Discussion Regarding Audit Risks of API

VerifiedAdded on 2023/03/17

|15

|3872

|98

AI Summary

This memo discusses the audit risks of API and the appropriate audit procedures to address them. It analyzes key ratios and their impact on the financial position of the business. The memo also highlights weaknesses in the internal control system for inventory and suggests necessary audit procedures.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: AUDITING

Auditing

Name of the Student:

Name of the University:

Author’s Note

Auditing

Name of the Student:

Name of the University:

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

AUDITING

Memo

To: Wayne Wiadrowski

From: The Audit Manager

Date: 8th May, 2019

Subject: Discussion Regarding Audit risks of API

Purpose and Scope

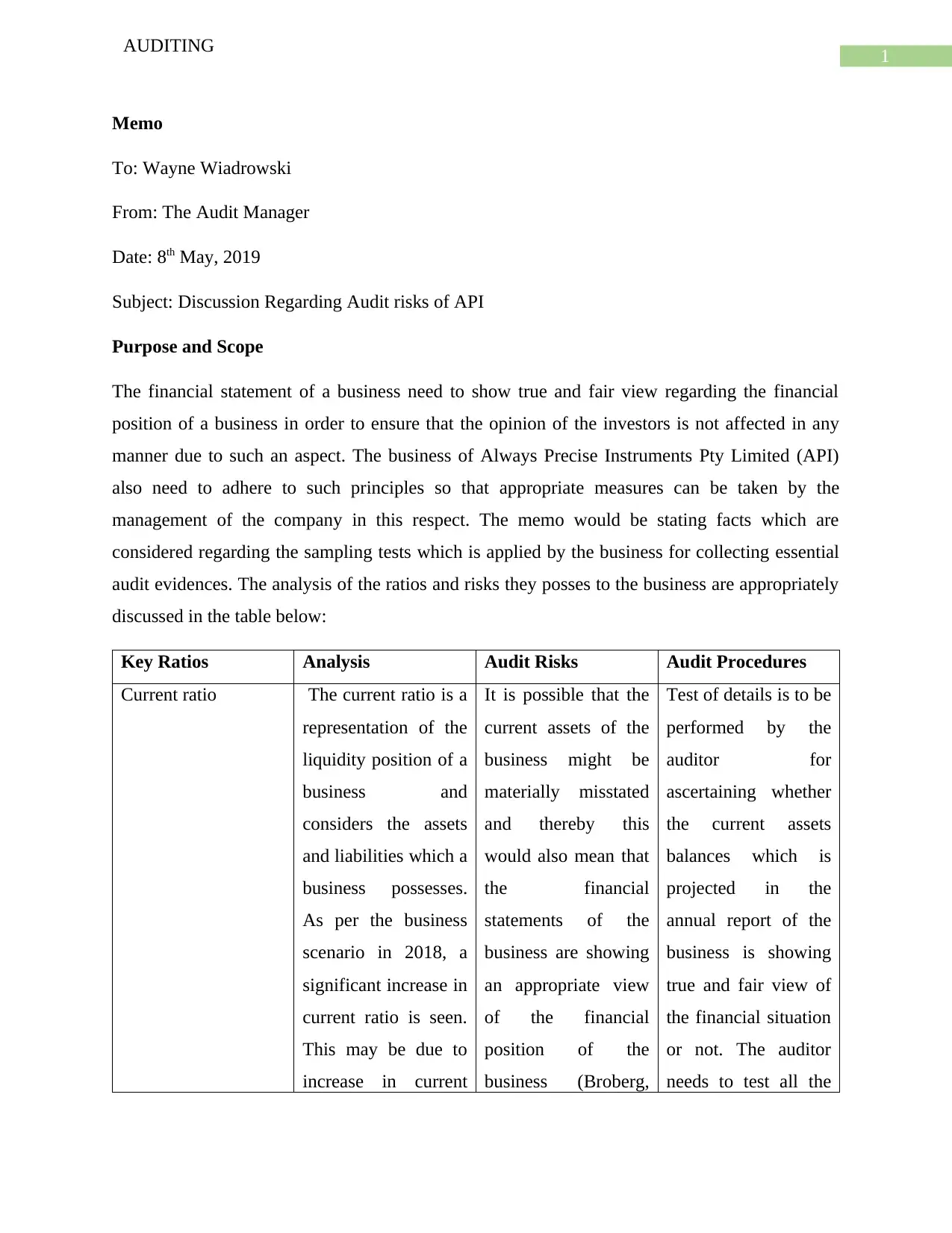

The financial statement of a business need to show true and fair view regarding the financial

position of a business in order to ensure that the opinion of the investors is not affected in any

manner due to such an aspect. The business of Always Precise Instruments Pty Limited (API)

also need to adhere to such principles so that appropriate measures can be taken by the

management of the company in this respect. The memo would be stating facts which are

considered regarding the sampling tests which is applied by the business for collecting essential

audit evidences. The analysis of the ratios and risks they posses to the business are appropriately

discussed in the table below:

Key Ratios Analysis Audit Risks Audit Procedures

Current ratio The current ratio is a

representation of the

liquidity position of a

business and

considers the assets

and liabilities which a

business possesses.

As per the business

scenario in 2018, a

significant increase in

current ratio is seen.

This may be due to

increase in current

It is possible that the

current assets of the

business might be

materially misstated

and thereby this

would also mean that

the financial

statements of the

business are showing

an appropriate view

of the financial

position of the

business (Broberg,

Test of details is to be

performed by the

auditor for

ascertaining whether

the current assets

balances which is

projected in the

annual report of the

business is showing

true and fair view of

the financial situation

or not. The auditor

needs to test all the

AUDITING

Memo

To: Wayne Wiadrowski

From: The Audit Manager

Date: 8th May, 2019

Subject: Discussion Regarding Audit risks of API

Purpose and Scope

The financial statement of a business need to show true and fair view regarding the financial

position of a business in order to ensure that the opinion of the investors is not affected in any

manner due to such an aspect. The business of Always Precise Instruments Pty Limited (API)

also need to adhere to such principles so that appropriate measures can be taken by the

management of the company in this respect. The memo would be stating facts which are

considered regarding the sampling tests which is applied by the business for collecting essential

audit evidences. The analysis of the ratios and risks they posses to the business are appropriately

discussed in the table below:

Key Ratios Analysis Audit Risks Audit Procedures

Current ratio The current ratio is a

representation of the

liquidity position of a

business and

considers the assets

and liabilities which a

business possesses.

As per the business

scenario in 2018, a

significant increase in

current ratio is seen.

This may be due to

increase in current

It is possible that the

current assets of the

business might be

materially misstated

and thereby this

would also mean that

the financial

statements of the

business are showing

an appropriate view

of the financial

position of the

business (Broberg,

Test of details is to be

performed by the

auditor for

ascertaining whether

the current assets

balances which is

projected in the

annual report of the

business is showing

true and fair view of

the financial situation

or not. The auditor

needs to test all the

2

AUDITING

assets of the business

in relation to current

liabilities of the

business.

Umans & Gerlofstig,

2013).

relevant documents

which are associated

with payment of

current liabilities and

ensure that both

current assets and

current liabilities of

the business are

appropriately valued.

Quick Ratio The quick ratio is an

extension of the

current assets but the

same deals with

assets which are more

liquid in nature and

the ratio signifies

how well the

management of the

company can take

care of the most

immediate liabilities

of the business.

Any misstatement of

the current assets of

the business would

also affect the quick

ratio and therefore it

would also affect the

financial position of

the business.

The auditor of the

company needs to

apply test of details

and test of control

while assessing the

balances of the

current assets and

liabilities of the

business

(Appelbaum, Kogan

& Vasarhelyi, 2017).

The auditor needs

apply verification

process for ensuring

that the assets are

properly valued and

presented in the

annual reports of the

business.

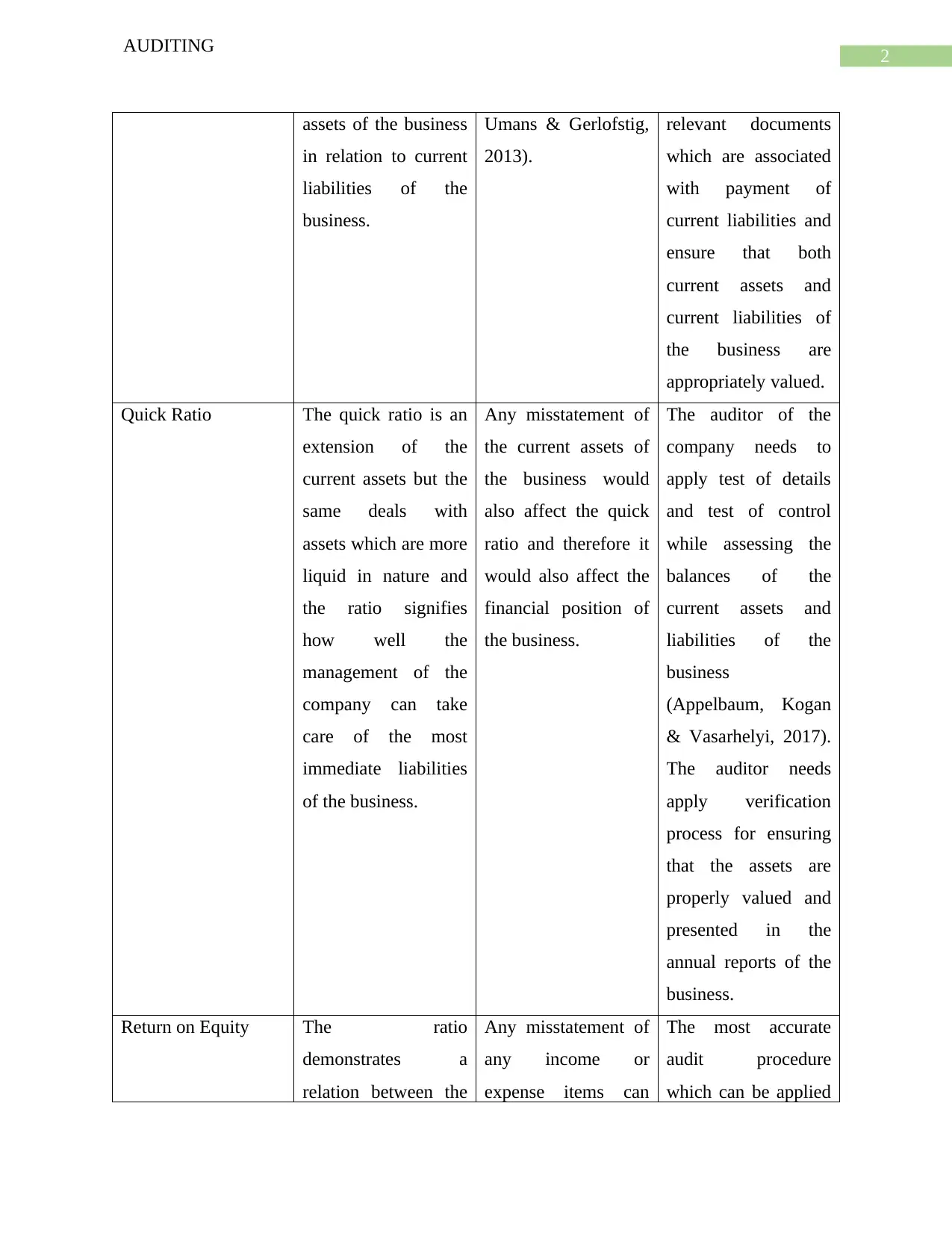

Return on Equity The ratio

demonstrates a

relation between the

Any misstatement of

any income or

expense items can

The most accurate

audit procedure

which can be applied

AUDITING

assets of the business

in relation to current

liabilities of the

business.

Umans & Gerlofstig,

2013).

relevant documents

which are associated

with payment of

current liabilities and

ensure that both

current assets and

current liabilities of

the business are

appropriately valued.

Quick Ratio The quick ratio is an

extension of the

current assets but the

same deals with

assets which are more

liquid in nature and

the ratio signifies

how well the

management of the

company can take

care of the most

immediate liabilities

of the business.

Any misstatement of

the current assets of

the business would

also affect the quick

ratio and therefore it

would also affect the

financial position of

the business.

The auditor of the

company needs to

apply test of details

and test of control

while assessing the

balances of the

current assets and

liabilities of the

business

(Appelbaum, Kogan

& Vasarhelyi, 2017).

The auditor needs

apply verification

process for ensuring

that the assets are

properly valued and

presented in the

annual reports of the

business.

Return on Equity The ratio

demonstrates a

relation between the

Any misstatement of

any income or

expense items can

The most accurate

audit procedure

which can be applied

3

AUDITING

profits which is

generated by the

business and equity

capital used for

generating the profits.

As per the analysis,

there has been an

decrease in the

estimate and the same

is shown to be lower

than industry

average. This may be

due to fall in profits

of the business.

affect the profit of the

business and

therefore the financial

position of the

business is also

affected. A decrease

or misstatement

associated with

equity capital can

also affect the ratio.

in such a case is Test

of Details which

would effectively

analyse whether the

financial statement is

misstated or not in

terms of income or

any expense items.

The auditor of the

business also needs to

check the books of

accounts and all other

relevant document in

a detailed manner to

avoid any audit risk

which may arise.

Return on Total Asset This ratio is

considered to be one

of the indicators of

the success of the

business. The ratio

shows that there has

been a decrease in the

estimate of API in

2018. This is also an

indicator that the

management of the

company is not using

the assets of the

business

appropriately.

The main risk which

is identified in case of

this ratio is material

misstatement in

valuing the assets of

the business or it is

also possible that the

profit of the business

might be misstated.

Therefore, it can be

said that the financial

statement is not

showing true and fair

view of the business.

Performance.

The auditor needs to

apply Test of details

process as the same

would assess every

transaction related to

income or expense

items of the business

for ensuring that they

are accurate in nature.

The auditor would

also be adopting

verification process

for valuing the assets

of the business in

order to give him

AUDITING

profits which is

generated by the

business and equity

capital used for

generating the profits.

As per the analysis,

there has been an

decrease in the

estimate and the same

is shown to be lower

than industry

average. This may be

due to fall in profits

of the business.

affect the profit of the

business and

therefore the financial

position of the

business is also

affected. A decrease

or misstatement

associated with

equity capital can

also affect the ratio.

in such a case is Test

of Details which

would effectively

analyse whether the

financial statement is

misstated or not in

terms of income or

any expense items.

The auditor of the

business also needs to

check the books of

accounts and all other

relevant document in

a detailed manner to

avoid any audit risk

which may arise.

Return on Total Asset This ratio is

considered to be one

of the indicators of

the success of the

business. The ratio

shows that there has

been a decrease in the

estimate of API in

2018. This is also an

indicator that the

management of the

company is not using

the assets of the

business

appropriately.

The main risk which

is identified in case of

this ratio is material

misstatement in

valuing the assets of

the business or it is

also possible that the

profit of the business

might be misstated.

Therefore, it can be

said that the financial

statement is not

showing true and fair

view of the business.

Performance.

The auditor needs to

apply Test of details

process as the same

would assess every

transaction related to

income or expense

items of the business

for ensuring that they

are accurate in nature.

The auditor would

also be adopting

verification process

for valuing the assets

of the business in

order to give him

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

AUDITING

satisfaction that the

same is showing a

true and fair view.

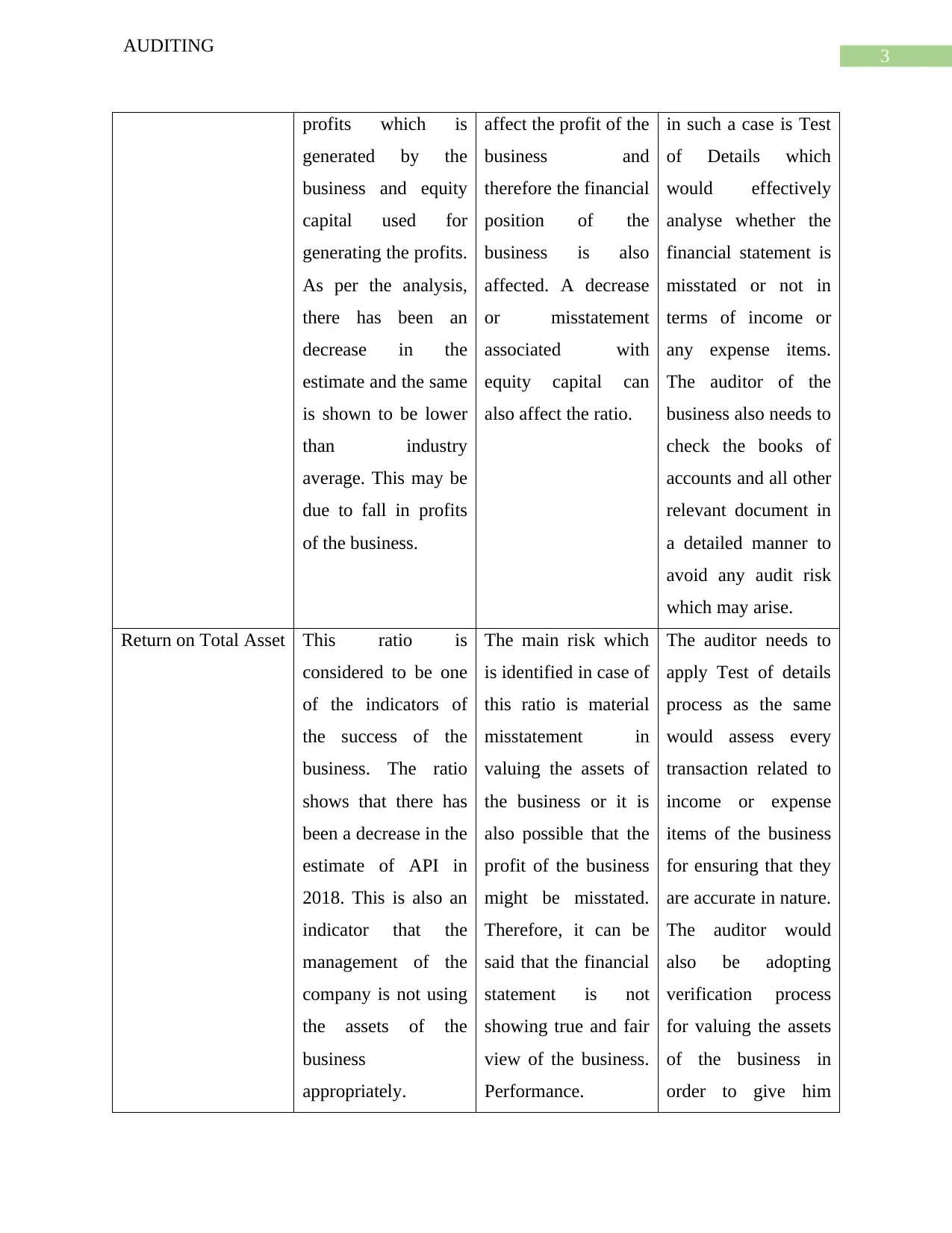

Gross Margin The gross profit

margin of the

business is shown to

be on fall in 2018 and

the ratio is also

shown to be lower

than industry

average. The cause

for the same might be

due to low sales or

low profits of the

business or high cost

of sales in the

business.

Audit risks arises

when there is a

misstatement in value

of sales or profits or

cost of sales of the

business. This would

wrongly represent the

profits of the business

and affect the

decision-making

process of the

investors of the

company.

The main tests which

can be applied by the

auditor in such a case

is test of details and

test of control. The

auditor needs to

check all the balances

of the transactions

relating to sales of

trading expenses and

in combination to

this, the auditor also

needs to check

whether the internal

control system is

working

appropriately or not.

Marketing Expenses The marketing

expenses of the

business reveal a

significant increase

which can affect the

profitability of the

business directly.

Any misstatement in

the market expenses

of the business would

affect the total costs

and profits of the

business thereby

misrepresenting them

for the business of

API.

In such a case, test of

details is the correct

approach which the

auditor of the

company needs to

adopt in order to

ascertain the

expenses figures are

showing accurate

results or not (Hay,

2014). Misstatement

AUDITING

satisfaction that the

same is showing a

true and fair view.

Gross Margin The gross profit

margin of the

business is shown to

be on fall in 2018 and

the ratio is also

shown to be lower

than industry

average. The cause

for the same might be

due to low sales or

low profits of the

business or high cost

of sales in the

business.

Audit risks arises

when there is a

misstatement in value

of sales or profits or

cost of sales of the

business. This would

wrongly represent the

profits of the business

and affect the

decision-making

process of the

investors of the

company.

The main tests which

can be applied by the

auditor in such a case

is test of details and

test of control. The

auditor needs to

check all the balances

of the transactions

relating to sales of

trading expenses and

in combination to

this, the auditor also

needs to check

whether the internal

control system is

working

appropriately or not.

Marketing Expenses The marketing

expenses of the

business reveal a

significant increase

which can affect the

profitability of the

business directly.

Any misstatement in

the market expenses

of the business would

affect the total costs

and profits of the

business thereby

misrepresenting them

for the business of

API.

In such a case, test of

details is the correct

approach which the

auditor of the

company needs to

adopt in order to

ascertain the

expenses figures are

showing accurate

results or not (Hay,

2014). Misstatement

5

AUDITING

in the accounting

records can be

identified by applying

vouching practices in

the business.

Effective

identification helps

the management to

takes steps for

reducing the risks

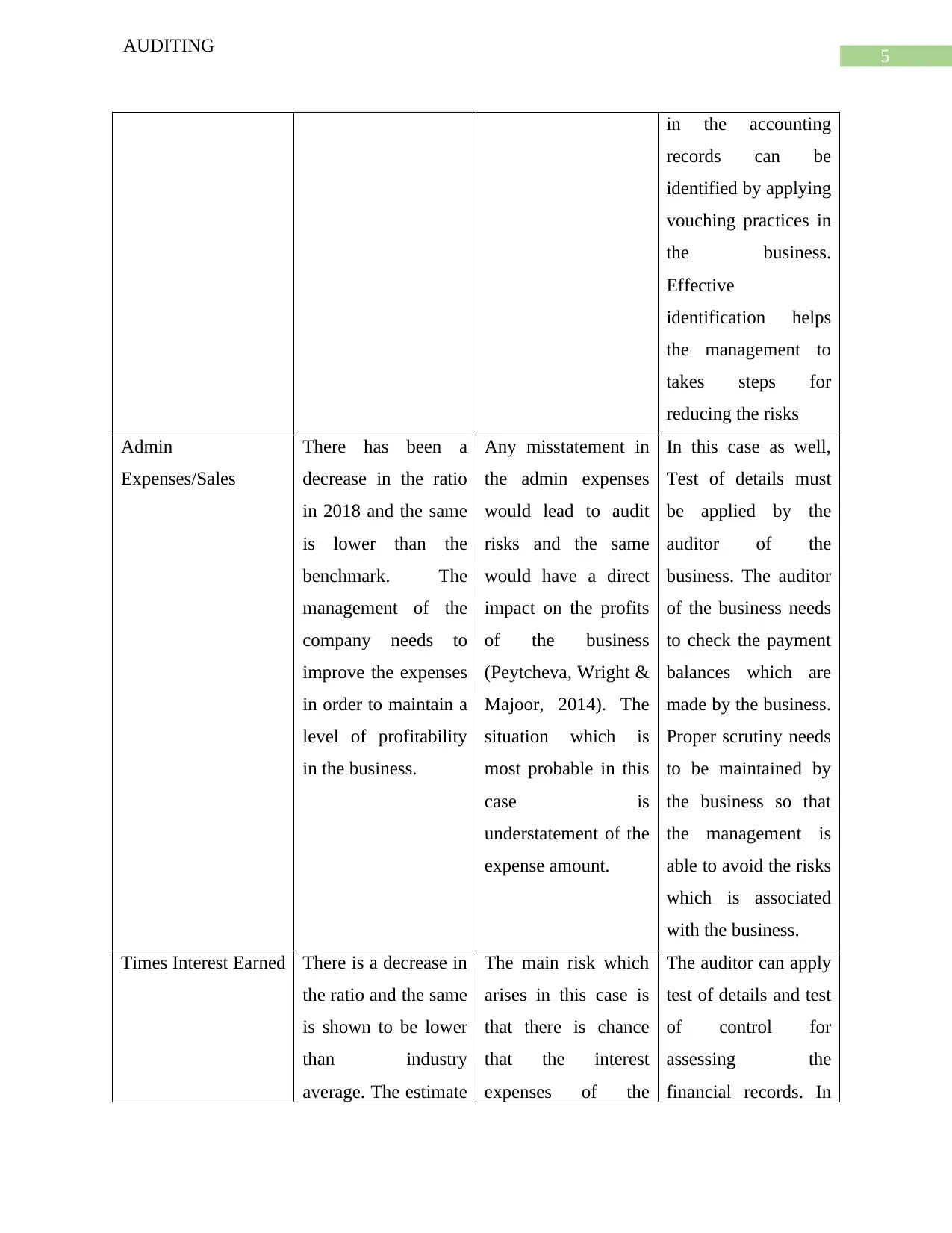

Admin

Expenses/Sales

There has been a

decrease in the ratio

in 2018 and the same

is lower than the

benchmark. The

management of the

company needs to

improve the expenses

in order to maintain a

level of profitability

in the business.

Any misstatement in

the admin expenses

would lead to audit

risks and the same

would have a direct

impact on the profits

of the business

(Peytcheva, Wright &

Majoor, 2014). The

situation which is

most probable in this

case is

understatement of the

expense amount.

In this case as well,

Test of details must

be applied by the

auditor of the

business. The auditor

of the business needs

to check the payment

balances which are

made by the business.

Proper scrutiny needs

to be maintained by

the business so that

the management is

able to avoid the risks

which is associated

with the business.

Times Interest Earned There is a decrease in

the ratio and the same

is shown to be lower

than industry

average. The estimate

The main risk which

arises in this case is

that there is chance

that the interest

expenses of the

The auditor can apply

test of details and test

of control for

assessing the

financial records. In

AUDITING

in the accounting

records can be

identified by applying

vouching practices in

the business.

Effective

identification helps

the management to

takes steps for

reducing the risks

Admin

Expenses/Sales

There has been a

decrease in the ratio

in 2018 and the same

is lower than the

benchmark. The

management of the

company needs to

improve the expenses

in order to maintain a

level of profitability

in the business.

Any misstatement in

the admin expenses

would lead to audit

risks and the same

would have a direct

impact on the profits

of the business

(Peytcheva, Wright &

Majoor, 2014). The

situation which is

most probable in this

case is

understatement of the

expense amount.

In this case as well,

Test of details must

be applied by the

auditor of the

business. The auditor

of the business needs

to check the payment

balances which are

made by the business.

Proper scrutiny needs

to be maintained by

the business so that

the management is

able to avoid the risks

which is associated

with the business.

Times Interest Earned There is a decrease in

the ratio and the same

is shown to be lower

than industry

average. The estimate

The main risk which

arises in this case is

that there is chance

that the interest

expenses of the

The auditor can apply

test of details and test

of control for

assessing the

financial records. In

6

AUDITING

signifies that the

company has made

lower interest

payment during the

year.

business might be

understated which

would create a

material misstatement

in the financial

accounts of the

business.

this instances, the

auditor also needs to

check all the other

details which are

applicable to verify

that the financial

statement are free

from material

misstatements

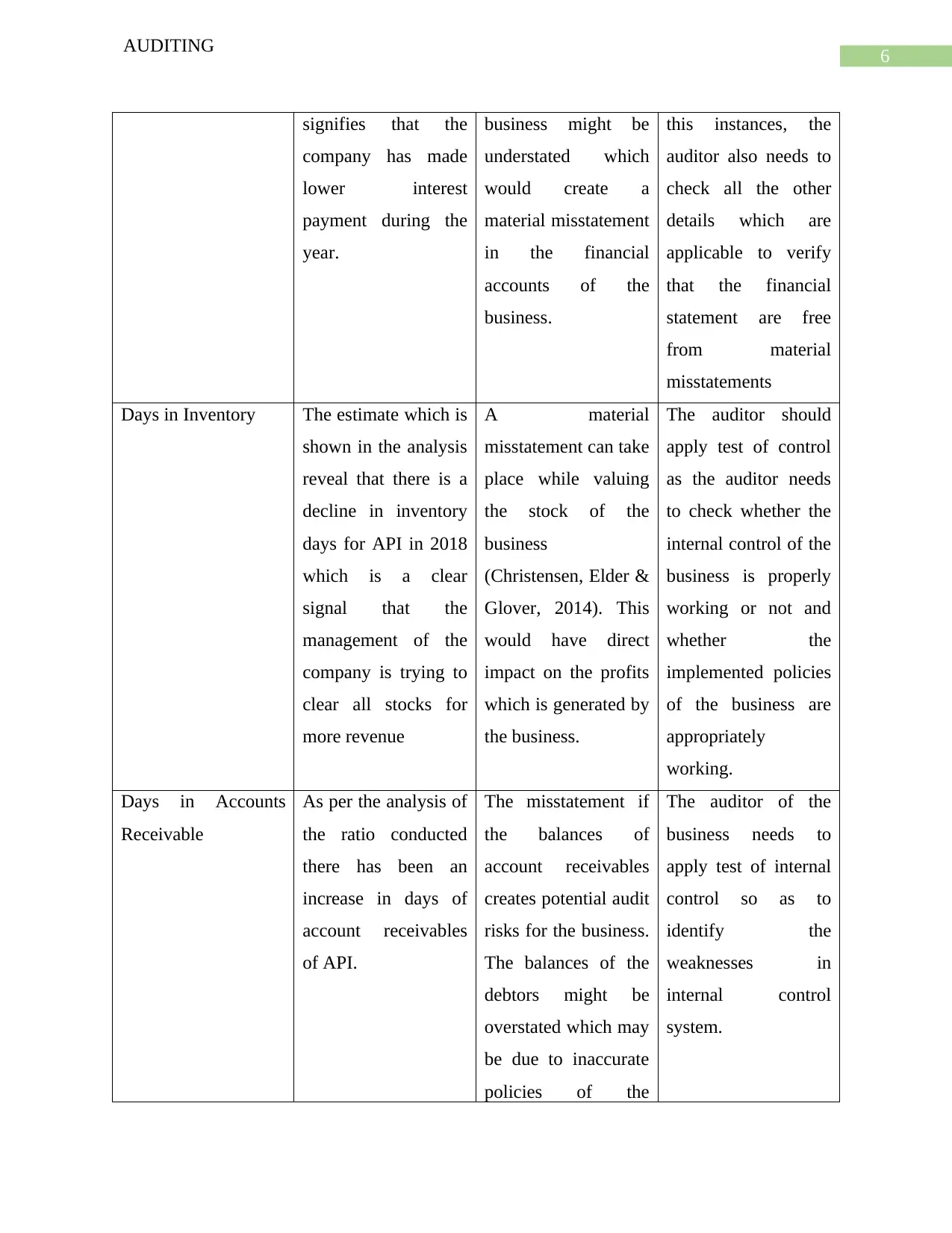

Days in Inventory The estimate which is

shown in the analysis

reveal that there is a

decline in inventory

days for API in 2018

which is a clear

signal that the

management of the

company is trying to

clear all stocks for

more revenue

A material

misstatement can take

place while valuing

the stock of the

business

(Christensen, Elder &

Glover, 2014). This

would have direct

impact on the profits

which is generated by

the business.

The auditor should

apply test of control

as the auditor needs

to check whether the

internal control of the

business is properly

working or not and

whether the

implemented policies

of the business are

appropriately

working.

Days in Accounts

Receivable

As per the analysis of

the ratio conducted

there has been an

increase in days of

account receivables

of API.

The misstatement if

the balances of

account receivables

creates potential audit

risks for the business.

The balances of the

debtors might be

overstated which may

be due to inaccurate

policies of the

The auditor of the

business needs to

apply test of internal

control so as to

identify the

weaknesses in

internal control

system.

AUDITING

signifies that the

company has made

lower interest

payment during the

year.

business might be

understated which

would create a

material misstatement

in the financial

accounts of the

business.

this instances, the

auditor also needs to

check all the other

details which are

applicable to verify

that the financial

statement are free

from material

misstatements

Days in Inventory The estimate which is

shown in the analysis

reveal that there is a

decline in inventory

days for API in 2018

which is a clear

signal that the

management of the

company is trying to

clear all stocks for

more revenue

A material

misstatement can take

place while valuing

the stock of the

business

(Christensen, Elder &

Glover, 2014). This

would have direct

impact on the profits

which is generated by

the business.

The auditor should

apply test of control

as the auditor needs

to check whether the

internal control of the

business is properly

working or not and

whether the

implemented policies

of the business are

appropriately

working.

Days in Accounts

Receivable

As per the analysis of

the ratio conducted

there has been an

increase in days of

account receivables

of API.

The misstatement if

the balances of

account receivables

creates potential audit

risks for the business.

The balances of the

debtors might be

overstated which may

be due to inaccurate

policies of the

The auditor of the

business needs to

apply test of internal

control so as to

identify the

weaknesses in

internal control

system.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDITING

business.

Debt to Equity Ratio The ratio which is

shown for API has

decreased which may

due to use of more of

debt capital in the

operations of the

business.

Misstatement in the

amount of debt of the

business would affect

the financial position

of the business as the

capital structure of

the business is

inaccurately

represented.

Test of detail should

be the audit

procedure which is

applied by the auditor

of the business for

conducting the audit

for the company.

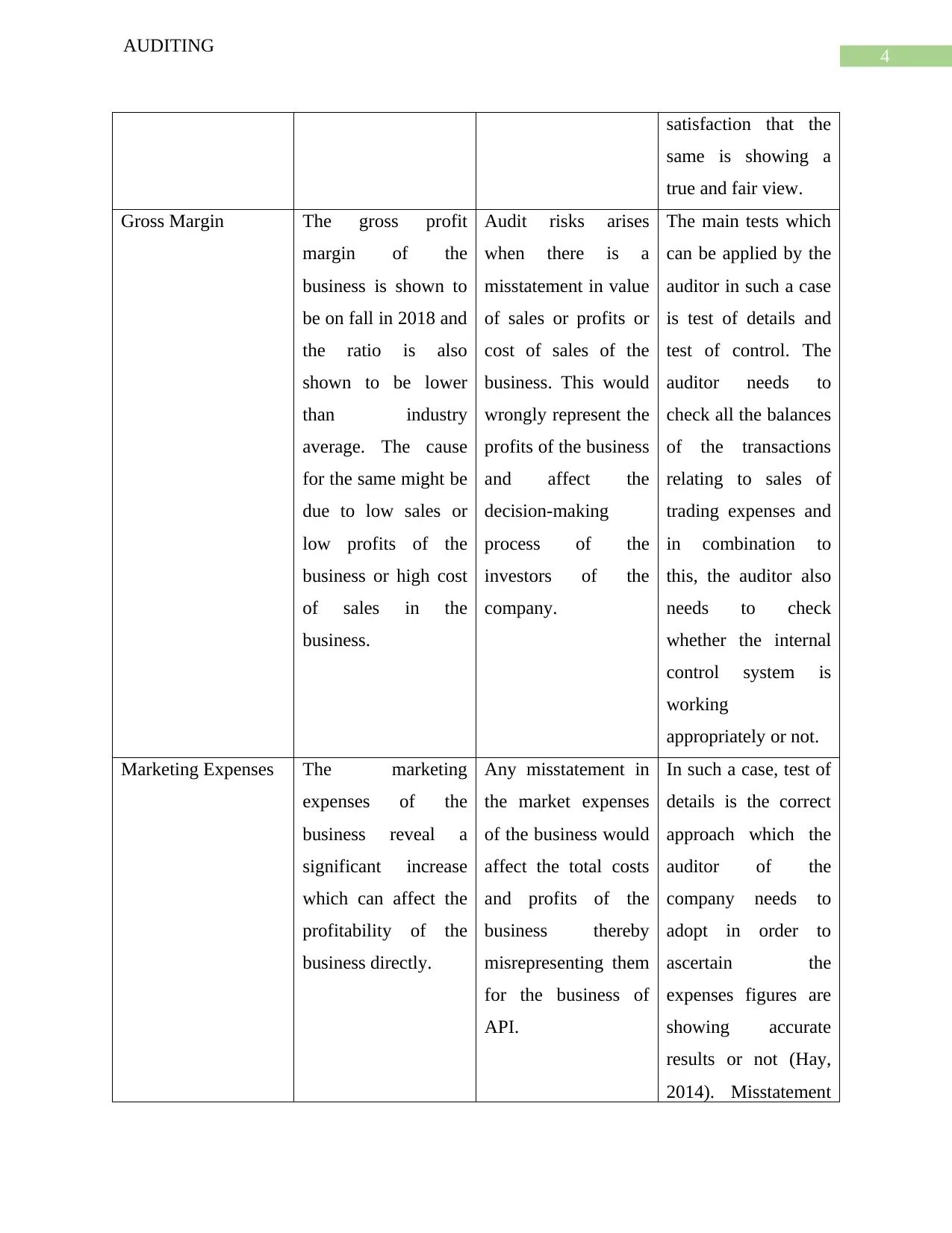

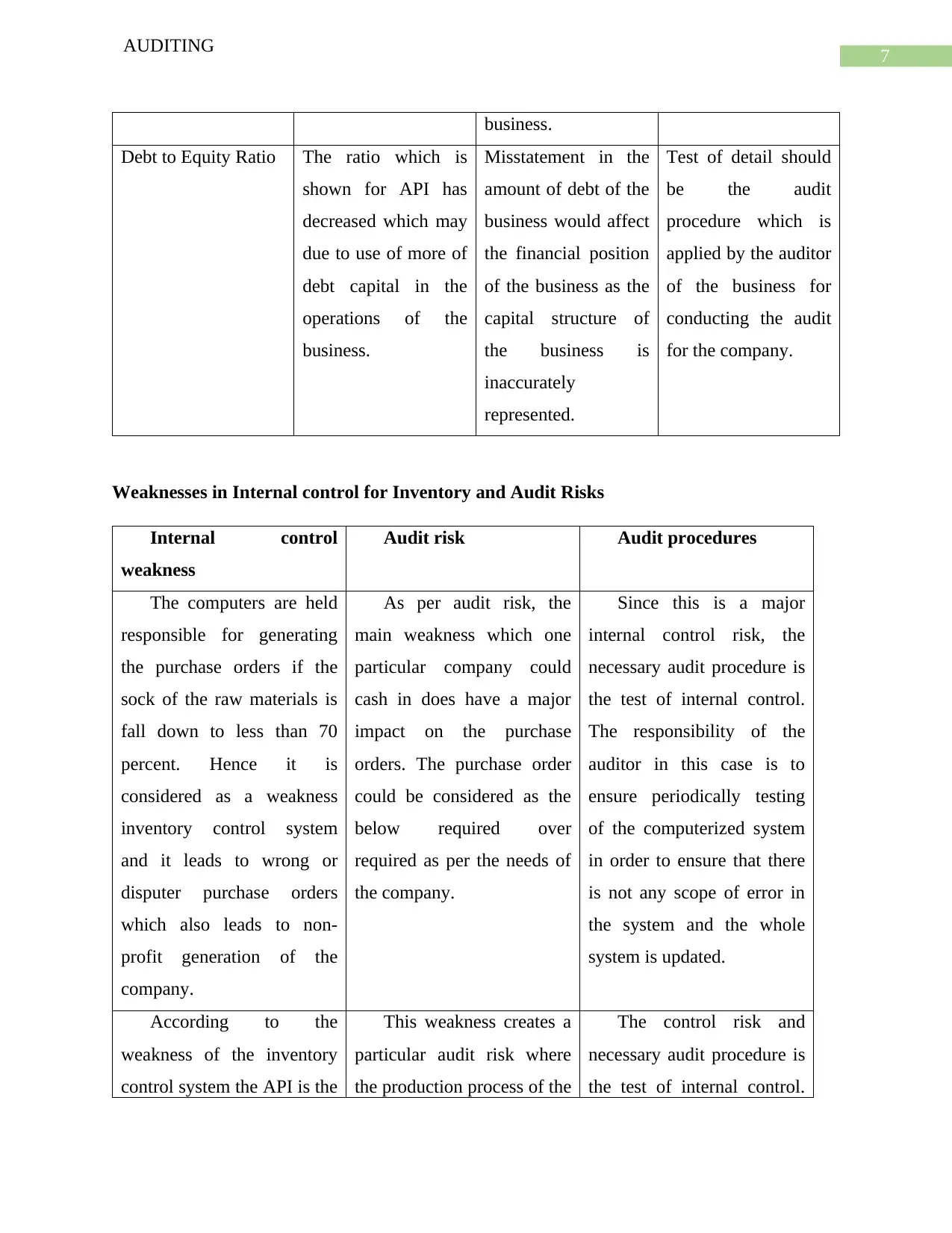

Weaknesses in Internal control for Inventory and Audit Risks

Internal control

weakness

Audit risk Audit procedures

The computers are held

responsible for generating

the purchase orders if the

sock of the raw materials is

fall down to less than 70

percent. Hence it is

considered as a weakness

inventory control system

and it leads to wrong or

disputer purchase orders

which also leads to non-

profit generation of the

company.

As per audit risk, the

main weakness which one

particular company could

cash in does have a major

impact on the purchase

orders. The purchase order

could be considered as the

below required over

required as per the needs of

the company.

Since this is a major

internal control risk, the

necessary audit procedure is

the test of internal control.

The responsibility of the

auditor in this case is to

ensure periodically testing

of the computerized system

in order to ensure that there

is not any scope of error in

the system and the whole

system is updated.

According to the

weakness of the inventory

control system the API is the

This weakness creates a

particular audit risk where

the production process of the

The control risk and

necessary audit procedure is

the test of internal control.

AUDITING

business.

Debt to Equity Ratio The ratio which is

shown for API has

decreased which may

due to use of more of

debt capital in the

operations of the

business.

Misstatement in the

amount of debt of the

business would affect

the financial position

of the business as the

capital structure of

the business is

inaccurately

represented.

Test of detail should

be the audit

procedure which is

applied by the auditor

of the business for

conducting the audit

for the company.

Weaknesses in Internal control for Inventory and Audit Risks

Internal control

weakness

Audit risk Audit procedures

The computers are held

responsible for generating

the purchase orders if the

sock of the raw materials is

fall down to less than 70

percent. Hence it is

considered as a weakness

inventory control system

and it leads to wrong or

disputer purchase orders

which also leads to non-

profit generation of the

company.

As per audit risk, the

main weakness which one

particular company could

cash in does have a major

impact on the purchase

orders. The purchase order

could be considered as the

below required over

required as per the needs of

the company.

Since this is a major

internal control risk, the

necessary audit procedure is

the test of internal control.

The responsibility of the

auditor in this case is to

ensure periodically testing

of the computerized system

in order to ensure that there

is not any scope of error in

the system and the whole

system is updated.

According to the

weakness of the inventory

control system the API is the

This weakness creates a

particular audit risk where

the production process of the

The control risk and

necessary audit procedure is

the test of internal control.

8

AUDITING

sole inventory control

process in every company’s

inventory management

system of the company

production system.

However, the presence of

any kind of error and fraud

will be held responsible for

the company and it can

adversely affect in the

production management.

company can have major

impact (Hassan, 2013). Due

to this risk, here can be over

placement or under

placement of the raw

materials or finished goods

or both. The date can also be

changed which could make

the ordered raw materials

and finished goods of no use

(Oprisor, 2015). And hence

the company could lose a

big amount of business

quickly.

Auditor needs to ensure

periodically testing of the

computerized system in

order to ensure that there is

not any scope of error in the

system and the whole

system is updated.

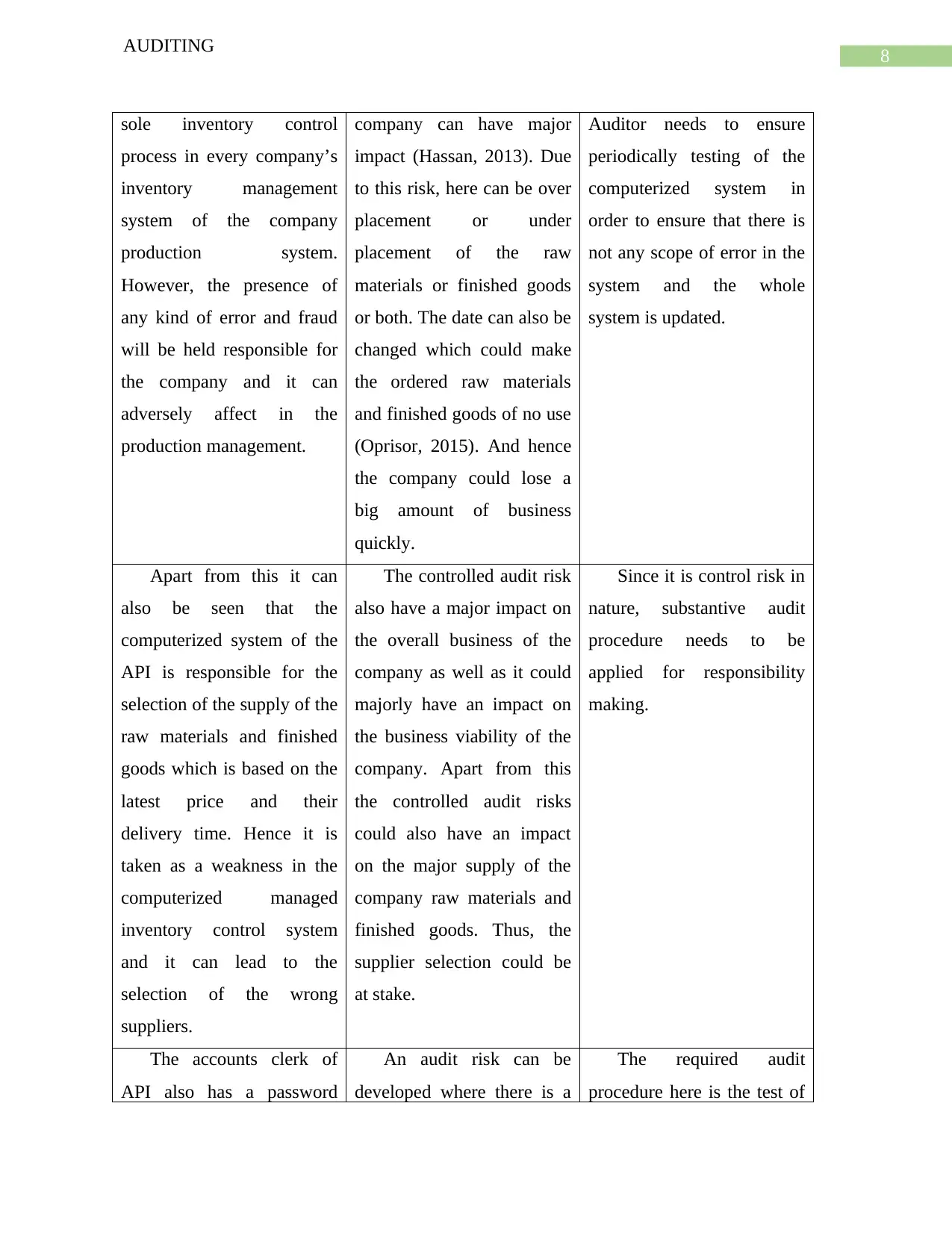

Apart from this it can

also be seen that the

computerized system of the

API is responsible for the

selection of the supply of the

raw materials and finished

goods which is based on the

latest price and their

delivery time. Hence it is

taken as a weakness in the

computerized managed

inventory control system

and it can lead to the

selection of the wrong

suppliers.

The controlled audit risk

also have a major impact on

the overall business of the

company as well as it could

majorly have an impact on

the business viability of the

company. Apart from this

the controlled audit risks

could also have an impact

on the major supply of the

company raw materials and

finished goods. Thus, the

supplier selection could be

at stake.

Since it is control risk in

nature, substantive audit

procedure needs to be

applied for responsibility

making.

The accounts clerk of

API also has a password

An audit risk can be

developed where there is a

The required audit

procedure here is the test of

AUDITING

sole inventory control

process in every company’s

inventory management

system of the company

production system.

However, the presence of

any kind of error and fraud

will be held responsible for

the company and it can

adversely affect in the

production management.

company can have major

impact (Hassan, 2013). Due

to this risk, here can be over

placement or under

placement of the raw

materials or finished goods

or both. The date can also be

changed which could make

the ordered raw materials

and finished goods of no use

(Oprisor, 2015). And hence

the company could lose a

big amount of business

quickly.

Auditor needs to ensure

periodically testing of the

computerized system in

order to ensure that there is

not any scope of error in the

system and the whole

system is updated.

Apart from this it can

also be seen that the

computerized system of the

API is responsible for the

selection of the supply of the

raw materials and finished

goods which is based on the

latest price and their

delivery time. Hence it is

taken as a weakness in the

computerized managed

inventory control system

and it can lead to the

selection of the wrong

suppliers.

The controlled audit risk

also have a major impact on

the overall business of the

company as well as it could

majorly have an impact on

the business viability of the

company. Apart from this

the controlled audit risks

could also have an impact

on the major supply of the

company raw materials and

finished goods. Thus, the

supplier selection could be

at stake.

Since it is control risk in

nature, substantive audit

procedure needs to be

applied for responsibility

making.

The accounts clerk of

API also has a password

An audit risk can be

developed where there is a

The required audit

procedure here is the test of

9

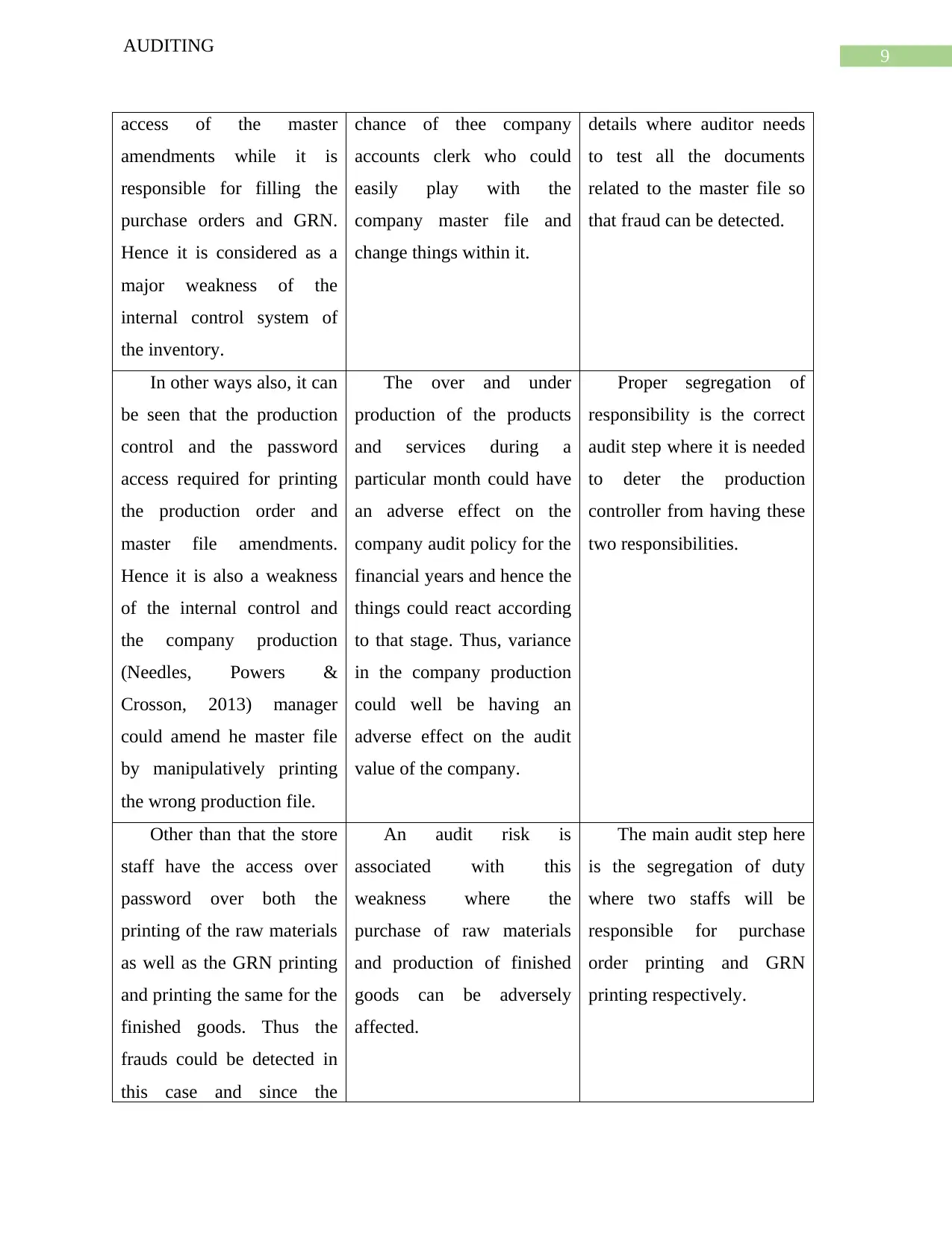

AUDITING

access of the master

amendments while it is

responsible for filling the

purchase orders and GRN.

Hence it is considered as a

major weakness of the

internal control system of

the inventory.

chance of thee company

accounts clerk who could

easily play with the

company master file and

change things within it.

details where auditor needs

to test all the documents

related to the master file so

that fraud can be detected.

In other ways also, it can

be seen that the production

control and the password

access required for printing

the production order and

master file amendments.

Hence it is also a weakness

of the internal control and

the company production

(Needles, Powers &

Crosson, 2013) manager

could amend he master file

by manipulatively printing

the wrong production file.

The over and under

production of the products

and services during a

particular month could have

an adverse effect on the

company audit policy for the

financial years and hence the

things could react according

to that stage. Thus, variance

in the company production

could well be having an

adverse effect on the audit

value of the company.

Proper segregation of

responsibility is the correct

audit step where it is needed

to deter the production

controller from having these

two responsibilities.

Other than that the store

staff have the access over

password over both the

printing of the raw materials

as well as the GRN printing

and printing the same for the

finished goods. Thus the

frauds could be detected in

this case and since the

An audit risk is

associated with this

weakness where the

purchase of raw materials

and production of finished

goods can be adversely

affected.

The main audit step here

is the segregation of duty

where two staffs will be

responsible for purchase

order printing and GRN

printing respectively.

AUDITING

access of the master

amendments while it is

responsible for filling the

purchase orders and GRN.

Hence it is considered as a

major weakness of the

internal control system of

the inventory.

chance of thee company

accounts clerk who could

easily play with the

company master file and

change things within it.

details where auditor needs

to test all the documents

related to the master file so

that fraud can be detected.

In other ways also, it can

be seen that the production

control and the password

access required for printing

the production order and

master file amendments.

Hence it is also a weakness

of the internal control and

the company production

(Needles, Powers &

Crosson, 2013) manager

could amend he master file

by manipulatively printing

the wrong production file.

The over and under

production of the products

and services during a

particular month could have

an adverse effect on the

company audit policy for the

financial years and hence the

things could react according

to that stage. Thus, variance

in the company production

could well be having an

adverse effect on the audit

value of the company.

Proper segregation of

responsibility is the correct

audit step where it is needed

to deter the production

controller from having these

two responsibilities.

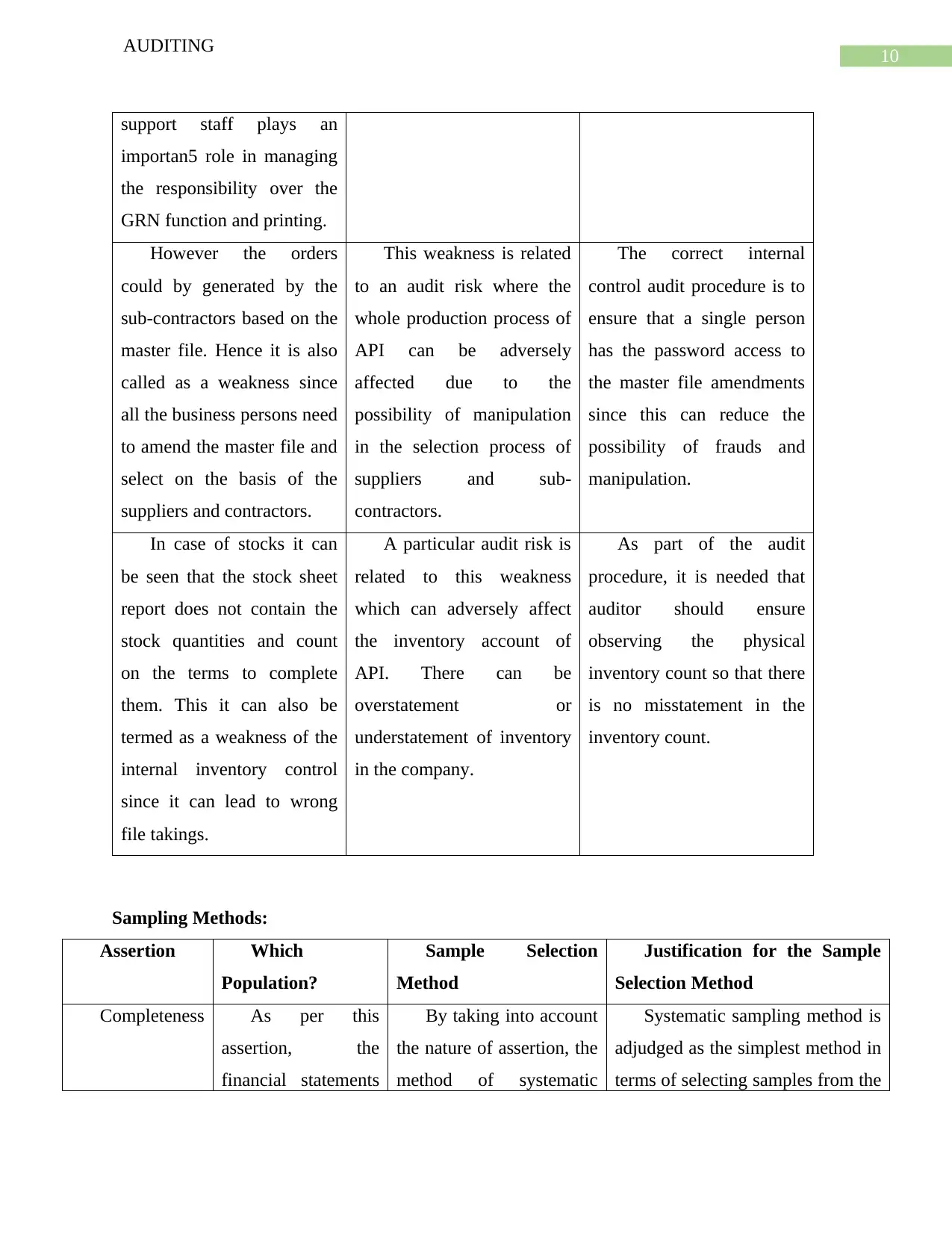

Other than that the store

staff have the access over

password over both the

printing of the raw materials

as well as the GRN printing

and printing the same for the

finished goods. Thus the

frauds could be detected in

this case and since the

An audit risk is

associated with this

weakness where the

purchase of raw materials

and production of finished

goods can be adversely

affected.

The main audit step here

is the segregation of duty

where two staffs will be

responsible for purchase

order printing and GRN

printing respectively.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

AUDITING

support staff plays an

importan5 role in managing

the responsibility over the

GRN function and printing.

However the orders

could by generated by the

sub-contractors based on the

master file. Hence it is also

called as a weakness since

all the business persons need

to amend the master file and

select on the basis of the

suppliers and contractors.

This weakness is related

to an audit risk where the

whole production process of

API can be adversely

affected due to the

possibility of manipulation

in the selection process of

suppliers and sub-

contractors.

The correct internal

control audit procedure is to

ensure that a single person

has the password access to

the master file amendments

since this can reduce the

possibility of frauds and

manipulation.

In case of stocks it can

be seen that the stock sheet

report does not contain the

stock quantities and count

on the terms to complete

them. This it can also be

termed as a weakness of the

internal inventory control

since it can lead to wrong

file takings.

A particular audit risk is

related to this weakness

which can adversely affect

the inventory account of

API. There can be

overstatement or

understatement of inventory

in the company.

As part of the audit

procedure, it is needed that

auditor should ensure

observing the physical

inventory count so that there

is no misstatement in the

inventory count.

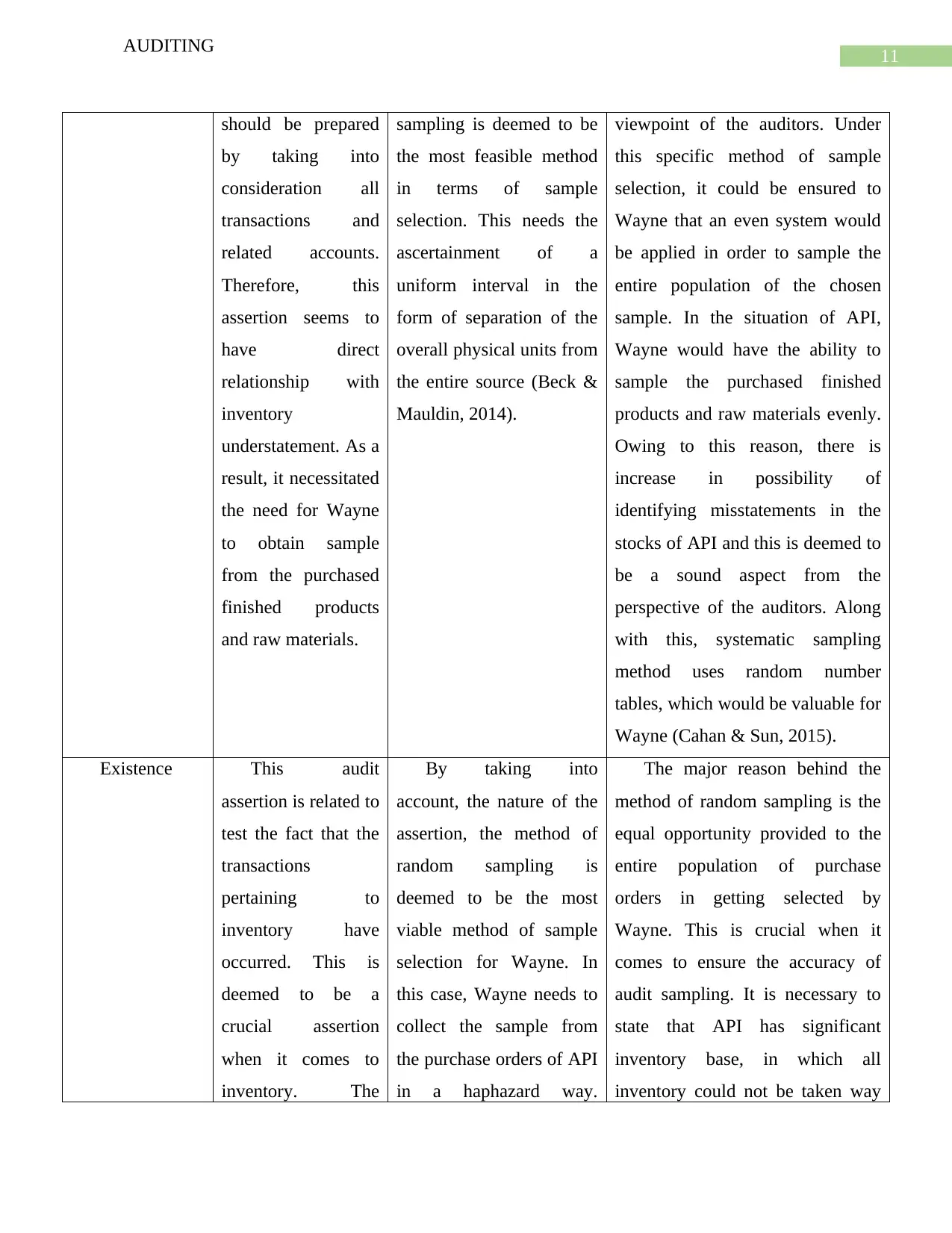

Sampling Methods:

Assertion Which

Population?

Sample Selection

Method

Justification for the Sample

Selection Method

Completeness As per this

assertion, the

financial statements

By taking into account

the nature of assertion, the

method of systematic

Systematic sampling method is

adjudged as the simplest method in

terms of selecting samples from the

AUDITING

support staff plays an

importan5 role in managing

the responsibility over the

GRN function and printing.

However the orders

could by generated by the

sub-contractors based on the

master file. Hence it is also

called as a weakness since

all the business persons need

to amend the master file and

select on the basis of the

suppliers and contractors.

This weakness is related

to an audit risk where the

whole production process of

API can be adversely

affected due to the

possibility of manipulation

in the selection process of

suppliers and sub-

contractors.

The correct internal

control audit procedure is to

ensure that a single person

has the password access to

the master file amendments

since this can reduce the

possibility of frauds and

manipulation.

In case of stocks it can

be seen that the stock sheet

report does not contain the

stock quantities and count

on the terms to complete

them. This it can also be

termed as a weakness of the

internal inventory control

since it can lead to wrong

file takings.

A particular audit risk is

related to this weakness

which can adversely affect

the inventory account of

API. There can be

overstatement or

understatement of inventory

in the company.

As part of the audit

procedure, it is needed that

auditor should ensure

observing the physical

inventory count so that there

is no misstatement in the

inventory count.

Sampling Methods:

Assertion Which

Population?

Sample Selection

Method

Justification for the Sample

Selection Method

Completeness As per this

assertion, the

financial statements

By taking into account

the nature of assertion, the

method of systematic

Systematic sampling method is

adjudged as the simplest method in

terms of selecting samples from the

11

AUDITING

should be prepared

by taking into

consideration all

transactions and

related accounts.

Therefore, this

assertion seems to

have direct

relationship with

inventory

understatement. As a

result, it necessitated

the need for Wayne

to obtain sample

from the purchased

finished products

and raw materials.

sampling is deemed to be

the most feasible method

in terms of sample

selection. This needs the

ascertainment of a

uniform interval in the

form of separation of the

overall physical units from

the entire source (Beck &

Mauldin, 2014).

viewpoint of the auditors. Under

this specific method of sample

selection, it could be ensured to

Wayne that an even system would

be applied in order to sample the

entire population of the chosen

sample. In the situation of API,

Wayne would have the ability to

sample the purchased finished

products and raw materials evenly.

Owing to this reason, there is

increase in possibility of

identifying misstatements in the

stocks of API and this is deemed to

be a sound aspect from the

perspective of the auditors. Along

with this, systematic sampling

method uses random number

tables, which would be valuable for

Wayne (Cahan & Sun, 2015).

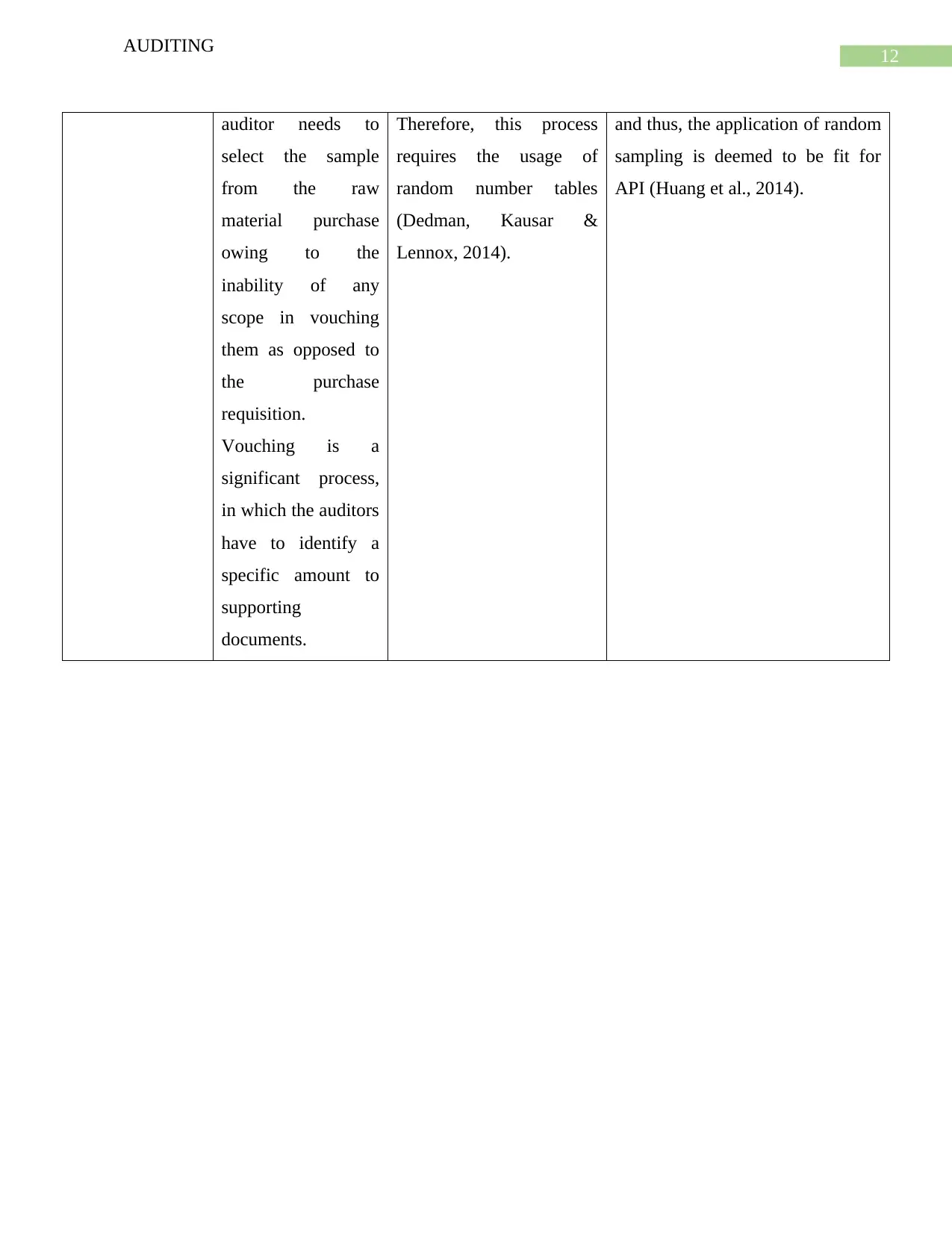

Existence This audit

assertion is related to

test the fact that the

transactions

pertaining to

inventory have

occurred. This is

deemed to be a

crucial assertion

when it comes to

inventory. The

By taking into

account, the nature of the

assertion, the method of

random sampling is

deemed to be the most

viable method of sample

selection for Wayne. In

this case, Wayne needs to

collect the sample from

the purchase orders of API

in a haphazard way.

The major reason behind the

method of random sampling is the

equal opportunity provided to the

entire population of purchase

orders in getting selected by

Wayne. This is crucial when it

comes to ensure the accuracy of

audit sampling. It is necessary to

state that API has significant

inventory base, in which all

inventory could not be taken way

AUDITING

should be prepared

by taking into

consideration all

transactions and

related accounts.

Therefore, this

assertion seems to

have direct

relationship with

inventory

understatement. As a

result, it necessitated

the need for Wayne

to obtain sample

from the purchased

finished products

and raw materials.

sampling is deemed to be

the most feasible method

in terms of sample

selection. This needs the

ascertainment of a

uniform interval in the

form of separation of the

overall physical units from

the entire source (Beck &

Mauldin, 2014).

viewpoint of the auditors. Under

this specific method of sample

selection, it could be ensured to

Wayne that an even system would

be applied in order to sample the

entire population of the chosen

sample. In the situation of API,

Wayne would have the ability to

sample the purchased finished

products and raw materials evenly.

Owing to this reason, there is

increase in possibility of

identifying misstatements in the

stocks of API and this is deemed to

be a sound aspect from the

perspective of the auditors. Along

with this, systematic sampling

method uses random number

tables, which would be valuable for

Wayne (Cahan & Sun, 2015).

Existence This audit

assertion is related to

test the fact that the

transactions

pertaining to

inventory have

occurred. This is

deemed to be a

crucial assertion

when it comes to

inventory. The

By taking into

account, the nature of the

assertion, the method of

random sampling is

deemed to be the most

viable method of sample

selection for Wayne. In

this case, Wayne needs to

collect the sample from

the purchase orders of API

in a haphazard way.

The major reason behind the

method of random sampling is the

equal opportunity provided to the

entire population of purchase

orders in getting selected by

Wayne. This is crucial when it

comes to ensure the accuracy of

audit sampling. It is necessary to

state that API has significant

inventory base, in which all

inventory could not be taken way

12

AUDITING

auditor needs to

select the sample

from the raw

material purchase

owing to the

inability of any

scope in vouching

them as opposed to

the purchase

requisition.

Vouching is a

significant process,

in which the auditors

have to identify a

specific amount to

supporting

documents.

Therefore, this process

requires the usage of

random number tables

(Dedman, Kausar &

Lennox, 2014).

and thus, the application of random

sampling is deemed to be fit for

API (Huang et al., 2014).

AUDITING

auditor needs to

select the sample

from the raw

material purchase

owing to the

inability of any

scope in vouching

them as opposed to

the purchase

requisition.

Vouching is a

significant process,

in which the auditors

have to identify a

specific amount to

supporting

documents.

Therefore, this process

requires the usage of

random number tables

(Dedman, Kausar &

Lennox, 2014).

and thus, the application of random

sampling is deemed to be fit for

API (Huang et al., 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

AUDITING

Reference

Appelbaum, D., Kogan, A., & Vasarhelyi, M. A. (2017). Big Data and analytics in the modern

audit engagement: Research needs. Auditing: A Journal of Practice & Theory, 36(4), 1-

27.

Beck, M. J., & Mauldin, E. G. (2014). Who's really in charge? Audit committee versus CFO

power and audit fees. The Accounting Review, 89(6), 2057-2085.

Broberg, P., Umans, T., & Gerlofstig, C. (2013). Balance between auditing and marketing: An

explorative study. Journal of International Accounting, Auditing and Taxation, 22(1), 57-

70.

Cahan, S. F., & Sun, J. (2015). The effect of audit experience on audit fees and audit

quality. Journal of Accounting, Auditing & Finance, 30(1), 78-100.

Christensen, B. E., Elder, R. J., & Glover, S. M. (2014). Behind the numbers: Insights into large

audit firm sampling policies. Accounting Horizons, 29(1), 61-81.

Dedman, E., Kausar, A., & Lennox, C. (2014). The demand for audit in private firms: recent

large-sample evidence from the UK. European Accounting Review, 23(1), 1-23.

Gustavson, M. (2015). Does good auditing generate quality of government?.

Hassan, M. K. (2013). Ethical principles of Islamic financial institutions. Journal of Economic

Cooperation and Development, 34(1), 63-90.

Hay, D. (2014). Auditing, international auditing and the International Journal of

Auditing. International Journal of Auditing, 18(1), 1-1.

AUDITING

Reference

Appelbaum, D., Kogan, A., & Vasarhelyi, M. A. (2017). Big Data and analytics in the modern

audit engagement: Research needs. Auditing: A Journal of Practice & Theory, 36(4), 1-

27.

Beck, M. J., & Mauldin, E. G. (2014). Who's really in charge? Audit committee versus CFO

power and audit fees. The Accounting Review, 89(6), 2057-2085.

Broberg, P., Umans, T., & Gerlofstig, C. (2013). Balance between auditing and marketing: An

explorative study. Journal of International Accounting, Auditing and Taxation, 22(1), 57-

70.

Cahan, S. F., & Sun, J. (2015). The effect of audit experience on audit fees and audit

quality. Journal of Accounting, Auditing & Finance, 30(1), 78-100.

Christensen, B. E., Elder, R. J., & Glover, S. M. (2014). Behind the numbers: Insights into large

audit firm sampling policies. Accounting Horizons, 29(1), 61-81.

Dedman, E., Kausar, A., & Lennox, C. (2014). The demand for audit in private firms: recent

large-sample evidence from the UK. European Accounting Review, 23(1), 1-23.

Gustavson, M. (2015). Does good auditing generate quality of government?.

Hassan, M. K. (2013). Ethical principles of Islamic financial institutions. Journal of Economic

Cooperation and Development, 34(1), 63-90.

Hay, D. (2014). Auditing, international auditing and the International Journal of

Auditing. International Journal of Auditing, 18(1), 1-1.

14

AUDITING

Huang, H. W., Parker, R. J., Yan, Y. C. A., & Lin, Y. H. (2014). CEO turnover and audit

pricing. Accounting Horizons, 28(2), 297-312.

Needles, B. E., Powers, M., & Crosson, S. V. (2013). Principles of accounting. Cengage

Learning.

Oprisor, T. (2015). Auditing integrated reports: Are there solutions to this puzzle?. Procedia

Economics and Finance, 25, 87-95.

Peytcheva, M., Wright, A. M., & Majoor, B. (2014). The impact of principles-based versus rules-

based accounting standards on auditors' motivations and evidence demands. Behavioral

Research in Accounting, 26(2), 51-72.

William Jr, M., Glover, S., & Prawitt, D. (2016). Auditing and assurance services: A systematic

approach. McGraw-Hill Education.

Zakari, M. (2013). Accounting and Auditing in Developing Countries-Arab Countries. Journal

of Economics and Political Sciences, Tripoli University, 16(10), 1-27.

AUDITING

Huang, H. W., Parker, R. J., Yan, Y. C. A., & Lin, Y. H. (2014). CEO turnover and audit

pricing. Accounting Horizons, 28(2), 297-312.

Needles, B. E., Powers, M., & Crosson, S. V. (2013). Principles of accounting. Cengage

Learning.

Oprisor, T. (2015). Auditing integrated reports: Are there solutions to this puzzle?. Procedia

Economics and Finance, 25, 87-95.

Peytcheva, M., Wright, A. M., & Majoor, B. (2014). The impact of principles-based versus rules-

based accounting standards on auditors' motivations and evidence demands. Behavioral

Research in Accounting, 26(2), 51-72.

William Jr, M., Glover, S., & Prawitt, D. (2016). Auditing and assurance services: A systematic

approach. McGraw-Hill Education.

Zakari, M. (2013). Accounting and Auditing in Developing Countries-Arab Countries. Journal

of Economics and Political Sciences, Tripoli University, 16(10), 1-27.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.