Taxation in the UK: Badges of Trade, Tax Evasion, Avoidance, VAT

VerifiedAdded on 2023/06/04

|12

|2836

|487

Report

AI Summary

This report provides a comprehensive overview of key aspects of UK taxation. It begins by explaining the 'badges of trade,' which are criteria used to determine if an activity qualifies as trading for tax purposes, referencing relevant case law. The report then differentiates between tax evasion (illegal) and tax avoidance (legal but potentially challenged), highlighting the consequences of evasion and HMRC's approach to both. Furthermore, it discusses the rules and requirements for VAT registration, payment, and return filing, including eligibility for the flat rate scheme. The report also includes practical examples and calculations related to adjusting trading profits and VAT liabilities. Desklib offers more resources like this for students.

Taxation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction......................................................................................................................................3

Question 1........................................................................................................................................3

Question 2........................................................................................................................................5

(a).................................................................................................................................................5

(b).................................................................................................................................................6

Question 3........................................................................................................................................6

(a).................................................................................................................................................6

(b).................................................................................................................................................7

(c).................................................................................................................................................8

Question 4........................................................................................................................................9

(a).................................................................................................................................................9

(b).................................................................................................................................................9

(c).................................................................................................................................................9

(d)...............................................................................................................................................10

REFERENCES..............................................................................................................................11

Introduction......................................................................................................................................3

Question 1........................................................................................................................................3

Question 2........................................................................................................................................5

(a).................................................................................................................................................5

(b).................................................................................................................................................6

Question 3........................................................................................................................................6

(a).................................................................................................................................................6

(b).................................................................................................................................................7

(c).................................................................................................................................................8

Question 4........................................................................................................................................9

(a).................................................................................................................................................9

(b).................................................................................................................................................9

(c).................................................................................................................................................9

(d)...............................................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Income tax is charged on the taxable income of the assesse, and this income is computed after

considering the allowances, disallowances, deductions and exemptions provided by the UK

government (Devereux, Liu, and Loretz, 2014). The present study is about the understanding of

badges of rules, which assist in determining whether the particular transaction comes within the

scope of the trading activity. Along with this, difference between the tax evasion and tax

avoidance is also stated in this study. Moreover the requirement of the registration under the vat,

payment of vat liability and manner of filing the return of vat by the person is also stated.

QUESTION 1

In the United Kingdom the income tax is levy on profit from business, profession or by the

vocational activities (Jenkins, 2016). With respect to this, HM revenue and custom (HMRC)

defines the nine badges of trade, therefore if any activity carried by the person fulfil the

condition of the badges of trade, then it will regarded as a trading activity and the tax will levy

on the profit earned by that activity.

Badges of trade is described as below-

If the person purchases the asset and sold within the short term period, then it is

considered as the person purchase the asset with the objective to sale the asset at a profit.

Therefore it is considered trading activity (Garbett, 2016).

If the organization is set up in such a way, by which the person carried out the activity,

even if only some part of this activity related with them is commercial then also it is

regarded as trading activity. In the case of The Cape Brandy Syndicate, Syndicates of

Income tax is charged on the taxable income of the assesse, and this income is computed after

considering the allowances, disallowances, deductions and exemptions provided by the UK

government (Devereux, Liu, and Loretz, 2014). The present study is about the understanding of

badges of rules, which assist in determining whether the particular transaction comes within the

scope of the trading activity. Along with this, difference between the tax evasion and tax

avoidance is also stated in this study. Moreover the requirement of the registration under the vat,

payment of vat liability and manner of filing the return of vat by the person is also stated.

QUESTION 1

In the United Kingdom the income tax is levy on profit from business, profession or by the

vocational activities (Jenkins, 2016). With respect to this, HM revenue and custom (HMRC)

defines the nine badges of trade, therefore if any activity carried by the person fulfil the

condition of the badges of trade, then it will regarded as a trading activity and the tax will levy

on the profit earned by that activity.

Badges of trade is described as below-

If the person purchases the asset and sold within the short term period, then it is

considered as the person purchase the asset with the objective to sale the asset at a profit.

Therefore it is considered trading activity (Garbett, 2016).

If the organization is set up in such a way, by which the person carried out the activity,

even if only some part of this activity related with them is commercial then also it is

regarded as trading activity. In the case of The Cape Brandy Syndicate, Syndicates of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

chartered accountants refined brandy. Since the organization argues that they sold only

that much brandy which is left after their consumption. But the department argues that,

the organization had set up special phone line, carried the promotion activity and separate

information desk, therefore all the activities are considered under definition of trading

activity.

The purpose of the buying and selling the asset is also plays a very important role in

determining whether the transaction is considered as a trading activity or not (Garbett,

2016). Even if the asset is acquired as a gift or in inheritance, but the person who

acquired the asset, sell the asset by making the advertisement and earn the profit on them.

Then it is regarded as trading activity.

Any transaction undertaken by the person with the intention to making the profit from the

same is regarded as a trading activity. However existence of the profit does not make any

impact, if the objective or the intention is present then only it is the trading activity.

The nature of transaction carried out by the person is also evaluated for ascertaining the

trading activity. Even if the single transaction of the buying and selling activity leads to

the trading profit then also it will be covered under trading activity. In the case of

“Rutledge v CIR” the tax payer purchased one million rolls of toilet paper in one

transaction and also sold all the rolls in single transaction (Garbett, 2016). It is termed as

trading which is in the nature of adventure.

For promoting the sale, if the person purchased the asset and then made the changes in

the asset which result in endorsing and selling the asset. Then this activity is regarded as

a trading activity.

that much brandy which is left after their consumption. But the department argues that,

the organization had set up special phone line, carried the promotion activity and separate

information desk, therefore all the activities are considered under definition of trading

activity.

The purpose of the buying and selling the asset is also plays a very important role in

determining whether the transaction is considered as a trading activity or not (Garbett,

2016). Even if the asset is acquired as a gift or in inheritance, but the person who

acquired the asset, sell the asset by making the advertisement and earn the profit on them.

Then it is regarded as trading activity.

Any transaction undertaken by the person with the intention to making the profit from the

same is regarded as a trading activity. However existence of the profit does not make any

impact, if the objective or the intention is present then only it is the trading activity.

The nature of transaction carried out by the person is also evaluated for ascertaining the

trading activity. Even if the single transaction of the buying and selling activity leads to

the trading profit then also it will be covered under trading activity. In the case of

“Rutledge v CIR” the tax payer purchased one million rolls of toilet paper in one

transaction and also sold all the rolls in single transaction (Garbett, 2016). It is termed as

trading which is in the nature of adventure.

For promoting the sale, if the person purchased the asset and then made the changes in

the asset which result in endorsing and selling the asset. Then this activity is regarded as

a trading activity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In the present study, Mr Desai has a vocation of collecting antique and restoring and make the

profit by selling the antique. The vocation is also included in the term of trading by the HMRC.

Therefore on the profit earned by the Mr Desai will be chargeable to the tax.

QUESTION 2

(a)

Tax avoidance is an easy procedure of minimizing tax liabilities by utilizing the different lawful

methods. Largely, it engages capitalizing on inadequacy inside the regulation for minimizing the

whole amount payable to the IRS. In several cases, tax avoidance is utilized to delay the payment

date intended for tax liability (Braithwaite, 2017).

Tax avoidance is the deliberate proceed of deteriorating to either file tax returns or pay the tax

liability otherwise both (Gallemore and Labro, 2015). Remarkably, tax evasion is a cruel offense

that pulls towards terrible consequences, for example lengthy jail terms and hefty fines.

Moreover in terms of legality, the additional important dissimilarity among evasion and

avoidance of tax is the moment or time at which the proceeding takes place. Generally, tax

avoidance occurs before the computation of tax liability, because it is predestined to decrease the

whole amount earlier or put off the payment date. Tax evasion, on the other hand, frequently

takes place after the burden of tax liability, because its main aim is to completely avoid paying

tax debts (Guenther, Wilson, and Wu, 2018).

Alternately, tax avoidance includes the utilization of lawful conducts, therefore creating the

same is morally suitable (Gallemore, Maydew, and Thornock, 2014).

profit by selling the antique. The vocation is also included in the term of trading by the HMRC.

Therefore on the profit earned by the Mr Desai will be chargeable to the tax.

QUESTION 2

(a)

Tax avoidance is an easy procedure of minimizing tax liabilities by utilizing the different lawful

methods. Largely, it engages capitalizing on inadequacy inside the regulation for minimizing the

whole amount payable to the IRS. In several cases, tax avoidance is utilized to delay the payment

date intended for tax liability (Braithwaite, 2017).

Tax avoidance is the deliberate proceed of deteriorating to either file tax returns or pay the tax

liability otherwise both (Gallemore and Labro, 2015). Remarkably, tax evasion is a cruel offense

that pulls towards terrible consequences, for example lengthy jail terms and hefty fines.

Moreover in terms of legality, the additional important dissimilarity among evasion and

avoidance of tax is the moment or time at which the proceeding takes place. Generally, tax

avoidance occurs before the computation of tax liability, because it is predestined to decrease the

whole amount earlier or put off the payment date. Tax evasion, on the other hand, frequently

takes place after the burden of tax liability, because its main aim is to completely avoid paying

tax debts (Guenther, Wilson, and Wu, 2018).

Alternately, tax avoidance includes the utilization of lawful conducts, therefore creating the

same is morally suitable (Gallemore, Maydew, and Thornock, 2014).

(b)

In every situation, HMRC required to add to the punishments and penalty for those who,

according to them, have chosen not to meet the terms. Furthermore they are required to eliminate

the financial benefit of evasion and/or avoidance (Sikka et al. 2016).

HMRC know how to offset tax benefit occur by, for instance, rising the tax payers tax liability

but the same is not sufficient. HMRC should pursue convinced technical requirements and in

case, it creates any adjustments than, these should be on a on the basis of just and reasonable

conditions (Riedel, 2018).

HMRC have an authority to name enablers regarding penalties where 50 or more quantifiable

punishment have been brought upon you at that time when exacting punishment become final or

the amount of the punishment moreover independently or with other quantifiable penalties

acquired by the enabler is over £25,000. On the other hand, HMRC should provide the

opportunity to the person to create image earlier than publishing (Sikka, 2016).

QUESTION 3

(a)

The income tax is levied on the taxable income of the assesse and the taxable income is

computed after considering the various allowances, deduction, exemption, disallowances

provided in the Act. Generally, all the expenses which are incurred by the person for generating

the profit in the course of business are allowed by the government (Sikka et al. 2016). The

person at the time of filing the income tax return can make the claim of the expenses. Further

only the expenses which are revenue in nature are allowed to the assesse. Capital expenses which

In every situation, HMRC required to add to the punishments and penalty for those who,

according to them, have chosen not to meet the terms. Furthermore they are required to eliminate

the financial benefit of evasion and/or avoidance (Sikka et al. 2016).

HMRC know how to offset tax benefit occur by, for instance, rising the tax payers tax liability

but the same is not sufficient. HMRC should pursue convinced technical requirements and in

case, it creates any adjustments than, these should be on a on the basis of just and reasonable

conditions (Riedel, 2018).

HMRC have an authority to name enablers regarding penalties where 50 or more quantifiable

punishment have been brought upon you at that time when exacting punishment become final or

the amount of the punishment moreover independently or with other quantifiable penalties

acquired by the enabler is over £25,000. On the other hand, HMRC should provide the

opportunity to the person to create image earlier than publishing (Sikka, 2016).

QUESTION 3

(a)

The income tax is levied on the taxable income of the assesse and the taxable income is

computed after considering the various allowances, deduction, exemption, disallowances

provided in the Act. Generally, all the expenses which are incurred by the person for generating

the profit in the course of business are allowed by the government (Sikka et al. 2016). The

person at the time of filing the income tax return can make the claim of the expenses. Further

only the expenses which are revenue in nature are allowed to the assesse. Capital expenses which

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

are normally related with buying the asset and give the benefit to the assesse for more than one

year are not claimed by the assesse. Therefore all the revenue expenses, related with the business

and assisting in generating the profit of the business can be claimed and allowed to the assesse.

(b)

Expenses

The expenses of £ 1500 incurred for obtaining the loan. Since, Mr Desai acquired the

loan for business purpose, therefore the expenses incurred for buying the loan is related

with the business and is revenue in nature. So, it is allowed expense. However it is

already deducted from profit therefore no further treatment is required.

Expenses of £ 4200, is incurred for the installation of the new window. Since it is the

asset of the company, therefore the expense which is incurred for installation are in

capital in nature and not allowed to Desai. However, this expense is already deducted

from profit, therefore it should be added back in profit.

Expenses of £250, was incurred in relation of the payment of fine and same is not

allowed, therefore should be added back.

The assesse can make the claim of the depreciation which is charged on the fixed asset.

Therefore Mr Desai can make the claim of £3500. However the depreciation expenses

already deducted from the profit of the business therefore no further treatment is required.

Expenses incurred for the renewal of the lease of the business premises amounted £286.

Since the expense was related with the business and is revenue in nature, therefore it is

allowed expense. Since, the expense already deducted from the profit therefore no further

treatment is required.

year are not claimed by the assesse. Therefore all the revenue expenses, related with the business

and assisting in generating the profit of the business can be claimed and allowed to the assesse.

(b)

Expenses

The expenses of £ 1500 incurred for obtaining the loan. Since, Mr Desai acquired the

loan for business purpose, therefore the expenses incurred for buying the loan is related

with the business and is revenue in nature. So, it is allowed expense. However it is

already deducted from profit therefore no further treatment is required.

Expenses of £ 4200, is incurred for the installation of the new window. Since it is the

asset of the company, therefore the expense which is incurred for installation are in

capital in nature and not allowed to Desai. However, this expense is already deducted

from profit, therefore it should be added back in profit.

Expenses of £250, was incurred in relation of the payment of fine and same is not

allowed, therefore should be added back.

The assesse can make the claim of the depreciation which is charged on the fixed asset.

Therefore Mr Desai can make the claim of £3500. However the depreciation expenses

already deducted from the profit of the business therefore no further treatment is required.

Expenses incurred for the renewal of the lease of the business premises amounted £286.

Since the expense was related with the business and is revenue in nature, therefore it is

allowed expense. Since, the expense already deducted from the profit therefore no further

treatment is required.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Income

Compensation received from the insurance company related with the damage of premised

amounted £18000 is not the profit from business activity therefore should be deducted

from trading profit.

Interest is received from the supplier in respect of the loan amount of £1000 is not trading

income so it will be deducted from profit.

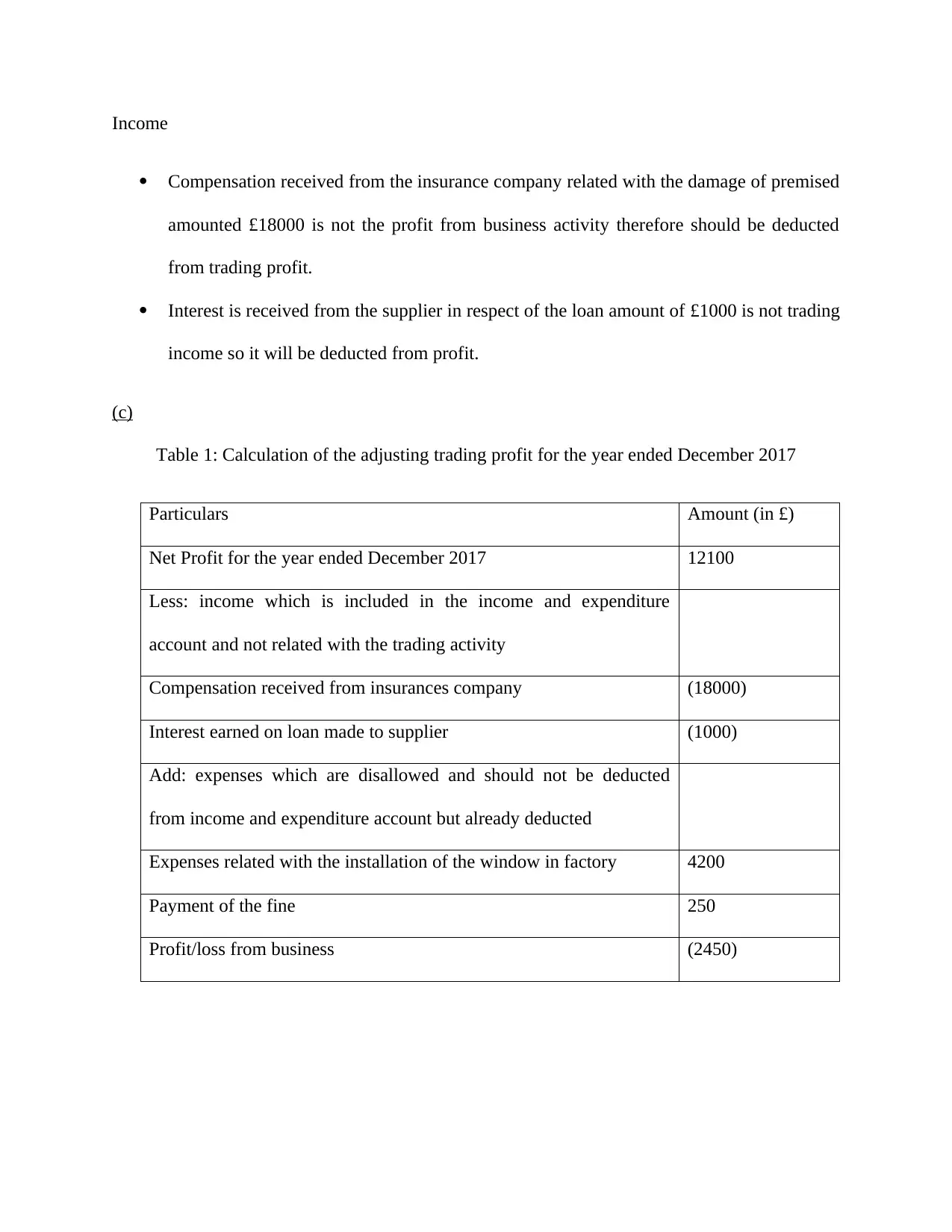

(c)

Table 1: Calculation of the adjusting trading profit for the year ended December 2017

Particulars Amount (in £)

Net Profit for the year ended December 2017 12100

Less: income which is included in the income and expenditure

account and not related with the trading activity

Compensation received from insurances company (18000)

Interest earned on loan made to supplier (1000)

Add: expenses which are disallowed and should not be deducted

from income and expenditure account but already deducted

Expenses related with the installation of the window in factory 4200

Payment of the fine 250

Profit/loss from business (2450)

Compensation received from the insurance company related with the damage of premised

amounted £18000 is not the profit from business activity therefore should be deducted

from trading profit.

Interest is received from the supplier in respect of the loan amount of £1000 is not trading

income so it will be deducted from profit.

(c)

Table 1: Calculation of the adjusting trading profit for the year ended December 2017

Particulars Amount (in £)

Net Profit for the year ended December 2017 12100

Less: income which is included in the income and expenditure

account and not related with the trading activity

Compensation received from insurances company (18000)

Interest earned on loan made to supplier (1000)

Add: expenses which are disallowed and should not be deducted

from income and expenditure account but already deducted

Expenses related with the installation of the window in factory 4200

Payment of the fine 250

Profit/loss from business (2450)

QUESTION 4

(a)

The person is required to take the registration under the VAT, if the taxable turnover of the

business is more than £85000 within the twelve month and or is likely that in the next thirty

days, the turnover will be more than the prescribed limit under the Act. In both the situation, it is

compulsory for the person to get registered under the VAT within the thirty days from the date

when the turnover of the business exceeded from £85000 (VAT registration, 2018).

In the given study, in the month of November the taxable turnover of the business more than

£85000, therefore it is compulsory for Mr Desai to obtain the registration of the vat within the

thirty days when the turnover get exceeded from the above prescribed limit.

(b)

Generally vat tax liability is submitted on the quarterly basis. However in the United Kingdom,

the person at the time of getting the registration under the VAT can choose the quarter at per

their own choice, quarter does not always means the calendar quarter. Further the vat liability for

the quarter end will be due by the 7th day of the next month. The person has to submit its vat

liability electronically (Liu, and Lockwood, 2016).

In the present study, the VAT liability of the Mr Desai will be due by the 7th day of the next

month related with the quarter end and can make the payment of the VAT tax through

electronically.

(c)

A person can get registration of the VAT under the flat rate scheme only if the turnover of the

business is up to the £150000. In this scheme the person has to make the payment of tax on the

(a)

The person is required to take the registration under the VAT, if the taxable turnover of the

business is more than £85000 within the twelve month and or is likely that in the next thirty

days, the turnover will be more than the prescribed limit under the Act. In both the situation, it is

compulsory for the person to get registered under the VAT within the thirty days from the date

when the turnover of the business exceeded from £85000 (VAT registration, 2018).

In the given study, in the month of November the taxable turnover of the business more than

£85000, therefore it is compulsory for Mr Desai to obtain the registration of the vat within the

thirty days when the turnover get exceeded from the above prescribed limit.

(b)

Generally vat tax liability is submitted on the quarterly basis. However in the United Kingdom,

the person at the time of getting the registration under the VAT can choose the quarter at per

their own choice, quarter does not always means the calendar quarter. Further the vat liability for

the quarter end will be due by the 7th day of the next month. The person has to submit its vat

liability electronically (Liu, and Lockwood, 2016).

In the present study, the VAT liability of the Mr Desai will be due by the 7th day of the next

month related with the quarter end and can make the payment of the VAT tax through

electronically.

(c)

A person can get registration of the VAT under the flat rate scheme only if the turnover of the

business is up to the £150000. In this scheme the person has to make the payment of tax on the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

basis of the fixed rate. There are several rates prescribed under the Act, which depends on the

nature of business of the person (Common VAT problems, 2018). Further the person who is

registered under this scheme, cannot claim the VAT paid at the time of purchase. Along with

this, it is also necessary to maintain the proper accounts related with the amount charged from

customer and the amount payable to the government.

In this study, the turnover of the Mr Desai exceeded from the £150000, therefore Mr Desai is not

eligible to obtain the benefit of this scheme.

(d)

The assesse registered under the VAT, make the payment of liability at the time of the

transaction take place. It is not always necessary that the assesse receives the payment from the

customer at the time of sale; sometime business grants the credit period to the customers. Since,

the VAT liability paid by the assesse when the transaction incurred, however later the customer

make the default in the payment, then this may lead to loss to the assesse. To resolve this

problem, the department of the government makes the rule regarding the bad debt relief (Geary,

and Habberley, 2018). Assesse can claim the bad debt relief, if the overdue amount is more than

six month from the date of invoice.

In the present study, one of the customers of Mr Desai makes the default in their payment.

Therefore Mr Desai can claim the bad debt relief, if the amount remains overdue for more than

six month from the date of invoice.

nature of business of the person (Common VAT problems, 2018). Further the person who is

registered under this scheme, cannot claim the VAT paid at the time of purchase. Along with

this, it is also necessary to maintain the proper accounts related with the amount charged from

customer and the amount payable to the government.

In this study, the turnover of the Mr Desai exceeded from the £150000, therefore Mr Desai is not

eligible to obtain the benefit of this scheme.

(d)

The assesse registered under the VAT, make the payment of liability at the time of the

transaction take place. It is not always necessary that the assesse receives the payment from the

customer at the time of sale; sometime business grants the credit period to the customers. Since,

the VAT liability paid by the assesse when the transaction incurred, however later the customer

make the default in the payment, then this may lead to loss to the assesse. To resolve this

problem, the department of the government makes the rule regarding the bad debt relief (Geary,

and Habberley, 2018). Assesse can claim the bad debt relief, if the overdue amount is more than

six month from the date of invoice.

In the present study, one of the customers of Mr Desai makes the default in their payment.

Therefore Mr Desai can claim the bad debt relief, if the amount remains overdue for more than

six month from the date of invoice.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Braithwaite, V., 2017. Taxing democracy: Understanding tax avoidance and evasion. Routledge.

Common VAT problems. 2018. [Online]. Available through

<https://www.moneydonut.co.uk/tax/vat/common-vat-problems>. [Accessed on 6th November

2018].

Devereux, M.P., Liu, L. and Loretz, S., 2014. The elasticity of corporate taxable income: New

evidence from UK tax records. American Economic Journal: Economic Policy, 6(2), pp.19-53.

Gallemore, J. and Labro, E., 2015. The importance of the internal information environment for

tax avoidance. Journal of Accounting and Economics, 60(1), pp.149-167.

Gallemore, J., Maydew, E.L. and Thornock, J.R., 2014. The reputational costs of tax

avoidance. Contemporary Accounting Research, 31(4), pp.1103-1133.

Garbett, J. 2016. Badges of trade. [Online]. Available through

<https://www.whitefieldtax.co.uk/badges-of-trade/>. [Accessed on 6th November 2018].

Geary, M. and Habberley, T., 2018. VAT and cosmetic procedures: policies and common

misconceptions. Journal of Aesthetic Nursing, 7(1), pp.44-46.

Guenther, D.A., Wilson, R.J. and Wu, K., 2018. Tax uncertainty and incremental tax

avoidance. The Accounting Review.

Jenkins, S.P., 2016. The Income Distribution in the UK. Social Advantage and Disadvantage,

ed. by H. Dean, and L. Platt, pp.135-160.

Braithwaite, V., 2017. Taxing democracy: Understanding tax avoidance and evasion. Routledge.

Common VAT problems. 2018. [Online]. Available through

<https://www.moneydonut.co.uk/tax/vat/common-vat-problems>. [Accessed on 6th November

2018].

Devereux, M.P., Liu, L. and Loretz, S., 2014. The elasticity of corporate taxable income: New

evidence from UK tax records. American Economic Journal: Economic Policy, 6(2), pp.19-53.

Gallemore, J. and Labro, E., 2015. The importance of the internal information environment for

tax avoidance. Journal of Accounting and Economics, 60(1), pp.149-167.

Gallemore, J., Maydew, E.L. and Thornock, J.R., 2014. The reputational costs of tax

avoidance. Contemporary Accounting Research, 31(4), pp.1103-1133.

Garbett, J. 2016. Badges of trade. [Online]. Available through

<https://www.whitefieldtax.co.uk/badges-of-trade/>. [Accessed on 6th November 2018].

Geary, M. and Habberley, T., 2018. VAT and cosmetic procedures: policies and common

misconceptions. Journal of Aesthetic Nursing, 7(1), pp.44-46.

Guenther, D.A., Wilson, R.J. and Wu, K., 2018. Tax uncertainty and incremental tax

avoidance. The Accounting Review.

Jenkins, S.P., 2016. The Income Distribution in the UK. Social Advantage and Disadvantage,

ed. by H. Dean, and L. Platt, pp.135-160.

Liu, L. and Lockwood, B., 2016. VAT notches, voluntary registration and bunching: Theory and

UK evidence. Sage.

Riedel, N., 2018. Quantifying international tax avoidance: A review of the academic

literature. Review of Economics, 69(2), pp.169-181.

Sikka, P., 2016. Big Four Accounting Firms: Addicted to Tax Avoidance. In Pioneers of Critical

Accounting (pp. 259-274). Palgrave Macmillan, London.

Sikka, P., Christensen, M., Christensen, J., Cooper, C., Hadden, T., Hargreaves, D., Haslam, C.,

Ireland, P., Morgan, G., Parker, M. and Pearson, G., 2016. Reforming HMRC: Making it Fit for

the Twenty-First Century-First Stage Report. `Routledge.

VAT registration, 2018. [Online]. Available through <https://www.gov.uk/vat-registration/when-

to-register>. [Accessed on 6th November 2018].

UK evidence. Sage.

Riedel, N., 2018. Quantifying international tax avoidance: A review of the academic

literature. Review of Economics, 69(2), pp.169-181.

Sikka, P., 2016. Big Four Accounting Firms: Addicted to Tax Avoidance. In Pioneers of Critical

Accounting (pp. 259-274). Palgrave Macmillan, London.

Sikka, P., Christensen, M., Christensen, J., Cooper, C., Hadden, T., Hargreaves, D., Haslam, C.,

Ireland, P., Morgan, G., Parker, M. and Pearson, G., 2016. Reforming HMRC: Making it Fit for

the Twenty-First Century-First Stage Report. `Routledge.

VAT registration, 2018. [Online]. Available through <https://www.gov.uk/vat-registration/when-

to-register>. [Accessed on 6th November 2018].

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.