Audit and Ethics Report for Flight Centre Travel Group

VerifiedAdded on 2023/03/21

|12

|2463

|35

Report

AI Summary

This report presents an in-depth analysis of the audit and ethics aspects of Flight Centre Travel Group's 2018 annual report, focusing on materiality, analytical procedures, and the auditor's opinion. The report begins by defining materiality and its application in auditing, specifically within the context of Flight Centre. It then examines key items in the notes to the accounts, such as dividends, business combinations, and events after the balance sheet date, assessing their materiality. The analysis continues with the application of analytical procedures, including ratio analysis of capital structure, gearing, profitability, and shareholder ratios, to assess the company's financial performance. A detailed review of the cash flow statement is provided, highlighting key cash inflows and outflows, and discussing the implications for the going concern principle. Finally, the report reviews the auditor's report from Ernest and Young, including key audit matters. The report is a response to an assignment brief for CQUniversity Australia's ACCT20075 course.

Running head: AUDIT AND ETHICS

AUDIT AND ETHICS

Name of the Student:

Name of the University:

Author’s Note

AUDIT AND ETHICS

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDIT AND ETHICS

Table of Contents

Section 1....................................................................................................................................2

Materiality and Scope of Audit.............................................................................................2

Review of Draft notes and Disclosures.................................................................................4

Section 2....................................................................................................................................5

Application of Analytical Procedure.....................................................................................5

Section 3....................................................................................................................................8

Analysis of Cash Flow Statement..........................................................................................8

Review of Auditor’s Report......................................................................................................9

Reference.................................................................................................................................10

AUDIT AND ETHICS

Table of Contents

Section 1....................................................................................................................................2

Materiality and Scope of Audit.............................................................................................2

Review of Draft notes and Disclosures.................................................................................4

Section 2....................................................................................................................................5

Application of Analytical Procedure.....................................................................................5

Section 3....................................................................................................................................8

Analysis of Cash Flow Statement..........................................................................................8

Review of Auditor’s Report......................................................................................................9

Reference.................................................................................................................................10

2

AUDIT AND ETHICS

Section 1

Materiality and Scope of Audit

The main purpose of the assessment is to consider the business of Flight Centre Travel

Group which provides travelling services to the residents of the Australia. The annual report of

the company would be considered from the perspective of audit and analyzed whether the

financial statements are free from material misstatement or not. The assessment would be

recognizing the materiality aspect of items from the perspective of audit (Fctgl.com. 2019). The

concept of materiality is considered to be an integral part of the auditing process and the same is

based on the judgement of the auditor. The materiality of an item represented in the financial

statement helps an auditor to decide whether or not more audit procedure is to be applied to the

same for the purpose of collecting audit evidences. The company which is considered is Flight

Centre Travel Group for which different items which are presented in the annual report of the

business for 2018.

The concept of materiality is widely used during the course of audit considering the

financial information which is presented in the annual report of the business. The auditor needs

to assess whether the financial information which is included in the financial statements are

showing true and fair view or not. In order to provide appropriate opinion regarding the financial

statements, the auditor firstly needs to compute the planning materiality of the business (Jacoby

and Levy, 2016). The planning materiality is based on the judgement of the auditor and it is on

the basis of such estimate that performance materiality of different items is considered. In

relative terms, the computation of planning materiality in a business depends on estimates which

are of key nature such as sales, total assets, equity. It is to be noted that the computation of

planning materiality considers the item which has the highest value which is shown to be the

AUDIT AND ETHICS

Section 1

Materiality and Scope of Audit

The main purpose of the assessment is to consider the business of Flight Centre Travel

Group which provides travelling services to the residents of the Australia. The annual report of

the company would be considered from the perspective of audit and analyzed whether the

financial statements are free from material misstatement or not. The assessment would be

recognizing the materiality aspect of items from the perspective of audit (Fctgl.com. 2019). The

concept of materiality is considered to be an integral part of the auditing process and the same is

based on the judgement of the auditor. The materiality of an item represented in the financial

statement helps an auditor to decide whether or not more audit procedure is to be applied to the

same for the purpose of collecting audit evidences. The company which is considered is Flight

Centre Travel Group for which different items which are presented in the annual report of the

business for 2018.

The concept of materiality is widely used during the course of audit considering the

financial information which is presented in the annual report of the business. The auditor needs

to assess whether the financial information which is included in the financial statements are

showing true and fair view or not. In order to provide appropriate opinion regarding the financial

statements, the auditor firstly needs to compute the planning materiality of the business (Jacoby

and Levy, 2016). The planning materiality is based on the judgement of the auditor and it is on

the basis of such estimate that performance materiality of different items is considered. In

relative terms, the computation of planning materiality in a business depends on estimates which

are of key nature such as sales, total assets, equity. It is to be noted that the computation of

planning materiality considers the item which has the highest value which is shown to be the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDIT AND ETHICS

figure of total assets in the annual report of the company. The estimate of total assets of the

business for the year 2018 is shown to be /$ 3,405,219,000 on the basis of which planning

materiality is to be computed. The rate which is considered for the purpose of estimating the he

computation of planning materiality of the business is shown in the equation which is presented

below:

Planning Materiality=Total Asset∗5 %

¿ $ 3.405.219 .000

¿ 5 %

¿ $ 170,260,950

The above computation shows that the planning materiality of the business is $

170,260,950 on the basis of which performance materiality of the items presented in the annual

reports are considered (Müller-Burmeister & Velte, 2016). The estimate which is computed

above can be used by the auditor of the company to take important decision regarding which

items aret o be considered as materially misstated.

Review of Draft notes and Disclosures

The draft motes and disclosures are included in the notes to account section of the annual

report of the business. The notes to account need to be considered by the auditor because the

notes to account section of the financial statement contains certain treatments which may have

significance to the business from the point of materiality. The significant items which are

included in the notes to accounting section are given below in details:

Dividends

AUDIT AND ETHICS

figure of total assets in the annual report of the company. The estimate of total assets of the

business for the year 2018 is shown to be /$ 3,405,219,000 on the basis of which planning

materiality is to be computed. The rate which is considered for the purpose of estimating the he

computation of planning materiality of the business is shown in the equation which is presented

below:

Planning Materiality=Total Asset∗5 %

¿ $ 3.405.219 .000

¿ 5 %

¿ $ 170,260,950

The above computation shows that the planning materiality of the business is $

170,260,950 on the basis of which performance materiality of the items presented in the annual

reports are considered (Müller-Burmeister & Velte, 2016). The estimate which is computed

above can be used by the auditor of the company to take important decision regarding which

items aret o be considered as materially misstated.

Review of Draft notes and Disclosures

The draft motes and disclosures are included in the notes to account section of the annual

report of the business. The notes to account need to be considered by the auditor because the

notes to account section of the financial statement contains certain treatments which may have

significance to the business from the point of materiality. The significant items which are

included in the notes to accounting section are given below in details:

Dividends

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDIT AND ETHICS

As per the financial statement of Flight Centre Group Ltd, significant amount of

dividends have been paid by the business during the period. The notes to account section shows

that there are several factors which are considered by the management determining dividend

returns to shareholders. These factors include anticipated cash requirements to fund its growth

and operational plans and current and future economic conditions. The auditor of the company

needs to apply substantive audit procedure in order to ascertain whether the dividends of the

business are appropriately represented or not.

Business Combinations

The management of the company has included regarding the different acquisitions which

have been undertaken by the management of the company during the period. The item business

combination is considered as numerous acquisitions have been made by the management during

the period which suggest that the item is material (Coppage & Shastri, 2014). The auditor of the

business needs to check in each of acquisition whether the management has appropriately valued

the assets of the company or not. The management of the company also needs to ensure that the

purchase consideration which is paid for acquisition are appropriately reflected in annual reports

of the business.

Events Occurring After Balance sheet date:

The annual reports of the business show that there is an acquisition which is made after

the reporting period but the same needs to be shown in the financial statement of the business in

an appropriate manner relating to relevant accounting standards (Louwers et al., 2015). The

auditor of the company needs to check whether the financial statement appropriately represent

the acquisition which is undertaken by the management of the company.

AUDIT AND ETHICS

As per the financial statement of Flight Centre Group Ltd, significant amount of

dividends have been paid by the business during the period. The notes to account section shows

that there are several factors which are considered by the management determining dividend

returns to shareholders. These factors include anticipated cash requirements to fund its growth

and operational plans and current and future economic conditions. The auditor of the company

needs to apply substantive audit procedure in order to ascertain whether the dividends of the

business are appropriately represented or not.

Business Combinations

The management of the company has included regarding the different acquisitions which

have been undertaken by the management of the company during the period. The item business

combination is considered as numerous acquisitions have been made by the management during

the period which suggest that the item is material (Coppage & Shastri, 2014). The auditor of the

business needs to check in each of acquisition whether the management has appropriately valued

the assets of the company or not. The management of the company also needs to ensure that the

purchase consideration which is paid for acquisition are appropriately reflected in annual reports

of the business.

Events Occurring After Balance sheet date:

The annual reports of the business show that there is an acquisition which is made after

the reporting period but the same needs to be shown in the financial statement of the business in

an appropriate manner relating to relevant accounting standards (Louwers et al., 2015). The

auditor of the company needs to check whether the financial statement appropriately represent

the acquisition which is undertaken by the management of the company.

5

AUDIT AND ETHICS

Section 2

Application of Analytical Procedure

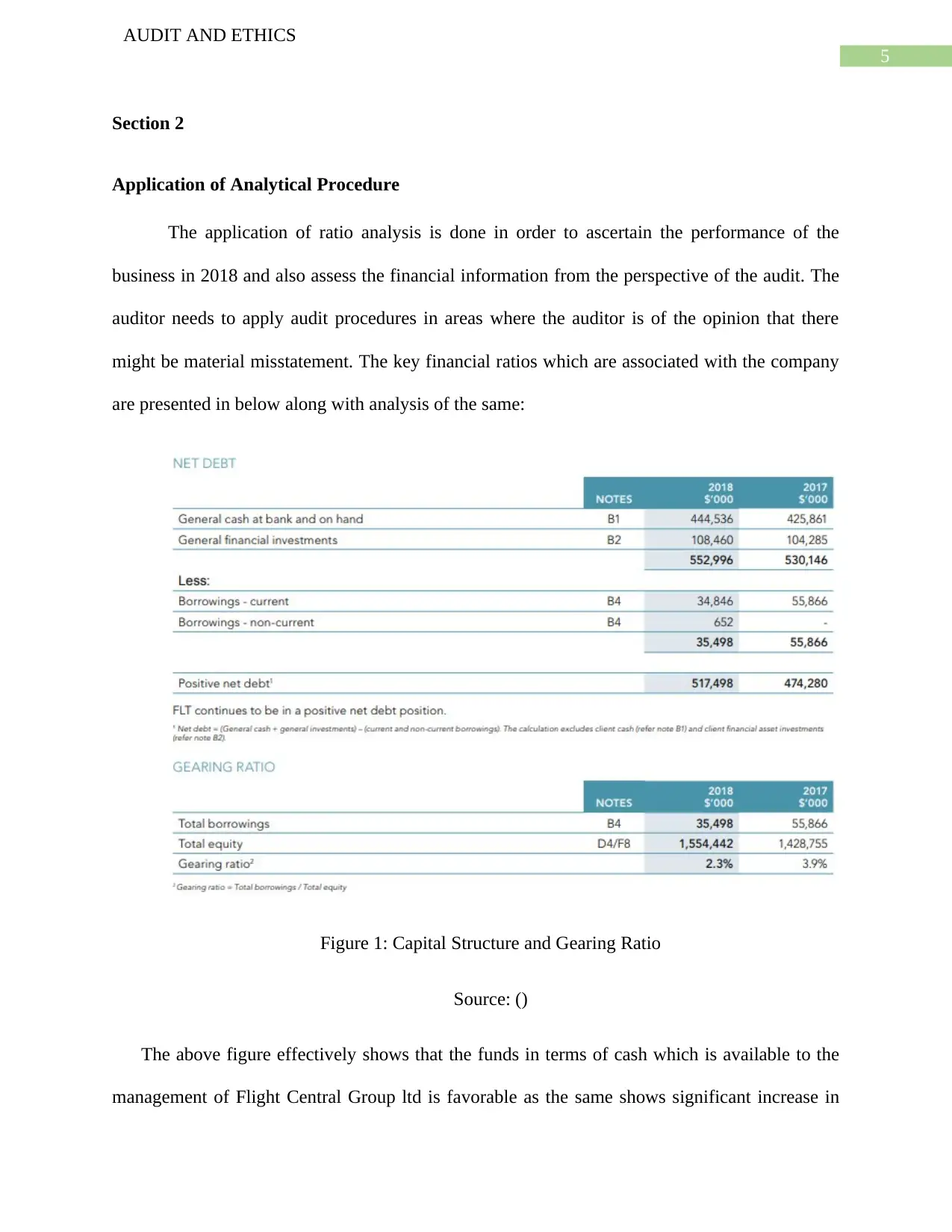

The application of ratio analysis is done in order to ascertain the performance of the

business in 2018 and also assess the financial information from the perspective of the audit. The

auditor needs to apply audit procedures in areas where the auditor is of the opinion that there

might be material misstatement. The key financial ratios which are associated with the company

are presented in below along with analysis of the same:

Figure 1: Capital Structure and Gearing Ratio

Source: ()

The above figure effectively shows that the funds in terms of cash which is available to the

management of Flight Central Group ltd is favorable as the same shows significant increase in

AUDIT AND ETHICS

Section 2

Application of Analytical Procedure

The application of ratio analysis is done in order to ascertain the performance of the

business in 2018 and also assess the financial information from the perspective of the audit. The

auditor needs to apply audit procedures in areas where the auditor is of the opinion that there

might be material misstatement. The key financial ratios which are associated with the company

are presented in below along with analysis of the same:

Figure 1: Capital Structure and Gearing Ratio

Source: ()

The above figure effectively shows that the funds in terms of cash which is available to the

management of Flight Central Group ltd is favorable as the same shows significant increase in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDIT AND ETHICS

comparison to previous year. The increase in the cash position of the business appropriately

shows that the liquidity situation of the business is appropriate and the business would be able to

take care of any current liabilities of the business in an appropriate manner (Eilifsen & Messier

Jr, 2014). The net debt position of the business is shown to be positive which shows that the

business is well placed in terms of debts which are taken by the management of the company.

The gearing ratio of the business is to have declined in the current year which shows that the

management of the company is trying to reduce the total debts of the business (Reid, 2015).

There has been a decline in the gearing ratio of the business which shows that the management

of the company is trying to reduce the overall risks which is associated with the business.

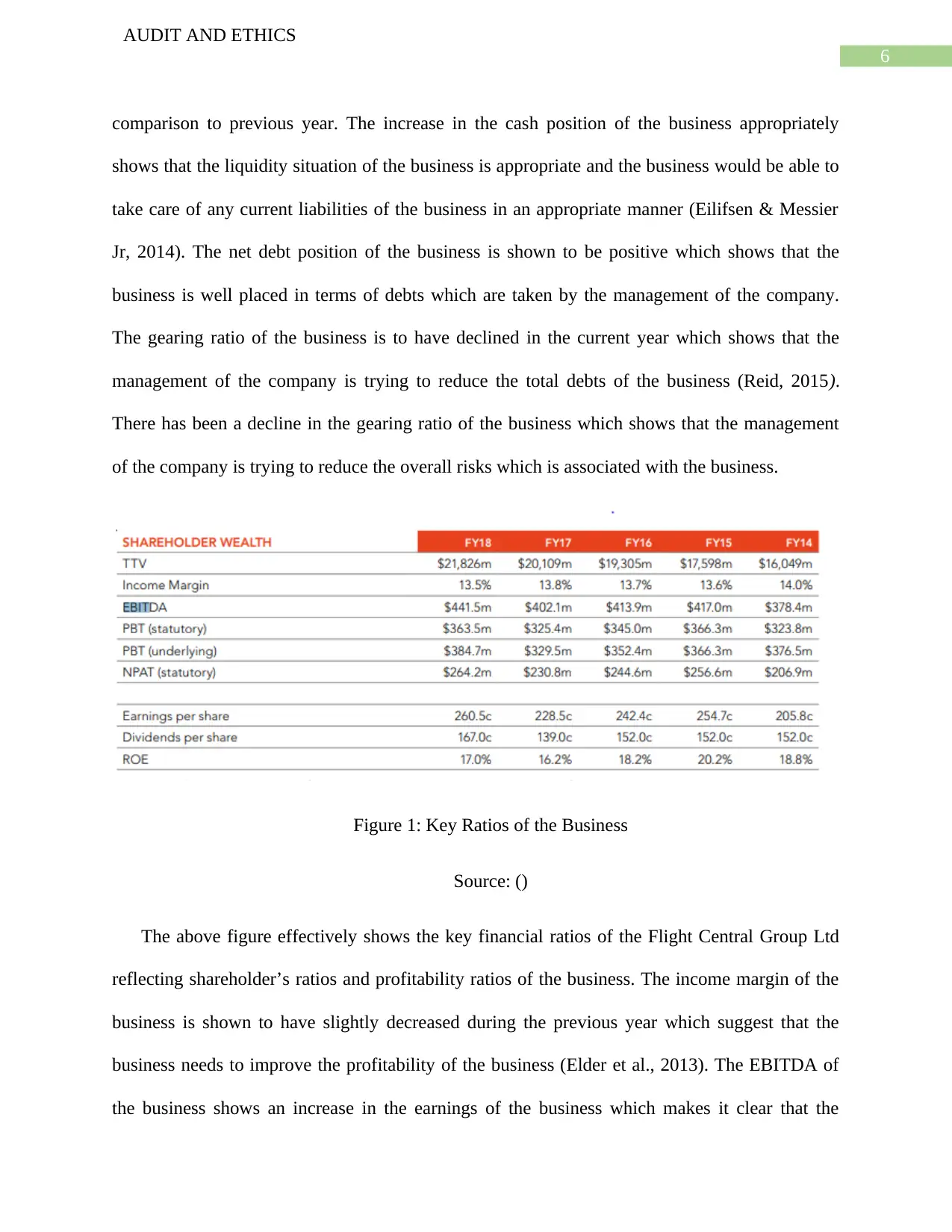

Figure 1: Key Ratios of the Business

Source: ()

The above figure effectively shows the key financial ratios of the Flight Central Group Ltd

reflecting shareholder’s ratios and profitability ratios of the business. The income margin of the

business is shown to have slightly decreased during the previous year which suggest that the

business needs to improve the profitability of the business (Elder et al., 2013). The EBITDA of

the business shows an increase in the earnings of the business which makes it clear that the

AUDIT AND ETHICS

comparison to previous year. The increase in the cash position of the business appropriately

shows that the liquidity situation of the business is appropriate and the business would be able to

take care of any current liabilities of the business in an appropriate manner (Eilifsen & Messier

Jr, 2014). The net debt position of the business is shown to be positive which shows that the

business is well placed in terms of debts which are taken by the management of the company.

The gearing ratio of the business is to have declined in the current year which shows that the

management of the company is trying to reduce the total debts of the business (Reid, 2015).

There has been a decline in the gearing ratio of the business which shows that the management

of the company is trying to reduce the overall risks which is associated with the business.

Figure 1: Key Ratios of the Business

Source: ()

The above figure effectively shows the key financial ratios of the Flight Central Group Ltd

reflecting shareholder’s ratios and profitability ratios of the business. The income margin of the

business is shown to have slightly decreased during the previous year which suggest that the

business needs to improve the profitability of the business (Elder et al., 2013). The EBITDA of

the business shows an increase in the earnings of the business which makes it clear that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDIT AND ETHICS

business has achieved efficiency in operational process of the business. The earning per share of

the business is also shown to have increased during the period which is a positive sign for the

business which is a clear indication that the management of the company is trying to enhance the

shareholder’s wealth effectively.

Section 3

Analysis of Cash Flow Statement

The cash flow statement is one of the statements which is included in the financial

statements of the business and the same effectively shows the cash inflows and outflows of the

business during the period. The cash flow statement is prepared by the management of the

company to appropriately shows revenue which can be generated by the management of the

company which would result in cash inflows in the business. As per the annual report of the

business, the main cash generating activity of the business includes cash from operating activities

(Goh, Krishnan & Li, 2013). The main cash inflow which is shown in the statement is receipts

from customers of the business and the same is shown to be $ 2,884,573,000 during the period

2018 which has significantly increased from previous year analysis. This shows that the business

is growing and achieving more profits along the process. The main cash outflow which can be

recognised from the financial statement of the business is shown to be $ 2,480,898,000 which is

cash paid to suppliers and employees of the business. This cash outflow represents the expenses

which the management of the company needs to incur for carrying out the operations of the

business. The net cash from operating activities is shown to be positive which is a favourable

sign for the business.

AUDIT AND ETHICS

business has achieved efficiency in operational process of the business. The earning per share of

the business is also shown to have increased during the period which is a positive sign for the

business which is a clear indication that the management of the company is trying to enhance the

shareholder’s wealth effectively.

Section 3

Analysis of Cash Flow Statement

The cash flow statement is one of the statements which is included in the financial

statements of the business and the same effectively shows the cash inflows and outflows of the

business during the period. The cash flow statement is prepared by the management of the

company to appropriately shows revenue which can be generated by the management of the

company which would result in cash inflows in the business. As per the annual report of the

business, the main cash generating activity of the business includes cash from operating activities

(Goh, Krishnan & Li, 2013). The main cash inflow which is shown in the statement is receipts

from customers of the business and the same is shown to be $ 2,884,573,000 during the period

2018 which has significantly increased from previous year analysis. This shows that the business

is growing and achieving more profits along the process. The main cash outflow which can be

recognised from the financial statement of the business is shown to be $ 2,480,898,000 which is

cash paid to suppliers and employees of the business. This cash outflow represents the expenses

which the management of the company needs to incur for carrying out the operations of the

business. The net cash from operating activities is shown to be positive which is a favourable

sign for the business.

8

AUDIT AND ETHICS

The cash flow statement shows that the management of the company has undertaken

numerous acquisition during the period which has affected the investing cash flows of the

business. This is the main reason that the net cash from investing activities is shown too be

negative during the period. The management of the company has made significant purchases for

assets during the period.

The cash from financing activities of the business is shown to be negative as well which

is mainly due to huge repayment of loans which is undertaken by the management of the

company during the period. The business has also taken loans during the period but the overall

repayment of loans and dividend payments which is made by the business has affected the net

cash position from financing activities of the business. The net cash position of the business is

shown to have declined slightly but the same is shown to be positive which is favourable for the

business.

The going concern principle is the fundamental principle in accounting process and the

auditor needs to report any factor which can affect the going concern principle of the business.

The auditor needs to make an assessment whether the going concern principle of the business is

affected in any way or not. The profitability of the business is shown to be favourable which is

shown in the annual report as there is significant increase in the profits which is generated by the

business. The overall cash position of the business is also shown to be appropriate which suggest

that the management has appropriate liquidity position. The overall debt position of the business

is shown to have decreased which also means that the overall risks which is associated with debts

have decreased. Therefore, the financial statements do not show appropriate sign which can

affect the going concern of the business.

AUDIT AND ETHICS

The cash flow statement shows that the management of the company has undertaken

numerous acquisition during the period which has affected the investing cash flows of the

business. This is the main reason that the net cash from investing activities is shown too be

negative during the period. The management of the company has made significant purchases for

assets during the period.

The cash from financing activities of the business is shown to be negative as well which

is mainly due to huge repayment of loans which is undertaken by the management of the

company during the period. The business has also taken loans during the period but the overall

repayment of loans and dividend payments which is made by the business has affected the net

cash position from financing activities of the business. The net cash position of the business is

shown to have declined slightly but the same is shown to be positive which is favourable for the

business.

The going concern principle is the fundamental principle in accounting process and the

auditor needs to report any factor which can affect the going concern principle of the business.

The auditor needs to make an assessment whether the going concern principle of the business is

affected in any way or not. The profitability of the business is shown to be favourable which is

shown in the annual report as there is significant increase in the profits which is generated by the

business. The overall cash position of the business is also shown to be appropriate which suggest

that the management has appropriate liquidity position. The overall debt position of the business

is shown to have decreased which also means that the overall risks which is associated with debts

have decreased. Therefore, the financial statements do not show appropriate sign which can

affect the going concern of the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

AUDIT AND ETHICS

Review of Auditor’s Report

The auditor of the business is Ernest and Young which is considered to be one of the big four

firms which is operating in the field of audit. As per the opinion of the auditor the financial

statements are prepared following relevant accounting standards and followed provisions of

Corporation Act 2001 and therefore are also showing true and fair view. This means that the

financial statements are free from any material misstatements.

Key audit matters are those matters that require professional judgment are considered to

be most significance in the audit of the financial report of the current year. The auditor of the

business has recognised certain key audit matters which can affect the financial position of the

business and the same is separately shown in the annual report of the business.

AUDIT AND ETHICS

Review of Auditor’s Report

The auditor of the business is Ernest and Young which is considered to be one of the big four

firms which is operating in the field of audit. As per the opinion of the auditor the financial

statements are prepared following relevant accounting standards and followed provisions of

Corporation Act 2001 and therefore are also showing true and fair view. This means that the

financial statements are free from any material misstatements.

Key audit matters are those matters that require professional judgment are considered to

be most significance in the audit of the financial report of the current year. The auditor of the

business has recognised certain key audit matters which can affect the financial position of the

business and the same is separately shown in the annual report of the business.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDIT AND ETHICS

Reference

Coppage, R., & Shastri, T. (2014). Effectively Applying Professional Skepticism to Improve

Audit Quality. The CPA Journal, 84(8), 24.

Eilifsen, A., & Messier Jr, W. F. (2014). Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), 3-26.

Elder, R. J., Akresh, A. D., Glover, S. M., Higgs, J. L., & Liljegren, J. (2013). Audit sampling

research: A synthesis and implications for future research. Auditing: A Journal of

Practice & Theory, 32(sp1), 99-129.

Fctgl.com. (2019). [online] Available at:

http://www.fctgl.com/wp-content/uploads/2018/09/Computershare-FLT-Final-Annual-

Report.pdf [Accessed 15 May 2019].

Goh, B. W., Krishnan, J., & Li, D. (2013). Auditor reporting under Section 404: The association

between the internal control and going concern audit opinions. Contemporary

Accounting Research, 30(3), 970-995.

Jacoby, J. and Levy, H.B., 2016. The materiality mystery. The CPA Journal, 86(7), p.14.

Louwers, T. J., Ramsay, R. J., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C.

(2015). Auditing & assurance services. McGraw-Hill Education.

Müller-Burmeister, C., & Velte, P. (2016). Increased materiality judgments in financial

accounting and external audit: a critical comparison between German and international

standard setting. International Journal of Critical Accounting, 8(3-4), 227-245.

AUDIT AND ETHICS

Reference

Coppage, R., & Shastri, T. (2014). Effectively Applying Professional Skepticism to Improve

Audit Quality. The CPA Journal, 84(8), 24.

Eilifsen, A., & Messier Jr, W. F. (2014). Materiality guidance of the major public accounting

firms. Auditing: A Journal of Practice & Theory, 34(2), 3-26.

Elder, R. J., Akresh, A. D., Glover, S. M., Higgs, J. L., & Liljegren, J. (2013). Audit sampling

research: A synthesis and implications for future research. Auditing: A Journal of

Practice & Theory, 32(sp1), 99-129.

Fctgl.com. (2019). [online] Available at:

http://www.fctgl.com/wp-content/uploads/2018/09/Computershare-FLT-Final-Annual-

Report.pdf [Accessed 15 May 2019].

Goh, B. W., Krishnan, J., & Li, D. (2013). Auditor reporting under Section 404: The association

between the internal control and going concern audit opinions. Contemporary

Accounting Research, 30(3), 970-995.

Jacoby, J. and Levy, H.B., 2016. The materiality mystery. The CPA Journal, 86(7), p.14.

Louwers, T. J., Ramsay, R. J., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C.

(2015). Auditing & assurance services. McGraw-Hill Education.

Müller-Burmeister, C., & Velte, P. (2016). Increased materiality judgments in financial

accounting and external audit: a critical comparison between German and international

standard setting. International Journal of Critical Accounting, 8(3-4), 227-245.

11

AUDIT AND ETHICS

Reid, L. C. (2015). Are auditor and audit committee report changes useful to investors?

Evidence from the United Kingdom.

AUDIT AND ETHICS

Reid, L. C. (2015). Are auditor and audit committee report changes useful to investors?

Evidence from the United Kingdom.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.