Understanding Financial Accounting Standards

VerifiedAdded on 2020/03/16

|22

|1789

|37

AI Summary

This assignment delves into the accounting standard AASB 3, specifically focusing on its provisions regarding business combinations. It examines the application of AASB 136 in disclosing goodwill impairment and requires an analysis of relevant case studies and examples. The document likely includes discussions on the measurement and recognition of goodwill, as well as the factors influencing its impairment assessment.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author Note:

Corporate Accounting

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2CORPORATE ACCOUNTING

Table of Contents

Question 1........................................................................................................................................3

First Investment Relationship......................................................................................................3

Second Investment Relationship..................................................................................................3

Third Investment Relationship....................................................................................................4

Fourth Investment Relationship...................................................................................................4

Fifth Investment Relationship......................................................................................................6

Question 2........................................................................................................................................7

Question 3......................................................................................................................................11

Question 4......................................................................................................................................14

Requirement A...........................................................................................................................14

Requirement B...........................................................................................................................15

Requirement C...........................................................................................................................15

Question 5......................................................................................................................................16

References and Bibliography.........................................................................................................21

Table of Contents

Question 1........................................................................................................................................3

First Investment Relationship......................................................................................................3

Second Investment Relationship..................................................................................................3

Third Investment Relationship....................................................................................................4

Fourth Investment Relationship...................................................................................................4

Fifth Investment Relationship......................................................................................................6

Question 2........................................................................................................................................7

Question 3......................................................................................................................................11

Question 4......................................................................................................................................14

Requirement A...........................................................................................................................14

Requirement B...........................................................................................................................15

Requirement C...........................................................................................................................15

Question 5......................................................................................................................................16

References and Bibliography.........................................................................................................21

3CORPORATE ACCOUNTING

Question 1

First Investment Relationship

As per this situation, LBX Pty Limited initially had two shareholders who had 25% of

shares that was held by Millionaires Club as well as Pty Limited while the remaining shares are

held by the founder of LBX Pty Limited. In addition, it is important to take into account all the

facts as well as situations at the time of evaluating the control over investors. Millionaires Club

had been provided with three seats in the Board of Directors as well as they also have a say in

some of the important activities that takes place within the organization. It is mentioned in the

paragraph B-19 of AASB 10 that an investor has the power to control over the directing activities

of business enterprise.

Second Investment Relationship

It is important to consider the fact that Millionaires Club need to involving in assessing

for the rights for determining consolidation requirements that controls rest of the activities. The

activities controlled by an investee actually have the protective rights when they get involved in

special events or situations. As per this circumstance, it is noted that financial operations of BBT

are controlled by the Executives of Millionaires Club for a time span of 5 years. In that way, the

controls mainly rest upon in the hands of Millionaires Club who looks after the financial

activities of the business. Therefore, it can be predicted that consolidation is not needed and

cannot be performed when the member of Millionaires Club does not have any seats in the Board

of Directors.

Question 1

First Investment Relationship

As per this situation, LBX Pty Limited initially had two shareholders who had 25% of

shares that was held by Millionaires Club as well as Pty Limited while the remaining shares are

held by the founder of LBX Pty Limited. In addition, it is important to take into account all the

facts as well as situations at the time of evaluating the control over investors. Millionaires Club

had been provided with three seats in the Board of Directors as well as they also have a say in

some of the important activities that takes place within the organization. It is mentioned in the

paragraph B-19 of AASB 10 that an investor has the power to control over the directing activities

of business enterprise.

Second Investment Relationship

It is important to consider the fact that Millionaires Club need to involving in assessing

for the rights for determining consolidation requirements that controls rest of the activities. The

activities controlled by an investee actually have the protective rights when they get involved in

special events or situations. As per this circumstance, it is noted that financial operations of BBT

are controlled by the Executives of Millionaires Club for a time span of 5 years. In that way, the

controls mainly rest upon in the hands of Millionaires Club who looks after the financial

activities of the business. Therefore, it can be predicted that consolidation is not needed and

cannot be performed when the member of Millionaires Club does not have any seats in the Board

of Directors.

4CORPORATE ACCOUNTING

Third Investment Relationship

As per this situation, CTL has two investors where Millionaires Club shows

responsibility in supplying loan as well as BJL for tackling the managerial activities

(Waegenaere, Sansing & Wielhouwer, 2015). When two investors are involved in any business,

then adequate activities of CTL need to be directed or controlled by both the investors together

and then planned mutually. Both the investors need to agree to one solution to any problem faced

by the organization, otherwise it will be difficult. However, CTL cannot be controlled by any of

the individual investor and interest in CTL would be accountable from joint arrangement as per

AASB 11.

Fourth Investment Relationship

As far this investment relationship is concerned. There are three investors present where

each investor has equal share of 33.3% (Warren, Reeve & Duchac, 2013). It is further noted that

the daily activities of PGH Pty Limited are controlled properly by Millionaires Club as they have

only one seat in the Board of Directors. The other two shareholders named as CCL and GJL have

only one seat out of three in the Board of Directors as well as they are treated as passive

investors. It is clearly mentioned in the Paragraph B-19 of AASB 10 that when an investor shows

passive interest towards company, then they mostly have some special relation with the investee

(Toraman & Öğreten, 2013). It is noted from the given situation that Millionaires Club has

enough power for exercising for the control on PGH Pty Limited where they are entitled for

some of the rights and shows more passive interest towards company. Therefore, involvement of

Millionaires Club in the daily activities resulted in exercising some control with large exposure

on variability in return (Williams, 2014).

Third Investment Relationship

As per this situation, CTL has two investors where Millionaires Club shows

responsibility in supplying loan as well as BJL for tackling the managerial activities

(Waegenaere, Sansing & Wielhouwer, 2015). When two investors are involved in any business,

then adequate activities of CTL need to be directed or controlled by both the investors together

and then planned mutually. Both the investors need to agree to one solution to any problem faced

by the organization, otherwise it will be difficult. However, CTL cannot be controlled by any of

the individual investor and interest in CTL would be accountable from joint arrangement as per

AASB 11.

Fourth Investment Relationship

As far this investment relationship is concerned. There are three investors present where

each investor has equal share of 33.3% (Warren, Reeve & Duchac, 2013). It is further noted that

the daily activities of PGH Pty Limited are controlled properly by Millionaires Club as they have

only one seat in the Board of Directors. The other two shareholders named as CCL and GJL have

only one seat out of three in the Board of Directors as well as they are treated as passive

investors. It is clearly mentioned in the Paragraph B-19 of AASB 10 that when an investor shows

passive interest towards company, then they mostly have some special relation with the investee

(Toraman & Öğreten, 2013). It is noted from the given situation that Millionaires Club has

enough power for exercising for the control on PGH Pty Limited where they are entitled for

some of the rights and shows more passive interest towards company. Therefore, involvement of

Millionaires Club in the daily activities resulted in exercising some control with large exposure

on variability in return (Williams, 2014).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5CORPORATE ACCOUNTING

Fifth Investment Relationship

As per this situation, Millionaires Club is the owner of 75% of shares of JB Hi-Fi where

they do not have any seat in the Board of Directors and so they are not even accountable for

managing or handling any of the decisions relating to finance and operations (Walker, 2015). It

is noted that there had been consolidation of assets because of deficiency as well as constant poor

and unhealthy performance. Millionaires Club in actual holds main shares of JB Hi-Fi where

they have not been provided with any of the voting rights. It is the rights of an investor to

exercise the control even if they do not have the voting rights as per B-38 of AASB 10. There

had been sufficient control that is performed by the investors when they get engaged in

managing for the relevant activities as well as maintaining contractual obligations. It is

understood from the situation that JB Hi-Fi does not have any engagement in directing for these

activities that takes place in business and thus control cannot be exercised (Weil, Schipper &

Francis, 2013).

Fifth Investment Relationship

As per this situation, Millionaires Club is the owner of 75% of shares of JB Hi-Fi where

they do not have any seat in the Board of Directors and so they are not even accountable for

managing or handling any of the decisions relating to finance and operations (Walker, 2015). It

is noted that there had been consolidation of assets because of deficiency as well as constant poor

and unhealthy performance. Millionaires Club in actual holds main shares of JB Hi-Fi where

they have not been provided with any of the voting rights. It is the rights of an investor to

exercise the control even if they do not have the voting rights as per B-38 of AASB 10. There

had been sufficient control that is performed by the investors when they get engaged in

managing for the relevant activities as well as maintaining contractual obligations. It is

understood from the situation that JB Hi-Fi does not have any engagement in directing for these

activities that takes place in business and thus control cannot be exercised (Weil, Schipper &

Francis, 2013).

6CORPORATE ACCOUNTING

Question 2

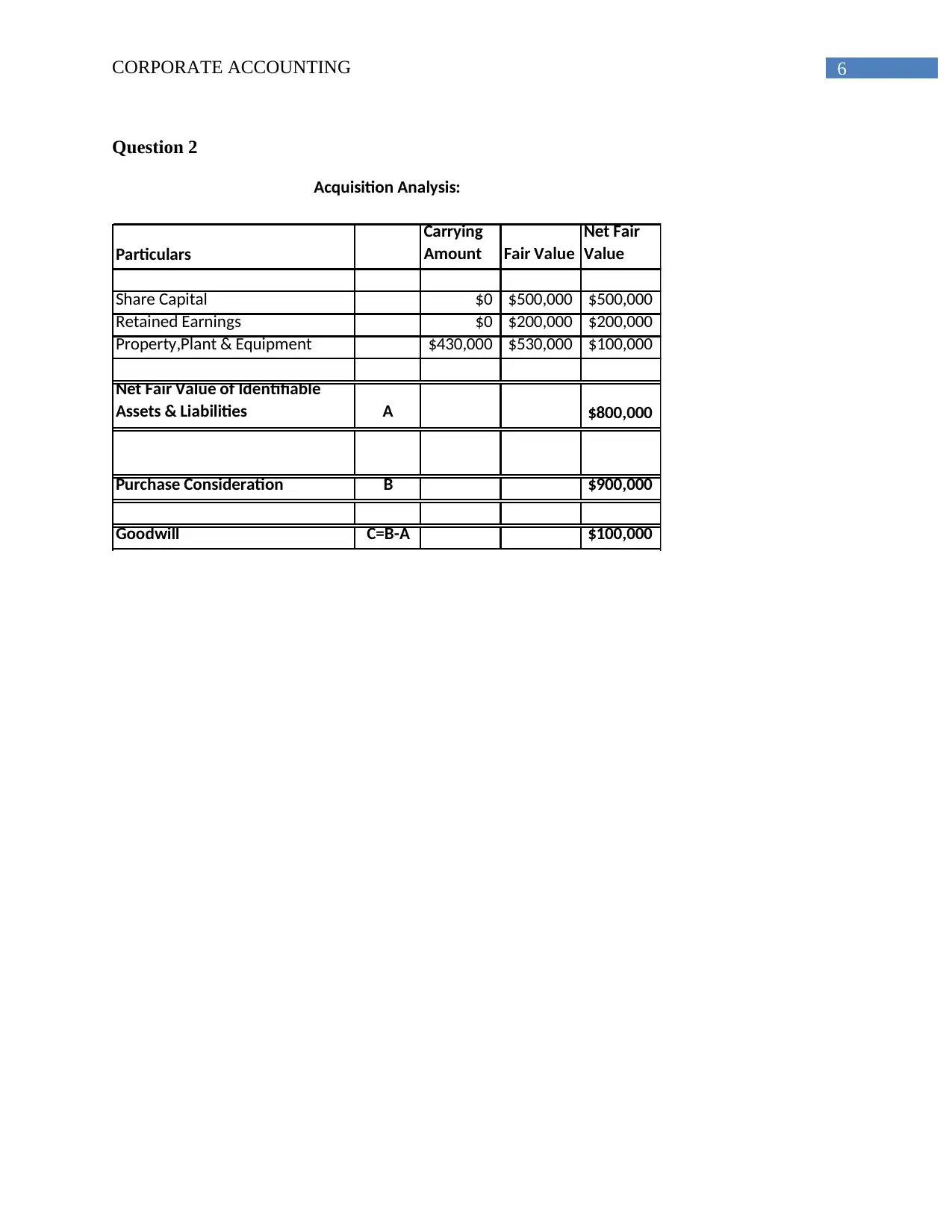

Particulars

Carrying

Amount Fair Value

Net Fair

Value

Share Capital $0 $500,000 $500,000

Retained Earnings $0 $200,000 $200,000

Property,Plant & Equipment $430,000 $530,000 $100,000

Net Fair Value of Identifiable

Assets & Liabilities A $800,000

Purchase Consideration B $900,000

Goodwill C=B-A $100,000

Acquisition Analysis:

Question 2

Particulars

Carrying

Amount Fair Value

Net Fair

Value

Share Capital $0 $500,000 $500,000

Retained Earnings $0 $200,000 $200,000

Property,Plant & Equipment $430,000 $530,000 $100,000

Net Fair Value of Identifiable

Assets & Liabilities A $800,000

Purchase Consideration B $900,000

Goodwill C=B-A $100,000

Acquisition Analysis:

7CORPORATE ACCOUNTING

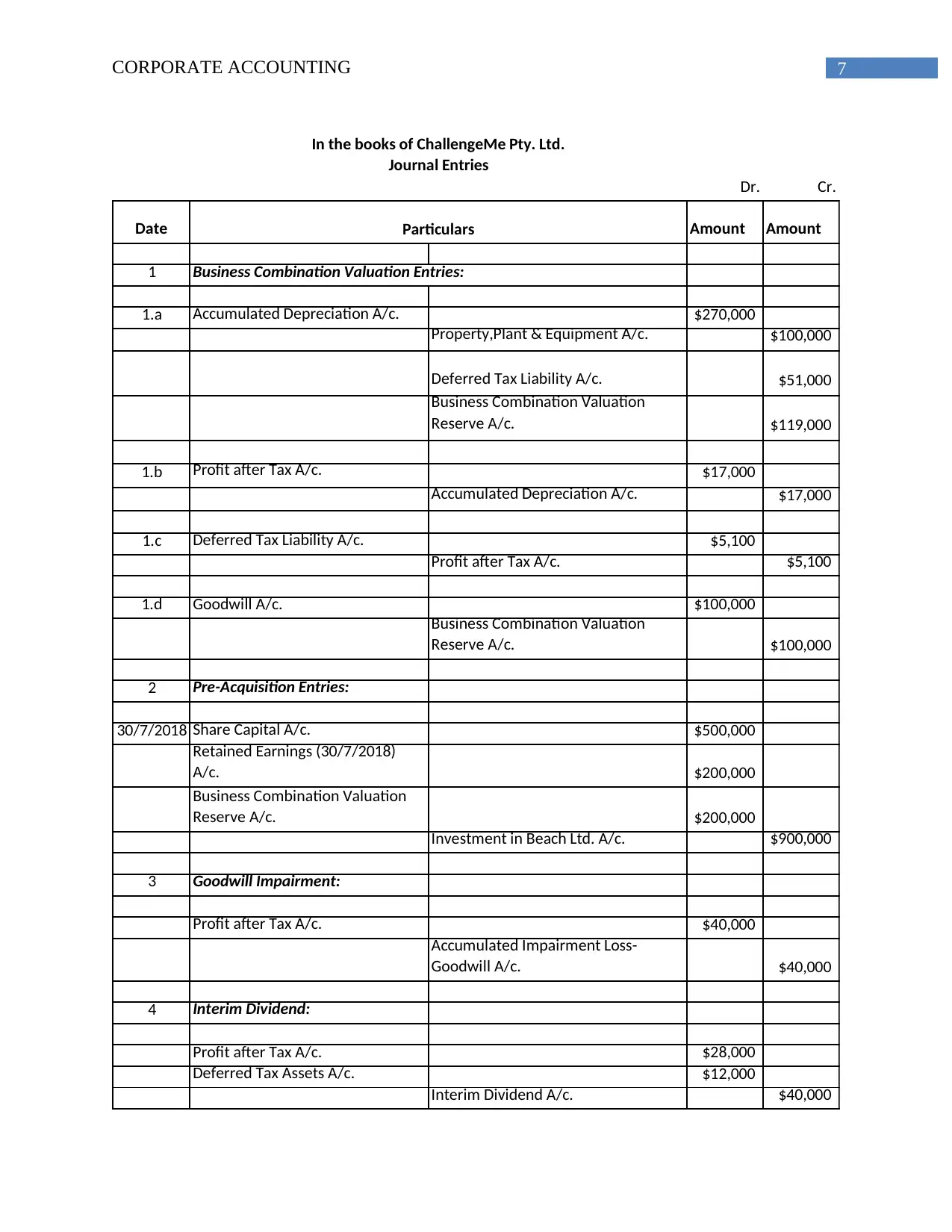

Dr. Cr.

Date Amount Amount

1

1.a Accumulated Depreciation A/c. $270,000

Property,Plant & Equipment A/c. $100,000

Deferred Tax Liability A/c. $51,000

Business Combination Valuation

Reserve A/c. $119,000

1.b Profit after Tax A/c. $17,000

Accumulated Depreciation A/c. $17,000

1.c Deferred Tax Liability A/c. $5,100

Profit after Tax A/c. $5,100

1.d Goodwill A/c. $100,000

Business Combination Valuation

Reserve A/c. $100,000

2 Pre-Acquisition Entries:

30/7/2018 Share Capital A/c. $500,000

Retained Earnings (30/7/2018)

A/c. $200,000

Business Combination Valuation

Reserve A/c. $200,000

Investment in Beach Ltd. A/c. $900,000

3 Goodwill Impairment:

Profit after Tax A/c. $40,000

Accumulated Impairment Loss-

Goodwill A/c. $40,000

4 Interim Dividend:

Profit after Tax A/c. $28,000

Deferred Tax Assets A/c. $12,000

Interim Dividend A/c. $40,000

Particulars

Business Combination Valuation Entries:

In the books of ChallengeMe Pty. Ltd.

Journal Entries

Dr. Cr.

Date Amount Amount

1

1.a Accumulated Depreciation A/c. $270,000

Property,Plant & Equipment A/c. $100,000

Deferred Tax Liability A/c. $51,000

Business Combination Valuation

Reserve A/c. $119,000

1.b Profit after Tax A/c. $17,000

Accumulated Depreciation A/c. $17,000

1.c Deferred Tax Liability A/c. $5,100

Profit after Tax A/c. $5,100

1.d Goodwill A/c. $100,000

Business Combination Valuation

Reserve A/c. $100,000

2 Pre-Acquisition Entries:

30/7/2018 Share Capital A/c. $500,000

Retained Earnings (30/7/2018)

A/c. $200,000

Business Combination Valuation

Reserve A/c. $200,000

Investment in Beach Ltd. A/c. $900,000

3 Goodwill Impairment:

Profit after Tax A/c. $40,000

Accumulated Impairment Loss-

Goodwill A/c. $40,000

4 Interim Dividend:

Profit after Tax A/c. $28,000

Deferred Tax Assets A/c. $12,000

Interim Dividend A/c. $40,000

Particulars

Business Combination Valuation Entries:

In the books of ChallengeMe Pty. Ltd.

Journal Entries

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

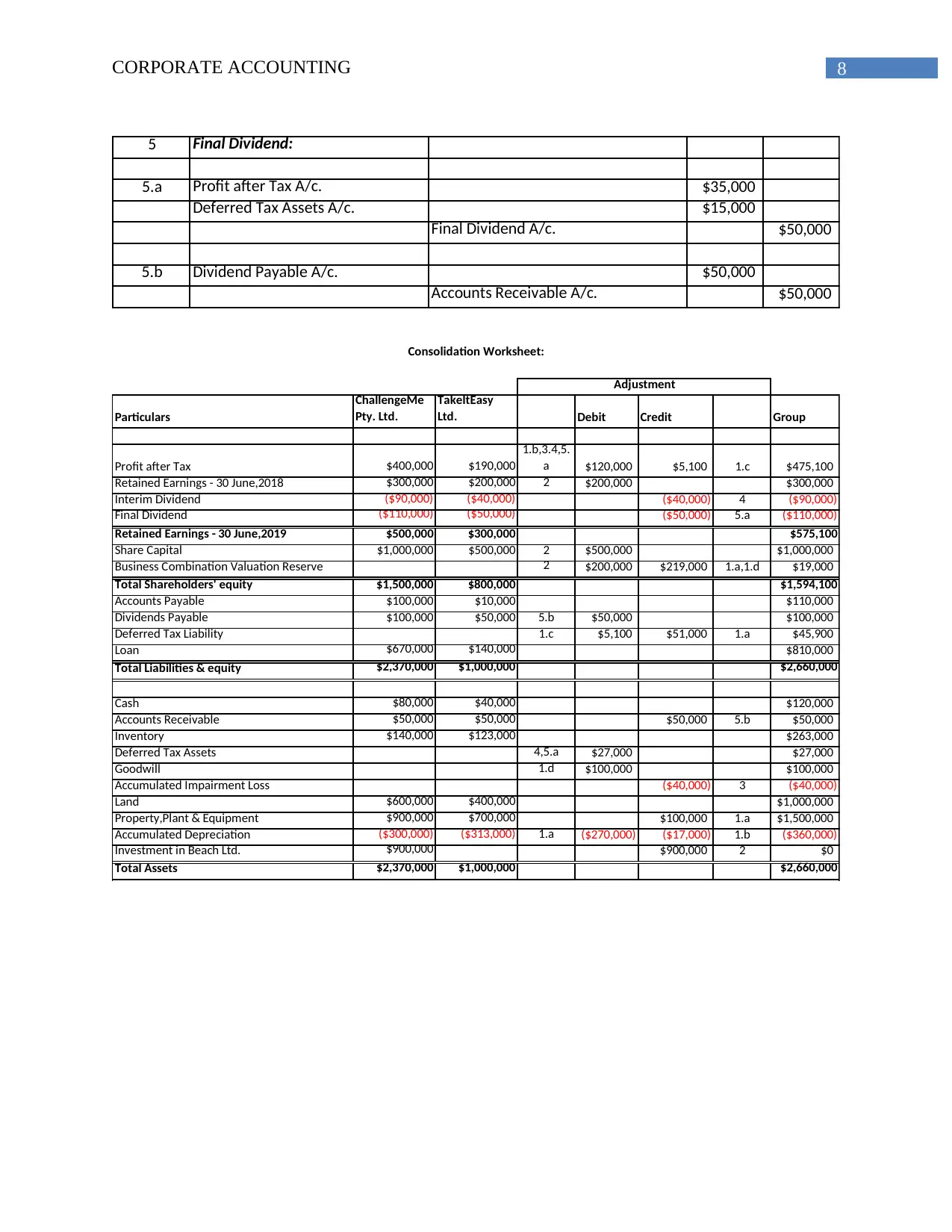

8CORPORATE ACCOUNTING

5 Final Dividend:

5.a Profit after Tax A/c. $35,000

Deferred Tax Assets A/c. $15,000

Final Dividend A/c. $50,000

5.b Dividend Payable A/c. $50,000

Accounts Receivable A/c. $50,000

Particulars

ChallengeMe

Pty. Ltd.

TakeItEasy

Ltd. Debit Credit Group

Profit after Tax $400,000 $190,000

1.b,3.4,5.

a $120,000 $5,100 1.c $475,100

Retained Earnings - 30 June,2018 $300,000 $200,000 2 $200,000 $300,000

Interim Dividend ($90,000) ($40,000) ($40,000) 4 ($90,000)

Final Dividend ($110,000) ($50,000) ($50,000) 5.a ($110,000)

Retained Earnings - 30 June,2019 $500,000 $300,000 $575,100

Share Capital $1,000,000 $500,000 2 $500,000 $1,000,000

Business Combination Valuation Reserve 2 $200,000 $219,000 1.a,1.d $19,000

Total Shareholders' equity $1,500,000 $800,000 $1,594,100

Accounts Payable $100,000 $10,000 $110,000

Dividends Payable $100,000 $50,000 5.b $50,000 $100,000

Deferred Tax Liability 1.c $5,100 $51,000 1.a $45,900

Loan $670,000 $140,000 $810,000

Total Liabilities & equity $2,370,000 $1,000,000 $2,660,000

Cash $80,000 $40,000 $120,000

Accounts Receivable $50,000 $50,000 $50,000 5.b $50,000

Inventory $140,000 $123,000 $263,000

Deferred Tax Assets 4,5.a $27,000 $27,000

Goodwill 1.d $100,000 $100,000

Accumulated Impairment Loss ($40,000) 3 ($40,000)

Land $600,000 $400,000 $1,000,000

Property,Plant & Equipment $900,000 $700,000 $100,000 1.a $1,500,000

Accumulated Depreciation ($300,000) ($313,000) 1.a ($270,000) ($17,000) 1.b ($360,000)

Investment in Beach Ltd. $900,000 $900,000 2 $0

Total Assets $2,370,000 $1,000,000 $2,660,000

Adjustment

Consolidation Worksheet:

5 Final Dividend:

5.a Profit after Tax A/c. $35,000

Deferred Tax Assets A/c. $15,000

Final Dividend A/c. $50,000

5.b Dividend Payable A/c. $50,000

Accounts Receivable A/c. $50,000

Particulars

ChallengeMe

Pty. Ltd.

TakeItEasy

Ltd. Debit Credit Group

Profit after Tax $400,000 $190,000

1.b,3.4,5.

a $120,000 $5,100 1.c $475,100

Retained Earnings - 30 June,2018 $300,000 $200,000 2 $200,000 $300,000

Interim Dividend ($90,000) ($40,000) ($40,000) 4 ($90,000)

Final Dividend ($110,000) ($50,000) ($50,000) 5.a ($110,000)

Retained Earnings - 30 June,2019 $500,000 $300,000 $575,100

Share Capital $1,000,000 $500,000 2 $500,000 $1,000,000

Business Combination Valuation Reserve 2 $200,000 $219,000 1.a,1.d $19,000

Total Shareholders' equity $1,500,000 $800,000 $1,594,100

Accounts Payable $100,000 $10,000 $110,000

Dividends Payable $100,000 $50,000 5.b $50,000 $100,000

Deferred Tax Liability 1.c $5,100 $51,000 1.a $45,900

Loan $670,000 $140,000 $810,000

Total Liabilities & equity $2,370,000 $1,000,000 $2,660,000

Cash $80,000 $40,000 $120,000

Accounts Receivable $50,000 $50,000 $50,000 5.b $50,000

Inventory $140,000 $123,000 $263,000

Deferred Tax Assets 4,5.a $27,000 $27,000

Goodwill 1.d $100,000 $100,000

Accumulated Impairment Loss ($40,000) 3 ($40,000)

Land $600,000 $400,000 $1,000,000

Property,Plant & Equipment $900,000 $700,000 $100,000 1.a $1,500,000

Accumulated Depreciation ($300,000) ($313,000) 1.a ($270,000) ($17,000) 1.b ($360,000)

Investment in Beach Ltd. $900,000 $900,000 2 $0

Total Assets $2,370,000 $1,000,000 $2,660,000

Adjustment

Consolidation Worksheet:

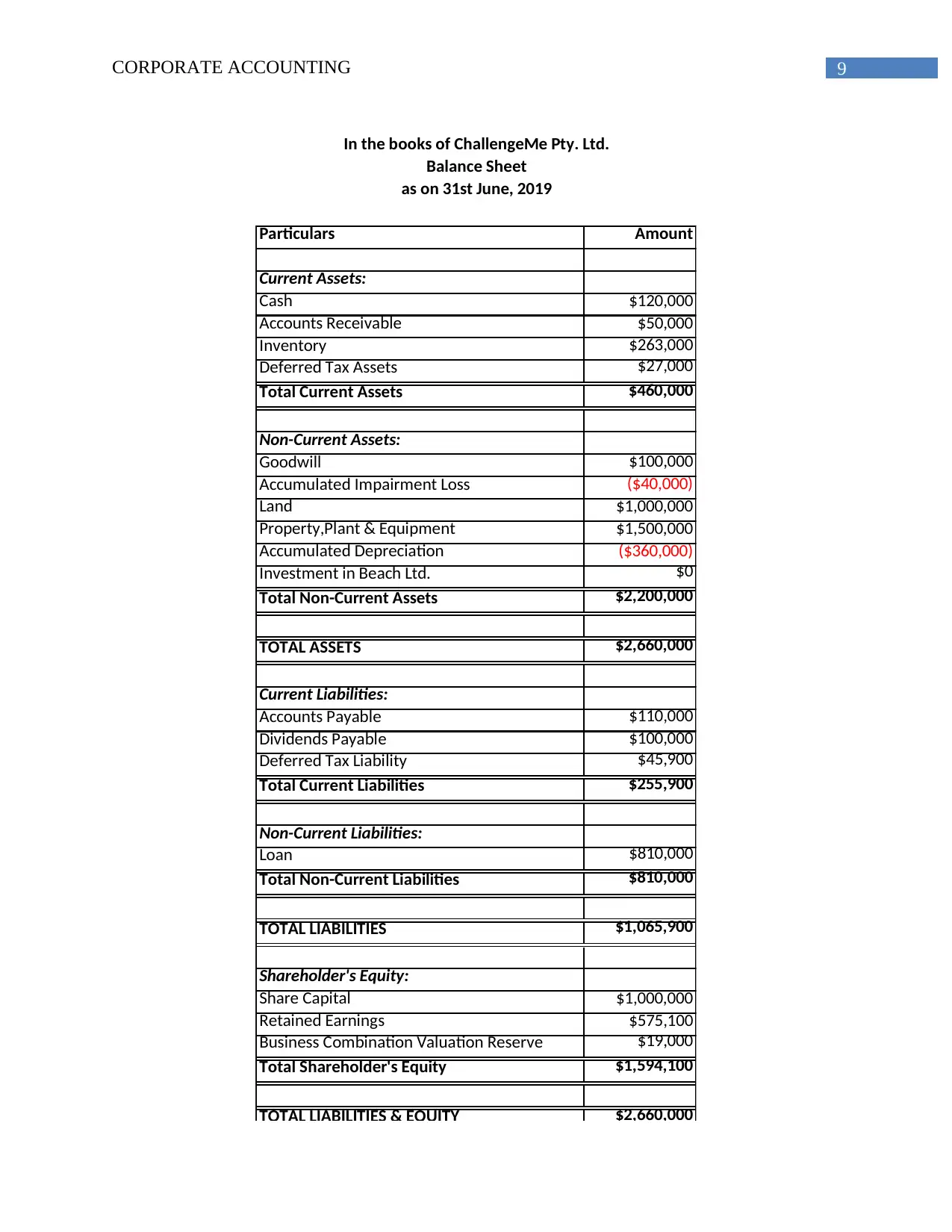

9CORPORATE ACCOUNTING

Particulars Amount

Current Assets:

Cash $120,000

Accounts Receivable $50,000

Inventory $263,000

Deferred Tax Assets $27,000

Total Current Assets $460,000

Non-Current Assets:

Goodwill $100,000

Accumulated Impairment Loss ($40,000)

Land $1,000,000

Property,Plant & Equipment $1,500,000

Accumulated Depreciation ($360,000)

Investment in Beach Ltd. $0

Total Non-Current Assets $2,200,000

TOTAL ASSETS $2,660,000

Current Liabilities:

Accounts Payable $110,000

Dividends Payable $100,000

Deferred Tax Liability $45,900

Total Current Liabilities $255,900

Non-Current Liabilities:

Loan $810,000

Total Non-Current Liabilities $810,000

TOTAL LIABILITIES $1,065,900

Shareholder's Equity:

Share Capital $1,000,000

Retained Earnings $575,100

Business Combination Valuation Reserve $19,000

Total Shareholder's Equity $1,594,100

TOTAL LIABILITIES & EQUITY $2,660,000

In the books of ChallengeMe Pty. Ltd.

Balance Sheet

as on 31st June, 2019

Particulars Amount

Current Assets:

Cash $120,000

Accounts Receivable $50,000

Inventory $263,000

Deferred Tax Assets $27,000

Total Current Assets $460,000

Non-Current Assets:

Goodwill $100,000

Accumulated Impairment Loss ($40,000)

Land $1,000,000

Property,Plant & Equipment $1,500,000

Accumulated Depreciation ($360,000)

Investment in Beach Ltd. $0

Total Non-Current Assets $2,200,000

TOTAL ASSETS $2,660,000

Current Liabilities:

Accounts Payable $110,000

Dividends Payable $100,000

Deferred Tax Liability $45,900

Total Current Liabilities $255,900

Non-Current Liabilities:

Loan $810,000

Total Non-Current Liabilities $810,000

TOTAL LIABILITIES $1,065,900

Shareholder's Equity:

Share Capital $1,000,000

Retained Earnings $575,100

Business Combination Valuation Reserve $19,000

Total Shareholder's Equity $1,594,100

TOTAL LIABILITIES & EQUITY $2,660,000

In the books of ChallengeMe Pty. Ltd.

Balance Sheet

as on 31st June, 2019

10CORPORATE ACCOUNTING

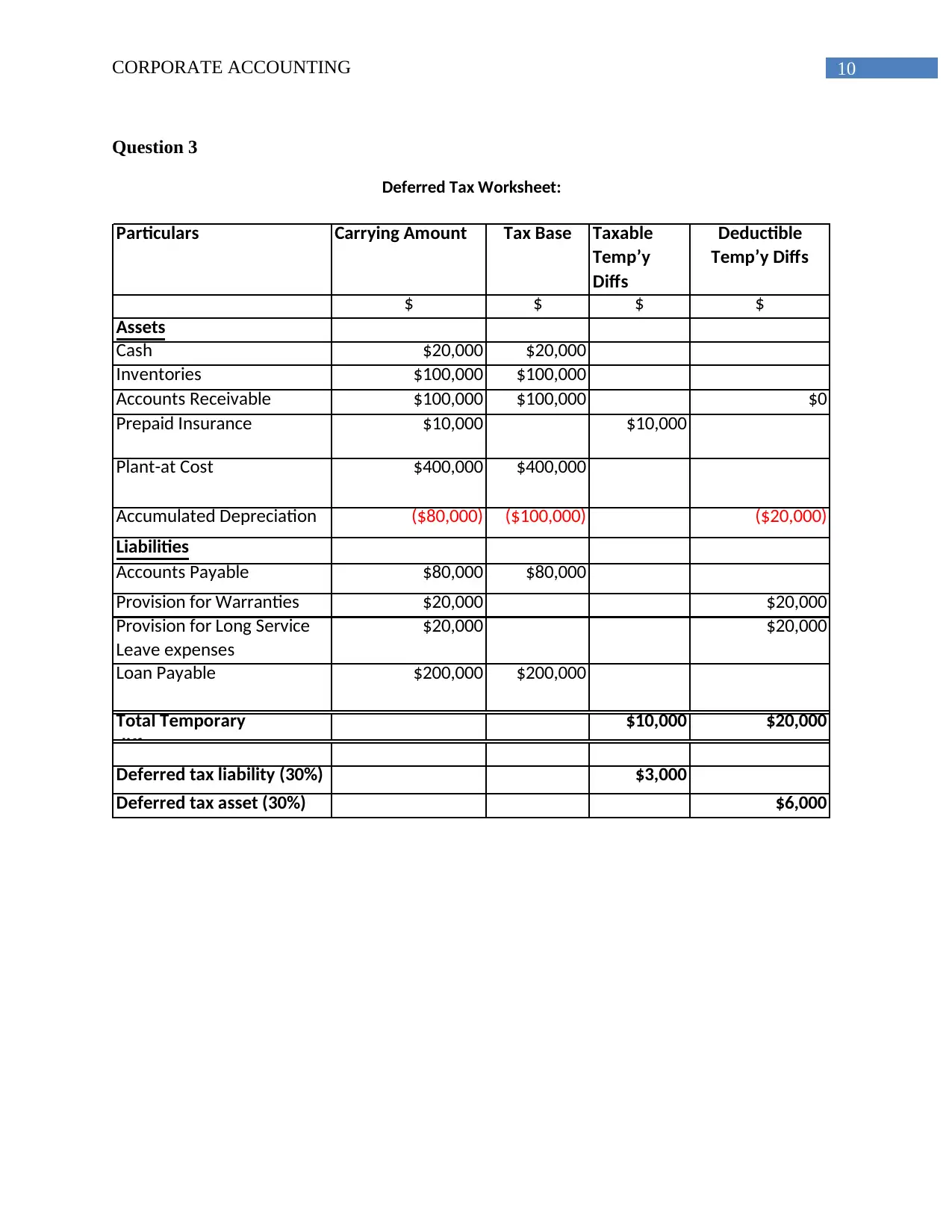

Question 3

Particulars Carrying Amount Tax Base Taxable

Temp’y

Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash $20,000 $20,000

Inventories $100,000 $100,000

Accounts Receivable $100,000 $100,000 $0

Prepaid Insurance $10,000 $10,000

Plant-at Cost $400,000 $400,000

Accumulated Depreciation ($80,000) ($100,000) ($20,000)

Liabilities

Accounts Payable $80,000 $80,000

Provision for Warranties $20,000 $20,000

Provision for Long Service

Leave expenses

$20,000 $20,000

Loan Payable $200,000 $200,000

Total Temporary

differences

$10,000 $20,000

Deferred tax liability (30%) $3,000

Deferred tax asset (30%) $6,000

Deferred Tax Worksheet:

Question 3

Particulars Carrying Amount Tax Base Taxable

Temp’y

Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash $20,000 $20,000

Inventories $100,000 $100,000

Accounts Receivable $100,000 $100,000 $0

Prepaid Insurance $10,000 $10,000

Plant-at Cost $400,000 $400,000

Accumulated Depreciation ($80,000) ($100,000) ($20,000)

Liabilities

Accounts Payable $80,000 $80,000

Provision for Warranties $20,000 $20,000

Provision for Long Service

Leave expenses

$20,000 $20,000

Loan Payable $200,000 $200,000

Total Temporary

differences

$10,000 $20,000

Deferred tax liability (30%) $3,000

Deferred tax asset (30%) $6,000

Deferred Tax Worksheet:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11CORPORATE ACCOUNTING

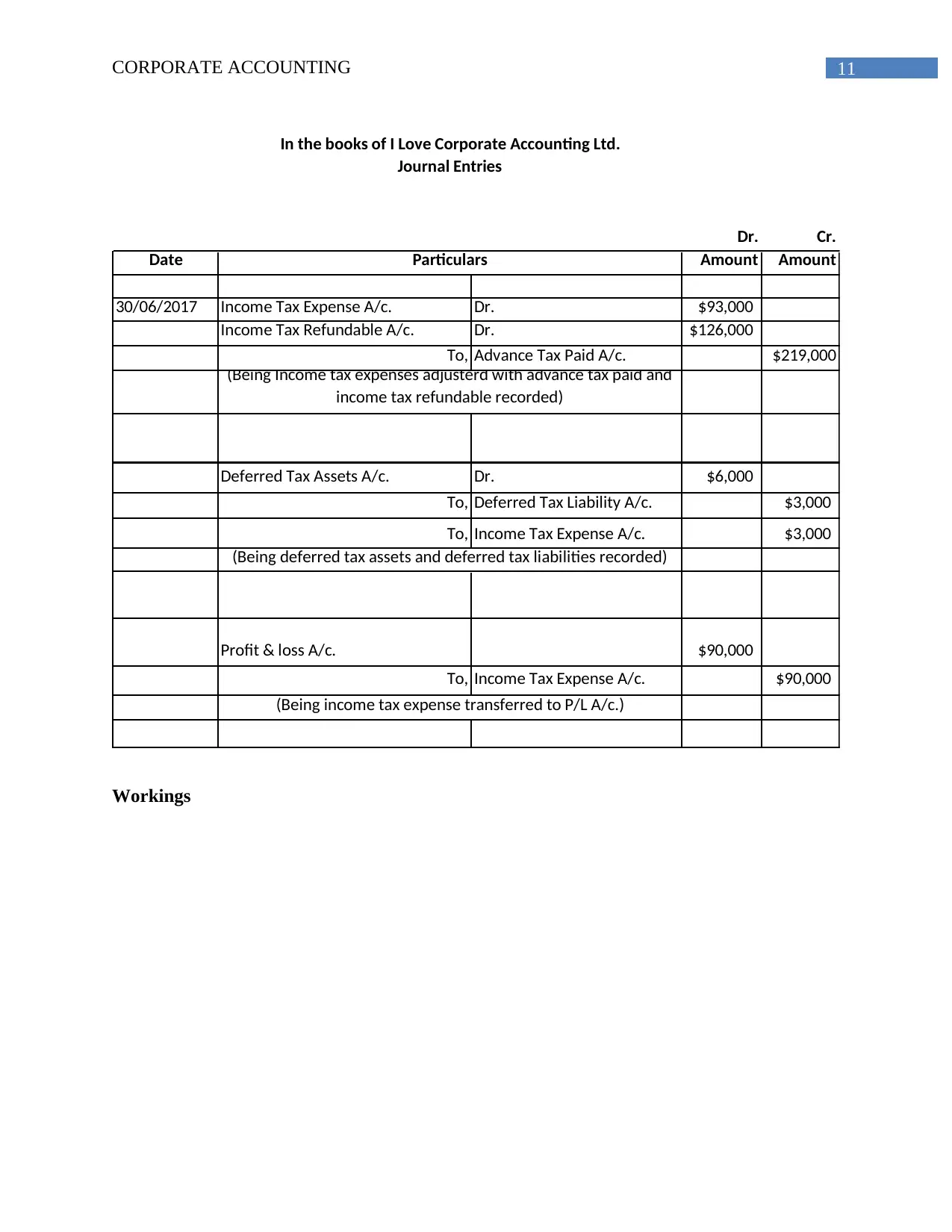

Dr. Cr.

Date Amount Amount

30/06/2017 Income Tax Expense A/c. Dr. $93,000

Income Tax Refundable A/c. Dr. $126,000

To, Advance Tax Paid A/c. $219,000

Deferred Tax Assets A/c. Dr. $6,000

To, Deferred Tax Liability A/c. $3,000

To, Income Tax Expense A/c. $3,000

Profit & loss A/c. $90,000

To, Income Tax Expense A/c. $90,000

(Being income tax expense transferred to P/L A/c.)

In the books of I Love Corporate Accounting Ltd.

Journal Entries

Particulars

(Being Income tax expenses adjusterd with advance tax paid and

income tax refundable recorded)

(Being deferred tax assets and deferred tax liabilities recorded)

Workings

Dr. Cr.

Date Amount Amount

30/06/2017 Income Tax Expense A/c. Dr. $93,000

Income Tax Refundable A/c. Dr. $126,000

To, Advance Tax Paid A/c. $219,000

Deferred Tax Assets A/c. Dr. $6,000

To, Deferred Tax Liability A/c. $3,000

To, Income Tax Expense A/c. $3,000

Profit & loss A/c. $90,000

To, Income Tax Expense A/c. $90,000

(Being income tax expense transferred to P/L A/c.)

In the books of I Love Corporate Accounting Ltd.

Journal Entries

Particulars

(Being Income tax expenses adjusterd with advance tax paid and

income tax refundable recorded)

(Being deferred tax assets and deferred tax liabilities recorded)

Workings

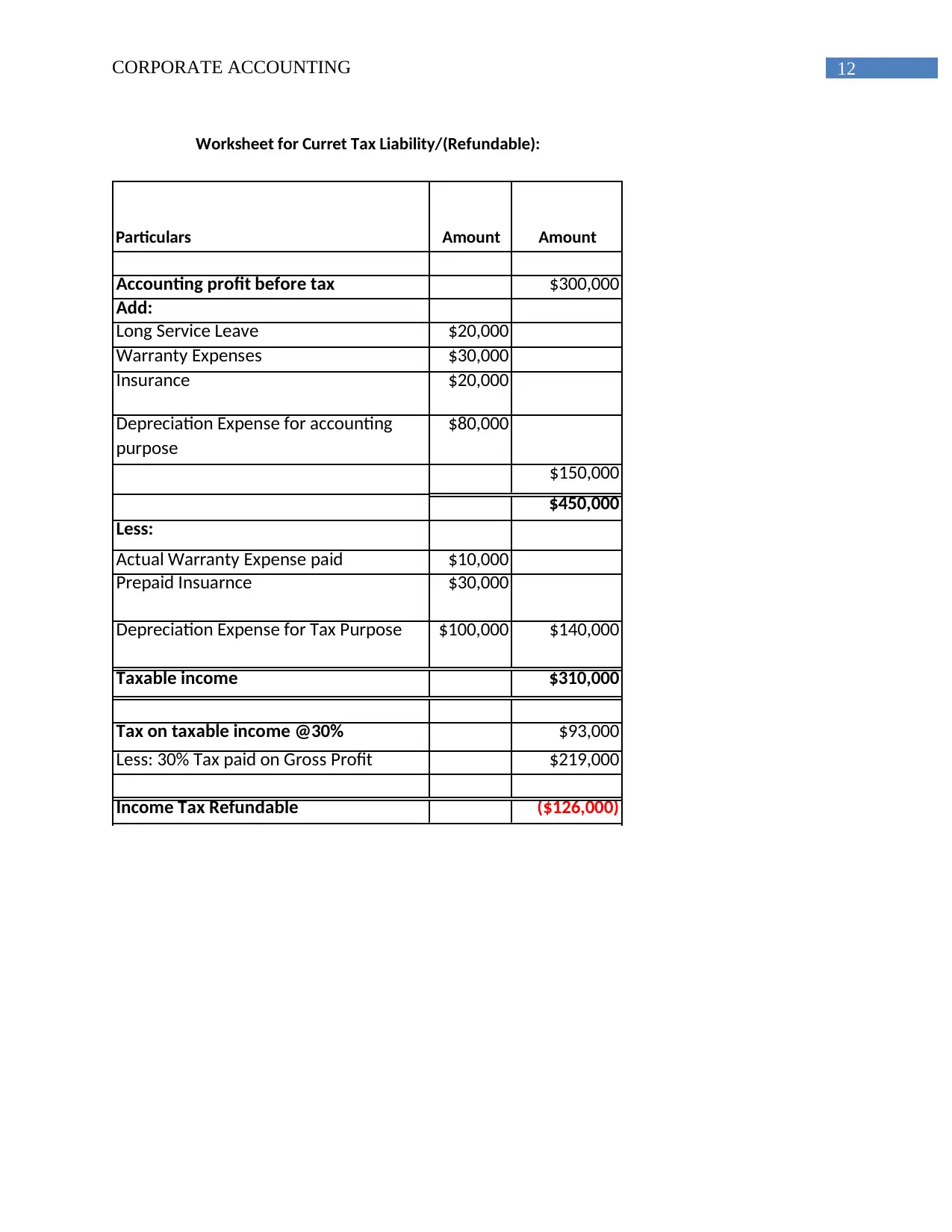

12CORPORATE ACCOUNTING

Particulars Amount Amount

Accounting profit before tax $300,000

Add:

Long Service Leave $20,000

Warranty Expenses $30,000

Insurance $20,000

Depreciation Expense for accounting

purpose

$80,000

$150,000

$450,000

Less:

Actual Warranty Expense paid $10,000

Prepaid Insuarnce $30,000

Depreciation Expense for Tax Purpose $100,000 $140,000

Taxable income $310,000

Tax on taxable income @30% $93,000

Less: 30% Tax paid on Gross Profit $219,000

Income Tax Refundable ($126,000)

Worksheet for Curret Tax Liability/(Refundable):

Particulars Amount Amount

Accounting profit before tax $300,000

Add:

Long Service Leave $20,000

Warranty Expenses $30,000

Insurance $20,000

Depreciation Expense for accounting

purpose

$80,000

$150,000

$450,000

Less:

Actual Warranty Expense paid $10,000

Prepaid Insuarnce $30,000

Depreciation Expense for Tax Purpose $100,000 $140,000

Taxable income $310,000

Tax on taxable income @30% $93,000

Less: 30% Tax paid on Gross Profit $219,000

Income Tax Refundable ($126,000)

Worksheet for Curret Tax Liability/(Refundable):

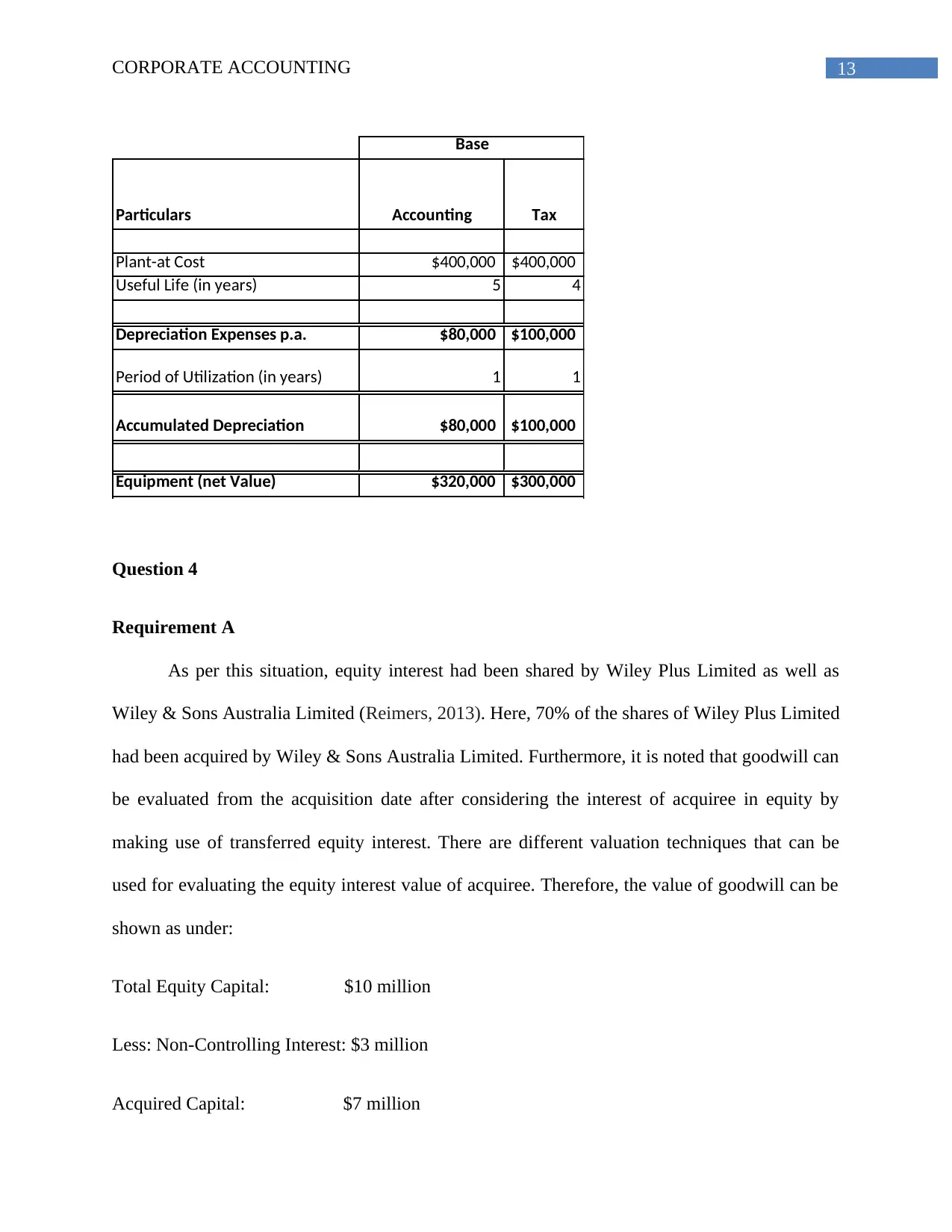

13CORPORATE ACCOUNTING

Particulars Accounting Tax

Plant-at Cost $400,000 $400,000

Useful Life (in years) 5 4

Depreciation Expenses p.a. $80,000 $100,000

Period of Utilization (in years) 1 1

Accumulated Depreciation $80,000 $100,000

Equipment (net Value) $320,000 $300,000

Base

Question 4

Requirement A

As per this situation, equity interest had been shared by Wiley Plus Limited as well as

Wiley & Sons Australia Limited (Reimers, 2013). Here, 70% of the shares of Wiley Plus Limited

had been acquired by Wiley & Sons Australia Limited. Furthermore, it is noted that goodwill can

be evaluated from the acquisition date after considering the interest of acquiree in equity by

making use of transferred equity interest. There are different valuation techniques that can be

used for evaluating the equity interest value of acquiree. Therefore, the value of goodwill can be

shown as under:

Total Equity Capital: $10 million

Less: Non-Controlling Interest: $3 million

Acquired Capital: $7 million

Particulars Accounting Tax

Plant-at Cost $400,000 $400,000

Useful Life (in years) 5 4

Depreciation Expenses p.a. $80,000 $100,000

Period of Utilization (in years) 1 1

Accumulated Depreciation $80,000 $100,000

Equipment (net Value) $320,000 $300,000

Base

Question 4

Requirement A

As per this situation, equity interest had been shared by Wiley Plus Limited as well as

Wiley & Sons Australia Limited (Reimers, 2013). Here, 70% of the shares of Wiley Plus Limited

had been acquired by Wiley & Sons Australia Limited. Furthermore, it is noted that goodwill can

be evaluated from the acquisition date after considering the interest of acquiree in equity by

making use of transferred equity interest. There are different valuation techniques that can be

used for evaluating the equity interest value of acquiree. Therefore, the value of goodwill can be

shown as under:

Total Equity Capital: $10 million

Less: Non-Controlling Interest: $3 million

Acquired Capital: $7 million

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14CORPORATE ACCOUNTING

Purchase Consideration: $10 million

Goodwill: $ 3 million

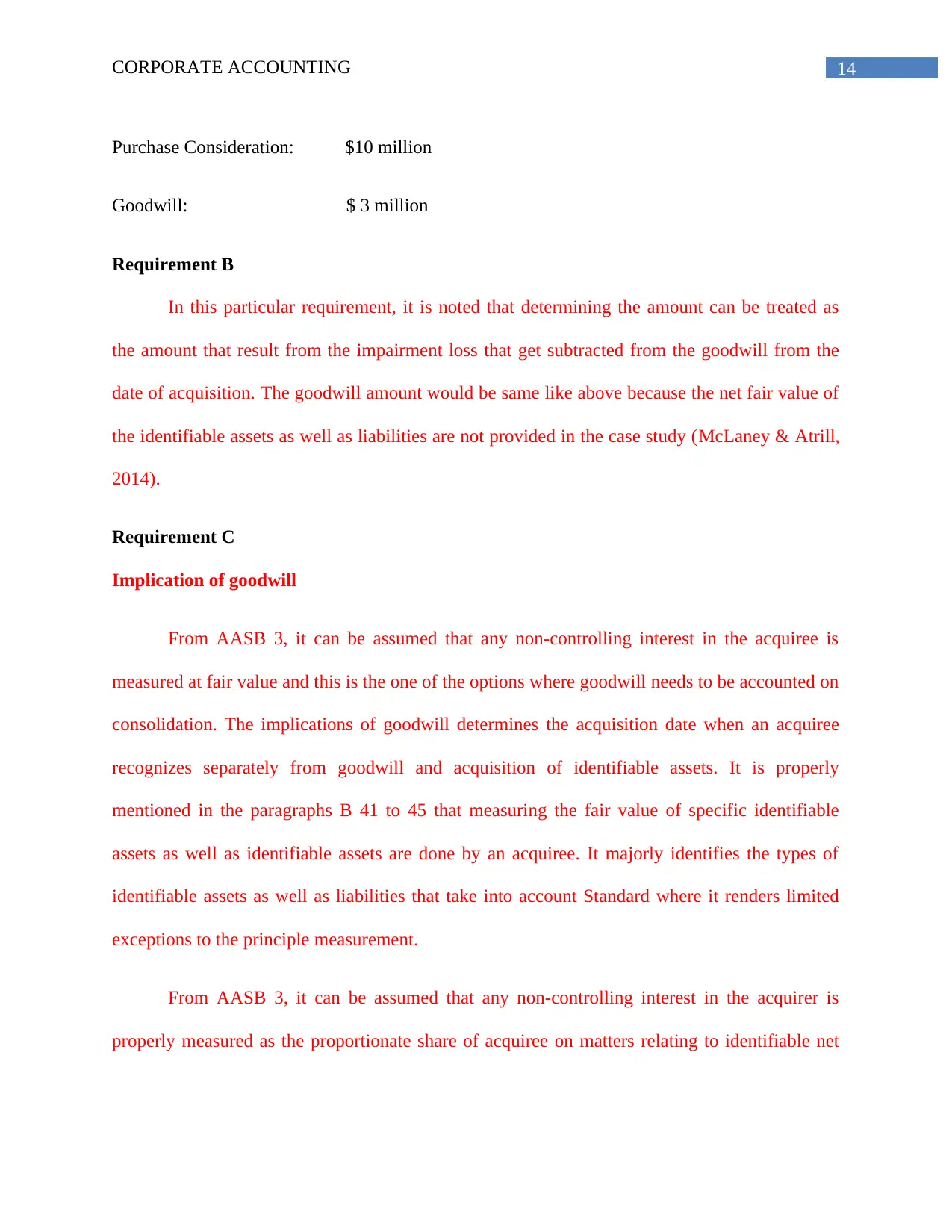

Requirement B

In this particular requirement, it is noted that determining the amount can be treated as

the amount that result from the impairment loss that get subtracted from the goodwill from the

date of acquisition. The goodwill amount would be same like above because the net fair value of

the identifiable assets as well as liabilities are not provided in the case study (McLaney & Atrill,

2014).

Requirement C

Implication of goodwill

From AASB 3, it can be assumed that any non-controlling interest in the acquiree is

measured at fair value and this is the one of the options where goodwill needs to be accounted on

consolidation. The implications of goodwill determines the acquisition date when an acquiree

recognizes separately from goodwill and acquisition of identifiable assets. It is properly

mentioned in the paragraphs B 41 to 45 that measuring the fair value of specific identifiable

assets as well as identifiable assets are done by an acquiree. It majorly identifies the types of

identifiable assets as well as liabilities that take into account Standard where it renders limited

exceptions to the principle measurement.

From AASB 3, it can be assumed that any non-controlling interest in the acquirer is

properly measured as the proportionate share of acquiree on matters relating to identifiable net

Purchase Consideration: $10 million

Goodwill: $ 3 million

Requirement B

In this particular requirement, it is noted that determining the amount can be treated as

the amount that result from the impairment loss that get subtracted from the goodwill from the

date of acquisition. The goodwill amount would be same like above because the net fair value of

the identifiable assets as well as liabilities are not provided in the case study (McLaney & Atrill,

2014).

Requirement C

Implication of goodwill

From AASB 3, it can be assumed that any non-controlling interest in the acquiree is

measured at fair value and this is the one of the options where goodwill needs to be accounted on

consolidation. The implications of goodwill determines the acquisition date when an acquiree

recognizes separately from goodwill and acquisition of identifiable assets. It is properly

mentioned in the paragraphs B 41 to 45 that measuring the fair value of specific identifiable

assets as well as identifiable assets are done by an acquiree. It majorly identifies the types of

identifiable assets as well as liabilities that take into account Standard where it renders limited

exceptions to the principle measurement.

From AASB 3, it can be assumed that any non-controlling interest in the acquirer is

properly measured as the proportionate share of acquiree on matters relating to identifiable net

15CORPORATE ACCOUNTING

assets. In the paragraphs B 23 to 24, it is mentioned about non-controlling interest share of an

acquiree that carries the amount of retained earnings as well as other equity interests.

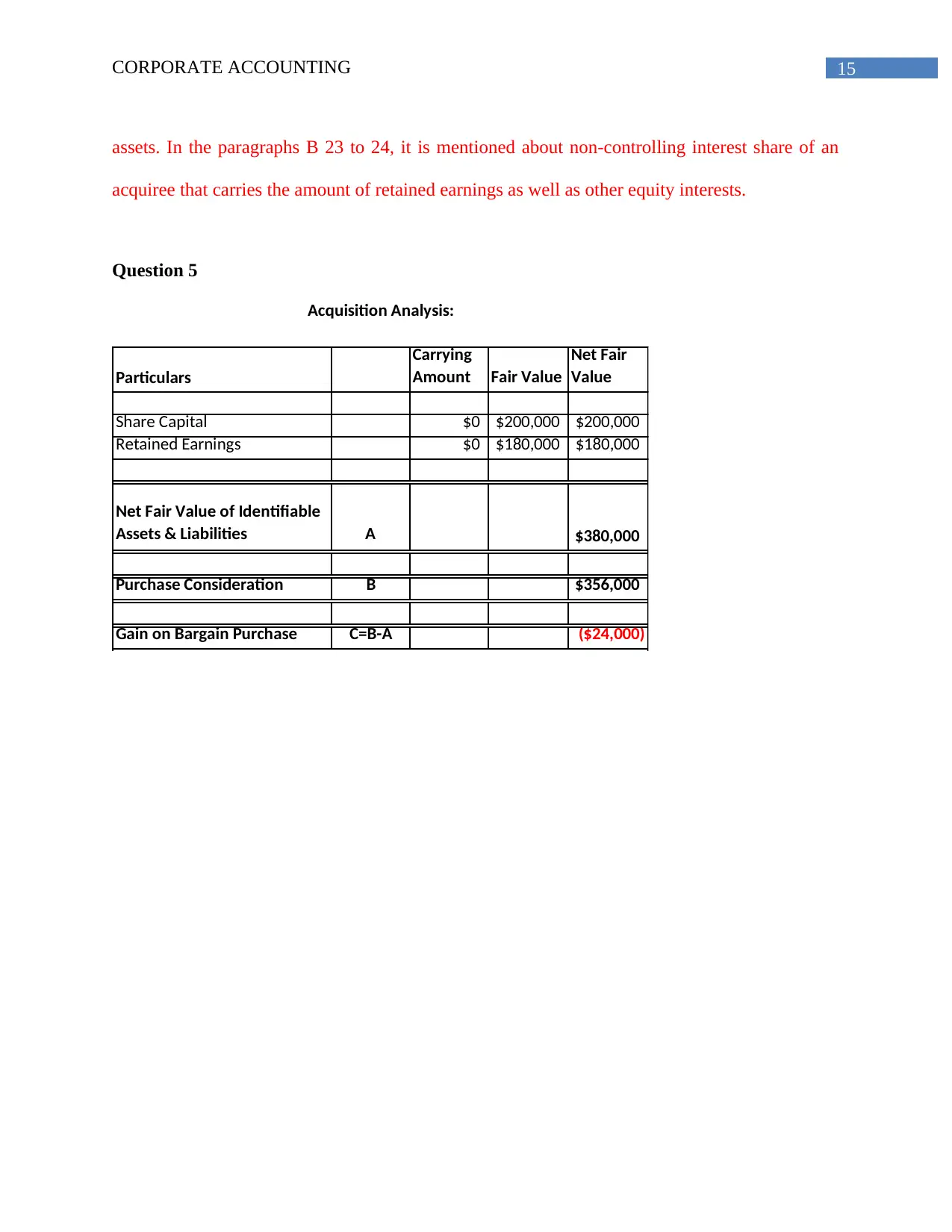

Question 5

Particulars

Carrying

Amount Fair Value

Net Fair

Value

Share Capital $0 $200,000 $200,000

Retained Earnings $0 $180,000 $180,000

Net Fair Value of Identifiable

Assets & Liabilities A $380,000

Purchase Consideration B $356,000

Gain on Bargain Purchase C=B-A ($24,000)

Acquisition Analysis:

assets. In the paragraphs B 23 to 24, it is mentioned about non-controlling interest share of an

acquiree that carries the amount of retained earnings as well as other equity interests.

Question 5

Particulars

Carrying

Amount Fair Value

Net Fair

Value

Share Capital $0 $200,000 $200,000

Retained Earnings $0 $180,000 $180,000

Net Fair Value of Identifiable

Assets & Liabilities A $380,000

Purchase Consideration B $356,000

Gain on Bargain Purchase C=B-A ($24,000)

Acquisition Analysis:

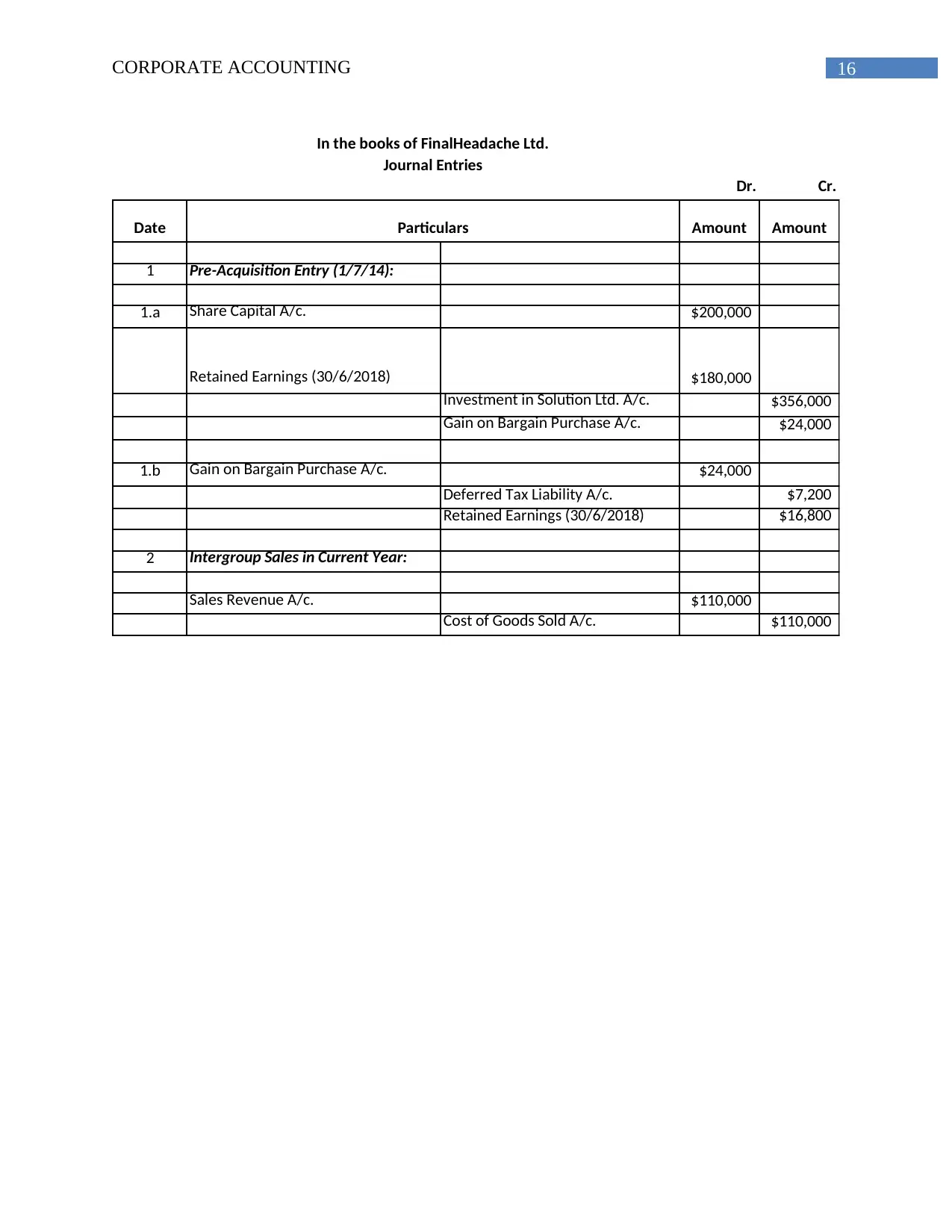

16CORPORATE ACCOUNTING

Dr. Cr.

Date Amount Amount

1 Pre-Acquisition Entry (1/7/14):

1.a Share Capital A/c. $200,000

Retained Earnings (30/6/2018) $180,000

Investment in Solution Ltd. A/c. $356,000

Gain on Bargain Purchase A/c. $24,000

1.b Gain on Bargain Purchase A/c. $24,000

Deferred Tax Liability A/c. $7,200

Retained Earnings (30/6/2018) $16,800

2 Intergroup Sales in Current Year:

Sales Revenue A/c. $110,000

Cost of Goods Sold A/c. $110,000

In the books of FinalHeadache Ltd.

Journal Entries

Particulars

Dr. Cr.

Date Amount Amount

1 Pre-Acquisition Entry (1/7/14):

1.a Share Capital A/c. $200,000

Retained Earnings (30/6/2018) $180,000

Investment in Solution Ltd. A/c. $356,000

Gain on Bargain Purchase A/c. $24,000

1.b Gain on Bargain Purchase A/c. $24,000

Deferred Tax Liability A/c. $7,200

Retained Earnings (30/6/2018) $16,800

2 Intergroup Sales in Current Year:

Sales Revenue A/c. $110,000

Cost of Goods Sold A/c. $110,000

In the books of FinalHeadache Ltd.

Journal Entries

Particulars

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

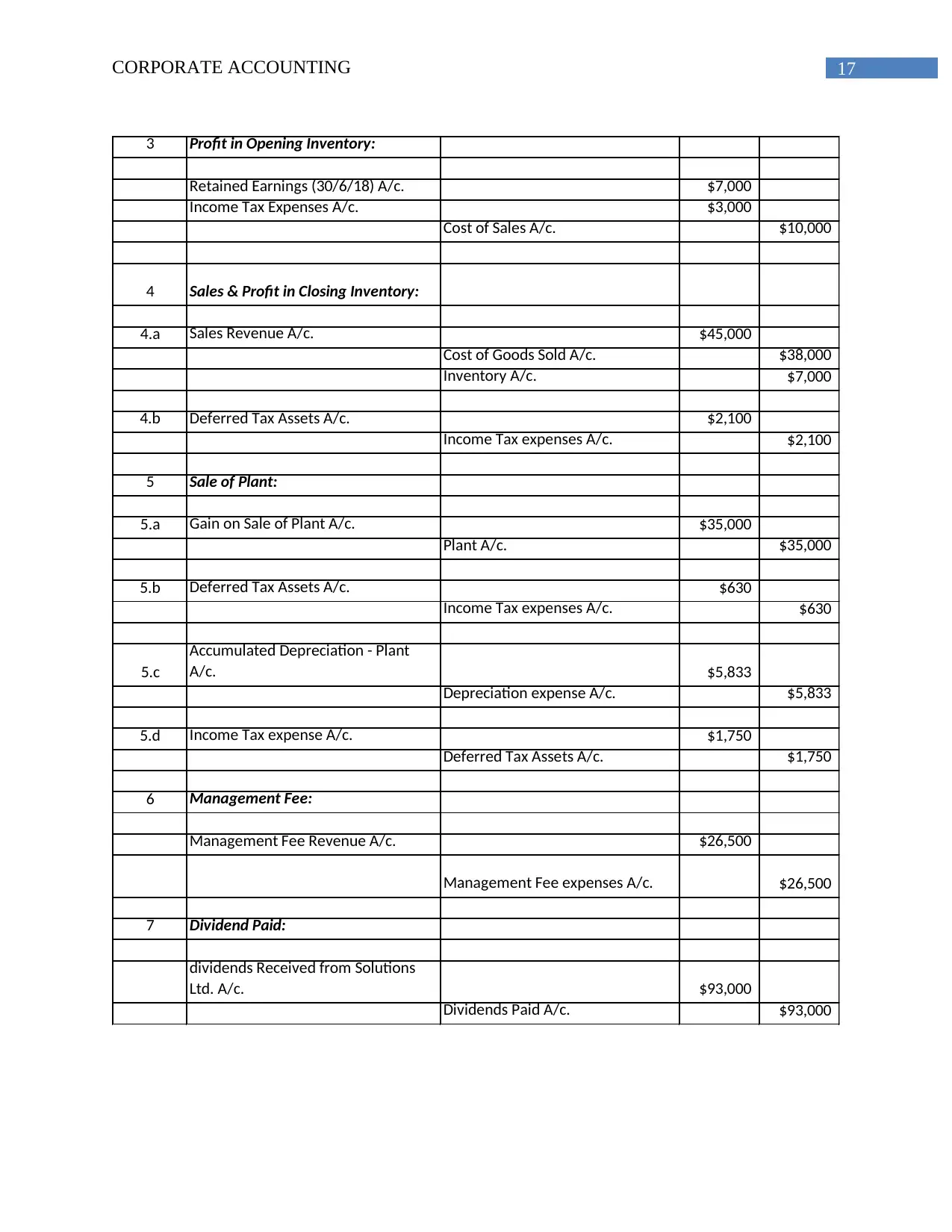

17CORPORATE ACCOUNTING

3 Profit in Opening Inventory:

Retained Earnings (30/6/18) A/c. $7,000

Income Tax Expenses A/c. $3,000

Cost of Sales A/c. $10,000

4 Sales & Profit in Closing Inventory:

4.a Sales Revenue A/c. $45,000

Cost of Goods Sold A/c. $38,000

Inventory A/c. $7,000

4.b Deferred Tax Assets A/c. $2,100

Income Tax expenses A/c. $2,100

5 Sale of Plant:

5.a Gain on Sale of Plant A/c. $35,000

Plant A/c. $35,000

5.b Deferred Tax Assets A/c. $630

Income Tax expenses A/c. $630

5.c

Accumulated Depreciation - Plant

A/c. $5,833

Depreciation expense A/c. $5,833

5.d Income Tax expense A/c. $1,750

Deferred Tax Assets A/c. $1,750

6 Management Fee:

Management Fee Revenue A/c. $26,500

Management Fee expenses A/c. $26,500

7 Dividend Paid:

dividends Received from Solutions

Ltd. A/c. $93,000

Dividends Paid A/c. $93,000

3 Profit in Opening Inventory:

Retained Earnings (30/6/18) A/c. $7,000

Income Tax Expenses A/c. $3,000

Cost of Sales A/c. $10,000

4 Sales & Profit in Closing Inventory:

4.a Sales Revenue A/c. $45,000

Cost of Goods Sold A/c. $38,000

Inventory A/c. $7,000

4.b Deferred Tax Assets A/c. $2,100

Income Tax expenses A/c. $2,100

5 Sale of Plant:

5.a Gain on Sale of Plant A/c. $35,000

Plant A/c. $35,000

5.b Deferred Tax Assets A/c. $630

Income Tax expenses A/c. $630

5.c

Accumulated Depreciation - Plant

A/c. $5,833

Depreciation expense A/c. $5,833

5.d Income Tax expense A/c. $1,750

Deferred Tax Assets A/c. $1,750

6 Management Fee:

Management Fee Revenue A/c. $26,500

Management Fee expenses A/c. $26,500

7 Dividend Paid:

dividends Received from Solutions

Ltd. A/c. $93,000

Dividends Paid A/c. $93,000

18CORPORATE ACCOUNTING

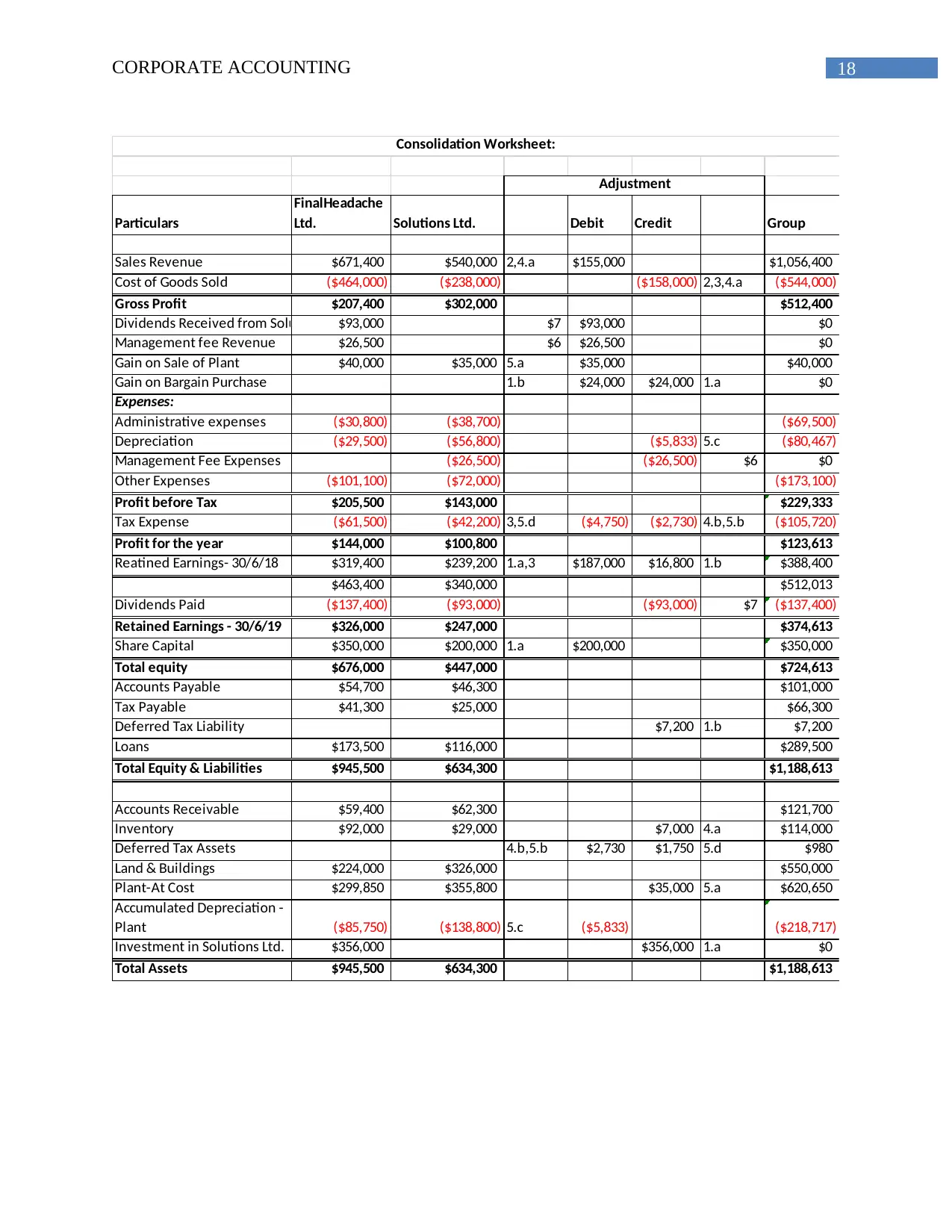

Particulars

FinalHeadache

Ltd. Solutions Ltd. Debit Credit Group

Sales Revenue $671,400 $540,000 2,4.a $155,000 $1,056,400

Cost of Goods Sold ($464,000) ($238,000) ($158,000) 2,3,4.a ($544,000)

Gross Profit $207,400 $302,000 $512,400

Dividends Received from Solutions Ltd.$93,000 $7 $93,000 $0

Management fee Revenue $26,500 $6 $26,500 $0

Gain on Sale of Plant $40,000 $35,000 5.a $35,000 $40,000

Gain on Bargain Purchase 1.b $24,000 $24,000 1.a $0

Expenses:

Administrative expenses ($30,800) ($38,700) ($69,500)

Depreciation ($29,500) ($56,800) ($5,833) 5.c ($80,467)

Management Fee Expenses ($26,500) ($26,500) $6 $0

Other Expenses ($101,100) ($72,000) ($173,100)

Profit before Tax $205,500 $143,000 $229,333

Tax Expense ($61,500) ($42,200) 3,5.d ($4,750) ($2,730) 4.b,5.b ($105,720)

Profit for the year $144,000 $100,800 $123,613

Reatined Earnings- 30/6/18 $319,400 $239,200 1.a,3 $187,000 $16,800 1.b $388,400

$463,400 $340,000 $512,013

Dividends Paid ($137,400) ($93,000) ($93,000) $7 ($137,400)

Retained Earnings - 30/6/19 $326,000 $247,000 $374,613

Share Capital $350,000 $200,000 1.a $200,000 $350,000

Total equity $676,000 $447,000 $724,613

Accounts Payable $54,700 $46,300 $101,000

Tax Payable $41,300 $25,000 $66,300

Deferred Tax Liability $7,200 1.b $7,200

Loans $173,500 $116,000 $289,500

Total Equity & Liabilities $945,500 $634,300 $1,188,613

Accounts Receivable $59,400 $62,300 $121,700

Inventory $92,000 $29,000 $7,000 4.a $114,000

Deferred Tax Assets 4.b,5.b $2,730 $1,750 5.d $980

Land & Buildings $224,000 $326,000 $550,000

Plant-At Cost $299,850 $355,800 $35,000 5.a $620,650

Accumulated Depreciation -

Plant ($85,750) ($138,800) 5.c ($5,833) ($218,717)

Investment in Solutions Ltd. $356,000 $356,000 1.a $0

Total Assets $945,500 $634,300 $1,188,613

Consolidation Worksheet:

Adjustment

Particulars

FinalHeadache

Ltd. Solutions Ltd. Debit Credit Group

Sales Revenue $671,400 $540,000 2,4.a $155,000 $1,056,400

Cost of Goods Sold ($464,000) ($238,000) ($158,000) 2,3,4.a ($544,000)

Gross Profit $207,400 $302,000 $512,400

Dividends Received from Solutions Ltd.$93,000 $7 $93,000 $0

Management fee Revenue $26,500 $6 $26,500 $0

Gain on Sale of Plant $40,000 $35,000 5.a $35,000 $40,000

Gain on Bargain Purchase 1.b $24,000 $24,000 1.a $0

Expenses:

Administrative expenses ($30,800) ($38,700) ($69,500)

Depreciation ($29,500) ($56,800) ($5,833) 5.c ($80,467)

Management Fee Expenses ($26,500) ($26,500) $6 $0

Other Expenses ($101,100) ($72,000) ($173,100)

Profit before Tax $205,500 $143,000 $229,333

Tax Expense ($61,500) ($42,200) 3,5.d ($4,750) ($2,730) 4.b,5.b ($105,720)

Profit for the year $144,000 $100,800 $123,613

Reatined Earnings- 30/6/18 $319,400 $239,200 1.a,3 $187,000 $16,800 1.b $388,400

$463,400 $340,000 $512,013

Dividends Paid ($137,400) ($93,000) ($93,000) $7 ($137,400)

Retained Earnings - 30/6/19 $326,000 $247,000 $374,613

Share Capital $350,000 $200,000 1.a $200,000 $350,000

Total equity $676,000 $447,000 $724,613

Accounts Payable $54,700 $46,300 $101,000

Tax Payable $41,300 $25,000 $66,300

Deferred Tax Liability $7,200 1.b $7,200

Loans $173,500 $116,000 $289,500

Total Equity & Liabilities $945,500 $634,300 $1,188,613

Accounts Receivable $59,400 $62,300 $121,700

Inventory $92,000 $29,000 $7,000 4.a $114,000

Deferred Tax Assets 4.b,5.b $2,730 $1,750 5.d $980

Land & Buildings $224,000 $326,000 $550,000

Plant-At Cost $299,850 $355,800 $35,000 5.a $620,650

Accumulated Depreciation -

Plant ($85,750) ($138,800) 5.c ($5,833) ($218,717)

Investment in Solutions Ltd. $356,000 $356,000 1.a $0

Total Assets $945,500 $634,300 $1,188,613

Consolidation Worksheet:

Adjustment

19CORPORATE ACCOUNTING

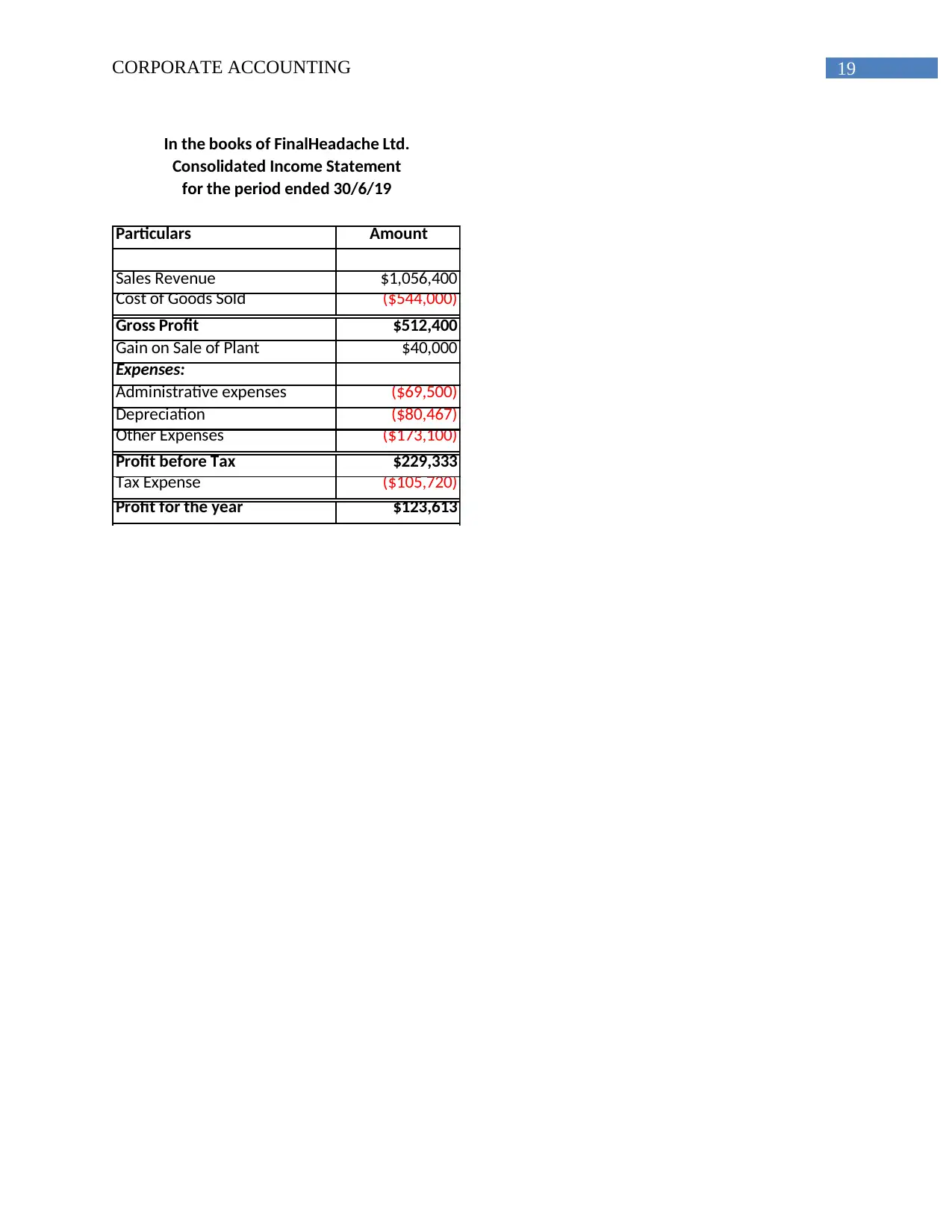

Particulars Amount

Sales Revenue $1,056,400

Cost of Goods Sold ($544,000)

Gross Profit $512,400

Gain on Sale of Plant $40,000

Expenses:

Administrative expenses ($69,500)

Depreciation ($80,467)

Other Expenses ($173,100)

Profit before Tax $229,333

Tax Expense ($105,720)

Profit for the year $123,613

In the books of FinalHeadache Ltd.

Consolidated Income Statement

for the period ended 30/6/19

Particulars Amount

Sales Revenue $1,056,400

Cost of Goods Sold ($544,000)

Gross Profit $512,400

Gain on Sale of Plant $40,000

Expenses:

Administrative expenses ($69,500)

Depreciation ($80,467)

Other Expenses ($173,100)

Profit before Tax $229,333

Tax Expense ($105,720)

Profit for the year $123,613

In the books of FinalHeadache Ltd.

Consolidated Income Statement

for the period ended 30/6/19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

20CORPORATE ACCOUNTING

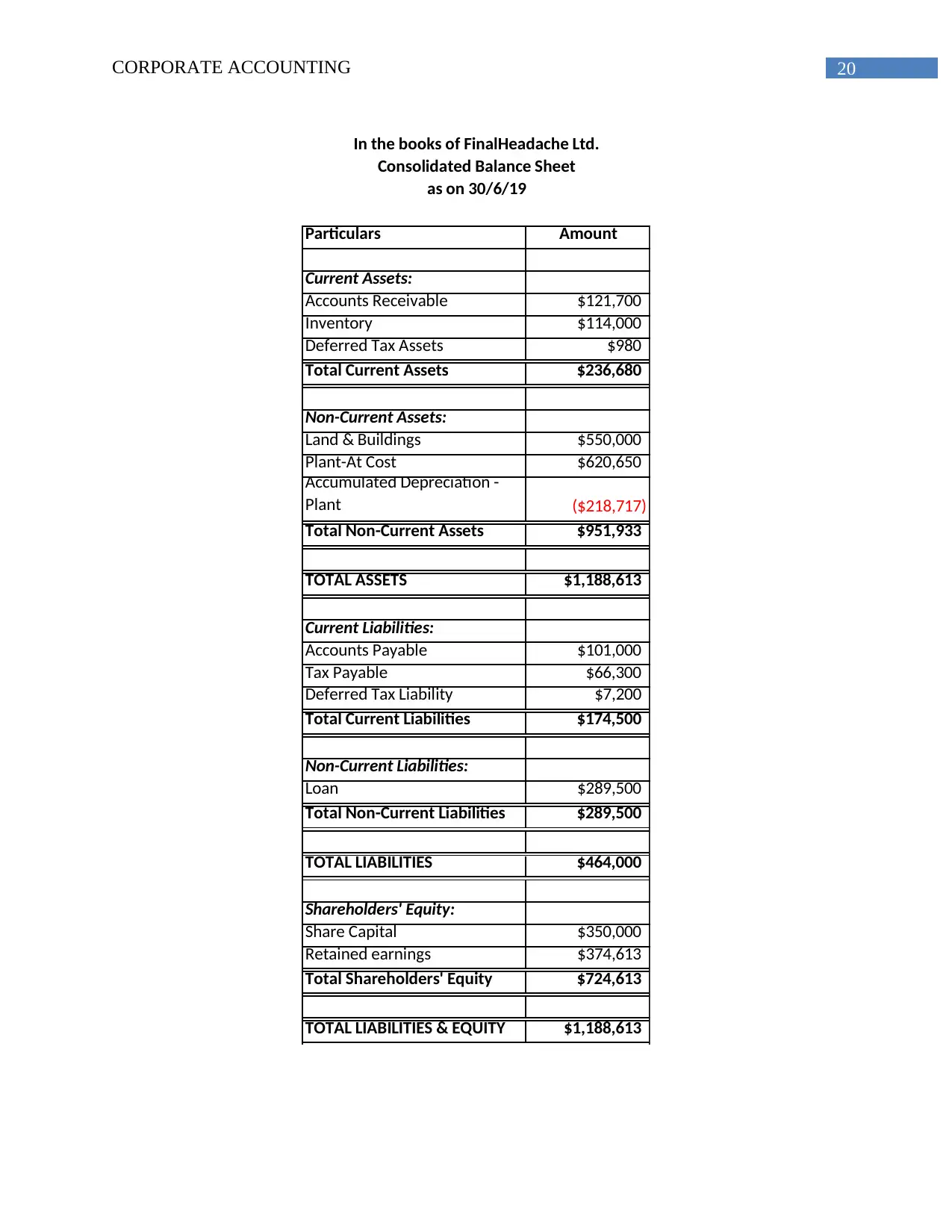

Particulars Amount

Current Assets:

Accounts Receivable $121,700

Inventory $114,000

Deferred Tax Assets $980

Total Current Assets $236,680

Non-Current Assets:

Land & Buildings $550,000

Plant-At Cost $620,650

Accumulated Depreciation -

Plant ($218,717)

Total Non-Current Assets $951,933

TOTAL ASSETS $1,188,613

Current Liabilities:

Accounts Payable $101,000

Tax Payable $66,300

Deferred Tax Liability $7,200

Total Current Liabilities $174,500

Non-Current Liabilities:

Loan $289,500

Total Non-Current Liabilities $289,500

TOTAL LIABILITIES $464,000

Shareholders' Equity:

Share Capital $350,000

Retained earnings $374,613

Total Shareholders' Equity $724,613

TOTAL LIABILITIES & EQUITY $1,188,613

Consolidated Balance Sheet

as on 30/6/19

In the books of FinalHeadache Ltd.

Particulars Amount

Current Assets:

Accounts Receivable $121,700

Inventory $114,000

Deferred Tax Assets $980

Total Current Assets $236,680

Non-Current Assets:

Land & Buildings $550,000

Plant-At Cost $620,650

Accumulated Depreciation -

Plant ($218,717)

Total Non-Current Assets $951,933

TOTAL ASSETS $1,188,613

Current Liabilities:

Accounts Payable $101,000

Tax Payable $66,300

Deferred Tax Liability $7,200

Total Current Liabilities $174,500

Non-Current Liabilities:

Loan $289,500

Total Non-Current Liabilities $289,500

TOTAL LIABILITIES $464,000

Shareholders' Equity:

Share Capital $350,000

Retained earnings $374,613

Total Shareholders' Equity $724,613

TOTAL LIABILITIES & EQUITY $1,188,613

Consolidated Balance Sheet

as on 30/6/19

In the books of FinalHeadache Ltd.

21CORPORATE ACCOUNTING

References and Bibliography

Aasb.gov.au. (2017). [online] Available at:

http://www.aasb.gov.au/admin/file/content105/c9/AASB3_03-08_COMPoct10_01-

11.pdf [Retrieved 5 Oct. 2017].

Aasb.gov.au. (2017). [online] Available at:

http://www.aasb.gov.au/admin/file/content105/c9/AASB3_03-08_COMPoct10_01-

11.pdf [Retrieved 5 Oct. 2017].

Barth, M. E. (2015). Financial accounting research, practice, and financial

accountability. Abacus, 51(4), 499-510.

Bevis, H. W. (2013). Corporate Financial Accounting in a Competitive Economy (RLE

Accounting). Routledge.

Deegan, C. (2013). Financial accounting theory. McGraw-Hill Education Australia.

Edwards, J. R. (2013). A History of Financial Accounting (RLE Accounting) (Vol. 29).

Routledge.

Guthrie, J. & Pang, T.T., (2013). Disclosure of Goodwill Impairment under AASB 136 from

2005–2010. Australian Accounting Review, 23(3), pp.216-231.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial accounting.

Pearson Higher Education AU.

Hoggett, J., Edwards, L., Medlin, J., Chalmers, K., Hellmann, A., Beattie, C., & Maxfield, J.

(2014). Financial accounting.

References and Bibliography

Aasb.gov.au. (2017). [online] Available at:

http://www.aasb.gov.au/admin/file/content105/c9/AASB3_03-08_COMPoct10_01-

11.pdf [Retrieved 5 Oct. 2017].

Aasb.gov.au. (2017). [online] Available at:

http://www.aasb.gov.au/admin/file/content105/c9/AASB3_03-08_COMPoct10_01-

11.pdf [Retrieved 5 Oct. 2017].

Barth, M. E. (2015). Financial accounting research, practice, and financial

accountability. Abacus, 51(4), 499-510.

Bevis, H. W. (2013). Corporate Financial Accounting in a Competitive Economy (RLE

Accounting). Routledge.

Deegan, C. (2013). Financial accounting theory. McGraw-Hill Education Australia.

Edwards, J. R. (2013). A History of Financial Accounting (RLE Accounting) (Vol. 29).

Routledge.

Guthrie, J. & Pang, T.T., (2013). Disclosure of Goodwill Impairment under AASB 136 from

2005–2010. Australian Accounting Review, 23(3), pp.216-231.

Henderson, S., Peirson, G., Herbohn, K., & Howieson, B. (2015). Issues in financial accounting.

Pearson Higher Education AU.

Hoggett, J., Edwards, L., Medlin, J., Chalmers, K., Hellmann, A., Beattie, C., & Maxfield, J.

(2014). Financial accounting.

22CORPORATE ACCOUNTING

Holzmann, O.J. & Munter, P., (2014). Accounting and Reporting by Development Stage

Enterprises. Journal of Corporate Accounting & Finance, 26(1), pp.69-72.

McLaney, E. J., & Atrill, P. (2014). Accounting and Finance: An Introduction. Pearson.

Reimers, J. L. (2013). Financial Accounting: Pearson New International Edition: A Business

Process Approach. Pearson Higher Ed.

Toraman, C. & Öğreten, A., (2013). From the First Corporate Accounting Practices in the

Ottoman Empire: Eregli Coal Company and Accounting Book Records.

Waegenaere, A., Sansing, R., & Wielhouwer, J. L. (2015). Financial accounting effects of tax

aggressiveness: Contracting and measurement. Contemporary Accounting

Research, 32(1), 223-242.

Walker, D.A., (2015). SEC. Journal of Corporate Accounting & Finance, 27(1), pp.109-110.

Warren, C.S., Reeve, J.M. & Duchac, J., (2013). Study Guide, Volume 1 for

Warren/Reeve/Duchac's Financial & Managerial Accounting, 12th and Corporate

Financial Accounting, 12th (Vol. 1). Cengage Learning.

Weil, R. L., Schipper, K., & Francis, J. (2013). Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

Williams, J. (2014). Financial accounting. McGraw-Hill Higher Education.

Holzmann, O.J. & Munter, P., (2014). Accounting and Reporting by Development Stage

Enterprises. Journal of Corporate Accounting & Finance, 26(1), pp.69-72.

McLaney, E. J., & Atrill, P. (2014). Accounting and Finance: An Introduction. Pearson.

Reimers, J. L. (2013). Financial Accounting: Pearson New International Edition: A Business

Process Approach. Pearson Higher Ed.

Toraman, C. & Öğreten, A., (2013). From the First Corporate Accounting Practices in the

Ottoman Empire: Eregli Coal Company and Accounting Book Records.

Waegenaere, A., Sansing, R., & Wielhouwer, J. L. (2015). Financial accounting effects of tax

aggressiveness: Contracting and measurement. Contemporary Accounting

Research, 32(1), 223-242.

Walker, D.A., (2015). SEC. Journal of Corporate Accounting & Finance, 27(1), pp.109-110.

Warren, C.S., Reeve, J.M. & Duchac, J., (2013). Study Guide, Volume 1 for

Warren/Reeve/Duchac's Financial & Managerial Accounting, 12th and Corporate

Financial Accounting, 12th (Vol. 1). Cengage Learning.

Weil, R. L., Schipper, K., & Francis, J. (2013). Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

Williams, J. (2014). Financial accounting. McGraw-Hill Higher Education.

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.