Applied Corporate Strategy Analysis of Sainsbury's and Asda Merger

VerifiedAdded on 2023/01/13

|16

|4489

|1

Report

AI Summary

This report provides a comprehensive analysis of the Sainsbury's and Asda merger, focusing on corporate strategy. It begins with an introduction outlining the objectives and scope of the analysis. The main body delves into external analysis using PESTEL factors and industry analysis via Porter's Five Forces to identify opportunities, threats, and industry attractiveness. Internal analysis examines resources, key competencies, and the identification of core competencies, followed by a VRIO analysis to assess competitive advantages. Strategic evaluation is also conducted to understand the overall strategic positioning of the merged entity. The report concludes with a summary of findings and references to supporting literature, providing a detailed assessment of the merger's strategic implications and potential for success in the competitive retail market.

Applied corporate

strategy

strategy

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY ..................................................................................................................................1

1. External analysis to identify opportunity and threats and assess industry attractiveness.......1

2. Resources and key competences of organisation and identify core competences..................3

3. Strategy Evaluation.................................................................................................................4

CONCLUSION................................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION...........................................................................................................................1

MAIN BODY ..................................................................................................................................1

1. External analysis to identify opportunity and threats and assess industry attractiveness.......1

2. Resources and key competences of organisation and identify core competences..................3

3. Strategy Evaluation.................................................................................................................4

CONCLUSION................................................................................................................................5

REFERENCES................................................................................................................................6

INTRODUCTION

Corporate strategy encompasses corporate action of firm with aim to accomplish

objectives of company with aim of achieving competitive advantages. Moreover,

corporate strategy estate a clear define long term vision which an organisation set, seek

for creating corporate values as well as for motivating staff to apply appropriate action

for gaining satisfaction of customers (Foucault and Frésard, 2019). In simple terms,

corporate strategy is continuous procedure which need constant efforts for engaging

investors in trusting business firm with their money because they help in increasing

equity of business.

This report is based on case study of Sainsbury and Asda merger. Sainsbury's

which is part of retail industry founded in 1869 and its founder was John James

Sainsbury. Its headquarter is located at London, United Kingdom and also serving in

UK. Assessment will going to conduct external analysis for identifying opportunities and

threats available for them in business environment. Along with this, industry analysis will

also conduct by using porter's five force model. In addition to this, internal analysis of

Sainsbury and Asda merger will conduct for identifying strength and weakness of

company. Unique capabilities of company will demonstrate by linking it to competitive

advantages using VRIO model. Furthermore strategic evaluation will also going to

conduct.

MAIN BODY

1. External analysis to identify opportunity and threats and assess industry

attractiveness

External analysis means examination of industry environment of an business

firm. This involve factors like competitive position, competitive structure, dynamic,

history and many more (Köhler and Zerfass, 2019). Primary purpose of conducting

external analysis is to determine opportunity as well as threats within industry and also

any segment which result in growth, profitability and volatility for organisation. For

external analysis PESTEL will going to conduct by company which is based on merger

of Sainsbury’s and Asda :-

1

Corporate strategy encompasses corporate action of firm with aim to accomplish

objectives of company with aim of achieving competitive advantages. Moreover,

corporate strategy estate a clear define long term vision which an organisation set, seek

for creating corporate values as well as for motivating staff to apply appropriate action

for gaining satisfaction of customers (Foucault and Frésard, 2019). In simple terms,

corporate strategy is continuous procedure which need constant efforts for engaging

investors in trusting business firm with their money because they help in increasing

equity of business.

This report is based on case study of Sainsbury and Asda merger. Sainsbury's

which is part of retail industry founded in 1869 and its founder was John James

Sainsbury. Its headquarter is located at London, United Kingdom and also serving in

UK. Assessment will going to conduct external analysis for identifying opportunities and

threats available for them in business environment. Along with this, industry analysis will

also conduct by using porter's five force model. In addition to this, internal analysis of

Sainsbury and Asda merger will conduct for identifying strength and weakness of

company. Unique capabilities of company will demonstrate by linking it to competitive

advantages using VRIO model. Furthermore strategic evaluation will also going to

conduct.

MAIN BODY

1. External analysis to identify opportunity and threats and assess industry

attractiveness

External analysis means examination of industry environment of an business

firm. This involve factors like competitive position, competitive structure, dynamic,

history and many more (Köhler and Zerfass, 2019). Primary purpose of conducting

external analysis is to determine opportunity as well as threats within industry and also

any segment which result in growth, profitability and volatility for organisation. For

external analysis PESTEL will going to conduct by company which is based on merger

of Sainsbury’s and Asda :-

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Political – It have wide impact on working of an organisation because at the time

of merger there are several rules as well as regulation which Sainsbury’s and

Asda have to follow. Thus, changes in these law result in reduction of usage of

raw materials that effects the selling of various products. Sainsbury and Asda

merger is going to be affected because of this as availability of certain product

may fall in shortage which results in loss in selling of these products. Along with

this, low minimum wages result is higher profit for company and result in higher

chances of merger survival.

Economical – This factor include inflation rate, foreign exchange rate, interest

rate, gross domestic product and many more. Emerging market work as

opportunity for merger of Sainsbury's and Asda because emerging market have

potential customers who has rising disposable income which will boost their

affordability. Thus, establishing stores in emerging market result in increasing

demand of such products within population and result in adding profitability of

business.

Social – The social factors that impact Mergers and Acquisitions are a direct

reflection of the society that Mergers and Acquisitions operates in, and

encompasses culture, belief, attitudes and values that the majority of the

population may hold as a community. The class distribution among the

population is of paramount importance: Mergers and Acquisitions would be

unable to promote a premium product to the general public if the majority of the

population was a lower class; rather, they would have to rely on very niche

marketing. Moreover, digital marketing is an opportunity for Sainsbury's and Asda

merger as they can also facilitates customers through online shopping

(Oppenheimer, 2019). As it will help customer who have mobility issue by

providing flexibility to them as they can purchase daily needed products by sitting

at home.

Technological – Digital market is technological factor which work as an

opportunity for Sainsbury's as they can also facilitates customers through online

shopping (Oppenheimer, 2019). As it will help customer who have mobility issue

by providing flexibility to them as they can purchase daily needed products by

2

of merger there are several rules as well as regulation which Sainsbury’s and

Asda have to follow. Thus, changes in these law result in reduction of usage of

raw materials that effects the selling of various products. Sainsbury and Asda

merger is going to be affected because of this as availability of certain product

may fall in shortage which results in loss in selling of these products. Along with

this, low minimum wages result is higher profit for company and result in higher

chances of merger survival.

Economical – This factor include inflation rate, foreign exchange rate, interest

rate, gross domestic product and many more. Emerging market work as

opportunity for merger of Sainsbury's and Asda because emerging market have

potential customers who has rising disposable income which will boost their

affordability. Thus, establishing stores in emerging market result in increasing

demand of such products within population and result in adding profitability of

business.

Social – The social factors that impact Mergers and Acquisitions are a direct

reflection of the society that Mergers and Acquisitions operates in, and

encompasses culture, belief, attitudes and values that the majority of the

population may hold as a community. The class distribution among the

population is of paramount importance: Mergers and Acquisitions would be

unable to promote a premium product to the general public if the majority of the

population was a lower class; rather, they would have to rely on very niche

marketing. Moreover, digital marketing is an opportunity for Sainsbury's and Asda

merger as they can also facilitates customers through online shopping

(Oppenheimer, 2019). As it will help customer who have mobility issue by

providing flexibility to them as they can purchase daily needed products by sitting

at home.

Technological – Digital market is technological factor which work as an

opportunity for Sainsbury's as they can also facilitates customers through online

shopping (Oppenheimer, 2019). As it will help customer who have mobility issue

by providing flexibility to them as they can purchase daily needed products by

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

sitting at home. For example, Sainsbury's products are available in some

selected outlets across United Kingdom. However, same brand can be

purchased easily online through their websites.

Environmental – Merger of Sainsbury’s and Asda may get impacted through

environmental factors as it will be difficult to manage transportation of both

resources finished and raw material. This may affect delivery dates product such

as unexpected monsoon. It is important for both the organisation to focus on

environmental factor while doing merger because now a day’s people are more

aware about environment.

Legal – This factor include laws which design by government bodies for retail

industry organisation and they have to follow these for conducting daily basis

operations in more effective manner. Liability laws differ from country to country

and this may lead to various kind of changes regarding claiming of liabilities

(Ntene, Azasu and Owusu-Ansah, 2020). Sainsbury and Asda may have face lot

of claims regarding products sold by it which may happen because of the

changes in policies of claiming compensation.

Industry analysis – It is an business function which which completed by owner of

company as well as other person for assessing present business environment. In simple

term, industry analysis is the tool which assist company in understanding their position

relative with other organisation who are producing same products or services

(Waverman, 2019). Sainsbury's and Asda have to conduct industry analysis by using

porter's five force model as this observe five force that have significant impact on

profitability of business firm which they will gain after merger. Explanation of five forces

which involved within this are as follows :-

Competitive rivalry – Retail industry is highly competitive as it have high crowed

market and now more companies are trying to enter within non food sector.

Thus, merger of Sainsbury's and Asda will face high competition from several

supermarkets such as Tesco, Morrisons and many more. As they are also

dealing within similar products such as clothings, food items, electronics and

many more. At margin similar cost result in switching costs low, hence customers

3

selected outlets across United Kingdom. However, same brand can be

purchased easily online through their websites.

Environmental – Merger of Sainsbury’s and Asda may get impacted through

environmental factors as it will be difficult to manage transportation of both

resources finished and raw material. This may affect delivery dates product such

as unexpected monsoon. It is important for both the organisation to focus on

environmental factor while doing merger because now a day’s people are more

aware about environment.

Legal – This factor include laws which design by government bodies for retail

industry organisation and they have to follow these for conducting daily basis

operations in more effective manner. Liability laws differ from country to country

and this may lead to various kind of changes regarding claiming of liabilities

(Ntene, Azasu and Owusu-Ansah, 2020). Sainsbury and Asda may have face lot

of claims regarding products sold by it which may happen because of the

changes in policies of claiming compensation.

Industry analysis – It is an business function which which completed by owner of

company as well as other person for assessing present business environment. In simple

term, industry analysis is the tool which assist company in understanding their position

relative with other organisation who are producing same products or services

(Waverman, 2019). Sainsbury's and Asda have to conduct industry analysis by using

porter's five force model as this observe five force that have significant impact on

profitability of business firm which they will gain after merger. Explanation of five forces

which involved within this are as follows :-

Competitive rivalry – Retail industry is highly competitive as it have high crowed

market and now more companies are trying to enter within non food sector.

Thus, merger of Sainsbury's and Asda will face high competition from several

supermarkets such as Tesco, Morrisons and many more. As they are also

dealing within similar products such as clothings, food items, electronics and

many more. At margin similar cost result in switching costs low, hence customers

3

can easily switch to other lower price supermarkets (Baena, 2019). Such

practices result in cut throat price wars as they have to conduct advertisement in

effective manner and try to bring innovative product for gaining competitive

advantages. This forced respective company to get merge with Asda for

surviving in cut-throat competition within UK food industry. Thus, competitive

rivalry for Sainsbury's and Asda merger is high.

Power of buyers – customers of Sainsbury's and Asda have high bargaining

power due to other supermarkets availability like Tesco Aldi, WM Morrisons and

many more who are offering same products at related costs. This result in

switching cost of product low as well as give power to buyers for selecting best

competitive offers in same price range (Adler and Florida, 2019). Moreover, there

are several customers who tends to be loyal for price instead of brand, this is the

major reason they are shifting towards Aldi and Lidl in last years.

Power of suppliers – For Sainsbury and Asda bargaining power of suppliers will

be low because of numerous suppliers availability within market. Due to merger

some suppliers will demand high as they have option to change it with other

because several are available in market. They will purchase from suppliers who

offer at low prices because it will result in enhancing their profit margins that

result in losses on the side of suppliers (Sako and Zylberberg, 2019).

Threat of substitute – Sainsbury and Asda both are part of retail industry and

getting merger apart from them there are several other business firm also who

are selling same products. As they have high threat of substitute product but

threat from each other will get reduce after their merger.

Threat of new entrants – Sainsbury's and Asda will have low threats of new

entrants because within retail market 69.8% of grocery market share is controlled

through big four. Although, retail sector have high competition but after getting

merger they booth organisation will no more competitors of each other (Ioannou

and Serafeim, 2019). Along with this, there is requirement of huge amount for

entering in retail industry. Thus, threat of new entrants for Sainsbury's and Asda

will be low.

4

practices result in cut throat price wars as they have to conduct advertisement in

effective manner and try to bring innovative product for gaining competitive

advantages. This forced respective company to get merge with Asda for

surviving in cut-throat competition within UK food industry. Thus, competitive

rivalry for Sainsbury's and Asda merger is high.

Power of buyers – customers of Sainsbury's and Asda have high bargaining

power due to other supermarkets availability like Tesco Aldi, WM Morrisons and

many more who are offering same products at related costs. This result in

switching cost of product low as well as give power to buyers for selecting best

competitive offers in same price range (Adler and Florida, 2019). Moreover, there

are several customers who tends to be loyal for price instead of brand, this is the

major reason they are shifting towards Aldi and Lidl in last years.

Power of suppliers – For Sainsbury and Asda bargaining power of suppliers will

be low because of numerous suppliers availability within market. Due to merger

some suppliers will demand high as they have option to change it with other

because several are available in market. They will purchase from suppliers who

offer at low prices because it will result in enhancing their profit margins that

result in losses on the side of suppliers (Sako and Zylberberg, 2019).

Threat of substitute – Sainsbury and Asda both are part of retail industry and

getting merger apart from them there are several other business firm also who

are selling same products. As they have high threat of substitute product but

threat from each other will get reduce after their merger.

Threat of new entrants – Sainsbury's and Asda will have low threats of new

entrants because within retail market 69.8% of grocery market share is controlled

through big four. Although, retail sector have high competition but after getting

merger they booth organisation will no more competitors of each other (Ioannou

and Serafeim, 2019). Along with this, there is requirement of huge amount for

entering in retail industry. Thus, threat of new entrants for Sainsbury's and Asda

will be low.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2. Resources and key competences of organisation and identify core competences

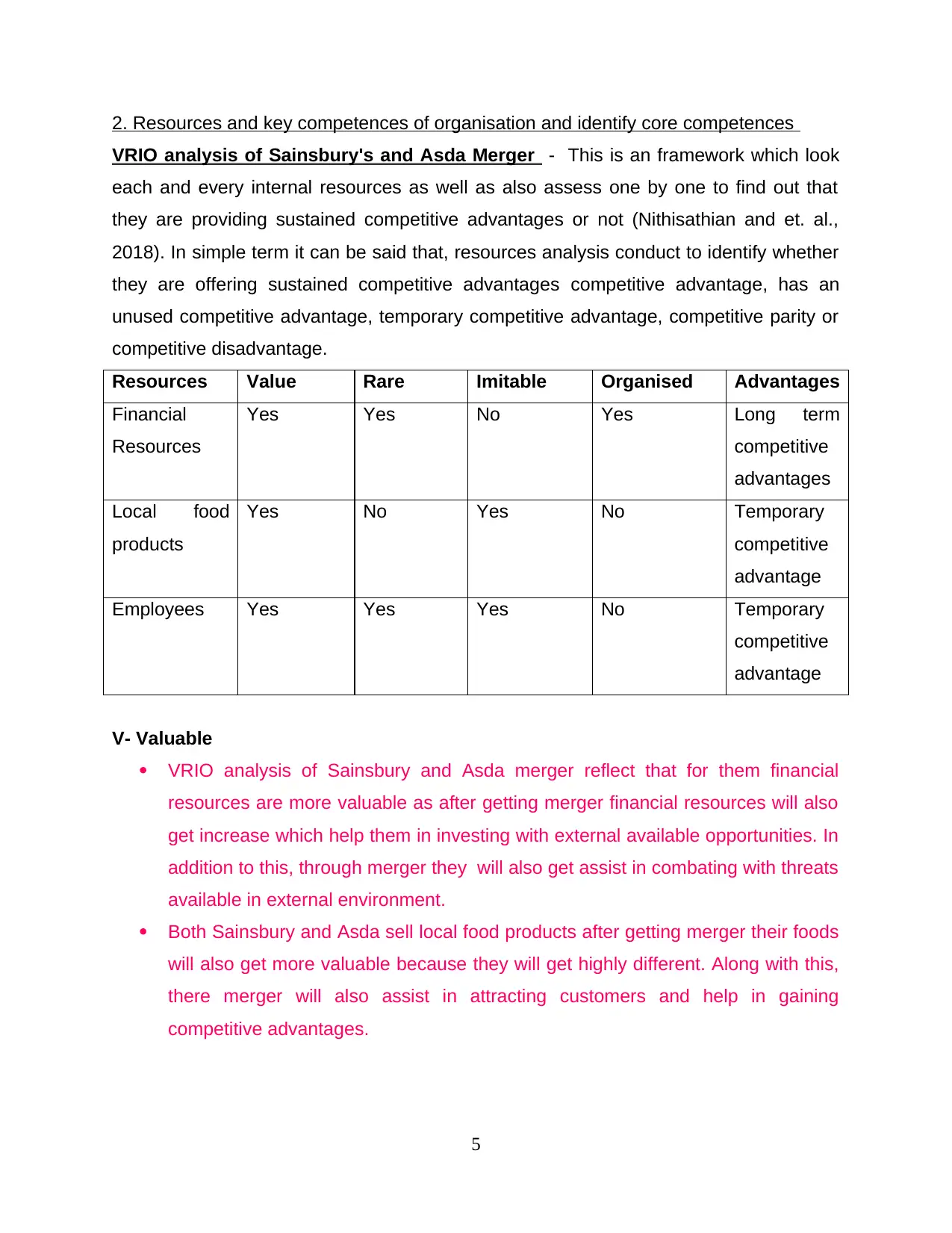

VRIO analysis of Sainsbury's and Asda Merger - This is an framework which look

each and every internal resources as well as also assess one by one to find out that

they are providing sustained competitive advantages or not (Nithisathian and et. al.,

2018). In simple term it can be said that, resources analysis conduct to identify whether

they are offering sustained competitive advantages competitive advantage, has an

unused competitive advantage, temporary competitive advantage, competitive parity or

competitive disadvantage.

Resources Value Rare Imitable Organised Advantages

Financial

Resources

Yes Yes No Yes Long term

competitive

advantages

Local food

products

Yes No Yes No Temporary

competitive

advantage

Employees Yes Yes Yes No Temporary

competitive

advantage

V- Valuable

VRIO analysis of Sainsbury and Asda merger reflect that for them financial

resources are more valuable as after getting merger financial resources will also

get increase which help them in investing with external available opportunities. In

addition to this, through merger they will also get assist in combating with threats

available in external environment.

Both Sainsbury and Asda sell local food products after getting merger their foods

will also get more valuable because they will get highly different. Along with this,

there merger will also assist in attracting customers and help in gaining

competitive advantages.

5

VRIO analysis of Sainsbury's and Asda Merger - This is an framework which look

each and every internal resources as well as also assess one by one to find out that

they are providing sustained competitive advantages or not (Nithisathian and et. al.,

2018). In simple term it can be said that, resources analysis conduct to identify whether

they are offering sustained competitive advantages competitive advantage, has an

unused competitive advantage, temporary competitive advantage, competitive parity or

competitive disadvantage.

Resources Value Rare Imitable Organised Advantages

Financial

Resources

Yes Yes No Yes Long term

competitive

advantages

Local food

products

Yes No Yes No Temporary

competitive

advantage

Employees Yes Yes Yes No Temporary

competitive

advantage

V- Valuable

VRIO analysis of Sainsbury and Asda merger reflect that for them financial

resources are more valuable as after getting merger financial resources will also

get increase which help them in investing with external available opportunities. In

addition to this, through merger they will also get assist in combating with threats

available in external environment.

Both Sainsbury and Asda sell local food products after getting merger their foods

will also get more valuable because they will get highly different. Along with this,

there merger will also assist in attracting customers and help in gaining

competitive advantages.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sainsbury and Asda for are well known organisation of retail sector and their

customers are also satisfy which show that their employees are well trained. If

these will work together then result in gaining productive outcomes.

R- Rare

Financial resources of Sainsbury and Asda merger are founded rare as in

respective sector resources are possessed through some business firm.

Local food products are not rare of Sainsbury's and Asda because these are

provided in market easily through several other competitiors (Brooks, Chen and

Zeng, 2018). After getting merger level of competition for both organisation get

reduce but other competitiors are also using these resources in same manner

like Sainsbury and Asda for gaining competitive advantages. Thus, local food

products are valuable and it still using these resources.

Employees of Sainsbury's and Asda are rare resources that have been

determined by utilisation of VRIO model. Both of the organisation have well

trained employees which after merger help in gaining more competitive

advantages.

I-Imitable

By VRIO analysis it has been identified that financial resources are costly to

imitate. Respective resources are acquired through Sainsbury's and Asda by

prolonged profit over the years. Along with this, competitors and new entrants

also need same profit for long term to gain this amount of fiscal resources.

Local food products are not expensive to imitate which has been identified

through VRIO analysis.

Staff members of Sainsbury's and Asda are not costly to imitate because other

companies of same sector can also provide training session to their employees

for enhancing their skills. Along with this, competitors can also hire employees of

Sainsbury's and Asda by offering them better package, growth, working

environment and other benefits.

O- organisation

Sainsbury's and asda financial resources are organised for capturing value which

has been identified by using VRIO analysis.

6

customers are also satisfy which show that their employees are well trained. If

these will work together then result in gaining productive outcomes.

R- Rare

Financial resources of Sainsbury and Asda merger are founded rare as in

respective sector resources are possessed through some business firm.

Local food products are not rare of Sainsbury's and Asda because these are

provided in market easily through several other competitiors (Brooks, Chen and

Zeng, 2018). After getting merger level of competition for both organisation get

reduce but other competitiors are also using these resources in same manner

like Sainsbury and Asda for gaining competitive advantages. Thus, local food

products are valuable and it still using these resources.

Employees of Sainsbury's and Asda are rare resources that have been

determined by utilisation of VRIO model. Both of the organisation have well

trained employees which after merger help in gaining more competitive

advantages.

I-Imitable

By VRIO analysis it has been identified that financial resources are costly to

imitate. Respective resources are acquired through Sainsbury's and Asda by

prolonged profit over the years. Along with this, competitors and new entrants

also need same profit for long term to gain this amount of fiscal resources.

Local food products are not expensive to imitate which has been identified

through VRIO analysis.

Staff members of Sainsbury's and Asda are not costly to imitate because other

companies of same sector can also provide training session to their employees

for enhancing their skills. Along with this, competitors can also hire employees of

Sainsbury's and Asda by offering them better package, growth, working

environment and other benefits.

O- organisation

Sainsbury's and asda financial resources are organised for capturing value which

has been identified by using VRIO analysis.

6

Patents of respective organisation are not organised in proper manner which

simply means that sainsbury's and Asda is not using their patents at full potential.

TOWS Matrix

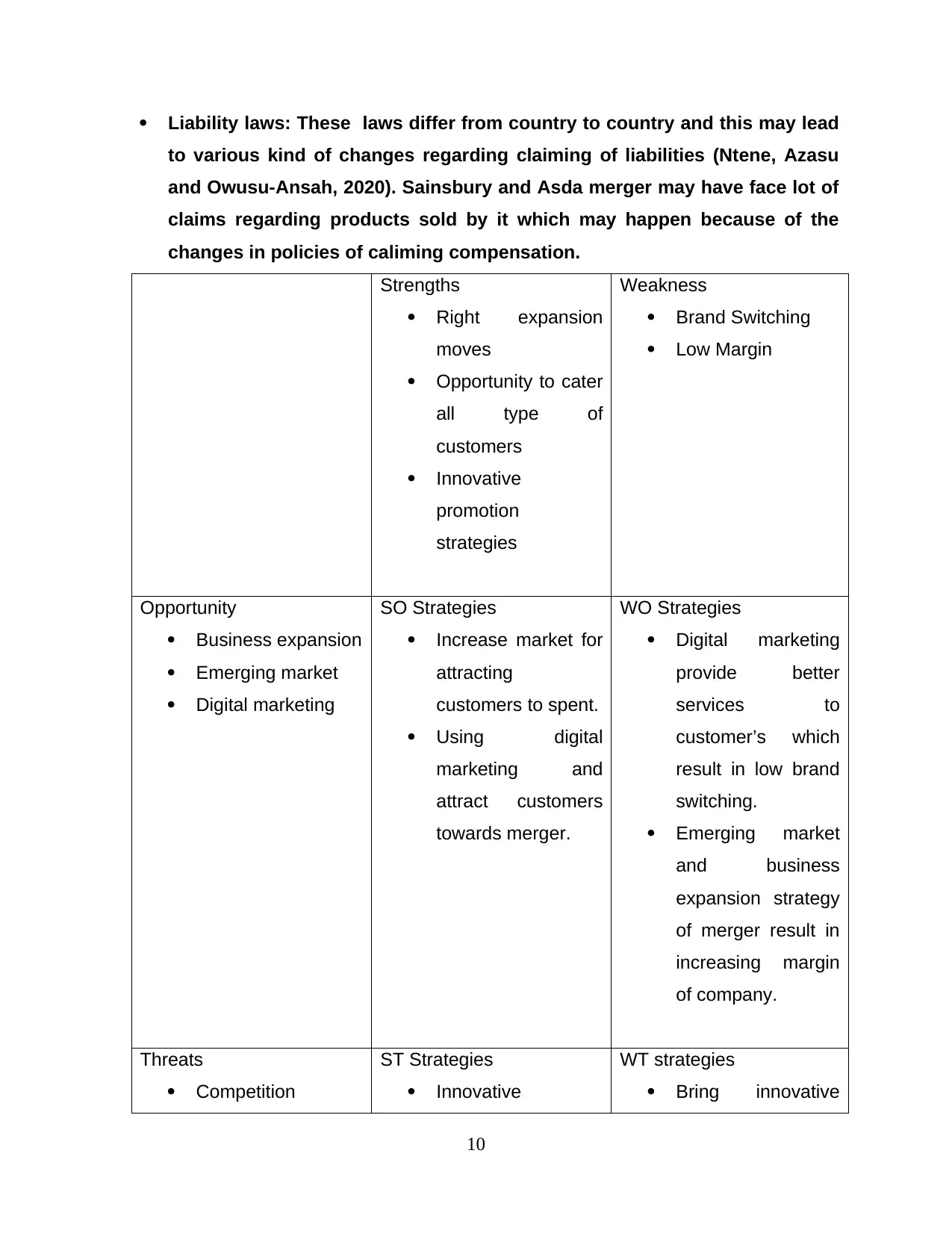

Strength – It involve positive aspects of an business firm, that reinforced position of

Tesla in becoming most dominant organisation at global level. Strength involves factors

that are believed as stronger point of Sainsbury's and Asda Maerger as it make sure

profitability of company, popularity, expansion with long term. Below mention are

strength

Right expansion moves – It is one of the biggest strength of Sainsbury's and

Asda merger as from small grocery store brand expanded to convenience store

which later on become supermarket. That deals with numerous merchandise

category which help in fulfilling daily basis needs of customers. Sainsbury's and

Asda are top supermarket brand within United Kingdom.

Opportunity to cater all type of customers – Sainsbury's and Asda is offering

their products for every type of customers while their value products are for

economic segment (Keyes, 2016). There are several branded as well as

expensive products which higher segment customers are looking for.

Innovative promotion strategies – There are several promotion strategies

which merger of both company is adopting and they are highly innovative as well

as they pitch brand direct against their competitors. For instance, brand match

promotion within this each and every product sold by Sainsbury's will compared

with other competitive company like Tesco and Aldi this type of practices

indicates that they are cheapest.

Weakness – along with strength every organisation have some weakness also

same as merger of Sainsbury and Asda also have. Thus, there are some shortcoming

of respective company's organisational structure that result in reducing its growth and

competitiveness. Explanation of these are as follows :-

Brand Switching – Same as other retail brand Sainsbury's and Asda merger will

also facing lot of risk from brand switching. After conducting promotional activities

as well as loyalty programs (Puranam and Vanneste, 2016). Respective merger

is still finding difficulty in retaining their customers for long duration.

7

simply means that sainsbury's and Asda is not using their patents at full potential.

TOWS Matrix

Strength – It involve positive aspects of an business firm, that reinforced position of

Tesla in becoming most dominant organisation at global level. Strength involves factors

that are believed as stronger point of Sainsbury's and Asda Maerger as it make sure

profitability of company, popularity, expansion with long term. Below mention are

strength

Right expansion moves – It is one of the biggest strength of Sainsbury's and

Asda merger as from small grocery store brand expanded to convenience store

which later on become supermarket. That deals with numerous merchandise

category which help in fulfilling daily basis needs of customers. Sainsbury's and

Asda are top supermarket brand within United Kingdom.

Opportunity to cater all type of customers – Sainsbury's and Asda is offering

their products for every type of customers while their value products are for

economic segment (Keyes, 2016). There are several branded as well as

expensive products which higher segment customers are looking for.

Innovative promotion strategies – There are several promotion strategies

which merger of both company is adopting and they are highly innovative as well

as they pitch brand direct against their competitors. For instance, brand match

promotion within this each and every product sold by Sainsbury's will compared

with other competitive company like Tesco and Aldi this type of practices

indicates that they are cheapest.

Weakness – along with strength every organisation have some weakness also

same as merger of Sainsbury and Asda also have. Thus, there are some shortcoming

of respective company's organisational structure that result in reducing its growth and

competitiveness. Explanation of these are as follows :-

Brand Switching – Same as other retail brand Sainsbury's and Asda merger will

also facing lot of risk from brand switching. After conducting promotional activities

as well as loyalty programs (Puranam and Vanneste, 2016). Respective merger

is still finding difficulty in retaining their customers for long duration.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Low Margin – With increasing level of competition in retail sector and risk of

online retailers there are several retailers who lost their sales volume. For

attracting more and more customers Sainsbury's and Asda cut down their cost

and keep price of products lower in comparison of competitors which will sustain

no longer.

Opportunities – It is exploitable set of circumstances with several unsure results,

explore to risk and necessitate commitment of resources. Opportunity is external factor

for Sainsbury's and Asda which assist in improving its performance, strategic growth,

management structure and many other aspects. Opportunities of both merger company

are as follows :-

Business expansion – Sainsbury's and Asda merger have several opportunities

in relation of expanding their presence at global level mainly in emerging

economies such as India, China, Brazil and many more. Because these nation

have large working population and they provide wide market to companies (Dahl

and Fløttum, 2019). In addition to this, countries which have fast growing

economy will provide plenty labour to company who are setting their business at

low cost. This will result in reducing production cost of company which result in

selling their finished products at low price and able to attract more and more

customers. As they will be able to minimise several expenditure which help them

in investing more in opening outlets. This would assist them in grabbing more

and more customers on global level as well as it also enable Sainsbury's and

Asda in gaining competitive advantages in term of high market share.

Emerging market – It also work as opportunity for Sainsbury's and Asda Merger

because emerging market have potential customers who has rising disposable

income which will boost their affordability. Thus, establishing stores in emerging

market result in increasing demand of such products within population and result

in adding profitability of business.

Digital marketing – It is also an opportunity for Sainsbury's and Asda merger as

they can also facilitates customers through online shopping (Oppenheimer,

2019). As it will help customer who have mobility issue by providing flexibility to

them as they can purchase daily needed products by sitting at home.

8

online retailers there are several retailers who lost their sales volume. For

attracting more and more customers Sainsbury's and Asda cut down their cost

and keep price of products lower in comparison of competitors which will sustain

no longer.

Opportunities – It is exploitable set of circumstances with several unsure results,

explore to risk and necessitate commitment of resources. Opportunity is external factor

for Sainsbury's and Asda which assist in improving its performance, strategic growth,

management structure and many other aspects. Opportunities of both merger company

are as follows :-

Business expansion – Sainsbury's and Asda merger have several opportunities

in relation of expanding their presence at global level mainly in emerging

economies such as India, China, Brazil and many more. Because these nation

have large working population and they provide wide market to companies (Dahl

and Fløttum, 2019). In addition to this, countries which have fast growing

economy will provide plenty labour to company who are setting their business at

low cost. This will result in reducing production cost of company which result in

selling their finished products at low price and able to attract more and more

customers. As they will be able to minimise several expenditure which help them

in investing more in opening outlets. This would assist them in grabbing more

and more customers on global level as well as it also enable Sainsbury's and

Asda in gaining competitive advantages in term of high market share.

Emerging market – It also work as opportunity for Sainsbury's and Asda Merger

because emerging market have potential customers who has rising disposable

income which will boost their affordability. Thus, establishing stores in emerging

market result in increasing demand of such products within population and result

in adding profitability of business.

Digital marketing – It is also an opportunity for Sainsbury's and Asda merger as

they can also facilitates customers through online shopping (Oppenheimer,

2019). As it will help customer who have mobility issue by providing flexibility to

them as they can purchase daily needed products by sitting at home.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Threats – These are the phenomenon that stop organisation in taking advantages of

benefits which derived from availability of strength. There are few threats which

Sainsbury's and Asda merger will face for maintaining business from unpredictable

market condition. Explanation of threats in relation of both organisation merger are

as follows :-

Competition – It is major threat for Sainsbury's and Asda as they are facing high

competition like all other organisations. Mainly with the companies like Aldi and

Lidl who are offering competitive quality product with discount rate (Cappa,

Cetrini and Oriani, 2019). Along with this, in United Kingdom cost of living is high

which force people to reduce their spending. It is one of the rising threats in an

organisation which can create a deadly impact over the survival of an

organisation in a bigger market and also over its emergence in it. This impacts

over various other aspects and growth of an organisation. Sainsbury and Asda is

an biggest chain of supermarket. It is going to be impacted because of this as

increase in competition leads to increase in substitute availability which creates

various preferences for an customers that automatically shifts the customers.

The company is going to be effected negatively as it has to face loss of money

and brand value loss as the substitute company like RESCO, ALDI and LIDL is

going to capturing its market.

Shortage of skilled workers: Work Force is an important factor in any company

as it provides services to the customers and performs task given by the mangers

(Espahbodi and et. al., 2019). Sainsbury and Asda merger is a developed and

large entity who gives quality to the customers. If the workers reduces then it

results in reductions of quality services leads to decrease in quality of customers

and ultimately growth of profit reduces.

Changing of environmental laws; AS the change in these law result in

reduction of usage of raw materials that effects the selling of various products.

Sainsbury and Asda is going to be effected because of this as availability of

certain product may fall in shortage which results in los in selling of these

products.

9

benefits which derived from availability of strength. There are few threats which

Sainsbury's and Asda merger will face for maintaining business from unpredictable

market condition. Explanation of threats in relation of both organisation merger are

as follows :-

Competition – It is major threat for Sainsbury's and Asda as they are facing high

competition like all other organisations. Mainly with the companies like Aldi and

Lidl who are offering competitive quality product with discount rate (Cappa,

Cetrini and Oriani, 2019). Along with this, in United Kingdom cost of living is high

which force people to reduce their spending. It is one of the rising threats in an

organisation which can create a deadly impact over the survival of an

organisation in a bigger market and also over its emergence in it. This impacts

over various other aspects and growth of an organisation. Sainsbury and Asda is

an biggest chain of supermarket. It is going to be impacted because of this as

increase in competition leads to increase in substitute availability which creates

various preferences for an customers that automatically shifts the customers.

The company is going to be effected negatively as it has to face loss of money

and brand value loss as the substitute company like RESCO, ALDI and LIDL is

going to capturing its market.

Shortage of skilled workers: Work Force is an important factor in any company

as it provides services to the customers and performs task given by the mangers

(Espahbodi and et. al., 2019). Sainsbury and Asda merger is a developed and

large entity who gives quality to the customers. If the workers reduces then it

results in reductions of quality services leads to decrease in quality of customers

and ultimately growth of profit reduces.

Changing of environmental laws; AS the change in these law result in

reduction of usage of raw materials that effects the selling of various products.

Sainsbury and Asda is going to be effected because of this as availability of

certain product may fall in shortage which results in los in selling of these

products.

9

Liability laws: These laws differ from country to country and this may lead

to various kind of changes regarding claiming of liabilities (Ntene, Azasu

and Owusu-Ansah, 2020). Sainsbury and Asda merger may have face lot of

claims regarding products sold by it which may happen because of the

changes in policies of caliming compensation.

Strengths

Right expansion

moves

Opportunity to cater

all type of

customers

Innovative

promotion

strategies

Weakness

Brand Switching

Low Margin

Opportunity

Business expansion

Emerging market

Digital marketing

SO Strategies

Increase market for

attracting

customers to spent.

Using digital

marketing and

attract customers

towards merger.

WO Strategies

Digital marketing

provide better

services to

customer’s which

result in low brand

switching.

Emerging market

and business

expansion strategy

of merger result in

increasing margin

of company.

Threats

Competition

ST Strategies

Innovative

WT strategies

Bring innovative

10

to various kind of changes regarding claiming of liabilities (Ntene, Azasu

and Owusu-Ansah, 2020). Sainsbury and Asda merger may have face lot of

claims regarding products sold by it which may happen because of the

changes in policies of caliming compensation.

Strengths

Right expansion

moves

Opportunity to cater

all type of

customers

Innovative

promotion

strategies

Weakness

Brand Switching

Low Margin

Opportunity

Business expansion

Emerging market

Digital marketing

SO Strategies

Increase market for

attracting

customers to spent.

Using digital

marketing and

attract customers

towards merger.

WO Strategies

Digital marketing

provide better

services to

customer’s which

result in low brand

switching.

Emerging market

and business

expansion strategy

of merger result in

increasing margin

of company.

Threats

Competition

ST Strategies

Innovative

WT strategies

Bring innovative

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.