Financial Analysis Report: Audit and Assurance of DIPL Ltd.

VerifiedAdded on 2020/03/04

|8

|2103

|37

Report

AI Summary

This report presents an audit and assurance analysis of DIPL Ltd.'s financial statements. It begins by examining analytical procedures, including the calculation and interpretation of key financial ratios such as current ratio, EPS, return on equity, interest coverage ratio, and gross profit margin over a three-year period. The analysis reveals potential red flags, including manipulations in tax expenses and earnings per share, unusual changes in the interest coverage ratio, and a declining gross profit margin. The report then delves into risk assessment procedures, identifying inherent risks related to inventory control and cash payment recording. Finally, it explores fraud risk factors within DIPL Ltd., highlighting unusual expenditures, changes in asset depreciation, the acquisition of another firm, and the adoption of a new IT system. The report concludes with a discussion of the potential implications of these findings and relevant references.

AUDIT AND ASSURANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer - 1:

Analytical procedures forms an important part of thr audit processes that helps an auditor in

planning and forming an overall opinion on the evidences so as to analyze the consistency

between his findings and his understanding of the entity. It involves determining the relationship

between both financial and non-financial data so as to form a complete study about all the

possible relationships existing within the firm. Analytical procedures are used by the auditor to

determine the nature, timing and extent of other audit procedures, used as a substantive test and

used to form an overall review in the final stage of audit & accounting.

As pee the given case of DIPL, the key ratios are being calculated for the previous three years so

as to analyze the books on the basis of three years records. The results reveals the following

conclusions:

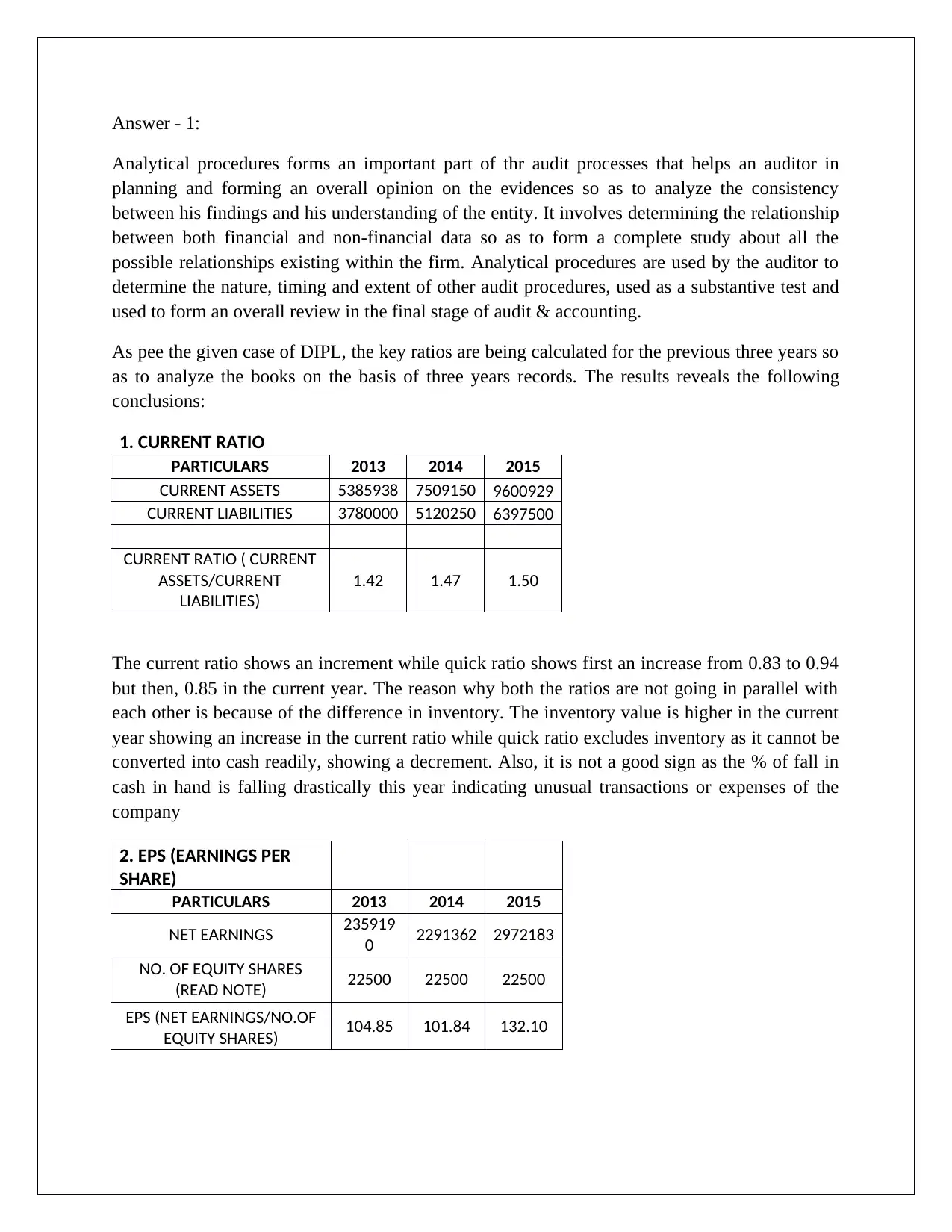

1. CURRENT RATIO

PARTICULARS 2013 2014 2015

CURRENT ASSETS 5385938 7509150 9600929

CURRENT LIABILITIES 3780000 5120250 6397500

CURRENT RATIO ( CURRENT

ASSETS/CURRENT

LIABILITIES)

1.42 1.47 1.50

The current ratio shows an increment while quick ratio shows first an increase from 0.83 to 0.94

but then, 0.85 in the current year. The reason why both the ratios are not going in parallel with

each other is because of the difference in inventory. The inventory value is higher in the current

year showing an increase in the current ratio while quick ratio excludes inventory as it cannot be

converted into cash readily, showing a decrement. Also, it is not a good sign as the % of fall in

cash in hand is falling drastically this year indicating unusual transactions or expenses of the

company

2. EPS (EARNINGS PER

SHARE)

PARTICULARS 2013 2014 2015

NET EARNINGS 235919

0 2291362 2972183

NO. OF EQUITY SHARES

(READ NOTE) 22500 22500 22500

EPS (NET EARNINGS/NO.OF

EQUITY SHARES) 104.85 101.84 132.10

Analytical procedures forms an important part of thr audit processes that helps an auditor in

planning and forming an overall opinion on the evidences so as to analyze the consistency

between his findings and his understanding of the entity. It involves determining the relationship

between both financial and non-financial data so as to form a complete study about all the

possible relationships existing within the firm. Analytical procedures are used by the auditor to

determine the nature, timing and extent of other audit procedures, used as a substantive test and

used to form an overall review in the final stage of audit & accounting.

As pee the given case of DIPL, the key ratios are being calculated for the previous three years so

as to analyze the books on the basis of three years records. The results reveals the following

conclusions:

1. CURRENT RATIO

PARTICULARS 2013 2014 2015

CURRENT ASSETS 5385938 7509150 9600929

CURRENT LIABILITIES 3780000 5120250 6397500

CURRENT RATIO ( CURRENT

ASSETS/CURRENT

LIABILITIES)

1.42 1.47 1.50

The current ratio shows an increment while quick ratio shows first an increase from 0.83 to 0.94

but then, 0.85 in the current year. The reason why both the ratios are not going in parallel with

each other is because of the difference in inventory. The inventory value is higher in the current

year showing an increase in the current ratio while quick ratio excludes inventory as it cannot be

converted into cash readily, showing a decrement. Also, it is not a good sign as the % of fall in

cash in hand is falling drastically this year indicating unusual transactions or expenses of the

company

2. EPS (EARNINGS PER

SHARE)

PARTICULARS 2013 2014 2015

NET EARNINGS 235919

0 2291362 2972183

NO. OF EQUITY SHARES

(READ NOTE) 22500 22500 22500

EPS (NET EARNINGS/NO.OF

EQUITY SHARES) 104.85 101.84 132.10

Coming to EPS calculation and considering the financial statements, the profit before tax is Rs.

3059299 and the tax on it is Rs. 87116 which is not possible without any manipulations as it

shows a tax amount of Rs. 1011081 in 2013 and Rs. 982012 in 2014. It may have happened to

show a higher net earning value so that the EPS could be higher as it is Rs 132.10 this year while

it was just Rs. 104.85 in 2013 and Rs. 101.84 in 2014. The company may be doing this to show a

strong financial position and win the interest of the investors (Basu, 2009).

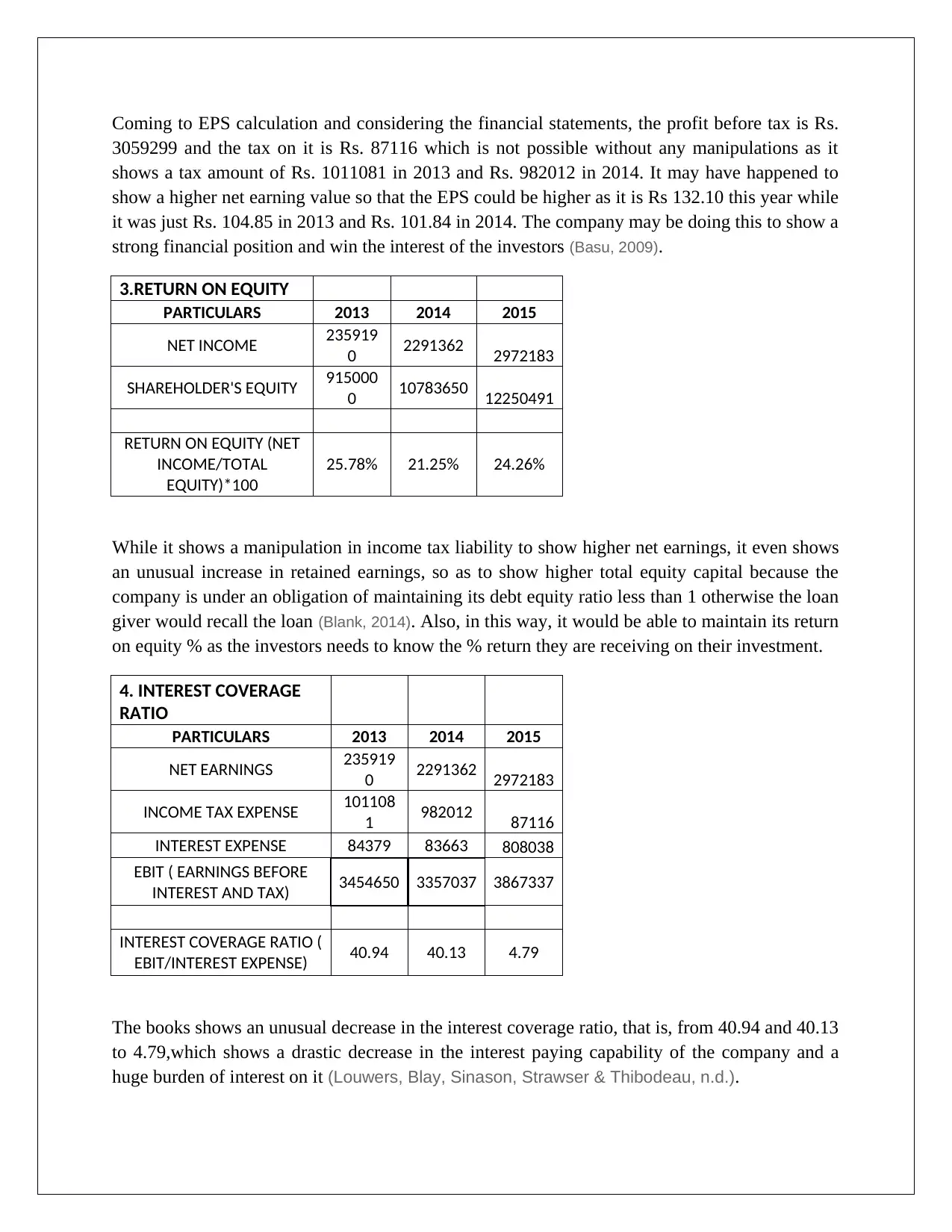

3.RETURN ON EQUITY

PARTICULARS 2013 2014 2015

NET INCOME 235919

0 2291362 2972183

SHAREHOLDER'S EQUITY 915000

0 10783650 12250491

RETURN ON EQUITY (NET

INCOME/TOTAL

EQUITY)*100

25.78% 21.25% 24.26%

While it shows a manipulation in income tax liability to show higher net earnings, it even shows

an unusual increase in retained earnings, so as to show higher total equity capital because the

company is under an obligation of maintaining its debt equity ratio less than 1 otherwise the loan

giver would recall the loan (Blank, 2014). Also, in this way, it would be able to maintain its return

on equity % as the investors needs to know the % return they are receiving on their investment.

4. INTEREST COVERAGE

RATIO

PARTICULARS 2013 2014 2015

NET EARNINGS 235919

0 2291362 2972183

INCOME TAX EXPENSE 101108

1 982012 87116

INTEREST EXPENSE 84379 83663 808038

EBIT ( EARNINGS BEFORE

INTEREST AND TAX) 3454650 3357037 3867337

INTEREST COVERAGE RATIO (

EBIT/INTEREST EXPENSE) 40.94 40.13 4.79

The books shows an unusual decrease in the interest coverage ratio, that is, from 40.94 and 40.13

to 4.79,which shows a drastic decrease in the interest paying capability of the company and a

huge burden of interest on it (Louwers, Blay, Sinason, Strawser & Thibodeau, n.d.).

3059299 and the tax on it is Rs. 87116 which is not possible without any manipulations as it

shows a tax amount of Rs. 1011081 in 2013 and Rs. 982012 in 2014. It may have happened to

show a higher net earning value so that the EPS could be higher as it is Rs 132.10 this year while

it was just Rs. 104.85 in 2013 and Rs. 101.84 in 2014. The company may be doing this to show a

strong financial position and win the interest of the investors (Basu, 2009).

3.RETURN ON EQUITY

PARTICULARS 2013 2014 2015

NET INCOME 235919

0 2291362 2972183

SHAREHOLDER'S EQUITY 915000

0 10783650 12250491

RETURN ON EQUITY (NET

INCOME/TOTAL

EQUITY)*100

25.78% 21.25% 24.26%

While it shows a manipulation in income tax liability to show higher net earnings, it even shows

an unusual increase in retained earnings, so as to show higher total equity capital because the

company is under an obligation of maintaining its debt equity ratio less than 1 otherwise the loan

giver would recall the loan (Blank, 2014). Also, in this way, it would be able to maintain its return

on equity % as the investors needs to know the % return they are receiving on their investment.

4. INTEREST COVERAGE

RATIO

PARTICULARS 2013 2014 2015

NET EARNINGS 235919

0 2291362 2972183

INCOME TAX EXPENSE 101108

1 982012 87116

INTEREST EXPENSE 84379 83663 808038

EBIT ( EARNINGS BEFORE

INTEREST AND TAX) 3454650 3357037 3867337

INTEREST COVERAGE RATIO (

EBIT/INTEREST EXPENSE) 40.94 40.13 4.79

The books shows an unusual decrease in the interest coverage ratio, that is, from 40.94 and 40.13

to 4.79,which shows a drastic decrease in the interest paying capability of the company and a

huge burden of interest on it (Louwers, Blay, Sinason, Strawser & Thibodeau, n.d.).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

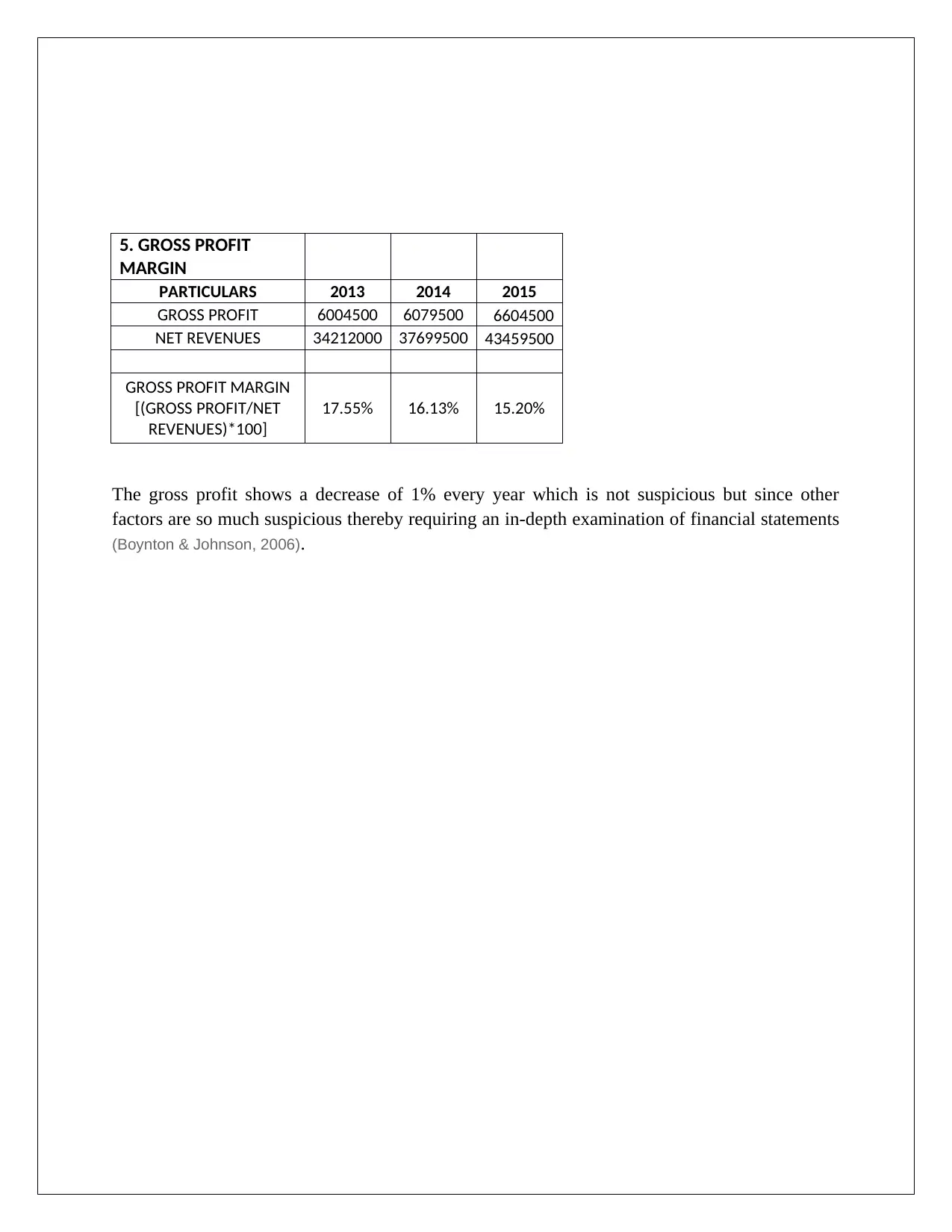

5. GROSS PROFIT

MARGIN

PARTICULARS 2013 2014 2015

GROSS PROFIT 6004500 6079500 6604500

NET REVENUES 34212000 37699500 43459500

GROSS PROFIT MARGIN

[(GROSS PROFIT/NET

REVENUES)*100]

17.55% 16.13% 15.20%

The gross profit shows a decrease of 1% every year which is not suspicious but since other

factors are so much suspicious thereby requiring an in-depth examination of financial statements

(Boynton & Johnson, 2006).

MARGIN

PARTICULARS 2013 2014 2015

GROSS PROFIT 6004500 6079500 6604500

NET REVENUES 34212000 37699500 43459500

GROSS PROFIT MARGIN

[(GROSS PROFIT/NET

REVENUES)*100]

17.55% 16.13% 15.20%

The gross profit shows a decrease of 1% every year which is not suspicious but since other

factors are so much suspicious thereby requiring an in-depth examination of financial statements

(Boynton & Johnson, 2006).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Answer-2 :

Risk assessment procedures forms an important part of an audit as these procedures are carried

out to find out whether the financial statements are free of material misstatements or not.

Inherent risk is one such risk that arises out of the misleading or omission of information other

than failure of controls (Messier, 2016).

Considering the present case of DIPL Ltd, where the books are being closed on 30th June, the

following are the two inherent risks identified:

Control over Inventory : The following points are to be considered while considering the

risk in inventory :

i. The inventory is received at the warehouse; there is no where mentioned that a physical

check is being done (Hooks, 2011). Also, only one in-charge records the arrival of it in his

books. This is a suspicious point as it may happen that the in-charge may record the entry

of more inventory and make the payment but uses the difference to sell it personally to

the outside parties and enjoy the entire earnings at the cost of the organization.

ii. The warehouse is being closed in the last two days of the year end which may free the

other employees who can manipulate the inventory the entire year such as theft may take

place on a regular basis. Not conducting stock counting at the month-end would not

discover the irregularity in the inventory that may take place throughout the year and any

difference at the end of the year would be regarded as discrepancies (Cahill & Kane,

2011).

Recording of cash payments received : The following points could be considered as a

risky factor under this context :

i. The cashier records the receipts in an inward remittance register whenever he opens the

mail. Its an indication of being casual as human errors are very common. The same in-

charge cannot be efficient all the time and it may happen that he may open the mail but

may not record it or he may overlook any mail (Knechel, Salterio & Ballou, 2017).

ii. The cashier may even remove any mail and credit the amount to his own account and

afterwards claiming that the amount is being received and used in the company itself.

iii. The cashier downloads the previous day's receipts from online banking and sends a copy

to accounts clerk. It is an indication of carelessness as leaving the entire responsibility of

the cash in the hand of one person can lead to cash defalcation. Also, the accounts clerk

and the cashier if in case forms a team, can together manipulate the entries of cash and

credit it in their own personal accounts (Fountain, n.d.).

Risk assessment procedures forms an important part of an audit as these procedures are carried

out to find out whether the financial statements are free of material misstatements or not.

Inherent risk is one such risk that arises out of the misleading or omission of information other

than failure of controls (Messier, 2016).

Considering the present case of DIPL Ltd, where the books are being closed on 30th June, the

following are the two inherent risks identified:

Control over Inventory : The following points are to be considered while considering the

risk in inventory :

i. The inventory is received at the warehouse; there is no where mentioned that a physical

check is being done (Hooks, 2011). Also, only one in-charge records the arrival of it in his

books. This is a suspicious point as it may happen that the in-charge may record the entry

of more inventory and make the payment but uses the difference to sell it personally to

the outside parties and enjoy the entire earnings at the cost of the organization.

ii. The warehouse is being closed in the last two days of the year end which may free the

other employees who can manipulate the inventory the entire year such as theft may take

place on a regular basis. Not conducting stock counting at the month-end would not

discover the irregularity in the inventory that may take place throughout the year and any

difference at the end of the year would be regarded as discrepancies (Cahill & Kane,

2011).

Recording of cash payments received : The following points could be considered as a

risky factor under this context :

i. The cashier records the receipts in an inward remittance register whenever he opens the

mail. Its an indication of being casual as human errors are very common. The same in-

charge cannot be efficient all the time and it may happen that he may open the mail but

may not record it or he may overlook any mail (Knechel, Salterio & Ballou, 2017).

ii. The cashier may even remove any mail and credit the amount to his own account and

afterwards claiming that the amount is being received and used in the company itself.

iii. The cashier downloads the previous day's receipts from online banking and sends a copy

to accounts clerk. It is an indication of carelessness as leaving the entire responsibility of

the cash in the hand of one person can lead to cash defalcation. Also, the accounts clerk

and the cashier if in case forms a team, can together manipulate the entries of cash and

credit it in their own personal accounts (Fountain, n.d.).

Answer - 3 :

Fraud in an intentional act done in the organization internally or externally so as to enjoy an

illegal advantage. Usually, the fraud is conducted by in internal members only. Fraud risk factors

are the factors that usually show an indication or a pressure for committing fraud. Fraud risk

factors are usually of three conditions that exists where a fraud occurs, namely, Incentives,

Opportunities and Attitude/Rationalizations

Based on the given case study of DIPL, the following are the identified fraud risk factors :

Unusual heavy expenditure: The Company made two heavy expenditure this year against

a loan of Rs. 75 lakhs which calls for a serious indication of fraud .

I. It made a heavy purchase of plant and equipment this year that accounts for Rs.

76,50,000. It is maybe because it wants to show a strong financial position so as to

enjoy the smooth funding in the future. Also, it changed the estimated life of its assets

from 20 years to 30 years which goes on against the policy adopted in the industry. It

may be decided so because by increasing the asset life, less depreciation will be

shown so that it can compensate for the overall effect of the high depreciation.

II. It took over another firm called Nuclear Publishing Ltd by paying for the net assets.

However, it is a susceptible thing that the company made an advance printing of

medical books as a journal was published in June 2015 that a new theory may became

valid and due to which the books already printed or in stock wil became obsolete. It is

matter of thought that usually until the medical authority doesn't approve the theories,

the medical printing company cannot print the books. So if there is a chance of

changing certain theories, the medical authority would have informed the industry

before hand so as to lessen the loss effect or no loss at all. Also, such a takeover

decision is not being justified even. It maybe to show itself a powerful company at the

year end of 2015 (Pitt, 2014)..

Adoption of New IT System: The board pressurized the IT department to install the new

computerized technology to automate the accounts. The IT department manager did claim

that the sudden installations are messing up the accounts as proper training of staffs and

testing of installations is not done. Thus, it is highly suspicious as the sudden installation

of new system in the company, provided it lacked the sufficient required knowledge too,

can be due to following reasons :

I. While transferring the books of accounts into computers, the transactions that would be

made to lost may be done to hide the fraudulent activities that might have taken place and

in that case, the inefficiency of the management could be blamed (Whittington & Pany,

2016).

II. As a new internal audit team was formed that would be examining the books of accounts

more accurately, the fraud the employees or any other member may have done will be

taken into consideration and this might have influenced the pressure of installing it in

Fraud in an intentional act done in the organization internally or externally so as to enjoy an

illegal advantage. Usually, the fraud is conducted by in internal members only. Fraud risk factors

are the factors that usually show an indication or a pressure for committing fraud. Fraud risk

factors are usually of three conditions that exists where a fraud occurs, namely, Incentives,

Opportunities and Attitude/Rationalizations

Based on the given case study of DIPL, the following are the identified fraud risk factors :

Unusual heavy expenditure: The Company made two heavy expenditure this year against

a loan of Rs. 75 lakhs which calls for a serious indication of fraud .

I. It made a heavy purchase of plant and equipment this year that accounts for Rs.

76,50,000. It is maybe because it wants to show a strong financial position so as to

enjoy the smooth funding in the future. Also, it changed the estimated life of its assets

from 20 years to 30 years which goes on against the policy adopted in the industry. It

may be decided so because by increasing the asset life, less depreciation will be

shown so that it can compensate for the overall effect of the high depreciation.

II. It took over another firm called Nuclear Publishing Ltd by paying for the net assets.

However, it is a susceptible thing that the company made an advance printing of

medical books as a journal was published in June 2015 that a new theory may became

valid and due to which the books already printed or in stock wil became obsolete. It is

matter of thought that usually until the medical authority doesn't approve the theories,

the medical printing company cannot print the books. So if there is a chance of

changing certain theories, the medical authority would have informed the industry

before hand so as to lessen the loss effect or no loss at all. Also, such a takeover

decision is not being justified even. It maybe to show itself a powerful company at the

year end of 2015 (Pitt, 2014)..

Adoption of New IT System: The board pressurized the IT department to install the new

computerized technology to automate the accounts. The IT department manager did claim

that the sudden installations are messing up the accounts as proper training of staffs and

testing of installations is not done. Thus, it is highly suspicious as the sudden installation

of new system in the company, provided it lacked the sufficient required knowledge too,

can be due to following reasons :

I. While transferring the books of accounts into computers, the transactions that would be

made to lost may be done to hide the fraudulent activities that might have taken place and

in that case, the inefficiency of the management could be blamed (Whittington & Pany,

2016).

II. As a new internal audit team was formed that would be examining the books of accounts

more accurately, the fraud the employees or any other member may have done will be

taken into consideration and this might have influenced the pressure of installing it in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

June, 2015 itself when the company has to close its books so that transfer of wrong

transactions or missing of transactions can be done to compensate for the fraud done.

III. Such an adoption can even serve as an opportunity to many other as messed up accounts

could give an illegal advantage of misappropriating the cash accounts of the company.

transactions or missing of transactions can be done to compensate for the fraud done.

III. Such an adoption can even serve as an opportunity to many other as messed up accounts

could give an illegal advantage of misappropriating the cash accounts of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References:

Basu, S. (2009). Fundamentals of auditing. Delhi: Pearson.

Blank, R. (2014). The Basics of Quality Auditing. Hoboken: Taylor and Francis.

Boynton, W., & Johnson, R. (2006). Modern Auditing. Hoboken: John Wiley and Sons.

Cahill, L., & Kane, R. (2011). Environmental health and safety audits. Lanham, MD:

Government Institutes.

Fountain, L. Leading the internal audit function.

Griffin, M. (2009). MBA fundamentals. New York, NY: Kaplan.

Hooks, K. (2011). Auditing and assurance services. Hoboken, NJ: Wiley.

Knechel, W., Salterio, S., & Ballou, B. (2017). Auditing. New York: Routledge.

Louwers, T., Blay, A., Sinason, D., Strawser, J., & Thibodeau, J. Auditing & assurance services.

Messier, W. (2016). Auditing & assurance services. [Place of publication not identified]:

Mcgraw-Hill Education.

Pitt, S. (2014). Internal audit quality. Hoboken: Wiley.

Whittington, O., & Pany, K. (2016). Principles of auditing & other assurance services. New

York, N.Y.: McGraw-Hill Education.

Basu, S. (2009). Fundamentals of auditing. Delhi: Pearson.

Blank, R. (2014). The Basics of Quality Auditing. Hoboken: Taylor and Francis.

Boynton, W., & Johnson, R. (2006). Modern Auditing. Hoboken: John Wiley and Sons.

Cahill, L., & Kane, R. (2011). Environmental health and safety audits. Lanham, MD:

Government Institutes.

Fountain, L. Leading the internal audit function.

Griffin, M. (2009). MBA fundamentals. New York, NY: Kaplan.

Hooks, K. (2011). Auditing and assurance services. Hoboken, NJ: Wiley.

Knechel, W., Salterio, S., & Ballou, B. (2017). Auditing. New York: Routledge.

Louwers, T., Blay, A., Sinason, D., Strawser, J., & Thibodeau, J. Auditing & assurance services.

Messier, W. (2016). Auditing & assurance services. [Place of publication not identified]:

Mcgraw-Hill Education.

Pitt, S. (2014). Internal audit quality. Hoboken: Wiley.

Whittington, O., & Pany, K. (2016). Principles of auditing & other assurance services. New

York, N.Y.: McGraw-Hill Education.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.