Complete Solution to ISYS3375 Business Analytics Final Assessment

VerifiedAdded on 2023/06/10

|16

|3033

|408

Homework Assignment

AI Summary

This document presents a comprehensive solution to the ISYS3375 Business Analytics final assessment. It addresses key concepts such as handling imbalanced data using resampling and algorithmic ensemble techniques, methods to avoid overfitting like cross-validation and regularization, and the application of logistic regression with examples. The solution also includes quantitative analysis, determining the optimal number of clusters based on intra-cluster distance, describing cluster characteristics, and developing both linear and polynomial regression models to analyze relationships between variables. Furthermore, it constructs multiple regression models to assess risk factors, evaluates model significance using ANOVA, and calculates risk percentages based on given parameters, providing a thorough understanding of the analytical processes and their implications.

BUSINESS ANALYTICS

ISYS3375 FINAL ASSESSMENT

Student Name

[Pick the date]

ISYS3375 FINAL ASSESSMENT

Student Name

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

SECTION A

Question 1

Class imbalance problem is a common issue in which significant differences exist between the

prior probabilities of different classes. Web, biology, data mining, finance, telecommunication

and ecology are some of the major areas where class imbalance problem can be found.

Various ways to handle imbalanced datasets are highlighted below:

Data level approach or Resampling techniques

This deals with the imbalanced dataset.

1. Improving classification algorithms

2. Balancing classes in processed data by increasing the frequency of minor class or decreasing

the frequency of major class.

3. Selection of appropriate sampling method

Random under sampling

Random over sampling

Cluster based over sampling

Synthetic minority over sampling technique

Modified synthetic minority over sampling technique (MSMOTE)

Algorithmic Ensemble Techniques

This deals in handling imbalanced data with the help of resampling the original data in order to

provide the balanced classes.

1. This improves the performance of the single classifiers by developing many two stage

classifiers from initial dataset.

Bagging based

Boosting based (XG Boost, Gradient boosting)

It can be said that MSMOTE method along with the boosting method can be used to resolve the

issues of imbalanced dataset. However, based on the characteristics of the imbalanced dataset,

the appropriate model would be taken into consideration.

Question 2

Over-fitting is considered as pivotal concern in many business scenarios. This is because the

model over–fitting consumes more than required attributes which reduces the effectiveness of the

1

Question 1

Class imbalance problem is a common issue in which significant differences exist between the

prior probabilities of different classes. Web, biology, data mining, finance, telecommunication

and ecology are some of the major areas where class imbalance problem can be found.

Various ways to handle imbalanced datasets are highlighted below:

Data level approach or Resampling techniques

This deals with the imbalanced dataset.

1. Improving classification algorithms

2. Balancing classes in processed data by increasing the frequency of minor class or decreasing

the frequency of major class.

3. Selection of appropriate sampling method

Random under sampling

Random over sampling

Cluster based over sampling

Synthetic minority over sampling technique

Modified synthetic minority over sampling technique (MSMOTE)

Algorithmic Ensemble Techniques

This deals in handling imbalanced data with the help of resampling the original data in order to

provide the balanced classes.

1. This improves the performance of the single classifiers by developing many two stage

classifiers from initial dataset.

Bagging based

Boosting based (XG Boost, Gradient boosting)

It can be said that MSMOTE method along with the boosting method can be used to resolve the

issues of imbalanced dataset. However, based on the characteristics of the imbalanced dataset,

the appropriate model would be taken into consideration.

Question 2

Over-fitting is considered as pivotal concern in many business scenarios. This is because the

model over–fitting consumes more than required attributes which reduces the effectiveness of the

1

model. In this, higher degree of polynomial might have higher level of accuracy for population

but it fails to test the selected data set. Hence, it is essential to avoid over-fitting of the dataset.

The main methods to avoid over-fitting are highlighted below:

1. Cross- validation

It is one round validation in which one will keep the lower variance and higher fold cross

validation. Further one sample would be taken as in time validation and rest of the sample for

training model.

2. Early stopping

In this, number of iterations run would be decided for avoiding over fitting.

3. Pruning

This method is more suitable in CART models. This method basically removes the nodes and

adds some predictive power.

4. Regularization

In this method a new term i.e. cost term would be incorporated in the model. In which the cost

term would force the coefficients of many variables to approach zero and therefore, the overall

cost can be reduced.

Question 3

Logistics regression is found useful typically when the dependent variable can be represented in

the form of a binary variable and hence it makes sense to estimate the odds ratio. On the contrary

linear regression makes more sense for regression involving dependent variable which is not

binary. Two examples are as follows.

2

but it fails to test the selected data set. Hence, it is essential to avoid over-fitting of the dataset.

The main methods to avoid over-fitting are highlighted below:

1. Cross- validation

It is one round validation in which one will keep the lower variance and higher fold cross

validation. Further one sample would be taken as in time validation and rest of the sample for

training model.

2. Early stopping

In this, number of iterations run would be decided for avoiding over fitting.

3. Pruning

This method is more suitable in CART models. This method basically removes the nodes and

adds some predictive power.

4. Regularization

In this method a new term i.e. cost term would be incorporated in the model. In which the cost

term would force the coefficients of many variables to approach zero and therefore, the overall

cost can be reduced.

Question 3

Logistics regression is found useful typically when the dependent variable can be represented in

the form of a binary variable and hence it makes sense to estimate the odds ratio. On the contrary

linear regression makes more sense for regression involving dependent variable which is not

binary. Two examples are as follows.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

One example which would require the use of logistic regression is with regards to

approval of loan by the new customers. In this particular case, there would be a binary

dependent variable as the loan may be approved or not. Thus, in such a case using a

linear regression would not serve the purpose as with varied set of independent variables,

it would not be possible to capture the output in binary form. As a result, it makes sense

to use logistic regression which can easily ensure this and thus would be appropriate.

Another example would be in the context of passing or failing a particular exam based on

independent variables such as study time, presence on social media, lectures attended etc.

In this case also, the desired output would be captured as pass or fail and hence is binary

and therefore logistic regression would be preferred over linear regression. The logistic

regression would yield values between 0 and 1 which are essentially probability and

hence based on the same the odds of the two events can be computed. This is not the case

in linear regression which gives the absolute value of the dependent variable and not the

underlying probability.

SECTION B

Question 1

(a) The analyst found out 6 as the appropriate number of clusters by considering the output

shown in sheet 1-a-2-1 and also sheet 1-a-1-1 of the given output. The output in these two

selected sheets tends to highlight the output given when the data is based on 5 clusters

and 6 clusters respectively. The tables highlighting sum of square distances in cluster

need to be referred in both the sheets. It is apparent from cell D40 of sheet 1-a-1-1 that

the lowest intra cluster distance square is 3447.02 in case of five clusters. However, in

case of six clusters, this is lower as highlighted by cell D41 of sheet 1-a-2-1 giving a

value of 3188.82. Since the objective in clustering is to ensure that intra-cluster variation

is minimised, hence six clusters would be preferred over five clusters for the given data.

(b) The description of the six clusters by their average characteristics is carried out below.

Cluster 1 (Married elderly customers) – High priced product (average price = $1,071) is

bought by the married elderly (greater than 55 years) who may or may not be members

and does not involve the use of discount cards. The average product category lies

between 2 and 3.

3

approval of loan by the new customers. In this particular case, there would be a binary

dependent variable as the loan may be approved or not. Thus, in such a case using a

linear regression would not serve the purpose as with varied set of independent variables,

it would not be possible to capture the output in binary form. As a result, it makes sense

to use logistic regression which can easily ensure this and thus would be appropriate.

Another example would be in the context of passing or failing a particular exam based on

independent variables such as study time, presence on social media, lectures attended etc.

In this case also, the desired output would be captured as pass or fail and hence is binary

and therefore logistic regression would be preferred over linear regression. The logistic

regression would yield values between 0 and 1 which are essentially probability and

hence based on the same the odds of the two events can be computed. This is not the case

in linear regression which gives the absolute value of the dependent variable and not the

underlying probability.

SECTION B

Question 1

(a) The analyst found out 6 as the appropriate number of clusters by considering the output

shown in sheet 1-a-2-1 and also sheet 1-a-1-1 of the given output. The output in these two

selected sheets tends to highlight the output given when the data is based on 5 clusters

and 6 clusters respectively. The tables highlighting sum of square distances in cluster

need to be referred in both the sheets. It is apparent from cell D40 of sheet 1-a-1-1 that

the lowest intra cluster distance square is 3447.02 in case of five clusters. However, in

case of six clusters, this is lower as highlighted by cell D41 of sheet 1-a-2-1 giving a

value of 3188.82. Since the objective in clustering is to ensure that intra-cluster variation

is minimised, hence six clusters would be preferred over five clusters for the given data.

(b) The description of the six clusters by their average characteristics is carried out below.

Cluster 1 (Married elderly customers) – High priced product (average price = $1,071) is

bought by the married elderly (greater than 55 years) who may or may not be members

and does not involve the use of discount cards. The average product category lies

between 2 and 3.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cluster 2 (Married middle age gender skewed customers) – High priced product (Average

price = $1,110) is bought on average by married customers aged 45-50 years having high

percentage of members and involves high usage of discount cards. Also, there is gender

skewing visible in this cluster. The average product category lies between 2 and 3.

Cluster 3 (Unmarried young age customers)- High priced product (Average price =

$1,210) is bought on average by unmarried customers aged 33-35 years having low

percentage of members and involves average usage of discount cards. The average

product category lies between 2 and 3.

Cluster 4 (Higher average product middle age customers): Low priced product (Average

price = $759) is bought dominantly by married customers aged 42-45 years having low

percentage of members and involves higher usage of discount cards. The average product

category is 4.

Cluster 5 (Unmarried old customers) - High priced product (Average price = $1224) is

bought dominantly by unmarried customers with average age above 60 years having

higher percentage of members and involves lower than average usage of discount cards.

The average product category exceeds 4.

Cluster 6 (Unmarried middle age customers) - Low priced product (Average price =

$743) is bought dominantly by unmarried customers (with high gender skewing) aged 40-

42 years having average representation of members and involves lower than average

usage of discount cards. The average product category lies between 3 and 4.

Question 2

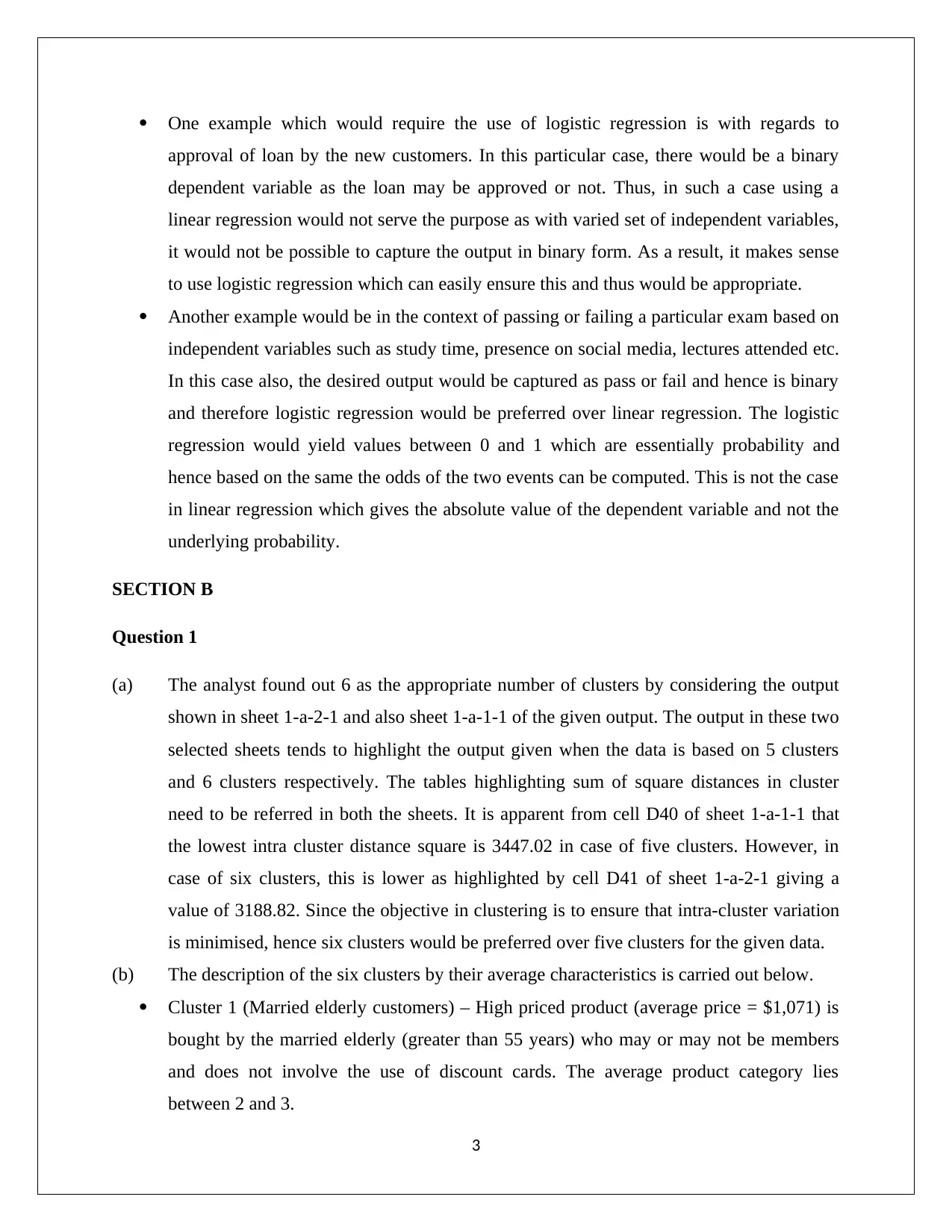

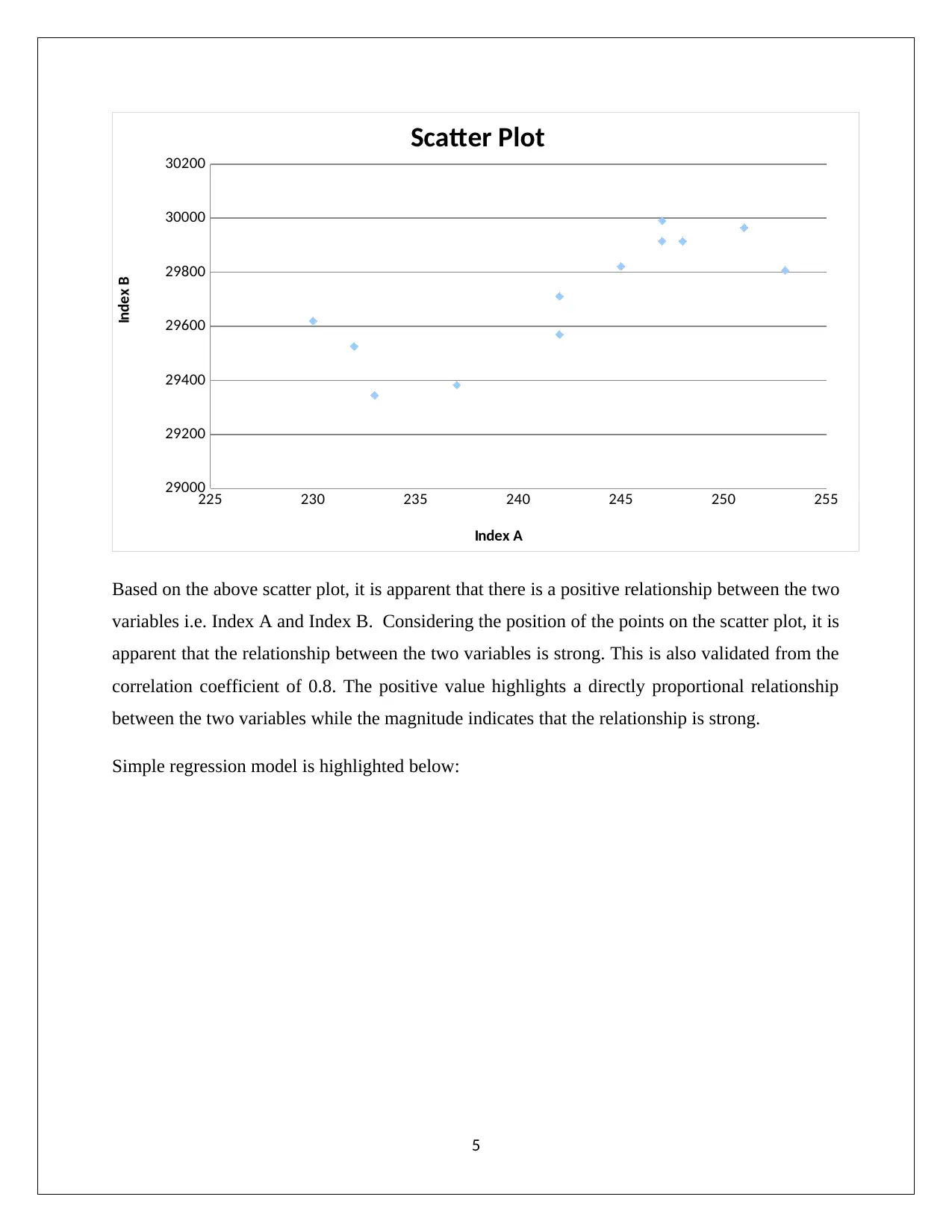

(a) The requisite scatter plot by taking index A as independent variable and index B as

dependent variable is highlighted below:

4

price = $1,110) is bought on average by married customers aged 45-50 years having high

percentage of members and involves high usage of discount cards. Also, there is gender

skewing visible in this cluster. The average product category lies between 2 and 3.

Cluster 3 (Unmarried young age customers)- High priced product (Average price =

$1,210) is bought on average by unmarried customers aged 33-35 years having low

percentage of members and involves average usage of discount cards. The average

product category lies between 2 and 3.

Cluster 4 (Higher average product middle age customers): Low priced product (Average

price = $759) is bought dominantly by married customers aged 42-45 years having low

percentage of members and involves higher usage of discount cards. The average product

category is 4.

Cluster 5 (Unmarried old customers) - High priced product (Average price = $1224) is

bought dominantly by unmarried customers with average age above 60 years having

higher percentage of members and involves lower than average usage of discount cards.

The average product category exceeds 4.

Cluster 6 (Unmarried middle age customers) - Low priced product (Average price =

$743) is bought dominantly by unmarried customers (with high gender skewing) aged 40-

42 years having average representation of members and involves lower than average

usage of discount cards. The average product category lies between 3 and 4.

Question 2

(a) The requisite scatter plot by taking index A as independent variable and index B as

dependent variable is highlighted below:

4

225 230 235 240 245 250 255

29000

29200

29400

29600

29800

30000

30200

Scatter Plot

Index A

Index B

Based on the above scatter plot, it is apparent that there is a positive relationship between the two

variables i.e. Index A and Index B. Considering the position of the points on the scatter plot, it is

apparent that the relationship between the two variables is strong. This is also validated from the

correlation coefficient of 0.8. The positive value highlights a directly proportional relationship

between the two variables while the magnitude indicates that the relationship is strong.

Simple regression model is highlighted below:

5

29000

29200

29400

29600

29800

30000

30200

Scatter Plot

Index A

Index B

Based on the above scatter plot, it is apparent that there is a positive relationship between the two

variables i.e. Index A and Index B. Considering the position of the points on the scatter plot, it is

apparent that the relationship between the two variables is strong. This is also validated from the

correlation coefficient of 0.8. The positive value highlights a directly proportional relationship

between the two variables while the magnitude indicates that the relationship is strong.

Simple regression model is highlighted below:

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

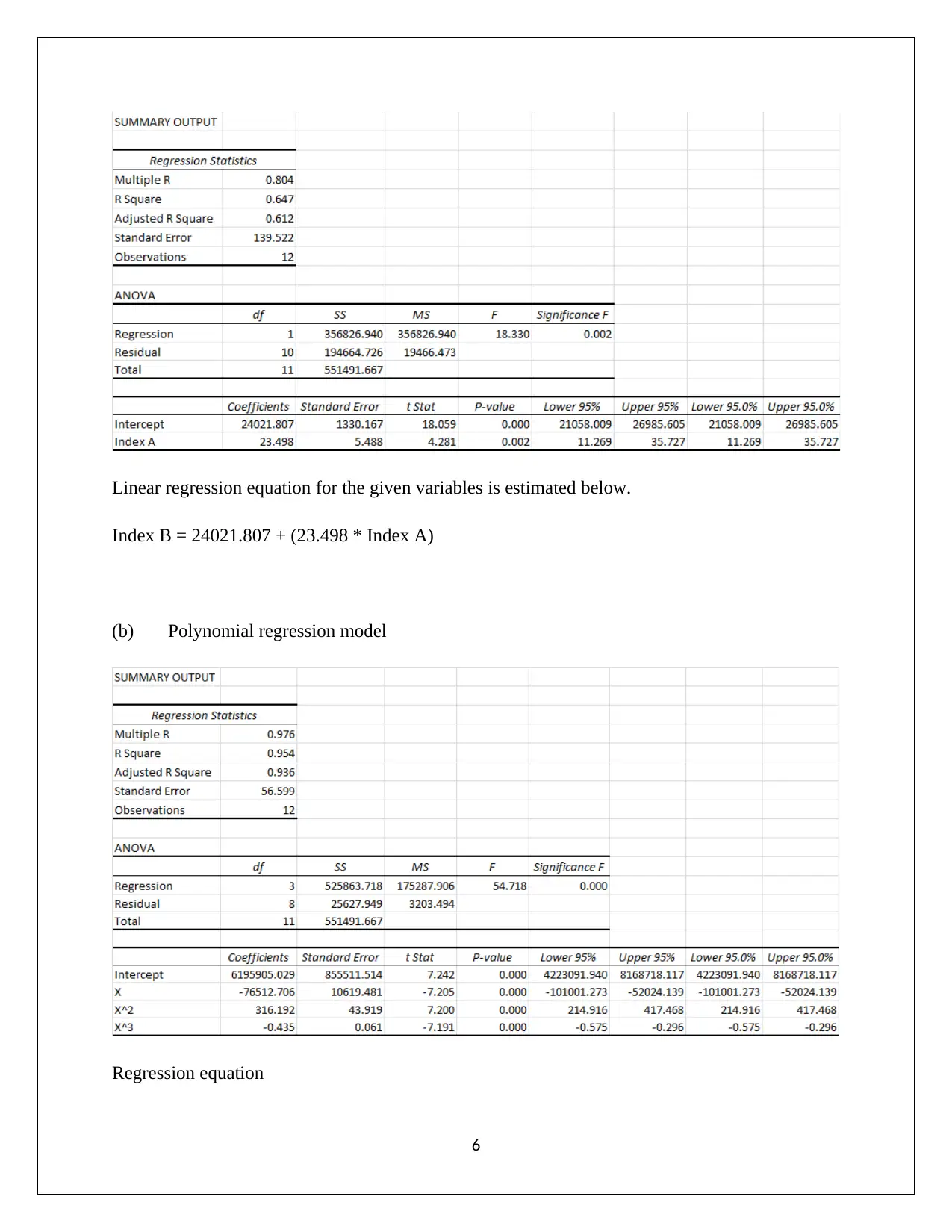

Linear regression equation for the given variables is estimated below.

Index B = 24021.807 + (23.498 * Index A)

(b) Polynomial regression model

Regression equation

6

Index B = 24021.807 + (23.498 * Index A)

(b) Polynomial regression model

Regression equation

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Let

Index A = X

Index B = Y

Y = 6195905.029 - 76512.706 X +316.192 X2 – 0.435 X3

In order to check the statistical significance of the given model, it is imperative to consider the

ANOVA output for regression.

Null Hypothesis: All slopes of the regression model are considered to be zero and hence

insignificant.

Alternative Hypothesis: Atleast one slope exists which cannot be considered as zero and hence is

not significant.

The F statistic is 54.718 and the corresponding p value is zero. Assuming a significance level of

5%, it is apparent that the p value is lower than the significance level and hence the available

evidence is sufficient to reject the null hypothesis and accept the alternative hypothesis.

Therefore, it can be concluded that there is atleast one slope coefficient which is significant

owing to which the regression model is also significant.

It is true that the new model is better than the old model which is apparent from the comparison

of R2 value which is significantly higher for the polynomial regression model than for the linear

regression. This highlights that the new model is able to explain a larger proportion of the

variation seen in the independent variable or Index B. As a result, it would be preferred over the

linear model computed earlier.

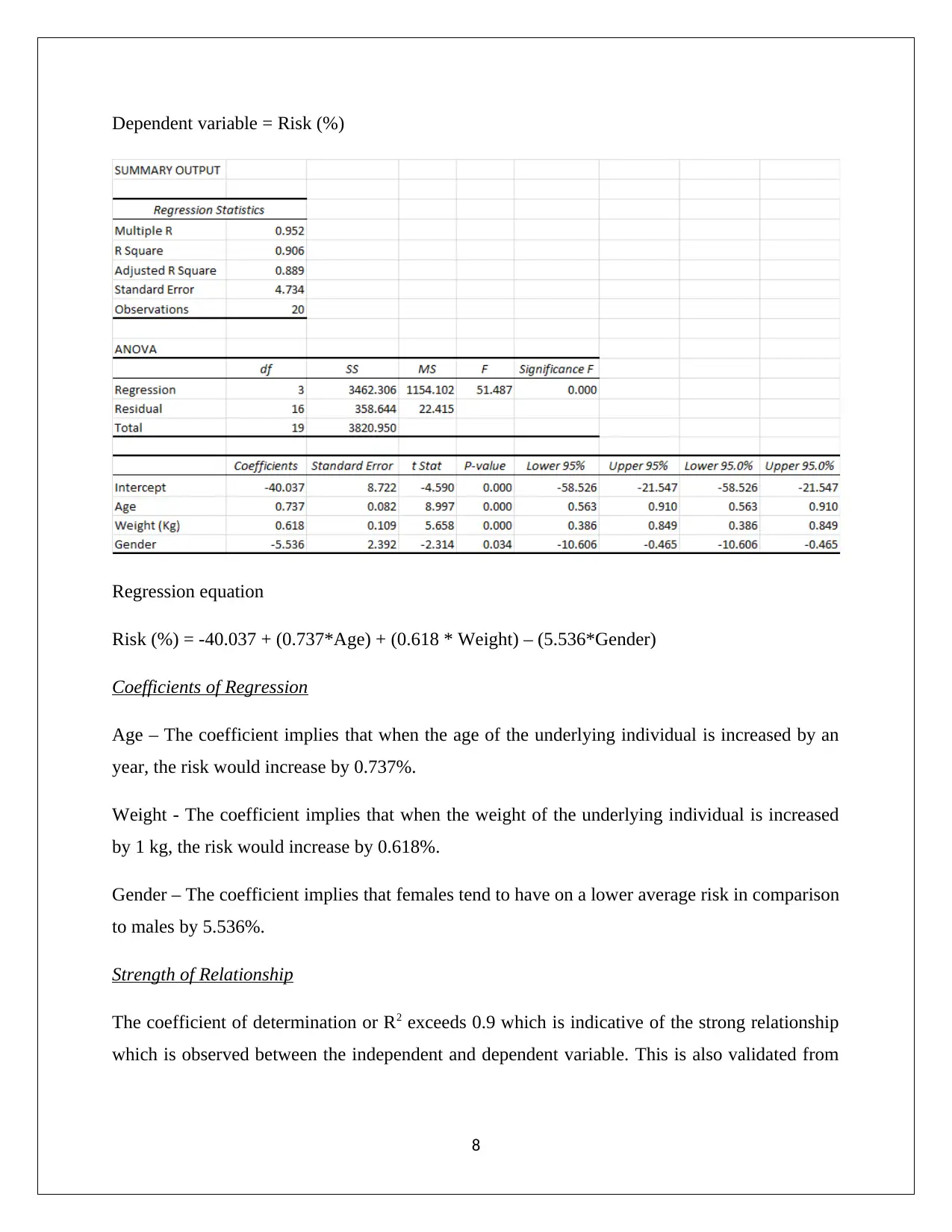

Question 3

(a) Multiple regression model

Independent variable = Person’s age, weight (kg), gender

Let’s gender: Male = 0, Female = 1

7

Index A = X

Index B = Y

Y = 6195905.029 - 76512.706 X +316.192 X2 – 0.435 X3

In order to check the statistical significance of the given model, it is imperative to consider the

ANOVA output for regression.

Null Hypothesis: All slopes of the regression model are considered to be zero and hence

insignificant.

Alternative Hypothesis: Atleast one slope exists which cannot be considered as zero and hence is

not significant.

The F statistic is 54.718 and the corresponding p value is zero. Assuming a significance level of

5%, it is apparent that the p value is lower than the significance level and hence the available

evidence is sufficient to reject the null hypothesis and accept the alternative hypothesis.

Therefore, it can be concluded that there is atleast one slope coefficient which is significant

owing to which the regression model is also significant.

It is true that the new model is better than the old model which is apparent from the comparison

of R2 value which is significantly higher for the polynomial regression model than for the linear

regression. This highlights that the new model is able to explain a larger proportion of the

variation seen in the independent variable or Index B. As a result, it would be preferred over the

linear model computed earlier.

Question 3

(a) Multiple regression model

Independent variable = Person’s age, weight (kg), gender

Let’s gender: Male = 0, Female = 1

7

Dependent variable = Risk (%)

Regression equation

Risk (%) = -40.037 + (0.737*Age) + (0.618 * Weight) – (5.536*Gender)

Coefficients of Regression

Age – The coefficient implies that when the age of the underlying individual is increased by an

year, the risk would increase by 0.737%.

Weight - The coefficient implies that when the weight of the underlying individual is increased

by 1 kg, the risk would increase by 0.618%.

Gender – The coefficient implies that females tend to have on a lower average risk in comparison

to males by 5.536%.

Strength of Relationship

The coefficient of determination or R2 exceeds 0.9 which is indicative of the strong relationship

which is observed between the independent and dependent variable. This is also validated from

8

Regression equation

Risk (%) = -40.037 + (0.737*Age) + (0.618 * Weight) – (5.536*Gender)

Coefficients of Regression

Age – The coefficient implies that when the age of the underlying individual is increased by an

year, the risk would increase by 0.737%.

Weight - The coefficient implies that when the weight of the underlying individual is increased

by 1 kg, the risk would increase by 0.618%.

Gender – The coefficient implies that females tend to have on a lower average risk in comparison

to males by 5.536%.

Strength of Relationship

The coefficient of determination or R2 exceeds 0.9 which is indicative of the strong relationship

which is observed between the independent and dependent variable. This is also validated from

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the ANOVA output which owing to a p value of lesser than 0.05 is indicative of the significance

of the given multiple linear regression model.

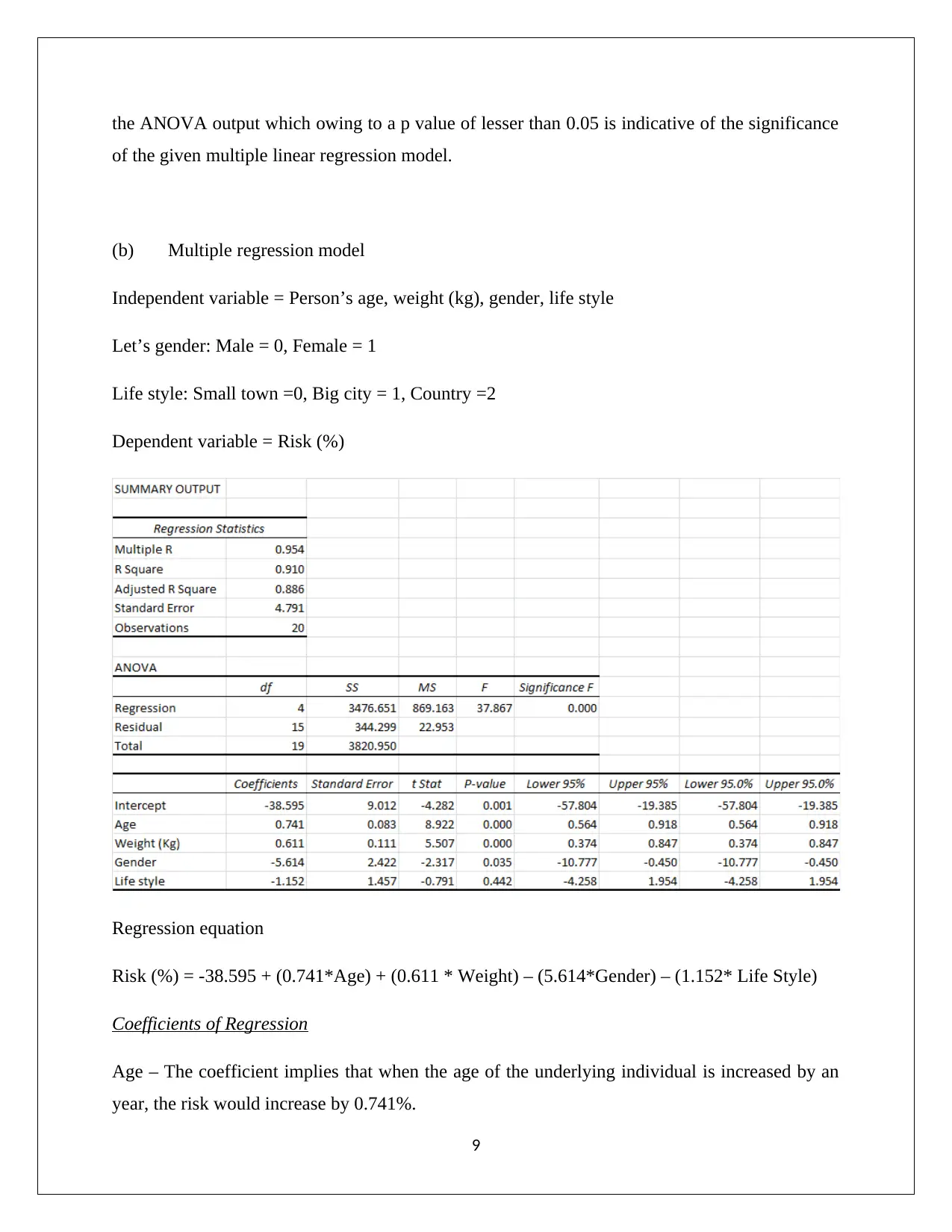

(b) Multiple regression model

Independent variable = Person’s age, weight (kg), gender, life style

Let’s gender: Male = 0, Female = 1

Life style: Small town =0, Big city = 1, Country =2

Dependent variable = Risk (%)

Regression equation

Risk (%) = -38.595 + (0.741*Age) + (0.611 * Weight) – (5.614*Gender) – (1.152* Life Style)

Coefficients of Regression

Age – The coefficient implies that when the age of the underlying individual is increased by an

year, the risk would increase by 0.741%.

9

of the given multiple linear regression model.

(b) Multiple regression model

Independent variable = Person’s age, weight (kg), gender, life style

Let’s gender: Male = 0, Female = 1

Life style: Small town =0, Big city = 1, Country =2

Dependent variable = Risk (%)

Regression equation

Risk (%) = -38.595 + (0.741*Age) + (0.611 * Weight) – (5.614*Gender) – (1.152* Life Style)

Coefficients of Regression

Age – The coefficient implies that when the age of the underlying individual is increased by an

year, the risk would increase by 0.741%.

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Weight - The coefficient implies that when the weight of the underlying individual is increased

by 1 kg, the risk would increase by 0.611%.

Gender – The coefficient implies that females tend to have on a lower average risk in comparison

to males by 5.614%.

Lifestyle – The coefficient implies that risk tends to be higher for the small town life style and

tends to be lower for Big city and country by 1.152% and 2.304% respectively.

Strength of Relationship

The coefficient of determination or R2 exceeds 0.9 which is indicative of the strong relationship

which is observed between the independent and dependent variable. This is also validated from

the ANOVA output which owing to a p value of lesser than 0.05 is indicative of the significance

of the given multiple linear regression model. However, there has been a decrease in the adjusted

R2 in comparison with the previous model and hence the previous model was superior in

comparison to the current regression model under consideration.

(c) Risk percentage =?

Person’s age = 55 years old

Weight (kg) = 70 kg

Gender = Male = 0

Life style = Big City = 1

Hence,

Risk (%) = -38.595 + (0.741*55) + (0.611 * 70) – (5.614*0) – (1.152* 1)

= 43.746%

Risk (%) = 43.746%

Therefore, the risk percentage of diabetes over the next 4 years for the given inputs is 43.746%.

10

by 1 kg, the risk would increase by 0.611%.

Gender – The coefficient implies that females tend to have on a lower average risk in comparison

to males by 5.614%.

Lifestyle – The coefficient implies that risk tends to be higher for the small town life style and

tends to be lower for Big city and country by 1.152% and 2.304% respectively.

Strength of Relationship

The coefficient of determination or R2 exceeds 0.9 which is indicative of the strong relationship

which is observed between the independent and dependent variable. This is also validated from

the ANOVA output which owing to a p value of lesser than 0.05 is indicative of the significance

of the given multiple linear regression model. However, there has been a decrease in the adjusted

R2 in comparison with the previous model and hence the previous model was superior in

comparison to the current regression model under consideration.

(c) Risk percentage =?

Person’s age = 55 years old

Weight (kg) = 70 kg

Gender = Male = 0

Life style = Big City = 1

Hence,

Risk (%) = -38.595 + (0.741*55) + (0.611 * 70) – (5.614*0) – (1.152* 1)

= 43.746%

Risk (%) = 43.746%

Therefore, the risk percentage of diabetes over the next 4 years for the given inputs is 43.746%.

10

Question 4

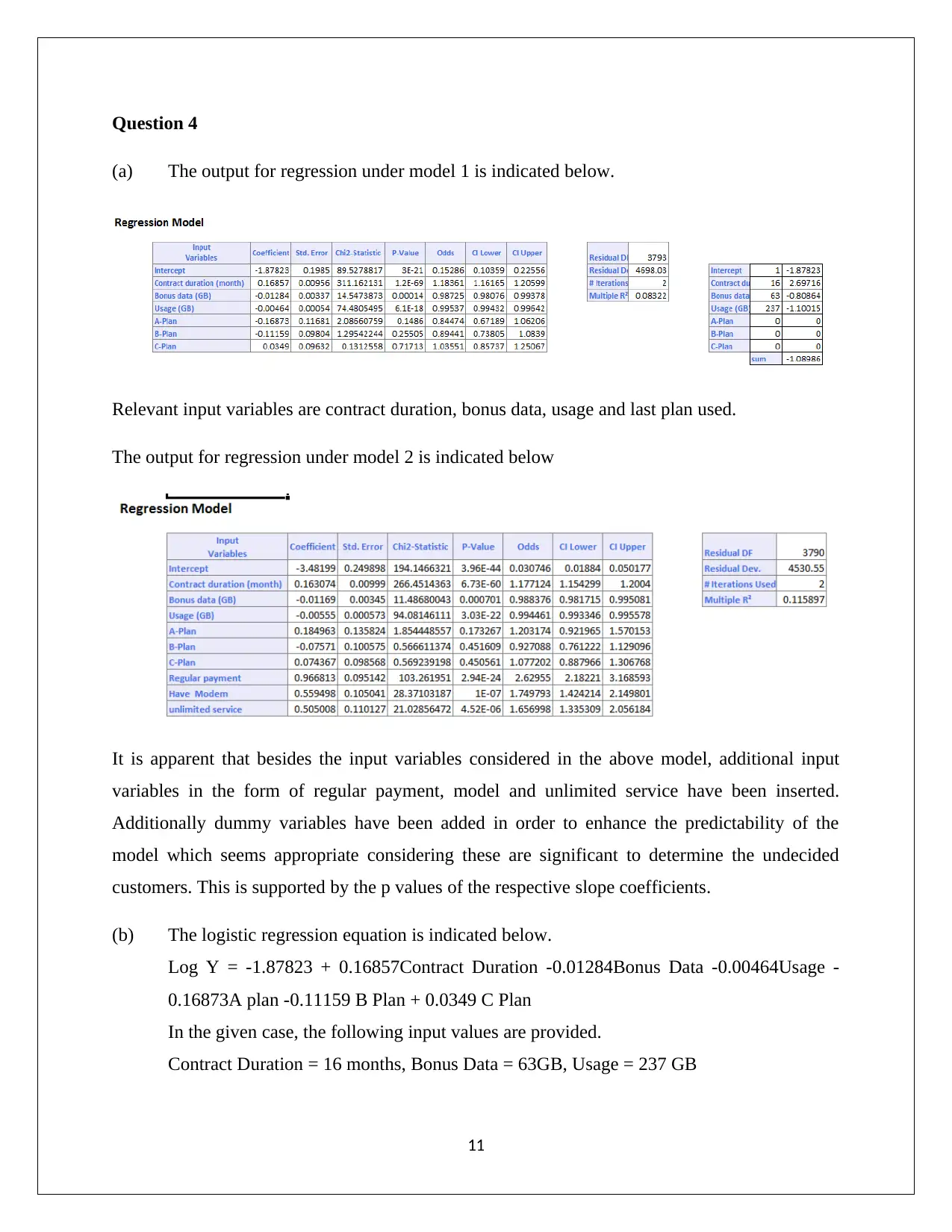

(a) The output for regression under model 1 is indicated below.

Relevant input variables are contract duration, bonus data, usage and last plan used.

The output for regression under model 2 is indicated below

It is apparent that besides the input variables considered in the above model, additional input

variables in the form of regular payment, model and unlimited service have been inserted.

Additionally dummy variables have been added in order to enhance the predictability of the

model which seems appropriate considering these are significant to determine the undecided

customers. This is supported by the p values of the respective slope coefficients.

(b) The logistic regression equation is indicated below.

Log Y = -1.87823 + 0.16857Contract Duration -0.01284Bonus Data -0.00464Usage -

0.16873A plan -0.11159 B Plan + 0.0349 C Plan

In the given case, the following input values are provided.

Contract Duration = 16 months, Bonus Data = 63GB, Usage = 237 GB

11

(a) The output for regression under model 1 is indicated below.

Relevant input variables are contract duration, bonus data, usage and last plan used.

The output for regression under model 2 is indicated below

It is apparent that besides the input variables considered in the above model, additional input

variables in the form of regular payment, model and unlimited service have been inserted.

Additionally dummy variables have been added in order to enhance the predictability of the

model which seems appropriate considering these are significant to determine the undecided

customers. This is supported by the p values of the respective slope coefficients.

(b) The logistic regression equation is indicated below.

Log Y = -1.87823 + 0.16857Contract Duration -0.01284Bonus Data -0.00464Usage -

0.16873A plan -0.11159 B Plan + 0.0349 C Plan

In the given case, the following input values are provided.

Contract Duration = 16 months, Bonus Data = 63GB, Usage = 237 GB

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.