Mining Giants: BHP vs Rio Tinto

VerifiedAdded on 2020/06/05

|33

|10149

|34

AI Summary

This assignment presents a comparative analysis of two leading mining companies: BHP Billiton and Rio Tinto. It delves into their market shares across various commodities, examines their financial performance by analyzing key ratios like return on assets (ROA), and explores their operational strengths and areas of focus.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Financial Analysis

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

1. BUSINESS AND STRATEGIC ANALYSIS.............................................................................1

Macro economic factors impaction the performance of business..........................................1

Place of Company in mining industry....................................................................................2

Competitors of BHP Billiton limited......................................................................................3

Porter five forces to analyse current profitability...................................................................4

Growth potential of an organisation.......................................................................................5

Competitive strategy, key success factors and risk drivers....................................................6

Corporate strategy used by BHP Billiton limited...................................................................7

2. ACCOUNTING ANALYSIS......................................................................................................7

3. FINANCIAL ANALYSIS...........................................................................................................8

4. PROSPECTIVE ANALYSIS....................................................................................................16

5. RECOMMENDATION.............................................................................................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

APPENDIX....................................................................................................................................21

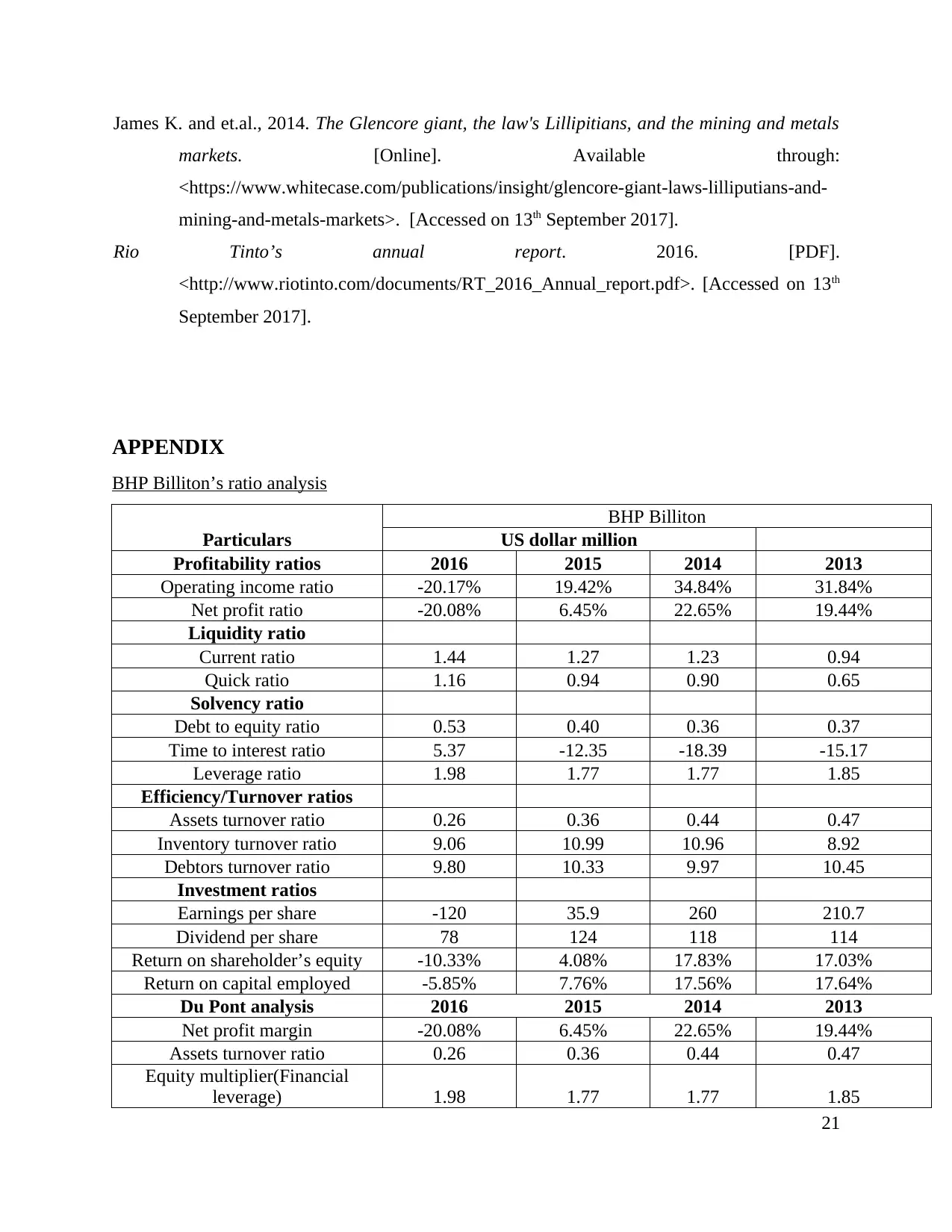

BHP Billiton’s ratio analysis................................................................................................21

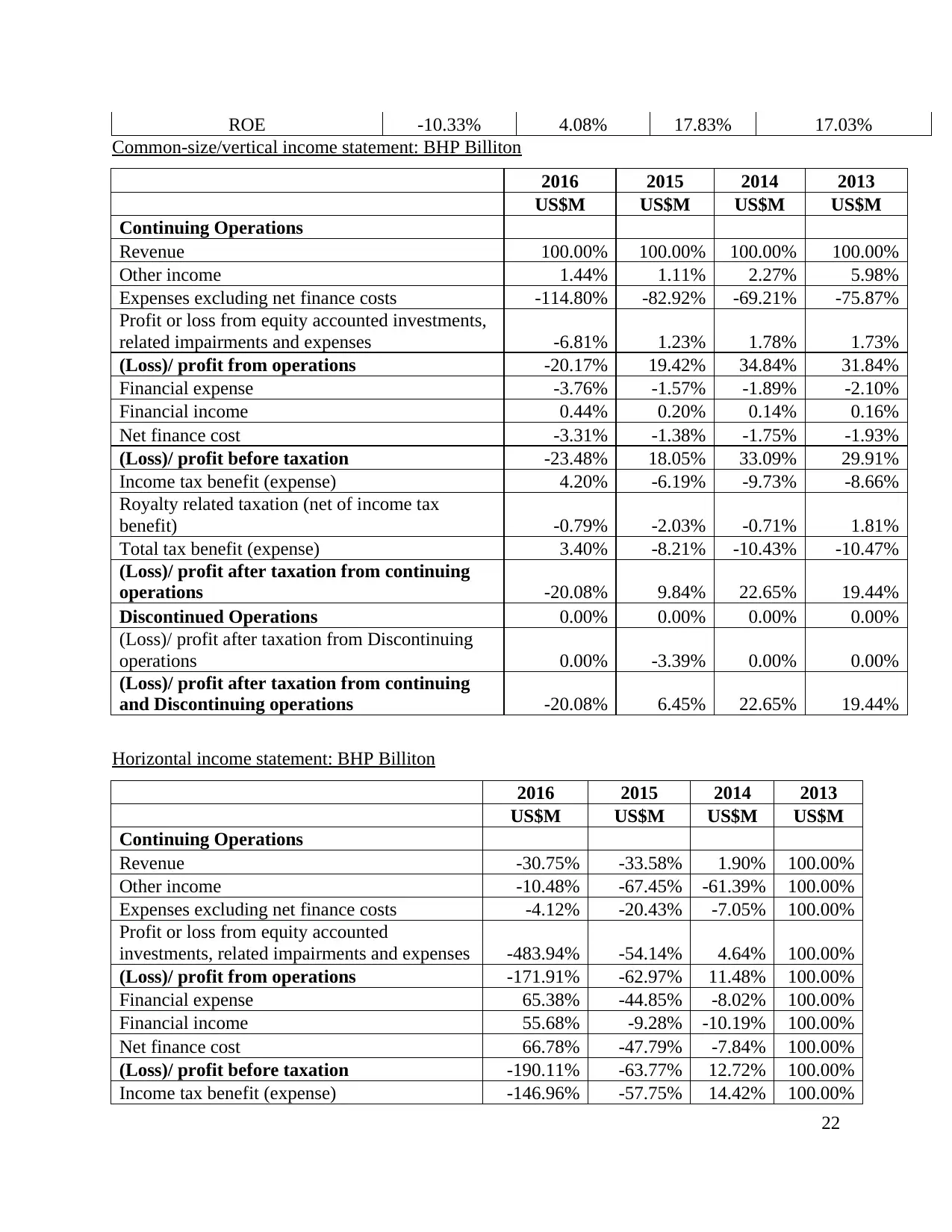

Common-size/vertical income statement: BHP Billiton......................................................22

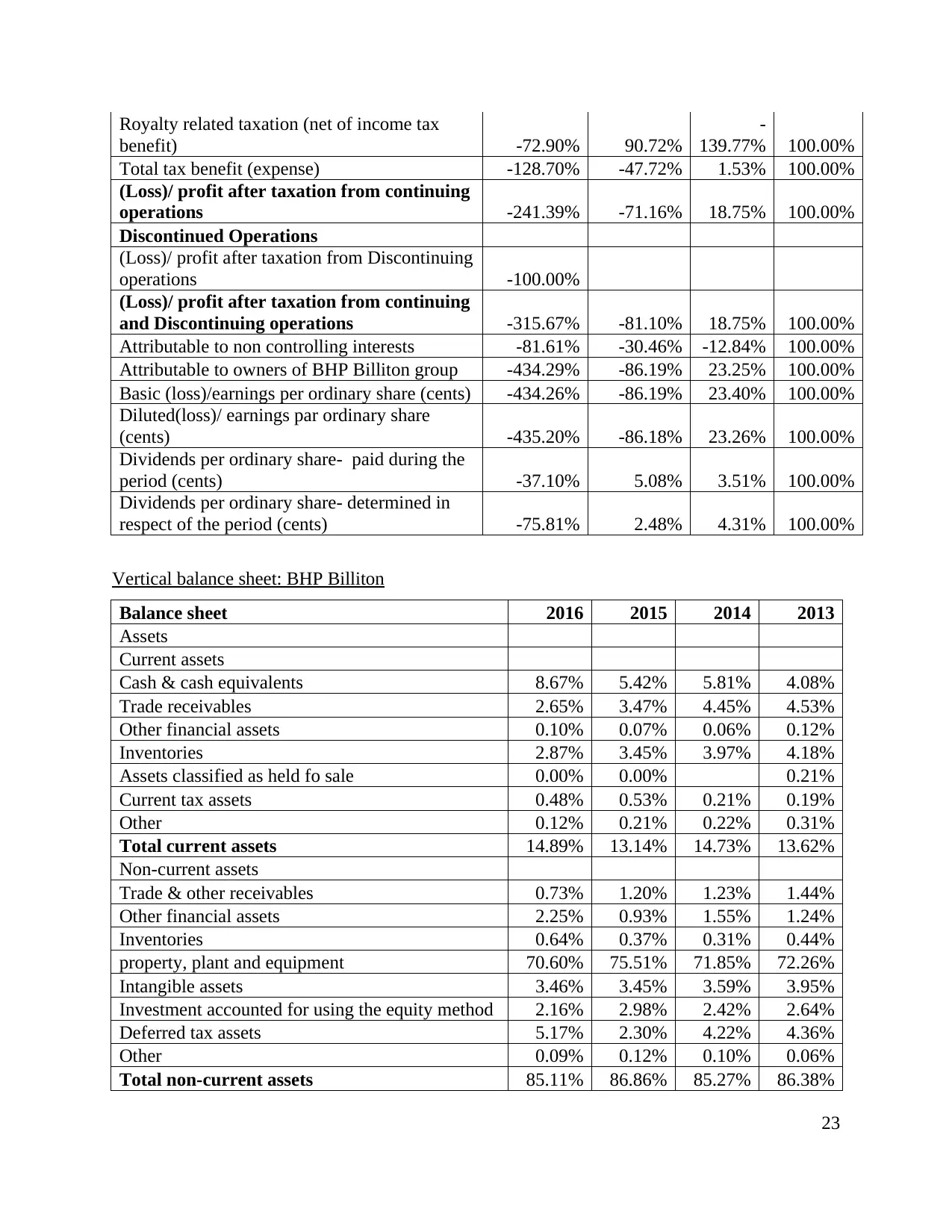

Horizontal income statement: BHP Billiton.........................................................................22

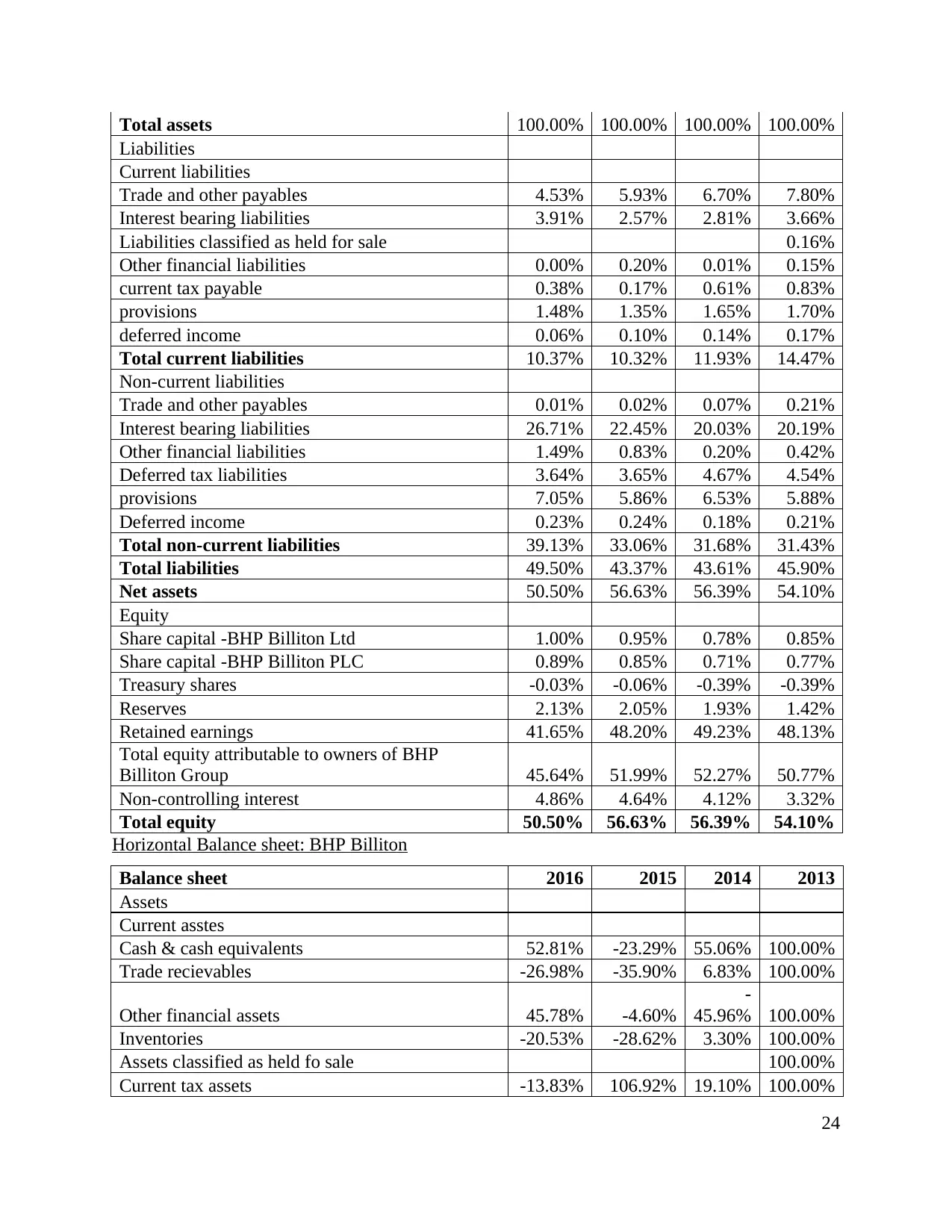

Vertical balance sheet: BHP Billiton....................................................................................23

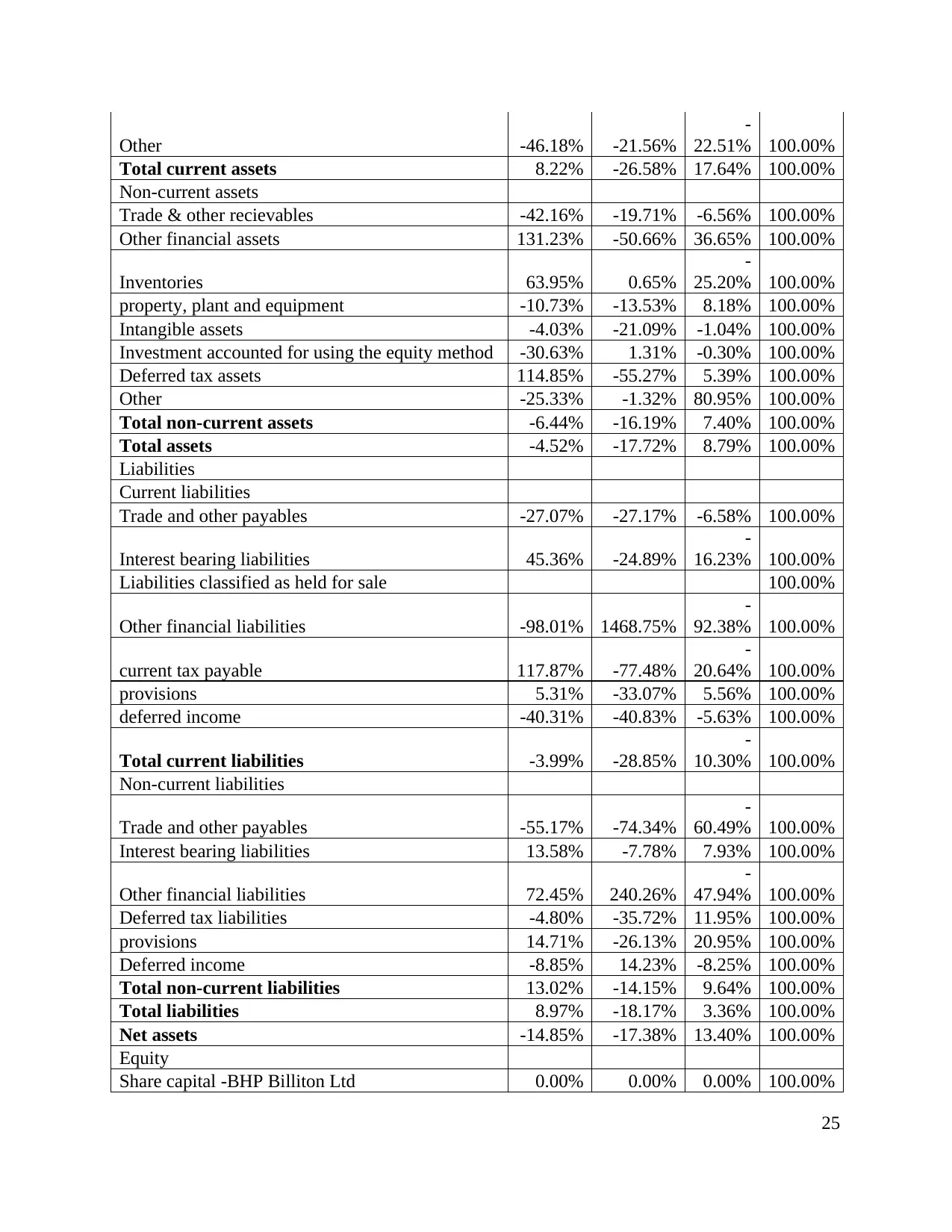

Horizontal Balance sheet: BHP Billiton...............................................................................24

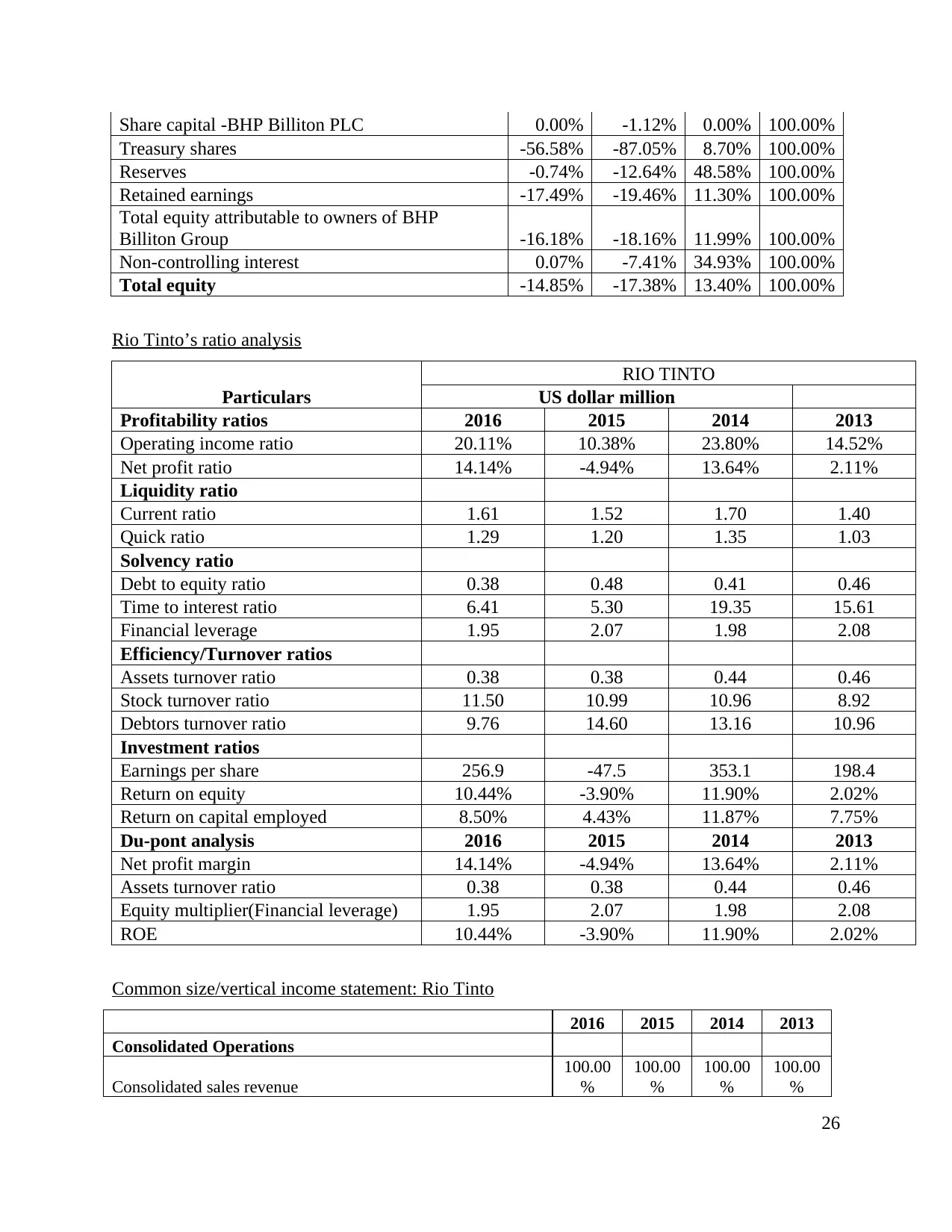

Rio Tinto’s ratio analysis......................................................................................................26

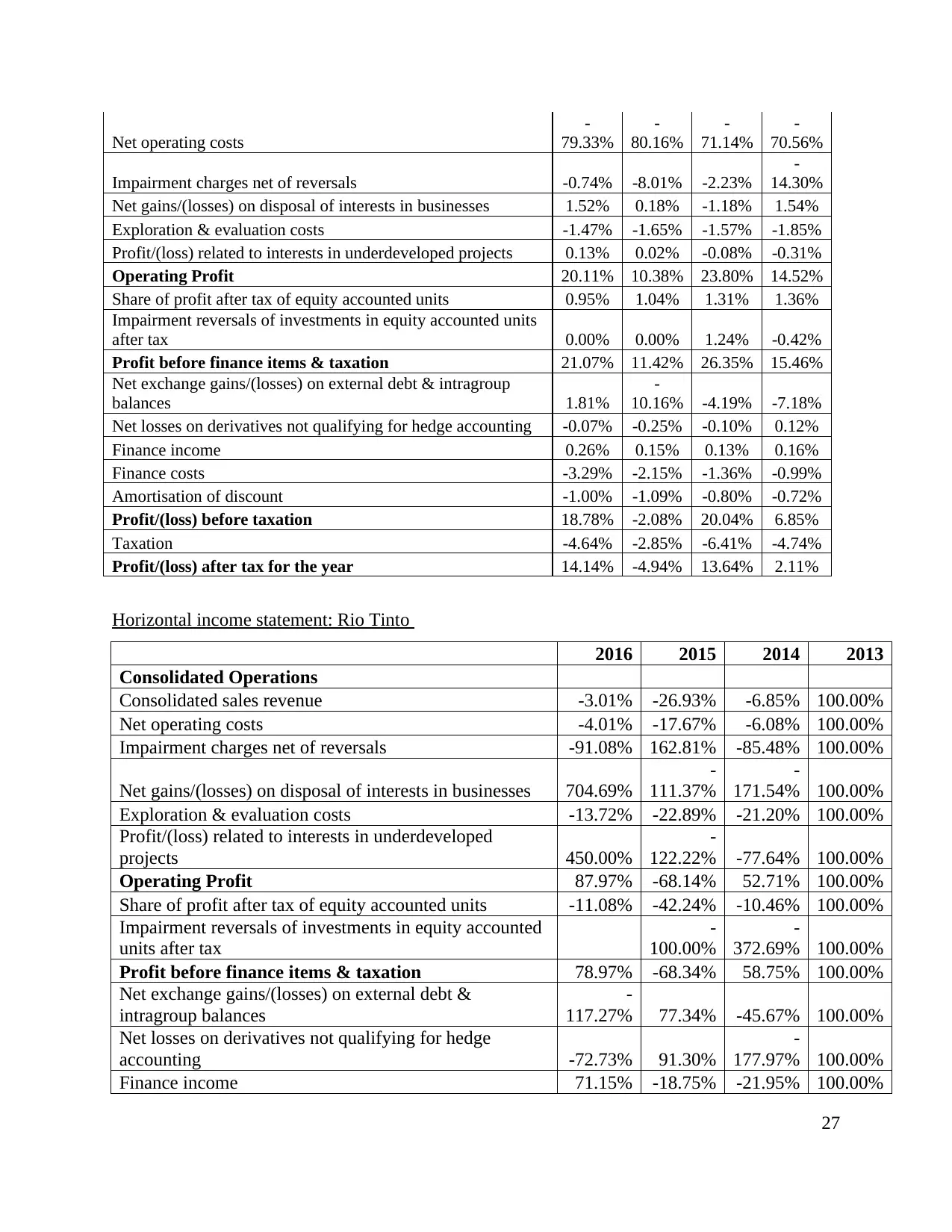

Common size/vertical income statement: Rio Tinto............................................................27

Horizontal income statement: Rio Tinto..............................................................................27

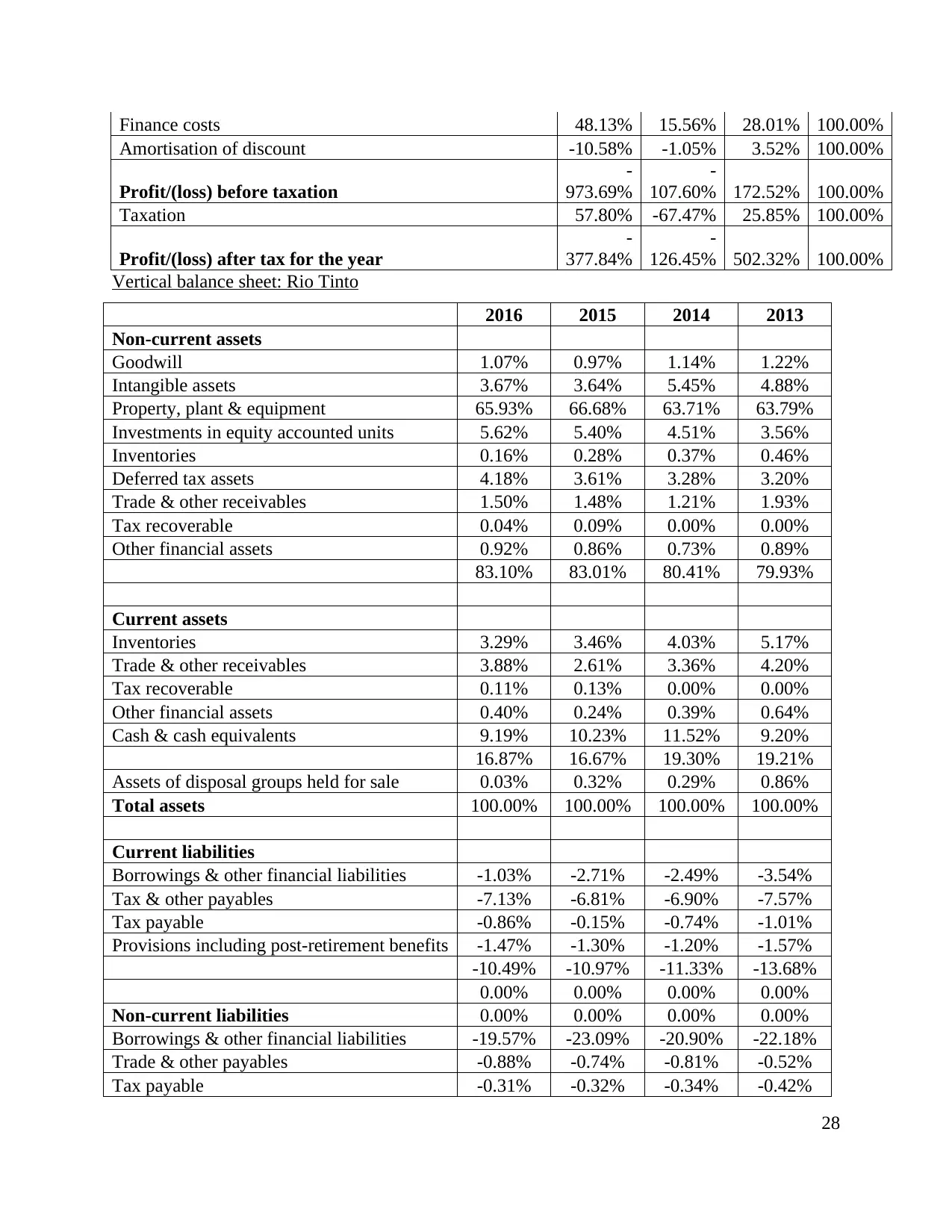

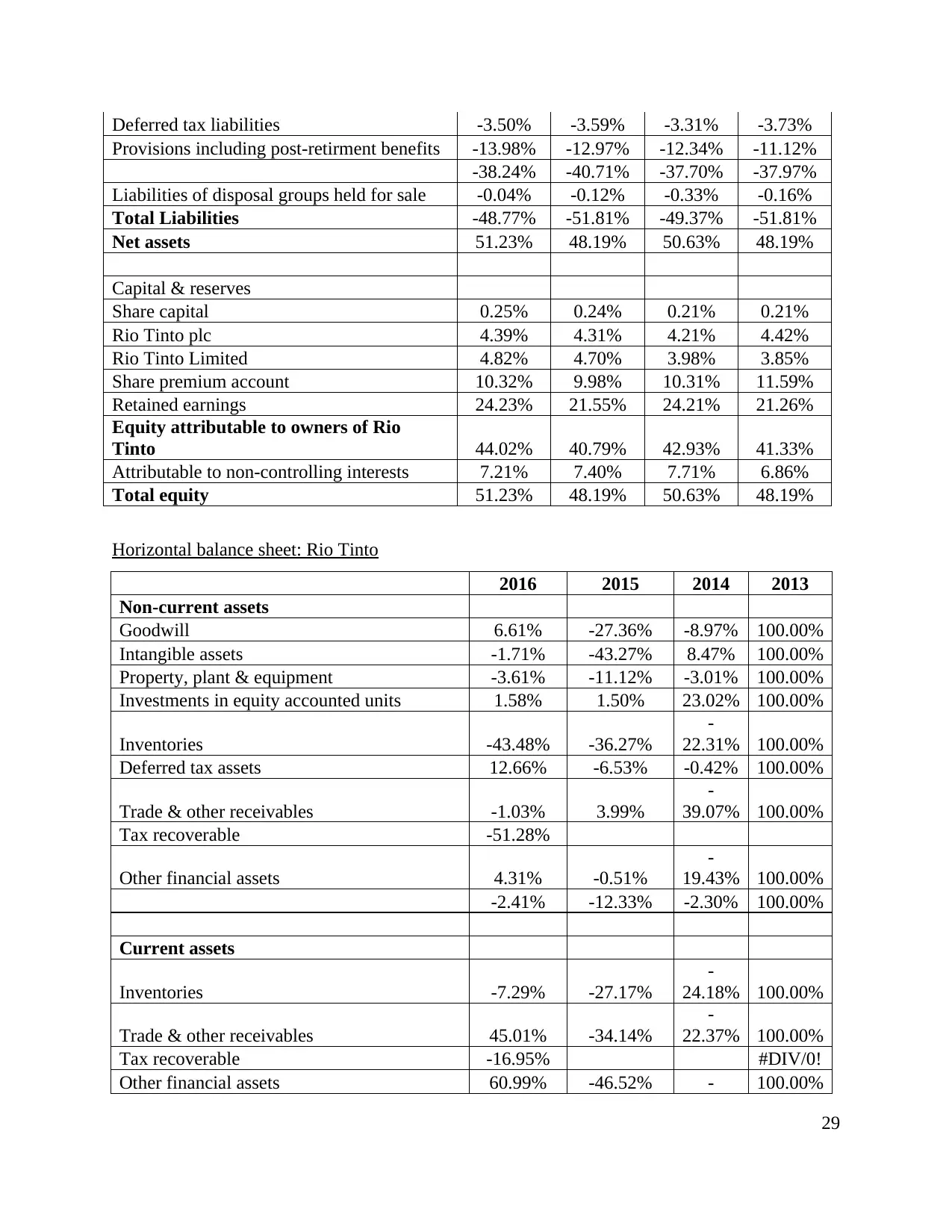

Vertical balance sheet: Rio Tinto.........................................................................................28

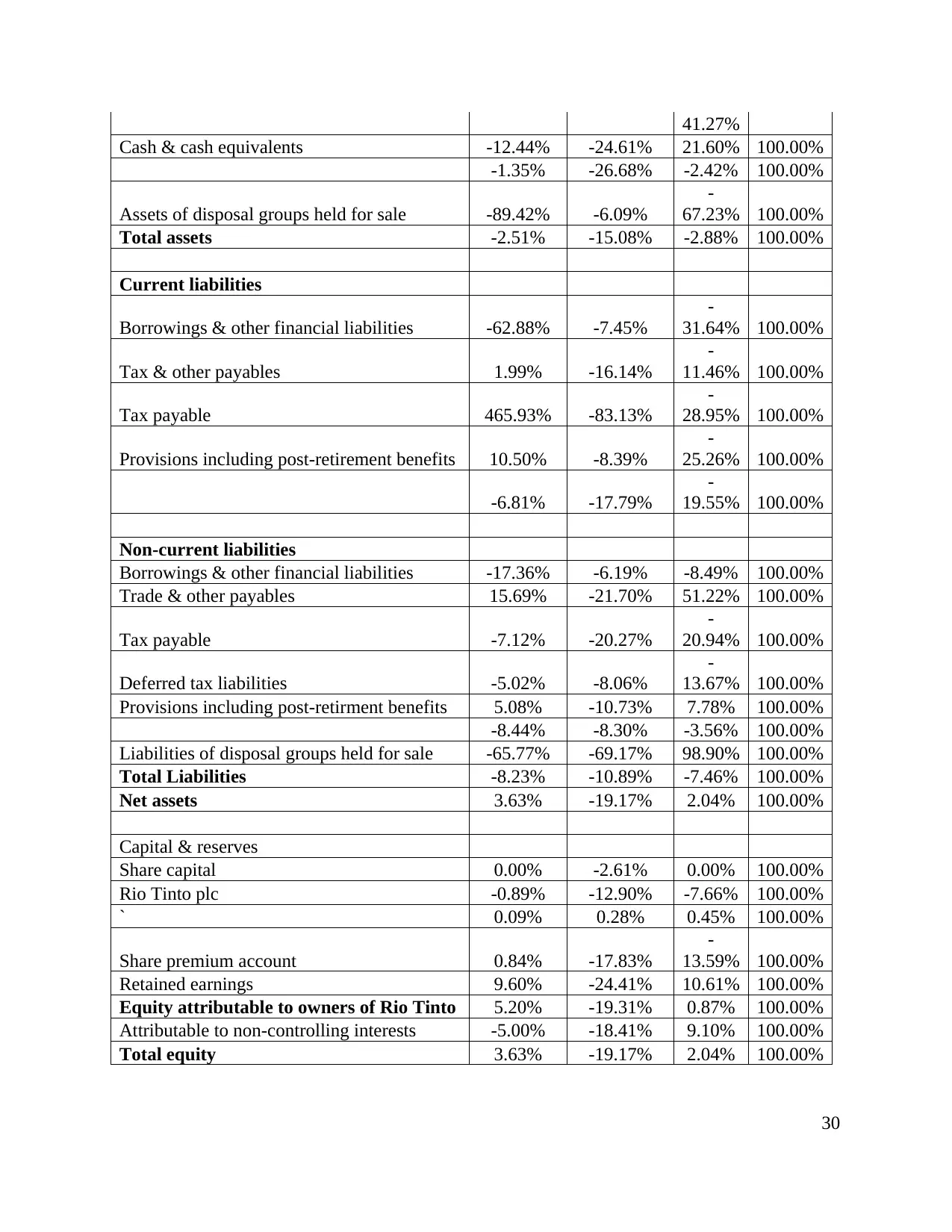

Horizontal balance sheet: Rio Tinto.....................................................................................29

INTRODUCTION...........................................................................................................................1

1. BUSINESS AND STRATEGIC ANALYSIS.............................................................................1

Macro economic factors impaction the performance of business..........................................1

Place of Company in mining industry....................................................................................2

Competitors of BHP Billiton limited......................................................................................3

Porter five forces to analyse current profitability...................................................................4

Growth potential of an organisation.......................................................................................5

Competitive strategy, key success factors and risk drivers....................................................6

Corporate strategy used by BHP Billiton limited...................................................................7

2. ACCOUNTING ANALYSIS......................................................................................................7

3. FINANCIAL ANALYSIS...........................................................................................................8

4. PROSPECTIVE ANALYSIS....................................................................................................16

5. RECOMMENDATION.............................................................................................................17

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

APPENDIX....................................................................................................................................21

BHP Billiton’s ratio analysis................................................................................................21

Common-size/vertical income statement: BHP Billiton......................................................22

Horizontal income statement: BHP Billiton.........................................................................22

Vertical balance sheet: BHP Billiton....................................................................................23

Horizontal Balance sheet: BHP Billiton...............................................................................24

Rio Tinto’s ratio analysis......................................................................................................26

Common size/vertical income statement: Rio Tinto............................................................27

Horizontal income statement: Rio Tinto..............................................................................27

Vertical balance sheet: Rio Tinto.........................................................................................28

Horizontal balance sheet: Rio Tinto.....................................................................................29

INTRODUCTION

Financial analysis is of great importance for the firm as it helps in making strategies

according to growth and development of business. Analysing financials of the BHP Billiton

assists the management in establishing reliability, viability, stability and profitability of business.

BHP Billiton is the second largest chain in mining industry. The report will outline the various

business strategies used by the business to analysis its strength and strategies which assist the

enterprise in dealing with fluctuations. Moreover, it will evaluate competition and corporate

strategies used by BHP to attain competitive advantage. Further, the report will outline annual

report data of BHP and its competitors which helps the company to make stability in the mining

industry.

1. BUSINESS AND STRATEGIC ANALYSIS

Macro economic factors impaction the performance of business.

In order to analyse competitive performance the company first focus on analysing in

macro economic factors with the use of PEST analysis which is as follows: Political: BHP Billiton is a leading mining organisation which is adapts changes as per

the political risk and fluctuations. Whereas there are few factors which are impacting the

growth and development of business in the industry. The major impact is caused by

changing government policies, rent agreements, terrorism, liberal leaders and many more.

For instance, the mandatory compliance of Mineral and petroleum resources development

act 2002 led to a major financial loss to firm. Economical: The fluctuation in expense, material, cost, labour can impact the growth and

development plans of enterprise. BHP Billiton is juggling to maintain stability with

changing economic factors but the loopholes in global economic factors are affecting net

turnover and demand and supply of products and services. Socio cultural: The company follows all the possible policies and procedures which can

affect the socio culture (Mauree and Geneletti 2017). Theses factors are depended on the

support provided by enterprise to neighbouring communities therefore BHP Billiton has

taken steps to maintaining appropriate working conditions, quality of life to most

neighbouring cities. For instance, currently the company is focusing on supporting its

neighbour Antofagasta.

1

Financial analysis is of great importance for the firm as it helps in making strategies

according to growth and development of business. Analysing financials of the BHP Billiton

assists the management in establishing reliability, viability, stability and profitability of business.

BHP Billiton is the second largest chain in mining industry. The report will outline the various

business strategies used by the business to analysis its strength and strategies which assist the

enterprise in dealing with fluctuations. Moreover, it will evaluate competition and corporate

strategies used by BHP to attain competitive advantage. Further, the report will outline annual

report data of BHP and its competitors which helps the company to make stability in the mining

industry.

1. BUSINESS AND STRATEGIC ANALYSIS

Macro economic factors impaction the performance of business.

In order to analyse competitive performance the company first focus on analysing in

macro economic factors with the use of PEST analysis which is as follows: Political: BHP Billiton is a leading mining organisation which is adapts changes as per

the political risk and fluctuations. Whereas there are few factors which are impacting the

growth and development of business in the industry. The major impact is caused by

changing government policies, rent agreements, terrorism, liberal leaders and many more.

For instance, the mandatory compliance of Mineral and petroleum resources development

act 2002 led to a major financial loss to firm. Economical: The fluctuation in expense, material, cost, labour can impact the growth and

development plans of enterprise. BHP Billiton is juggling to maintain stability with

changing economic factors but the loopholes in global economic factors are affecting net

turnover and demand and supply of products and services. Socio cultural: The company follows all the possible policies and procedures which can

affect the socio culture (Mauree and Geneletti 2017). Theses factors are depended on the

support provided by enterprise to neighbouring communities therefore BHP Billiton has

taken steps to maintaining appropriate working conditions, quality of life to most

neighbouring cities. For instance, currently the company is focusing on supporting its

neighbour Antofagasta.

1

Technological: The growth of mining industry is completely depended on advancement

of technology therefore the enterprise is focusing on exploring and adapting changes

which can help the business in serving customer satisfaction and maintain its profitability

(Pike, Spennemann and Watson 2017). Moreover, the management of firm believes that

investment in appropriate technological resources can assist BHP Billiton in adapting

fluctuations quickly. For instance, the major technological up-gradation in mining

industry are, machinery, refiners, cranes and lorry. The advanced technology used by

BHP Billiton are Advanced shaft and tunnel boring stems, 3D laser scanning and

automated drilling.\

Industry Analysis

Place of Company in mining industry.

Market position: BHP Billiton is striving hard to maintain is leading position in the

mining industry but still it holds the second position after Rio Tinto Besides the prices of iron ore

is falling but still the company is focusing on increasing its production level to meet the demand

of the consumers. The business operations are, extracting resources, and manufacturing products.

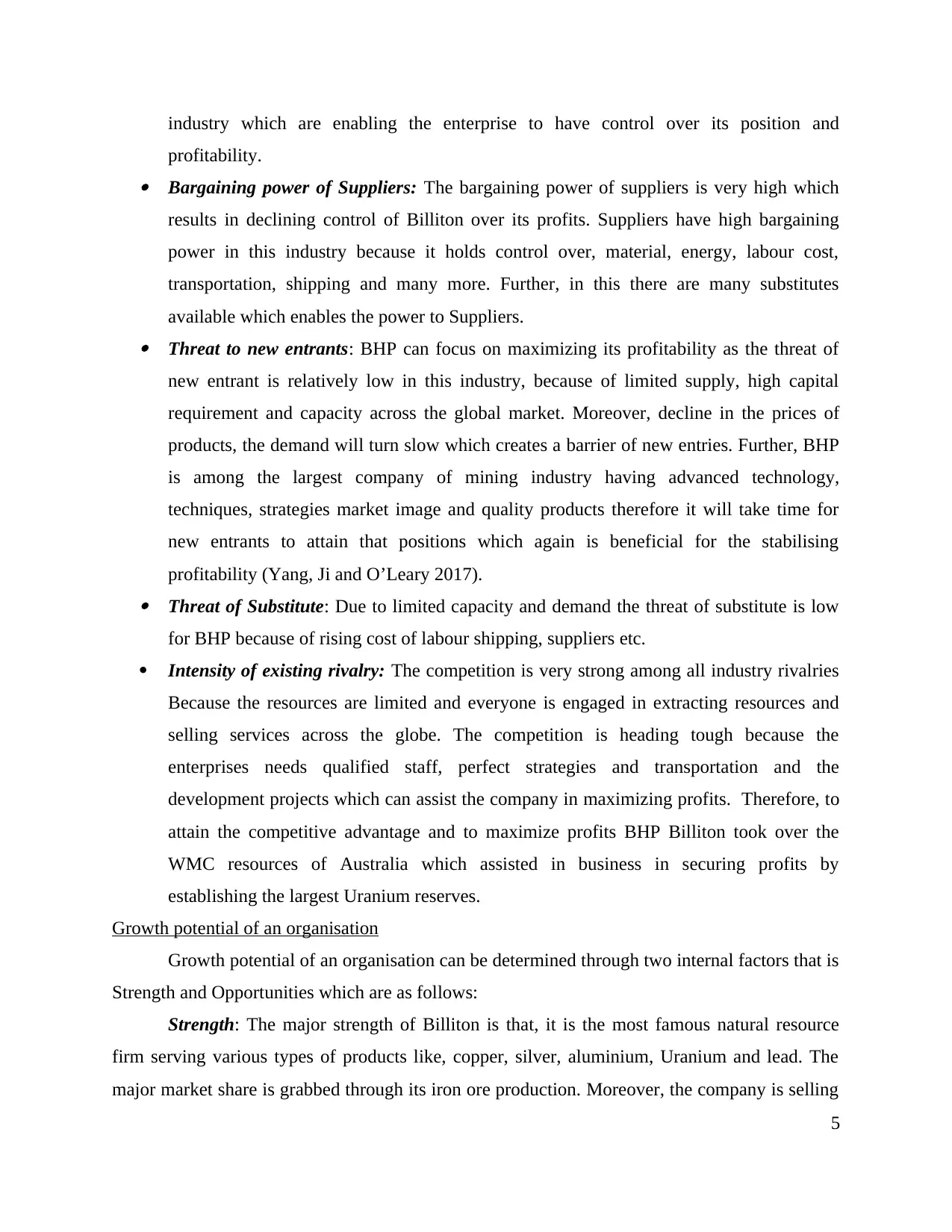

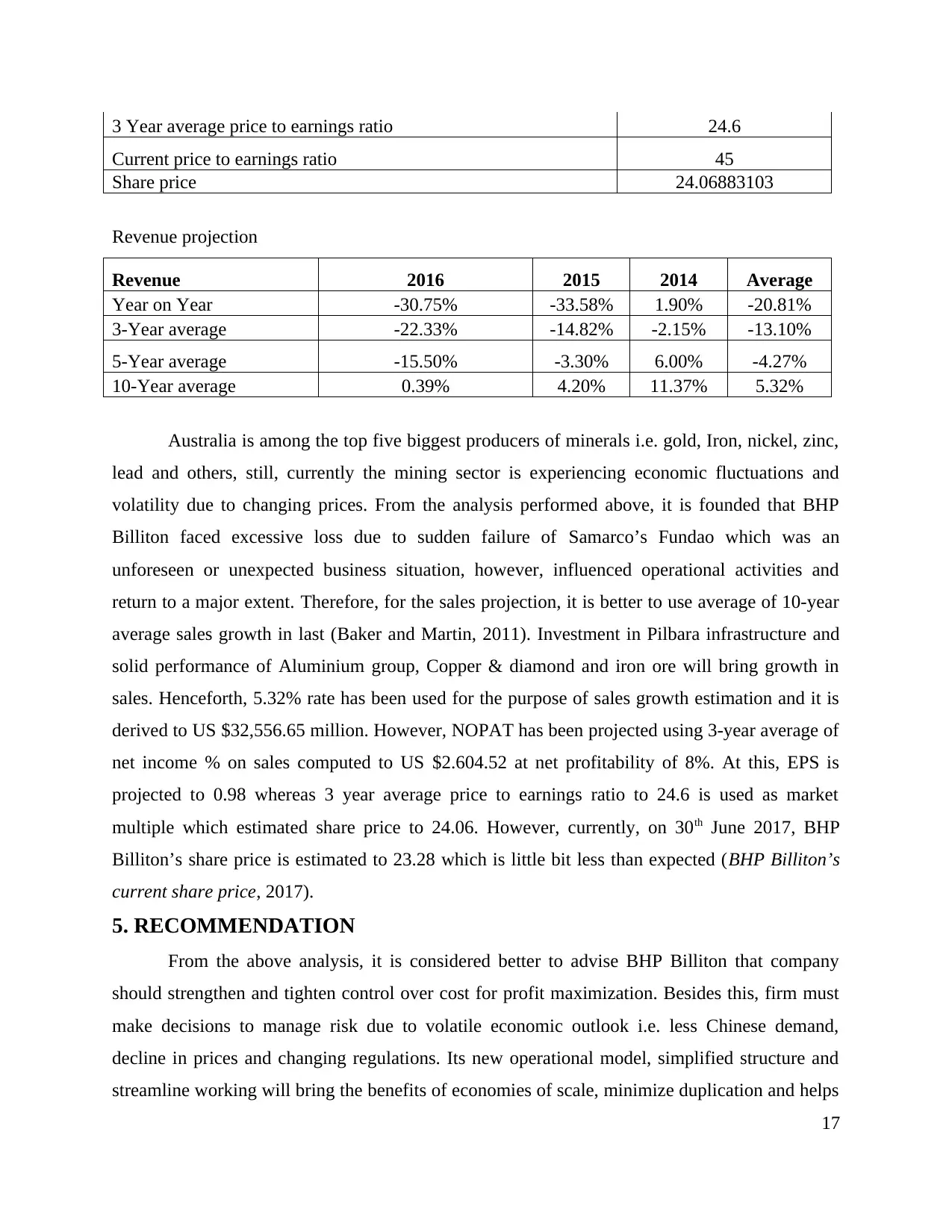

Market Share: There are 4 competitors which are, Rio Tinto, Arconic Inc. and Vale S/A

form which BHP Billiton is competing for the high market share according to its commodities

like for copper its holds 7%, for seaborne thermal coal it holds 5% and for seaborne coking coal

it holds 19% that is highest amongst all the rivalries of mining industry (James K. and et.al.,

2014). Thus, the management is focusing on grabbing the market share for all of its metal and

materials therefore the enterprise is slowly drifting towards oligopoly like potash market. Beside,

the data represents that the mining industry is under the control of BHP. The data demonstrate

that, the maximum market share is for its iron ore production which is 29% and least is for

diamonds which is 2 percent. Despite of highest and lowest the company holds the strong control

over its base metals, energy coals and petroleum

2

of technology therefore the enterprise is focusing on exploring and adapting changes

which can help the business in serving customer satisfaction and maintain its profitability

(Pike, Spennemann and Watson 2017). Moreover, the management of firm believes that

investment in appropriate technological resources can assist BHP Billiton in adapting

fluctuations quickly. For instance, the major technological up-gradation in mining

industry are, machinery, refiners, cranes and lorry. The advanced technology used by

BHP Billiton are Advanced shaft and tunnel boring stems, 3D laser scanning and

automated drilling.\

Industry Analysis

Place of Company in mining industry.

Market position: BHP Billiton is striving hard to maintain is leading position in the

mining industry but still it holds the second position after Rio Tinto Besides the prices of iron ore

is falling but still the company is focusing on increasing its production level to meet the demand

of the consumers. The business operations are, extracting resources, and manufacturing products.

Market Share: There are 4 competitors which are, Rio Tinto, Arconic Inc. and Vale S/A

form which BHP Billiton is competing for the high market share according to its commodities

like for copper its holds 7%, for seaborne thermal coal it holds 5% and for seaborne coking coal

it holds 19% that is highest amongst all the rivalries of mining industry (James K. and et.al.,

2014). Thus, the management is focusing on grabbing the market share for all of its metal and

materials therefore the enterprise is slowly drifting towards oligopoly like potash market. Beside,

the data represents that the mining industry is under the control of BHP. The data demonstrate

that, the maximum market share is for its iron ore production which is 29% and least is for

diamonds which is 2 percent. Despite of highest and lowest the company holds the strong control

over its base metals, energy coals and petroleum

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Source: (Alex R. 2015).

Competitors of BHP Billiton limited.

The biggest rivalry of BHP Billiton in mining industry is Rio Tinto Limited. It is the

world largest metal and material multinational organisation. Moreover, the enterprise has more

than 30 operating sites across the globe producing various types of metals and materials like,

aluminium, uranium, coal bauxite, salts, diamonds and many more. Beside, in order to maintain

the stability of growth and development the company focus on producing and delivering

environmental friendly products (Pike, Spennemann and Watson 2017).

Market position: The business holds the first position in mining industry and to

maintaining the stability and sustainability the organisation is continuously improving its

production according to market fluctuation and its stake holders(Alex R. 2015).

3

Illustration 1: Market share of BHP Billiton

Competitors of BHP Billiton limited.

The biggest rivalry of BHP Billiton in mining industry is Rio Tinto Limited. It is the

world largest metal and material multinational organisation. Moreover, the enterprise has more

than 30 operating sites across the globe producing various types of metals and materials like,

aluminium, uranium, coal bauxite, salts, diamonds and many more. Beside, in order to maintain

the stability of growth and development the company focus on producing and delivering

environmental friendly products (Pike, Spennemann and Watson 2017).

Market position: The business holds the first position in mining industry and to

maintaining the stability and sustainability the organisation is continuously improving its

production according to market fluctuation and its stake holders(Alex R. 2015).

3

Illustration 1: Market share of BHP Billiton

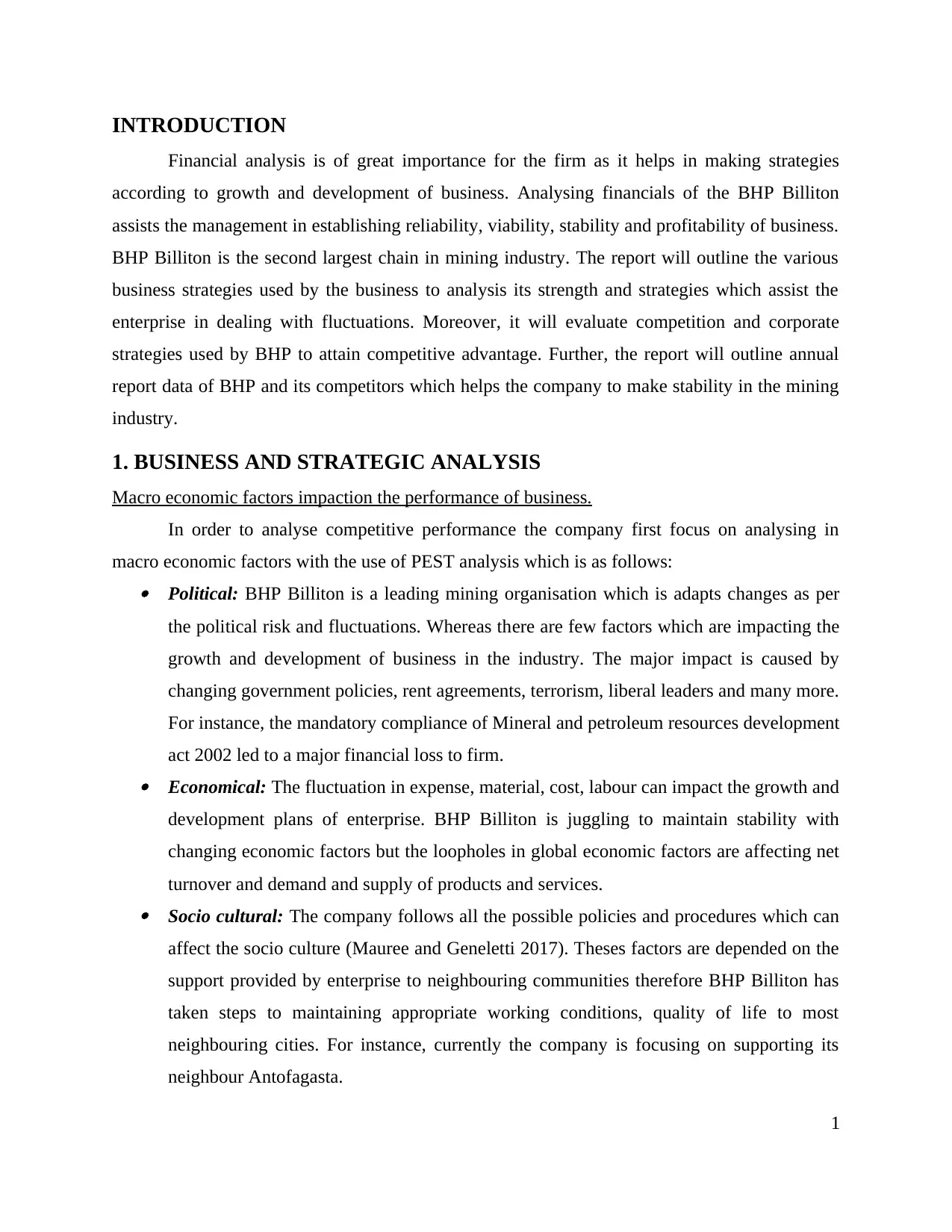

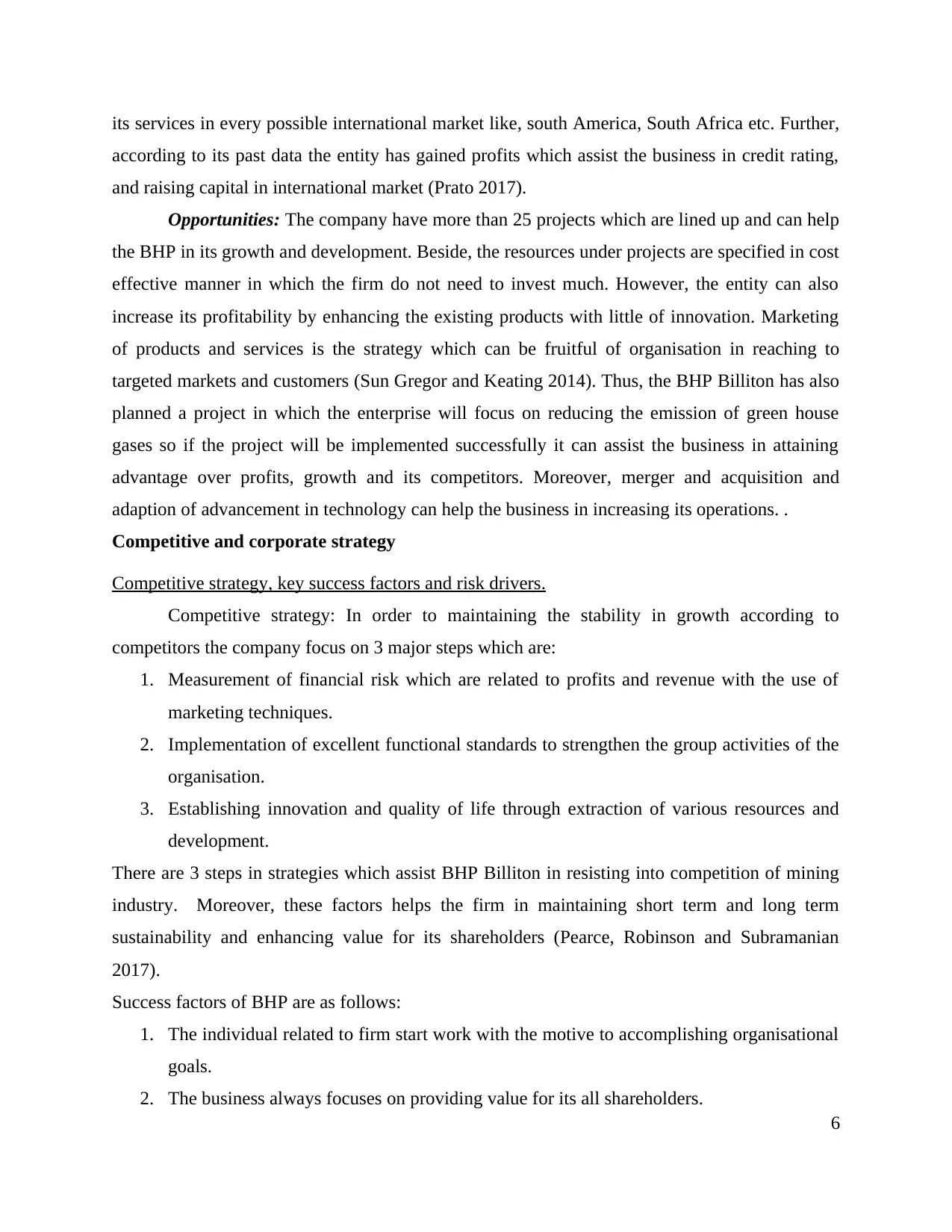

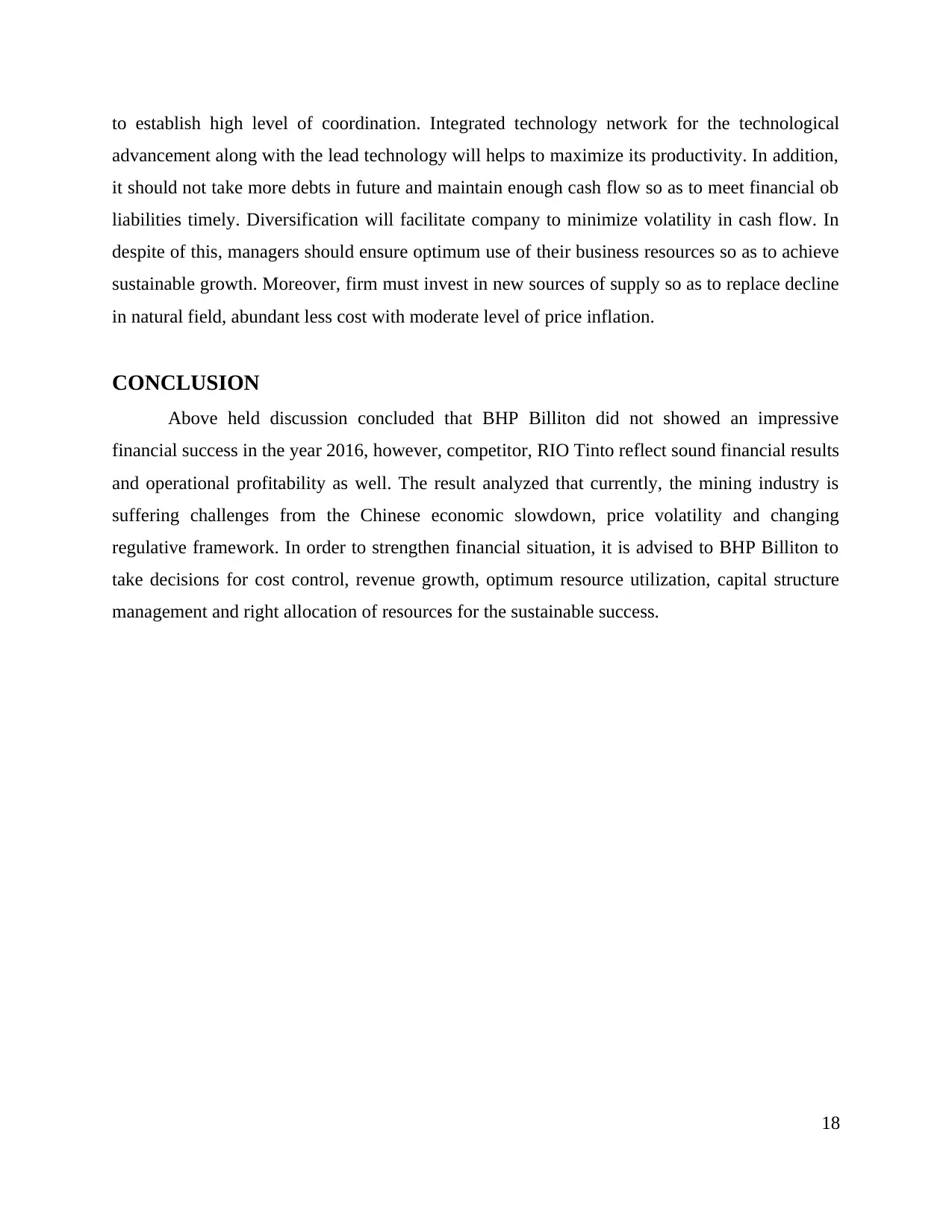

Market Share: The market share of Rio Tinto is divided according to its commodities in

which it represents that Sea borne cooking coal golds 6% of market, copper holds 7% and

Seaborne of thermal coal holds 2% of market share which is low according to its market position

(James K. and et.al., 2014). Moreover, from pie chart it can be evaluated that 80% of revenue of

Rio is depended upon its iron ore production which holds the market share of 43%.

Source: (Alex R. 2015).

Porter five forces to analyse current profitability.

It is the best strategy used by BHP Billiton to measure its profitability and market

competition (Hill, Jones and Schilling 2014). It provides the company access over its resource

production, strengths, goals and objectives. The porter five forces of enterprise are as follows: Bargaining power of Buyers: The bargaining power of buyers in this industry is average

and even low because the metals and materials have high demand but restricted supply

which do not provide control to buyers over bargaining. Moreover, for these types of

resources substitute products are not available therefore BHP Billiton have advantage to

maintain its profitability. Beside, the current environmental factors are stable for mining

4

Illustration 2: Market Share of Rio Tinto

which it represents that Sea borne cooking coal golds 6% of market, copper holds 7% and

Seaborne of thermal coal holds 2% of market share which is low according to its market position

(James K. and et.al., 2014). Moreover, from pie chart it can be evaluated that 80% of revenue of

Rio is depended upon its iron ore production which holds the market share of 43%.

Source: (Alex R. 2015).

Porter five forces to analyse current profitability.

It is the best strategy used by BHP Billiton to measure its profitability and market

competition (Hill, Jones and Schilling 2014). It provides the company access over its resource

production, strengths, goals and objectives. The porter five forces of enterprise are as follows: Bargaining power of Buyers: The bargaining power of buyers in this industry is average

and even low because the metals and materials have high demand but restricted supply

which do not provide control to buyers over bargaining. Moreover, for these types of

resources substitute products are not available therefore BHP Billiton have advantage to

maintain its profitability. Beside, the current environmental factors are stable for mining

4

Illustration 2: Market Share of Rio Tinto

industry which are enabling the enterprise to have control over its position and

profitability. Bargaining power of Suppliers: The bargaining power of suppliers is very high which

results in declining control of Billiton over its profits. Suppliers have high bargaining

power in this industry because it holds control over, material, energy, labour cost,

transportation, shipping and many more. Further, in this there are many substitutes

available which enables the power to Suppliers. Threat to new entrants: BHP can focus on maximizing its profitability as the threat of

new entrant is relatively low in this industry, because of limited supply, high capital

requirement and capacity across the global market. Moreover, decline in the prices of

products, the demand will turn slow which creates a barrier of new entries. Further, BHP

is among the largest company of mining industry having advanced technology,

techniques, strategies market image and quality products therefore it will take time for

new entrants to attain that positions which again is beneficial for the stabilising

profitability (Yang, Ji and O’Leary 2017). Threat of Substitute: Due to limited capacity and demand the threat of substitute is low

for BHP because of rising cost of labour shipping, suppliers etc.

Intensity of existing rivalry: The competition is very strong among all industry rivalries

Because the resources are limited and everyone is engaged in extracting resources and

selling services across the globe. The competition is heading tough because the

enterprises needs qualified staff, perfect strategies and transportation and the

development projects which can assist the company in maximizing profits. Therefore, to

attain the competitive advantage and to maximize profits BHP Billiton took over the

WMC resources of Australia which assisted in business in securing profits by

establishing the largest Uranium reserves.

Growth potential of an organisation

Growth potential of an organisation can be determined through two internal factors that is

Strength and Opportunities which are as follows:

Strength: The major strength of Billiton is that, it is the most famous natural resource

firm serving various types of products like, copper, silver, aluminium, Uranium and lead. The

major market share is grabbed through its iron ore production. Moreover, the company is selling

5

profitability. Bargaining power of Suppliers: The bargaining power of suppliers is very high which

results in declining control of Billiton over its profits. Suppliers have high bargaining

power in this industry because it holds control over, material, energy, labour cost,

transportation, shipping and many more. Further, in this there are many substitutes

available which enables the power to Suppliers. Threat to new entrants: BHP can focus on maximizing its profitability as the threat of

new entrant is relatively low in this industry, because of limited supply, high capital

requirement and capacity across the global market. Moreover, decline in the prices of

products, the demand will turn slow which creates a barrier of new entries. Further, BHP

is among the largest company of mining industry having advanced technology,

techniques, strategies market image and quality products therefore it will take time for

new entrants to attain that positions which again is beneficial for the stabilising

profitability (Yang, Ji and O’Leary 2017). Threat of Substitute: Due to limited capacity and demand the threat of substitute is low

for BHP because of rising cost of labour shipping, suppliers etc.

Intensity of existing rivalry: The competition is very strong among all industry rivalries

Because the resources are limited and everyone is engaged in extracting resources and

selling services across the globe. The competition is heading tough because the

enterprises needs qualified staff, perfect strategies and transportation and the

development projects which can assist the company in maximizing profits. Therefore, to

attain the competitive advantage and to maximize profits BHP Billiton took over the

WMC resources of Australia which assisted in business in securing profits by

establishing the largest Uranium reserves.

Growth potential of an organisation

Growth potential of an organisation can be determined through two internal factors that is

Strength and Opportunities which are as follows:

Strength: The major strength of Billiton is that, it is the most famous natural resource

firm serving various types of products like, copper, silver, aluminium, Uranium and lead. The

major market share is grabbed through its iron ore production. Moreover, the company is selling

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

its services in every possible international market like, south America, South Africa etc. Further,

according to its past data the entity has gained profits which assist the business in credit rating,

and raising capital in international market (Prato 2017).

Opportunities: The company have more than 25 projects which are lined up and can help

the BHP in its growth and development. Beside, the resources under projects are specified in cost

effective manner in which the firm do not need to invest much. However, the entity can also

increase its profitability by enhancing the existing products with little of innovation. Marketing

of products and services is the strategy which can be fruitful of organisation in reaching to

targeted markets and customers (Sun Gregor and Keating 2014). Thus, the BHP Billiton has also

planned a project in which the enterprise will focus on reducing the emission of green house

gases so if the project will be implemented successfully it can assist the business in attaining

advantage over profits, growth and its competitors. Moreover, merger and acquisition and

adaption of advancement in technology can help the business in increasing its operations. .

Competitive and corporate strategy

Competitive strategy, key success factors and risk drivers.

Competitive strategy: In order to maintaining the stability in growth according to

competitors the company focus on 3 major steps which are:

1. Measurement of financial risk which are related to profits and revenue with the use of

marketing techniques.

2. Implementation of excellent functional standards to strengthen the group activities of the

organisation.

3. Establishing innovation and quality of life through extraction of various resources and

development.

There are 3 steps in strategies which assist BHP Billiton in resisting into competition of mining

industry. Moreover, these factors helps the firm in maintaining short term and long term

sustainability and enhancing value for its shareholders (Pearce, Robinson and Subramanian

2017).

Success factors of BHP are as follows:

1. The individual related to firm start work with the motive to accomplishing organisational

goals.

2. The business always focuses on providing value for its all shareholders.

6

according to its past data the entity has gained profits which assist the business in credit rating,

and raising capital in international market (Prato 2017).

Opportunities: The company have more than 25 projects which are lined up and can help

the BHP in its growth and development. Beside, the resources under projects are specified in cost

effective manner in which the firm do not need to invest much. However, the entity can also

increase its profitability by enhancing the existing products with little of innovation. Marketing

of products and services is the strategy which can be fruitful of organisation in reaching to

targeted markets and customers (Sun Gregor and Keating 2014). Thus, the BHP Billiton has also

planned a project in which the enterprise will focus on reducing the emission of green house

gases so if the project will be implemented successfully it can assist the business in attaining

advantage over profits, growth and its competitors. Moreover, merger and acquisition and

adaption of advancement in technology can help the business in increasing its operations. .

Competitive and corporate strategy

Competitive strategy, key success factors and risk drivers.

Competitive strategy: In order to maintaining the stability in growth according to

competitors the company focus on 3 major steps which are:

1. Measurement of financial risk which are related to profits and revenue with the use of

marketing techniques.

2. Implementation of excellent functional standards to strengthen the group activities of the

organisation.

3. Establishing innovation and quality of life through extraction of various resources and

development.

There are 3 steps in strategies which assist BHP Billiton in resisting into competition of mining

industry. Moreover, these factors helps the firm in maintaining short term and long term

sustainability and enhancing value for its shareholders (Pearce, Robinson and Subramanian

2017).

Success factors of BHP are as follows:

1. The individual related to firm start work with the motive to accomplishing organisational

goals.

2. The business always focuses on providing value for its all shareholders.

6

3. BHP focus on maintaining sustainable development.

4. Organised and systematic business operation assists the enterprise in attaining growth and

development.

Risk drivers for BHP are described under: Climate change: This is the major risk company generally faces which can arise due to

rising sea levels, water shortages, storms, rainfall patterns and many more. Moreover, the

implementation of project which is reduction of emission of green house gases is also

creating pressure on the entity (Ketchen, Jr and Shook 2016).

Fluctuation in macro trends: Changes in exchange rate, operating cost and product

prices impacts the business operations for long run.

Corporate strategy used by BHP Billiton limited.

The corporate strategy of company is based on handling and operating life of asset which

can be fluctuated by market and geographical changes.

The company seek for approaches which assist the enterprise in adapting climate

changes.

The strategy of business to innovate production and organisational operations according

to advancement of technology.

The BHP aims at proving healthy and safe working environment to its employee which

assist the business in boosting the morale workers (Bracker 2010).

The compliance with the corporate Governance practices and rules assist the BHP in

directing, controlling and balancing the interests of stakeholders with the company.

Maintaining the appropriateness with the advancement and market competition company

hold the chance to grow in the industry (Hall 2012).

2. ACCOUNTING ANALYSIS

According to corporate strategy and competitor analysis, it can be determined that the

company has only 2 key success factors which are as increasing equity which denotes the

personal investment done by BHP Billiton. Moreover, the increasing current asset of firm

denotes that there are chances for the enterprise to attain competitive advantage over Rio Tinto.

Thus, the financial analysis of the BHP demonstrates that the current situation of entity is risking

its growth and stability in market according to its rivalries.

7

4. Organised and systematic business operation assists the enterprise in attaining growth and

development.

Risk drivers for BHP are described under: Climate change: This is the major risk company generally faces which can arise due to

rising sea levels, water shortages, storms, rainfall patterns and many more. Moreover, the

implementation of project which is reduction of emission of green house gases is also

creating pressure on the entity (Ketchen, Jr and Shook 2016).

Fluctuation in macro trends: Changes in exchange rate, operating cost and product

prices impacts the business operations for long run.

Corporate strategy used by BHP Billiton limited.

The corporate strategy of company is based on handling and operating life of asset which

can be fluctuated by market and geographical changes.

The company seek for approaches which assist the enterprise in adapting climate

changes.

The strategy of business to innovate production and organisational operations according

to advancement of technology.

The BHP aims at proving healthy and safe working environment to its employee which

assist the business in boosting the morale workers (Bracker 2010).

The compliance with the corporate Governance practices and rules assist the BHP in

directing, controlling and balancing the interests of stakeholders with the company.

Maintaining the appropriateness with the advancement and market competition company

hold the chance to grow in the industry (Hall 2012).

2. ACCOUNTING ANALYSIS

According to corporate strategy and competitor analysis, it can be determined that the

company has only 2 key success factors which are as increasing equity which denotes the

personal investment done by BHP Billiton. Moreover, the increasing current asset of firm

denotes that there are chances for the enterprise to attain competitive advantage over Rio Tinto.

Thus, the financial analysis of the BHP demonstrates that the current situation of entity is risking

its growth and stability in market according to its rivalries.

7

Quality of disclosure of BHP denotes that that strategy of the company is good enough to

support the growth and development according to its market competition. Therefore, as per the

analysis of corporate strategy, it can be determined that implementing functional standards and

making regular innovation in products and manufacturing process assist the company to deliver

quality products to its buyers which implies that Billiton can enhance its success and minimize

its risk drivers by analysing its financial situation on regular basis (Zahra and Covin 2015).

In accordance to above analysis it can be determined, that according to RIO Tinto, BHP

Billiton is facing major risk due to 3 major factors which as follows:

Revenue and profit: as per the analysis it has been evaluated that from past 3 years that

is from 2014 the revenues of the company are continuously decreasing which clearly

representing the declining situation which can turn risky for maintaining stability of firm

whereas in comparison to Rio Tinto the revenue of Rio has increased since 3 years which

determines the red flag for BHP.

Expense: In accordance to the evaluation it has been determined that expense of BHP

Billiton are continuously increasing and till 2016, which is not good factor for the companies'

growth and development. In comparison to Rio Tinto the revenue of company are increasing

vary fast rate.

Total current liability: The continuous increase in current liability of BHP Billiton can

be very risky for its sustainability and growth because according to its competitor, the entity is

going down continuously from past few years.

Hence, the company also makes use of Red flag which helps it in determining the

situation which are reason of potential problems for decreasing revenue and profits. In

accordance to analysis it has been demonstrated that there are three major 3 flags of the BHP

Billiton are decreasing revenue and profits and increasing expenses.

3. FINANCIAL ANALYSIS

Financial analysis of the company is the key element of the appropriate investment

advice. Ratio analysis is a quantitative expression of company’s results in annual report that

provides a quick indication to analyze financial strengthens of an enterprise. BHP Billton’s

performance for a period of 4 years and its comparison with the competitor, Rio Tinto has been

performed here as under:

Calculations attached in Appendix

8

support the growth and development according to its market competition. Therefore, as per the

analysis of corporate strategy, it can be determined that implementing functional standards and

making regular innovation in products and manufacturing process assist the company to deliver

quality products to its buyers which implies that Billiton can enhance its success and minimize

its risk drivers by analysing its financial situation on regular basis (Zahra and Covin 2015).

In accordance to above analysis it can be determined, that according to RIO Tinto, BHP

Billiton is facing major risk due to 3 major factors which as follows:

Revenue and profit: as per the analysis it has been evaluated that from past 3 years that

is from 2014 the revenues of the company are continuously decreasing which clearly

representing the declining situation which can turn risky for maintaining stability of firm

whereas in comparison to Rio Tinto the revenue of Rio has increased since 3 years which

determines the red flag for BHP.

Expense: In accordance to the evaluation it has been determined that expense of BHP

Billiton are continuously increasing and till 2016, which is not good factor for the companies'

growth and development. In comparison to Rio Tinto the revenue of company are increasing

vary fast rate.

Total current liability: The continuous increase in current liability of BHP Billiton can

be very risky for its sustainability and growth because according to its competitor, the entity is

going down continuously from past few years.

Hence, the company also makes use of Red flag which helps it in determining the

situation which are reason of potential problems for decreasing revenue and profits. In

accordance to analysis it has been demonstrated that there are three major 3 flags of the BHP

Billiton are decreasing revenue and profits and increasing expenses.

3. FINANCIAL ANALYSIS

Financial analysis of the company is the key element of the appropriate investment

advice. Ratio analysis is a quantitative expression of company’s results in annual report that

provides a quick indication to analyze financial strengthens of an enterprise. BHP Billton’s

performance for a period of 4 years and its comparison with the competitor, Rio Tinto has been

performed here as under:

Calculations attached in Appendix

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

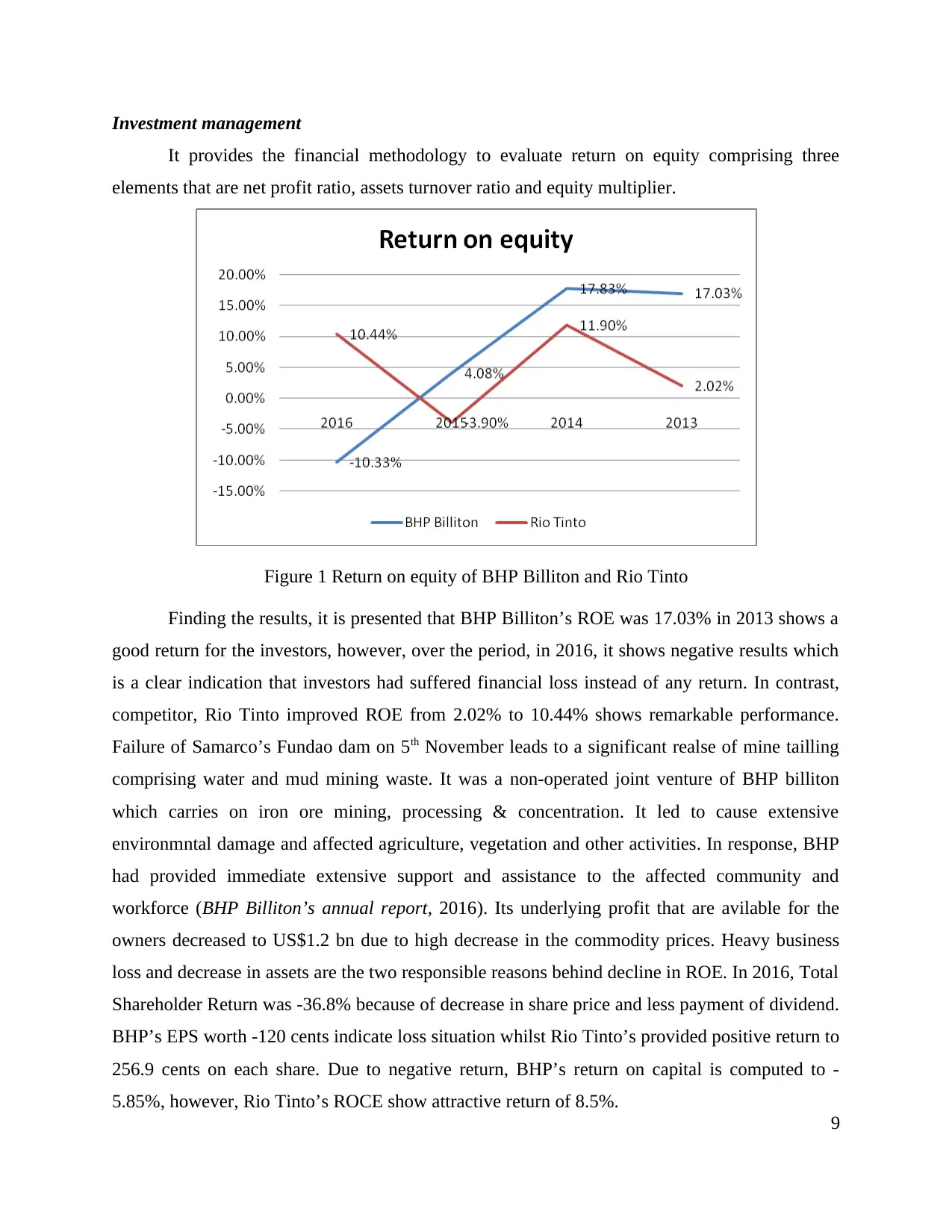

Investment management

It provides the financial methodology to evaluate return on equity comprising three

elements that are net profit ratio, assets turnover ratio and equity multiplier.

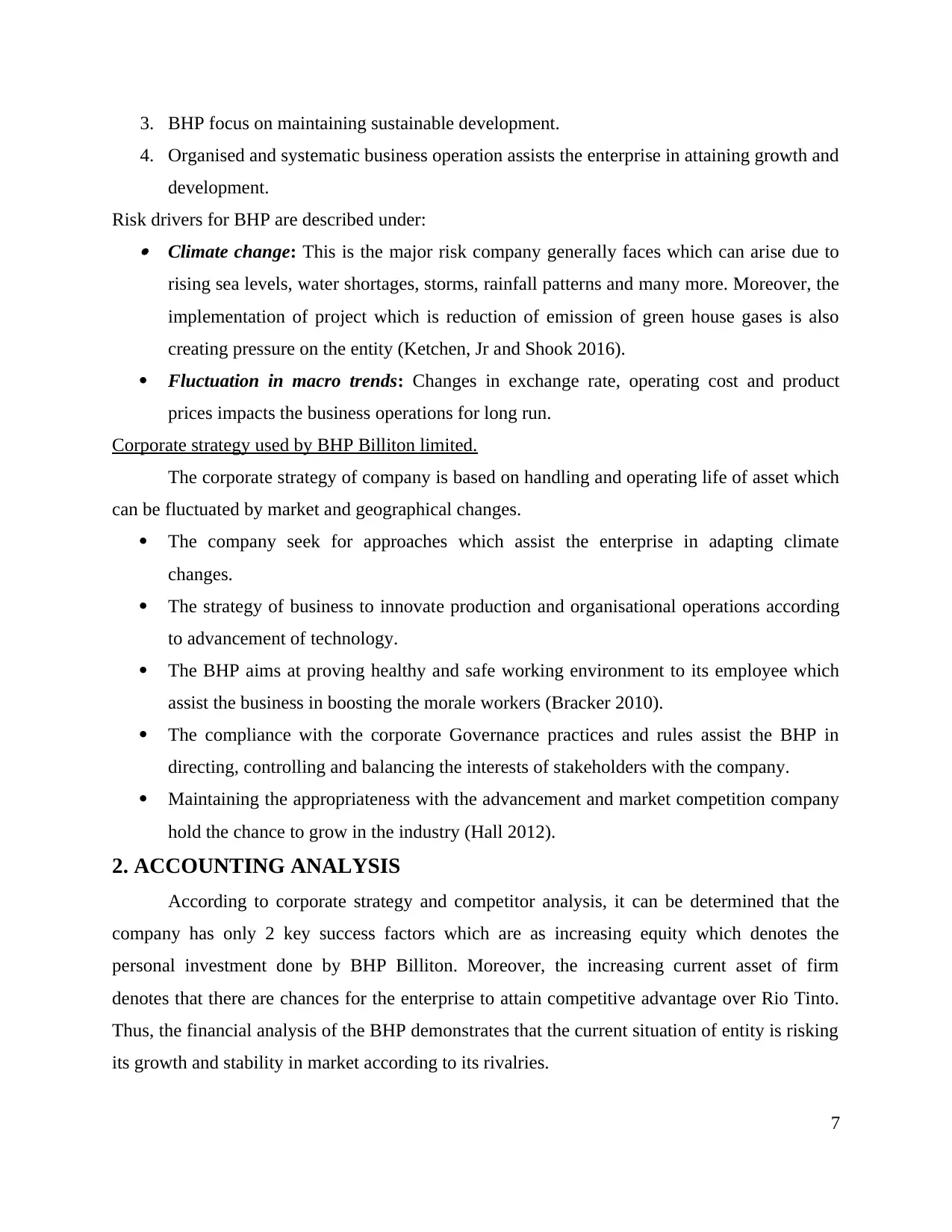

Figure 1 Return on equity of BHP Billiton and Rio Tinto

Finding the results, it is presented that BHP Billiton’s ROE was 17.03% in 2013 shows a

good return for the investors, however, over the period, in 2016, it shows negative results which

is a clear indication that investors had suffered financial loss instead of any return. In contrast,

competitor, Rio Tinto improved ROE from 2.02% to 10.44% shows remarkable performance.

Failure of Samarco’s Fundao dam on 5th November leads to a significant realse of mine tailling

comprising water and mud mining waste. It was a non-operated joint venture of BHP billiton

which carries on iron ore mining, processing & concentration. It led to cause extensive

environmntal damage and affected agriculture, vegetation and other activities. In response, BHP

had provided immediate extensive support and assistance to the affected community and

workforce (BHP Billiton’s annual report, 2016). Its underlying profit that are avilable for the

owners decreased to US$1.2 bn due to high decrease in the commodity prices. Heavy business

loss and decrease in assets are the two responsible reasons behind decline in ROE. In 2016, Total

Shareholder Return was -36.8% because of decrease in share price and less payment of dividend.

BHP’s EPS worth -120 cents indicate loss situation whilst Rio Tinto’s provided positive return to

256.9 cents on each share. Due to negative return, BHP’s return on capital is computed to -

5.85%, however, Rio Tinto’s ROCE show attractive return of 8.5%.

9

It provides the financial methodology to evaluate return on equity comprising three

elements that are net profit ratio, assets turnover ratio and equity multiplier.

Figure 1 Return on equity of BHP Billiton and Rio Tinto

Finding the results, it is presented that BHP Billiton’s ROE was 17.03% in 2013 shows a

good return for the investors, however, over the period, in 2016, it shows negative results which

is a clear indication that investors had suffered financial loss instead of any return. In contrast,

competitor, Rio Tinto improved ROE from 2.02% to 10.44% shows remarkable performance.

Failure of Samarco’s Fundao dam on 5th November leads to a significant realse of mine tailling

comprising water and mud mining waste. It was a non-operated joint venture of BHP billiton

which carries on iron ore mining, processing & concentration. It led to cause extensive

environmntal damage and affected agriculture, vegetation and other activities. In response, BHP

had provided immediate extensive support and assistance to the affected community and

workforce (BHP Billiton’s annual report, 2016). Its underlying profit that are avilable for the

owners decreased to US$1.2 bn due to high decrease in the commodity prices. Heavy business

loss and decrease in assets are the two responsible reasons behind decline in ROE. In 2016, Total

Shareholder Return was -36.8% because of decrease in share price and less payment of dividend.

BHP’s EPS worth -120 cents indicate loss situation whilst Rio Tinto’s provided positive return to

256.9 cents on each share. Due to negative return, BHP’s return on capital is computed to -

5.85%, however, Rio Tinto’s ROCE show attractive return of 8.5%.

9

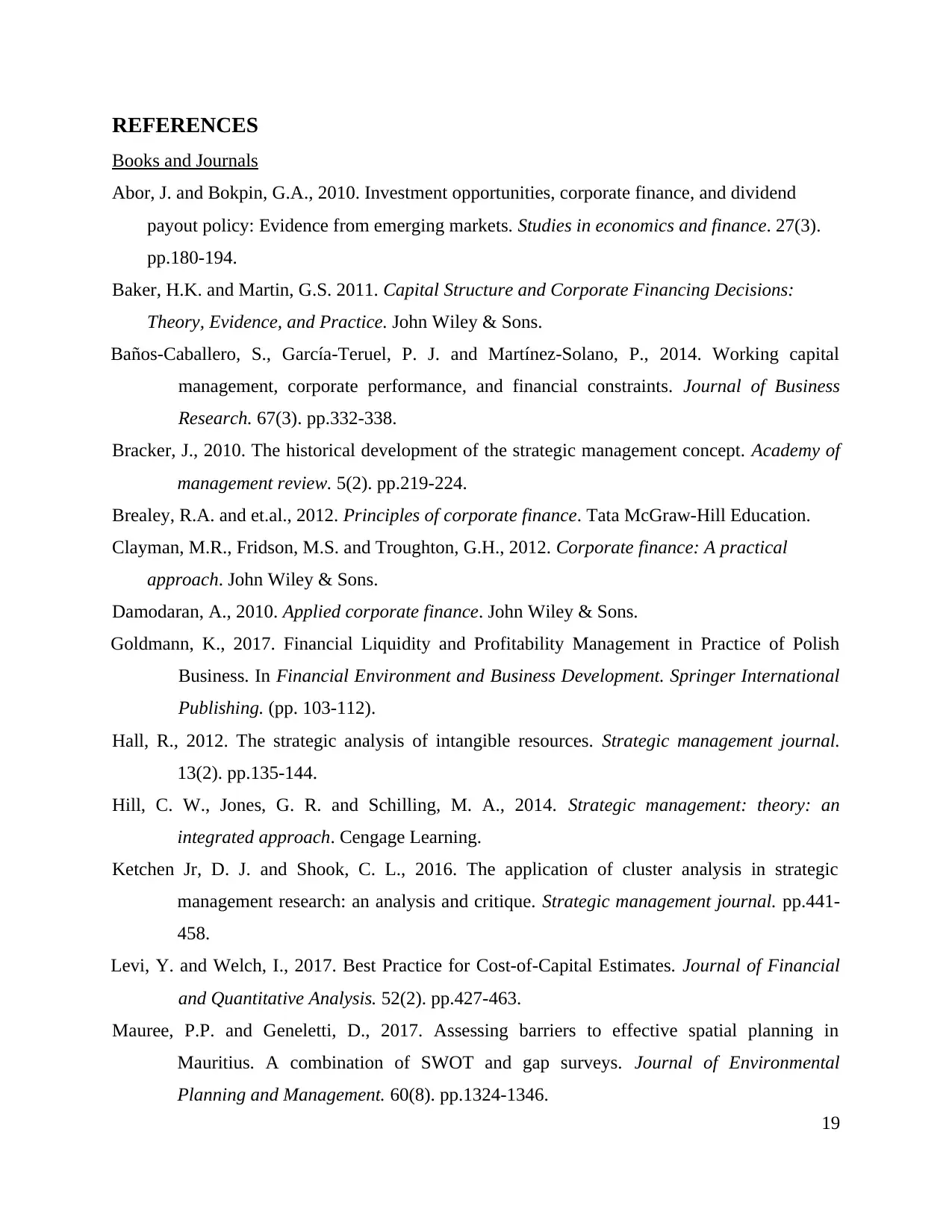

Due to detrioriation in pricing and high market volatility, Rio Tinto changed its

progressive dividend policy in 2016 by adopting a flexible approach comprising three factors,

maintaining strong financial position, reinvestment and rewarding to the shareholders (Abor and

Bokpin, 2010).

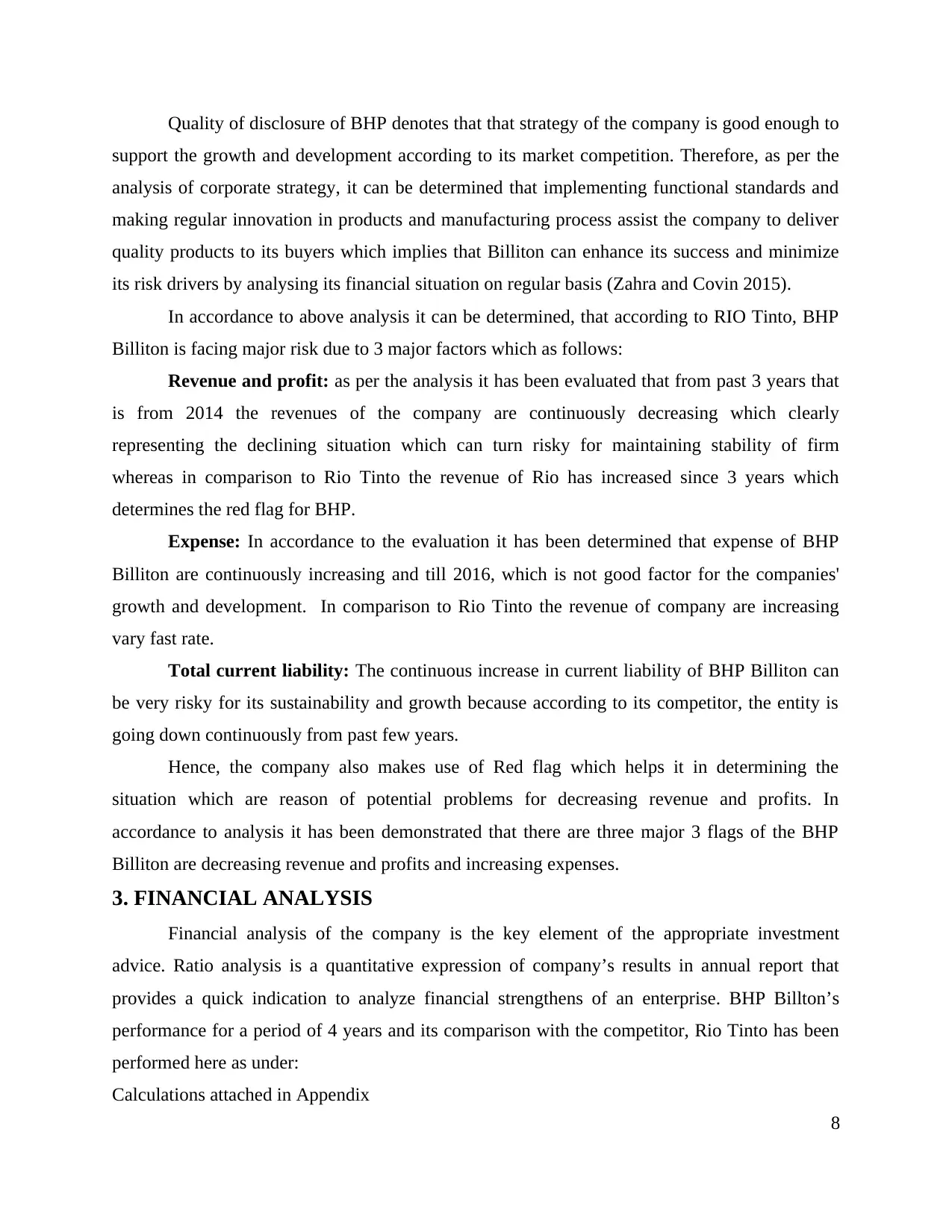

Figure 2 Rio Tinto's cash management policy

(Source: Rio Tinto’s annual report, 2016)

Following company’s financial planning to resilient against the macroeconomic

conditions and challengin external environment, firm has maintained impressive results and

deliverd favorble return o the shareholders. Investment in Pilbara infrastructure and its

Aluminium group, Copper & diamond and iron ore operations achieved solid results. High net

profit availability made it possible for the firm to deliver good return. High growth projects i.e.

Oyu Tolgoi underground, Amrun and Silvergrass maintained sound control over CAPEX to US

$3 bn (Rio Tinto’s annual report, 2016). Following portfolio strategy, firm disposed off

Lochaber UK by $1.3 bn. World-class assets, robust and strong balance sheet, talented personnel

base and performance drivers. Besides this, volatility in the oil, gas and other mineral prices with

the change in global economic and political factors, supply and demand forces, natural tariffs

resulted decline in the sales revenue. Rio Tinto’s TSR % highly influenced from the weakened

commodity prices, in 2016, its TSR is 41.3% that depicts outerperformance over peers TSR who

reported 17% return over 4 years.

10

progressive dividend policy in 2016 by adopting a flexible approach comprising three factors,

maintaining strong financial position, reinvestment and rewarding to the shareholders (Abor and

Bokpin, 2010).

Figure 2 Rio Tinto's cash management policy

(Source: Rio Tinto’s annual report, 2016)

Following company’s financial planning to resilient against the macroeconomic

conditions and challengin external environment, firm has maintained impressive results and

deliverd favorble return o the shareholders. Investment in Pilbara infrastructure and its

Aluminium group, Copper & diamond and iron ore operations achieved solid results. High net

profit availability made it possible for the firm to deliver good return. High growth projects i.e.

Oyu Tolgoi underground, Amrun and Silvergrass maintained sound control over CAPEX to US

$3 bn (Rio Tinto’s annual report, 2016). Following portfolio strategy, firm disposed off

Lochaber UK by $1.3 bn. World-class assets, robust and strong balance sheet, talented personnel

base and performance drivers. Besides this, volatility in the oil, gas and other mineral prices with

the change in global economic and political factors, supply and demand forces, natural tariffs

resulted decline in the sales revenue. Rio Tinto’s TSR % highly influenced from the weakened

commodity prices, in 2016, its TSR is 41.3% that depicts outerperformance over peers TSR who

reported 17% return over 4 years.

10

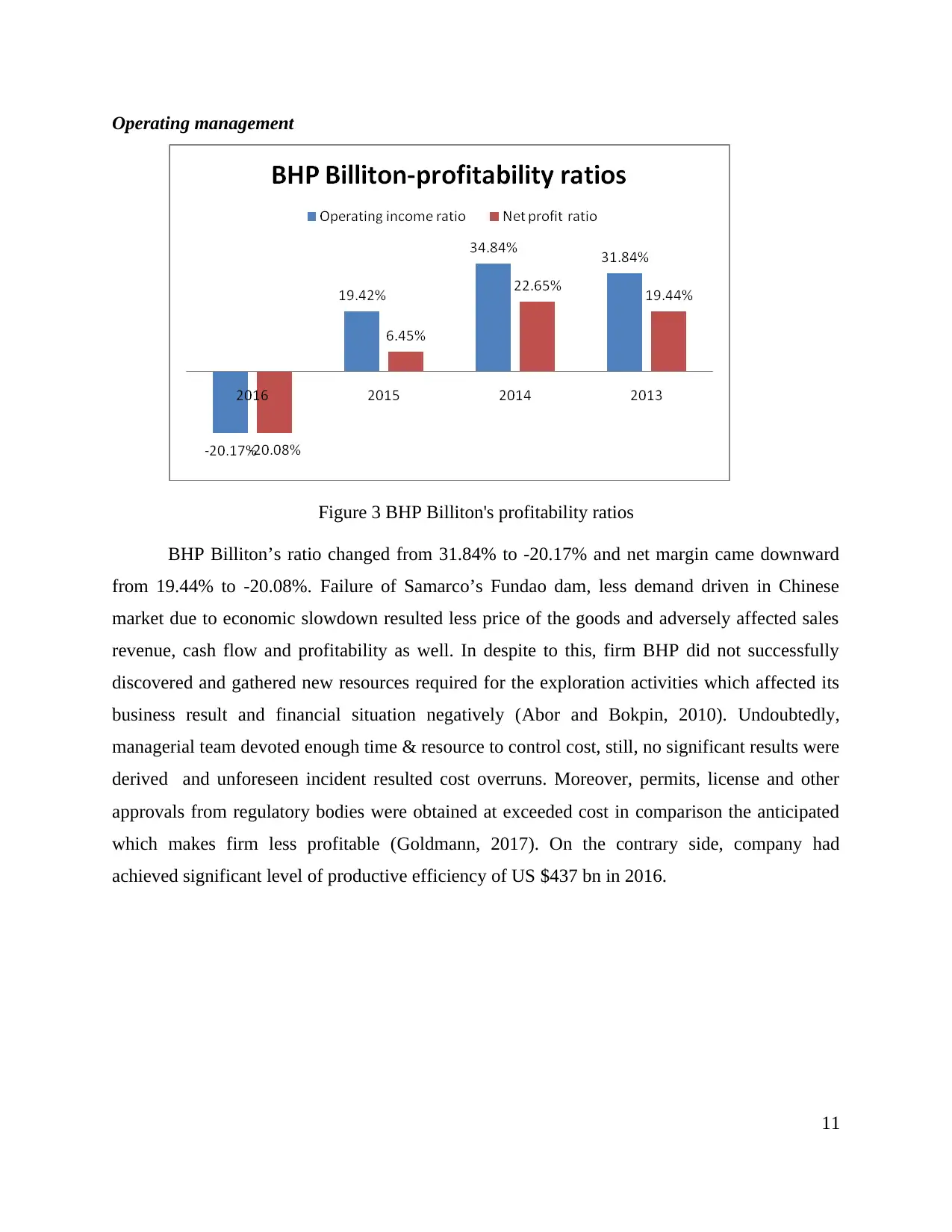

Operating management

Figure 3 BHP Billiton's profitability ratios

BHP Billiton’s ratio changed from 31.84% to -20.17% and net margin came downward

from 19.44% to -20.08%. Failure of Samarco’s Fundao dam, less demand driven in Chinese

market due to economic slowdown resulted less price of the goods and adversely affected sales

revenue, cash flow and profitability as well. In despite to this, firm BHP did not successfully

discovered and gathered new resources required for the exploration activities which affected its

business result and financial situation negatively (Abor and Bokpin, 2010). Undoubtedly,

managerial team devoted enough time & resource to control cost, still, no significant results were

derived and unforeseen incident resulted cost overruns. Moreover, permits, license and other

approvals from regulatory bodies were obtained at exceeded cost in comparison the anticipated

which makes firm less profitable (Goldmann, 2017). On the contrary side, company had

achieved significant level of productive efficiency of US $437 bn in 2016.

11

Figure 3 BHP Billiton's profitability ratios

BHP Billiton’s ratio changed from 31.84% to -20.17% and net margin came downward

from 19.44% to -20.08%. Failure of Samarco’s Fundao dam, less demand driven in Chinese

market due to economic slowdown resulted less price of the goods and adversely affected sales

revenue, cash flow and profitability as well. In despite to this, firm BHP did not successfully

discovered and gathered new resources required for the exploration activities which affected its

business result and financial situation negatively (Abor and Bokpin, 2010). Undoubtedly,

managerial team devoted enough time & resource to control cost, still, no significant results were

derived and unforeseen incident resulted cost overruns. Moreover, permits, license and other

approvals from regulatory bodies were obtained at exceeded cost in comparison the anticipated

which makes firm less profitable (Goldmann, 2017). On the contrary side, company had

achieved significant level of productive efficiency of US $437 bn in 2016.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

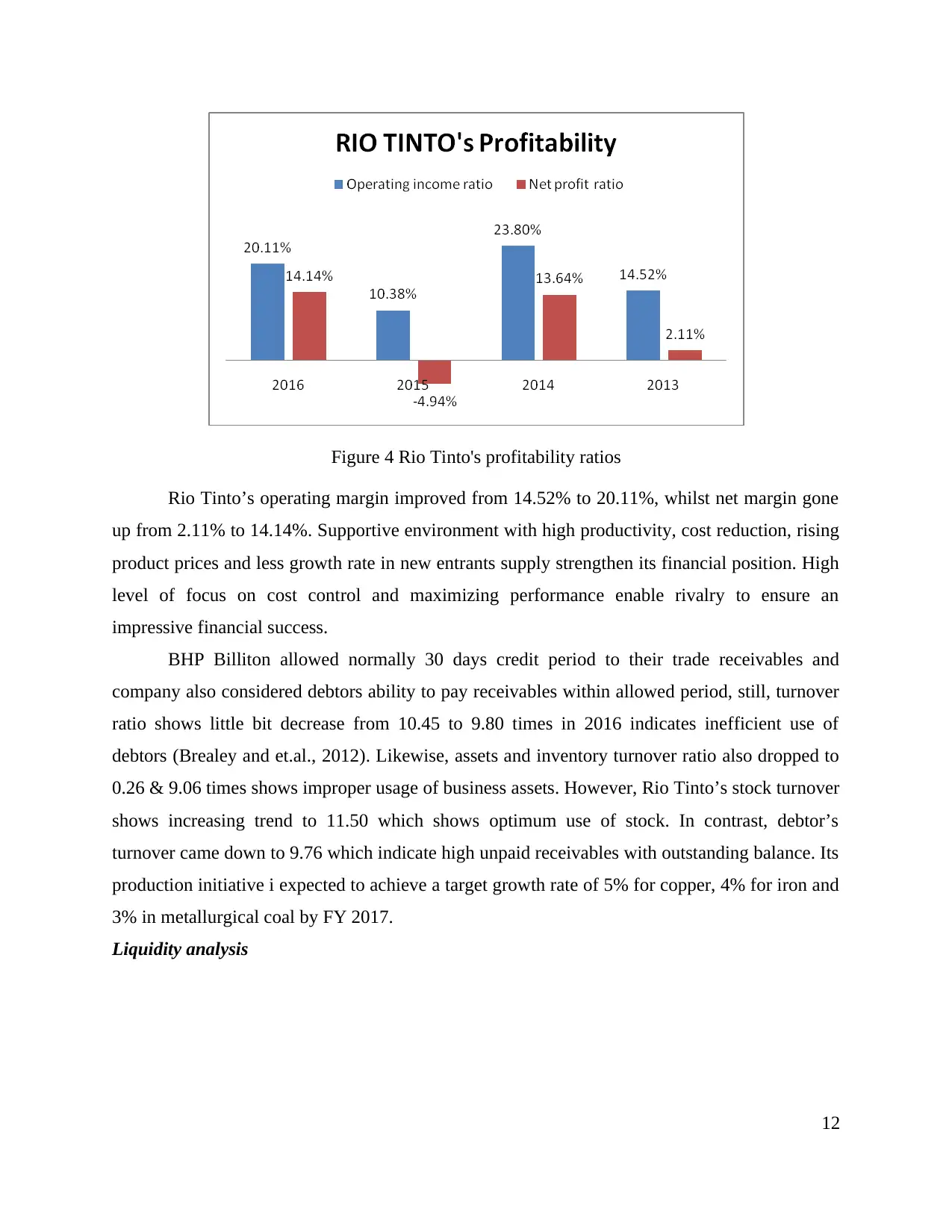

Figure 4 Rio Tinto's profitability ratios

Rio Tinto’s operating margin improved from 14.52% to 20.11%, whilst net margin gone

up from 2.11% to 14.14%. Supportive environment with high productivity, cost reduction, rising

product prices and less growth rate in new entrants supply strengthen its financial position. High

level of focus on cost control and maximizing performance enable rivalry to ensure an

impressive financial success.

BHP Billiton allowed normally 30 days credit period to their trade receivables and

company also considered debtors ability to pay receivables within allowed period, still, turnover

ratio shows little bit decrease from 10.45 to 9.80 times in 2016 indicates inefficient use of

debtors (Brealey and et.al., 2012). Likewise, assets and inventory turnover ratio also dropped to

0.26 & 9.06 times shows improper usage of business assets. However, Rio Tinto’s stock turnover

shows increasing trend to 11.50 which shows optimum use of stock. In contrast, debtor’s

turnover came down to 9.76 which indicate high unpaid receivables with outstanding balance. Its

production initiative i expected to achieve a target growth rate of 5% for copper, 4% for iron and

3% in metallurgical coal by FY 2017.

Liquidity analysis

12

Rio Tinto’s operating margin improved from 14.52% to 20.11%, whilst net margin gone

up from 2.11% to 14.14%. Supportive environment with high productivity, cost reduction, rising

product prices and less growth rate in new entrants supply strengthen its financial position. High

level of focus on cost control and maximizing performance enable rivalry to ensure an

impressive financial success.

BHP Billiton allowed normally 30 days credit period to their trade receivables and

company also considered debtors ability to pay receivables within allowed period, still, turnover

ratio shows little bit decrease from 10.45 to 9.80 times in 2016 indicates inefficient use of

debtors (Brealey and et.al., 2012). Likewise, assets and inventory turnover ratio also dropped to

0.26 & 9.06 times shows improper usage of business assets. However, Rio Tinto’s stock turnover

shows increasing trend to 11.50 which shows optimum use of stock. In contrast, debtor’s

turnover came down to 9.76 which indicate high unpaid receivables with outstanding balance. Its

production initiative i expected to achieve a target growth rate of 5% for copper, 4% for iron and

3% in metallurgical coal by FY 2017.

Liquidity analysis

12

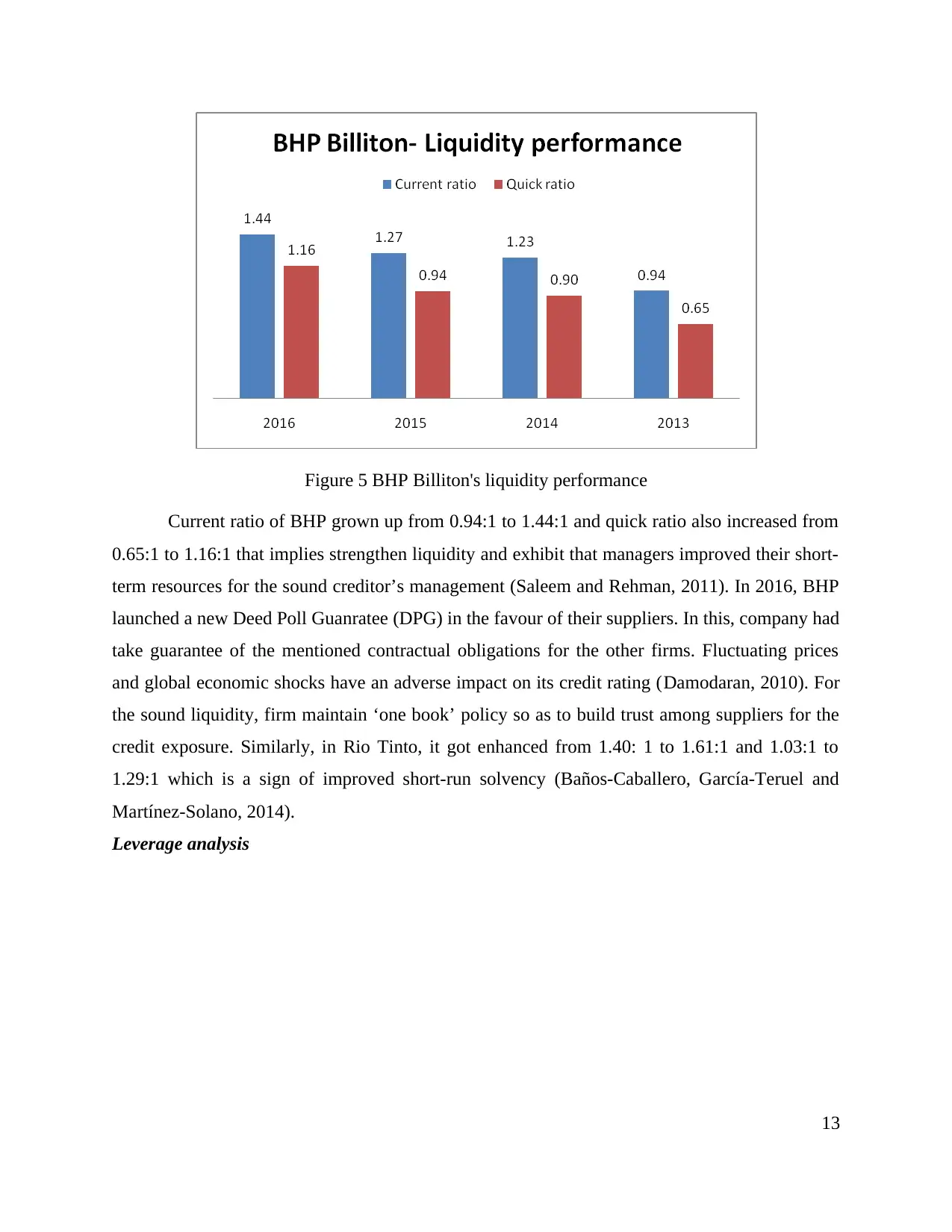

Figure 5 BHP Billiton's liquidity performance

Current ratio of BHP grown up from 0.94:1 to 1.44:1 and quick ratio also increased from

0.65:1 to 1.16:1 that implies strengthen liquidity and exhibit that managers improved their short-

term resources for the sound creditor’s management (Saleem and Rehman, 2011). In 2016, BHP

launched a new Deed Poll Guanratee (DPG) in the favour of their suppliers. In this, company had

take guarantee of the mentioned contractual obligations for the other firms. Fluctuating prices

and global economic shocks have an adverse impact on its credit rating (Damodaran, 2010). For

the sound liquidity, firm maintain ‘one book’ policy so as to build trust among suppliers for the

credit exposure. Similarly, in Rio Tinto, it got enhanced from 1.40: 1 to 1.61:1 and 1.03:1 to

1.29:1 which is a sign of improved short-run solvency (Baños-Caballero, García-Teruel and

Martínez-Solano, 2014).

Leverage analysis

13

Current ratio of BHP grown up from 0.94:1 to 1.44:1 and quick ratio also increased from

0.65:1 to 1.16:1 that implies strengthen liquidity and exhibit that managers improved their short-

term resources for the sound creditor’s management (Saleem and Rehman, 2011). In 2016, BHP

launched a new Deed Poll Guanratee (DPG) in the favour of their suppliers. In this, company had

take guarantee of the mentioned contractual obligations for the other firms. Fluctuating prices

and global economic shocks have an adverse impact on its credit rating (Damodaran, 2010). For

the sound liquidity, firm maintain ‘one book’ policy so as to build trust among suppliers for the

credit exposure. Similarly, in Rio Tinto, it got enhanced from 1.40: 1 to 1.61:1 and 1.03:1 to

1.29:1 which is a sign of improved short-run solvency (Baños-Caballero, García-Teruel and

Martínez-Solano, 2014).

Leverage analysis

13

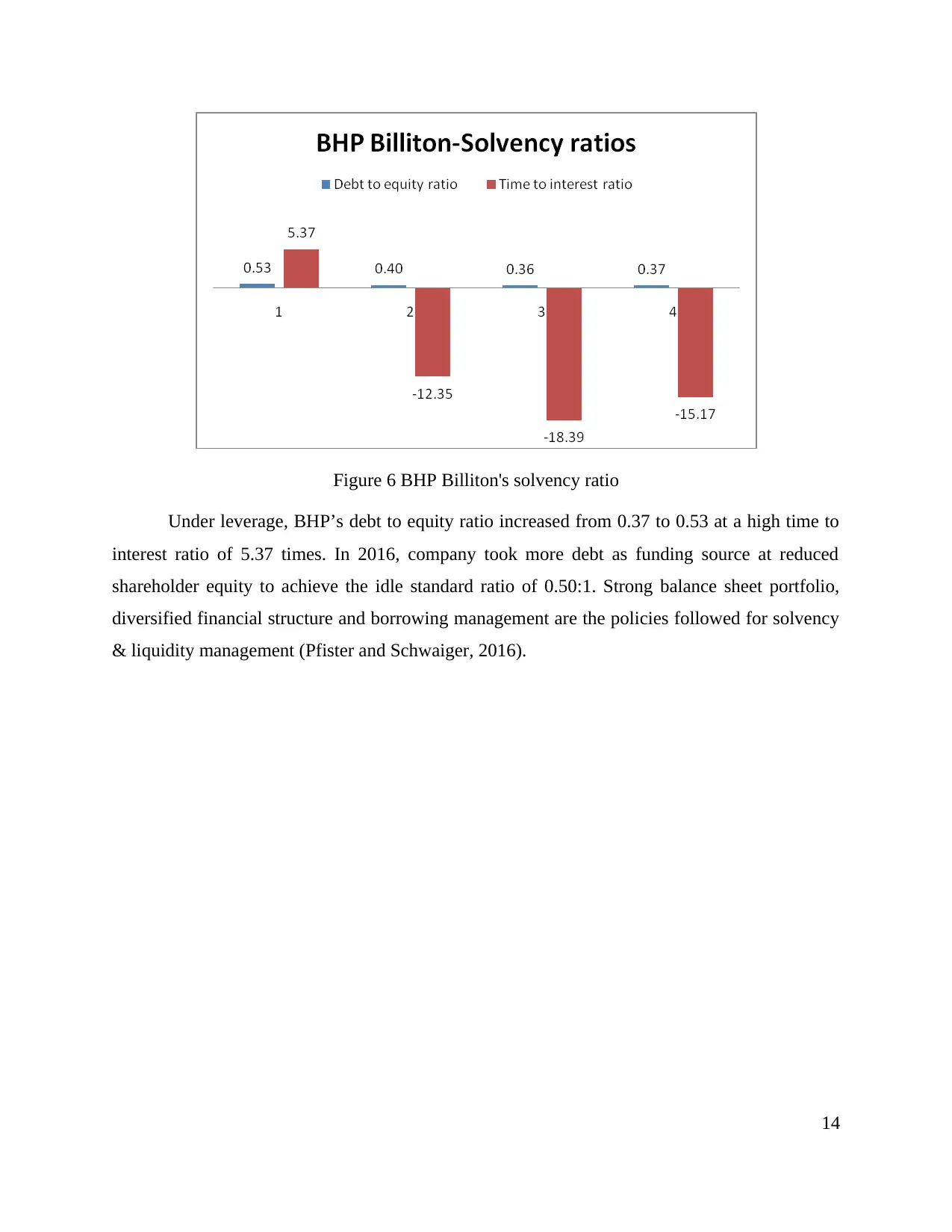

Figure 6 BHP Billiton's solvency ratio

Under leverage, BHP’s debt to equity ratio increased from 0.37 to 0.53 at a high time to

interest ratio of 5.37 times. In 2016, company took more debt as funding source at reduced

shareholder equity to achieve the idle standard ratio of 0.50:1. Strong balance sheet portfolio,

diversified financial structure and borrowing management are the policies followed for solvency

& liquidity management (Pfister and Schwaiger, 2016).

14

Under leverage, BHP’s debt to equity ratio increased from 0.37 to 0.53 at a high time to

interest ratio of 5.37 times. In 2016, company took more debt as funding source at reduced

shareholder equity to achieve the idle standard ratio of 0.50:1. Strong balance sheet portfolio,

diversified financial structure and borrowing management are the policies followed for solvency

& liquidity management (Pfister and Schwaiger, 2016).

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

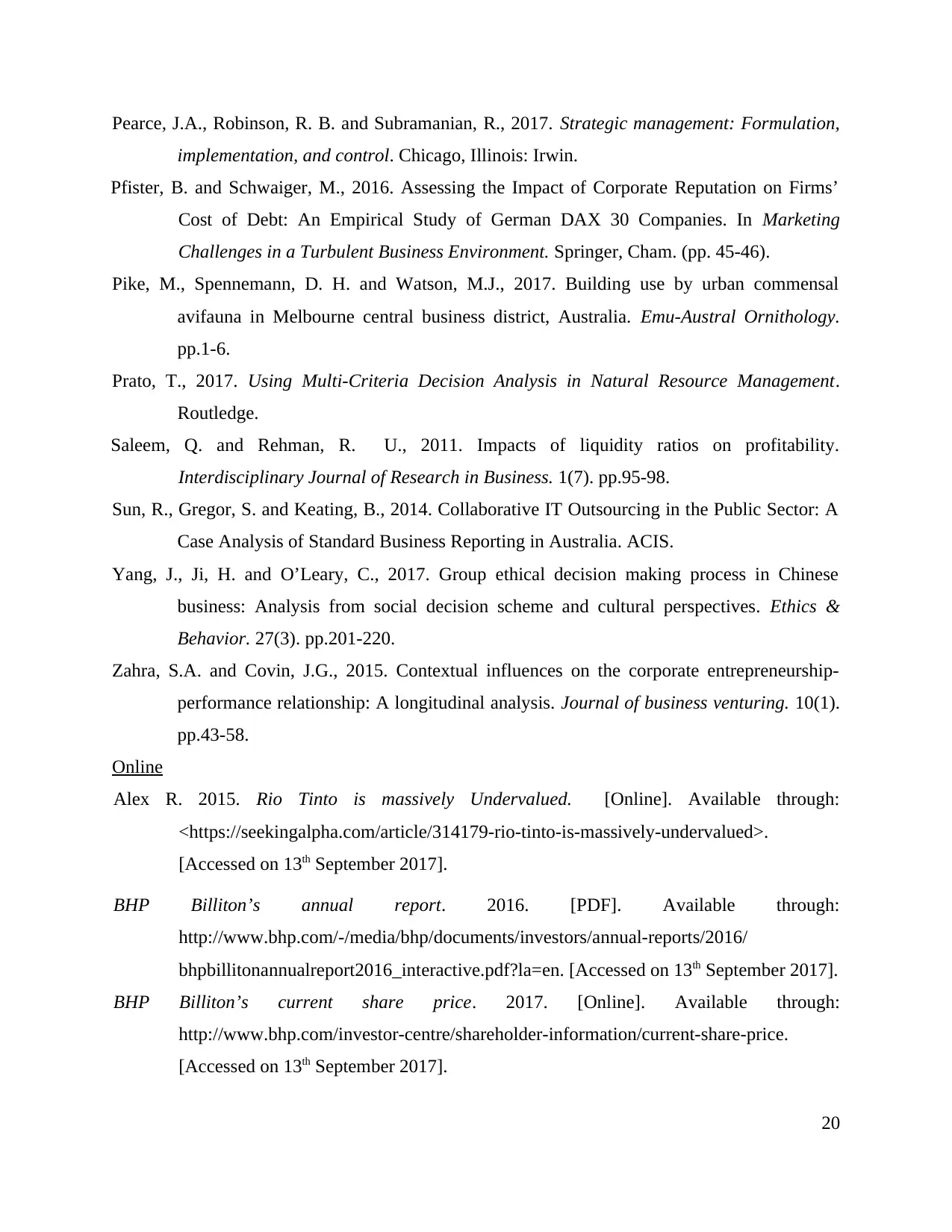

Figure 7 BHP Billiton's capital allocation framework

(Source: BHP Billiton’s annual report, 2016)

Its capital allocation framework is based on value optimization with reduction in debt,

shares buy-back, investment in growth projects and other growth driven operations (Levi and

Welch, 2017). However, in the 2016 annual report, its Standard & Poor credit rating lowered

from A+ to A whereas Moody’s credit rating reported from A1 to A3 shows negative outlook.

15

(Source: BHP Billiton’s annual report, 2016)

Its capital allocation framework is based on value optimization with reduction in debt,

shares buy-back, investment in growth projects and other growth driven operations (Levi and

Welch, 2017). However, in the 2016 annual report, its Standard & Poor credit rating lowered

from A+ to A whereas Moody’s credit rating reported from A1 to A3 shows negative outlook.

15

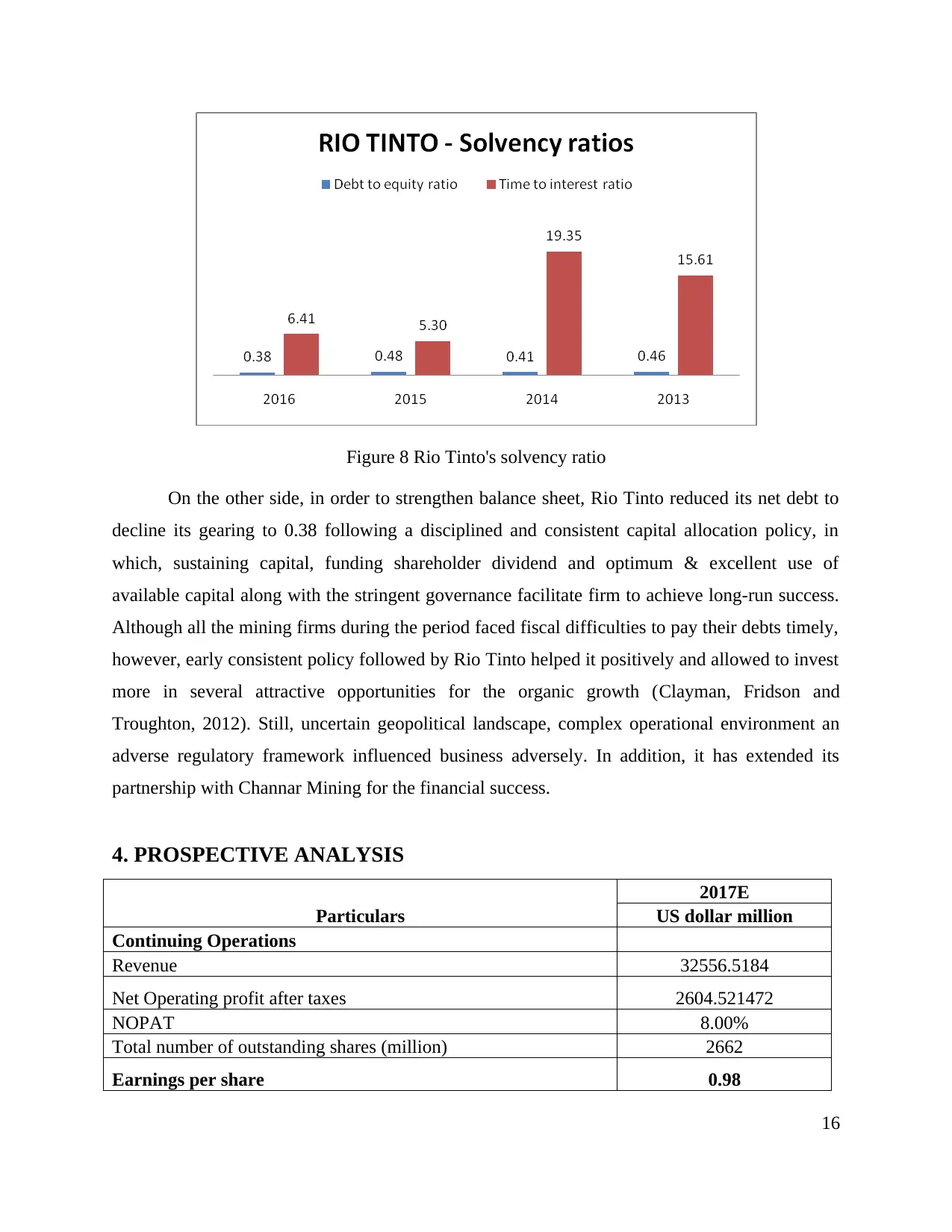

Figure 8 Rio Tinto's solvency ratio

On the other side, in order to strengthen balance sheet, Rio Tinto reduced its net debt to

decline its gearing to 0.38 following a disciplined and consistent capital allocation policy, in

which, sustaining capital, funding shareholder dividend and optimum & excellent use of

available capital along with the stringent governance facilitate firm to achieve long-run success.

Although all the mining firms during the period faced fiscal difficulties to pay their debts timely,

however, early consistent policy followed by Rio Tinto helped it positively and allowed to invest

more in several attractive opportunities for the organic growth (Clayman, Fridson and

Troughton, 2012). Still, uncertain geopolitical landscape, complex operational environment an

adverse regulatory framework influenced business adversely. In addition, it has extended its

partnership with Channar Mining for the financial success.

4. PROSPECTIVE ANALYSIS

Particulars

2017E

US dollar million

Continuing Operations

Revenue 32556.5184

Net Operating profit after taxes 2604.521472

NOPAT 8.00%

Total number of outstanding shares (million) 2662

Earnings per share 0.98

16

On the other side, in order to strengthen balance sheet, Rio Tinto reduced its net debt to

decline its gearing to 0.38 following a disciplined and consistent capital allocation policy, in

which, sustaining capital, funding shareholder dividend and optimum & excellent use of

available capital along with the stringent governance facilitate firm to achieve long-run success.

Although all the mining firms during the period faced fiscal difficulties to pay their debts timely,

however, early consistent policy followed by Rio Tinto helped it positively and allowed to invest

more in several attractive opportunities for the organic growth (Clayman, Fridson and

Troughton, 2012). Still, uncertain geopolitical landscape, complex operational environment an

adverse regulatory framework influenced business adversely. In addition, it has extended its

partnership with Channar Mining for the financial success.

4. PROSPECTIVE ANALYSIS

Particulars

2017E

US dollar million

Continuing Operations

Revenue 32556.5184

Net Operating profit after taxes 2604.521472

NOPAT 8.00%

Total number of outstanding shares (million) 2662

Earnings per share 0.98

16

3 Year average price to earnings ratio 24.6

Current price to earnings ratio 45

Share price 24.06883103

Revenue projection

Revenue 2016 2015 2014 Average

Year on Year -30.75% -33.58% 1.90% -20.81%

3-Year average -22.33% -14.82% -2.15% -13.10%

5-Year average -15.50% -3.30% 6.00% -4.27%

10-Year average 0.39% 4.20% 11.37% 5.32%

Australia is among the top five biggest producers of minerals i.e. gold, Iron, nickel, zinc,

lead and others, still, currently the mining sector is experiencing economic fluctuations and

volatility due to changing prices. From the analysis performed above, it is founded that BHP

Billiton faced excessive loss due to sudden failure of Samarco’s Fundao which was an

unforeseen or unexpected business situation, however, influenced operational activities and

return to a major extent. Therefore, for the sales projection, it is better to use average of 10-year

average sales growth in last (Baker and Martin, 2011). Investment in Pilbara infrastructure and

solid performance of Aluminium group, Copper & diamond and iron ore will bring growth in

sales. Henceforth, 5.32% rate has been used for the purpose of sales growth estimation and it is

derived to US $32,556.65 million. However, NOPAT has been projected using 3-year average of

net income % on sales computed to US $2.604.52 at net profitability of 8%. At this, EPS is

projected to 0.98 whereas 3 year average price to earnings ratio to 24.6 is used as market

multiple which estimated share price to 24.06. However, currently, on 30th June 2017, BHP

Billiton’s share price is estimated to 23.28 which is little bit less than expected (BHP Billiton’s

current share price, 2017).

5. RECOMMENDATION

From the above analysis, it is considered better to advise BHP Billiton that company

should strengthen and tighten control over cost for profit maximization. Besides this, firm must

make decisions to manage risk due to volatile economic outlook i.e. less Chinese demand,

decline in prices and changing regulations. Its new operational model, simplified structure and

streamline working will bring the benefits of economies of scale, minimize duplication and helps

17

Current price to earnings ratio 45

Share price 24.06883103

Revenue projection

Revenue 2016 2015 2014 Average

Year on Year -30.75% -33.58% 1.90% -20.81%

3-Year average -22.33% -14.82% -2.15% -13.10%

5-Year average -15.50% -3.30% 6.00% -4.27%

10-Year average 0.39% 4.20% 11.37% 5.32%

Australia is among the top five biggest producers of minerals i.e. gold, Iron, nickel, zinc,

lead and others, still, currently the mining sector is experiencing economic fluctuations and

volatility due to changing prices. From the analysis performed above, it is founded that BHP

Billiton faced excessive loss due to sudden failure of Samarco’s Fundao which was an

unforeseen or unexpected business situation, however, influenced operational activities and

return to a major extent. Therefore, for the sales projection, it is better to use average of 10-year

average sales growth in last (Baker and Martin, 2011). Investment in Pilbara infrastructure and

solid performance of Aluminium group, Copper & diamond and iron ore will bring growth in

sales. Henceforth, 5.32% rate has been used for the purpose of sales growth estimation and it is

derived to US $32,556.65 million. However, NOPAT has been projected using 3-year average of

net income % on sales computed to US $2.604.52 at net profitability of 8%. At this, EPS is

projected to 0.98 whereas 3 year average price to earnings ratio to 24.6 is used as market

multiple which estimated share price to 24.06. However, currently, on 30th June 2017, BHP

Billiton’s share price is estimated to 23.28 which is little bit less than expected (BHP Billiton’s

current share price, 2017).

5. RECOMMENDATION

From the above analysis, it is considered better to advise BHP Billiton that company

should strengthen and tighten control over cost for profit maximization. Besides this, firm must

make decisions to manage risk due to volatile economic outlook i.e. less Chinese demand,

decline in prices and changing regulations. Its new operational model, simplified structure and

streamline working will bring the benefits of economies of scale, minimize duplication and helps

17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to establish high level of coordination. Integrated technology network for the technological

advancement along with the lead technology will helps to maximize its productivity. In addition,

it should not take more debts in future and maintain enough cash flow so as to meet financial ob

liabilities timely. Diversification will facilitate company to minimize volatility in cash flow. In

despite of this, managers should ensure optimum use of their business resources so as to achieve

sustainable growth. Moreover, firm must invest in new sources of supply so as to replace decline

in natural field, abundant less cost with moderate level of price inflation.

CONCLUSION

Above held discussion concluded that BHP Billiton did not showed an impressive

financial success in the year 2016, however, competitor, RIO Tinto reflect sound financial results

and operational profitability as well. The result analyzed that currently, the mining industry is

suffering challenges from the Chinese economic slowdown, price volatility and changing

regulative framework. In order to strengthen financial situation, it is advised to BHP Billiton to

take decisions for cost control, revenue growth, optimum resource utilization, capital structure

management and right allocation of resources for the sustainable success.

18

advancement along with the lead technology will helps to maximize its productivity. In addition,

it should not take more debts in future and maintain enough cash flow so as to meet financial ob

liabilities timely. Diversification will facilitate company to minimize volatility in cash flow. In

despite of this, managers should ensure optimum use of their business resources so as to achieve

sustainable growth. Moreover, firm must invest in new sources of supply so as to replace decline

in natural field, abundant less cost with moderate level of price inflation.

CONCLUSION

Above held discussion concluded that BHP Billiton did not showed an impressive

financial success in the year 2016, however, competitor, RIO Tinto reflect sound financial results

and operational profitability as well. The result analyzed that currently, the mining industry is

suffering challenges from the Chinese economic slowdown, price volatility and changing

regulative framework. In order to strengthen financial situation, it is advised to BHP Billiton to

take decisions for cost control, revenue growth, optimum resource utilization, capital structure

management and right allocation of resources for the sustainable success.

18

REFERENCES

Books and Journals

Abor, J. and Bokpin, G.A., 2010. Investment opportunities, corporate finance, and dividend

payout policy: Evidence from emerging markets. Studies in economics and finance. 27(3).

pp.180-194.

Baker, H.K. and Martin, G.S. 2011. Capital Structure and Corporate Financing Decisions:

Theory, Evidence, and Practice. John Wiley & Sons.

Baños-Caballero, S., García-Teruel, P. J. and Martínez-Solano, P., 2014. Working capital

management, corporate performance, and financial constraints. Journal of Business

Research. 67(3). pp.332-338.

Bracker, J., 2010. The historical development of the strategic management concept. Academy of

management review. 5(2). pp.219-224.

Brealey, R.A. and et.al., 2012. Principles of corporate finance. Tata McGraw-Hill Education.

Clayman, M.R., Fridson, M.S. and Troughton, G.H., 2012. Corporate finance: A practical

approach. John Wiley & Sons.

Damodaran, A., 2010. Applied corporate finance. John Wiley & Sons.

Goldmann, K., 2017. Financial Liquidity and Profitability Management in Practice of Polish

Business. In Financial Environment and Business Development. Springer International

Publishing. (pp. 103-112).

Hall, R., 2012. The strategic analysis of intangible resources. Strategic management journal.

13(2). pp.135-144.

Hill, C. W., Jones, G. R. and Schilling, M. A., 2014. Strategic management: theory: an

integrated approach. Cengage Learning.

Ketchen Jr, D. J. and Shook, C. L., 2016. The application of cluster analysis in strategic

management research: an analysis and critique. Strategic management journal. pp.441-

458.

Levi, Y. and Welch, I., 2017. Best Practice for Cost-of-Capital Estimates. Journal of Financial

and Quantitative Analysis. 52(2). pp.427-463.

Mauree, P.P. and Geneletti, D., 2017. Assessing barriers to effective spatial planning in

Mauritius. A combination of SWOT and gap surveys. Journal of Environmental

Planning and Management. 60(8). pp.1324-1346.

19

Books and Journals

Abor, J. and Bokpin, G.A., 2010. Investment opportunities, corporate finance, and dividend

payout policy: Evidence from emerging markets. Studies in economics and finance. 27(3).

pp.180-194.

Baker, H.K. and Martin, G.S. 2011. Capital Structure and Corporate Financing Decisions:

Theory, Evidence, and Practice. John Wiley & Sons.

Baños-Caballero, S., García-Teruel, P. J. and Martínez-Solano, P., 2014. Working capital

management, corporate performance, and financial constraints. Journal of Business

Research. 67(3). pp.332-338.

Bracker, J., 2010. The historical development of the strategic management concept. Academy of

management review. 5(2). pp.219-224.

Brealey, R.A. and et.al., 2012. Principles of corporate finance. Tata McGraw-Hill Education.

Clayman, M.R., Fridson, M.S. and Troughton, G.H., 2012. Corporate finance: A practical

approach. John Wiley & Sons.

Damodaran, A., 2010. Applied corporate finance. John Wiley & Sons.

Goldmann, K., 2017. Financial Liquidity and Profitability Management in Practice of Polish

Business. In Financial Environment and Business Development. Springer International

Publishing. (pp. 103-112).

Hall, R., 2012. The strategic analysis of intangible resources. Strategic management journal.

13(2). pp.135-144.

Hill, C. W., Jones, G. R. and Schilling, M. A., 2014. Strategic management: theory: an

integrated approach. Cengage Learning.

Ketchen Jr, D. J. and Shook, C. L., 2016. The application of cluster analysis in strategic

management research: an analysis and critique. Strategic management journal. pp.441-

458.

Levi, Y. and Welch, I., 2017. Best Practice for Cost-of-Capital Estimates. Journal of Financial

and Quantitative Analysis. 52(2). pp.427-463.

Mauree, P.P. and Geneletti, D., 2017. Assessing barriers to effective spatial planning in

Mauritius. A combination of SWOT and gap surveys. Journal of Environmental

Planning and Management. 60(8). pp.1324-1346.

19

Pearce, J.A., Robinson, R. B. and Subramanian, R., 2017. Strategic management: Formulation,

implementation, and control. Chicago, Illinois: Irwin.

Pfister, B. and Schwaiger, M., 2016. Assessing the Impact of Corporate Reputation on Firms’

Cost of Debt: An Empirical Study of German DAX 30 Companies. In Marketing

Challenges in a Turbulent Business Environment. Springer, Cham. (pp. 45-46).

Pike, M., Spennemann, D. H. and Watson, M.J., 2017. Building use by urban commensal

avifauna in Melbourne central business district, Australia. Emu-Austral Ornithology.

pp.1-6.

Prato, T., 2017. Using Multi-Criteria Decision Analysis in Natural Resource Management.

Routledge.

Saleem, Q. and Rehman, R. U., 2011. Impacts of liquidity ratios on profitability.

Interdisciplinary Journal of Research in Business. 1(7). pp.95-98.

Sun, R., Gregor, S. and Keating, B., 2014. Collaborative IT Outsourcing in the Public Sector: A

Case Analysis of Standard Business Reporting in Australia. ACIS.

Yang, J., Ji, H. and O’Leary, C., 2017. Group ethical decision making process in Chinese

business: Analysis from social decision scheme and cultural perspectives. Ethics &

Behavior. 27(3). pp.201-220.

Zahra, S.A. and Covin, J.G., 2015. Contextual influences on the corporate entrepreneurship-

performance relationship: A longitudinal analysis. Journal of business venturing. 10(1).

pp.43-58.

Online

Alex R. 2015. Rio Tinto is massively Undervalued. [Online]. Available through:

<https://seekingalpha.com/article/314179-rio-tinto-is-massively-undervalued>.

[Accessed on 13th September 2017].

BHP Billiton’s annual report. 2016. [PDF]. Available through:

http://www.bhp.com/-/media/bhp/documents/investors/annual-reports/2016/

bhpbillitonannualreport2016_interactive.pdf?la=en. [Accessed on 13th September 2017].

BHP Billiton’s current share price. 2017. [Online]. Available through:

http://www.bhp.com/investor-centre/shareholder-information/current-share-price.

[Accessed on 13th September 2017].

20

implementation, and control. Chicago, Illinois: Irwin.

Pfister, B. and Schwaiger, M., 2016. Assessing the Impact of Corporate Reputation on Firms’

Cost of Debt: An Empirical Study of German DAX 30 Companies. In Marketing

Challenges in a Turbulent Business Environment. Springer, Cham. (pp. 45-46).

Pike, M., Spennemann, D. H. and Watson, M.J., 2017. Building use by urban commensal

avifauna in Melbourne central business district, Australia. Emu-Austral Ornithology.

pp.1-6.

Prato, T., 2017. Using Multi-Criteria Decision Analysis in Natural Resource Management.

Routledge.

Saleem, Q. and Rehman, R. U., 2011. Impacts of liquidity ratios on profitability.

Interdisciplinary Journal of Research in Business. 1(7). pp.95-98.

Sun, R., Gregor, S. and Keating, B., 2014. Collaborative IT Outsourcing in the Public Sector: A

Case Analysis of Standard Business Reporting in Australia. ACIS.

Yang, J., Ji, H. and O’Leary, C., 2017. Group ethical decision making process in Chinese

business: Analysis from social decision scheme and cultural perspectives. Ethics &

Behavior. 27(3). pp.201-220.

Zahra, S.A. and Covin, J.G., 2015. Contextual influences on the corporate entrepreneurship-

performance relationship: A longitudinal analysis. Journal of business venturing. 10(1).

pp.43-58.

Online

Alex R. 2015. Rio Tinto is massively Undervalued. [Online]. Available through:

<https://seekingalpha.com/article/314179-rio-tinto-is-massively-undervalued>.

[Accessed on 13th September 2017].

BHP Billiton’s annual report. 2016. [PDF]. Available through:

http://www.bhp.com/-/media/bhp/documents/investors/annual-reports/2016/

bhpbillitonannualreport2016_interactive.pdf?la=en. [Accessed on 13th September 2017].

BHP Billiton’s current share price. 2017. [Online]. Available through:

http://www.bhp.com/investor-centre/shareholder-information/current-share-price.

[Accessed on 13th September 2017].

20

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

James K. and et.al., 2014. The Glencore giant, the law's Lillipitians, and the mining and metals

markets. [Online]. Available through:

<https://www.whitecase.com/publications/insight/glencore-giant-laws-lilliputians-and-

mining-and-metals-markets>. [Accessed on 13th September 2017].

Rio Tinto’s annual report. 2016. [PDF].

<http://www.riotinto.com/documents/RT_2016_Annual_report.pdf>. [Accessed on 13th

September 2017].

APPENDIX

BHP Billiton’s ratio analysis

Particulars

BHP Billiton

US dollar million

Profitability ratios 2016 2015 2014 2013

Operating income ratio -20.17% 19.42% 34.84% 31.84%

Net profit ratio -20.08% 6.45% 22.65% 19.44%

Liquidity ratio

Current ratio 1.44 1.27 1.23 0.94

Quick ratio 1.16 0.94 0.90 0.65

Solvency ratio

Debt to equity ratio 0.53 0.40 0.36 0.37

Time to interest ratio 5.37 -12.35 -18.39 -15.17

Leverage ratio 1.98 1.77 1.77 1.85

Efficiency/Turnover ratios

Assets turnover ratio 0.26 0.36 0.44 0.47

Inventory turnover ratio 9.06 10.99 10.96 8.92

Debtors turnover ratio 9.80 10.33 9.97 10.45

Investment ratios

Earnings per share -120 35.9 260 210.7

Dividend per share 78 124 118 114

Return on shareholder’s equity -10.33% 4.08% 17.83% 17.03%

Return on capital employed -5.85% 7.76% 17.56% 17.64%

Du Pont analysis 2016 2015 2014 2013

Net profit margin -20.08% 6.45% 22.65% 19.44%

Assets turnover ratio 0.26 0.36 0.44 0.47

Equity multiplier(Financial

leverage) 1.98 1.77 1.77 1.85

21

markets. [Online]. Available through:

<https://www.whitecase.com/publications/insight/glencore-giant-laws-lilliputians-and-

mining-and-metals-markets>. [Accessed on 13th September 2017].

Rio Tinto’s annual report. 2016. [PDF].

<http://www.riotinto.com/documents/RT_2016_Annual_report.pdf>. [Accessed on 13th

September 2017].

APPENDIX

BHP Billiton’s ratio analysis

Particulars

BHP Billiton

US dollar million

Profitability ratios 2016 2015 2014 2013

Operating income ratio -20.17% 19.42% 34.84% 31.84%

Net profit ratio -20.08% 6.45% 22.65% 19.44%

Liquidity ratio

Current ratio 1.44 1.27 1.23 0.94

Quick ratio 1.16 0.94 0.90 0.65

Solvency ratio

Debt to equity ratio 0.53 0.40 0.36 0.37

Time to interest ratio 5.37 -12.35 -18.39 -15.17

Leverage ratio 1.98 1.77 1.77 1.85

Efficiency/Turnover ratios

Assets turnover ratio 0.26 0.36 0.44 0.47

Inventory turnover ratio 9.06 10.99 10.96 8.92

Debtors turnover ratio 9.80 10.33 9.97 10.45

Investment ratios

Earnings per share -120 35.9 260 210.7

Dividend per share 78 124 118 114

Return on shareholder’s equity -10.33% 4.08% 17.83% 17.03%

Return on capital employed -5.85% 7.76% 17.56% 17.64%

Du Pont analysis 2016 2015 2014 2013

Net profit margin -20.08% 6.45% 22.65% 19.44%

Assets turnover ratio 0.26 0.36 0.44 0.47

Equity multiplier(Financial

leverage) 1.98 1.77 1.77 1.85

21

ROE -10.33% 4.08% 17.83% 17.03%

Common-size/vertical income statement: BHP Billiton

2016 2015 2014 2013

US$M US$M US$M US$M

Continuing Operations

Revenue 100.00% 100.00% 100.00% 100.00%

Other income 1.44% 1.11% 2.27% 5.98%

Expenses excluding net finance costs -114.80% -82.92% -69.21% -75.87%

Profit or loss from equity accounted investments,

related impairments and expenses -6.81% 1.23% 1.78% 1.73%

(Loss)/ profit from operations -20.17% 19.42% 34.84% 31.84%

Financial expense -3.76% -1.57% -1.89% -2.10%

Financial income 0.44% 0.20% 0.14% 0.16%

Net finance cost -3.31% -1.38% -1.75% -1.93%

(Loss)/ profit before taxation -23.48% 18.05% 33.09% 29.91%

Income tax benefit (expense) 4.20% -6.19% -9.73% -8.66%

Royalty related taxation (net of income tax

benefit) -0.79% -2.03% -0.71% 1.81%

Total tax benefit (expense) 3.40% -8.21% -10.43% -10.47%

(Loss)/ profit after taxation from continuing

operations -20.08% 9.84% 22.65% 19.44%

Discontinued Operations 0.00% 0.00% 0.00% 0.00%

(Loss)/ profit after taxation from Discontinuing

operations 0.00% -3.39% 0.00% 0.00%

(Loss)/ profit after taxation from continuing

and Discontinuing operations -20.08% 6.45% 22.65% 19.44%

Horizontal income statement: BHP Billiton

2016 2015 2014 2013

US$M US$M US$M US$M