Competitive Strength Assessment

VerifiedAdded on 2023/06/14

|14

|2966

|410

AI Summary

This report evaluates the competitive strength of BP Australia against its rivals Caltex and Shell in the oil and gas industry in Australia. It identifies key success factors such as product features, reputation and goodwill, financial strength, technological services and distribution network. The report recommends defensive strategies for BP Australia to maintain its competitive position.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: COMPETITIVE STRENGTH ANALYSIS

Competitive Strength Assessment

Name of the University:

Name of the Student:

Authors Note:

Competitive Strength Assessment

Name of the University:

Name of the Student:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1COMPETITIVE STRENGTH ANALYSIS

Table of Contents

Part A...................................................................................................................................2

Overview of BP Australia and Industry...........................................................................2

Competitive Strength Analysis of BP Australia and its Rival companies - Caltex and

Shell.............................................................................................................................................3

Key Success Factors for the Industry..............................................................................4

Competitiveness of BP Australia against its Rivals........................................................5

Strategy Selection Based on Competitive Position in the Market...................................7

Part B...................................................................................................................................8

Peer Evaluation Form......................................................................................................8

References..........................................................................................................................11

Table of Contents

Part A...................................................................................................................................2

Overview of BP Australia and Industry...........................................................................2

Competitive Strength Analysis of BP Australia and its Rival companies - Caltex and

Shell.............................................................................................................................................3

Key Success Factors for the Industry..............................................................................4

Competitiveness of BP Australia against its Rivals........................................................5

Strategy Selection Based on Competitive Position in the Market...................................7

Part B...................................................................................................................................8

Peer Evaluation Form......................................................................................................8

References..........................................................................................................................11

2COMPETITIVE STRENGTH ANALYSIS

Part A

Overview of BP Australia and Industry

BP Australia operates its business within Oil and Gas Services Industry and is involved in

manufacturing and distributing petroleum services and products. The firm was established n

1919 and is situated in Melbourne Australia that operates as a subsidiary of BP Plc. The

company is involved in upstream exploration, crude oil and natural gas refining, downstream

marketing supply of necessary fuel, lubricant and bitumen products (Al-Dajani et al. 2014). The

company offers services and products to its consumers all over Australia. The company is

involved in exploration and manufacturing of oil, natural gas, liquefied natural gas along with

transportation, refining and marketing of lubricant or petroleum products. BP Australia

transports refined as well as unrefined products to and from terminals and refineries along with

the consumers employing gas carriers, ships, pipelines, trains and trucks. The company offers its

goods to retail and commercial consumers from several industries including aviation, racing and

retail service stations in (Australia bp.com. 2018).

Oil and gas services industry in Australia is robust that has resulted in substantial growth

over the past twenty years. In the industry the local organizations great considered to develop its

deep and remote resources in order to attain expertise in exploration and drilling technologies,

engineering and design along with operations and maintenance. The oil and gas industry of

Australia has a global reputation in order to deal with challenges associated with remote location

of its resources along with social and environmental challenges. Education and training ability of

Australia is also vita to global competitiveness of its oil and gas industry (Browne et al. 2016).

Since the 1965 drilling of first offshore well and with the modern coal seam gas boom, the

Part A

Overview of BP Australia and Industry

BP Australia operates its business within Oil and Gas Services Industry and is involved in

manufacturing and distributing petroleum services and products. The firm was established n

1919 and is situated in Melbourne Australia that operates as a subsidiary of BP Plc. The

company is involved in upstream exploration, crude oil and natural gas refining, downstream

marketing supply of necessary fuel, lubricant and bitumen products (Al-Dajani et al. 2014). The

company offers services and products to its consumers all over Australia. The company is

involved in exploration and manufacturing of oil, natural gas, liquefied natural gas along with

transportation, refining and marketing of lubricant or petroleum products. BP Australia

transports refined as well as unrefined products to and from terminals and refineries along with

the consumers employing gas carriers, ships, pipelines, trains and trucks. The company offers its

goods to retail and commercial consumers from several industries including aviation, racing and

retail service stations in (Australia bp.com. 2018).

Oil and gas services industry in Australia is robust that has resulted in substantial growth

over the past twenty years. In the industry the local organizations great considered to develop its

deep and remote resources in order to attain expertise in exploration and drilling technologies,

engineering and design along with operations and maintenance. The oil and gas industry of

Australia has a global reputation in order to deal with challenges associated with remote location

of its resources along with social and environmental challenges. Education and training ability of

Australia is also vita to global competitiveness of its oil and gas industry (Browne et al. 2016).

Since the 1965 drilling of first offshore well and with the modern coal seam gas boom, the

3COMPETITIVE STRENGTH ANALYSIS

industry has generated and sustained internationally respected, innovative services and

technology. This is built around the huge number of oil and gas projects.

Competitive Strength Analysis of BP Australia and its Rival companies - Caltex and Shell

Competitive strength of BP Australia along with its rival companies such as Caltex and

Shell is evaluated. BP Australia has competitive strength is in its exceptionally developed

business model. To maintain its competitive and sustainable position, the company has

maintained diversified portfolio all across business, geographies as well as resource types (Busch

and McCormick 2014). Developing the upstream and downstream businesses and properly

established trading capabilities can support in mitigating the impact of lower commodity pricing

cycles. The company has competitive advantage of maintaining balanced portfolio with

advantaged oil and gas along with dynamic investment strategy offers with resilience.

On the other hand, competitive strengths attained by Caltex include an efficient supply

and marketing infrastructure that had facilitated the company in attaining a competitive edge.

Moreover, a fast successful growth in the marketing business has also resulted in its profitability

increase. Board service and product portfolio including diesel, biofuel blends, precision spray

oils and marine fuels facilities in decreasing risks associated with one field and attain revenue

from a number of diverse sources (Caltex 2018). The company also has competitive strengths in

having efficient refining output results supported by stronger refinery margins, plant reliability

advantages along with having decreased depreciation charge. This has also resulted in the

company’s financial success.

Competitive strengths of Shell Company include strong market position, strong exploring

capability, vertical integration along with strong research and development. The company has

industry has generated and sustained internationally respected, innovative services and

technology. This is built around the huge number of oil and gas projects.

Competitive Strength Analysis of BP Australia and its Rival companies - Caltex and Shell

Competitive strength of BP Australia along with its rival companies such as Caltex and

Shell is evaluated. BP Australia has competitive strength is in its exceptionally developed

business model. To maintain its competitive and sustainable position, the company has

maintained diversified portfolio all across business, geographies as well as resource types (Busch

and McCormick 2014). Developing the upstream and downstream businesses and properly

established trading capabilities can support in mitigating the impact of lower commodity pricing

cycles. The company has competitive advantage of maintaining balanced portfolio with

advantaged oil and gas along with dynamic investment strategy offers with resilience.

On the other hand, competitive strengths attained by Caltex include an efficient supply

and marketing infrastructure that had facilitated the company in attaining a competitive edge.

Moreover, a fast successful growth in the marketing business has also resulted in its profitability

increase. Board service and product portfolio including diesel, biofuel blends, precision spray

oils and marine fuels facilities in decreasing risks associated with one field and attain revenue

from a number of diverse sources (Caltex 2018). The company also has competitive strengths in

having efficient refining output results supported by stronger refinery margins, plant reliability

advantages along with having decreased depreciation charge. This has also resulted in the

company’s financial success.

Competitive strengths of Shell Company include strong market position, strong exploring

capability, vertical integration along with strong research and development. The company has

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4COMPETITIVE STRENGTH ANALYSIS

always attempted to improve its technologies for carbon footprint decrease along with

developing methods to explore more fuels in decreased effort. It is also gathered that the

company is associated with exploration and production (Chan, Cameron and Yoon 2017).

Moreover, in downstream market it is associated with marketing the refined products. The

vertical integration offers high competitive advantages in aspects of cost benefits and quality

control.

Key Success Factors for the Industry

Key success factors that are present in the oil and gas industry in Australia include

product features, reputation and goodwill, financial strength, technological services and

distribution network. The product features of diversification are deemed to be important in

decreasing business risks encompassing anticipation of oil price fluctuation. Spread out location

of the oil and gas reserve might facilitate in decreasing business interruption risk (Chang, Hsieh

and Chen 2016).

Another key success factor that is important in the oil and gas industry is the financial

strength. This evaluation encompasses an analysis of management policy, strategy and

philosophy towards the financial risk. This also encompasses analysis of financial targets of the

management, hedging and certain other policies in an effort to decrease overall risks of a

petroleum company. Management of the liabilities of the petroleum companies are also reviewed

in a better manner (Chuang and Yang 2014).

Reputation and goodwill is another key success factor as the petroleum industry for long

time has been an industry where discretionary decisions such as concessions or license awards

always attempted to improve its technologies for carbon footprint decrease along with

developing methods to explore more fuels in decreased effort. It is also gathered that the

company is associated with exploration and production (Chan, Cameron and Yoon 2017).

Moreover, in downstream market it is associated with marketing the refined products. The

vertical integration offers high competitive advantages in aspects of cost benefits and quality

control.

Key Success Factors for the Industry

Key success factors that are present in the oil and gas industry in Australia include

product features, reputation and goodwill, financial strength, technological services and

distribution network. The product features of diversification are deemed to be important in

decreasing business risks encompassing anticipation of oil price fluctuation. Spread out location

of the oil and gas reserve might facilitate in decreasing business interruption risk (Chang, Hsieh

and Chen 2016).

Another key success factor that is important in the oil and gas industry is the financial

strength. This evaluation encompasses an analysis of management policy, strategy and

philosophy towards the financial risk. This also encompasses analysis of financial targets of the

management, hedging and certain other policies in an effort to decrease overall risks of a

petroleum company. Management of the liabilities of the petroleum companies are also reviewed

in a better manner (Chuang and Yang 2014).

Reputation and goodwill is another key success factor as the petroleum industry for long

time has been an industry where discretionary decisions such as concessions or license awards

5COMPETITIVE STRENGTH ANALYSIS

have been vital. Reputation is also deemed as a vital factor in measuring success of the

petroleum industry.

Technological services acts as one of the key success indicator in the petroleum industry

as for attaining competitive advantages within the industry. The industry measures success of the

companies operating within it through analyzing how well they are maintaining technologically

advanced supply industry.

Distribution network serves as another key success indicator in the petroleum industry.

This is for the reason that competitive advantages can be attained from several activates

performed by the petroleum companies operating within the industry through generating and

delivering value (Fryer, Antony and Douglas 2015). Value chain maintenance is one of the major

key success indicator this makes the way in which the petroleum companies maintain

relationship between the shop and the consumers.

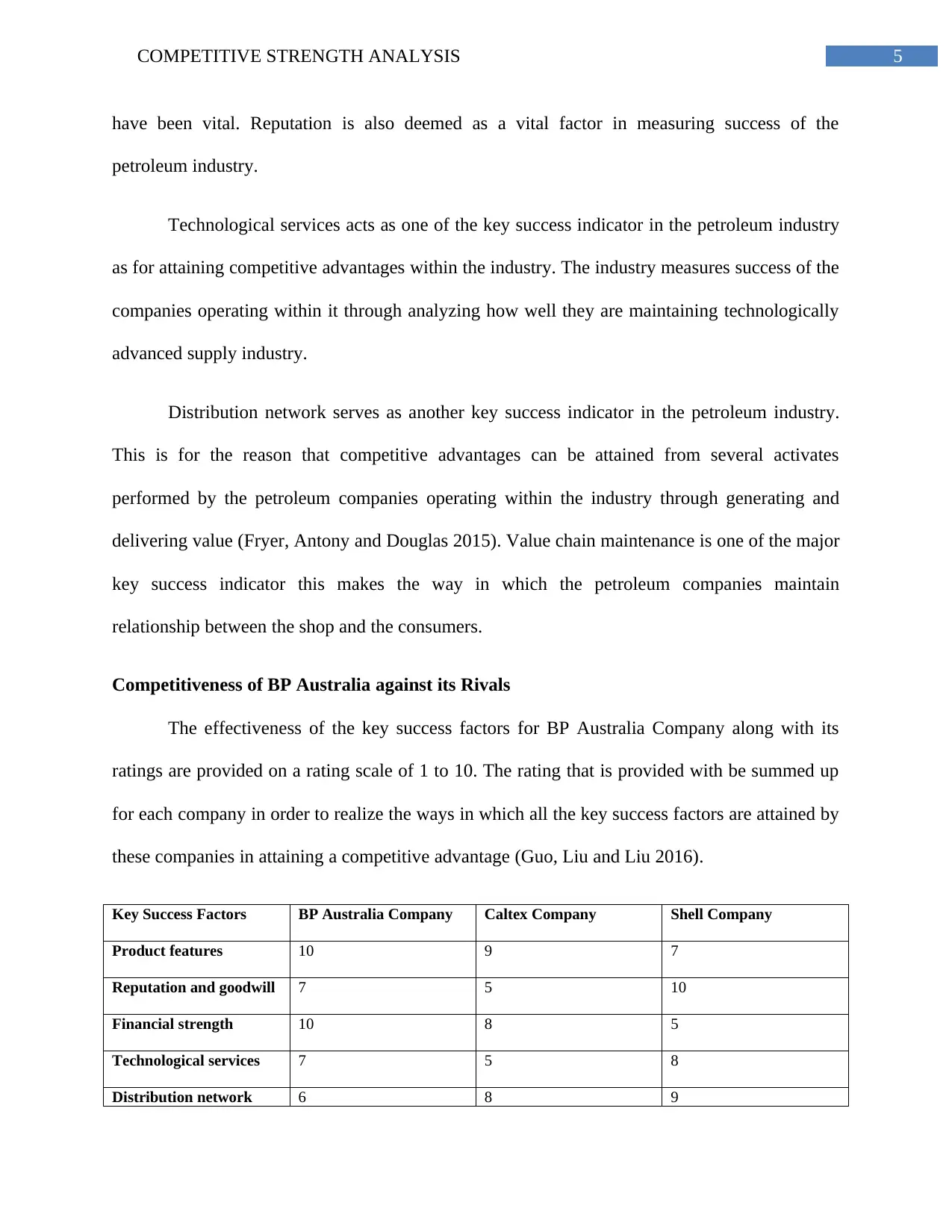

Competitiveness of BP Australia against its Rivals

The effectiveness of the key success factors for BP Australia Company along with its

ratings are provided on a rating scale of 1 to 10. The rating that is provided with be summed up

for each company in order to realize the ways in which all the key success factors are attained by

these companies in attaining a competitive advantage (Guo, Liu and Liu 2016).

Key Success Factors BP Australia Company Caltex Company Shell Company

Product features 10 9 7

Reputation and goodwill 7 5 10

Financial strength 10 8 5

Technological services 7 5 8

Distribution network 6 8 9

have been vital. Reputation is also deemed as a vital factor in measuring success of the

petroleum industry.

Technological services acts as one of the key success indicator in the petroleum industry

as for attaining competitive advantages within the industry. The industry measures success of the

companies operating within it through analyzing how well they are maintaining technologically

advanced supply industry.

Distribution network serves as another key success indicator in the petroleum industry.

This is for the reason that competitive advantages can be attained from several activates

performed by the petroleum companies operating within the industry through generating and

delivering value (Fryer, Antony and Douglas 2015). Value chain maintenance is one of the major

key success indicator this makes the way in which the petroleum companies maintain

relationship between the shop and the consumers.

Competitiveness of BP Australia against its Rivals

The effectiveness of the key success factors for BP Australia Company along with its

ratings are provided on a rating scale of 1 to 10. The rating that is provided with be summed up

for each company in order to realize the ways in which all the key success factors are attained by

these companies in attaining a competitive advantage (Guo, Liu and Liu 2016).

Key Success Factors BP Australia Company Caltex Company Shell Company

Product features 10 9 7

Reputation and goodwill 7 5 10

Financial strength 10 8 5

Technological services 7 5 8

Distribution network 6 8 9

6COMPETITIVE STRENGTH ANALYSIS

Total 40 35 39

From the evaluation of the key success factors of these companies it has been gathered

that BP Australia has efficient product features that serves as its major success factor within

Australian oil and gas industry. The products features of this company is deemed to attain

competitive advantage over Shell and Caltex Company for there are efficient forms of gas to

liquids fuel along with other products. Shell Company has better success factor in goodwill and

reputation. BP Australia is in the second position compared to its competitors as its competitors

have adopted better environment reforms as an aspect of their reputation management strategies.

Financial strength of BP Australia is better than its competitors that serve as one of its major

success factors. This is for the reason that the company has maintained better liquidity along with

effective capital resources. Technological services offered by BP Australia are situated in the

second position in comparison to its competitors. This is for the reason that the company offers a

wide range of technical services and expertise that focuses on enhancing health, safety along

with company’s performance in the industry. Distribution network of BP Australia is not much

better than its business rivals. This is for the reason that it operates within downstream fuels it

has diverse fuel sources, domestic refineries along with its fuel distributors.

Strategy Selection Based on Competitive Position in the Market

In order to attain competitive advantage over Shell and Caltex Company, BP Australia is

recommended to implement certain defensive strategy based on the effectiveness of its key

success factors. In following this strategy, the company will try to develop a balanced portfolio

with having competitive downstream along with low carbon future maintenance (Irjayanti and

Azis 2015).

Total 40 35 39

From the evaluation of the key success factors of these companies it has been gathered

that BP Australia has efficient product features that serves as its major success factor within

Australian oil and gas industry. The products features of this company is deemed to attain

competitive advantage over Shell and Caltex Company for there are efficient forms of gas to

liquids fuel along with other products. Shell Company has better success factor in goodwill and

reputation. BP Australia is in the second position compared to its competitors as its competitors

have adopted better environment reforms as an aspect of their reputation management strategies.

Financial strength of BP Australia is better than its competitors that serve as one of its major

success factors. This is for the reason that the company has maintained better liquidity along with

effective capital resources. Technological services offered by BP Australia are situated in the

second position in comparison to its competitors. This is for the reason that the company offers a

wide range of technical services and expertise that focuses on enhancing health, safety along

with company’s performance in the industry. Distribution network of BP Australia is not much

better than its business rivals. This is for the reason that it operates within downstream fuels it

has diverse fuel sources, domestic refineries along with its fuel distributors.

Strategy Selection Based on Competitive Position in the Market

In order to attain competitive advantage over Shell and Caltex Company, BP Australia is

recommended to implement certain defensive strategy based on the effectiveness of its key

success factors. In following this strategy, the company will try to develop a balanced portfolio

with having competitive downstream along with low carbon future maintenance (Irjayanti and

Azis 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7COMPETITIVE STRENGTH ANALYSIS

Another effective defensive strategy that can be implemented by the company is hybrid

strategy that indicates the company must operate its business in a low cost based environment.

The company must also focus on reinvesting in low price along with differentiation in business

operation. In order to sustain its competitive position as one of the most established petroleum

organization, it must employ hybrid strategy (Kayikci, Bartolacci and LeBlanc 2018). It must

also consider following this strategy in the long term for the reason that it can facilitate the

company in attaining differentiation along with a price which is lower in comparison to the

competitors of BP Australia. Over the years, the company must also consider undergoing major

rebuilds of CDU in order to process heavy crude along with its efficient manufacture.

Technological success factor can be improved by the company through maintaining effective

new world scale sculpture removal along with gas oil hydro treating units. The focus of this

strategy is relied on profit growth along with application of alternative energy. This defensive

strategy if implemented by BP Australia can facilitate in developing leading technologies along

with effective consumer relationships (Lee, Kim and Hong 2017). Resources and capabilities of

the company must also change gradually that can result in increased investments and profits with

increased oil prices.

Part B

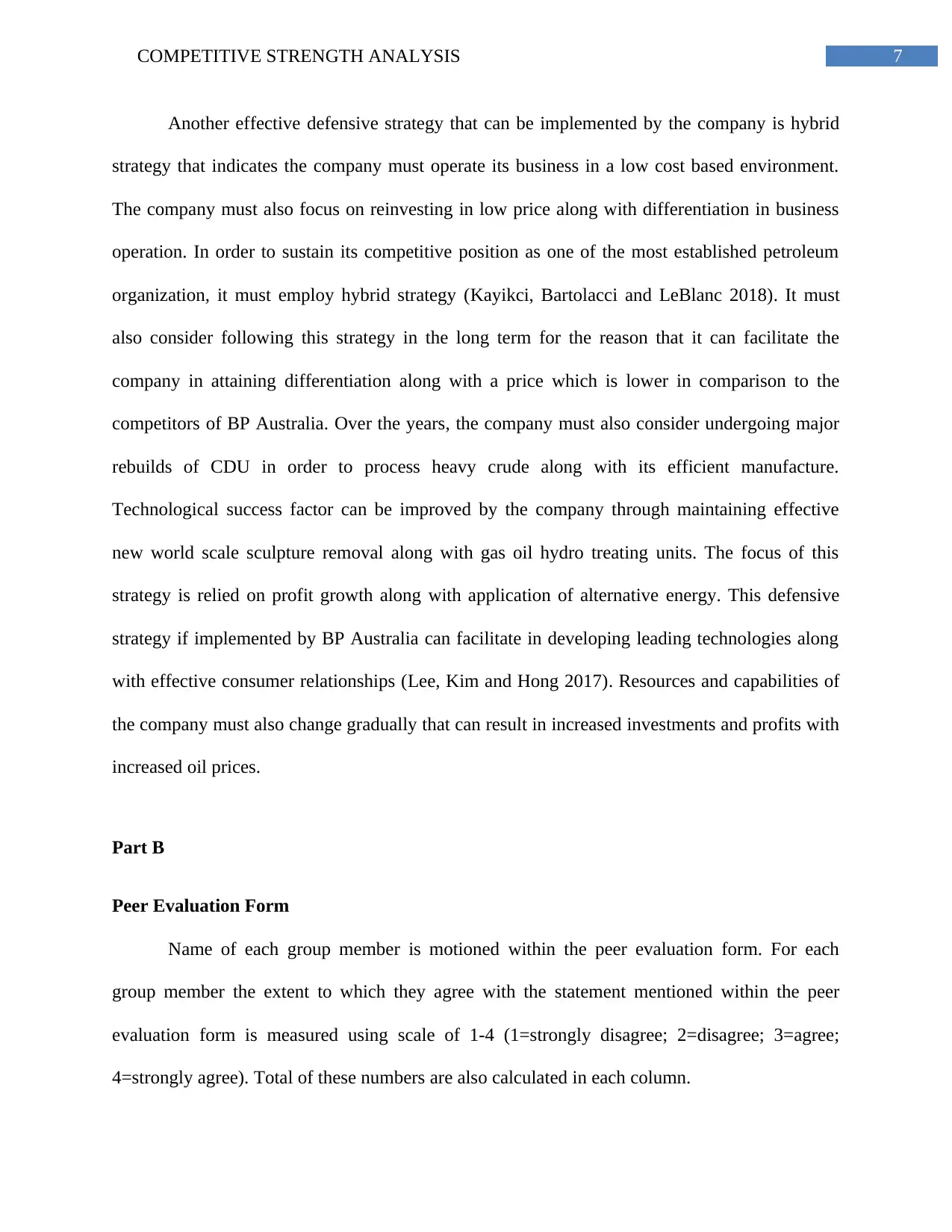

Peer Evaluation Form

Name of each group member is motioned within the peer evaluation form. For each

group member the extent to which they agree with the statement mentioned within the peer

evaluation form is measured using scale of 1-4 (1=strongly disagree; 2=disagree; 3=agree;

4=strongly agree). Total of these numbers are also calculated in each column.

Another effective defensive strategy that can be implemented by the company is hybrid

strategy that indicates the company must operate its business in a low cost based environment.

The company must also focus on reinvesting in low price along with differentiation in business

operation. In order to sustain its competitive position as one of the most established petroleum

organization, it must employ hybrid strategy (Kayikci, Bartolacci and LeBlanc 2018). It must

also consider following this strategy in the long term for the reason that it can facilitate the

company in attaining differentiation along with a price which is lower in comparison to the

competitors of BP Australia. Over the years, the company must also consider undergoing major

rebuilds of CDU in order to process heavy crude along with its efficient manufacture.

Technological success factor can be improved by the company through maintaining effective

new world scale sculpture removal along with gas oil hydro treating units. The focus of this

strategy is relied on profit growth along with application of alternative energy. This defensive

strategy if implemented by BP Australia can facilitate in developing leading technologies along

with effective consumer relationships (Lee, Kim and Hong 2017). Resources and capabilities of

the company must also change gradually that can result in increased investments and profits with

increased oil prices.

Part B

Peer Evaluation Form

Name of each group member is motioned within the peer evaluation form. For each

group member the extent to which they agree with the statement mentioned within the peer

evaluation form is measured using scale of 1-4 (1=strongly disagree; 2=disagree; 3=agree;

4=strongly agree). Total of these numbers are also calculated in each column.

8COMPETITIVE STRENGTH ANALYSIS

Evaluation Criteria Group member: Group member: Group member: Group member:

Attended every group

meetings regularly and

arrives within time.

4 3 2 4

Contributes

meaningfully within the

group discussions.

3 4 4 4

Attaining group

assignments within

time.

3 2 4 4

Accomplishing work

within a quality manner.

4 4 3 3

Indicates a cooperative

and supportive attitude.

2 4 3 3

Contributes

considerably to the

project success.

3 3 4 3

Totals 19 20 20 21

Feedback on team dynamics:

Evaluation Criteria Group member: Group member: Group member: Group member:

Attended every group

meetings regularly and

arrives within time.

4 3 2 4

Contributes

meaningfully within the

group discussions.

3 4 4 4

Attaining group

assignments within

time.

3 2 4 4

Accomplishing work

within a quality manner.

4 4 3 3

Indicates a cooperative

and supportive attitude.

2 4 3 3

Contributes

considerably to the

project success.

3 3 4 3

Totals 19 20 20 21

Feedback on team dynamics:

9COMPETITIVE STRENGTH ANALYSIS

1. How effectively did the group work?

The group was deemed to be efficient in attaining the objectives of the report. This group

work facilitated them to get involved in developing the process of evaluation. This might

encompass maintaining their establishment on attaining advanced and deep understanding of

the subject contents, processes and skills. This can also encompass evaluating individual

assessment criteria by methods of consultation with teaching staff (Park, Chang and Kang

2015). The major aim of the report was attained by the group that increased their advanced

and deep learning of key success factors within the petroleum industry. The group work

encourages increased group involvement as well as responsibility. The group attained great

success in attaining the report objectives through goal setting.

2. Where the behaviors of the group members valuable or detrimental for the team?

The behaviors of the group members were valuable and detrimental to the performance of the

team in attaining project objectives. The team attained good points in the fair work sharing.

There was a sense of equity and fairness within a good team member. There was also a sense of

equity that has greatly vital for collective motivation of the team members. The team members

efficiently identified key success factors that are present in the oil and gas industry in Australia

includes product features, reputation and goodwill, financial strength, technological services and

distribution network (Soetanto et al. 2015).

3. What learning is gathered regarding working within a group from this report that will be

carried by the group members in the next group experience?

1. How effectively did the group work?

The group was deemed to be efficient in attaining the objectives of the report. This group

work facilitated them to get involved in developing the process of evaluation. This might

encompass maintaining their establishment on attaining advanced and deep understanding of

the subject contents, processes and skills. This can also encompass evaluating individual

assessment criteria by methods of consultation with teaching staff (Park, Chang and Kang

2015). The major aim of the report was attained by the group that increased their advanced

and deep learning of key success factors within the petroleum industry. The group work

encourages increased group involvement as well as responsibility. The group attained great

success in attaining the report objectives through goal setting.

2. Where the behaviors of the group members valuable or detrimental for the team?

The behaviors of the group members were valuable and detrimental to the performance of the

team in attaining project objectives. The team attained good points in the fair work sharing.

There was a sense of equity and fairness within a good team member. There was also a sense of

equity that has greatly vital for collective motivation of the team members. The team members

efficiently identified key success factors that are present in the oil and gas industry in Australia

includes product features, reputation and goodwill, financial strength, technological services and

distribution network (Soetanto et al. 2015).

3. What learning is gathered regarding working within a group from this report that will be

carried by the group members in the next group experience?

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10COMPETITIVE STRENGTH ANALYSIS

From accomplishing this report, the group members learned regarding the key success

factors that are present in the oil and gas industry in Australia. This includes product features,

reputation and goodwill, financial strength, technological services and distribution network. The

team has also considered enhancing future analysis of the petroleum industry performance based

on few more key success factors.

From accomplishing this report, the group members learned regarding the key success

factors that are present in the oil and gas industry in Australia. This includes product features,

reputation and goodwill, financial strength, technological services and distribution network. The

team has also considered enhancing future analysis of the petroleum industry performance based

on few more key success factors.

11COMPETITIVE STRENGTH ANALYSIS

References

Al-Dajani, H., Dedoussis, E., Watson, E. and Tzokas, N., 2014. Graduate entrepreneurship

incubation environments: A framework of key success factors. Industry and Higher bp.com.,

2018Education, 28(3), pp.201-213.

bp.com., 2018. [online] Available at: https://www.bp.com/en_au/australia.html [Accessed 3 Apr.

2018].

Browne, W., Dreitlein, S., Manzoni, J. and Mere, A., 2016. Two key success factors for global

project team leadership: Communications and human resource management. Journal of

Information Technology and Economic Development, 7(2), p.40.

Busch, H. and McCormick, K., 2014. Local power: exploring the motivations of mayors and key

success factors for local municipalities to go 100% renewable energy. Energy, Sustainability and

Society, 4(1), p.5.

Caltex., 2018. Caltex Australia | Fuels, Convenience Retail & Lubricants. [online] Available at:

https://www.caltex.com.au/ [Accessed 3 Apr. 2018].

Chan, D., Cameron, M. and Yoon, Y., 2017. Key success factors for global application of micro

energy grid model. Sustainable cities and society, 28, pp.209-224.

Chan, D., Cameron, M. and Yoon, Y., 2017. Key success factors for global application of micro

energy grid model. Sustainable cities and society, 28, pp.209-224.

References

Al-Dajani, H., Dedoussis, E., Watson, E. and Tzokas, N., 2014. Graduate entrepreneurship

incubation environments: A framework of key success factors. Industry and Higher bp.com.,

2018Education, 28(3), pp.201-213.

bp.com., 2018. [online] Available at: https://www.bp.com/en_au/australia.html [Accessed 3 Apr.

2018].

Browne, W., Dreitlein, S., Manzoni, J. and Mere, A., 2016. Two key success factors for global

project team leadership: Communications and human resource management. Journal of

Information Technology and Economic Development, 7(2), p.40.

Busch, H. and McCormick, K., 2014. Local power: exploring the motivations of mayors and key

success factors for local municipalities to go 100% renewable energy. Energy, Sustainability and

Society, 4(1), p.5.

Caltex., 2018. Caltex Australia | Fuels, Convenience Retail & Lubricants. [online] Available at:

https://www.caltex.com.au/ [Accessed 3 Apr. 2018].

Chan, D., Cameron, M. and Yoon, Y., 2017. Key success factors for global application of micro

energy grid model. Sustainable cities and society, 28, pp.209-224.

Chan, D., Cameron, M. and Yoon, Y., 2017. Key success factors for global application of micro

energy grid model. Sustainable cities and society, 28, pp.209-224.

12COMPETITIVE STRENGTH ANALYSIS

Chang, S.F., Hsieh, P.J. and Chen, H.F., 2016. Key success factors for clinical knowledge

management systems: Comparing physician and hospital manager viewpoints. Technology and

Health Care, 24(s1), pp.S297-S306.

Chuang, S.P. and Yang, C.L., 2014. Key success factors when implementing a green-

manufacturing system. Production Planning & Control, 25(11), pp.923-937.

Fryer, K.J., Antony, J. and Douglas, A., 2015. Critical Success Factors of Continuous

Improvement in the Public Sector: A review of literature and some key findings.

Guo, J., Liu, Z. and Liu, Y., 2016. Key success factors for the launch of government social media

platform: Identifying the formation mechanism of continuance intention. Computers in Human

Behavior, 55, pp.750-763.

Irjayanti, M. and Azis, A.M., 2015. Key Success Factors (KSF) of Small Medium.

Kayikci, Y., Bartolacci, M.R. and LeBlanc, L.J., 2018. Identifying the Key Success Factors in

Strategic Alignment of Transport Collaboration Using a Hybrid Delphi-AHP. In Contemporary

Approaches and Strategies for Applied Logistics (pp. 1-36). IGI Global.

Lee, S.M., Kim, N.R. and Hong, S.G., 2017. Erratum to: Key success factors for mobile app

platform activation. Service Business, 11(2), pp.451-451.

Park, C., Chang, B. and Kang, P., 2015. Analysis on Key Success Factors for Partner

Relationship Management. Korean Management Science Review, 32(4), pp.45-56.

Soetanto, R., Childs, M., Poh, P.S., Austin, S., Glass, J., Adamu, Z.A., Isiadinso, C., Tolley, H.

and Mackenzie, H., 2015. Key success factors and guidance for international collaborative

design projects. International Journal of Architectural Research: ArchNet-IJAR, 9(3), pp.6-25.

Chang, S.F., Hsieh, P.J. and Chen, H.F., 2016. Key success factors for clinical knowledge

management systems: Comparing physician and hospital manager viewpoints. Technology and

Health Care, 24(s1), pp.S297-S306.

Chuang, S.P. and Yang, C.L., 2014. Key success factors when implementing a green-

manufacturing system. Production Planning & Control, 25(11), pp.923-937.

Fryer, K.J., Antony, J. and Douglas, A., 2015. Critical Success Factors of Continuous

Improvement in the Public Sector: A review of literature and some key findings.

Guo, J., Liu, Z. and Liu, Y., 2016. Key success factors for the launch of government social media

platform: Identifying the formation mechanism of continuance intention. Computers in Human

Behavior, 55, pp.750-763.

Irjayanti, M. and Azis, A.M., 2015. Key Success Factors (KSF) of Small Medium.

Kayikci, Y., Bartolacci, M.R. and LeBlanc, L.J., 2018. Identifying the Key Success Factors in

Strategic Alignment of Transport Collaboration Using a Hybrid Delphi-AHP. In Contemporary

Approaches and Strategies for Applied Logistics (pp. 1-36). IGI Global.

Lee, S.M., Kim, N.R. and Hong, S.G., 2017. Erratum to: Key success factors for mobile app

platform activation. Service Business, 11(2), pp.451-451.

Park, C., Chang, B. and Kang, P., 2015. Analysis on Key Success Factors for Partner

Relationship Management. Korean Management Science Review, 32(4), pp.45-56.

Soetanto, R., Childs, M., Poh, P.S., Austin, S., Glass, J., Adamu, Z.A., Isiadinso, C., Tolley, H.

and Mackenzie, H., 2015. Key success factors and guidance for international collaborative

design projects. International Journal of Architectural Research: ArchNet-IJAR, 9(3), pp.6-25.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13COMPETITIVE STRENGTH ANALYSIS

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.