One Beauty Ltd: Preparation of Financial Statements for 2019 - Finance

VerifiedAdded on 2023/03/20

|13

|2414

|95

Homework Assignment

AI Summary

This document presents a comprehensive financial analysis of One Beauty Ltd for the year ended June 30, 2019. It includes the preparation of the Profit and Loss Account, Statement of Comprehensive Income, Statement of Changes in Equity, and Statement of Financial Position. The solution details the allocation of common expenses, calculations for amortization, and adjustments for various financial transactions. The document also covers adjusting events, prior period errors, and the treatment of doubtful debts, along with the related journal entries. Furthermore, the assignment includes journal entries for share issuance and forfeiture, and accounting for plant and equipment. This detailed analysis demonstrates a solid understanding of accounting principles and financial statement preparation.

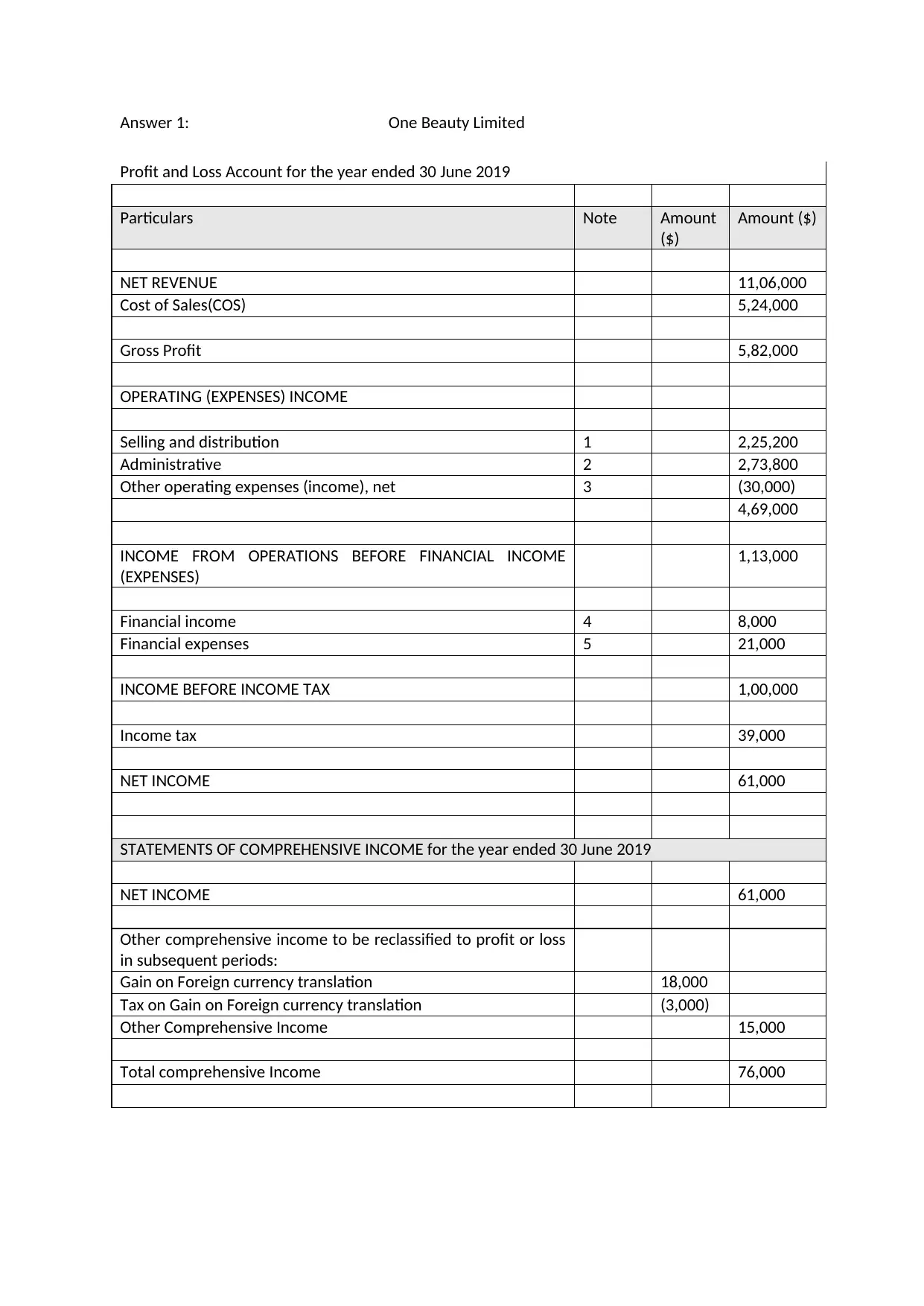

Answer 1: One Beauty Limited

Profit and Loss Account for the year ended 30 June 2019

Particulars Note Amount

($)

Amount ($)

NET REVENUE 11,06,000

Cost of Sales(COS) 5,24,000

Gross Profit 5,82,000

OPERATING (EXPENSES) INCOME

Selling and distribution 1 2,25,200

Administrative 2 2,73,800

Other operating expenses (income), net 3 (30,000)

4,69,000

INCOME FROM OPERATIONS BEFORE FINANCIAL INCOME

(EXPENSES)

1,13,000

Financial income 4 8,000

Financial expenses 5 21,000

INCOME BEFORE INCOME TAX 1,00,000

Income tax 39,000

NET INCOME 61,000

STATEMENTS OF COMPREHENSIVE INCOME for the year ended 30 June 2019

NET INCOME 61,000

Other comprehensive income to be reclassified to profit or loss

in subsequent periods:

Gain on Foreign currency translation 18,000

Tax on Gain on Foreign currency translation (3,000)

Other Comprehensive Income 15,000

Total comprehensive Income 76,000

Profit and Loss Account for the year ended 30 June 2019

Particulars Note Amount

($)

Amount ($)

NET REVENUE 11,06,000

Cost of Sales(COS) 5,24,000

Gross Profit 5,82,000

OPERATING (EXPENSES) INCOME

Selling and distribution 1 2,25,200

Administrative 2 2,73,800

Other operating expenses (income), net 3 (30,000)

4,69,000

INCOME FROM OPERATIONS BEFORE FINANCIAL INCOME

(EXPENSES)

1,13,000

Financial income 4 8,000

Financial expenses 5 21,000

INCOME BEFORE INCOME TAX 1,00,000

Income tax 39,000

NET INCOME 61,000

STATEMENTS OF COMPREHENSIVE INCOME for the year ended 30 June 2019

NET INCOME 61,000

Other comprehensive income to be reclassified to profit or loss

in subsequent periods:

Gain on Foreign currency translation 18,000

Tax on Gain on Foreign currency translation (3,000)

Other Comprehensive Income 15,000

Total comprehensive Income 76,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

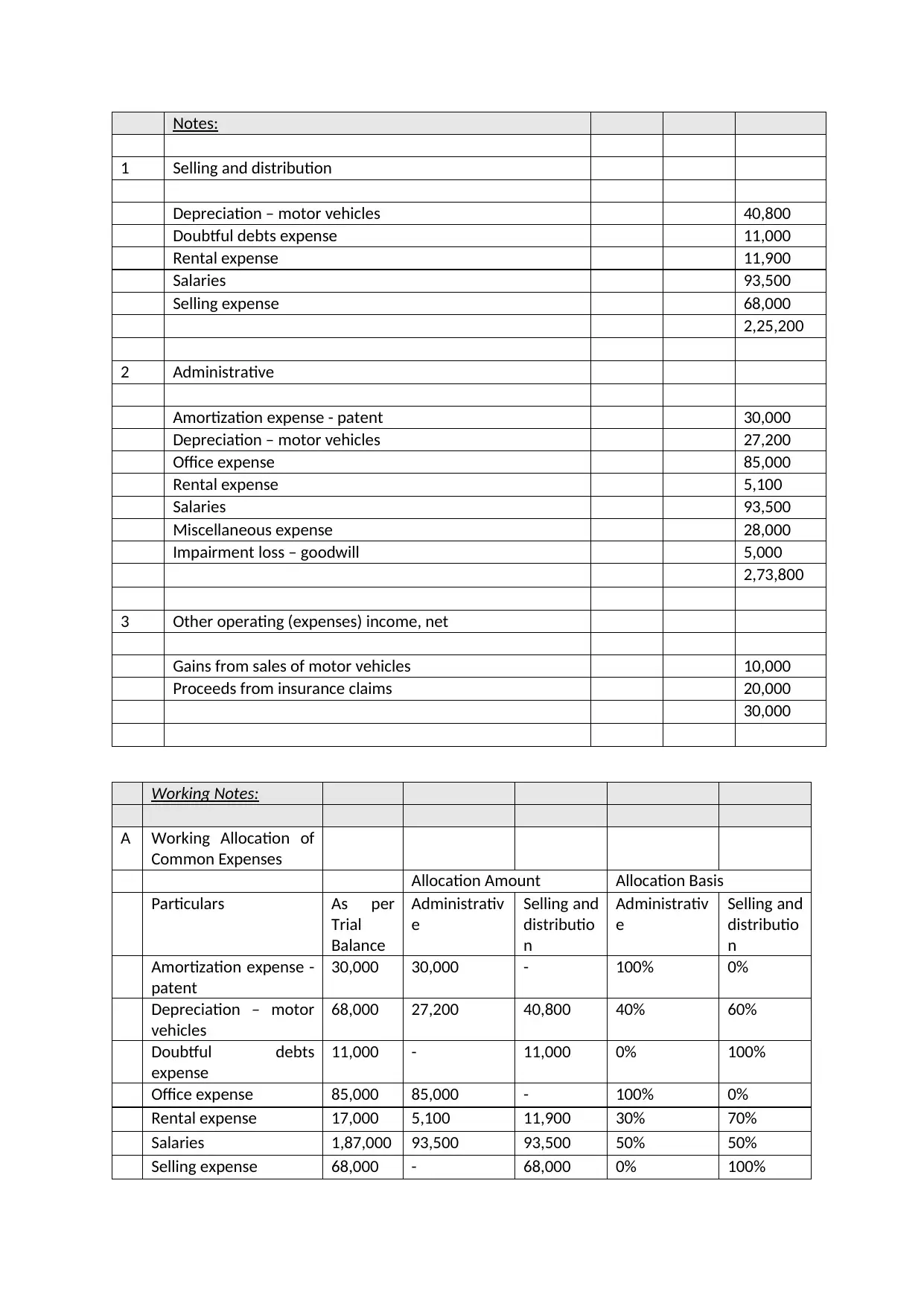

Notes:

1 Selling and distribution

Depreciation – motor vehicles 40,800

Doubtful debts expense 11,000

Rental expense 11,900

Salaries 93,500

Selling expense 68,000

2,25,200

2 Administrative

Amortization expense - patent 30,000

Depreciation – motor vehicles 27,200

Office expense 85,000

Rental expense 5,100

Salaries 93,500

Miscellaneous expense 28,000

Impairment loss – goodwill 5,000

2,73,800

3 Other operating (expenses) income, net

Gains from sales of motor vehicles 10,000

Proceeds from insurance claims 20,000

30,000

Working Notes:

A Working Allocation of

Common Expenses

Allocation Amount Allocation Basis

Particulars As per

Trial

Balance

Administrativ

e

Selling and

distributio

n

Administrativ

e

Selling and

distributio

n

Amortization expense -

patent

30,000 30,000 - 100% 0%

Depreciation – motor

vehicles

68,000 27,200 40,800 40% 60%

Doubtful debts

expense

11,000 - 11,000 0% 100%

Office expense 85,000 85,000 - 100% 0%

Rental expense 17,000 5,100 11,900 30% 70%

Salaries 1,87,000 93,500 93,500 50% 50%

Selling expense 68,000 - 68,000 0% 100%

1 Selling and distribution

Depreciation – motor vehicles 40,800

Doubtful debts expense 11,000

Rental expense 11,900

Salaries 93,500

Selling expense 68,000

2,25,200

2 Administrative

Amortization expense - patent 30,000

Depreciation – motor vehicles 27,200

Office expense 85,000

Rental expense 5,100

Salaries 93,500

Miscellaneous expense 28,000

Impairment loss – goodwill 5,000

2,73,800

3 Other operating (expenses) income, net

Gains from sales of motor vehicles 10,000

Proceeds from insurance claims 20,000

30,000

Working Notes:

A Working Allocation of

Common Expenses

Allocation Amount Allocation Basis

Particulars As per

Trial

Balance

Administrativ

e

Selling and

distributio

n

Administrativ

e

Selling and

distributio

n

Amortization expense -

patent

30,000 30,000 - 100% 0%

Depreciation – motor

vehicles

68,000 27,200 40,800 40% 60%

Doubtful debts

expense

11,000 - 11,000 0% 100%

Office expense 85,000 85,000 - 100% 0%

Rental expense 17,000 5,100 11,900 30% 70%

Salaries 1,87,000 93,500 93,500 50% 50%

Selling expense 68,000 - 68,000 0% 100%

Miscellaneous expense 28,000 28,000 - 100% 0%

B Patent (cost) 2,20,000

Accumulated

amortization – patent

20,000

Ammortisation in PL 18,000

Life assumed 147

Monthly

Ammortisation

1,500

Time elapsed (A) 13

Actual Life remaining

until 31 Dec 2025 from

30 June 2019 (B)

78

Total Life (A+B) 91

Ammortisation till date 32,117

Round off 32,000

Already Amortised 2,000

Amortisation in current

year PL

30,000

B Patent (cost) 2,20,000

Accumulated

amortization – patent

20,000

Ammortisation in PL 18,000

Life assumed 147

Monthly

Ammortisation

1,500

Time elapsed (A) 13

Actual Life remaining

until 31 Dec 2025 from

30 June 2019 (B)

78

Total Life (A+B) 91

Ammortisation till date 32,117

Round off 32,000

Already Amortised 2,000

Amortisation in current

year PL

30,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

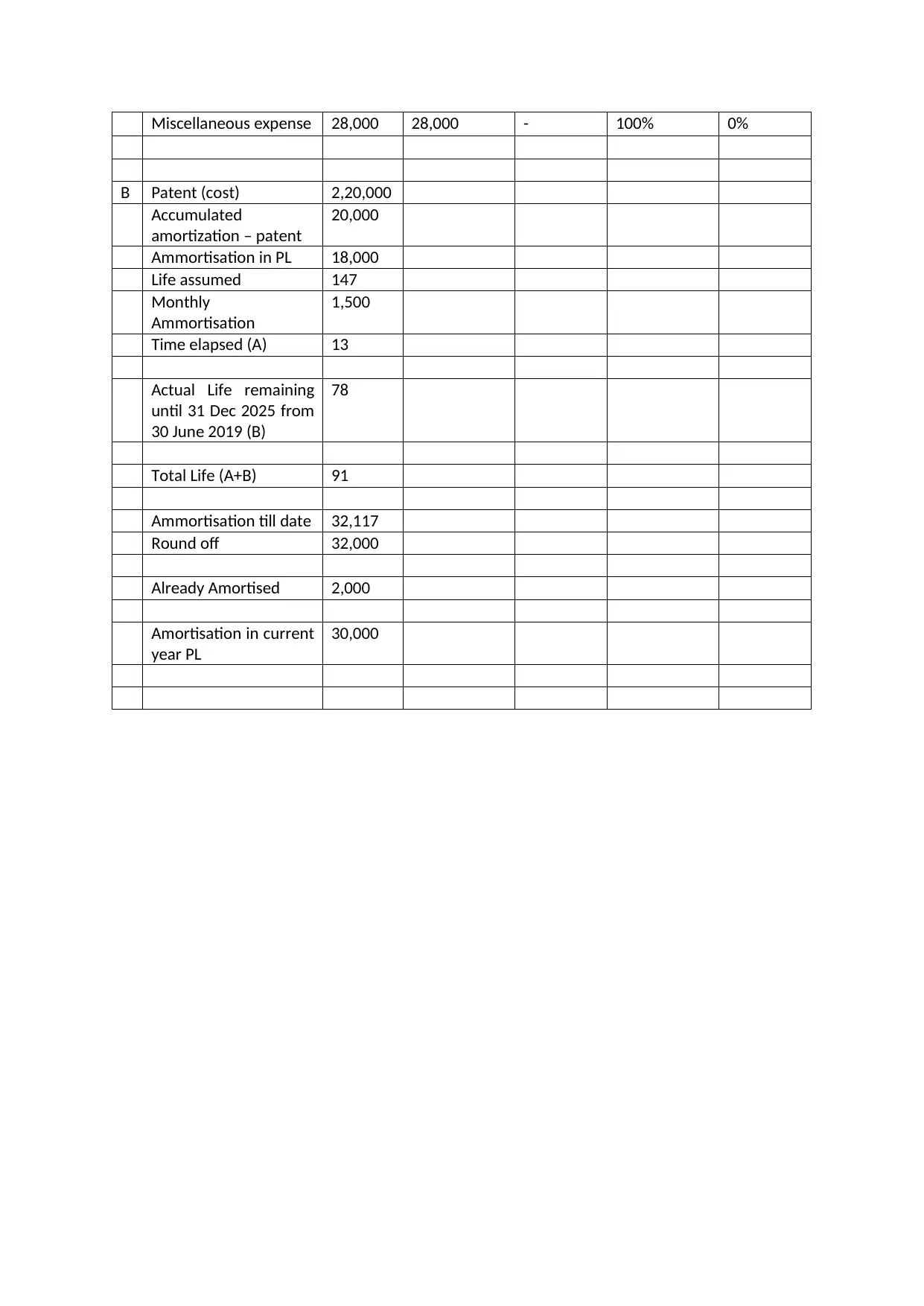

One Beauty Ltd

Statement of change in Equity as of 30 Jun2019

Particulars Equity Share

Capital

Retained

Earnings

Currency Translation

reserve

Opening Balance as on 01 July

2018

4,00,000 52,000 10,000

Interim Dividend Paid - (16,000) -

Profit for the year - 61,000 -

Foreign currency Translation

Gain

- - 15,000

Closing balance as on 30 June

2019

4,00,000 97,000 25,000

Working Notes:

A Retained earnings at 16

December 2018

36,000

Add: Interim Dividend Paid 16,000

Retained earnings at 01 July

2018

52,000

One Beauty Ltd

Statement of Financial Position as on 30 June 2019

ASSETS Note Amount ($)

Non-current Assets

Property, Plant & Equipment 6 2,69,000

Intangible Assets 7 2,63,000

Deferred tax assets 18,000

Current Assets

Cash & Cash Equivalent 8 1,34,000

Inventories 92,000

Accounts receivable (Net) 9 1,07,000

Total Assets 8,83,000

EQUITY AND LIABILITIES

EQUITY

Equity Capital 4,00,000

Retained Earnings 97,000

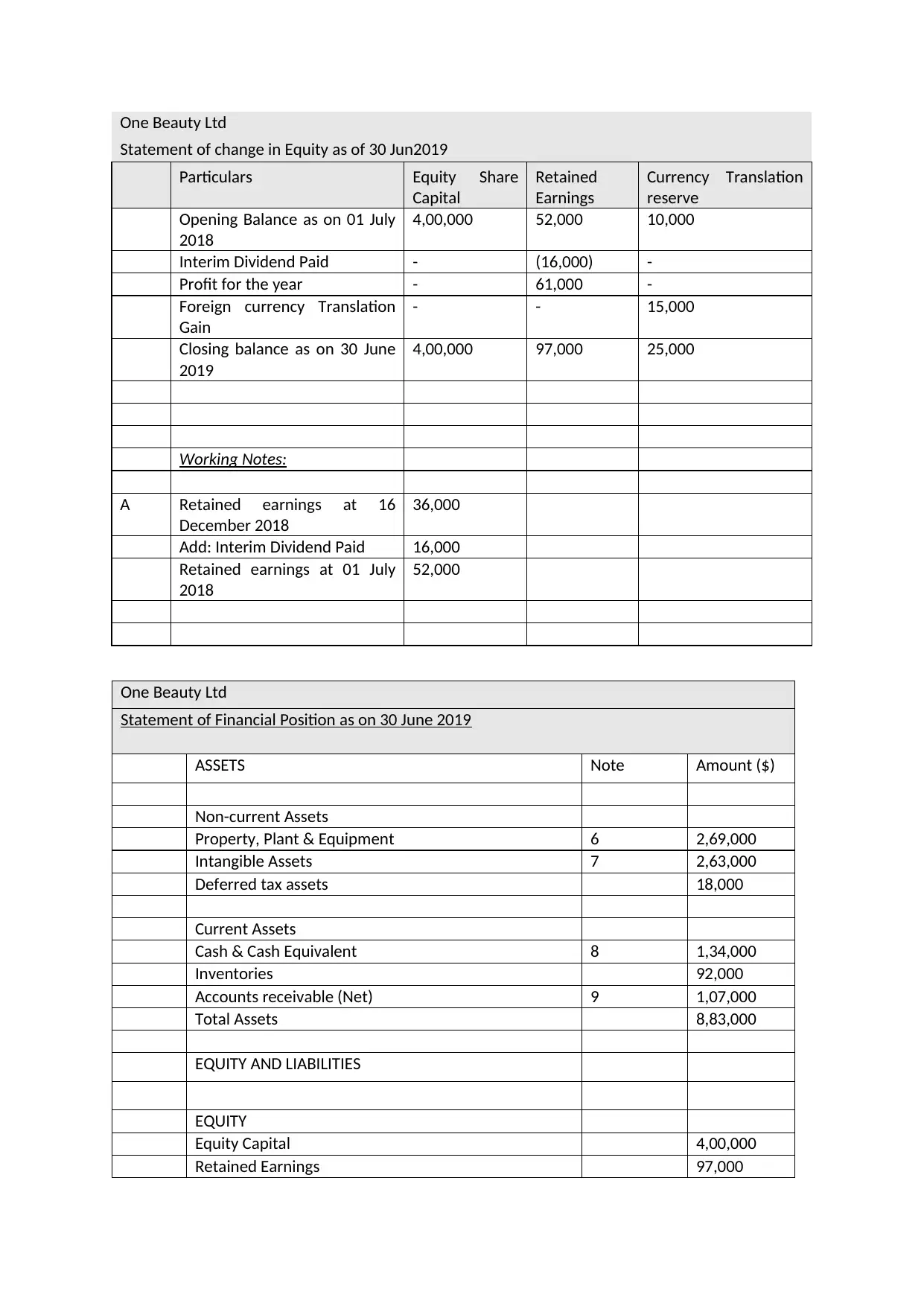

Statement of change in Equity as of 30 Jun2019

Particulars Equity Share

Capital

Retained

Earnings

Currency Translation

reserve

Opening Balance as on 01 July

2018

4,00,000 52,000 10,000

Interim Dividend Paid - (16,000) -

Profit for the year - 61,000 -

Foreign currency Translation

Gain

- - 15,000

Closing balance as on 30 June

2019

4,00,000 97,000 25,000

Working Notes:

A Retained earnings at 16

December 2018

36,000

Add: Interim Dividend Paid 16,000

Retained earnings at 01 July

2018

52,000

One Beauty Ltd

Statement of Financial Position as on 30 June 2019

ASSETS Note Amount ($)

Non-current Assets

Property, Plant & Equipment 6 2,69,000

Intangible Assets 7 2,63,000

Deferred tax assets 18,000

Current Assets

Cash & Cash Equivalent 8 1,34,000

Inventories 92,000

Accounts receivable (Net) 9 1,07,000

Total Assets 8,83,000

EQUITY AND LIABILITIES

EQUITY

Equity Capital 4,00,000

Retained Earnings 97,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

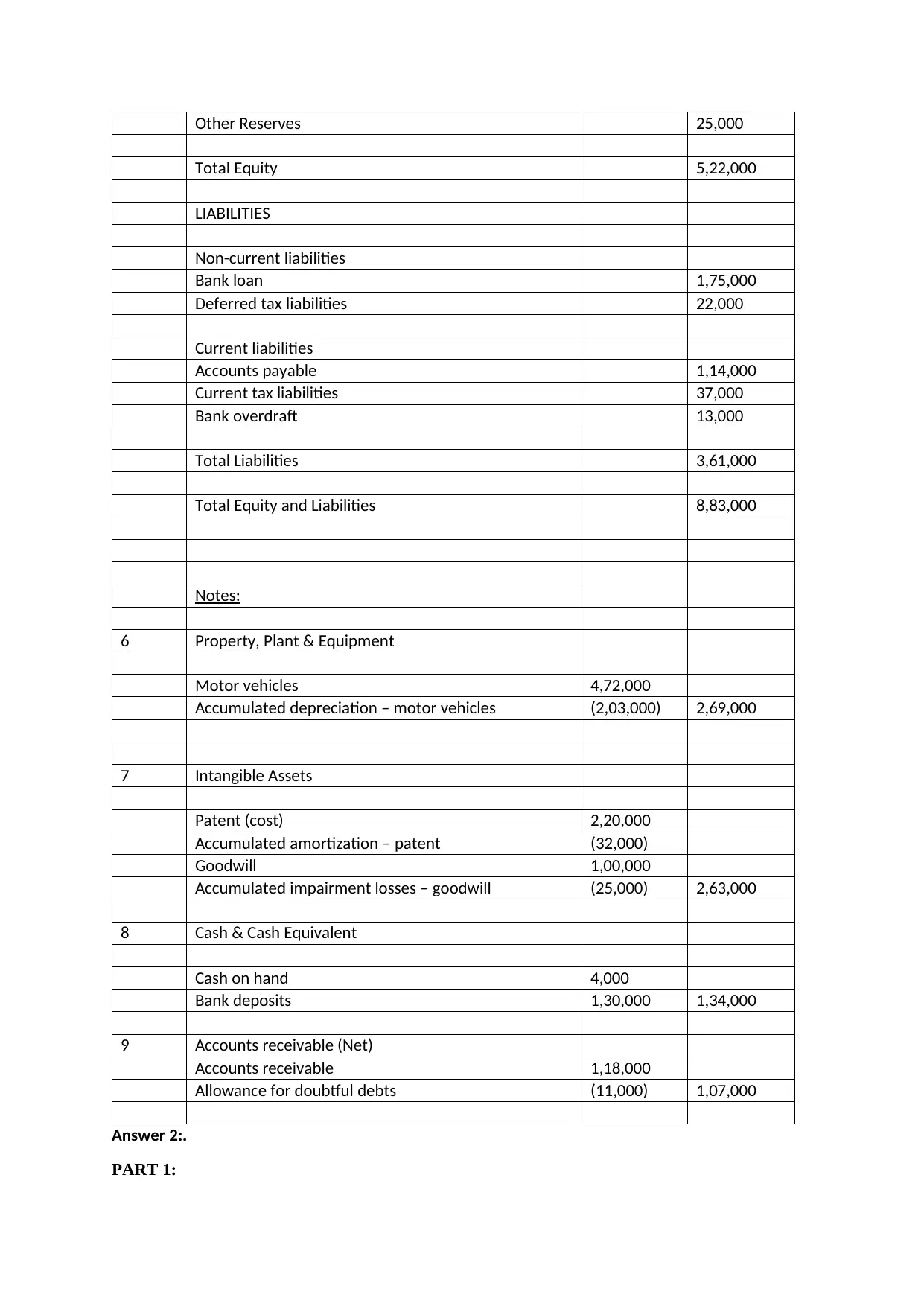

Other Reserves 25,000

Total Equity 5,22,000

LIABILITIES

Non-current liabilities

Bank loan 1,75,000

Deferred tax liabilities 22,000

Current liabilities

Accounts payable 1,14,000

Current tax liabilities 37,000

Bank overdraft 13,000

Total Liabilities 3,61,000

Total Equity and Liabilities 8,83,000

Notes:

6 Property, Plant & Equipment

Motor vehicles 4,72,000

Accumulated depreciation – motor vehicles (2,03,000) 2,69,000

7 Intangible Assets

Patent (cost) 2,20,000

Accumulated amortization – patent (32,000)

Goodwill 1,00,000

Accumulated impairment losses – goodwill (25,000) 2,63,000

8 Cash & Cash Equivalent

Cash on hand 4,000

Bank deposits 1,30,000 1,34,000

9 Accounts receivable (Net)

Accounts receivable 1,18,000

Allowance for doubtful debts (11,000) 1,07,000

Answer 2:.

PART 1:

Total Equity 5,22,000

LIABILITIES

Non-current liabilities

Bank loan 1,75,000

Deferred tax liabilities 22,000

Current liabilities

Accounts payable 1,14,000

Current tax liabilities 37,000

Bank overdraft 13,000

Total Liabilities 3,61,000

Total Equity and Liabilities 8,83,000

Notes:

6 Property, Plant & Equipment

Motor vehicles 4,72,000

Accumulated depreciation – motor vehicles (2,03,000) 2,69,000

7 Intangible Assets

Patent (cost) 2,20,000

Accumulated amortization – patent (32,000)

Goodwill 1,00,000

Accumulated impairment losses – goodwill (25,000) 2,63,000

8 Cash & Cash Equivalent

Cash on hand 4,000

Bank deposits 1,30,000 1,34,000

9 Accounts receivable (Net)

Accounts receivable 1,18,000

Allowance for doubtful debts (11,000) 1,07,000

Answer 2:.

PART 1:

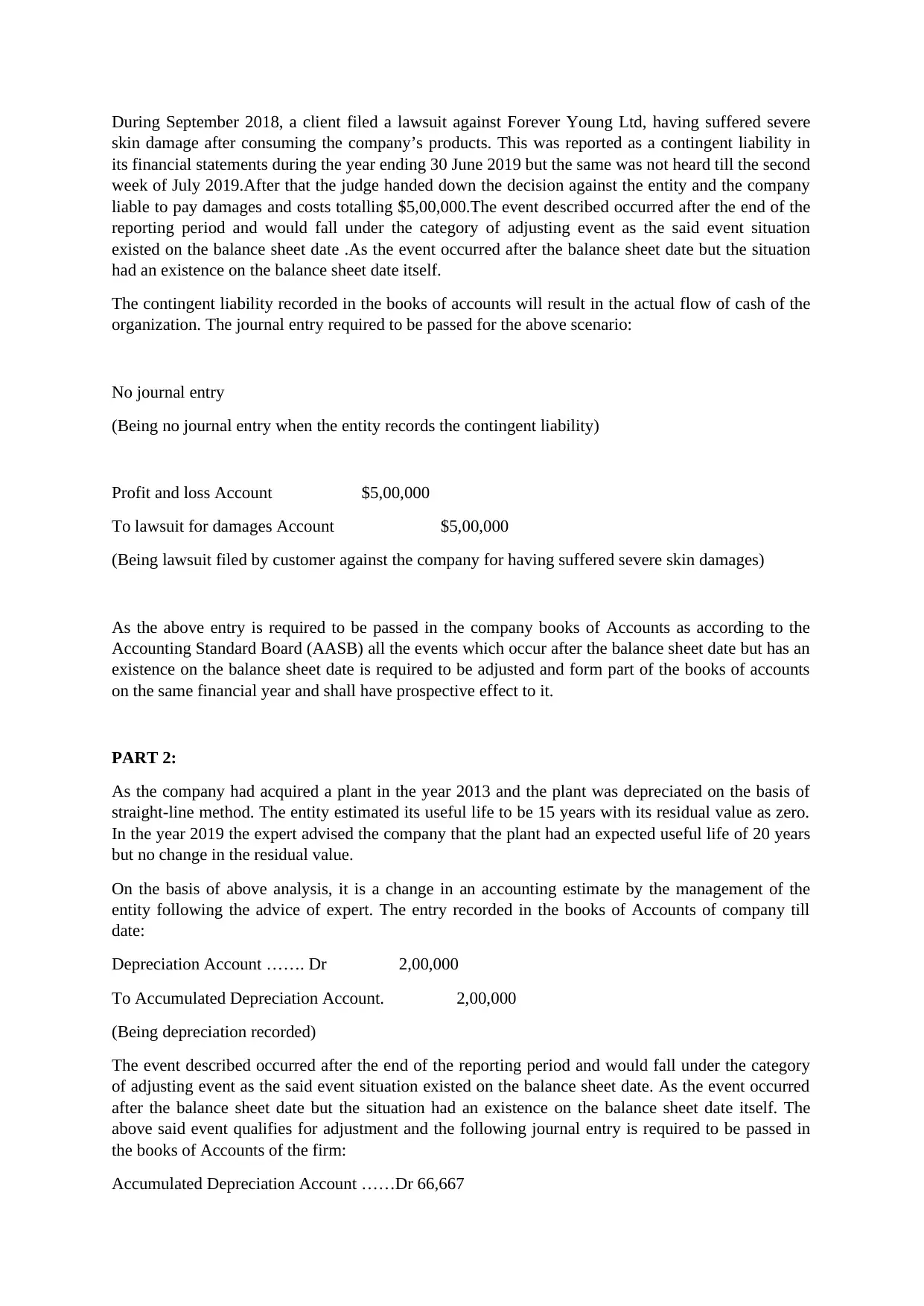

During September 2018, a client filed a lawsuit against Forever Young Ltd, having suffered severe

skin damage after consuming the company’s products. This was reported as a contingent liability in

its financial statements during the year ending 30 June 2019 but the same was not heard till the second

week of July 2019.After that the judge handed down the decision against the entity and the company

liable to pay damages and costs totalling $5,00,000.The event described occurred after the end of the

reporting period and would fall under the category of adjusting event as the said event situation

existed on the balance sheet date .As the event occurred after the balance sheet date but the situation

had an existence on the balance sheet date itself.

The contingent liability recorded in the books of accounts will result in the actual flow of cash of the

organization. The journal entry required to be passed for the above scenario:

No journal entry

(Being no journal entry when the entity records the contingent liability)

Profit and loss Account $5,00,000

To lawsuit for damages Account $5,00,000

(Being lawsuit filed by customer against the company for having suffered severe skin damages)

As the above entry is required to be passed in the company books of Accounts as according to the

Accounting Standard Board (AASB) all the events which occur after the balance sheet date but has an

existence on the balance sheet date is required to be adjusted and form part of the books of accounts

on the same financial year and shall have prospective effect to it.

PART 2:

As the company had acquired a plant in the year 2013 and the plant was depreciated on the basis of

straight-line method. The entity estimated its useful life to be 15 years with its residual value as zero.

In the year 2019 the expert advised the company that the plant had an expected useful life of 20 years

but no change in the residual value.

On the basis of above analysis, it is a change in an accounting estimate by the management of the

entity following the advice of expert. The entry recorded in the books of Accounts of company till

date:

Depreciation Account ……. Dr 2,00,000

To Accumulated Depreciation Account. 2,00,000

(Being depreciation recorded)

The event described occurred after the end of the reporting period and would fall under the category

of adjusting event as the said event situation existed on the balance sheet date. As the event occurred

after the balance sheet date but the situation had an existence on the balance sheet date itself. The

above said event qualifies for adjustment and the following journal entry is required to be passed in

the books of Accounts of the firm:

Accumulated Depreciation Account ……Dr 66,667

skin damage after consuming the company’s products. This was reported as a contingent liability in

its financial statements during the year ending 30 June 2019 but the same was not heard till the second

week of July 2019.After that the judge handed down the decision against the entity and the company

liable to pay damages and costs totalling $5,00,000.The event described occurred after the end of the

reporting period and would fall under the category of adjusting event as the said event situation

existed on the balance sheet date .As the event occurred after the balance sheet date but the situation

had an existence on the balance sheet date itself.

The contingent liability recorded in the books of accounts will result in the actual flow of cash of the

organization. The journal entry required to be passed for the above scenario:

No journal entry

(Being no journal entry when the entity records the contingent liability)

Profit and loss Account $5,00,000

To lawsuit for damages Account $5,00,000

(Being lawsuit filed by customer against the company for having suffered severe skin damages)

As the above entry is required to be passed in the company books of Accounts as according to the

Accounting Standard Board (AASB) all the events which occur after the balance sheet date but has an

existence on the balance sheet date is required to be adjusted and form part of the books of accounts

on the same financial year and shall have prospective effect to it.

PART 2:

As the company had acquired a plant in the year 2013 and the plant was depreciated on the basis of

straight-line method. The entity estimated its useful life to be 15 years with its residual value as zero.

In the year 2019 the expert advised the company that the plant had an expected useful life of 20 years

but no change in the residual value.

On the basis of above analysis, it is a change in an accounting estimate by the management of the

entity following the advice of expert. The entry recorded in the books of Accounts of company till

date:

Depreciation Account ……. Dr 2,00,000

To Accumulated Depreciation Account. 2,00,000

(Being depreciation recorded)

The event described occurred after the end of the reporting period and would fall under the category

of adjusting event as the said event situation existed on the balance sheet date. As the event occurred

after the balance sheet date but the situation had an existence on the balance sheet date itself. The

above said event qualifies for adjustment and the following journal entry is required to be passed in

the books of Accounts of the firm:

Accumulated Depreciation Account ……Dr 66,667

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To Depreciation Account 66,667

(Being excess depreciation, which has been recorded in the books is reversed)

As the above entry is required to be passed in the company books of Accounts as according to the

Accounting Standard Board (AASB) all the events which occur after the balance sheet date but has an

existence on the balance sheet date is required to be adjusted and form part of the books of accounts

on the same financial year and shall have prospective effect to it.

PART 3:

This is a situation in which it is realised upon checking the assets register that something is missed.

As the entity has acquired a new vehicle on 1st January 2018 for $80,000 and the accountant of the

company charged the same to cost to the vehicle maintenance expenses account for the year ended

30th June 2018.The directors also have decided to depreciate all the expenses at 20% per annum.

On the basis of the above analysis there is a prior period error made by the accountant while recording

in the books of accounts and treated in the books of accounts as expenses and deducted from the

respective profit of the entity. The following journal entry is passed in the books of Accounts of the

firm:

Repairs to Vehicle Expenses Account ……Dr 80,0000

To Bank Account 80,0000

(Being vehicle expenses incurred)

Profit and Loss Account ……. Dr

To Repairs to vehicle Expenses Account

(Being Repairs transferred to Profit and Loss Account)

The following rectification journal entry is required to be passed in the books of Accounts of the

firm:

In the year 2018

Asset Account ………. Dr $80,000

To Repairs Account $80,000

(Being Assets debited and Repairs credited for the same)

Depreciation Account…………. Dr $8,000

To Accumulated Depreciation Account $8,000

(80000*20%/2)

(Being excess depreciation, which has been recorded in the books is reversed)

As the above entry is required to be passed in the company books of Accounts as according to the

Accounting Standard Board (AASB) all the events which occur after the balance sheet date but has an

existence on the balance sheet date is required to be adjusted and form part of the books of accounts

on the same financial year and shall have prospective effect to it.

PART 3:

This is a situation in which it is realised upon checking the assets register that something is missed.

As the entity has acquired a new vehicle on 1st January 2018 for $80,000 and the accountant of the

company charged the same to cost to the vehicle maintenance expenses account for the year ended

30th June 2018.The directors also have decided to depreciate all the expenses at 20% per annum.

On the basis of the above analysis there is a prior period error made by the accountant while recording

in the books of accounts and treated in the books of accounts as expenses and deducted from the

respective profit of the entity. The following journal entry is passed in the books of Accounts of the

firm:

Repairs to Vehicle Expenses Account ……Dr 80,0000

To Bank Account 80,0000

(Being vehicle expenses incurred)

Profit and Loss Account ……. Dr

To Repairs to vehicle Expenses Account

(Being Repairs transferred to Profit and Loss Account)

The following rectification journal entry is required to be passed in the books of Accounts of the

firm:

In the year 2018

Asset Account ………. Dr $80,000

To Repairs Account $80,000

(Being Assets debited and Repairs credited for the same)

Depreciation Account…………. Dr $8,000

To Accumulated Depreciation Account $8,000

(80000*20%/2)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Being depreciation charged for the asset added newly)

Profit and Loss Account. …………Dr $8,000

To Depreciation Account. $8,000

(Being depreciation during the year charged to profit and loss Account)

Repairs V………………………. Dr $80,000

To Profit and Loss Account $80,000

(Being the entry wrongly debited now credited and reversal done)

In the year 2019

Depreciation Account……………………...Dr $16,000

To Accumulated Depreciation Account $16,000

(80000*20%)

(Being Depreciation charged to Accumulated depreciation)

Profit and Loss Account…………… Dr $16,000

To Depreciation Account. $16,000

(Being depreciation charged to profit and loss Account)

On the basis of above analysis there is a retrospective amendment to be made in the books of the

company.

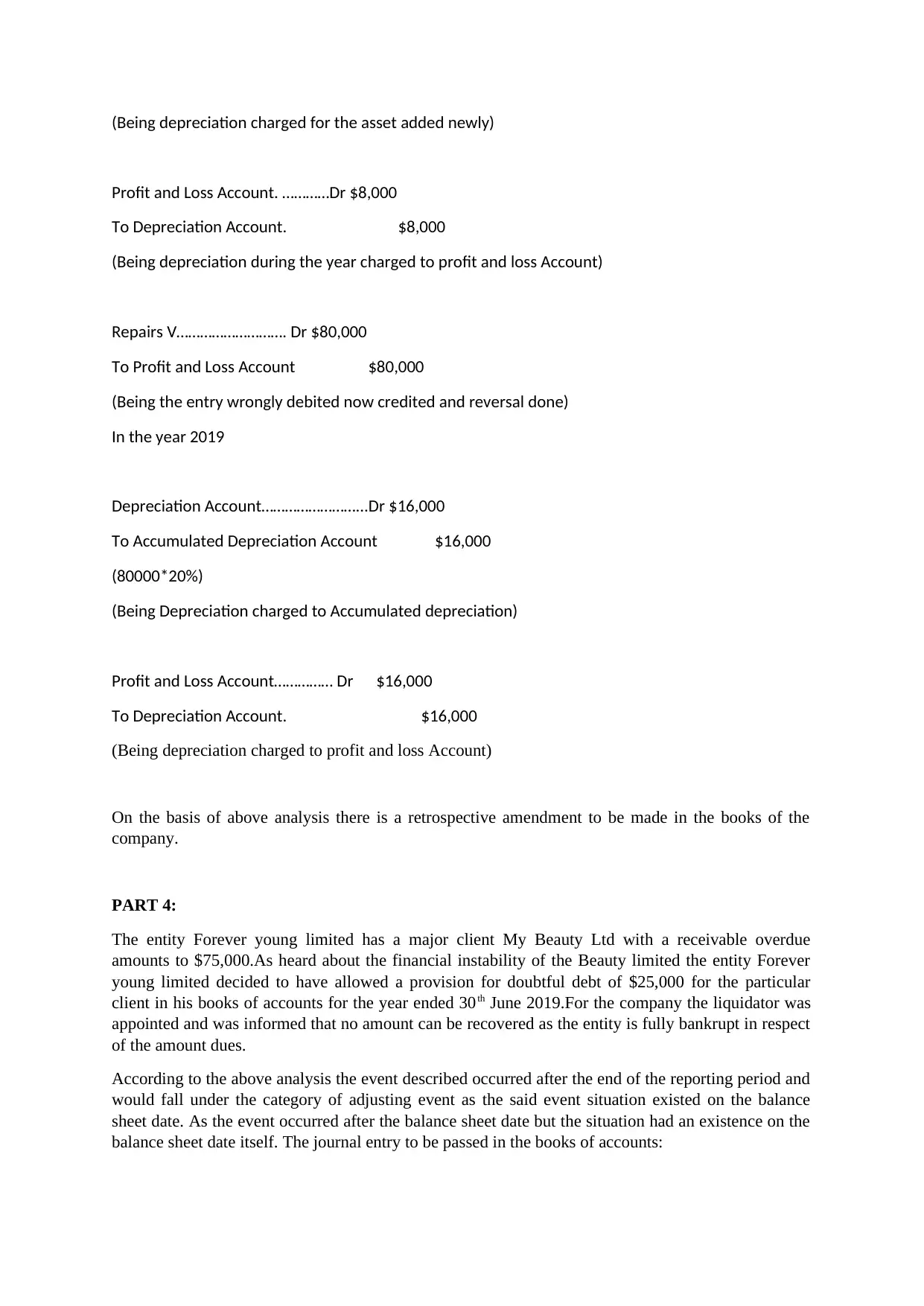

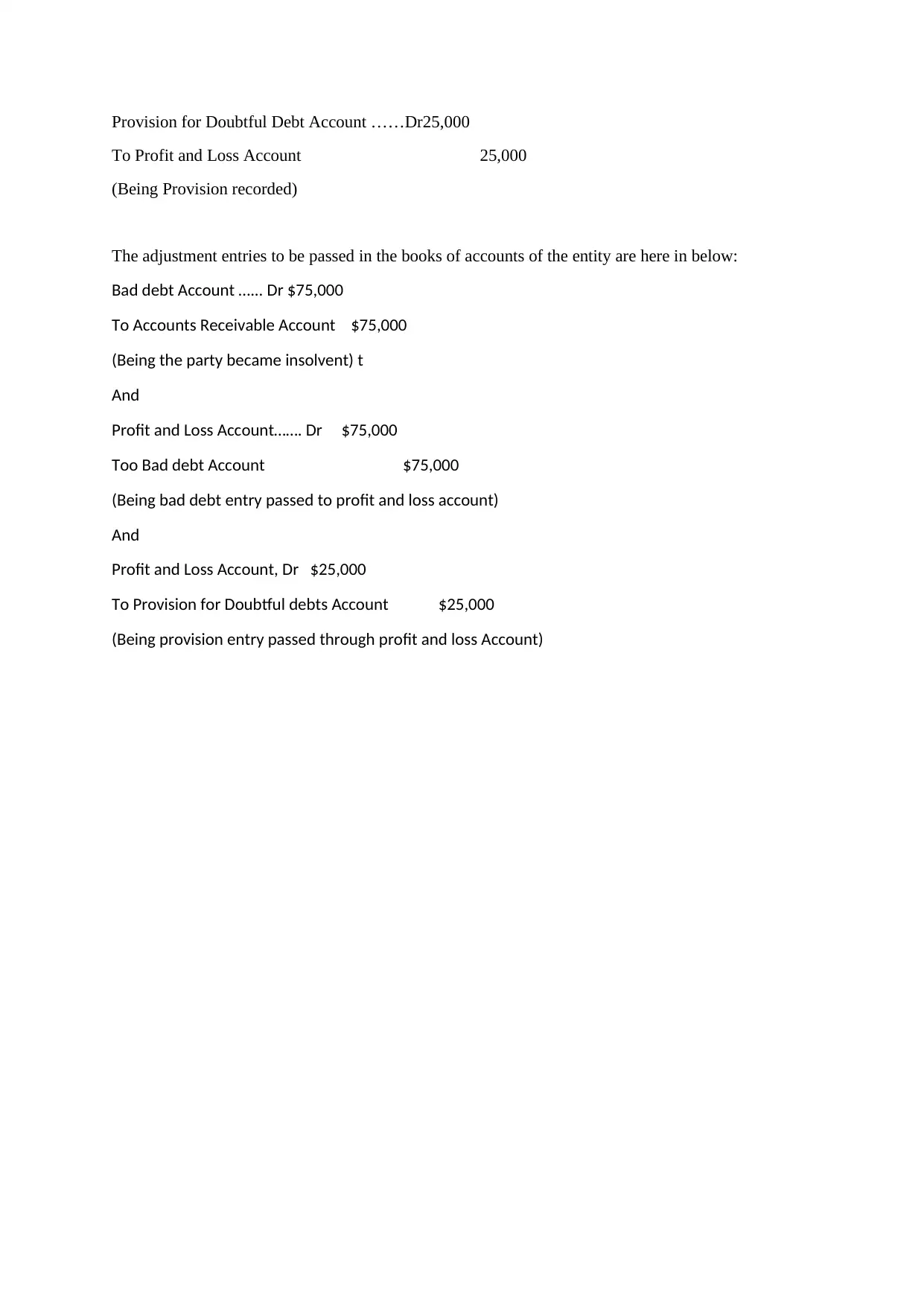

PART 4:

The entity Forever young limited has a major client My Beauty Ltd with a receivable overdue

amounts to $75,000.As heard about the financial instability of the Beauty limited the entity Forever

young limited decided to have allowed a provision for doubtful debt of $25,000 for the particular

client in his books of accounts for the year ended 30th June 2019.For the company the liquidator was

appointed and was informed that no amount can be recovered as the entity is fully bankrupt in respect

of the amount dues.

According to the above analysis the event described occurred after the end of the reporting period and

would fall under the category of adjusting event as the said event situation existed on the balance

sheet date. As the event occurred after the balance sheet date but the situation had an existence on the

balance sheet date itself. The journal entry to be passed in the books of accounts:

Profit and Loss Account. …………Dr $8,000

To Depreciation Account. $8,000

(Being depreciation during the year charged to profit and loss Account)

Repairs V………………………. Dr $80,000

To Profit and Loss Account $80,000

(Being the entry wrongly debited now credited and reversal done)

In the year 2019

Depreciation Account……………………...Dr $16,000

To Accumulated Depreciation Account $16,000

(80000*20%)

(Being Depreciation charged to Accumulated depreciation)

Profit and Loss Account…………… Dr $16,000

To Depreciation Account. $16,000

(Being depreciation charged to profit and loss Account)

On the basis of above analysis there is a retrospective amendment to be made in the books of the

company.

PART 4:

The entity Forever young limited has a major client My Beauty Ltd with a receivable overdue

amounts to $75,000.As heard about the financial instability of the Beauty limited the entity Forever

young limited decided to have allowed a provision for doubtful debt of $25,000 for the particular

client in his books of accounts for the year ended 30th June 2019.For the company the liquidator was

appointed and was informed that no amount can be recovered as the entity is fully bankrupt in respect

of the amount dues.

According to the above analysis the event described occurred after the end of the reporting period and

would fall under the category of adjusting event as the said event situation existed on the balance

sheet date. As the event occurred after the balance sheet date but the situation had an existence on the

balance sheet date itself. The journal entry to be passed in the books of accounts:

Provision for Doubtful Debt Account ……Dr25,000

To Profit and Loss Account 25,000

(Being Provision recorded)

The adjustment entries to be passed in the books of accounts of the entity are here in below:

Bad debt Account …... Dr $75,000

To Accounts Receivable Account $75,000

(Being the party became insolvent) t

And

Profit and Loss Account……. Dr $75,000

Too Bad debt Account $75,000

(Being bad debt entry passed to profit and loss account)

And

Profit and Loss Account, Dr $25,000

To Provision for Doubtful debts Account $25,000

(Being provision entry passed through profit and loss Account)

To Profit and Loss Account 25,000

(Being Provision recorded)

The adjustment entries to be passed in the books of accounts of the entity are here in below:

Bad debt Account …... Dr $75,000

To Accounts Receivable Account $75,000

(Being the party became insolvent) t

And

Profit and Loss Account……. Dr $75,000

Too Bad debt Account $75,000

(Being bad debt entry passed to profit and loss account)

And

Profit and Loss Account, Dr $25,000

To Provision for Doubtful debts Account $25,000

(Being provision entry passed through profit and loss Account)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

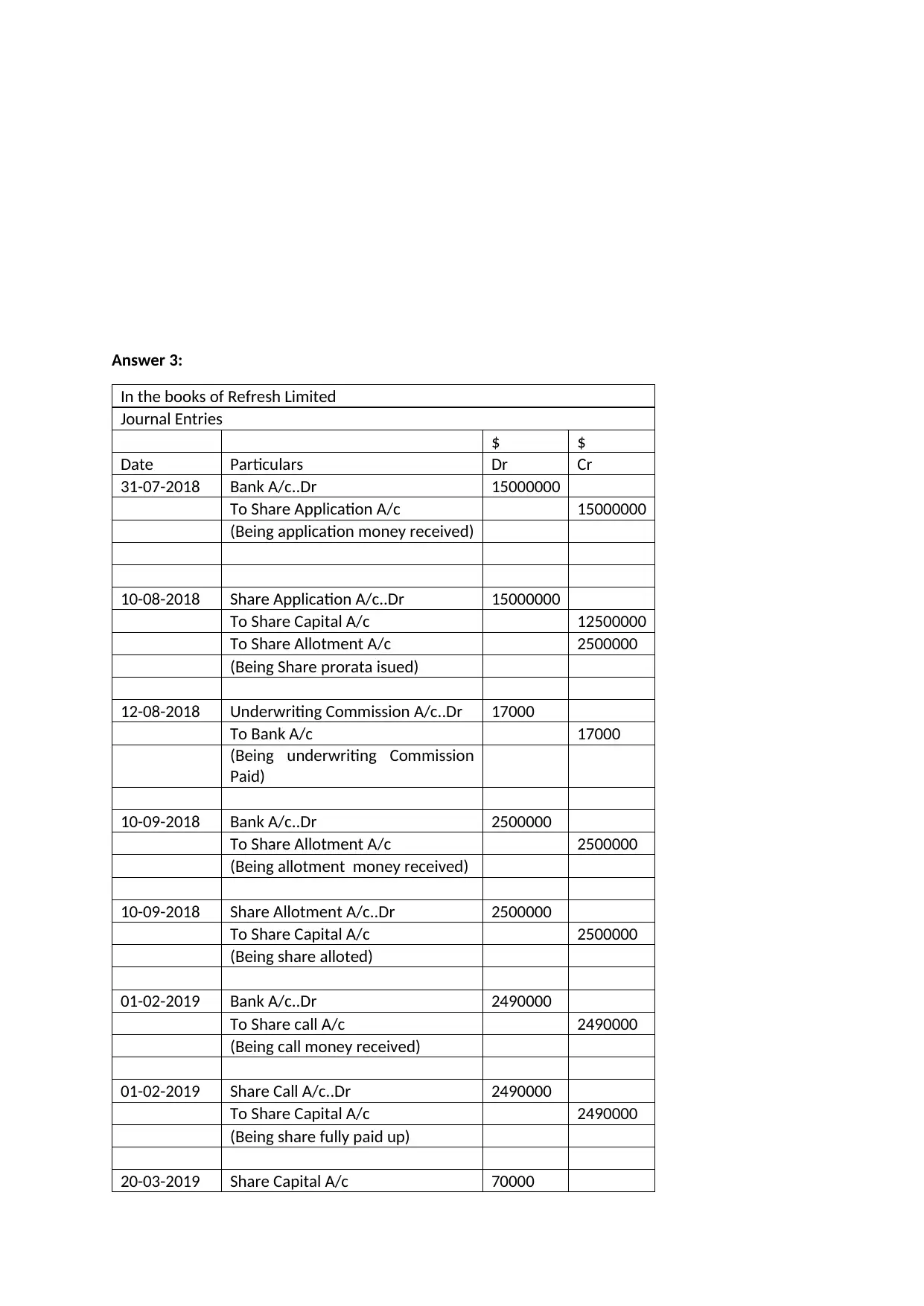

Answer 3:

In the books of Refresh Limited

Journal Entries

$ $

Date Particulars Dr Cr

31-07-2018 Bank A/c..Dr 15000000

To Share Application A/c 15000000

(Being application money received)

10-08-2018 Share Application A/c..Dr 15000000

To Share Capital A/c 12500000

To Share Allotment A/c 2500000

(Being Share prorata isued)

12-08-2018 Underwriting Commission A/c..Dr 17000

To Bank A/c 17000

(Being underwriting Commission

Paid)

10-09-2018 Bank A/c..Dr 2500000

To Share Allotment A/c 2500000

(Being allotment money received)

10-09-2018 Share Allotment A/c..Dr 2500000

To Share Capital A/c 2500000

(Being share alloted)

01-02-2019 Bank A/c..Dr 2490000

To Share call A/c 2490000

(Being call money received)

01-02-2019 Share Call A/c..Dr 2490000

To Share Capital A/c 2490000

(Being share fully paid up)

20-03-2019 Share Capital A/c 70000

In the books of Refresh Limited

Journal Entries

$ $

Date Particulars Dr Cr

31-07-2018 Bank A/c..Dr 15000000

To Share Application A/c 15000000

(Being application money received)

10-08-2018 Share Application A/c..Dr 15000000

To Share Capital A/c 12500000

To Share Allotment A/c 2500000

(Being Share prorata isued)

12-08-2018 Underwriting Commission A/c..Dr 17000

To Bank A/c 17000

(Being underwriting Commission

Paid)

10-09-2018 Bank A/c..Dr 2500000

To Share Allotment A/c 2500000

(Being allotment money received)

10-09-2018 Share Allotment A/c..Dr 2500000

To Share Capital A/c 2500000

(Being share alloted)

01-02-2019 Bank A/c..Dr 2490000

To Share call A/c 2490000

(Being call money received)

01-02-2019 Share Call A/c..Dr 2490000

To Share Capital A/c 2490000

(Being share fully paid up)

20-03-2019 Share Capital A/c 70000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

To Share Forfeiture A/c 70000

(Being Share forfeited)

05-04-2019 Bank A/c..Dr 68000

Share Forfeiture A/c 12000

To Share Capital A/c 80000

(Being Forfeited shares issued)

05-04-2019 Share reissue Cost A/c..dr 5000

To Bank A/c..Dr 5000

(Being cost incurred for share

reissue)

12-04-2019 Share Forfeiture A/c...Dr 58000

To Share reissue cost A/c. 5000

To Bank A/c 53000

(Being Balance paid to defaulters)

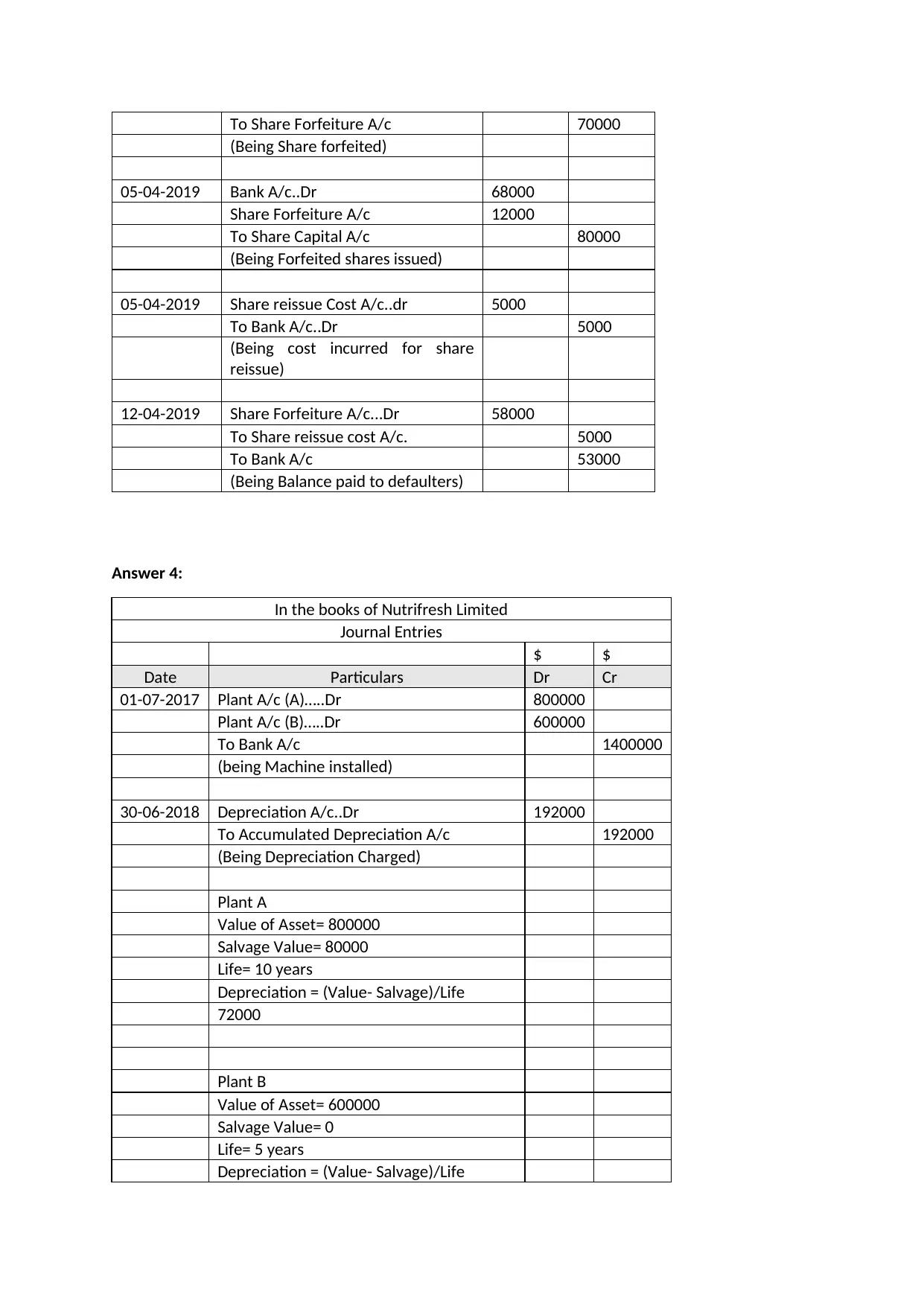

Answer 4:

In the books of Nutrifresh Limited

Journal Entries

$ $

Date Particulars Dr Cr

01-07-2017 Plant A/c (A)…..Dr 800000

Plant A/c (B)…..Dr 600000

To Bank A/c 1400000

(being Machine installed)

30-06-2018 Depreciation A/c..Dr 192000

To Accumulated Depreciation A/c 192000

(Being Depreciation Charged)

Plant A

Value of Asset= 800000

Salvage Value= 80000

Life= 10 years

Depreciation = (Value- Salvage)/Life

72000

Plant B

Value of Asset= 600000

Salvage Value= 0

Life= 5 years

Depreciation = (Value- Salvage)/Life

(Being Share forfeited)

05-04-2019 Bank A/c..Dr 68000

Share Forfeiture A/c 12000

To Share Capital A/c 80000

(Being Forfeited shares issued)

05-04-2019 Share reissue Cost A/c..dr 5000

To Bank A/c..Dr 5000

(Being cost incurred for share

reissue)

12-04-2019 Share Forfeiture A/c...Dr 58000

To Share reissue cost A/c. 5000

To Bank A/c 53000

(Being Balance paid to defaulters)

Answer 4:

In the books of Nutrifresh Limited

Journal Entries

$ $

Date Particulars Dr Cr

01-07-2017 Plant A/c (A)…..Dr 800000

Plant A/c (B)…..Dr 600000

To Bank A/c 1400000

(being Machine installed)

30-06-2018 Depreciation A/c..Dr 192000

To Accumulated Depreciation A/c 192000

(Being Depreciation Charged)

Plant A

Value of Asset= 800000

Salvage Value= 80000

Life= 10 years

Depreciation = (Value- Salvage)/Life

72000

Plant B

Value of Asset= 600000

Salvage Value= 0

Life= 5 years

Depreciation = (Value- Salvage)/Life

120000

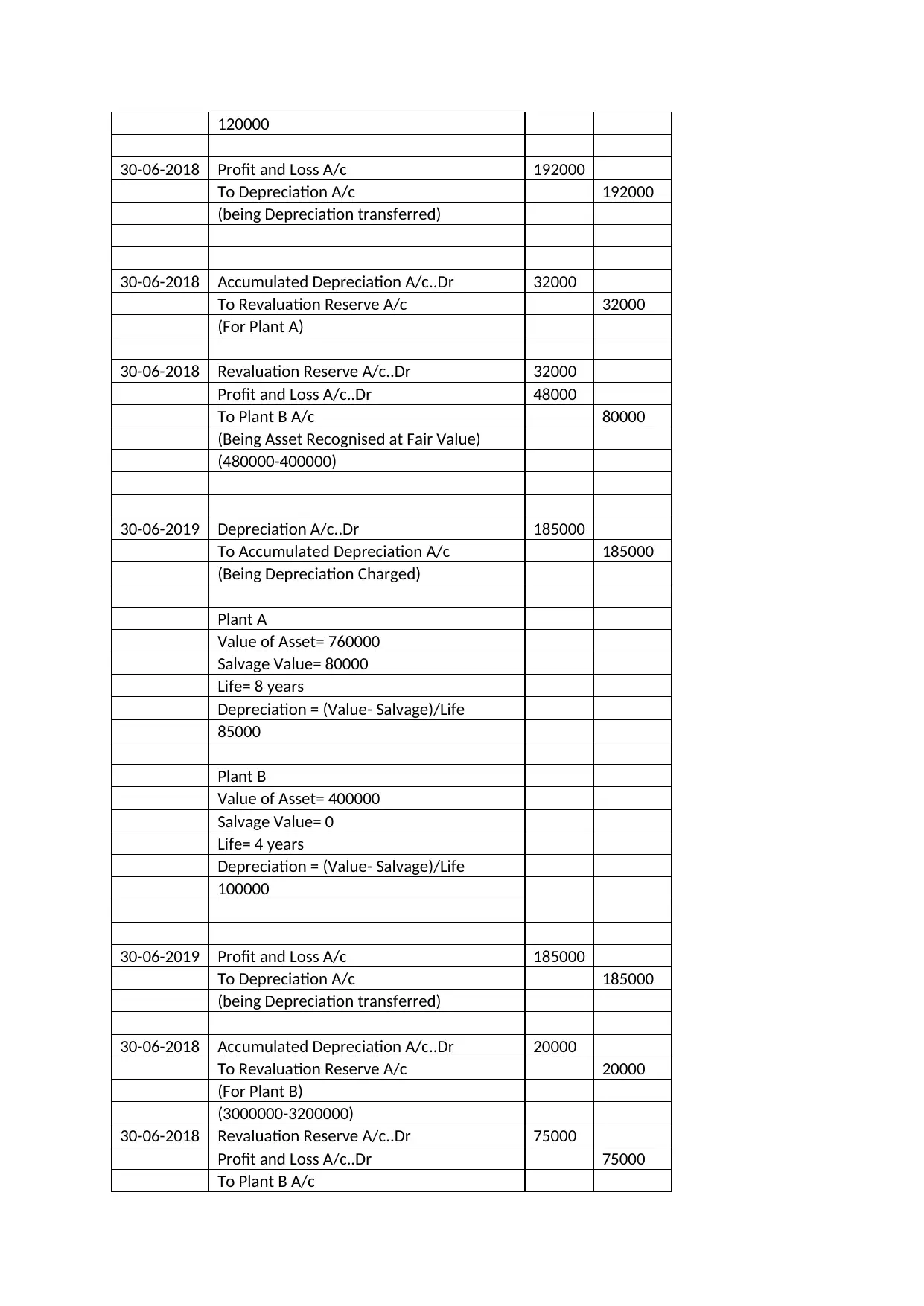

30-06-2018 Profit and Loss A/c 192000

To Depreciation A/c 192000

(being Depreciation transferred)

30-06-2018 Accumulated Depreciation A/c..Dr 32000

To Revaluation Reserve A/c 32000

(For Plant A)

30-06-2018 Revaluation Reserve A/c..Dr 32000

Profit and Loss A/c..Dr 48000

To Plant B A/c 80000

(Being Asset Recognised at Fair Value)

(480000-400000)

30-06-2019 Depreciation A/c..Dr 185000

To Accumulated Depreciation A/c 185000

(Being Depreciation Charged)

Plant A

Value of Asset= 760000

Salvage Value= 80000

Life= 8 years

Depreciation = (Value- Salvage)/Life

85000

Plant B

Value of Asset= 400000

Salvage Value= 0

Life= 4 years

Depreciation = (Value- Salvage)/Life

100000

30-06-2019 Profit and Loss A/c 185000

To Depreciation A/c 185000

(being Depreciation transferred)

30-06-2018 Accumulated Depreciation A/c..Dr 20000

To Revaluation Reserve A/c 20000

(For Plant B)

(3000000-3200000)

30-06-2018 Revaluation Reserve A/c..Dr 75000

Profit and Loss A/c..Dr 75000

To Plant B A/c

30-06-2018 Profit and Loss A/c 192000

To Depreciation A/c 192000

(being Depreciation transferred)

30-06-2018 Accumulated Depreciation A/c..Dr 32000

To Revaluation Reserve A/c 32000

(For Plant A)

30-06-2018 Revaluation Reserve A/c..Dr 32000

Profit and Loss A/c..Dr 48000

To Plant B A/c 80000

(Being Asset Recognised at Fair Value)

(480000-400000)

30-06-2019 Depreciation A/c..Dr 185000

To Accumulated Depreciation A/c 185000

(Being Depreciation Charged)

Plant A

Value of Asset= 760000

Salvage Value= 80000

Life= 8 years

Depreciation = (Value- Salvage)/Life

85000

Plant B

Value of Asset= 400000

Salvage Value= 0

Life= 4 years

Depreciation = (Value- Salvage)/Life

100000

30-06-2019 Profit and Loss A/c 185000

To Depreciation A/c 185000

(being Depreciation transferred)

30-06-2018 Accumulated Depreciation A/c..Dr 20000

To Revaluation Reserve A/c 20000

(For Plant B)

(3000000-3200000)

30-06-2018 Revaluation Reserve A/c..Dr 75000

Profit and Loss A/c..Dr 75000

To Plant B A/c

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.