ACC210 - Financial Accounting Task 2 Assignment, Semester 2, 2017

VerifiedAdded on 2020/04/01

|14

|2314

|34

Homework Assignment

AI Summary

This assignment solution for ACC210 Financial Accounting Task 2 addresses several key concepts in financial accounting. It begins with a detailed analysis of fair value measurement, including determining the subject of measurement, valuation premises, market determination, and valuation techniques. The solution then provides comprehensive calculations and general journal entries for the periods from 1/7/16 to 30/6/17, 1/8/18, and 30/6/18, including depreciation, revaluation, and impairment loss calculations, supported by working notes. The assignment also explores accounting issues related to internally generated versus acquired intangible assets, discussing the differences and reasons for reluctance in applying relevant accounting standards. Finally, it covers the deficit of funds, net defined benefit liability, and net interest calculations, including journal entries and a reconciliation of defined benefit obligations and plan assets. The solution is supported by a list of references including books, journals and online resources.

ACC210(ATMC) - Financial Accounting

Task 2 – Major Assignment

Semester 2 - 2017

Student Name:

Student ID #:

Campus:

Task 2 – Major Assignment

Semester 2 - 2017

Student Name:

Student ID #:

Campus:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Question 1..................................................................................................................................4

Measurement of fair value.........................................................................................................4

Determine subject of measurement........................................................................................4

Determine valuation premise/method.....................................................................................4

Determination of market........................................................................................................4

Determine Valuation technique..............................................................................................5

Question 2..................................................................................................................................5

1. Calculations & General Journal Entries 1/7/16 to 30/6/17:................................................5

Working Note:....................................................................................................................6

2. Calculations & General Journal Entries 1/8/18:.................................................................8

3. Calculations & General Journal Entries 30/6/18:...............................................................8

Question 3................................................................................................................................10

Explain accounting issues.....................................................................................................10

2. Differences Internally Generated vs Acquired.............................................................10

3. Reasons for Reluctance.................................................................................................11

Question 4................................................................................................................................12

Deficit of Fund.....................................................................................................................12

Net Defined Benefit Liability...............................................................................................12

Net Interest........................................................................................................................12

3000000............................................................................................................................12

Reconciliation.......................................................................................................................12

Journal Entries......................................................................................................................13

References................................................................................................................................15

Page 2 of 15

Question 1..................................................................................................................................4

Measurement of fair value.........................................................................................................4

Determine subject of measurement........................................................................................4

Determine valuation premise/method.....................................................................................4

Determination of market........................................................................................................4

Determine Valuation technique..............................................................................................5

Question 2..................................................................................................................................5

1. Calculations & General Journal Entries 1/7/16 to 30/6/17:................................................5

Working Note:....................................................................................................................6

2. Calculations & General Journal Entries 1/8/18:.................................................................8

3. Calculations & General Journal Entries 30/6/18:...............................................................8

Question 3................................................................................................................................10

Explain accounting issues.....................................................................................................10

2. Differences Internally Generated vs Acquired.............................................................10

3. Reasons for Reluctance.................................................................................................11

Question 4................................................................................................................................12

Deficit of Fund.....................................................................................................................12

Net Defined Benefit Liability...............................................................................................12

Net Interest........................................................................................................................12

3000000............................................................................................................................12

Reconciliation.......................................................................................................................12

Journal Entries......................................................................................................................13

References................................................................................................................................15

Page 2 of 15

QUESTION 1: MEASUREMENT OF FAIR VALUE

Determine subject of measurement

The subject matter of measurement is the land and property which is demolished and renewed

by the entity engaged in manufacturing of women shoes. The cost of land and factory will be

recognised only if the entity is certain about its future economic benefits and the asset’s cost

can be measured reliably1. The entity does the evaluation of all the costs associated with

property, plant and equipment under this recognition principle (Plant, Property and

Equipment AASB 116), at the time when they are incurred. These costs include the costs

which are incurred initially at the time of acquiring or constructing the asset and subsequent

costs incurred to replace or reconstruct the asset2. The costs associated with the day to day

service are not to be included in the carrying amount of asset. These costs are recognized

separately in the profit or loss account.

Determine valuation premise/method

After the land and factory is recognized as an asset whose fair value is measureable reliably

shall be represented at revalue amount minus any accumulated depreciation and impairment

losses; this will give its fair value at the date of the revaluation3. Revaluations shall be made

regularly for ensuring that there is no material discrepancy in carrying amount and the fair

value of the asset at the end of the reporting period.

Determination of market

The fair value of asset is usually determined by evidence provided by appraisal of market

undertaken by professionals. The fair value asset is usually their current market value. The

1 Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting. Pearson

Higher Education AU.

2 AASB 116.Property Plant and Equipment. 2016. (PDF). Available through <

http://www.aasb.gov.au/admin/file/content105/c9/AASB116_07-04_COMPjun09_07-09.pdf>. [Accessed on

30th September 2017.]

3 Davies, B., 2014. Defined Benefit vs Defined Contribution or is There a Third Way? Defined Ambition

Schemes: An Alternative Approach to Risk Sharing.

Page 3 of 15

Determine subject of measurement

The subject matter of measurement is the land and property which is demolished and renewed

by the entity engaged in manufacturing of women shoes. The cost of land and factory will be

recognised only if the entity is certain about its future economic benefits and the asset’s cost

can be measured reliably1. The entity does the evaluation of all the costs associated with

property, plant and equipment under this recognition principle (Plant, Property and

Equipment AASB 116), at the time when they are incurred. These costs include the costs

which are incurred initially at the time of acquiring or constructing the asset and subsequent

costs incurred to replace or reconstruct the asset2. The costs associated with the day to day

service are not to be included in the carrying amount of asset. These costs are recognized

separately in the profit or loss account.

Determine valuation premise/method

After the land and factory is recognized as an asset whose fair value is measureable reliably

shall be represented at revalue amount minus any accumulated depreciation and impairment

losses; this will give its fair value at the date of the revaluation3. Revaluations shall be made

regularly for ensuring that there is no material discrepancy in carrying amount and the fair

value of the asset at the end of the reporting period.

Determination of market

The fair value of asset is usually determined by evidence provided by appraisal of market

undertaken by professionals. The fair value asset is usually their current market value. The

1 Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting. Pearson

Higher Education AU.

2 AASB 116.Property Plant and Equipment. 2016. (PDF). Available through <

http://www.aasb.gov.au/admin/file/content105/c9/AASB116_07-04_COMPjun09_07-09.pdf>. [Accessed on

30th September 2017.]

3 Davies, B., 2014. Defined Benefit vs Defined Contribution or is There a Third Way? Defined Ambition

Schemes: An Alternative Approach to Risk Sharing.

Page 3 of 15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

entity must allocates the initial amount of the non-current tangible assets to its significant

parts and apply depreciation to each part separately. On the other hand if the entity acquires

the physical asset on lease basis, it is appropriate to depreciate the asset separately. The

disclosure required by standard requires reflecting the following-

The existence of any title on the property, plant and equipment pledged as

security and their respective amounts4;

The amount of expenditures which are being recognised in the carrying

amount of property, plant and equipment in its construction phase;

the amount of contractual obligations which are to be paid for the acquisition

of the assets5;

If the impairment is not disclosed separately in the comprehensive income

statement, that is included in profit or loss account in total.

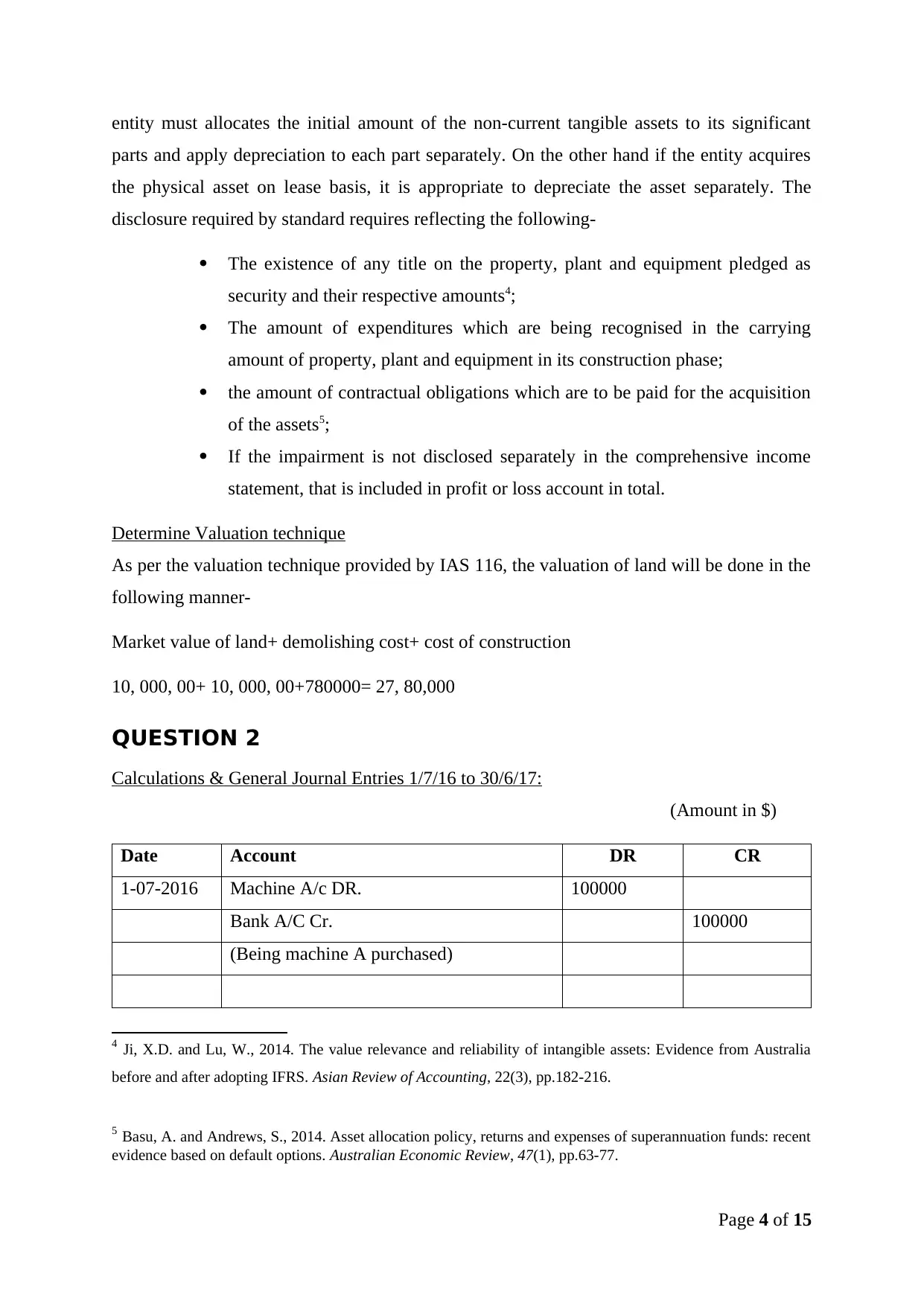

Determine Valuation technique

As per the valuation technique provided by IAS 116, the valuation of land will be done in the

following manner-

Market value of land+ demolishing cost+ cost of construction

10, 000, 00+ 10, 000, 00+780000= 27, 80,000

QUESTION 2

Calculations & General Journal Entries 1/7/16 to 30/6/17:

(Amount in $)

Date Account DR CR

1-07-2016 Machine A/c DR. 100000

Bank A/C Cr. 100000

(Being machine A purchased)

4 Ji, X.D. and Lu, W., 2014. The value relevance and reliability of intangible assets: Evidence from Australia

before and after adopting IFRS. Asian Review of Accounting, 22(3), pp.182-216.

5 Basu, A. and Andrews, S., 2014. Asset allocation policy, returns and expenses of superannuation funds: recent

evidence based on default options. Australian Economic Review, 47(1), pp.63-77.

Page 4 of 15

parts and apply depreciation to each part separately. On the other hand if the entity acquires

the physical asset on lease basis, it is appropriate to depreciate the asset separately. The

disclosure required by standard requires reflecting the following-

The existence of any title on the property, plant and equipment pledged as

security and their respective amounts4;

The amount of expenditures which are being recognised in the carrying

amount of property, plant and equipment in its construction phase;

the amount of contractual obligations which are to be paid for the acquisition

of the assets5;

If the impairment is not disclosed separately in the comprehensive income

statement, that is included in profit or loss account in total.

Determine Valuation technique

As per the valuation technique provided by IAS 116, the valuation of land will be done in the

following manner-

Market value of land+ demolishing cost+ cost of construction

10, 000, 00+ 10, 000, 00+780000= 27, 80,000

QUESTION 2

Calculations & General Journal Entries 1/7/16 to 30/6/17:

(Amount in $)

Date Account DR CR

1-07-2016 Machine A/c DR. 100000

Bank A/C Cr. 100000

(Being machine A purchased)

4 Ji, X.D. and Lu, W., 2014. The value relevance and reliability of intangible assets: Evidence from Australia

before and after adopting IFRS. Asian Review of Accounting, 22(3), pp.182-216.

5 Basu, A. and Andrews, S., 2014. Asset allocation policy, returns and expenses of superannuation funds: recent

evidence based on default options. Australian Economic Review, 47(1), pp.63-77.

Page 4 of 15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

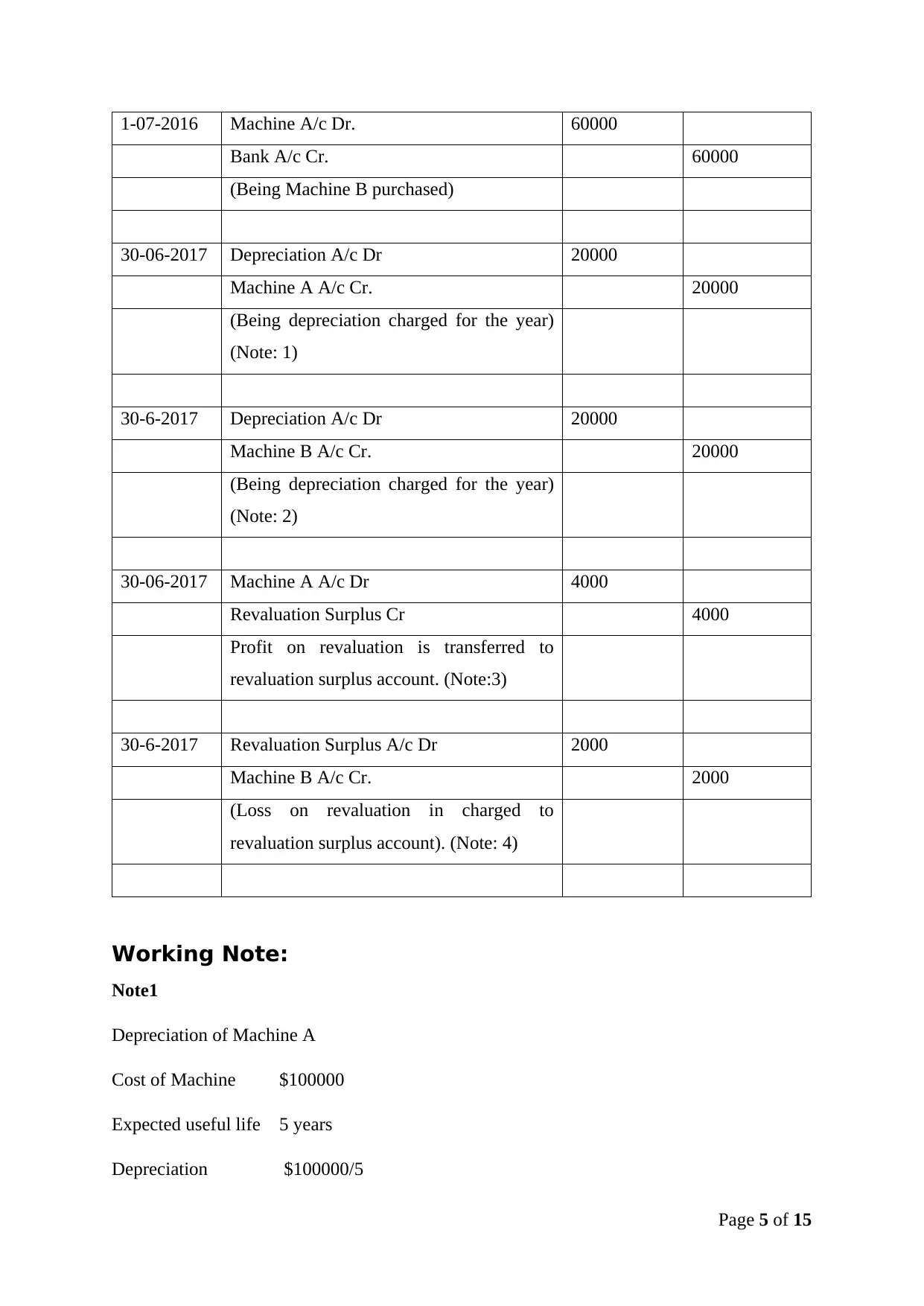

1-07-2016 Machine A/c Dr. 60000

Bank A/c Cr. 60000

(Being Machine B purchased)

30-06-2017 Depreciation A/c Dr 20000

Machine A A/c Cr. 20000

(Being depreciation charged for the year)

(Note: 1)

30-6-2017 Depreciation A/c Dr 20000

Machine B A/c Cr. 20000

(Being depreciation charged for the year)

(Note: 2)

30-06-2017 Machine A A/c Dr 4000

Revaluation Surplus Cr 4000

Profit on revaluation is transferred to

revaluation surplus account. (Note:3)

30-6-2017 Revaluation Surplus A/c Dr 2000

Machine B A/c Cr. 2000

(Loss on revaluation in charged to

revaluation surplus account). (Note: 4)

Working Note:

Note1

Depreciation of Machine A

Cost of Machine $100000

Expected useful life 5 years

Depreciation $100000/5

Page 5 of 15

Bank A/c Cr. 60000

(Being Machine B purchased)

30-06-2017 Depreciation A/c Dr 20000

Machine A A/c Cr. 20000

(Being depreciation charged for the year)

(Note: 1)

30-6-2017 Depreciation A/c Dr 20000

Machine B A/c Cr. 20000

(Being depreciation charged for the year)

(Note: 2)

30-06-2017 Machine A A/c Dr 4000

Revaluation Surplus Cr 4000

Profit on revaluation is transferred to

revaluation surplus account. (Note:3)

30-6-2017 Revaluation Surplus A/c Dr 2000

Machine B A/c Cr. 2000

(Loss on revaluation in charged to

revaluation surplus account). (Note: 4)

Working Note:

Note1

Depreciation of Machine A

Cost of Machine $100000

Expected useful life 5 years

Depreciation $100000/5

Page 5 of 15

$20000 p.a.

Note2

Depreciation of Machine B

Cost of Machine $60000

Expected useful life 3 years

Depreciation $60000/3

$20000 p.a.

Note 3

Revaluation Surplus on Machine A

Fair value of Machine A on 30th June 2017

= $84000

Book Value of Machine A on 30th June 2017

=$100000-$20000

=$80000

Revaluation Surplus of Machine A

Fair Value – Book Value

$84000- $80000

$4000

Note 4

Impairment loss on Machine B

Fair value of Machine B on 30th June 2017

= $38000

Book Value of Machine B on 30th June 2017

Page 6 of 15

Note2

Depreciation of Machine B

Cost of Machine $60000

Expected useful life 3 years

Depreciation $60000/3

$20000 p.a.

Note 3

Revaluation Surplus on Machine A

Fair value of Machine A on 30th June 2017

= $84000

Book Value of Machine A on 30th June 2017

=$100000-$20000

=$80000

Revaluation Surplus of Machine A

Fair Value – Book Value

$84000- $80000

$4000

Note 4

Impairment loss on Machine B

Fair value of Machine B on 30th June 2017

= $38000

Book Value of Machine B on 30th June 2017

Page 6 of 15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

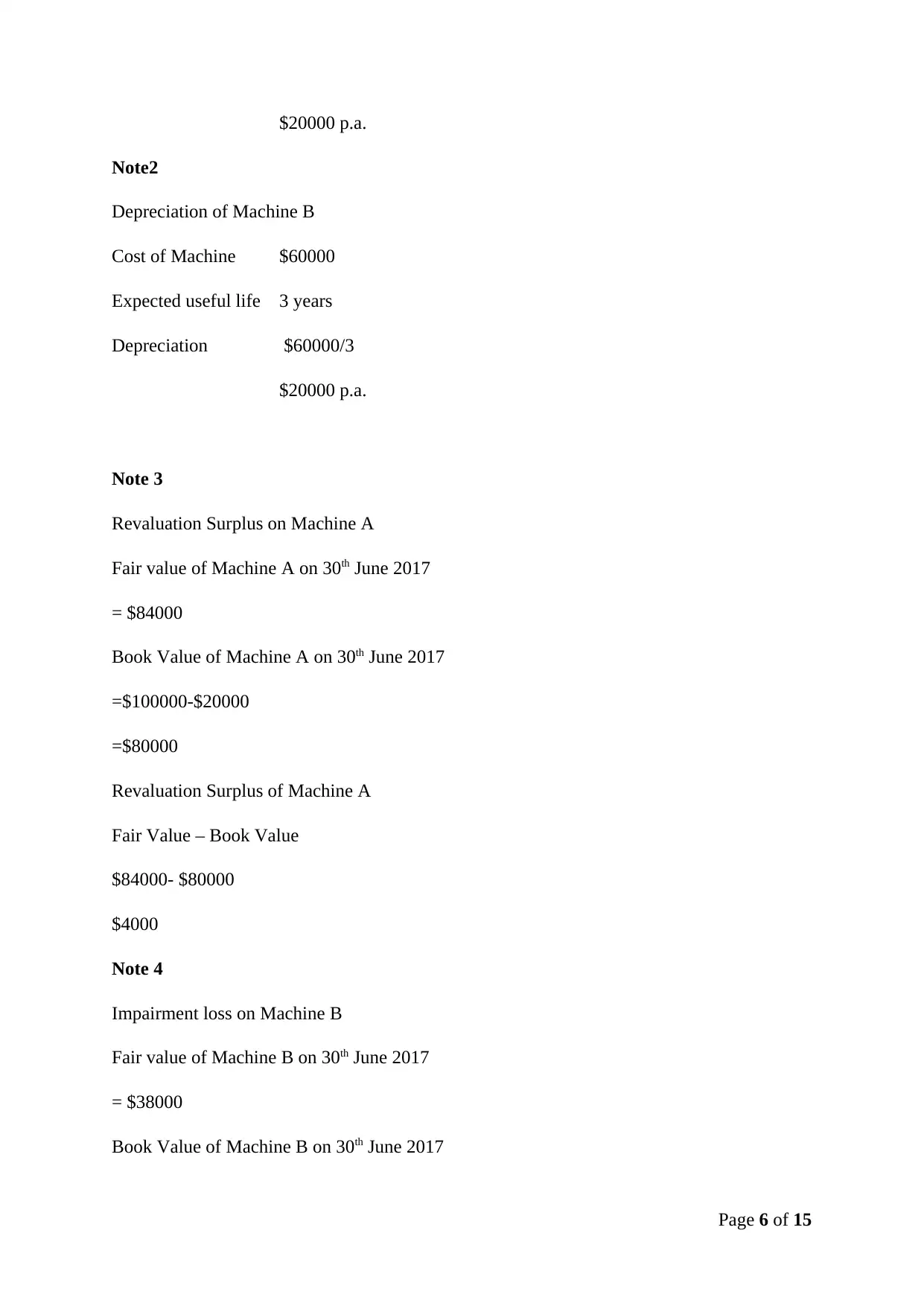

=$40000

Impairment Loss

=$38000-$40000

=-$2000

In accordance with provisions specified in AASB 116 Property, Plant and Equipment

revaluation surplus is transferred to surplus on revaluation account6. Further, if any loss

relating to revaluation occurs than the same is adjusted with existing balance of revaluation

account and in case of higher loss the remaining balance is charged to profit and loss account

as impairment loss7.

Calculations & General Journal Entries 1/8/18:

(Amount in $)

Date Account DR CR

1-1-2018 Bank Account Dr. 29000

Revaluation A/c Dr 2000

Profit & Loss A/c Dr. 7000

Machine B A/c Cr. 38000

(Being machine B sold at loss of $9000)

1-1-2018 Cash A/c Dr 80000

Machine C A/c Cr. 80000

(Being machine purchased for cash)

1-1-2018 General reserve A/c Dr. 8000

Revaluation Surplus A/c Dr. 2000

Share Capital A/c Cr. 10000

6 Zakaria, A., Edwards, D.J., Holt, G.D. and Ramachandran, V., 2014. A Review of Property, Plant and

Equipment Asset Revaluation Decision Making in Indonesia: Development of a Conceptual Model. Mindanao

Journal of Science and Technology, 12(1), pp.1-1.

7 Deegan, C., 2013. Financial accounting theory. McGraw-Hill Education Australia.

Page 7 of 15

Impairment Loss

=$38000-$40000

=-$2000

In accordance with provisions specified in AASB 116 Property, Plant and Equipment

revaluation surplus is transferred to surplus on revaluation account6. Further, if any loss

relating to revaluation occurs than the same is adjusted with existing balance of revaluation

account and in case of higher loss the remaining balance is charged to profit and loss account

as impairment loss7.

Calculations & General Journal Entries 1/8/18:

(Amount in $)

Date Account DR CR

1-1-2018 Bank Account Dr. 29000

Revaluation A/c Dr 2000

Profit & Loss A/c Dr. 7000

Machine B A/c Cr. 38000

(Being machine B sold at loss of $9000)

1-1-2018 Cash A/c Dr 80000

Machine C A/c Cr. 80000

(Being machine purchased for cash)

1-1-2018 General reserve A/c Dr. 8000

Revaluation Surplus A/c Dr. 2000

Share Capital A/c Cr. 10000

6 Zakaria, A., Edwards, D.J., Holt, G.D. and Ramachandran, V., 2014. A Review of Property, Plant and

Equipment Asset Revaluation Decision Making in Indonesia: Development of a Conceptual Model. Mindanao

Journal of Science and Technology, 12(1), pp.1-1.

7 Deegan, C., 2013. Financial accounting theory. McGraw-Hill Education Australia.

Page 7 of 15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Being bonus share issued)

3. Calculations & General Journal Entries 30/6/18:

Date Account DR CR

30-6-2018 Depreciation A/c Dr. 21000

Machine A A/c Cr 21000

(Being depreciation charged) (Note 1)

30-6-2018 Depreciation A/c Dr. 20000

Machine C A/c Cr. 20000

(Being depreciation charged) (Note 2)

30-6-2018 Impairment loss A/c Dr 3500

Machine A Cr. 2000

Machine C A/c Cr. 1500

(Being impairment loss charged) (note 3 &

4)

Working Notes

Note 1

Depreciation as per revaluated amount

Revalue amount / No of remaining years

$84000/ 4

= $21000

Note 2

= $80000/4

Page 8 of 15

3. Calculations & General Journal Entries 30/6/18:

Date Account DR CR

30-6-2018 Depreciation A/c Dr. 21000

Machine A A/c Cr 21000

(Being depreciation charged) (Note 1)

30-6-2018 Depreciation A/c Dr. 20000

Machine C A/c Cr. 20000

(Being depreciation charged) (Note 2)

30-6-2018 Impairment loss A/c Dr 3500

Machine A Cr. 2000

Machine C A/c Cr. 1500

(Being impairment loss charged) (note 3 &

4)

Working Notes

Note 1

Depreciation as per revaluated amount

Revalue amount / No of remaining years

$84000/ 4

= $21000

Note 2

= $80000/4

Page 8 of 15

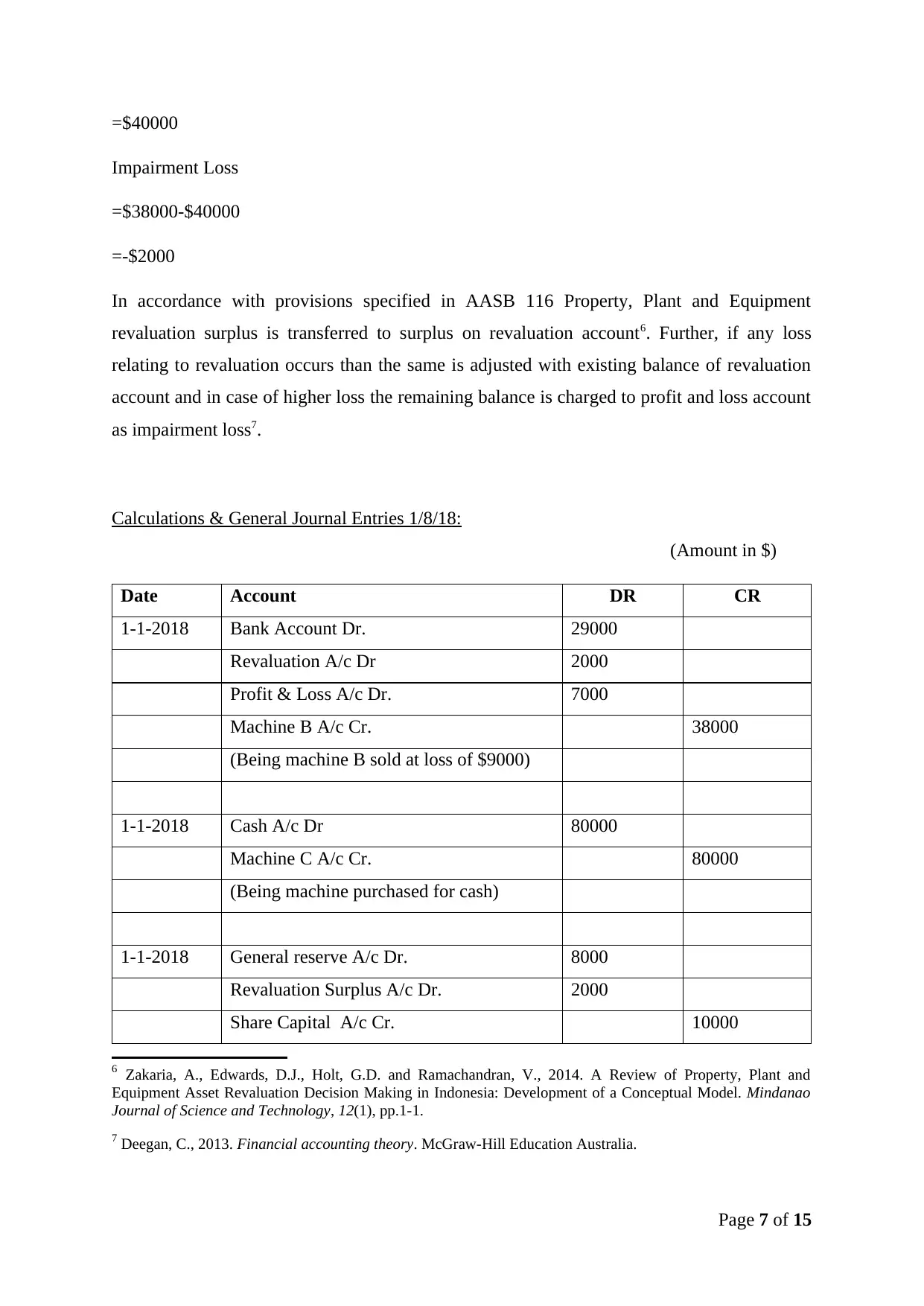

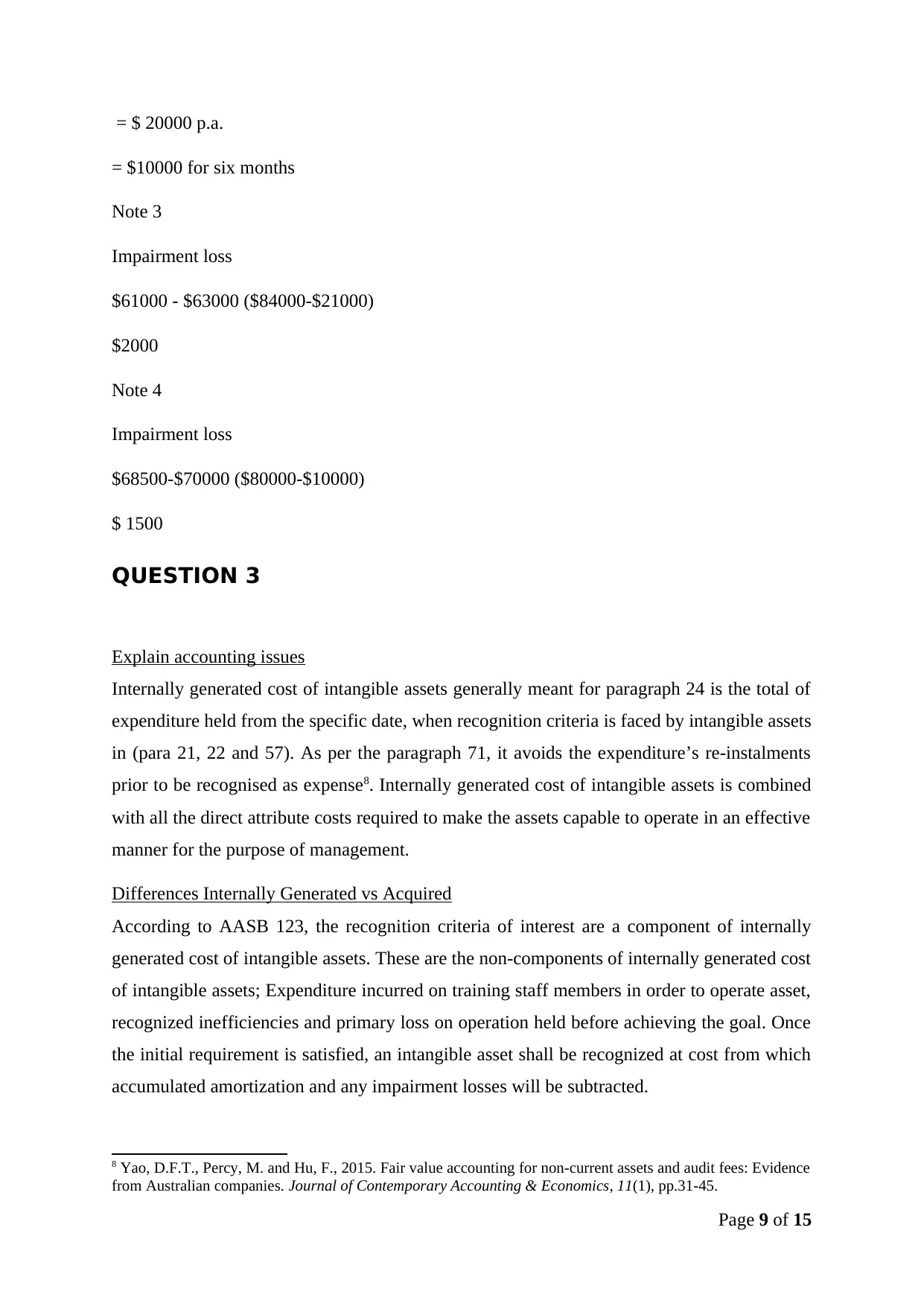

= $ 20000 p.a.

= $10000 for six months

Note 3

Impairment loss

$61000 - $63000 ($84000-$21000)

$2000

Note 4

Impairment loss

$68500-$70000 ($80000-$10000)

$ 1500

QUESTION 3

Explain accounting issues

Internally generated cost of intangible assets generally meant for paragraph 24 is the total of

expenditure held from the specific date, when recognition criteria is faced by intangible assets

in (para 21, 22 and 57). As per the paragraph 71, it avoids the expenditure’s re-instalments

prior to be recognised as expense8. Internally generated cost of intangible assets is combined

with all the direct attribute costs required to make the assets capable to operate in an effective

manner for the purpose of management.

Differences Internally Generated vs Acquired

According to AASB 123, the recognition criteria of interest are a component of internally

generated cost of intangible assets. These are the non-components of internally generated cost

of intangible assets; Expenditure incurred on training staff members in order to operate asset,

recognized inefficiencies and primary loss on operation held before achieving the goal. Once

the initial requirement is satisfied, an intangible asset shall be recognized at cost from which

accumulated amortization and any impairment losses will be subtracted.

8 Yao, D.F.T., Percy, M. and Hu, F., 2015. Fair value accounting for non-current assets and audit fees: Evidence

from Australian companies. Journal of Contemporary Accounting & Economics, 11(1), pp.31-45.

Page 9 of 15

= $10000 for six months

Note 3

Impairment loss

$61000 - $63000 ($84000-$21000)

$2000

Note 4

Impairment loss

$68500-$70000 ($80000-$10000)

$ 1500

QUESTION 3

Explain accounting issues

Internally generated cost of intangible assets generally meant for paragraph 24 is the total of

expenditure held from the specific date, when recognition criteria is faced by intangible assets

in (para 21, 22 and 57). As per the paragraph 71, it avoids the expenditure’s re-instalments

prior to be recognised as expense8. Internally generated cost of intangible assets is combined

with all the direct attribute costs required to make the assets capable to operate in an effective

manner for the purpose of management.

Differences Internally Generated vs Acquired

According to AASB 123, the recognition criteria of interest are a component of internally

generated cost of intangible assets. These are the non-components of internally generated cost

of intangible assets; Expenditure incurred on training staff members in order to operate asset,

recognized inefficiencies and primary loss on operation held before achieving the goal. Once

the initial requirement is satisfied, an intangible asset shall be recognized at cost from which

accumulated amortization and any impairment losses will be subtracted.

8 Yao, D.F.T., Percy, M. and Hu, F., 2015. Fair value accounting for non-current assets and audit fees: Evidence

from Australian companies. Journal of Contemporary Accounting & Economics, 11(1), pp.31-45.

Page 9 of 15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

After the initial recognition is done an intangible asset’s amount shall be revalued, as fair

value at the specific date of revaluation from any accumulated amortization and any

impairment losses will be subtracted. For revaluation purpose as per the Standard, fair value

must be measured by considering active market. Revaluation must comprise with such kind

of regularity which ultimately does not vary from its fair value. On the contrary under IAS

38, there are several requirements for accounting of intangibles and will vary on the basis of

source of asset. Internally generated cost of intangible assets shall be valued initially on the

basis of direct attributable costs which will meet the terms with recognition criteria (para 81).

Individually obtained intangibles shall be valued at the cost of actual transaction, inclusive of

directly attributable costs having the asset readily available (para 82)9. It must be considered

that the transactional price for individually obtained intangibles may be assisted by valuing of

assets before the transaction; however it is not considered as an actual requirement. After

analysing methods available in both the standard it can be assessed that it is comparatively

easier for calculation.

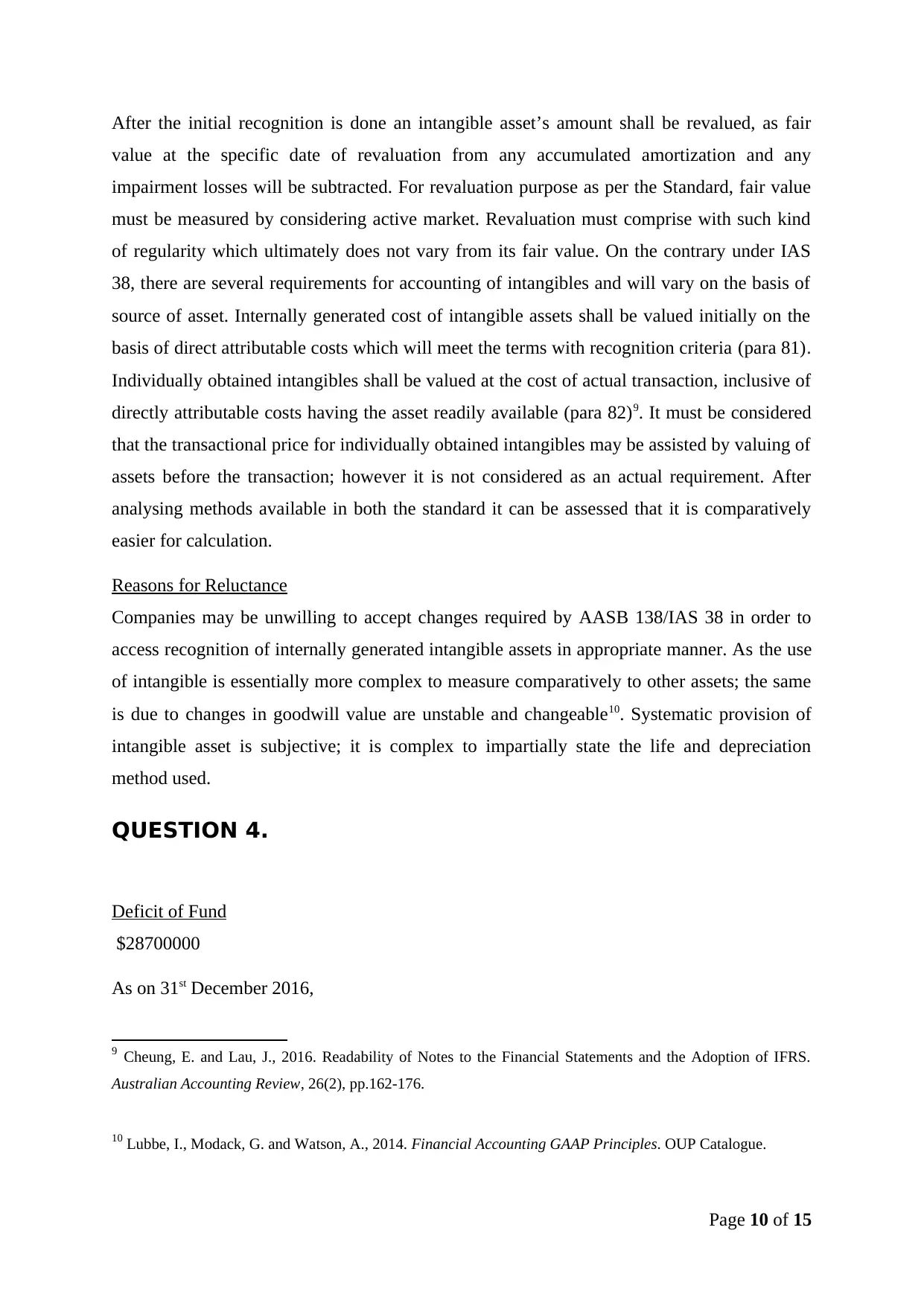

Reasons for Reluctance

Companies may be unwilling to accept changes required by AASB 138/IAS 38 in order to

access recognition of internally generated intangible assets in appropriate manner. As the use

of intangible is essentially more complex to measure comparatively to other assets; the same

is due to changes in goodwill value are unstable and changeable10. Systematic provision of

intangible asset is subjective; it is complex to impartially state the life and depreciation

method used.

QUESTION 4.

Deficit of Fund

$28700000

As on 31st December 2016,

9 Cheung, E. and Lau, J., 2016. Readability of Notes to the Financial Statements and the Adoption of IFRS.

Australian Accounting Review, 26(2), pp.162-176.

10 Lubbe, I., Modack, G. and Watson, A., 2014. Financial Accounting GAAP Principles. OUP Catalogue.

Page 10 of 15

value at the specific date of revaluation from any accumulated amortization and any

impairment losses will be subtracted. For revaluation purpose as per the Standard, fair value

must be measured by considering active market. Revaluation must comprise with such kind

of regularity which ultimately does not vary from its fair value. On the contrary under IAS

38, there are several requirements for accounting of intangibles and will vary on the basis of

source of asset. Internally generated cost of intangible assets shall be valued initially on the

basis of direct attributable costs which will meet the terms with recognition criteria (para 81).

Individually obtained intangibles shall be valued at the cost of actual transaction, inclusive of

directly attributable costs having the asset readily available (para 82)9. It must be considered

that the transactional price for individually obtained intangibles may be assisted by valuing of

assets before the transaction; however it is not considered as an actual requirement. After

analysing methods available in both the standard it can be assessed that it is comparatively

easier for calculation.

Reasons for Reluctance

Companies may be unwilling to accept changes required by AASB 138/IAS 38 in order to

access recognition of internally generated intangible assets in appropriate manner. As the use

of intangible is essentially more complex to measure comparatively to other assets; the same

is due to changes in goodwill value are unstable and changeable10. Systematic provision of

intangible asset is subjective; it is complex to impartially state the life and depreciation

method used.

QUESTION 4.

Deficit of Fund

$28700000

As on 31st December 2016,

9 Cheung, E. and Lau, J., 2016. Readability of Notes to the Financial Statements and the Adoption of IFRS.

Australian Accounting Review, 26(2), pp.162-176.

10 Lubbe, I., Modack, G. and Watson, A., 2014. Financial Accounting GAAP Principles. OUP Catalogue.

Page 10 of 15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

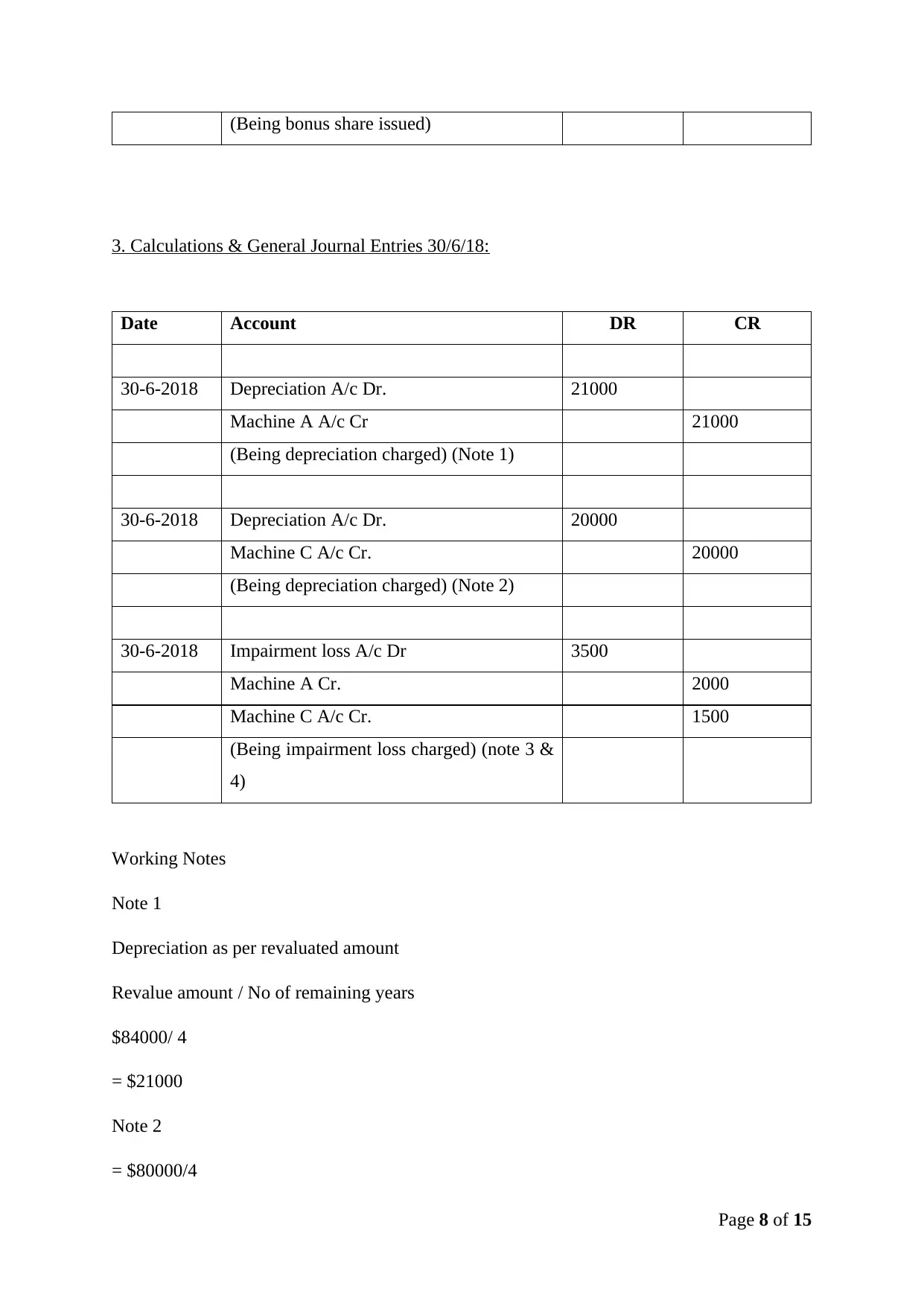

the value of benefit obligation 23000000

-

fair value of plan assets 20130000

=

Deficit of fund 28700000

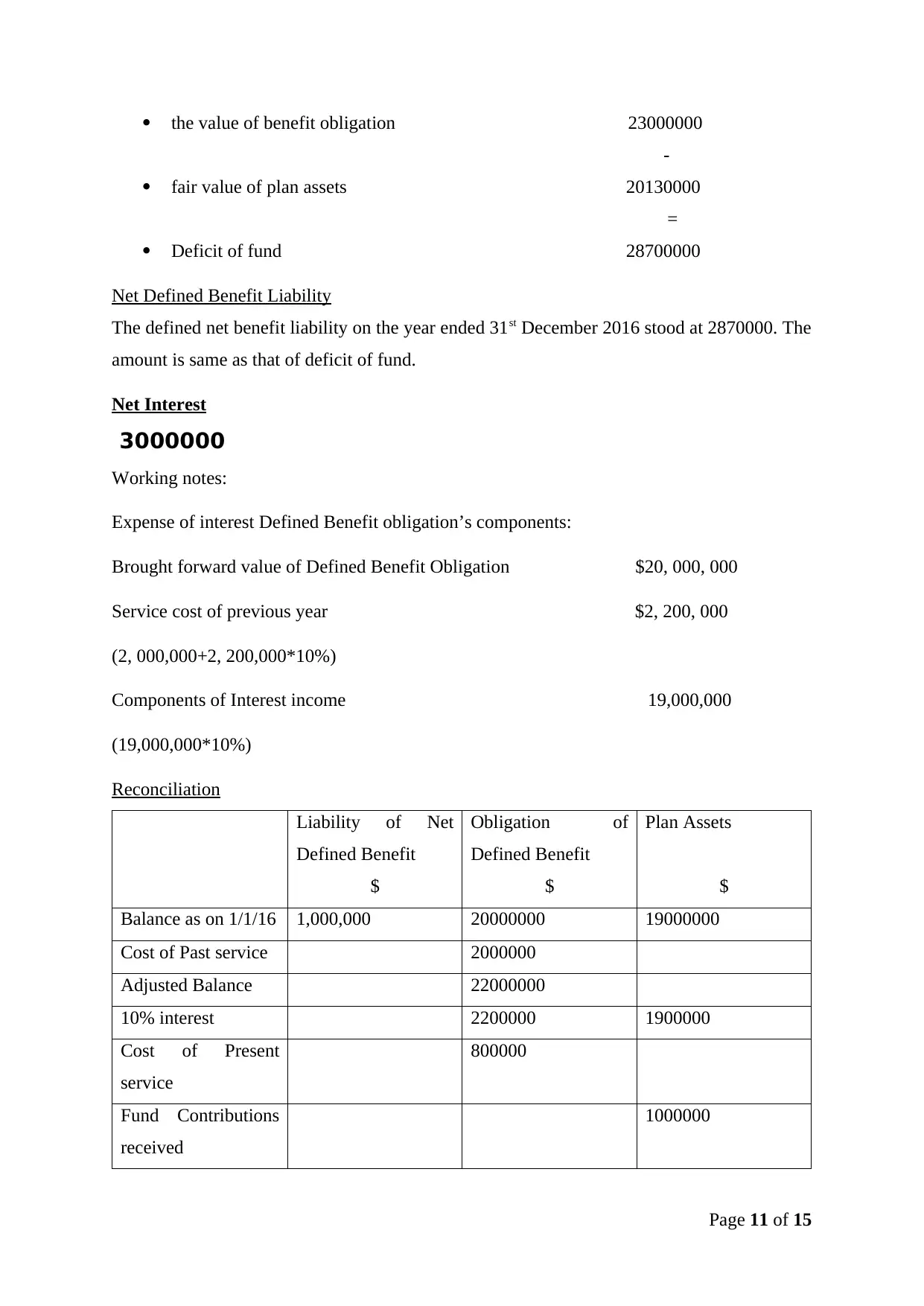

Net Defined Benefit Liability

The defined net benefit liability on the year ended 31st December 2016 stood at 2870000. The

amount is same as that of deficit of fund.

Net Interest

3000000

Working notes:

Expense of interest Defined Benefit obligation’s components:

Brought forward value of Defined Benefit Obligation $20, 000, 000

Service cost of previous year $2, 200, 000

(2, 000,000+2, 200,000*10%)

Components of Interest income 19,000,000

(19,000,000*10%)

Reconciliation

Liability of Net

Defined Benefit

$

Obligation of

Defined Benefit

$

Plan Assets

$

Balance as on 1/1/16 1,000,000 20000000 19000000

Cost of Past service 2000000

Adjusted Balance 22000000

10% interest 2200000 1900000

Cost of Present

service

800000

Fund Contributions

received

1000000

Page 11 of 15

-

fair value of plan assets 20130000

=

Deficit of fund 28700000

Net Defined Benefit Liability

The defined net benefit liability on the year ended 31st December 2016 stood at 2870000. The

amount is same as that of deficit of fund.

Net Interest

3000000

Working notes:

Expense of interest Defined Benefit obligation’s components:

Brought forward value of Defined Benefit Obligation $20, 000, 000

Service cost of previous year $2, 200, 000

(2, 000,000+2, 200,000*10%)

Components of Interest income 19,000,000

(19,000,000*10%)

Reconciliation

Liability of Net

Defined Benefit

$

Obligation of

Defined Benefit

$

Plan Assets

$

Balance as on 1/1/16 1,000,000 20000000 19000000

Cost of Past service 2000000

Adjusted Balance 22000000

10% interest 2200000 1900000

Cost of Present

service

800000

Fund Contributions

received

1000000

Page 11 of 15

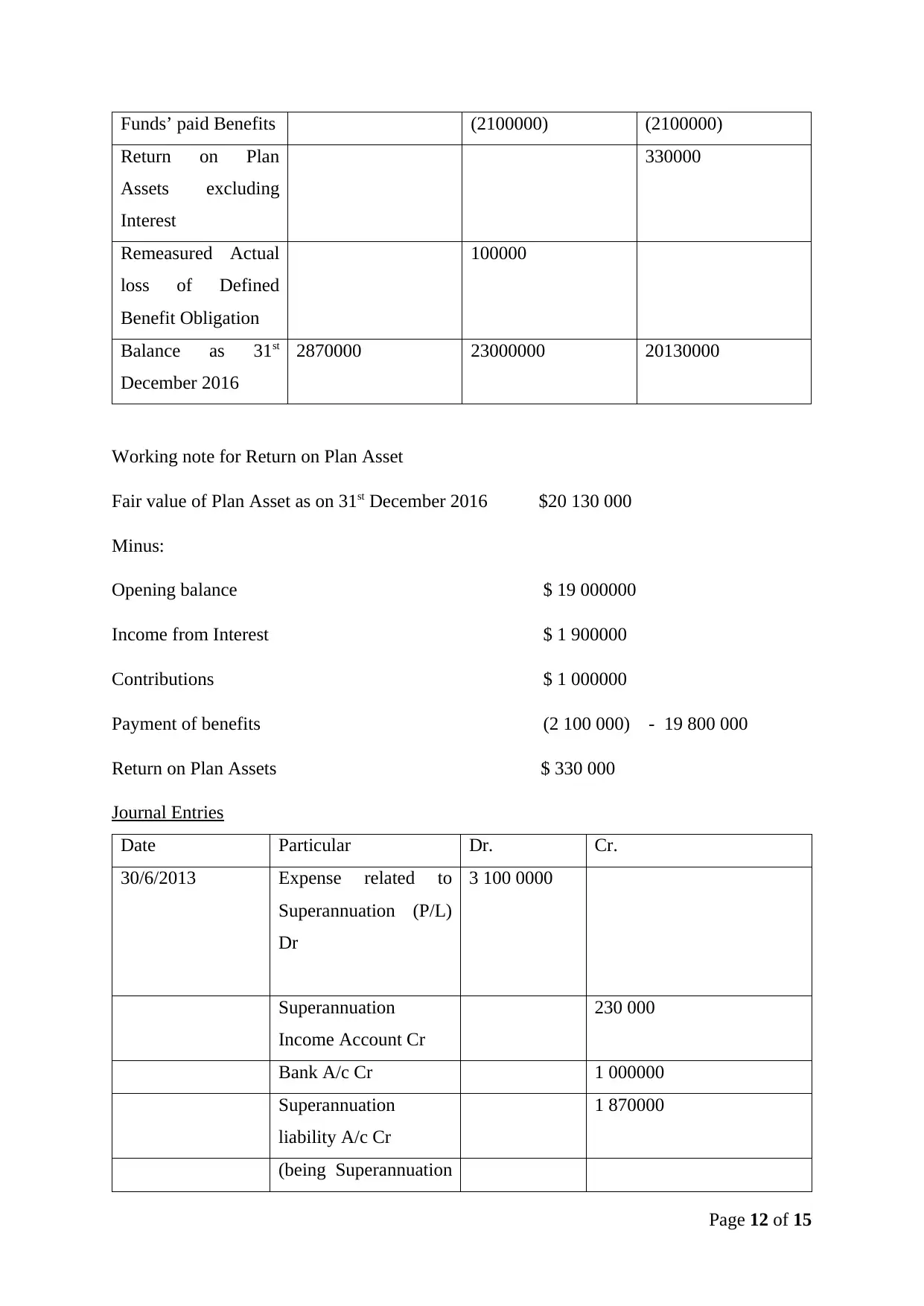

Funds’ paid Benefits (2100000) (2100000)

Return on Plan

Assets excluding

Interest

330000

Remeasured Actual

loss of Defined

Benefit Obligation

100000

Balance as 31st

December 2016

2870000 23000000 20130000

Working note for Return on Plan Asset

Fair value of Plan Asset as on 31st December 2016 $20 130 000

Minus:

Opening balance $ 19 000000

Income from Interest $ 1 900000

Contributions $ 1 000000

Payment of benefits (2 100 000) - 19 800 000

Return on Plan Assets $ 330 000

Journal Entries

Date Particular Dr. Cr.

30/6/2013 Expense related to

Superannuation (P/L)

Dr

3 100 0000

Superannuation

Income Account Cr

230 000

Bank A/c Cr 1 000000

Superannuation

liability A/c Cr

1 870000

(being Superannuation

Page 12 of 15

Return on Plan

Assets excluding

Interest

330000

Remeasured Actual

loss of Defined

Benefit Obligation

100000

Balance as 31st

December 2016

2870000 23000000 20130000

Working note for Return on Plan Asset

Fair value of Plan Asset as on 31st December 2016 $20 130 000

Minus:

Opening balance $ 19 000000

Income from Interest $ 1 900000

Contributions $ 1 000000

Payment of benefits (2 100 000) - 19 800 000

Return on Plan Assets $ 330 000

Journal Entries

Date Particular Dr. Cr.

30/6/2013 Expense related to

Superannuation (P/L)

Dr

3 100 0000

Superannuation

Income Account Cr

230 000

Bank A/c Cr 1 000000

Superannuation

liability A/c Cr

1 870000

(being Superannuation

Page 12 of 15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.