Audit Risk and Financial Reporting

VerifiedAdded on 2020/02/18

|6

|1244

|225

AI Summary

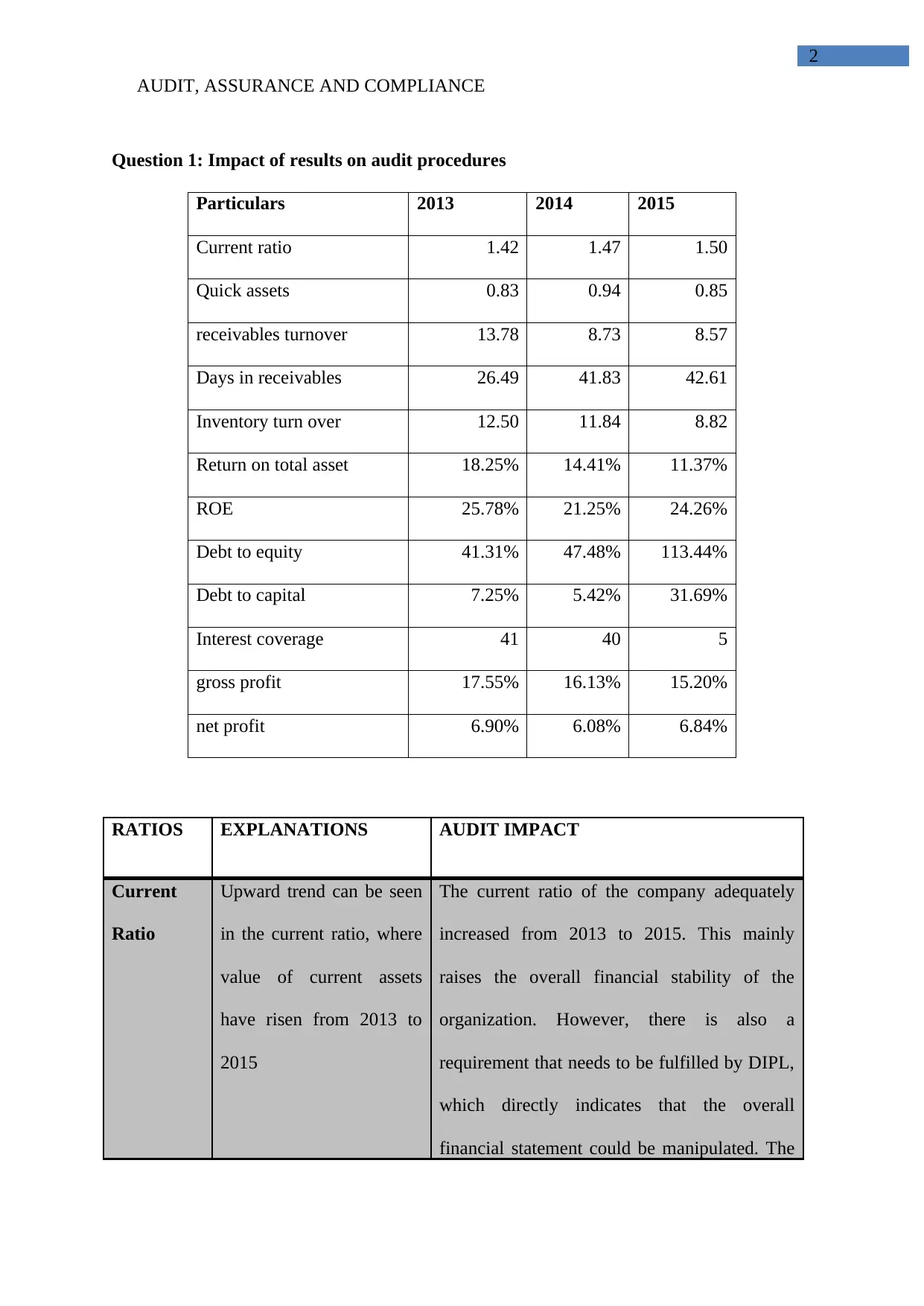

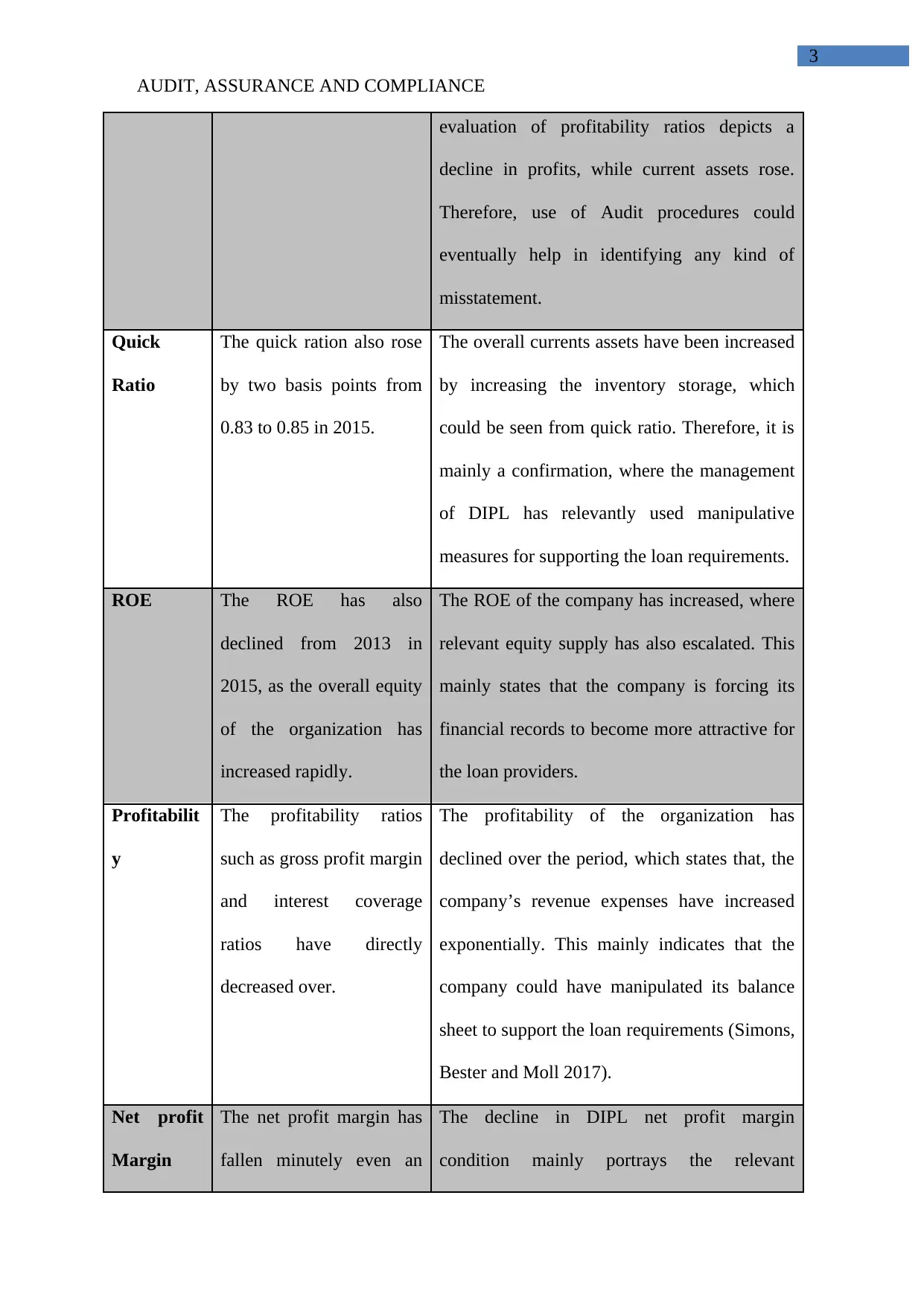

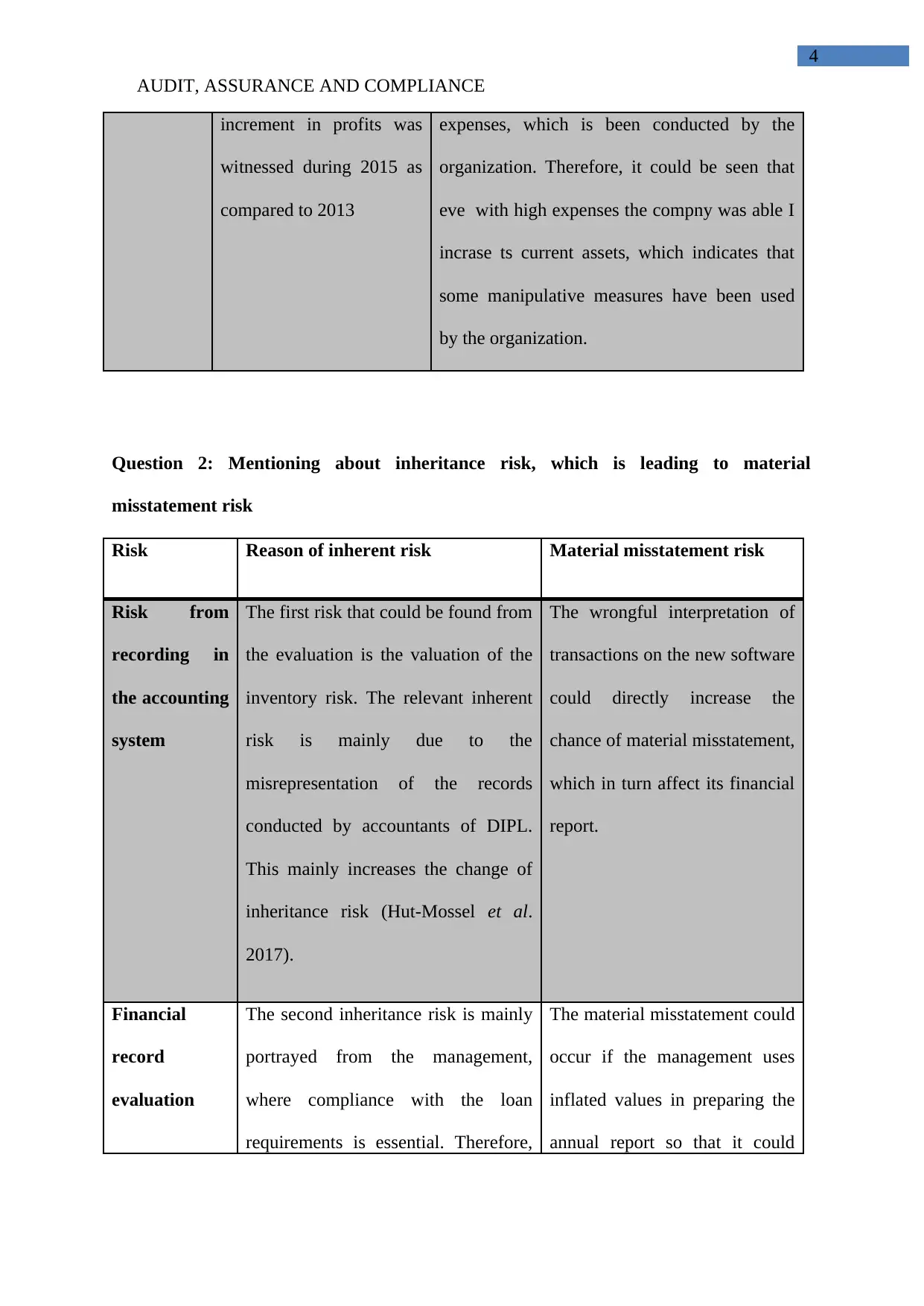

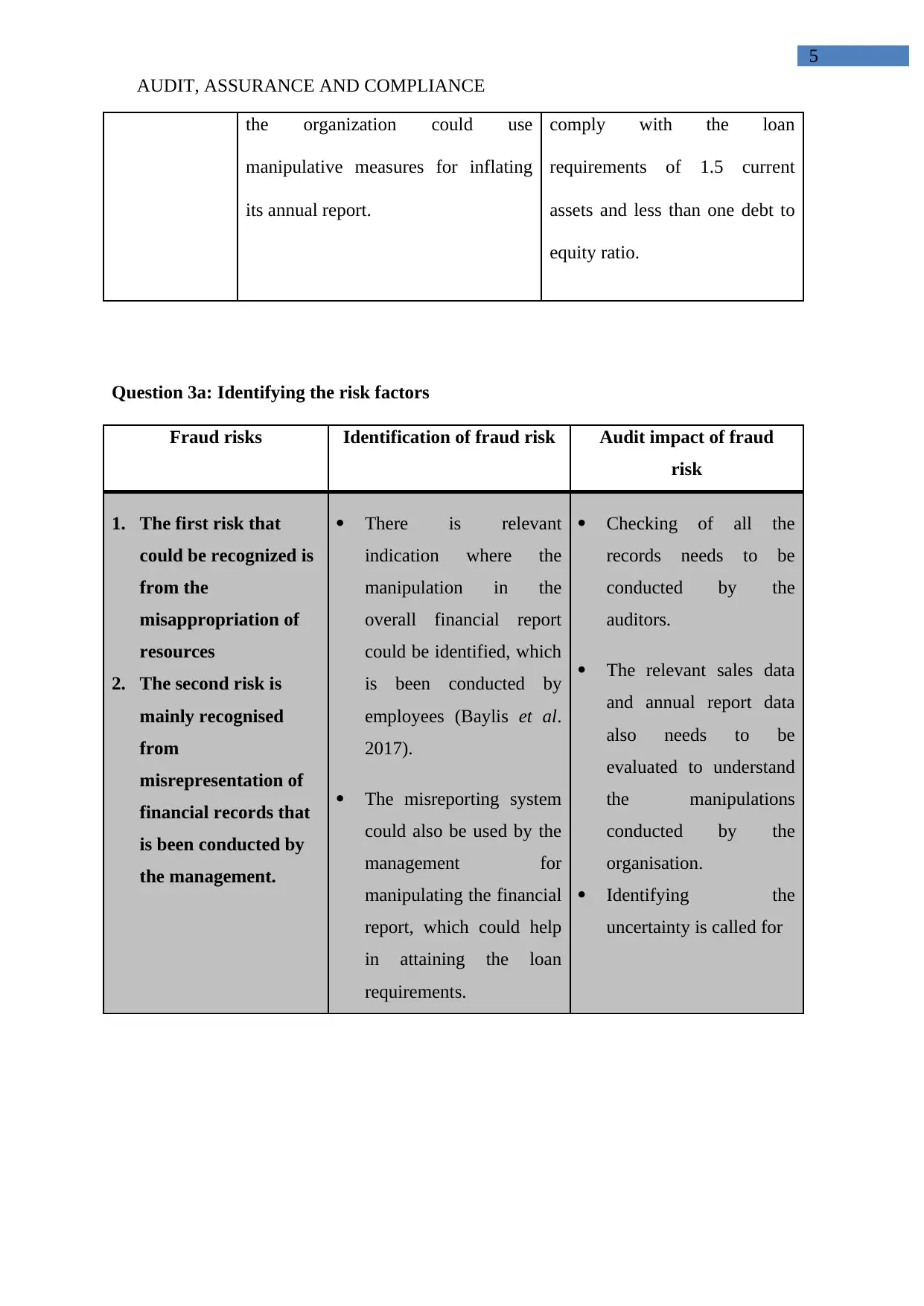

This assignment examines the inherent audit risks faced by DIPL, a company transitioning to new software and facing loan requirements. It delves into two key areas: (1) The risk of material misstatement arising from new software implementation and (2) Management's potential for manipulating financial records to meet loan conditions. The assignment requires students to identify specific fraud risks, analyze their impact on the audit, and propose audit procedures to mitigate these risks.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)