Comprehensive Business Resource and Financial Analysis Report

VerifiedAdded on 2020/10/22

|13

|3548

|217

Report

AI Summary

This report provides a detailed analysis of business resources within the context of Hendy Group Ltd, a vehicle dealership. It begins by examining recruitment documents, including job adverts, descriptions, and person specifications. The report then explores employability, personal, and communication skills essential for various job roles. It further delves into physical and technological resources, including human resources, facilities, and computer-based systems. The report also covers internal and external sources of finance, such as retained earnings, bank loans, and hire purchase agreements. Additionally, it interprets the contents of trading, profit and loss accounts, and balance sheets to assess the financial performance of the business. The report concludes with an evaluation of the financial state of the business, using the financial statements to assess the company’s overall financial health and performance, providing valuable insights into the business's operations and financial management.

BUSINESS

RESOURCES

RESOURCES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

P1 Recruitment document used in a selected organisation....................................................1

P2 Employability, personal and communication skills..........................................................2

P3 Physical and technological resources................................................................................3

P4 Sources of internal and external finance...........................................................................4

P5 Interpret the contents of a trading and profit and loss account and balance sheet............6

P6 Use of budgets as a means of exercising financial control...............................................7

P7 Financial state of a given business....................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

P1 Recruitment document used in a selected organisation....................................................1

P2 Employability, personal and communication skills..........................................................2

P3 Physical and technological resources................................................................................3

P4 Sources of internal and external finance...........................................................................4

P5 Interpret the contents of a trading and profit and loss account and balance sheet............6

P6 Use of budgets as a means of exercising financial control...............................................7

P7 Financial state of a given business....................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Business resources are known as factors of production, consist of land and labour along

with capital and enterprise (Maglio and Spohrer, 2013). Everything represents as a business

resources from natural resources and farm products to machinery and office equipment. Business

resources also include employees, mentors and all of the business that support to supply chain.

To understand the concept of selected organisation Hendy group Ltd, it is operating as a dealer

of new and used vehicles. The company has been provided service plans, tires, accessories and

accident repair service. In the report consist of recruitment documentation, different types of

skills regarding to job role and main physical technology resources essential in the operation.

Apart from different types of resources related to finance and interpret contents of profit and loss

account and balance sheet of selected organisation. In addition, explain financial ratio of the

selected business.

MAIN BODY

P1 Recruitment document used in a selected organisation

Job Advert: Before placing a job advert, it is essential for HR managers of a company to

prepare job analysis process first. Here, they need to identify the number of vacant position at

workplace, eligibility criteria required to fulfil same and more. After preparation of such plan,

further they need to determine platform where job advertisement has to place. Generally in such

adverts, there is a description presented that includes company's name, vacant position, deadline

of application and pay scale. This would help candidates to measure their eligibilities as well.

Job Description: This document defines entire roles and responsibilities of a specified

vacant position including experience and other eligibility criteria required for the same. This

would help interested candidates to apply for job on given website.

Person Specification: Here, company provide a sample required for fulfilment of

specified position through which interested candidates can match their profiles and apply

accordingly for same.

Application form: It is provided to interested candidates who have applied for certain

job where they have to give details about their personal details

1

Business resources are known as factors of production, consist of land and labour along

with capital and enterprise (Maglio and Spohrer, 2013). Everything represents as a business

resources from natural resources and farm products to machinery and office equipment. Business

resources also include employees, mentors and all of the business that support to supply chain.

To understand the concept of selected organisation Hendy group Ltd, it is operating as a dealer

of new and used vehicles. The company has been provided service plans, tires, accessories and

accident repair service. In the report consist of recruitment documentation, different types of

skills regarding to job role and main physical technology resources essential in the operation.

Apart from different types of resources related to finance and interpret contents of profit and loss

account and balance sheet of selected organisation. In addition, explain financial ratio of the

selected business.

MAIN BODY

P1 Recruitment document used in a selected organisation

Job Advert: Before placing a job advert, it is essential for HR managers of a company to

prepare job analysis process first. Here, they need to identify the number of vacant position at

workplace, eligibility criteria required to fulfil same and more. After preparation of such plan,

further they need to determine platform where job advertisement has to place. Generally in such

adverts, there is a description presented that includes company's name, vacant position, deadline

of application and pay scale. This would help candidates to measure their eligibilities as well.

Job Description: This document defines entire roles and responsibilities of a specified

vacant position including experience and other eligibility criteria required for the same. This

would help interested candidates to apply for job on given website.

Person Specification: Here, company provide a sample required for fulfilment of

specified position through which interested candidates can match their profiles and apply

accordingly for same.

Application form: It is provided to interested candidates who have applied for certain

job where they have to give details about their personal details

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

P2 Employability, personal and communication skills

Employability skills – The particular skill can include expected qualification according

to job description and in the most of the job need to formal qualification. An applicant will be

required formal qualification in reference to job description. For example company wants to

sales manager so applicant have formal qualification of MBA in sales.

It is important for specific job because it shows learning power and qualification of

particular person. On the behalf of the skill select that person.

Personal skills – It is important part because it can present a person in effective manner

and show their

Soft skills – In the soft skill make good employee and present their skills such as

listening, communication and etiquette.

2

Employability skills – The particular skill can include expected qualification according

to job description and in the most of the job need to formal qualification. An applicant will be

required formal qualification in reference to job description. For example company wants to

sales manager so applicant have formal qualification of MBA in sales.

It is important for specific job because it shows learning power and qualification of

particular person. On the behalf of the skill select that person.

Personal skills – It is important part because it can present a person in effective manner

and show their

Soft skills – In the soft skill make good employee and present their skills such as

listening, communication and etiquette.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Hard Skills – The hard skill can use to analysis and measure personality of applicant in

manner to maths, reading and writing.

It is important for job because as a sales manager many time a person become soft and

may times become soft. So in the field need to both types skills.

Communication Skills – It is vary important skill where interviewer judge their

communication skills and their effectiveness regarding to presentation. In the sales field it is

more important to present their product in front of customer.

Verbal communication – Through verbal communication communicate with customer

and define about their product (Williams, 2014). There are defined two main types of oral

communication these are – (1) Storytelling – It is consider as form of verbal

communication which can help in the construction of common meanings for the

individual in an organisation. (2) Crucial conversation – The particular process is similar,

reflection and planning for high stakes communication in comparison to daily

interactions at work. And other forms face to face video conferencing, voice chat and

phone.

Non verbal communication – In this communicate with expression where deaf and dumb

people easily understand about their product. The forms of non verbal communication (1)

Paralanguage – In this way something is said instead of what is said actually. (2) Visual

communication – It takes place with the help of visual like colour, graphic design.

P3 Physical and technological resources

Physical resources – These type resources are used to conduct business and provide

different types of products and services. To conduct different types of activities provide support

to action of the Hendy group Ltd. There are included most common physical resources these are

-

Human resources – These are part of organisation that can help to conduct operation

activities in effective manner. In the Hendy group Ltd have about 4500 employees who

can work in efficient manner.

Building and facilities – At Hendy group Ltd have about many vehicles which can

provide facility to people to buy any where. They have many stores in UK into local

areas.

3

manner to maths, reading and writing.

It is important for job because as a sales manager many time a person become soft and

may times become soft. So in the field need to both types skills.

Communication Skills – It is vary important skill where interviewer judge their

communication skills and their effectiveness regarding to presentation. In the sales field it is

more important to present their product in front of customer.

Verbal communication – Through verbal communication communicate with customer

and define about their product (Williams, 2014). There are defined two main types of oral

communication these are – (1) Storytelling – It is consider as form of verbal

communication which can help in the construction of common meanings for the

individual in an organisation. (2) Crucial conversation – The particular process is similar,

reflection and planning for high stakes communication in comparison to daily

interactions at work. And other forms face to face video conferencing, voice chat and

phone.

Non verbal communication – In this communicate with expression where deaf and dumb

people easily understand about their product. The forms of non verbal communication (1)

Paralanguage – In this way something is said instead of what is said actually. (2) Visual

communication – It takes place with the help of visual like colour, graphic design.

P3 Physical and technological resources

Physical resources – These type resources are used to conduct business and provide

different types of products and services. To conduct different types of activities provide support

to action of the Hendy group Ltd. There are included most common physical resources these are

-

Human resources – These are part of organisation that can help to conduct operation

activities in effective manner. In the Hendy group Ltd have about 4500 employees who

can work in efficient manner.

Building and facilities – At Hendy group Ltd have about many vehicles which can

provide facility to people to buy any where. They have many stores in UK into local

areas.

3

Technological resources – These resources are mainly conduct operations and activities

with the help of different types of technology. There are mainly consist of different technological

equipment which can help to manage all operations.

Computer based resources – These resources are arrange in effective manner and provide

all appropriate things which can help to run smoothly business activities. For example –

Hardware, software, documentation.

Software and ICT – There are most of the officers need to telephone, wifi, chair, desk and

storage for their equipment. Technological resources can help to fulfil the requirement as

per demand.

Maintenance and security – The company has been planned to provide best experience in

reference to their customers and on the time of festival provide too much security at their

store. To maintain of their resources keep monitor through security guard as well as

CCTV camera.

P4 Sources of internal and external finance

Business can not survive without money so operate business act ivies need to funds

which is getting from different sources. These are categorised into two sources, external sources

and internal sources. In internal sources includes sales of fixed assets, debt collection, retained

earnings, personal savings and in external sources includes trade credit, hire purchase, bank loan,

overdraft, mortgage (Sahut and Peris-Ortiz, 2014) .

Internal sources – These sources of finance are generated with in the business from the

existing assets or activities. There are defined advantage and disadvantage of different types of

internal sources of fund -

Retained Earnings – It is part of internal sources of finance and defined as the profit left

after paying a dividend to the shareholders or drawings by the capital owners of Hendy group

Ltd. Advantage – There is no need to issue additional equity an there is no dilution to control

in reference to their ownership. Disadvantage – In practical way there no disadvantage regrading to generate retained

earnings.

4

with the help of different types of technology. There are mainly consist of different technological

equipment which can help to manage all operations.

Computer based resources – These resources are arrange in effective manner and provide

all appropriate things which can help to run smoothly business activities. For example –

Hardware, software, documentation.

Software and ICT – There are most of the officers need to telephone, wifi, chair, desk and

storage for their equipment. Technological resources can help to fulfil the requirement as

per demand.

Maintenance and security – The company has been planned to provide best experience in

reference to their customers and on the time of festival provide too much security at their

store. To maintain of their resources keep monitor through security guard as well as

CCTV camera.

P4 Sources of internal and external finance

Business can not survive without money so operate business act ivies need to funds

which is getting from different sources. These are categorised into two sources, external sources

and internal sources. In internal sources includes sales of fixed assets, debt collection, retained

earnings, personal savings and in external sources includes trade credit, hire purchase, bank loan,

overdraft, mortgage (Sahut and Peris-Ortiz, 2014) .

Internal sources – These sources of finance are generated with in the business from the

existing assets or activities. There are defined advantage and disadvantage of different types of

internal sources of fund -

Retained Earnings – It is part of internal sources of finance and defined as the profit left

after paying a dividend to the shareholders or drawings by the capital owners of Hendy group

Ltd. Advantage – There is no need to issue additional equity an there is no dilution to control

in reference to their ownership. Disadvantage – In practical way there no disadvantage regrading to generate retained

earnings.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sales of fixed assets – When company needs to funds that time sale out old assets to

generate fund from their internal sources. The company Hendy group Ltd has been sale out their

old assets which can not use for office work. Advantages – It can work as a short term and long term finance which is related to sale of

fixed assets. After regularly of screen of fixed assets identify in books which are no

longer use should be sold out as early as happens.

Disadvantages – When the assets are sold before use properly their useful life and it can

lose their services.

External Sources – It can apply in an organisation to arrange of capital and funds from

different sources which is related to outside of business.

Bank Loan – It is the most common form which is applied by every organisation in

effective manner. In reference to Hendy group Ltd contact to bank and set particular time period

regarding to repayment of loan and rate of interest. Advantage – They would provide loan on time if the their business plan according to their

rules and regulation. Bank understand strategy regarding to business and satisfy that in

future company has been paid their loans on time. Disadvantage – the business would pay back require hight rate of interest and if business

does not have sufficient amount to pay back bank loan that time they can sale out their

properties and take their amount (Popovič and et.al, 2018).

Hire Purchase – It is a system where business have to paid set amount in instalments to

use particular assets. In the context of Hendy group Ltd has been used to particular source to

increase their profitability. Advantage – With the help of this source business can pay in instalment to that person

who give assets to company. It can help to increase net worth and able to continue using

to pay for particular product.

Disadvantage - The company has paid amount in monthly basis which can use one item.

Some times it can not provide worth so instead of purchase new assets which is cheaper

rather than to hire for Hendy group Ltd.

P5 Interpret the contents of a trading and profit and loss account and balance sheet

Financial statements are reports which is prepared by finance department of the company

to present financial performance in effective manner in front of top management. In financial

5

generate fund from their internal sources. The company Hendy group Ltd has been sale out their

old assets which can not use for office work. Advantages – It can work as a short term and long term finance which is related to sale of

fixed assets. After regularly of screen of fixed assets identify in books which are no

longer use should be sold out as early as happens.

Disadvantages – When the assets are sold before use properly their useful life and it can

lose their services.

External Sources – It can apply in an organisation to arrange of capital and funds from

different sources which is related to outside of business.

Bank Loan – It is the most common form which is applied by every organisation in

effective manner. In reference to Hendy group Ltd contact to bank and set particular time period

regarding to repayment of loan and rate of interest. Advantage – They would provide loan on time if the their business plan according to their

rules and regulation. Bank understand strategy regarding to business and satisfy that in

future company has been paid their loans on time. Disadvantage – the business would pay back require hight rate of interest and if business

does not have sufficient amount to pay back bank loan that time they can sale out their

properties and take their amount (Popovič and et.al, 2018).

Hire Purchase – It is a system where business have to paid set amount in instalments to

use particular assets. In the context of Hendy group Ltd has been used to particular source to

increase their profitability. Advantage – With the help of this source business can pay in instalment to that person

who give assets to company. It can help to increase net worth and able to continue using

to pay for particular product.

Disadvantage - The company has paid amount in monthly basis which can use one item.

Some times it can not provide worth so instead of purchase new assets which is cheaper

rather than to hire for Hendy group Ltd.

P5 Interpret the contents of a trading and profit and loss account and balance sheet

Financial statements are reports which is prepared by finance department of the company

to present financial performance in effective manner in front of top management. In financial

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

statement includes profit and loss statement, balance sheet and cash flow statement. The purpose

of financial statements to record all transactions which is related to day to day activities. It can

help to track daily routine activities and know ability of company regarding to cash and the

sources ans uses of the cash. Analysis to capability pay back their debts to identify condition of

the Hendy group Ltd. In reference to Hendy group Ltd there are defined Profit and loss statement

and balance sheet in detailed information.

The income statement is one of the important statement and kind of financial statements.

It can present how much net profit earn by company in particular accounting period. In the

statement record all expenses and income after than from income less amount of expenses

remaining amount known as net profit (Bajomi-Lázár,2014) . The purpose of prepare income

statement to provide all detailed information to management of Hendy group Ltd and they will

take appropriate information as per situation. The main purpose to provide accurate financial

information in reference to financial earning performance.

Sales – In 2017 company has been sold out about 550000 nu t in 2018 it increased by

50000. It is beneficial for company because every company wants to more sales to

generate profit.

Cost of Sales – There are comparing cost of sales of 2018 with 2017 so it is getting that

in 2017 it was 125000 and in 2018 it was 220000. It means it is increasing by 95000.

Gross profit – Due to increase of cost of sales decrease amount of gross profit so it is

identified that it was decreasing as compare to 2017. In 2017 amount of gross profit

425000 but in 2018 it was 380000. Gross profit beneficial and show performance of the

company in effective manner.

Net Profit – It can present financial performance of the company and in 2017 company

generate 264000 in 2017 but in 2018 it came down, earn 184000 due to increase of cost

of sales. Through net profit calculate financial situation of company and on the basis

taken investing decision so it is very important for each company.

The balance sheet is a part of financial statement which contains assets and liabilities of

company and also shareholders equity in reference to Hendy group Ltd in particular time period.

It can provide a basis of computing rates of return and analysing of capital structure. It is based

on the fundamental equation which is Assets = Liabilities + equity. It is important to prepare for

6

of financial statements to record all transactions which is related to day to day activities. It can

help to track daily routine activities and know ability of company regarding to cash and the

sources ans uses of the cash. Analysis to capability pay back their debts to identify condition of

the Hendy group Ltd. In reference to Hendy group Ltd there are defined Profit and loss statement

and balance sheet in detailed information.

The income statement is one of the important statement and kind of financial statements.

It can present how much net profit earn by company in particular accounting period. In the

statement record all expenses and income after than from income less amount of expenses

remaining amount known as net profit (Bajomi-Lázár,2014) . The purpose of prepare income

statement to provide all detailed information to management of Hendy group Ltd and they will

take appropriate information as per situation. The main purpose to provide accurate financial

information in reference to financial earning performance.

Sales – In 2017 company has been sold out about 550000 nu t in 2018 it increased by

50000. It is beneficial for company because every company wants to more sales to

generate profit.

Cost of Sales – There are comparing cost of sales of 2018 with 2017 so it is getting that

in 2017 it was 125000 and in 2018 it was 220000. It means it is increasing by 95000.

Gross profit – Due to increase of cost of sales decrease amount of gross profit so it is

identified that it was decreasing as compare to 2017. In 2017 amount of gross profit

425000 but in 2018 it was 380000. Gross profit beneficial and show performance of the

company in effective manner.

Net Profit – It can present financial performance of the company and in 2017 company

generate 264000 in 2017 but in 2018 it came down, earn 184000 due to increase of cost

of sales. Through net profit calculate financial situation of company and on the basis

taken investing decision so it is very important for each company.

The balance sheet is a part of financial statement which contains assets and liabilities of

company and also shareholders equity in reference to Hendy group Ltd in particular time period.

It can provide a basis of computing rates of return and analysing of capital structure. It is based

on the fundamental equation which is Assets = Liabilities + equity. It is important to prepare for

6

every organisation because it can present actual situation of a company and purpose of prepare to

arrange all liabilities and assets in effective manner (Harris, Gibson and McDowell, 2014) .

Assets (include tangible and intangible assests) – It also known as fixed assets where

including tangible and non tangible assets. The amount of tangible assets 15000 (office

equipment) and intangible assets 7000. If company have much more assets and can not

utilised in any work so it is not good and work as wastage. But company can utilise all

types assets so it will present good presentation.

Current assets – In the Hendy group Ltd includes current assets cash in bank, debtors ans

stock respectively 300000, 15000 and 50000. Much more current assets reason of

liquidity and these are convert less than 12 months so company have limited current

assets and manage liquidity.

Liabilities – There are including current liabilities and long term liabilities.

Current liabilities – In this section of the company Hendy group Ltd includes short term

creditors (60000) and directors loan (80000).

Long term liabilities – In the balance sheet of the company include long term creditors

which was 43000.

Net assets – From assets less current liabilities and long term liabilities remain balance of

net assets which was 183000.

Owner's equity (Share capital) – The company have about 2000 share capital.

P6 Use of budgets as a means of exercising financial control

In every organisation need to planning and control which can help to gain much more

profitability in future. To conduct any task need to proper planning than controlling of different

activities of the business. In reference to Hendy group Ltd has applied two methods which can

help to control financial activities these are -

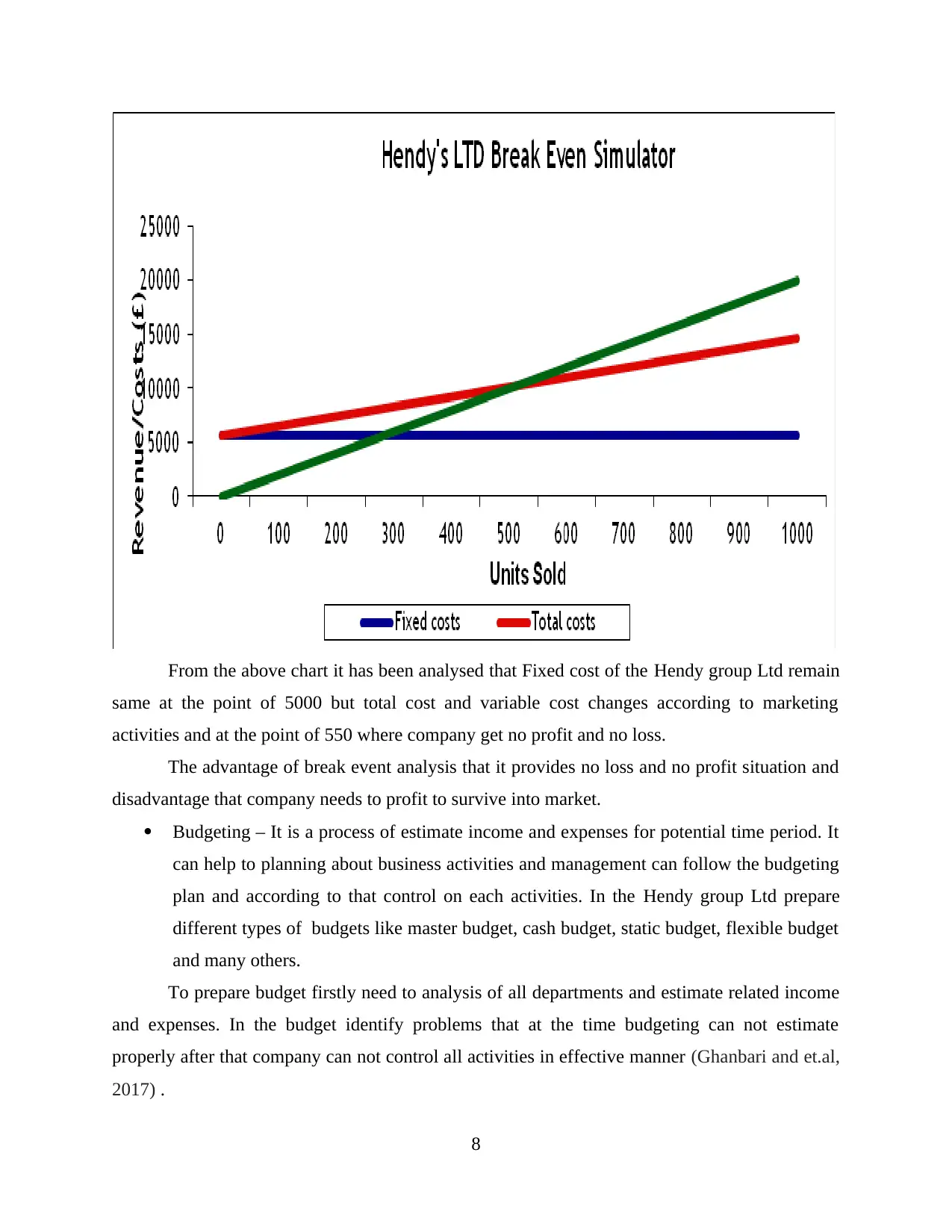

Break even Analysis – It is a financial tool which can provide accurate situation and

level regarding to their products and services. Break even analysis provide that particular

point where company get no profit and no loss (Patton, 2014) .

7

arrange all liabilities and assets in effective manner (Harris, Gibson and McDowell, 2014) .

Assets (include tangible and intangible assests) – It also known as fixed assets where

including tangible and non tangible assets. The amount of tangible assets 15000 (office

equipment) and intangible assets 7000. If company have much more assets and can not

utilised in any work so it is not good and work as wastage. But company can utilise all

types assets so it will present good presentation.

Current assets – In the Hendy group Ltd includes current assets cash in bank, debtors ans

stock respectively 300000, 15000 and 50000. Much more current assets reason of

liquidity and these are convert less than 12 months so company have limited current

assets and manage liquidity.

Liabilities – There are including current liabilities and long term liabilities.

Current liabilities – In this section of the company Hendy group Ltd includes short term

creditors (60000) and directors loan (80000).

Long term liabilities – In the balance sheet of the company include long term creditors

which was 43000.

Net assets – From assets less current liabilities and long term liabilities remain balance of

net assets which was 183000.

Owner's equity (Share capital) – The company have about 2000 share capital.

P6 Use of budgets as a means of exercising financial control

In every organisation need to planning and control which can help to gain much more

profitability in future. To conduct any task need to proper planning than controlling of different

activities of the business. In reference to Hendy group Ltd has applied two methods which can

help to control financial activities these are -

Break even Analysis – It is a financial tool which can provide accurate situation and

level regarding to their products and services. Break even analysis provide that particular

point where company get no profit and no loss (Patton, 2014) .

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

From the above chart it has been analysed that Fixed cost of the Hendy group Ltd remain

same at the point of 5000 but total cost and variable cost changes according to marketing

activities and at the point of 550 where company get no profit and no loss.

The advantage of break event analysis that it provides no loss and no profit situation and

disadvantage that company needs to profit to survive into market.

Budgeting – It is a process of estimate income and expenses for potential time period. It

can help to planning about business activities and management can follow the budgeting

plan and according to that control on each activities. In the Hendy group Ltd prepare

different types of budgets like master budget, cash budget, static budget, flexible budget

and many others.

To prepare budget firstly need to analysis of all departments and estimate related income

and expenses. In the budget identify problems that at the time budgeting can not estimate

properly after that company can not control all activities in effective manner (Ghanbari and et.al,

2017) .

8

same at the point of 5000 but total cost and variable cost changes according to marketing

activities and at the point of 550 where company get no profit and no loss.

The advantage of break event analysis that it provides no loss and no profit situation and

disadvantage that company needs to profit to survive into market.

Budgeting – It is a process of estimate income and expenses for potential time period. It

can help to planning about business activities and management can follow the budgeting

plan and according to that control on each activities. In the Hendy group Ltd prepare

different types of budgets like master budget, cash budget, static budget, flexible budget

and many others.

To prepare budget firstly need to analysis of all departments and estimate related income

and expenses. In the budget identify problems that at the time budgeting can not estimate

properly after that company can not control all activities in effective manner (Ghanbari and et.al,

2017) .

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

P7 Financial state of a given business

The financial accounting ratios compare of two year ratio to present financial situation of

the particular company. With the help of these ratio analysis the performance and compare with

last year activities. It is important for Hendy group Ltd because company get all accurate

financial information in appropriate manner. These financial ratios are divided into these

categories -

Profitability Ratios – These ratios are a class of financial metrics where investors and

analyst can measure and analysis the ability of company. It can define how much company

generate profit which is related to operating costs, shareholders equity and balance sheet assets in

the accounting period. There are considering different types of ratios which are -

Gross Profit margin – It can present Net sales and gross profit of the company in effective

manner. Gross profit margin = Gross profit/Net sales*100

Net profit margin – The formula of net profit margin = Net profit/net sales*100

The particular ratio important for Hendy group Ltd because it can provide profitability of

company and know performance to present in front of investors, creditors and others. So it is

important to know ability.

Liquidity ratios – This ratio present liquidity in the organisation ad ability to pay back of

debt. Liquidity ratio an show how much cash in hand of the Hendy group Ltd.

Current ratio – The particular ratio can based on the current assets and current liabilities.

The particular formula to present current ratio – Current assets/current liabilities

Quick ratio – This ratio based on the quick assets and current liabilities. Here in preset

formula to calculate quick ratio = Quick assets/Current liabilities.

With the help of particular ratio analysis of liquidity of Hendy group Ltd because to pay off

short term loan need to cash. If company have much more liquidity so it will manage and reduce

it.

Performance Ratio = The particular ratio can present performance of the company on

the basis of stock turn over and debtors turn over basis (Dudin and et.al, 2015).

Inventory turn over – It is calculated to know in how many time period Inventory survive

by company in effective manner.

Debtors days – Here define about to collection time period regarding to debtors.

9

The financial accounting ratios compare of two year ratio to present financial situation of

the particular company. With the help of these ratio analysis the performance and compare with

last year activities. It is important for Hendy group Ltd because company get all accurate

financial information in appropriate manner. These financial ratios are divided into these

categories -

Profitability Ratios – These ratios are a class of financial metrics where investors and

analyst can measure and analysis the ability of company. It can define how much company

generate profit which is related to operating costs, shareholders equity and balance sheet assets in

the accounting period. There are considering different types of ratios which are -

Gross Profit margin – It can present Net sales and gross profit of the company in effective

manner. Gross profit margin = Gross profit/Net sales*100

Net profit margin – The formula of net profit margin = Net profit/net sales*100

The particular ratio important for Hendy group Ltd because it can provide profitability of

company and know performance to present in front of investors, creditors and others. So it is

important to know ability.

Liquidity ratios – This ratio present liquidity in the organisation ad ability to pay back of

debt. Liquidity ratio an show how much cash in hand of the Hendy group Ltd.

Current ratio – The particular ratio can based on the current assets and current liabilities.

The particular formula to present current ratio – Current assets/current liabilities

Quick ratio – This ratio based on the quick assets and current liabilities. Here in preset

formula to calculate quick ratio = Quick assets/Current liabilities.

With the help of particular ratio analysis of liquidity of Hendy group Ltd because to pay off

short term loan need to cash. If company have much more liquidity so it will manage and reduce

it.

Performance Ratio = The particular ratio can present performance of the company on

the basis of stock turn over and debtors turn over basis (Dudin and et.al, 2015).

Inventory turn over – It is calculated to know in how many time period Inventory survive

by company in effective manner.

Debtors days – Here define about to collection time period regarding to debtors.

9

The particular ratio are presented performance and help to decision making process of

management. Through these ratio know debtors turn over as well as inventory turn over and

analysis days to recover.

CONCLUSION

As per the above report it has been concluded that in every business need different types

of resources which can help to conduct different business activities in effective manner. There

are technology resources and physical resources both the important for an organisation. To

evaluate the financial performance of the company prepare financial statement and understand

financial ratios.

10

management. Through these ratio know debtors turn over as well as inventory turn over and

analysis days to recover.

CONCLUSION

As per the above report it has been concluded that in every business need different types

of resources which can help to conduct different business activities in effective manner. There

are technology resources and physical resources both the important for an organisation. To

evaluate the financial performance of the company prepare financial statement and understand

financial ratios.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.