Balance Scorecard: Features, Differences from Traditional Performance Measurement, and Suitability for Tesco Plc

VerifiedAdded on 2023/06/13

|15

|3354

|171

AI Summary

This article discusses the features of the balance scorecard, how it differs from traditional performance measurement, and its suitability for Tesco Plc. It also includes a brief discussion on Tesco Plc and its activities.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

1

Balance Scorecard

Balance Scorecard

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

Contents

Introduction......................................................................................................................................3

Discussion on the Tesco Plc............................................................................................................3

Balance Scorecard and its main features.........................................................................................4

Discussion on how the balance scorecard is different from the traditional performance

measurement....................................................................................................................................7

Discussion on whether balance scorecard can be applied in Tesco Plc or not................................8

Conclusion.......................................................................................................................................9

References......................................................................................................................................10

Contents

Introduction......................................................................................................................................3

Discussion on the Tesco Plc............................................................................................................3

Balance Scorecard and its main features.........................................................................................4

Discussion on how the balance scorecard is different from the traditional performance

measurement....................................................................................................................................7

Discussion on whether balance scorecard can be applied in Tesco Plc or not................................8

Conclusion.......................................................................................................................................9

References......................................................................................................................................10

3

Introduction

In the recent time it has been found that Balance Scorecard has gain considerable

attention among the organization due to special features of the balance scorecard that no other

technique have. Balance scorecard (BSC) has some features similar to the management

technique known as MBO (Management by Objective). The purpose of both the techniques is to

help the organization in the providing the base that align the activities of the organization with

the objectives of the organization. The main difference that these techniques have is that BSC is

more systematic as compare to the MBO. The balance scorecard is more systematic that links the

organization strategic objectives in more meaningful way with its activities. Despite of numerous

advantages of the balance scorecard there have some limitations that force the organization to

implement the balance scorecard at limited stage. It can be said that there are many difference

between the traditional financial performance metrics and balance scorecard. As traditional

financial performance metrics provides only the information about the past performance of the

organization and does not include any future plan for the financial performance and

implementing & controlling the firm’s strategic plan. Managers are keen to know about the

management perspective about the strategic plan that needs to be followed for the future period.

This information is successfully provided by the balance scorecard. In this regard, balance

scorecard has been defined management system that maps all the strategic management

objectives into four perspectives of performance metrics. These four perspectives are financial,

internal processes, customer perspectives and learning & growth. The main purpose of these

perspectives is to provide the management with relevant feedback on how well the strategic plan

has been executing so that necessary changes can be made (Smith, 2010).

Introduction

In the recent time it has been found that Balance Scorecard has gain considerable

attention among the organization due to special features of the balance scorecard that no other

technique have. Balance scorecard (BSC) has some features similar to the management

technique known as MBO (Management by Objective). The purpose of both the techniques is to

help the organization in the providing the base that align the activities of the organization with

the objectives of the organization. The main difference that these techniques have is that BSC is

more systematic as compare to the MBO. The balance scorecard is more systematic that links the

organization strategic objectives in more meaningful way with its activities. Despite of numerous

advantages of the balance scorecard there have some limitations that force the organization to

implement the balance scorecard at limited stage. It can be said that there are many difference

between the traditional financial performance metrics and balance scorecard. As traditional

financial performance metrics provides only the information about the past performance of the

organization and does not include any future plan for the financial performance and

implementing & controlling the firm’s strategic plan. Managers are keen to know about the

management perspective about the strategic plan that needs to be followed for the future period.

This information is successfully provided by the balance scorecard. In this regard, balance

scorecard has been defined management system that maps all the strategic management

objectives into four perspectives of performance metrics. These four perspectives are financial,

internal processes, customer perspectives and learning & growth. The main purpose of these

perspectives is to provide the management with relevant feedback on how well the strategic plan

has been executing so that necessary changes can be made (Smith, 2010).

4

As the consultant in the management consultancy firm, the purpose is to define balance

scorecard and know its suitability in the Tesco Plc. Tesco Plc is most famous British retail

company and it is listed on the London Stock Exchange. In this report it has been evaluated

about the balance scorecard and its various features. There will be detailed discussion on the

difference between the balance scorecard and traditional performance measurement systems. At

the end there will discussion on the whether the balance scorecard is suitable for Tesco Plc or

not. Initially a brief description about the Tesco Plc has been provided to understand the main

activities performed by the management.

Discussion on the Tesco Plc

Tesco has been founded by the Jack Cohen in early 1919 from the small store to the giant

retailer in the whole of the United States and Ireland. In year 1947, Tesco has started to be

floated on the London stock exchange and currently become the number one retailer company in

whole of United Kingdom. As it was said that Tesco is the UK’s main food retailer in the highly

completive market that makes management to expand the business in Europe and Ireland. Tesco

has purchased Quinnsworth, Crazy Prices and Stewart’s stores in order to expand its business in

the Ireland. The strategic planning of the Tesco has been known as balance scorecard by many of

the people but management of Tesco has given it a name known as Steering Wheel. The business

tool has helped the management to align all the strategies with the core business objectives. In

balance scorecard there are four main perspectives while in steering wheel there are five

perspectives. The added perspective to the steering wheel is known as Community (Tesco:

History, 2018).

As the consultant in the management consultancy firm, the purpose is to define balance

scorecard and know its suitability in the Tesco Plc. Tesco Plc is most famous British retail

company and it is listed on the London Stock Exchange. In this report it has been evaluated

about the balance scorecard and its various features. There will be detailed discussion on the

difference between the balance scorecard and traditional performance measurement systems. At

the end there will discussion on the whether the balance scorecard is suitable for Tesco Plc or

not. Initially a brief description about the Tesco Plc has been provided to understand the main

activities performed by the management.

Discussion on the Tesco Plc

Tesco has been founded by the Jack Cohen in early 1919 from the small store to the giant

retailer in the whole of the United States and Ireland. In year 1947, Tesco has started to be

floated on the London stock exchange and currently become the number one retailer company in

whole of United Kingdom. As it was said that Tesco is the UK’s main food retailer in the highly

completive market that makes management to expand the business in Europe and Ireland. Tesco

has purchased Quinnsworth, Crazy Prices and Stewart’s stores in order to expand its business in

the Ireland. The strategic planning of the Tesco has been known as balance scorecard by many of

the people but management of Tesco has given it a name known as Steering Wheel. The business

tool has helped the management to align all the strategies with the core business objectives. In

balance scorecard there are four main perspectives while in steering wheel there are five

perspectives. The added perspective to the steering wheel is known as Community (Tesco:

History, 2018).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

The current business operations in United Kingdom and in oversea countries has opened

many challenges and threats that is required to be handled using the management performance

techniques that can overcome all these issues. In recent years Tesco has tried to increase its

presence in other countries but even it is very less as compared to Walmart, Metro and

Wesfarmers. Nevertheless the market share and growth in the company revenue has been

increasing in last few years that drive the permanent growth strategy of the company. While

making entry into any of the new market Tesco faces huge competition and environmental

difficulties that needs to be overcome through use of proper business planning and aligning the

business strategies with the expansion strategies using the balance scorecard technique (Tesco:

History, 2018).

Balance Scorecard and its main features

Balance Scorecard is the most famous strategy management approach that helps the

management in planning or mapping all the operational strategies of the organization into the

defined operational objectives and provides various strategies to implement the same. As balance

scorecard is divided into four perspectives and all four perspectives are very important from the

management point of view. Balance scorecard or BSC looks the organization strategies from four

different perspectives and these perspectives are financial, internal processes, customer

perspectives and learning & growth. The main purpose of making the balance scorecard is to

ensure that there is clarity in the strategies and all these strategies have been communicated to all

the employees effectively (Lillis, 2008). The main motive to communicate the strategies to the

employees is to ensure that effective implementation of the strategies can take place. There are

four most important steps that are needed for balance scorecard designing and implementation.

These four steps are translating all the visions of the company into the effective operational

The current business operations in United Kingdom and in oversea countries has opened

many challenges and threats that is required to be handled using the management performance

techniques that can overcome all these issues. In recent years Tesco has tried to increase its

presence in other countries but even it is very less as compared to Walmart, Metro and

Wesfarmers. Nevertheless the market share and growth in the company revenue has been

increasing in last few years that drive the permanent growth strategy of the company. While

making entry into any of the new market Tesco faces huge competition and environmental

difficulties that needs to be overcome through use of proper business planning and aligning the

business strategies with the expansion strategies using the balance scorecard technique (Tesco:

History, 2018).

Balance Scorecard and its main features

Balance Scorecard is the most famous strategy management approach that helps the

management in planning or mapping all the operational strategies of the organization into the

defined operational objectives and provides various strategies to implement the same. As balance

scorecard is divided into four perspectives and all four perspectives are very important from the

management point of view. Balance scorecard or BSC looks the organization strategies from four

different perspectives and these perspectives are financial, internal processes, customer

perspectives and learning & growth. The main purpose of making the balance scorecard is to

ensure that there is clarity in the strategies and all these strategies have been communicated to all

the employees effectively (Lillis, 2008). The main motive to communicate the strategies to the

employees is to ensure that effective implementation of the strategies can take place. There are

four most important steps that are needed for balance scorecard designing and implementation.

These four steps are translating all the visions of the company into the effective operational

6

objectives, circulating the visions and goals in the organization and linking them with the

performance of individuals, changes that are made in the already designed strategies according to

the feedback received and lastly learning that is required on the base of the total outcome of the

implemented strategies. In short it can be said that balance scorecard takes past year financial

performance to link them with the drivers of the future performance. The objectives and

measures that are needed to frame the BSC are derived from the vision and strategies of an

organization. Through use of balance scorecard management executives can measure how the

business units create the value for their current and future customers. BSC helps in enhancing the

internal business capabilities and also improve the business all around performance through

incorporating the people, system and procedures necessary for the organization (Eisenberg,

2016).

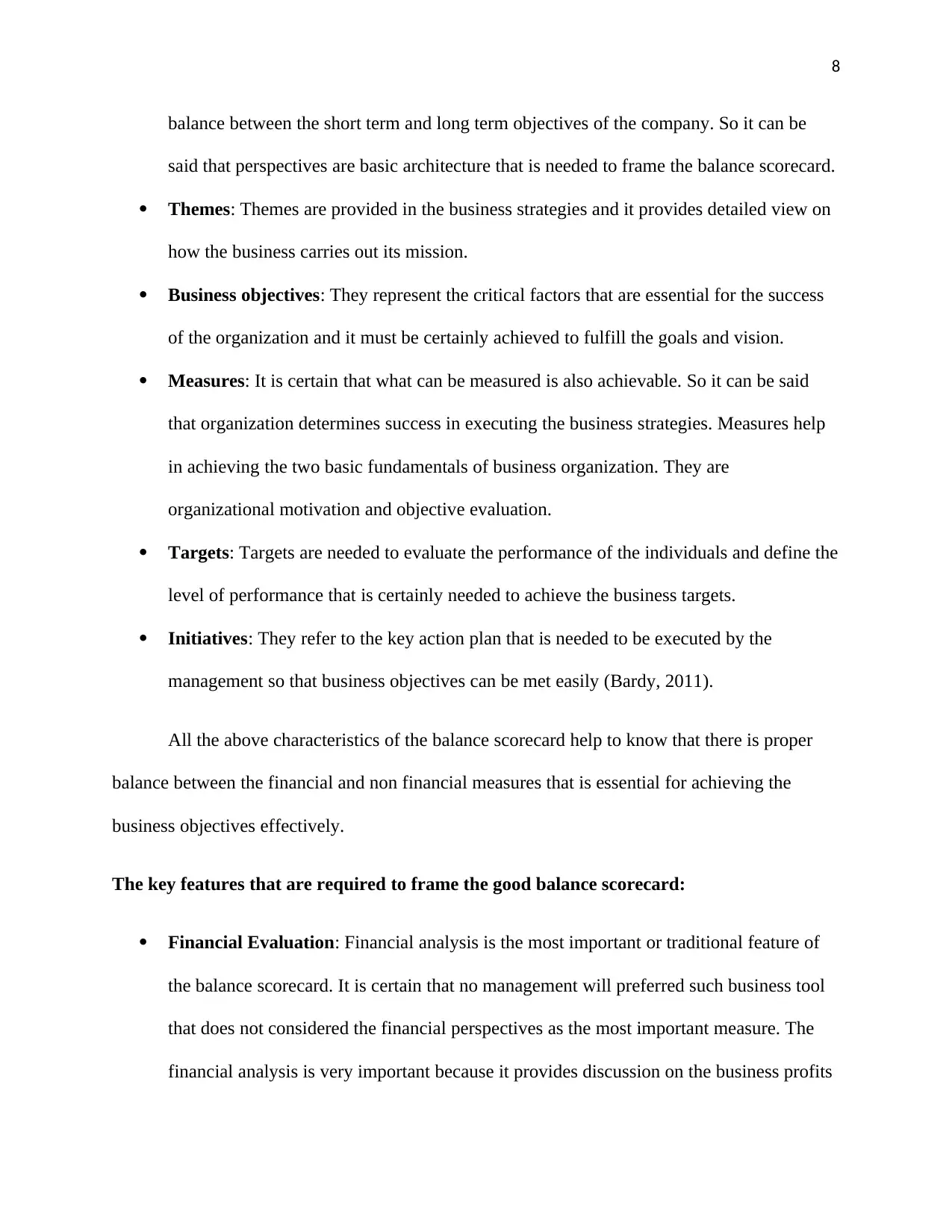

Balance scorecard helps in maintaining the balance between the long term and short term

objectives of the company. It also helps in maintaining the proper balance between the financial

outcomes and business performance drivers through following the continuous process of learning

and adoption of the modified strategies. According to the balance scorecard every business

strategies need to be broken into the various operational strategic objectives through taking into

consideration the value proposition of the customers.

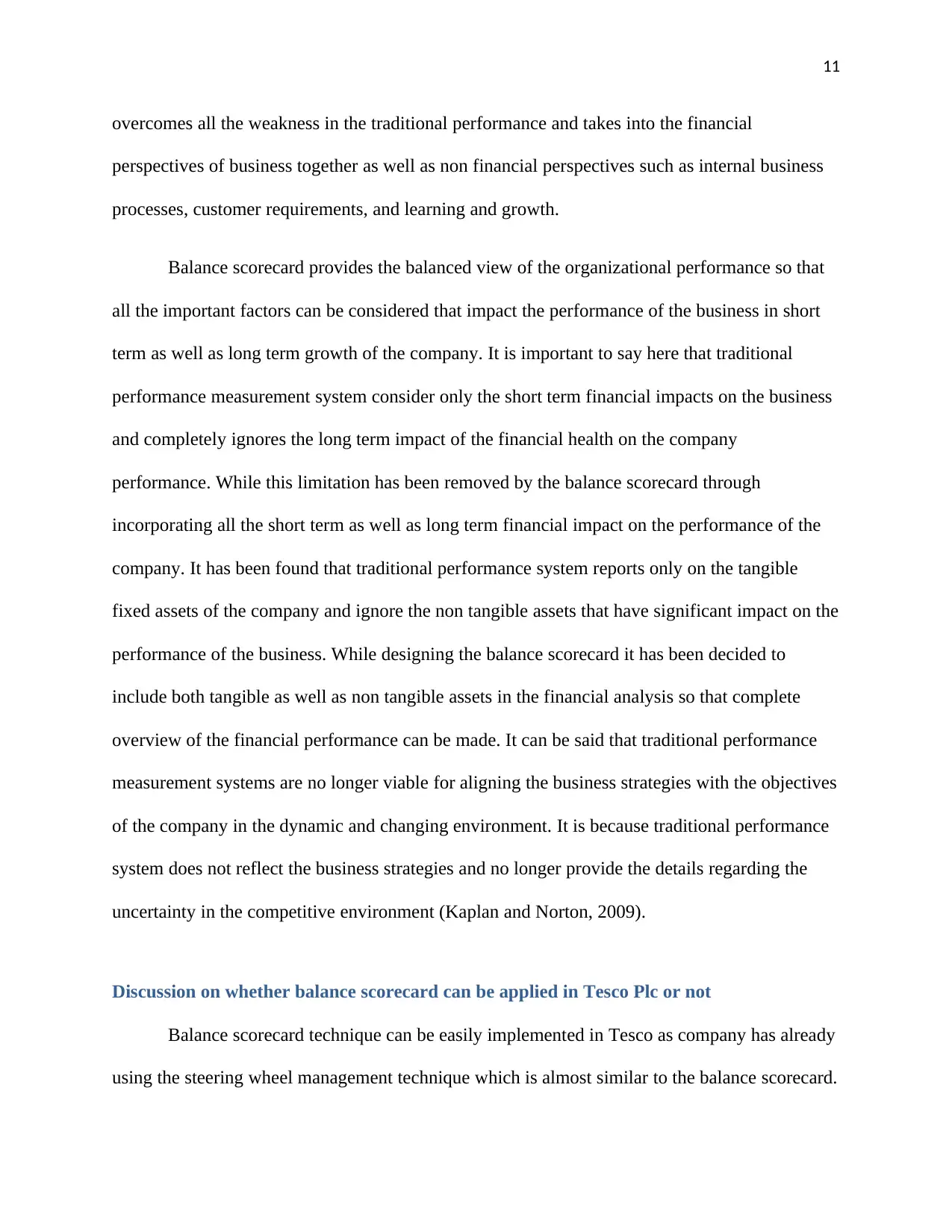

The framework of balance scorecard has been provided below:

objectives, circulating the visions and goals in the organization and linking them with the

performance of individuals, changes that are made in the already designed strategies according to

the feedback received and lastly learning that is required on the base of the total outcome of the

implemented strategies. In short it can be said that balance scorecard takes past year financial

performance to link them with the drivers of the future performance. The objectives and

measures that are needed to frame the BSC are derived from the vision and strategies of an

organization. Through use of balance scorecard management executives can measure how the

business units create the value for their current and future customers. BSC helps in enhancing the

internal business capabilities and also improve the business all around performance through

incorporating the people, system and procedures necessary for the organization (Eisenberg,

2016).

Balance scorecard helps in maintaining the balance between the long term and short term

objectives of the company. It also helps in maintaining the proper balance between the financial

outcomes and business performance drivers through following the continuous process of learning

and adoption of the modified strategies. According to the balance scorecard every business

strategies need to be broken into the various operational strategic objectives through taking into

consideration the value proposition of the customers.

The framework of balance scorecard has been provided below:

7

(Source: http://shodhganga.inflibnet.ac.in/bitstream/10603/16130/12/12_chapter_2.pdf )

There are sic main components or characteristics of the balance scorecard and it is

defined in detail below:

Perspectives: As earlier discussed there are four main perspectives of the balance

scorecard that has been defined earlier in the definition. Apart from these perspectives

management can chose to add any number of perspectives as required measuring the

business present performance and also framing drivers for the future performance. So it

can be said that number of perspectives is totally depended upon the business needs to

define the present business needs. Main purpose to frame the perspectives is to account

all the relevant factors of the strategy execution that helps in maintaining the proper

(Source: http://shodhganga.inflibnet.ac.in/bitstream/10603/16130/12/12_chapter_2.pdf )

There are sic main components or characteristics of the balance scorecard and it is

defined in detail below:

Perspectives: As earlier discussed there are four main perspectives of the balance

scorecard that has been defined earlier in the definition. Apart from these perspectives

management can chose to add any number of perspectives as required measuring the

business present performance and also framing drivers for the future performance. So it

can be said that number of perspectives is totally depended upon the business needs to

define the present business needs. Main purpose to frame the perspectives is to account

all the relevant factors of the strategy execution that helps in maintaining the proper

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

balance between the short term and long term objectives of the company. So it can be

said that perspectives are basic architecture that is needed to frame the balance scorecard.

Themes: Themes are provided in the business strategies and it provides detailed view on

how the business carries out its mission.

Business objectives: They represent the critical factors that are essential for the success

of the organization and it must be certainly achieved to fulfill the goals and vision.

Measures: It is certain that what can be measured is also achievable. So it can be said

that organization determines success in executing the business strategies. Measures help

in achieving the two basic fundamentals of business organization. They are

organizational motivation and objective evaluation.

Targets: Targets are needed to evaluate the performance of the individuals and define the

level of performance that is certainly needed to achieve the business targets.

Initiatives: They refer to the key action plan that is needed to be executed by the

management so that business objectives can be met easily (Bardy, 2011).

All the above characteristics of the balance scorecard help to know that there is proper

balance between the financial and non financial measures that is essential for achieving the

business objectives effectively.

The key features that are required to frame the good balance scorecard:

Financial Evaluation: Financial analysis is the most important or traditional feature of

the balance scorecard. It is certain that no management will preferred such business tool

that does not considered the financial perspectives as the most important measure. The

financial analysis is very important because it provides discussion on the business profits

balance between the short term and long term objectives of the company. So it can be

said that perspectives are basic architecture that is needed to frame the balance scorecard.

Themes: Themes are provided in the business strategies and it provides detailed view on

how the business carries out its mission.

Business objectives: They represent the critical factors that are essential for the success

of the organization and it must be certainly achieved to fulfill the goals and vision.

Measures: It is certain that what can be measured is also achievable. So it can be said

that organization determines success in executing the business strategies. Measures help

in achieving the two basic fundamentals of business organization. They are

organizational motivation and objective evaluation.

Targets: Targets are needed to evaluate the performance of the individuals and define the

level of performance that is certainly needed to achieve the business targets.

Initiatives: They refer to the key action plan that is needed to be executed by the

management so that business objectives can be met easily (Bardy, 2011).

All the above characteristics of the balance scorecard help to know that there is proper

balance between the financial and non financial measures that is essential for achieving the

business objectives effectively.

The key features that are required to frame the good balance scorecard:

Financial Evaluation: Financial analysis is the most important or traditional feature of

the balance scorecard. It is certain that no management will preferred such business tool

that does not considered the financial perspectives as the most important measure. The

financial analysis is very important because it provides discussion on the business profits

9

which is essential part for any organization. Analysis of the financial perspective of the

business is critically required as helps in creating the shareholder value. So, financial

perspective has been kept as most important and equal to the other perspective of the

balance scorecard. In some cases financial perspective is given more important as

compare to other perspectives due to its unique of feature of increasing the financial

revenue of the company. The main functions that are performed in the financial analysis

are measuring the firm’s financial performance using the financial tools such as ratios

analysis, trend analysis etc (API, 2010).

Customer perception: This perspective is the most critical and most affected by the

management decisions. Understanding the costumer perception helps to measure how the

organization is perceived by their customers. It is true that without the customers no

business can exist a single minute, so it is very important to measure the customer

perception. The customer perception is not regarded as static performance indicator

because customer perception cannot be measured in financial terms. In order to evaluate

the customer perceptions of any organization there is need to conduct the surveys and

creating the customer value for the organization.

Identification if the internal business processes: In order to get success company must

understand and evaluate its core competencies. The balance scorecard is designed in such

a way that it identifies the most important internal business processes. The analysis of

this BSC perspective helps to make understand the management about the processes that

are most important to an organization that helps them to get succeed and helps them to

evaluate the business performance in long run. This perspective also measures the

efficiency that the business main operation provides to achieve the business objectives.

which is essential part for any organization. Analysis of the financial perspective of the

business is critically required as helps in creating the shareholder value. So, financial

perspective has been kept as most important and equal to the other perspective of the

balance scorecard. In some cases financial perspective is given more important as

compare to other perspectives due to its unique of feature of increasing the financial

revenue of the company. The main functions that are performed in the financial analysis

are measuring the firm’s financial performance using the financial tools such as ratios

analysis, trend analysis etc (API, 2010).

Customer perception: This perspective is the most critical and most affected by the

management decisions. Understanding the costumer perception helps to measure how the

organization is perceived by their customers. It is true that without the customers no

business can exist a single minute, so it is very important to measure the customer

perception. The customer perception is not regarded as static performance indicator

because customer perception cannot be measured in financial terms. In order to evaluate

the customer perceptions of any organization there is need to conduct the surveys and

creating the customer value for the organization.

Identification if the internal business processes: In order to get success company must

understand and evaluate its core competencies. The balance scorecard is designed in such

a way that it identifies the most important internal business processes. The analysis of

this BSC perspective helps to make understand the management about the processes that

are most important to an organization that helps them to get succeed and helps them to

evaluate the business performance in long run. This perspective also measures the

efficiency that the business main operation provides to achieve the business objectives.

10

Learning and growth perspective: After understanding and analyzing the business

process and customer demand along with measuring the financial performance of the

organization it is highly important to learn from the past mistakes and grow to achieve

the expertise in the relative field. So there is requirement that business must constantly

develop and advance its features otherwise the risks that are incorporated in the business

with make business obsolete by the time. This perspective of the BSC provides how well

the business can adopt the new changes and develop new knowledge in order to survive

the competition. It is very important in order to maintain the regular growth and

development in the firm (Balanced Scorecard Institute, 2010).

Discussion on how the balance scorecard is different from the traditional performance

measurement

The main difference between the balance scorecard and traditional performance

measurement is related with the perspectives that each one of method incorporates in their

discussion. Traditional performance system is completely based on financial performance of the

company while balance scorecard gives equal importance to the financial performance but it also

incorporates customer perspectives, business internal process and learning and growth that are

required by the business to get success. The traditional performance measurement system

focuses mainly on the financial measures that are completely based on the internal financial

reports (Drury, 2011). The main motive of the traditional performance measurement systems is

evaluate the profitability, capital structure, efficiency, earning per share, cash flows and other

important financial performance indicators. So main backdrop of the traditional financial

performance indicator is that it only analyses and report the past data of the company without

considering the future performance of the company. On the other hand, balance scorecard

Learning and growth perspective: After understanding and analyzing the business

process and customer demand along with measuring the financial performance of the

organization it is highly important to learn from the past mistakes and grow to achieve

the expertise in the relative field. So there is requirement that business must constantly

develop and advance its features otherwise the risks that are incorporated in the business

with make business obsolete by the time. This perspective of the BSC provides how well

the business can adopt the new changes and develop new knowledge in order to survive

the competition. It is very important in order to maintain the regular growth and

development in the firm (Balanced Scorecard Institute, 2010).

Discussion on how the balance scorecard is different from the traditional performance

measurement

The main difference between the balance scorecard and traditional performance

measurement is related with the perspectives that each one of method incorporates in their

discussion. Traditional performance system is completely based on financial performance of the

company while balance scorecard gives equal importance to the financial performance but it also

incorporates customer perspectives, business internal process and learning and growth that are

required by the business to get success. The traditional performance measurement system

focuses mainly on the financial measures that are completely based on the internal financial

reports (Drury, 2011). The main motive of the traditional performance measurement systems is

evaluate the profitability, capital structure, efficiency, earning per share, cash flows and other

important financial performance indicators. So main backdrop of the traditional financial

performance indicator is that it only analyses and report the past data of the company without

considering the future performance of the company. On the other hand, balance scorecard

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

overcomes all the weakness in the traditional performance and takes into the financial

perspectives of business together as well as non financial perspectives such as internal business

processes, customer requirements, and learning and growth.

Balance scorecard provides the balanced view of the organizational performance so that

all the important factors can be considered that impact the performance of the business in short

term as well as long term growth of the company. It is important to say here that traditional

performance measurement system consider only the short term financial impacts on the business

and completely ignores the long term impact of the financial health on the company

performance. While this limitation has been removed by the balance scorecard through

incorporating all the short term as well as long term financial impact on the performance of the

company. It has been found that traditional performance system reports only on the tangible

fixed assets of the company and ignore the non tangible assets that have significant impact on the

performance of the business. While designing the balance scorecard it has been decided to

include both tangible as well as non tangible assets in the financial analysis so that complete

overview of the financial performance can be made. It can be said that traditional performance

measurement systems are no longer viable for aligning the business strategies with the objectives

of the company in the dynamic and changing environment. It is because traditional performance

system does not reflect the business strategies and no longer provide the details regarding the

uncertainty in the competitive environment (Kaplan and Norton, 2009).

Discussion on whether balance scorecard can be applied in Tesco Plc or not

Balance scorecard technique can be easily implemented in Tesco as company has already

using the steering wheel management technique which is almost similar to the balance scorecard.

overcomes all the weakness in the traditional performance and takes into the financial

perspectives of business together as well as non financial perspectives such as internal business

processes, customer requirements, and learning and growth.

Balance scorecard provides the balanced view of the organizational performance so that

all the important factors can be considered that impact the performance of the business in short

term as well as long term growth of the company. It is important to say here that traditional

performance measurement system consider only the short term financial impacts on the business

and completely ignores the long term impact of the financial health on the company

performance. While this limitation has been removed by the balance scorecard through

incorporating all the short term as well as long term financial impact on the performance of the

company. It has been found that traditional performance system reports only on the tangible

fixed assets of the company and ignore the non tangible assets that have significant impact on the

performance of the business. While designing the balance scorecard it has been decided to

include both tangible as well as non tangible assets in the financial analysis so that complete

overview of the financial performance can be made. It can be said that traditional performance

measurement systems are no longer viable for aligning the business strategies with the objectives

of the company in the dynamic and changing environment. It is because traditional performance

system does not reflect the business strategies and no longer provide the details regarding the

uncertainty in the competitive environment (Kaplan and Norton, 2009).

Discussion on whether balance scorecard can be applied in Tesco Plc or not

Balance scorecard technique can be easily implemented in Tesco as company has already

using the steering wheel management technique which is almost similar to the balance scorecard.

12

It is belief that steering wheel method used by the Tesco is derived from the balance scorecard

and has been modified to fit it to the management needs and business objectives. The Tesco

Steering Wheel (TSW) has added the fifth dimension to the balance scorecard by making certain

modification and named this dimension as Community. The TSW or Balance scorecard approach

can be implemented in Tesco in order to ensure that employees in multiple countries can easily

understand the objectives of the Tesco and act in best possible manner to achieve the set targets

of the company. There are some pre-requite that management of Tesco has must fulfill for the

effective implementation of the Balance Scorecard technique. These pre-requite are as follows:

First of all there is need to define each of the primary business objectives of the Tesco so

that it can be aligned in the balance scorecard effectively.

There is need by the organization to understand how the stakeholders and business

processes contribute to the primary objectives of the business.

In order to implement the BSC as an effective tool to drive the business performance

there is need to make the secondary objectives that are aligned with the primary

objectives and behave as the drivers of the performance of the primary objectives.

There is need to set standards that help to develop the set of measures in order to monitor

the performance of the business primary and secondary objectives (Kaplan and Norton,

2011).

Through following all the above criteria’s it is possible to implement the balance

scorecard management performance technique in the Tesco. As Tesco is the multinational

company and has its presence for more than 89 years, it has definite set of primary as well as

secondary objectives that can be evaluated using the set of pre defined set of standards. So it can

It is belief that steering wheel method used by the Tesco is derived from the balance scorecard

and has been modified to fit it to the management needs and business objectives. The Tesco

Steering Wheel (TSW) has added the fifth dimension to the balance scorecard by making certain

modification and named this dimension as Community. The TSW or Balance scorecard approach

can be implemented in Tesco in order to ensure that employees in multiple countries can easily

understand the objectives of the Tesco and act in best possible manner to achieve the set targets

of the company. There are some pre-requite that management of Tesco has must fulfill for the

effective implementation of the Balance Scorecard technique. These pre-requite are as follows:

First of all there is need to define each of the primary business objectives of the Tesco so

that it can be aligned in the balance scorecard effectively.

There is need by the organization to understand how the stakeholders and business

processes contribute to the primary objectives of the business.

In order to implement the BSC as an effective tool to drive the business performance

there is need to make the secondary objectives that are aligned with the primary

objectives and behave as the drivers of the performance of the primary objectives.

There is need to set standards that help to develop the set of measures in order to monitor

the performance of the business primary and secondary objectives (Kaplan and Norton,

2011).

Through following all the above criteria’s it is possible to implement the balance

scorecard management performance technique in the Tesco. As Tesco is the multinational

company and has its presence for more than 89 years, it has definite set of primary as well as

secondary objectives that can be evaluated using the set of pre defined set of standards. So it can

13

be said management can be successful in implementing the balance scorecard in Tesco if all the

pre requites are followed properly.

Conclusion

Balance scorecard is the dynamic and most advanced management performance

measurement technique that is used by many of the companies all around the world. BSC differs

with the traditional management measurement technique in various contexts and it can be said

that BSC considers both financial as well as non financial perspective of any organization so that

overall business growth can be maintained.

be said management can be successful in implementing the balance scorecard in Tesco if all the

pre requites are followed properly.

Conclusion

Balance scorecard is the dynamic and most advanced management performance

measurement technique that is used by many of the companies all around the world. BSC differs

with the traditional management measurement technique in various contexts and it can be said

that BSC considers both financial as well as non financial perspective of any organization so that

overall business growth can be maintained.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

References

API. 2010. Balanced Scorecard Perspectives. [Online]. Available at: http://www.ap-

institute.com/Balanced%20Scorecard.html [Accessed on: 17 April, 2018].

Balanced Scorecard Institute. 2010. Balanced Scorecard Basics, Balanced Scorecard Institute.

[Online]. Available at:

http://www.balancedscorecard.org/BSCResources/AbouttheBalancedScorecard/tabid/55/

Default.aspx [Accessed on: 17 April, 2018].

Bardy, R., 2011. Management control in a business network: new challenges for accounting.

Qualitative Research in Accounting & Management 3(2), pp.161 – 181.

Drury, C. 2011. Management and Cost Accounting, 6th ed.Thomson.

Eisenberg, P. 2016. The Balanced Scorecard and Beyond–Applying theories of Performance

Measurement, Employment and Rewards in Management Accounting Education. International

Research Journal of Management Sciences 4 (7), pp.483-491.

Kaplan, R.S. and Norton, D.P. 2009. The Balanced Scorecard: Translating Strategy into Action.

Harvard Business School Press.

Kaplan, R.S. and Norton, D.P. 2011. The Strategy Focused Organization: How Balanced

Scorecard Companies Thrive in the New Business Environment. Harvard Business School Press.

Lillis, A., 2008. Qualitative management accounting research: rationale, pitfalls and potential: A

comment on Vaivio. Qualitative Research in Accounting & Management 5(3). pp.239 – 246.

References

API. 2010. Balanced Scorecard Perspectives. [Online]. Available at: http://www.ap-

institute.com/Balanced%20Scorecard.html [Accessed on: 17 April, 2018].

Balanced Scorecard Institute. 2010. Balanced Scorecard Basics, Balanced Scorecard Institute.

[Online]. Available at:

http://www.balancedscorecard.org/BSCResources/AbouttheBalancedScorecard/tabid/55/

Default.aspx [Accessed on: 17 April, 2018].

Bardy, R., 2011. Management control in a business network: new challenges for accounting.

Qualitative Research in Accounting & Management 3(2), pp.161 – 181.

Drury, C. 2011. Management and Cost Accounting, 6th ed.Thomson.

Eisenberg, P. 2016. The Balanced Scorecard and Beyond–Applying theories of Performance

Measurement, Employment and Rewards in Management Accounting Education. International

Research Journal of Management Sciences 4 (7), pp.483-491.

Kaplan, R.S. and Norton, D.P. 2009. The Balanced Scorecard: Translating Strategy into Action.

Harvard Business School Press.

Kaplan, R.S. and Norton, D.P. 2011. The Strategy Focused Organization: How Balanced

Scorecard Companies Thrive in the New Business Environment. Harvard Business School Press.

Lillis, A., 2008. Qualitative management accounting research: rationale, pitfalls and potential: A

comment on Vaivio. Qualitative Research in Accounting & Management 5(3). pp.239 – 246.

15

Smith, R. 2010. Business Process Management and the Balanced Scorecard: Using Processes as

Strategic Drivers. John Wiley & Sons.

Tesco: History. 2018. About Us. [Online]. Available at: https://www.tescoplc.com/about-us/

[Accessed on: 17 April, 2018].

Smith, R. 2010. Business Process Management and the Balanced Scorecard: Using Processes as

Strategic Drivers. John Wiley & Sons.

Tesco: History. 2018. About Us. [Online]. Available at: https://www.tescoplc.com/about-us/

[Accessed on: 17 April, 2018].

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.