BUS-7120: Weighted Average Cost of Capital Presentation & AHG

VerifiedAdded on 2023/04/21

|14

|930

|312

Presentation

AI Summary

This presentation provides a comprehensive analysis of the Weighted Average Cost of Capital (WACC) for Automotive Holding Group Limited. It begins by defining WACC and its significance in evaluating a firm's profitability and return on investment. The presentation details the formula for calculating WACC, including the cost of debt, cost of preference capital, and cost of equity capital, explaining various methods for computing each component. It then applies these concepts to estimate the current WACC for Automotive Holding Group Limited, utilizing the company's beta, risk-free rate, and market risk premium. The analysis concludes that Automotive Holding Group Limited's WACC is 4.38%, indicating the return required by investors for each additional dollar of funding. Desklib offers a wealth of similar solved assignments and past papers to aid students in their studies.

Business financial systems

Name of the student

Name of the university

Student ID

Name of the student

Name of the university

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

The presentation will analyse the component

of weighted average cost of capital (WACC)

and the computation method of the same in

detail. The presentation will further analyse

the present WACC of the entity Automotive

Holding Group Limited. Automotive Holding

Group Limited is the diversified automotive

logistics and retailing group along with the

operations in each mainland state of New

Zealand and Australia.

The presentation will analyse the component

of weighted average cost of capital (WACC)

and the computation method of the same in

detail. The presentation will further analyse

the present WACC of the entity Automotive

Holding Group Limited. Automotive Holding

Group Limited is the diversified automotive

logistics and retailing group along with the

operations in each mainland state of New

Zealand and Australia.

Discussion

As most of the firms are highly

dependent on borrowed fund for their

business operation cost of the capital

becomes crucial parameter while

assessing the potential of the firm

regarding net profitability. Investors

as well as analysts use WACC to

analyse the return on investment.

WACC is computation of the capital

cost for the firm under which each of

the capital category is weighted on

proportionate basis.

As most of the firms are highly

dependent on borrowed fund for their

business operation cost of the capital

becomes crucial parameter while

assessing the potential of the firm

regarding net profitability. Investors

as well as analysts use WACC to

analyse the return on investment.

WACC is computation of the capital

cost for the firm under which each of

the capital category is weighted on

proportionate basis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Formula used for computing the WACC is –

WACC = E/V * Re + D/V * Rd * (1 – Tc)

It is computed through multiplying the cost of

each capital component by the proportional

weight. After that the sum of the result is

considered and is multiplied by (1 – corporate

rate of tax).

WACC = E/V * Re + D/V * Rd * (1 – Tc)

It is computed through multiplying the cost of

each capital component by the proportional

weight. After that the sum of the result is

considered and is multiplied by (1 – corporate

rate of tax).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Components of cost of capital

It is the maximum rate of return that

the entity must earn from the

investment so that market value of the

market value of the entity’s equity

does not drop. This arrangement is

done with overall objective of the firm

with regard to maximization of wealthy.

It is the maximum rate of return that

the entity must earn from the

investment so that market value of the

market value of the entity’s equity

does not drop. This arrangement is

done with overall objective of the firm

with regard to maximization of wealthy.

3 major components of cost of capital are –

Cost of debt

Debt can be issued at premium, at par or at

the discount and can be redeemable or

perpetual. Method of computing cost of each

type of debt is –

Debt issued at par – computation approach for

this type of debt is an easy task compared to

other approach. It is explicit rate of interest

adjusted for entity’s tax liability. It is computed

as –

Kd = (I – T)*R

Cost of debt

Debt can be issued at premium, at par or at

the discount and can be redeemable or

perpetual. Method of computing cost of each

type of debt is –

Debt issued at par – computation approach for

this type of debt is an easy task compared to

other approach. It is explicit rate of interest

adjusted for entity’s tax liability. It is computed

as –

Kd = (I – T)*R

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Debt issued at discount or premium –

when the debentures are issued ad

discount or at premium, cost of the

debt shall be computed on based on

the net proceeds received from

issuance of such bonds or

debentures. Such cost shall be further

adjusted taking into consideration the

applicable tax rate for the entity. Cost

of debt shall be computed as per the

below formula –

Kd = I * (1 – T) / NP

when the debentures are issued ad

discount or at premium, cost of the

debt shall be computed on based on

the net proceeds received from

issuance of such bonds or

debentures. Such cost shall be further

adjusted taking into consideration the

applicable tax rate for the entity. Cost

of debt shall be computed as per the

below formula –

Kd = I * (1 – T) / NP

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost of preference capital –

Calculation for cost of preference capital poses

few conceptual issues. For the borrowings,

legal obligation is there on the firm for paying

the interest at the fixed rate while for the

preference share no such obligation is there.

Therefore, some of the people argue that the

payable dividends on the preference share

capital shall not be treated as cost component.

Calculation for cost of preference capital poses

few conceptual issues. For the borrowings,

legal obligation is there on the firm for paying

the interest at the fixed rate while for the

preference share no such obligation is there.

Therefore, some of the people argue that the

payable dividends on the preference share

capital shall not be treated as cost component.

Accumulation of the arrears for

preference dividend may have adverse

impact on the right of the equity

shareholders to receive the dividends.

The reason behind that is dividend

cannot be paid to the shareholders unless

the entity clears the arrears for

preference dividend. Owing to the same

the cost of preference capital is

calculated taking the same basis of

dividend.

preference dividend may have adverse

impact on the right of the equity

shareholders to receive the dividends.

The reason behind that is dividend

cannot be paid to the shareholders unless

the entity clears the arrears for

preference dividend. Owing to the same

the cost of preference capital is

calculated taking the same basis of

dividend.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost of equity capital –

Computation for cost of equity capital is difficult

one. Conceptually it is defined as minimum rate

of return that the firm shall earn on the part of

investment that is financed by equity.

Dividend price (D/P) approach

This approach emphasizes the dividend’s

importance however, it does not take into

account the fact that the retained earnings also

have an impact on the equity share’s market

price.

Cast of the new equity under this approach can

be computed as –

Ke = D/Np

Computation for cost of equity capital is difficult

one. Conceptually it is defined as minimum rate

of return that the firm shall earn on the part of

investment that is financed by equity.

Dividend price (D/P) approach

This approach emphasizes the dividend’s

importance however, it does not take into

account the fact that the retained earnings also

have an impact on the equity share’s market

price.

Cast of the new equity under this approach can

be computed as –

Ke = D/Np

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dividend price plus growth [(D/P) +

g] approach

As per this approach cost of the

equity capital is determined based

on the expected rate of dividend plus

growth rate of dividend. Rate of

growth for dividend is computed

based on the dividend amount paid

by the entity for past few years.

Computation for cost of capital as

per this approach can be done

through using the below mentioned

formula –

Ke = (D/Np) + g

g] approach

As per this approach cost of the

equity capital is determined based

on the expected rate of dividend plus

growth rate of dividend. Rate of

growth for dividend is computed

based on the dividend amount paid

by the entity for past few years.

Computation for cost of capital as

per this approach can be done

through using the below mentioned

formula –

Ke = (D/Np) + g

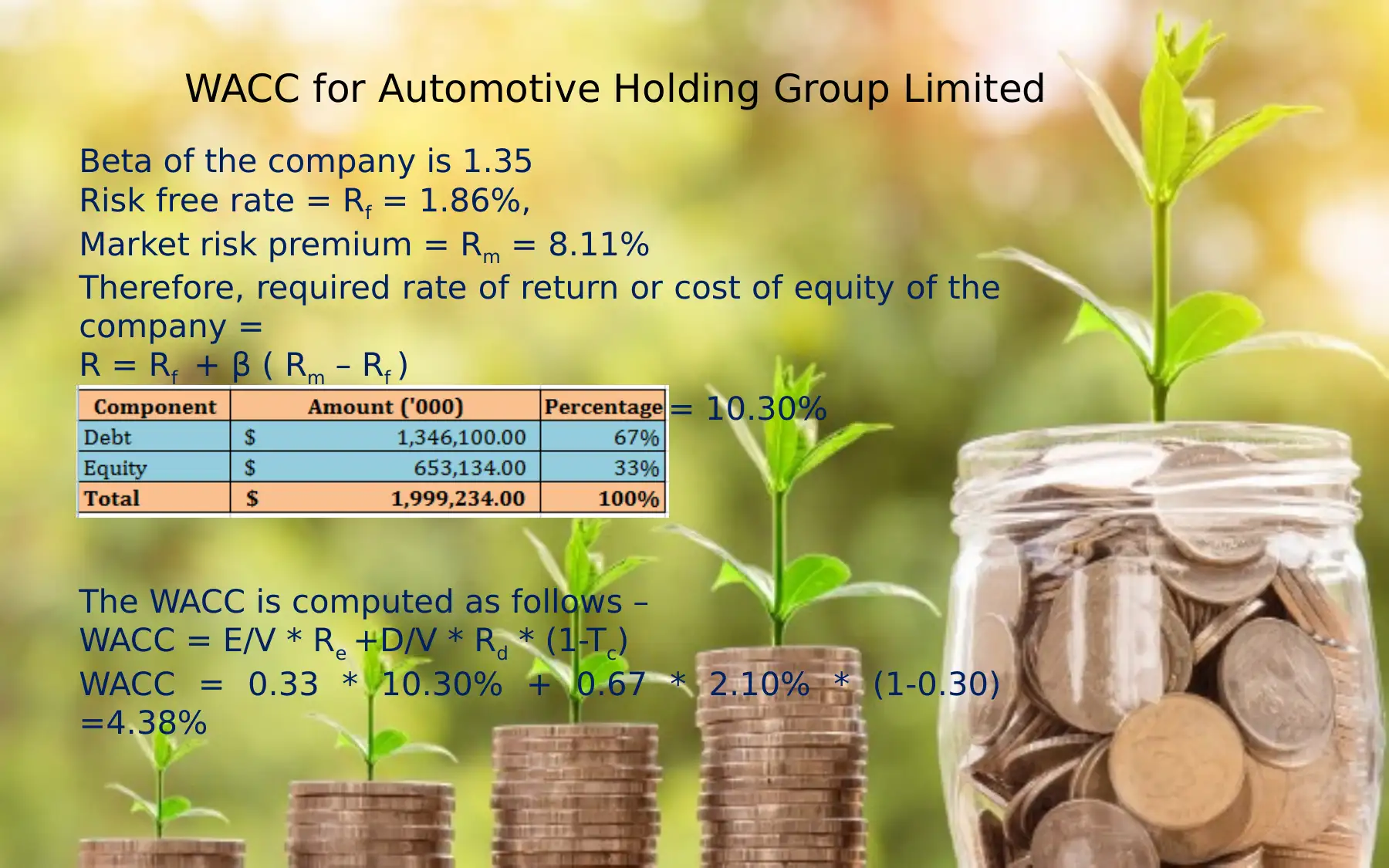

WACC for Automotive Holding Group Limited

Beta of the company is 1.35

Risk free rate = Rf = 1.86%,

Market risk premium = Rm = 8.11%

Therefore, required rate of return or cost of equity of the

company =

R = Rf + β ( Rm – Rf )

R = 1.86% + 1.35* (8.11% - 1.86%) = 10.30%

The WACC is computed as follows –

WACC = E/V * Re +D/V * Rd * (1-Tc)

WACC = 0.33 * 10.30% + 0.67 * 2.10% * (1-0.30)

=4.38%

Beta of the company is 1.35

Risk free rate = Rf = 1.86%,

Market risk premium = Rm = 8.11%

Therefore, required rate of return or cost of equity of the

company =

R = Rf + β ( Rm – Rf )

R = 1.86% + 1.35* (8.11% - 1.86%) = 10.30%

The WACC is computed as follows –

WACC = E/V * Re +D/V * Rd * (1-Tc)

WACC = 0.33 * 10.30% + 0.67 * 2.10% * (1-0.30)

=4.38%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.