University Auditing Theory and Practice: Financial Analysis Report

VerifiedAdded on 2023/06/07

|18

|4333

|330

Report

AI Summary

This report examines auditing theory and practice, focusing on financial analysis and risk assessment within the context of the company TCW. The report begins with an abstract outlining the key areas of investigation, including audit and business risks. It then delves into a detailed analysis of specific accounts like accounts receivable, investments, property assets, and marketing expenses, identifying associated audit risks and recommending mitigation strategies. The report also explores business risks through financial ratio analysis, including return on equity, gross margin, and various operational ratios. The analysis includes comparisons of audited and unaudited financial data, providing insights into the company's performance and potential areas of concern. Furthermore, the report considers internal controls and their impact on operational effectiveness and efficiency, aligning with assurance objectives.

Running head: AUDITING THEORY AND PRACTICE

Auditing theory and practice

Name of the Student:

Name of the University:

Auditing theory and practice

Name of the Student:

Name of the University:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1AUDITING THEORY AND PRACTICE

Abstract

The paper examines about the audit risk that includes issue that the auditor aces while

recognizing the material misstatements. This may happen because of fraud or error. The most

ideal approach to examine the business risk faced in audit process is to the examination of the

key financial ratios that would help in getting a speedy measurement of the performance of

the firm. It would assist the administration to find put the limitations and the benefits from

with different strategies and initiatives can be framed. The organization of TCW has been

investigated in the below paper. For the company in order to examine the operational

effectiveness and efficiency the internal control has been focused upon that slo complies with

the assurance objectives of TCW.

Abstract

The paper examines about the audit risk that includes issue that the auditor aces while

recognizing the material misstatements. This may happen because of fraud or error. The most

ideal approach to examine the business risk faced in audit process is to the examination of the

key financial ratios that would help in getting a speedy measurement of the performance of

the firm. It would assist the administration to find put the limitations and the benefits from

with different strategies and initiatives can be framed. The organization of TCW has been

investigated in the below paper. For the company in order to examine the operational

effectiveness and efficiency the internal control has been focused upon that slo complies with

the assurance objectives of TCW.

2AUDITING THEORY AND PRACTICE

Table of Contents

Solution to Question 1A.............................................................................................................3

Solution to Question 1B.............................................................................................................6

Solution to Question 2A...........................................................................................................10

Solution to Question 2B...........................................................................................................13

Reference list............................................................................................................................15

Table of Contents

Solution to Question 1A.............................................................................................................3

Solution to Question 1B.............................................................................................................6

Solution to Question 2A...........................................................................................................10

Solution to Question 2B...........................................................................................................13

Reference list............................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3AUDITING THEORY AND PRACTICE

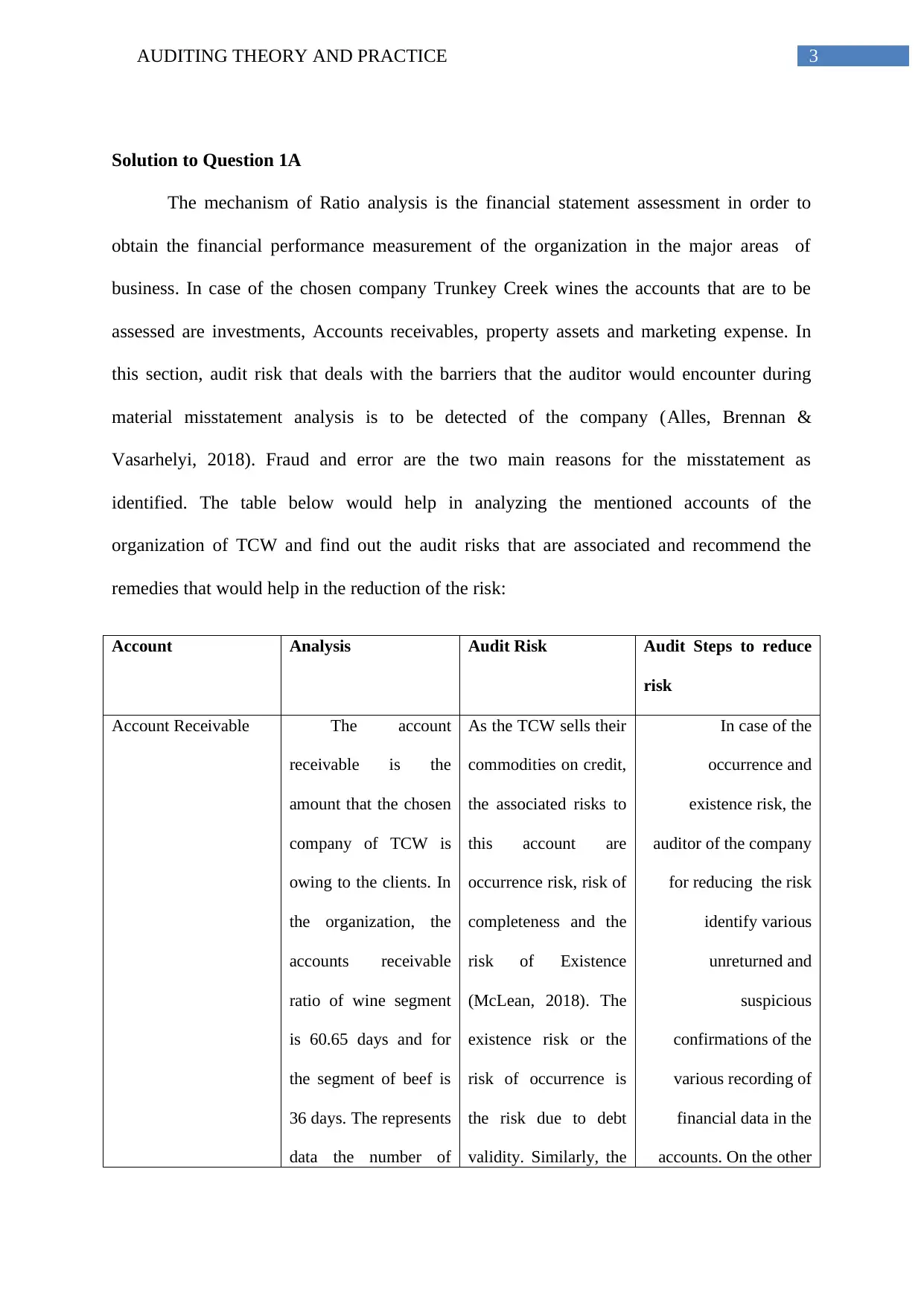

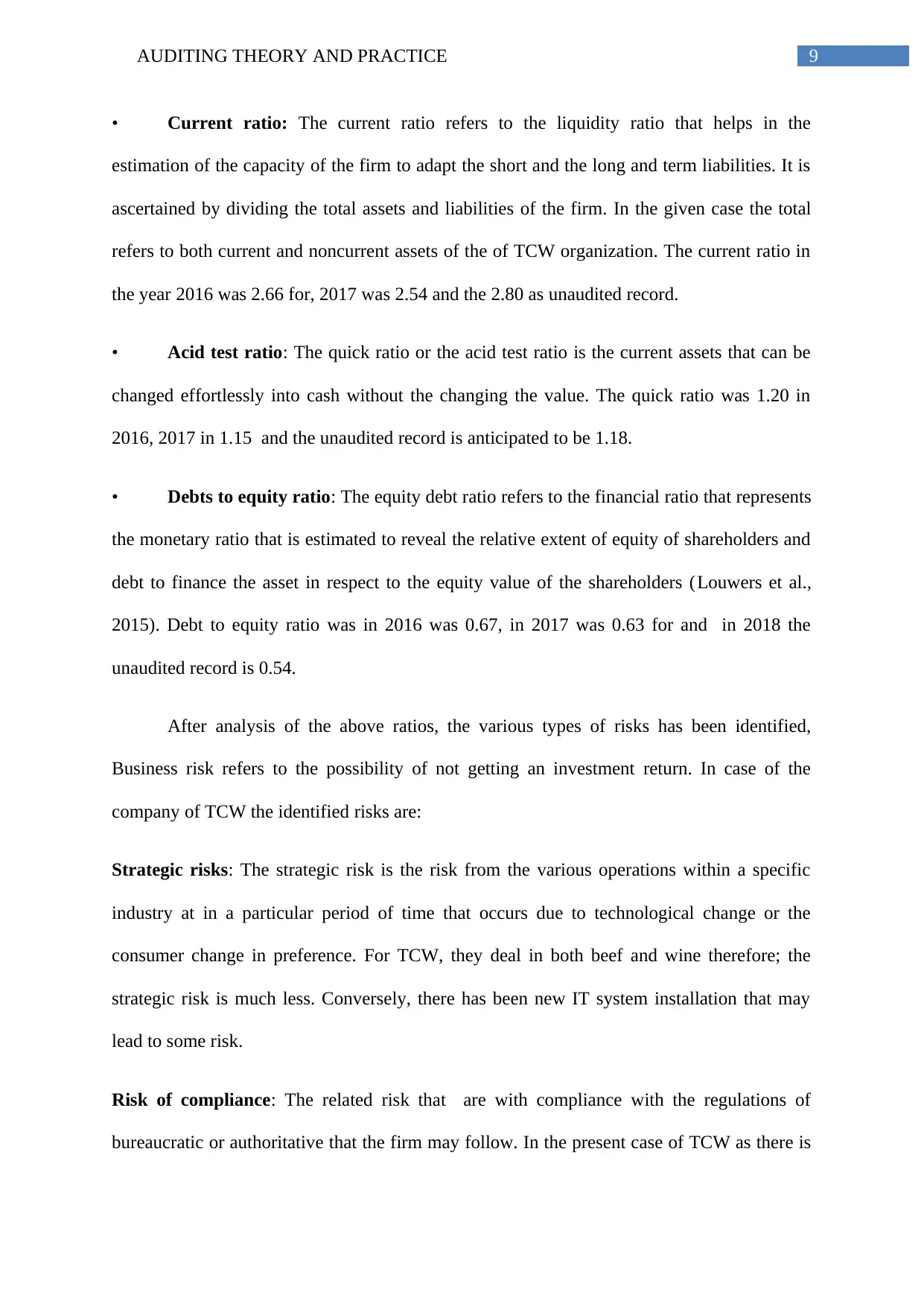

Solution to Question 1A

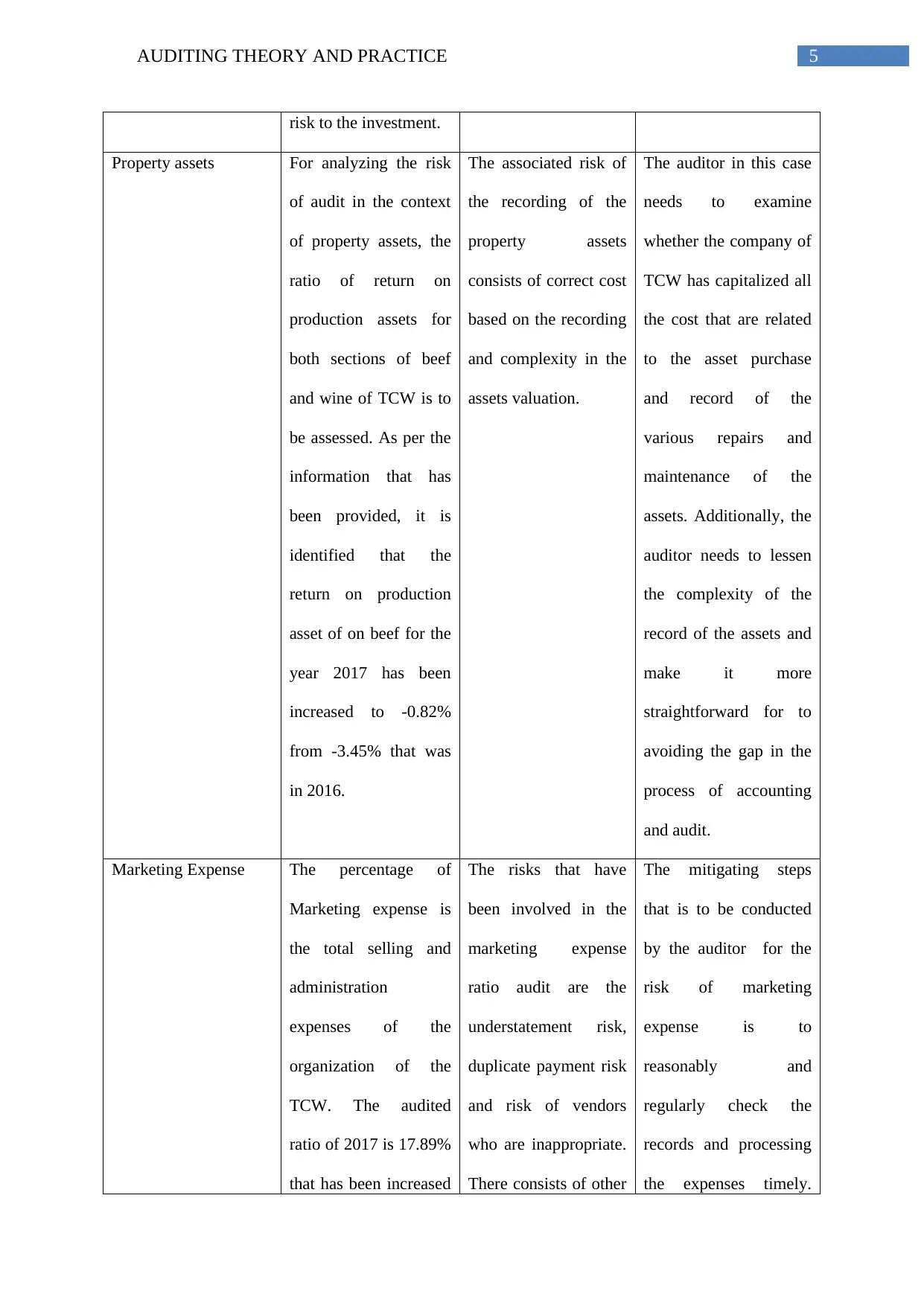

The mechanism of Ratio analysis is the financial statement assessment in order to

obtain the financial performance measurement of the organization in the major areas of

business. In case of the chosen company Trunkey Creek wines the accounts that are to be

assessed are investments, Accounts receivables, property assets and marketing expense. In

this section, audit risk that deals with the barriers that the auditor would encounter during

material misstatement analysis is to be detected of the company (Alles, Brennan &

Vasarhelyi, 2018). Fraud and error are the two main reasons for the misstatement as

identified. The table below would help in analyzing the mentioned accounts of the

organization of TCW and find out the audit risks that are associated and recommend the

remedies that would help in the reduction of the risk:

Account Analysis Audit Risk Audit Steps to reduce

risk

Account Receivable The account

receivable is the

amount that the chosen

company of TCW is

owing to the clients. In

the organization, the

accounts receivable

ratio of wine segment

is 60.65 days and for

the segment of beef is

36 days. The represents

data the number of

As the TCW sells their

commodities on credit,

the associated risks to

this account are

occurrence risk, risk of

completeness and the

risk of Existence

(McLean, 2018). The

existence risk or the

risk of occurrence is

the risk due to debt

validity. Similarly, the

In case of the

occurrence and

existence risk, the

auditor of the company

for reducing the risk

identify various

unreturned and

suspicious

confirmations of the

various recording of

financial data in the

accounts. On the other

Solution to Question 1A

The mechanism of Ratio analysis is the financial statement assessment in order to

obtain the financial performance measurement of the organization in the major areas of

business. In case of the chosen company Trunkey Creek wines the accounts that are to be

assessed are investments, Accounts receivables, property assets and marketing expense. In

this section, audit risk that deals with the barriers that the auditor would encounter during

material misstatement analysis is to be detected of the company (Alles, Brennan &

Vasarhelyi, 2018). Fraud and error are the two main reasons for the misstatement as

identified. The table below would help in analyzing the mentioned accounts of the

organization of TCW and find out the audit risks that are associated and recommend the

remedies that would help in the reduction of the risk:

Account Analysis Audit Risk Audit Steps to reduce

risk

Account Receivable The account

receivable is the

amount that the chosen

company of TCW is

owing to the clients. In

the organization, the

accounts receivable

ratio of wine segment

is 60.65 days and for

the segment of beef is

36 days. The represents

data the number of

As the TCW sells their

commodities on credit,

the associated risks to

this account are

occurrence risk, risk of

completeness and the

risk of Existence

(McLean, 2018). The

existence risk or the

risk of occurrence is

the risk due to debt

validity. Similarly, the

In case of the

occurrence and

existence risk, the

auditor of the company

for reducing the risk

identify various

unreturned and

suspicious

confirmations of the

various recording of

financial data in the

accounts. On the other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4AUDITING THEORY AND PRACTICE

days that the invoice of

a client stays

outstanding.

completeness risk is

the risk that takes

place due to

incomplete record of

financial data.

hand, in case of the

completeness risk, it is

the duty of the auditor

to assess all the sales

proceeds and obtain

ability of the company’s

transaction process.

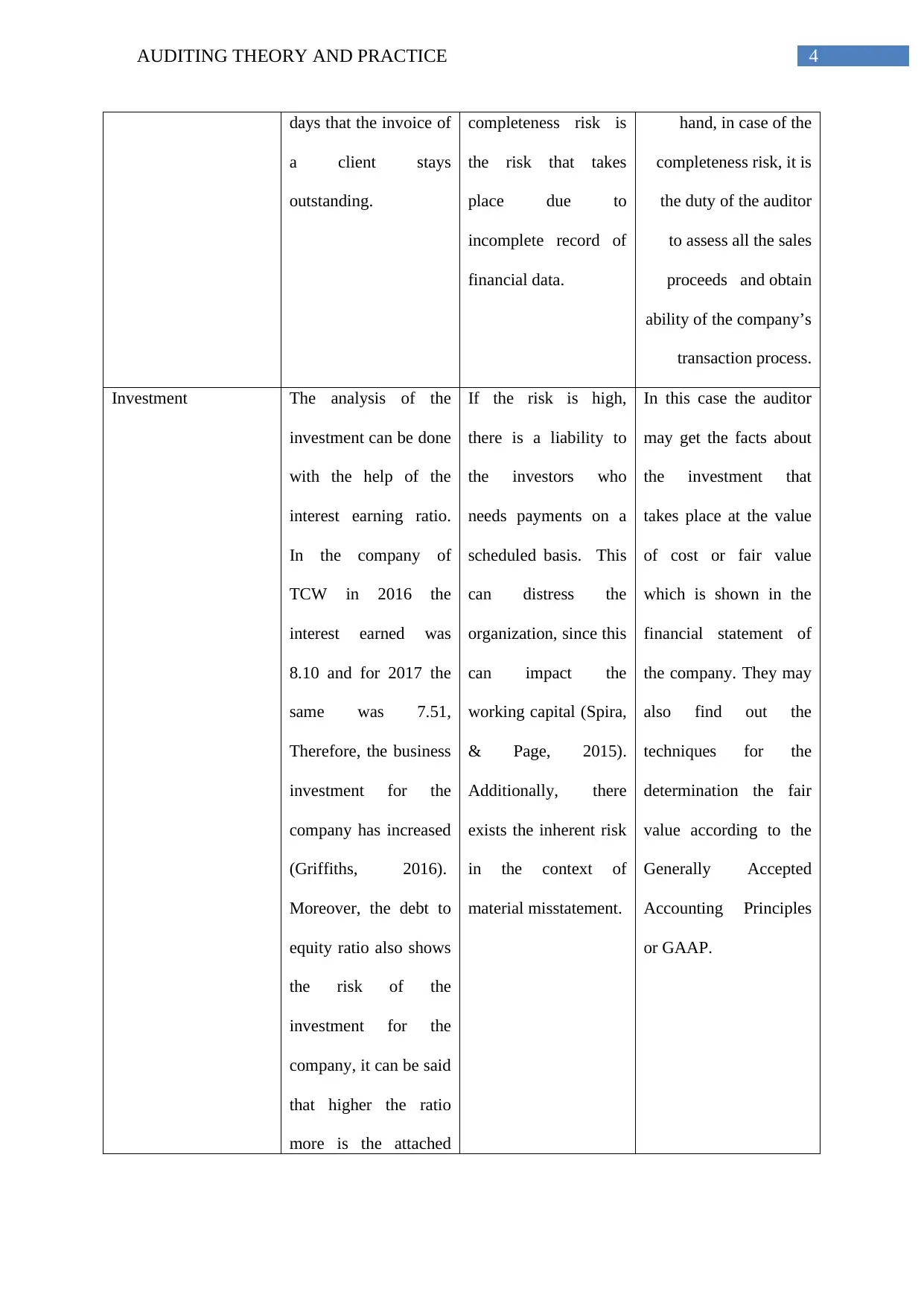

Investment The analysis of the

investment can be done

with the help of the

interest earning ratio.

In the company of

TCW in 2016 the

interest earned was

8.10 and for 2017 the

same was 7.51,

Therefore, the business

investment for the

company has increased

(Griffiths, 2016).

Moreover, the debt to

equity ratio also shows

the risk of the

investment for the

company, it can be said

that higher the ratio

more is the attached

If the risk is high,

there is a liability to

the investors who

needs payments on a

scheduled basis. This

can distress the

organization, since this

can impact the

working capital (Spira,

& Page, 2015).

Additionally, there

exists the inherent risk

in the context of

material misstatement.

In this case the auditor

may get the facts about

the investment that

takes place at the value

of cost or fair value

which is shown in the

financial statement of

the company. They may

also find out the

techniques for the

determination the fair

value according to the

Generally Accepted

Accounting Principles

or GAAP.

days that the invoice of

a client stays

outstanding.

completeness risk is

the risk that takes

place due to

incomplete record of

financial data.

hand, in case of the

completeness risk, it is

the duty of the auditor

to assess all the sales

proceeds and obtain

ability of the company’s

transaction process.

Investment The analysis of the

investment can be done

with the help of the

interest earning ratio.

In the company of

TCW in 2016 the

interest earned was

8.10 and for 2017 the

same was 7.51,

Therefore, the business

investment for the

company has increased

(Griffiths, 2016).

Moreover, the debt to

equity ratio also shows

the risk of the

investment for the

company, it can be said

that higher the ratio

more is the attached

If the risk is high,

there is a liability to

the investors who

needs payments on a

scheduled basis. This

can distress the

organization, since this

can impact the

working capital (Spira,

& Page, 2015).

Additionally, there

exists the inherent risk

in the context of

material misstatement.

In this case the auditor

may get the facts about

the investment that

takes place at the value

of cost or fair value

which is shown in the

financial statement of

the company. They may

also find out the

techniques for the

determination the fair

value according to the

Generally Accepted

Accounting Principles

or GAAP.

5AUDITING THEORY AND PRACTICE

risk to the investment.

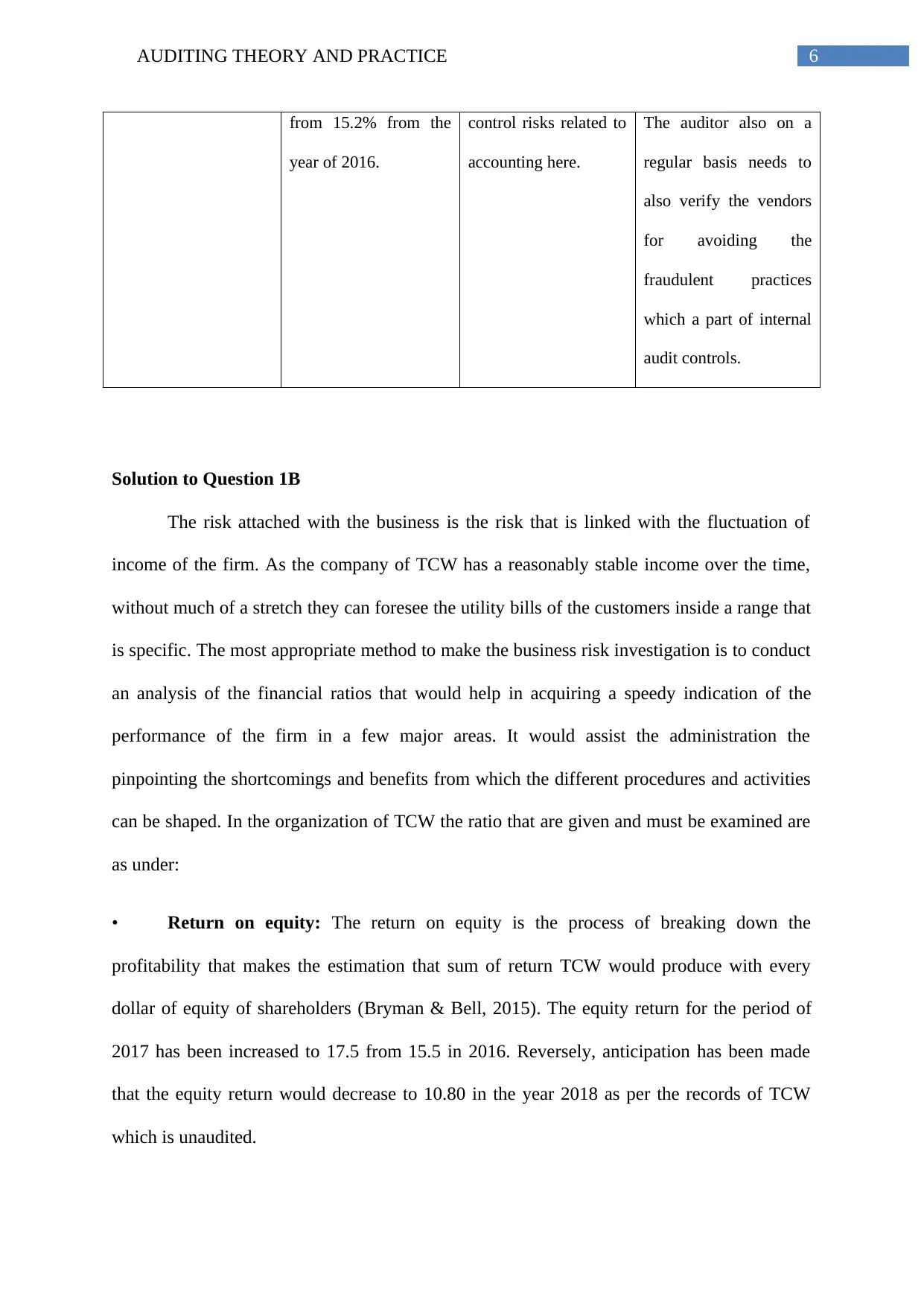

Property assets For analyzing the risk

of audit in the context

of property assets, the

ratio of return on

production assets for

both sections of beef

and wine of TCW is to

be assessed. As per the

information that has

been provided, it is

identified that the

return on production

asset of on beef for the

year 2017 has been

increased to -0.82%

from -3.45% that was

in 2016.

The associated risk of

the recording of the

property assets

consists of correct cost

based on the recording

and complexity in the

assets valuation.

The auditor in this case

needs to examine

whether the company of

TCW has capitalized all

the cost that are related

to the asset purchase

and record of the

various repairs and

maintenance of the

assets. Additionally, the

auditor needs to lessen

the complexity of the

record of the assets and

make it more

straightforward for to

avoiding the gap in the

process of accounting

and audit.

Marketing Expense The percentage of

Marketing expense is

the total selling and

administration

expenses of the

organization of the

TCW. The audited

ratio of 2017 is 17.89%

that has been increased

The risks that have

been involved in the

marketing expense

ratio audit are the

understatement risk,

duplicate payment risk

and risk of vendors

who are inappropriate.

There consists of other

The mitigating steps

that is to be conducted

by the auditor for the

risk of marketing

expense is to

reasonably and

regularly check the

records and processing

the expenses timely.

risk to the investment.

Property assets For analyzing the risk

of audit in the context

of property assets, the

ratio of return on

production assets for

both sections of beef

and wine of TCW is to

be assessed. As per the

information that has

been provided, it is

identified that the

return on production

asset of on beef for the

year 2017 has been

increased to -0.82%

from -3.45% that was

in 2016.

The associated risk of

the recording of the

property assets

consists of correct cost

based on the recording

and complexity in the

assets valuation.

The auditor in this case

needs to examine

whether the company of

TCW has capitalized all

the cost that are related

to the asset purchase

and record of the

various repairs and

maintenance of the

assets. Additionally, the

auditor needs to lessen

the complexity of the

record of the assets and

make it more

straightforward for to

avoiding the gap in the

process of accounting

and audit.

Marketing Expense The percentage of

Marketing expense is

the total selling and

administration

expenses of the

organization of the

TCW. The audited

ratio of 2017 is 17.89%

that has been increased

The risks that have

been involved in the

marketing expense

ratio audit are the

understatement risk,

duplicate payment risk

and risk of vendors

who are inappropriate.

There consists of other

The mitigating steps

that is to be conducted

by the auditor for the

risk of marketing

expense is to

reasonably and

regularly check the

records and processing

the expenses timely.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6AUDITING THEORY AND PRACTICE

from 15.2% from the

year of 2016.

control risks related to

accounting here.

The auditor also on a

regular basis needs to

also verify the vendors

for avoiding the

fraudulent practices

which a part of internal

audit controls.

Solution to Question 1B

The risk attached with the business is the risk that is linked with the fluctuation of

income of the firm. As the company of TCW has a reasonably stable income over the time,

without much of a stretch they can foresee the utility bills of the customers inside a range that

is specific. The most appropriate method to make the business risk investigation is to conduct

an analysis of the financial ratios that would help in acquiring a speedy indication of the

performance of the firm in a few major areas. It would assist the administration the

pinpointing the shortcomings and benefits from which the different procedures and activities

can be shaped. In the organization of TCW the ratio that are given and must be examined are

as under:

• Return on equity: The return on equity is the process of breaking down the

profitability that makes the estimation that sum of return TCW would produce with every

dollar of equity of shareholders (Bryman & Bell, 2015). The equity return for the period of

2017 has been increased to 17.5 from 15.5 in 2016. Reversely, anticipation has been made

that the equity return would decrease to 10.80 in the year 2018 as per the records of TCW

which is unaudited.

from 15.2% from the

year of 2016.

control risks related to

accounting here.

The auditor also on a

regular basis needs to

also verify the vendors

for avoiding the

fraudulent practices

which a part of internal

audit controls.

Solution to Question 1B

The risk attached with the business is the risk that is linked with the fluctuation of

income of the firm. As the company of TCW has a reasonably stable income over the time,

without much of a stretch they can foresee the utility bills of the customers inside a range that

is specific. The most appropriate method to make the business risk investigation is to conduct

an analysis of the financial ratios that would help in acquiring a speedy indication of the

performance of the firm in a few major areas. It would assist the administration the

pinpointing the shortcomings and benefits from which the different procedures and activities

can be shaped. In the organization of TCW the ratio that are given and must be examined are

as under:

• Return on equity: The return on equity is the process of breaking down the

profitability that makes the estimation that sum of return TCW would produce with every

dollar of equity of shareholders (Bryman & Bell, 2015). The equity return for the period of

2017 has been increased to 17.5 from 15.5 in 2016. Reversely, anticipation has been made

that the equity return would decrease to 10.80 in the year 2018 as per the records of TCW

which is unaudited.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7AUDITING THEORY AND PRACTICE

• Return on production assets of beef: The assets on production of beef refer to the

amount of production and estimation of profits with the total resources put into business. At

present, percentage of return alludes to the beef production of the TCW. The profit level for

beef production asset has been increased from - 3.45 in the year 2016 to 0.82 in 2017.

nevertheless, as per the unaudited records the return on beef asset production identified would

increase to 1.67 in the year 2018.

• Return on grape and wine asset production: The grape and wine production return

on asset highlights the amount of production and measurement and of returns with the total

assets that has been invested ny the business (McDONALD, 2016). In TCW the rate return

on grape and wine generation asset in 2016 was 16.2 that decreased to 14.5 in the year 2017.

As per the unaudited record the expected return is less that amounts to 12.2.

• Gross Margin: The margin of gross profit in the company of TWC refers to the total

income after reducing cost of goods sold, that has been divided by the total sales. The

estimation of the total percentage of sales that the TCW holds after the investing in the

various direct costs that are associated with manufacturing of the beef and wine (Bulyga,

2014). In the present case there is high rate, the firm can hold back the dollar of sales. The

margin of gross profit of TCW Company in 2016 was the highest that amounted to 31.76 abd

reduced to 14.5 in the period of 2017; the gross margin that is anticipated to fall to 12.2 in

2018. This represents that TCW could is now being able retain greater sales dollars.

Marketing cost over S/A costs: The costs of marketing is the cash level that has

been spent out of the profits from the total of administrative and selling costs considering the

end result to enhance the sales. This is an indirect cost. As per the audited records of the years

2017 and 2016, the marketing cost level has been reducing from 2016 increasing to 15.2 and

17.89 in 2017.

• Return on production assets of beef: The assets on production of beef refer to the

amount of production and estimation of profits with the total resources put into business. At

present, percentage of return alludes to the beef production of the TCW. The profit level for

beef production asset has been increased from - 3.45 in the year 2016 to 0.82 in 2017.

nevertheless, as per the unaudited records the return on beef asset production identified would

increase to 1.67 in the year 2018.

• Return on grape and wine asset production: The grape and wine production return

on asset highlights the amount of production and measurement and of returns with the total

assets that has been invested ny the business (McDONALD, 2016). In TCW the rate return

on grape and wine generation asset in 2016 was 16.2 that decreased to 14.5 in the year 2017.

As per the unaudited record the expected return is less that amounts to 12.2.

• Gross Margin: The margin of gross profit in the company of TWC refers to the total

income after reducing cost of goods sold, that has been divided by the total sales. The

estimation of the total percentage of sales that the TCW holds after the investing in the

various direct costs that are associated with manufacturing of the beef and wine (Bulyga,

2014). In the present case there is high rate, the firm can hold back the dollar of sales. The

margin of gross profit of TCW Company in 2016 was the highest that amounted to 31.76 abd

reduced to 14.5 in the period of 2017; the gross margin that is anticipated to fall to 12.2 in

2018. This represents that TCW could is now being able retain greater sales dollars.

Marketing cost over S/A costs: The costs of marketing is the cash level that has

been spent out of the profits from the total of administrative and selling costs considering the

end result to enhance the sales. This is an indirect cost. As per the audited records of the years

2017 and 2016, the marketing cost level has been reducing from 2016 increasing to 15.2 and

17.89 in 2017.

8AUDITING THEORY AND PRACTICE

According to the record that are unaudited the ratio of marketing expense is to be increased

to 23.67.

• Times interest earned: The earned interest refers to the coverage ratio that measures

the organization capacity to consider the debt payment. At the present scenario, the coverage

ratio is less than one that indicates that, the firm not getting sufficient cash from the various

operations. The premium that is earned is decreasing in the firm of TCW that represents that

there no sufficient cash generation. In the 2017 the amount of premium that has been earned

was 7.51; in 2016 was 8.10 and the expected and unaudited enthusiasm for 2018 was 6.67.

• Days in inventory (wine): The sales days represents the days that takes for the sale of

its stocks during the period that is determined. In the present scenario, the stock refers to the

wine generation. For wine, the inventory days for 2016 was 460, in 2017 was 423 and when it

comes to the unaudited record the days number is 367.

• Days in accounts receivables (wine): The accounts receivables days refers to the

number of dates that the company of TCW would need for acquire the goods installments that

are sold. In case there are high numbers of days, it represents that there is a problem in cash

flows acquisition. In case of less number of days it represents that there is a credit policy that

may reduce the revenue of sales. In this situation, the goods refer to the wine production of

the company of TCW (Yip, Lee & Tsui, 2015). The days that are receivable for the case of

wine was in 2016 53.24, 60.65 in 2017 and as per unaudited records that amount is 50.2 in

2018.

• Days in accounts receivables (beef): In TCW, the accounts receivables days of the

production of beef is the days that are needed for acquiring the sales payment of beef from

the company. The account receivable for beef in 2016 was 24, in 2017 were 36 and the in

2018 the unaudited record is 57.

According to the record that are unaudited the ratio of marketing expense is to be increased

to 23.67.

• Times interest earned: The earned interest refers to the coverage ratio that measures

the organization capacity to consider the debt payment. At the present scenario, the coverage

ratio is less than one that indicates that, the firm not getting sufficient cash from the various

operations. The premium that is earned is decreasing in the firm of TCW that represents that

there no sufficient cash generation. In the 2017 the amount of premium that has been earned

was 7.51; in 2016 was 8.10 and the expected and unaudited enthusiasm for 2018 was 6.67.

• Days in inventory (wine): The sales days represents the days that takes for the sale of

its stocks during the period that is determined. In the present scenario, the stock refers to the

wine generation. For wine, the inventory days for 2016 was 460, in 2017 was 423 and when it

comes to the unaudited record the days number is 367.

• Days in accounts receivables (wine): The accounts receivables days refers to the

number of dates that the company of TCW would need for acquire the goods installments that

are sold. In case there are high numbers of days, it represents that there is a problem in cash

flows acquisition. In case of less number of days it represents that there is a credit policy that

may reduce the revenue of sales. In this situation, the goods refer to the wine production of

the company of TCW (Yip, Lee & Tsui, 2015). The days that are receivable for the case of

wine was in 2016 53.24, 60.65 in 2017 and as per unaudited records that amount is 50.2 in

2018.

• Days in accounts receivables (beef): In TCW, the accounts receivables days of the

production of beef is the days that are needed for acquiring the sales payment of beef from

the company. The account receivable for beef in 2016 was 24, in 2017 were 36 and the in

2018 the unaudited record is 57.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9AUDITING THEORY AND PRACTICE

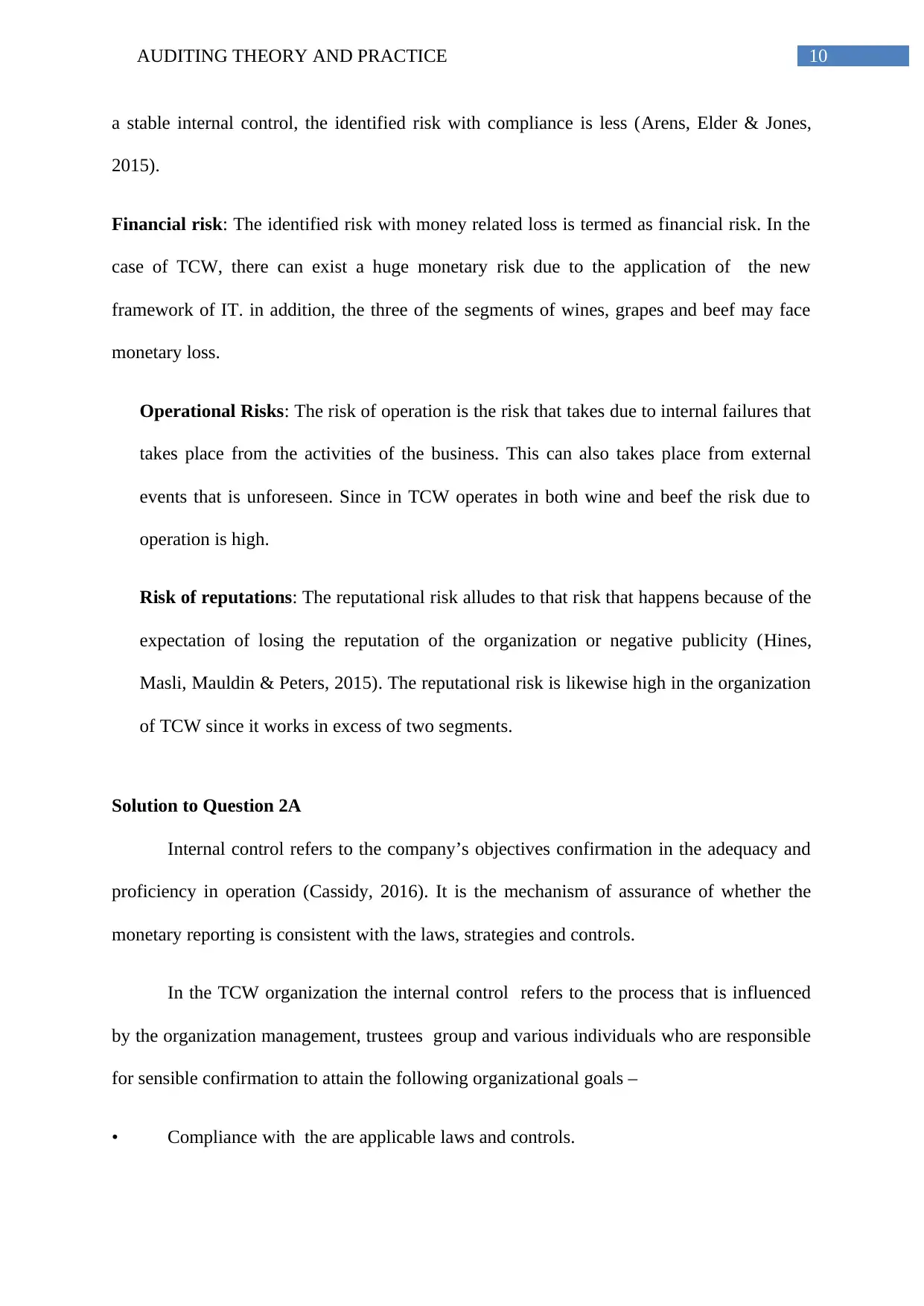

• Current ratio: The current ratio refers to the liquidity ratio that helps in the

estimation of the capacity of the firm to adapt the short and the long and term liabilities. It is

ascertained by dividing the total assets and liabilities of the firm. In the given case the total

refers to both current and noncurrent assets of the of TCW organization. The current ratio in

the year 2016 was 2.66 for, 2017 was 2.54 and the 2.80 as unaudited record.

• Acid test ratio: The quick ratio or the acid test ratio is the current assets that can be

changed effortlessly into cash without the changing the value. The quick ratio was 1.20 in

2016, 2017 in 1.15 and the unaudited record is anticipated to be 1.18.

• Debts to equity ratio: The equity debt ratio refers to the financial ratio that represents

the monetary ratio that is estimated to reveal the relative extent of equity of shareholders and

debt to finance the asset in respect to the equity value of the shareholders (Louwers et al.,

2015). Debt to equity ratio was in 2016 was 0.67, in 2017 was 0.63 for and in 2018 the

unaudited record is 0.54.

After analysis of the above ratios, the various types of risks has been identified,

Business risk refers to the possibility of not getting an investment return. In case of the

company of TCW the identified risks are:

Strategic risks: The strategic risk is the risk from the various operations within a specific

industry at in a particular period of time that occurs due to technological change or the

consumer change in preference. For TCW, they deal in both beef and wine therefore; the

strategic risk is much less. Conversely, there has been new IT system installation that may

lead to some risk.

Risk of compliance: The related risk that are with compliance with the regulations of

bureaucratic or authoritative that the firm may follow. In the present case of TCW as there is

• Current ratio: The current ratio refers to the liquidity ratio that helps in the

estimation of the capacity of the firm to adapt the short and the long and term liabilities. It is

ascertained by dividing the total assets and liabilities of the firm. In the given case the total

refers to both current and noncurrent assets of the of TCW organization. The current ratio in

the year 2016 was 2.66 for, 2017 was 2.54 and the 2.80 as unaudited record.

• Acid test ratio: The quick ratio or the acid test ratio is the current assets that can be

changed effortlessly into cash without the changing the value. The quick ratio was 1.20 in

2016, 2017 in 1.15 and the unaudited record is anticipated to be 1.18.

• Debts to equity ratio: The equity debt ratio refers to the financial ratio that represents

the monetary ratio that is estimated to reveal the relative extent of equity of shareholders and

debt to finance the asset in respect to the equity value of the shareholders (Louwers et al.,

2015). Debt to equity ratio was in 2016 was 0.67, in 2017 was 0.63 for and in 2018 the

unaudited record is 0.54.

After analysis of the above ratios, the various types of risks has been identified,

Business risk refers to the possibility of not getting an investment return. In case of the

company of TCW the identified risks are:

Strategic risks: The strategic risk is the risk from the various operations within a specific

industry at in a particular period of time that occurs due to technological change or the

consumer change in preference. For TCW, they deal in both beef and wine therefore; the

strategic risk is much less. Conversely, there has been new IT system installation that may

lead to some risk.

Risk of compliance: The related risk that are with compliance with the regulations of

bureaucratic or authoritative that the firm may follow. In the present case of TCW as there is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10AUDITING THEORY AND PRACTICE

a stable internal control, the identified risk with compliance is less (Arens, Elder & Jones,

2015).

Financial risk: The identified risk with money related loss is termed as financial risk. In the

case of TCW, there can exist a huge monetary risk due to the application of the new

framework of IT. in addition, the three of the segments of wines, grapes and beef may face

monetary loss.

Operational Risks: The risk of operation is the risk that takes due to internal failures that

takes place from the activities of the business. This can also takes place from external

events that is unforeseen. Since in TCW operates in both wine and beef the risk due to

operation is high.

Risk of reputations: The reputational risk alludes to that risk that happens because of the

expectation of losing the reputation of the organization or negative publicity (Hines,

Masli, Mauldin & Peters, 2015). The reputational risk is likewise high in the organization

of TCW since it works in excess of two segments.

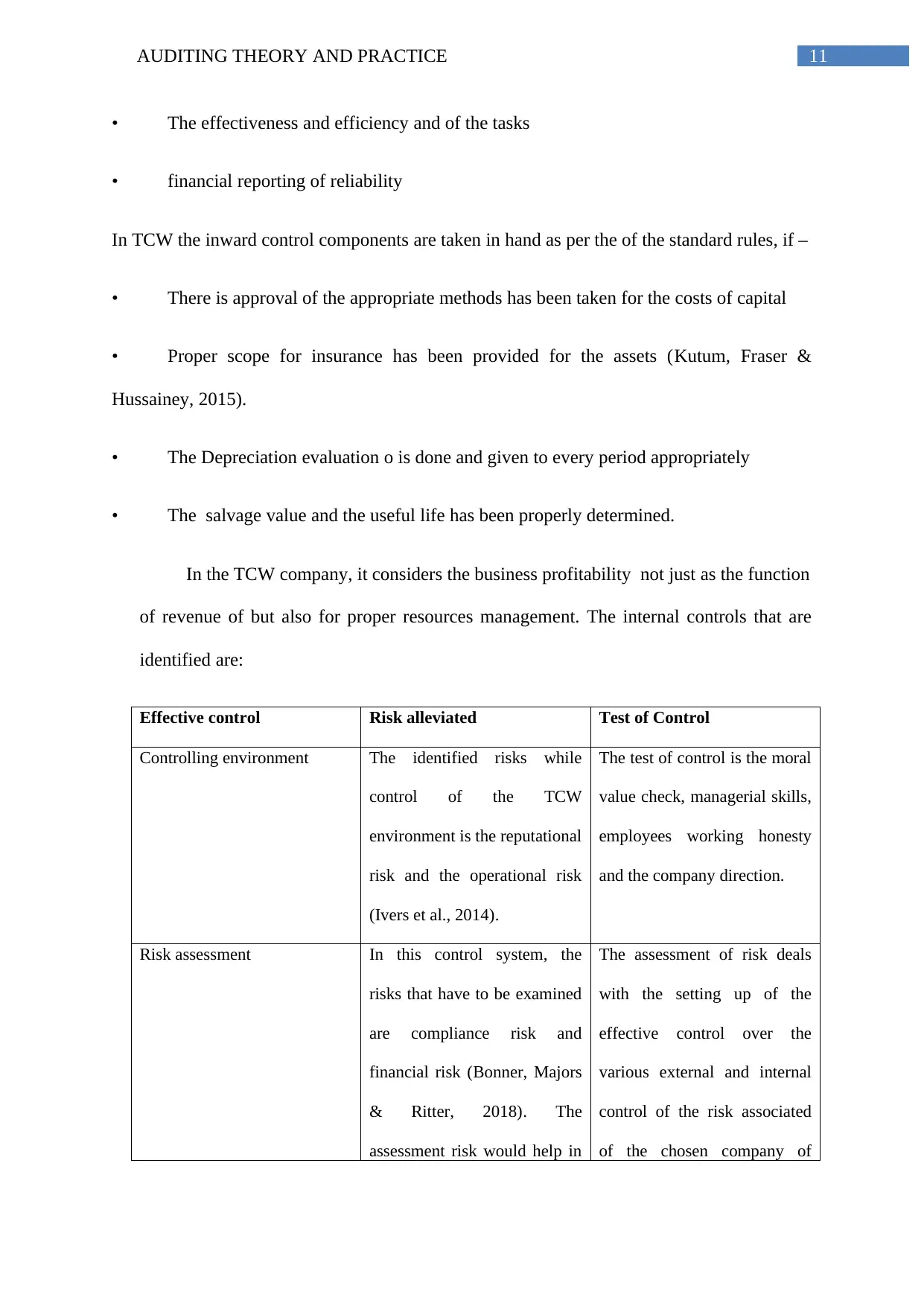

Solution to Question 2A

Internal control refers to the company’s objectives confirmation in the adequacy and

proficiency in operation (Cassidy, 2016). It is the mechanism of assurance of whether the

monetary reporting is consistent with the laws, strategies and controls.

In the TCW organization the internal control refers to the process that is influenced

by the organization management, trustees group and various individuals who are responsible

for sensible confirmation to attain the following organizational goals –

• Compliance with the are applicable laws and controls.

a stable internal control, the identified risk with compliance is less (Arens, Elder & Jones,

2015).

Financial risk: The identified risk with money related loss is termed as financial risk. In the

case of TCW, there can exist a huge monetary risk due to the application of the new

framework of IT. in addition, the three of the segments of wines, grapes and beef may face

monetary loss.

Operational Risks: The risk of operation is the risk that takes due to internal failures that

takes place from the activities of the business. This can also takes place from external

events that is unforeseen. Since in TCW operates in both wine and beef the risk due to

operation is high.

Risk of reputations: The reputational risk alludes to that risk that happens because of the

expectation of losing the reputation of the organization or negative publicity (Hines,

Masli, Mauldin & Peters, 2015). The reputational risk is likewise high in the organization

of TCW since it works in excess of two segments.

Solution to Question 2A

Internal control refers to the company’s objectives confirmation in the adequacy and

proficiency in operation (Cassidy, 2016). It is the mechanism of assurance of whether the

monetary reporting is consistent with the laws, strategies and controls.

In the TCW organization the internal control refers to the process that is influenced

by the organization management, trustees group and various individuals who are responsible

for sensible confirmation to attain the following organizational goals –

• Compliance with the are applicable laws and controls.

11AUDITING THEORY AND PRACTICE

• The effectiveness and efficiency and of the tasks

• financial reporting of reliability

In TCW the inward control components are taken in hand as per the of the standard rules, if –

• There is approval of the appropriate methods has been taken for the costs of capital

• Proper scope for insurance has been provided for the assets (Kutum, Fraser &

Hussainey, 2015).

• The Depreciation evaluation o is done and given to every period appropriately

• The salvage value and the useful life has been properly determined.

In the TCW company, it considers the business profitability not just as the function

of revenue of but also for proper resources management. The internal controls that are

identified are:

Effective control Risk alleviated Test of Control

Controlling environment The identified risks while

control of the TCW

environment is the reputational

risk and the operational risk

(Ivers et al., 2014).

The test of control is the moral

value check, managerial skills,

employees working honesty

and the company direction.

Risk assessment In this control system, the

risks that have to be examined

are compliance risk and

financial risk (Bonner, Majors

& Ritter, 2018). The

assessment risk would help in

The assessment of risk deals

with the setting up of the

effective control over the

various external and internal

control of the risk associated

of the chosen company of

• The effectiveness and efficiency and of the tasks

• financial reporting of reliability

In TCW the inward control components are taken in hand as per the of the standard rules, if –

• There is approval of the appropriate methods has been taken for the costs of capital

• Proper scope for insurance has been provided for the assets (Kutum, Fraser &

Hussainey, 2015).

• The Depreciation evaluation o is done and given to every period appropriately

• The salvage value and the useful life has been properly determined.

In the TCW company, it considers the business profitability not just as the function

of revenue of but also for proper resources management. The internal controls that are

identified are:

Effective control Risk alleviated Test of Control

Controlling environment The identified risks while

control of the TCW

environment is the reputational

risk and the operational risk

(Ivers et al., 2014).

The test of control is the moral

value check, managerial skills,

employees working honesty

and the company direction.

Risk assessment In this control system, the

risks that have to be examined

are compliance risk and

financial risk (Bonner, Majors

& Ritter, 2018). The

assessment risk would help in

The assessment of risk deals

with the setting up of the

effective control over the

various external and internal

control of the risk associated

of the chosen company of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.