Comparing Business Structures: Partnership, Company, and Family Trust

VerifiedAdded on 2023/01/10

|6

|1036

|34

Report

AI Summary

This report provides a comparative analysis of three key business structures: partnerships, companies, and family trusts. It begins by examining the advantages and disadvantages of partnerships, including ease of setup, shared skill sets, and unlimited liability, along with the tax implications. Next, the report discusses companies, highlighting limited liability and tax rates, while also acknowledging the complexities of operation and taxation of shareholder distributions. Finally, it delves into family trusts, outlining the tax benefits related to capital gains and asset protection, but also the potential drawbacks such as beneficiary uncertainty and high tax rates. The report also includes references to relevant case law and academic sources to support its analysis. This analysis is crucial for business owners to make informed decisions about the most suitable structure for their needs.

Case law

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Section C....................................................................................................................................3

(a) Partnership........................................................................................................................3

(b) Company...........................................................................................................................4

(c) Family Trust......................................................................................................................4

REFERENCES...........................................................................................................................6

Section C....................................................................................................................................3

(a) Partnership........................................................................................................................3

(b) Company...........................................................................................................................4

(c) Family Trust......................................................................................................................4

REFERENCES...........................................................................................................................6

Section C

(a) Partnership

The partnership can be between husband and wife as per TR 94/8. In case Betty

switches from sole trader to partnership entities then there are certain advantages and

disadvantages she is having to face which are stated below (Grob, 2017).

Advantages:

Entering into partnership is very cheap and requires less paper work and few start up

cost in respect to the general partnership as compared to other forms of business

organizations.

Opportunity for getting wide range of skill sets which is one of the advantages of it as

each partner will bring in different skill sets in the business which will enhance the

opportunity to create more capital and resources.

Partnership firm is simpler to operate as compared to sole trader structure, is there is

no reporting obligation as the work is carried out is completely up to partners

themselves. No tax on the personal income of partners.

Disadvantages:

Under general partnership, each partner will be having a unlimited liability which

means that in case of any problem, the personal belongings of the partners can be

accessed.

The profits of the partnership are distributed among the partners as the agreement,

which means that the no one partner will receive full amount (I. R. Commrs v.

Williamson (1928) 14 T.C. 335).

In case, any of the partner fails to pay his or her share, then it is the obligation of

other partners to jointly make the payment.

Under partnership, the business may not be able to take the benefit of government

grants and other tax concessions such as early stage investor concessions.

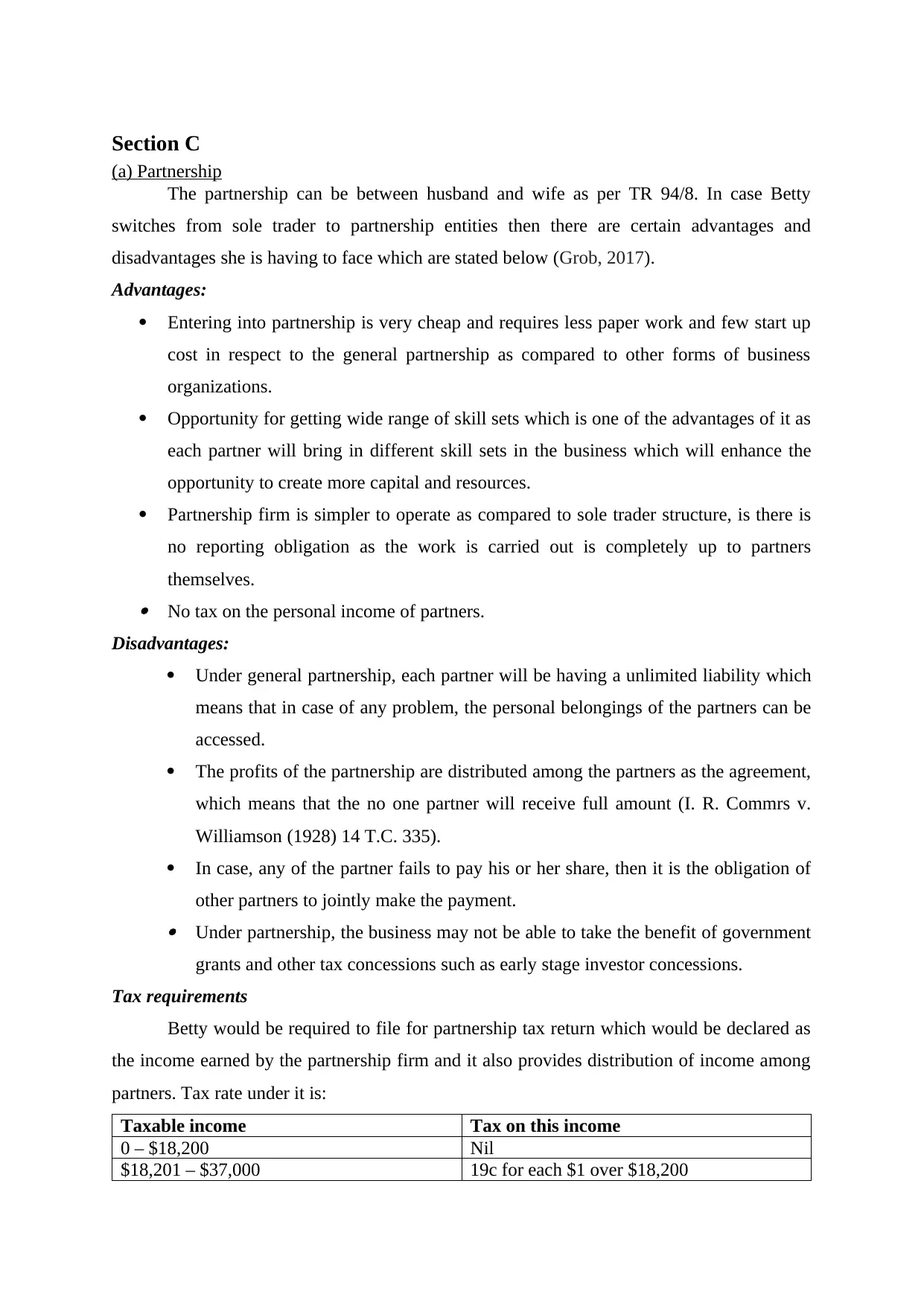

Tax requirements

Betty would be required to file for partnership tax return which would be declared as

the income earned by the partnership firm and it also provides distribution of income among

partners. Tax rate under it is:

Taxable income Tax on this income

0 – $18,200 Nil

$18,201 – $37,000 19c for each $1 over $18,200

(a) Partnership

The partnership can be between husband and wife as per TR 94/8. In case Betty

switches from sole trader to partnership entities then there are certain advantages and

disadvantages she is having to face which are stated below (Grob, 2017).

Advantages:

Entering into partnership is very cheap and requires less paper work and few start up

cost in respect to the general partnership as compared to other forms of business

organizations.

Opportunity for getting wide range of skill sets which is one of the advantages of it as

each partner will bring in different skill sets in the business which will enhance the

opportunity to create more capital and resources.

Partnership firm is simpler to operate as compared to sole trader structure, is there is

no reporting obligation as the work is carried out is completely up to partners

themselves. No tax on the personal income of partners.

Disadvantages:

Under general partnership, each partner will be having a unlimited liability which

means that in case of any problem, the personal belongings of the partners can be

accessed.

The profits of the partnership are distributed among the partners as the agreement,

which means that the no one partner will receive full amount (I. R. Commrs v.

Williamson (1928) 14 T.C. 335).

In case, any of the partner fails to pay his or her share, then it is the obligation of

other partners to jointly make the payment.

Under partnership, the business may not be able to take the benefit of government

grants and other tax concessions such as early stage investor concessions.

Tax requirements

Betty would be required to file for partnership tax return which would be declared as

the income earned by the partnership firm and it also provides distribution of income among

partners. Tax rate under it is:

Taxable income Tax on this income

0 – $18,200 Nil

$18,201 – $37,000 19c for each $1 over $18,200

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

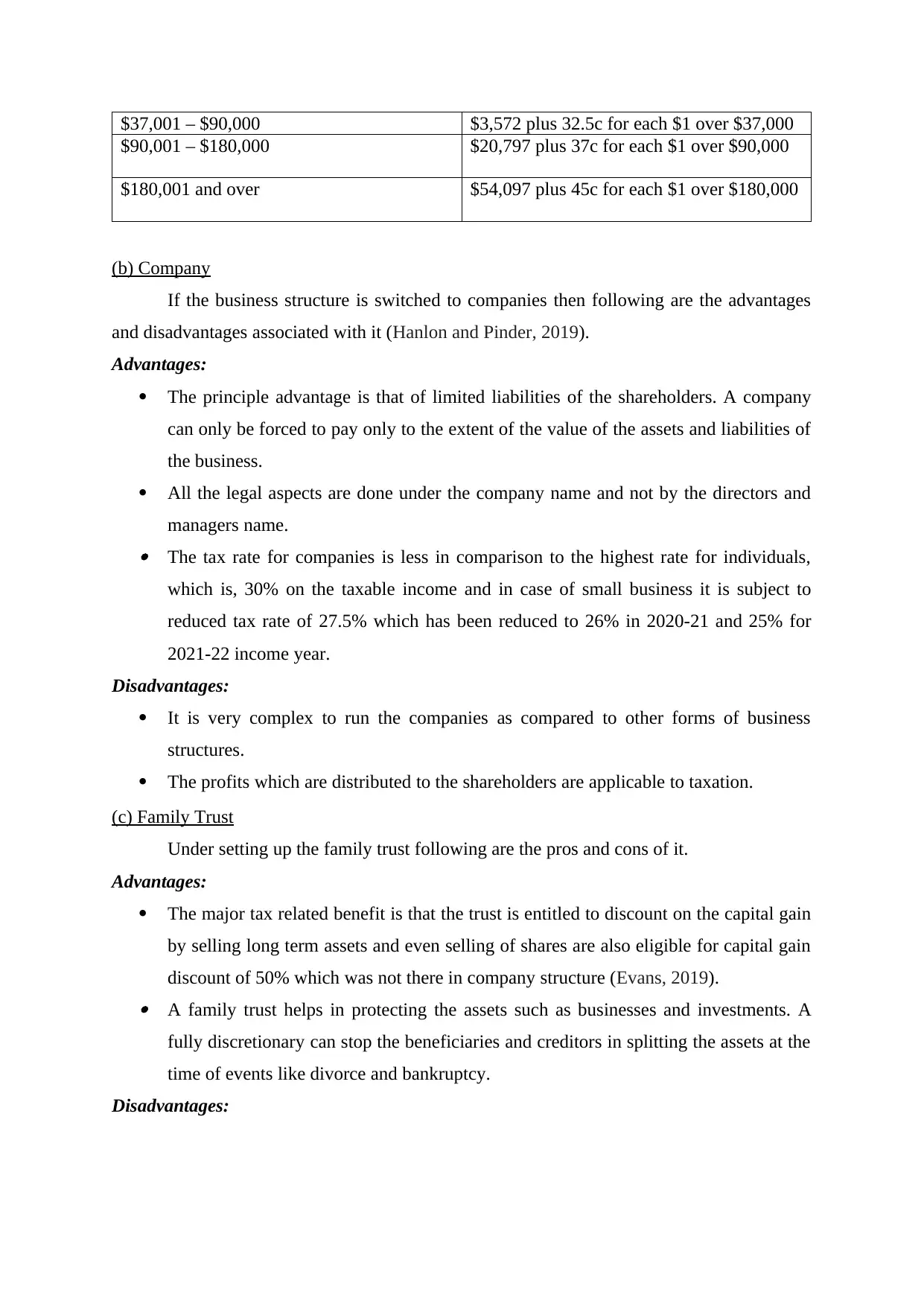

$37,001 – $90,000 $3,572 plus 32.5c for each $1 over $37,000

$90,001 – $180,000 $20,797 plus 37c for each $1 over $90,000

$180,001 and over $54,097 plus 45c for each $1 over $180,000

(b) Company

If the business structure is switched to companies then following are the advantages

and disadvantages associated with it (Hanlon and Pinder, 2019).

Advantages:

The principle advantage is that of limited liabilities of the shareholders. A company

can only be forced to pay only to the extent of the value of the assets and liabilities of

the business.

All the legal aspects are done under the company name and not by the directors and

managers name. The tax rate for companies is less in comparison to the highest rate for individuals,

which is, 30% on the taxable income and in case of small business it is subject to

reduced tax rate of 27.5% which has been reduced to 26% in 2020-21 and 25% for

2021-22 income year.

Disadvantages:

It is very complex to run the companies as compared to other forms of business

structures.

The profits which are distributed to the shareholders are applicable to taxation.

(c) Family Trust

Under setting up the family trust following are the pros and cons of it.

Advantages:

The major tax related benefit is that the trust is entitled to discount on the capital gain

by selling long term assets and even selling of shares are also eligible for capital gain

discount of 50% which was not there in company structure (Evans, 2019). A family trust helps in protecting the assets such as businesses and investments. A

fully discretionary can stop the beneficiaries and creditors in splitting the assets at the

time of events like divorce and bankruptcy.

Disadvantages:

$90,001 – $180,000 $20,797 plus 37c for each $1 over $90,000

$180,001 and over $54,097 plus 45c for each $1 over $180,000

(b) Company

If the business structure is switched to companies then following are the advantages

and disadvantages associated with it (Hanlon and Pinder, 2019).

Advantages:

The principle advantage is that of limited liabilities of the shareholders. A company

can only be forced to pay only to the extent of the value of the assets and liabilities of

the business.

All the legal aspects are done under the company name and not by the directors and

managers name. The tax rate for companies is less in comparison to the highest rate for individuals,

which is, 30% on the taxable income and in case of small business it is subject to

reduced tax rate of 27.5% which has been reduced to 26% in 2020-21 and 25% for

2021-22 income year.

Disadvantages:

It is very complex to run the companies as compared to other forms of business

structures.

The profits which are distributed to the shareholders are applicable to taxation.

(c) Family Trust

Under setting up the family trust following are the pros and cons of it.

Advantages:

The major tax related benefit is that the trust is entitled to discount on the capital gain

by selling long term assets and even selling of shares are also eligible for capital gain

discount of 50% which was not there in company structure (Evans, 2019). A family trust helps in protecting the assets such as businesses and investments. A

fully discretionary can stop the beneficiaries and creditors in splitting the assets at the

time of events like divorce and bankruptcy.

Disadvantages:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The beneficiaries cannot necessarily expect of receiving their share of assets as the

allocation can be changes in a whim. This can be studied in a recent case study of

Kennon vs Spry, which shows that the even trustees decision can be overturned.

The family trust distribution tax is applied when the distribution is made to other than

the family group, that is, outside.

The amount of tax paid is high, which is, top marginal rate of 47% which includes

Medicare levy.

The trustee of the family group will be liable for trustee beneficial non-disclosure tax

in case, the share of net income is included the assessable income of the trust

beneficiary as per the section 97 of ITAA 1936.

Taxation

Under family trust, the tax is not calcualted on the trust but instead the income derived

from it allocated among the beneficiaries who are then taxed individually at teh personal tax

rates. The tax is only paid by the trust when the income is not distributed among the

beneficiaries. Under this, trust is get taxed at teh highest marginal rate.

allocation can be changes in a whim. This can be studied in a recent case study of

Kennon vs Spry, which shows that the even trustees decision can be overturned.

The family trust distribution tax is applied when the distribution is made to other than

the family group, that is, outside.

The amount of tax paid is high, which is, top marginal rate of 47% which includes

Medicare levy.

The trustee of the family group will be liable for trustee beneficial non-disclosure tax

in case, the share of net income is included the assessable income of the trust

beneficiary as per the section 97 of ITAA 1936.

Taxation

Under family trust, the tax is not calcualted on the trust but instead the income derived

from it allocated among the beneficiaries who are then taxed individually at teh personal tax

rates. The tax is only paid by the trust when the income is not distributed among the

beneficiaries. Under this, trust is get taxed at teh highest marginal rate.

REFERENCES

Books and Journals

Evans, A. C., 2019. Why we use private trusts in Australia: The income tax dimension

explained. Sydney L. Rev.. 41. p.217.

Grob, P., 2017. Tax governance and justified trust. Taxation in Australia. 52(5). p.261.

Hanlon, D. and Pinder, S., 2019, October. The Impact of Australia's Income Tax System on

Company Ownership Structure. In Australian Tax Forum (Vol. 34, No. 4).

Books and Journals

Evans, A. C., 2019. Why we use private trusts in Australia: The income tax dimension

explained. Sydney L. Rev.. 41. p.217.

Grob, P., 2017. Tax governance and justified trust. Taxation in Australia. 52(5). p.261.

Hanlon, D. and Pinder, S., 2019, October. The Impact of Australia's Income Tax System on

Company Ownership Structure. In Australian Tax Forum (Vol. 34, No. 4).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.