Pestle and Swot Analysis of Business Environment

VerifiedAdded on 2020/10/05

|16

|4712

|214

AI Summary

The provided document is an analysis of the business environment using PESTLE (Political, Economic, Social, Technological, Legal, and Environmental) and SWOT (Strengths, Weaknesses, Opportunities, and Threats) methods. The document includes a list of references from various academic sources, such as journals, books, and online resources. It also mentions specific topics, including innovation clusters, public-private partnerships, and business process standardization. The purpose of the assignment is to understand how these factors influence business environments and entrepreneurship globally.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Business and business

Environment

Environment

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Different types size and scope of organisation.......................................................................1

TASK 2............................................................................................................................................5

Two types of organisation structure and relationship between organisation functions..........5

The relationship between different organisation functions and they link organisation

objectives and structure..........................................................................................................6

TASK 3............................................................................................................................................7

PESTLE tools impact on an organisation...............................................................................7

TASK 4............................................................................................................................................9

SWOT analysis of Yorkshire Bank........................................................................................9

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

Different types size and scope of organisation.......................................................................1

TASK 2............................................................................................................................................5

Two types of organisation structure and relationship between organisation functions..........5

The relationship between different organisation functions and they link organisation

objectives and structure..........................................................................................................6

TASK 3............................................................................................................................................7

PESTLE tools impact on an organisation...............................................................................7

TASK 4............................................................................................................................................9

SWOT analysis of Yorkshire Bank........................................................................................9

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................1

INTRODUCTION

Business environment means that all external and internal factors which is impacted on

business supply, demand and regulation (Banica and Hagiu, 2015). Report will be based on

“YORKSHIRE BANK”. It was established on 1859. Its headquarter establish in Leeds, England

Report will cover different types, size, scope of public private and voluntary organisation

and advantages and disadvantages along with some differences. It discusses that organisation

operate in the primary, secondary sector. It will cover interrelationship of the various function

within an organisation and examples of positive and negative impact on the business operations.

It discuses about the SWOT analysis of Yorkshire bank and also evaluate the impact factors up

on business decision making.

TASK 1

Different types size and scope of organisation.

Organisation is a group of people where they work together like association, a

corporation, unity or a charity. It includes program, department, projects to produce service or

products. Every organisation have purpose to fulfil mission, vision, values and direct people in

right way to achieve goals of organisation (Banica and Hagiu, 2015). Here are some different

type of organisations are given below.

Private Organisation: It is own by a person or individual or via group in order to gain

profit. Ownership of these organisations is limited to small number of lender. Some largest

private companies in UK are Stemcor, Greenergy, Swire, John Lewis Partnership, Barilla and

many more (Caiazza, Shimizu and Yoshikawa, 2017).

Purpose of Private Organisation: Purpose of private companies is survived by making

profits and advantages and to earn benefits and maximise it. This includes reporting financial

date with clarity, optimizing profits, protect companies policies like marketing plans, to limit

liability selecting proper structure of organisation (Chang, 2016). Here, GHD Group is a

multinational technical professional services firm which provide engineering, management

design, environmental services etc. Purpose of this group is to deliver quality outcomes across

the asset value chain to clients.

Advantage and Disadvantage of Private Sector

Advantages

1

Business environment means that all external and internal factors which is impacted on

business supply, demand and regulation (Banica and Hagiu, 2015). Report will be based on

“YORKSHIRE BANK”. It was established on 1859. Its headquarter establish in Leeds, England

Report will cover different types, size, scope of public private and voluntary organisation

and advantages and disadvantages along with some differences. It discusses that organisation

operate in the primary, secondary sector. It will cover interrelationship of the various function

within an organisation and examples of positive and negative impact on the business operations.

It discuses about the SWOT analysis of Yorkshire bank and also evaluate the impact factors up

on business decision making.

TASK 1

Different types size and scope of organisation.

Organisation is a group of people where they work together like association, a

corporation, unity or a charity. It includes program, department, projects to produce service or

products. Every organisation have purpose to fulfil mission, vision, values and direct people in

right way to achieve goals of organisation (Banica and Hagiu, 2015). Here are some different

type of organisations are given below.

Private Organisation: It is own by a person or individual or via group in order to gain

profit. Ownership of these organisations is limited to small number of lender. Some largest

private companies in UK are Stemcor, Greenergy, Swire, John Lewis Partnership, Barilla and

many more (Caiazza, Shimizu and Yoshikawa, 2017).

Purpose of Private Organisation: Purpose of private companies is survived by making

profits and advantages and to earn benefits and maximise it. This includes reporting financial

date with clarity, optimizing profits, protect companies policies like marketing plans, to limit

liability selecting proper structure of organisation (Chang, 2016). Here, GHD Group is a

multinational technical professional services firm which provide engineering, management

design, environmental services etc. Purpose of this group is to deliver quality outcomes across

the asset value chain to clients.

Advantage and Disadvantage of Private Sector

Advantages

1

Financial Result: Private sector manage its capital by owners of themselves. It is not

required to reveal its financial results to the public (Mazurand et.al., 2016). It helps to reduce

short term pressure of analyst expectations and meeting shareholders.

Limited Liability: Financial liability of shareholders is limited for private companies. If

company is in lose then shareholders would not lose their personal assets (Sarmento and

Renneboog, 2016). While committing a fraud related to private sector company can deny limited

liability protection of owner.

Continued Existence: private sector has advantage of continue existence even owner

leave or dies (Chang, 2016). This sector is incorporated and it can own assets individually apart

from company or to becomes an independent owner entity.

Disadvantages

Restricted Access to Capital Markets: This sector is legally denied to use its share as

an initial public offering. They are not able to trade their share on stock exchange. So that they

find difficulties to attract outside investors. They are not able to sell or transfer share before

asking company's directors (Banica and Hagiu, 2015). Due to this, investment decision not

execute or made on timely manner.

Limited Personal Control: directors of private companies have not total control mover

operations of entity. When directors want to decision any private issue to others they have to

invite other owners. With reduced control, any decision cannot execute or make without

including other shareholders (MacGregor Doyle and McEachern, 2015).

Higher Administration Costs: As a legal duty, private company has to appoint least one

director or shareholder (Caiazza Shimizu and Yoshikawa, 2017). They hire secretary for

company and accountants to manage accurate reports. This can increase administrative and

general expanses of company.

Public Organisation

Public sector is operated and owned by the government and provide services to citizens.

It controlled by publicly or publicly funded agencies, entities, enterprises that deliver public

services, goods and programs. Some public organisations are Audit Commission, The Cabinet

Office, Yorkshire Bank etc (Grosanu and et.al., 2015).

Advantage and Disadvantage of Public Organisation

Advantages

2

required to reveal its financial results to the public (Mazurand et.al., 2016). It helps to reduce

short term pressure of analyst expectations and meeting shareholders.

Limited Liability: Financial liability of shareholders is limited for private companies. If

company is in lose then shareholders would not lose their personal assets (Sarmento and

Renneboog, 2016). While committing a fraud related to private sector company can deny limited

liability protection of owner.

Continued Existence: private sector has advantage of continue existence even owner

leave or dies (Chang, 2016). This sector is incorporated and it can own assets individually apart

from company or to becomes an independent owner entity.

Disadvantages

Restricted Access to Capital Markets: This sector is legally denied to use its share as

an initial public offering. They are not able to trade their share on stock exchange. So that they

find difficulties to attract outside investors. They are not able to sell or transfer share before

asking company's directors (Banica and Hagiu, 2015). Due to this, investment decision not

execute or made on timely manner.

Limited Personal Control: directors of private companies have not total control mover

operations of entity. When directors want to decision any private issue to others they have to

invite other owners. With reduced control, any decision cannot execute or make without

including other shareholders (MacGregor Doyle and McEachern, 2015).

Higher Administration Costs: As a legal duty, private company has to appoint least one

director or shareholder (Caiazza Shimizu and Yoshikawa, 2017). They hire secretary for

company and accountants to manage accurate reports. This can increase administrative and

general expanses of company.

Public Organisation

Public sector is operated and owned by the government and provide services to citizens.

It controlled by publicly or publicly funded agencies, entities, enterprises that deliver public

services, goods and programs. Some public organisations are Audit Commission, The Cabinet

Office, Yorkshire Bank etc (Grosanu and et.al., 2015).

Advantage and Disadvantage of Public Organisation

Advantages

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Economic Development through Public Sector: public sector is generally large so that

they can get advantage from economic scale via better quality of service and cheaper pricing. It

is wholly owned by government coordination and planning is easy to make any decision.

Erase of Raising Funds: This sector is totally owned by government so they are free to

owned statutory bodies and can raise the funds by issuing bonds (Epifanova and et.al., 2015).

They entirely depend on their financial requirement.

Employee Welfare: Public sectors follow their own recruitment process. They can hire

the best and provide them appropriate training (Ferrell and Fraedrich, 2015). They are able to

maintain healthy relationship between employees and employers that retain, attract talent and

enhance productivity level.

Disadvantages:

Financial Burden: When public sector bears lose, it provides subsidies to carry the loss.

But these provision on regular basis make great force on government finance (Georgescu and

Popescul, 2015).

Funding: Government funding from local resources are always controversial (Kljucnikov

and et.al, 2016). The lowest areas are required higher level of services but tax revenue or these

areas is less than wealthier areas so that government has to redistribute resources.

Consumer Interests Ignored: this sector is operated as monopolies. Due to less

competition, they are not functioned properly and has less focus on customer service, improving

products that offered (Kurian and Cismas, Bank of America Corp, 2016).

Purpose of Public Organisations: public sectors has purpose to enhance and increase

local job supply including local authorities, employees and health services can provide jobs that

are appealing destinations and realistic as well (White, 2016). Like for example Halifax Bank

which is a public bank, whose purpose is to take customers deposit in return for paying consumer

an annaul interest.

Voluntary Organisation

Voluntary organisation is a group which is democratic, flexible, independent, secular

with no government intervention and non-profit organisation that work for the welfare of society.

It contributes to various projects like training, education or other humanitarian etc (MacGregor,

Doyle and McEachern, 2015).

Advantage and Disadvantage of Voluntary Organisation

3

they can get advantage from economic scale via better quality of service and cheaper pricing. It

is wholly owned by government coordination and planning is easy to make any decision.

Erase of Raising Funds: This sector is totally owned by government so they are free to

owned statutory bodies and can raise the funds by issuing bonds (Epifanova and et.al., 2015).

They entirely depend on their financial requirement.

Employee Welfare: Public sectors follow their own recruitment process. They can hire

the best and provide them appropriate training (Ferrell and Fraedrich, 2015). They are able to

maintain healthy relationship between employees and employers that retain, attract talent and

enhance productivity level.

Disadvantages:

Financial Burden: When public sector bears lose, it provides subsidies to carry the loss.

But these provision on regular basis make great force on government finance (Georgescu and

Popescul, 2015).

Funding: Government funding from local resources are always controversial (Kljucnikov

and et.al, 2016). The lowest areas are required higher level of services but tax revenue or these

areas is less than wealthier areas so that government has to redistribute resources.

Consumer Interests Ignored: this sector is operated as monopolies. Due to less

competition, they are not functioned properly and has less focus on customer service, improving

products that offered (Kurian and Cismas, Bank of America Corp, 2016).

Purpose of Public Organisations: public sectors has purpose to enhance and increase

local job supply including local authorities, employees and health services can provide jobs that

are appealing destinations and realistic as well (White, 2016). Like for example Halifax Bank

which is a public bank, whose purpose is to take customers deposit in return for paying consumer

an annaul interest.

Voluntary Organisation

Voluntary organisation is a group which is democratic, flexible, independent, secular

with no government intervention and non-profit organisation that work for the welfare of society.

It contributes to various projects like training, education or other humanitarian etc (MacGregor,

Doyle and McEachern, 2015).

Advantage and Disadvantage of Voluntary Organisation

3

Advantages

Exempt from Tax: These organisations generally does not need to pay tax, stamp duty,

capital gains and gifts to these sectors is free from inheritance tax.

Funds: voluntary organisation can raise funds from grant making trusts, public and local

government (Parker, 2018.). They are able to give assurance for being monitored by office of the

Scottish Charity Regulator of England.

Disadvantages:

Restriction and Requirements: They can face restriction on work that funded. Certain

type of trading and political activities are restricted(Prajogo and Oke, 2016.). They have to

comply with regulatory requirement like annual accounts and return.

Unpaid Board: board of voluntary not to paid unless the constitution of it. In voluntary

organisation agreement, trustees are being paid by authority must be included in governing

document (Parker, 2018).

Purpose of Voluntary Organisation

Purpose of voluntary organisation is to benefit and enrich society, to make social wealth

than material wealth. Wellcome trust in UK is biomedical research charity. It has purpose to

improve human animal health (Pearson, 2017).

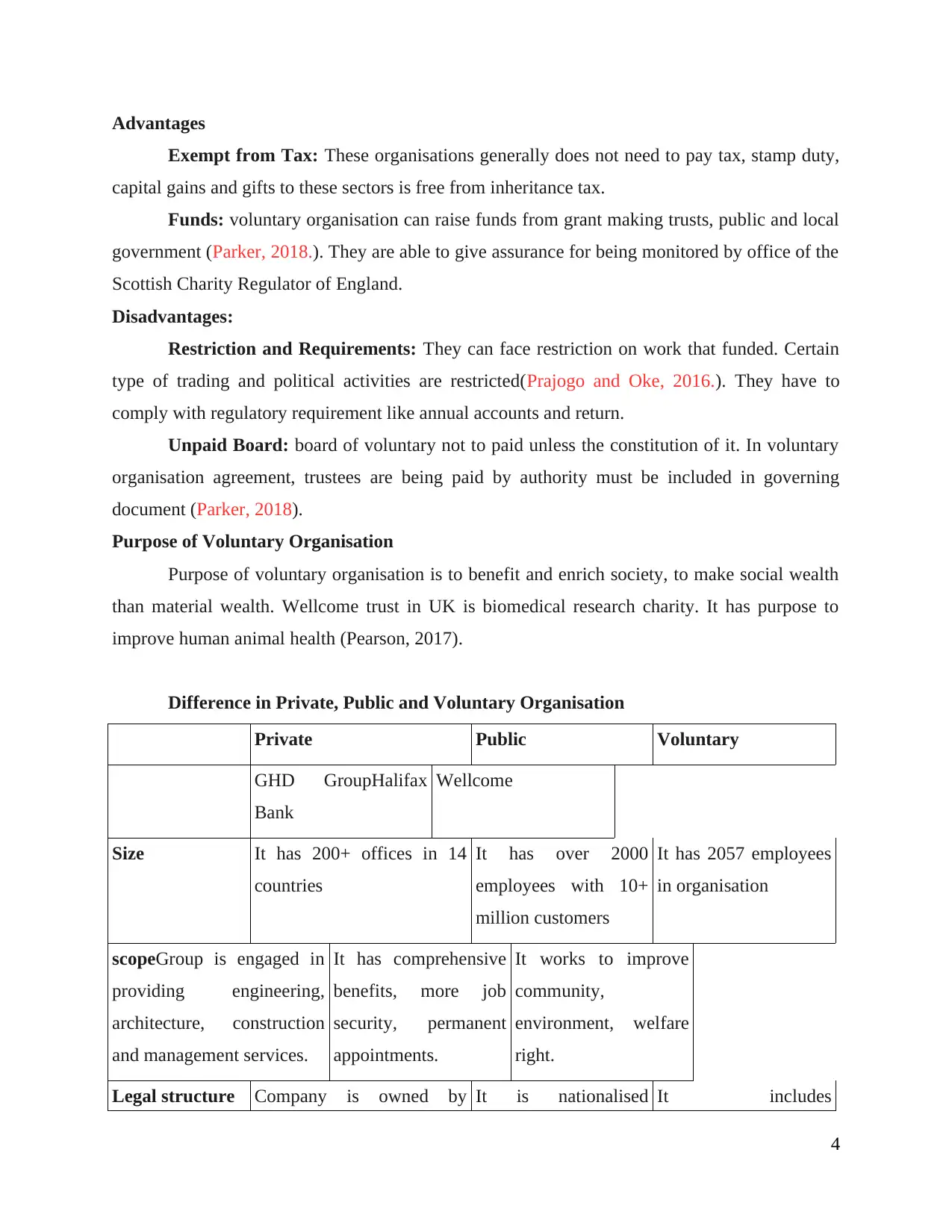

Difference in Private, Public and Voluntary Organisation

Private Public Voluntary

GHD GroupHalifax

Bank

Wellcome

Size It has 200+ offices in 14

countries

It has over 2000

employees with 10+

million customers

It has 2057 employees

in organisation

scopeGroup is engaged in

providing engineering,

architecture, construction

and management services.

It has comprehensive

benefits, more job

security, permanent

appointments.

It works to improve

community,

environment, welfare

right.

Legal structure Company is owned by It is nationalised It includes

4

Exempt from Tax: These organisations generally does not need to pay tax, stamp duty,

capital gains and gifts to these sectors is free from inheritance tax.

Funds: voluntary organisation can raise funds from grant making trusts, public and local

government (Parker, 2018.). They are able to give assurance for being monitored by office of the

Scottish Charity Regulator of England.

Disadvantages:

Restriction and Requirements: They can face restriction on work that funded. Certain

type of trading and political activities are restricted(Prajogo and Oke, 2016.). They have to

comply with regulatory requirement like annual accounts and return.

Unpaid Board: board of voluntary not to paid unless the constitution of it. In voluntary

organisation agreement, trustees are being paid by authority must be included in governing

document (Parker, 2018).

Purpose of Voluntary Organisation

Purpose of voluntary organisation is to benefit and enrich society, to make social wealth

than material wealth. Wellcome trust in UK is biomedical research charity. It has purpose to

improve human animal health (Pearson, 2017).

Difference in Private, Public and Voluntary Organisation

Private Public Voluntary

GHD GroupHalifax

Bank

Wellcome

Size It has 200+ offices in 14

countries

It has over 2000

employees with 10+

million customers

It has 2057 employees

in organisation

scopeGroup is engaged in

providing engineering,

architecture, construction

and management services.

It has comprehensive

benefits, more job

security, permanent

appointments.

It works to improve

community,

environment, welfare

right.

Legal structure Company is owned by It is nationalised It includes

4

board of directors and

headed by a chairman, sells

it shares on the stock

exchange. It shared revenue

with shareholders of

company (Prajogo and Oke,

2016).

industry and

controlled by

government has

separate legal entity.

constitution, the

precise form depends

on governing legal

structure.

objective To gain competitive

advantage and make profit

for own.

Provide services to

citizens by offering

local jobs to them.

It has objective to

enrich society to

improve their lifestyle

and health.

Business Secondary organisation Tertiary organisation Tertiary organisation

Sole trader: It is a type of enterprise which is owned and run by only one person. Benefit of this

type of business is that it requires low cost. Also, disadvantage is capacity to raise capital is

limited.

Partnership: A partnership is an arrangement where parties, known as partners, agree to

cooperate to advance their mutual interests. Benefit of this type of business is that more capital is

available for investment. Also, disadvantage is the liability of the partners for the debts of the

business is unlimited.

TASK 2

Two types of organisation structure and relationship between organisation functions.

Functional top down structure : In a top-down structure, instruction, rules, information

flows from upper management to lower management. Top down organisation don't include lower

level subordinates in the planning. Marshalls follow this structure for generates company vision,

mission, goals and instruction. Top down approaches helps in the Marshalls through maintain the

problems like any confusion related to their work(Banica and Hagiu, 2015). Each department has

a manager who supervised and instructed the employees In the functional structure.

Employees knows their roles, performance and information also share through functional

structure. Its disadvantages affect the management that they do not involve the employees in

5

headed by a chairman, sells

it shares on the stock

exchange. It shared revenue

with shareholders of

company (Prajogo and Oke,

2016).

industry and

controlled by

government has

separate legal entity.

constitution, the

precise form depends

on governing legal

structure.

objective To gain competitive

advantage and make profit

for own.

Provide services to

citizens by offering

local jobs to them.

It has objective to

enrich society to

improve their lifestyle

and health.

Business Secondary organisation Tertiary organisation Tertiary organisation

Sole trader: It is a type of enterprise which is owned and run by only one person. Benefit of this

type of business is that it requires low cost. Also, disadvantage is capacity to raise capital is

limited.

Partnership: A partnership is an arrangement where parties, known as partners, agree to

cooperate to advance their mutual interests. Benefit of this type of business is that more capital is

available for investment. Also, disadvantage is the liability of the partners for the debts of the

business is unlimited.

TASK 2

Two types of organisation structure and relationship between organisation functions.

Functional top down structure : In a top-down structure, instruction, rules, information

flows from upper management to lower management. Top down organisation don't include lower

level subordinates in the planning. Marshalls follow this structure for generates company vision,

mission, goals and instruction. Top down approaches helps in the Marshalls through maintain the

problems like any confusion related to their work(Banica and Hagiu, 2015). Each department has

a manager who supervised and instructed the employees In the functional structure.

Employees knows their roles, performance and information also share through functional

structure. Its disadvantages affect the management that they do not involve the employees in

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

decision making process. Functional units also does not communicate with the lower level

employees therefore projects completion is difficult to manage. Employees disappointing

chances has increased when upper management does not communicate and also does not include

in any activity.

Flat organisation structure : This type of structure have self management between

owner and employees. Owner involve their employees in decision making process and other

activities. Large companies also follow this structure like GHD company(Caiazza, Shimizu and

Yoshikawa, 2017). Through flat management in GHD company improved decision making

process because upper management involve decision making and encourage collaboration and

speed of innovation.

GHD Company cost also reduced because they do not hire more employees and decision

process also faster through flat structure. With the help of this structure employees also satisfied

and do their work with effectively. But there have also some disadvantages. Without the proper

guidance, confusion has created and progress opportunities also decreased(Chang,2016).

Management can also lose their control in flat structure.

The relationship between different organisation functions and they link organisation objectives

and structure.

Organisation has many departments like production, research and development,

purchasing, marketing, human resource management, accounting and finance. They are all

connected with each other.

Marketing and production department

Marketing and production function relationship must be cooperative. Production

department focus create the new products and manage the quality and quantity of the product.

Marketing function focus to the customer satisfaction by knowing their demands and needs.

Marketing department employees of GHD company identified customer need then production

department products new product according to the customer needs(Grosanu, 2015). Thus,

relation between production and marketing important for the company objectives because they

help to enhance the company profit.

Marketing and finance department

6

employees therefore projects completion is difficult to manage. Employees disappointing

chances has increased when upper management does not communicate and also does not include

in any activity.

Flat organisation structure : This type of structure have self management between

owner and employees. Owner involve their employees in decision making process and other

activities. Large companies also follow this structure like GHD company(Caiazza, Shimizu and

Yoshikawa, 2017). Through flat management in GHD company improved decision making

process because upper management involve decision making and encourage collaboration and

speed of innovation.

GHD Company cost also reduced because they do not hire more employees and decision

process also faster through flat structure. With the help of this structure employees also satisfied

and do their work with effectively. But there have also some disadvantages. Without the proper

guidance, confusion has created and progress opportunities also decreased(Chang,2016).

Management can also lose their control in flat structure.

The relationship between different organisation functions and they link organisation objectives

and structure.

Organisation has many departments like production, research and development,

purchasing, marketing, human resource management, accounting and finance. They are all

connected with each other.

Marketing and production department

Marketing and production function relationship must be cooperative. Production

department focus create the new products and manage the quality and quantity of the product.

Marketing function focus to the customer satisfaction by knowing their demands and needs.

Marketing department employees of GHD company identified customer need then production

department products new product according to the customer needs(Grosanu, 2015). Thus,

relation between production and marketing important for the company objectives because they

help to enhance the company profit.

Marketing and finance department

6

Finance department and HR department responsible for two main parts of the company –

people and money. Open communication between HR and finance department important for the

company to increase profit . Both the departments knows about the legal activities. Their

relationship leads employees engagement, increased corporate revenues and higher productivity

which is help to increase GHD profit (MacGregor, Doyle and McEachern, 2015).. Marketing is

responsible for helping the organization acquire and keep profitable customers and therefore

relate its functions directly to cash flow

Marketing and research department

Research and development department, research new products and update existing

products. They also check the product quality(Kurian and Cismas, Bank of America Corp, 2016).

With the help of research department, production department produce new products according to

customer needs and trends. GHD company profit will increase when production department

produces product according to customer. Thus, research and development department helps to

the production department whereby company profit has increased.

Marketing and purchase department

Purchasing and accounting department of GHD linked with together. For example

purchasing department need to purchase raw material that time accounting department received

payment request whereby they recorded all data related to purchasing sell cost. They both

department interact in the area of budgeting and account payable(MacGregor, Doyle and

McEachern, 2015). They both connected with each other whereby work can run in proper way.

Accounts department audit invoices whereby company has known about the total cost. Through

the auditing GHD know about the profit and loss. Thus, company can reduce their product cost.

Marketing and HR department

HR department connected with the all department because they make new policies and

rules which is followed by all departments. HR department helps to achieve company goal

because all department follows the rules and do their work accordingly. For example HR make

the policy that employees can take incentives for their accurate and extra work. It is beneficial

for the company because employees will motivate and do their work more(Pearson,2017).

7

people and money. Open communication between HR and finance department important for the

company to increase profit . Both the departments knows about the legal activities. Their

relationship leads employees engagement, increased corporate revenues and higher productivity

which is help to increase GHD profit (MacGregor, Doyle and McEachern, 2015).. Marketing is

responsible for helping the organization acquire and keep profitable customers and therefore

relate its functions directly to cash flow

Marketing and research department

Research and development department, research new products and update existing

products. They also check the product quality(Kurian and Cismas, Bank of America Corp, 2016).

With the help of research department, production department produce new products according to

customer needs and trends. GHD company profit will increase when production department

produces product according to customer. Thus, research and development department helps to

the production department whereby company profit has increased.

Marketing and purchase department

Purchasing and accounting department of GHD linked with together. For example

purchasing department need to purchase raw material that time accounting department received

payment request whereby they recorded all data related to purchasing sell cost. They both

department interact in the area of budgeting and account payable(MacGregor, Doyle and

McEachern, 2015). They both connected with each other whereby work can run in proper way.

Accounts department audit invoices whereby company has known about the total cost. Through

the auditing GHD know about the profit and loss. Thus, company can reduce their product cost.

Marketing and HR department

HR department connected with the all department because they make new policies and

rules which is followed by all departments. HR department helps to achieve company goal

because all department follows the rules and do their work accordingly. For example HR make

the policy that employees can take incentives for their accurate and extra work. It is beneficial

for the company because employees will motivate and do their work more(Pearson,2017).

7

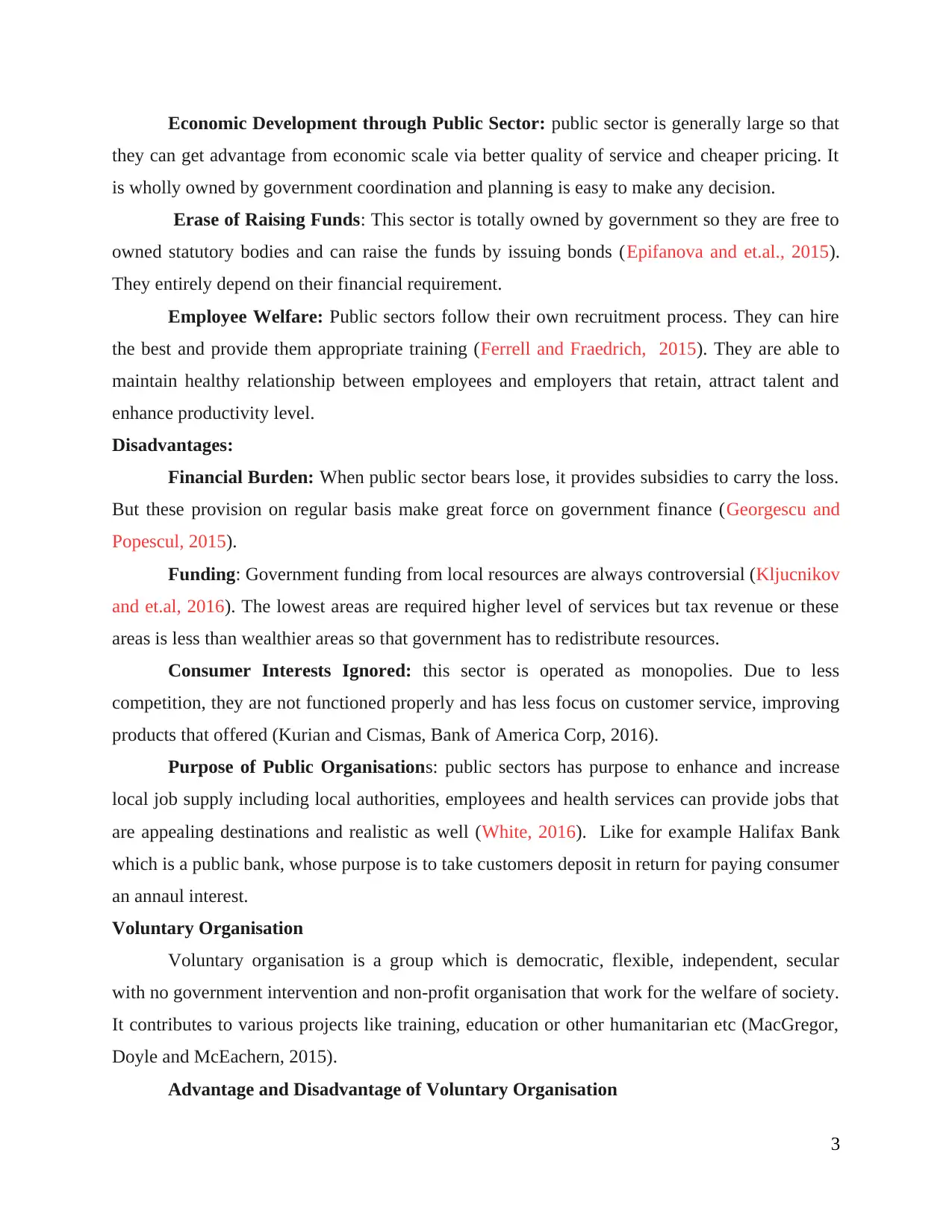

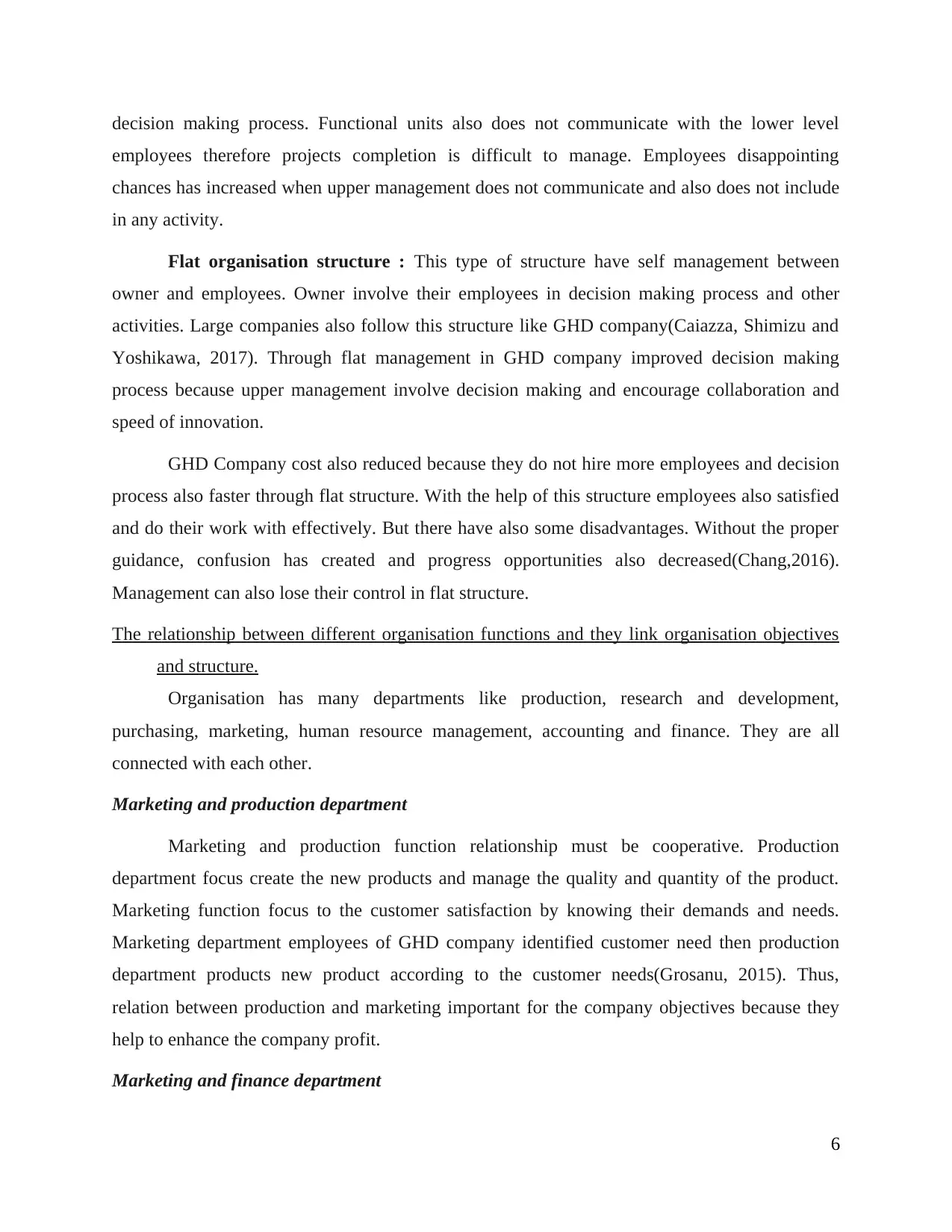

TASK 3

PESTLE tools impact on an organisation.

PESTLE tools describes that micro environment factors which is impacted up on the business

activities, growth and regulations.

Political factor : This factor define the political situations which is impacted on the

business and company. All taxes, rates, government law and legislations includes the political

factor. In any condition, tax are reduced by the government so it is beneficial for the Yorkshire

bank(Pestle analysis, 2017). If interest rates are increased then Yorkshire bank earn more money

through the loans but its negative impact also there. Bank give interest in high interest rates so it

is not good for them. Corruption amongst Political parties also affected the banking industry.

Economic factor : Yorkshire bank influenced easily through economic factor. Exchange

rates affect the Yorkshire bank(Prajogo and Oke, 2016). Stable currency like us dollar impact

other currency. After Brexit the economic condition of country has been severely impacted, this

has created trade barriers for banks. If Yorkshire bank invest in other country where economic is

8

Illustration 1: PESTLE Analysis

source : PEST Analysis, 2017

PESTLE tools impact on an organisation.

PESTLE tools describes that micro environment factors which is impacted up on the business

activities, growth and regulations.

Political factor : This factor define the political situations which is impacted on the

business and company. All taxes, rates, government law and legislations includes the political

factor. In any condition, tax are reduced by the government so it is beneficial for the Yorkshire

bank(Pestle analysis, 2017). If interest rates are increased then Yorkshire bank earn more money

through the loans but its negative impact also there. Bank give interest in high interest rates so it

is not good for them. Corruption amongst Political parties also affected the banking industry.

Economic factor : Yorkshire bank influenced easily through economic factor. Exchange

rates affect the Yorkshire bank(Prajogo and Oke, 2016). Stable currency like us dollar impact

other currency. After Brexit the economic condition of country has been severely impacted, this

has created trade barriers for banks. If Yorkshire bank invest in other country where economic is

8

Illustration 1: PESTLE Analysis

source : PEST Analysis, 2017

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

very good then they help to raise fund therefore in case of mixed economic, country depends on

bank. The negative impact is that If country economic has reduced where Yorkshire bank

invested their money so, bank may be huge loss.

Social factor : Social factor also impacted Yorkshire bank. Changing trends and

preferences can affect the banking brands. Presently, maximum Small and big business taking

financial assistance (like loans) from the banks whereby bank charges interest on high rates. It is

good for Yorkshire bank. It is also negative impact that other banks gives loans and funds in low

rates then people also attracted towards them(Schaltegger, Lüdeke-Freund and Hansen, 2016).

That time Yorkshire bank affected by social factor. It is necessary to make new strategies in

competitive market.

Technological factor : Technology plays a big role in every company and banking

industry. If Yorkshire bank use the new technology for example online money transaction will

process in easy way. Then customers also use Yorkshire bank application. They can also use

more new technologies for attract the customer (Epifanova and et.al., 2015). On other hand, if

competitor banks uses affective technology like they provide effective application whereby

banking work processed fast. Thus, customers attracted those side.

Legal factor : Security laws, government policies are includes in legal factor. Yorkshire

bank follow the legal law for safe and secure banking transaction(Tregear, 2015). Compliance

requires focus and also spending money. Yorkshire bank can applies consumer law, employment

law. Yorkshire bank pay equal pay to their employees according to their post because labour law

affected the banking industry. For example customer invest the banking policy so, its

responsibility of Yorkshire bank that they provide all information related to the policies. On

other hand customer have a lot of rights so, customer law can affects the bank.

Environment factor : Government has implemented various environmental laws which

needs to be assessed by firm. Like for example Bank needs to be involve in performing CSR

activities. They need to contribute 2% of their profit in corporate social responsibility. Also if not

followed these laws, then companies business can get hamper (Kljucnikov and et.al, 2016).

9

bank. The negative impact is that If country economic has reduced where Yorkshire bank

invested their money so, bank may be huge loss.

Social factor : Social factor also impacted Yorkshire bank. Changing trends and

preferences can affect the banking brands. Presently, maximum Small and big business taking

financial assistance (like loans) from the banks whereby bank charges interest on high rates. It is

good for Yorkshire bank. It is also negative impact that other banks gives loans and funds in low

rates then people also attracted towards them(Schaltegger, Lüdeke-Freund and Hansen, 2016).

That time Yorkshire bank affected by social factor. It is necessary to make new strategies in

competitive market.

Technological factor : Technology plays a big role in every company and banking

industry. If Yorkshire bank use the new technology for example online money transaction will

process in easy way. Then customers also use Yorkshire bank application. They can also use

more new technologies for attract the customer (Epifanova and et.al., 2015). On other hand, if

competitor banks uses affective technology like they provide effective application whereby

banking work processed fast. Thus, customers attracted those side.

Legal factor : Security laws, government policies are includes in legal factor. Yorkshire

bank follow the legal law for safe and secure banking transaction(Tregear, 2015). Compliance

requires focus and also spending money. Yorkshire bank can applies consumer law, employment

law. Yorkshire bank pay equal pay to their employees according to their post because labour law

affected the banking industry. For example customer invest the banking policy so, its

responsibility of Yorkshire bank that they provide all information related to the policies. On

other hand customer have a lot of rights so, customer law can affects the bank.

Environment factor : Government has implemented various environmental laws which

needs to be assessed by firm. Like for example Bank needs to be involve in performing CSR

activities. They need to contribute 2% of their profit in corporate social responsibility. Also if not

followed these laws, then companies business can get hamper (Kljucnikov and et.al, 2016).

9

TASK 4

SWOT analysis of Yorkshire Bank

SWOT analysis is used to understand strength, weakness, opportunities and threats of an

organisation.

Strengths: It has 12+ million customers and it is one of the world's top 40 financial

service sectors. Bank has strength to increase its pre tax earning substantially due to undertaken

different restructuring measures. It vis able to reduce poor debt provision that can increase in

quality of assets. Bank was awarded with Money net winner in 2014 for new current account. It

provides various types of services like private, personal and business banking services. It

includes mortgages, loans, current account service and saving account service, wealth

management service etc (Schaltegger, Lüdeke-Freund and Hansen, 2016).

Weaknesses: In future performance of bank may affect if economic recovery is slow in

Europe and UK. Bank had to cut its workers that reduce morale of them and can affect the

quality service which bank provides (SWOT ANALYSIS, 2016). It can be closed some branches

of it that can reduce the confidence of employees and customers. It has not any major persistence

in UK that can affect its business.

Opportunities: By providing tremendous services to customers, bank has increased its

customer base. Bank has opportunity to expand its customers base by increasing its branches. It

can make some innovations like low rate loan schemes, providing new financial products,

offering customers diversify products. Economy recovery of UK can help to increase financial

services (Tregear, 2015).

Threats: Due to movement of market rates, bank can face interest rate risk band faces

risk due to obligation of counter party defaulting. Fluctuation in foreign exchange rates bank also

faces some hurdles. Banks has its competitors in market like UBS, Standard Chartered, Barclays

that can affect the number of customers.

Impact of micro and macro factors on business objective and decision making.

If economic recovery is slow of UK, it affects currency and its value and can cause

instability. Foreign visitors can hesitate to invest in bank that bring loss to it. Exchange and tax

rate can also affect bank. For example, if tax rate increase, bank has to pay more tax and due to

this bank can make decision to increase interest rate, that can effect its consumers. They can

switch their bank (Tregear, 2015).

10

SWOT analysis of Yorkshire Bank

SWOT analysis is used to understand strength, weakness, opportunities and threats of an

organisation.

Strengths: It has 12+ million customers and it is one of the world's top 40 financial

service sectors. Bank has strength to increase its pre tax earning substantially due to undertaken

different restructuring measures. It vis able to reduce poor debt provision that can increase in

quality of assets. Bank was awarded with Money net winner in 2014 for new current account. It

provides various types of services like private, personal and business banking services. It

includes mortgages, loans, current account service and saving account service, wealth

management service etc (Schaltegger, Lüdeke-Freund and Hansen, 2016).

Weaknesses: In future performance of bank may affect if economic recovery is slow in

Europe and UK. Bank had to cut its workers that reduce morale of them and can affect the

quality service which bank provides (SWOT ANALYSIS, 2016). It can be closed some branches

of it that can reduce the confidence of employees and customers. It has not any major persistence

in UK that can affect its business.

Opportunities: By providing tremendous services to customers, bank has increased its

customer base. Bank has opportunity to expand its customers base by increasing its branches. It

can make some innovations like low rate loan schemes, providing new financial products,

offering customers diversify products. Economy recovery of UK can help to increase financial

services (Tregear, 2015).

Threats: Due to movement of market rates, bank can face interest rate risk band faces

risk due to obligation of counter party defaulting. Fluctuation in foreign exchange rates bank also

faces some hurdles. Banks has its competitors in market like UBS, Standard Chartered, Barclays

that can affect the number of customers.

Impact of micro and macro factors on business objective and decision making.

If economic recovery is slow of UK, it affects currency and its value and can cause

instability. Foreign visitors can hesitate to invest in bank that bring loss to it. Exchange and tax

rate can also affect bank. For example, if tax rate increase, bank has to pay more tax and due to

this bank can make decision to increase interest rate, that can effect its consumers. They can

switch their bank (Tregear, 2015).

10

Interrelation of strength and weakness with macro factors

Political factor: Laws, rules and regulations can impact the working of Yorkshire bank.

Yorkshire bank has a strength that it was able to increase its pre-tax earnings substantially.

Pounds due to the various restructuring measures undertaken by the bank. This can be affected

by political factors. Like for example if in certain country rules related to pre-tax changes then

firm might suffer a phase of decline (Virglerová Dobeš and Vojtovič, 2016).

Economical factor: Economic condition of the country can severely impact the working

of Yorkshire bank. For instance The bank’s performance can be hit severely if the economic

recovery of UK and Europe is slow in the future. It can become the weakness of firm.

Social factor: Cultural influences, such as buying behaviors and necessities, affect how

people see and use banking options. People turn to banks for advice and assistance for loans

related to business, home, and academics. Consumers seek knowledge from bank tellers

regarding saving accounts, bank related credit cards, investments, and more. It is a strength of

bank which can be impacted because of social factor (Ferrell and Fraedrich, 2015).

Technological factor: Advancing technology can impact the working of Yorkshire bank.

Like for example company is making use of facilities like online payment through app that acts

as there strength.

Legal factor: Bank follows strict guidelines, regarding privacy consumer laws that trade

that is a major strength of firm.

Environmental factor: York sire bank is engaged in doing CSR activities which is a big

time strength of firm(Georgescu and Popescul, 2015).

11

Political factor: Laws, rules and regulations can impact the working of Yorkshire bank.

Yorkshire bank has a strength that it was able to increase its pre-tax earnings substantially.

Pounds due to the various restructuring measures undertaken by the bank. This can be affected

by political factors. Like for example if in certain country rules related to pre-tax changes then

firm might suffer a phase of decline (Virglerová Dobeš and Vojtovič, 2016).

Economical factor: Economic condition of the country can severely impact the working

of Yorkshire bank. For instance The bank’s performance can be hit severely if the economic

recovery of UK and Europe is slow in the future. It can become the weakness of firm.

Social factor: Cultural influences, such as buying behaviors and necessities, affect how

people see and use banking options. People turn to banks for advice and assistance for loans

related to business, home, and academics. Consumers seek knowledge from bank tellers

regarding saving accounts, bank related credit cards, investments, and more. It is a strength of

bank which can be impacted because of social factor (Ferrell and Fraedrich, 2015).

Technological factor: Advancing technology can impact the working of Yorkshire bank.

Like for example company is making use of facilities like online payment through app that acts

as there strength.

Legal factor: Bank follows strict guidelines, regarding privacy consumer laws that trade

that is a major strength of firm.

Environmental factor: York sire bank is engaged in doing CSR activities which is a big

time strength of firm(Georgescu and Popescul, 2015).

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the above study, it has been summarised that private organisation has been engaged

in creating profits by expanding their business. Clients of Yorkshire bank like GHD company

has followed flat organisation structure in which they involve upper management for decision

making process (Schaltegger, Lüdeke-Freund and Hansen, 2016). It has also been analysed that

external macro factors such as political and economical has laid severe impact on the working of

firm. Like bank has to shut-down their branches across London because of new rules and

regulations implemented by State. Bank has faced risks due to movement of foreign exchange

rates against the bank. This has impacted their working in long run.

From the above study, it has been summarised that private organisation has been engaged

in creating profits by expanding their business. Clients of Yorkshire bank like GHD company

has followed flat organisation structure in which they involve upper management for decision

making process (Schaltegger, Lüdeke-Freund and Hansen, 2016). It has also been analysed that

external macro factors such as political and economical has laid severe impact on the working of

firm. Like bank has to shut-down their branches across London because of new rules and

regulations implemented by State. Bank has faced risks due to movement of foreign exchange

rates against the bank. This has impacted their working in long run.

REFERENCES

Books and journals

Banica, L. and Hagiu, A., 2015. Big Data In Business Environment. Scientific Bulletin-

Economic Sciences.14(1). pp.79-86.

Caiazza, R., Shimizu, K. and Yoshikawa, T., 2017. Cross‐border M&A: Challenges and

opportunities in global business environment. Thunderbird International Business

Review.59(2). pp.147-151.

Chang, J.F., 2016. Business process management systems: strategy and implementation.

Auerbach Publications.

Epifanova and et.al., 2015. Modernization of institutional environment of entrepreneurship in

Russia for development of innovation initiative in small business structures. European

Research Studies. 18(3). p.137.

Ferrell, O.C. and Fraedrich, J., 2015. Business ethics: Ethical decision making & cases. Nelson

Education.

Georgescu, M. and Popescul, D., 2015. Social Media–the new paradigm of collaboration and

communication for business environment. Procedia Economics and Finance. 20.

pp.277-282.

Grosanu, A. and et.al., 2015. The influence of country-level governance on business

environment and entrepreneurship: A global perspective. Amfiteatru Economic

Journal.17(38).pp.60-75.

Kljucnikov and et.al, 2016. The entreprenurial perception of SME business environment quality

in the Czech Republic. Journal of Competitiveness. 8(1).

MacGregor, S., Doyle, T. and McEachern, D., 2015. Environment and politics. Routledge.

Mazurand et.al., 2016. Innovation clusters: Advantages and disadvantages. International Journal

of Economics and Financial Issues. 6(1S). pp.270-274.

Parker, H., 2018. Instead of the Dole: An enquiry into integration of the tax and benefit systems.

Routledge.

Pearson, R., 2017. Business ethics as communication ethics: Public relations practice and the

idea of dialogue. In Public relations theory (pp. 111-131). Routledge.

Prajogo, D.I. and Oke, A., 2016. Human capital, service innovation advantage, and business

performance: The moderating roles of dynamic and competitive

environments. International Journal of Operations & Production Management.36(9).

pp.974-994.

Books and journals

Banica, L. and Hagiu, A., 2015. Big Data In Business Environment. Scientific Bulletin-

Economic Sciences.14(1). pp.79-86.

Caiazza, R., Shimizu, K. and Yoshikawa, T., 2017. Cross‐border M&A: Challenges and

opportunities in global business environment. Thunderbird International Business

Review.59(2). pp.147-151.

Chang, J.F., 2016. Business process management systems: strategy and implementation.

Auerbach Publications.

Epifanova and et.al., 2015. Modernization of institutional environment of entrepreneurship in

Russia for development of innovation initiative in small business structures. European

Research Studies. 18(3). p.137.

Ferrell, O.C. and Fraedrich, J., 2015. Business ethics: Ethical decision making & cases. Nelson

Education.

Georgescu, M. and Popescul, D., 2015. Social Media–the new paradigm of collaboration and

communication for business environment. Procedia Economics and Finance. 20.

pp.277-282.

Grosanu, A. and et.al., 2015. The influence of country-level governance on business

environment and entrepreneurship: A global perspective. Amfiteatru Economic

Journal.17(38).pp.60-75.

Kljucnikov and et.al, 2016. The entreprenurial perception of SME business environment quality

in the Czech Republic. Journal of Competitiveness. 8(1).

MacGregor, S., Doyle, T. and McEachern, D., 2015. Environment and politics. Routledge.

Mazurand et.al., 2016. Innovation clusters: Advantages and disadvantages. International Journal

of Economics and Financial Issues. 6(1S). pp.270-274.

Parker, H., 2018. Instead of the Dole: An enquiry into integration of the tax and benefit systems.

Routledge.

Pearson, R., 2017. Business ethics as communication ethics: Public relations practice and the

idea of dialogue. In Public relations theory (pp. 111-131). Routledge.

Prajogo, D.I. and Oke, A., 2016. Human capital, service innovation advantage, and business

performance: The moderating roles of dynamic and competitive

environments. International Journal of Operations & Production Management.36(9).

pp.974-994.

Sarmento, J.M. and Renneboog, L., 2016. Anatomy of public-private partnerships: their creation,

financing and renegotiations. International Journal of Managing Projects in

Business. 9(1). pp.94-122.

Schaltegger, S., Lüdeke-Freund, F. and Hansen, E.G., 2016. Business models for sustainability:

A co-evolutionary analysis of sustainable entrepreneurship, innovation, and

transformation. Organization & Environment.29(3). pp.264-289.

Tregear, R., 2015. Business process standardization. In Handbook on Business Process

Management 2 (pp. 421-441). Springer, Berlin, Heidelberg.

Virglerová, Z., Dobeš, K. and Vojtovič, S., 2016. The perception of the state’s influence on its

business environment in the SMEs from Czech Republic. Administratie si Management

Public.

Wheelen, T.L. and et.al., 2017. Strategic management and business policy. Pearson.

White, P.R., 2016. Public transport: its planning, management and operation. Routledge.

Online

SWOT ANALYSIS. 2016. [online]. Available through

<https://www.mbaskool.com/brandguide/banking-and-financial-services/9506-

yorkshire-bank.html>

Pestle analysis. 2017 [online]. Available through

<http://fernfortuniversity.com/term-papers/pestel/nyse4/4204-bank-of-queensland-

limited-.php>

financing and renegotiations. International Journal of Managing Projects in

Business. 9(1). pp.94-122.

Schaltegger, S., Lüdeke-Freund, F. and Hansen, E.G., 2016. Business models for sustainability:

A co-evolutionary analysis of sustainable entrepreneurship, innovation, and

transformation. Organization & Environment.29(3). pp.264-289.

Tregear, R., 2015. Business process standardization. In Handbook on Business Process

Management 2 (pp. 421-441). Springer, Berlin, Heidelberg.

Virglerová, Z., Dobeš, K. and Vojtovič, S., 2016. The perception of the state’s influence on its

business environment in the SMEs from Czech Republic. Administratie si Management

Public.

Wheelen, T.L. and et.al., 2017. Strategic management and business policy. Pearson.

White, P.R., 2016. Public transport: its planning, management and operation. Routledge.

Online

SWOT ANALYSIS. 2016. [online]. Available through

<https://www.mbaskool.com/brandguide/banking-and-financial-services/9506-

yorkshire-bank.html>

Pestle analysis. 2017 [online]. Available through

<http://fernfortuniversity.com/term-papers/pestel/nyse4/4204-bank-of-queensland-

limited-.php>

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.