Business Finance: Risk, Return, and Capital Budgeting

VerifiedAdded on 2023/02/01

|18

|4928

|100

Report

AI Summary

This assignment analyzes the financial aspects of JB Hi-Fi Limited, covering business description, risk and return, and capital budgeting. Part I provides an overview of the company, including its market capitalization, product offerings, and operational history. Part II delves into risk and return calculations, including continuously compounded return, expected return, standard deviation, and correlation coefficient. The analysis uses the CAPM model to determine the cost of equity and evaluates portfolio risk and return. Part III examines capital budgeting, comparing the attractiveness of different projects based on gross cash flows. The report includes formulas, calculations, and interpretations of financial metrics, providing insights into JB Hi-Fi's financial performance and investment strategies. The assignment demonstrates an understanding of financial concepts and their application in a real-world business context.

Running Head: Business Finance

Business Finance

[Pick the date]

Business Finance

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance

Part I (Business Description)

1. Company Name- JB Hi-Fi Limited

GICS SECTOR- Consumer Discretionary

GICS Industry Group- Retailing

GICS Industry- Specialty Retail (Morningstar, 2019)

2. Total Market Capitalization of JB Hi-Fi Limited- $2,901.95m (Morningstar, 2019)

3. JB Hi-Fi Limited (JBH) deals in consumer electronics, whitegoods and softwares like

music, games as well as movies. The group is a speciality discount retailer of highly

branded home entertainment related products. It conducts its business from standalone

destination sites, shopping centres and the online stores operating in Australia and

New Zealand.

The JB HI-FI Limited deals in the following products and services:

i. Televisions

ii. Audio equipment

iii. Computers

iv. Cameras

v. Telecommunications products and services

vi. Software

vii. Musical instruments

viii. Whitegoods

ix. Cooking products

x. Small appliances

xi. Digital content

xii. Information technology and consulting services

The company is working under the stewardship of Mr Gregory (Greg) Richards, the

Chairman and Mr Richard Murray, the Managing Director (MD) and Chief Executive Officer

(CEO) of JB HI-FI Limited.

4. The market risk (beta) of JB HI-FI Limited stands at 0.95 (Morningstar, 2019).

1

Part I (Business Description)

1. Company Name- JB Hi-Fi Limited

GICS SECTOR- Consumer Discretionary

GICS Industry Group- Retailing

GICS Industry- Specialty Retail (Morningstar, 2019)

2. Total Market Capitalization of JB Hi-Fi Limited- $2,901.95m (Morningstar, 2019)

3. JB Hi-Fi Limited (JBH) deals in consumer electronics, whitegoods and softwares like

music, games as well as movies. The group is a speciality discount retailer of highly

branded home entertainment related products. It conducts its business from standalone

destination sites, shopping centres and the online stores operating in Australia and

New Zealand.

The JB HI-FI Limited deals in the following products and services:

i. Televisions

ii. Audio equipment

iii. Computers

iv. Cameras

v. Telecommunications products and services

vi. Software

vii. Musical instruments

viii. Whitegoods

ix. Cooking products

x. Small appliances

xi. Digital content

xii. Information technology and consulting services

The company is working under the stewardship of Mr Gregory (Greg) Richards, the

Chairman and Mr Richard Murray, the Managing Director (MD) and Chief Executive Officer

(CEO) of JB HI-FI Limited.

4. The market risk (beta) of JB HI-FI Limited stands at 0.95 (Morningstar, 2019).

1

Business Finance

5. The market risk (beta) of Industry stands at 0.96 (Morningstar, 2019).

6. The market risk of JB HI-FI Limited is 0.95 and the company operates its business in

retailing industry whose beta or market risk is 0.96. The difference between the beta

figures of market and company are differing by 0.01 which cannot be considered a big

gap. However, if we compare both these figures, then JB HI-FI Limited is little less

risky than its industry counterpart. From here, we can interpret that both industry and

JB HI-FI Limited are less volatile/unstable than the market because their beta fall in

the range of 0-1. If we look from an investor’s point of view, then the ones who are

more risk averse may opt for making investment in the companies operating in

retailing industry and one of those companies could be JB HI-FI Limited whose

market risk is less than the industry too.

7. 5 year holding period return for JB HI-FI Limited stands at 12.46% (Morningstar,

2019).

8. JB HI-FI Limited started its journey from one single store situated at East Keilor,

Victoria. It was established in the year 1974 by the owner whose name was Mr John

Barbuto (JB) and his major intention was to provide the best range of Hi-Fi along

with the recorded music at a price which stands the lowest in whole Australia. In the

year 1983, Mr John Barbuto sold his business and more nine stores came into

existence by the year 1999. When the business became successful then in order to

take the efficacious business model nationally it was acquired by the private equity

bankers as well as the senior management in July, 2000. Later, the business got itself

listed on the Australian Stock Exchange (ASX) in the month of October, 2003.

Presently, the company has become the largest retailer, dealing in home entertainment

products which is growing on a very fast pace. In the year 2004, JB HI-FI Limited

acquired the Queensland Clive Anthony chain of stores and these stores deals in the

products like white goods, air-conditioning, consumer electronics and cooking

appliances. At present, in all these stores a consumer can find all the products of JB

plus more and now it is JB Hi-Fi HOME stores. The renowned brands of computers,

Televisions, Hi-Fi, Car sound, Tablets, Portable Audio etc. are provided by the JB

stores. In all these stores, the consumers can find a vast range of recorded music,

DVD movies, games, Television shows etc. and all at a very low price. The company

is also known for its high quality personal service from their experts (JB HI-FI, N.D.).

If we talk about its operational history, then in the year 2018 it reported a rise of

12.3% in Net Profit after Tax (NPAT) and as per 2019 results the NPAT had again

2

5. The market risk (beta) of Industry stands at 0.96 (Morningstar, 2019).

6. The market risk of JB HI-FI Limited is 0.95 and the company operates its business in

retailing industry whose beta or market risk is 0.96. The difference between the beta

figures of market and company are differing by 0.01 which cannot be considered a big

gap. However, if we compare both these figures, then JB HI-FI Limited is little less

risky than its industry counterpart. From here, we can interpret that both industry and

JB HI-FI Limited are less volatile/unstable than the market because their beta fall in

the range of 0-1. If we look from an investor’s point of view, then the ones who are

more risk averse may opt for making investment in the companies operating in

retailing industry and one of those companies could be JB HI-FI Limited whose

market risk is less than the industry too.

7. 5 year holding period return for JB HI-FI Limited stands at 12.46% (Morningstar,

2019).

8. JB HI-FI Limited started its journey from one single store situated at East Keilor,

Victoria. It was established in the year 1974 by the owner whose name was Mr John

Barbuto (JB) and his major intention was to provide the best range of Hi-Fi along

with the recorded music at a price which stands the lowest in whole Australia. In the

year 1983, Mr John Barbuto sold his business and more nine stores came into

existence by the year 1999. When the business became successful then in order to

take the efficacious business model nationally it was acquired by the private equity

bankers as well as the senior management in July, 2000. Later, the business got itself

listed on the Australian Stock Exchange (ASX) in the month of October, 2003.

Presently, the company has become the largest retailer, dealing in home entertainment

products which is growing on a very fast pace. In the year 2004, JB HI-FI Limited

acquired the Queensland Clive Anthony chain of stores and these stores deals in the

products like white goods, air-conditioning, consumer electronics and cooking

appliances. At present, in all these stores a consumer can find all the products of JB

plus more and now it is JB Hi-Fi HOME stores. The renowned brands of computers,

Televisions, Hi-Fi, Car sound, Tablets, Portable Audio etc. are provided by the JB

stores. In all these stores, the consumers can find a vast range of recorded music,

DVD movies, games, Television shows etc. and all at a very low price. The company

is also known for its high quality personal service from their experts (JB HI-FI, N.D.).

If we talk about its operational history, then in the year 2018 it reported a rise of

12.3% in Net Profit after Tax (NPAT) and as per 2019 results the NPAT had again

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance

experienced a rise of 5.5% (Morningstar, 2019). So the company is operating from

1974- present that is JB Hi-Fi is approximately forty-five years old company.

3

experienced a rise of 5.5% (Morningstar, 2019). So the company is operating from

1974- present that is JB Hi-Fi is approximately forty-five years old company.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance

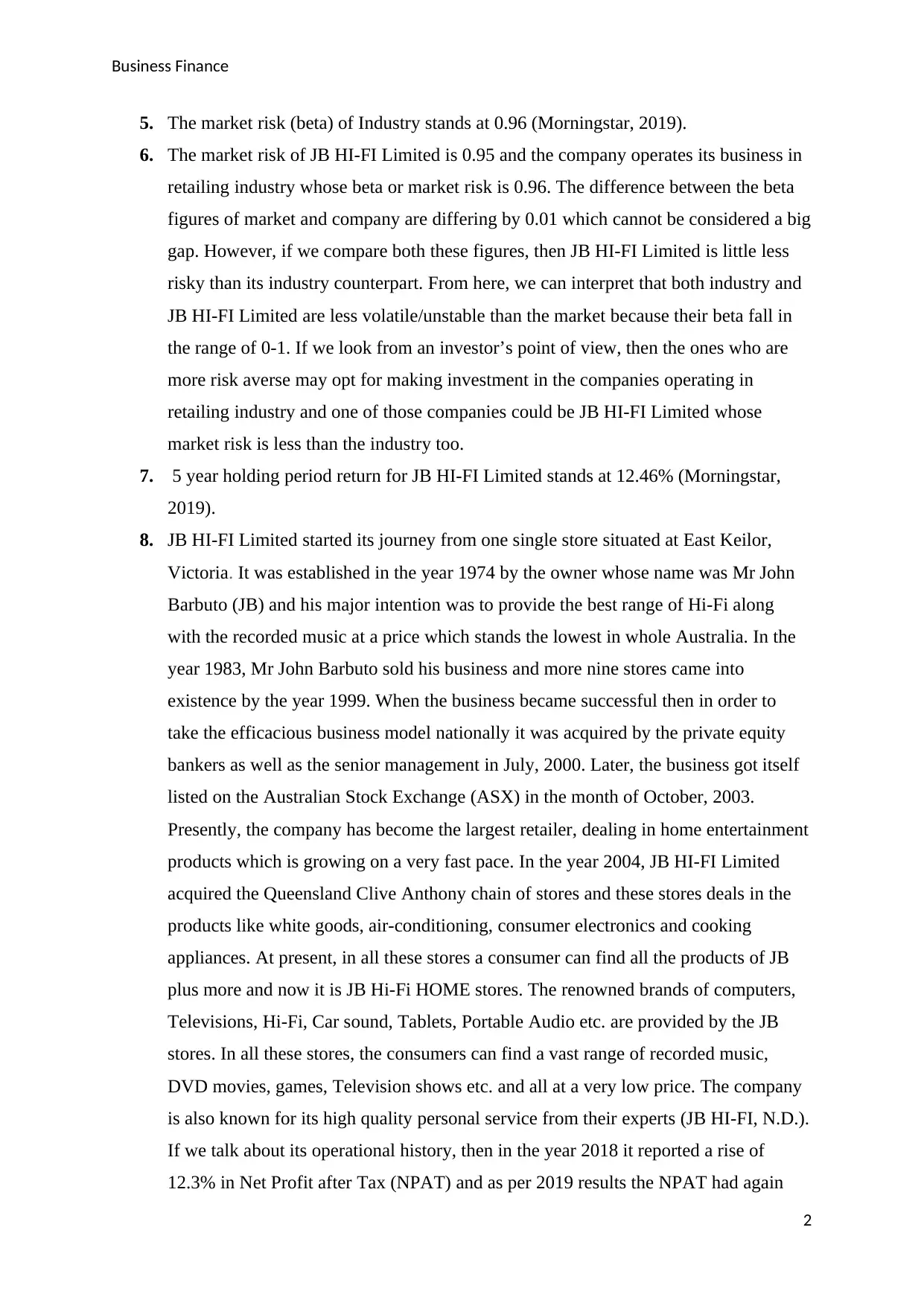

Part II Risk and Return

1.

2.

3.

4.

5. The correlation coefficient commonly employed in order to enumerate the link/

relationship between two different variables (Bakdash and Marusich, 2017). Now

if we would be required to comment on the return movement of JB Hi-Fi Limited

and the market in the given time period, then we can see its correlation coefficient

value is coming out to be 0.36, that means there is hardly any significant

relationship between the two. Therefore, the return movement of the company is

not highly influenced by the market return movement.

6. The beta value of the company as per the finance website (Morningstar) is 0.95.

However, when we calculate the value of beta through excel then it is coming out

4

-0.06%

2%

0.36

-15.67%

-16%

*Continuously Compounded

Return of JB Hi-Fi Limited

**Daily Expected Return of JB Hi-

Fi Limited

***Annual Expected Return of JB

Hi-Fi Limited

****Standard Deviation of JB Hi-Fi

Limited

*****Correlation Coefficient

Part II Risk and Return

1.

2.

3.

4.

5. The correlation coefficient commonly employed in order to enumerate the link/

relationship between two different variables (Bakdash and Marusich, 2017). Now

if we would be required to comment on the return movement of JB Hi-Fi Limited

and the market in the given time period, then we can see its correlation coefficient

value is coming out to be 0.36, that means there is hardly any significant

relationship between the two. Therefore, the return movement of the company is

not highly influenced by the market return movement.

6. The beta value of the company as per the finance website (Morningstar) is 0.95.

However, when we calculate the value of beta through excel then it is coming out

4

-0.06%

2%

0.36

-15.67%

-16%

*Continuously Compounded

Return of JB Hi-Fi Limited

**Daily Expected Return of JB Hi-

Fi Limited

***Annual Expected Return of JB

Hi-Fi Limited

****Standard Deviation of JB Hi-Fi

Limited

*****Correlation Coefficient

Business Finance

to be 0.88******. We can see the difference in the beta value because of the

following reasons:

a. The time interval taken by the finance website and the time taken by us may

differ. For example- the website might have considered the monthly return and

we had considered the daily return for the beta calculation through the

regression analysis.

b. The estimation period considered by the website and by us may also result in

the difference arising in the values of beta. It is said, that the longer estimation

period is often biased and therefore, is hardly of any use to the person looking

at the area of finance (Daves, Ehrhardt and Kunkel, 2000).

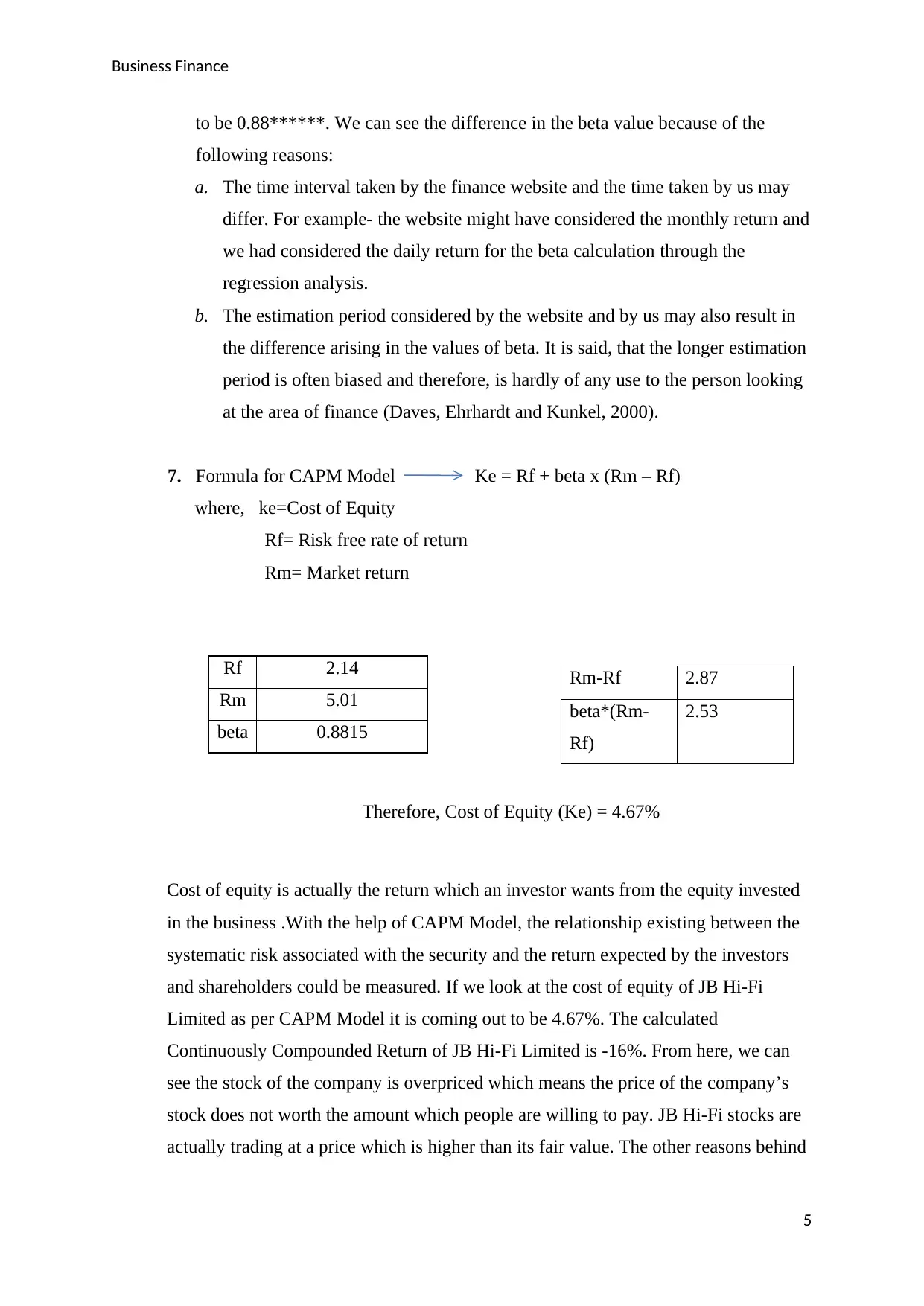

7. Formula for CAPM Model Ke = Rf + beta x (Rm – Rf)

where, ke=Cost of Equity

Rf= Risk free rate of return

Rm= Market return

Therefore, Cost of Equity (Ke) = 4.67%

Cost of equity is actually the return which an investor wants from the equity invested

in the business .With the help of CAPM Model, the relationship existing between the

systematic risk associated with the security and the return expected by the investors

and shareholders could be measured. If we look at the cost of equity of JB Hi-Fi

Limited as per CAPM Model it is coming out to be 4.67%. The calculated

Continuously Compounded Return of JB Hi-Fi Limited is -16%. From here, we can

see the stock of the company is overpriced which means the price of the company’s

stock does not worth the amount which people are willing to pay. JB Hi-Fi stocks are

actually trading at a price which is higher than its fair value. The other reasons behind

5

Rf 2.14

Rm 5.01

beta 0.8815

Rm-Rf 2.87

beta*(Rm-

Rf)

2.53

to be 0.88******. We can see the difference in the beta value because of the

following reasons:

a. The time interval taken by the finance website and the time taken by us may

differ. For example- the website might have considered the monthly return and

we had considered the daily return for the beta calculation through the

regression analysis.

b. The estimation period considered by the website and by us may also result in

the difference arising in the values of beta. It is said, that the longer estimation

period is often biased and therefore, is hardly of any use to the person looking

at the area of finance (Daves, Ehrhardt and Kunkel, 2000).

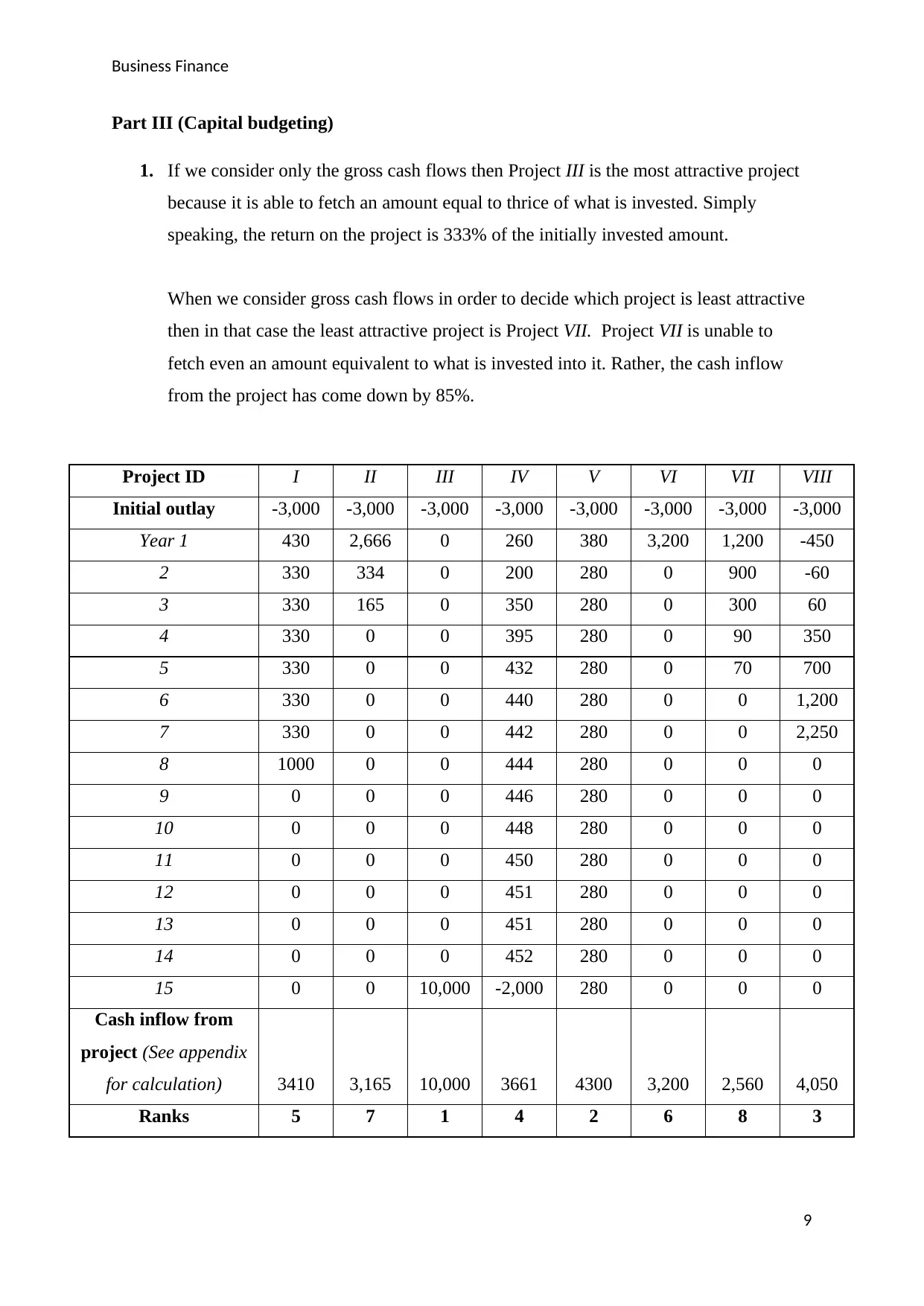

7. Formula for CAPM Model Ke = Rf + beta x (Rm – Rf)

where, ke=Cost of Equity

Rf= Risk free rate of return

Rm= Market return

Therefore, Cost of Equity (Ke) = 4.67%

Cost of equity is actually the return which an investor wants from the equity invested

in the business .With the help of CAPM Model, the relationship existing between the

systematic risk associated with the security and the return expected by the investors

and shareholders could be measured. If we look at the cost of equity of JB Hi-Fi

Limited as per CAPM Model it is coming out to be 4.67%. The calculated

Continuously Compounded Return of JB Hi-Fi Limited is -16%. From here, we can

see the stock of the company is overpriced which means the price of the company’s

stock does not worth the amount which people are willing to pay. JB Hi-Fi stocks are

actually trading at a price which is higher than its fair value. The other reasons behind

5

Rf 2.14

Rm 5.01

beta 0.8815

Rm-Rf 2.87

beta*(Rm-

Rf)

2.53

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance

the overpriced stock could be the investors’ confidence or unchanged market price in

spite of fall in the company’s fundamentals like revenue/earnings.

8. Expected Return of Portfolio= (Weight of market*Return of market) + (Weight of

JB Hi-Fi Limited*Return of JB Hi-Fi Limited)

Therefore, expected return of portfolio= (0.5 * -4.87) + (0.5 * -15.67)

= -10%

Standard Deviation= [(Weight of Market) 2 (Standard Deviation of market) 2] +

[(Weight of JB Hi-Fi Limited) 2 (Standard Deviation of JB Hi-Fi Limited) 2] + 2

(Weight of Market) (Weight of JB Hi-Fi Limited) (Standard Deviation of market)

(Standard Deviation of JB Hi-Fi Limited) (Correlation of JB Hi-Fi Limited and

Market)

Therefore, Standard Deviation of portfolio=

(0.25*0.000256)+(0.25*0.2455489)+2 * (0.25) (0.25) (0.36)

= 5%

9. The expected return and risk of JB Hi-Fi limited is -15.67% and 2% respectively

and the expected market return and risk is -4.87% and 1% respectively. When we

consider a portfolio wherein an equal amount is invested in JB Hi-Fi Limited and

the market then the expected return and risk of the portfolio is -10% and 5%

respectively.

Herein, we can see when the amount is invested in a portfolio then the rate of

return has improved. Diversification helps the investors in minimizing the loss and

generating the income. In a case when the company’s stock is not performing as

per our expectation but market is going good then the investor will not have to

depend only upon the company’s stock for the source of income and vice versa

when the stock is performing according to the expectations of investors but the

market performance is not appealing. For example- stock of JB Hi-Fi Limited is

not performing as expected and is unable to generate an income but since a part of

6

the overpriced stock could be the investors’ confidence or unchanged market price in

spite of fall in the company’s fundamentals like revenue/earnings.

8. Expected Return of Portfolio= (Weight of market*Return of market) + (Weight of

JB Hi-Fi Limited*Return of JB Hi-Fi Limited)

Therefore, expected return of portfolio= (0.5 * -4.87) + (0.5 * -15.67)

= -10%

Standard Deviation= [(Weight of Market) 2 (Standard Deviation of market) 2] +

[(Weight of JB Hi-Fi Limited) 2 (Standard Deviation of JB Hi-Fi Limited) 2] + 2

(Weight of Market) (Weight of JB Hi-Fi Limited) (Standard Deviation of market)

(Standard Deviation of JB Hi-Fi Limited) (Correlation of JB Hi-Fi Limited and

Market)

Therefore, Standard Deviation of portfolio=

(0.25*0.000256)+(0.25*0.2455489)+2 * (0.25) (0.25) (0.36)

= 5%

9. The expected return and risk of JB Hi-Fi limited is -15.67% and 2% respectively

and the expected market return and risk is -4.87% and 1% respectively. When we

consider a portfolio wherein an equal amount is invested in JB Hi-Fi Limited and

the market then the expected return and risk of the portfolio is -10% and 5%

respectively.

Herein, we can see when the amount is invested in a portfolio then the rate of

return has improved. Diversification helps the investors in minimizing the loss and

generating the income. In a case when the company’s stock is not performing as

per our expectation but market is going good then the investor will not have to

depend only upon the company’s stock for the source of income and vice versa

when the stock is performing according to the expectations of investors but the

market performance is not appealing. For example- stock of JB Hi-Fi Limited is

not performing as expected and is unable to generate an income but since a part of

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance

the available amount has been invested in market too which is performing as per

the expectations, the investor can rely upon the market for earning income.

10. Spurious correlation refers to the relationship between two variables whose

activities appear to depend on each other but actually their activities are the effect

of some other factor or third party factor which is not identified at the time of

examining the correlation. A study was conducted on Company X both before

relocating the office and after the relocation to check whether there is any

correlation between the work environment satisfaction and job satisfaction among

the employees. To know about the job satisfaction, perspective index of the

employees were measured. It was found that even after the office move, there

were no changes in the job satisfaction and perspective index of the employees.

This means that in spite of increased work environment satisfaction the job

satisfaction among the employees remain unchanged. Statistically if we find the

correlation among the two then we can notice a significant positive correlation

among the work environment satisfaction and job satisfaction (Inamizu, 2016). So

the correlation existing between the job satisfaction and work environment

satisfaction is a spurious correlation.

Now, let’s take the example of the correlation existing between the return of

McDonalds and YUM. Both of these companies operate in the restaurant industry

the reason for which they share almost the same unsystematic risk. The correlation

between these two stands at 0.34 which is not a very strong relationship but such

weak correlation may be a result of the systematic risks faced by both of these

companies.

Notes:

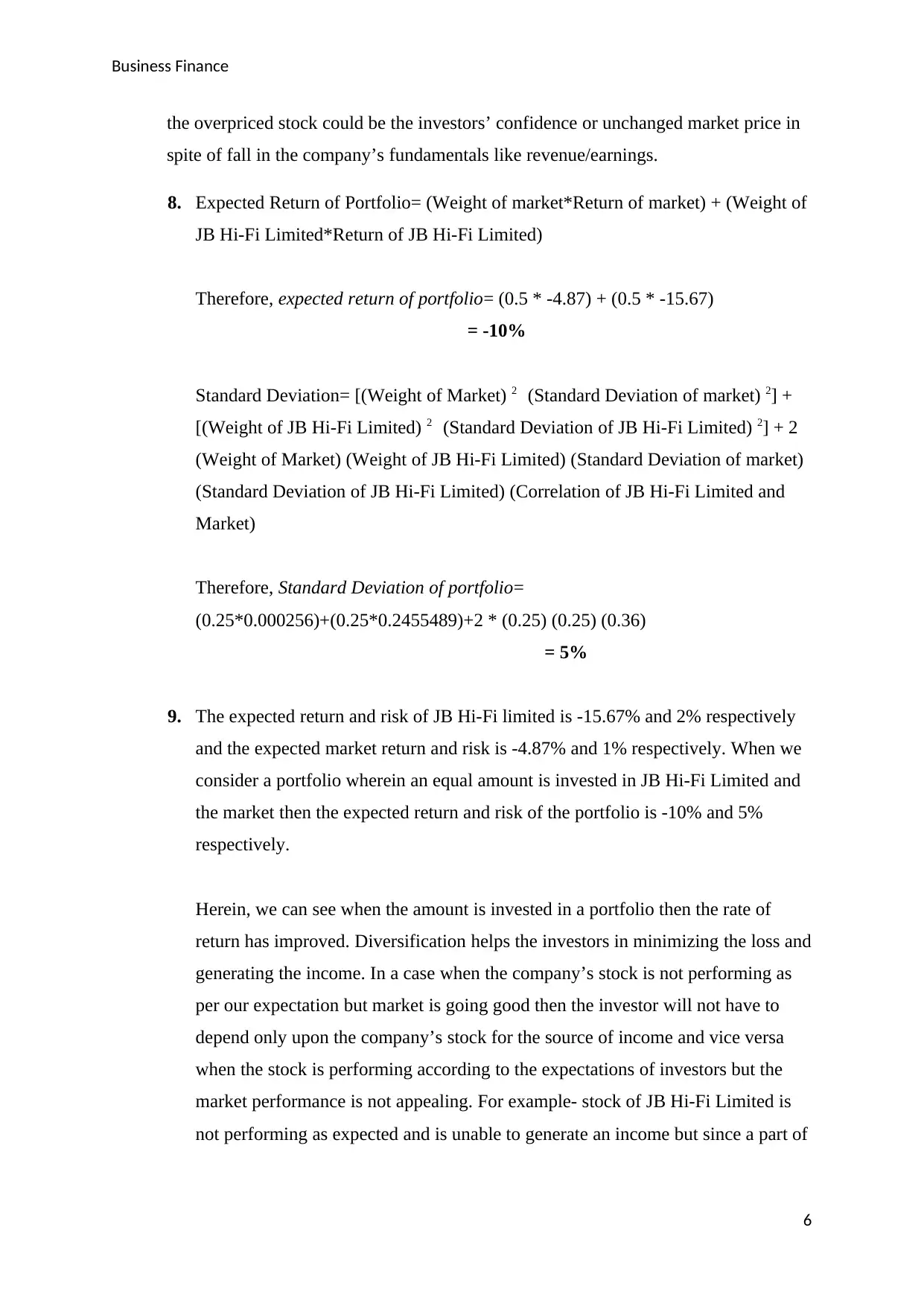

1. * Excel formula used to calculate daily return of the JB Hi-Fi Limited is

where

where, Price t = Price of today

Price t-1 = Price of yesterday

Excel formula used to calculate continuously compounded return of the JB Hi-Fi Limited is

2. ** Excel formula used to calculate daily expected return of JB Hi-Fi Limited

7

=LN (Price t)/ (Price t-1)

=Average (Return

market)*252 trading days

=Average (Return JB Hi-Fi

Limited

the available amount has been invested in market too which is performing as per

the expectations, the investor can rely upon the market for earning income.

10. Spurious correlation refers to the relationship between two variables whose

activities appear to depend on each other but actually their activities are the effect

of some other factor or third party factor which is not identified at the time of

examining the correlation. A study was conducted on Company X both before

relocating the office and after the relocation to check whether there is any

correlation between the work environment satisfaction and job satisfaction among

the employees. To know about the job satisfaction, perspective index of the

employees were measured. It was found that even after the office move, there

were no changes in the job satisfaction and perspective index of the employees.

This means that in spite of increased work environment satisfaction the job

satisfaction among the employees remain unchanged. Statistically if we find the

correlation among the two then we can notice a significant positive correlation

among the work environment satisfaction and job satisfaction (Inamizu, 2016). So

the correlation existing between the job satisfaction and work environment

satisfaction is a spurious correlation.

Now, let’s take the example of the correlation existing between the return of

McDonalds and YUM. Both of these companies operate in the restaurant industry

the reason for which they share almost the same unsystematic risk. The correlation

between these two stands at 0.34 which is not a very strong relationship but such

weak correlation may be a result of the systematic risks faced by both of these

companies.

Notes:

1. * Excel formula used to calculate daily return of the JB Hi-Fi Limited is

where

where, Price t = Price of today

Price t-1 = Price of yesterday

Excel formula used to calculate continuously compounded return of the JB Hi-Fi Limited is

2. ** Excel formula used to calculate daily expected return of JB Hi-Fi Limited

7

=LN (Price t)/ (Price t-1)

=Average (Return

market)*252 trading days

=Average (Return JB Hi-Fi

Limited

Business Finance

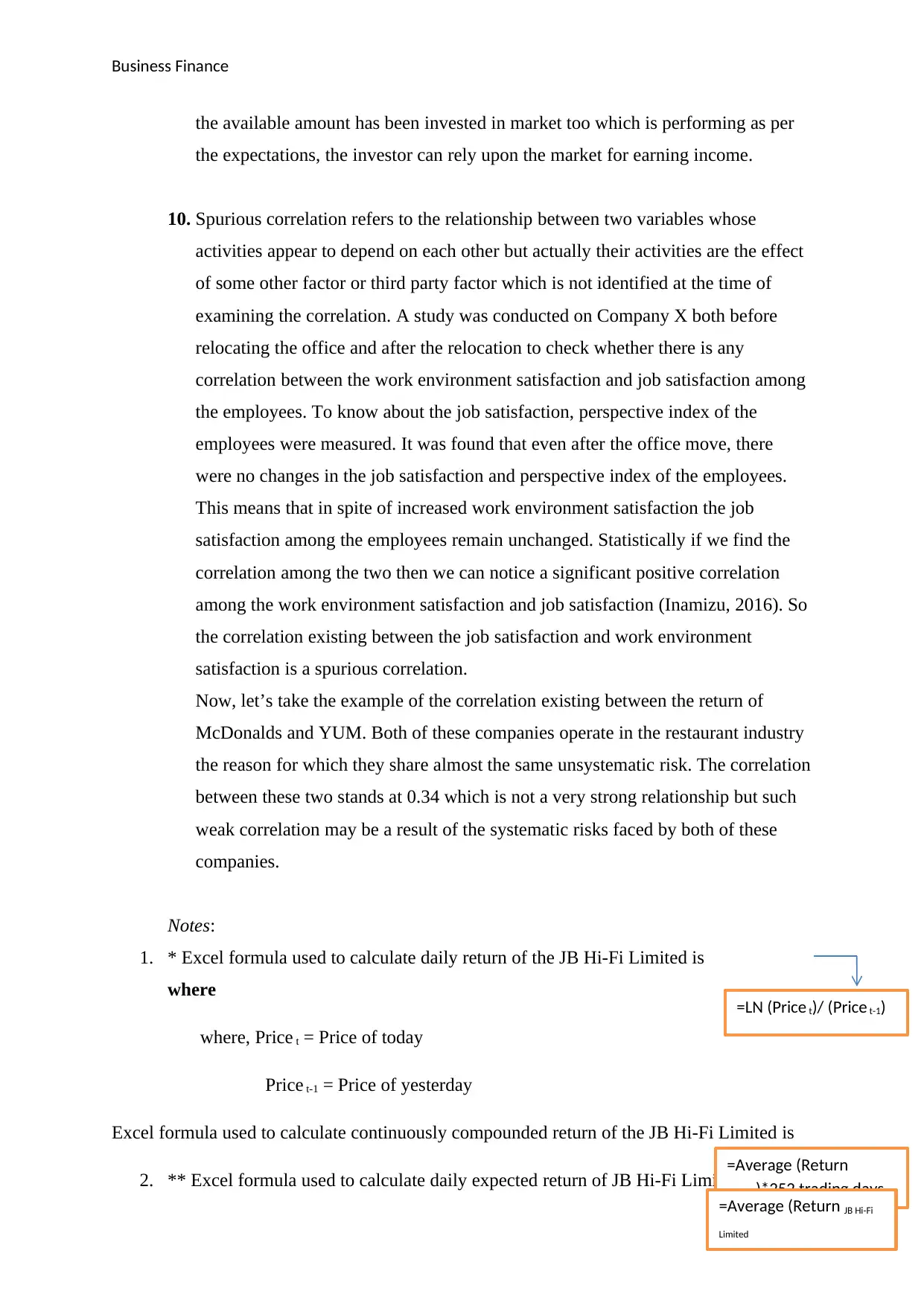

3. *** Excel formula used to calculate annual expected return of JB Hi-Fi Limited

4. **** Excel formula used to calculate standard deviation of JB Hi-Fi Limited

5. ***** Excel formula used to calculate correlation Coefficient

6. ****** Beta of the company was calculated by running a regression analysis on the

Return JB Hi-Fi Limited and Return market.

8

=Average (Return

market)*252 trading

days

=STDEV.S (Return JB Hi-

Fi Limited)

=CORREL (Return JB Hi-Fi Limited , Return market)

3. *** Excel formula used to calculate annual expected return of JB Hi-Fi Limited

4. **** Excel formula used to calculate standard deviation of JB Hi-Fi Limited

5. ***** Excel formula used to calculate correlation Coefficient

6. ****** Beta of the company was calculated by running a regression analysis on the

Return JB Hi-Fi Limited and Return market.

8

=Average (Return

market)*252 trading

days

=STDEV.S (Return JB Hi-

Fi Limited)

=CORREL (Return JB Hi-Fi Limited , Return market)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business Finance

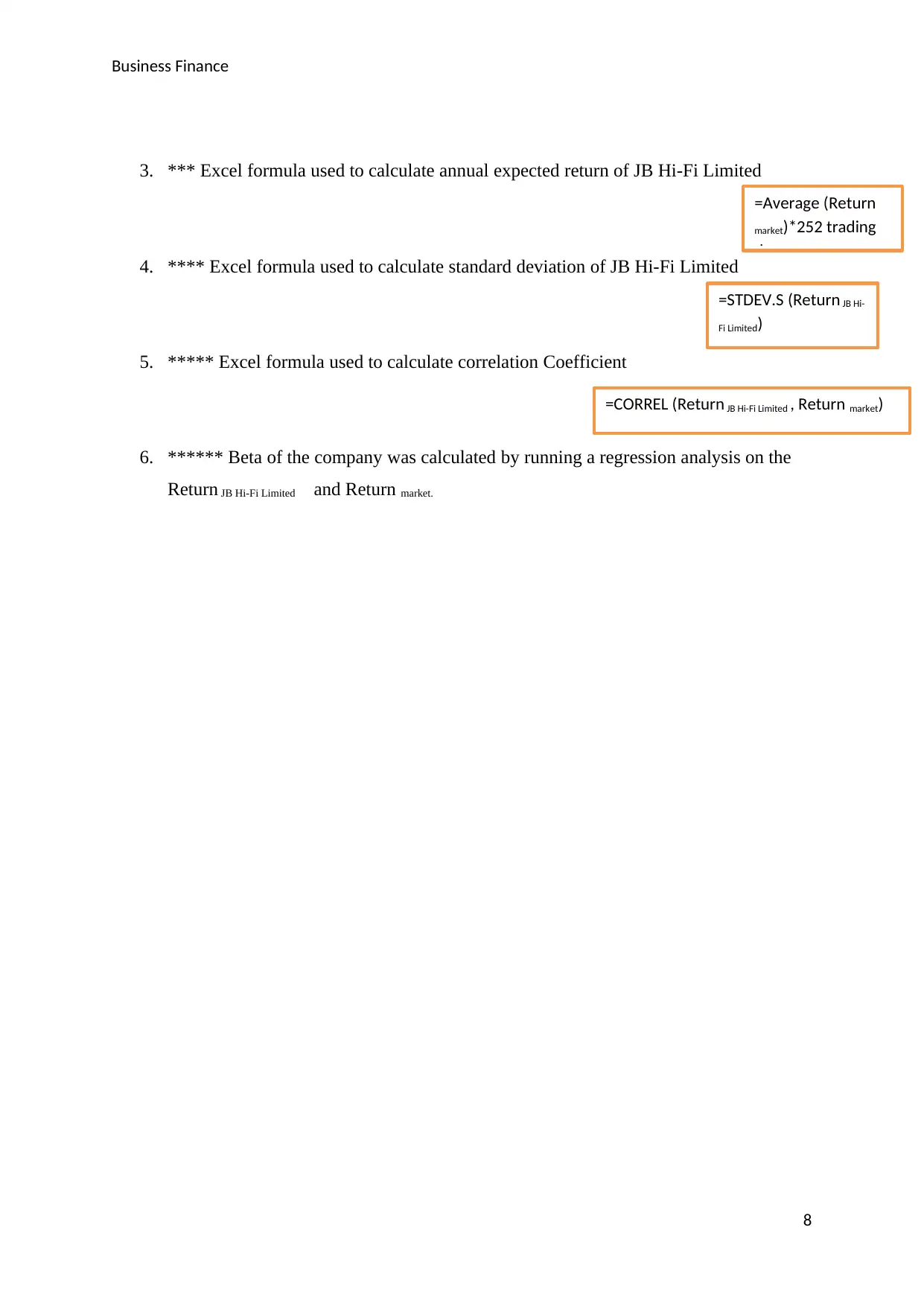

Part III (Capital budgeting)

1. If we consider only the gross cash flows then Project III is the most attractive project

because it is able to fetch an amount equal to thrice of what is invested. Simply

speaking, the return on the project is 333% of the initially invested amount.

When we consider gross cash flows in order to decide which project is least attractive

then in that case the least attractive project is Project VII. Project VII is unable to

fetch even an amount equivalent to what is invested into it. Rather, the cash inflow

from the project has come down by 85%.

Project ID I II III IV V VI VII VIII

Initial outlay -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000

Year 1 430 2,666 0 260 380 3,200 1,200 -450

2 330 334 0 200 280 0 900 -60

3 330 165 0 350 280 0 300 60

4 330 0 0 395 280 0 90 350

5 330 0 0 432 280 0 70 700

6 330 0 0 440 280 0 0 1,200

7 330 0 0 442 280 0 0 2,250

8 1000 0 0 444 280 0 0 0

9 0 0 0 446 280 0 0 0

10 0 0 0 448 280 0 0 0

11 0 0 0 450 280 0 0 0

12 0 0 0 451 280 0 0 0

13 0 0 0 451 280 0 0 0

14 0 0 0 452 280 0 0 0

15 0 0 10,000 -2,000 280 0 0 0

Cash inflow from

project (See appendix

for calculation) 3410 3,165 10,000 3661 4300 3,200 2,560 4,050

Ranks 5 7 1 4 2 6 8 3

9

Part III (Capital budgeting)

1. If we consider only the gross cash flows then Project III is the most attractive project

because it is able to fetch an amount equal to thrice of what is invested. Simply

speaking, the return on the project is 333% of the initially invested amount.

When we consider gross cash flows in order to decide which project is least attractive

then in that case the least attractive project is Project VII. Project VII is unable to

fetch even an amount equivalent to what is invested into it. Rather, the cash inflow

from the project has come down by 85%.

Project ID I II III IV V VI VII VIII

Initial outlay -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000

Year 1 430 2,666 0 260 380 3,200 1,200 -450

2 330 334 0 200 280 0 900 -60

3 330 165 0 350 280 0 300 60

4 330 0 0 395 280 0 90 350

5 330 0 0 432 280 0 70 700

6 330 0 0 440 280 0 0 1,200

7 330 0 0 442 280 0 0 2,250

8 1000 0 0 444 280 0 0 0

9 0 0 0 446 280 0 0 0

10 0 0 0 448 280 0 0 0

11 0 0 0 450 280 0 0 0

12 0 0 0 451 280 0 0 0

13 0 0 0 451 280 0 0 0

14 0 0 0 452 280 0 0 0

15 0 0 10,000 -2,000 280 0 0 0

Cash inflow from

project (See appendix

for calculation) 3410 3,165 10,000 3661 4300 3,200 2,560 4,050

Ranks 5 7 1 4 2 6 8 3

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Business Finance

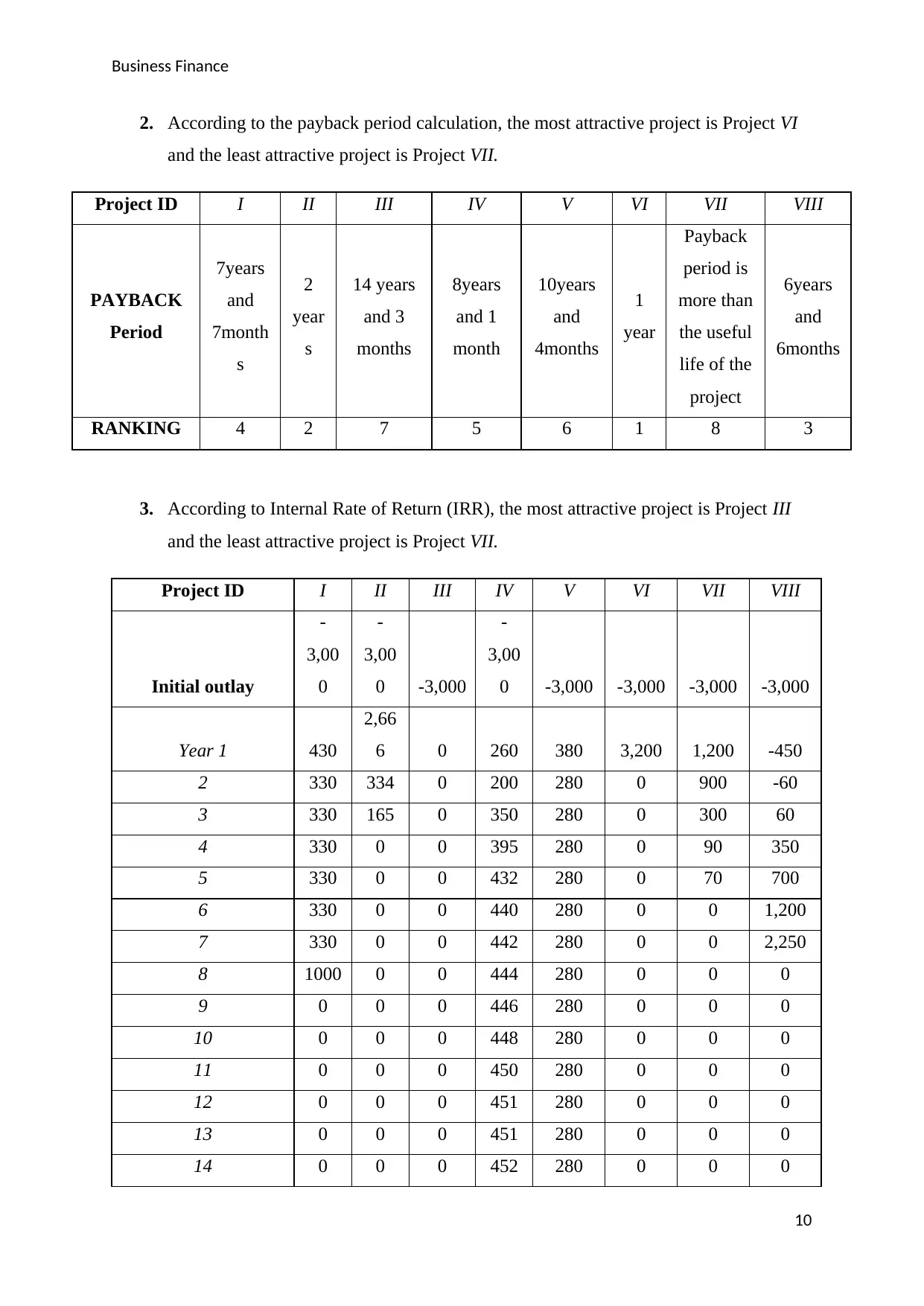

2. According to the payback period calculation, the most attractive project is Project VI

and the least attractive project is Project VII.

Project ID I II III IV V VI VII VIII

PAYBACK

Period

7years

and

7month

s

2

year

s

14 years

and 3

months

8years

and 1

month

10years

and

4months

1

year

Payback

period is

more than

the useful

life of the

project

6years

and

6months

RANKING 4 2 7 5 6 1 8 3

3. According to Internal Rate of Return (IRR), the most attractive project is Project III

and the least attractive project is Project VII.

Project ID I II III IV V VI VII VIII

Initial outlay

-

3,00

0

-

3,00

0 -3,000

-

3,00

0 -3,000 -3,000 -3,000 -3,000

Year 1 430

2,66

6 0 260 380 3,200 1,200 -450

2 330 334 0 200 280 0 900 -60

3 330 165 0 350 280 0 300 60

4 330 0 0 395 280 0 90 350

5 330 0 0 432 280 0 70 700

6 330 0 0 440 280 0 0 1,200

7 330 0 0 442 280 0 0 2,250

8 1000 0 0 444 280 0 0 0

9 0 0 0 446 280 0 0 0

10 0 0 0 448 280 0 0 0

11 0 0 0 450 280 0 0 0

12 0 0 0 451 280 0 0 0

13 0 0 0 451 280 0 0 0

14 0 0 0 452 280 0 0 0

10

2. According to the payback period calculation, the most attractive project is Project VI

and the least attractive project is Project VII.

Project ID I II III IV V VI VII VIII

PAYBACK

Period

7years

and

7month

s

2

year

s

14 years

and 3

months

8years

and 1

month

10years

and

4months

1

year

Payback

period is

more than

the useful

life of the

project

6years

and

6months

RANKING 4 2 7 5 6 1 8 3

3. According to Internal Rate of Return (IRR), the most attractive project is Project III

and the least attractive project is Project VII.

Project ID I II III IV V VI VII VIII

Initial outlay

-

3,00

0

-

3,00

0 -3,000

-

3,00

0 -3,000 -3,000 -3,000 -3,000

Year 1 430

2,66

6 0 260 380 3,200 1,200 -450

2 330 334 0 200 280 0 900 -60

3 330 165 0 350 280 0 300 60

4 330 0 0 395 280 0 90 350

5 330 0 0 432 280 0 70 700

6 330 0 0 440 280 0 0 1,200

7 330 0 0 442 280 0 0 2,250

8 1000 0 0 444 280 0 0 0

9 0 0 0 446 280 0 0 0

10 0 0 0 448 280 0 0 0

11 0 0 0 450 280 0 0 0

12 0 0 0 451 280 0 0 0

13 0 0 0 451 280 0 0 0

14 0 0 0 452 280 0 0 0

10

Business Finance

15 0 0

10,00

0

-

2,00

0 280 0 0 0

IRR 3% 5% 8% 4% 5% 7% -8% 4%

Ranks 6 3 1 4 5 2 7 4

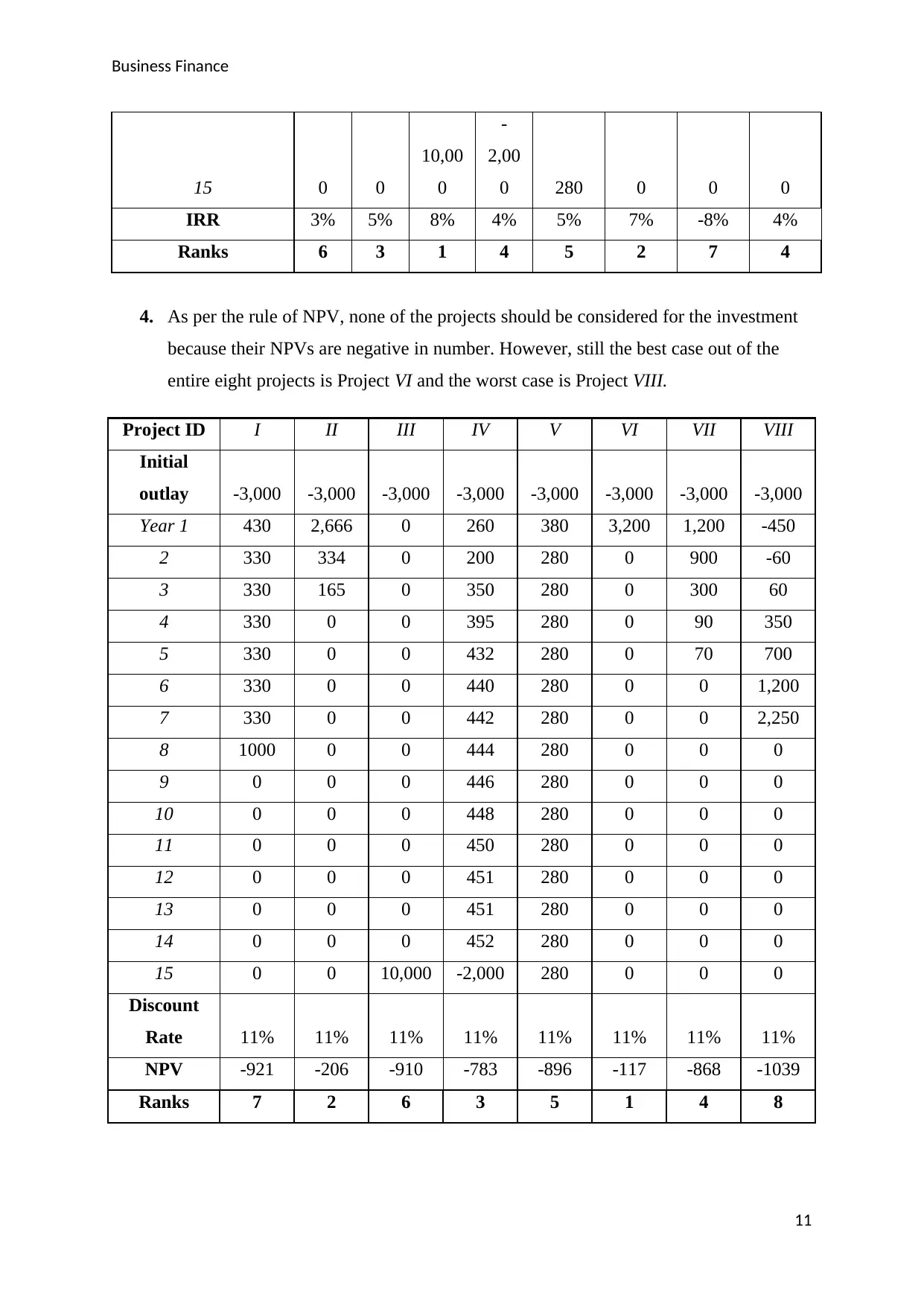

4. As per the rule of NPV, none of the projects should be considered for the investment

because their NPVs are negative in number. However, still the best case out of the

entire eight projects is Project VI and the worst case is Project VIII.

Project ID I II III IV V VI VII VIII

Initial

outlay -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000

Year 1 430 2,666 0 260 380 3,200 1,200 -450

2 330 334 0 200 280 0 900 -60

3 330 165 0 350 280 0 300 60

4 330 0 0 395 280 0 90 350

5 330 0 0 432 280 0 70 700

6 330 0 0 440 280 0 0 1,200

7 330 0 0 442 280 0 0 2,250

8 1000 0 0 444 280 0 0 0

9 0 0 0 446 280 0 0 0

10 0 0 0 448 280 0 0 0

11 0 0 0 450 280 0 0 0

12 0 0 0 451 280 0 0 0

13 0 0 0 451 280 0 0 0

14 0 0 0 452 280 0 0 0

15 0 0 10,000 -2,000 280 0 0 0

Discount

Rate 11% 11% 11% 11% 11% 11% 11% 11%

NPV -921 -206 -910 -783 -896 -117 -868 -1039

Ranks 7 2 6 3 5 1 4 8

11

15 0 0

10,00

0

-

2,00

0 280 0 0 0

IRR 3% 5% 8% 4% 5% 7% -8% 4%

Ranks 6 3 1 4 5 2 7 4

4. As per the rule of NPV, none of the projects should be considered for the investment

because their NPVs are negative in number. However, still the best case out of the

entire eight projects is Project VI and the worst case is Project VIII.

Project ID I II III IV V VI VII VIII

Initial

outlay -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000 -3,000

Year 1 430 2,666 0 260 380 3,200 1,200 -450

2 330 334 0 200 280 0 900 -60

3 330 165 0 350 280 0 300 60

4 330 0 0 395 280 0 90 350

5 330 0 0 432 280 0 70 700

6 330 0 0 440 280 0 0 1,200

7 330 0 0 442 280 0 0 2,250

8 1000 0 0 444 280 0 0 0

9 0 0 0 446 280 0 0 0

10 0 0 0 448 280 0 0 0

11 0 0 0 450 280 0 0 0

12 0 0 0 451 280 0 0 0

13 0 0 0 451 280 0 0 0

14 0 0 0 452 280 0 0 0

15 0 0 10,000 -2,000 280 0 0 0

Discount

Rate 11% 11% 11% 11% 11% 11% 11% 11%

NPV -921 -206 -910 -783 -896 -117 -868 -1039

Ranks 7 2 6 3 5 1 4 8

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.