ACC00724: In-depth Financial Analysis of Bega Cheese Ltd (BGA)

VerifiedAdded on 2023/06/10

|15

|2669

|297

Report

AI Summary

This report presents a comprehensive financial analysis of Bega Cheese Ltd, covering the period from 2013 to 2017. It includes a horizontal analysis of the income statement, highlighting trends in revenue, cost of sales, and profitability. The analysis reveals consistent revenue growth and improved cost management. Key financial ratios, such as return on assets, return on equity, and profit margins, are computed and analyzed to assess the company's operational efficiency, liquidity, and capital structure. The report also discusses the implications of these ratios for the company's financial health and future performance, with a focus on improvements in liquidity and profitability over the analyzed period. The assignment is based on ACC00724 Accounting for Managers course.

Running head: ACCOUNTING FOR MANAGER

Accounting for Manager

Name of the Student:

Name of the University:

Author’s Note:

Accounting for Manager

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ACCOUNTING FOR MANAGER

Table of Contents

Horizontal Analysis of the Income Statement of Bega Cheese Ltd................................................2

Analysis of Key Financial Ratios....................................................................................................4

Reference.........................................................................................................................................8

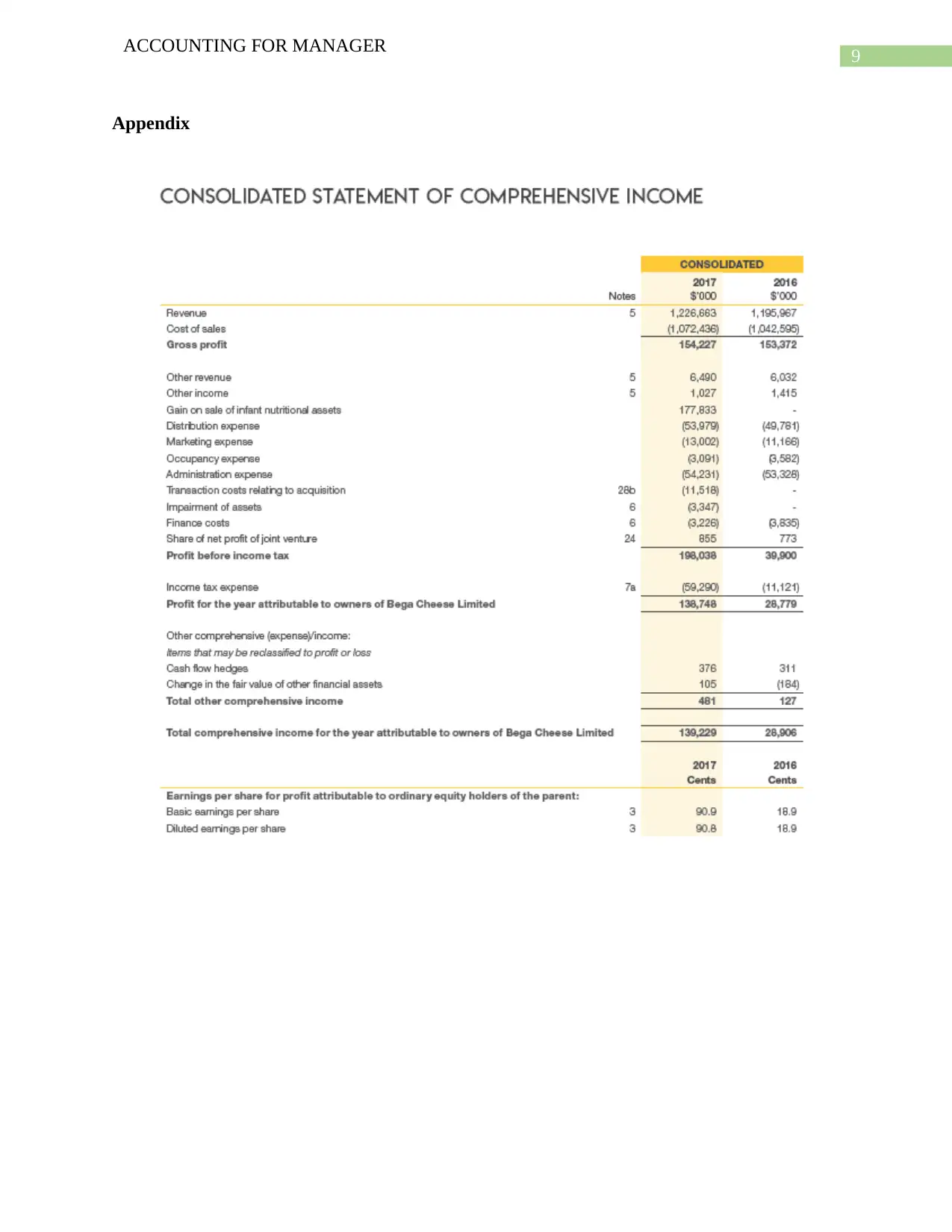

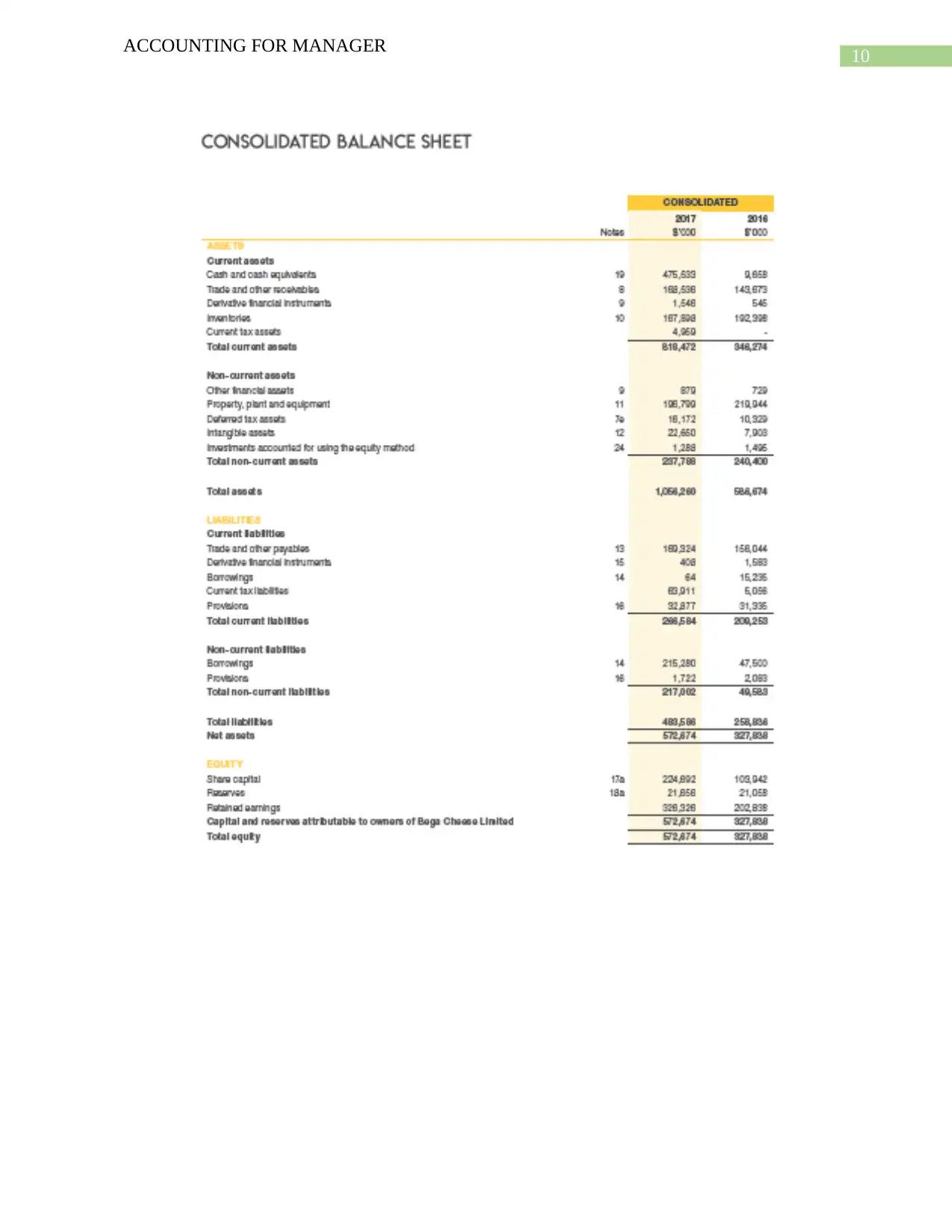

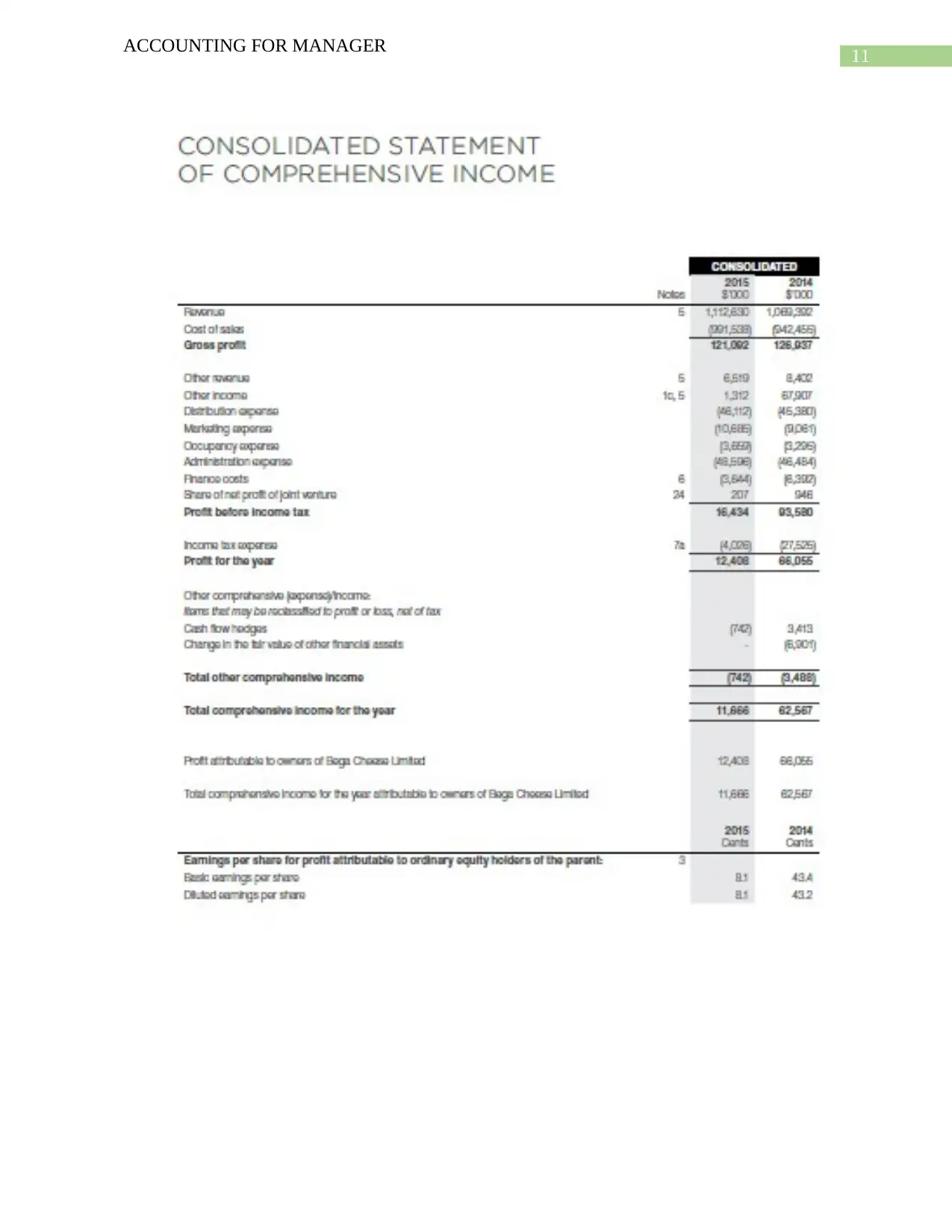

Appendix..........................................................................................................................................9

ACCOUNTING FOR MANAGER

Table of Contents

Horizontal Analysis of the Income Statement of Bega Cheese Ltd................................................2

Analysis of Key Financial Ratios....................................................................................................4

Reference.........................................................................................................................................8

Appendix..........................................................................................................................................9

2

ACCOUNTING FOR MANAGER

Horizontal Analysis of the Income Statement of Bega Cheese Ltd

Particulars 2017 2016 Difference Percentage 2016 2015 Difference Percentage 2015 2014 Difference Percentage 2014 2013 Difference Percentage

(in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000)

Revenue 1,226,663.00$ 1,195,967.00$ 30,696.00$ 3% 1,195,967.00$ 1,112,630.00$ 83,337.00$ 7% 1,112,630.00$ 1,069,392.00$ 43,238.00$ 4% 1,069,392.00$ 1,010,086.00$ 59,306.00$ 6%

Cost of sales 1,072,436.00$ 1,042,595.00$ 29,841.00$ 3% 1,042,595.00$ 991,538.00$ 51,057.00$ 5% 991,538.00$ 942,455.00$ 49,083.00$ 5% 942,455.00$ 874,961.00$ 67,494.00$ 8%

Gross profit 154,227.00$ 153,372.00$ 855.00$ 1% 153,372.00$ 121,092.00$ 32,280.00$ 27% 121,092.00$ 126,937.00$ 5,845.00-$ -5% 126,937.00$ 135,125.00$ 8,188.00-$ -6%

Other revenue 6,490.00$ 6,032.00$ 458.00$ 8% 6,032.00$ 6,519.00$ 487.00-$ -7% 6,519.00$ 8,402.00$ 1,883.00-$ -22% 8,402.00$ -$ 8,402.00$ 0%

Other income 1,027.00$ 1,415.00$ 388.00-$ -27% 1,415.00$ 1,312.00$ 103.00$ 8% 1,312.00$ 67,907.00$ 66,595.00-$ -98% 67,907.00$ 8,660.00$ 59,247.00$ 684%

Gain on sale of infant nutritional assets 177,833.00$ -$ 177,833.00$ 0% -$ -$ -$ 0% -$ -$ -$ 0% -$ -$ -$ 0%

Distribution expense 53,979.00$ 49,781.00$ 4,198.00$ 8% 49,781.00$ 46,112.00$ 3,669.00$ 8% 46,112.00$ 45,380.00$ 732.00$ 2% 45,380.00$ 44,255.00$ 1,125.00$ 3%

Marketing expense 13,002.00$ 11,166.00$ 1,836.00$ 16% 11,166.00$ 10,685.00$ 481.00$ 5% 10,685.00$ 9,061.00$ 1,624.00$ 18% 9,061.00$ 9,733.00$ 672.00-$ -7%

Occupancy expense 3,091.00$ 3,582.00$ 491.00-$ -14% 3,582.00$ 3,659.00$ 77.00-$ -2% 3,659.00$ 3,295.00$ 364.00$ 11% 3,295.00$ 2,552.00$ 743.00$ 29%

Administration expense 54,231.00$ 53,328.00$ 903.00$ 2% 53,328.00$ 48,596.00$ 4,732.00$ 10% 48,596.00$ 46,484.00$ 2,112.00$ 5% 46,484.00$ 43,449.00$ 3,035.00$ 7%

Transaction costs relating to acquisition 11,518.00$ -$ 11,518.00$ 0% -$ -$ -$ 0% -$ -$ -$ 0% -$ -$ -$ 0%

Impairment of assets 3,347.00$ -$ 3,347.00$ 0% -$ -$ -$ 0% -$ -$ -$ 0% -$ -$ -$ 0%

Finance costs 3,226.00$ 3,835.00$ 609.00-$ -16% 3,835.00$ 3,644.00$ 191.00$ 5% 3,644.00$ 6,392.00$ 2,748.00-$ -43% 6,392.00$ 8,447.00$ 2,055.00-$ -24%

Share of net profit of joint venture 855.00$ 773.00$ 82.00$ 11% 773.00$ 207.00$ 566.00$ 273% 207.00$ 946.00$ 739.00-$ -78% 946.00$ -$ 946.00$ 0%

Profit before income tax 198,038.00$ 39,900.00$ 158,138.00$ 396% 39,900.00$ 16,434.00$ 23,466.00$ 143% 16,434.00$ 93,580.00$ 77,146.00-$ -82% 93,580.00$ 35,349.00$ 58,231.00$ 165%

Income tax expense 59,290.00$ 11,121.00$ 48,169.00$ 433% 11,121.00$ 4,026.00$ 7,095.00$ 176% 4,026.00$ 27,525.00$ 23,499.00-$ -85% 27,525.00$ 9,904.00$ 17,621.00$ 178%

Profit for the year attributable to owners 138,748.00$ 28,779.00$ 109,969.00$ 382% 28,779.00$ 12,408.00$ 16,371.00$ 132% 12,408.00$ 66,055.00$ 53,647.00-$ -81% 66,055.00$ 25,445.00$ 40,610.00$ 160%

Horizontal Analysis of Income Statement of Bega Cheese Ltd

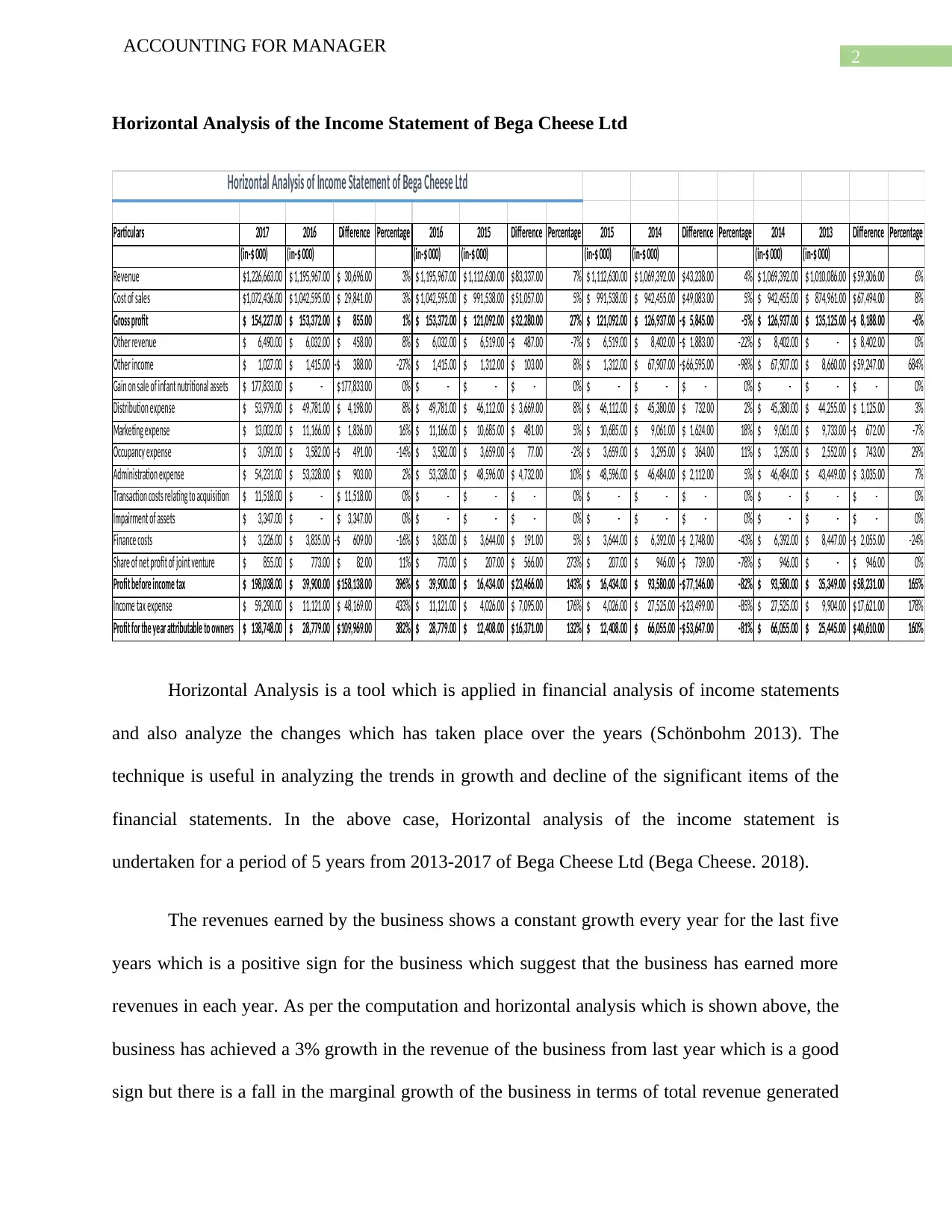

Horizontal Analysis is a tool which is applied in financial analysis of income statements

and also analyze the changes which has taken place over the years (Schönbohm 2013). The

technique is useful in analyzing the trends in growth and decline of the significant items of the

financial statements. In the above case, Horizontal analysis of the income statement is

undertaken for a period of 5 years from 2013-2017 of Bega Cheese Ltd (Bega Cheese. 2018).

The revenues earned by the business shows a constant growth every year for the last five

years which is a positive sign for the business which suggest that the business has earned more

revenues in each year. As per the computation and horizontal analysis which is shown above, the

business has achieved a 3% growth in the revenue of the business from last year which is a good

sign but there is a fall in the marginal growth of the business in terms of total revenue generated

ACCOUNTING FOR MANAGER

Horizontal Analysis of the Income Statement of Bega Cheese Ltd

Particulars 2017 2016 Difference Percentage 2016 2015 Difference Percentage 2015 2014 Difference Percentage 2014 2013 Difference Percentage

(in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000) (in-$ 000)

Revenue 1,226,663.00$ 1,195,967.00$ 30,696.00$ 3% 1,195,967.00$ 1,112,630.00$ 83,337.00$ 7% 1,112,630.00$ 1,069,392.00$ 43,238.00$ 4% 1,069,392.00$ 1,010,086.00$ 59,306.00$ 6%

Cost of sales 1,072,436.00$ 1,042,595.00$ 29,841.00$ 3% 1,042,595.00$ 991,538.00$ 51,057.00$ 5% 991,538.00$ 942,455.00$ 49,083.00$ 5% 942,455.00$ 874,961.00$ 67,494.00$ 8%

Gross profit 154,227.00$ 153,372.00$ 855.00$ 1% 153,372.00$ 121,092.00$ 32,280.00$ 27% 121,092.00$ 126,937.00$ 5,845.00-$ -5% 126,937.00$ 135,125.00$ 8,188.00-$ -6%

Other revenue 6,490.00$ 6,032.00$ 458.00$ 8% 6,032.00$ 6,519.00$ 487.00-$ -7% 6,519.00$ 8,402.00$ 1,883.00-$ -22% 8,402.00$ -$ 8,402.00$ 0%

Other income 1,027.00$ 1,415.00$ 388.00-$ -27% 1,415.00$ 1,312.00$ 103.00$ 8% 1,312.00$ 67,907.00$ 66,595.00-$ -98% 67,907.00$ 8,660.00$ 59,247.00$ 684%

Gain on sale of infant nutritional assets 177,833.00$ -$ 177,833.00$ 0% -$ -$ -$ 0% -$ -$ -$ 0% -$ -$ -$ 0%

Distribution expense 53,979.00$ 49,781.00$ 4,198.00$ 8% 49,781.00$ 46,112.00$ 3,669.00$ 8% 46,112.00$ 45,380.00$ 732.00$ 2% 45,380.00$ 44,255.00$ 1,125.00$ 3%

Marketing expense 13,002.00$ 11,166.00$ 1,836.00$ 16% 11,166.00$ 10,685.00$ 481.00$ 5% 10,685.00$ 9,061.00$ 1,624.00$ 18% 9,061.00$ 9,733.00$ 672.00-$ -7%

Occupancy expense 3,091.00$ 3,582.00$ 491.00-$ -14% 3,582.00$ 3,659.00$ 77.00-$ -2% 3,659.00$ 3,295.00$ 364.00$ 11% 3,295.00$ 2,552.00$ 743.00$ 29%

Administration expense 54,231.00$ 53,328.00$ 903.00$ 2% 53,328.00$ 48,596.00$ 4,732.00$ 10% 48,596.00$ 46,484.00$ 2,112.00$ 5% 46,484.00$ 43,449.00$ 3,035.00$ 7%

Transaction costs relating to acquisition 11,518.00$ -$ 11,518.00$ 0% -$ -$ -$ 0% -$ -$ -$ 0% -$ -$ -$ 0%

Impairment of assets 3,347.00$ -$ 3,347.00$ 0% -$ -$ -$ 0% -$ -$ -$ 0% -$ -$ -$ 0%

Finance costs 3,226.00$ 3,835.00$ 609.00-$ -16% 3,835.00$ 3,644.00$ 191.00$ 5% 3,644.00$ 6,392.00$ 2,748.00-$ -43% 6,392.00$ 8,447.00$ 2,055.00-$ -24%

Share of net profit of joint venture 855.00$ 773.00$ 82.00$ 11% 773.00$ 207.00$ 566.00$ 273% 207.00$ 946.00$ 739.00-$ -78% 946.00$ -$ 946.00$ 0%

Profit before income tax 198,038.00$ 39,900.00$ 158,138.00$ 396% 39,900.00$ 16,434.00$ 23,466.00$ 143% 16,434.00$ 93,580.00$ 77,146.00-$ -82% 93,580.00$ 35,349.00$ 58,231.00$ 165%

Income tax expense 59,290.00$ 11,121.00$ 48,169.00$ 433% 11,121.00$ 4,026.00$ 7,095.00$ 176% 4,026.00$ 27,525.00$ 23,499.00-$ -85% 27,525.00$ 9,904.00$ 17,621.00$ 178%

Profit for the year attributable to owners 138,748.00$ 28,779.00$ 109,969.00$ 382% 28,779.00$ 12,408.00$ 16,371.00$ 132% 12,408.00$ 66,055.00$ 53,647.00-$ -81% 66,055.00$ 25,445.00$ 40,610.00$ 160%

Horizontal Analysis of Income Statement of Bega Cheese Ltd

Horizontal Analysis is a tool which is applied in financial analysis of income statements

and also analyze the changes which has taken place over the years (Schönbohm 2013). The

technique is useful in analyzing the trends in growth and decline of the significant items of the

financial statements. In the above case, Horizontal analysis of the income statement is

undertaken for a period of 5 years from 2013-2017 of Bega Cheese Ltd (Bega Cheese. 2018).

The revenues earned by the business shows a constant growth every year for the last five

years which is a positive sign for the business which suggest that the business has earned more

revenues in each year. As per the computation and horizontal analysis which is shown above, the

business has achieved a 3% growth in the revenue of the business from last year which is a good

sign but there is a fall in the marginal growth of the business in terms of total revenue generated

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

ACCOUNTING FOR MANAGER

(Robinson et al. 2015). The overall cost of sales which the business has incurred over the years

in operational process of the business has declined as shown in the percentage. The overall cost

of sales rise was 7.71% in 2014 and the same has declined over the years and the same is shown

to be 2.862% in 2017. The reduction in the costs of the business suggest that the business is able

to management the operational structure of the business better and improved the overall

efficiency of the business (Bugreev 2016).

The overall growth in the profit in 2017 is phenomenal and the growth is shown to be

about 382.115% from the last year’s estimate. The overall increase and growth in the net profits

of the business is due to the sale of nutritional assets of the business. The business has improved

significantly judging from the fall in profits in 2015 which showed a fall of approximately 81%

and the same has improved significantly in 2016 and 2017. Therefore, this signifies that the

overall sales and profitability of the business has improved which suggest better management

and overall development of the business in comparison to the performance of the business in

2014.

ACCOUNTING FOR MANAGER

(Robinson et al. 2015). The overall cost of sales which the business has incurred over the years

in operational process of the business has declined as shown in the percentage. The overall cost

of sales rise was 7.71% in 2014 and the same has declined over the years and the same is shown

to be 2.862% in 2017. The reduction in the costs of the business suggest that the business is able

to management the operational structure of the business better and improved the overall

efficiency of the business (Bugreev 2016).

The overall growth in the profit in 2017 is phenomenal and the growth is shown to be

about 382.115% from the last year’s estimate. The overall increase and growth in the net profits

of the business is due to the sale of nutritional assets of the business. The business has improved

significantly judging from the fall in profits in 2015 which showed a fall of approximately 81%

and the same has improved significantly in 2016 and 2017. Therefore, this signifies that the

overall sales and profitability of the business has improved which suggest better management

and overall development of the business in comparison to the performance of the business in

2014.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ACCOUNTING FOR MANAGER

Analysis of Key Financial Ratios

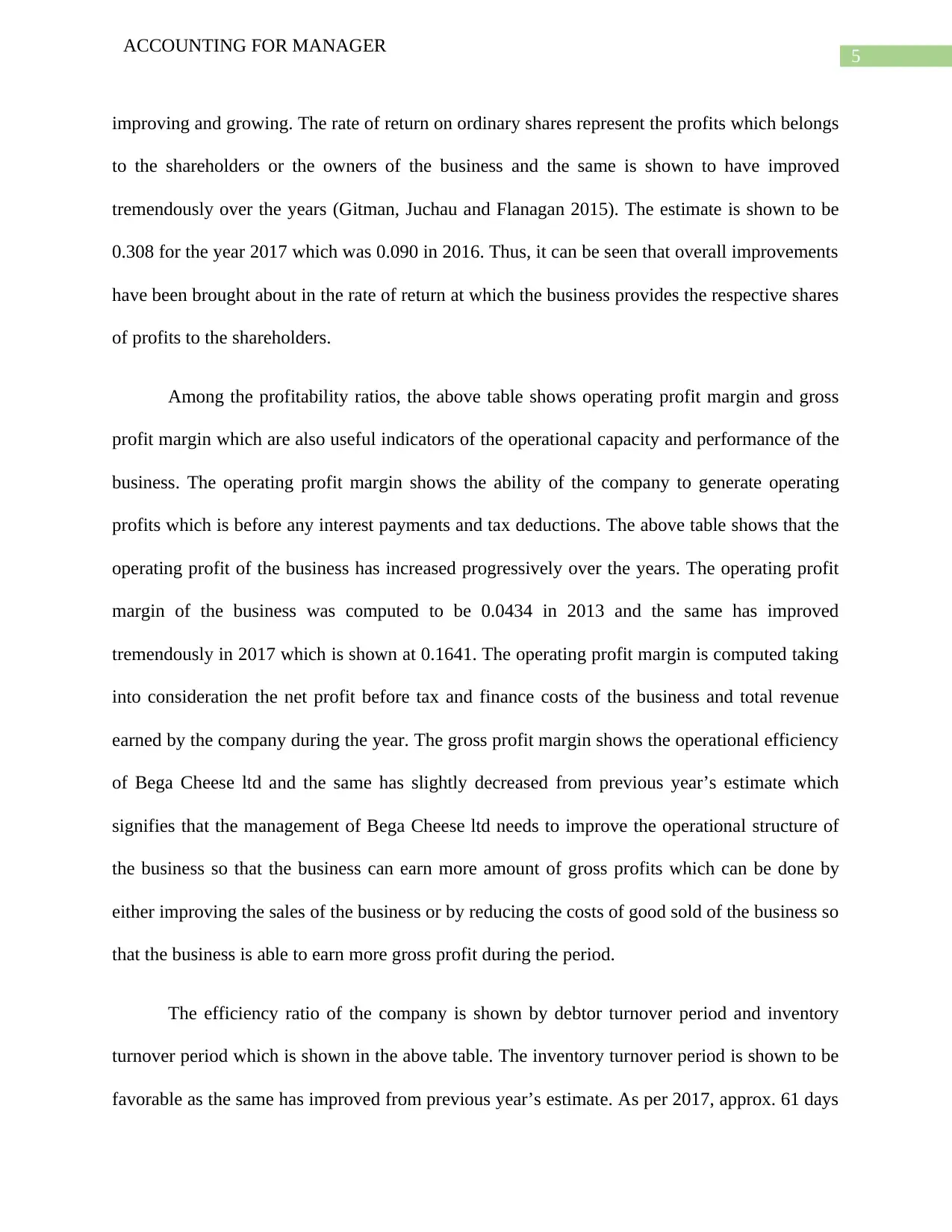

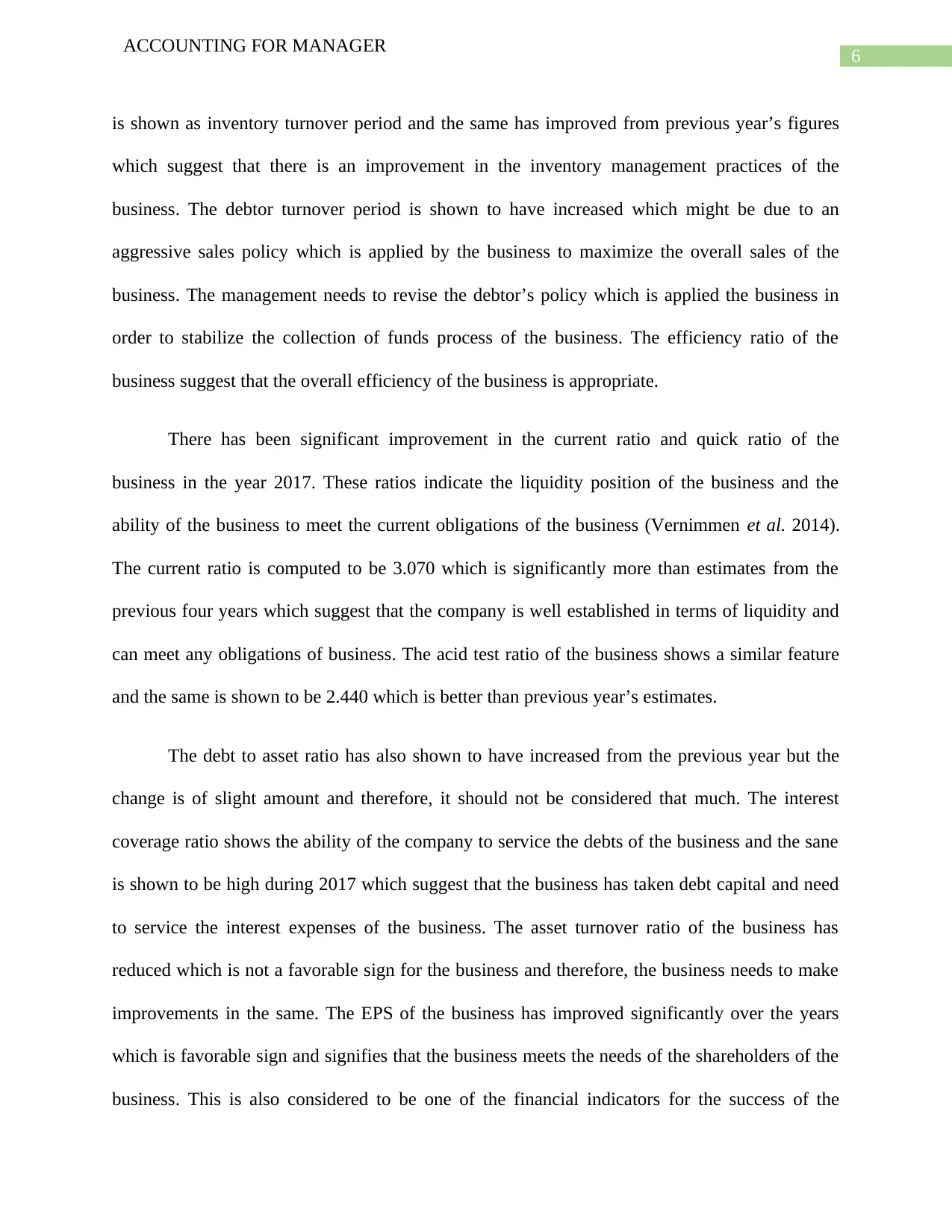

Particulars Formulas 2017 2016 2015 2014 2013

Return on Assets Net Profit/Total Assets 0.131 0.049 0.022 0.120 0.046

Rate of return on ordinary equity Net Profit/(Average Shareholder's Equity) 0.308 0.090 0.040 0.229 0.100

Operating Profit Margin (Net Profit Before Tax+ Finance Cost)/Total Revenue 0.1641 0.0366 0.0180 0.0935 0.0434

Gross Profit Margin Gross Profit/ Total Revenue 0.126 0.128 0.109 0.119 0.134

Inventories turnover period (Average Inventory/Cost of Good Sold)*365 61.313 67.792 69.768 67.280 67.986

Debtor Turnover Period (Average Debtor/Total Revenue)*365 46.450 40.160 37.097 36.002 36.148

Current ratio Current Asset/ Current Liabilities 3.070 1.655 1.833 1.515 1.648

Quick ratio (Current Asset-Inventory)/Current Liabilities 2.440 0.735 0.746 0.647 0.726

Debt to assets ratio Total Liabilities/ Total Asset 0.458 0.441 0.434 0.427 0.525

Interest cover ratio (Net Profit Before Tax+Finance Cost)/Finance Cost 62.388 11.404 5.510 15.640 5.185

Assets turnover Total Revenue/Average Total Assets 1.493 2.100 2.021 1.944 1.893

Earnings per share Total Shareholder's Equity/ Number of Shares 0.791 0.128 0.081 0.635 0.168

Price-earnings ratio MPS/EPS 8.234 44.190 53.254 7.663 15.398

Dividend yield Dividend Paid During the year/ MPS 0.015 0.016 0.020 0.016 0.027

Significant Financial Ratio Computation

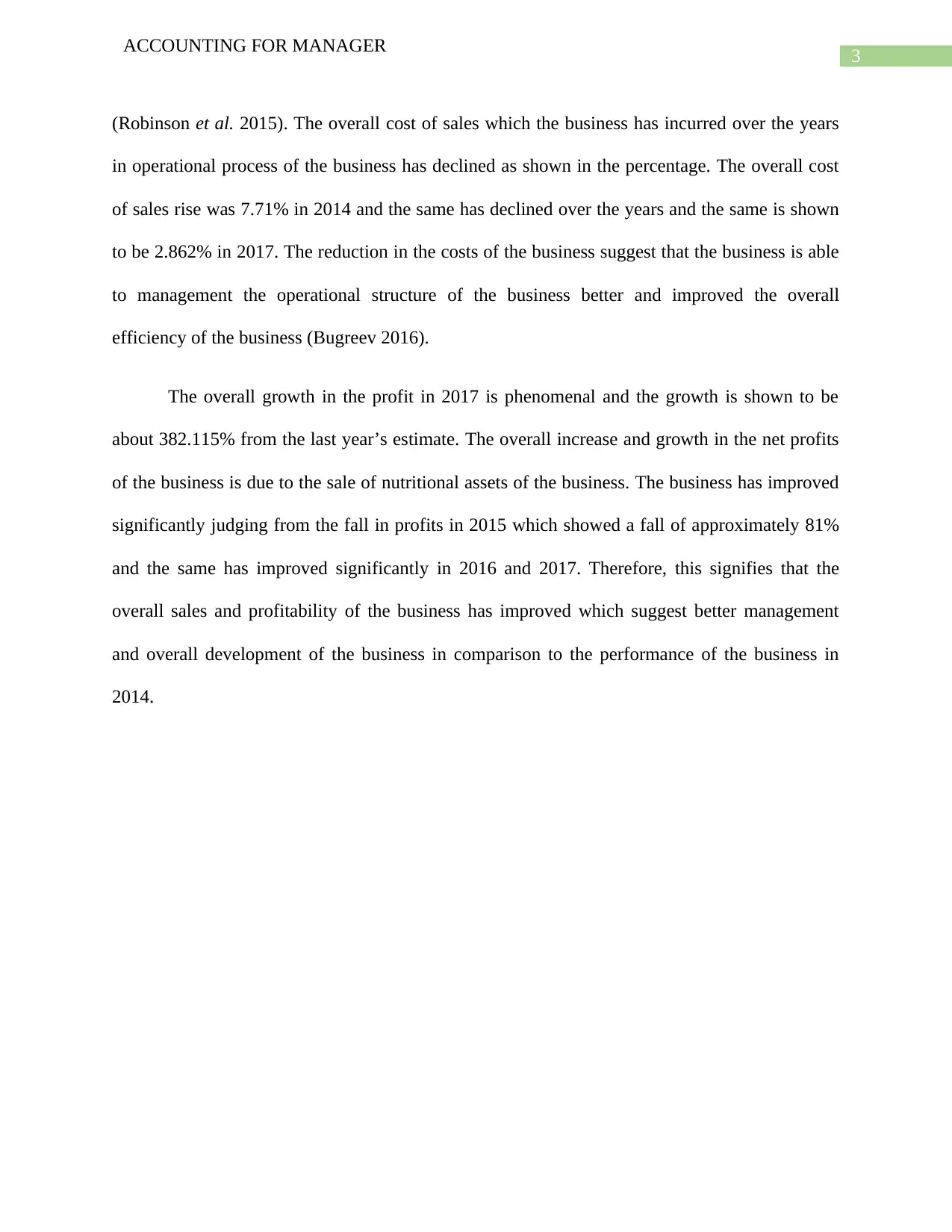

Ratio analysis is an important tool which is used by the management to evaluate the

performance of the business in terms of certain key financial ratios (Greco, Figueira and Ehrgott

2016). The financial ratios are computed based on the items which are contained in the income

statement and balance sheet. Ratio analysis is used to measure the performance of the company

in terms of operational capacity as well as financial aspect. The method is useful for bring about

the liquidity position, efficiency and capital structure of the business (Ongore and Kusa 2013).

The key financial ratios for Bega Cheese ltd has been computed which is shown in the above

table for a period of five years.

The return on asset of the business shows the ability of the business to generates revenues

by utilizing the assets of the business. The estimate is considered to a financial indicator for

overall success and development of the business. The return on assets of the business is shown to

have improved over the last 4 years and the return on asset for the year 2017 is shown to be

0.131. As the same has been improving from year to year, it can be said that the business is

ACCOUNTING FOR MANAGER

Analysis of Key Financial Ratios

Particulars Formulas 2017 2016 2015 2014 2013

Return on Assets Net Profit/Total Assets 0.131 0.049 0.022 0.120 0.046

Rate of return on ordinary equity Net Profit/(Average Shareholder's Equity) 0.308 0.090 0.040 0.229 0.100

Operating Profit Margin (Net Profit Before Tax+ Finance Cost)/Total Revenue 0.1641 0.0366 0.0180 0.0935 0.0434

Gross Profit Margin Gross Profit/ Total Revenue 0.126 0.128 0.109 0.119 0.134

Inventories turnover period (Average Inventory/Cost of Good Sold)*365 61.313 67.792 69.768 67.280 67.986

Debtor Turnover Period (Average Debtor/Total Revenue)*365 46.450 40.160 37.097 36.002 36.148

Current ratio Current Asset/ Current Liabilities 3.070 1.655 1.833 1.515 1.648

Quick ratio (Current Asset-Inventory)/Current Liabilities 2.440 0.735 0.746 0.647 0.726

Debt to assets ratio Total Liabilities/ Total Asset 0.458 0.441 0.434 0.427 0.525

Interest cover ratio (Net Profit Before Tax+Finance Cost)/Finance Cost 62.388 11.404 5.510 15.640 5.185

Assets turnover Total Revenue/Average Total Assets 1.493 2.100 2.021 1.944 1.893

Earnings per share Total Shareholder's Equity/ Number of Shares 0.791 0.128 0.081 0.635 0.168

Price-earnings ratio MPS/EPS 8.234 44.190 53.254 7.663 15.398

Dividend yield Dividend Paid During the year/ MPS 0.015 0.016 0.020 0.016 0.027

Significant Financial Ratio Computation

Ratio analysis is an important tool which is used by the management to evaluate the

performance of the business in terms of certain key financial ratios (Greco, Figueira and Ehrgott

2016). The financial ratios are computed based on the items which are contained in the income

statement and balance sheet. Ratio analysis is used to measure the performance of the company

in terms of operational capacity as well as financial aspect. The method is useful for bring about

the liquidity position, efficiency and capital structure of the business (Ongore and Kusa 2013).

The key financial ratios for Bega Cheese ltd has been computed which is shown in the above

table for a period of five years.

The return on asset of the business shows the ability of the business to generates revenues

by utilizing the assets of the business. The estimate is considered to a financial indicator for

overall success and development of the business. The return on assets of the business is shown to

have improved over the last 4 years and the return on asset for the year 2017 is shown to be

0.131. As the same has been improving from year to year, it can be said that the business is

5

ACCOUNTING FOR MANAGER

improving and growing. The rate of return on ordinary shares represent the profits which belongs

to the shareholders or the owners of the business and the same is shown to have improved

tremendously over the years (Gitman, Juchau and Flanagan 2015). The estimate is shown to be

0.308 for the year 2017 which was 0.090 in 2016. Thus, it can be seen that overall improvements

have been brought about in the rate of return at which the business provides the respective shares

of profits to the shareholders.

Among the profitability ratios, the above table shows operating profit margin and gross

profit margin which are also useful indicators of the operational capacity and performance of the

business. The operating profit margin shows the ability of the company to generate operating

profits which is before any interest payments and tax deductions. The above table shows that the

operating profit of the business has increased progressively over the years. The operating profit

margin of the business was computed to be 0.0434 in 2013 and the same has improved

tremendously in 2017 which is shown at 0.1641. The operating profit margin is computed taking

into consideration the net profit before tax and finance costs of the business and total revenue

earned by the company during the year. The gross profit margin shows the operational efficiency

of Bega Cheese ltd and the same has slightly decreased from previous year’s estimate which

signifies that the management of Bega Cheese ltd needs to improve the operational structure of

the business so that the business can earn more amount of gross profits which can be done by

either improving the sales of the business or by reducing the costs of good sold of the business so

that the business is able to earn more gross profit during the period.

The efficiency ratio of the company is shown by debtor turnover period and inventory

turnover period which is shown in the above table. The inventory turnover period is shown to be

favorable as the same has improved from previous year’s estimate. As per 2017, approx. 61 days

ACCOUNTING FOR MANAGER

improving and growing. The rate of return on ordinary shares represent the profits which belongs

to the shareholders or the owners of the business and the same is shown to have improved

tremendously over the years (Gitman, Juchau and Flanagan 2015). The estimate is shown to be

0.308 for the year 2017 which was 0.090 in 2016. Thus, it can be seen that overall improvements

have been brought about in the rate of return at which the business provides the respective shares

of profits to the shareholders.

Among the profitability ratios, the above table shows operating profit margin and gross

profit margin which are also useful indicators of the operational capacity and performance of the

business. The operating profit margin shows the ability of the company to generate operating

profits which is before any interest payments and tax deductions. The above table shows that the

operating profit of the business has increased progressively over the years. The operating profit

margin of the business was computed to be 0.0434 in 2013 and the same has improved

tremendously in 2017 which is shown at 0.1641. The operating profit margin is computed taking

into consideration the net profit before tax and finance costs of the business and total revenue

earned by the company during the year. The gross profit margin shows the operational efficiency

of Bega Cheese ltd and the same has slightly decreased from previous year’s estimate which

signifies that the management of Bega Cheese ltd needs to improve the operational structure of

the business so that the business can earn more amount of gross profits which can be done by

either improving the sales of the business or by reducing the costs of good sold of the business so

that the business is able to earn more gross profit during the period.

The efficiency ratio of the company is shown by debtor turnover period and inventory

turnover period which is shown in the above table. The inventory turnover period is shown to be

favorable as the same has improved from previous year’s estimate. As per 2017, approx. 61 days

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ACCOUNTING FOR MANAGER

is shown as inventory turnover period and the same has improved from previous year’s figures

which suggest that there is an improvement in the inventory management practices of the

business. The debtor turnover period is shown to have increased which might be due to an

aggressive sales policy which is applied by the business to maximize the overall sales of the

business. The management needs to revise the debtor’s policy which is applied the business in

order to stabilize the collection of funds process of the business. The efficiency ratio of the

business suggest that the overall efficiency of the business is appropriate.

There has been significant improvement in the current ratio and quick ratio of the

business in the year 2017. These ratios indicate the liquidity position of the business and the

ability of the business to meet the current obligations of the business (Vernimmen et al. 2014).

The current ratio is computed to be 3.070 which is significantly more than estimates from the

previous four years which suggest that the company is well established in terms of liquidity and

can meet any obligations of business. The acid test ratio of the business shows a similar feature

and the same is shown to be 2.440 which is better than previous year’s estimates.

The debt to asset ratio has also shown to have increased from the previous year but the

change is of slight amount and therefore, it should not be considered that much. The interest

coverage ratio shows the ability of the company to service the debts of the business and the sane

is shown to be high during 2017 which suggest that the business has taken debt capital and need

to service the interest expenses of the business. The asset turnover ratio of the business has

reduced which is not a favorable sign for the business and therefore, the business needs to make

improvements in the same. The EPS of the business has improved significantly over the years

which is favorable sign and signifies that the business meets the needs of the shareholders of the

business. This is also considered to be one of the financial indicators for the success of the

ACCOUNTING FOR MANAGER

is shown as inventory turnover period and the same has improved from previous year’s figures

which suggest that there is an improvement in the inventory management practices of the

business. The debtor turnover period is shown to have increased which might be due to an

aggressive sales policy which is applied by the business to maximize the overall sales of the

business. The management needs to revise the debtor’s policy which is applied the business in

order to stabilize the collection of funds process of the business. The efficiency ratio of the

business suggest that the overall efficiency of the business is appropriate.

There has been significant improvement in the current ratio and quick ratio of the

business in the year 2017. These ratios indicate the liquidity position of the business and the

ability of the business to meet the current obligations of the business (Vernimmen et al. 2014).

The current ratio is computed to be 3.070 which is significantly more than estimates from the

previous four years which suggest that the company is well established in terms of liquidity and

can meet any obligations of business. The acid test ratio of the business shows a similar feature

and the same is shown to be 2.440 which is better than previous year’s estimates.

The debt to asset ratio has also shown to have increased from the previous year but the

change is of slight amount and therefore, it should not be considered that much. The interest

coverage ratio shows the ability of the company to service the debts of the business and the sane

is shown to be high during 2017 which suggest that the business has taken debt capital and need

to service the interest expenses of the business. The asset turnover ratio of the business has

reduced which is not a favorable sign for the business and therefore, the business needs to make

improvements in the same. The EPS of the business has improved significantly over the years

which is favorable sign and signifies that the business meets the needs of the shareholders of the

business. This is also considered to be one of the financial indicators for the success of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

ACCOUNTING FOR MANAGER

business and one of the estimates which is considered by the potentials investors before they take

any appropriate investment decisions.

Reference

Bega Cheese. (2018). Annual Reports - Bega Cheese. [online] Available at:

https://www.begacheese.com.au/investors/annual-reports/ [Accessed 28 Jul. 2018].

Bugreev, D.O., 2016. Financial analysis of small business enterprises. Contemporary Problems

of Social Work, 2(1), pp.28-35.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Greco, S., Figueira, J. and Ehrgott, M., 2016. Multiple criteria decision analysis. New York:

Springer.

Ongore, V.O. and Kusa, G.B., 2013. Determinants of financial performance of commercial banks

in Kenya. International Journal of Economics and Financial Issues, 3(1), pp.237-252.

ACCOUNTING FOR MANAGER

business and one of the estimates which is considered by the potentials investors before they take

any appropriate investment decisions.

Reference

Bega Cheese. (2018). Annual Reports - Bega Cheese. [online] Available at:

https://www.begacheese.com.au/investors/annual-reports/ [Accessed 28 Jul. 2018].

Bugreev, D.O., 2016. Financial analysis of small business enterprises. Contemporary Problems

of Social Work, 2(1), pp.28-35.

Gitman, L.J., Juchau, R. and Flanagan, J., 2015. Principles of managerial finance. Pearson

Higher Education AU.

Greco, S., Figueira, J. and Ehrgott, M., 2016. Multiple criteria decision analysis. New York:

Springer.

Ongore, V.O. and Kusa, G.B., 2013. Determinants of financial performance of commercial banks

in Kenya. International Journal of Economics and Financial Issues, 3(1), pp.237-252.

8

ACCOUNTING FOR MANAGER

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Schönbohm, A., 2013. Performance measurement and management with financial ratios: the

BASF SE case (No. 72). Working Papers of the Institute of Management Berlin at the Berlin

School of Economics and Law (HWR Berlin).

Vernimmen, P., Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., 2014. Corporate finance:

theory and practice. John Wiley & Sons.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

ACCOUNTING FOR MANAGER

Robinson, T.R., Henry, E., Pirie, W.L. and Broihahn, M.A., 2015. International financial

statement analysis. John Wiley & Sons.

Schönbohm, A., 2013. Performance measurement and management with financial ratios: the

BASF SE case (No. 72). Working Papers of the Institute of Management Berlin at the Berlin

School of Economics and Law (HWR Berlin).

Vernimmen, P., Quiry, P., Dallocchio, M., Le Fur, Y. and Salvi, A., 2014. Corporate finance:

theory and practice. John Wiley & Sons.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial accounting. John

Wiley & Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ACCOUNTING FOR MANAGER

Appendix

ACCOUNTING FOR MANAGER

Appendix

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ACCOUNTING FOR MANAGER

ACCOUNTING FOR MANAGER

11

ACCOUNTING FOR MANAGER

ACCOUNTING FOR MANAGER

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.