LSME505 Business Finance Case Study: Costs, Budgets, and Profitability

VerifiedAdded on 2023/01/12

|12

|2740

|78

Case Study

AI Summary

This case study analyzes various aspects of business finance, starting with the calculation of the breakeven point and margin of safety, and extending to the application of marginal and absorption costing techniques for profit calculation. Part A covers these core financial concepts, while Part B delves into a deeper understanding of different cost types and their relevance to pricing decisions and the role of budgeting. The assignment then proceeds to calculate material, labor rate, and fixed overhead variances, followed by the preparation of budgets to control operations. The study incorporates detailed calculations, explanations, and practical applications, demonstrating a comprehensive understanding of financial management principles. The case study provides a detailed analysis of costs, budgeting, and profitability, equipping students with the skills to analyze and interpret financial data effectively. The solution provides a comprehensive overview of the key concepts, including the calculation of variances, and offers practical insights into how to improve financial performance.

CASE STUDY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

1. Calculation of breakeven point and margin of safety..............................................................3

2. Calculation of profit with the technique of marginal costing and absorption costing.............5

PART B...........................................................................................................................................6

i) Demonstrate an understanding by explaining different types of costs and their relevance to

pricing decisions and the role of budget......................................................................................6

ii) Calculate all material variance, labor rate variance and fixed overhead expenditure variance

.....................................................................................................................................................8

iii) Prepare budgets to control operations....................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................3

PART A...........................................................................................................................................3

1. Calculation of breakeven point and margin of safety..............................................................3

2. Calculation of profit with the technique of marginal costing and absorption costing.............5

PART B...........................................................................................................................................6

i) Demonstrate an understanding by explaining different types of costs and their relevance to

pricing decisions and the role of budget......................................................................................6

ii) Calculate all material variance, labor rate variance and fixed overhead expenditure variance

.....................................................................................................................................................8

iii) Prepare budgets to control operations....................................................................................9

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Budget control assumes that management has made a budget for all departments / units of the

enterprise and these budgets are summarized as a master budget. Budgetary control requires the

recording of actual performance, its continuous comparison with budgetary performance, and the

analysis of variations in terms of causes and responsibility. Budget control is a system that

suggests appropriate corrective action to prevent future deviations. A good budgeting system

should involve individuals at different levels while preparing the budget. Subordinates should

not accuse them of any kind. Budgetary control considers the existence of business enterprise

forecasts and plans. There should be proper determination of authority and responsibility.

Delegation of authority should be done appropriately. This project report consists of two parts; A

and B. First part covers the concept of breakeven point and margin of safety and second part

focuses on variance analyses.

PART A

1. Calculation of breakeven point and margin of safety

Breakeven point: The break-even point (BEP) in business — and especially cost accounting

— is the point at which total cost and total revenue are equal, i.e. "even". There is no net loss

or gain, and none is "broken", although the opportunity cost has been paid and the capital has

received a risk-adjusted, expected return. In short, all the costs paid are paid, and there is

neither profit nor loss.

The size of the degree of operation in which the revenue amount and the cost amount agree

with the entire enterprise or each division. That is, if the profit is greater than that, it means

the sales volume or production amount where the loss is recorded if it is less than or equal to

it. This is achieved by the intersection of profit and cost on the break-even point chart. A

guideline for preparing this short-term benefit plan; the calculation of breakeven point has

been done below:

Price per unit (£) Units Total (£)

Selling price per unit 24 140,000 £

Budget control assumes that management has made a budget for all departments / units of the

enterprise and these budgets are summarized as a master budget. Budgetary control requires the

recording of actual performance, its continuous comparison with budgetary performance, and the

analysis of variations in terms of causes and responsibility. Budget control is a system that

suggests appropriate corrective action to prevent future deviations. A good budgeting system

should involve individuals at different levels while preparing the budget. Subordinates should

not accuse them of any kind. Budgetary control considers the existence of business enterprise

forecasts and plans. There should be proper determination of authority and responsibility.

Delegation of authority should be done appropriately. This project report consists of two parts; A

and B. First part covers the concept of breakeven point and margin of safety and second part

focuses on variance analyses.

PART A

1. Calculation of breakeven point and margin of safety

Breakeven point: The break-even point (BEP) in business — and especially cost accounting

— is the point at which total cost and total revenue are equal, i.e. "even". There is no net loss

or gain, and none is "broken", although the opportunity cost has been paid and the capital has

received a risk-adjusted, expected return. In short, all the costs paid are paid, and there is

neither profit nor loss.

The size of the degree of operation in which the revenue amount and the cost amount agree

with the entire enterprise or each division. That is, if the profit is greater than that, it means

the sales volume or production amount where the loss is recorded if it is less than or equal to

it. This is achieved by the intersection of profit and cost on the break-even point chart. A

guideline for preparing this short-term benefit plan; the calculation of breakeven point has

been done below:

Price per unit (£) Units Total (£)

Selling price per unit 24 140,000 £

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

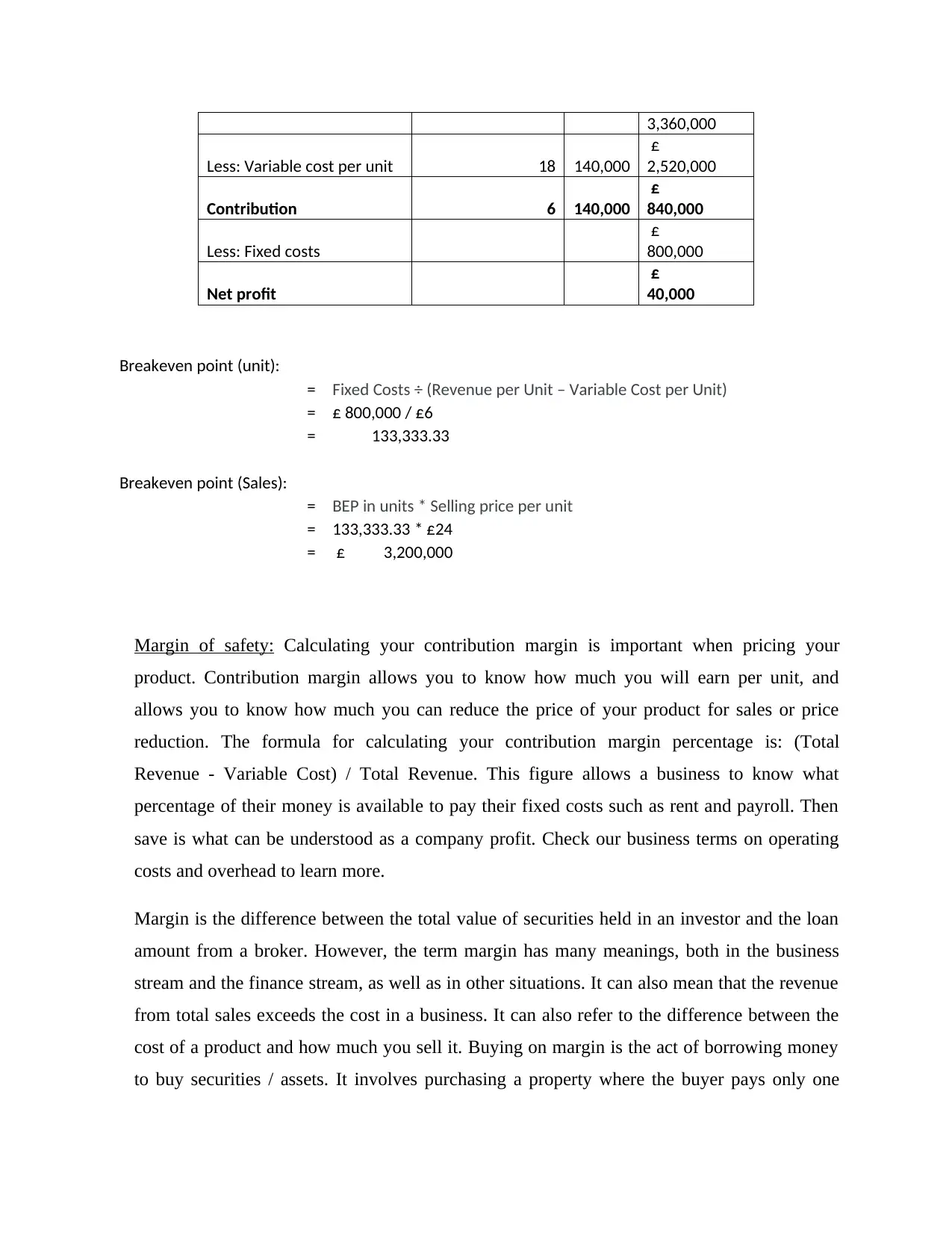

3,360,000

Less: Variable cost per unit 18 140,000

£

2,520,000

Contribution 6 140,000

£

840,000

Less: Fixed costs

£

800,000

Net profit

£

40,000

Breakeven point (unit):

= Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

= £ 800,000 / £6

= 133,333.33

Breakeven point (Sales):

= BEP in units * Selling price per unit

= 133,333.33 * £24

= £ 3,200,000

Margin of safety: Calculating your contribution margin is important when pricing your

product. Contribution margin allows you to know how much you will earn per unit, and

allows you to know how much you can reduce the price of your product for sales or price

reduction. The formula for calculating your contribution margin percentage is: (Total

Revenue - Variable Cost) / Total Revenue. This figure allows a business to know what

percentage of their money is available to pay their fixed costs such as rent and payroll. Then

save is what can be understood as a company profit. Check our business terms on operating

costs and overhead to learn more.

Margin is the difference between the total value of securities held in an investor and the loan

amount from a broker. However, the term margin has many meanings, both in the business

stream and the finance stream, as well as in other situations. It can also mean that the revenue

from total sales exceeds the cost in a business. It can also refer to the difference between the

cost of a product and how much you sell it. Buying on margin is the act of borrowing money

to buy securities / assets. It involves purchasing a property where the buyer pays only one

Less: Variable cost per unit 18 140,000

£

2,520,000

Contribution 6 140,000

£

840,000

Less: Fixed costs

£

800,000

Net profit

£

40,000

Breakeven point (unit):

= Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

= £ 800,000 / £6

= 133,333.33

Breakeven point (Sales):

= BEP in units * Selling price per unit

= 133,333.33 * £24

= £ 3,200,000

Margin of safety: Calculating your contribution margin is important when pricing your

product. Contribution margin allows you to know how much you will earn per unit, and

allows you to know how much you can reduce the price of your product for sales or price

reduction. The formula for calculating your contribution margin percentage is: (Total

Revenue - Variable Cost) / Total Revenue. This figure allows a business to know what

percentage of their money is available to pay their fixed costs such as rent and payroll. Then

save is what can be understood as a company profit. Check our business terms on operating

costs and overhead to learn more.

Margin is the difference between the total value of securities held in an investor and the loan

amount from a broker. However, the term margin has many meanings, both in the business

stream and the finance stream, as well as in other situations. It can also mean that the revenue

from total sales exceeds the cost in a business. It can also refer to the difference between the

cost of a product and how much you sell it. Buying on margin is the act of borrowing money

to buy securities / assets. It involves purchasing a property where the buyer pays only one

percent of the property's value and borrows the rest from a broker or bank. The broker acts as

a lender and the securities act as collateral in the investor's account. Margin percentages for

Signs and FCA customers are generally estimated at 2%, 1%, or 0.5% or 50%, 20%, 10%,

5%, or 3.33% for CIMA customers.

To improve margin of safety; company can adopt following strategies:

Do not exit product due to shortage of stock

Compliance with deadline for customers, no problem to finish some items

Continuous production or sales flow

Stock area occupied in a balanced way

Avoid immediate (and sometimes more expensive) purchases

Calculation of margin of safety has been done below:

Margin of safety in

pounds: Current sales – Breakeven sales

= £ 3,360,000 - £ 3,200,000

= £ 160,000

Margin of safety in units: Current sales units – Breakeven point

= 140,000 - 133,333.33

= 6666.67

Margin of safety in

percentage: 5%

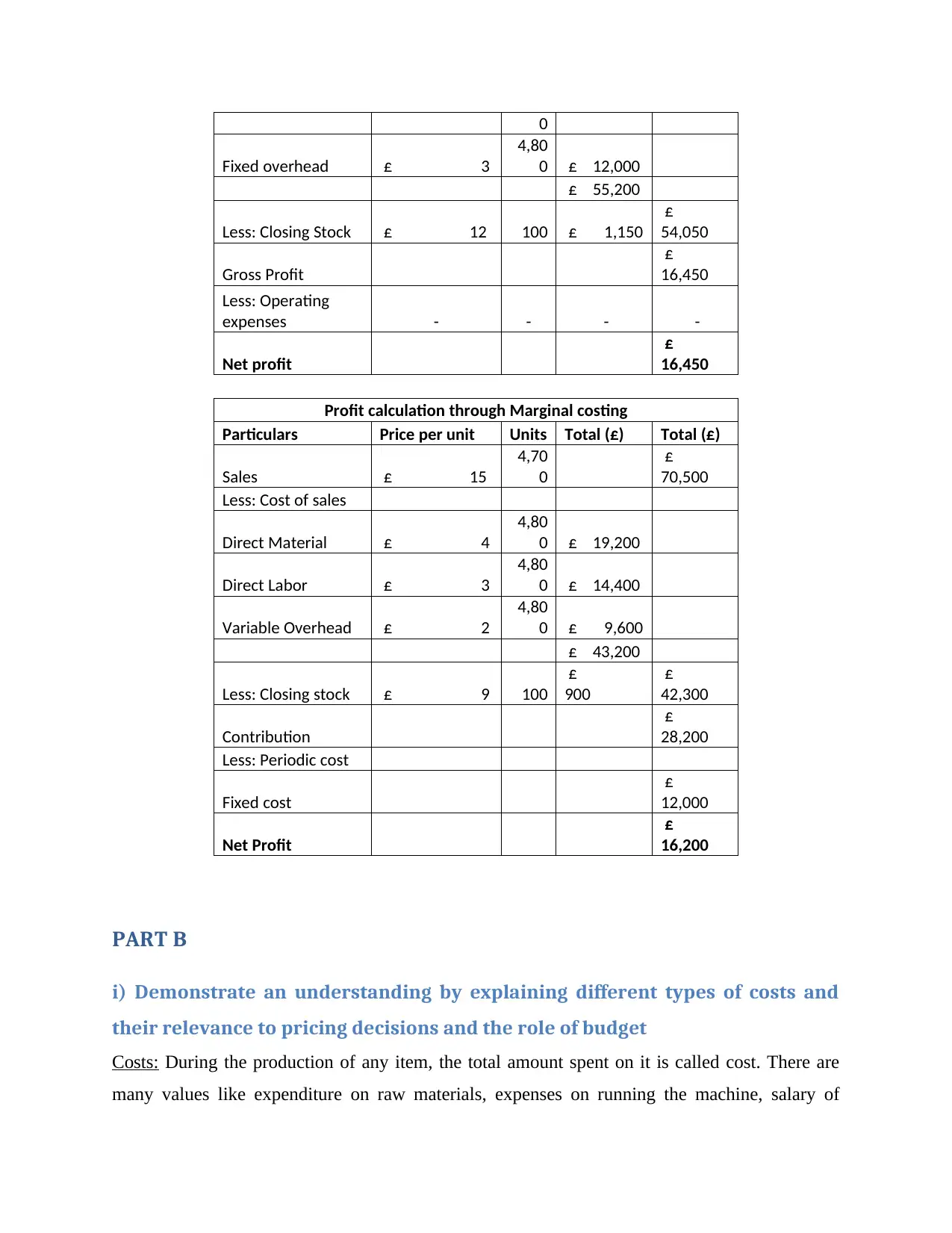

2. Calculation of profit with the technique of marginal costing and absorption

costing

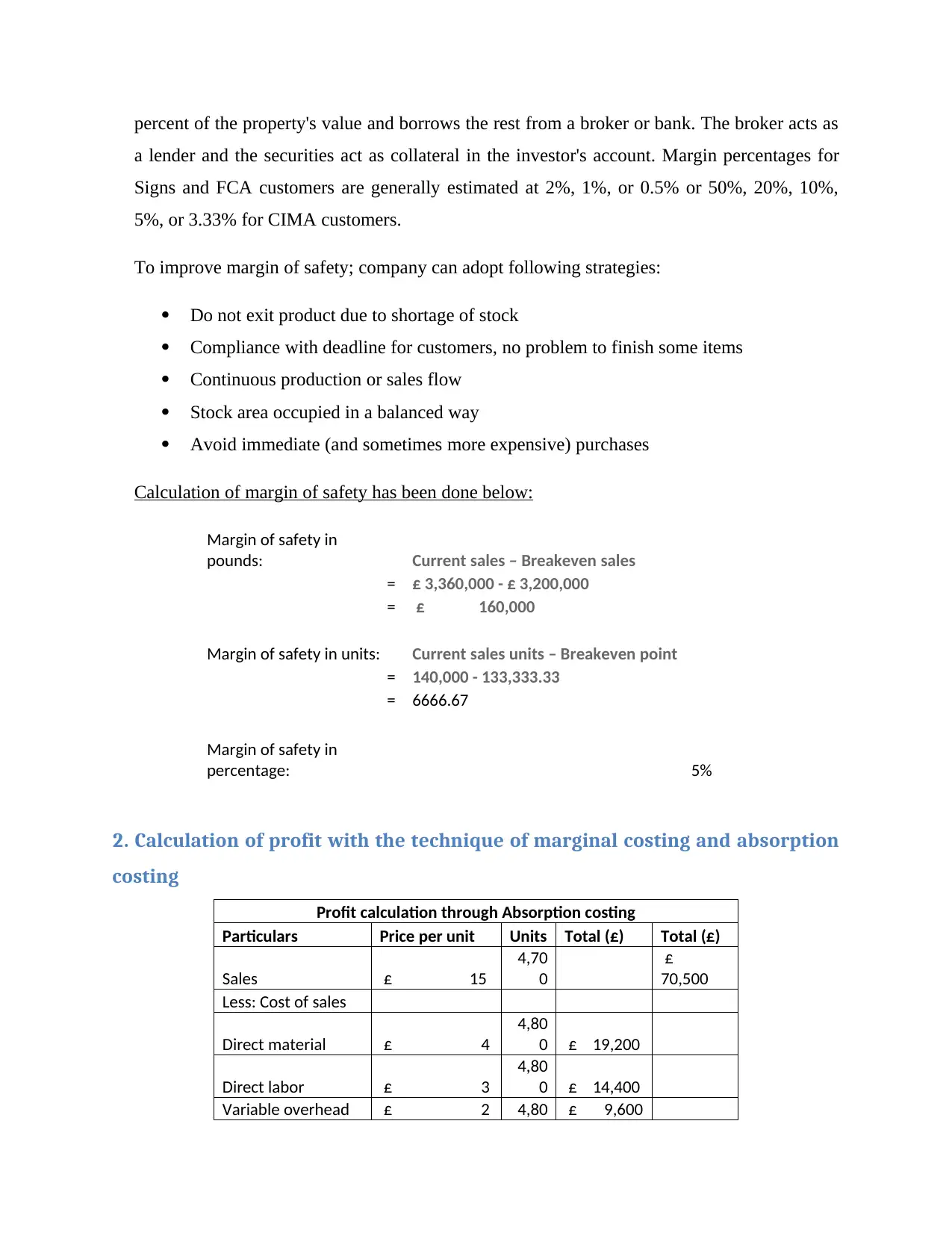

Profit calculation through Absorption costing

Particulars Price per unit Units Total (£) Total (£)

Sales £ 15

4,70

0

£

70,500

Less: Cost of sales

Direct material £ 4

4,80

0 £ 19,200

Direct labor £ 3

4,80

0 £ 14,400

Variable overhead £ 2 4,80 £ 9,600

a lender and the securities act as collateral in the investor's account. Margin percentages for

Signs and FCA customers are generally estimated at 2%, 1%, or 0.5% or 50%, 20%, 10%,

5%, or 3.33% for CIMA customers.

To improve margin of safety; company can adopt following strategies:

Do not exit product due to shortage of stock

Compliance with deadline for customers, no problem to finish some items

Continuous production or sales flow

Stock area occupied in a balanced way

Avoid immediate (and sometimes more expensive) purchases

Calculation of margin of safety has been done below:

Margin of safety in

pounds: Current sales – Breakeven sales

= £ 3,360,000 - £ 3,200,000

= £ 160,000

Margin of safety in units: Current sales units – Breakeven point

= 140,000 - 133,333.33

= 6666.67

Margin of safety in

percentage: 5%

2. Calculation of profit with the technique of marginal costing and absorption

costing

Profit calculation through Absorption costing

Particulars Price per unit Units Total (£) Total (£)

Sales £ 15

4,70

0

£

70,500

Less: Cost of sales

Direct material £ 4

4,80

0 £ 19,200

Direct labor £ 3

4,80

0 £ 14,400

Variable overhead £ 2 4,80 £ 9,600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0

Fixed overhead £ 3

4,80

0 £ 12,000

£ 55,200

Less: Closing Stock £ 12 100 £ 1,150

£

54,050

Gross Profit

£

16,450

Less: Operating

expenses - - - -

Net profit

£

16,450

Profit calculation through Marginal costing

Particulars Price per unit Units Total (£) Total (£)

Sales £ 15

4,70

0

£

70,500

Less: Cost of sales

Direct Material £ 4

4,80

0 £ 19,200

Direct Labor £ 3

4,80

0 £ 14,400

Variable Overhead £ 2

4,80

0 £ 9,600

£ 43,200

Less: Closing stock £ 9 100

£

900

£

42,300

Contribution

£

28,200

Less: Periodic cost

Fixed cost

£

12,000

Net Profit

£

16,200

PART B

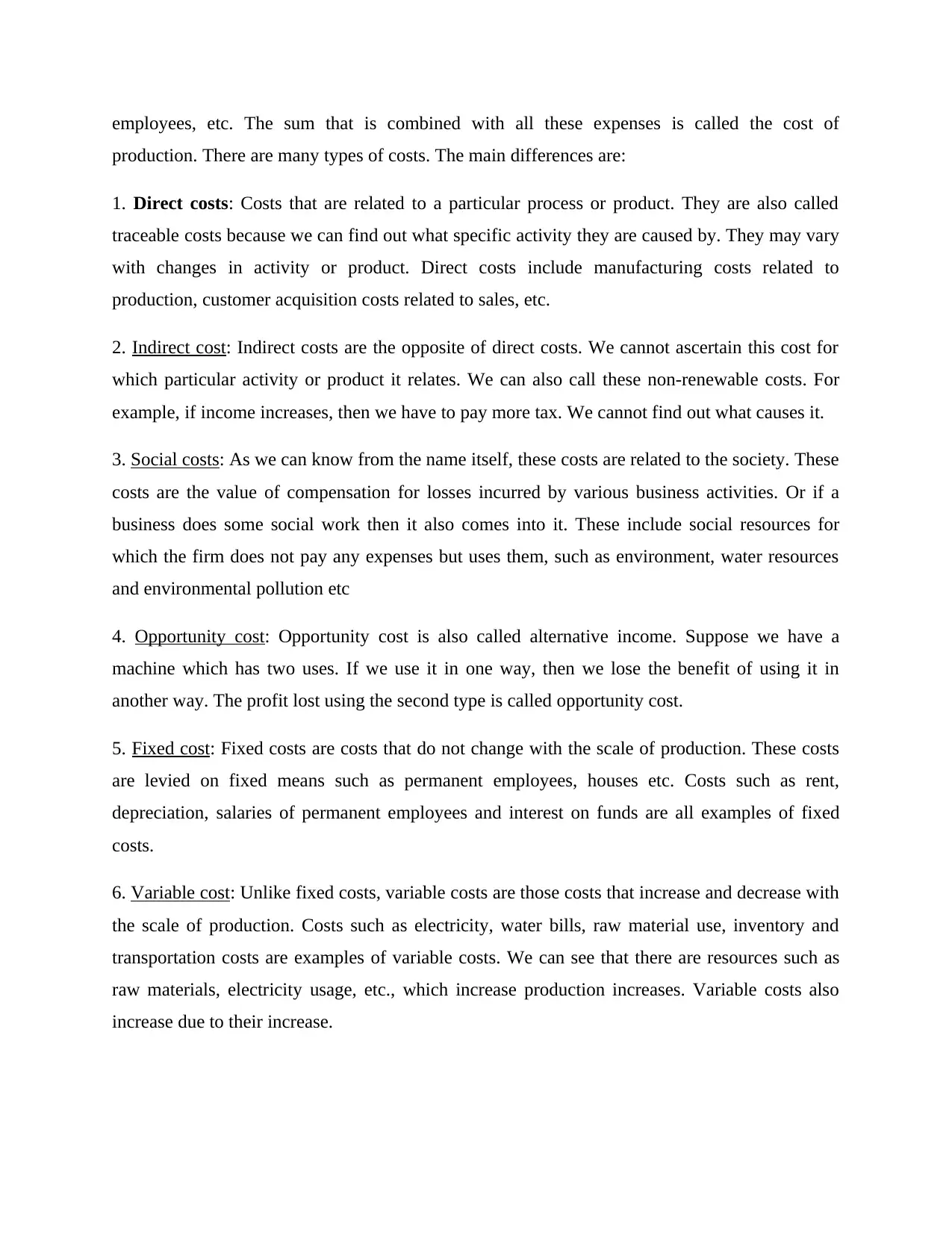

i) Demonstrate an understanding by explaining different types of costs and

their relevance to pricing decisions and the role of budget

Costs: During the production of any item, the total amount spent on it is called cost. There are

many values like expenditure on raw materials, expenses on running the machine, salary of

Fixed overhead £ 3

4,80

0 £ 12,000

£ 55,200

Less: Closing Stock £ 12 100 £ 1,150

£

54,050

Gross Profit

£

16,450

Less: Operating

expenses - - - -

Net profit

£

16,450

Profit calculation through Marginal costing

Particulars Price per unit Units Total (£) Total (£)

Sales £ 15

4,70

0

£

70,500

Less: Cost of sales

Direct Material £ 4

4,80

0 £ 19,200

Direct Labor £ 3

4,80

0 £ 14,400

Variable Overhead £ 2

4,80

0 £ 9,600

£ 43,200

Less: Closing stock £ 9 100

£

900

£

42,300

Contribution

£

28,200

Less: Periodic cost

Fixed cost

£

12,000

Net Profit

£

16,200

PART B

i) Demonstrate an understanding by explaining different types of costs and

their relevance to pricing decisions and the role of budget

Costs: During the production of any item, the total amount spent on it is called cost. There are

many values like expenditure on raw materials, expenses on running the machine, salary of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

employees, etc. The sum that is combined with all these expenses is called the cost of

production. There are many types of costs. The main differences are:

1. Direct costs: Costs that are related to a particular process or product. They are also called

traceable costs because we can find out what specific activity they are caused by. They may vary

with changes in activity or product. Direct costs include manufacturing costs related to

production, customer acquisition costs related to sales, etc.

2. Indirect cost: Indirect costs are the opposite of direct costs. We cannot ascertain this cost for

which particular activity or product it relates. We can also call these non-renewable costs. For

example, if income increases, then we have to pay more tax. We cannot find out what causes it.

3. Social costs: As we can know from the name itself, these costs are related to the society. These

costs are the value of compensation for losses incurred by various business activities. Or if a

business does some social work then it also comes into it. These include social resources for

which the firm does not pay any expenses but uses them, such as environment, water resources

and environmental pollution etc

4. Opportunity cost: Opportunity cost is also called alternative income. Suppose we have a

machine which has two uses. If we use it in one way, then we lose the benefit of using it in

another way. The profit lost using the second type is called opportunity cost.

5. Fixed cost: Fixed costs are costs that do not change with the scale of production. These costs

are levied on fixed means such as permanent employees, houses etc. Costs such as rent,

depreciation, salaries of permanent employees and interest on funds are all examples of fixed

costs.

6. Variable cost: Unlike fixed costs, variable costs are those costs that increase and decrease with

the scale of production. Costs such as electricity, water bills, raw material use, inventory and

transportation costs are examples of variable costs. We can see that there are resources such as

raw materials, electricity usage, etc., which increase production increases. Variable costs also

increase due to their increase.

production. There are many types of costs. The main differences are:

1. Direct costs: Costs that are related to a particular process or product. They are also called

traceable costs because we can find out what specific activity they are caused by. They may vary

with changes in activity or product. Direct costs include manufacturing costs related to

production, customer acquisition costs related to sales, etc.

2. Indirect cost: Indirect costs are the opposite of direct costs. We cannot ascertain this cost for

which particular activity or product it relates. We can also call these non-renewable costs. For

example, if income increases, then we have to pay more tax. We cannot find out what causes it.

3. Social costs: As we can know from the name itself, these costs are related to the society. These

costs are the value of compensation for losses incurred by various business activities. Or if a

business does some social work then it also comes into it. These include social resources for

which the firm does not pay any expenses but uses them, such as environment, water resources

and environmental pollution etc

4. Opportunity cost: Opportunity cost is also called alternative income. Suppose we have a

machine which has two uses. If we use it in one way, then we lose the benefit of using it in

another way. The profit lost using the second type is called opportunity cost.

5. Fixed cost: Fixed costs are costs that do not change with the scale of production. These costs

are levied on fixed means such as permanent employees, houses etc. Costs such as rent,

depreciation, salaries of permanent employees and interest on funds are all examples of fixed

costs.

6. Variable cost: Unlike fixed costs, variable costs are those costs that increase and decrease with

the scale of production. Costs such as electricity, water bills, raw material use, inventory and

transportation costs are examples of variable costs. We can see that there are resources such as

raw materials, electricity usage, etc., which increase production increases. Variable costs also

increase due to their increase.

7. Total fixed cost: In the short run, the total expenditure incurred by a firm on its fixed resources

for production is called total fixed cost. It does not change with increasing production and

remains constant. Hence, it has a ladder line in its curve. It is also called TFC.

8. Total variable cost: In the short run, the total expenditure incurred by a firm on its variable

resources in the production process is called total variable cost. It increases with increasing

production. So, when there is zero production, the variable cost is also zero. As production

increases it increases.

9. Total cost: In the short run, the sum of total fixed costs and total variable costs incurred by the

firm is called total cost. Total cost includes total fixed cost and total variable cost.

10. Average fixed cost: Average fixed cost or AFC means the fixed cost per unit of production.

This means that if we produce one thousand units and our total fixed cost is 1000, then the

average fixed cost will be 1 pound.

11. Marginal Cost: Marginal cost or Marginal Cost (MC) is the change in the total cost due to the

production of another unit. As production increases, the marginal cost increases.

12. Average Total Cost: Total Average Cost or Average Total Cost (ATC) means the total cost

incurred on every unit produced. It includes total fixed and total variable costs.

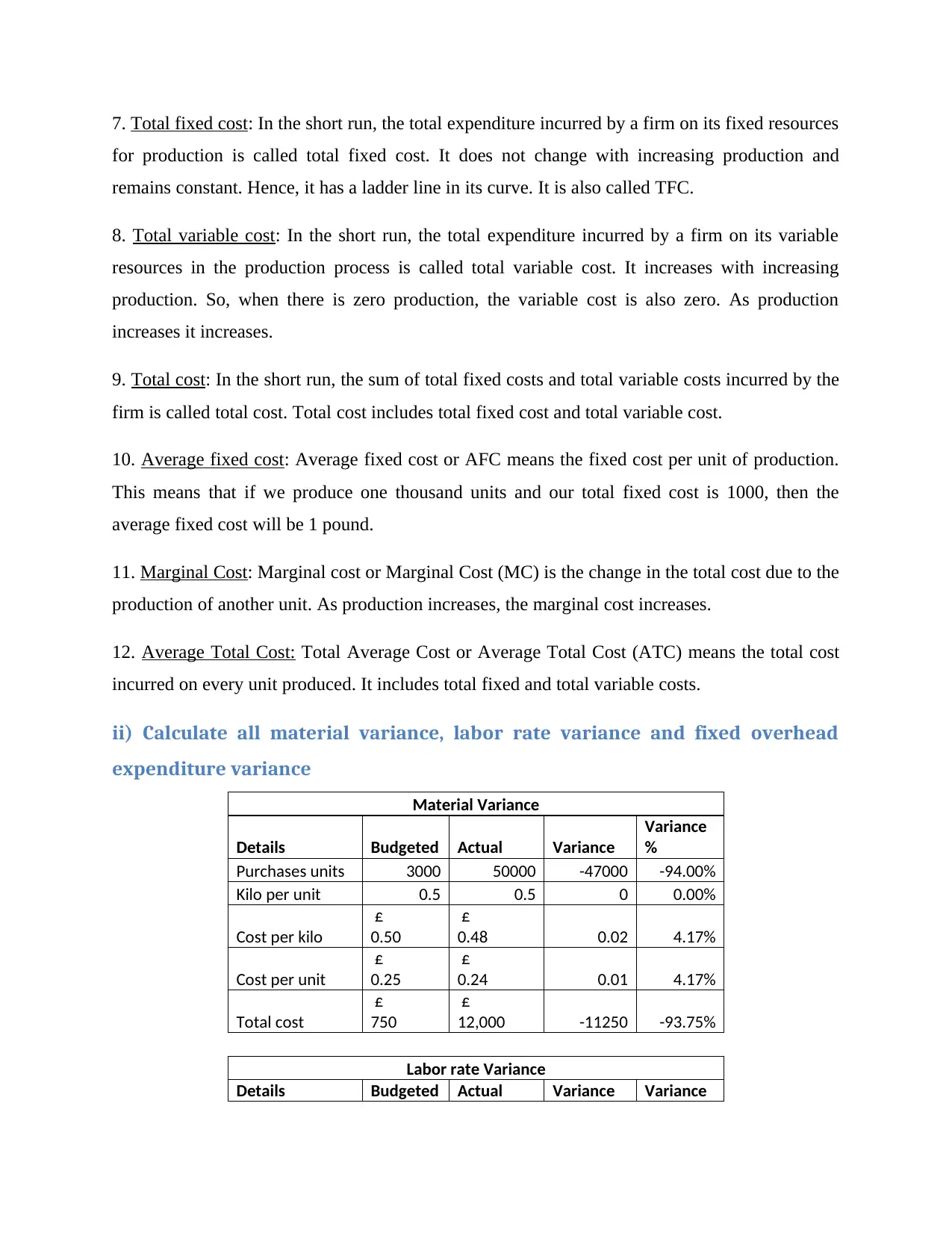

ii) Calculate all material variance, labor rate variance and fixed overhead

expenditure variance

Material Variance

Details Budgeted Actual Variance

Variance

%

Purchases units 3000 50000 -47000 -94.00%

Kilo per unit 0.5 0.5 0 0.00%

Cost per kilo

£

0.50

£

0.48 0.02 4.17%

Cost per unit

£

0.25

£

0.24 0.01 4.17%

Total cost

£

750

£

12,000 -11250 -93.75%

Labor rate Variance

Details Budgeted Actual Variance Variance

for production is called total fixed cost. It does not change with increasing production and

remains constant. Hence, it has a ladder line in its curve. It is also called TFC.

8. Total variable cost: In the short run, the total expenditure incurred by a firm on its variable

resources in the production process is called total variable cost. It increases with increasing

production. So, when there is zero production, the variable cost is also zero. As production

increases it increases.

9. Total cost: In the short run, the sum of total fixed costs and total variable costs incurred by the

firm is called total cost. Total cost includes total fixed cost and total variable cost.

10. Average fixed cost: Average fixed cost or AFC means the fixed cost per unit of production.

This means that if we produce one thousand units and our total fixed cost is 1000, then the

average fixed cost will be 1 pound.

11. Marginal Cost: Marginal cost or Marginal Cost (MC) is the change in the total cost due to the

production of another unit. As production increases, the marginal cost increases.

12. Average Total Cost: Total Average Cost or Average Total Cost (ATC) means the total cost

incurred on every unit produced. It includes total fixed and total variable costs.

ii) Calculate all material variance, labor rate variance and fixed overhead

expenditure variance

Material Variance

Details Budgeted Actual Variance

Variance

%

Purchases units 3000 50000 -47000 -94.00%

Kilo per unit 0.5 0.5 0 0.00%

Cost per kilo

£

0.50

£

0.48 0.02 4.17%

Cost per unit

£

0.25

£

0.24 0.01 4.17%

Total cost

£

750

£

12,000 -11250 -93.75%

Labor rate Variance

Details Budgeted Actual Variance Variance

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

%

Total hours 4,030 4,000 30 0.75%

Hour per unit 1.3 1.3 0 0.00%

Cost per hour

£

8.00

£

6.92 1 15.56%

Cost per unit

£

10.40

£

9.00 1 15.56%

Total cost

£

41,912

£

36,000 5,912 16.42%

Fixed manufacturing overhead Variance

Details Budgeted Actual Variance

Variance

%

Fixed cost

£

24,180

£

25,000

-£

820 -3%

iii) Prepare budgets to control operations

Budget control:

Budgetary or budget control is the process of determining the various budgetary figures for

enterprises for future periods and then comparing the budgetary figures with the actual

performance to calculate the variances, if any. First, the budget is prepared and then the actual

results are recorded. Comparing budget and actual data will help management detect anomalies

and take remedial measures at the appropriate time.

Steps in controlling operational costs:

Items are determined by preparing a budget.

The business is divided into various responsibility centers to prepare different budgets.

Actual figures are recorded.

Budget and actual data are compared to study the performance of different cost centers.

If the actual performance is below the budget criteria, immediate action is taken.

Total hours 4,030 4,000 30 0.75%

Hour per unit 1.3 1.3 0 0.00%

Cost per hour

£

8.00

£

6.92 1 15.56%

Cost per unit

£

10.40

£

9.00 1 15.56%

Total cost

£

41,912

£

36,000 5,912 16.42%

Fixed manufacturing overhead Variance

Details Budgeted Actual Variance

Variance

%

Fixed cost

£

24,180

£

25,000

-£

820 -3%

iii) Prepare budgets to control operations

Budget control:

Budgetary or budget control is the process of determining the various budgetary figures for

enterprises for future periods and then comparing the budgetary figures with the actual

performance to calculate the variances, if any. First, the budget is prepared and then the actual

results are recorded. Comparing budget and actual data will help management detect anomalies

and take remedial measures at the appropriate time.

Steps in controlling operational costs:

Items are determined by preparing a budget.

The business is divided into various responsibility centers to prepare different budgets.

Actual figures are recorded.

Budget and actual data are compared to study the performance of different cost centers.

If the actual performance is below the budget criteria, immediate action is taken.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

Hence, after analysis of whole report it can be concluded that a budget is a plan of policy to be

adopted during a set period of time to achieve a certain objective. Budgetary control will force

management at all levels to plan all activities that will take place during future periods.

Budgetary control coordinates the various activities of the firm and secures the cooperation of all

concerned so as to successfully achieve the general objective of the firm. This forces the officers

to think and think as a group. It coordinates macroeconomic trends and the economic condition

of an enterprise. It is also helpful in coordination of policies, plans and actions.

Hence, after analysis of whole report it can be concluded that a budget is a plan of policy to be

adopted during a set period of time to achieve a certain objective. Budgetary control will force

management at all levels to plan all activities that will take place during future periods.

Budgetary control coordinates the various activities of the firm and secures the cooperation of all

concerned so as to successfully achieve the general objective of the firm. This forces the officers

to think and think as a group. It coordinates macroeconomic trends and the economic condition

of an enterprise. It is also helpful in coordination of policies, plans and actions.

REFERENCES

Books and Journals

Rubin, I.S., 2019. The politics of public budgeting: Getting and spending, borrowing and

balancing. CQ Press.

Bogsnes, B., 2016. Implementing beyond budgeting: unlocking the performance potential. John

Wiley & Sons.

Miller, G., 2018. Performance based budgeting. Routledge.

Stotsky, M.J.G., 2016. Gender budgeting: Fiscal context and current outcomes. International

Monetary Fund.

Chohan, U.W., 2019. Public Value Theory and Budgeting: International Perspectives.

Routledge.

Schiavo-Campo, S., 2017. Government budgeting and expenditure management: principles and

international practice. Taylor & Francis.

Morgan, D., Robinson, K.S., Strachota, D. and Hough, J.A., 2017. Budgeting for local

governments and communities. Routledge.

Downes, R., Von Trapp, L. and Nicol, S., 2017. Gender budgeting in OECD countries. OECD

Journal on Budgeting, 16(3), pp.71-107.

Chohan, U.W., 2016. The idea of legislative budgeting in Iraq. International Journal of

Contemporary Iraqi Studies, 10(1-2), pp.89-103.

Sintomer, Y., Röcke, A. and Herzberg, C., 2016. Participatory Budgeting in Europe: Democracy

and public governance. Routledge.

Gilman, H.R., 2016. Democracy reinvented: Participatory budgeting and civic innovation in

America. Brookings Institution Press.

Zor, U., Linder, S. and Endenich, C., 2019. CEO characteristics and budgeting practices in

emerging market SMEs. Journal of Small Business Management, 57(2), pp.658-678.

Moynihan, D. and Beazley, I., 2016. Toward next-generation performance budgeting: Lessons

from the experiences of seven reforming countries. The World Bank.

Pape, M. and Lerner, J., 2016. Budgeting for equity: How can participatory budgeting advance

equity in the United States?. Journal of Public Deliberation, 12(2), p.9.

Breunig, C., Lipsmeyer, C.S. and Whitten, G.D., 2017. Introduction: Political budgeting from a

comparative perspective. Journal of European Public Policy, 24(6), pp.789-791.

Tosun, C. and Bağdadioğlu, N., 2016. Evaluating gender responsive budgeting in

Turkey. International Journal of Monetary Economics and Finance, 9(2), pp.187-197.

Books and Journals

Rubin, I.S., 2019. The politics of public budgeting: Getting and spending, borrowing and

balancing. CQ Press.

Bogsnes, B., 2016. Implementing beyond budgeting: unlocking the performance potential. John

Wiley & Sons.

Miller, G., 2018. Performance based budgeting. Routledge.

Stotsky, M.J.G., 2016. Gender budgeting: Fiscal context and current outcomes. International

Monetary Fund.

Chohan, U.W., 2019. Public Value Theory and Budgeting: International Perspectives.

Routledge.

Schiavo-Campo, S., 2017. Government budgeting and expenditure management: principles and

international practice. Taylor & Francis.

Morgan, D., Robinson, K.S., Strachota, D. and Hough, J.A., 2017. Budgeting for local

governments and communities. Routledge.

Downes, R., Von Trapp, L. and Nicol, S., 2017. Gender budgeting in OECD countries. OECD

Journal on Budgeting, 16(3), pp.71-107.

Chohan, U.W., 2016. The idea of legislative budgeting in Iraq. International Journal of

Contemporary Iraqi Studies, 10(1-2), pp.89-103.

Sintomer, Y., Röcke, A. and Herzberg, C., 2016. Participatory Budgeting in Europe: Democracy

and public governance. Routledge.

Gilman, H.R., 2016. Democracy reinvented: Participatory budgeting and civic innovation in

America. Brookings Institution Press.

Zor, U., Linder, S. and Endenich, C., 2019. CEO characteristics and budgeting practices in

emerging market SMEs. Journal of Small Business Management, 57(2), pp.658-678.

Moynihan, D. and Beazley, I., 2016. Toward next-generation performance budgeting: Lessons

from the experiences of seven reforming countries. The World Bank.

Pape, M. and Lerner, J., 2016. Budgeting for equity: How can participatory budgeting advance

equity in the United States?. Journal of Public Deliberation, 12(2), p.9.

Breunig, C., Lipsmeyer, C.S. and Whitten, G.D., 2017. Introduction: Political budgeting from a

comparative perspective. Journal of European Public Policy, 24(6), pp.789-791.

Tosun, C. and Bağdadioğlu, N., 2016. Evaluating gender responsive budgeting in

Turkey. International Journal of Monetary Economics and Finance, 9(2), pp.187-197.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.