Business Accounting: Solved Assignments and Essays - Desklib

VerifiedAdded on 2023/06/18

|15

|3486

|297

AI Summary

The article contains solved assignments and essays on Business Accounting. It includes topics such as dual aspect effect, trial balance, profit and loss, capital and revenue expenditure, sales ledger control account, and more. The article also provides comments on the ratios computed in light of the data of the industry. The subject is relevant to various courses and universities.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Accounts

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

Q.1.......................................................................................................................................................3

i. Fill in the missing figures................................................................................................................3

ii. Dual aspect effect of the following transactions.............................................................................3

Q.2.......................................................................................................................................................3

Q.3 Trial balance of Jane Green made as on 31st December 2020......................................................5

Q.4.......................................................................................................................................................5

Q.5 Indicating the type and amount of capital / revenue expenditure of following transactions.......7

Q.6.......................................................................................................................................................7

Q7. Comments on the ratios computed in light of the data of industry..............................................8

Q.8.....................................................................................................................................................10

Q9. Answer to the following questions.............................................................................................11

a) State briefly the main reasons why company may employ team of accountants..........................11

b) Reason and purpose of external auditors in limited liability company.........................................11

c) Importance of accounting:............................................................................................................12

d) Stating statutory obligations required for the preparation of management accounts...................12

e) Nature and purpose of accounts:...................................................................................................12

Q.10 Defining the following terms:..................................................................................................13

REFERENCES...................................................................................................................................15

Q.1.......................................................................................................................................................3

i. Fill in the missing figures................................................................................................................3

ii. Dual aspect effect of the following transactions.............................................................................3

Q.2.......................................................................................................................................................3

Q.3 Trial balance of Jane Green made as on 31st December 2020......................................................5

Q.4.......................................................................................................................................................5

Q.5 Indicating the type and amount of capital / revenue expenditure of following transactions.......7

Q.6.......................................................................................................................................................7

Q7. Comments on the ratios computed in light of the data of industry..............................................8

Q.8.....................................................................................................................................................10

Q9. Answer to the following questions.............................................................................................11

a) State briefly the main reasons why company may employ team of accountants..........................11

b) Reason and purpose of external auditors in limited liability company.........................................11

c) Importance of accounting:............................................................................................................12

d) Stating statutory obligations required for the preparation of management accounts...................12

e) Nature and purpose of accounts:...................................................................................................12

Q.10 Defining the following terms:..................................................................................................13

REFERENCES...................................................................................................................................15

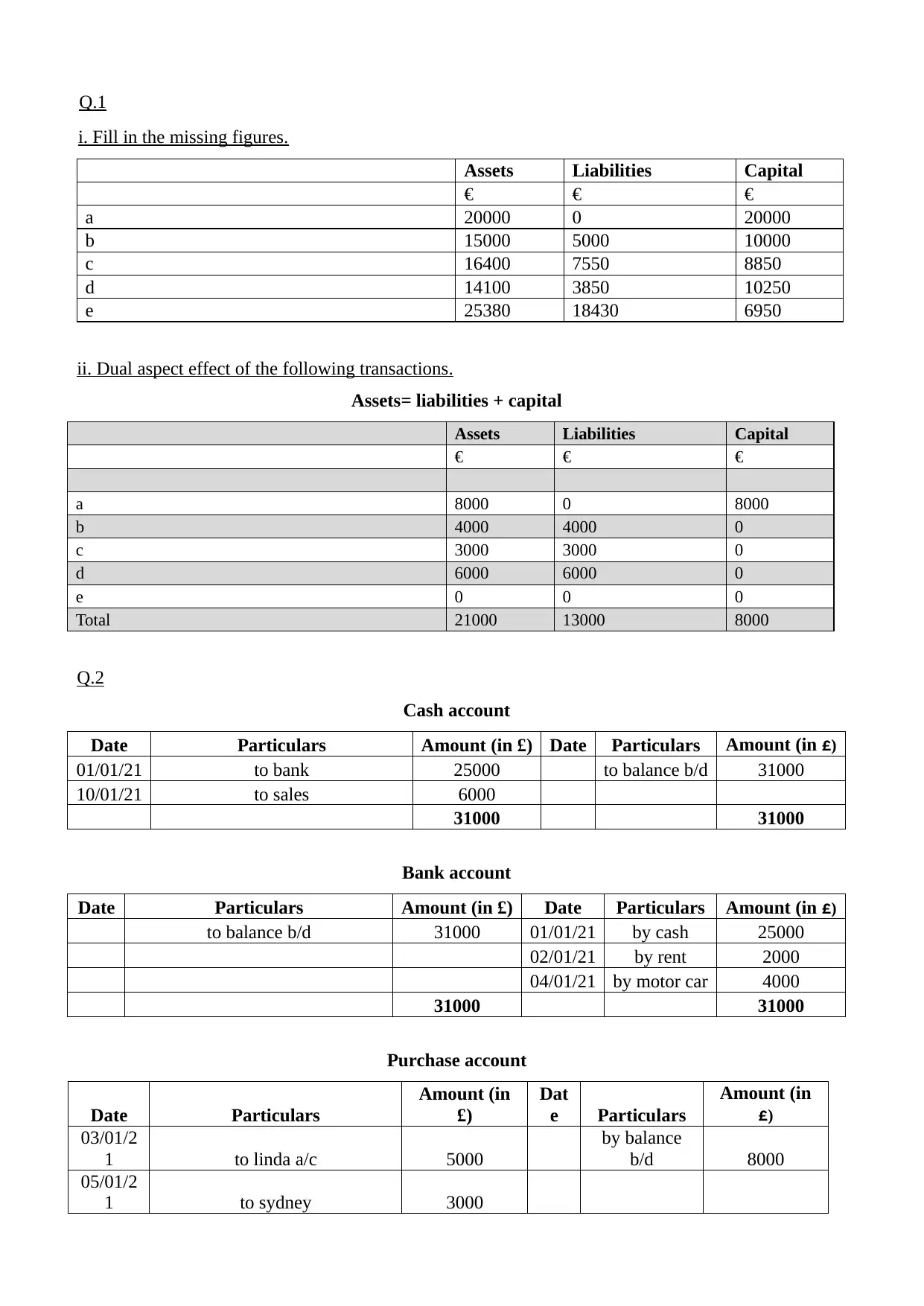

Q.1

i. Fill in the missing figures.

Assets Liabilities Capital

€ € €

a 20000 0 20000

b 15000 5000 10000

c 16400 7550 8850

d 14100 3850 10250

e 25380 18430 6950

ii. Dual aspect effect of the following transactions.

Assets= liabilities + capital

Assets Liabilities Capital

€ € €

a 8000 0 8000

b 4000 4000 0

c 3000 3000 0

d 6000 6000 0

e 0 0 0

Total 21000 13000 8000

Q.2

Cash account

Date Particulars Amount (in £) Date Particulars Amount (in £)

01/01/21 to bank 25000 to balance b/d 31000

10/01/21 to sales 6000

31000 31000

Bank account

Date Particulars Amount (in £) Date Particulars Amount (in £)

to balance b/d 31000 01/01/21 by cash 25000

02/01/21 by rent 2000

04/01/21 by motor car 4000

31000 31000

Purchase account

Date Particulars

Amount (in

£)

Dat

e Particulars

Amount (in

£)

03/01/2

1 to linda a/c 5000

by balance

b/d 8000

05/01/2

1 to sydney 3000

i. Fill in the missing figures.

Assets Liabilities Capital

€ € €

a 20000 0 20000

b 15000 5000 10000

c 16400 7550 8850

d 14100 3850 10250

e 25380 18430 6950

ii. Dual aspect effect of the following transactions.

Assets= liabilities + capital

Assets Liabilities Capital

€ € €

a 8000 0 8000

b 4000 4000 0

c 3000 3000 0

d 6000 6000 0

e 0 0 0

Total 21000 13000 8000

Q.2

Cash account

Date Particulars Amount (in £) Date Particulars Amount (in £)

01/01/21 to bank 25000 to balance b/d 31000

10/01/21 to sales 6000

31000 31000

Bank account

Date Particulars Amount (in £) Date Particulars Amount (in £)

to balance b/d 31000 01/01/21 by cash 25000

02/01/21 by rent 2000

04/01/21 by motor car 4000

31000 31000

Purchase account

Date Particulars

Amount (in

£)

Dat

e Particulars

Amount (in

£)

03/01/2

1 to linda a/c 5000

by balance

b/d 8000

05/01/2

1 to sydney 3000

8000 8000

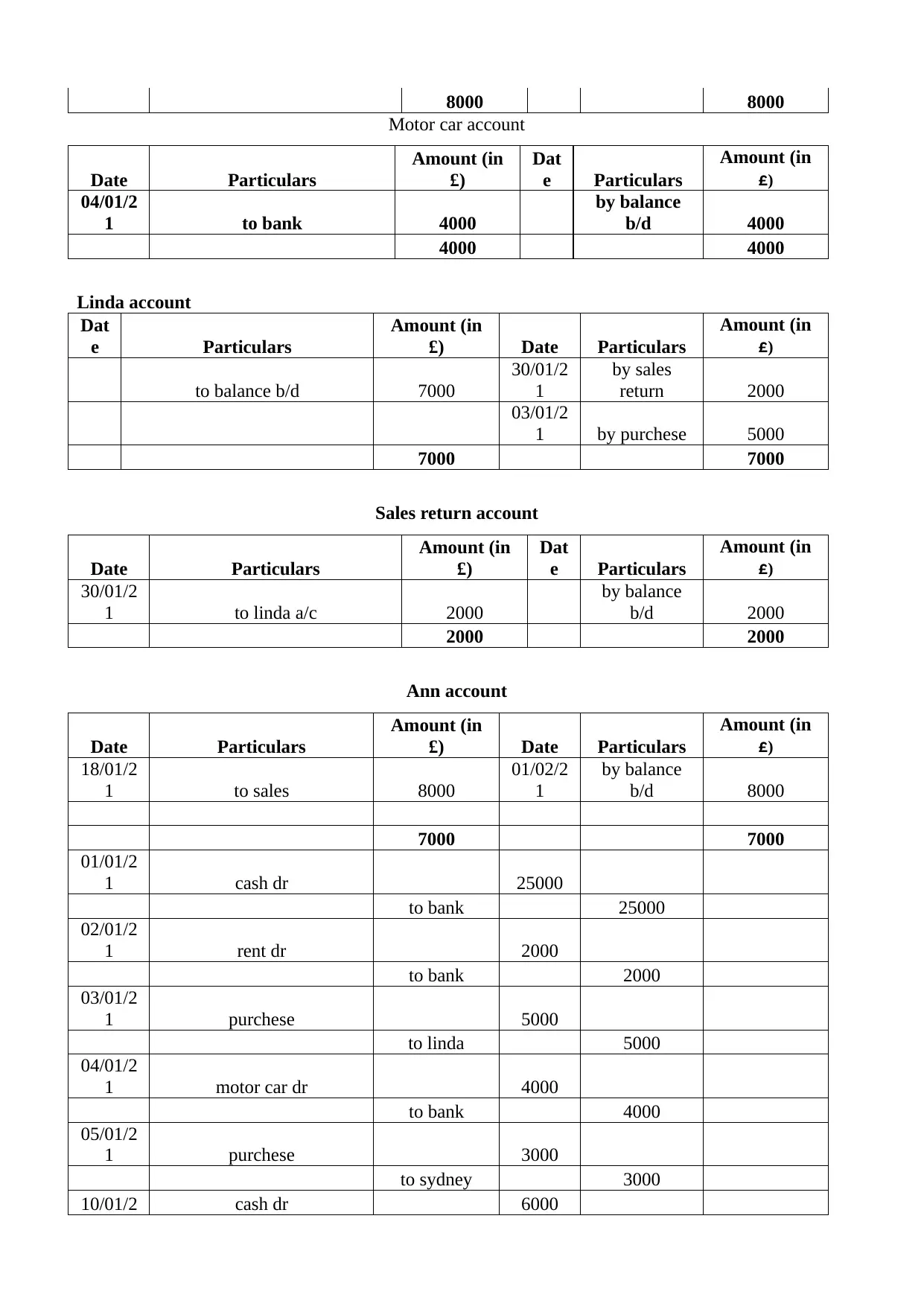

Motor car account

Date Particulars

Amount (in

£)

Dat

e Particulars

Amount (in

£)

04/01/2

1 to bank 4000

by balance

b/d 4000

4000 4000

Linda account

Dat

e Particulars

Amount (in

£) Date Particulars

Amount (in

£)

to balance b/d 7000

30/01/2

1

by sales

return 2000

03/01/2

1 by purchese 5000

7000 7000

Sales return account

Date Particulars

Amount (in

£)

Dat

e Particulars

Amount (in

£)

30/01/2

1 to linda a/c 2000

by balance

b/d 2000

2000 2000

Ann account

Date Particulars

Amount (in

£) Date Particulars

Amount (in

£)

18/01/2

1 to sales 8000

01/02/2

1

by balance

b/d 8000

7000 7000

01/01/2

1 cash dr 25000

to bank 25000

02/01/2

1 rent dr 2000

to bank 2000

03/01/2

1 purchese 5000

to linda 5000

04/01/2

1 motor car dr 4000

to bank 4000

05/01/2

1 purchese 3000

to sydney 3000

10/01/2 cash dr 6000

Motor car account

Date Particulars

Amount (in

£)

Dat

e Particulars

Amount (in

£)

04/01/2

1 to bank 4000

by balance

b/d 4000

4000 4000

Linda account

Dat

e Particulars

Amount (in

£) Date Particulars

Amount (in

£)

to balance b/d 7000

30/01/2

1

by sales

return 2000

03/01/2

1 by purchese 5000

7000 7000

Sales return account

Date Particulars

Amount (in

£)

Dat

e Particulars

Amount (in

£)

30/01/2

1 to linda a/c 2000

by balance

b/d 2000

2000 2000

Ann account

Date Particulars

Amount (in

£) Date Particulars

Amount (in

£)

18/01/2

1 to sales 8000

01/02/2

1

by balance

b/d 8000

7000 7000

01/01/2

1 cash dr 25000

to bank 25000

02/01/2

1 rent dr 2000

to bank 2000

03/01/2

1 purchese 5000

to linda 5000

04/01/2

1 motor car dr 4000

to bank 4000

05/01/2

1 purchese 3000

to sydney 3000

10/01/2 cash dr 6000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

to sales 6000

18/01/2

1 Ann dr 8000

to sales 8000

30/01/2

1 sales return dr 2000

To linda 2000

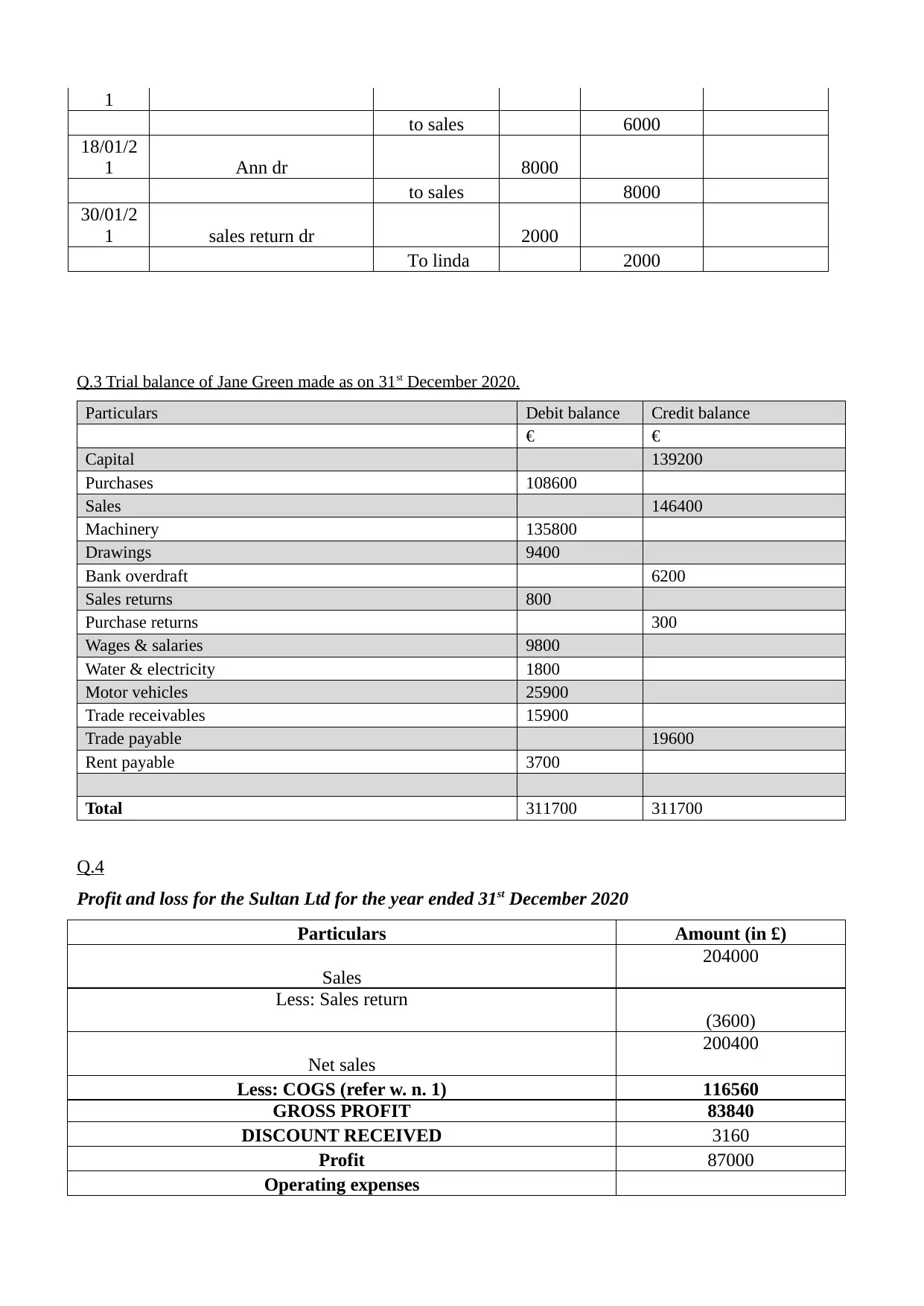

Q.3 Trial balance of Jane Green made as on 31st December 2020.

Particulars Debit balance Credit balance

€ €

Capital 139200

Purchases 108600

Sales 146400

Machinery 135800

Drawings 9400

Bank overdraft 6200

Sales returns 800

Purchase returns 300

Wages & salaries 9800

Water & electricity 1800

Motor vehicles 25900

Trade receivables 15900

Trade payable 19600

Rent payable 3700

Total 311700 311700

Q.4

Profit and loss for the Sultan Ltd for the year ended 31st December 2020

Particulars Amount (in £)

Sales

204000

Less: Sales return

(3600)

Net sales

200400

Less: COGS (refer w. n. 1) 116560

GROSS PROFIT 83840

DISCOUNT RECEIVED 3160

Profit 87000

Operating expenses

to sales 6000

18/01/2

1 Ann dr 8000

to sales 8000

30/01/2

1 sales return dr 2000

To linda 2000

Q.3 Trial balance of Jane Green made as on 31st December 2020.

Particulars Debit balance Credit balance

€ €

Capital 139200

Purchases 108600

Sales 146400

Machinery 135800

Drawings 9400

Bank overdraft 6200

Sales returns 800

Purchase returns 300

Wages & salaries 9800

Water & electricity 1800

Motor vehicles 25900

Trade receivables 15900

Trade payable 19600

Rent payable 3700

Total 311700 311700

Q.4

Profit and loss for the Sultan Ltd for the year ended 31st December 2020

Particulars Amount (in £)

Sales

204000

Less: Sales return

(3600)

Net sales

200400

Less: COGS (refer w. n. 1) 116560

GROSS PROFIT 83840

DISCOUNT RECEIVED 3160

Profit 87000

Operating expenses

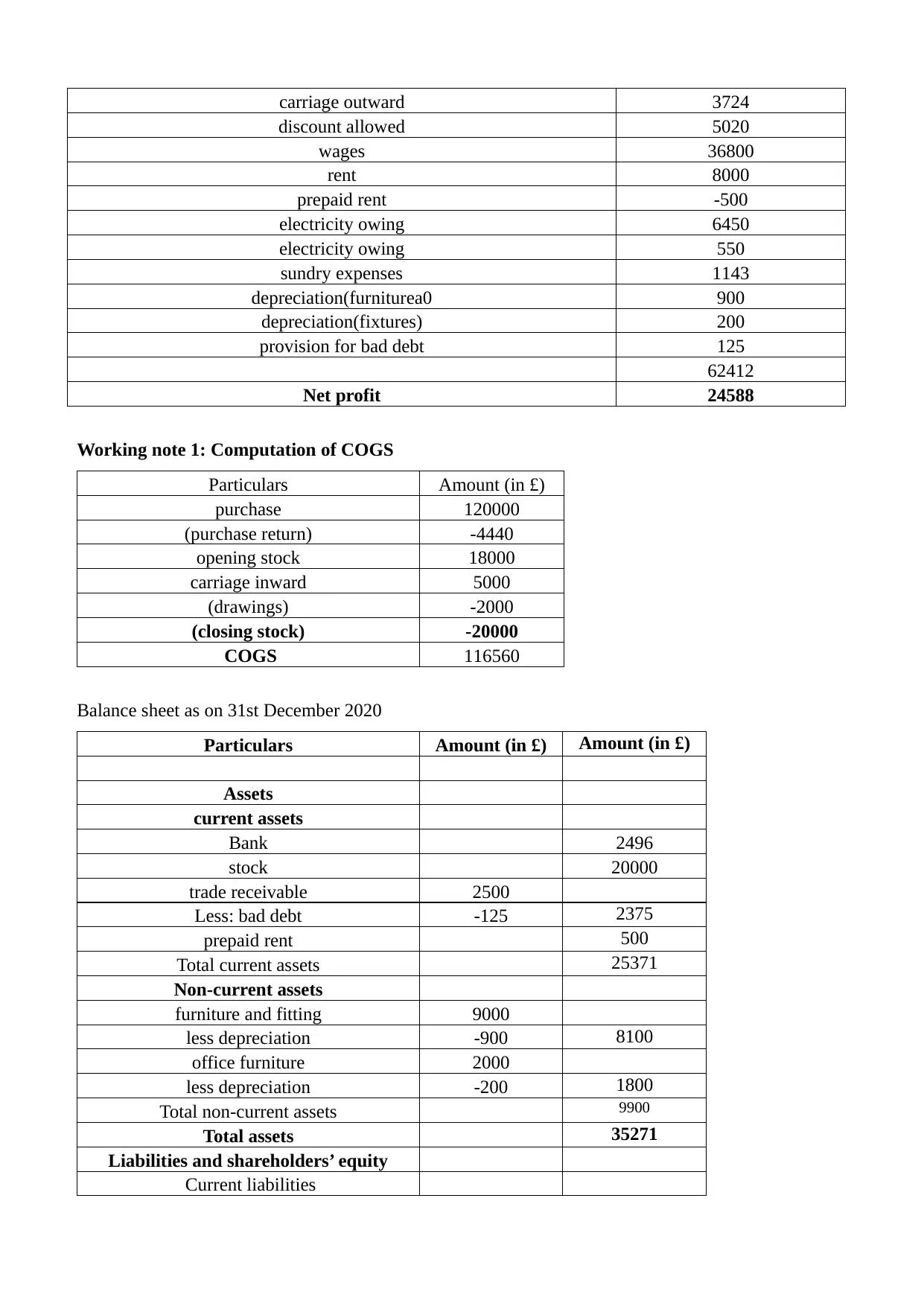

carriage outward 3724

discount allowed 5020

wages 36800

rent 8000

prepaid rent -500

electricity owing 6450

electricity owing 550

sundry expenses 1143

depreciation(furniturea0 900

depreciation(fixtures) 200

provision for bad debt 125

62412

Net profit 24588

Working note 1: Computation of COGS

Particulars Amount (in £)

purchase 120000

(purchase return) -4440

opening stock 18000

carriage inward 5000

(drawings) -2000

(closing stock) -20000

COGS 116560

Balance sheet as on 31st December 2020

Particulars Amount (in £) Amount (in £)

Assets

current assets

Bank 2496

stock 20000

trade receivable 2500

Less: bad debt -125 2375

prepaid rent 500

Total current assets 25371

Non-current assets

furniture and fitting 9000

less depreciation -900 8100

office furniture 2000

less depreciation -200 1800

Total non-current assets 9900

Total assets 35271

Liabilities and shareholders’ equity

Current liabilities

discount allowed 5020

wages 36800

rent 8000

prepaid rent -500

electricity owing 6450

electricity owing 550

sundry expenses 1143

depreciation(furniturea0 900

depreciation(fixtures) 200

provision for bad debt 125

62412

Net profit 24588

Working note 1: Computation of COGS

Particulars Amount (in £)

purchase 120000

(purchase return) -4440

opening stock 18000

carriage inward 5000

(drawings) -2000

(closing stock) -20000

COGS 116560

Balance sheet as on 31st December 2020

Particulars Amount (in £) Amount (in £)

Assets

current assets

Bank 2496

stock 20000

trade receivable 2500

Less: bad debt -125 2375

prepaid rent 500

Total current assets 25371

Non-current assets

furniture and fitting 9000

less depreciation -900 8100

office furniture 2000

less depreciation -200 1800

Total non-current assets 9900

Total assets 35271

Liabilities and shareholders’ equity

Current liabilities

account payable 2660

electricity owing 550

Total current liability 3210

EQUITY ND LIBILITY

Shareholders fund

capital 30000

(drawings) -22527

Reserve and surplus

Profit from P & L 24588 32061

Total liabilities 35271

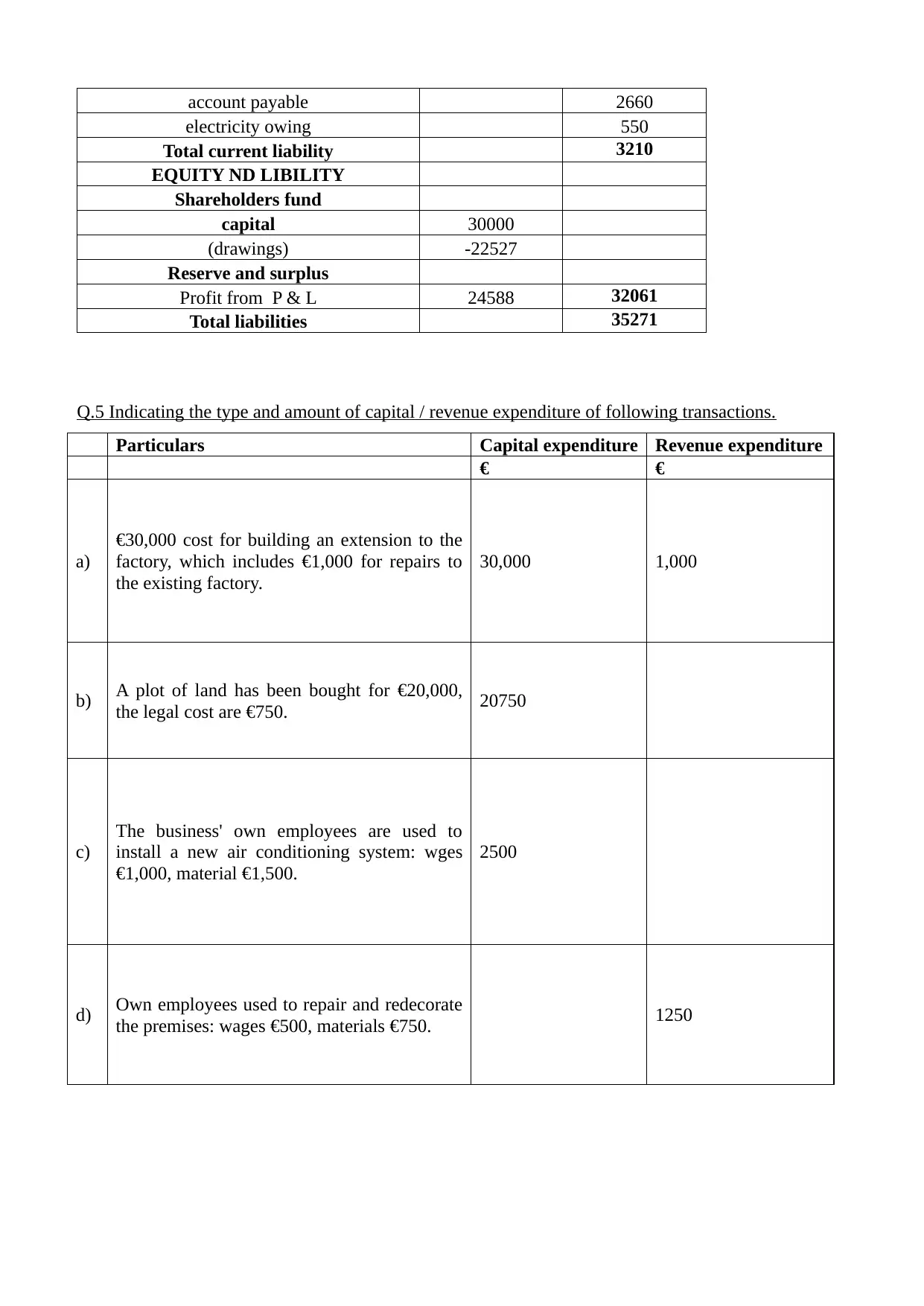

Q.5 Indicating the type and amount of capital / revenue expenditure of following transactions.

Particulars Capital expenditure Revenue expenditure

€ €

a)

€30,000 cost for building an extension to the

factory, which includes €1,000 for repairs to

the existing factory.

30,000 1,000

b) A plot of land has been bought for €20,000,

the legal cost are €750. 20750

c)

The business' own employees are used to

install a new air conditioning system: wges

€1,000, material €1,500.

2500

d) Own employees used to repair and redecorate

the premises: wages €500, materials €750. 1250

electricity owing 550

Total current liability 3210

EQUITY ND LIBILITY

Shareholders fund

capital 30000

(drawings) -22527

Reserve and surplus

Profit from P & L 24588 32061

Total liabilities 35271

Q.5 Indicating the type and amount of capital / revenue expenditure of following transactions.

Particulars Capital expenditure Revenue expenditure

€ €

a)

€30,000 cost for building an extension to the

factory, which includes €1,000 for repairs to

the existing factory.

30,000 1,000

b) A plot of land has been bought for €20,000,

the legal cost are €750. 20750

c)

The business' own employees are used to

install a new air conditioning system: wges

€1,000, material €1,500.

2500

d) Own employees used to repair and redecorate

the premises: wages €500, materials €750. 1250

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

e) Purchase of a new machine €10,000, payment

for installation and setting up €250. 10250

Q.6

Sales ledger control account

Date Particulars

Amount

(Dr) Date Particulars Amount (Cr)

01/11/20 to balance c/d 32600 01/11/20 by balance b/d 450

30/11/20 to balance c/d 550

to contra transfer 350 by creditors 99600

to balance b/d 66550

100050 100050

Purchase ledger control account

Date Particulars

Amount

(Dr) Date Particulars Amount (Cr)

01/11/20 to balance c/d 250 1//11/20 by balance b/d 22200

to debtors 65500 30/11/20 by balance b/d 300

by contra transfer 350

by balance b/d 42900

65750 65750

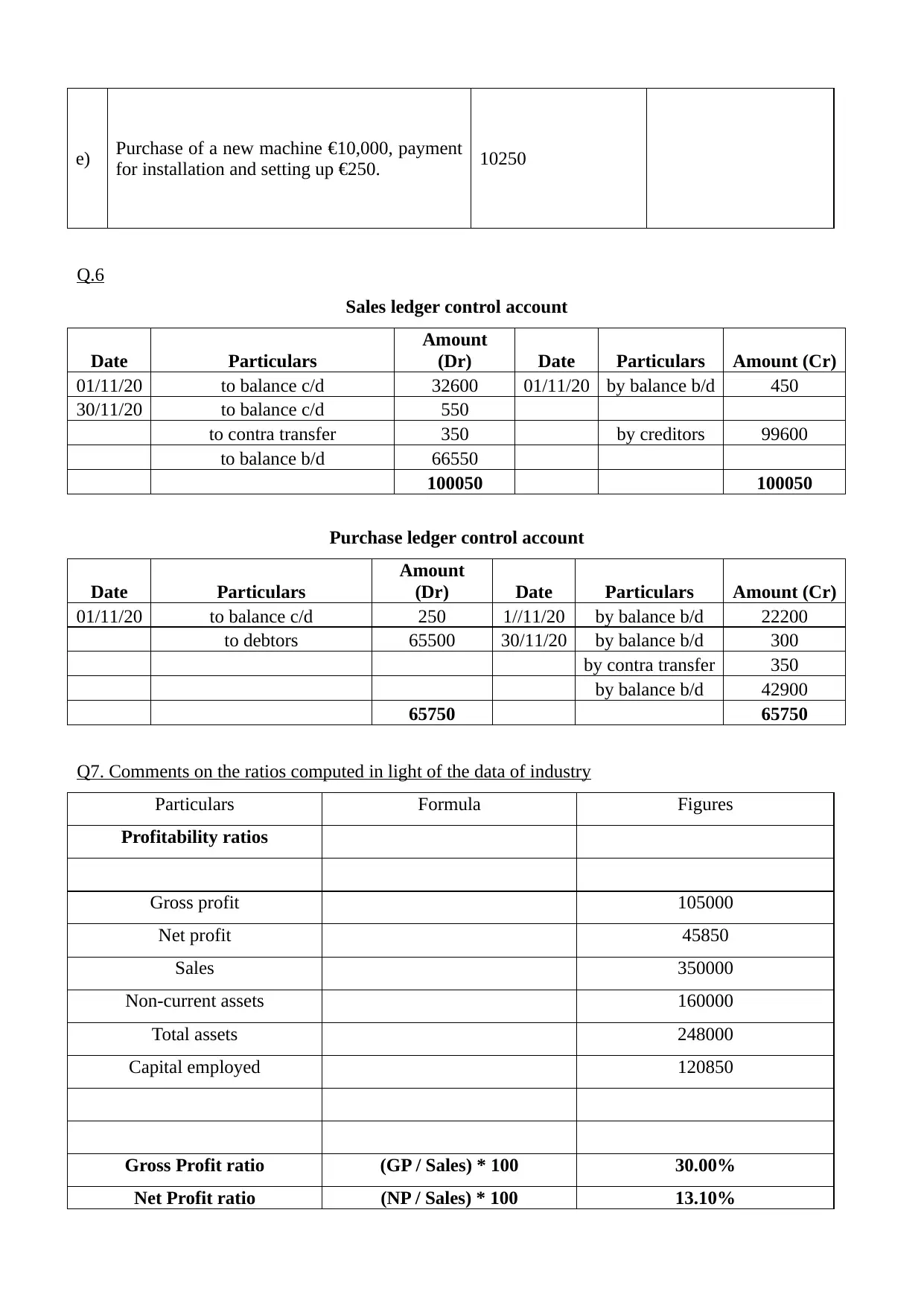

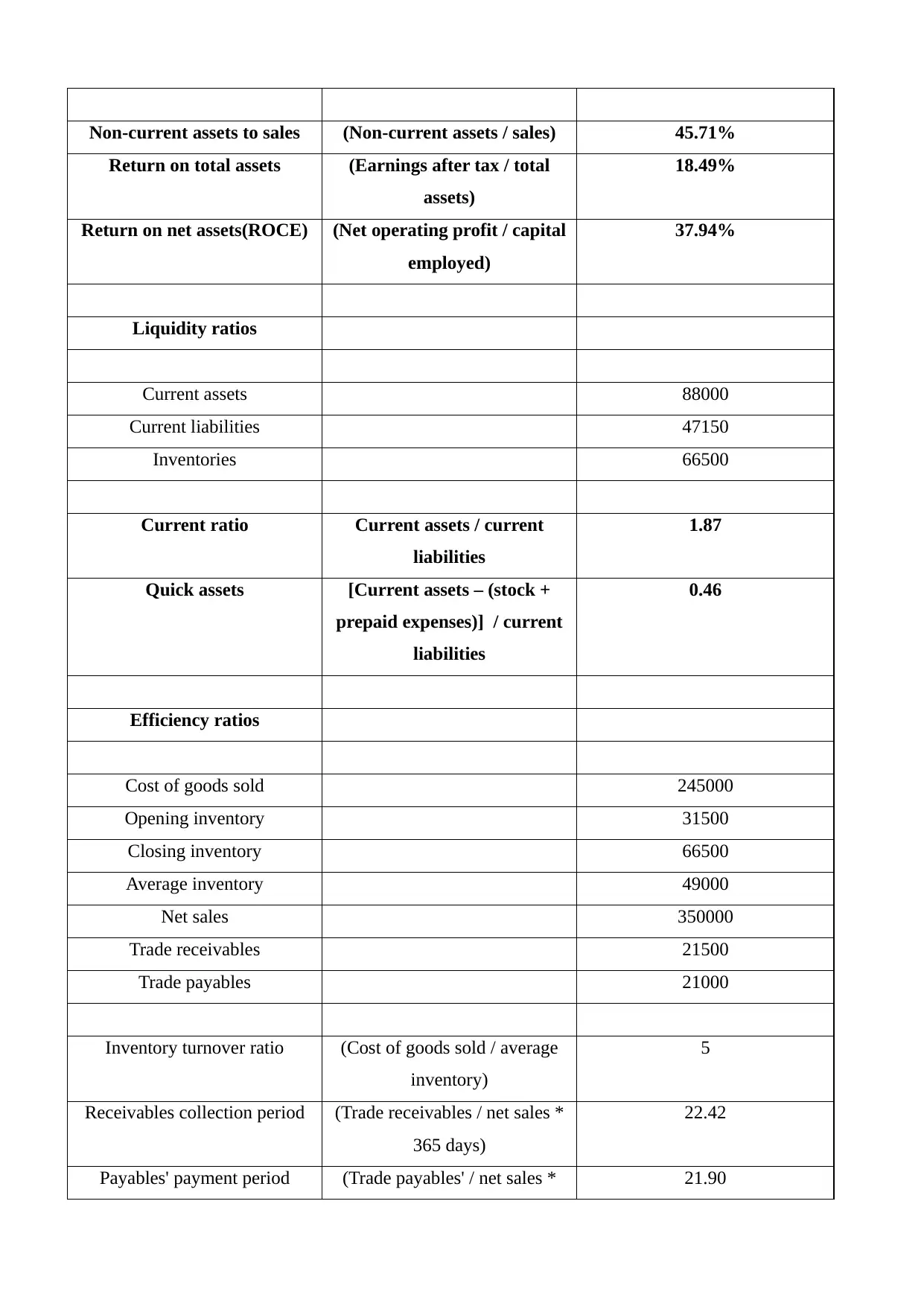

Q7. Comments on the ratios computed in light of the data of industry

Particulars Formula Figures

Profitability ratios

Gross profit 105000

Net profit 45850

Sales 350000

Non-current assets 160000

Total assets 248000

Capital employed 120850

Gross Profit ratio (GP / Sales) * 100 30.00%

Net Profit ratio (NP / Sales) * 100 13.10%

for installation and setting up €250. 10250

Q.6

Sales ledger control account

Date Particulars

Amount

(Dr) Date Particulars Amount (Cr)

01/11/20 to balance c/d 32600 01/11/20 by balance b/d 450

30/11/20 to balance c/d 550

to contra transfer 350 by creditors 99600

to balance b/d 66550

100050 100050

Purchase ledger control account

Date Particulars

Amount

(Dr) Date Particulars Amount (Cr)

01/11/20 to balance c/d 250 1//11/20 by balance b/d 22200

to debtors 65500 30/11/20 by balance b/d 300

by contra transfer 350

by balance b/d 42900

65750 65750

Q7. Comments on the ratios computed in light of the data of industry

Particulars Formula Figures

Profitability ratios

Gross profit 105000

Net profit 45850

Sales 350000

Non-current assets 160000

Total assets 248000

Capital employed 120850

Gross Profit ratio (GP / Sales) * 100 30.00%

Net Profit ratio (NP / Sales) * 100 13.10%

Non-current assets to sales (Non-current assets / sales) 45.71%

Return on total assets (Earnings after tax / total

assets)

18.49%

Return on net assets(ROCE) (Net operating profit / capital

employed)

37.94%

Liquidity ratios

Current assets 88000

Current liabilities 47150

Inventories 66500

Current ratio Current assets / current

liabilities

1.87

Quick assets [Current assets – (stock +

prepaid expenses)] / current

liabilities

0.46

Efficiency ratios

Cost of goods sold 245000

Opening inventory 31500

Closing inventory 66500

Average inventory 49000

Net sales 350000

Trade receivables 21500

Trade payables 21000

Inventory turnover ratio (Cost of goods sold / average

inventory)

5

Receivables collection period (Trade receivables / net sales *

365 days)

22.42

Payables' payment period (Trade payables' / net sales * 21.90

Return on total assets (Earnings after tax / total

assets)

18.49%

Return on net assets(ROCE) (Net operating profit / capital

employed)

37.94%

Liquidity ratios

Current assets 88000

Current liabilities 47150

Inventories 66500

Current ratio Current assets / current

liabilities

1.87

Quick assets [Current assets – (stock +

prepaid expenses)] / current

liabilities

0.46

Efficiency ratios

Cost of goods sold 245000

Opening inventory 31500

Closing inventory 66500

Average inventory 49000

Net sales 350000

Trade receivables 21500

Trade payables 21000

Inventory turnover ratio (Cost of goods sold / average

inventory)

5

Receivables collection period (Trade receivables / net sales *

365 days)

22.42

Payables' payment period (Trade payables' / net sales * 21.90

365 days)

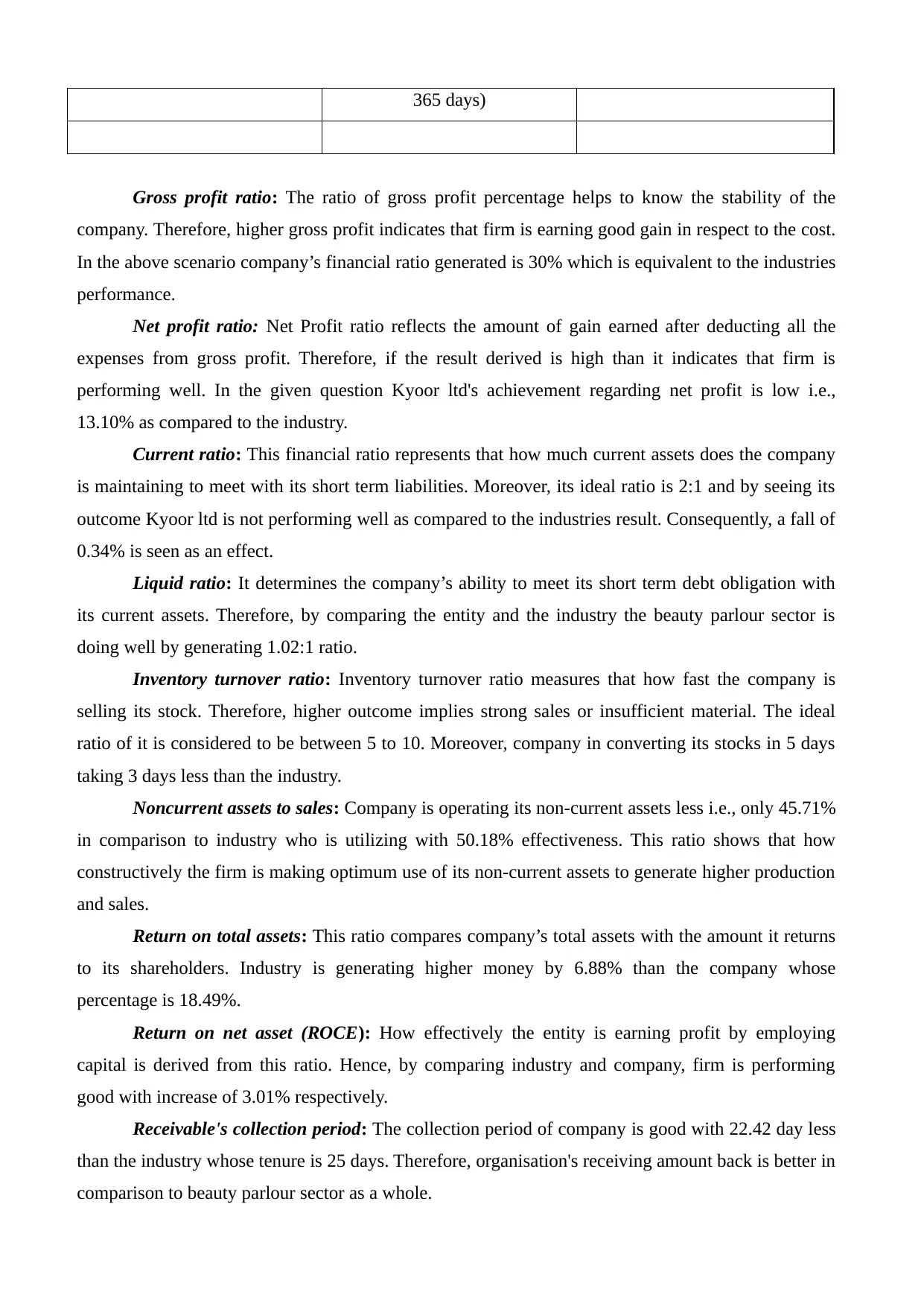

Gross profit ratio: The ratio of gross profit percentage helps to know the stability of the

company. Therefore, higher gross profit indicates that firm is earning good gain in respect to the cost.

In the above scenario company’s financial ratio generated is 30% which is equivalent to the industries

performance.

Net profit ratio: Net Profit ratio reflects the amount of gain earned after deducting all the

expenses from gross profit. Therefore, if the result derived is high than it indicates that firm is

performing well. In the given question Kyoor ltd's achievement regarding net profit is low i.e.,

13.10% as compared to the industry.

Current ratio: This financial ratio represents that how much current assets does the company

is maintaining to meet with its short term liabilities. Moreover, its ideal ratio is 2:1 and by seeing its

outcome Kyoor ltd is not performing well as compared to the industries result. Consequently, a fall of

0.34% is seen as an effect.

Liquid ratio: It determines the company’s ability to meet its short term debt obligation with

its current assets. Therefore, by comparing the entity and the industry the beauty parlour sector is

doing well by generating 1.02:1 ratio.

Inventory turnover ratio: Inventory turnover ratio measures that how fast the company is

selling its stock. Therefore, higher outcome implies strong sales or insufficient material. The ideal

ratio of it is considered to be between 5 to 10. Moreover, company in converting its stocks in 5 days

taking 3 days less than the industry.

Noncurrent assets to sales: Company is operating its non-current assets less i.e., only 45.71%

in comparison to industry who is utilizing with 50.18% effectiveness. This ratio shows that how

constructively the firm is making optimum use of its non-current assets to generate higher production

and sales.

Return on total assets: This ratio compares company’s total assets with the amount it returns

to its shareholders. Industry is generating higher money by 6.88% than the company whose

percentage is 18.49%.

Return on net asset (ROCE): How effectively the entity is earning profit by employing

capital is derived from this ratio. Hence, by comparing industry and company, firm is performing

good with increase of 3.01% respectively.

Receivable's collection period: The collection period of company is good with 22.42 day less

than the industry whose tenure is 25 days. Therefore, organisation's receiving amount back is better in

comparison to beauty parlour sector as a whole.

Gross profit ratio: The ratio of gross profit percentage helps to know the stability of the

company. Therefore, higher gross profit indicates that firm is earning good gain in respect to the cost.

In the above scenario company’s financial ratio generated is 30% which is equivalent to the industries

performance.

Net profit ratio: Net Profit ratio reflects the amount of gain earned after deducting all the

expenses from gross profit. Therefore, if the result derived is high than it indicates that firm is

performing well. In the given question Kyoor ltd's achievement regarding net profit is low i.e.,

13.10% as compared to the industry.

Current ratio: This financial ratio represents that how much current assets does the company

is maintaining to meet with its short term liabilities. Moreover, its ideal ratio is 2:1 and by seeing its

outcome Kyoor ltd is not performing well as compared to the industries result. Consequently, a fall of

0.34% is seen as an effect.

Liquid ratio: It determines the company’s ability to meet its short term debt obligation with

its current assets. Therefore, by comparing the entity and the industry the beauty parlour sector is

doing well by generating 1.02:1 ratio.

Inventory turnover ratio: Inventory turnover ratio measures that how fast the company is

selling its stock. Therefore, higher outcome implies strong sales or insufficient material. The ideal

ratio of it is considered to be between 5 to 10. Moreover, company in converting its stocks in 5 days

taking 3 days less than the industry.

Noncurrent assets to sales: Company is operating its non-current assets less i.e., only 45.71%

in comparison to industry who is utilizing with 50.18% effectiveness. This ratio shows that how

constructively the firm is making optimum use of its non-current assets to generate higher production

and sales.

Return on total assets: This ratio compares company’s total assets with the amount it returns

to its shareholders. Industry is generating higher money by 6.88% than the company whose

percentage is 18.49%.

Return on net asset (ROCE): How effectively the entity is earning profit by employing

capital is derived from this ratio. Hence, by comparing industry and company, firm is performing

good with increase of 3.01% respectively.

Receivable's collection period: The collection period of company is good with 22.42 day less

than the industry whose tenure is 25 days. Therefore, organisation's receiving amount back is better in

comparison to beauty parlour sector as a whole.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Payable's payment period: Represents time lag between credit purchase and making payment

to the supplier. Company is said to be credit worthiness because they are paying within 21.90 days as

compare to industry that is returning in 30 days.

Q.8

Computation of Net present value

Year

cash

inflow Discounting factor

Discounted

cash inflows

1 40000 0.909 36363.636

2 40000 0.826 33057.851

3 60000 0.751 45078.888

4 30000 0.683 20490.404

Total

discounted

cash

inflows 134990.78

Less:

initial

investment 120000

NPV 14990.78

Computation of payback period

Year Cash flow (in £) Cumulative cash inflows (in £)

1 40000 40000

2 40000 80000

3 60000 140000

4 30000 170000

Payback period: (12000 – 80000) / 60000

= 2.3 year

Interpretation: In the above question it is to be concluded that the project is having positive

net present value and also its payback period is short so this project is viable for company. Also, it

will sustain its business in longer period.

Q9. Answer to the following questions

a) State briefly the main reasons why company may employ team of accountants.

In the business unit, accountants protect the interest of the users by computing them true

and fair view of company’s financial position.

Accountants help businesses to take timely and relevant decisions by following the

budgeting and cash flows (Warren, Jonick and Schneider, 2020).

to the supplier. Company is said to be credit worthiness because they are paying within 21.90 days as

compare to industry that is returning in 30 days.

Q.8

Computation of Net present value

Year

cash

inflow Discounting factor

Discounted

cash inflows

1 40000 0.909 36363.636

2 40000 0.826 33057.851

3 60000 0.751 45078.888

4 30000 0.683 20490.404

Total

discounted

cash

inflows 134990.78

Less:

initial

investment 120000

NPV 14990.78

Computation of payback period

Year Cash flow (in £) Cumulative cash inflows (in £)

1 40000 40000

2 40000 80000

3 60000 140000

4 30000 170000

Payback period: (12000 – 80000) / 60000

= 2.3 year

Interpretation: In the above question it is to be concluded that the project is having positive

net present value and also its payback period is short so this project is viable for company. Also, it

will sustain its business in longer period.

Q9. Answer to the following questions

a) State briefly the main reasons why company may employ team of accountants.

In the business unit, accountants protect the interest of the users by computing them true

and fair view of company’s financial position.

Accountants help businesses to take timely and relevant decisions by following the

budgeting and cash flows (Warren, Jonick and Schneider, 2020).

Businesses need to pay taxes so the calculations and timely payment of it are seen by

business accountants.

b) Reason and purpose of external auditors in limited liability company.

The main work of external auditor is to investigate the financial statements and detect frauds

and errors if finds such. Moreover, they make companies books free from material misstatements and

guide to comply with regulations.

Purposes:

External auditor makes the books of accounts free from biasness’s. Further, make the

statements presentable by indicating whether the financial health of company is good

or not (Sudarna and et.al., 2020).

They also guide organisation regarding optimum utilization of resources, waste

management, compliances of government regulation, etc.

The audit is done by not-related party, they are independent so the judgement is also

true and fair.

c) Importance of accounting:

Every organisation in an industry requires accountant in order to to comply with the

rules and regulations properly according to the prescribed format or guidelines.

Accountant acts like a parachute to the company as they protect the entity from

contingent events by forecasting and preparing accounts accordingly.

The work of accounting is always in demand wherever the monetary value is involved

(Warren, Jonick and Schneider, 2020).

d) Stating statutory obligations required for the preparation of management accounts

The company should maintain and record the accounting nature transactions occurred

during the period.

Financial statements need to be prepared on accounting period basis so that with this

entity help its stakeholders in knowing the performance of the company (Maheshwari,

Maheshwari and Maheshwari, 2021).

Companies are requiring to submit its audited financial accounts copy, directors and

auditors report to registrars within 42 days from the end of the period. Moreover,

before presenting the documents in general meeting the filing should be done.

Once a year company is required to file with registrar of company its annual return

signed by one of the director or by company secretary.

e) Nature and purpose of accounts:

Nature of accounts includes the following:

1. Quantitative attribute

business accountants.

b) Reason and purpose of external auditors in limited liability company.

The main work of external auditor is to investigate the financial statements and detect frauds

and errors if finds such. Moreover, they make companies books free from material misstatements and

guide to comply with regulations.

Purposes:

External auditor makes the books of accounts free from biasness’s. Further, make the

statements presentable by indicating whether the financial health of company is good

or not (Sudarna and et.al., 2020).

They also guide organisation regarding optimum utilization of resources, waste

management, compliances of government regulation, etc.

The audit is done by not-related party, they are independent so the judgement is also

true and fair.

c) Importance of accounting:

Every organisation in an industry requires accountant in order to to comply with the

rules and regulations properly according to the prescribed format or guidelines.

Accountant acts like a parachute to the company as they protect the entity from

contingent events by forecasting and preparing accounts accordingly.

The work of accounting is always in demand wherever the monetary value is involved

(Warren, Jonick and Schneider, 2020).

d) Stating statutory obligations required for the preparation of management accounts

The company should maintain and record the accounting nature transactions occurred

during the period.

Financial statements need to be prepared on accounting period basis so that with this

entity help its stakeholders in knowing the performance of the company (Maheshwari,

Maheshwari and Maheshwari, 2021).

Companies are requiring to submit its audited financial accounts copy, directors and

auditors report to registrars within 42 days from the end of the period. Moreover,

before presenting the documents in general meeting the filing should be done.

Once a year company is required to file with registrar of company its annual return

signed by one of the director or by company secretary.

e) Nature and purpose of accounts:

Nature of accounts includes the following:

1. Quantitative attribute

2. Qualitative attribute

Quantitative attribute:

The entries are recorded in the chronological order. Further, they include only

monetary nature transaction and other non-financial items are ignored.

It classifies and groups together similar nature entries at one place known as ledger

book. Therefore, helps to find the data easily.

Analysing and interpretation of accounts helps the users to know the financial position

of the company.

Qualitative attribute:

The accounts prepared are said to be reliable as the information involved are verified

from the sources like purchase invoices, cash memos, etc.

Financial statements only include relevant data and ignores irrelevant one, hence helps

users to take decisions accurately (Adu-Gyamfi and Chipwere, 2020).

Books of financial accounts are presented in simple and logical way which can be

understood by the shareholders easily.

Purpose of accounts:

The main role of accounting is to prepare financial statement in a systematic and

accurate manner with complete information.

Helps to prepare budget and plan how to allocate and use the resources effectively and

efficiently to accomplish the organisational goal.

Assist to take make or buy decision and what price should be charged by the business

on a particular product.

Preparation of accounts helps in determining the mismanagement of cash and know

about the liquidity position.

Q.10 Defining the following terms:

Depreciation: It is fall in the value of fixed assets which can be due to various reasons like

change in market condition etc (Oliveira and et.al., 2021). Every company follows different method

of calculating depreciation. There are two methods of calculating this:

Straight line method: under this a fix amount is deducted every year till the useful life of

assets. For example: A company is having a fixed asset of €24000 and its policy is to provide

depreciation @10%. So every year 24000*10% that is 2400 is deducted every year.

Written down value method: Under this a fix percentage of amount is deducted every year

on accumulate basis. It is also known as reducing balance method.

For example: PQR ltd is having machinery of €15000 and depreciation rate is 10% so for the

first year it is 1500. After that 1350 and so on as its on accumulated basis.

Quantitative attribute:

The entries are recorded in the chronological order. Further, they include only

monetary nature transaction and other non-financial items are ignored.

It classifies and groups together similar nature entries at one place known as ledger

book. Therefore, helps to find the data easily.

Analysing and interpretation of accounts helps the users to know the financial position

of the company.

Qualitative attribute:

The accounts prepared are said to be reliable as the information involved are verified

from the sources like purchase invoices, cash memos, etc.

Financial statements only include relevant data and ignores irrelevant one, hence helps

users to take decisions accurately (Adu-Gyamfi and Chipwere, 2020).

Books of financial accounts are presented in simple and logical way which can be

understood by the shareholders easily.

Purpose of accounts:

The main role of accounting is to prepare financial statement in a systematic and

accurate manner with complete information.

Helps to prepare budget and plan how to allocate and use the resources effectively and

efficiently to accomplish the organisational goal.

Assist to take make or buy decision and what price should be charged by the business

on a particular product.

Preparation of accounts helps in determining the mismanagement of cash and know

about the liquidity position.

Q.10 Defining the following terms:

Depreciation: It is fall in the value of fixed assets which can be due to various reasons like

change in market condition etc (Oliveira and et.al., 2021). Every company follows different method

of calculating depreciation. There are two methods of calculating this:

Straight line method: under this a fix amount is deducted every year till the useful life of

assets. For example: A company is having a fixed asset of €24000 and its policy is to provide

depreciation @10%. So every year 24000*10% that is 2400 is deducted every year.

Written down value method: Under this a fix percentage of amount is deducted every year

on accumulate basis. It is also known as reducing balance method.

For example: PQR ltd is having machinery of €15000 and depreciation rate is 10% so for the

first year it is 1500. After that 1350 and so on as its on accumulated basis.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Allowance for bad and doubtful debt: It is prepared with respect to account receivables, because

it is expected that such amount is not recovered by company. When an entity gives goods on credit,

then there are expectations that all the dues will be received timely, but those amount which is

irrecoverable will be termed as bad debts (Kryukova, 2021). Also, when company assumes that

amount will not be received by shareholders and makes provision in advance then its known as

doubtful debt. Moreover, company make its provision in advance so that such money is utilized in

case of unfortunate event.

Debentures: This is the loan taken by companies and government on fixed rate basis. They can be

secured, unsecured, convertible, non-convertible etc. It has lower risk of default, Corporations

holding debentures do not have any voting right and control over management (Ang and Tjio, 2021).

So for a company issuing debt securities their borrowing capacities has been reduced. Also, they are

required to make provision in advance to repay at a predetermined date.

Preference shares: As the name suggests these shareholders have preference over others. Also

they have dividend advantages in comparison to equity holders (Dunbar, Lewbel, and Pendakur,

2021). If a company become insolvent, then in such a case these shareholders are given amount first

and whatever is left that will be distributed to others. Preference shares can be cumulative, non-

cumulative, convertible, non-convertible etc.

Ordinary shares: This is the normal shares which are sold to public for raising capital from

public and private sources. It is not mandatory for company to pay dividend to ordinary shareholders

(Sugiyanto, 2021). In the context of business unit, investors having many advantages like voting

rights along with claim over dividends if company is performing good and generated good returns.

Along with this, they do not have any fixed date of maturity so investors can enjoy ownership till the

time they want. Various types of Ordinary shares include right shares, sweat equity, along with

voting/ non-voting rights.

it is expected that such amount is not recovered by company. When an entity gives goods on credit,

then there are expectations that all the dues will be received timely, but those amount which is

irrecoverable will be termed as bad debts (Kryukova, 2021). Also, when company assumes that

amount will not be received by shareholders and makes provision in advance then its known as

doubtful debt. Moreover, company make its provision in advance so that such money is utilized in

case of unfortunate event.

Debentures: This is the loan taken by companies and government on fixed rate basis. They can be

secured, unsecured, convertible, non-convertible etc. It has lower risk of default, Corporations

holding debentures do not have any voting right and control over management (Ang and Tjio, 2021).

So for a company issuing debt securities their borrowing capacities has been reduced. Also, they are

required to make provision in advance to repay at a predetermined date.

Preference shares: As the name suggests these shareholders have preference over others. Also

they have dividend advantages in comparison to equity holders (Dunbar, Lewbel, and Pendakur,

2021). If a company become insolvent, then in such a case these shareholders are given amount first

and whatever is left that will be distributed to others. Preference shares can be cumulative, non-

cumulative, convertible, non-convertible etc.

Ordinary shares: This is the normal shares which are sold to public for raising capital from

public and private sources. It is not mandatory for company to pay dividend to ordinary shareholders

(Sugiyanto, 2021). In the context of business unit, investors having many advantages like voting

rights along with claim over dividends if company is performing good and generated good returns.

Along with this, they do not have any fixed date of maturity so investors can enjoy ownership till the

time they want. Various types of Ordinary shares include right shares, sweat equity, along with

voting/ non-voting rights.

REFERENCES

Book and Journals

Adu-Gyamfi, J. and Chipwere, K. Y. W., 2020. The Impact of Management Accounting Practices on

the Performance of Manufacturing Firms: An Empirical Evidence from Ghana. Research Journal

of Finance and Accounting. 11(20). pp.100-113.

Ang, D. W. E. and Tjio, H., 2021. The inherent weakness of floating charges: Malayan Banking Bhd

v Bakri Navigation Co Ltd [2020] 2 SLR 167 [Case Note]. Singapore Academy of Law Journal.

33(2). pp. 625-644.

Dunbar, G. R., Lewbel, A. and Pendakur, K., 2021. Identification of random resource shares in

collective households without preference similarity restrictions. Journal of Business & Economic

Statistics. 39(2). pp. 402-421.

Kryukova, I. V., 2021. PROVISIONS FOR DOUBTFUL DEBTS: ACCOUNTING AND TAX

ACCOUNTING. E-Scio. (5). pp. 238-242.

Maheshwari, S. N., Maheshwari, S. K. and Maheshwari, M. S. K., 2021. Principles of Management

Accounting. Sultan Chand & Sons.

Oliveira, M. L. and et.al., 2021. Environmental aspects of the depreciation of the culturally

significant Wall of Cartagena de Indias–Colombia. Chemosphere. 265. p.129119.

Sudarna, S. and et.al., 2020. The Implementation Of Legal Audit By The Audit Committee: The Case

Of One Company. International Journal of Scientific & Technology Research. 9(01). pp.3964-

3971.

Sugiyanto, S., 2021. Intellectual Capital And Earning Management, To Future Stock Return.

Proceedings Universitas Pamulang. 1(1). pp. 558-567.

Warren, C. S., Jonick, C. and Schneider, J., 2020. Accounting. Cengage Learning.

Book and Journals

Adu-Gyamfi, J. and Chipwere, K. Y. W., 2020. The Impact of Management Accounting Practices on

the Performance of Manufacturing Firms: An Empirical Evidence from Ghana. Research Journal

of Finance and Accounting. 11(20). pp.100-113.

Ang, D. W. E. and Tjio, H., 2021. The inherent weakness of floating charges: Malayan Banking Bhd

v Bakri Navigation Co Ltd [2020] 2 SLR 167 [Case Note]. Singapore Academy of Law Journal.

33(2). pp. 625-644.

Dunbar, G. R., Lewbel, A. and Pendakur, K., 2021. Identification of random resource shares in

collective households without preference similarity restrictions. Journal of Business & Economic

Statistics. 39(2). pp. 402-421.

Kryukova, I. V., 2021. PROVISIONS FOR DOUBTFUL DEBTS: ACCOUNTING AND TAX

ACCOUNTING. E-Scio. (5). pp. 238-242.

Maheshwari, S. N., Maheshwari, S. K. and Maheshwari, M. S. K., 2021. Principles of Management

Accounting. Sultan Chand & Sons.

Oliveira, M. L. and et.al., 2021. Environmental aspects of the depreciation of the culturally

significant Wall of Cartagena de Indias–Colombia. Chemosphere. 265. p.129119.

Sudarna, S. and et.al., 2020. The Implementation Of Legal Audit By The Audit Committee: The Case

Of One Company. International Journal of Scientific & Technology Research. 9(01). pp.3964-

3971.

Sugiyanto, S., 2021. Intellectual Capital And Earning Management, To Future Stock Return.

Proceedings Universitas Pamulang. 1(1). pp. 558-567.

Warren, C. S., Jonick, C. and Schneider, J., 2020. Accounting. Cengage Learning.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.