Budget and Financial Plans Management: Detailed Report 2016/17

VerifiedAdded on 2023/06/03

|17

|2912

|123

Report

AI Summary

This report provides a detailed analysis of budget and financial plan management, focusing on the operations of Big Red Bicycle Pty Ltd. It includes an examination of cash flow projections, operational plans, and a quarterly income statement budget for the financial year 2016/17. The report assesses the company's ability to achieve its target net profit, identifies potential errors in the budget, and suggests improvements for better financial planning. It also addresses how to manage uncertainties, adjust revenue and expenditure items, and ensure effective communication within the organization. Furthermore, the report outlines processes for monitoring actual expenses, controlling costs, and developing contingency plans, emphasizing the use of spreadsheets for variance analysis. It concludes with an analysis of the impact of economic slowdown on the company's financials and provides a list of accounts with under and over values.

Running head: MANAGE BUDGET AND FINANCIAL PLANS

Manage Budget and Financial Plans

Name of the Student:

Name of the University:

Authors Note:

Manage Budget and Financial Plans

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGE BUDGET AND FINANCIAL PLANS

Contents

Assessment task 1:...........................................................................................................................2

Part 1:...........................................................................................................................................2

Part 2:...........................................................................................................................................3

Part 3:...........................................................................................................................................8

Part 4:...........................................................................................................................................9

Assessment task 2:.........................................................................................................................10

Part 1:.........................................................................................................................................10

Part 2:.........................................................................................................................................12

Part 3:.........................................................................................................................................14

References:....................................................................................................................................17

Contents

Assessment task 1:...........................................................................................................................2

Part 1:...........................................................................................................................................2

Part 2:...........................................................................................................................................3

Part 3:...........................................................................................................................................8

Part 4:...........................................................................................................................................9

Assessment task 2:.........................................................................................................................10

Part 1:.........................................................................................................................................10

Part 2:.........................................................................................................................................12

Part 3:.........................................................................................................................................14

References:....................................................................................................................................17

2MANAGE BUDGET AND FINANCIAL PLANS

Assessment task 1:

Part 1:

Sub part a:

Big Red Bicycle Pty Ltd is an Australian company involved in manufacturing and selling of

bicycle in Australia. Manufacturing and selling of bicycle is the primary activities of the

company to generate revenue for the business of the company.

Sub part b:

The responsibility of the team is to achieve the desired production level by making optimum

utilization of resources and achieve desired level of sales to maximize the amount of profit of the

company (Gitman, Juchau & Flanagan, 2015).

Sub part c:

Cash flow projections:

Cash flow projections is made with the objective to make effective use of cash resources of

company.

Operational plans:

Operational plans are made to effectively operate the business affairs of the company. The

company wants to earn a net profit after tax of $1,000,000 and the operational plan shall be

helpful in achieving the objective of the company (Bryson, 2018).

Assessment task 1:

Part 1:

Sub part a:

Big Red Bicycle Pty Ltd is an Australian company involved in manufacturing and selling of

bicycle in Australia. Manufacturing and selling of bicycle is the primary activities of the

company to generate revenue for the business of the company.

Sub part b:

The responsibility of the team is to achieve the desired production level by making optimum

utilization of resources and achieve desired level of sales to maximize the amount of profit of the

company (Gitman, Juchau & Flanagan, 2015).

Sub part c:

Cash flow projections:

Cash flow projections is made with the objective to make effective use of cash resources of

company.

Operational plans:

Operational plans are made to effectively operate the business affairs of the company. The

company wants to earn a net profit after tax of $1,000,000 and the operational plan shall be

helpful in achieving the objective of the company (Bryson, 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGE BUDGET AND FINANCIAL PLANS

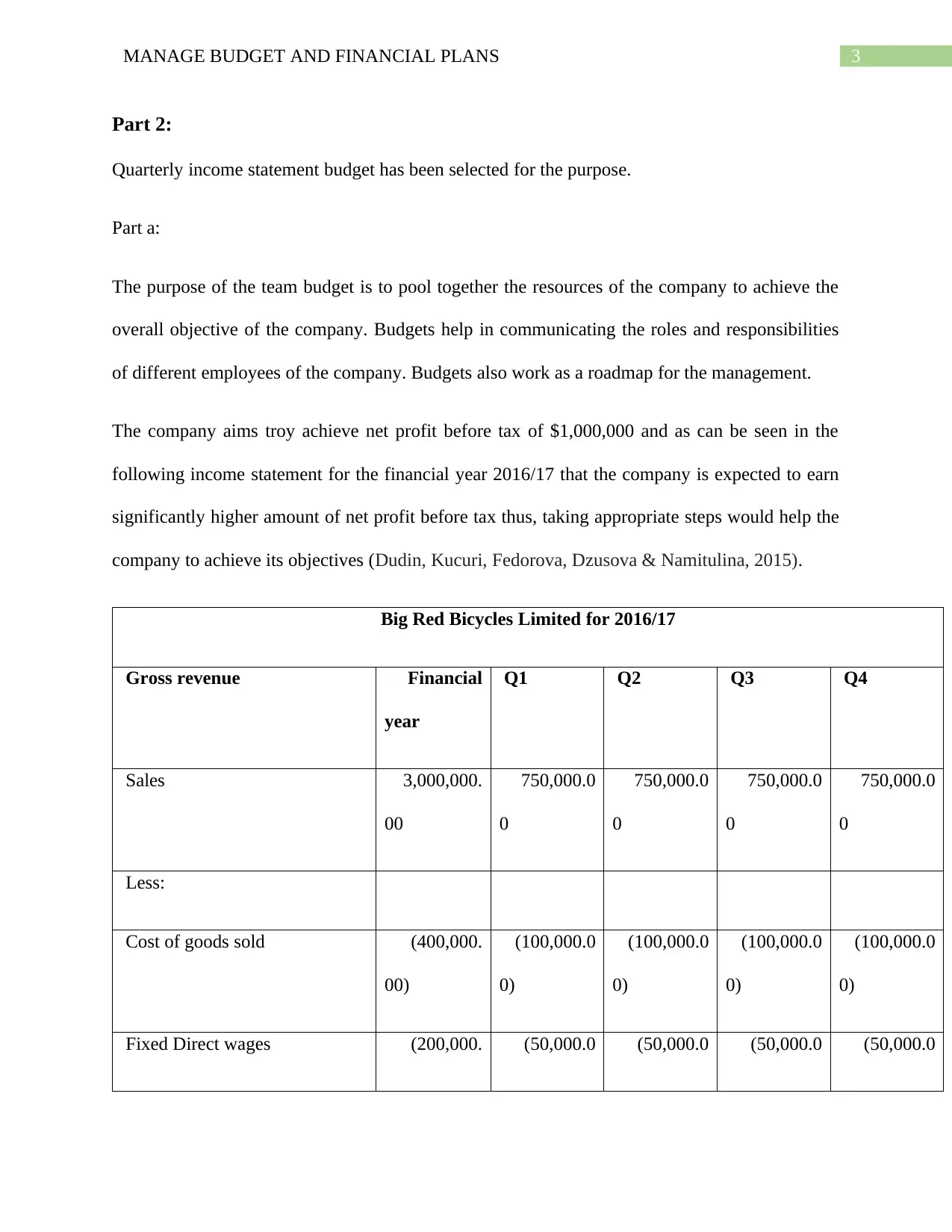

Part 2:

Quarterly income statement budget has been selected for the purpose.

Part a:

The purpose of the team budget is to pool together the resources of the company to achieve the

overall objective of the company. Budgets help in communicating the roles and responsibilities

of different employees of the company. Budgets also work as a roadmap for the management.

The company aims troy achieve net profit before tax of $1,000,000 and as can be seen in the

following income statement for the financial year 2016/17 that the company is expected to earn

significantly higher amount of net profit before tax thus, taking appropriate steps would help the

company to achieve its objectives (Dudin, Kucuri, Fedorova, Dzusova & Namitulina, 2015).

Big Red Bicycles Limited for 2016/17

Gross revenue Financial

year

Q1 Q2 Q3 Q4

Sales 3,000,000.

00

750,000.0

0

750,000.0

0

750,000.0

0

750,000.0

0

Less:

Cost of goods sold (400,000.

00)

(100,000.0

0)

(100,000.0

0)

(100,000.0

0)

(100,000.0

0)

Fixed Direct wages (200,000. (50,000.0 (50,000.0 (50,000.0 (50,000.0

Part 2:

Quarterly income statement budget has been selected for the purpose.

Part a:

The purpose of the team budget is to pool together the resources of the company to achieve the

overall objective of the company. Budgets help in communicating the roles and responsibilities

of different employees of the company. Budgets also work as a roadmap for the management.

The company aims troy achieve net profit before tax of $1,000,000 and as can be seen in the

following income statement for the financial year 2016/17 that the company is expected to earn

significantly higher amount of net profit before tax thus, taking appropriate steps would help the

company to achieve its objectives (Dudin, Kucuri, Fedorova, Dzusova & Namitulina, 2015).

Big Red Bicycles Limited for 2016/17

Gross revenue Financial

year

Q1 Q2 Q3 Q4

Sales 3,000,000.

00

750,000.0

0

750,000.0

0

750,000.0

0

750,000.0

0

Less:

Cost of goods sold (400,000.

00)

(100,000.0

0)

(100,000.0

0)

(100,000.0

0)

(100,000.0

0)

Fixed Direct wages (200,000. (50,000.0 (50,000.0 (50,000.0 (50,000.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGE BUDGET AND FINANCIAL PLANS

00) 0) 0) 0) 0)

Commissions @2% (60,000.

00)

(15,000.0

0)

(15,000.0

0)

(15,000.0

0)

(15,000.0

0)

(A): Gross profit 2,340,000.

00

585,000.0

0

585,000.0

0

585,000.0

0

585,000.0

0

Expenses:

Administrative & general expenses

Accounting consultancy fees 20,000

.00

5,000.

00

5,000.

00

5,000.

00

5,000.

00

Legal expenses 5,000

.00

1,250.

00

1,250.

00

1,250.

00

1,250.

00

Bank charges 60

0.00

150.

00

150.

00

150.

00

150.

00

Supplies for office 5,000

.00

1,250.

00

1,250.

00

1,250.

00

1,250.

00

Printing and stationery 40

0.00

100.

00

100.

00

100.

00

100.

00

Subscriptions 50 125. 125. 125. 125.

00) 0) 0) 0) 0)

Commissions @2% (60,000.

00)

(15,000.0

0)

(15,000.0

0)

(15,000.0

0)

(15,000.0

0)

(A): Gross profit 2,340,000.

00

585,000.0

0

585,000.0

0

585,000.0

0

585,000.0

0

Expenses:

Administrative & general expenses

Accounting consultancy fees 20,000

.00

5,000.

00

5,000.

00

5,000.

00

5,000.

00

Legal expenses 5,000

.00

1,250.

00

1,250.

00

1,250.

00

1,250.

00

Bank charges 60

0.00

150.

00

150.

00

150.

00

150.

00

Supplies for office 5,000

.00

1,250.

00

1,250.

00

1,250.

00

1,250.

00

Printing and stationery 40

0.00

100.

00

100.

00

100.

00

100.

00

Subscriptions 50 125. 125. 125. 125.

5MANAGE BUDGET AND FINANCIAL PLANS

0.00 00 00 00 00

Telephone expenses 10,000

.00

2,500.

00

2,500.

00

2,500.

00

2,500.

00

Repaid and maintenance

expenses

50,000

.00

12,500.

00

12,500.

00

12,500.

00

12,500.

00

Tax on payroll 25,000

.00

6,250.

00

6,250.

00

6,250.

00

6,250.

00

Advertising and promotional

expenses

200,000

.00

50,000.

00

50,000.

00

50,000.

00

50,000.

00

Superannuation expenses 45,000

.00

11,250.

00

11,250.

00

11,250.

00

11,250.

00

Wages and salaries 500,000

.00

125,000.0

0

125,000.0

0

125,000.0

0

125,000.0

0

Amenities for staffs 20,000

.00

5,000.

00

5,000.

00

5,000.

00

5,000.

00

Occupancy costs

Cost of electricity 40,000

.00

10,000.

00

10,000.

00

10,000.

00

10,000.

00

0.00 00 00 00 00

Telephone expenses 10,000

.00

2,500.

00

2,500.

00

2,500.

00

2,500.

00

Repaid and maintenance

expenses

50,000

.00

12,500.

00

12,500.

00

12,500.

00

12,500.

00

Tax on payroll 25,000

.00

6,250.

00

6,250.

00

6,250.

00

6,250.

00

Advertising and promotional

expenses

200,000

.00

50,000.

00

50,000.

00

50,000.

00

50,000.

00

Superannuation expenses 45,000

.00

11,250.

00

11,250.

00

11,250.

00

11,250.

00

Wages and salaries 500,000

.00

125,000.0

0

125,000.0

0

125,000.0

0

125,000.0

0

Amenities for staffs 20,000

.00

5,000.

00

5,000.

00

5,000.

00

5,000.

00

Occupancy costs

Cost of electricity 40,000

.00

10,000.

00

10,000.

00

10,000.

00

10,000.

00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGE BUDGET AND FINANCIAL PLANS

Insurance expenses 100,000

.00

25,000.

00

25,000.

00

25,000.

00

25,000.

00

Rates 100,000

.00

25,000.

00

25,000.

00

25,000.

00

25,000.

00

Rent 200,000

.00

50,000.

00

50,000.

00

50,000.

00

50,000.

00

Water charges 30,000

.00

7,500.

00

7,500.

00

7,500.

00

7,500.

00

Waste removal charges 50,000

.00

12,500.

00

12,500.

00

12,500.

00

12,500.

00

(B): Total operating expenses 1,401,500.

00

350,375.0

0

350,375.0

0

350,375.0

0

350,375.0

0

Net profit before interest and

taxes (A B)

938,500

.00

234,625.0

0

234,625.0

0

234,625.0

0

234,625.0

0

Less: Income tax @25% 234,625

.00

58,656.

25

58,656.

25

58,656.

25

58,656.

25

Net profit after tax 703,875

.00

175,968.7

5

175,968.7

5

175,968.7

5

175,968.7

5

Insurance expenses 100,000

.00

25,000.

00

25,000.

00

25,000.

00

25,000.

00

Rates 100,000

.00

25,000.

00

25,000.

00

25,000.

00

25,000.

00

Rent 200,000

.00

50,000.

00

50,000.

00

50,000.

00

50,000.

00

Water charges 30,000

.00

7,500.

00

7,500.

00

7,500.

00

7,500.

00

Waste removal charges 50,000

.00

12,500.

00

12,500.

00

12,500.

00

12,500.

00

(B): Total operating expenses 1,401,500.

00

350,375.0

0

350,375.0

0

350,375.0

0

350,375.0

0

Net profit before interest and

taxes (A B)

938,500

.00

234,625.0

0

234,625.0

0

234,625.0

0

234,625.0

0

Less: Income tax @25% 234,625

.00

58,656.

25

58,656.

25

58,656.

25

58,656.

25

Net profit after tax 703,875

.00

175,968.7

5

175,968.7

5

175,968.7

5

175,968.7

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGE BUDGET AND FINANCIAL PLANS

Sub part b:

(i) Its seems very much a possibility for the company to achieve its target of earning net profit

before tax of $1,000,000 as the master budget shows a significantly higher amount of net

profit before interest and tax.

(ii) No, the figures provided in the budget not seem correct as all the expenses have been divided

equally in different quarters. Except fixed costs no costs are expected to be incurred evenly

throughout the year thus, definitely there is some errors in the above budget.

(iii) No, it is not comprehensive as the master budget includes only table without any

explanations.

Sub part c:

The expenses should have been correctly segregated by using some standard basis in different

quarters along with the expected revenue. It is seldom that an organization earns equal amount of

revenue on every day, month and quarter of a year. As per the master budget of Big Red Bicycle

Pty Ltd this definitely needs to be changed to improve the quality of budget (Sekaran & Bougie,

2016).

Sub part d:

The operational manager shall be approached to discuss each and every single item mentioned in

the budgeted income statement. Because the ability of the company to generate revenue and earn

profit from business are dependent on the business operations of the company.

Part 3:

Sub part a:

Sub part b:

(i) Its seems very much a possibility for the company to achieve its target of earning net profit

before tax of $1,000,000 as the master budget shows a significantly higher amount of net

profit before interest and tax.

(ii) No, the figures provided in the budget not seem correct as all the expenses have been divided

equally in different quarters. Except fixed costs no costs are expected to be incurred evenly

throughout the year thus, definitely there is some errors in the above budget.

(iii) No, it is not comprehensive as the master budget includes only table without any

explanations.

Sub part c:

The expenses should have been correctly segregated by using some standard basis in different

quarters along with the expected revenue. It is seldom that an organization earns equal amount of

revenue on every day, month and quarter of a year. As per the master budget of Big Red Bicycle

Pty Ltd this definitely needs to be changed to improve the quality of budget (Sekaran & Bougie,

2016).

Sub part d:

The operational manager shall be approached to discuss each and every single item mentioned in

the budgeted income statement. Because the ability of the company to generate revenue and earn

profit from business are dependent on the business operations of the company.

Part 3:

Sub part a:

8MANAGE BUDGET AND FINANCIAL PLANS

(i) A business organization has to operate in an uncertain environment. Most of the macro

economic factors that affect an organization are out of the control of the management of an

organization. Changes in these factors affect the financial performance and position of an

organization. An organization must have necessary flexibility to make changes in the budget

and operating activities to deal with any possible scenarios that may arise in the future. In this

case if the company fails to achieve the expected sales due to any untoward incident then the

company would not be able to achieve its budgeted profit. To deal with such circumstances

the company should continuously monitor the market demand and supply. Based on

assessment of market condition necessary changes shall be made to the operating budget and

quantity of productions. Flexibility is key to the successful management of an organization.

Thus, appropriate course of actions shall be taken based on the market condition and

situation.

(ii) The items of revenue shall be adjusted on the basis of expected consequences of such events

along with the items of expenditures. Generally particular percentages shall be added or

deducted to these items of revenue and expenditures.

(iii) Revenue and expenditures shall be reduced or increased as per the expected market condition

in the future and assessment of management.

(iv) The expected consequences on the business of the company due to changes in the market

conditions shall be evaluated to make necessary adjustments.

(v) In case the company fails to achieve the sales as per the master budget then the profit before

and after tax would reduce significantly.

Part 4:

Sub part a:

(i) A business organization has to operate in an uncertain environment. Most of the macro

economic factors that affect an organization are out of the control of the management of an

organization. Changes in these factors affect the financial performance and position of an

organization. An organization must have necessary flexibility to make changes in the budget

and operating activities to deal with any possible scenarios that may arise in the future. In this

case if the company fails to achieve the expected sales due to any untoward incident then the

company would not be able to achieve its budgeted profit. To deal with such circumstances

the company should continuously monitor the market demand and supply. Based on

assessment of market condition necessary changes shall be made to the operating budget and

quantity of productions. Flexibility is key to the successful management of an organization.

Thus, appropriate course of actions shall be taken based on the market condition and

situation.

(ii) The items of revenue shall be adjusted on the basis of expected consequences of such events

along with the items of expenditures. Generally particular percentages shall be added or

deducted to these items of revenue and expenditures.

(iii) Revenue and expenditures shall be reduced or increased as per the expected market condition

in the future and assessment of management.

(iv) The expected consequences on the business of the company due to changes in the market

conditions shall be evaluated to make necessary adjustments.

(v) In case the company fails to achieve the sales as per the master budget then the profit before

and after tax would reduce significantly.

Part 4:

Sub part a:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGE BUDGET AND FINANCIAL PLANS

The organization must have an effective communication line to disseminate the relevant details

about agree plan. Having proper hierarchy within the organization is very helpful to disseminate

the information in an orderly manner to the employees of an organization.

Sub part b:

Regular meetings shall be held to communicate the relevant details about organizational

objectives and the plan to achieve such objectives.

Sub part c:

Employees shall be asked to participate in the meetings and shall be encouraged to put forward

their point of views and opinion on organizational plan. This would be helpful in communicating

and gaining and agreements on different plans of the company.

Sub part d:

I. The procurement manager shall be given the responsibility of procurement of materials.

II. The production manager shall be responsible for the production of bicycles.

III. Sales manager shall be given the responsibility to maximise the sales of the company.

Sub part e:

The members shall give their feedback on each and every aspect of operational plan of the

company. Communicating the ideas in the meeting will be helpful to understand the roles and

responsibilities of different employees.

Sub part f:

A proper recruitment policy shall be in place to recruit skilful and talented employees as required

by the organization. Employees and workers shall be given the responsibility as per their skills

The organization must have an effective communication line to disseminate the relevant details

about agree plan. Having proper hierarchy within the organization is very helpful to disseminate

the information in an orderly manner to the employees of an organization.

Sub part b:

Regular meetings shall be held to communicate the relevant details about organizational

objectives and the plan to achieve such objectives.

Sub part c:

Employees shall be asked to participate in the meetings and shall be encouraged to put forward

their point of views and opinion on organizational plan. This would be helpful in communicating

and gaining and agreements on different plans of the company.

Sub part d:

I. The procurement manager shall be given the responsibility of procurement of materials.

II. The production manager shall be responsible for the production of bicycles.

III. Sales manager shall be given the responsibility to maximise the sales of the company.

Sub part e:

The members shall give their feedback on each and every aspect of operational plan of the

company. Communicating the ideas in the meeting will be helpful to understand the roles and

responsibilities of different employees.

Sub part f:

A proper recruitment policy shall be in place to recruit skilful and talented employees as required

by the organization. Employees and workers shall be given the responsibility as per their skills

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGE BUDGET AND FINANCIAL PLANS

and knowledge. Necessary training shall be help to improve the skills and knowledge of the

employee to help them to discharge their duties and responsibilities effectively.

Sub part g:

The funds of the company shall be used effectively by procuring quality raw materials at

relatively low costs and the employees shall be used effectively by using their skills and

knowledge in relevant operations of the company.

Assessment task 2:

Part 1:

Processes essential to monitor the actual expenses incurred:

I. Operations of the company shall be supervised effectively.

II. Expenditures must be incurred as per the financial plan until unless there is any changes

in the level of activity.

III. In case of any changes in the actual condition compared to the assumptions then

necessary adjustments shall be made to the financial budget.

In order to control costs the following processes shall be used:

I. Providing training to the employees to improve their ability to provide services to the

customers.

II. Technology shall be used to reduce cost of operations.

III. Changes in production process to make optimum use of raw materials and employee time.

Contingency plans monitoring and controlling processes:

and knowledge. Necessary training shall be help to improve the skills and knowledge of the

employee to help them to discharge their duties and responsibilities effectively.

Sub part g:

The funds of the company shall be used effectively by procuring quality raw materials at

relatively low costs and the employees shall be used effectively by using their skills and

knowledge in relevant operations of the company.

Assessment task 2:

Part 1:

Processes essential to monitor the actual expenses incurred:

I. Operations of the company shall be supervised effectively.

II. Expenditures must be incurred as per the financial plan until unless there is any changes

in the level of activity.

III. In case of any changes in the actual condition compared to the assumptions then

necessary adjustments shall be made to the financial budget.

In order to control costs the following processes shall be used:

I. Providing training to the employees to improve their ability to provide services to the

customers.

II. Technology shall be used to reduce cost of operations.

III. Changes in production process to make optimum use of raw materials and employee time.

Contingency plans monitoring and controlling processes:

11MANAGE BUDGET AND FINANCIAL PLANS

I. Business environment must be evaluated continuously to make adjustments to the operating

plans and when required.

II. Taking into consideration the business objective necessary modifications shall be made to the

operational plan of the company.

Feedback:

I. The performance of employees and labour shall be documented.

II. Rewarding employees’ base on their performance would be an effective way to encourage

and motivate employees to perform even better in the future as well as providing them

feedback about their performance.

III. Actual performance and expected performance shall be compared to assess the discrepancies

between the two to provide necessary feedback.

Spreadsheet to be used as a tool:

It is very easy to use a spreadsheet to calculate the variances between the actual performance of

an organization and the budgeted performance of the organization. With the effective use of

statistical and analytical tools present in spreadsheet it is relatively easy to calculate the

difference between the two.

Part 2:

a. With the economic slowdown the sales of the company is expected to be lower than as estimated

in the budget. Similarly the expenditures expected to increase significantly due to the economic

slowdown. The following elements shall be effected due to the economic slowdown.

I. Sales.

I. Business environment must be evaluated continuously to make adjustments to the operating

plans and when required.

II. Taking into consideration the business objective necessary modifications shall be made to the

operational plan of the company.

Feedback:

I. The performance of employees and labour shall be documented.

II. Rewarding employees’ base on their performance would be an effective way to encourage

and motivate employees to perform even better in the future as well as providing them

feedback about their performance.

III. Actual performance and expected performance shall be compared to assess the discrepancies

between the two to provide necessary feedback.

Spreadsheet to be used as a tool:

It is very easy to use a spreadsheet to calculate the variances between the actual performance of

an organization and the budgeted performance of the organization. With the effective use of

statistical and analytical tools present in spreadsheet it is relatively easy to calculate the

difference between the two.

Part 2:

a. With the economic slowdown the sales of the company is expected to be lower than as estimated

in the budget. Similarly the expenditures expected to increase significantly due to the economic

slowdown. The following elements shall be effected due to the economic slowdown.

I. Sales.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.