Capital Asset Pricing Model: Assumptions, Limitations, and Use

VerifiedAdded on 2023/06/05

|9

|2680

|211

Report

AI Summary

This report provides a detailed analysis of the Capital Asset Pricing Model (CAPM), a widely used financial tool for pricing securities with higher risk. It explores the model's core principles, including its formula for calculating expected return based on risk-free rate, beta, and market return. The report highlights the key assumptions underlying the CAPM, such as perfect markets, risk-averse investors, and efficient information access, while also acknowledging their unrealistic nature. It delves into the limitations of the CAPM, including the presence of transaction costs, varying market participants, and the challenges in accurately measuring beta. Despite these limitations, the report explains why the CAPM remains popular in the industry, citing its simplicity, consideration of systematic risk, and theoretical connection between risk and return. The report also touches upon alternative models like the Fama-French three-factor model and concludes by acknowledging the CAPM's enduring influence on modern finance.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

[Type the document subtitle]

LAPTOP_MP016

LAPTOP_MP016

INTRODUCTION

CAPM is a widely used term in the financial accounts and businesses across the world. CAPM

stands for Capital Asset Pricing Model and it first came into light by Harry Markowitz in the

year 1952. It was then in the upcoming years used by many investors and economists who

used them to explain a lot of different things (Accaglobal.com, 2014). It was also used by a

well-known person William Sharpe. It is a model which is used when the pricing of securities

which have a higher risk are to be explained. CAPM helps in describing a relation between

the risk which an investor has to bear in accordance with the expected rate of return on the

finances invested in the business.

As per the CAPM hypothesis, the normal return of a specific security or a portfolio is

equivalent to the rate on a risk free security in addition to a hazard premium. On the off

chance that the security or portfolio does not either meet or surpass the required return, at

that point the venture ought not be gone into (Brealey, 2004).

One imperative extra to the CAPM hypothesis is that high-beta offers normally give the

most noteworthy returns. Over a more extended timeframe, however, high-beta offers have

a tendency to be the most noticeably bad entertainers amid bear markets. In this manner,

while you may get exceptional yields from high-beta offers in a given window of time, there

is no assurance that the CAPM return will be figured it out (Chong, 2014).

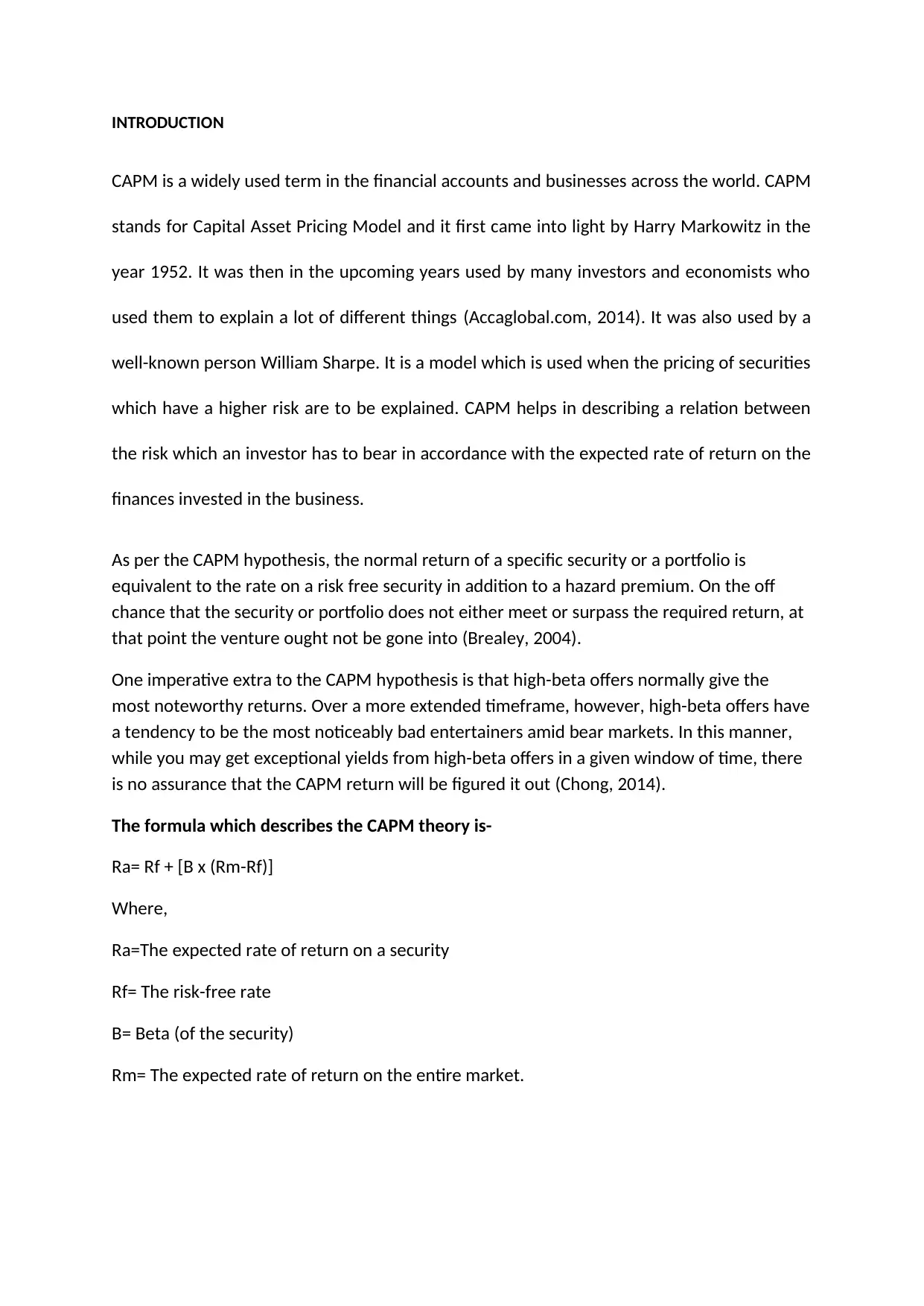

The formula which describes the CAPM theory is-

Ra= Rf + [B x (Rm-Rf)]

Where,

Ra=The expected rate of return on a security

Rf= The risk-free rate

B= Beta (of the security)

Rm= The expected rate of return on the entire market.

CAPM is a widely used term in the financial accounts and businesses across the world. CAPM

stands for Capital Asset Pricing Model and it first came into light by Harry Markowitz in the

year 1952. It was then in the upcoming years used by many investors and economists who

used them to explain a lot of different things (Accaglobal.com, 2014). It was also used by a

well-known person William Sharpe. It is a model which is used when the pricing of securities

which have a higher risk are to be explained. CAPM helps in describing a relation between

the risk which an investor has to bear in accordance with the expected rate of return on the

finances invested in the business.

As per the CAPM hypothesis, the normal return of a specific security or a portfolio is

equivalent to the rate on a risk free security in addition to a hazard premium. On the off

chance that the security or portfolio does not either meet or surpass the required return, at

that point the venture ought not be gone into (Brealey, 2004).

One imperative extra to the CAPM hypothesis is that high-beta offers normally give the

most noteworthy returns. Over a more extended timeframe, however, high-beta offers have

a tendency to be the most noticeably bad entertainers amid bear markets. In this manner,

while you may get exceptional yields from high-beta offers in a given window of time, there

is no assurance that the CAPM return will be figured it out (Chong, 2014).

The formula which describes the CAPM theory is-

Ra= Rf + [B x (Rm-Rf)]

Where,

Ra=The expected rate of return on a security

Rf= The risk-free rate

B= Beta (of the security)

Rm= The expected rate of return on the entire market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The CAPM hypothesis states that

The equation of CAPM is used in order to describe the normal profit for financial return. The

equation of the CAPM is dependent on the process that the dealers have speculations of the

systematic risk and along with that it should be devised as a risk premium. It is therefore a

measurement of market return which is much more eminent than the non-hazardous rate. While

resources are kept in the security, a high amount of profit is needed in order to take that extra risk.

Taking an example of a stock traded on New York stock exchange, let’s calculate the value of

the expected return for an investor using the CAPM method:

The present yield on a U.S. treasury is 3.5%

Average of excess historical rate is 8%

The beta value is 1.25

From the above mentioned values the rate of return using the CAPM model is as follows-

The equation of CAPM is used in order to describe the normal profit for financial return. The

equation of the CAPM is dependent on the process that the dealers have speculations of the

systematic risk and along with that it should be devised as a risk premium. It is therefore a

measurement of market return which is much more eminent than the non-hazardous rate. While

resources are kept in the security, a high amount of profit is needed in order to take that extra risk.

Taking an example of a stock traded on New York stock exchange, let’s calculate the value of

the expected return for an investor using the CAPM method:

The present yield on a U.S. treasury is 3.5%

Average of excess historical rate is 8%

The beta value is 1.25

From the above mentioned values the rate of return using the CAPM model is as follows-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Expected return = Risk Free Rate + [Beta x Excess of Market Return]

Expected return = 3.5% + [1.25 x 8%]

Expected return = 13.1%

In this report, the following things would be taken care of. As the CAPM method is used

widely in the industry even after having a number of assumptions which are too many to

base a theory, hence, in this report there would be the assumptions related to Capital Asset

Pricing Model mentioned along with the limitations for using this method. With this the area

why the industries widely used the CAPM model will be covered so as to know the reasons

behind such a large use of this model (Kothari, 2000).

Some of the assumptions on which the CAPM model is based are somewhat too unrealistic.

Even despite such unrealistic assumptions this model is one of the most frequently used

models. The model of CAPM is dependent on the assumptions which are as follows:

Markets are absolutely perfect—no exchange expenses, charges, swelling, or short

offering limitations.

All financial specialists are loath to hazard (R.F. Bruner, 2000).

Markets are exceptionally proficient. All financial specialists have level with access to

all accessible data and no one can outperform the other just because of lack of some

data.

All financial specialists can get and loan boundless sums under a hazard free rate.

Beta coefficient is the main proportion of hazard.

All benefits are completely fluid and limitlessly separated.

The measure of accessible resources is settled amid a given timeframe.

Markets are in harmony. All financial specialists are value takers, not value creators.

Return of every accessible resource is liable to ordinary conveyance work.

As the CAPM model is based on many such unrealistic assumptions, there are many

limitations through which the CAPM model suffers from as the real market in general does

not go along the way the CAPM model assumes. Some of the limitations of this model are as

follows-

There is a presence of exchange costs in the real market. The markets is also in

variation for the showcase members. One such example is that the exchange costs

had ben lessen by the financial specialists of the institutions. (Thomas R. Piper and

William E. Fruhan, 2000).

A few assessments are available on contributed capital, e.g., capital additions

expense and salary impose. Speculators endeavor to boost their financial utility by

thinking about the impact of tax collection. Such conduct lessens the proficiency of

speculations and influences the estimating of benefits.

Expected return = 3.5% + [1.25 x 8%]

Expected return = 13.1%

In this report, the following things would be taken care of. As the CAPM method is used

widely in the industry even after having a number of assumptions which are too many to

base a theory, hence, in this report there would be the assumptions related to Capital Asset

Pricing Model mentioned along with the limitations for using this method. With this the area

why the industries widely used the CAPM model will be covered so as to know the reasons

behind such a large use of this model (Kothari, 2000).

Some of the assumptions on which the CAPM model is based are somewhat too unrealistic.

Even despite such unrealistic assumptions this model is one of the most frequently used

models. The model of CAPM is dependent on the assumptions which are as follows:

Markets are absolutely perfect—no exchange expenses, charges, swelling, or short

offering limitations.

All financial specialists are loath to hazard (R.F. Bruner, 2000).

Markets are exceptionally proficient. All financial specialists have level with access to

all accessible data and no one can outperform the other just because of lack of some

data.

All financial specialists can get and loan boundless sums under a hazard free rate.

Beta coefficient is the main proportion of hazard.

All benefits are completely fluid and limitlessly separated.

The measure of accessible resources is settled amid a given timeframe.

Markets are in harmony. All financial specialists are value takers, not value creators.

Return of every accessible resource is liable to ordinary conveyance work.

As the CAPM model is based on many such unrealistic assumptions, there are many

limitations through which the CAPM model suffers from as the real market in general does

not go along the way the CAPM model assumes. Some of the limitations of this model are as

follows-

There is a presence of exchange costs in the real market. The markets is also in

variation for the showcase members. One such example is that the exchange costs

had ben lessen by the financial specialists of the institutions. (Thomas R. Piper and

William E. Fruhan, 2000).

A few assessments are available on contributed capital, e.g., capital additions

expense and salary impose. Speculators endeavor to boost their financial utility by

thinking about the impact of tax collection. Such conduct lessens the proficiency of

speculations and influences the estimating of benefits.

Genuine markets are not constantly effective, so speculators don't have

homogeneous desires.

No benefit is free of hazard. Indeed, even T-bills are presented to swelling hazard,

liquidity hazard, and reinvestment chance (A, 2007).

Speculators have distinctive capacities in order to acquire a rate that will be free

from hazard. The cost of financing is much less when they are been compared with

private financial specialists for the institutional speculators.

In case of The beta coefficient isn't the main hazard estimation in CAPM on the

grounds that it just mirrors the proportion between a given security's arrival

instability and market return unpredictability.

Experimental examinations have demonstrated that the arrival of a security doesn't

take after any typical appropriation work.

Securities exchange harmony is one CAPM display fundamental suspicion, which implies

that the normal rate of return is equivalent to the required rate of return, and the present

cost of a given security is equivalent to its inherent esteem. In the event, that the stock

exchange is in balance, no securities are underestimated or exaggerated. The genuine

securities exchange, be that as it may, isn't in balance, so both underestimated and

exaggerated stocks are available, and their normal return is not quite the same as the CAPM

evaluation.

If the organizations are still using the CAPM method despite of it having so many issues,

there has to exist a number of advantages for using such a method. The advantages of

CAPM method over other methods explains it’d success over other methods for past 40

years and they are as follows-

Orderly hazard are been though which shows reality where most the specialists

have broaden portfolios from where the hazard which is not systematic is been

mopped out.

It is hypothetically deduced connection among the hazard which is methodical and

the required return which is responsible to visit testing and research

It is one of the most improved technique in order to ascertain the expanse of value

than the dividend growth model which considers a level of organization of hazard

which is in respect to the share trading system.

The weighted average cost of capital is not good compared to it while giving rates of

rebate for using examination for speculation.

The capital resource valuing model of utilizing the model gives about the market estimating

of securities and desire return rate assurance of contemplations; it can likewise be broadly

homogeneous desires.

No benefit is free of hazard. Indeed, even T-bills are presented to swelling hazard,

liquidity hazard, and reinvestment chance (A, 2007).

Speculators have distinctive capacities in order to acquire a rate that will be free

from hazard. The cost of financing is much less when they are been compared with

private financial specialists for the institutional speculators.

In case of The beta coefficient isn't the main hazard estimation in CAPM on the

grounds that it just mirrors the proportion between a given security's arrival

instability and market return unpredictability.

Experimental examinations have demonstrated that the arrival of a security doesn't

take after any typical appropriation work.

Securities exchange harmony is one CAPM display fundamental suspicion, which implies

that the normal rate of return is equivalent to the required rate of return, and the present

cost of a given security is equivalent to its inherent esteem. In the event, that the stock

exchange is in balance, no securities are underestimated or exaggerated. The genuine

securities exchange, be that as it may, isn't in balance, so both underestimated and

exaggerated stocks are available, and their normal return is not quite the same as the CAPM

evaluation.

If the organizations are still using the CAPM method despite of it having so many issues,

there has to exist a number of advantages for using such a method. The advantages of

CAPM method over other methods explains it’d success over other methods for past 40

years and they are as follows-

Orderly hazard are been though which shows reality where most the specialists

have broaden portfolios from where the hazard which is not systematic is been

mopped out.

It is hypothetically deduced connection among the hazard which is methodical and

the required return which is responsible to visit testing and research

It is one of the most improved technique in order to ascertain the expanse of value

than the dividend growth model which considers a level of organization of hazard

which is in respect to the share trading system.

The weighted average cost of capital is not good compared to it while giving rates of

rebate for using examination for speculation.

The capital resource valuing model of utilizing the model gives about the market estimating

of securities and desire return rate assurance of contemplations; it can likewise be broadly

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

utilized in the venture administration and corporate fund. Its numerous utilizations make it

prominent among speculation specialists (Dickie, 2006).

1. Utilized for risk venture choice.

A figured hazard balanced rate of capital resource valuing model furnishes with the portfolio

hypothesis a solitary securities chance estimation list to enable financial specialists to expect

a solitary resource non-diversifiable hazard. The model is utilized for chance speculation

venture choice; the most generally utilized strategy is the hazard balanced markdown rate

technique. The fundamental thought of this strategy is for high-hazard ventures; utilize a

higher rebate rate to compute the net present esteem, at that point the choices as indicated

by the tenets of net present esteem technique (Pratt, 2010).

2. Utilized for portfolio choices in the capital resource estimating model is gotten from the

portfolio hypothesis, and thus for portfolio choices. For each level of expected return, we

can settle for the portfolio blend of benefits that has the most minimal hazard. Or then

again for each level of hazard, we can comprehend for the mix of benefits that has the most

astounding expected return. The effective wilderness comprises of the accumulation of

these ideal portfolios, and every financial specialist can pick which of these best matches

their hazard resilience.

CAPM is a fundamental commitment to our comprehension of the basic factor of benefit

costs. Also, the model is connected across the board in down to earth investigate and turn

into a critical reason for basic leadership in various regions. CAPM will never kick the bucket.

The CAPM is viewed as the foundation of current value hypothesis in monetary markets.

Also, it will assist numerous people with getting motivation from CAPM to advance the

cutting edge value hypothesis and make a more productive capital markets.

Of the most important reasons for widely use of CAPM model is the simplicity it has. Fama

and French declared the “ the CAPM is pointless for accurately what it was produced to do”

in the year 1992. A lot of paper have been made by Eugene Fama and Kenneth French

attempting to find an option to the model of CAPM. According to the paper of 2004 , one of

the difficulty with the CAPM is that it construct usually market portfolio hypothesis. The way

on how the CAPM is dependent on various suspicions which are not probable ought to not

erase from the relevance of the model. In the year 1993, the three factor model made by

Fama and French expresses an option with contrast to the CAPM. The model of fama and

French made used three factors without using one used in the CAPM in order to depit the

stock returns. The model states that the beta is not the alone factor which used the normal

return of a stock. The book to showcase and market capitalization were applicable in order

to decide the stock returns. It was contended that the proof of Fama and French is

dependent on the information which is influenced by the predisposition of the survivorship.

prominent among speculation specialists (Dickie, 2006).

1. Utilized for risk venture choice.

A figured hazard balanced rate of capital resource valuing model furnishes with the portfolio

hypothesis a solitary securities chance estimation list to enable financial specialists to expect

a solitary resource non-diversifiable hazard. The model is utilized for chance speculation

venture choice; the most generally utilized strategy is the hazard balanced markdown rate

technique. The fundamental thought of this strategy is for high-hazard ventures; utilize a

higher rebate rate to compute the net present esteem, at that point the choices as indicated

by the tenets of net present esteem technique (Pratt, 2010).

2. Utilized for portfolio choices in the capital resource estimating model is gotten from the

portfolio hypothesis, and thus for portfolio choices. For each level of expected return, we

can settle for the portfolio blend of benefits that has the most minimal hazard. Or then

again for each level of hazard, we can comprehend for the mix of benefits that has the most

astounding expected return. The effective wilderness comprises of the accumulation of

these ideal portfolios, and every financial specialist can pick which of these best matches

their hazard resilience.

CAPM is a fundamental commitment to our comprehension of the basic factor of benefit

costs. Also, the model is connected across the board in down to earth investigate and turn

into a critical reason for basic leadership in various regions. CAPM will never kick the bucket.

The CAPM is viewed as the foundation of current value hypothesis in monetary markets.

Also, it will assist numerous people with getting motivation from CAPM to advance the

cutting edge value hypothesis and make a more productive capital markets.

Of the most important reasons for widely use of CAPM model is the simplicity it has. Fama

and French declared the “ the CAPM is pointless for accurately what it was produced to do”

in the year 1992. A lot of paper have been made by Eugene Fama and Kenneth French

attempting to find an option to the model of CAPM. According to the paper of 2004 , one of

the difficulty with the CAPM is that it construct usually market portfolio hypothesis. The way

on how the CAPM is dependent on various suspicions which are not probable ought to not

erase from the relevance of the model. In the year 1993, the three factor model made by

Fama and French expresses an option with contrast to the CAPM. The model of fama and

French made used three factors without using one used in the CAPM in order to depit the

stock returns. The model states that the beta is not the alone factor which used the normal

return of a stock. The book to showcase and market capitalization were applicable in order

to decide the stock returns. It was contended that the proof of Fama and French is

dependent on the information which is influenced by the predisposition of the survivorship.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

What is without a doubt, anyway wasteful the CAPM may seem, by all accounts, to be, is

that the CAPM is as yet an extremely prevalent strategy for foreseeing expected returns.

Harvey and Graham (2001) appear in their paper (Kurschner, 2008) 'The hypothesis and

routine with regards to corporate back: prove from the field' that the Capital asset pricing

model is been utilized. According to the examination seventy three percent and according to

the investigation made by Brute et. al(1998), it can be concluded that the capital asset

pricing model and the adjusted capital asset pricing model had been utilized by eighty five

percent of the best hone firms. It have been clarified by The Harvard Business Review that

there is a presence of lot of commentators in the CAPM and also strikingly portrays the

appearance towards the capital asset pricing model which was usually a new model. The

basic concerns of the HBR includes that the beta qualities are responsible after some time

after the capital structure of the concerned firm changes although the beta qualities are

established from the registered information. Secondly a huge number of evaluations are

responsible for mistake. By applying the capital asset pricing model the HBR draws upon the

“pragmatic and hypothetical issues” which it accepts exists in “any money related related

market show”. It has been prescribed by the HBR that the CAPM be used is relevant to the

models which are related to money estimating the expense. Like for example the model

related to profit growth and the weighted average cost of capital and can be concluded that

the CAPM can be used for evaluating the expense of value.

Conclusion

In order to conclude it can be stated that the model CAPM is a very important equipment in order to

measure the expected returns. It is also important for calculating the expense of value although the

different suppositions and inspections have covered the believability in the questions. The defects

lies in the structures which is hypothetical and also no presence of relevance. An impression is

created such that the perfect market that has been acquired from Markovitz,s shows that the

portfolio hypothesis allows the Capital market pricing model to go down concerning the common

sense. It also takes in lots of reactions. It is not that easy to accept that there is no presence of

exchange expenses in the cutting edge.

that the CAPM is as yet an extremely prevalent strategy for foreseeing expected returns.

Harvey and Graham (2001) appear in their paper (Kurschner, 2008) 'The hypothesis and

routine with regards to corporate back: prove from the field' that the Capital asset pricing

model is been utilized. According to the examination seventy three percent and according to

the investigation made by Brute et. al(1998), it can be concluded that the capital asset

pricing model and the adjusted capital asset pricing model had been utilized by eighty five

percent of the best hone firms. It have been clarified by The Harvard Business Review that

there is a presence of lot of commentators in the CAPM and also strikingly portrays the

appearance towards the capital asset pricing model which was usually a new model. The

basic concerns of the HBR includes that the beta qualities are responsible after some time

after the capital structure of the concerned firm changes although the beta qualities are

established from the registered information. Secondly a huge number of evaluations are

responsible for mistake. By applying the capital asset pricing model the HBR draws upon the

“pragmatic and hypothetical issues” which it accepts exists in “any money related related

market show”. It has been prescribed by the HBR that the CAPM be used is relevant to the

models which are related to money estimating the expense. Like for example the model

related to profit growth and the weighted average cost of capital and can be concluded that

the CAPM can be used for evaluating the expense of value.

Conclusion

In order to conclude it can be stated that the model CAPM is a very important equipment in order to

measure the expected returns. It is also important for calculating the expense of value although the

different suppositions and inspections have covered the believability in the questions. The defects

lies in the structures which is hypothetical and also no presence of relevance. An impression is

created such that the perfect market that has been acquired from Markovitz,s shows that the

portfolio hypothesis allows the Capital market pricing model to go down concerning the common

sense. It also takes in lots of reactions. It is not that easy to accept that there is no presence of

exchange expenses in the cutting edge.

Reference list

A, W.D.a.H., 2007. Corporate Finance: Principles and Practice. FT: Prentice Hall.

Accaglobal.com, 2014. CAPM: theory, advantages, and disadvantages. [Online] Available at:

http://www.accaglobal.com/uk/en/student/acca-qual-student-journey/qual-resource/acca-

qualification/f9/technical-articles/CAPM-theory.html [Accessed 20 September 2018].

Brealey, R..M.S.a.M.A., 2004. Fundamentals of corporate finance.. Boston: McGraw-Hill Irwin.

Chong, J..J.Y.a.P.G., 2014. The Entrepreneur's Cost of Capital: Incorporating Downside Risk. Business

Valuation Review, , pp.81-99.

Dickie, R., 2006. Financial Statement Analysis and Business Valuation. New York: Wiley Publications.

Francis, J.a.K.D., 2013. Modern portfolio theory. Hoboken.: Wiley Publications.

Kothari, S..S.J.a.S.R., 2000. Another Look at the Cross-Section of Expected Stock Returns.. The

Journal of Finance, 50(1), p.185.

Kurschner, M., 2008. Limitations of the Capital Asset Pricing Model (CAPM). London: Springer

Publications.

Pratt, S., 2010. Cost of Capital: Applications and Examples. London: Springer Publications.

R.F. Bruner, K.M.E.R.H.R.C.H., 2000. Best practices in estimating the cost of capital: survey and

synthesis. Financial Management, , 27(1), pp.13-28.

Thomas R. Piper and William E. Fruhan, J., 2000. Is Your Stock Worth Its Market Price. HBR , p.124.

Van, N., 2013. Finance: A Quantitative Introduction. London: Wiley Publications.

A, W.D.a.H., 2007. Corporate Finance: Principles and Practice. FT: Prentice Hall.

Accaglobal.com, 2014. CAPM: theory, advantages, and disadvantages. [Online] Available at:

http://www.accaglobal.com/uk/en/student/acca-qual-student-journey/qual-resource/acca-

qualification/f9/technical-articles/CAPM-theory.html [Accessed 20 September 2018].

Brealey, R..M.S.a.M.A., 2004. Fundamentals of corporate finance.. Boston: McGraw-Hill Irwin.

Chong, J..J.Y.a.P.G., 2014. The Entrepreneur's Cost of Capital: Incorporating Downside Risk. Business

Valuation Review, , pp.81-99.

Dickie, R., 2006. Financial Statement Analysis and Business Valuation. New York: Wiley Publications.

Francis, J.a.K.D., 2013. Modern portfolio theory. Hoboken.: Wiley Publications.

Kothari, S..S.J.a.S.R., 2000. Another Look at the Cross-Section of Expected Stock Returns.. The

Journal of Finance, 50(1), p.185.

Kurschner, M., 2008. Limitations of the Capital Asset Pricing Model (CAPM). London: Springer

Publications.

Pratt, S., 2010. Cost of Capital: Applications and Examples. London: Springer Publications.

R.F. Bruner, K.M.E.R.H.R.C.H., 2000. Best practices in estimating the cost of capital: survey and

synthesis. Financial Management, , 27(1), pp.13-28.

Thomas R. Piper and William E. Fruhan, J., 2000. Is Your Stock Worth Its Market Price. HBR , p.124.

Van, N., 2013. Finance: A Quantitative Introduction. London: Wiley Publications.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.