ACC621 Auditing Practice Report: Materiality and Fraud Risks

VerifiedAdded on 2023/06/08

|15

|2181

|447

Report

AI Summary

This report provides a comprehensive analysis of auditing practices, focusing on the audit of Chamoisee Enterprises. The report begins by addressing the concept of materiality in financial reporting, explaining its significance and how auditors determine materiality thresholds. It then examines the financial statements of Chamoisee Enterprises, including trend analysis of key accounts like sales, cost of goods sold, and net profit. The report identifies potential risks of material misstatement in accounts such as cash, accounts receivable, inventory, and bank loans, and proposes specific audit procedures to address these risks. Furthermore, the report discusses the importance of fraud risk assessment and highlights the limitations of the audit partner's initial assessment. Finally, the report concludes by summarizing the key findings and recommendations, emphasizing the importance of thorough audit procedures and a comprehensive understanding of financial statement analysis.

Issues in Auditing Practice

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction................................................................................................................................3

Materiality for the financial report.............................................................................................4

Four income statement accounts that appear to be at risk..........................................................7

Audit procedure..........................................................................................................................8

Risk of Fraud..............................................................................................................................9

Conclusion................................................................................................................................10

References................................................................................................................................11

Appendix..................................................................................................................................12

2

Introduction................................................................................................................................3

Materiality for the financial report.............................................................................................4

Four income statement accounts that appear to be at risk..........................................................7

Audit procedure..........................................................................................................................8

Risk of Fraud..............................................................................................................................9

Conclusion................................................................................................................................10

References................................................................................................................................11

Appendix..................................................................................................................................12

2

Introduction

Preparation of financial statements has specific purpose and objectives that should be

achieved by such statements for growth and development of a company. Main purpose of

these financial statements is to satisfy the demands of stakeholders. For example,

shareholders of the company expect that financial statements of the company should

represent its actual financial position in market. This is the main reason that audit of the

financial statements are conducted at the end of financial year (Louwers et.al, 2015). There

are specific rules and responsibility that an auditor of the company should follow while

conducting financial audit. This report is prepared in order to conduct audit of Chamoisee

Enterprises. Various aspects of auditing are included in this report with respect to errors and

material misstatements that can be evaluated form trail balance of the company.

3

Preparation of financial statements has specific purpose and objectives that should be

achieved by such statements for growth and development of a company. Main purpose of

these financial statements is to satisfy the demands of stakeholders. For example,

shareholders of the company expect that financial statements of the company should

represent its actual financial position in market. This is the main reason that audit of the

financial statements are conducted at the end of financial year (Louwers et.al, 2015). There

are specific rules and responsibility that an auditor of the company should follow while

conducting financial audit. This report is prepared in order to conduct audit of Chamoisee

Enterprises. Various aspects of auditing are included in this report with respect to errors and

material misstatements that can be evaluated form trail balance of the company.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Materiality for the financial report

Concept of materiality is applied by auditor of the company during the planning stage of

audit. This concept is related to minimum level of financial amount which could be

considered as threshold limit for taking relevant decisions by stakeholders. In simple words,

Maternity in financial statement can be defined as the limit of discrepancy in financial data

after audit is conducted on financial statement which can affect decisions to be taken by

stakeholders (Choudhary, Merkley and Schipper, 2018). For example, let's assume that

material at in financial statement is $5000 then stakeholder’s decision in relation to business

will not be affected by discrepancy in financial data below $5000 but if it exceeds $5000 then

it might change decision of stakeholder. There are commonly used percentages of financial

items in balance sheet that are considered by auditor before setting Maternity threshold limit.

Financial item Limit

Total net profit 5%

Net profit distributable to equity

shareholders

5%

Total revenue earned .5% to 2%

Total shareholder's equity 2% to 5%

According to the above data following threshold limit should be decided by auditors of

Chamoisee Enterprises. (Calculation of Net profit are given in Appendix)

Particular Amount and

Percentage

Materiality

Net profit 57,00

0 & 5%

$2850

Total revenue 1,87,45

0 & 2%

$3750

4

Concept of materiality is applied by auditor of the company during the planning stage of

audit. This concept is related to minimum level of financial amount which could be

considered as threshold limit for taking relevant decisions by stakeholders. In simple words,

Maternity in financial statement can be defined as the limit of discrepancy in financial data

after audit is conducted on financial statement which can affect decisions to be taken by

stakeholders (Choudhary, Merkley and Schipper, 2018). For example, let's assume that

material at in financial statement is $5000 then stakeholder’s decision in relation to business

will not be affected by discrepancy in financial data below $5000 but if it exceeds $5000 then

it might change decision of stakeholder. There are commonly used percentages of financial

items in balance sheet that are considered by auditor before setting Maternity threshold limit.

Financial item Limit

Total net profit 5%

Net profit distributable to equity

shareholders

5%

Total revenue earned .5% to 2%

Total shareholder's equity 2% to 5%

According to the above data following threshold limit should be decided by auditors of

Chamoisee Enterprises. (Calculation of Net profit are given in Appendix)

Particular Amount and

Percentage

Materiality

Net profit 57,00

0 & 5%

$2850

Total revenue 1,87,45

0 & 2%

$3750

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

During the planning stage of auditing Chamoisee Enterprise, audit partner decided to set the

limit of materiality at $15000 which is very high as compared to commonly acceptable limit

for an organisation like currently in consideration.

Above step taken by the audit partner can affect the audit budget prepared by auditors in a

negative manner. According to the threshold limit of $15000, shareholders will not be

affected if there is a discrepancy in financial statements prepared by the management up to

15000 but in actually they will be affected if this discrepancy goes beyond $4000. Therefore

management of audit firm is required to conduct more audit procedures as compared to audit

procedure decided in planning stage. This will require more human capital and time which

will increase overall audit budget (Lakis and Masiulevičius, 2017).

5

limit of materiality at $15000 which is very high as compared to commonly acceptable limit

for an organisation like currently in consideration.

Above step taken by the audit partner can affect the audit budget prepared by auditors in a

negative manner. According to the threshold limit of $15000, shareholders will not be

affected if there is a discrepancy in financial statements prepared by the management up to

15000 but in actually they will be affected if this discrepancy goes beyond $4000. Therefore

management of audit firm is required to conduct more audit procedures as compared to audit

procedure decided in planning stage. This will require more human capital and time which

will increase overall audit budget (Lakis and Masiulevičius, 2017).

5

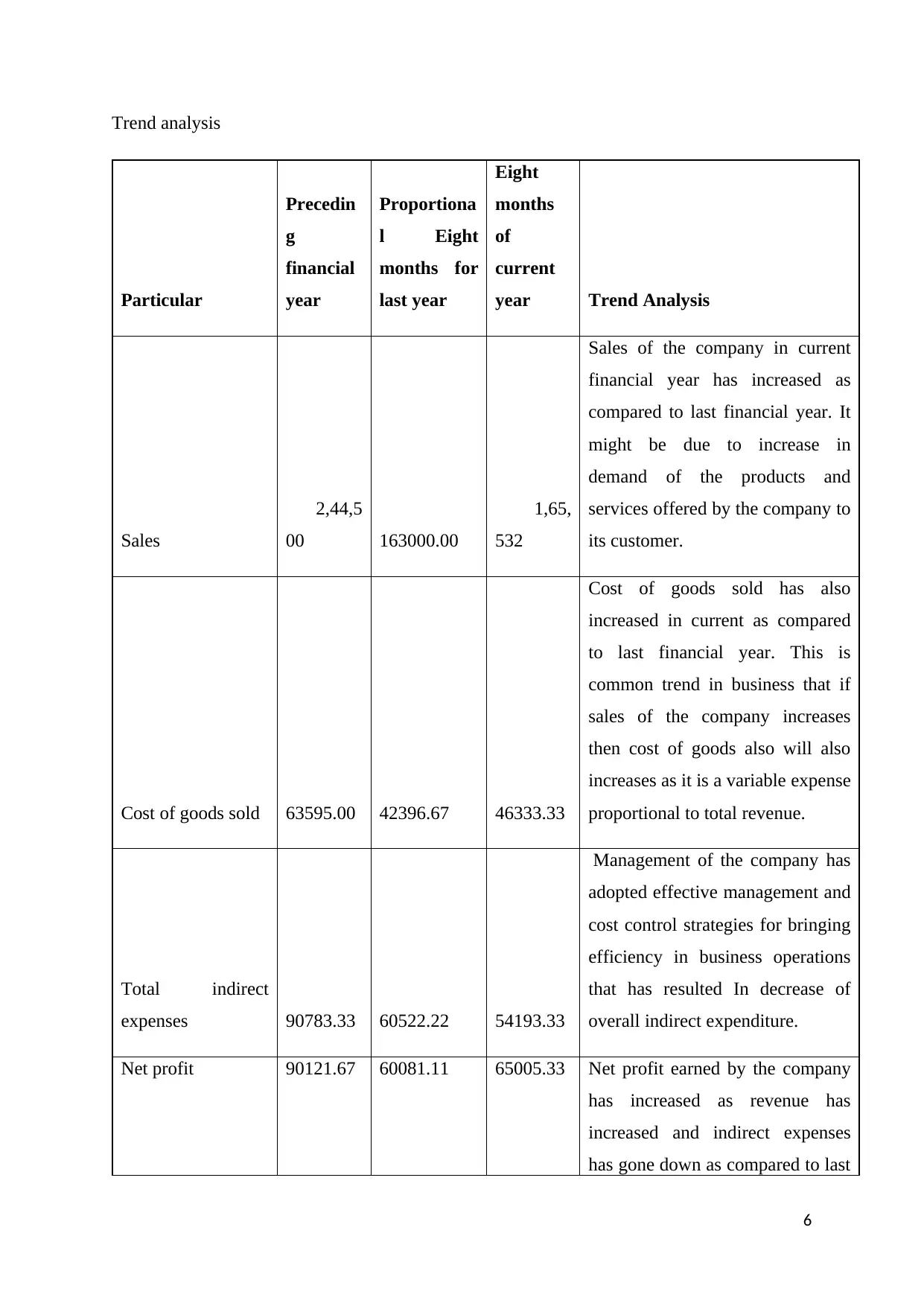

Trend analysis

Particular

Precedin

g

financial

year

Proportiona

l Eight

months for

last year

Eight

months

of

current

year Trend Analysis

Sales

2,44,5

00 163000.00

1,65,

532

Sales of the company in current

financial year has increased as

compared to last financial year. It

might be due to increase in

demand of the products and

services offered by the company to

its customer.

Cost of goods sold 63595.00 42396.67 46333.33

Cost of goods sold has also

increased in current as compared

to last financial year. This is

common trend in business that if

sales of the company increases

then cost of goods also will also

increases as it is a variable expense

proportional to total revenue.

Total indirect

expenses 90783.33 60522.22 54193.33

Management of the company has

adopted effective management and

cost control strategies for bringing

efficiency in business operations

that has resulted In decrease of

overall indirect expenditure.

Net profit 90121.67 60081.11 65005.33 Net profit earned by the company

has increased as revenue has

increased and indirect expenses

has gone down as compared to last

6

Particular

Precedin

g

financial

year

Proportiona

l Eight

months for

last year

Eight

months

of

current

year Trend Analysis

Sales

2,44,5

00 163000.00

1,65,

532

Sales of the company in current

financial year has increased as

compared to last financial year. It

might be due to increase in

demand of the products and

services offered by the company to

its customer.

Cost of goods sold 63595.00 42396.67 46333.33

Cost of goods sold has also

increased in current as compared

to last financial year. This is

common trend in business that if

sales of the company increases

then cost of goods also will also

increases as it is a variable expense

proportional to total revenue.

Total indirect

expenses 90783.33 60522.22 54193.33

Management of the company has

adopted effective management and

cost control strategies for bringing

efficiency in business operations

that has resulted In decrease of

overall indirect expenditure.

Net profit 90121.67 60081.11 65005.33 Net profit earned by the company

has increased as revenue has

increased and indirect expenses

has gone down as compared to last

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

year (Arens, Elder and Beasley,

2014).

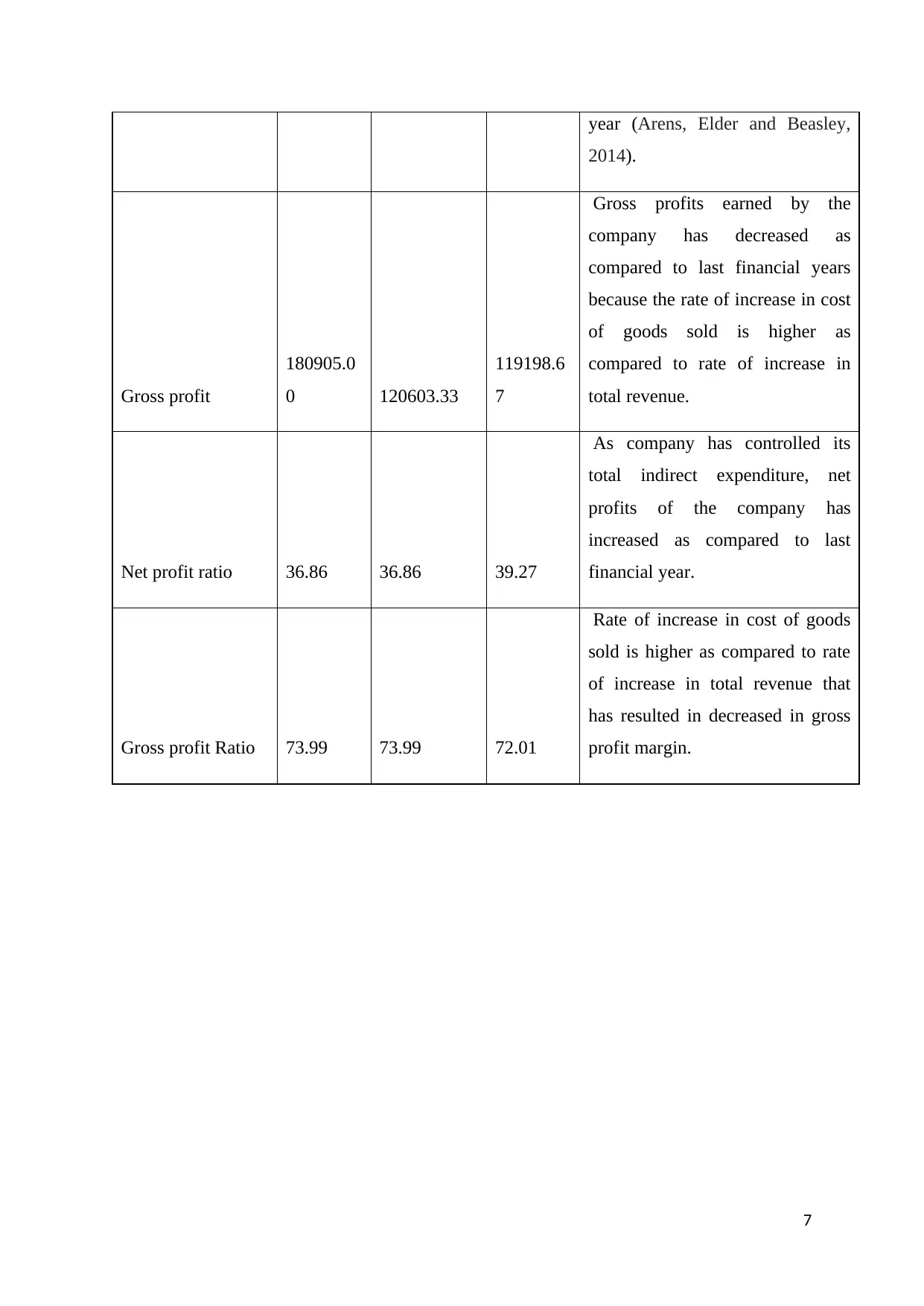

Gross profit

180905.0

0 120603.33

119198.6

7

Gross profits earned by the

company has decreased as

compared to last financial years

because the rate of increase in cost

of goods sold is higher as

compared to rate of increase in

total revenue.

Net profit ratio 36.86 36.86 39.27

As company has controlled its

total indirect expenditure, net

profits of the company has

increased as compared to last

financial year.

Gross profit Ratio 73.99 73.99 72.01

Rate of increase in cost of goods

sold is higher as compared to rate

of increase in total revenue that

has resulted in decreased in gross

profit margin.

7

2014).

Gross profit

180905.0

0 120603.33

119198.6

7

Gross profits earned by the

company has decreased as

compared to last financial years

because the rate of increase in cost

of goods sold is higher as

compared to rate of increase in

total revenue.

Net profit ratio 36.86 36.86 39.27

As company has controlled its

total indirect expenditure, net

profits of the company has

increased as compared to last

financial year.

Gross profit Ratio 73.99 73.99 72.01

Rate of increase in cost of goods

sold is higher as compared to rate

of increase in total revenue that

has resulted in decreased in gross

profit margin.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

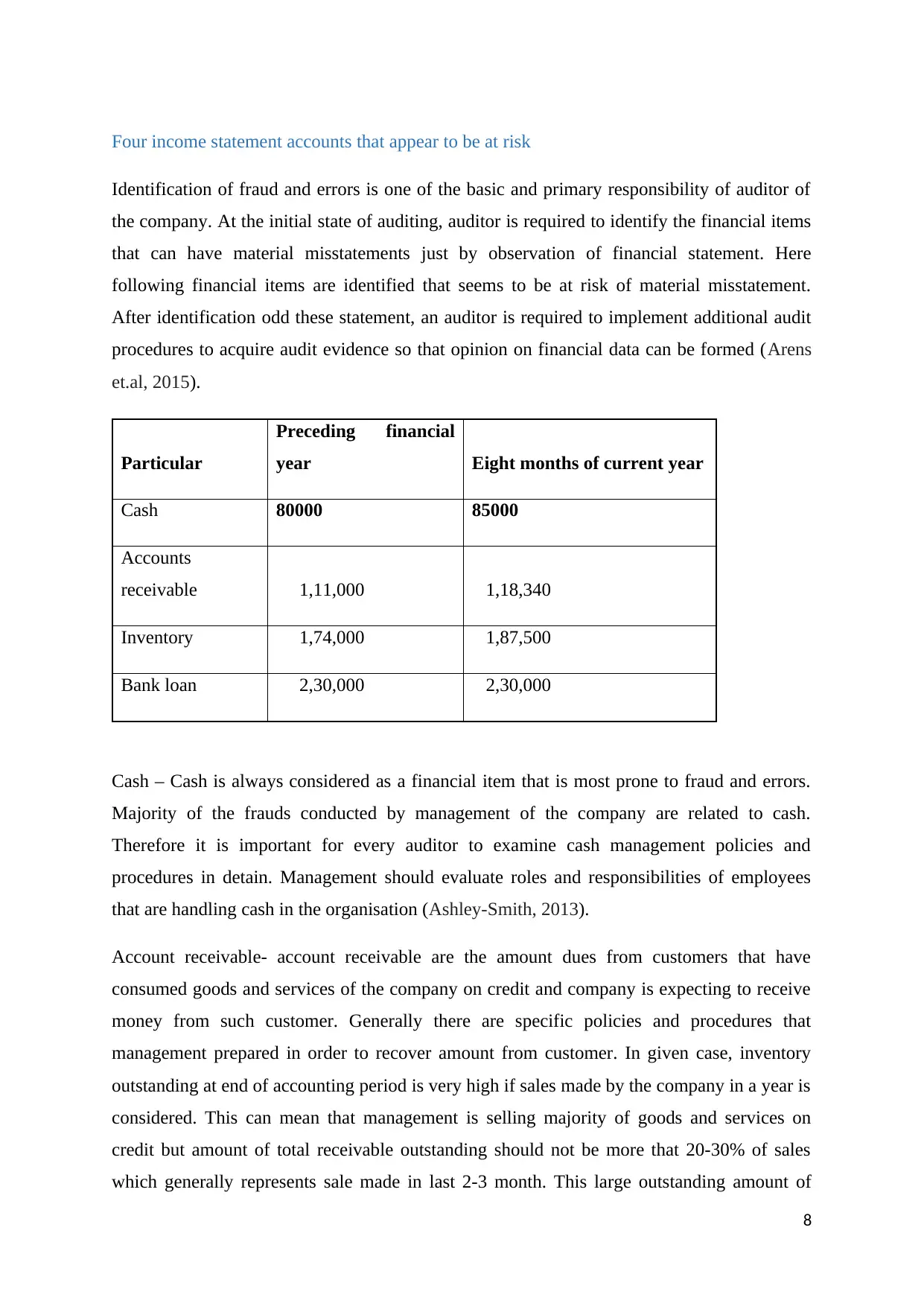

Four income statement accounts that appear to be at risk

Identification of fraud and errors is one of the basic and primary responsibility of auditor of

the company. At the initial state of auditing, auditor is required to identify the financial items

that can have material misstatements just by observation of financial statement. Here

following financial items are identified that seems to be at risk of material misstatement.

After identification odd these statement, an auditor is required to implement additional audit

procedures to acquire audit evidence so that opinion on financial data can be formed (Arens

et.al, 2015).

Particular

Preceding financial

year Eight months of current year

Cash 80000 85000

Accounts

receivable 1,11,000 1,18,340

Inventory 1,74,000 1,87,500

Bank loan 2,30,000 2,30,000

Cash – Cash is always considered as a financial item that is most prone to fraud and errors.

Majority of the frauds conducted by management of the company are related to cash.

Therefore it is important for every auditor to examine cash management policies and

procedures in detain. Management should evaluate roles and responsibilities of employees

that are handling cash in the organisation (Ashley-Smith, 2013).

Account receivable- account receivable are the amount dues from customers that have

consumed goods and services of the company on credit and company is expecting to receive

money from such customer. Generally there are specific policies and procedures that

management prepared in order to recover amount from customer. In given case, inventory

outstanding at end of accounting period is very high if sales made by the company in a year is

considered. This can mean that management is selling majority of goods and services on

credit but amount of total receivable outstanding should not be more that 20-30% of sales

which generally represents sale made in last 2-3 month. This large outstanding amount of

8

Identification of fraud and errors is one of the basic and primary responsibility of auditor of

the company. At the initial state of auditing, auditor is required to identify the financial items

that can have material misstatements just by observation of financial statement. Here

following financial items are identified that seems to be at risk of material misstatement.

After identification odd these statement, an auditor is required to implement additional audit

procedures to acquire audit evidence so that opinion on financial data can be formed (Arens

et.al, 2015).

Particular

Preceding financial

year Eight months of current year

Cash 80000 85000

Accounts

receivable 1,11,000 1,18,340

Inventory 1,74,000 1,87,500

Bank loan 2,30,000 2,30,000

Cash – Cash is always considered as a financial item that is most prone to fraud and errors.

Majority of the frauds conducted by management of the company are related to cash.

Therefore it is important for every auditor to examine cash management policies and

procedures in detain. Management should evaluate roles and responsibilities of employees

that are handling cash in the organisation (Ashley-Smith, 2013).

Account receivable- account receivable are the amount dues from customers that have

consumed goods and services of the company on credit and company is expecting to receive

money from such customer. Generally there are specific policies and procedures that

management prepared in order to recover amount from customer. In given case, inventory

outstanding at end of accounting period is very high if sales made by the company in a year is

considered. This can mean that management is selling majority of goods and services on

credit but amount of total receivable outstanding should not be more that 20-30% of sales

which generally represents sale made in last 2-3 month. This large outstanding amount of

8

receivable can suggest that management is giving special relaxation period to certain

customers without getting approval from management.

Inventory- amount of inventory has also increased as compared to financial year.

Management of the company should evaluate inventory management of the company. It is

general practice of business organisations to adopt FIFO method as it reduces wastage of

inventory (Melikhova, and Nikolayenko¸ 2017). In current year outstanding inventory is

increased, therefore management should evaluate the reason for such.

Bank loan- In case of bank loan, management of the company is required to make annual

instalment and such payments should be deducted from total amount of loan in the balance

sheet. In case of Chamoisee Enterprises, the amount of bank loan is similar in both financial

years. This can be a result of error or omission in accounting.

9

customers without getting approval from management.

Inventory- amount of inventory has also increased as compared to financial year.

Management of the company should evaluate inventory management of the company. It is

general practice of business organisations to adopt FIFO method as it reduces wastage of

inventory (Melikhova, and Nikolayenko¸ 2017). In current year outstanding inventory is

increased, therefore management should evaluate the reason for such.

Bank loan- In case of bank loan, management of the company is required to make annual

instalment and such payments should be deducted from total amount of loan in the balance

sheet. In case of Chamoisee Enterprises, the amount of bank loan is similar in both financial

years. This can be a result of error or omission in accounting.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Audit procedure

Cash

1. Audit of the company should check the bank statement of the company and compare it

with cash register maintained in the books of accounts.

2. Bank confirmation should be taken by auditor from banking institution for closing balance.

3. This can be done with the help of preparing a Bank Reconciliation statement.

Accounts receivable

Auditor should evaluate the steps and procedures taken by the company in order to recover

money from these accounts and determine whether such policies are in the interest of the

company or not. In addition to that management should also evaluate that such polices are

applied for recovery from each account (Knechel and Salterio, 2016).

Inventory

Best audit procedure to conduct to evaluate fraud and errors in inventory is through physical

verification. Auditor should evaluate proper records are maintained by the management in

respect to inventory or not (Makarenko and Yardanova, 2015).

Bank loan

Audit should check the terms and conditions of the loan between organisation and banking

institution to make sure that records are maintained according to such terms and conditions.

10

Cash

1. Audit of the company should check the bank statement of the company and compare it

with cash register maintained in the books of accounts.

2. Bank confirmation should be taken by auditor from banking institution for closing balance.

3. This can be done with the help of preparing a Bank Reconciliation statement.

Accounts receivable

Auditor should evaluate the steps and procedures taken by the company in order to recover

money from these accounts and determine whether such policies are in the interest of the

company or not. In addition to that management should also evaluate that such polices are

applied for recovery from each account (Knechel and Salterio, 2016).

Inventory

Best audit procedure to conduct to evaluate fraud and errors in inventory is through physical

verification. Auditor should evaluate proper records are maintained by the management in

respect to inventory or not (Makarenko and Yardanova, 2015).

Bank loan

Audit should check the terms and conditions of the loan between organisation and banking

institution to make sure that records are maintained according to such terms and conditions.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Risk of Fraud

Identification and estimation of fraud is one of the most important function of audit and it is

included in roles and responsibilities of an auditor. It is important that proper evidences are

collected by auditor before making the audit opinion that there are no risk of fraud in a

particular business organisation (Arens et.al, 2013). In this case of Chamoisee Enterprises,

audit partner is of the opinion that there is no risk of management fraud just on the basis of

his interaction with the management. This is not sufficient audit evidence to make such

conclusion. Therefore it can be said that audit is not correct in making such suggestion.

11

Identification and estimation of fraud is one of the most important function of audit and it is

included in roles and responsibilities of an auditor. It is important that proper evidences are

collected by auditor before making the audit opinion that there are no risk of fraud in a

particular business organisation (Arens et.al, 2013). In this case of Chamoisee Enterprises,

audit partner is of the opinion that there is no risk of management fraud just on the basis of

his interaction with the management. This is not sufficient audit evidence to make such

conclusion. Therefore it can be said that audit is not correct in making such suggestion.

11

Conclusion

This report has discussed various aspect of auditing procedures to be conducted in a

proprietorship firm. This report has identified some financial items that have possibility of

material misstatement on the basis of trend analysis of trial balance of the company. In

addition to that various audit procedures are also suggested to auditors of the company to

form accurate audit opinion on such expected material misstatements. In addition to that this

report has also discussed the concept of materiality with its impact on audit budget.

12

This report has discussed various aspect of auditing procedures to be conducted in a

proprietorship firm. This report has identified some financial items that have possibility of

material misstatement on the basis of trend analysis of trial balance of the company. In

addition to that various audit procedures are also suggested to auditors of the company to

form accurate audit opinion on such expected material misstatements. In addition to that this

report has also discussed the concept of materiality with its impact on audit budget.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.