appropriately

important for proper business monitoring this is supported by the common need of a fact-based

Auditing and Reporting, Assessment 2, v1.0 Page 9

T-1.8.1

analysis of data that helps in further focus effects on specifically very successful tactics.

Therefore, ready measurement as well has the capacity to make it clear I aiming for

improvements.

The most preferable monitoring technique is the business performing monitoring as its worth

considerable as the most cost effective control.

Activity – 05 Due: Week 5 20 Marks

(This activity to be completed both in class and at home)

Assessment description

This is a case study. Students are required to complete this task both in class and at home.

While in class, discuss the outcome, findings etc. with the teacher. At home, students can do

their own research by other reference books, internet etc.

Your assessor will be looking for:

The purpose of the case study is to relate the broad principles and features of a system of internal control

to a real world business application. As you identify the different components of an accounting system,

refer to the case study and see how the various features can be found. This case study will be used in the

assessment task at the end of

this section.

Case study – Audit of Downers Ltd.

Introduction

Samuel Vouch, an audit supervisor, has been assigned a new client, Downers Ltd. He is asked to

evaluate the company's internal control system with the object of preparing a preliminary audit program.

Vouch arranges to visit the company and speak to key personnel in the accounting department. He is

introduced to Frank Boss, the Managing Director, and a formal conversation is held:

A. Supervisor What I would like to do first is get as much formal information as possible on all

aspects of the company operations particularly those with a bearing on how

effectively the system of internal control operates.

M. Director Can you give me some examples of the type of information you require?

A. Supervisor A statement of operating policies, an organisation chart, a manual of

procedures, job specification files and duty lists for each position in the

company. And a manual of accounts.

M. Director Quite an exhaustive list. I'll give a secretary a buzz to see whether the files

exist. Our previous auditors put a lot of emphasis on the internal control

questionnaire. Will you do the same?

A. Supervisor Yes. It is an important audit technique for gathering facts about each area of

the internal control system.

I would like to catch up with your principal accounting officer in the next couple of

days. He should be able to help me answer a lot of the questions contained in

the ICQ.

Auditing and Reporting, Assessment 2, v1.0 Page 10

analysis of data that helps in further focus effects on specifically very successful tactics.

Therefore, ready measurement as well has the capacity to make it clear I aiming for

improvements.

The most preferable monitoring technique is the business performing monitoring as its worth

considerable as the most cost effective control.

Activity – 05 Due: Week 5 20 Marks

(This activity to be completed both in class and at home)

Assessment description

This is a case study. Students are required to complete this task both in class and at home.

While in class, discuss the outcome, findings etc. with the teacher. At home, students can do

their own research by other reference books, internet etc.

Your assessor will be looking for:

The purpose of the case study is to relate the broad principles and features of a system of internal control

to a real world business application. As you identify the different components of an accounting system,

refer to the case study and see how the various features can be found. This case study will be used in the

assessment task at the end of

this section.

Case study – Audit of Downers Ltd.

Introduction

Samuel Vouch, an audit supervisor, has been assigned a new client, Downers Ltd. He is asked to

evaluate the company's internal control system with the object of preparing a preliminary audit program.

Vouch arranges to visit the company and speak to key personnel in the accounting department. He is

introduced to Frank Boss, the Managing Director, and a formal conversation is held:

A. Supervisor What I would like to do first is get as much formal information as possible on all

aspects of the company operations particularly those with a bearing on how

effectively the system of internal control operates.

M. Director Can you give me some examples of the type of information you require?

A. Supervisor A statement of operating policies, an organisation chart, a manual of

procedures, job specification files and duty lists for each position in the

company. And a manual of accounts.

M. Director Quite an exhaustive list. I'll give a secretary a buzz to see whether the files

exist. Our previous auditors put a lot of emphasis on the internal control

questionnaire. Will you do the same?

A. Supervisor Yes. It is an important audit technique for gathering facts about each area of

the internal control system.

I would like to catch up with your principal accounting officer in the next couple of

days. He should be able to help me answer a lot of the questions contained in

the ICQ.

Auditing and Reporting, Assessment 2, v1.0 Page 10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

Samuel Vouch is given a guided tour of the company's office, purchasing and sales sections and the

warehouse. After brief exchanges with the financial accountant, the sales manager and the stores

supervisor, Vouch returns to the Managing Director's office. He receives the following documents/files:

(a) Organisation chart: refer work paper A2

(b) Statement of operating policies: refer work paper A3

(c) Manual of procedures: refer work paper A5

(d) Job specification files

(e) Manual of accounts.

To review the internal control procedures of a trading enterprise such as a wholesaler or a retailer, Vouch

divides the system into two main cycles:

(a) The revenue cycle which consists of sales (credit and cash), trade debtors and

cash receipts

(b) The payments cycle which consists of purchases (credit and cash), trade creditors and cash

payments (creditors and expenses, such as payroll)?

The manual of procedures for Downers Ltd was prepared quickly and unprofessionally at the inception of

the company. It provides Vouch with few details about the current sales, purchasing, and financial

operations.

Vouch's first aim, therefore, is to obtain up-to-date information. He decides to tackle the revenue cycle

first.

Vouch has detailed discussions with the various managers, supervisors and key employees. He also

briefly examines the various forms, documents and records produced by the finance and sales segments.

From this investigation, Vouch is able to prepare:

(a) Internal control questionnaires (ICQ) for sales, accounts receivable and cash receipts (refer to work

papers B1 -4)

(b) Flow charts of the above (refer to work papers (C1-3)

(c) Management letter of the internal control weaknesses for the systems covered above

(refer to work papers D1-3).

WORK PAPER A1

PREPARED BY S. Vouch

Client Downers Ltd

Period 30 June 1997

Extract from Memorandum of Association

1. Shares. Registered as a public company on 5 August 1978.

2. Objects of the company

Auditing and Reporting, Assessment 2, v1.0 Page 11

Samuel Vouch is given a guided tour of the company's office, purchasing and sales sections and the

warehouse. After brief exchanges with the financial accountant, the sales manager and the stores

supervisor, Vouch returns to the Managing Director's office. He receives the following documents/files:

(a) Organisation chart: refer work paper A2

(b) Statement of operating policies: refer work paper A3

(c) Manual of procedures: refer work paper A5

(d) Job specification files

(e) Manual of accounts.

To review the internal control procedures of a trading enterprise such as a wholesaler or a retailer, Vouch

divides the system into two main cycles:

(a) The revenue cycle which consists of sales (credit and cash), trade debtors and

cash receipts

(b) The payments cycle which consists of purchases (credit and cash), trade creditors and cash

payments (creditors and expenses, such as payroll)?

The manual of procedures for Downers Ltd was prepared quickly and unprofessionally at the inception of

the company. It provides Vouch with few details about the current sales, purchasing, and financial

operations.

Vouch's first aim, therefore, is to obtain up-to-date information. He decides to tackle the revenue cycle

first.

Vouch has detailed discussions with the various managers, supervisors and key employees. He also

briefly examines the various forms, documents and records produced by the finance and sales segments.

From this investigation, Vouch is able to prepare:

(a) Internal control questionnaires (ICQ) for sales, accounts receivable and cash receipts (refer to work

papers B1 -4)

(b) Flow charts of the above (refer to work papers (C1-3)

(c) Management letter of the internal control weaknesses for the systems covered above

(refer to work papers D1-3).

WORK PAPER A1

PREPARED BY S. Vouch

Client Downers Ltd

Period 30 June 1997

Extract from Memorandum of Association

1. Shares. Registered as a public company on 5 August 1978.

2. Objects of the company

Auditing and Reporting, Assessment 2, v1.0 Page 11

T-1.8.1

‘...to buy, import, sell and export, repair and generally deal in goods and merchandise, and without

restricting the foregoing, in particular to buy, import, sell and export, repair and deal in swimming pool

accessories, and leisure products.’

Auditing and Reporting, Assessment 2, v1.0 Page 12

‘...to buy, import, sell and export, repair and generally deal in goods and merchandise, and without

restricting the foregoing, in particular to buy, import, sell and export, repair and deal in swimming pool

accessories, and leisure products.’

Auditing and Reporting, Assessment 2, v1.0 Page 12

T-1.8.1

Client Downers Ltd

Period 30 June 1997

Extract from Statement of Operating Policies

Accounting Records and Control

1 Formal chart of accounts to be maintained.

2 General ledger and subsidiary ledger to be kept up-to-date and balanced at least monthly.

3 Budgets to be prepared covering:

(i) Revenue

(ii) Cash

(iii) Purchases

(iv) Operating expenses

(v) Capital expenditure.

4 Insurance policies to be maintained for all insurable risks.

5 Duties of accounting employees are to be rotated on a regular basis.

WORK PAPER A4

PREPARED BY S. Vouch

Client Downers Ltd

Period 30 June 1997

Extracts from Manual of Procedures

Sales and Debtors

General

The company distributes its products through two outlets:

(a) Retail counter and showroom

(b) Wholesale section and warehouse.

Auditing and Reporting, Assessment 2, v1.0 Page 13

WORK PAPER A3

PREPARED BY S. Vouch

Client Downers Ltd

Period 30 June 1997

Extract from Statement of Operating Policies

Accounting Records and Control

1 Formal chart of accounts to be maintained.

2 General ledger and subsidiary ledger to be kept up-to-date and balanced at least monthly.

3 Budgets to be prepared covering:

(i) Revenue

(ii) Cash

(iii) Purchases

(iv) Operating expenses

(v) Capital expenditure.

4 Insurance policies to be maintained for all insurable risks.

5 Duties of accounting employees are to be rotated on a regular basis.

WORK PAPER A4

PREPARED BY S. Vouch

Client Downers Ltd

Period 30 June 1997

Extracts from Manual of Procedures

Sales and Debtors

General

The company distributes its products through two outlets:

(a) Retail counter and showroom

(b) Wholesale section and warehouse.

Auditing and Reporting, Assessment 2, v1.0 Page 13

WORK PAPER A3

PREPARED BY S. Vouch

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Retail trade is exclusively cash and carry but wholesale trade may be for cash or by credit.

While a considerable volume of cash trade is normally undertaken the greater monetary value of sales

results from telephoned orders handled by the wholesale section.

Wholesale credit sales

1 Order clerk to enter details of credit sales on pre-numbered invoice sets of:

(i) White - original to customer (sent with goods)

(ii) Yellow - carrier's copy

(iii) Green - delivery docket (returned by customer)

(iv) Pink - sales order copy (retained in stores)

(v) Blue - accounts copy

2 Order clerk to contact credit department to determine credit standing of customer.

3 Carrier's copy to be signed by customer upon delivery and to be returned to despatch section on

same day.

4 Invoice price list to be reviewed by the sales manager at least monthly.

5 Credit returns - credit notes to be composed with receiving reports by despatch clerk.

Credit allowances - credit notes to be checked against applicable documentation by

accounts clerk.

All credit notes to be approved by the sales manager.

6 The following records are to be prepared by the accounts receivable section each month:

aged debtors’ trial balance

debtors’ statement

7 Credit manager to regularly review each customer’s credit limit, especially

overdue accounts.

Collections from debtors

1 Mail opener to prepare a daily listing of cheques received from debtors.

2 All debtors’ cheques to be passed on to Cashier's section for preparation of bank deposit slip (in

duplicate).

3 Cash receipts to be deposited daily at bank by company messenger.

4 Financial accountant to compare cheque listing against cash book at least weekly.

Questions: Please answer the following questions (4 * 5 = 20 Mark)

(a) List at least six material departures (internal control weaknesses) from the controls previously noted

(b) Explain why each material departure violates sound internal control principles.

(c) Identify the internal control weaknesses in the purchases and accounts payable systems

(d) Recommend alternate procedures which would overcome the weaknesses and strengthen internal

control in these areas.

Answer

(a) - Weaknesses in cash receipts

- Weakness in payroll system

-Weakness in internal audit control system

-Weakness in financial management internal control

-Weakness in maintaining of accuracy and integrity.

Auditing and Reporting, Assessment 2, v1.0 Page 14

Retail trade is exclusively cash and carry but wholesale trade may be for cash or by credit.

While a considerable volume of cash trade is normally undertaken the greater monetary value of sales

results from telephoned orders handled by the wholesale section.

Wholesale credit sales

1 Order clerk to enter details of credit sales on pre-numbered invoice sets of:

(i) White - original to customer (sent with goods)

(ii) Yellow - carrier's copy

(iii) Green - delivery docket (returned by customer)

(iv) Pink - sales order copy (retained in stores)

(v) Blue - accounts copy

2 Order clerk to contact credit department to determine credit standing of customer.

3 Carrier's copy to be signed by customer upon delivery and to be returned to despatch section on

same day.

4 Invoice price list to be reviewed by the sales manager at least monthly.

5 Credit returns - credit notes to be composed with receiving reports by despatch clerk.

Credit allowances - credit notes to be checked against applicable documentation by

accounts clerk.

All credit notes to be approved by the sales manager.

6 The following records are to be prepared by the accounts receivable section each month:

aged debtors’ trial balance

debtors’ statement

7 Credit manager to regularly review each customer’s credit limit, especially

overdue accounts.

Collections from debtors

1 Mail opener to prepare a daily listing of cheques received from debtors.

2 All debtors’ cheques to be passed on to Cashier's section for preparation of bank deposit slip (in

duplicate).

3 Cash receipts to be deposited daily at bank by company messenger.

4 Financial accountant to compare cheque listing against cash book at least weekly.

Questions: Please answer the following questions (4 * 5 = 20 Mark)

(a) List at least six material departures (internal control weaknesses) from the controls previously noted

(b) Explain why each material departure violates sound internal control principles.

(c) Identify the internal control weaknesses in the purchases and accounts payable systems

(d) Recommend alternate procedures which would overcome the weaknesses and strengthen internal

control in these areas.

Answer

(a) - Weaknesses in cash receipts

- Weakness in payroll system

-Weakness in internal audit control system

-Weakness in financial management internal control

-Weakness in maintaining of accuracy and integrity.

Auditing and Reporting, Assessment 2, v1.0 Page 14

T-1.8.1

(b)

-The weakness in cash receipt is a factor hindering smooth operation of internal control.It’s

not enough to simply create an overall cash handling policy.

-For the weakness in payroll system, Human resources should establish clear procedures for

requesting time off and changes to employee pay rates. Signatures should be required for

any transaction affecting an employee's rate of pay or payroll processing.

- Internal controls represent the specific policies the business owner, manager and

employees must follow in the business. Internal audit control systems have a few

weaknesses that business owners must address.

(c)

-Weakness in the reconciliation activities- Performing monthly ledger reconciliations to catch

improper charges and validate transaction has been realized to fail in reaching the expected

standards.

-Weakness in securing assets- this has contributed in poor account for resources. therefore

periodically counting for inventory and compare the results with amounts is not fully shown on

control records.

- Weakness in Accountability, authorization, and approval- Accountability ensures that you

authorize, review, and approve invoices for payment based on signed agreements, contract

terms, and purchase orders. This has not been fully possible as always expected.

(d)

The recommendable alternative is Separation of duties- this step can enhance ensuring that

payment documents are processed correctly by having different people involved in the

payment process. This principle is called separation of duties.

Questionnaires on internal control

Introductory note

'Yes' signifies that the procedure is satisfactory and conforms to sound principles of

internal control.

Auditing and Reporting, Assessment 2, v1.0 Page 15

(b)

-The weakness in cash receipt is a factor hindering smooth operation of internal control.It’s

not enough to simply create an overall cash handling policy.

-For the weakness in payroll system, Human resources should establish clear procedures for

requesting time off and changes to employee pay rates. Signatures should be required for

any transaction affecting an employee's rate of pay or payroll processing.

- Internal controls represent the specific policies the business owner, manager and

employees must follow in the business. Internal audit control systems have a few

weaknesses that business owners must address.

(c)

-Weakness in the reconciliation activities- Performing monthly ledger reconciliations to catch

improper charges and validate transaction has been realized to fail in reaching the expected

standards.

-Weakness in securing assets- this has contributed in poor account for resources. therefore

periodically counting for inventory and compare the results with amounts is not fully shown on

control records.

- Weakness in Accountability, authorization, and approval- Accountability ensures that you

authorize, review, and approve invoices for payment based on signed agreements, contract

terms, and purchase orders. This has not been fully possible as always expected.

(d)

The recommendable alternative is Separation of duties- this step can enhance ensuring that

payment documents are processed correctly by having different people involved in the

payment process. This principle is called separation of duties.

Questionnaires on internal control

Introductory note

'Yes' signifies that the procedure is satisfactory and conforms to sound principles of

internal control.

Auditing and Reporting, Assessment 2, v1.0 Page 15

T-1.8.1

'No' indicates that the procedure and associated controls are not carried out

by the business or that the procedure may not be carried out according to sound principles of internal

control. For example, the employee who performs the particular task may also carry out other conflicting

tasks or some internal check may be absent (for instance documents are prepared but they are not pre-

numbered).

'N/A' indicates that the procedure does not apply because the relevant transaction is not undertaken by

this business or specific documents, records or internal checks relating to this procedure are not carried

out.

'Employee or authorising body' represents the individual or group which performs one of the following

functions:

(a) authorisation of transaction

(b) recording of transaction

(c) custody of assets resulting from transaction

(d) approval of transaction.

Comments: 'No' answers usually signify a ‘major’ or ‘minor’ internal control weakness. A brief description

of the weakness and any other procedure carried out which would reduce the audit significance of the

weakness should be noted here.

Auditing and Reporting, Assessment 2, v1.0 Page 16

'No' indicates that the procedure and associated controls are not carried out

by the business or that the procedure may not be carried out according to sound principles of internal

control. For example, the employee who performs the particular task may also carry out other conflicting

tasks or some internal check may be absent (for instance documents are prepared but they are not pre-

numbered).

'N/A' indicates that the procedure does not apply because the relevant transaction is not undertaken by

this business or specific documents, records or internal checks relating to this procedure are not carried

out.

'Employee or authorising body' represents the individual or group which performs one of the following

functions:

(a) authorisation of transaction

(b) recording of transaction

(c) custody of assets resulting from transaction

(d) approval of transaction.

Comments: 'No' answers usually signify a ‘major’ or ‘minor’ internal control weakness. A brief description

of the weakness and any other procedure carried out which would reduce the audit significance of the

weakness should be noted here.

Auditing and Reporting, Assessment 2, v1.0 Page 16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

T-1.8.1

WORK PAPER B1

PREPARED BY S. Vouch

Questionnaire on Internal Control

Sales

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

1 Are all sales orders received from

customers in writing?

Sales order

clerk

Minor weakness –

industry practice

2 If not, how are sales orders

received? (list)

combination of mail, telephone

and

over the counter orders

3 Is there approval of:

(a) acceptance of customer order?

(b) credit rating?

(c) price and discounts?

(d) terms?

Credit officer Major weakness:

no written credit

authorisation.

Prices are inserted by

Sales order clerk from

official price list.

4 Is the customer’s credit limit

regularly reviewed?

Credit manager Major weakness:

only subject to a

thorough examination if

account

is overdue.

5 Are delivery dockets prepared for all

outward movements of goods:

(a) Pre-numbered?

(b) checked with invoice and

cross-referenced?

(c) accounted for in regard to

sequence (including cancelled

dockets)?

Sales order

clerk

Sales order

clerk

Delivery docket is a

copy of invoice

Major weakness:

no evidence that all

deliveries are made to

customers

6 Are goods delivered only on pre-

numbered stock requisition or

delivery docket?

Despatch clerk

7 Are goods compared with packing

slip or delivery docket or invoice prior

to delivery?

Despatch clerk

8 Is proof of delivery accounted for

filed?

Despatch

section

Carrier’s copy is signed

by customer and filed.

Auditing and Reporting, Assessment 2, v1.0 Page 17

Client Downers Ltd

Period 30 June 1997

WORK PAPER B1

PREPARED BY S. Vouch

Questionnaire on Internal Control

Sales

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

1 Are all sales orders received from

customers in writing?

Sales order

clerk

Minor weakness –

industry practice

2 If not, how are sales orders

received? (list)

combination of mail, telephone

and

over the counter orders

3 Is there approval of:

(a) acceptance of customer order?

(b) credit rating?

(c) price and discounts?

(d) terms?

Credit officer Major weakness:

no written credit

authorisation.

Prices are inserted by

Sales order clerk from

official price list.

4 Is the customer’s credit limit

regularly reviewed?

Credit manager Major weakness:

only subject to a

thorough examination if

account

is overdue.

5 Are delivery dockets prepared for all

outward movements of goods:

(a) Pre-numbered?

(b) checked with invoice and

cross-referenced?

(c) accounted for in regard to

sequence (including cancelled

dockets)?

Sales order

clerk

Sales order

clerk

Delivery docket is a

copy of invoice

Major weakness:

no evidence that all

deliveries are made to

customers

6 Are goods delivered only on pre-

numbered stock requisition or

delivery docket?

Despatch clerk

7 Are goods compared with packing

slip or delivery docket or invoice prior

to delivery?

Despatch clerk

8 Is proof of delivery accounted for

filed?

Despatch

section

Carrier’s copy is signed

by customer and filed.

Auditing and Reporting, Assessment 2, v1.0 Page 17

Client Downers Ltd

Period 30 June 1997

T-1.8.1

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor weaknesses)

9 Are invoices:

(a) prepared (if so, give number

of copies)?

(b) pre-numbered?

Sales order

clerk

Printer

Five copies

10 Is the invoice sequence checked at

time of recording (including

cancelled invoices)?

Sales order

clerk

11 Are invoiced prices determined from

price lists

(a) properly authorised?

(b) regularly updated?

Sales order

clerk

12 Are invoices checked by an

independent employee as to:

(a) prices?

(b) extensions and additions?

(c) discounts?

(d) correlation with delivery dockets?

}Sales manager

Major weakness:

No internal check over

accuracy and validity of

invoice details.

13 Are stocks of and issue of unused

delivery dockets and invoices

properly controlled?

Stationery

officer

Delivery docket is a carbon

copy of invoice

14 Is there a check between the total of

the invoices prepared by the

Invoicing department and the total

charged to customer accounts by the

ledger keeper?

Accounts clerk

15 Are complaints, both written and

telephoned from customers sent

direct to Sales manager? If not, to

whom?

Major weakness:

Complaints are handled by

Sales order clerk.

No independent check on

the validity of complaints.

16 Are credit notes raised for all returns

and allowances:

(a) pre-numbered?

(b) compared with supporting data

and receiving reports where

required?

(c) properly authorised?

(d) all accounted for (including

cancelled notes) and

authorisations checked?

(e) recorded daily in sales returns

and allowances journal?

Printer

Despatch clerk

- returns

Accounts clerk

-

allowances

Sales manager

Machine ledger

keeper

Major weakness:

No guarantee that credit

notes raised for all returns

and allowances.

Auditing and Reporting, Assessment 2, v1.0 Page 18

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor weaknesses)

9 Are invoices:

(a) prepared (if so, give number

of copies)?

(b) pre-numbered?

Sales order

clerk

Printer

Five copies

10 Is the invoice sequence checked at

time of recording (including

cancelled invoices)?

Sales order

clerk

11 Are invoiced prices determined from

price lists

(a) properly authorised?

(b) regularly updated?

Sales order

clerk

12 Are invoices checked by an

independent employee as to:

(a) prices?

(b) extensions and additions?

(c) discounts?

(d) correlation with delivery dockets?

}Sales manager

Major weakness:

No internal check over

accuracy and validity of

invoice details.

13 Are stocks of and issue of unused

delivery dockets and invoices

properly controlled?

Stationery

officer

Delivery docket is a carbon

copy of invoice

14 Is there a check between the total of

the invoices prepared by the

Invoicing department and the total

charged to customer accounts by the

ledger keeper?

Accounts clerk

15 Are complaints, both written and

telephoned from customers sent

direct to Sales manager? If not, to

whom?

Major weakness:

Complaints are handled by

Sales order clerk.

No independent check on

the validity of complaints.

16 Are credit notes raised for all returns

and allowances:

(a) pre-numbered?

(b) compared with supporting data

and receiving reports where

required?

(c) properly authorised?

(d) all accounted for (including

cancelled notes) and

authorisations checked?

(e) recorded daily in sales returns

and allowances journal?

Printer

Despatch clerk

- returns

Accounts clerk

-

allowances

Sales manager

Machine ledger

keeper

Major weakness:

No guarantee that credit

notes raised for all returns

and allowances.

Auditing and Reporting, Assessment 2, v1.0 Page 18

T-1.8.1

WORK PAPER B2

PREPARED BY S. Vouch

Questionnaire on Internal Control

Accounts receivable

Client Downers Ltd

Period 30 June 1997

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

Accounts receivable

1 In a separate debtor’s ledger

maintained?

Accounts

receivable clerk

2 If so:

(a) is it balanced monthly?

(b) is the total of the individual

accounts regularly compared to

the control account in the

general ledger?

Accounts

receivable clerk

Financial

accountant

3 Do bookkeepers on accounts

receivables perform any duties other

than recording of this ledger?

Examine debtor’s

statements. Handle

disputed items on

statements

4 Are these bookkeepers rotated?

Debtors statement

5 Are monthly debtors

statements prepared?

6 If so, are they:

(a) sent to all debtors?

(b) checked to the debtor’s ledger

before despatch?

(c) mailed independently of cashier

and bookkeeper?

Mailing section

Mailing section

Minor weakness:

Random sample of

statements are checked

by Accounts receivable

officer

7 Are disputed items or

statements investigated?

Accounts

receivable clerk

8 Are credit balances properly watched

and handled?

Accounts

receivable clerk

9 Is the payment of credit balances

properly approved?

Financial

accountant

Auditing and Reporting, Assessment 2, v1.0 Page 19

WORK PAPER B2

PREPARED BY S. Vouch

Questionnaire on Internal Control

Accounts receivable

Client Downers Ltd

Period 30 June 1997

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

Accounts receivable

1 In a separate debtor’s ledger

maintained?

Accounts

receivable clerk

2 If so:

(a) is it balanced monthly?

(b) is the total of the individual

accounts regularly compared to

the control account in the

general ledger?

Accounts

receivable clerk

Financial

accountant

3 Do bookkeepers on accounts

receivables perform any duties other

than recording of this ledger?

Examine debtor’s

statements. Handle

disputed items on

statements

4 Are these bookkeepers rotated?

Debtors statement

5 Are monthly debtors

statements prepared?

6 If so, are they:

(a) sent to all debtors?

(b) checked to the debtor’s ledger

before despatch?

(c) mailed independently of cashier

and bookkeeper?

Mailing section

Mailing section

Minor weakness:

Random sample of

statements are checked

by Accounts receivable

officer

7 Are disputed items or

statements investigated?

Accounts

receivable clerk

8 Are credit balances properly watched

and handled?

Accounts

receivable clerk

9 Is the payment of credit balances

properly approved?

Financial

accountant

Auditing and Reporting, Assessment 2, v1.0 Page 19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

T-1.8.1

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

Credit control

10 Are debtor’s accounts aged

monthly?

Accounts

receivable clerk

11 Is any independent check made of

the ageing analysis?

Credit officer

12 Are overdue accounts periodically

reviewed and followed up by a

senior official?

Credit officer

13 Are bad debt write-offs:

(a) supported by proper

documentation?

(b) approved by an independent

senior official?

Credit manager

Minor weakness:

Bad debt write-offs are

initiated by the credit

department. No

independent check on

whether these write offs

are bona fide.

14 Are accounts written off:

(a) controlled by an independent

senior official?

(b) regularly reviewed?

Major weakness:

No control is exercised

over accounts once they

are written off except if

partial payments are

subsequently received.

15 Are accounts confirmed on a

surprise basis at reasonable

intervals by responsible officials?

Serious weakness:

because there are no

offsetting procedures to

check the accuracy of

each debtors account.

Auditing and Reporting, Assessment 2, v1.0 Page 20

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

Credit control

10 Are debtor’s accounts aged

monthly?

Accounts

receivable clerk

11 Is any independent check made of

the ageing analysis?

Credit officer

12 Are overdue accounts periodically

reviewed and followed up by a

senior official?

Credit officer

13 Are bad debt write-offs:

(a) supported by proper

documentation?

(b) approved by an independent

senior official?

Credit manager

Minor weakness:

Bad debt write-offs are

initiated by the credit

department. No

independent check on

whether these write offs

are bona fide.

14 Are accounts written off:

(a) controlled by an independent

senior official?

(b) regularly reviewed?

Major weakness:

No control is exercised

over accounts once they

are written off except if

partial payments are

subsequently received.

15 Are accounts confirmed on a

surprise basis at reasonable

intervals by responsible officials?

Serious weakness:

because there are no

offsetting procedures to

check the accuracy of

each debtors account.

Auditing and Reporting, Assessment 2, v1.0 Page 20

T-1.8.1

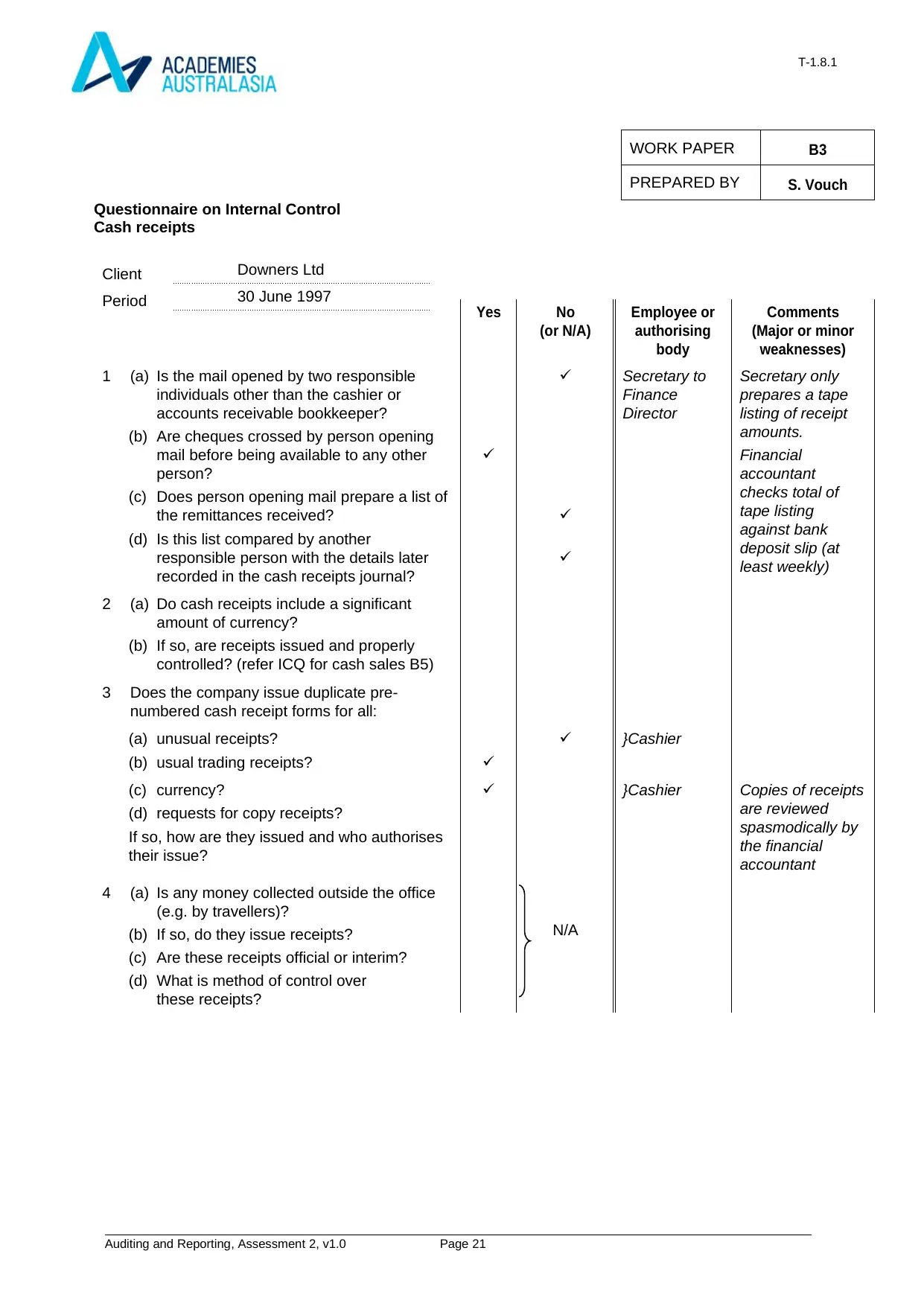

WORK PAPER B3

PREPARED BY S. Vouch

Questionnaire on Internal Control

Cash receipts

Yes No

(or N/A)

Employee or

authorising

body

Comments

(Major or minor

weaknesses)

1 (a) Is the mail opened by two responsible