Business Finance Case Study: Costing, Budgeting, and Variance Analysis

VerifiedAdded on 2022/12/14

|13

|2563

|380

Case Study

AI Summary

This case study examines key concepts in business finance, including cost classification (fixed, variable, and semi-variable), break-even analysis, and the importance of contribution per unit. It delves into marginal and absorption costing methods, illustrating their application through income statements. The case study also explores the role of budgets in controlling business operations, detailing variance calculations for direct materials, labor, and overheads. Furthermore, it covers the preparation of budgets, emphasizing the significance of both fixed and variable overhead budgets, and direct labor budgets. The solution provides a comprehensive understanding of financial management principles essential for effective decision-making.

Business Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION.......................................................................................................................................3

PART A.......................................................................................................................................................3

Contribution per unit...............................................................................................................................3

Break even points in units and sales........................................................................................................3

Margin of safety as a percentage of budgeted sales.................................................................................4

Breakeven units if Maxwell expects profit of £100,000 during the current year.....................................4

Importance of classifying cost.................................................................................................................4

Absorption and marginal costing.............................................................................................................5

PART B.......................................................................................................................................................7

Role of budgets in controlling the operation of business.........................................................................7

Calculation of variances and prepare budget...........................................................................................8

CONCLUSION.........................................................................................................................................10

REFERENCES..........................................................................................................................................11

INTRODUCTION.......................................................................................................................................3

PART A.......................................................................................................................................................3

Contribution per unit...............................................................................................................................3

Break even points in units and sales........................................................................................................3

Margin of safety as a percentage of budgeted sales.................................................................................4

Breakeven units if Maxwell expects profit of £100,000 during the current year.....................................4

Importance of classifying cost.................................................................................................................4

Absorption and marginal costing.............................................................................................................5

PART B.......................................................................................................................................................7

Role of budgets in controlling the operation of business.........................................................................7

Calculation of variances and prepare budget...........................................................................................8

CONCLUSION.........................................................................................................................................10

REFERENCES..........................................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Finance refers to the administration of money and the acquisition of assets. Finance is a

board concept that refers to operations involving finance, equity, finance, financial markets,

assets, and acquisitions. The term "business financing" refers to the use of funds and credit in a

company (Hong, Karolyi and Scheinkman, 2020). This also aids in the management of financial

assets in order to increase the profitability of the company when analyzing financial reports

(profit and loss accounts, balance sheets and cash flow statements). It is not only sustaining need

but also effective requirement of corporation. It is most essential element that is required to

attention and follows procurement sources on its administration, investment that forced in this

conduct identified as the finance committee. In this report consist of contribution, margin of

safety, break even and importance of different cost. Along with, mention about the role of

budgets in controlling operation of an entity.

PART A

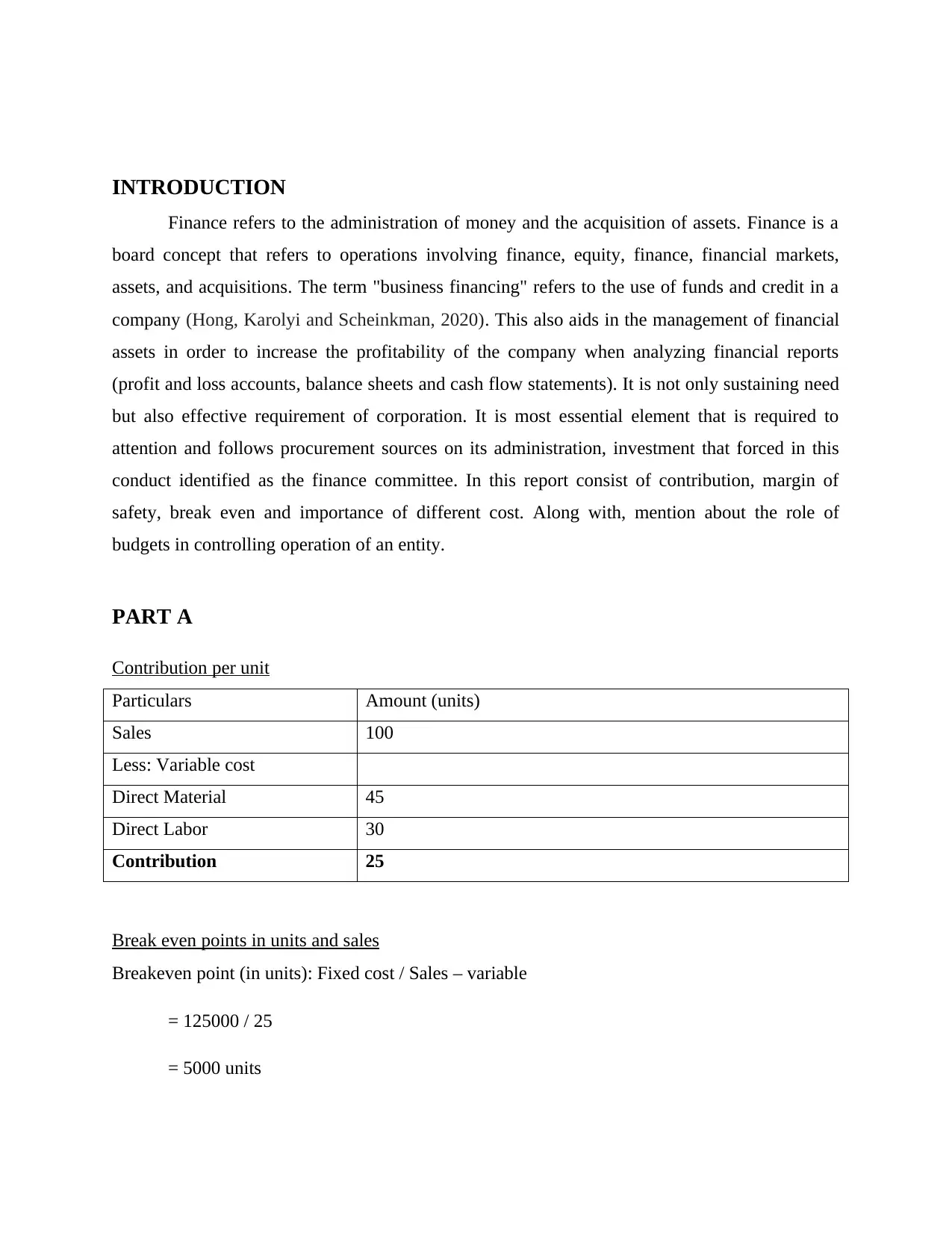

Contribution per unit

Particulars Amount (units)

Sales 100

Less: Variable cost

Direct Material 45

Direct Labor 30

Contribution 25

Break even points in units and sales

Breakeven point (in units): Fixed cost / Sales – variable

= 125000 / 25

= 5000 units

Finance refers to the administration of money and the acquisition of assets. Finance is a

board concept that refers to operations involving finance, equity, finance, financial markets,

assets, and acquisitions. The term "business financing" refers to the use of funds and credit in a

company (Hong, Karolyi and Scheinkman, 2020). This also aids in the management of financial

assets in order to increase the profitability of the company when analyzing financial reports

(profit and loss accounts, balance sheets and cash flow statements). It is not only sustaining need

but also effective requirement of corporation. It is most essential element that is required to

attention and follows procurement sources on its administration, investment that forced in this

conduct identified as the finance committee. In this report consist of contribution, margin of

safety, break even and importance of different cost. Along with, mention about the role of

budgets in controlling operation of an entity.

PART A

Contribution per unit

Particulars Amount (units)

Sales 100

Less: Variable cost

Direct Material 45

Direct Labor 30

Contribution 25

Break even points in units and sales

Breakeven point (in units): Fixed cost / Sales – variable

= 125000 / 25

= 5000 units

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

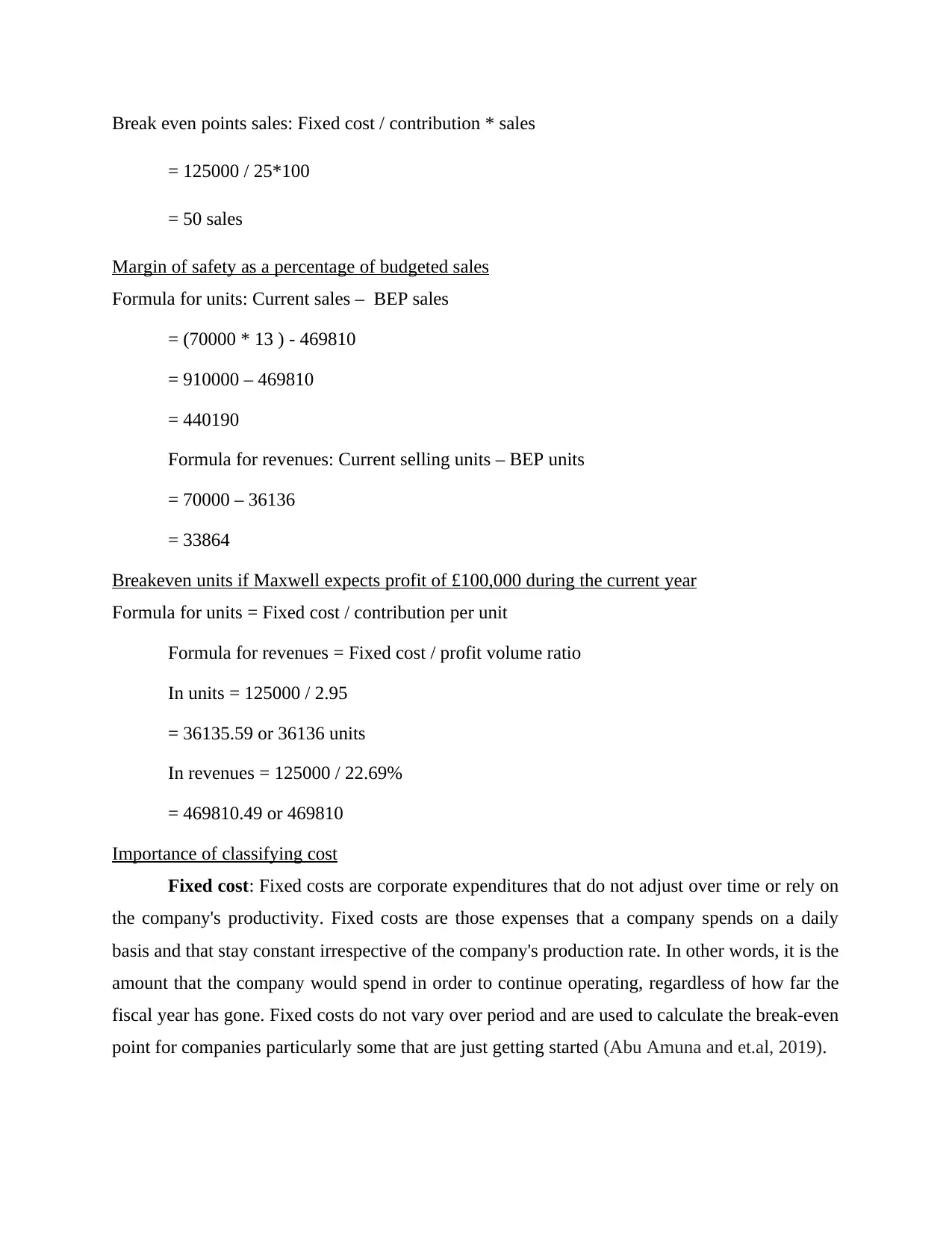

Break even points sales: Fixed cost / contribution * sales

= 125000 / 25*100

= 50 sales

Margin of safety as a percentage of budgeted sales

Formula for units: Current sales – BEP sales

= (70000 * 13 ) - 469810

= 910000 – 469810

= 440190

Formula for revenues: Current selling units – BEP units

= 70000 – 36136

= 33864

Breakeven units if Maxwell expects profit of £100,000 during the current year

Formula for units = Fixed cost / contribution per unit

Formula for revenues = Fixed cost / profit volume ratio

In units = 125000 / 2.95

= 36135.59 or 36136 units

In revenues = 125000 / 22.69%

= 469810.49 or 469810

Importance of classifying cost

Fixed cost: Fixed costs are corporate expenditures that do not adjust over time or rely on

the company's productivity. Fixed costs are those expenses that a company spends on a daily

basis and that stay constant irrespective of the company's production rate. In other words, it is the

amount that the company would spend in order to continue operating, regardless of how far the

fiscal year has gone. Fixed costs do not vary over period and are used to calculate the break-even

point for companies particularly some that are just getting started (Abu Amuna and et.al, 2019).

= 125000 / 25*100

= 50 sales

Margin of safety as a percentage of budgeted sales

Formula for units: Current sales – BEP sales

= (70000 * 13 ) - 469810

= 910000 – 469810

= 440190

Formula for revenues: Current selling units – BEP units

= 70000 – 36136

= 33864

Breakeven units if Maxwell expects profit of £100,000 during the current year

Formula for units = Fixed cost / contribution per unit

Formula for revenues = Fixed cost / profit volume ratio

In units = 125000 / 2.95

= 36135.59 or 36136 units

In revenues = 125000 / 22.69%

= 469810.49 or 469810

Importance of classifying cost

Fixed cost: Fixed costs are corporate expenditures that do not adjust over time or rely on

the company's productivity. Fixed costs are those expenses that a company spends on a daily

basis and that stay constant irrespective of the company's production rate. In other words, it is the

amount that the company would spend in order to continue operating, regardless of how far the

fiscal year has gone. Fixed costs do not vary over period and are used to calculate the break-even

point for companies particularly some that are just getting started (Abu Amuna and et.al, 2019).

Variable cost: A variable cost is one that varies depending on the level of output or the

number of services rendered. There can be no costs that vary where no manufacturing or

facilities are offered. Variable costs should rise in tandem with increased demand or services.

The material used to make disposable items is an example of a cost factor; solvent is a central

component of a plastic product and therefore ranges in direct proportion to the number of units

produced. The cost of direct products is a contingent cost. If labor is not applied to or deducted

from the manufacturing chain as production levels shift, direct labor will not be a contingent

expense (Lu and et.al, 2019).

Variable costs are still fundamental steps: Variable costs are only relevant costs where

they vary in sum between the options being considered. Relevant costs are ones that vary

between the various options for intervention. The definition of relevant expense is incredibly

beneficial for excluding irrelevant data from a judgment process. Furthermore, by excluding non-

essential costs from a judgment, management is discouraged from relying on facts that would

otherwise influence the decision inappropriately (Frizzo-Barker and et.al, 2020).

Semi variable cost: A semi-variable cost, also called a semi-fixed cost or a mixed cost, is

one that has both fixed and variable elements. Expenses are constant for a certain level of output

or demand, and then they become volatile until that level is surpassed. And if no good is

produced, a fixed cost is always sustained. Up to a certain output level, the constant component

of a semi-variable cost is fixed. This implies that semi-variable costs are set for a certain number

of activities but which vary for various levels of service. This is the fixed cost where a certain

amount of labor is needed for manufacturing plant activities (Weikmans and Roberts, 2019).

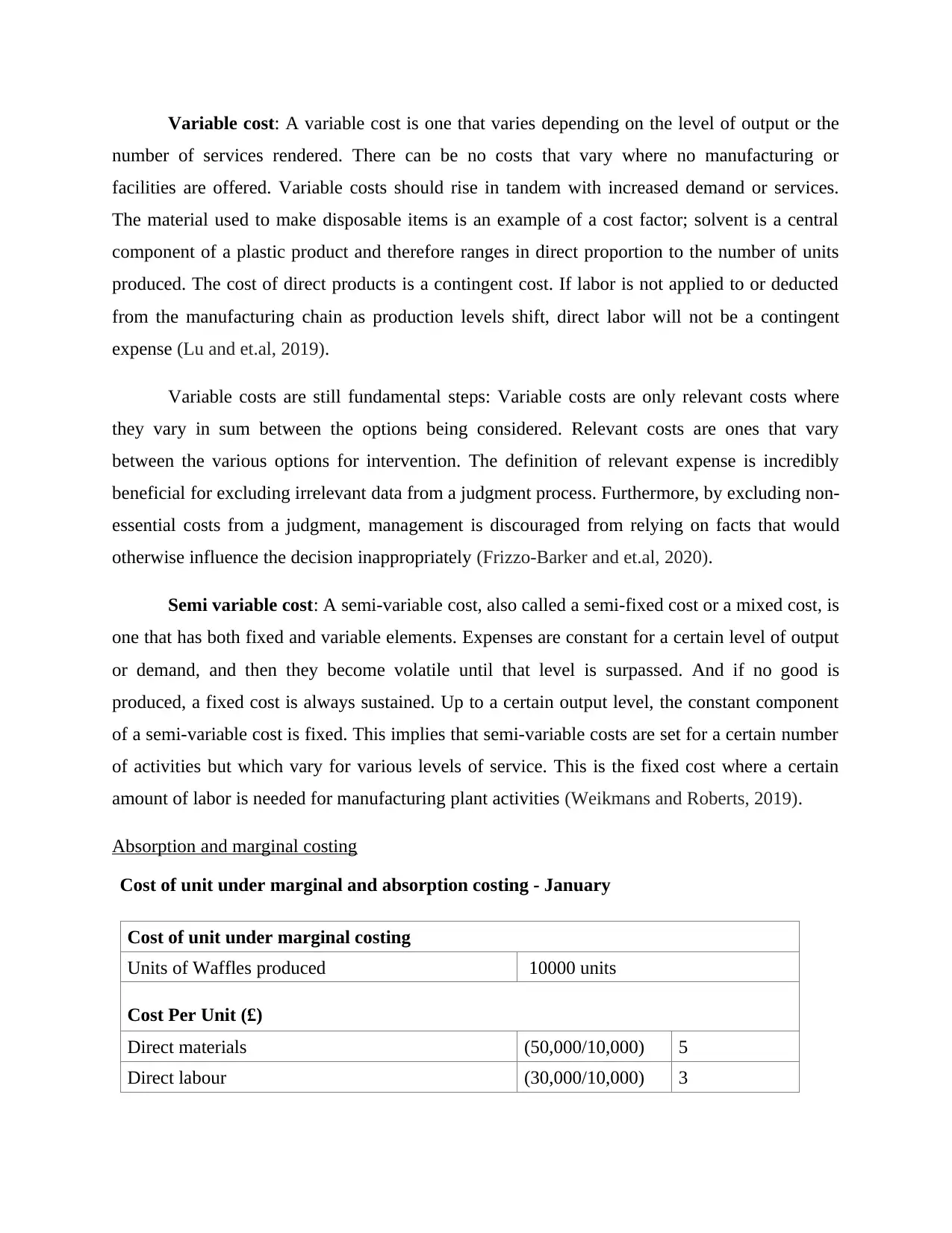

Absorption and marginal costing

Cost of unit under marginal and absorption costing - January

Cost of unit under marginal costing

Units of Waffles produced 10000 units

Cost Per Unit (£)

Direct materials (50,000/10,000) 5

Direct labour (30,000/10,000) 3

number of services rendered. There can be no costs that vary where no manufacturing or

facilities are offered. Variable costs should rise in tandem with increased demand or services.

The material used to make disposable items is an example of a cost factor; solvent is a central

component of a plastic product and therefore ranges in direct proportion to the number of units

produced. The cost of direct products is a contingent cost. If labor is not applied to or deducted

from the manufacturing chain as production levels shift, direct labor will not be a contingent

expense (Lu and et.al, 2019).

Variable costs are still fundamental steps: Variable costs are only relevant costs where

they vary in sum between the options being considered. Relevant costs are ones that vary

between the various options for intervention. The definition of relevant expense is incredibly

beneficial for excluding irrelevant data from a judgment process. Furthermore, by excluding non-

essential costs from a judgment, management is discouraged from relying on facts that would

otherwise influence the decision inappropriately (Frizzo-Barker and et.al, 2020).

Semi variable cost: A semi-variable cost, also called a semi-fixed cost or a mixed cost, is

one that has both fixed and variable elements. Expenses are constant for a certain level of output

or demand, and then they become volatile until that level is surpassed. And if no good is

produced, a fixed cost is always sustained. Up to a certain output level, the constant component

of a semi-variable cost is fixed. This implies that semi-variable costs are set for a certain number

of activities but which vary for various levels of service. This is the fixed cost where a certain

amount of labor is needed for manufacturing plant activities (Weikmans and Roberts, 2019).

Absorption and marginal costing

Cost of unit under marginal and absorption costing - January

Cost of unit under marginal costing

Units of Waffles produced 10000 units

Cost Per Unit (£)

Direct materials (50,000/10,000) 5

Direct labour (30,000/10,000) 3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

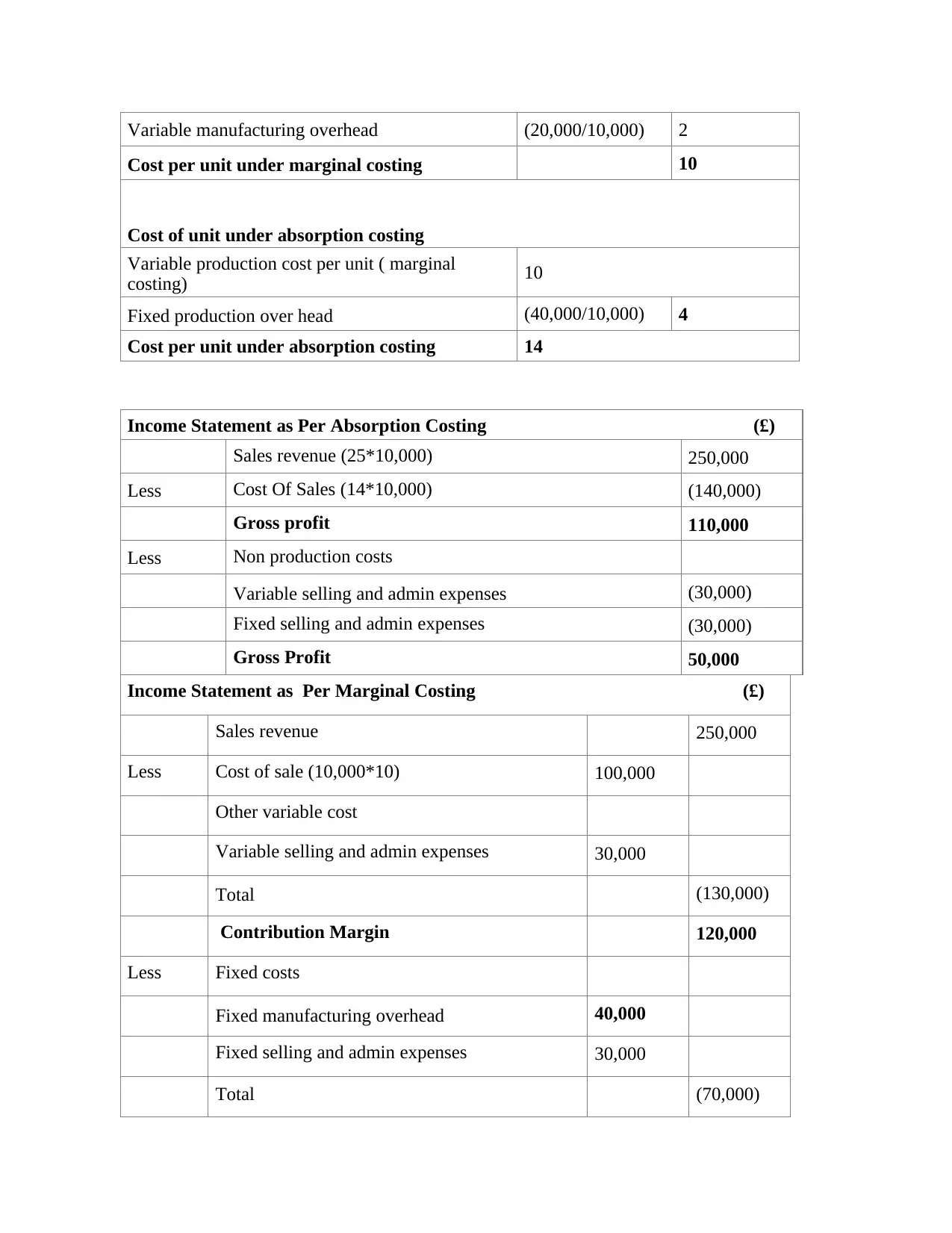

Variable manufacturing overhead (20,000/10,000) 2

Cost per unit under marginal costing 10

Cost of unit under absorption costing

Variable production cost per unit ( marginal

costing) 10

Fixed production over head (40,000/10,000) 4

Cost per unit under absorption costing 14

Income Statement as Per Absorption Costing (£)

Sales revenue (25*10,000) 250,000

Less Cost Of Sales (14*10,000) (140,000)

Gross profit 110,000

Less Non production costs

Variable selling and admin expenses (30,000)

Fixed selling and admin expenses (30,000)

Gross Profit 50,000

Income Statement as Per Marginal Costing (£)

Sales revenue 250,000

Less Cost of sale (10,000*10) 100,000

Other variable cost

Variable selling and admin expenses 30,000

Total (130,000)

Contribution Margin 120,000

Less Fixed costs

Fixed manufacturing overhead 40,000

Fixed selling and admin expenses 30,000

Total (70,000)

Cost per unit under marginal costing 10

Cost of unit under absorption costing

Variable production cost per unit ( marginal

costing) 10

Fixed production over head (40,000/10,000) 4

Cost per unit under absorption costing 14

Income Statement as Per Absorption Costing (£)

Sales revenue (25*10,000) 250,000

Less Cost Of Sales (14*10,000) (140,000)

Gross profit 110,000

Less Non production costs

Variable selling and admin expenses (30,000)

Fixed selling and admin expenses (30,000)

Gross Profit 50,000

Income Statement as Per Marginal Costing (£)

Sales revenue 250,000

Less Cost of sale (10,000*10) 100,000

Other variable cost

Variable selling and admin expenses 30,000

Total (130,000)

Contribution Margin 120,000

Less Fixed costs

Fixed manufacturing overhead 40,000

Fixed selling and admin expenses 30,000

Total (70,000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

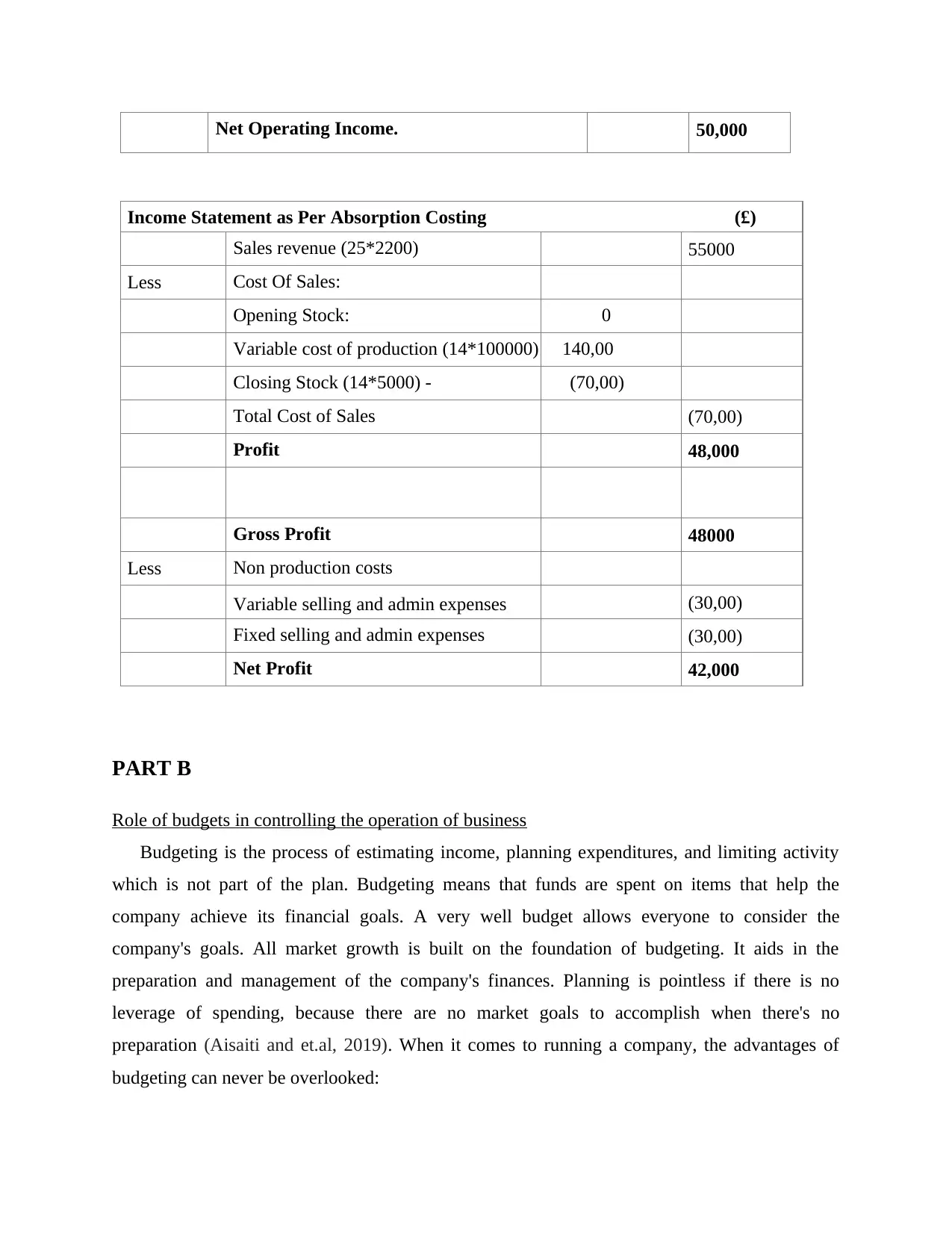

Net Operating Income. 50,000

Income Statement as Per Absorption Costing (£)

Sales revenue (25*2200) 55000

Less Cost Of Sales:

Opening Stock: 0

Variable cost of production (14*100000) 140,00

Closing Stock (14*5000) - (70,00)

Total Cost of Sales (70,00)

Profit 48,000

Gross Profit 48000

Less Non production costs

Variable selling and admin expenses (30,00)

Fixed selling and admin expenses (30,00)

Net Profit 42,000

PART B

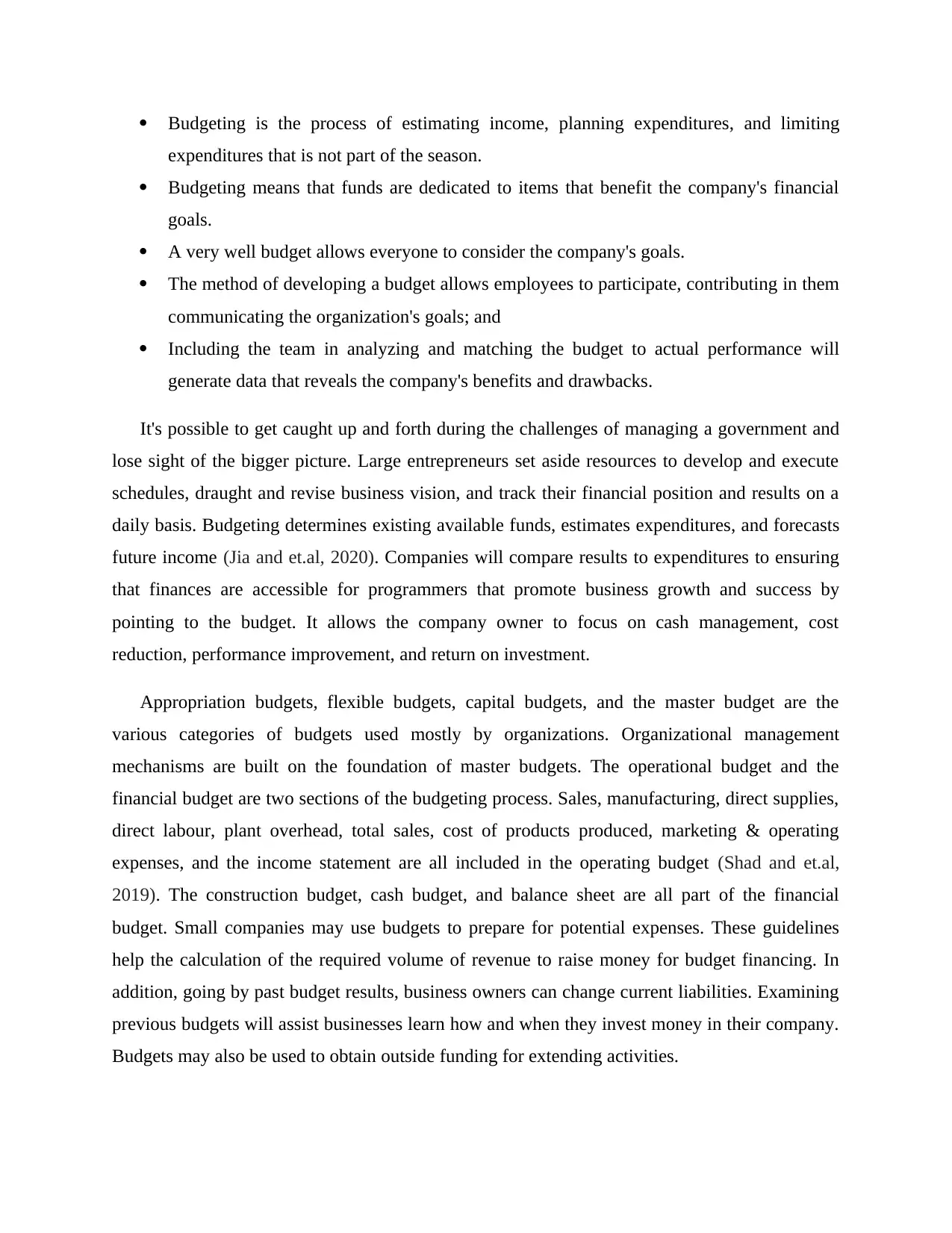

Role of budgets in controlling the operation of business

Budgeting is the process of estimating income, planning expenditures, and limiting activity

which is not part of the plan. Budgeting means that funds are spent on items that help the

company achieve its financial goals. A very well budget allows everyone to consider the

company's goals. All market growth is built on the foundation of budgeting. It aids in the

preparation and management of the company's finances. Planning is pointless if there is no

leverage of spending, because there are no market goals to accomplish when there's no

preparation (Aisaiti and et.al, 2019). When it comes to running a company, the advantages of

budgeting can never be overlooked:

Income Statement as Per Absorption Costing (£)

Sales revenue (25*2200) 55000

Less Cost Of Sales:

Opening Stock: 0

Variable cost of production (14*100000) 140,00

Closing Stock (14*5000) - (70,00)

Total Cost of Sales (70,00)

Profit 48,000

Gross Profit 48000

Less Non production costs

Variable selling and admin expenses (30,00)

Fixed selling and admin expenses (30,00)

Net Profit 42,000

PART B

Role of budgets in controlling the operation of business

Budgeting is the process of estimating income, planning expenditures, and limiting activity

which is not part of the plan. Budgeting means that funds are spent on items that help the

company achieve its financial goals. A very well budget allows everyone to consider the

company's goals. All market growth is built on the foundation of budgeting. It aids in the

preparation and management of the company's finances. Planning is pointless if there is no

leverage of spending, because there are no market goals to accomplish when there's no

preparation (Aisaiti and et.al, 2019). When it comes to running a company, the advantages of

budgeting can never be overlooked:

Budgeting is the process of estimating income, planning expenditures, and limiting

expenditures that is not part of the season.

Budgeting means that funds are dedicated to items that benefit the company's financial

goals.

A very well budget allows everyone to consider the company's goals.

The method of developing a budget allows employees to participate, contributing in them

communicating the organization's goals; and

Including the team in analyzing and matching the budget to actual performance will

generate data that reveals the company's benefits and drawbacks.

It's possible to get caught up and forth during the challenges of managing a government and

lose sight of the bigger picture. Large entrepreneurs set aside resources to develop and execute

schedules, draught and revise business vision, and track their financial position and results on a

daily basis. Budgeting determines existing available funds, estimates expenditures, and forecasts

future income (Jia and et.al, 2020). Companies will compare results to expenditures to ensuring

that finances are accessible for programmers that promote business growth and success by

pointing to the budget. It allows the company owner to focus on cash management, cost

reduction, performance improvement, and return on investment.

Appropriation budgets, flexible budgets, capital budgets, and the master budget are the

various categories of budgets used mostly by organizations. Organizational management

mechanisms are built on the foundation of master budgets. The operational budget and the

financial budget are two sections of the budgeting process. Sales, manufacturing, direct supplies,

direct labour, plant overhead, total sales, cost of products produced, marketing & operating

expenses, and the income statement are all included in the operating budget (Shad and et.al,

2019). The construction budget, cash budget, and balance sheet are all part of the financial

budget. Small companies may use budgets to prepare for potential expenses. These guidelines

help the calculation of the required volume of revenue to raise money for budget financing. In

addition, going by past budget results, business owners can change current liabilities. Examining

previous budgets will assist businesses learn how and when they invest money in their company.

Budgets may also be used to obtain outside funding for extending activities.

expenditures that is not part of the season.

Budgeting means that funds are dedicated to items that benefit the company's financial

goals.

A very well budget allows everyone to consider the company's goals.

The method of developing a budget allows employees to participate, contributing in them

communicating the organization's goals; and

Including the team in analyzing and matching the budget to actual performance will

generate data that reveals the company's benefits and drawbacks.

It's possible to get caught up and forth during the challenges of managing a government and

lose sight of the bigger picture. Large entrepreneurs set aside resources to develop and execute

schedules, draught and revise business vision, and track their financial position and results on a

daily basis. Budgeting determines existing available funds, estimates expenditures, and forecasts

future income (Jia and et.al, 2020). Companies will compare results to expenditures to ensuring

that finances are accessible for programmers that promote business growth and success by

pointing to the budget. It allows the company owner to focus on cash management, cost

reduction, performance improvement, and return on investment.

Appropriation budgets, flexible budgets, capital budgets, and the master budget are the

various categories of budgets used mostly by organizations. Organizational management

mechanisms are built on the foundation of master budgets. The operational budget and the

financial budget are two sections of the budgeting process. Sales, manufacturing, direct supplies,

direct labour, plant overhead, total sales, cost of products produced, marketing & operating

expenses, and the income statement are all included in the operating budget (Shad and et.al,

2019). The construction budget, cash budget, and balance sheet are all part of the financial

budget. Small companies may use budgets to prepare for potential expenses. These guidelines

help the calculation of the required volume of revenue to raise money for budget financing. In

addition, going by past budget results, business owners can change current liabilities. Examining

previous budgets will assist businesses learn how and when they invest money in their company.

Budgets may also be used to obtain outside funding for extending activities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

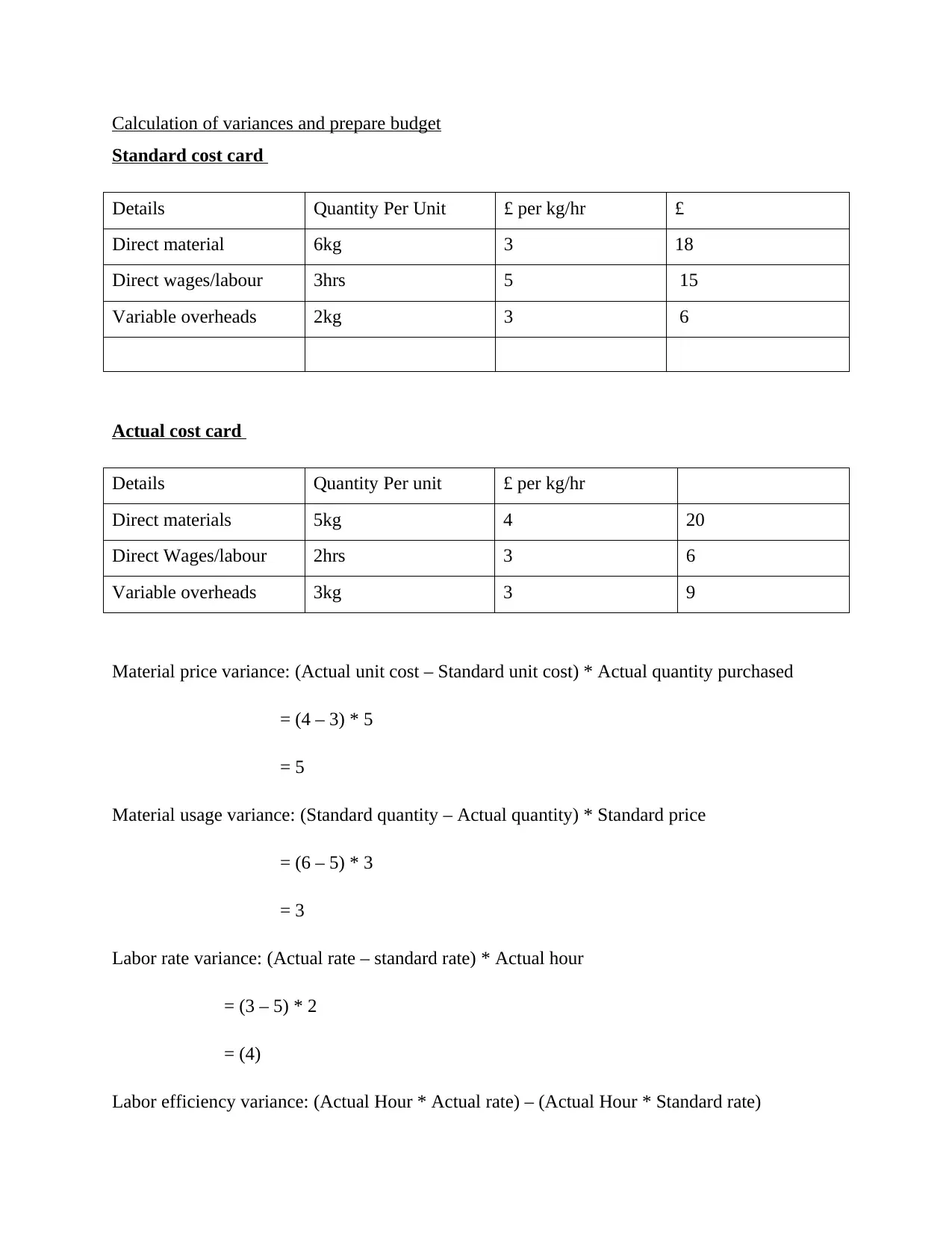

Calculation of variances and prepare budget

Standard cost card

Details Quantity Per Unit £ per kg/hr £

Direct material 6kg 3 18

Direct wages/labour 3hrs 5 15

Variable overheads 2kg 3 6

Actual cost card

Details Quantity Per unit £ per kg/hr

Direct materials 5kg 4 20

Direct Wages/labour 2hrs 3 6

Variable overheads 3kg 3 9

Material price variance: (Actual unit cost – Standard unit cost) * Actual quantity purchased

= (4 – 3) * 5

= 5

Material usage variance: (Standard quantity – Actual quantity) * Standard price

= (6 – 5) * 3

= 3

Labor rate variance: (Actual rate – standard rate) * Actual hour

= (3 – 5) * 2

= (4)

Labor efficiency variance: (Actual Hour * Actual rate) – (Actual Hour * Standard rate)

Standard cost card

Details Quantity Per Unit £ per kg/hr £

Direct material 6kg 3 18

Direct wages/labour 3hrs 5 15

Variable overheads 2kg 3 6

Actual cost card

Details Quantity Per unit £ per kg/hr

Direct materials 5kg 4 20

Direct Wages/labour 2hrs 3 6

Variable overheads 3kg 3 9

Material price variance: (Actual unit cost – Standard unit cost) * Actual quantity purchased

= (4 – 3) * 5

= 5

Material usage variance: (Standard quantity – Actual quantity) * Standard price

= (6 – 5) * 3

= 3

Labor rate variance: (Actual rate – standard rate) * Actual hour

= (3 – 5) * 2

= (4)

Labor efficiency variance: (Actual Hour * Actual rate) – (Actual Hour * Standard rate)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

= (2*3) – (2*5)

= (4)

Fixed overhead expenditure variance: Budgeted fixed overhead – Actual fixed overhead

= 15000 - 13000

= 2000

Direct material budget: The direct materials budget estimates the products that should be

bought over time to determine the manufacturing budget's specifications. In the yearly

budget, it is usually addressed in either a weekly or monthly layout (Brown, Mawson and

Rowe, 2019).

Fixed overhead expenditure budget: The proportion for which the gross fixed overhead

measured using the fixed overhead application rate reaches or falls well short of the true

fixed overhead capital expenditure accrued for the year is referred to this as the FOH

budget variation.

Variable overhead budget: Going to spend on Variable Overhead the disparity between

how much variable outputs overheads currently cost versus what they could have cost

considering the amount of operation during a time is known as variance. Whereas if real

expenses exceed the estimated cost, it is negative.

Direct labor budget: The estimated direct labor expense and the amount of direct labor

hours required for production are seen in the direct labor budget. It aids managers in

forecasting labor needs. A part of the master budget is the direct labor budget (Cao and

et.al, 2019).

CONCLUSION

As per the above report it has been concluded that the collection and management of

funds by businesses is referred to as corporate financing. The financial officer, who is typically

the responsibility of a company's corporate hierarchy, is in charge of planning, research, and

management system that allows. Big financial decisions are mostly taken by a budget committee

of very big companies.

= (4)

Fixed overhead expenditure variance: Budgeted fixed overhead – Actual fixed overhead

= 15000 - 13000

= 2000

Direct material budget: The direct materials budget estimates the products that should be

bought over time to determine the manufacturing budget's specifications. In the yearly

budget, it is usually addressed in either a weekly or monthly layout (Brown, Mawson and

Rowe, 2019).

Fixed overhead expenditure budget: The proportion for which the gross fixed overhead

measured using the fixed overhead application rate reaches or falls well short of the true

fixed overhead capital expenditure accrued for the year is referred to this as the FOH

budget variation.

Variable overhead budget: Going to spend on Variable Overhead the disparity between

how much variable outputs overheads currently cost versus what they could have cost

considering the amount of operation during a time is known as variance. Whereas if real

expenses exceed the estimated cost, it is negative.

Direct labor budget: The estimated direct labor expense and the amount of direct labor

hours required for production are seen in the direct labor budget. It aids managers in

forecasting labor needs. A part of the master budget is the direct labor budget (Cao and

et.al, 2019).

CONCLUSION

As per the above report it has been concluded that the collection and management of

funds by businesses is referred to as corporate financing. The financial officer, who is typically

the responsibility of a company's corporate hierarchy, is in charge of planning, research, and

management system that allows. Big financial decisions are mostly taken by a budget committee

of very big companies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.